Advance reservation online or phone 640040

In a great location opposite the airport

Sizes from 16 sq ft up to 600 sq ft

Bulk storage units and pallet racking available 24/7 access via pin code at the main door

CCTV Security

Packing materials, locks & accessories for sale

Automatic lighting in every unit

Ample loading area and parking

Undercover loading bay and freight lift

Free use of trolleys

The 20th Manx State of the Nation conference, hosted by the Alliance of Isle of Man Compliance Professionals (AICP), was held at the Comis Hotel on 7 February 2025. Sponsored for the 11th consecutive year by PwC Isle of Man, the event attracted a record number of 250 delegates, with a waiting list, demonstrating the importance placed by Isle of Man based professionals on engagement in compliance issues.

The annual conference was opened by the Island’s Chief Minister, Alfred Cannan MHK who emphasised the importance of working together to safeguard the island from the devastating effects of financial crime and thanked the attendees for their crucial role in maintaining the robustness of the island’s financial services sector.

A varied programme followed with a mix of local and UK speakers. A range of important topics and trending insights across the regulatory and business landscape were discussed including: updates from the Financial Services Authority and the new Information Commissioner; as well as international regulation, Anti-Money Laundering/Counter Financial Terrirism, Proliferation Finance, Sanctions, Corporate Criminal Liability, and Modern Slavery, and its impact on the Isle of Man. There was also time for networking with others in the regulated sector.

Gerry Ganly, AICP Chair, shared: “The conference continues to grow stronger each year, and we are delighted to celebrate its 20th anniversary. It has become a must-attend event for the local compliance, risk and governance community. Over the past two decades, the international regulatory landscape has changed significantly and will undoubtedly continue to evolve. This year’s conference featured a wealth of insights from knowledgeable speakers who are practitioners in their field of expertise. The positive engagement from the audience, through polling and

questions, greatly enhanced the value of the day. I hope those who attended will continue to look forward and collaborate, both professionally and individually, for the success of the island and our common interest.”

Colin Manley, Director, PwC Isle of Man, added: “As long-serving sponsors of the conference, PwC Isle of Man echoes Gerry’s sentiment that it is fantastic to celebrate two decades of bringing together compliance professionals across the island’s industries. With the news of Moneyval’s visit taking place in October 2026, these opportunities to learn and collaborate are key to helping keep compliance standards at the forefront of the professional community. From my own presentation on AML effectiveness I was delighted with the strong engagement in the room. The presentation highlighted shared challenges, the role of technology and the continued importance of skilled resources as the cornerstone of effective control frameworks.”

Special thanks go to the attendees, speakers, Kevin Ellis at Avid Events, Comis Hotel, ELS Group, lead sponsor PwC Isle of Man, and other sponsors Impact Professional Services, DQ Advocates and FIM Capital, who all helped to make the event such a success.

King William’s College (KWC) and The Buchan School have shared an important update on school fees and future developments, reinforcing their commitment to providing an outstanding education while ensuring long-term sustainability.

In August 2024, the School confirmed that there would be no changes to the fees already announced for the 2024-25 academic year. Thanks to careful financial planning, KWC absorbed the VAT element of school fees for this year, preventing an immediate increase and giving families time to prepare.

Looking ahead, the School will introduce a phased and controlled fee adjustment starting in September 2025. Over the next four years, fee increases will remain below double digits, covering inflation and the VAT impact. This means the College will continue to absorb a portion of the VAT, ensuring stability for families.

Principal Damian Henderson said: “We understand that school fees are a significant consideration for families, and we are committed to keeping increases as manageable as possible, while continuing to invest in our students' education and experiences. By taking a phased approach, we can support our families while maintaining the excellence that defines King William’s College and The Buchan School.”

Continent 8 Technologies, a leading provider of global managed hosting, connectivity, cloud and cybersecurity solutions to the iGaming and online sports betting industry, attended the SBC Summit Rio 2025 at the end of February.

At the event, Continent 8 technical and industry experts was on hand to provide insights on complying with Brazil's Ordinance No. 722, which outlines the specific and essential technical and cybersecurity standard for licensees launching in the Brazilian market. Operators must comply within six months of obtaining their gaming licenses in the Latin American (LATAM) market.

To support Brazil’s launch, Continent 8 offers a state-of-the-art data centre facility in São Paulo, along with a complete suite of services to address rigorous data residency, backup, disaster recovery and cybersecurity requirements. Furthermore, the specific utilisation of submarine cable capacity from Brazil to Portugal minimises latency between Europe and LATAM. By taking this route, rather than via North

America as other in-region cloud providers, Continent 8 provides the best support to European operations targeting the region by improving latency by over 40%. This unique, localised support, combined with global planning, enables the regulated Brazilian gaming market to rapidly deploy secure, compliant and ultralow-latency gaming platforms and operations.

The LATAM market is of considerable strategic importance to Continent 8. The trusted infrastructure and cybersecurity services provider in the region, Continent 8 first launched LATAM and Caribbean operations in Colombia in 2020 and has since expanded its data centre locations and best-in-class managed and professional services to Brazil, Curaçao, Peru and Puerto Rico, with further expansion plans underway.

Luana Monje, Sales Executive at Continent 8 said, “Continent 8 continues its deep investment and commitment to the LATAM market, with the newly established regulated Brazilian jurisdiction being a top priority. We have invested in a new data centre and the provision of customised services to address a comprehensive range of local mandated requirements, including latency, cybersecurity, public/private cloud, AWS hybrid cloud, and more – all with the goal of providing the best regulated iGaming launch and support experience.

“We were excited to continue this conversation at SBC Summit Rio and explore how we can support gaming initiatives.”

Continent 8’s head office has been based in the Isle of Man for over 20 years. Their Isle of Man data centre is a purpose-built Tier-3 facility located in the island’s capital, Douglas.

Continent 8 connects the Isle of Man directly to their core global MPLS backbone using high-capacity diverse connectivity to our global peering and PoP locations. This means that in the event of a carrier cable failure, Continent 8 is resilient and able to continue to deliver services via separate carrier cable systems.

In the Isle of Man, connectivity is provided via multiple 5Gbe and 10Gbe circuits on three diverse routes over the Vodafone and MUA cable systems. These circuits terminate into separate London and Dublin POPs where IP and MPLS services are located.

Selling your business is never an easy decision. It often comes with unique challenges and needs significant preparation and resources. Our experts can help you understand the process of selling a business. Let us help you make this journey as smooth and successful as possible.

The launch of The Level Up Club has been announced, billed as a fresh, exciting and non-traditional networking community designed for young to midlevel professionals and entrepreneurs who want more than just business talk.

Launching in March 2025, the Level Up Club aims to redefine professional networking with vibrant, themed experiences that blend career growth, personal development, and pure fun.

Reimagining networking

Created with the aim of offering something different to traditional networking events, the Level Up Club is a space where people can build confidence, gain new skills, and form meaningful connections, without the stiffness of conventional business meet-ups.

Each month, members will have access to unique, interactive events that mix expert-led discussions with hands-on, creative activities, making networking more authentic, empowering, and enjoyable. More than just business

The Level Up Club is designed for the next generation of professionals, entrepreneurs, mid-levels, and career builders who see work differently. Whether you're looking to sharpen your skills, explore creative outlets, or expand your professional circle, the club provides an environment that fosters real growth, both professionally and personally.

“This isn’t just another networking club putting on another set of networking events. You may not find your next business deal here. But you will hopefully find the tools, confidence, and connections to grow—in your career and your life” says Ealish Corlett, who’s one of the team behind the Level Up Club.

A mission to empower

The Level Up Club is committed to creating a supportive, engaging, and inspiring space where ambitious professionals—especially women—can develop their careers, explore creativity, and build genuine relationships. With a focus on celebrating local talent, fostering confidence, and encouraging innovative thinking, the club aims to reimagine networking and professional development for the modern workforce.

Get involved

The first official events will be announced in March 2025, and people are encouraged to follow the Level Up Club on social media for updates.

Additionally, those with valuable skills to share can become a speaker… the club is actively seeking experts who can provide insight and inspiration to its growing community.

