O

THE M A GAZINE TH AT KEEPS Y OU AT THE F ORE F RON T BUSINESS | INVESTMENT | FINANCE | POLITICS | SATIRE www.forerunner.co.za 3rd Quarter 2022 | ISSUE 1 ENERGY Eskom, comeback or burnout BUSINESS Future of mining Transport sector under attack POLITICS & SATIRE Ramaphosa’s re-election SA’s new national anthem INVESTMENT The art of investment art

F

R E R U N N E R

Providing

e environmental, social and

the

info@digbywells.com | www.digbywells.com

sustainability solutions to

resources, infrastructure, energy and agriculture sectors globally.

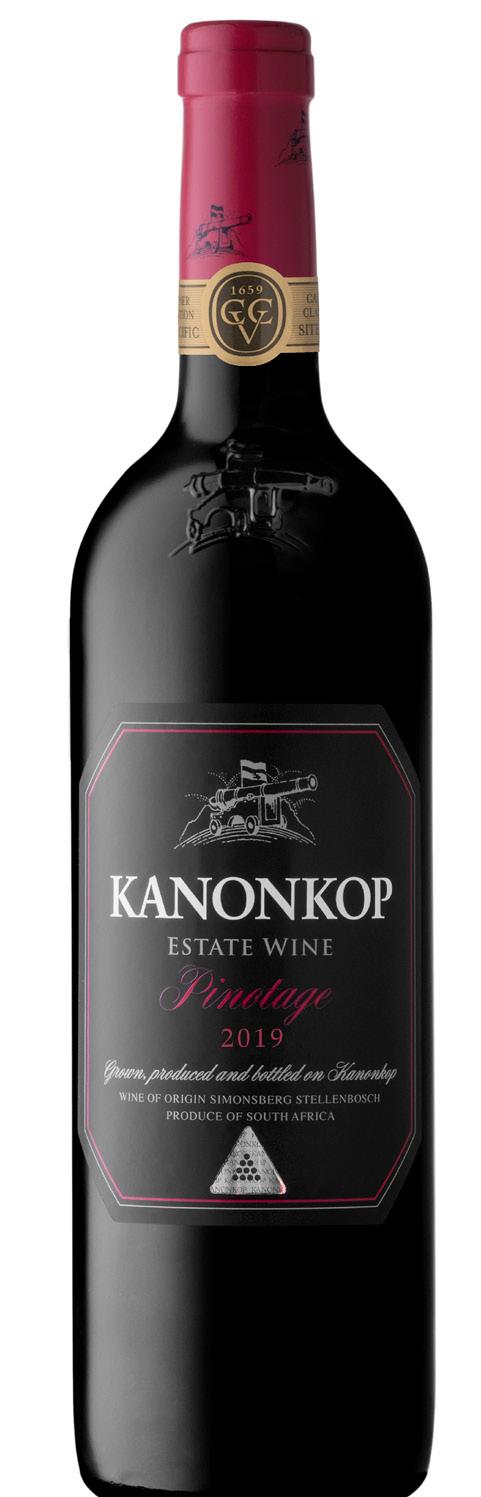

COVER STORY 20 ENERGY 1 - ESKOM…COMEBACK OR FINAL BURNOUT 28 ENERGY 2 - THE ESKOM TIMELINE… DISASTER IN THE MAKING REGULAR FEATURES 10 BOARDROOM BUZZ A SATIRICAL LOOK AT SOME BOARDROOM TALK 36 THE INTERVIEW ROGER BAXTER, CEO OF THE MINERALS COUNCIL, ANSWERS THE QUESTION, WHERE TO SOUTH AFRICAN MINING? 52 THE SPOTLILGHT KANONKOP BLACK LABEL PINOTAGE 2019 AND MUKWA RIVER LODGE 67 FROM THE PRESIDENT’S DESK A SATIRICAL NEWSLETTER 70 POLITICUS A NEW NATIONAL ANTHEM FOR SOUTH AFRICA & OTHER SATIRICAL THINGS 10 20 36 52 70 FORERUNNER | www.forerunner.co.za | Issue 1 | 5

THREE INTRINSIC VALUES: ACCURACY, RELIABILITY AND EASE OF USE. THE 6X ®. OUT NOW!

