Capital International Group Limited is pleased to announce the acquisition of Martello Asset Management Limited (Martello), a boutique investment firm headquartered in Jersey. This strategic acquisition aims to enhance the jurisdictional footprint of the Capital International Group (the Group) of companies beyond their current locations in the Isle of Man and South Africa. The acquisition will increase the Group’s market presence and broaden its portfolio of services across Jersey and beyond. The acquisition is subject to regulatory consent in Jersey.

“We are thrilled to welcome Martello into the Capital International Group family,” said Head of Investment Management, Antony Kelsey, who has been leading the transaction. “This acquisition represents a significant milestone in our growth journey. By combining our respective service offerings, we are wellpositioned to expand the distribution of the Martello Global Equity Fund, and the wider Martello proposition into Capital International Group’s extensive relationships with intermediaries and advisers.

Martello has built a strong reputation for delivering

exceptional investment management services and maintaining robust, good quality client relationships. The performance track record of the Martello Global Equity Fund speaks for itself and we are looking forward to working with the Martello team to distribute it more widely through the Capital International Group. The seamless integration of both companies will ensure continuity of service and a smooth transition for all clients and employees.”

“We are excited about the opportunities this acquisition brings,” said Gary Hill, Director of Martello.

“Joining forces with the Capital International Group will enable us to leverage their extensive resources and expertise, ultimately benefiting our clients with enhanced investment options and services. We have been impressed with the Capital International team throughout our negotiations and we are confident that our team of professional employees and our clients will be well looked after in the future. The team will now engage closely with the necessary authorities to ensure the transaction receives all regulatory approvals as soon as possible.”

Anthony Long, Capital International Group’s Chairman said: “We have been keen to establish a strategic link with Jersey because of the strong investment management industry and community and so we are delighted that we have found Martello to help make a presence in Jersey a reality. The company’s African client base is also a great fit for us as we have 40+ staff across Cape Town, Johannesburg and Durban who are well placed to support and strengthen the relationships Martello have built.”

Isle of Man Post Office (IOMPO) has announced the achievement of its ISO/IEC 27001:2022 certification, making IOMPO one of the first businesses on Island to achieve this standard.

It is a globally recognised standard for information security management systems (ISMS). It provides businesses of any size and from all sectors of activity with guidance for establishing, implementing, maintaining and continually improving information security management systems.

Adhering to ISO/IEC 27001:2022 signifies that IOMPO has established a system to handle risks associated with data security, ensuring alignment with the best practices and principles.

IOMPO also successfully renewed its ISO 9001:2015 certification for quality management systems. It outlines seven principles, including a strong customer focus and continual improvement.

Elizabeth Raleigh, IOMPO Manager for the Business Solutions division, commented, “The achievement of these ISO certifications demonstrate IOMPO’s commitment to providing outstanding services by upholding the highest quality assurance standards across its operations. We take pride in being one of the first business on the Island to achieve ISO 27001:2022 certification, and with the dedication and effort of our team we have successfully renewed our ISO 9001 certification, ensuring the best information security and quality standards for our valued customers.”

ISO is an independent, non-governmental international organisation with a membership of 172 national standards bodies.

Jens Bachem will be the keynote speaker at the annual Research Festival on Friday 18th October.

Jens is a former CEO of a £5m+ digital creative agency which worked with some of the biggest brands in media and entertainment such as Disney, Universal Studios and the BBC. He has also chaired a Rough Guides top destination rural tourism group and served as Executive Director for a US grassroots innovation ecosystem builder.

Having studied at University College Dublin, École Supérieure de Commerce de Paris, and Harvard Business School, as well as being a Fellow of the Royal Society of Arts and a former TEDster, Jens is well versed in academia and research.

He moved to the Island with his family last year and has fallen in love with the Isle of Man and our community, with a particular love of dinghy sailing and sea swimming.

Jens has been actively engaged in researching the Island's potential; his recent piece, “An Island at Sea” highlights the Isle of Man’s strengths and the need to build resilience by fostering an enterprise-led culture.

Jens commented: ‘I’m really looking forward to the Research Festival, where I will delve into the “story of place,” why it matters and how each of us can help shape a better future for the Isle of Man through our research.’

Gail Corrin, UCM’s Higher Education manager who organises the UCM Research Festival, commented: “We’re delighted to have Jens as our keynote for this year’s event. He aims to challenge our perception of our Island and what is possible. The Research Festival always attracts such a diverse range of topics and people from all sectors across the Island as well as some international guests, and this year’s event will not disappoint.”Attendance at the Research Festival is free.

The Board of iPlan Retirement Solutions Limited (“iPlan”), a leading independent provider of pension trustee and administration services to employers, announce the acquisition of Equilibrium Pensions Limited (“EPL”), a long established and respected pension services provider.

Brian Bodell, Managing Director said “We are thrilled to welcome the team at EPL to the iPlan family, this acquisition unites two highly complementary businesses. By bringing two dedicated teams and a suite of complementary products together which perfectly align with our commitment to providing best-in-class retirement solutions, we are able to provide broader expertise to clients, enabling both employers and individuals to design and manage their retirement plans to their needs.”

This strategic move will offer clients:

Enhanced flexibility:

Clients will benefit from a broader selection of services to design and manage their retirement plans.

Deeper industry expertise:

The combined team brings a wealth of knowledge and experience to navigate the ever-changing pension landscape.

Unparalleled service:

employees to manage their plans online. iPlan is dedicated to helping businesses empower their employees to achieve a secure and comfortable retirement.

Suntera Global Trust Manager, Matthew Palmer, has been presented with a Society of Trust and Estate Practitioners (STEP) Isle of Man award for being among the highest achievers in the Isle of Man in a STEP certified qualification.

Matthew was presented with the award at the STEP Isle of Man Summer Awards on Friday (19 July) evening for his top score in the STEP Advanced Certificate in Trusts Law and Practice (International) exam. He also received a £250 donation to the charity of his choice Isle Listen.

Having worked with Suntera Global for close to three years, Matthew has a wealth of experience in supporting a diverse portfolio of international clients and is a member of the Institute of Chartered Accountants in England and Wales and holds a Bachelor of Arts Degree in Business Management.

Janine Cubbon, Director, Head of Private Wealth, Isle of Man in the Isle of Man, commented:

“Although Matthew has been part of the Suntera family for a relatively short period of time, his dedication and expertise have made a considerable contribution both to what we offer our global client base and to the team. We are delighted his excellent score in this professional exam has been duly recognised and we look forward to supporting his professional development further and watching him flourish.”

STEP is the international body for advisers who specialise in inheritance and succession planning.

Suntera Global is a multi-jurisdictional provider of bespoke corporate, fund and private wealth services. They are c.550 specialists who balance responsibility with ambition through the seamless delivery of a comprehensive range of administration and accounting services delivered from their offices in the Bahamas, Cayman Islands, Guernsey, Hong Kong, Isle of Man, Jersey, Luxembourg, United Kingdom and the United States.

iPlan is committed to maintaining the exceptional service clients have come to expect from both companies.

iPlan, established in 2009, is a respected innovator in employer pension provision known for its excellent client service, can-do attitude, and user-friendly technology. Specialising in international pension plans for multinational employers, iPlan quickly became a key partner to its clients by making technology a cornerstone of its offerings. The company provides a fully interactive website and accompanying smartphone apps, allowing clients and their

With more than 20 years’ experience in the pension industry, EPL serves a diverse clientele providing retirement solutions in the Isle of Man and across national and international barriers. Leveraging on a dedicated team and a suite of products designed to solve the retirement challenges for individuals and corporate entities.

Brian Bodell added, “both businesses are long established, and from their origins have been built on excellent client service, integrity and understanding.”

The integration of the businesses will begin in the coming weeks and initially focus of the back office functions and business administration. Clients can expect a seamless transition and will continue to deal with the team they are familiar with, assured of the new management’s continued commitment to the highest standards of service and support.

