Create critical youth jobs. Empower communities. Transform SA.

Join trailblazing businesses like Anglo American Platinum, South 32 and Goldfields who are changing the game by integrating YES into their ESG strategies and social and labour plans (SLPs).

Say YES today and gain B-BBEE levels.

The Youth Employment Service (YES), a business-led youth employment programme, is affecting broad-based change across sectors, provinces, and the country. YES addresses the country’s youth unemployment crisis by empowering businesses to create jobs for our unemployed youth. We’re youth-focused and business-led. In just four years, YES has collaborated with over 2,200 businesses and created 112,334 job opportunities with no government funding, pouring an estimated R6 billion worth of youth salaries into communities and the economy.

Businesses can choose to place youth within their own structures or within a YES host partner through the turnkey solution.

With 20 vetted host partners across the country, YES offers an effective way for companies to uplift communities in high-impact sectors like healthcare, education, and early childhood development, or future-facing sectors like digital, ICT, and green economies. YES plays a vital role by providing work experiences in community-based NPOs and small businesses, enabling youth to reinvest their earnings into local economies. This feeds into poverty eradication and upliftment of communities beyond the mines these towns surround.

ESG strategies and reporting are crucial to your business’ success, and YES provides an opportunity to develop youth jobs that correspond with these goals, making a difference in the lives of South African youth and communities.

This model integrates seamlessly with the Local Economic Development (LED) and Human Resource Development elements of the SLP.

Businesses, in collaboration with YES, can create economic success, foster a fairer society, and act as change agents, all while reaching their ESG goals.

Uplift communities. Capacitate underresourced sectors. Discover hidden gems.

Contact: Tel: 087 330 0084

Email: corporatesupport@yes4youth.co.za

www.yes4youth.co.za

Songatech was established in 2013 by a group of engineers because of the gap in the market for local owned and managed companies in South Africa and Africa for the supply and services of mineral processing products and services. The company is currently owned and managed by experienced engineers who understand the challenges of the Mining Industry. As such, the company has remained relevant to its vision of being the preferred supplier of high quality products and services. The company has over the years realised its mission of supplying high quality products and services to the Mining Industry in an effort to increase wealth and to triple customer bottomline.

The global economy is on the brink of a recess where there are very few green field projects thus creating fewer opportunities and limited potential for growth and expansion. The Brown Field Projects which are existing are under immense pressure to make profits and growth. As a consequence the cost of operation has become excessively high, affecting price of procured services and products. This constantly creates a situation of continuous requests for low cost / low price products which compromise the product quality. To combat this impact, we have had to be very agile and innovative in order to remain supplying products and services of the highest quality to our clients thereby ensuring that their operations stay afloat. How do you plan to overcome these challenges?

Songatech is built on the basis of low-cost operations through innovative methods of manufacturing and production of high quality products and services. We have hired the best employees in various fields of technical expertise such as Engineering, Manufacturing, SHEQ, Supply Chain Management and Business Administration.

We are a very orientated company in the areas of research and development and social economic development. We are cautious of global economics and political trends that affect trading stability and fiscal policies which in turn influence markets and trading trends. Where our customers are affected, we initiate such initiatives within a short space/period of time to nullify adverse effects and cushion the situation.

I started Songatech due to the lack of locally owned companies in the mining industry, with a specific focus on mineral processing products and services. The dispensation amalgamated and created a hostile environment, thus creating lack of economic development for local companies in the said industry. The resultant has been for Africa to fail to realise economic development at the expense of Europe, Asia and America. Songatech has a potential to grow to a large corporate multibillion organisation which will create a huge impact on the African Continent. The company has recently put up a 100m rand factory and is in the process of putting up a 500m rand factory. We are definitely looking for new partnerships around the globe to enable exponential growth and expansion. The company has a non-discriminatory policy and is looking forward to being a global market player. The government of South Africa has already adopted us through their industrial funding mechanisms in an effort to grow the organisation and create much needed employment in the current constraint and slow growing economy.

I want to impact people’s lives by creation of lateral wealth to ensure a sustainable universe of love and peace for people

coming from various walks of life, thus fulfilling the ideology of global citizen, started by high profile and influential people around the globe. Furthermore, to participate on the emancipation of a better African economy and realisation of Ubuntu for everyone around the globe.

The company has gone through various funding mechanisms over the years, including amongst others boot strapping, family and friends, private institution, government funds and grants.

I am a go getter by nature, through the grooming of life and economic participation by my grandmother who was a farmer that used to trade vegetation and livestock, my parents who were employed as educators by the Department of Education in South Africa. I am very intuitive and persuasive, having studied, qualified and achieved professionalism in the fields of engineering, business management and administration, quality control and assurance, international trade, thus holding

qualifications of metallurgical engineering degree, business management honours, business administration honours, sales & marketing, international trading terms, quality assurance, legal liability, Master of Business Administration. All enabling me as an individual to run the business effectively, efficiently, profitably, sustainably, creatively, innovatively, successfully and compliant to laws. My personal motto is 100% success, which is very much aligned with the company’s motto (Putting Technology Together). The Company, through its motto remains very relevant and echos a leading part on the 4th Industrial Revolution, which seeks to change or improve business operations and systems.

The organisation is owned and managed by people from historical disadvantaged population groups with limited access to opportunities and economic development. As a consequence of the preceding statement, the company has created a culture to celebrate every opportunity regardless of size, quantity/quality and geographical location. Our employees and host communities are at the core/key of our reward system, in an effort to empower, invest, redress and create a better economy and future for all that share in the universe. Furthermore, we have and we will continue to endeavour on programmes to empower and create value for our stakeholders such as employees, suppliers, customers, strategic employment partners, JV partners, financing institutions, host communities, current and future investors and the global market.

Songatech (Pty) Ltd

Address: 6 Flamink road, Alrode, Alberton South Ext 5, 1451

Email: admin@songatech.co.za

Website: www.songatech.co.za

Tel: 010 474 1272

Cell: 083 597 3427

PUBLISHER

TTL Media www.sector.org.za

MANAGING DIRECTOR :

Michael Keys

EDITOR:

Stef Terblanche Phone: 076 647 8235

DIVISIONAL SALES FLOOR MANAGER: Marc Wessels Marc@ttlmedia.co.za

SALES EXECUTIVES:

Debbie Dosson - sales3@ttlmedia.co.za

Marc Wessels - marc@ttlmedia.co.za

Kim Jeneke - kimjen@ttlmedia.co.za

ACCOUNTS:

Samantha Fox accounts@ttlmedia.co.za

OFFICE MANAGER: Sumaya Abrahams sumaya@ttlmedia.co.za

CLIENT LIAISON:

Tania Johnson tania@ttlmedia.co.za

PROJECT MANAGER:

Kim Jeneke kimjen@ttlmedia.co.za

ONLINE:

Tina Lewis forerunner@ttlmedia.co.za

DESIGNED BY:

KCDA - Design Agency

Jaco Kotze - jk@kcda.co.za

www.kcda.co.za - 021 981 6333

PRINTED BY:

F A PRINT CC

Phone: 021 510 5039

Fax: 021 510 5038

Email: faprintcc@yahoo.com

DISCLAIMER

Views expressed in articles are those of the author and not necessarily those of FORERUNNER MAGAZINE. The publisher accepts no liability of whatever nature arising out of / or in connection with contents of the publication. Copyright subsist in TTL MEDIA & FORERUNNER MAGAZINE and, in the case of freelance photographers and writers, in the individual concerned. Material in this publication may not be reproduced in any form without the permission of the editor

Welcome to the first edition of Sector, the mining magazine with a difference!

During this, our 4th Industrial Revolution (4IR) and a world in the grip of climate change, the mining industry is in a state of change and transition not seen since the steam-driven industrial revolution of almost 200 years ago and the next industrial revolution that followed the introduction of electricity. As a mining magazine with a difference, it is our mission to reflect this latest change and transition in the industry and to look ahead at the opportunities and challenges that await. We trust that you will join us on this exciting journey of innovation and change.