Admittedly, at first glance, you can’t tell what’s inside the new VEGAPULS 6X radar sensor: A high-precision level instrument that doesn’t care if its measuring liquids or bulk solids. Only its colour gives you a hint that it’s going to be great to use.

VEGA. HOME OF VALUES. www.vega.com/radar

In this issue

PUBLISHER

TTL Media www.forerunner.co.za

MANAGING DIRECTOR : Michael Keys

EDITOR: Stef Terblanche Phone: 076 647 8235

SALES MANAGER: Marc Wessels

SALES EXECUTIVES: Vera Valentine - sales2@ttlmedia.co.za

Sachin Brown - sales3@ttlmedia.co.za

Marco Gibbs - marco@ttlmedia.co.za

Marc Wessels - marc@ttlmedia.co.za

Kim Jeneke - kimjen@ttlmedia.co.za

ACCOUNTS:

Tania Johnson tania@ttlmedia.co.za

OFFICE MANAGER: Sumaya Abrahams sumaya@ttlmedia.co.za

DESIGNED BY: KCDA - Design Agency Jaco Kotze - jk@kcda.co.za www.kcda.co.za - 021 981 6333

PRINTED BY: F A PRINT CC Phone: 021 510 5039 Fax: 021 510 5038 Email: faprintcc@yahoo.com

DISCLAIMER

Views expressed in articles are those of the author and not necessarily those of FORERUNNER MAGAZINE. The publisher accepts no liability of whatever nature arising out of / or in connection with contents of the publication. Copyright subsist in TTL MEDIA & FORERUNNER MAGAZINE and, in the case of freelance photographers and writers, in the individual concerned. Material in this publication may not be reproduced in any form without the permission of the editor

14 Luxury guest villas WHERE KINGS AND OIL BILLIONAIRES COME TO STAY 32 TRANSPORT CRIMINALS ARE KILLING SOUTH AFRICA’S VITAL TRANSPORT SECTOR 44 INVESTMENT THE SATISFYING AND REWARDING ART OF INVESTING IN ART 58 POLITICS WILL PRESIDENT CYRIL RAMAPHOSA WIN A SECOND TERM? MOSES MUDZWITI SHARES HIS THOUGHTS 63 ECONOMY LESSONS FROM SAUDI ARABIA FOR SOUTH AFRICA

14 44 63 F O R E R U N N E R THE MAGAZINE THAT KEEPS YOU AT THE FOREFRONT BUSINESS | INVESTMENT | FINANCE | POLITICS SATIRE

SOUTH AFRICA Tel: +27 14 573 3444/666 E-mail: admin@discoverydrilling.co.za www.discoverydrilling.co.za BOTSWANA Tel: +26 7 396 0053 Fax: +26 7 396 0143 E-mail: kowie@discoverydrilling.co.bw

EDITOR from the

Starting a fresh new conversation

It is with much pride and joy that we present to you…Forerunner.

This is the launch edition of our brand-new magazine that strives to bring a fresh new conversation to the South African debate with news, views, interviews and more.

In due time, having earned the right, I trust Forerunner will have become the quintessential go-to publication in the South African market for the best and latest on business, finance, investment, politics, government, satire, and rounded off with a dash of lifestyle and leisure. As our name implies, we want to keep you, our readers, at the very forefront of everything important happening in South Africa today.

With Forerunner we endeavour filling a vital void in South Africa’s toplevel decision-making environment, bridging the communication and information gap between the public and private sectors with our definitive analyses, articles, thought leader pieces, satire and interviews.

In this, our very first edition, Eskom and South Africa’s energy crisis were an easy choice as our cover story. More than anything else, the precarious situation around Eskom’s broken electricity provision threatens

our economy and our society. We pose the question whether government will be able to fix it.

And in an in-depth interview with Roger Baxter, CEO of the Minerals Council South Africa, we delve deep into the current state and future prospects of mining in South Africa. Once the cornerstone of the South African economy, mining has evolved through many transitions to where it is today – still as important a sector as ever before. But it also faces some significant challenges.

From mining we go to the transport industry – with October being Transport Month - and analyse how criminals are sadly busy destroying this vital economic sector across all modes of transport. But it’s never too late, and much can still be done to return the sector to its former health, allowing it to fully play its critically important economic role.

