New era of cooperation between Isle of Man and Liv erpool

ISLEof MAN

What could Trump’s US mean for UK businesses?

Multi Cloud vs Hybrid Cloud: What’s the Difference?

How Enhanced Due Diligence is helping to tackle new threats

FIRST FOR PRESTIGE & PERFORMANCE CARS

Advance reservation online or phone 640040

In a great location opposite the airport

Sizes from 16 sq ft up to 600 sq ft

Bulk storage units and pallet racking available 24/7 access via pin code at the main door

CCTV Security

Packing materials, locks & accessories for sale

Automatic lighting in every unit

Ample loading area and parking

Undercover loading bay and freight lift

Free use of trolleys

Miami International Holdings announces offer to acquire The International Stock Exchange

Miami International Holdings, Inc. (MIH) and The International Stock Exchange Group Limited (TISE) has announced that they have reached agreement on the terms of a recommended cash offer to be made by MIH, via MIH’s wholly-owned subsidiary, MIH East Holdings, Limited (MIH East Holdings), to acquire the entire issued and to be issued ordinary share capital of TISE not already owned by MIH East Holdings (the Acquisition).

The cash consideration for the Acquisition, of £22.50 per TISE ordinary share, values the entire issued and to be issued ordinary share capital of TISE at approximately £70.4 million ($91.5 million1), representing approximately £66.4 million ($86.4 million1), net of proceeds received from the expected exercise of options subsisting under the TISE Share Plans. MIH East Holdings currently owns 29.46% of the issued ordinary share capital in TISE.

Headquartered in Guernsey, TISE provides financial markets and securities services to public and private companies. Best known as one of Europe’s major professional bond markets, at the end of 2024, TISE reported having over 4,400 securities on its Official List with a total market value of more than £750 billion ($975 billion1).

“The acquisition of TISE represents an attractive international expansion opportunity for MIH, allowing us to further execute on our strategy of operating

regulated financial markets both in the U.S. and internationally,” said Thomas P. Gallagher, Chairman and CEO of MIH. “We are committed to growing our international business and believe that investing additional resources in TISE will help expand its reach and capabilities. We look forward to working with the TISE team to develop new relationships with member firms and issuers and collaborate on opportunities for TISE’s future growth.”

TRANSFORMED FROM A LOCAL STOCK AND BOND MARKET, TODAY TISE IS AN ESTABLISHED OPERATOR OF PUBLIC MARKETS WITH AN ENLARGED PORTFOLIO OF FINANCIAL MARKETS AND SECURITIES SERVICES FOR BOTH PUBLIC AND PRIVATE COMPANIES

“This offer is a testament to the significant progress we have made in executing our strategy to grow and diversify the business, as well as an endorsement of Guernsey as a leading international finance centre. Transformed from a local stock and bond market, today TISE is an established operator of public markets with an enlarged portfolio of financial markets and securities services for both public and private companies,” said Anderson Whamond, Chair of TISE.

“The recommended cash acquisition recognises the strength of the business and enables our shareholders to realise the value of their investment. We are excited about the opportunities to collaborate with MIH to expand TISE’s offering across Europe and internationally.”

TISE’s board of directors intends to unanimously recommend the acquisition, which is intended to be effected by means of a court-sanctioned scheme of arrangement under Part VIII of the Companies Law of Guernsey. The Acquisition is subject to the approval of the requisite majority of TISE ordinary shareholders and the satisfaction of other regulatory approvals, among other conditions, further details of which are set out in the announcement released today regarding the Acquisition.

Expol celebrate 20th anniversary

More than 100 guests from across the Island’s business community celebrated Expol’s 20th anniversary.

The Douglas-based business is a leading provider of risk mitigation and forensic investigation services which covers work including compliance training, employment screening, and enhanced due diligence research. Deputy Chief Minister Jane Poole-Wilson MHK was among VIPs guests who included Expol customers, plus present employees and consultants. Over the years Expol has provided services to numerous public and private sector clients, on-Island and off-Island, including governments, regulatory bodies, representative organisations, plus businesses in the finance, gaming and legal sectors.

Expol Chief Executive Rob Kinrade thanked all the guests for helping to celebrate the company’s anniversary, especially those who had travelled from off-Island. He paid tribute to current and former members of the Expol team, including founder David Bell, researchers, investigators and directors. Last but not least, he said, thanks must go to loyal customers, many of whom were at the event. Without you, he commented, we don’t have a business. He added that support from customers, no matter how big or small, is highly valued, never taken for granted, and always appreciated.

Expol was founded in 2005 by former Detective Chief Inspector and Senior Investigating Officer, David Bell. He retired from the day to day running of the business in 2021 but still works with Expol as a consultant.

Konica Minolta awards Typhoon House Exclusive Partner status

Konica Minolta Business Solutions (UK) Ltd has recognised Isle of Man-based managed print solutions specialist, Typhoon House, as an Exclusive Partner.

As the island’s first Exclusive Partner, Typhoon House offers Konica Minolta’s multifunctional print devices, print consumables, and expert technical support to businesses across the Isle of Man and beyond.

Geoff McCann, Managing Director of Typhoon House, stated, “Having worked with Konica Minolta’s print solutions for many years, we know the welldeserved reputation for innovation, reliability, quality, and service are vital for our customers. Customer demand for Konica Minolta products makes this the perfect time for Typhoon House to become an Exclusive Partner, benefiting us and our customers in terms of technical support, training, device and consumables availability, and pricing.”

Typhoon House, launched in 1993, has a longstanding association with Konica Minolta, formally becoming a partner in 2017 and soon achieving Premium Partner status. This close cooperation has been key in gaining market share in a unique location where logistical support is critical.

Geoff added, “As a solutions provider, we focus on finding the right technology to meet our customers’ needs, an ethos closely shared with Konica Minolta. We have helped customers rationalise their print fleet for greater efficiency and operational cost savings, including a large financial institution where we achieved a 40% saving on their managed print costs.”

Cameron Mitchell, Business Leader for Indirect Channel at Konica Minolta commented, “We are proud to award Typhoon House Exclusive Partner status. Their dedication to customers is reflected in an impressive near 100% customer retention rate, and our close partnership means Typhoon House is very much an extension of our brand and values.”

Part of the global Konica Minolta Group, Konica Minolta Business Solutions (UK) Ltd empowers producers of high-volume print and communications through innovation and cutting-edge technologies, combining our global heritage and expertise to deliver our customers’ vision for a sustainable and brighter future.

Konica Minolta Business Solutions (UK) Ltd is headquartered in Basildon, Essex with 10 regional offices across the UK, employing over 750 people.

Are you considering a career in law?

Apply for DQ’s Insight Days and Summer Internship Programme now!

Our Insight Days and Summer Internship Programme provide students the opportunity to develop the skills that every advocate needs and learn more about the different work advocates do at our dynamic local law 昀rm. For more information and the application forms, please visit our website or contact internships@dq.im

www.dq.im/careers

IQ-EQ achieves STEP Partner Platinum accreditation

across Crown Dependencies

IQ-EQ has achieved the prestigious STEP Employer Partner Platinum accreditation across its businesses in the Isle of Man, Guernsey and Jersey. This recognition highlights the company’s commitment to employee development within the private wealth sector.

Awarded by the Society of Trust and Estate Practitioners (STEP), the Platinum-level accreditation of its Employer Partnership Programme demonstrates IQ-EQ’s focus on continuous learning, professional excellence and investment in its people. The company’s Jersey and Guernsey offices have held this accreditation since 2017 and 2018, respectively, and the Isle of Man office has now joined them.

To earn this status, IQ-EQ showcased a strong culture of learning and development, leadership support and ongoing commitment to STEP qualifications. Feedback from team members highlighted how this culture supports their career growth.

Simon Scott, Managing Director, Isle of Man, said: “I’m incredibly proud that our business has achieved the STEP Employer Partner Platinum accreditation. This recognition reflects our unwavering commitment to fostering a culture of excellence, where our team’s professional growth and development are prioritised.”

Championing responsible energy management in its data centres

Continent 8 Technologies, a leading provider of global managed hosting, connectivity, cloud and cybersecurity solutions to the iGaming and online sports betting industry, has achieved of the International Organisation for Standardisation (ISO) 50001:2018 Energy Management Systems (EnMS) standard.