Get in touch

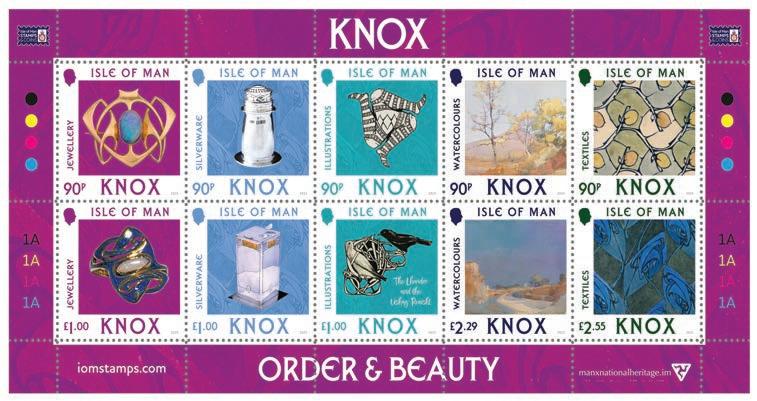

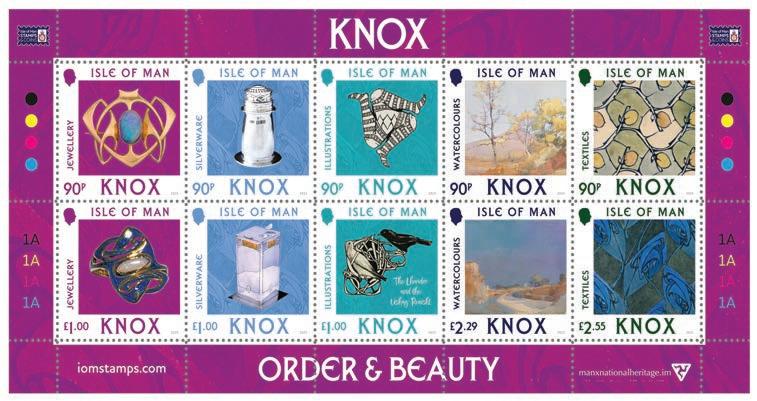

Isle of Man Post Office unveils new stamp collection celebrating Archibald Knox

The Isle of Man Post Office has announced the release of its latest stamp collection, Archibald Knox: Order & Beauty, celebrating the life and work of one of the Isle of Man’s most influential cultural icons.

This exquisite set of ten stamps has been created in collaboration with Manx National Heritage and the Archibald Knox Forum to mark the KNOX: Order & Beauty exhibition, the largest-ever display of Knox’s works. Running from 5th April 2025 to 5th April 2026 at the Manx Museum, the exhibition explores Knox’s artistic journey, his profound connection to the Isle of Man, and his role as a pioneer in modern design.

Archibald Knox (1864 - 1933) is celebrated worldwide for his exceptional craftsmanship and innovative designs. His work for Liberty & Co., including the renowned Cymric and Tudric ranges, combined Celtic-inspired patterns with the modern aesthetics of the Arts and Crafts movement. Each of the ten stamps in this collection features a carefully chosen piece from Knox’s vast body of work, showcasing his extraordinary versatility and artistic brilliance.

The Archibald Knox: Order & Beauty stamp collection has been designed by EJC Design and features imagery from the Manx National Heritage Collection, the Peartree Collection, and private collections.

Maxine Cannon, General Manager of Isle of Man Stamps and Coins remarked: “We are honoured to celebrate the legacy of Archibald Knox with this beautifully curated stamp collection. Knox’s work continues to inspire artists and designers around the world, and this issue serves as both a tribute to his remarkable talent and a reflection of the Isle of Man’s rich cultural heritage. We hope collectors and admirers alike will enjoy this stunning set, which captures the essence of Knox’s timeless designs.” Katie King, Curator for Art at Manx National Heritage, said: “The Post Office played a pivotal role in Archibald Knox’s life and career, making this stamp issue a particularly fitting way to celebrate his legacy. From his tranquil cottage in Sulby, Knox sketched and coloured thousands of designs for Liberty & Co., dispatching them via the nearby post office to London. This collection brings together some of Knox’s most iconic works and reminds us of the enduring beauty and relevance of his designs.”

Chris Hobdell, Managing Director of the Archibald Knox Forum, added: “This stamp issue is a wonderful opportunity to share Knox’s extraordinary designs with a global audience. It offers a glimpse into the depth and diversity of his work, celebrating the rich cultural heritage of the Isle of Man that inspired him. We hope it will encourage people to explore the KNOX: Order & Beauty exhibition and learn more about this remarkable

The Archibald Knox: Order & Beauty stamp issue is available now and a range of products is available, including the stamp set, First Day Cover, Presentation Pack, Prestige Booklet, and booklet panes, making it the perfect choice for collectors and fans of Knox’s work.

Douglas City Council’s Public Sector Housing Tenants will be offered a more flexible way to pay their rent from April.

Designed to assist families with their budget management across a full year, the local authority is to adopt a more straightforward approach in a move designed to standardise the rent collection process.

Chair of the Council’s Housing and Property Committee, Councillor Devon Watson, explained: “Tenants currently pay rent covering the full 52 weeks of the year but, historically, that rent has been collected across a 50-week period and divided accordingly, dating back to a time when most payments were collected in cash and paid in person. More than 60% of our tenants already pay over the 52 weeks so this is about standardising and giving tenants control over their preferred payment approach.

“Nowadays, of course, there are a wide range of payment options, including the very popular direct debit, online payments, phone payments, standing orders and the Isle of Man Government’s social security direct pay, so there is no longer any need to divide a year into a 50-week collection system.

“All existing payment interval choices for tenants (whether weekly, fortnightly, four-weekly or monthly) will remain the same, there will be no change. The

yearly rent amount will also be the same and payments will simply be calculated over 52 weeks rather than 50.”

The move will bring the Council in line with the majority of the other local authorities who provide Public Sector Housing Island-wide, simplifying payment processes and offering the option for tenants who wish to take a rent break during a particular period of the year the opportunity to increase their rent payments to cover this break. For example, a tenant may choose to take a one week rent break in the summer and one week rent break during the festive period and, as long as they have increased their weekly payment and therefore have sufficient credit, this will be possible.

Those tenants who do not want to take a rent break will pay the actual weekly rent rather than the previously inflated rent that was required to cover the traditional non-collection weeks at the end of the year, assisting greatly with their budget management.

A detailed explanation of the change and potential benefits of the new approach, complete with available payment options, will be outlined in a letter to all tenants next month and in the Council’s annual Housing Newsletter.

An online Public Sector Housing Tenant Portal will also be introduced in late 2025 making it very easy for tenants to view their Housing rent account balance,

which will help with payment planning.

“This is all about providing a more straightforward yet flexible way to pay and collect rent, with the main purpose to better assist families with their budget management across a full year, alongside the benefit of offering a ‘rent holiday’ for those who want it. Essentially, it places control back in the hands of our tenants,” added Councillor Watson.

The new measures will come into effect in the new financial year and will be implemented from the week beginning 7th of April, 2025.

Offer accepted for former housing site

Also, Douglas City Council can confirm it has accepted an offer for a landmark site in the heart of the capital, subject to contract.

The local authority placed the Lord Street flats on the market in November as it continues to invest in providing accommodation considered more suitable to modern day standards.

Proceeds from the sale of the four-storey building will be reinvested into future housing projects for Douglas, alongside its general maintenance and refurbishment programme.

Although details of the offer are commercially sensitive at this time, the authority will release more information on completion of the contract.

A modern office suite in a great Isle of Man location

A modern Office Suite is now available at our prestigious Champion House offices in Tromode, Douglas.

Situated in an established business park, in landscaped grounds adjacent to the Millennium Wood, the modern building is accessible within 20 minutes by car from Castletown, Peel and Ramsey. Avoid the morning queues and traffic lights into central Douglas, and add an hour or two each week to leisure time in our beautiful island!

1,504 sq ft (140m2)

| Beam vacuum system From

| Extensive car park spaces available

| Gents, ladies and disabled WCs

| Landscaped gardens on three sides

| Outdoor seating areas

| Otis lift

| Kitchens, breakout rooms

| Fibre connections with MT and Sure

| Extensive network cabling, door access control systems

| Double-glazed, 3-phase electricity

| Oil fired heating, fresh air ventilation system on first floor

| E-bike park with charging

Calculations regarding the Final Expenditure Revenue Sharing Arrangement (FERSA) with the United Kingdom Government have been finalised.