It is against this background that in this very first edition of Sector we bring you thought-provoking articles ranging from digitalisation in mining to the decarbonising green transition, the great copper comeback to feed a hungry electric vehicle (EV) industry, and to the ever-growing role women are fulfilling in mining.

As companies transition to smart procurement after a period of many challenges in the supply chain environment, we find that South African mining companies are progressing well in this respect. In another article we probe the credentials of lithium as a critical battery metal widely used in electric vehicles (EVs) among other things, with demand spiralling. We also look at where South Africa stands in respect of rare earth minerals – another critical component of the drive to electrification. Another topic that we tackle is the shortage of sought-after technical mining skills in the context of all of this change.

And lastly, but by far not least, we look at the current position of junior and emerging miners, how deep-sea floor bed mining is being blocked due to environmental concerns, and we bring you an-depth interview on the state of South African mining with Roger Baxter who stepped down as CEO of the Minerals Council South Africa this year. Also, be sure not to miss our regular section under the banner of Headgear which brings you news snippets and developments from the world of mining.

I trust that you, our readers and advertisers alike, will enjoy these articles and find value in them. So, on that note, forward with the transition and the exciting era of the 4IR!

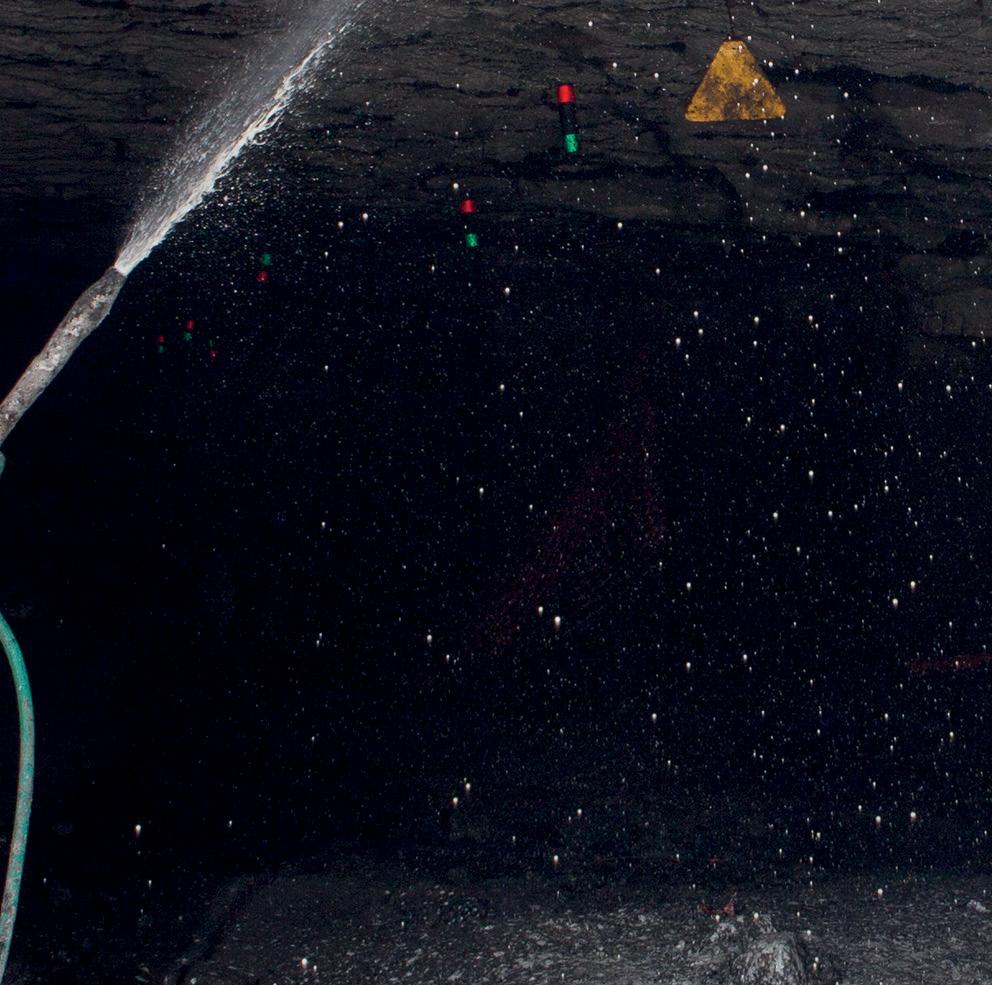

The EditorInnovative chemistry for sustainable mining solutions.

A GLOBAL LEADER IN THE FORMULATION, MANUFACTURE AND DISTRIBUTION OF CONCRETE ADMIXTURES.

» Backfill

» Shotcrete

» Grout Plants

» Water Sealing and Consolidation

» Dust Suppression

» Ventilation Sealer

» Shaft Sinking

The company’s team of highly- skilled technicians are fully trained in the repair & maintenance of variety of internationally branded machines.

In particular we offer expert services in the repair of components for New Holland Flameproof Tractors as well as Clark & Spicer.

MINING SOLUTIONS

PROCESSING

PLANT SOLUTIONS

CUSTOM BUILD SOLUTIONS

HENCON EVY

In the mining industry (gold, platinum, diamonds, chrome, coal, etc.) vacuumation is used to recover precious material from spillages around conveyor belts, trenches, shaft bottoms, sumps, ore passes and feed back into production. Further, these units are also used for sweeping & vamping, fines recovery (Madala sites), clearing of settling dams and confined areas. Vacuumation is integrated with tunnel borers, shaft sinking cutters and continuous miners for the purpose of efficiently transferring material.

These units are custom designed and robust built to withstand the harsh conditions that the mining industry has to offer.

Products:

• Skid mounted

• Rail mounted

• Rubber wheeled

• Low profile cassette

• Centralised vacuum system

• Gravity discharge collectors

• Teardrop collector

• Continuous discharge collectors

Vacuumation is used to recover production losses due to inefficiencies found in plants. This refers to conveyor belt spillages, production spillages, sump and pit spillage control, dust buildup on horizontal surfaces, general housekeeping, losses by road transport and impact due to weather conditions. Vacuum sweeping of plant roads and cemented surfaces. The valuable material is recovered and reintroduced back into production.

The process of transferring material using vacuumation is spillage- and dust-free in contrast to other commonly used methods.

Products:

• Stationary

• Mobile

• Truck-mounted

• Centralised vacuum system

• Gravity discharge collectors

• Continuous discharge collectors

• High efficiency cyclones

• Reverse-pulse filter/collector

Transferring of material in processing plants. Moisture removal during material transfer. Conveyor belt vacuum nozzle on return idler. Custom designed vacuum solutions to client needs.

Products:

• Belt vacuum nozzle

• Transfer system

• Road sweeping trucks

• Custom solutions

“Valuable material is lost in processing. Let vacuumation recapture these losses and return them back into production.”

M84 Geotech is a South African company which was established in 2014 in a mining town of Mokopane in Limpopo province. The company is a geohazards mitigation and rope access company specializing in rockfall protection, rockfall barriers, rock scaling, slope stabilization and slope monitors installations for open pit mines.

The beginning was not as clear as it is now because all we wanted was just to trade with the mine to make a living. We just took any opportunity which came along at the time until we settled as a geotechnical contractor for open pit mines.

For us to stand a chance of being a successful business, we had to change our way of doing things and the shift from being a middleman to being the main man. As a supplier we were just a middleman with not much control on our costs and profits margins. The decision was made that we are going to be a specialist and be valuable to

the mine. We took 2 guys to train for rope access and sourced other two experienced rope technicians to make up our first team as geohazards mitigation and rope access company. In 2018 we got our first working at height project at Mogalakwena mine to do rock scaling on a high wall and since then we have been building ourselves up as the next best alternative and partner when it comes to rockfall protection, rockfall barriers, slope stabilization and rock scaling for open pits mines.

As a company we pride ourselves in having 100% completion rate on every project we have done and also keeping a 100% safety record on-site. This is a big deal for us because we do high risk and high priority projects and that’s why we say, “Safety is Our Priority.”