The ISO 50001 certification is an internationally recognised benchmark for energy management. As part of the ISO 50001 certification initiative, Continent 8 is committed to implementing both short- and long-term energy management strategies, identifying energy-saving opportunities and promoting environmental sustainability across its data centre operations. Continent 8’s commitments include:

• Enhancing energy performance by optimising design and operations and investing in energy-efficient technologies.

• Complying with all relevant energy laws, regulations and other operational requirements.

• Exploring opportunities to increase the use of renewable energy sources, such as solar and wind power, to reduce reliance on fossil fuels.

• Engaging employees in company-wide energy conservation initiatives.

• Collaborating with customers, suppliers and the community to advance energy efficiency and environmental sustainability.

Two Cybersecurity events inspire UCM Students and Business Analysts

International Cybersecurity expert Mark Cross delivered two engaging and insightful talks about the ever-evolving cyber threat landscape.

The first event, which was for the Island’s Business Analysts, organised and hosted by the BA Network IOM and sponsored by Utmost International Isle of Man, saw Mark deliver a presentation on ‘The Fishtank that Owned a Casino’, an indepth, real-world case study that highlighted vulnerabilities in cybersecurity and their impact on businesses.

As part of the sponsorship, Mark then kindly delivered an exclusive session for UCM’s Cybersecurity degree students the following day, offering them firsthand insights into current industry challenges and trends. His visit provided students with a unique opportunity to gain real-world cybersecurity knowledge from a leading expert in the field.

UCM’s Principal, Jesamine Kelly, said: "Mark is a globally recognised expert, with over 25 years of international experience in business analysis and

cybersecurity; having an industry expert of his calibre speak directly to our students was such a fantastic opportunity for our students. His insights into real-world cybersecurity challenges and evolving threats provided our students with a deeper understanding of how their studies apply in practice.

Ben Callow from Utmost International added: ". Not only is supporting education and skills development in cybersecurity essential for the future of our industry, but facilitating the growth of Business Analysts across the Island also plays a vital role in strengthening our business community. Bringing Mark to the island was an easy decision, and we were pleased to be part of it

Bronia Anderson-Kelly, Founder of the BA Network IOM, added: “When I heard Mark speak at a conference a couple of years ago, I was eager to bring him to the Island to present to the Business Analysis community. The BA industry on the Island is really strong, and events like this go to show how important our role within an organisation is.”

PDMS joins forces with Oceans HQ

Volaris Group (Volaris) has announced the acquisition of Oceans HQ, the leading provider of SaaS solutions for international ship registries. As a result, Oceans HQ is now operating as part of PDMS, which combines their ship registry solutions into a unified maritime service offering.

Headquartered in the UK, Oceans HQ has been working with maritime administrations for over 10 years serving customers including Gibraltar Maritime Administration, San Marino Ship Register, and the Swiss Maritime Navigation Office. Their full suite of software products (OHQ Cloud) has been designed to support the daily operations of maritime registries from vessel registration and survey and inspections through to seafarer certification.

PDMS has been serving the maritime sector for over 20 years with their MARIS solution, which already serves several leading ship registry clients including the Bahamas Maritime Authority, Bermuda Shipping and Maritime Authority, and Isle of Man Ship Registry. With

this acquisition, PDMS is further expanding its global footprint in the ship registry and seafarer management market.

Catriona Watt, CEO of PDMS, stated: “We are delighted to join forces with the team at Oceans HQ, combining our extensive domain experience and technical expertise to advance our mission of leading digital transformation for ship registries.

“Oceans HQ’s in-depth knowledge of the ship registry sector perfectly enhances our own capabilities, positioning us to deliver unparalleled innovative solutions.”

Through the acquisition, PDMS and Oceans HQ are set to continue developing digital solutions to help ship registries and maritime regulators worldwide, to improve the services provided to ship owners, managers and seafarers. With MARIS, OHQ Cloud and PDMS' wider digital and data services, PDMS can now support ship registries of all sizes and scales to help them streamline their maritime administration.

CHAMPION HOUSE SUITE TO LET

A modern office suite in a great Isle of Man location

A modern Office Suite is now available at our prestigious Champion House offices in Tromode, Douglas.

Situated in an established business park, in landscaped grounds adjacent to the Millennium Wood, the modern building is accessible within 20 minutes by car from Castletown, Peel and Ramsey. Avoid the morning queues and traffic lights into central Douglas, and add an hour or two each week to leisure time in our beautiful island!

1,504 sq ft (140m2)

| Beam vacuum system From

| Extensive car park spaces available

| Gents, ladies and disabled WCs

| Landscaped gardens on three sides

| Outdoor seating areas

| Otis lift

| Kitchens, breakout rooms

| Fibre connections with MT and Sure

| Extensive network cabling, door access control systems

| Double-glazed, 3-phase electricity

| Oil fired heating, fresh air ventilation system on first floor

| E-bike park with charging

PORTFOLIO

GOVERNMENT

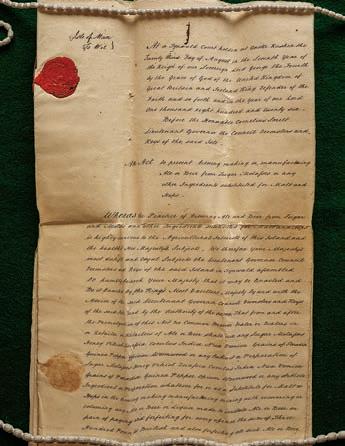

New era of cooperation between Island and Liverpool region to boost growth

A landmark agreement between Liverpool City Region and the Isle of Man has been signed signalling an era of increased cooperation between the regions.

The joint commitment pledges that the Isle of Man and Liverpool City Region will improve the prosperity and wellbeing of their communities ‘through further strengthening our economic, cultural, and political ties’.

Relationships between the Isle of Man and Liverpool have historically been strong, and further amplified by the opening of the new Isle of Man ferry terminal in Liverpool last year - the construction phase of which generated £3.2 million for the regional economy.

Today’s Memorandum of Understanding between the Isle of Man Government, Liverpool City Council, and Liverpool City Region Combined Authority, is a major step forward in forging new opportunities for growth and development in areas including:

• Economic opportunities

• Tourism and cultural cooperation

• Transport connections

• Health and public services

• Infrastructure, energy and net zero

Isle of Man Chief Minister, Alfred Cannan said the agreement would help usher in a new era of opportunity.

He said: “The Isle of Man and Liverpool have deep and historic ties of mutual cooperation. I am delighted to sign this Memorandum of Understanding with our neighbours across the Irish Sea to forge new opportunities for growth and collaboration between our two regions.

“Our investment in the new ferry terminal in the city is our biggest single investment in the UK, ever, and has been a catalyst for these discussions. The significance of us signing the agreement in the new ferry terminal should not be lost, it is a clear commitment to how important the connection between the two regions is.

“The Isle of Man and Liverpool have been connected via the Isle of Man Steam Packet Company – the oldest continuously running ferry company in the world - which has seen the continuous movement of people, goods and ideas across the Irish Sea - for business, education, sport, tourism or visiting family and friends -– for two centuries.

“The signing of this MoU is a clear statement from both administrations that forging closer economic ties is a strategic priority and one which offers mutual benefits.”But the opportunities for both regions go beyond the economic benefits of business collaboration and the opportunity for the wider sharing and cooperation on public services will have positive impacts for our communities.

“I look forward to continuing to work closely with colleagues to realise the potential that this exciting partnership will offer.’

Mayor of the Liverpool City Region Steve Rotheram, said: “From being a go-to tourist destination favoured by Liverpudlians for decades, the Isle of Man has always been a highly valued neighbour to our region, and this agreement is a reflection of our commitment to strengthening that bond.

“For centuries, our people have been connected through travel, trade, and shared culture, and today we are taking that relationship to the next level.

“This MoU marks the beginning of a new era of cooperation, one that will unlock new opportunities for economic growth, skills development, and sustainable innovation. By working more closely together, we can create a more dynamic and prosperous future for our businesses, our communities, and our residents.”

Leader of Liverpool City Council, Cllr Liam Robinson, said: “Many people from the Liverpool City Region have long, fond associations with the Isle of Man dating back generations.

“It makes sense for us to forge closer ties with one of our nearest neighbours, exploring opportunities for collaboration and mutually beneficial associations.

“By signing this MoU, we are opening the door to greater innovation, technology exchange, and investment opportunities.”