The FERSA is the calculation mechanism for sharing the common duties including VAT that are collected under the 1979 Customs and Excise Agreement between the UK and the Isle of Man.

Treasury Minister Dr Alex Allinson MHK informed Tynwald this morning while announcing the Budget for the forthcoming year.

He said: “I am able to confirm to you today that we have finalised the required FERSA calculations and agreed them with His Majesty’s Government. The Island’s estimated share of VAT and the other Common Duties has been calculated using the agreed FERSA methodology and this has resulted in the Island’s share being broadly in line with budgeted projections.

“Over the past five years we have prudently held back a provisional amount, some of which will be paid as a rebalancing payment to HM Treasury, the remainder of this I am now able to release. This book adjustment will offset additional spending that has been incurred and approved by Tynwald in supplementary votes, and an additional £10m will now be available to offset anticipated additional spending in the forthcoming year.

“I would like to thank HM Treasury and HM Revenue and Customs for their detailed and professional approach together with Officers both in Treasury and the Cabinet Office who have worked in such an efficient manner to reach this conclusion.”

This Agreement provides the Treasury with confidence and certainty in terms of the revenue the Isle of Man will receive under FERSA in each of the next five years, until the next calculation is undertaken in 2028/29.

A public consultation has been published to gather feedback on proposed changes to the Island’s Proceeds of Crime Act 2008 (POCA 2008).

The draft changes aim to enhance the effectiveness of the legislation which is one of the Island’s most important tools in combating financial crime.

POCA 2008 is vital in tackling money laundering and countering the financing of terrorism or proliferation but needs modernisation to meet changing international standards and keep up with ever evolving technology and products.

These changes take the form of three separate draft Bills, the:

• Draft Proceeds of Crime (Miscellaneous Amendments) Bill 2025

• Draft Proceeds of Crime (Amendment) (Forfeiture of Money held in Bank and Building Society Accounts) Bill 2025

• Draft Proceeds of Crime (Amendment) (Unexplained Wealth Orders) Bill 2025

The consultation questions focus on several key areas including updating the terminology related to virtual assets (cryptocurrencies and digital assets) in line with international standards.

Comments are also invited on the expansion of references to include civilian investigators alongside Police and Customs Officers, as well as changes to confiscation orders, threshold exemptions, unexplained wealth orders and changes to the Anti-Money Laundering and Countering the Financing of Terrorism Code 2019 and the Gambling Code 2019.

There is also a proposed change which will create a positive obligation on individuals to report suspicions of money laundering to the Financial Intelligence Unit (FIU).

Minister for Justice and Home Affairs, Jane PooleWilson MHK, said: “The economic and fiscal stability of the Island is key to its future success, as is our ability to continue to be part of the wider world of respected and responsible financial jurisdictions. These crucial updates will play a pivotal role in providing the legislative basis for us to properly combat financial crime, a key aspect of the Island Plan vision of a ‘strong and diverse economy.”

Submissions can be made on the online consultation hub, other formats or assistance can be requested by emailing GeneralEnquiries.DHA@gov.im or calling +44 1624 694300. The consultation will close on the 27 March 2025.

The Cyber Security Centre for the Isle of Man (CSC) has released its annual threat report. The latest report indicates that residents who fell victim to scams lost over £2.2 million in 2024.

The report, breaking down losses into categories, reveals that Investment scams were the largest contributor at £1.2 million, with other losses including £391,674 to scam voice calls (Vishing) and £113,472 to account compromises.

However, the report clarifies that these figures only come from the reports received and so the actual figure is likely to be much higher.

Cyber Security Centre Isle of Man Director, Mike Haywood, said: “Every pound lost to scams is not just a loss for our local economy - it’s the hard-earned money of individuals in our community that could be spent on essential needs, families, or supporting local businesses and creating jobs. Instead, it is lining the pockets of criminals operating from all corners of the world.”

This year the Island has seen a number of tailored scams aimed at local residents and organisations

including widespread manx.net scam emails, criminals imitating Isle of Man Transport as well as websites copying local financial institutions.

“The figures in this report are deeply concerning, but they are likely just the tip of the iceberg. Many scams go unreported, meaning the real cost to residents could be significantly higher.

“We encourage anyone who has been in receipt of or been a victim of a scam to report it to us. We can only fight against cybercrime if we have a picture of the threats facing our Island. Reports allow us to work with the private sector and tailor our education and awareness initiatives to counter the threats’.”

A broad range of information to help you stay safe online, be aware of scams and understand security is available on the CSC Advice and Guidance webpage. The CSC can also deliver presentations and education events with schools and community groups on request.

The full threat report is available online and residents are encouraged to contact report any cyber concerns to the CSC through their online form, or by calling 01624 685557.

Revised planning rules will simplify and reduce the cost of various home improvements and small building projects by eliminating the need to submit a planning application.

The amended regulations will reduce the number of planning requests, improving the speed and efficiency of the applications process. A key revision will more than double the size of extensions that can be added to houses, depending on the size of the house and garden.

The changes update and replace the Town and Country Planning (Permitted Development) Order 2012. They are the result of a review of permitted development allowances which was undertaken by the Cabinet Office and supported by the Department of Environment, Food and Agriculture.

On Wednesday 19 February Tynwald approved the Town and Country Planning (Permitted Development) Order 2025. With two, related planning Orders, it was implemented from 1 March 2025.

Amendments designed to help speed up small building projects and home improvements include:

• Increasing works that can be undertaken in Conservation Areas including replacement windows and - in back gardens - sheds, greenhouses, extensions and air source heat pumps

• New provisions for porches, dormers and chimney pipes

• Providing powers for Local Authorities to install play equipment and public art, and to hold events

The Order expands permitted development for operations which can be undertaken at the Grandstand/Nobles Park during events.

The Meayll Peninsula and Calf of Man continue to have limited permitted development with strict rules about what can be built or changed without special permission.

Minister for the Cabinet Office, David Ashford MHK, said: “Permitted Development Orders play a crucial role in supporting the commitments of the Built Environment Reform Programme (BERP), which is a key part of the Island Plan action to build great communities. The three amended Orders approved by Tynwald support BERP’s vital objectives for an agile and responsive planning system and policies.

“Allowing certain types of development to proceed without formal planning permission will enable planning authorities to focus their efforts on more significant and complex applications. The changes will reduce the burden placed on building owners, encourage investments in, and improvements to properties, and in doing so they will also support the construction industry. As well as these benefits, a number of measures could improve thermal efficiency and so contribute to the Government’s response to climate change.

“These Orders have been informed by the 12-week public consultation last summer and I would like to thank everyone who contributed.”

Permitted development allows small and uncontroversial projects to proceed without planning approval. Projects that aren't permitted development may need to go through the planning application process and about 90% of these requests are approved.

Between 2020 and 2023 an average of around 1,400 applications each year were made under the Town and Country Planning Act each year. Over 60% of these sought full planning approval for smaller proposals such as applications from householders and included an average of over 70 applications each year for replacing windows to properties in Conservation Areas.

The Isle of Man Government has published its final update to the Island Plan for this administration.

The Island Plan, a living document that is revised every year, aims to deliver tangible improvements that residents and businesses can see, building on the work of the last three years.

The latest update, the Island Plan 2025-26, will run from March 2025 to September 2026, subject to Tynwald approval at the next sitting.

The Plan sustains focus on six key priorities:

• Public Sector Efficiency and Financial Discipline: Ensuring prudent financial management, with further emphasis on greater efficiency of public services, including the continuation of monthly Departmental spending reviews and publication of Quarterly Management Accounts for transparency and accountability. The Government Efficiency and Reform plan to deliver £50 million of savings over five years outside of healthcare will also be prioritised, which includes the recent implementation of a recruitment control framework and quarterly reports to manage government headcount.

• Security: Strengthening measures to ensure the safety and security of all residents. This expands on actions already taken improve security measures at our air and sea ports to tackle organised crime, including the transfer of ports officers to the Isle of Man Constabulary, the introduction of more police dogs and the creation of a new search facility and the upcoming introduction of ANPR.