The systems we use to keep open pit operations safe from rockfall hazards and slope failure are one of the best in the market and with us as a contractor you are guaranteed a professional service and safest installation. The use of rope access techniques makes it possible for

us to install the systems with minimum interruption to production. We can access high areas using the safest methods while keeping your miners and equipment safe from possible rockfall hazards. We are an accredited member of the IWH which means we follow the industry standards when executing our work and as a company we are also trained as an installer of Geobrugg systems which is a global leader in high tensile steel wire mesh.

Now that we have found a niche, our goal is to build our brand to be associated with what we do. We want to be a leader in the field of geohazards mitigation and rockfall protection systems in the mining sector and other related fields. We want to partner with the mining companies to protect their miners and equipment from rockfall hazards in open pit operations as well as underground mining.

M84 Geotech is the go-to contractor when it comes to slope stabilization, rockfall protection, rockfall barriers, rock scaling, devegetation on high walls and slope monitoring installation. We are well experienced when it comes to managing high pressure and high-risk projects with high level of quality and safety.

As a project-oriented company, we have learned a thing or two on delivering projects successfully with the triple constraint of project management well managed. Some of the projects we have competed successfully include: •

Rock scaling involves moving loose rocks on open pit mine high walls to avoid them free falling to the foot of the slope. We have moved boulders on high walls to protect miners and equipment. Rope access techniques and blasting are used to remove boulders and rocks on high walls.

If not controlled, vegetation on open pit high walls can make it difficult for the geotech team

to monitor slopes. Using rope access techniques, vegetation can be removed or trimmed to keep high wall clear of distractions.

Prisms are installed on high walls to monitor any movement on the slope. No production interference is needed because we do the work while suspended on ropes.

Depending on the needs or scope from the client, we have few systems which we use to protect open pit mines against rockfall hazards. The systems include drape mesh or net, pinned system, rockfall attenuator and rockfall barriers. Our team will provide the relevant solution according to your needs and conditions of your site. We are one of the trusted companies when it comes to installation of high wall support systems.

•

Whether on the surface or on high wall, we have the expertise to drill and installing anchors.

Tel: 015 023 1400 072 2038 405

Email: info@m84geotech.co.za

Website: www.m84geotech.co.za

Instagram: m84_geotech.co.za

LinkedIn: M84 Geotech

Address:

Mokopane: 11 Sussex Street, Industrial, Mokopane, 0601

Polokwane: 4 Rhodesdrift Street, Suite 3

Rhodesdrift Office Park, Bendor

Polokwane, 0699

072 2038 405

info@m84geotech.co.za

MOKOPANE BRANCH:

11 Sussex Street, Industrial Mokopane, Mokopane 0601

POLOKWANE BRANCH:

4 RhodesDrift Street, Suite 3 RhodesDrift Office Park, Bendor Polokwane

One of the things which makes us stand out among our competitors is that we do not cut corners when it comes to our installation. The reason being that we want to make sure that each step of the installation is followed as per the manufacture’s instruction to guarantee the strength and safety of the solution. We are in the business of eliminating or minimizing rockfall hazards in the mining and civil industries and our priority is to keep our clients at easy by providing them with solutions which will guarantee safety for their miners and equipment. The high tensile steel we use is one of its kind and we work hand in hand with the manufacture to provide the right systems as per the clients’ requirement and conditions on the site. Whether you want to keep your high walls safe from free falling rocks or want to support your slope, we have the solution for you.

The are other contractors who do what we do but there is none like M84 Geotech. We are not just another geotechnical contractor but we are a solution driven company with an excellent record in installation of geohazards solutions, rock scaling, slope monitors and safety standards. As a company our priority is not just about making money but the safety of the people who are exposed to rockfall hazards in open pit mines. So, when you choose to partner with us you are choosing:

• A specialist. We are the best at what we do but we treat each project like it’s our first so that we do not lose the learning spirit.

• Trained. As a company we have been trained at Geobrugg which is the leading manufacture of high tensile steel in the world. We have the theory and practical knowledge of the systems we provide. Our technicians are not only experienced but trained to keep your high walls safe.

• Safety Record. At M84 Geotech, safety is our priority and we prioritize it in every project we do. Our motto is that we do not do it until we find the safest way to do. That’s how we manage to keep a 100% safety record on-site.

• Project Skills. We have gained some valuable knowledge and skills from the projects we have successfully completed in the past and that helps us in managing difficult projects.

• Compliance & Competence. We are fully compliant when it comes to safety standards for site compliance such as safety files and the required trainings. We have competence in compiling risk assessments for each site and doing site declarations.

Writing in Business Day, Clarence Tshitereke, communications director for Africa’s Critical Minerals Summit, says as the world transitions from coal and

hydrocarbons to green energy solutions, critical minerals have taken on a new salience. The demand for these minerals is compounded by it only being available in small quantities. Availability and access to critical minerals have come to underpin countries’ national security. Through strategic policy positioning the

SA government must lead its critical minerals sector to seize opportunities of the clean energy revolution, requiring that it urgently sets out a vision to grow and strategically position its critical minerals sector. This is critical because SA remains pre-eminently a mining nation with rich geological reserves,

established expertise in extracting minerals, and a reliable track record as a supplier of minerals.

Critical minerals are metals that are central to the sustainability of hi-tech sectors and devices, for personal and commercial use. Most industrialised countries do not have such critical mineral endowments and are therefore dependent on imports.

A general concern is that countries with critical minerals may use control of such resources as leverage on other issues. To mitigate their vulnerabilities from potential supply disruptions, developed countries have formulated national critical mineral strategies, focusing primarily on reducing national vulnerability to disruption to ensure sustainability of their advanced technologies and industrial bases. Due to these realities SA urgently needs a national critical minerals strategy to enhance international trade and co-operation in domestic exploration investments regarding critical minerals.

Nyasha Nyaungwa of Reuters reports that Japan recently signed an agreement with Namibia to jointly explore for rare earth minerals as part of its broader plan to develop supply chains for cobalt and other minerals used in making electric vehicle batteries. The Japan Organization for Metals and Energy Security (JOGMEC) will collaborate with Namibia’s stateowned mining firm Epangelo, a Namibia mines and energy ministry official said on the sidelines of the signing ceremony in Windhoek.

Yasutoshi Nishimura, Japan’s minister for economy, trade and industry was visiting five countries with significant

deposits of rare earths, including Namibia, Zambia and Democratic Republic of Congo to try to build an African supply chain of critical minerals. Japan, like other advanced economies, is seeking to be less reliant on China, which has dominated supplies of battery minerals.

In a recent article in the Mail & Guardian, Sikho Luthango, a Rosa Luxemburg Stiftung programme manager, writes that new exploration and mining projects will require mining licences but it is becoming increasingly difficult to open new mines across the world, including in South Africa, without community buy-in. Mineral Resources and Energy Minister Gwede Mantashe announced in January an exploration campaign to open mine sites in Limpopo, North West and Northern Cape, which have been identified as a “new mining belt” for transitional minerals. Transitional minerals are key to the energy, mobility and digital transition and include platinum group minerals (PGMs), lithium, cobalt and copper.

South Africa is endowed with PGMs and manganese. Many Industrialised states have identified these minerals as “critical” and a new rush for cooperation and business with many mineral-rich states is underway especially in light of the 2015 climate change Paris Agreement.

It is becoming increasingly difficult to open new mines across the world, including in South Africa, without community buy-in. This is largely because it is no longer enough to convince people of the social benefits of mining such as jobs and “development”. Instead, people are

increasingly weighing potential social benefits with the negative environmental impacts of mining, particularly in the context of climate change and a just transition.

It becomes even more difficult for companies to justify mining when there have been no material benefits for communities. This has major implications for minerals critical for many industrial states’ energy and mobility transitions. One can argue that the “social licence to operate” — as a means to manage social tensions and contestations against mining — no longer captures the reality on the ground. Instead, the Sustainable Licence to Operate (SDLO) better captures these shifts. There is also an increasing awareness of people’s rights as it relates to the environment, writes Luthango.