On the investment front, we join two experts on an eye-opening, aesthetically pleasing journey into the fascinating world of investment art. Our guest writer, Moses Mudzwiti, shares his take on Cyril Ramaphosa’s chances of winning a second term as ANC president. Then there’s a piece on how Saudi Arabia, as the fastest recovering and growing post-Covid economy, can provide some important lessons to South Africa.

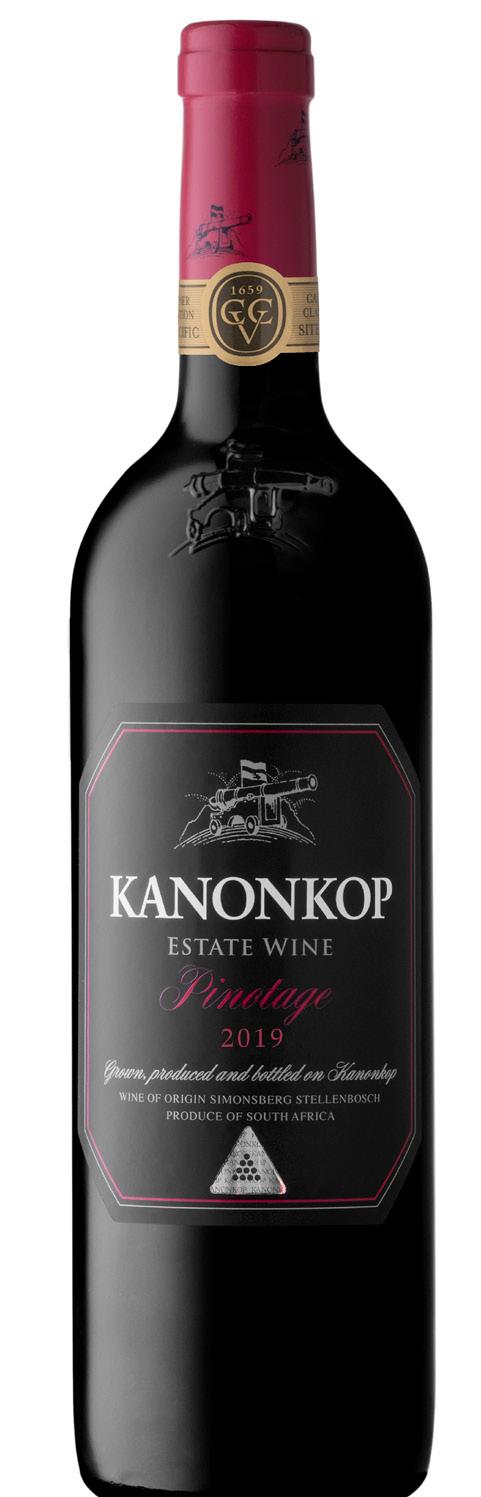

On the leisure and lifestyle side, we look at some magnificent villas to rent, as well as shining a spotlight on the 2019 Kanonkop Black Label Pinotage and the exclusive new Mukwa River Lodge on the banks of the Zambezi River. Finally, we round things off with a light-hearted, satirical look at business and politics in our regular columns - Boardroom Buzz, From the President’s Desk, and Politicus.

Please feel free to send us your opinions and ideas – you’ll find all our contact details on the credits page. And with that, I truly hope you will enjoy our maiden edition.

Yours sincerely

Stef Terblanche

FORERUNNER | www.forerunner.co.za | Issue 1 | 9

BOARDROOM BUZZ

B attle of the billionaires and their nomdeplume companies

All political parties in South Africa are strapped for cash, none more so than the governing ANC perhaps. The latter cannot even pay its staff… for many months now. And making their lives even more miserable – if misery can be a condition that afflicts political practitioners – is the 2018 legislation they all supported that requires disclosure of their donations and places a cap on them.

What a wonderful law that is, for now we know who’s giving how much money to which political party, although we still have to guess why. Maybe that’s what Cyril Ramaphosa hoped to do with those dollars stashed in his furniture before they got stolen? Who knows, because he refuses to tell Parliament, last time we checked at least.

10 | Issue 1 | www.forerunner.co.za | FORERUNNER

Nonetheless, against this legal background we have just learnt of the battle of the billionaires – that is, who is giving the largest donation to which party. But we still have to be good sleuths to find out just who exactly is behind some of the biggest donations. A little whispering birdie told us that some donors who prefer staying in the nameless shadows are using a loophole in the Political Party Funding Act to make use of different commercial or legal entities to donate in the name of those entities and above the annual threshold of R15-million donation per person. That’s cap-busting anonymity for you! Clever trick.