• More Homes Occupied: Initiatives to increase housing occupancy and address housing needs, this follows planning approval for 800 new homes since 2021 and the work of the Manx Development Corporation to redevelop the Former Nurses Home, as well as in-principle support for four brownfield sites to be redeveloped through the Island Infrastructure Scheme.

• Energy Security: Promoting sustainable energy solutions and ensuring a reliable energy supply by continuing work to progress significant infrastructure projects

The Island’s Minimum Wage rates will increase from 1 April 2025, following Tynwald approval at the February sitting, with the Single Hourly Rate increasing to £12.25, and the Youth Rate increasing to £9.55.

In addition, the Department for Enterprise (the Department) confirmed that work is also underway with Treasury, working jointly with the Minimum Wage Committee, on a review into the existing process for determining proposals in respect of the Minimum Wage, considering the statutory requirements prescribed in the Minimum Wage Act and the current Tynwald policy position of achieving parity with the Living Wage by July 2026.

Minister for Enterprise, Tim Johnston MHK, commented: “Bringing forward proposals in respect of the Minimum Wage is always a challenging task, as we strive to enhance the safety net for low-paid workers while considering the broader economic impact on local businesses.

“I believe that the approach Government has set out, including the increased rates approved by Tynwald last week is the correct path to take at this stage. Minimum Wage workers will benefit from a seven percent increase to the headline rate from April, whilst we take advantage of the window of opportunity to review, reflect and consider if the current approach is correct.”

The Minister added: “As confirmed in Tynwald, work is already underway planning the review into how the Minimum Wage is calculated, how future proposals are brought forward, as well as how a statutory Minimum Wage interacts with a Living Wage, and I will be reporting back to Tynwald on this no later than July.

“Further details of the review will be released in coming weeks, including how all interested parties can contribute their views. The Department looks forward to engaging with as broad a range of stakeholders as possible, including local businesses and representative groups, workers, trade unions, the third sector and Members of Tynwald.”

The Department offers a range of support Schemes for local businesses, including funding, training, and advisory services which can be accessed to support a range of initiatives including, importantly, measures which can improve productivity and reduce costs. To find out about the support available, businesses should contact the Department directly or visit dfe.im.

which aim to unlock the potential of offshore and onshore energy, and to begin the process of integrating solar energy generation on the government estate where practical.

• Travel Connectivity: Improving transportation links to enhance connectivity to the Island, including the implementation of the Strategic Air Services Policy framework, which was approved by Tynwald last month, to strategically intervene in the market to deliver longer term security and surety across core and regional routes. Alongside working with the Steam Packet Company to improve the service, building on extended special offer fares for residents secured in 2024.

• The Economy: Supporting economic growth and development to create a thriving economy and building on foundations of the Economic Strategy to bring forward initiatives which will boost productivity and capitalise on opportunities, including within Sustainable Finance and Artificial Intelligence through training and collaboration, and empowering our communities through the Local Economy Strategy to enhance the vibrancy of towns and villages for the benefit of residents and visitors.

Chief Minister, Alfred Cannan MHK, said: “We are absolutely committed to delivering meaningful change for the people of the Isle of Man. We continue to work towards the vision set out in the first iteration of the Island Plan of a secure, vibrant, and sustainable future for our Island. The actions and priorities set out in this update show that we are aware and responding to the world around us, and continually refining how we need to reach our goal.”

The Island Plan 2025-26 is available to read on the Tynwald Register of Business and will be discussed at the March sitting of Tynwald.

Treasury Minister Dr Alex Allinson MHK attended a Chamber of Commerce event to give a Budget update to the business community.

The event – which was sponsored by Appleby and Celton Manx – was held at the Manx Museum on Friday (Feb 21st). It began with a presentation by the Minister in which he summarised the main points of the Budget, with a focus on those of greatest interest to Chamber members and the wider business community. This was followed by a Q&A session featuring questions from the audience, plus some submitted by those who were not able to attend. Chamber sees the following as the key takeaways and talking points:

Acknowledging the economic challenges facing some sectors, the Treasury Minister highlighted the importance of attracting older workers and encouraging the long-term unemployed back into work.

He also emphasised the importance of encouraging greater secondment opportunities between government and the private sector, including a call for senior government employees to gain private sector experience and vice-versa

The Minister stressed that maintaining the Island’s credibility on the international stage requires a joint effort between businesses and government. By working together, he said, both sectors can reinforce the Isle of Man’s position as a globally competitive and economically resilient jurisdiction

Chamber of Commerce CEO Rebecca George thanked the Treasury Minister, guests and sponsors for supporting the event, and commented: “As always, we’re very grateful when Ministers and our members take the time to engage in forums like this. It’s a great example of how Chamber works to encourage dialogue and collaboration between Government and the business community.”

BUSINESSES TODAY ARE IN A TRANSITIONARY STAG E, SHIFTING FROM THE ‘OLD WAY OF WORKING’ TO A MUCH MORE FLEXIBLE AND MODERN APPROACH. TO SUPPORT WITH THIS SHIFT AND PROVIDE SOLUTIONS TO IT CHALLENGES, SURE BUSINESS HAS INTRODUCED THREE LEVELS OF SUPPORT AS PART OF ITS SURE BUSINESS SUITE.

The new offering has been divided into three packages – Essential, Enhanced and Flex. For businesses wishing to reduce operational costs, enhance their data security and upgrade IT infrastructure, these options offer varying levels of support, depending on the customers’ requirements.

The Suite offers Microsoft 365 Business or Enterprise Licenses which include Microsoft Office applications suited to the needs of each customer, who can also benefit from the use of new modern technology like Microsoft Copilot. Sure can then manage customers’ devices remotely or on-site, ensuring their data is secure and that there is minimal downtime for the business.

One of the most critical features is Sure’s Service Operations Centre – a contact point based locally and manned round-the-clock. With many of Sure Business’ customers operating at a significant scale with staff based around the world, this aspect of the Suite ensures that customers’ issues can be resolved quickly with minimal impact on their business.

Sure Business Suite is also an avenue for customers to improve their data security through the Cloud. Sure manages servers wherever they are hosted, whether that is in a private cloud, in Sure’s public cloud or on hyperscaler public clouds like Azure, and can also assist in migrating data to a new platform. Legacy hardware can be expensive to maintain, which is why Sure Business is keen to help customers understand the benefits of Public

Azure or AWS, public cloud or dedicated hardware in their data centres.

Cybersecurity is a key priority for businesses today, many of which come under regular cyber-attacks. The Suite has security built in, and the Enhanced service includes not only technology to protect businesses, but also a set of security policies that align with the included cyber essentials certification, assuring customers that they have the framework to base their cyber security on.

David Salisbury, Enterprise Product Manager, said: “It has been very rewarding to work with some of our recent customers on a journey from legacy technology to a modern managed service. The feedback we have had from customers and their staff on how much easier their job is when they have confidence and flexibility in their it services has been wonderful.”

Are IT challenges impacting on the growth of your business? Contact our expert team via our website to find out how Sure Business can support you: https://business.sure.com/contact

‘‘

IT HAS BEEN VERY REWARDING TO WORK WITH SOME OF OUR RECENT CUSTOMERS ON A JOURNEY FROM LEGACY TECHNOLOGY TO A MODERN MANAGED SERVICE

PAYROLL HAS EVOLVED SIGNIFICANTLY OVER THE PAST DECADE, TRANSFORMING FROM A MANUAL, BACK-OFFICE TASK INTO A VITAL STRATEGIC BUSINESS FUNCTION. ONCE RELIANT ON PAPER CHECKS AND TIME-CONSUMING DATA ENTRY, MODERN PAYROLL NOW BENEFITS FROM AUTOMATION, CLOUD-BASED SYSTEMS, AND ADVANCED COMPLIANCE MANAGEMENT, MAKING IT FASTER, MORE ACCURATE, AND MORE SECURE. OFFSHORE PAYROLL IS PROUD TO BE PART OF THIS EVOLUTION, OFFERING INNOVATIVE SOFTWARE THAT SIMPLIFIES PROCESSES AND ENHANCES EFFICIENCY. AS WE LOOK AHEAD TO 2035, WE’RE EXCITED TO EXPLORE THE NEXT WAVE OF ADVANCEMENTS THAT WILL CONTINUE TO REDEFINE PAYROLL.