A Reuters report published by Business Report, says industry data shows that South Africa’s mining output has fallen further below pre-pandemic levels due to persistent electricity outages and rail disruptions, threatening dividend payouts to investors. South Africa is the world’s biggest producer of platinum and chrome and a leading producer of gold and diamonds. But the industry has been shrinking for years as ore grades decline and output was disrupted in 2020 when Covid-19 lockdowns impacted operations.

Now severe power cuts since the end of 2022 are affecting output, while state-owned freight rail firm Transnet is struggling to haul minerals to port due to cable theft and vandalism of infrastructure. As a result, mine output and sales for the 12 months to May 2023 were down 4.6% and 4.2%, respectively, compared to the same period a year earlier, new data

from the Minerals Council of South Africa showed. Output in May was down 7.8% from pre-pandemic levels, the council’s chief economist Henk Langenhoven said. “It’s been very hard to get back to 2019 production levels.

We’re really struggling,” Langenhoven said. “Although we sort of recovered at the beginning of 2021, we’ve faltered since then.” South Africa produces 70-75% of mined platinum supply, for example, and lower production in the country has helped spur a surge in the price of the metal. Diversified miner Sibanye-Stillwater has said South Africa’s platinum group metal (PGM) output could decline by as much as 20% this year as erratic power supplies hit processing capacity.

In a report in Miningmx.com David McKay writes Glencore had no interest in separately listing its coal business should a plan to combine it with Teck’s steelmaking coal business (EVR) fail. In June, Glencore said it had offered to buy EVR whilst also keeping a broader offer to buy Teck on the table. The latter is thought to be a non-starter as Teck’s controlling shareholder Norman Keevil doesn’t support it, but discussions continue on the sale of EVR. If acquired,

Glencore would first reduce debt and about a year later separately list it. Glencore is almost unique among diversified mining companies in having decided to keep thermal coal mines. While Anglo American and Rio Tinto have exited coal mining, Glencore opted to run down the resources – a strategy that still attracts sizeable opposition. At its last annual general meeting, 30% of shareholders did not support its climate plan. Gary Nagle, CEO, Glencore said that in discussions with shareholders there was significant

support for spinning out coal if combined with Teck because in that instance the overall business would be stronger with a wider geographic spread and higher quality assets. Asked for his views of prospects for coal, Nagle said there was not any new capital allocations for new high quality steam coal mines while demand remained “very good” with new customers developed in Europe. “We have seen 85 million tons (of demand) in Europe last year and it will continue to import coal,” he said.

Nagle added: “It still is the cheapest form of baseload power especially for developing nations.”

According to a report in Construction World, BME, a member of the Omnia group, is leading the charge in creating a future where the mining sector offers attractive and rewarding career paths for women. By empowering women and providing them with abundant

opportunities, BME is contributing to equality and progression in the sector. “Mining has seen significant progress in recent years thanks to the remarkable efforts and resilience of women in this sector,” said BME Managing Director Ralf Hennecke. “Their dedication, skills and determination have paved the way for meaningful change and transformation.”

According to the Minerals Council of South Africa, the number of women employed in the mining industry has risen from around 11,400 in 2002 to almost 72,200 in 2023. Women make up 15% of the country’s mining labour force of about 475,000 people. On South Africa’s National Women’s Day on 9 August, the company saluted these trailblazers – who inspire further advancements in gender equality within the industry, said Hennecke. There are highly-skilled and qualified women throughout the business, he said, including senior levels of operation and management – with roles ranging from technical and engineering to law and safety. While the day is part of South Africa’s heritage, BME applies these principles across all its global territories. Among the women in senior roles are Dr Rakhi Pathak, BME’s Senior Product Manager

for AN Products, Equipment and Services (Australia) and Nelisile Thanjekwayo, BME’s Head of Legal.

Each had their own inspirational message to offer women working in the sector.

A Miningmx.com report by David McKay recently broke the news that Glencore was to buy 100% of the MARA Project, a copper and gold brownfields prospect in Argentina.

South Africa’s Gold Fields bid for the project last year. The Swiss miner and commodities trader will pay $475m in cash to buy 56.25% in MARA representing shares it doesn’t already own. The seller, Pan American, bought the asset as part of the purchase of Yamana Gold last year for which Gold Fields bid $6.7bn. In addition to the cash payment, Glencore has also granted Pan American a 0.75% net smelter return as part of the deal consideration. The project was first formed through the integration of the Minera Alumbrera plant and mining infrastructure and Agua Rica project in a joint venture between Yamana, Glencore and Newmont Corp., in 2020.

Glencore bought Newmont’s 18.75% stake in October last year taking its shareholding to 43.75%. Pan American completed the takeover of Yamana in March. The project has proven and probable mineral reserves of 5.4 million tons of copper and 7.4 million ounces of gold. Mineral reserves will support mining for 27 years, according to estimates.

Glencore said the MARA project ranked as “one of the lowest capital intensive copper projects in the world today” owing to existing and well maintained

infrastructure including the Alumbrera processing plant.

Melanie Burton reports in Business Day that Rio Tinto was looking at potential bolt-on lithium acquisitions. Rio Tinto CEO Jakob Stausholm is quoted as saying that the global miner is focused on small, bolt-on acquisitions to shape its portfolio and is looking at a number of potential lithium acquisitions but added the sector remains quite hot. The boss of the world’s biggest iron ore producer has said that he wants Rio Tinto to focus on being the world’s best operator rather than conducting huge buyouts that would change the nature of the company and divert the focus of the

group. The Australian miner has already announced several small partnerships and deals this year, including the purchase of a 57.74% stake in the Agua de la Falda copper project in Chile. Earlier in July, Rio Tinto agreed to buy a 15% stake in Australia’s Sovereign Metals for A$40.4m ($27.04m) to help develop a rutile and graphite project in Malawi.

Rio was looking at a number of possible lithium interests, Stausholm said, but the market for energy transition metals like copper and lithium was “pretty hot”. “I wouldn’t mind having lithium production in Canada,” he said. Rio wants to raise its lithium exposure, and Quebec, home to Rio’s green aluminium operations, is a hotspot for new hard rock lithium deposits, with battery chemicals makers setting up shop in the region ready to supply the US electric vehicle market.

Procurement in the mining industry is an essential force in adding or destroying value for mining companies, with consequential impacts on all industry stakeholders. Procurement in the South African mining industry experienced a number of highly adverse impacts over the past few years. First there was the restrictive proposed 2018 Mining Charter, later successfully contested by the Minerals Council SA in the courts. That was followed by the devastations of the

Covid-19 pandemic, the global supply chain crisis, and then the Russia-Ukraine war, among other factors.

Many of these developments not only created supply chain pressures, but also exposed serious weaknesses. Emerging from these setbacks has brought new challenges, new opportunities and new rewards. The key is getting it right.

The global mining industry continues to be a large contributor to global value

chains, and mining procurement spend is predicted to increase substantially in the years ahead. However, much uncertainty still prevails as international supply chains are shifting and new risks emerge, while new developments bring new challenges such as those related to increased digitisation within the 4IR context, for example. Moving mining into the green economy is another.

For mining companies to get procurement right in this new age of change, is therefore

a major challenge. But if it is done correctly and effectively, procurement is a powerful tool for driving value in the mining industry by effectively managing quality, reducing costs, expediting schedules and saving time, mitigating risk, and ensuring important environmental, social, and governance (ESG) best practice and compliance across the supply chain.

While the past few years may have been challenging, at the same time, all these pressures and impacts caused innovation and transformation to become key. Many businesses are now counting on smart procurement – much of it in a 4IR digital transformation context - to provide stability and growth. This applies also to South Africa, and particularly to its mining industry. Naturally, all of this brings up the question: what are the key focus areas procurement professionals are looking at going forward?

In February last year, the Minerals Council South Africa and business services firm PwC jointly released a report called, The state of digital transformation in the South African mining industry. The report aimed to provide an understanding of how the mining industry visualises the impact of 4IR on its people, processes and technologies and how mining businesses will respond and transform.