Appleby Isle of Man has been recognised in the 2024 edition of the Chambers and Partners High Net Worth (HNW) Guide, having secured a Band 2 ranking for its Private Client & Trusts practice.

Appleby was praised for its ‘excellent senior lawyers who supervise the more junior members of the team… bringing in expertise from other teams where necessary’, with the Guide also praising the team’s responsiveness and that they ‘can be called upon to assist in extremely short timeframes’.

Erin Trimble-Cregeen, Counsel in both Appleby Isle of Man and Jersey, was also individually recognised as ‘Up and Coming’. Within her Private Client & Trusts practice, Erin focuses on the contentious aspects of trust law and estate administration and is regarded as a ‘highly skilled lawyer who is passionate about her work and has the ability to gain the trust of her clients and provide creative solutions’.

Commenting on the latest set of rankings, Appleby

Isle of Man Managing Partner Mark Holligon, said: “We’re delighted to see that our Private Client and Trusts practice has been recognised in this year’s rankings and to receive such wonderful feedback from our clients. It’s also great to see that Erin has been individually recognised - which is well deserved and reflects the expertise that she brings to the team.”

Microsoft Teams has quickly become the standard business collaboration tool with 90% of the largest companies globally now using the service.

Sure Business is launching an innovative new service to integrate voice calls to Microsoft Teams. This means calls made to traditional landlines and mobile phones can now be automatically directed to Microsoft’s Teams application giving great flexibility and features to businesses.

The service will allow businesses to record and transcribe calls, control call queues and make and receive calls from desktops or mobiles and ultimately, stay connected on a global scale – all managed through the Cloud based Teams environment; working and collaborating from anywhere in a secure platform.

The Sure Connect for Microsoft Teams is a first for the Channel Islands and Isle of Man, allowing businesses to use their existing numbers and mean that legacy equipment and systems can be decommissioned, reducing costs.Enterprise Product Manager David Salisbury said: “Teams has become almost ubiquitous to the way most modern businesses work. Sure Connect for Microsoft Teams is the next step in streamlining communication for local businesses and ensuring seamless business collaboration, not just within our island communities, but globally.

“At Sure, we're committed to providing the very best solutions so businesses can get the most out of their IT investments and stay connected as efficiently as possible with the very best in modern technology.”

Sure Business’ has a team of certified experts ready to support local businesses to easily adopt these services and attain the benefits quickly and cost effectively.

Castletown-based wealth platform Ardan International has once again been awarded a B rating (strong) for Financial Strength by AKG.

And the specialist firm also reaffirmed Ardan’s maximum five stars for service.

All of this means Ardan has the highest combined rating of any international platform reviewed by AKG.

The report noted the benefits to Ardan of being part of the wider International Financial Group Limited (IFGL).

It also noted how re-platforming Ardan in 2020 had been a success, which was now playing a significant role in AKG’s five star view of Ardan’s service levels.

‘Feedback on service from advisers is reported as excellent,’ said the report.

Ardan’s Chief Executive Officer Sarah Dunnage said: “As always, it’s great to receive external validation from AKG and I’m proud that we have maintained our B rating, as well as five stars for service.

“In particular I’m happy to see that AKG has acknowledged the value of our re-platforming, and all the work we have done with the platform since 2020 to create a high quality experience for advisers and customers.”

Moody’s rating hails Island’s ‘robust’ economic growth and ‘stable outlook’

An annual report on the Isle of Man’s financial standing has assessed its economic growth to be ‘stronger than in most of Europe’.

International credit ratings agency Moody’s expects growth to climb from an estimated 1.5% in 2023 to 3% by 2025, rating the Island’s economic strength as ‘a3’ which reflects ‘a robust record of economic growth and high income levels’.

Its analysis of the fiscal positions of different jurisdictions puts the Island’s overall credit rating on par with the UK, as ‘Aa3 stable’, noting the ‘substantial’ linkages between the two.

The report identifies labour shortages as ‘the most significant credit challenge facing the Isle of Man’s economy with the number of job vacancies remaining high against a low unemployment rate’.

Treasury Minister Dr Alex Allinson MHK welcomed the findings, and said: “This report demonstrates that the Island is on the right path. It recognises that our economy, along with those of our near neighbours, has been impacted by international factors such as the Coronavirus pandemic and Brexit, but is showing signs of a healthy recovery.

“It also acknowledges Isle of Man Government’s ‘fiscal prudence’ and ‘proactive policymaking’ which have helped maintain stability in spite of global uncertainty.

“The economic strategy sets clear targets in relation to the labour market, aiming to grow the Island’s working population by 5,000 which will help address job vacancies and skills shortages.”

Moore Dixon has announced that Andrew Dixon, Partner, has been named one of the 2024 eprivateclient Crown Dependencies NextGen Leaders.

The 2024 eprivateclient Crown Dependencies NextGen Leaders list was open to private client advisory professionals, including private client tax, trust, dispute resolution, and family lawyers, accountants, and trustees from the Isle of Man, Jersey, or Guernsey. The list aims to showcase the rising stars and future leaders within the global private wealth sector, highlighting those who have demonstrated exceptional talent and dedication in their respective fields.

With years of experience in financial services, Andrew has worked with a wide range of industries, including local and international manufacturing, shipping, agriculture, distribution, banks, pensions, and stock exchange-listed clients.

Beyond his client responsibilities, Andrew leads and mentors qualified staff and students and is an integral part of the firm’s relationship management implementation project and ISO 9001 reaccreditation programme. His dedication to improvement and quality assurance has significantly contributed to the firm's success in maintaining high standards of service delivery.

A media spokesperson for Moore Dixon stated: “Congratulations to Andrew on being recognised as a leading professional in the private client advisory sector. We are always proud when our people succeed and are recognised for their talents and hard work, and everyone in the firm is thrilled for him to receive this prestigious accolade. His inclusion on eprivateclient’s Crown Dependencies NextGen Leaders list is very well deserved.”

Andrew’s primary responsibility is the assurance, advisory and consulting departments. Handling a growing portfolio of over 150 engagements annually, Andrew and his specialised teams provide services to a range of entities from small local businesses to large international groups and government departments, while liaising with Moore Global firms around the world.

After training at a Big Four firm Andrew joined Moore Dixon and since joining has identified and developed new service lines and is responsible for a significant number of new engagements for Moore Dixon, locally and internationally.

Island nominated for ‘Most Desirable Island in Europe’ in the

Visit Isle of Man has announced that the Isle of Man has been nominated for ‘Most Desirable Island in Europe’ in the 2024 Wanderlust Reader Travel Awards. Wanderlust Magazine is a leading travel publication renowned for its in-depth travel guides, expert advice, and inspiring features on destinations worldwide. Established in 1993, Wanderlust has become a trusted resource for passionate travellers and is now the mostread UK travel magazine with the highest average circulation across print and digital, and continues to pioneer coverage of authentic, responsible and sustainable travel.

Now in its 23rd year, the Wanderlust Reader Travel Awards celebrates the best in travel and will spotlight the most desirable destinations, tour operators and travel brands in the industry. This year’s awards will see the Isle of Man competing against other islands across the UK and Europe, including Gran Canaria, Jersey, Madeira, Orkney, and Sicily to name a few. Over 91,000 readers took part in voting last year, and it is expected that over 100,000 votes will be cast for the 2024 awards.

Melanie Allen, Director of Marketing and Communications for Visit Isle of Man, commented: “The Isle of Man's nomination in such a prestigious travel magazine as Wanderlust is a testament to the hard work and dedication of all those involved in the Island’s visitor community and the warm hospitality of our local community. This is the first time the Isle of Man has been nominated for such an award, and to be so in the ‘Most Desirable Island in Europe’ category helps to raise the profile of the Island and its unique offering for visitors.

“Whether you’ve visited once or a hundred times, we know the Island has made a lasting impression and we encourage all fans of the Isle of Man to cast their votes and support this exciting recognition. We also ask our wonderful local community and industry partners to share the voting link with their friends, family, customers and anyone else that’s visited the Isle of Man.”