WHAT’S NEXT FOR PAYROLL?

As work evolves, so too does payroll. Technology, changing employee expectations, and new regulations are reshaping how organisations manage pay and compensation. Payroll is no longer just about processing wages - it is fast becoming a strategic tool that enhances employee experience. Here’s some of the trends that we at Offshore Payroll believe will redefine payroll’s future:

AI-Powered Automation & Personalisation

It will come as no surprise that AI makes our list, as artificial intelligence becomes more sophisticated it will further simplify payroll by automating complex processes and ensuring compliance with local laws. Systems could even become more personalised, offering employees customised pay schedules or on-demand access to their earnings information.

Real-Time Payroll & OnDemand Pay

Imagine accessing your wages as you earn them, no more waiting for payday. Real-time payroll could make traditional

‘‘

pay cycles obsolete, giving employees greater financial freedom and flexibility.

Consider an employee who may pick up shifts sporadically. Instead of waiting a week or a month for their pay, they can access their earnings immediately after completing a shift. This allows them to cover unexpected expenses, avoid costly loans or credit card debt, and better manage their finances in real time. Whether it's paying a bill on time, handling an emergency, or simply having more control over cash flow, on-demand pay empowers employees to make financial decisions that suit their needs.

IMAGINE ACCESSING YOUR WAGES AS YOU EARN THEM, NO MORE WAITING FOR PAYDAY. REAL-TIME PAYROLL COULD MAKE TRADITIONAL PAY CYCLES OBSOLETE, GIVING EMPLOYEES GREATER FINANCIAL FREEDOM AND FLEXIBILITY

Integration with Well-Being and Financial Wellness Programs

Payroll is increasingly seen as part of a broader approach to employee wellbeing. Future systems may integrate with financial wellness platforms, helping employees manage their finances and plan for the future. By embedding financial wellbeing into payroll, companies can reduce employee stress and improve retention, creating a more engaged and financially secure workforce.

For Isle of Man companies expanding internationally, or who already operate across multiple jurisdictions, managing payroll across different regions is a challenge, and staying on top of changes in financial regulations and statutory requirements is vital. The future will include a wider choice of payroll software that will automatically adapt to each country’s tax and compliance requirements in real time, making global payroll far simpler to manage.

Payroll software is likely to become more intuitive with the integration of NLP-driven chatbots and virtual assistants, enabling employees to get instant answers to payroll-related queries. Instead of waiting for HR or payroll teams to respond to common question, such as “When will I receive my pay this month?” or “How do I update my bank details?” AI-powered assistants can provide immediate assistance within the payroll system.

Imagine an employee wants to check their overtime pay for the previous month. Instead of submitting a request or searching through multiple screens, they can simply ask the payroll software’s chatbot, “How much was my overtime pay last month?” The system instantly retrieves the data from payroll records, displaying the exact breakdown.

By automating these interactions, NLP-powered payroll software will reduce administrative workload, enhance accuracy, and allow payroll teams to focus more on strategic tasks.

Sustainability is a growing focus for businesses globally, including those on the Isle of Man. By adopting paperless payroll and optimising data processing, businesses can reduce their environmental footprint and improve efficiency.

Our cloud-based payroll solution is already driving this change, eliminating the need for spreadsheets and paper records. The employee payslip portal reduces waste, enhances accessibility, and strengthens security. With digital payslips, businesses cut down on paper usage while employees enjoy easy access to their earnings and tax information. Looking ahead, sustainable payroll practices will continue evolving with advancements in automation and eco-friendly technologies, helping businesses become even more environmentally responsible.

There are many exciting changes ahead, and while we’ve highlighted some of the most impactful, this is just the start. The future of payroll is filled with endless possibilities, and we’re eager to continue pushing the boundaries. By embracing these innovations, Offshore Payroll is part of the evolution of payroll software ensuring they remain efficient, secure, focused on the user experience and aligned with the needs of the modern day workforce.

‘‘

FOR ISLE OF MAN COMPANIES EXPANDING INTERNATIONALLY, OR WHO ALREADY OPERATE ACROSS MULTIPLE JURISDICTIONS, THE FUTURE WILL INCLUDE A WIDER CHOICE OF PAYROLL SOFTWARE THAT WILL AUTOMATICALLY ADAPT TO EACH COUNTRY’S TAX AND COMPLIANCE REQUIREMENTS IN REAL TIME

As we move into the spring of 2025, I am excited to be able to update you on the progress the Capital International Group has made in the last 12 months and share with you some of the exciting developments that lie ahead.

Our mission and vision statements galvanise us to constantly work to enhance our client service offerings within our three core propositions: Investment Platform, Investment Management and Banking. ‘To make money work better for our clients, our people and our communities’ and ‘to simply connect the financial ecosystem in one place, to empower you’ are powerful statements of intent. They challenge our people to drive innovation and client-centric change through the business, and to dedicate time to supporting our communities.

For our clients, we have made numerous significant improvements to our product offering, whether that’s through the high-quality, client-centric care we have established across our Banking services, or the 100+ new releases made to enhance online access for our investment clients. We asked our clients what they valued most, we listened to their feedback and we set about delivering improvements to our service.

If you have driven through Douglas recently, you will have noticed the refurbishment work taking place at our offices on Circular Road. Across the four floors of our headquarters, we are investing over £2.0mil to expand and upgrade our client and office facilities to create a fantastic new working environment. Based on feedback gathered from across our teams and the results of our employee engagement surveys, we have implemented a number of changes, including updating our core benefits package and introducing industry standard salary benchmarking.

In our communities, we continue to invest in our Conscious Capital commitments, dedicating both financial and human resources to good causes and reducing our environmental footprint. These actions have enabled us to achieve an 80+% alignment to the WEF common metrics to sustainable value creation across the four pillars of people, planet, prosperity and governance. All of our people are encouraged to take two volunteering days a year to support a local charity of their choosing and through this work we have provided continued support to the Isle of Man Woodland Trust, the Energy & Sustainability Centre, Manx Wildlife Trust, Hospice Isle of Man, numerous

WE HAVE MADE NUMEROUS SIGNIFICANT IMPROVEMENTS TO OUR PRODUCT OFFERING, WHETHER THAT’S THROUGH THE HIGHQUALITY, CLIENT-CENTRIC CARE WE HAVE ESTABLISHED ACROSS OUR BANKING SERVICES, OR THE 100+ NEW RELEASES MADE TO ENHANCE ONLINE ACCESS FOR OUR INVESTMENT CLIENTS

Manx national sporting endeavours, as well as to Souper Troopers and Resthaven in South Africa.

Once again, we funded 12 members of our team to travel to Tanzania and spend a week at the Huruma Orphanage. Their individual fundraising efforts have continued to support the orphanage in the invaluable work they do for the children there, and this is part of our wider ambition to assist the orphanage in building a sustainable future. Collectively we invested over £70,000 in these projects last year and we have committed over £100,000 of investment into these and other Conscious Capital projects in the year ahead, all of which will be delivered through our newly created Conscious Capital Charitable Foundation.

Turning back to our core business, we plan to release a new mobile app, enabling our banking clients to better manage their accounts on-the-go. This exciting development will be hugely beneficial for payment and foreign exchange authorisations, particularly for our multi-jurisdictional corporate clients. Additionally, we will be releasing a new Bulk Payments feature that will enable clients to import and process multiple transactions, considerably streamlining their administrative payment processes.

Client centricity has always been a core pillar of our service delivery and we will continue with our Voice of the Client work to ensure that this informs our product development program. In the Investment Platform business, this will not only result in further incremental improvements to our Platform interface, but also in the

release of new digital onboarding and self-service portals. These significant developments will allow our clients to input and update their details digitally, upload documents, save progress on their applications, see exactly what is missing from their submissions, and reduce the back and forth with our onboarding and client service teams.

2024 also saw a major expansion of our Investment Management business through our acquisition of Martello Asset Management Limited in Jersey. In the year ahead we will expand our Jersey operation and integrate our investment management professionals across both jurisdictions.