When identifying key insights into 4IR in the mining industry around the question of where the biggest benefits will come from, the respondents in the survey, being

23 executives across 19 Minerals Council member companies, mostly believed that production, engineering and asset management related investments would unlock the most value. Supply chain and logistics seemed to be an underestimated area in mining as it related to driving costs and efficiencies. But it was also found that the companies that were digitally more mature and advanced, were actively investing in emerging technologies in the supply chain function, such as blockchain, IoT and AI to unlock value.

Of course, South Africa has specific challenges that also need to be considered. As Roger Baxter, at the time still CEO of the Minerals Council, cautioned, the local mining industry needed 4IR, and Covid-19 necessitated accelerated application of 4IR technologies, these should be a people-centric, 4IR enabled approach to modernisation of the sector.

“With the high levels of unemployment, poverty and inequality, a pure technologyfocused approach will not be socially acceptable,” said Baxter.

Two years ago, The Hacket Group®, a leading global intellectual property-based strategic consultancy and enterprise benchmarking firm headquartered in Miami in the United States, compiled an insightful report, the 2021 Procurement Key Issues. The authors of the report, Laura Gibbons and Nicolas Walden, noted that the preceding volatile year when Covid-19 hit the planet, had pushed

spend-cost reduction to provide stability to the enterprise firmly back to the top of the procurement agenda.

They found that reducing supply risk and investing in third-party risk management emerged as the procurement function’s second most important objective in 2021. The authors also found that procurement must also support enterprise stabilisation and recovery strategies, for example, securing new and innovative sources of supply and early warnings of potential supply risk.

Among the other key issues that this report revealed, were the need for:

• modernising procurement application platforms;

• improving analytical and reporting capabilities;

• aligning skills and talent with changing business needs;

• accelerating the digital transformation of procurement;

• increasing spend influence that leads to reduced purchasing costs, improved quality and better strategic outcomes like product innovation;

• procurement entities having strong business relationships to allow them to act as strategic advisors to the business;

• making a corporate social responsibility impact through sustainable procurement;

• and improving procurement agility.

The authors also suggested that by 2023, when looking back, procurement officers

and managers should have accomplished all of these critical actions. They should have developed a strong master data programme and supporting element and also have developed capabilities that respond to business needs and enable the procurement function to influence spend across the enterprise.

A report compiled by Axis Group Global Procurement & Supply, who have supported mining projects and operations for over 20 years, provides insights on how procurement and supply can be a strategic value driver for mining companies.

Axis points out the massive size of the global mining industry with a market value of some US$2 trillion, representing a significant share of global GDP, its role as a major player in international trade, capital flows and technology, and the

significant influence it has across regions and industries. In 2019, the total output of the mining industry was US$5.9 trillion, nearly 7% of total global GDP.

In 2021, the global mining market size was US$ 1.84 trillion, having recovered from around US$1.4 trillion in 2020 after being affected by Covid-19. According to Axis, estimates put the total market size at around US$2.06 trillion at the end of 2022. The top 100 mining companies had a combined market capitalisation of US$1.72 trillion as of January 2023. Many mining projects are underway globally, with mining-related equipment having a market size of nearly US$ 133 billion in 2021. This was forecast to grow to US$ 185 billion by 2030.

Against such a background, global mining procurement is a big lever that drives value for mining companies and for their many stakeholders, and consequently global mining spend is a big force. The report holds that the scale

of mining procurement spend is often a significant engine for economic activity and technology development, among others, with widespread impacts.

Axis says the world’s top 100 mining companies spent around US$100 billion on capex projects in 2021, with the top 40 mining companies having increased their capex spend from US#71 billion in 2021 to an estimated US$ 82 billion in 2022. Overall, the mining industry’s ongoing procurement spend amounts to around US$200 billion annually.

Axis expects this number to grow as the world further transitions past the challenges brought on by the pandemic and other recent events. These disruptive events caused a fall in capex projects, instability in procuring essential materials and supplies, and a scarcity of key transition metals such as copper. But Axis believes recovery followed as markets reopened.

The global exploration budget of solid minerals has increased again to pre-Covid levels and is expected to grow more in 2023 and beyond, mainly due to the necessity of finding new copper and other materials as reserves are depleting. According to Axis other factors include the rising need of finding more energy transition metals such as lithium, while the demand for copper is expected to rise by three times the current demand by 2040. The demand for cobalt is expected to increase by 20 times during the same period. Countries rich in these transition metals such as the African nations and Australia have seen an increase in exploration budgets and investments - and therefore mining procurement spend will continue to grow, says Axis.

Other factors that come into play include the potential of mining spend having both positive impacts and negative consequences. Therefore, procurement must incorporate an array of competing interests, e.g. cost reduction vs better quality, or local vs global, among others. Depending on where and when it is spent, it can both create as well as destroy value in mining projects. The efficiency and effectiveness of procurement may considerably raise or lower capex and opex expenses during the lifetime of a project or operations.

There is a significant potential in mining having a positive impact on society at large, such as the creation of jobs directly or indirectly in local communities. However, there is also the potential for mining spend to have negative impacts on these communities as well, such as through the effects on the local environment if proper efforts are not made to deliver a sustainable project. Also, the trade-off between local and global procurement must be carefully balanced. Axis points out that while mining companies act and compete globally, their operations are always ‘local’. This means that there is

the need to balance social factors and community interest with economic considerations such as cost reduction. According to the report, effective global procurement in the mining industry is not a simple endeavour and there are various factors to get right throughout the process. Many procurement ideas and approaches that still continue are dated and were developed in a previous era, for example, before globalisation reached its current levels, before ESG became a strategic imperative, and before new global supply markets rose to prominence.

Striking a proper balance in local vs global sourcing is crucial, as while localisation needs to be protected, the efficiency and cost effectiveness of global supply chains need to be leveraged as well. Hiring the right people, keeping them motivated, and retaining them is essential to ensure operations are supported by the right talent. Proper investment in developing the right capabilities and choosing the best partners must be made.

Operating models need to be planned, designed and readjusted to achieve the best results. Mining companies must have the right ‘inward’ orientation, such as having good strategy, goals, spend data, and process. But must also have

the right ‘outward’ orientation and gather sufficient market intelligence in order to appreciate the right global supply markets and key strategic global categories of importance. Getting all of the above right will help to determine who the winners and losers will be in the mining industry. What is clear, says Axix in the report, is that in the coming decade, procurement and supply should be a top priority for mining industry procurement managers and teams given the risks and challenges in global supply chains.

“The global mining industry will remain a large contributor to global value chains, and mining procurement spend will only increase in the coming years. As such, we need to understand the impact and consequences of procurement spend in this dynamic industry. When done effectively, procurement is a powerful lever for driving value in the mining industry that can reduce cost, manage quality, expedite schedules, mitigate risk, and ensure important ESG compliance across the supply chain. Good leadership, strategy and implementation will lead the way,” says Axis.

– Staff WriterATTYS PROJECTS (PTY) LTD is a 100% black owned company. It’s an emerging Mining and Construction company which envisages being the leading company in the mining and construction industry. The unstable South African economy has shaken the very fabric of the economy contributing to the high unemployment especially among youth. The Atty’s projects seek to correct this anomaly. The formation of this corporation ushers a new era of systematic and intelligent maximum utility of resources and skills to attain predetermined goals.

ATTYS PROJECTS (PTY) LTD will be structured with detailed analysis, planning, organising, leading, and controlling. Our corporation seeks to empower youth in particular by creating sustainable opportunities and set record standards in the process. The corporation would formulate key performance standards such as productivity standards and staff development standards. This will result in the emergence of developed youth around our communities and will be achieved through partnerships we want to enter into.

• Our number one priority is safety and customer care

In a world grappling with environmental challenges, Ovum Corporation stands as a beacon of hope and progress. Each project undertaken echoes its values of collaboration, innovation, and sustainability.

In the heart of South Africa, an engineering powerhouse is reshaping the landscape of sustainable infrastructure. Ovum Corporation, a civil engineering consultancy, has been crafting a legacy of innovation, collaboration, and excellence since its inception in June 2020.