Voting for the 2024 Wanderlust Reader Travel Awards is now open and is free. Voting closes on the 18th October, with the winners announced at a gala ceremony at the Tate Modern in London later this year.

University College Isle of Man’s (UCM) has launched a new adult learning course in Enterprise Risk Management.

The 12-week course will see learners be able to identify and assess risks, use quantitative and qualitative risk analysis techniques, create risk response and mitigation strategies, design and implement risk frameworks, and use root cause analysis. The course will also look at best practice, regulatory and legal aspects, technology in risk management, crisis management and business continuity planning.

At the end of the course learners will complete a written, graded assessment. CPD credits will be awarded to all participants.

Kerry Birchall, who manages UCM’s adult learning provision added: ‘In all industries Risk Management is a really important topic, in any role at all levels, everyone has a responsibility for risk. This course will help learners understand and identify risks and give them the tools to manage those risks.’

UCM’s adult learning upskilling courses designed to support people and businesses with lifelong learning, whether that’s addressing skills shortages or developing existing skills.

To find out more about this course and how to book a place visit www.ucm.ac.im

Create tomorro w Start toda y

Lading Fund Administration and Investment Management Company, FIM Capital, has confirmed that David Bushe, CEO (Chief Executive Officer), has been awarded the prestigious Chartered Director status by the Institute of Directors. This recognition marks a significant milestone in his professional journey, acknowledging his commitment to excellence in corporate governance and leadership.

“I am honoured to achieve Chartered Director status. This accomplishment reflects my dedication to upholding the highest standards of governance and ethical leadership,” said David. “I look forward to applying this knowledge and experience to further contribute to FIM Capital and the wider business community.”

Chartered Director status is a distinguished qualification that requires rigorous assessment and demonstration of expertise in strategic thinking, governance, and leadership. It is awarded to individuals who have shown exceptional capability in steering organisations towards success while maintaining the principles of good governance.

David has been with FIM Capital since March 2022 and was promoted to CEO in June 2023, where he has played a pivotal role in the future strategy, structure, and development of the business. David is also a Chartered Fellow of the Chartered Institute for Securities & Investment, a Chartered Wealth Manager and holds a BA(Hons) from the University of Central Lancashire.

MAC Group is proud to announce that Todd Crellin, one of MAC Financial’s Trainee Paraplanners, has successfully passed the Chartered Insurance Institute (CII) Regulated Diploma in Financial Planning. This significant achievement marks a major milestone in Todd’s career and underscores MAC Financial’s commitment to the professional development of its team.

The CII Regulated Diploma in Financial Planning is a highly respected qualification in the financial

services industry, providing a solid foundation in the core disciplines required for comprehensive financial planning. To earn the diploma, Todd completed exams covering six core areas, emphasizing technical knowledge and financial planning capabilities. The qualification is recognized for its rigorous standards.

Todd joined MAC Financial in May 2023 as a Trainee Paraplanner, bringing over three years of life assurance experience. He quickly established himself as a dedicated and knowledgeable team member.

Ed Walter, Head of Private Client at MAC Financial, commented: “Since joining MAC Financial last year, Todd has dedicated himself to passing the CII Diploma in Regulated Financial Planning, investing around 400 hours of study time during this period. We are very proud of him. This accomplishment not only highlights his commitment to his career but also reinforces our firm’s dedication to providing clients with the highest standard of financial advice and service.”

With his newly acquired diploma, Todd will continue to work in our Paraplanning team, supporting our advisers in delivering leading financial advice to our private and corporate clients.

Todd Crellin added: “I am thrilled to have passed the CII Regulated Diploma and to continue my journey with MAC Financial. I’m grateful for the support and mentorship I’ve received since joining the company, and I’m excited to use my skills to further enhance our clients’ financial well-being.”

Canaccord Genuity Wealth Management, Isle of Man Investment Director Alex Toohey has been shortlisted for Investment Manager of the Year.

Alex is one of 6 outstanding individuals in his

category to be recognised for the excellence of his work and is excited and honoured to have made the shortlist.

“I consider it a privilege to be on the shortlist among such reputable professionals in the wealth management industry”, he said. “Canaccord has developed a culture whereby they not only recognise and encourage individual career development, but also make you feel valued as part of a greater team with common goals. It’s this support and company ethos that has allowed me to grow and thrive during my time with the firm.”

Isle of Man and Channel Island companies and individuals feature strongly among the shortlisted nominees for the Citywealth International Financial Centre Awards 2025.

Commenting on the news, Head of Wealth Management in the Isle of Man Tom Richards said: “Alex has come a long way since he joined us as a Trainee Investment Manager in 2013 and this honour is welldeserved. He’s a great example of someone who’s adopted the company’s ‘can-do’ attitude, and we wish him every success at the awards ceremony.”

The prestigious awards are now in their fifteenth year and recognise the excellence of companies and individuals in international financial centres.

Those working in the global private wealth industry now have time to comment on the shortlist before the panel of highly respected practitioners decide on the winners and announce their choices early New Year.

•

•

•

•

Business Isle of Man, an Executive Agency within the Department for Enterprise, has today published its draft Local Economy Strategy which sets out a 10 year vision to ensure the Island remains a great place to live by increasing the vibrancy of our retail, leisure, and hospitality sectors.

The draft Local Economy Strategy is built on the principle of providing residents, Local Authorities and businesses with the tools to drive positive change and enable them to take ownership of their local areas.

To achieve its vision, the Strategy details clearly defined goals, objectives and actions, categorised using three policy pillars; Infrastructure & Place Management, Enterprise & Consumer Experience and Local Empowerment & Partnerships. Priority action, put forward by the Strategy, will be taken to:

• Transform underutilised and vacant spaces

• Invigorate high streets and catalyse vibrancy

• Encourage increased consumer choice

• Reduce barriers to business

• Develop effective town partnerships

• Empower Local Authorities by creating new funding routes

The Strategy advocates adopting a local-first approach and includes the creation of a Local Economy Fund, accessible to Local Authorities and Trader Groups.

The Strategy has been published in draft form whilst further consultation is undertaken over the summer, to facilitate the development of a detailed implementation plan to be published in autumn.

Tim Johnston MHK, Minister for Enterprise,

commented: “The draft Local Economy Strategy sets out a framework to secure the economic health of our high streets and urban centres, and facilitate a local economy which is thriving, sustainable and distinctively Manx.

“Extensive consultation and research across numerous stakeholder groups has been conducted to bring forward this draft Strategy. This has enabled us

to compile a strong evidence base to inform an approach which encourages investment, initiatives and ideas that will see significant results over the coming decade.

“‘I acknowledge that our local economy has faced challenges in recent years. This Strategy provides us with a robust foundation and direction to ensure a secure, vibrant, and sustainable future for these sectors, addressing current issues while laying the groundwork for long-term success.”

The draft Local Economy Strategy encompasses twenty strategic goals that address the challenges determined by research and capitalise on the strengths and opportunities identified.

Tim Cowsill, Chief Executive Officer, Business Isle of Man, commented: “Understanding the impact of this strategy is crucial. It is not a one-size-fits-all approach and tailored plans will be developed for Douglas and each town across the Island, with monitoring of impact through metrics such as footfall, the number of empty shops and future town audits.

“Whilst measures implemented earlier this year went some way to alleviate certain pressures, we recognise we needed a long-term plan in place to deliver meaningful and sustainable results. I hope that the draft Local Economy Strategy will drive forward positive change by uniting local area stakeholders and contributing towards community led decision making.”

Business Isle of Man will gather feedback on the draft Local Economy Strategy through an online survey and a series of direct outreach sessions across the Island which took place last month.

Finance Isle of Man, an Executive Agency of the Department for Enterprise, has launched an initiative to develop a Sustainable Finance proposition for the Isle of Man. This project aims to enhance the Island's reputation as a leading International Finance Centre by facilitating capital flows for sustainability-based products.