It’s no surprise then that our battling billionaires also made use of this loophole. Here they are: the largest donors to South Africa’s two largest political parties are billionaires Michiel le Roux and Patrice Motsepe. Le Roux, founder of Capitec Bank in which he has an 11% stake, donated R15-million to the DA via an obscure company registered by him and Johan le Roux and called Fynbos Ekwiteit (Pty) Ltd. What a flamboyant name for a company that doesn’t seem to do any business at all. Outdone by Le Roux, Motsepe – brother-in-law of our stolen-dollars President – only managed to bankroll the ANC to the miserable tune of R10 million, and did so in the name of his company, Botho-Botho Commercial Enterprise (Pty) Ltd.

Botho Botho is not to be confused with Batho Batho Trust, which is invested in petroleum giant Shell’s exploration business, and which donated R15-million to the ANC last year. Batho Batho Trust in turn has a majority stake in Thebe Investments, the local empowerment partner of Shell SA. Quite recently our intrepid Minerals and Energy Minister Gwede Mantashe wanted nothing more than to give lucrative offshore gas exploration rights to Shell, even pleading their case in two courts when those nasty environmentalists and affected communities successfully tried to stop them. A wounded Mantashe accused these environmental groups of “harassing” Shell and said their objections amounted to “apartheid and colonialism of a special type”. What type would that be, we wonder – the political party funding type

perhaps? You can be sure that’s not what the late Joe Slovo had in mind when he coined that phrase.

Meanwhile Herman Mashaba’s Action SA party came in with a measly R750,000 split between two donations - R600,000 from Style Eyes of California (Pty) Ltd and R150,000 donated by Shave & Gibson Group (Pty) Ltd. A few lesser-known businesspeople are behind those. The Patriotic Alliance revealed a donation totalling R310,000, made up of two separate amounts, both donated unashamedly by party leader and convict-turned-businessman Gayton McKenzie. If he also used nom de plume companies is not quite clear.

Meanwhile, whether Motsepe does not trust his brotherin-law to keep the ANC in power and is hedging his bets is also not clear, but his African Rainbow Minerals (ARM), and Harmony Gold Mining in which he has a large stake and of which he is the chairman, together donated an amount of almost R2.2-million to Julius Malema’s Economic Freedom Fighters (EFF). Yes, that’s economic freedom of a different type all right. But Motsepe’s long and generous ARM also gave the DA a big wad of notes. That’s right Mr Motsepe; keep all the bases covered, just in case.

So, there you have it. Whether these gentlemen just love these parties for sentiment’s sake, have family connections, prefer their policies, or want one of them to rule until Jesus comes, is open to speculation. But

POLITICS & BUSINESS FORERUNNER | www.forerunner.co.za | Issue 1 | 11

Dr Patrice Motsepe

at least now Luthuli House no longer has any excuse for not paying staff. We don’t know yet where Johan Rupert (calm down Julius Malema) or some of the other well-heeled local billionaires will feature in the donor rankings, if at all. But watch this space. There may be more money coming.

Standard Bank’s alive with the sound of music

It has been reported that some strange noises have lately been emanating from the boardroom and corridors of Standard Bank’s executive floor. On closer inspection it sounds like music, especially singing. A little falsetto mixed with some bass and baritone, some of it decidedly offkey. However, our sources in the bank say there’s a simple explanation for this: it’s been announced that Standard Bank is the headline sponsor for the new season of Idols SA. And everyone has singing fever, from the chief down. It’s even rumoured – but we have no confirmation – that Group Chief Executive, Sim Tshabalala has been taking singing lessons from a world-renowned opera coach. By the sound of it, he may be better off sticking to his day job.

Be that as it may, on a much less offkey note, some 9,000 hopefuls auditioned for this year’s season 18 instalment of the much-loved competition which premiered on July 17. The theme for this season

is ‘Singing a Different Tune’ – which also explains the singing noise in the bank. “True to our values at Standard Bank we want to give young South Africans the tools and support they need to achieve their dreams and aspirations and this sponsorship helps us do just that,” says Lindy Lou Alexander, Brand & Marketing Consumer & HNW honcho at Standard Bank. All we can say is, happy singing to Sim and his team, and to the 9,000 hopefuls!