At the core of Ovum Corporation's philosophy is a commitment to transforming ideas into realities that uplift mankind Deriving its name from the essence of birth and genesis, symbolizing the nurturing of ideas that sustain humanity With a holistic approach that draws inspiration from nature and leverages cutting-edge technology, Ovum Corporation is rewriting the blueprint for modern engineering.

The journey of Ovum Corporation is a narrative of innovation intertwined with collaboration. Guided by the principles of green building and sustainable technologies, the company collaborates with architects, scientists, educators, and visionaries who share their passion for change Ovum Corporation's vision was ignited by the green building movement witnessed in Singapore, which left an indelible mark on the founders

This spark of inspiration led to a commitment to revitalize South Africa's infrastructure with sustainable, energyefficient solutions that bridge the gap between urban development and environmental conservation.

Ovum Corporation's narrative goes beyond projects; it's a story of research, exploration, and a commitment to a greener world. The company delves into non-standard structural materials, green roofs, and wildlife bridges, exemplifying its dedication to engineering excellence Collaborations with electronics engineers pave the way for smart device systems that monitor building energy usage, driving progress towards more sustainable living.

M2 Bridges Rehabilitation ProjectEVERY PROJECT WE WORK ON IS UNIQUE, AND WE TAKE GREAT PRIDE IN BRINGING OUR CLIENTS' VISION TO LIFE

These projects are just a few examples of the diverse range of work that Ovum Corporation does. We are committed to providing our clients with exceptional service, and our team of experienced engineers ensures that each project is completed to the highest standard

The Dhaka Elevated Expressway is a mega bridge project that is divided into three tranche sections of work. Ovum is subcontracted as the appointed Independent Bridge Engineer for this mega-bridge project in Dhaka, Bangladesh The project includes some 40km of new elevated bridge structure cutting a North-South line through the heart of Dhaka. The majority of the bridges in the 40km of elevated viaduct are constructed from I-beams and T-beams, which are erected using a launching girder frame.

Regarding the project Nicholas Featherston, the owner of Ovum Corporation stated, "We are proud to be a part of this project, which will have a significant impact on the transportation infrastructure of Dhaka and will significantly alleviate the current traffic problems in the city Our team is dedicated to ensuring that these bridge structures are designed and built to the highest standards."

The Northern Platinum Mining project is another project that Ovum Corporation is currently working on. We have been appointed to do the preliminary design of the new HMV (hydrogen compliant) workshops, New Tyre

Bay, Cable Repair workshops, Barloworld and Epiroc Stores, Auxillary Workshops, and new Crane Maintenance Buildings.

Another project we are involved with is the Detailed and Basic Engineering Design of the Materials Handling component for a new SASOL coal mine in Trichardt, Secunda.

The project includes some 15km of conveyors, trestles and transfer structures, including a Rotary Breaker and ROM Tip area. Ovum are excited and privileged to be involved in this mega-mining project!

With governments committing to decarbonising their economies, much attention has been focused on lithium as a critical battery metal widely used in electric vehicles (EVs) among other things. It has turned this once nondescript member of the alkali family into something of a mining rockstar, with demand escalating, prices rising, and major investments being channelled into lithium projects.

It is projected that by 2040 global demand will be 40 times higher than now. For more perspective: as much as 8kg of lithium can be used in a single EV battery.

Inevitably this has put the spotlight on this supposed super metal, with questions arising about its environmental

impact. For South Africa this poses the question, does the country have significant enough sources of this metal to become a meaningful part of the lithium rush, or should it seek some other role? And is lithium’s sudden rock star status sustainable over the longer run?

Already back in 1987, a study by two researchers at the University of Leeds showed that lithium-bearing pegmatite – the hard rock which is one of three types of lithium deposit – was widely found across the African continent. Back then, however, climate change, decarbonisation, and things like the development of an electric vehicle industry, were not yet priorities, or even spoken about. So, lithium’s rise to glory was only to come much later, once most governments had developed net-zero strategies to decarbonise their

economies, with ambitious EV targets moving centre stage.

As demand for battery-operated EVs will increase, so too will demand for metals such as lithium, cobalt, nickel, aluminium and manganese. There are three types of lithium ion batteries that are expected to drive the EV sector, namely Lithium Nickel Cobalt Aluminium Oxide (NCA), Lithium Nickel Cobalt Manganese Oxide (NCM) and Lithium Iron Phosphate (LFP).

As that early study showed, the African continent has significant natural lithium resources, which may provide extensive new opportunities for many African countries. Most of these resources, however, are found in West and Southern Africa.

In Southern Africa the most significant deposits are found in Zimbabwe, Namibia, and the Democratic Republic of Congo, while South Africa also has some lithium, but not that much.

However, global supply chains of lithium for batteries are currently predominantly concentrated in South America, Australia and China, with processing and manufacturing of the battery compounds and components taking place mostly in China, Japan and South Korea.

For its part, Africa has not yet developed any significant capacity for lithium mineral processing, or for further refining of lithium chemicals, or for the manufacture of battery components, with most if not all of its lithium being exported and value being added outside of Africa, with the end products – EV batteries – being imported back into the continent.

Zimbabwe is leading the way in Southern Africa. It has a number of large lithium pegmatites, including one of Africa’s only currently active lithium mine at Bikita, while exploration has taken place at several other localities in recent years. After Zimbabwe, Namibia is the only other African country that has exported lithium mineral concentrate in recent years, but it is not engaged in the further battery supply chain. The most advanced lithium project in Namibia is

at Karibib. The DRC is only engaged in the exploration stage of the supply chain. However, it does have some of Africa’s largest lithium pegmatites.

So far South Africa has engaged mostly in limited exploration for lithium. Some pegmatite deposits are known, but little or no lithium extraction or mineral processing has occurred, with one exception. Marula Mining’s Blesberg project in the Northern Cape, is sitting on stockpiles of between 250 000 t and 400 000 t that are now being reprocessed. In January Marula Mining announced that its Blesberg Lithium & Tantalum Mine was ready to start initial deliveries of 1,000 tons of high-grade lithium ore. This battery metals mining and development company is focused on

exploring several high-value mining projects across Africa. The company started reprocessing existing stockpiles at Blesberg in November 2022 to produce a high-grade lithium ore with commercial grades of between 4% and 5.5% Li20.

If successful, this could possibly lead to the establishment of a long-term, hard rock conventional open pit lithium mining operation. The company said it was ready to start deliveries under the US$5 million Lithium Prepayment Facility that was secured by it in October last year.

Blesberg’s existing stockpiles are said to be on top of the pegmatite from which lithium could in future be extracted, so the residues from reprocessing are being

moved to a new stockpile site to allow for future mining of the current site.

However, recent research has shown that the country may be better suited to engage in the refining and processing stage in the supply chain. In this regard some projects are already established to develop manufacturing of some battery chemicals with the potential for this to eventually extend to lithium chemicals.

South Africa is also active in the manufacturing of battery cell components and the Energy Storage Innovation Laboratory (ESIL) at the University of the Western Cape (UWC) has a pilot plant for battery production. ESIL is also working with a number of external partners on the development of battery technology, with fuel cells being considered as one of the most plausible choices for alternative energy because of the abundance of elemental hydrogen available.

As one of the world’s leading mineral-rich countries, South Africa possesses minerals and metals that will play a pivotal role in future technologies. With a declining demand for catalytic converters in the future, South Africa’s platinum industry could establish new opportunities in

hydrogen fuel cell technology for EVs. And while lithium will be a key component, of which South Africa has relatively little, the country has an abundance of other metals used to produce batteries, such as iron, manganese and nickel. Platinum, of which it has huge reserves, could also find new roles in the various emerging new green technologies.

So, just what is Lithium all about? It has been called a super metal, the world’s “new oil”, or “white gold” – the rockstar of the new in-vogue metals. Its praises have been sung around the world as the key ingredient enabling the global transition to green transport in the form of electric and hybrid vehicles with rechargeable batteries. Its price has soared these past years as a star in the commodities boom that has allowed mining companies to post record profits.