The initiative, supported by the Economic Strategy Board, aligns with the Isle of Man Government’s longterm Economic Strategy and leverages the Island's unique status as the world’s only whole-nation UNESCO Biosphere. A Steering Group, consisting of industry and public sector representatives has been formed to provide strategic direction, project management and governance.

In the project's initial phase, Finance Isle of Man has partnered with the International Sustainable

Finance Centre of Excellence (ISFCOE) in Dublin. They will also collaborate with the United Nations' Financial Centres for Sustainability (FC4S). The Isle of Man has already been granted observer member status by FC4S, which will conduct a baseline assessment of the Island's positioning to guide the development roadmap and serve as a benchmark for the initiative.

Tim Johnston MHK, Minister for Enterprise, commented: “The global financial system, and its products and services, play a critical role in providing the capital needed for countries and institutions to meet the sustainability goals set under the Paris Agreement. With financial services representing around 48% of the Isle of Man’s economy, this sector can play an important role in this evolution.

“Furthermore, this project aligns closely with the

long-term ambitions of the Economic Strategy, leveraging the green economy to build a more secure, vibrant and sustainable future for the Isle of Man.’

Paul Blake, Head of Banking & Fiduciaries at Finance Isle of Man, added: “We see this as a ‘mustdo’ initiative for the Isle of Man’s Financial and Professional Services sector. This project helps to ensure that our proposition remains competitive and relevant. Key market indicators predict increasing demand for Sustainable Finance products and services. We are particularly pleased to establish a partnership with ISFCOE and to become an observer member of FC4S early in our journey, enabling us to tap into some of the best thinking around in this area. Additionally, our unique status as the only entire UNESCO Biosphere nation in the world has already sparked considerable interest from our partners.”

Digital Isle of Man has announced the first phase of their ‘Activate AI’ programme, which will see the implementation of new products and services to help the community understand and adopt evolving Artificial Intelligence (AI) technology in ways which will benefit businesses, jobs and the wider economy.

‘Activate AI’, a programme supported by the Economic Strategy Board, aims to raise awareness of how AI can support the growth and upskilling of businesses and individuals in the Isle of Man, with the headline target to increase GDP by 10% by 2030 using AI solutions across public and private sectors.

The first phase of the ‘Activate AI’ programme is focused on initiatives which seek to dispel fear of the technology, educate and provide upskilling opportunities for all Island residents.

At a community level, Activate AI will begin with the launch of a new free training platform, Learnai.im, which will provide over 200 hours of online training for all members of the community with an ‘AI for everyone’ approach to content.

For local businesses, Digital Isle of Man will be launching an applied AI service enabling them to work with Activation Partners to explore AI growth opportunities, submit problem statements and work with Activation Partners to develop AI solutions to be trialled.

The applied AI service will commence with the opening of expressions of interest for experienced local individuals to become ‘Activation Partners’ who will support businesses to drive forward AI-based solutions and proof of concepts (trials) to solve business problems using AI technology.

Following the appointment of Activation Partners, local businesses will be able to sign up through Digital Isle of Man’s website to begin the process which will enable them to work with Activation Partners to realise the value of AI within their business and implement tangible solutions free of charge.

The applied AI service will be headquartered at the 'AI Activation Centre' at Hilary House, Douglas, offering a physical space for businesses to work with Activation Partners.

Lyle Wraxall, Chief Executive Officer, Digital Isle of Man, commented: “The Activate AI programme is an exciting initiative for Digital Isle of Man, enabling us to work with the local community to empower and share knowledge and applications of AI which have the potential to increase productivity and skills across the economy.

“AI is a rapidly evolving technology with a vast range of applications, and its landscape is changing daily. That’s why our first phase is focused on educating, and helping our community become more comfortable with the technology at a fundamental level.

“Through our Memorandum of Understanding with AI Singapore we have secured our residents and businesses access to the best products, services and expertise to harness AI’s potential and boost productivity on a national scale.

“This is just the beginning of our journey in this space, and I look forward to working collectively with the community to continue to evolve our proposition and explore its full potential.”

Tim Johnston MHK, Minister for Enterprise, commented: “The long-term Economic Strategy sets out a vision to create a more secure, vibrant and sustainable future for the Isle of Man. This includes significant economic ambitions and shifts such as growing our GDP, increasing jobs, enhancing infrastructure and services, and prioritising sustainability targets.

“The Activate AI programme supports all of these ambitions, and signals an active investment into skills, productivity and our businesses as we seek to leverage existing advantages and further enable innovation across our entire economy by making this technology as accessible as possible for our residents and businesses.”

‘‘

THROUGH OUR MEMORANDUM OF UNDERSTANDING WITH AI SINGAPORE WE HAVE SECURED OUR RESIDENTS AND BUSINESSES ACCESS TO THE BEST PRODUCTS, SERVICES AND EXPERTISE TO HARNESS AI’S POTENTIAL AND BOOST PRODUCTIVITY

Measures to streamline the development of offshore wind power generation in the Isle of Man’s territorial waters are in the process of being introduced.

The Marine Infrastructure Management Act 2016 (MIMA) establishes a consenting process for specific activities to take place in the Island’s marine environment, defined as being between the mean highwater mark and the 12-mile territorial sea boundary.

Modernising this legislative framework reflects a commitment within Our Island Plan under Energy Security to ‘provide certainty for the overall management in optimising the economic benefit of our seas’.

One of the key principles of the changes is to simplify the process for applicants - enabling a single consent to be granted through the MIMA while removing the need to seek consent under multiple pieces of current legislation.

The regulations will initially focus on the following controlled marine activities:

• Offshore renewable energy generation

• Aggregate extraction

• Laying of submarine cables and pipelines

This approach aims to promote the sustainable development and effective management of the Island's marine resources and does not include drilling for gas, carbon capture or the exploitation of natural gas and petroleum.

New Section 61 regulations were approved by Tynwald in July and will enable ongoing projects to transition smoothly to the new MIMA regime without losing progress made under previous regulations.

In addition to the Section 61 regulations, the Department has made others in respect of: procedural requirements for pre-application processes; detailed application procedures; mandatory consultations; examination of applications; and the content of Marine Infrastructure Consents. These regulations will be laid before the October sitting of Tynwald.

Further regulations will be required in respect of

The Island Plan Quarterly Report has been designed to help the public track progress on the 2024-25 Island Plan commitments, priorities and projects.

The summary document provides reporting on the individual milestones which make up the overall government programme.

Updates also help to highlight work taking place in the background in support of the overarching goal of a secure, vibrant and sustainable future for our Island.

The report spotlights some of the key areas of progress in the last quarter, including the delivery of over 3,000 operations to reduce hospital waiting lists, a new Childcare Credit Scheme which means more parents qualify for financial help towards early year’s education and childcare costs, and the introduction of further protections at three Manx fishing sites, together with a new fishing quota which presents great opportunity for our fishing industry.

It also identifies progress on upcoming or completed Island Plan milestones, such as the ongoing build of the Sexual Assault Referral Centre, and the redevelopment of brownfield sites by incentivising private investment through the Island Infrastructure Scheme.

Key related announcements are summarised in one

place for each of the Island Plan themes to show context, impact and delivery. While some milestones have experienced delays from their initial target dates, work continues towards successfully delivering each of the actions over the course of the year.

Chief Minister, Alfred Cannan MHK, said: “This Island Plan Quarterly Report marks the beginning of a series of consistent and transparent reporting on the work and policy in the Island Plan. It has been designed not only to ensure the community have regular access to updates on progress towards milestones set and delivery by Government departments, but to provide a summary including related announcements, of actions taken to make a positive impact on the day-to-day of people’s lives, as well as work towards the longer term strategic issues that matter.

“Our focus remains on driving delivery for these commitments and tangible improvements for people, whilst also responding to the issues of the day and the improvement of government services.”

The first quarterly report covers the period from April to June 2024, and can be found on the Island Plan website. The next report will be published in October and will cover milestones from July-September.