As a global leader in finance the Isle of Man serves as an effective gateway to the UK market, particularly for sectors such as life insurance and businesses operating within the European Economic Area (EEA).

The Island Plan has ambitions to double GDP and create thousands of new jobs, and sits alongside a 10-year tourism strategy which aims to attract 500,000 visitors per year by 2032.

This agreement comes after the Isle of Man Department for Enterprise became a strategic partner of the Liverpool Chamber of Commerce last year, aiming to foster trade opportunities between Isle of Man businesses and the 600 members of the Liverpool Chamber.

There are approximately 24,800 businesses on the Island with strong links into the UK. They provide reciprocal benefit to UK companies through supply chains and collaborative working, with total trade in goods and services between the UK and Isle of Man around £2 billion a year.

The MOU will include an annual conference between partners, alternating between the Isle of Man and Liverpool as hosts, and will be reviewed regularly and ‘expanded where possible’ to further enhance cooperation.

Changes to the Companies Act 2006: New director notification requirements

The Isle of Man Companies Act 2006 has undergone changes that took effect from 1 April 2025. Under these new provisions, the first appointment of directors, or any subsequent changes to the register of directors, must be notified to the Registrar of Companies within one month.

Additionally, any previous appointments that have not yet been notified to the Registrar must be submitted by 1 May 2025.

These changes will streamline the annual return filing process under the 2006 Act, as director information will no longer be updated via the annual return (with a new annual return form to be introduced from 1 May 2025), enabling a significant increase in online filing potential.

Currently, more than 40% of annual returns for companies operating under the Companies Act 1931 are filed online, and this update will enable companies operating under the 2006 Act to take similar advantage of the availability of online processes.

Implementation for existing companies

The Companies Act 2006 is well established, and to facilitate a smooth transition to these new requirements, the Central Registry will not introduce a new form.

Instead, all 2006 Act companies that have not already elected to file their register of directors (IMRD) must submit a copy of their register before 1 May 2025.

Any subsequent changes to the register must be reported to the Registrar within one month of the change using Form IM12 – Notice of Change in Register of Directors

Freedom of Information - views sought on potential changes

Public views are being sought on proposals which may help public authorities manage the growing number of often complex Freedom of Information (FOI) requests.

FOI requests allow individuals to ask public authorities for access to information held by them, free of charge, promoting transparency and accountability. Some requests can require significant resources to process.

The Council of Ministers has today (Monday 17 March) launched a consultation outlining potential changes to the process, which are the introduction of fees and cost limits. The consultation is intended to seek views on these proposals which aim to strike a balance between the right to access information, cost-effective administration, and value for taxpayers.

Since 2018, the number of FOI requests received by the Isle of Man Government has increased by around 17% year on year, putting increasing demands on Departments Boards and Offices.

In 2024 a total of 982 requests were received by Isle of Man Government. Notably, the majority came from a small group of individuals, with 7% of requesters responsible for nearly half of the requests. In total, officers spent 5,300 hours working on responses - nearly 700 workdays - at a cost of £180,000.

Last year the overall number of FOI requests decreased, with a drop in requests that took less than an hour to complete. However, those that took between 1-18 hours have increased, particularly those that took more than 18 hours to process.

More than half of the total requests were resolved in seven hours or less at a cost of £66,000. Nearly 50 cases (5%) took longer than 18 hours and cost £43,000. Almost 20% (197) took between seven and 18 hours to process while 18% (172) were managed in less than an hour.

Minister for the Cabinet Office, David Ashford MHK, said: “Council recognises and supports the right of all Isle of Man residents to request information from public authorities, which is why we want people from all across the Island to share their views.

“We want to ensure any future changes align with the spirit of the Freedom of Information Act. Any changes must strike a balance between people’s right to access information, cost-effective administration, and value for taxpayers.”

Feedback is also invited on what constitutes a reasonable fee, discretion to waive or reduce fees, and the reasonable number of requests an individual can make in a calendar year. The results will be used to inform future policy options for the Council of Ministers to consider.

The consultation can be completed at www.consult.gov.im and closes on 9 May.

The register of directors must include all information required under section 101 of the Act, including:

• The names and business or residential addresses of all directors;

• The date of appointment of each director;

• The date on which any director ceased to hold office.

• The new requirements provide no exemption nor exclusion for 2006 Act companies that are already in the dissolution or winding up process. It applies to all 2006 Act companies that are live on the register.

Requirements for companies incorporated after 1 April 2025

Companies incorporated under the 2006 Act after 1 April 2025 will be required to submit their register of directors within one month of the appointment of their first directors.

Any subsequent changes to the register must be reported to the Registrar within one month of the change using Form IM12 – Notice of Change in Register of Directors.

Form IM13 - Notice of Ceasing to File a Copy of Register of Directors will no longer be accepted after 1 April 2025 and will be removed from the Registry’s list of available forms.

Further improvements to online services available through the Central Registry are planned as part of efforts to digitise processes for customers, and in line with the Isle of Man Government efficiencies programme.

Strengthening defences against evolving threats from Southeast Asia

Online gaming and gambling platforms are the centre point of an increasingly complex and sophisticated criminal landscape in East and Southeast Asia. That landscape has extended outside of East and Southeast Asia, impacting countries worldwide and there has become a need for increasing vigilance when conducting business linked to this region.

Given the Isle of Man’s well-established financial, non-financial and online gambling sectors which are globally attractive for customers, coupled with the geographical and constitutional links to the UK, the Island is attractive for exploitation by these transnational organised crime groups. This is a risk for international finance centres globally as a result of the international reach of their nature of business.

As with many sectors that have an international focus, there is a constantly changing threat landscape which may increase the risk of exploitation. Actions taken by Isle of Man authorities, which have been the subject of media attention, have clearly indicated that the Isle of Man has been subject to attacks by criminals to bypass the Island’s controls against financial crime and immigration. Law enforcement actions cannot be subject to further comment.

The Isle of Man Government is committed to international anti-money laundering and countering terrorist and proliferation financing (AML/CFT/CPF) efforts as evidenced by the Island’s Financial Crime Strategy 2024-2026 which outlines the allIsland approach to tackling financial crime.

The Isle of Man Gambling Supervision Commission (GSC), which supervises the egaming sector is reviewing and strengthening its framework and practices in market licencing, supervision and enforcement. This complements further investment by the GSC of a dedicated and fully resourced unit with experienced staff in AML/CTF/CPF. The GSC have an enhanced programme of monitoring underway and continue to share information with agencies where they identify concerns. Alongside this, new licence applications will be subject to additional scrutiny whilst the framework and practices are under review and more information concerning the national risk appetite for new gaming licences with links to South and Southeast Asia will be published soon. Equally, to assist industry in the Island’s shared endeavour to remain vigilant against these threats, the authorities will publish further information concerning the types of risks and typologies being used in the near future.

More broadly, work is underway to produce an updated National Risk Assessment (NRA). This builds on previous NRAs completed in 2015 and 2020 and is a key tool in identifying, assessing, and understanding the money laundering and terrorist financing risks facing the Isle of Man. In order to mitigate the risks identified as part of the NRA, a National Action Plan will be developed, published and actions advanced which aim to continually strengthen the Island’s approach to financial crime.

Visiting House of Lords member says “Commonwealth never been more important”

Dame Meg Hillier MP, the Labour MP for Hackney South and Shoreditch, was speaking ahead of the Tynwald Commonwealth Day dinner on Friday 14 March, at which she was guest speaker.

She said that at a time of geopolitical uncertainty “the Commonwealth family was a strength on which to draw and from which to learn’, and she called for the organisation to be ‘robustly supported.”

Dame Meg has served as an MP continually since May 2005 and her political career has been distinguished by her roles in financial oversight. From 2015-2024 she was chair of the public accounts committee and is now chair of the Treasury select committee, the body that examines the expenditure, administration and policy of HM Treasury, HM Revenue & Customs, and associated public bodies, including the Bank of England and the Financial Conduct Authority. She also chairs

the liaison committee, which is comprised of all select committee chairs and considers the overall work of select committees, promotes effective scrutiny of government, and questions the prime minister. She explained: ‘The committee currently has the opportunity to question the prime minister three times a year, but we’re looking to extend that to four.