Lithium carbonate is one of the two key compounds used for the manufacture of batteries that underpin the mass transition to EVs. But due to all the hype, perhaps less known are its many other

uses that range from being used in the manufacture of aircraft to ceramics, glass, electrodes, lubricants, pyrotechnics, as an additive to aluminium smelters, in silicon nano-welding, in air purification, in specialist optics, in nuclear physics, and even as a medicine in the treatment of bipolar disorder. It’s easy to see where its rockstar status comes from.

Lithium is a chemical element with the symbol Li and atomic number 3. Under standard conditions it is the world’s lightest known metal and lightest solid element which comes as a soft, silverywhite alkali meta. It is highly reactive and flammable and must be stored in very specific ways. The nucleus of the lithium atom is close to being unstable since the two stable lithium isotopes found in nature have among the lowest binding energies per nucleon of all stable nuclides.

It does not occur freely in nature, but is usually found only in ionic compounds, such as pegmatitic minerals. It is soluble as an ion and is therefore also found in ocean water. Lithium metal is isolated electrolytically from a mixture of lithium chloride and potassium chloride. And for reasons still unknown, trace amounts of lithium are also present in biological systems. It is generally mined from brine in salt flats or from hard rock.

Lithium’s history goes very far back –indeed, all the way to the Big Bang when it was synthesized. However, lithium together with beryllium and boron is markedly less abundant in the universe than other elements because of the comparatively low stellar temperatures required to destroy lithium. But its more modern history goes back some two centuries to when the Brazilian naturalist and statesman, Jozé Bonifácio de Andralda e Silva, first discovered petalite on the Swedish isle of Utö around 1800. But it was only in 1817 that Johan August

Arfwedson, who worked in the laboratory of a chemist, discovered the presence of a new element that formed compounds similar to those of sodium and potassium while analysing petalite ore. Arfwedson named this alkaline material ‘lithion/ lithina’, taken from the Greek word lithos, meaning ‘stone’.

Lithium is not without controversy, and some are beginning to question its role and qualities, alleging that the mining and processing of lithium are turning out to be far more environmentally harmful than the previously highly controversial fracking ever proved to be.

Some critics say the lithium extraction process from salt flat brine - one of two major sources - uses an extreme amount of water which it poisons while it also harms the soil and causes air contamination. When lithium is extracted in salt flats some 500,000 gallons of water is pumped down drilled holes to bring one metric ton of mineral-rich brine to the surface. It is argued by critics that lithium is known to cause surface water contamination, potable water contamination, unsustainable water table reduction, wildlife habitat degradation, respiratory problems, and ecosystem degradation. Lithium extraction also produces substantial harmful by-products such as large amounts of magnesium and lime waste.

In China, the Ganzizhou Rongda Lithium mine – where lithium is mined from hard rock - was closed after waste leakages poisoned fish in the Lichu River in 2009 and 2013. When the mine reopened in 2016, Tibetans staged protests when mine waste again caused thousands of dead fish to wash up on the banks of the river with dead cow carcasses found floating downstream.

At other Chinese mines similar incidents occurred due to the rapid increase in lithium mining activity, including operations run by China’s BYD, one of the world’s biggest suppliers of lithium-ion batteries. Behind this turn of events was China’s decision to dramatically step up the production of lithium mining, lithium batteries and electric and hybrid vehicles - all part of its move in 2015 towards Green Development which forms part of China’s 13th Five Year Plan.

Many of China’s lithium mines still use old, traditional methods for extracting lithium both from brine and hard rock, while there are newer, safer and cleaner –but arguably more expensive - extraction technologies available.

On the other side of the world, South America is home to more than half the world’s reserves of lithium which lie beneath the salt flats of the Lithium Triangle, an area that covers parts of Argentina, Bolivia and Chile. But it is also one of the driest places on earth, and uit is being claimed that lithium mining activities here have consumed

65% of the region’s water. China is among the top five countries having the most lithium resources. Apart from increasing its own domestic lithium mining production, it has also been buying stakes in mining operations in Australia and South America where most of the world’s lithium reserves are found. In Australia and North America, as in South Africa, lithium is mined from rock using chemicals to extract it into a useful form, processes that often are also accused of causing pollution.

Is all the hype about lithium over the top? Will its bubble burst sooner or later like many before it? Already vanadium and cobalt are challenging lithium and are being called the new super metals. Both of these are already mined in South Africa in sustainable quantities. Since 2002 South Africa became the world’s second largest host of vanadium after China moved to the number one slot following the discovery of new deposits. And cobalt has long been mined here as a by-product of copper and nickel. So, South Africa is certainly in many ways a contender to participate profitably in the booming global EV and battery business, with or without lithium.

For now, the last word has not yet been spoken on whether lithium is truly the new rockstar of metals, or whether its good qualities are overshadowed by the environmental harm it is causing. If the development of lithium-rich EV batteries is a key element of creating green economies, then it simply won’t do for lithium to cause so much environmental damage at the same time. Something will have to give.

- Written by Stef Terblanche

We are excited to share our latest achievement in the realm of research and innovation. At the recently concluded EDHE Lekgotla 2023, hosted by the University of the Western Cape from September 6th to 8th, 2023, Kubu Science and Technology Institute (KSTI) showcased our commitment to fostering entrepreneurship and driving positive change within the education sector.

The Entrepreneurship Development in Higher Education (EDHE) Lekgotla, hosted by the University of the Western Cape, served as a prominent platform for the exchange of ideas and insights among thought leaders, educators, and industry professionals.

This year, our institute had the privilege of conducting commissioned research in the critical area of Student Women Entrepreneurship.

KSTI’s participation at EDHE Lekgotla 2023 revolved around our commissioned research project on Student Women Entrepreneurship. We are immensely proud to have been entrusted with this vital mission, which aligns perfectly with our mission of empowering students with the knowledge and skills to succeed in an everchanging world.

Our dedicated team of researchers delved deep into the intricacies of student entrepreneurship, examining

the challenges, opportunities, and best practices in fostering a culture of innovation and business acumen among our youth. The insights we have gained from this research are invaluable and will undoubtedly inform future policy decisions and educational strategies.

During the event, our very own CEO, Professor Eunice Seekoe, had the distinct honour of facilitating the book launch of the Sakhumnotho Foundation’s “Global Entrepreneurship Toolkit.” further exemplifying our institute’s leadership and expertise in the field of entrepreneurship and education.

We invite all members of our community to stay engaged with our institute as we continue to

drive innovation, research, and education in the field of Student Entrepreneurship.

Don’t miss the opportunity to harness the power of research to drive your organization’s success. Whether you’re a forward-thinking business, a government agency with a mandate for evidencebased policy, or an individual seeking in-depth insights, KSTI is your trusted partner in the pursuit of knowledge.

Contact us today to discuss your organisations research needs and discover how Kubu can help you unlock new horizons through research. Together, we’ll turn your questions into answers and your challenges into opportunities. For more information about our commissioned research, collaboration opportunities, and other exciting developments at KSTI, please enquire at info@ksti. co.za or call 076 150 6762 and follow us on social media.

KSTI had the honour of participating

and showcasing our commitment to education, innovation, and excellence at the PHASA 2023 conference held in Qgeberha, Eastern Cape.

The Public Health Association of South Africa (PHASA) conference, held from September 10th to 13th, 2023, brought together leaders, researchers, and professionals from various fields in the public health sector. As part of this esteemed event, KSTI secured a prominent exhibition stall, where we proudly displayed our diverse range of offerings and introduced our new short courses.

Our stall was a hub of activity and excitement throughout the conference, with delegates eager to learn about our institution and its unique approach to education. Our team, engaged with visitors, showcasing the depth and breadth of our course offerings. At the heart of our showcase were our innovative short courses.

From Public Health and Nursing to Education, Agriculture, IT & Engineering, Research as well as Performing Arts, KSTI displayed a comprehensive array of short courses designed to meet the evolving needs of the job market,

empower individuals with practical skills and knowledge and equip students with the tools needed to excel in their chosen fields.