The Isle of Man Government has announced significant changes to its procurement policies aimed at supporting local businesses. These changes will allow the Government to favour Isle of Man-based businesses in contract awards.

The Council of Ministers agreed to reserve contracts below the World Trade Organisation (WTO) tender threshold for Isle of Man-based businesses.

Under this new policy, up to 94% of Government spending opportunities, potentially £50 million annually, could be directed into the local economy. This move is a positive outcome of Brexit, allowing the Isle of Man to support its own businesses, something that was not possible under previous EU procurement rules.

At its June sitting Tynwald approved an Order that will ensure that reserving contracts for local businesses does not constitute an anti-competitive practice.

Treasury Minister, Alex Allinson MHK, said, “This policy is a significant step in supporting local businesses and our economy. For the first time in nearly fifty years, we can actively favour local businesses in an open and legitimate manner.

“By directing even more government spending into the Isle of Man economy, we are fostering a more robust and self-sustaining economic environment. We believe this will provide local businesses with greater opportunities and help strengthen our community.”

For more information, contact the Procurement team at procurement@gov.im

matters that arise after consent for a controlled marine activity has been granted. These will continue to be prepared by the Department and laid before future sittings of Tynwald.

Overall, the measures are designed to ensure clarity and continuity for developers and stakeholders involved in marine infrastructure projects.

Infrastructure Minister Tim Crookall MHK said: “Developing these regulations and bringing them into effect is vital to modernising the way we manage infrastructure within our seas. The Department is committed to aligning the regulations with established practices in the UK and providing a familiar and reliable framework for industry professionals.”

Regulations to enact the legislation will be uploaded to the Register of Business on the Tynwald website in due course. All those who responded to the consultation process have been offered the opportunity to be provided with a copy of the regulations.

Authority seeks to raise awareness of future activities

The Isle of Man Financial Services Authority has published a calendar to highlight the dates of its outreach and engagement for the months ahead.

The ‘at-a-glance’ timetable for 2024/25 offers a snapshot of the regulator’s forthcoming data requests, thematic reviews, inspections, events, consultations, and reports.

The intention is to keep Island firms and other stakeholders informed of developments by providing advance notice of the Authority’s key milestones where possible.

It is hoped that publishing the calendar online and updating it on a regular basis will assist firms with their forward planning, particularly in relation to anticipated demands on compliance functions.

In addition to a high-level overview of its activities, the Authority is also compiling a more detailed breakdown of requirements in relation to data returns by class of licence. Further details will be provided in due course.

Bettina Roth, Chief Executive Officer, said: “We continue to work closely with industry and are seeking to help firms by providing even more visibility of what we have coming down the tracks. The Authority will be stepping up its engagement in the time ahead, as well as requesting more information from certain firms and sectors in line with our data-driven approach to supervision.”

She added: ‘By publishing a rolling calendar of our activities, we hope to raise awareness of when we will be reaching out to stakeholders for data that supports our efforts to protect consumers, reduce financial crime, and maintain confidence in the finance sector.’

The Department for Enterprise's Business Agency will support Manx food and drink exporters at the International Food Event (IFE) at the ExCel Centre in London in 2025. This announcement follows a successful 2024 show that generated over £600,000 in orders and dozens of promising sales leads for the participating Manx businesses.

Earlier this year, Isle of Man Creamery, The Fynoderee Distillery, Outlier Distilling Company, and Okell's Brewery exhibited and showcased the finest Manx produce to attendees from across the world at the 2024 IFE. Business Isle of Man, through the Food & Drink Export Development Group, jointly funded the cost of exhibiting to enable Manx businesses to capitalise on the opportunities presented by the event, with the ultimate aim of increasing exports of their products into new markets.

Food & drink exported from the Isle of Man has wellestablished and loyal markets in Spain, France, Italy, USA, Canada and Australia, and each year the Island exports over 450 tonnes of cheese and seafood to the value of £7-8 million.

Minister for Enterprise, Tim Johnston MHK commented: “It was a pleasure to visit our exhibitors at the IFE earlier this year with the Business Agency in London. The Economic Strategy highlights the need for us to protect, nurture and develop our export sectors, with the food and drink sector playing an important part in this ambition. I was impressed by how well Manx Produce stacked up against food and drink from all over the world. It is clear from the sales achieved from this year's event that we have a real opportunity to push Manx food and drink onto menus worldwide. This success is just the beginning, and we have a lot of potential for growth in the future.”

Findlay Macleod, Managing Director at the Isle of Man Creamery and Business Isle of Man Non-Executive Board Member, commented: “Attending IFE 2024

‘‘

IT IS CLEAR FROM THE SALES ACHIEVED FROM THIS YEAR'S EVENT THAT WE HAVE A REAL OPPORTUNITY TO PUSH MANX FOOD AND DRINK ONTO MENUS WORLDWIDE.

resulted in us securing valuable orders from a European customer and allowed us to effectively market our products to a discerning audience of national and international buyers. We were pleased to represent the Isle of Man at the show and found there to be a huge amount of interest in the Island and the food and drink we produce.”

Having won a World Food Innovation Award at IFE 2024 and recently the Great Taste Award, Okell’s Brewery was one of the first companies to sign up to exhibit in 2025. Okell’s will again present its products under the banner of Isle of Man Drinks, joined by the award-winning Fynoderee Distillery.

Ollie Neale, Managing Director at Okell's Brewery and Business Isle of Man Non-Executive Board Member, commented: “IFE offers a great opportunity for Okell's to promote our unique Manx beers to potential customers from a diverse range of businesses. Exhibiting under the banner of 'Isle of Man Drinks' in March made us stand out among the other drinks producers, and we received a lot of appreciation for our unique status as an entire nation Biosphere. We are excited to return in 2025 to develop new relationships with potential buyers.”

In addition to supporting businesses seeking to grow international sales, Business Isle of Man is working with the Department for Environment, Food and Agriculture to increase the value of local produce sold in the Isle of Man. In support of this goal, an exclusive ‘Meet Your Producer’ Event will be held at the Market Hall in Douglas on 23 September 2024.

This event will offer local food and drink producers the chance to strengthen relationships with retail, food service, and hospitality businesses in the Island. Businesses wishing to attend the Meet the Producer event can get in touch at contact-business@gov.im. Food & drink producers looking to exhibit are encouraged to reach out to food@gov.im for details.

A series of consultations have been published which seek the views of the general public and businesses on further potential reforms to employment legislation.

The consultations, covering parental and caring rights, annual leave and rest breaks, and trade union legislation to name a few, are available on the Government Consultation Hub and follow on from previous consultations and reforms already being progressed.

Our Island Plan sets out a vision of a secure, vibrant and sustainable Island, with a commitment for the Department for Enterprise to deliver reforms to employment legislation, ensuring the Island is aligned with international standards and remains a competitive and attractive place to work.

Seven consultations, split into bitesize topics to encourage participation, have been launched on the following:

Parental and caring rights including redundancy protections, carer’s leave and neo-natal care leave;

• The statutory provisions for annual leave and rest breaks;

• The licencing and conduct of Employment Agencies and Businesses;

• Trade Union legislation including ballot threshold requirements;

• The difference between workers and employees and the rights afforded to these groups;

• Unfair dismissal qualifying periods and maximum awards; and

• The operation of the Minimum Wage Act 2001.

Tim Johnston MHK, Minister for Enterprise commented: “We welcome feedback from this consultation process and are open to hearing the perspectives of the Isle of Man business community, worker representative groups and the general public, to ensure we receive a wide range of views on these important matters.

“Each of the consultations seek input on the progression of rights in the workplace, with the aim to bring legislation in line with comparable legislation in neighbouring jurisdictions and further afield. These improvements will contribute to our efforts in making the Island a great place to live and work and ensuring the Island continues to be an appealing destination for both new and existing businesses.