“As chair of the Treasury select committee I have been blessed to have been able to build a diverse and strong team of members who bring different perspectives to our work, which is to ensure value for money in matters of government spending. As well as looking retrospectively and drawing on those findings, we’re working in “real time”, trying to catch things as they happen and avoid waste and inefficiency.”

Of her role as liaison committee chair she said: “There are 31 select committees with members able to ‘guest’ on other committees. This is really helpful as it means we can spread expertise around.

“I believe that parliamentarians should always remember whom they serve - the people. In these difficult economic times, when public services are being cut back and many households are facing financial hardship, it’s important that we recognise what matters to people. In our financial oversight role, we’re the conduit between the people and government. We serve as the ‘voice’ of the public.”

A firm believer in ‘knocking on people’s doors and hearing what constituents have to say’ she said: “Hackney South and Shoreditch is a very diverse community - it’s right on the edge of the City of London - where people speak to me with no filter, which is great.”

Turning to the Commonwealth she said: “The Commonwealth is a huge asset and, for those parliamentarians who sit on public accounts committees, the Commonwealth Association of Public Accounts Committees (CAPAC) provides a vital international network for sharing information and learning from each other. Very often it’s less about what is value for money, rather it’s about how do we go about achieving value for money? To be able to share that kind of workload across the organisation is invaluable. In short, the connections and alliances the Commonwealth creates are enormously powerful.”

In 2024 the Speaker of the House of Keys, Juan Watterson SHK, was appointed CAPAC chair. Speaking before the event he said: “It’s a great honour to follow such illustrious company as Dame Meg. The Isle of Man can be rightly proud of the role we have played over many years in supporting and developing the Commonwealth family.

“Meg’s insights on scrutiny of public finances, as well as British politics, will doubtless be as enjoyable as they are informative.”

Chief Minister holds discussions with UK Security Minister

Chief Minister Alfred Cannan

met with the UK Security Minister Dan Jarvis MP last month at the Home Office along with representatives from Guernsey and Jersey.

Discussions covered a number of areas, including progress on access to beneficial ownership by those with a legitimate interest, tackling illicit finance, and co-operation between the Isle of Man and the United Kingdom on law enforcement.

The Chief Minister said: “I welcomed today’s constructive discussions, particularly the opportunity to emphasise the Isle of Man’s ongoing and unwavering commitment to supporting law enforcement agencies with access to information on the ultimate beneficial owners of any companies and entities registered in the Isle of Man.

“This co-operation has been in place since 2016 and is working extremely well, with the Island’s Financial Intelligence Unit providing information to UK law enforcement agencies in as little as an hour.”

The Chief Minister continued: “On the point of making beneficial ownership data publicly available, the Isle of Man - alongside Guernsey and Jersey - continues to monitor developments and explore this policy area. However, the Crown dependencies remain concerned that such a policy could lead to a legal challenge. This follows a ruling by the Court of Justice of the European Union in November 2022 that open access to beneficial ownership would be incompatible with the European Convention on Human Rights around respect for a private life.

“We have again emphasised the importance and need for international standards in this area to provide clarity and to ensure a level playing field for all jurisdictions.”

The Chief Minister added: “Despite this significant hurdle, our talks were positive. I was able to update the Minister on the Isle of Man fulfilling its commitment to provide beneficial ownership information to entities obliged to conduct due diligence checks. This was implemented in December 2024, fully in line with our commitment to do so.

ALFRED CANNAN MHK; DAN JARVIS MP, UK MINISTER OF STATE FOR SECURITY; DEPUTY LYNDON TROTT, CHIEF MINISTER OF GUERNSEY; DEPUTY IAN GORST, MINISTER FOR EXTERNAL RELATIONS IN JERSEY

“I was also able to reassure the Minister that the Island can progress access for legitimate entities relatively swiftly, but with the European Union only now developing its definitions in this area, we will need to closely monitor developments and ensure alignment with EU standards.”

The Chief Minister concluded: “We will continue to work closely and positively with our partners in the UK, Guernsey and Jersey on these matters and I look forward to continuing our dialogue.”

FEATURES PORTFOLIO

DAVID KNEESHAW TO RETIRE AS IFGL CEO

DAVID KNEESHAW IS TO STEP DOWN AS IFGL’S CEO AT THE END OF APRIL 2025, AFTER 21 YEARS IN THE ROLE. WHILE DA VID WILL BE RETIRING FROM FULL-TIME WORK, HE WILL STAY ON AS A SPECIAL ADVISER TO THE IF GL BOARD AND, SUBJECT TO REGULATORY APPROVAL, WILL ALSO BE THE CHAIRMAN OF IF GL’S BUSINESS IN THE DIFC IN THE UAE.

David’s successor as CEO has already been appointed and the details will be announced in April. The new CEO will take the reins from 1 May 2025.

IFGL employs more than 520 staff across its two offices in Douglas and Castletown and is perhaps best known locally for its RL360, Friends Provident International and Ardan International brands.

“The Isle of Man is IFGL’s home,” said David. “We have always been proud to be based here and to be one of the island’s largest employers.”

David became CEO of what was then Scottish Life International in 2004 and together with Sales Director Simon Pack and Managing Director Mike Crellin devised and implemented a strategy to grow the business organically, by opening up new markets and through Merger and Acquisition (M&A). These guiding principles still remain at the very heart of IFGL’s strategy.

David led IFGL through a management-led buyout from Royal London in 2013, and the acquisitions of Scottish Provident International, Clerical Medical International, Ardan International, Friends Provident International and Sovereign Pension Services. In 2023 David guided IFGL through the process of Cinven becoming IFGL’s majority shareholder. He is regarded as one of the industry’s most well- known figures and is a regular contributor to industry events.

“It was always my intention to step down once the dust had settled after the Cinven investment,” said David. “I’m now 68 and I don’t intend to still be CEO in 4 or 5 years. It’s the right time for a new CEO to take the business forward.”

News of David’s successor, who will be an external appointment from outside IFGL, will be announced in April. “I am convinced my successor is an exceptional leader,” says David, who was involved in the recruitment process. “He has experience in The City and a good understanding of the adviser and international markets.”

Looking back on his 21 years at IFGL, David added: “The past 21 years have been the most extraordinary and momentous period of my working life. We have built a business that is 20 times the size it was in 2004. We are now a business of 7 different principal brands.

“Despite the growth we’ve stuck to the very important principles that have always been the core building blocks of our success. I’ve always believed that if you provide great products, great service and forge strong relationships with advisers, regulators and other stakeholders then good things will follow.

“Private equity backing has helped us to be dynamic

DAVID

KNEESHAW

and fleet of foot and has provided the financial backing to help us achieve our M&A successes.

“The future looks very positive for IFGL. Sales are robust, we’ve maintained our strong adviser relationships and we are making a huge investment in our technology infrastructure that is well underway. We have owners who share our ambitions for further M&A as and when attractive opportunities become available.”

David is looking forward to having more time with his family in retirement and “spending more time doing the things I enjoy, such as skiing, golf and cycling. There are some other, smaller projects that I’ve been asked to be involved in, that I will look at over the Summer. But I am definitely retiring! And I’m delighted that I will still have some involvement with IFGL and will help in whatever way is needed.”

He’s also in training to tackle the famous Isle of Man Parish Walk in June, with the target of walking the 32.5 miles to Peel.

“What we have built at IFGL is very special,” added David. “Hundreds of people have helped along the way, but I want to say a special thank you to Mike Crellin and Simon Pack, who’ve been with me every step of the way. Without them what has been achieved would not have been possible.”

‘‘

THE PAST 21 YEARS HAVE BEEN THE MOST EXTRAORDINARY AND MOMENTOUS PERIOD OF MY WORKING LIFE. WE HAVE BUILT A BUSINESS THAT IS 20 TIMES THE SIZE IT WAS IN 2004. WE ARE NOW A BUSINESS OF 7 DIFFERENT PRINCIPAL BRANDS

THE ISLE OF MAN: A GATEWAY, A BUSINESS BASE, A SAFE PLACE, A HOME

BY LEE PENROSE HEAD OF BUSINESS

Over the last few years there has been a series of elections and political changes around the world. In the past such changes brought about policy changes that took months and often years to take effect whilst the economies of the world continued to be affected by the prevailing economic conditions and cycles.