During our time in Qgeberha, we enjoyed a brief visit with the SWEEP chapter of Nelson Mandela University (NMU) Centre for Entrepreneurship. This visit allowed us to engage with vibrant studentpreneurs and witness first-hand the remarkable work being done.

If you missed us at PHASA 2023, don’t worry! Join KSTI today and unlock your potential. Visit our website www.kubuinstitute.co.za to explore our course offerings, meet our team, and discover how we can help you achieve your dreams.

SRE275-24V Vlt & SRE185 -24Vlt JB & PAD Mount high amp brushless alternators available

High temperature rated (-40°C to 125°C).

Fitted with high heat and dust resistance bearings and seals for mining applications.

Brushless regulator design to survive high heat mining environment.

Isolated ground technology, which protects the engine from stray voltage & severe electrolytic damage.

Light weight design 17.5kg

Pad Mount (fits both 108mm and 126mm) and JB mount application available.

Remote sense capability optimizes alternator output and increases battery life.

Best in class charging Amp output at engine idle.

M128R 24v starter m motor range.

Prestolite OE quality starter motors upgrade for Delco Remy 50MT 24v 9kw

Oil sealed for wet clutch application with rotatable mounting bracket for multiple engine applications

12KW (Measured with 5mOhm battery pack)

OE quality with soft start relay system, extending engine ring gear life.

Light weight @17.5kg -competitors 50MT starter 34kg

Lasts +/- 3 times the service life of competitors’ products.

Applications: Cummins, Cat, Komatsu, MTU, John Deere, Liebherr, etc.

Shelhurst Components Pty Ltd - Master Importers of Prestolite/Leece-Neville in Southern Africa

Whether motivated by the ongoing 4th industrial revolution (4IR) or whether responding to the global crisis created by Covid-19, or both, South African mining companies are embracing digital transformation and are adapting to the use of new technologies that enhance efficiency while lowering risk and costs.

More than a year on from the pandemic, this has become more an imperative than a choice.

Providing key insights into the state of digital transformation in the South African mining industry, is the second two-yearly report commissioned by the Minerals Council South Africa from global business services firm PwC.

“Digital transformation is an imperative for mining – a non-negotiable if you like – as it serves as the seamless thread through all of the mining value chain processes, and enhances safety and health, security, production, and workforce and leadership capability. The implementation of these processes needs to be executed with care and responsibility,” writes former Minerals Council CEO Roger Baxter in the foreword of the report.

The first study by PwC in 2020 that resulted in the first report, provided useful insights with many mining companies referencing it to either start or accelerate their digitalisation and 4IR preparedness programmes. At the time, the onset of Covid-19 also played a role in the industry embracing digitalisation and 4IR technologies. As a result, the Minerals Council mandated PWC’s Smart Mining Team, and the Mandela Mining Precinct’s Real-Time Information Management Systems programme, to conduct this study every two years, hence the second study having taken place in 2022 with a report released this year.

Essentially, digitalisation refers to the use of new digital technologies to change a business model, enable the optimisation of processes, and provide new revenue and value-producing opportunities. Since 2020 and the onset of Covid-19, 4IR-driven transformation gained greater prominence because of its potential to help businesses overcome multiple challenges brought about by the global coronavirus pandemic. This transformation was further driven by the subsequent global supply chain crisis and other global developments.

Another study conducted was conducted around the same time by software development company Oxalys South Africa in partnership with the Chartered Institute of Procurement and Supply (CIPS) and Smart Procurement, titled ‘Post Covid-19: Procurement Key Priorities and Challenges in the Digital Era in South Africa’. It found that many South African organisations had a poor understanding of what digital procurement actually entails, some confusing it with simple applications like Excel spreadsheets and others associating it with implementing complex and costly ERP solutions.

In the mining industry the paradigm was already shifting. The 2020 mining digital transformation report found that South Africa’s mining industry was increasingly making use of innovative and cuttingedge technologies to run more efficient operations, to manage risk, to improve health and safety, reduce the cost of maintenance and extraction, as well as bringing about a skills uplift.

At the time, Baxter commented that, “adoption of innovations emerging out of the 4IR did not go into lockdown during the

Covid-19 pandemic. In fact, the Covid-19 pandemic accelerated the application of 4IR technologies helping Minerals Council members and others to manage the pandemic more effectively.”

“South African mining needs 4IR. We need to be globally competitive on costs and on environmental, social and governance issues. Over the last decade, multi-factor productivity in South Africa has fallen by 7.6%. Mining cost inflation was 2-3% higher annually than general inflation, leading to two thirds of our output being on the upper half of the global mining cost curve. Mining output declined by 10% and minerals sales contracted by 11%,” said Baxter.

In South Africa’s mining industry, the transformation focus is on a people-centric 4IR enabled approach to modernisation of the sector. High levels of unemployment, poverty and inequality rule out a pure technology-focused approach. Hence the first transformation report produced by PwC did not only focus on technological issues, but also on issues related to culture and the upskilling and/or reskilling of the workforce.

At the time, Andries Rossouw, PwC Africa Energy Utilities and Resources Leader, added that South Africa’s mining industry was set to undergo significant transformation over the next decade. With the digital world presenting so much opportunity and disruption, mining companies will need to be more agile when thinking about how to align technology with their business needs, as well as making the right choices on partnership and implementation, said Rossouw. In his view, mining companies that genuinely understood technology and leveraged it strategically, would be the winners.

“Digital is a pivotal game-changer in the mining industry,” said Pieter Theron, PwC Partner Advisory Services and Head of

Industry. “It is disrupting mining operations and business models and, in some instances, changing the entire fabric of the mining industry.”

“New technologies such as artificial intelligence (AI), the Internet of Things (IoT), Robotic Process Automation (RPA), smart sensors, big data analytics, 3D printing, and machine learning will all boost productivity in the mining industry. In the process, mining companies will need to look at ways to upskill their workforces to work in this new world as it will require new skills in order to unlock the benefits of digital transformation,” said Theron.

In the first report, the authors said they had identified 10 emerging trends they believed were consistent with other international studies and could be used by mining executives and other decision makers “to navigate their digital transformation journey”. Briefly, the ten key insights were:

1. The CEO drives the digital agenda.

2. Champions and innovators are emerging.

3. Investments are growing.

4. The main reasons for investing in digital.

5. Where will the benefits come from?

6. Industrial IoT gets the biggest share of the wallet.

7. The workforce is changing.

8. Organisational culture is keeping up with the times.

9. Challenges to overcome.

10. It is all about the data.

11.

This first report and its findings laid the basis for the second report released this year. Whereas the 2020 study focused purely on digital transformation and 4IR readiness, the 2022 study was expanded to include ESG aspects into the study to help bring the industry in line with what is expected of companies in a changing world.

The target respondents for the survey were predominantly CEOs, and/or nominated senior leaders from their companies, while organised labour representatives were also interviewed. The anonymised results of the study aimed to capture a broad range of opinions to extrapolate the implications and impacts of digital transformation on South African mining and ESG.

The more than 30 insights identified in the study, were extrapolated and again summarised into ten key insights that addressed the categories of Vision, Priorities and Strategy; Workforce; Business Sustainability; ESG Imperatives; and Stakeholder Collaborations.

“A striking difference from the previous study is how prolific and integrated all of these issues have become. We can no longer speak or think about these issues in silos - they are integrated, holistically connected, and comprise systems of systems,” said Baxter in the foreword of the 2022 study. The ten key insights of the 2022 study are:

1. 1. Mining CEOs and their Executives are being deliberate.

2. Technology is being applied where it has the greatest measurable benefit.

3. The hunt for value requires cooperation and compromise.

4. Digital tools don’t just measure, they contribute.

5. The imperatives for sustainability, and the crown jewels.

6. We are up to the challenge and have the tools to win.

7. Mining is about people – and we need to fight globally for talent.

8. ESG – critical for business survival or tick-box?

9. Regulations shape ESG (for better or worse).

10. ESG drives long-term value.