“‘The Department is firmly committed, as outlined in the Island Plan, to reforming employment legislation as it has done so far with the first Employment (Amendment) Bill in 2023 with a particular focus on parental leave rights, ensuring it is fit for purpose and keeping pace with an ever-evolving landscape while also solidifying our stance as a secure, vibrant and sustainable place to live, work and do business.”

These consultations form part of the wider work that the Department is undertaking regarding Employment Legislation, with the first Employment (Amendment) Bill awaiting Royal Assent and its secondary legislation to be introduced to Legislative Branches later this year. Most changes as a result of the first Bill are expected to take effect from 1 April 2025.

The consultations are now open and will conclude on 29 October 2024.

‘‘

THE DEPARTMENT IS FIRMLY COMMITTED, AS OUTLINED IN THE ISLAND PLAN, TO REFORMING EMPLOYMENT LEGISLATION AS IT HAS DONE SO FAR WITH THE FIRST EMPLOYMENT (AMENDMENT) BILL IN 2023 WITH A PARTICULAR FOCUS ON PARENTAL LEAVE RIGHTS

Views are being sought on the latest proposals to streamline the Isle of Man’s planning system and make it easier for people to use.

The consultation invites public feedback on plans to improve the planning process for property owners and boost protection for the island’s built heritage.

This includes a Definitions of Development Order that specifies the most common home improvements that do, or don’t, require planning approval. This is separate, but complementary, to the review of Permitted Development, which is also being consulted on.

The new proposals would also update the Registered Building Regulations that align with a new process for applying for planning approval, which come into force next month.

Clare Barber MHK, Minister for Environment, Food and Agriculture, said: “The changes would ensure processes are clear, accessible and effective in creating

attractive places to live, protecting the environment and supporting sustained economic growth.”

If supported, the updates will help the department implement changes being made to the Town and Country Planning Act, which is currently being considered by the House of Keys.

Minister Barber added: “There is a lot going on in planning at the moment and these positive changes would mean people can carry out straight forward proposals without the need for a planning application, saving time and money.”

The changes form part of the Built Environment Reform Programme’s commitments to ensure detailed and accurate applications, a proportionate appeals system and to increase the small scale/routine activity that can be undertaken without a planning application.

The 12-week consultation can be found on the consultation hub.

Residents are encouraged to take advantage of the expanding Online Services, which offer a range of benefits, such as job searches, bill payments and license applications.

A popular use of Online Services is for filing personal tax returns. The number of users has significantly increased in recent years, with over 62% of Isle of Man residents submitting their tax returns online in 2023.

The process is designed to be simple and userfriendly. After registration, tax forms are pre-filled with salary and state benefit details, eliminating the need to input the data manually.

As this year's deadline of Sunday 6 October approaches, those who haven't yet switched to this convenient, secure, and environmentally friendly service are encouraged to do so.

An animated instruction video is available on the Isle of Man Government YouTube channel.

A senior executive at the Isle of Man Financial Services Authority has been shortlisted in the Citywealth Powerwomen Awards 2025 - International.

Sarah Kennedy, Head of the Authority’s Portfolio Supervision Division, is nominated in the ‘Woman of the Year – Government, Regulatory, and Not-for-profit Organisations’ category.

She faces competition from six other female business leaders for the prestigious honour, with the results set to be announced in London on 5 March 2025.

The Citywealth Powerwomen Awards champion companies and individuals who excel as leaders, mentors, or entrepreneurs within the international finance sector. Shortlists are based on submissions, editorial research, and judges’ recommendations.

Sarah joined the Authority in July 2023 following a career in the financial services industry spanning more than 30 years. She was appointed as Head of Portfolio Supervision, a role created as part of the organisational restructure at the Island’s financial regulator.

impact, excluding banks and insurers. A qualified accountant with experience in business risk and governance, she also works alongside colleagues to oversee the authorisation of regulated and registered firms in the Island, and individuals seeking appointment to senior compliance roles.

The results of the Awards are determined by a combination of a public vote and the deliberations of the judging panel. Online voting is open until 29 November 2024, and people can register their support for Sarah by signing up to cast their vote via the Citywealth website.

Sarah said: ‘It was a wonderful surprise to learn that I had been shortlisted. The Citywealth Awards showcase the contributions made by women in the finance industry and it’s an honour to be nominated alongside some truly inspirational people. I feel very fortunate to work in such a supportive environment at the Authority. I have relished the opportunity to work with fantastic colleagues, both within the Portfolio Division and wider organisation, and to engage collaboratively with our firms, as we all play a critical role in maintaining the Island’s reputation as a well-

Sarah leads a team that is responsible for the effective supervision of regulated firms classed as low

SURE’S FIRST ENVIRONMENTAL REPORT – THE GREEN CONNECTION – DEMONSTRATES THE ORGANISATION’S EFFORTS AND ONGOING INVESTMENT TOWARDS A MORE SUSTAINABLE FUTURE THROUGH RESPONSIBLE BUSINESS PRACTICES AND TRANSPARENCY IN ITS OPERATIONS. SURE’S CARBON FOOTPRINT PER EMPLOYEE IS SIGNIFICANTLY BETTER THAN THE TELECOMS INDUSTRY AVERAGE AND FAR BELOW THE FIGURES OF MANY UK PROVIDERS.

Sure partnered with FutureTracker to assess its carbon footprint. FutureTracker’s assessment is based on industry best practices which provide recognised and robust benchmarking.

Sure Group CEO Alistair Beak said: “Sustainability is an essential aspect of our business operations and The Green Connection is a clear signal of our intent to have a more sustainable future. Our island communities expect us to deliver, and this annual report is one way of shining a light on our proactive progress.”

Sure’s sustainability pillars:

• Green Change: The practical changes that Sure has implemented based on the FutureTracker report.

• Green Responsibility: The key areas that Sure can make, and has made, a difference in the communities it operates in.

• Green Team: The people who champion and drive sustainability at Sure.

Report highlights include:

• Carbon footprint reduced by 27% in a year (from 1,729 tonnes of carbon dioxide equivalent [tCO2e] for 2021 to 1,260 tCO2e for 2022).

• Investment in innovative, state-of-the-art Uninterruptible Power Supply (UPS) units for its data centres, which have reduced the amounts of energy needed to power these crucial pieces of island infrastructure, reducing energy consumption in these systems by 26-30%.

• Investment in Free Cooling Air Handling Units has doubled cooling capacity, with up to 80% energy reduction for 90% of the year.

• Sure is significantly better than the telecommunications industry average for its tCO2e per employee.

Human Resources Director and Chair of Sure’s Green Team Lucienne De La Mare said: “Sure’s sustainability strategy is aligned with our purpose of connecting our island communities for a better future. We aim to involve all employees to foster joint responsibility, develop a sustainability policy and targets, and evaluate our carbon footprint.

“It’s important to measure, manage, minimise, and benchmark our environmental impact and embed sustainability into the Sure DNA.”

‘‘

WE AIM TO INVOLVE ALL EMPLOYEES TO FOSTER JOINT RESPONSIBILITY, DEVELOP A SUSTAINABILITY POLICY AND TARGETS, AND EVALUATE OUR CARBON FOOTPRINT

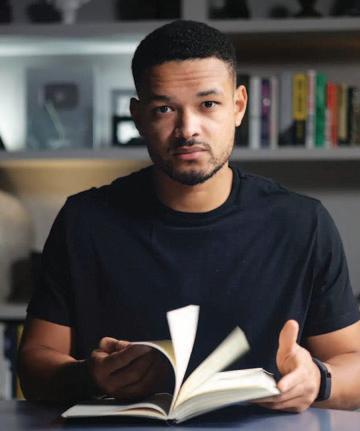

LIKE MANY OTHERS OVER THE LAST COUPLE OF YEARS, I HAVE DEVELOPED A GREAT LOVE OF LISTENING TO A GOOD PODCAST. MY GO-TO IS ‘THE DIARY OF A CEO’ – A PODCAST PRODUCED BY STEVEN BARTLETT, A YOUNG BRITISH ENTREPRENEUR WHO BUILT HIS CAREER AS THE FOUNDER AND FORMER CEO OF THE SOCIAL CHAIN, A SOCIAL MEDIA MARKETING AGENCY, MORE RECENTLY APPEARING ON DRAGON’S DEN. EACH WEEK, HE SITS DOWN WITH A DIFFERENT GUEST PROVIDING AN UNFILTERED JOURNEY INTO THE REMARKABLE STORIES OF THE WORLD’S MOST INFLUENTIAL PE OPLE, EXPERTS AND THINKERS.