Another core focus for the year ahead is to bring closer alignment to our client services across the Group. We are investing in a more unified brand, rather than being known as a provider of three distinctly different service offerings. I am extremely proud of the reputation that we have built in each of these business areas, but I also recognise that the sum of the parts is greater than each standing alone. Being part of a strong and well diversified financial services group creates resilience and strength that enables us to focus in on the delivery of outstanding client service, as expertise, resources and infrastructural resilience can be shared to the benefit of all.

With this in mind, in future the Capital International Group will simply become known as ‘Capital International’ and we will further align our three core businesses with one shared mission and vision. We are introducing a subtle change to our logo by removing the word ‘Group’ and later this year we will also be changing our website URL to support our wider international focus as we continue to grow.

The year ahead is going to be another exciting period of growth for Capital International and I look forward seeing our progress develop in the months ahead. If you have any feedback that you would like to share with us or if you would like to join us on our journey into the future, please do not hesitate to contact us.

‘‘

TURNING BACK TO OUR CORE BUSINESS, WE PLAN TO RELEASE A NEW MOBILE APP, ENABLING OUR BANKING CLIENTS TO BETTER MANAGE THEIR ACCOUNTS ON-THEGO. THIS EXCITING DEVELOPMENT WILL BE HUGELY BENEFICIAL FOR PAYMENT AND FOREIGN EXCHANGE AUTHORISATIONS, PARTICULARLY FOR OUR MULTI-JURISDICTIONAL CORPORATE CLIENTS.

THE ISLE OF MAN’S 2025 BUDGET, DELIVERED BY TREASURY MINISTER DR. ALEX ALLINSON ON 18 FEBRUARY, WAS BADGED AS BEING “RESPONSIBLE AND SUSTAINABLE,” WITH A POSITIVE OVERALL THEME OF STABILITY, PROGRESS, FAIRNESS AND “PUTTING MORE MONEY INTO PEOPLE’S POCKETS”.

BY AMANDA REID TAX MANAGER

Economically, the outlook for the Isle of Man (IoM) seems positive. After a more stable economic year inflation has fallen from around 5% at the end of 2023 to 1.9% in October 2024 and the investment climate remains bullish. These factors helped the Minister to deliver a Budget focussed on supporting working families, protecting businesses, driving government efficiencies and ensuring long term economic resilience in the Isle of Man.

MORE GENERALLY, THE USE OF THE TAX SYSTEM TO DIRECTLY ACHIEVE INBOUND ECONOMIC STIMULUS BY ATTRACTING HNWIS AND ENTREPRENEURS REMAINS A COMPLEX POLITICAL MATTER GIVEN THE ISLAND’S COMMITMENT TO A PROGRESSIVE SYSTEM OF TAX

The Budget presented Government’s financial plan for the next 5 years, with its aim to reduce the on-going reliance on reserves and deliver a more robust and sustainable economy for the Island.

Perhaps the most striking announcement was a cut of 1% to the higher rate of income tax, reducing the rate to 21% from 6 April 2025. The previous IoM Budget included a surprise increase of 2% to the higher income tax rate from 20% to 22%. The increase was badged as a temporary measure to provide additional, ring-fenced income for the NHS, although the reduction of the increase by only 1% suggests that financially it may be difficult to reverse it as soon as had been hoped by Treasury. The new, higher rate of 21% may therefore be a longer term position.

The proposed increase in revenue generated by last year’s rate increase (earmarked for the NHS) was budgeted at roughly £20million. The Government Pink Book suggests that income tax receipts in 2024/25 will be around £40million higher than the equivalent figure in 2023/24. Whilst these additional receipts won’t be wholly attributable to the additional 2% tax rate, it does appear that the higher rate is delivering the additional tax hoped for.

The extra tax raised by the remaining 1% increase was not explicitly stated as continuing to be ring-fenced for the NHS, however, we assume this will be the case. The Minister did announce that a consultation will be launched later in the year in respect of the introduction

BY KEVIN COWLEY DIRECTOR

of a separate NHS Levy to help tackle the growing costs of the provision of care.

The budget also announced an increase to the personal allowance of £250 for an individual and £500 for a jointly assessed couple. These increases take the annual amounts that can be earned tax free to £14,750 for an individual and £29,500 for jointly assessed couples.

National insurance was not subject to any significant change. This could be seen as good news given the 2% increases in Employer’s NIC announced by the UK Government in their 2024 Autumn Budget. There were no increases in employer or employee contribution rates, but a slight increase in the Class 1 primary and secondary thresholds and Class 4 lower profits limit were announced. These increases were confirmed as “allowing workers earning £49,000 or less to keep more of their money”.

Unfortunately, these NI increases were coupled with an increase to the Class 1 upper earnings limit and Class 4 upper profits limit, which will gradually erode any tax benefit attained for workers earning £55,000 or more.

The NI holiday scheme has been a widely used and popular measure with workers arriving in the IoM. The scheme is changing from 6 April 2025 and will only be available for returning Manx students. However, applications will still be accepted by the Income Tax Division for new Manx residents who have started employment before 5 April 2025, provided they meet the eligibility criteria.

There were no changes to the taxation of corporate entities announced. It is worth recalling that one of the actions of the Tax Strategy announced in last year’s budget was to review the scope of Isle of Man businesses that are subject to positive rates of corporation tax. This review will still be on Treasury’s agenda then, although it is possible that it may not happen until 2027/28 given the potential significance of any change and in the context of 2026 being an election year.

The Tax Cap has been increased to £220,000 per annum from £200,000 per annum from 6 April 2025. Introduced in 2006, the Tax Cap is a significant feature of the Isle of Man’s tax policy aimed at attracting highnet worth individuals to the Island to stimulate economic growth. How effective the Tax Cap has been in achieving this objective is a matter for debate. IoM Treasury has carried out a review of the Tax Cap with a report published earlier this year.

Whilst the report does suggest that the Tax Cap plays a part in attracting and retaining High Net Worth Individuals to the IoM, it also suggests that the Cap itself is not the only relevant factor at play in doing so. Lifestyle factors and other facets of the Island’s tax system (in particular the absence of capital taxes) all act to present the Island as an attractive location to live.

The Report also confirms the regressive nature of the Tax Cap given that the overall effective rate of income tax enjoyed by those who use it is only 3.31% (based on 2022/23 figures). This divergence from the IoM policy objective of having a progressive tax system seems to be increasingly problematic for Government as fairness and equity become more important to taxpayers.

The future of the Tax Cap is therefore far from clear. The Treasury review sets the foundations for future changes to the regime, including the possibility of linking the cap to a requirement to make a wider investment in the IoM.

More generally, the use of the tax system to directly achieve inbound economic stimulus by attracting HNWIs and entrepreneurs remains a complex political matter given the Island’s commitment to a progressive system of tax. The potential overall upside of providing tax incentives remains firmly on Treasury’s agenda however, as the Treasure Minister noted that the Isle of Man’s overall Tax Strategy “...commits to us working with the Department for Enterprise to reform how we offer financial incentives to a much wider range of people to ensure we increase our actively working population.”

Such financial (tax) incentives are currently limited although the Island does offer some direct ‘relocation’ benefits, namely;

• Beneficial tax treatment for Key Employees encouraging skilled workers, entrepreneurship and economic growth to the Island by restricting a new resident’s exposure to Isle of Man income tax for their first 3 years of residence; and

• A generous £20,000 relocation relief for qualifying expenditure incurred by employers on behalf of their employees when they relocate.

Of course the current 0% rate of corporate income tax is also very appealing in the context of business relocation. It therefore remains to be seen what, if any, additional tax incentives may be introduced to help drive the Island’s growth agenda.

The final announcement in the Treasury Minister’s speech confirmed that the Island had agreed a position with the UK Treasury in respect of the VAT revenue sharing arrangement that exists between the two countries (known as FERSA). The agreement is subject to a 5 yearly review and the successful outcome of this review is welcome news. In the words of the Minister “This Agreement provides the Treasury with confidence and certainty in terms of the revenue the Isle of Man will receive under FERSA in each of the next five years, until the next calculation is undertaken in 2028/29.”