‘‘

SOME LEAVING THE UK HAVE GONE TO THE SUN IN DUBAI OR THE FAR EAST BUT, WHILST THESE AREAS ARE ATTRACTIVE, IN MANY WAYS THEY TOO ARE ALSO AFFECTED BY GEOPOLITICS INVOLVING THESE REGIONS

Increasingly, for many, there has seemed to be little real change between elections and with the political elite in many countries appearing ineffectual and disconnected from the view of sections of the electorate. This in turn has led to increased support for parties that are willing to make radical changes aligned with such increasingly polarised views. As a result, the world seems to have become angrier, and the pace of change has moved from being cyclical over years and months, to now being almost daily.

Last year the new United Kingdom government started to implement many of the political changes covered in their election manifesto and has been criticised in some quarters for driving investment and entrepreneurs from the UK, but even these policies now

seem to have been overtaken by events forcing changes to the UK Government’s approach and fiscal strategy.

The US election has brought in a President and administration which seems more than willing to take any measure and change any arrangement no matter how disruptive to meet the political objectives of the President’s supporters.

The UK and the rest of the world are now dealing with emerging tariff wars, and a frenetic political and military realignment with changing alliances. Geopolitics has become more focused with, for example, conflicts in the Middle East, Russia and Ukraine, issues in the South China Sea and with challenges to sovereignty and competition for scarce resources in strategic areas involving Africa, Antarctica, South America (Panama), Taiwan and Greenland.

If you are worried for your family, business and wealth, where can you go to get far from this madding crowd?

Some leaving the UK have gone to the sun in Dubai or the Far East but as mentioned whilst these areas are

WHAT DID THOMAS HARDY MEAN BY THE USE OF THE WORD “MADDING” IN “FAR FROM THE MADDING CROWD”? ACCORDING TO THE DICTIONARY THE SLANG WORD “MADDING” MEANS “BEHAVING IN A WILD AND CRAZY WAY, ESPECIALLY IN A WAY THAT MAKES PEOPLE ANGRY” –IN THIS WAY “MADDING” MEANS FRENZIED. SO BEING “FAR FROM THE MADDING CROWD” INVOLVES FINDING A PLACE OF PEACEFULNESS, QUIET AND SAFETY AWAY FROM THE FRENZY OF THE WORLD.

attractive in many ways they too are also affected by geopolitics involving these regions.

When considering relocating to these areas it is worth considering setting up asset holding structures in a stable and favourable area like the Isle of Man beforehand as a safeguard to regional uncertainty – rather than placing all one’s eggs in one basket with a relocation!

‘‘

FOR INTERNATIONAL CLIENTS, THE ISLAND CAN ALSO BE AN OPTIMAL GATEWAY FOR FAMILIES AND FIRMS LOOKING TO INVEST INTO THE UK AND WITH OUR FAVOURABLE REGIME, SPACE, SKILLED WORKFORCE AND ACCESSIBILITY

On a similar basis wealthy families and individuals based in areas of regional uncertainty are also considering the Island for holding structures to provide some geographic risk diversification away from their core activities – a form of wealth insurance policy for uncertain times.

With over 1000 years of self-rule and being geographically part of the British Isles but not part of the United Kingdom the Island offers a unique a stable alternative location for asset holding and risk diversification.

For international clients, the Island can also be an optimal gateway for families and firms looking to invest into the UK and with our favourable regime, space,

skilled workforce and accessibility, the Island is the ideal area to base a business and physically operate from within the British Isles.

The Island is a unique place to live and work, especially for those with family or business connections in the British Isles. We have a mature and stable political system, and we are a globally connected international financial centre offering range of sophisticated services for those looking to protect their wealth or considering relocating their business or establishing a new operation on the Isle of Man. With our expert local knowledge The Fortress Group can help you and/or your business when considering the island for your relocation and structuring options.

The Island is a special place to live, indeed it is the only entire nation UNESCO biosphere and is an attractive safe place - far from the madding crowd in these turbulent times!

WHAT COULD TRUMP’S US MEAN FOR UK BUSINESSES?

BY DOUGLAS GRANT, MANAGING DIRECTOR, MANX FINANCIAL GROUP

HOWEVER, IF THE UK FACES HIGHER TARIFFS, IT COULD ALIGN MORE WITH OTHER AFFECTED NATIONS, FOSTERING INCREASED TRADE OUTSIDE THE US AND CHINA. THIS SHIFT COULD BE BENEFICIAL FOR UK SMES BY OPENING NEW MARKETS AND TRADING PARTNERSHIPS

Under a second Trump presidency, UK small and medium-sized enterprises (SMEs) are tackling shifts in global economic policies. “Trumponomics”, defined by protectionist trade policies, deregulation, and assertive geopolitical stances, could significantly impact the business landscape for UK companies.

Navigating an already complex post-Brexit economy, UK SMEs must be ready to adapt to changes ranging from trade barriers and currency fluctuations to investment opportunities and supply chain adjustments. Here’s how the challenges and opportunities could present themselves under a resurgence of Trump’s economic agenda for UK SMEs.

1. Trade barriers and tariffs vs. strengthened UK-US trading relations

Trump’s ‘America First’ policy prioritises domestic manufacturing and economic growth, which could lead to heightened tariffs and protectionist measures. For UK SMEs exporting to the US, this could increase costs and regulatory challenges, impacting competitiveness. Any renegotiation of trade agreements may create uncertainty for firms reliant on US partnerships. However, if the UK faces higher tariffs, it could align more with other affected nations, fostering increased trade outside the US and China. This shift could be beneficial for UK SMEs by opening new markets and trading partnerships. To capitalise on these opportunities, SMEs should monitor trade negotiations, remain flexible in market strategies, and be mindful of currency movements and regulatory changes.

2. Regulatory changes and market volatility vs. favourable tax policies

Trump’s history of deregulation could increase domestic competition in the US, complicating market entry for UK businesses. Additionally, his unpredictable policymaking might cause market volatility, influencing exchange rates and investor confidence. UK SMEs should prepare for sudden shifts in market dynamics that could disrupt financial planning and investment strategies. On the positive side, Trump’s commitment to reducing corporate taxes and deregulation could benefit UK firms with US operations by lowering costs and easing market entry barriers. SMEs should stay informed about potential tax reforms and adjust their financial strategies accordingly.

3. Currency fluctuations and cost implications vs. M&A opportunities

If US economic policies strengthen the dollar, UK businesses may face higher import costs, affecting supply chains and profitability. Although a stronger dollar could boost UK exports, this advantage might be offset by increased trade barriers. SMEs should implement currency hedging strategies to manage exchange rate risks. Conversely, if new trading blocs

emerge due to US protectionism, currency dynamics could stabilise within these groups. This could reduce currency volatility and provide a more predictable trading environment. UK SMEs should monitor currency movements in these markets and explore new partnerships or acquisitions to capitalise on increased trade flows.

4. Geopolitical uncertainty vs. supply chain opportunities

A return to Trump’s assertive foreign policy could heighten geopolitical tensions, especially with China and the EU, potentially disrupting global supply chains. Additionally, changes in NATO dynamics and global alliances could impact UK firms operating in multiple regions. However, escalating US-China tensions might prompt American companies to diversify supply chains, creating opportunities for UK suppliers. SMEs with competitive pricing and reliable alternatives could benefit from increased demand. To seize these opportunities, businesses should build agile supply chain networks and invest in logistics infrastructure.

5. Tighter US immigration policies vs. increased UK services demand

Stricter US immigration policies could limit UK businesses' expansion in the US or hinder talent mobility. SMEs with international growth ambitions should explore alternative markets or remote working solutions to maintain access to global talent. Nevertheless, if the US economy grows under Trump’s economic agenda, demand for international services, especially financial, legal, and tech solutions, could rise. UK firms specialising in these areas may benefit from this demand as US companies expand globally. Scaling digital and consulting services could be a strategic move for UK SMEs.

Looking

ahead

While Trumponomics poses challenges, it also presents opportunities for adaptable and innovative UK SMEs. A shift towards increased trade among nations affected by US protectionism could benefit UK businesses, particularly within Europe. This would require awareness of currency movements, potential deregulation, and changes in labour mobility. By strategically navigating trade barriers, leveraging investment opportunities, and enhancing supply chain resilience, SMEs can position themselves for growth. Digital transformation and agile business models will be crucial for thriving in an evolving global economy.