CHARLOTTE CUNNINGHAM INVESTMENT MANAGER, FIM CAPITAL LIMITED

In February, I attended an investor day held by Pershing Square Holdings in London where I had the honour of meeting the esteemed Bill Ackman. Travelling to the City can be laborious and to make this journey a little more tolerable, I had downloaded an episode entitled ‘The Savings Expert: ‘Do not Buy a House!’, How to turn £100 into £1.5 million without effort’. Here, Steven Bartlett sat down with Morgan Housel, a partner at the Collaborative Fund, a leading venture capital firm with a specific focus on technology companies.

I initially took an interest in the episode as, like many 20-something year olds, one of my next big moves would be to purchase my first home and for someone to make the statement: ‘Do not Buy a House!’, left me intrigued by his rationale. In the episode, I learnt that Morgan was also the author of ‘The Psychology of Money: Timeless Lessons on Wealth, Greed and Happiness’, and while I would prefer to listen to a podcast or audio book, I felt compelled to buy this novel as soon as I could.

Being in London, I was in luck and quickly found a bookshop located near my hotel, which had a copy. At times my attention span can be limited, so sometimes sitting down for long periods of time to read a book can be challenging, however reading through the introduction, I was delighted to find that, despite all the chapters revolving around a similar theme, each one could be read independently. Through the first few chapters, you learn of how luck and risk are related to one another and that some people, despite having huge amount of wealth, just never have enough and are always willing to risk their fortunes to achieve that next big financial goal. That said, one man who hasn’t been stupid with his fortunes is Warren Buffett.

As Bill Ackman rightly pointed out at the investor day in February, Warren Buffett is one of the world’s best-known investors of the late 20th and 21st century. His huge success has led to over 2,000 books being written about his investment journey, but few pay attention to one of the key drivers of his success. His fortunes haven’t just been created by being a good investor, but by being a good investor since he was a young boy – in fact Warren Buffett started investing at the age of 10. At the age of 26, the same age as I am today, he had accumulated wealth of $140,000 and by his early 30s, he had earnt his first $1 million. As the years rolled on, his wealth continued to accumulate, however during his mid-40s he faced financial challenges and his net worth dropped to $19 million. From there, his resilience allowed him to recover and at 47, his net worth reached $67 million. Nine years later, aged 56, new fortune levels were reached as he

STEVEN BARTLETT

became a billionaire. Entering 2020, Mr Buffett had a net worth of $84.5 billion. These amounts are only imaginable to the average person like you and I, but surprisingly, $84.2 billion of his net worth was generated after his 50th birthday and $81.5 billion after his 65th birthday, the same age he qualified for Social Security in the US. Today at the spritely age of 93, he is the eighth richest man in the world with a net worth of $134.4 billion.

In fact, nine out of the ten Forbes real-time billionaires are over 50, with Mark Zuckerberg being the only exception and of these nine people, five are aged 70 and over. Though these huge amounts of wealth might not be created from investing alone, it does highlight that accumulating significant wealth typically requires decades of discipline and patience.

With Warren Buffett, his investment strategy has remained robust throughout his 83 years of investing: to focus on long-term investments in the stock market, building a diversified portfolio of stocks and holding onto them for extended periods, much as we do here at FIM Capital. With patience and long-term growth, it allows our clients to benefit from the powers of compounding, where earnings from an investment are re-invested to generate their own earnings, leading to exponential growth over time. This approach is summarised nicely by Warren Buffett himself in his documentary ‘Becoming Buffett’: ‘The biggest thing about making money is time. You don’t have to be particularly smart; you just have to be patient.’

THE BIGGEST THING ABOUT MAKING MONEY IS TIME. YOU DON’T HAVE TO BE PARTICULARLY SMART; YOU JUST HAVE TO BE PATIENT

“HOPING FOR THE BEST, PREPARED FOR THE WORST AND UNSURPRISED BY ANYTHING IN BETWEEN” MAYA ANGELOU

LEE PENROSE HEAD OF BUSINESS DEVELOPMENT THE FORTRESS GROUP

As the “dust” from our neighbour’s recent election starts to settle and the Island (and our government) start to consider how this affects us and the implications for the Island’s future I think there is much merit Maya Angelou’s approach.

The UK now has a Labour government with the largest parliamentary majority in 25 years (albeit with lowest voter turn-out in 20 years and a vote share of 33.8 per cent (only up 1.6% on 2019)).

A win is a win and Keir Starmer’s government now have the wherewithal, as law makers, to bring about radical political and legislative change in line with the Labour Party’s ideology.

Ironically, as seen with the last government, a large majority does not guarantee success. Though many go into politics for worthy reasons personal egos and vested interests can also, over time, cause infighting and chaos unless there is strict party discipline. Given the low vote share of this Labour Government (largely achieving power because of the split of the centre right with the emergence of the Reform Party) Keir Starmer will need to somehow temper the extreme views and agendas within his parliamentary majority and demonstrate that

it can effectively govern for all of the UK if he wants to achieve future terms in office.

Political power provides the ability to change society. Changing legislation with a majority is the relatively easy part but funding real change is more difficult and emotive. Essentially there are three options, borrowing, increasing tax revenue by growing the economy and redistributing wealth and raising funding by tax policy.

The UK economy is already heavily indebted. Liz Truss’ proposal to raise further borrowing to cut taxes without the clear means to fund it caused severe damage to the economy and confidence in the UK. This experience effectively constrains Keir Starmer’s government in this area.

Growing the economy, creates more (taxable) economic activity. However, we should make a distinction between “growing an economy” and “a growing economy”.

WHO WILL PAY? WEALTHY INDIVIDUALS, SAVERS, WEALTHY PENSIONERS, COMPANIES WITH MONEY (USUALLY SET ASIDE FOR INVESTMENT), BANKS, ENERGY COMPANIES, FINANCIAL INSTITUTIONS AND FINANCIAL CENTRES TO NAME A FEW

In the past, Keynesian theory would dictate that a government could borrow to spend on the public sector which in turn would stimulate the private sector. The overall economic growth created would then increase tax revenues. However, as already pointed out unfunded government borrowing risks crashing the economy. Governments do not have a great record in “value” investing and there is a great risk that increased (borrowed) public funding actually ends up paying for bureaucracy (see health and defence projects) and pay rises with little economic benefit.

It's about real productivity, otherwise the economy could be easily “grown” by Governments borrowing money to employ more people to just fill potholes and then creating new ones to keep employment growing! In that scenario employment would rise in the short run, and in theory so would tax take, however eventually the constantly increasing level of debt would bankrupt the economy as without real economic activity and productivity this artificial economic activity is a fiction, a “Ponzi scheme”. So, in the long run Government can only create the environment for real growth and perhaps kick start it at the right time.

A country that reflates its economy out of step with the rest of the world may create a domestic boom followed by a bust as there is no international market for its goods and services at that time. In the end the UK is in competition with the rest of the world for the investment and markets which creates long term jobs and economic growth. Creating a domestic boom is not enough if it doesn’t attract international investment and create a competitive private sector that can succeed internationally.

Of course, as the objective in this scenario is to raise tax take from economic activity then Government needs to find the “goldilocks” spot where the level of tax, and type of taxation, does not in itself stifle investment and growth. With current estimates ranging from £15bn to £50bn of tax revenue needed for the Labour Government to meet its’ ideological spending requirements – achieving a balance between stimulating growth and raising tax is not looking good over the next five years.