By reducing income tax rates and increasing allowances, the government has aimed to alleviate the tax burden for individuals and families as far as they can. However, financial pressures have meant that the amount of help that could be provided is limited. Indeed, whilst there will be some tax payers who are better off after this year’s budget there will be others, mostly higher earners, who find themselves with a bigger overall tax bill to pay.

Get in touch with tax experts Kevin and Amanda to discuss IOM budget questions or to find out how Equiom can support you.

This article has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only. This article cannot be relied upon to cover specific situations, and you should not act, or refrain from acting, upon the information contained within this article without obtaining specific professional advice. Please contact Equiom to discuss these matters in the context of your particular circumstance. Equiom Group, its partners, employees, and agents do not accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this article or for any decision based on it. For information on the regulatory status of our companies, please visit www.equiomgroup.com/regulatory.

TWO OF UNIVERSITY COLLEGE ISLE OF MAN’S (UCM) STUDENTS WON FIRST PLACE AT THE PAN-ISLAND SKILLS TEST IN GUERNSEY LAST WEEK. FREDDIE KERMODE AND BROOKE GOLDSMITH SHOWCASED THEIR TALENT AND HARD WORK IN BRICKWORK AND PAINTING AND DECORATING, EARNING THE COVETED PLACES IN THIS HIGHLY SKILLED CHALLENGE.

UCM PAINTING & DECORATING STUDENT BROOKE GOLDSMITH WITH DR LOUISE MISSELKE, PRINCIPAL OF THE GUERNSEY COLLEGE OF FURTHER EDUCATION

NOT ONLY DID THE STUDENTS SHOW THEIR HIGH LEVEL OF TECHNICAL SKILLS, BUT THEY ALSO REPRESENTED OUR ISLAND WITH PROFESSIONALISM AND ENTHUSIASM

The event, held on Friday 14th February during National Apprenticeship Week (NAW25), saw apprentices from UCM compete against peers from Highlands College Jersey and the Guernsey Institute in a series of timed trade challenges. Under the guidance and judging of industry professionals, the students demonstrated not only their technical abilities but also problem-solving and time management skills.

Overall, ten apprentices competed in carpentry and joinery, electrical installation, plumbing, brickwork, and painting and decorating related tasks. In addition to the two first places, Carpentry and joinery student, Adrian Chisoi’s skills were also recognised with a second-place award.

Jesamine Kelly, Principal of UCM, expressed her pride in the students: "We are incredibly proud of our apprentices for taking part in this year’s Pan-Island Skills Test. Not only did they show their high level of technical skills, but they also represented our Island

with professionalism and enthusiasm. This experience will undoubtedly benefit them as they continue their apprenticeships and progress in their careers. Congratulations to all participants!"

Beyond the competition, this experience allowed apprentices to fully engage in their work while developing key life skills in a supportive environment. Traveling and networking with peers in similar positions gave them valuable industry insight and a sense of connection. Representing both UCM and the Isle of Man, they demonstrated not only their dedication and skills but also the high-quality training that supports their success.

The event concluded with an awards ceremony, recognising the top two competitors in each category. Regardless of the final results, all UCM apprentices should feel proud of their achievements, having gained invaluable experience and confidence that will support them in their future careers.

RENEWABLE ENERGY OFFERS MANY POTENTIAL ADVANTAGES FOR THE ISLE OF MAN, BUT IT’S NOT ONLY ABOUT ENERGY SECURITY AND CHEAPER ELECTRICITY BILLS – THERE ARE MANY OPPORTUNITIES FOR ECONOMIC AND BUSINESS BENEFITS TOO. GOVERNMENT’S FUTURE DECISIONS ABOUT ENERGY STRATEGY COULD CREATE A STRONG, SUSTAINABLE ECONOMY THAT WILL SHAPE THE ISLAND’S FUTURE FOR DECADES TO COME.

FOUNDING MANAGING DIRECTOR

WHATEVER YOUR PERSONAL OPINIONS ARE ABOUT CLIMATE CHANGE AND ITS CAUSES, OR THE FOSSIL FUELS VERSUS RENEWABLES DEBATE, IT’S CLEAR THAT MANY NATIONS AND ISLAND JURISDICTIONS ALREADY UNDERSTAND THAT THEY WILL BE STRONGER AND MORE SECURE BY HAVING THEIR OWN SOURCES OF ENERGY

Right now the Isle of Man relies heavily on fossil fuels to power our economy. From the oil used to generate electricity, to gas that heats many business premises, we’re at the mercy of spikes in global fossil fuel prices beyond our control.

We’re not alone of course, because many islands and nations around the world face the same challenges regarding energy costs and energy security. What makes the Isle of Man different is what we have done so far to address these problems.

The UK and EU nations are ahead of us in terms of building renewable energy infrastructure which they own and control. In January this year Neso (the UK’s national energy systems operator) released annual figures for 2024 which showed that wind was the largest source of energy for the first time. In a year when over a century of generating electricity from coal came to an end, gas accounted for 26% of electricity, while wind, solar, biomass and hydroelectric power generated 43.8%. Some small islands are ahead of us too. The Danish island of Samsø (smaller in size than the Isle of Man and with a population of around 4,000) has already reduced its annual carbon dioxide emissions close to zero, effectively becoming carbon neutral. That’s the independent view of the United Nations which highlights Samsø as an example of what small island communities can achieve when there is a strong vision and commitment to investing in renewable energy. With the Isle of Man facing important decisions this year about onshore and offshore wind farm proposals, it’s also interesting to note that Samsø relies on wind energy to generate its electricity. So, what tangible benefits could the Isle of Man gain from renewables?

Moving away from fossil fuels and towards renewables isn’t just about meeting the Island’s net-zero targets – it’s about gaining real economic, business and community benefits. Here’s my top 3.

1: Energy security

Ending our reliance on imported oil and gas from major fossil fuel producing nations will make the Isle of Man a stronger, more independent jurisdiction. Renewable energy offers a way to break away from the vicious circle of global price hikes that are beyond our control. Yes, there is a possibility there may be a source of gas within the Island’s territorial waters which could be technically and economically viable to extract – but whether that’s feasible has not yet been proven. What we do know for certain is that we have a plentiful sources of solar and wind energy, so they are much more realistic options right now.

2: ESG & net-zero factors

Corporations in sectors that are major GDP contributors – and industries which the Island is aiming to attract in the future to support economic growth – need renewable energy to meet ESG and net-zero targets. Inevitably, these internationally mobile businesses will gravitate towards jurisdictions that give them what they need. In this context,

if we fail to offer global corporations a reliable, secure and cost-effective source of green energy then there’s a major risk to Island’s future economic prosperity.

3: A direct boost to the economy

Seabed rental plus taxation and royalties from offshore projects could provide new revenue streams for the Treasury. Inward investment from global renewable energy firms has the potential to create jobs, career opportunities, plus the possibility of forming the basis of an IOM renewable energy hub. Ever since it was established in the 1980s, the Island’s financial services sector has created well paid jobs for highly-skilled professionals. Today, it still offers opportunities for school leavers and graduates to pursue careers here on the Island, or as a gateway to work in other leading business centres around the world. In a similar way, the renewable energy industry could open the door to exciting technical and engineering careers in a sector that has a bright future.

All of the above could play a vital role in creating a strong, sustainable economy which will allow the Isle of Man to maintain the community and quality of life that we enjoy today.

Summary

I’ve been working alongside third sector and other organisations involved in the net-zero, green energy and sustainability sectors for the past three years and have seen first-hand not only the many economic benefits, but also how renewable energy can support biodiversity.

Whatever your personal opinions are about climate change and its causes, or the fossil fuels versus renewables debate, it’s clear that many nations and island jurisdictions already understand that they will be stronger and more secure by having their own sources of energy. In the longterm, nations and islands that don’t have their own sources of fossil fuels will choose renewable energy to power their economies.

It's encouraging that the transition away from fossil fuels is firmly on the agenda for Isle of Man Government and the business community – but we have a lot of catching up to do. Crucial decisions must be made by our political leaders this year and during the remainder of the current government’s term in office. There are no perfect solutions, so compromises will have to be made that will not please everyone. But many other jurisdictions have already made these big calls, so Isle of Man’s decision makers must take the opportunities we have now to make up this lost ground before the next General Election in September 2026. The alternative is getting left behind by competitor jurisdictions in the decades to come and leaving our children and grandchildren to count the cost.