To succeed, UK SMEs must engage in proactive planning, maintain strategic foresight, and embrace emerging opportunities. Although the future may be uncertain, the right strategies can help UK businesses not only withstand challenges but also emerge stronger and more competitive on the global stage.

MULTI CLOUD vs HYBRID CLOUD: WHAT’S THE DIFFERENCE?

AT SURE BUSINESS, MATCHING THE RIGHT RELIABLE CLOUD SOLUTIONS TO OUR CUSTOMERS' NEEDS IS ONE OF THE THINGS WE DO BEST. MULTI CLOUD AND HYBRID CLOUD MODELS BOTH OFFER FLEXIBILITY AND INCREASED CONTROL, HOWEVER THERE ARE DISTINCT DIFFERENCES THAT WILL INFORM WHICH OPTION IS MOST SUITABLE FOR YOUR BUSINESS. WE ASKED SENIOR CL OUD SERVICES INFRASTRUCTURE ENGINEER CHRIS NAISBITT TO SIMPLIFY THESE CLOUD COMPUTING SOLUTIONS, HOW THEY WORK, AND THE TYPES OF BUSINESSES THAT THEY BENEFIT THE MOST.

WHAT IS MULTI CLOUD?

STORING YOUR DATA LOCALLY WILL ALSO GIVE YOU PEACE OF MIND THAT ALL REGULATORY REQUIREMENTS ARE BEING ADHERED TO, AS SOME TYPES OF DATA STORED IN LOCAL INFRASTRUCTURE ARE SUBJECT TO MEET STRICT COMPLIANCE REQUIREMENTS

This refers to the use of multiple public Cloud providers which host environments that can include infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS) and software-as-a-service (SaaS) offerings, from vendors such as Microsoft Azure or Sure. This model gives businesses the advantage of protecting themselves from downtime when an incident occurs, by carefully designing their systems to seamlessly failover to applications hosted by other providers. For businesses that have critical requirements, this can mean the difference between a minor problem or suffering potential reputational damage and costly downtime.

Multi Cloud environments can be easily tailored to improve operational capabilities and help mitigate the chance of becoming dependent on one provider and therefore removing any single point of failure.

WHAT IS HYBRID CLOUD?

Hybrid Cloud is a combination of private and public Cloud environments. Businesses using this strategy can keep some of their data and applications on-premises while also using public Cloud services from a provider simultaneously.

The advantage of this solution is that you can easily migrate and manage workloads between environments and isolate critical workloads in private Clouds, while less-sensitive information can be stored in public Clouds.

A Hybrid Cloud strategy is also optimal for businesses that have tighter budget constraints. In-

house solutions allow IT teams to use fewer resources, as private Cloud can be tailored to enable users to work faster and be more productive. They work by offloading non-critical or short-term requirements to Cloud services as needed and are perfectly suited to predictable workloads.

It is also very easy to scale a Hybrid Cloud model to optimise performance in periods of high demand, meaning you won’t need to invest in expanding your capacity during this time.

Storing your data locally will also give you peace of mind that all regulatory requirements are being adhered to, as some types of data stored in local infrastructure are subject to meet strict compliance requirements.

WHICH IS RIGHT FOR YOU?

Multi Cloud and Hybrid Cloud solutions each have their benefits; choosing the right strategy for your organisation really depends on your business’ unique needs.

If you need more resilience, the more-complex structure of Multi Cloud solutions minimise the risk of a single point of failure and therefore enhances protection against potential cyber threats - you can also choose security features from various providers, creating a comprehensive strategy that suits you.

If you require tight security, Hybrid Cloud keeps your sensitive data on-premises, and all information remains in your infrastructure and cannot be accessed by any third parties. This allows for increased control over sensitive data, a solution appealing to industries such as finance or healthcare, which are more likely to have strict compliance requirements and require easy access to their data.

Whether you need resilience and flexibility or control and compliance, we have a solution to fit your business.

If you would like to find out more about which one is right for you, speak to our expect team at business.sure.com/contact

175 YEARS OF PURE PERFECTION

IT’S A LANDMARK YEAR FOR OKELL’S BREWER Y AS IT CELEBRATES THE 175TH ANNIVERSARY OF ITS F OUNDER DR WILLIAM OKELL (LEFT) STARTING HIS BREWING OPERATIONS IN THE ISLE OF MAN.

THE MANX BREWERS ACT, WHICH SET OUT THE RULES THAT BEER IN THE ISLE OF MAN SHOULD BE MADE ONLY OF HOPS, MALT, SUGAR AND WATER, ENSURING THAT, FROM THE START, OKELL’S ALES WERE “OF THE PUREST QUALITY.”

As befits such an occasion, the anniversary is being commemorated with a number of special events, including a new limited-edition anniversary Smoked Porter beer (see side panel).

Celebrations have already begun with the official opening in March by Lieutenant Governor Sir John Lorimer of a new state-of-the-art canning line at the brewery’s Kewaigue headquarters and a special oneday offer of a pint for £1.75 in Okell’s Inns.

Okell’s Managing Director Ollie Neale said, “A 175th anniversary is a significant milestone in the history of any business and we are delighted that we have so much to celebrate in 2025.

“Our founder, Dr Okell, was clear from the beginning that his beers should be high quality products. Generations of master brewers have followed in his footsteps to ensure Manx drinkers – and those further afield – should enjoy Okell’s beers that use both the best ingredients and brewing techniques.

“Not only are we still producing outstanding Bitters and Pale Ales to the exacting demands of the Manx Brewers Act, just as Dr Okell did, but we are continuing to invest in technology to improve our efficiency and ensure our operations are as sustainable as possible.

“Our new canning line, for example, allows us to can our brews here on the Island and to make that facility available to others. Capable of producing 1500 canned drinks per hour, in a number of different sizes, the facility can be used for cider, seltzers and soft drinks as well as Okell’s trademark range of beers.

“Meanwhile, the launch of our special anniversary Smoked Porter is a nod back to the early days of commercial brewing whilst also showcasing the talents of our modern master brewer in using quality ingredients and sophisticated brewing techniques. We think Dr Okell would be proud to see that, to this day, we continue with his commitment both to purity and perfection in our brews.”

The Doctor’s orders

It was in 1850 that Dr William Okell, a Lancashire surgeon, took up brewing in the Isle of Man. No one is quite sure what brought him to our Island – or why he moved into brewing from medicine – but his legacy is mighty.

Using his scientific background coupled with his shrewd business acumen, Dr Okell soon formed plans for establishing his own brewery at Falcon Cliff in

Douglas. The result was the Falcon Brewery, built to a new patented steam design that was displayed at the Great Exhibition at Crystal Palace in London in 1851.

This commitment to investing in the latest brewing techniques, combined with the introduction of the Manx Brewers Act, which set out the rules that beer in the Isle of Man should be made only of hops, malt, sugar and water, ensured that, from the start, Okell’s ales were “of the purest quality.”

This is an adage that has been a guiding principle at Okell’s ever since and has seen the business withstand the ups and downs of the Manx economy including the boom (and subsequent collapse) of the Victorian tourist trade from the north-west of England, higher duties, competition from the UK and the increasingly vocal temperance movement.

Okell’s also survived the notorious Dumbell’s bank crash of 1900 and two World Wars, as well as the further economic woes of the Island. Becoming part of the Heron & Brearley Group in 1945, Okell’s has continued as a subsidiary business and moved its brewing operations to Kewaigue in 1996.

Today, 175 years after Dr Okell’s first began brewing in earnest, Okell’s still honours his commitment to producing top quality ales in accordance with the Manx Pure Beer Act.

‘‘

NOT ONLY ARE WE STILL PRODUCING OUTSTANDING BITTERS AND PALE ALES TO THE EXACTING DEMANDS OF THE MANX BREWERS ACT, JUST AS DR OKELL DID, BUT WE ARE CONTINUING TO INVEST IN TECHNOLOGY TO IMPROVE OUR EFFICIENCY AND SUSTAINABILITY

SPECIAL EDITION SMOKED PORTER A NOD TO THE PAST

How do you celebrate a 175th anniversary? Well, if you’re a legendary brewing company, it has to be with a new beer. So, raise your glasses for Smoked Porter, Okell’s special edition brew for the occasion.

The Smoked Porter brew is an updated version of a classic traditional ale that harks back to the early days of brewing when the dark malty beer was said to be highly popular among London porters.