If growth cannot be created by borrowing and cannot be stimulated unilaterally in the long term, then what a government can control is wealth redistribution through taxation.

There is nothing quite so intoxicating than knowing you can fund your constituents’ pay rises, pensions, public spending, green policies and your social agenda and knowing that someone else will pay! Whilst most recognise the benefits of the state (health, defence, security, etc . . .) some find it hard to accept that any Government knows much better how to spend your hard earned (and taxed) savings and cash than you do!

Who will pay? Wealthy individuals, savers (though their savings have already been taxed many times over), wealthy pensioners, companies with money (usually set aside for investment), banks, energy companies, financial institutions and financial centres to name a few. Income tax, capital gains tax and IHT tax rises, thresholds frozen or reduced, reliefs (BPR, AR reduced or removed), windfall taxes, treaties changed or removed, VAT sharing arrangements revisited, all are possible but if the funding raised doesn’t provide any tangible economic growth value and/or drives away long-term investment the risk is that UK is perceived to be an unattractive location with further social and political division.

Labour can avoid this but only if it truly focuses on protecting the economy and growth first and puts the nation ahead of ideology.

Taxation tied with social engineering is emotive and open to criticism such as the politics of envy. Capitalism vs Socialism. It can set neighbour against neighbour.

Whilst a majority government has the power to indulge itself in such ways, handled badly it may not get reelected but more importantly this approach could drive away private wealth and corporate investment from the UK over the long term.

Watching the UK what should the Island and its government do?

We should hope that the UK Government will take a more reasoned approach and not give in to the extreme ideologies within the Labour Party, that they will bring in measures to protect and grow the British economy while respecting the broader views and interests of the entire population. Whilst we are independent to the UK we are affected greatly by our nearest neighbour and a successful UK benefits us all.

We should also prepare for the worst, a high taxing, socially divisive UK Government could cause an economic crash, so we should ensure our economy is robust and watch our spending (looking at value for money - Isle of Man Government take note). This is not the time for expensive vanity projects or virtue signalling. It is a time to focus on protecting our economy and independence. We succeed because we are independent and different.

It may be somewhat boring but if we continue to provide the safe, financially stable environment for which we are renowned then we will attract the investment and talent needed for a successful economy. The Isle of Man with its independent, strong and stable home rule, is a place of stability and opportunity in the British Isles especially should things go wrong, and the UK becomes less stable over the next five years. The Island is a safe and optimal place to relocate to, where you can do business and reach out to the world from. We should look internationally beyond the UK to broaden our economic base.

As we are seen to be safe harbour in the British Isles for talent and investment that may be driven from the UK we should, in extreme, be prepared for a direct political and economic threats from the UK over the term of the new parliament. Our independence both politically and economically is not something we should take for granted but needs to be constantly fought for and preserved.

In the end if we are prepared we will not be surprised by what happens in the future and we will create our own future no matter what happens across the water. The Island’s motto Jeceris Quocunque stabit, whithersoever you throw it, it will stand, sums up the position we must maintain appropriately.

‘‘

WE SHOULD ALSO PREPARE FOR THE WORST, A HIGH TAXING, SOCIALLY DIVISIVE UK GOVERNMENT COULD CAUSE AN ECONOMIC CRASH, SO WE SHOULD ENSURE OUR ECONOMY IS ROBUST AND WATCH OUR SPENDING (LOOKING AT VALUE FOR MONEY - ISLE OF MAN GOVERNMENT TAKE NOTE)

FOR GEN Z EMPLOYEES, THE CHALLENGES THEY FACE IN AN UNCERTAIN WORLD ARE UNIQUE WHEN COMPARED TO PREVIOUS GENERATIONS. FO R THOSE IN THE GEN Z GROUP – AND WORKING PEOPLE OF ALL AGES – EXPEC TATIONS, CHALLENGES AND CONCERNS NATURALLY EVOLVE AS THEY PURSUE CAREER AND PERSONAL GOALS. THAT’S WHY COMPANIES SUCH AS ZURICH ARE INVESTING MORE IN EDUCATIONAL TOOLS AND TECHNOLOGY AS ONE WAY TO HELP CURRENT AND FUTURE GENERATIONS FACE THE FUTURE WITH CONFIDENCE.

From the rising cost of living and retiring, through to concerns about the future impact of AI on their employment prospects, it’s not surprising there’s a high level of financial anxiety among the Gen Z age group.

But this isn’t only a worry for those in the Gen Z age group because it’s estimated 70% of people of all ages feel anxious about their finances. To help ease these anxieties, Zurich provides a range of financial education tools to suit everyone, no matter their age, level of knowledge or where they are on their career journey. From new starters to those nearing retirement, the tools are designed to provide useful information and guidance for all.

However, addressing the concerns of Gen Z employees is particularly important because this age group will have growing significance in the decade ahead as they become the leaders of the future. By 2025 it’s estimated that Gen Z (i.e. those born between 1995 and 2005) will account for approximately 27% of the global workforce, rising to around 31% in 2035. Right now, many in this age group fear what the decades ahead may hold for them. When it comes to career and personal finances, a common concern is how they can save now when the cost of living is so high, and what they can do to future-proof their retirement plans.

combines data and analytics with content and behavioral psychology to help people better understand and manage their money. The ZIO app is one of an expanding range of services offered as part of Zurich’s Group Personal Pension Plan and SIPP (Self-Invested Personal Pensions).

Nudge gives access to articles covering 29 areas of personal finance, ranging from budgeting and saving to retirement and pensions, plus…

• Financial education to help users identify, plan, and achieve their goals

• Unbiased insights specific to their financial world, with 30+ interests to choose from

• Bite-sized, jargon free, knowledge, tips, and tricks to help users make the best decisions, saving time, effort, and money

• Personalised nudges in the right direction whenever needed, via the users’ preferred method of communication

Nudge also complements an award-winning financial education tool, ZOGO, that’s already on the app. Stephanie added: “ZOGO is a brilliant tool which makes it easier to understand and manage personal finances. As it is gamified, it makes it feel like a fun thing to do rather than a chore, which of course helps to encourage regular, long-term, engagement.”

FOR ALL FORWARD-THINKING EMPLOYERS IT’S ESSENTIAL TO UNDERSTAND HOW FINANCIAL EDUCATION WILL HELP TO RECRUIT AND RETAIN THE BEST PEOPLE OVER THE NEXT DECADE AND BEYOND

Stephanie Hatton, Corporate Benefits Executive at Zurich on the Isle of Man, says this is why financial education is essential: “While professionals across all age groups are already highly educated and techsavvy,” she says, “many still have some degree of financial anxiety, so there’s still a need to offer more support to cut through the complexity about financial and retirement planning.”

One example of how Zurich is addressing this challenge is the introduction of Nudge to the ZIO (Zurich International Online) app, which acts like a financial ‘coach’ by helping users to take informed action to plan their future. By setting up a profile, employees get personalised guidance, timely prompts and tailored learning to help them on their financial wellbeing journey. This financial education solution

ZOGO gives access to a range of topics geared towards improving financial knowledge and skills, such as saving and spending or investing and retirement. The content is delivered in an engaging and digestible way which is tailored for a global and diverse audience. Content is being reviewed and added to all the time. Right now, it includes 800+ modules. This is one of many reasons why it is trusted by more than 250 financial institutions and has more than 1.6million users worldwide. Data from the platform shows that 95% of users feel that it boosts their financial confidence.

Summing up, Stephanie says: “For all forwardthinking employers it’s essential to understand how financial education, as part of a comprehensive employee benefits package, will help to recruit and retain the best people over the next decade and beyond.”

To find out more about a variety of other value-added services which Zurich provides for employee benefits customers in the Isle of Man and Channel Island, please go to www.zurichinternational.com/im/products

Nudge gives access to articles covering 29 areas of personal finance, ranging from budgeting and saving to retirement and pensions, plus…

Financial education to help users identify, plan, and achieve their goals

30+

Unbiased insights specific to their financial world, with 30+ interests to choose from