No matter what your personal opinions are about the moral arguments regarding climate change and net-zero, wouldn’t you prefer that a cleaner, greener, stronger and more secure Island is the legacy we leave for future generations?

in association with

n Higher rate of Income Tax to fall from 22% to 21%.

n Personal income tax allowance to rise by £250 for individuals, £500 for jointly-assessed couples.

n Changes to National Insurance thresholds will mean more take-home pay for many.

n More families can claim Child Benefit as thresholds increase by £10,000.

n Protection for businesses with no increase to employer National Insurance contributions.

n £25m available for Health and Social Care.

n Education funding to increase by £8.3m.

n £5.3m committed to digitising/automating processes across Isle of Man Government.

n The higher rate of Income Tax will fall from 22% to 21%, reducing the financial burden on families and putting money back in people’s pockets.

n The personal income tax allowance will rise by £250. From April, individuals will only start paying tax on annual earnings over £14,750 with jointly-assessed couples starting from £29,500.

n Revenue collected by implementing new global tax rules will lead to £10m a year being allocated to support businesses in our local economy from 2027-28 to 2029-30.

n From April this year the tax cap will increase to £220,000 a year.

n A consultation will be launched into the creation of a healthcare levy to help address the growing cost of the National Health Service.

n Increasing National Insurance Class 1 Primary and Secondary Thresholds and Class 4 Lower Profits Limit will mean workers keep more money through starting to pay NI on earnings of £168 a week rather than £160.

n There will be no change to employers’ National Insurance contributions for the new financial year, enabling businesses to plan with confidence and support their employees.

n The National Insurance Holiday Scheme will continue for returning Manx students, but will close to new residents who start work after 5 April 2025.

n Departments will receive uplifts of 2% for pay and 1% for non-pay as part of this year’s Budget measures, aligning with the drive for greater efficiency across the Isle of Man Government.

n Digitising and automating processes in order to achieve greater efficiency across the Isle of Man Government will benefit from investment in the Transformation Fund totalling £5.3m.

n The number of families able to claim Child Benefit will increase in April, as the thresholds to qualify for support will rise by £10,000, to a maximum of £90,000.

n Most benefits will increase in line with inflation at September 2024 – reciprocal benefits with the UK by 1.7% (UK CPI) and others by 2.2% (Isle of Man CPI).

n Above inflation benefit rises will be applied to the Nursing Care Contribution (5.3%) and Maternity, Paternity and Adoption allowances (3.5%).

n The Winter Bonus, an annual benefit aimed at helping vulnerable individuals, will be increased by £50 to £400.

n The Basic State Pension will increase by 4.1% to £176.45 a week. The Manx State Pension will also rise by 4.1% to £251.30 a week.

n Investment supporting the aims of Our Island Plan is being enabled through injections to existing funds focussing on transforming our health service (£4m), developing major infrastructure projects (£5m) and supporting the agriculture industry (£4m).

n The creation of a Housing Deficiency Fund, comprising £7.5m from the Department of Infrastructure and an injection of £2m from reserves, will centralise funding for local authority housing schemes, providing additional affordable housing.

n A full capital programme totalling £300m commits investment in the Island over the next five years.

n Capital expenditure of £87.4m in 2025-26 will support the local construction sector and provide much needed improvements to critical national infrastructure.

n More than £1m will be invested in improving sports facilities around the Island and £6.1m will be committed t maintaining the Island’s roads.

n The Isle of Man Government will continue to reduce its reliance on reserves over the next five years.

n The medium-term financial plan allows for a total of £110.6m to be withdrawn to balance the budget in 202526, gradually reducing to £49.7m in 2029-30.

n The plan also shows the Island’s reserves growing to £2 billion and the National Insurance Fund continuing to grow to over £1 billion by 2030.

in association with

‘‘

THERE OF COURSE REMAINS A LOT TO BE SAID FOR THE BENEFITS OF THE ISLE OF MAN’S TAXATION SYSTEM AND THE OVERALL ATTRACTIVENESS OF THE ISLAND AS A PLACE TO LIVE AND WORK; HOWEVER, STABILITY IS PRECIOUS TO BUSINESS AND WE HAVE SEEN PRECIOUS LITTLE OF IT IN RECENT BUDGETS

The tax measure grabbing many of the headlines off the back of the Isle of Man’s 2025/26 Budget was, of course, the 1% cut in the top rate of income tax. This will be the third different top rate in as many years, after a long period during which it remained stable at 20%.

This move, together with the first (very modest!) increase in personal allowances for four years, was described as having the aim of putting money back into the pockets of workers.

Whilst no doubt true for many, the increases made to the Class 1 employees’ National Insurance Contributions (“NICs”) earnings thresholds will heavily dilute the effect for some, particularly those in the £50k£60k per annum earnings bracket.

We have also seen a steady climb in many local workers’ effective tax rates (particularly when factoring in NICs) over the last few years, caused by a combination of below-inflationary increases to personal allowance thresholds, the effective freezing of the 10% rate band, an overall increase to the top rate of tax and the NIC threshold increases referred to above (which continues the recent trend). For higher earners (i.e. those earning in excess of £100k) this has been compounded by the “clawback” of personal allowances introduced in 2023.

What this means is that a worker who has had inflationary pay-rises over the last few years (i.e. is on the same salary in real terms) will, nevertheless, be paying a higher proportion of tax and NICs than before resulting in them having less money in their pocket, in percentage terms.

With this as the backdrop, two matters to be consulted on shortly will likely result in further charges: the healthcare levy, first mooted at last year’s Budget, and a possible charge to NICs on dividends paid by certain owner-managed businesses (“OMBs”), neither of which are likely to be popular, for different reasons.

The healthcare levy may come in for criticism as there appears to be a political will for it to be payable by all (to at least some extent), which would thus imply that those on lower incomes will be impacted,

including potentially those who do not currently earn enough to fall into a tax or NIC-paying bracket. More fundamentally, given the stated aim for this to be a new, standalone levy, it may be seen as a cumbersome, potentially expensive-to-administer alternative to simply adjusting the existing income tax/ NIC regimes, as well as being a further sign that controlling Government healthcare costs is proving to be an extremely difficult challenge.

The issue of whether (and, if so, how) to charge NICs on dividends paid by OMBs has been talked about for a long time now and derives from a perception in some political quarters that the rules is this area contain an inherent unfairness. This is that local shareholders of Isle of Man companies operating a local business can effectively decide to remunerate themselves disproportionately in the form of dividends (which aren’t subject to NICs) rather than salary (which is) when, if their business was not incorporated, they would pay NICs on what would be self-employment earnings. Without delving into the technical aspects of this or seeking to set out in full the various pros and cons of taking action in this area, it is clear that one of the likely main criticisms of making such a move would be the perception that this would be a new liability effectively introduced on a cohort typically seen as the lifeblood of any vibrant economy, ie small businesses.

There of course remains a lot to be said for the benefits of the Isle of Man’s taxation system and the overall attractiveness of the Island as a place to live and work; however, stability is precious to business and we have seen precious little of it in recent budgets –changing tax rates, increased NIC burdens and the background threat of new levies and charges in the context of what many consider to be an outsized Government - and certainly one that continues to draw down from reserves - is a combination of factors that doesn’t sit comfortably with some.

That said, it is encouraging to see that both the potential changes described above are to be consulted upon, and not rushed, thus giving those interested ample opportunity to have their views heard before any decisions are made.

MANAGER

ISLE OF MAN

Treasury Minister Dr Alex Allinson MHK delivered his third Budget on 18 February focused on “stability, progress and fairness” which saw a modest increase in personal allowances, a 1% reduction in the higher tax rate, an adjustment to the National Insurance thresholds, and a rise in line with the UK’s triple lock policy for pension payouts.

While the Isle of Man’s financial situation seems stable, there were a number of challenges faced over the past 12 months and arguably more to come for this administration. The ever- increasing pressures on health and social care and the long-term viability of the Manx National Insurance Fund have been at the forefront of discussion in recent months. The reliance on reserves is perhaps more significant than previously forecast, and was an area that many MHKs touched on during the debate, saying that they felt the Government needs to find a way to reduce reliance on reserves.