It was also clearly very popular in the Isle of Man as in 1864 there is a record of Okell’s founder, Dr William Okell, donating 100 gallons of porter to the General Hospital and Dispensary!

Adding a modern touch to the recipe, Okell’s anniversary Smoked Porter is made from carefully selected premium malts and is aged on wood to imbue the beer with a smooth smoky profile that creates a unique taste experience.

Head Brewer Kevin Holmes explained, “The beer is a classic 5% Porter with rich malt character combined with a gentle hint of smoke derived from peated malt and the aging process on American oak wood chips.

“This results in a beer that is complex and satisfying with a distinct smokiness that lingers with each sip. I believe the beer is a fitting tribute to Okell’s legacy on the Isle of Man.”

Okell’s Smoked Porter is available bottled in a special anniversary gift box, in cans from Spar stores and by cask at Okell’s Inns and selected independent pubs across the Island.

TISE REPORTS RECORD TURNOVER, PROFIT AND EPS FOR 2024

• RECORD TURNOVER OF £13.3 MILLION – UP 22.6% YEAR ON YEAR

• PROFIT INCREASED 24.2% YEAR ON YEAR TO A NEW HIGH OF £6.0 MILLION

• EARNINGS PER SHARE INCREASED TO 212.7p; £9.1 MILLION RETURNED TO SHAREHOLDERS DURING 2024

• 952 NEW LISTINGS CONTRIBUTED TO OVER ALL PUBLIC MARKET GROWTH OF 5.3% YEAR ON YEAR

• EXPANSION OF EQUITY MARKET OFFERING WITH LAUNCH OF SPECIALIST COMPANY LISTING RULES

• DELIVERY OF PRIVATE MARKETS SERVICE TO FIRST CLIENT, WITH PIPELINE OF FURTHER BUSINESS

The International Stock Exchange (TISE) has reported record turnover, profit and earnings per share for 2024.

The International Stock Exchange Group Limited (the Group) has released its latest Annual Report which shows revenues up 22.6% year on year to a new high of £13.3 million, post-tax profit increased 24.2% year on year to £6.0 million, and earnings per share increased to 212.7p during the financial year ended 31 December 2024.

The Group declared a special dividend and two ordinary dividends during the year which returned a total of £9.1 million (320p per share) to shareholders in 2024.

continuing to grow it reputation as a listing venue for securitisations.

There were 13 newly listed securities across TISE’s equity market during 2024. Of those, four securities were admitted under TISE’s Equity Listing Rules for Specialist Companies which were introduced in November. Enhancing its product range and responding to changing market expectations, TISE launched the new rulebook to streamline initial application and continuing obligation requirements for Specialist Companies such as SPV holding companies, closely held Real Estate Investment Trusts (REITs) and equivalent vehicles.

OUR INVESTMENT INTO AN INCREASINGLY SCALABLE AND DIVERSIFIED BUSINESS MODEL MEANS THAT WE ARE IN AN EXCELLENT POSITION AS WE EMBARK ON OUR REFRESHED 2025-2027 STRATEGY

“With the macro-economic picture providing tailwinds despite the continued geo-political uncertainties, I am pleased to report a record financial performance for 2024,” said Isle of Man-based Chair of the Group, Anderson Whamond.

“The Group remains highly cash generative, supporting the payment of a special dividend and two ordinary dividends during the year which returned 320p per share to shareholders in 2024. The Group’s financial and business performance in 2024 demonstrates the success of our strategy during the last three years to support sustained growth.”

TISE’s Isle of Man-based Members, which facilitate listings on the exchange, are Boston Sponsor Services Limited, Cains Listing Services Limited, Equiom (Isle of Man) Ltd, FIM Capital Ltd and IQ EQ (Isle of Man) Limited.

There were 952 newly listed securities on TISE during 2024, which was an increase of 13.1% year on year. This took the total number of listed securities on TISE’s Official List to 4,487 at 31 December 2024, which is a 5.3% increase year on year and the highest total since the Exchange opened. The combined market value of these listings also reached a new high of £756 billion at 31 December 2024.

During 2024, there were 939 newly listed securities admitted to TISE’s leading European professional bond market, the Qualified Investor Bond Market (QIBM), which maintained its market-leader position across both private equity debt and high yield bonds, while also

One of the newly listed Specialist Companies was among the four UK REITs which listed on TISE during 2024 and during the first quarter of 2025, several REITs already listed on the Exchange reclassified under the new rulebook. As the second largest venue for listed UK REITs, there are currently 42 UK REITs listed on TISE.

Beyond its public market, TISE continued with the efficient and effective delivery of its private markets service to the first client, Blue Diamond Limited. In addition, TISE has developed a strong pipeline of further business and is close to announcing its next clients for TISE Private Markets. The pool of prospective users continues to rise as London’s public markets further contract and the UK becomes an increasingly private company economy. The number of private companies in the UK that have more than 100 employees grew by 3,430 over the last decade to 19,483, while the number of listed companies reduced by 290 during the same period. TISE Private Markets provides private companies and other private asset owners with their own ‘stock exchange in a box’.

Cees Vermaas, CEO of the Group, said: “I am delighted with the strength of our financial and operational performance during 2024. Our investment into an increasingly scalable and diversified business model means that we are in an excellent position as we embark on our refreshed 2025-2027 strategy to make the most of the opportunities which emerge through the introduction of new and innovative products and services across both public and private markets.”

SALES AND MARKETING: FRIENDS NOT FOES

THERE IS OFTEN A NATURAL RIVALRY BETWEEN MARKETING AND SALES, SAYS ASHGROVE MARKETING’S TERRY VAN RHYN, BUT THEY ARE REALLY TWO SIDES OF THE SAME COIN.

TERRY VAN RHYN MANAGING DIRECTOR AND FOUNDER, ASHGROVE MARKETING

IN MY OPINION MARKETING IS, AND ALWAYS HAS BEEN, A SALES SUPPORT FUNCTION. BUT SAYING THAT DOES NOT MEAN IT’S A DOWNGRADE: IT’S A REALITY CHECK. ‘‘

Some time ago, when I was working in the US, I left my natural habitat of advertising agencies and stepped over to the “dark side” to join a corporation. Working in what was essentially a manufacturing and sales organisation, I was the lonely Head of Marketing.

This was a world where everyone from CEO, CFO, COO and CTO believed they could also easily fulfil the CMO role: everyone had an opinion on the positioning of a product or brand and how it should be marketed. More often than not, the lines between sales and marketing functions got blurred.

The fact is marketing and sales are squabbling siblings. Marketers are usually seen as the sprinklers of fairy dust who brainstorm with scented markers, mood boards, and a Spotify playlist called “Brand Vibes Only”, while the sales team are out there on the front line, coffee in hand, trying to close deals and hit monthly targets.

But the truth is that this so-called rivalry is as outdated as Telex machines and 'synergy' workshops.

Marketing and sales are not competing functions. They are co-dependent and the yin to the other’s yang. More Morecambe and Wise than Montague and Capulet.

Most meetings I have with clients are about how to increase business. You can dress it up all you want, but that is the bottom line for any company. For example, a website and a social media campaign are typically seen as marketing tools - they build awareness, tell your story, showcase your value, and attract interest. But their true power is only realised when they’re aligned with sales goals.

A great website shouldn’t just look pretty - it should guide visitors toward action such as signing up, enquiring or, even better, buying. Likewise, social media isn’t just for inspirational quotes and team photos; it’s a tool to warm up leads, drive engagement, and create opportunities for sales to step in and close the deal.

While marketing may build and manage the platforms, sales should be feeding back on what’s working, what’s converting, and what the customers/clients care about. When the two functions collaborate, your digital presence becomes more than a shop window, it becomes an engine for leads.

Marketing is the strategist, a storyteller, and the seducer. Its role is to shape the brand, define the narrative, identify the audience or tribe, and create purpose and desire. It’s the one that makes people want what you’ve got, even if they don’t yet know they need it.

Sales is the closer, the persuader and the therapist with a quota. It takes the leads, the brand promise, and

the shiny brochures - and turns interest into income. It listens, negotiates, reassures, and follows up (often with alarming persistence).

If marketing builds the runway, sales is the pilot flying the plane. Both are essential. One without the other is like trying to make a gin and tonic without either gin or tonic.

In my opinion marketing is, and always has been, a sales support function.

But saying that does not mean it’s a downgrade: it’s a reality check. Marketing exists to enable growth, to drive leads and to grease the wheels of business development so sales and business development can do what it does best - convert.

As I have said many times, branding isn’t just a logo or a catchy tagline. It’s the accumulated emotional equity you build in the hearts and minds of your audience. And that positioning - how your brand is perceived - massively influences the success of your sales team.

Brand positioning sets the stage. It gives sales the permission to ask for the price they want, with the confidence that the value is already understood. If this is done right, your brand builds trust before a salesperson even picks up the phone. Done poorly, and they’ll spend the first 15 minutes of every meeting explaining why your company or brand exists.

The magic happens when there is goal alignment between these two functions. Not just at the annual strategy workshop, but daily. When marketing listens to the feedback from the field (the objections, the pain points, the “we love you, but…” moments) and refines the message accordingly.

Likewise, when sales or business development people take the time to understand the thinking behind the latest campaign instead of moaning “No one reads brochures anymore,” you start to see real results. The way I see it is that sales bring the stories from the trenches so marketing can shape smarter campaigns. Let both remember - they’re on the same side.

Because in the end, whether you're painting the dream or signing the deal, it's all about making the business grow. And if you're not supporting that, then what are you doing?

(NB Back in the US, it was only towards the end of my time when a new CEO stepped in that all functions in the organisation found the energy and inclination to work together towards a common goal. I was fortunate as the Head of Marketing to have worked very closely with the Heads of Sales and Manufacturing so we could turn a steadily declining sales trend into a positive trend.)

FINANCIAL CRIME: HOW ENHANCED DUE DILIGENCE IS HELPING TO TACKLE NEW THREATS

FINANCIAL CRIME IS A WORLDWIDE PROBLEM THAT AFFECTS NUMEROUS SECTORS, BUT ESPECIALLY FINANCE AND GAMING, WHICH ARE VITALLY IMPORTANT TO THE ISLE OF MAN’S ECONOMY. WITH CRIMINALS USING AI TECHNOLOGY AND COMPLEX MONEYLAUNDERING OPERATIONS, THE USE OF ENHANCED DUE DILIGENCE (EDD) TECHNIQUES IS GROWING IN BOTH THE PUBLIC AND PRIVATE SECTOR. ROB KINRADE , CHIEF EXECUTIVE OF EMPLOYMENT SCREENING EXPERTS EXPOL AND A FORMER POLICE DETECTIVE, EXPLAINS WHY IT’S AN ESSENTIAL TOOL IN THE FIGHT AGAINST FINANCIAL CRIME AND WHY BUSINESSES MAY BE AT RISK IF THEY’RE NOT USING IT.

For generations, organised crime gangs have used fake businesses and profiles to hide their activities – what’s different today is that technology makes it easier for them to hide in plain sight.

‘‘

CRYPTOCURRENCIES, SHAM BUSINESSES WITH COMPLICATED STRUCTURES TO HIDE MONEY-LAUNDERING, PLUS AI TECH USED TO CREATE ULTRACONVINCING WEBSITES AND FAKE IDS, ALL MAKE IT TOUGH FOR EVEN THE MOST EXPERIENCED INVESTIGATORS

Criminals often have access to more funding and resources than some law enforcement or other agencies. That’s especially the case in scenarios where smaller jurisdictions are targeted by international crime syndicates. As a former police officer – and with 20+ years as a private sector investigator – I understand the scale of the challenge faced by law enforcement agencies and all other organisations with a responsibility to protect the public.

New threats

Cryptocurrencies, sham businesses with complicated structures to hide money-laundering, plus AI tech used to create ultra-convincing websites and fake IDs, all make it tough for even the most experienced investigators to separate the good guys from the villains. In December last year, the UK’s biggest ever ‘ponzi’ scheme was uncovered, and the directors behind it were ordered by the High Court to repay £400m. The company behind the fraud had been operating for over six years with a website that was open for all to see – and it took years of painstaking investigations by the Serious Fraud Office to bring it to court. In some other cases fraudulent businesses involve human trafficking and even modern slavery. This context explains why EDD services are being

used more frequently by public and private sector organisations.

EDD for businesses and employers

EDD is used for a wide range of purposes ranging from research about politically exposed persons, to checking company details ahead of takeovers. It’s the gold standard for risk mitigation for these and many other scenarios. EDD, in conjunction with quality training to help managers and employees stay up to speed with the law and industry regulations, also has a crucial role to play in compliance. Similar ongoing training to enable employees to carry out their own due diligence checks is essential too. In the Isle of Man, as with all other leading jurisdictions with a focus on financial services, the legal framework has understandably been strengthened in recent years to close loopholes that have been or could be exploited by criminals. As one measure to combat the latest threats, proposals have been put forward to amend the 2008 Proceeds of Crime Act to modernise laws to tackle the risks posed by cryptocurrencies and digital assets. These reforms are currently only at the public consultation phase, but it’s a good example to show the direction of travel which places even more responsibility on businesses to ensure compliance.

What is EDD?

It’s a much deeper level of background checking and, because it requires skills and experience that some public sector organisations and businesses don’t have in house, this work is often done by specialist firms such as Expol.

In broad terms, EDD means in-depth research using similar methods and techniques employed by businesses, but within the legal framework that applies to corporate investigators. However, for specialist EDD firms this framework allows a lot of information to be gathered, if you know where, how and what to look for. EDD can involve:

• Gathering very detailed information about a company or individual and their business activities

• Examining financial transactions to establish source of wealth or detect unusual or suspicious patterns

• Using online search tools to carry out ‘deep dive’ internet investigations

• ‘On the ground’ investigations in the jurisdiction being examined to gather information not otherwise available online (eg local media and certain Registries)

• Contacting key individuals, associations and organisations directly in that jurisdiction to obtain intelligence and check and verify facts

Can’t AI tools do this job without the need for expert EDD investigators?

No. AI is certainly a useful tool to search for and analyse information, but its sources of data are limited to what has been digitised and AI still needs a human to oversee and check information for accuracy and omissions. It’s true that an immense amount of information about organisations and individuals has been digitised, but there’s still a lot which isn’t available via the internet or off-net databases. For example, a digital search for a company may give the impression that it’s a bona fide business – but an experienced investigator’s involvement may tell a different story. This is where the skill of the experienced, well-trained and motivated investigator is crucial. It’s that sixth sense which tells you when something doesn’t add up, knowing where to look to dig a little deeper and who you can contact to verify whether those suspicions have innocent explanations or were justified because they’re corroborated by hard evidence. This last point is important because financial

fraud often involves international networks which means that EDD investigators, such as Expol, also need trusted contacts they can go to who can do local, on the ground research anywhere in the world.

Summing up

In an era when businesses are counting every penny it’s understandable that some may think EDD checks is an area where they can make savings. However, it only takes one rogue to slip through the net for them to realise it was a costly false economy. A comparatively small investment in EDD at the outset can avoid huge financial and credibility headaches in the future. The immediate cost of crises that could have been avoided by better due diligence can be calculated by the sum of fines, legal fees and compensation payments. Long-term, the total cost of reputational damage is immeasurable, especially for businesses or international business centres where trust is hard to win and easy to lose.

AI IS CERTAINLY A USEFUL TOOL TO SEARCH FOR AND ANALYSE INFORMATION, BUT ITS SOURCES OF DATA ARE LIMITED TO WHAT HAS BEEN DIGITISED AND AI STILL NEEDS A HUMAN TO OVERSEE AND CHECK INFORMATION FOR ACCURACY AND OMISSIONS ‘‘

Business Directory brought to you

Big Red Building, Ronaldsway Industrial Estate, Ballasalla, IM9 2AA

BUSINESS DIRECTORY

Accountants

Atla Accountancy Services Ltd, Ground Floor, 11-13 Hill Street, Douglas Tel +44 1624 777403 hello@atla.im

Callin & Co, 6-7 Fort William, Head Road, Douglas. Tel. +44 1624 675528 callin@manx.net

CM Partners, 8, St George’s Street, Douglas. Tel. +44 1624 665100 admin@cmiom.com

EY, Rose House, 51-59 Circular Road, Douglas. Tel. +44 1624 691800 www.ey.com/im

Fryers Bell & Co, 27, Athol Street, Douglas. Tel. +44 1624 639850 fryers_bell@manx.net