CEOs and CFOs, are you battling to balance the books and strengthen the bottom line in these trying times? Your troubles are nothing compared to some. Spare a thought for the poor – or soon-to-be-poor – former president, Jacob Zuma, holed up in his Nkandla mansion beside his giant fire pool and cattle kraal as he watches his fortune literally dwindling away right in front of his eyes. And remember, the Gupta Bank is no longer in town, so business rescue is out of the question.

First, back in 2016, our scowling, showerhead-adorned ex-president paid back to the Treasury some R7.8million which a court ruled was a portion of the tax money spent on installing non-security luxury features at his private Nkandla home. In the meantime, our ex-president was busy running up huge legal bills in court case after court case while also trying to avoid the big one – facing trial on charges of arms deal corruption going back decades.

All was well as long as Mister Zuma thought the state was going to pay those bills. But then the courts – up to the Supreme Court of Appeals – last

Never mind your bottom-line, spare a thought for an expresident

12 | Issue 1 | www.forerunner.co.za | FORERUNNER

year shocked him by ruling he had to pay back to the state attorney at least R15-million it paid for legal fees in his corruption case out of a total of some R25-million illegally spent on his various cases. By that July Zuma’s pay-back bill had risen to R18-million and it was said his pension could be attached if he couldn’t pay.

Now adding injury on top of injury, the High Court in Pietermaritzburg has ruled that Anoosh Rooplal, curator of the troubled VBS Mutual Bank, could attach Zuma’s cattle and other assets if he failed to pay back the R6.5-million he still owed the bank from a R7.8mllion bond given to him to help pay back taxpayers’ money for the illegal Nkandla upgrades. For a while Zuma reportedly paid back the monthly instalments of about R70,000 as stipulated in the loan agreement. But then, having fallen from power in February 2018, he soon afterwards stopped paying. The bank, under curatorship after its own directors and officials cleaned it out, now wants its money back.

The land on which Zuma’s Nkandla home stands cannot be attached as it is tribal trust land belonging to the Ingonyama Trust. Try taking that land, and you will invite a response from armed impis like last seen at the Battle of Rorke’s Drift, what with a young and energetic new Zulu king having just ascended the throne. Be warned. And you worry about your bottom line?

Keep your company afloat like a pumpkin

If you are struggling to keep your company afloat post-Covid and now with the Russian-induced nightmare in Europe affecting everyone around the globe, maybe you should get some tips from Duane Hansen. Never heard of him? Neither did we. That is, until Erin Snodgrass of Business Insider US reported his amusing shenanigans. You see, Hansen

celebrated his 60th birthday recently by floating 61 kilometres down the Missouri River in a 383-kilogram pumpkin named ‘Berta’ — and is thought to have set a new world record in the process.

Not only must this be the biggest pumpkin ever grown, but it’s also the first ever pumpkin to stay afloat on a river for such a long time and trip. The previous paddle record for a floating pumpkin was a measly 40 kilometres. Hansen told a local radio station that it had taken him a decade to grow the perfect pumpkin, which boasted a circumference of 3.7 metres. Once he had cleaned out the flesh and pips and was able to sit inside, off he went. But it wasn’t all plain sailing and without risk.

Source: People.com

The radio station reported that he had to traverse rocky shores and shallow sand bars and every time he waved to onlookers on the banks, he risked tipping into the water. The message in this to all boardroom warriors is, if your company is in trouble and going under, get Hansen to fix it. Any man who can stay afloat for over 60 kilometres in a giant pumpkin while waving at people, can surely keep a sinking company afloat. No problem.

POLITICS & BUSINESS FORERUNNER | www.forerunner.co.za | Issue 1 | 13

EXCLUSIVE LUXURY VILLA RENTALS

WHERE KINGS AND OIL BILLIONAIRES COME TO STAY

Ever wondered where the super-affluent, famous Hollywood stars, royalty, or high-profile business and political leaders stay when visiting South Africa? Especially those who place a high premium on top quality, good service, discretion and privacy?

Of course, there are any number of top-class hotels and lodges available. But those come with compromised privacy and many other limitations. The better option – for those in the know - is to rent a luxurious villa complete with personal chef, butler, driver, and security, while leaving all the hassles to someone else.

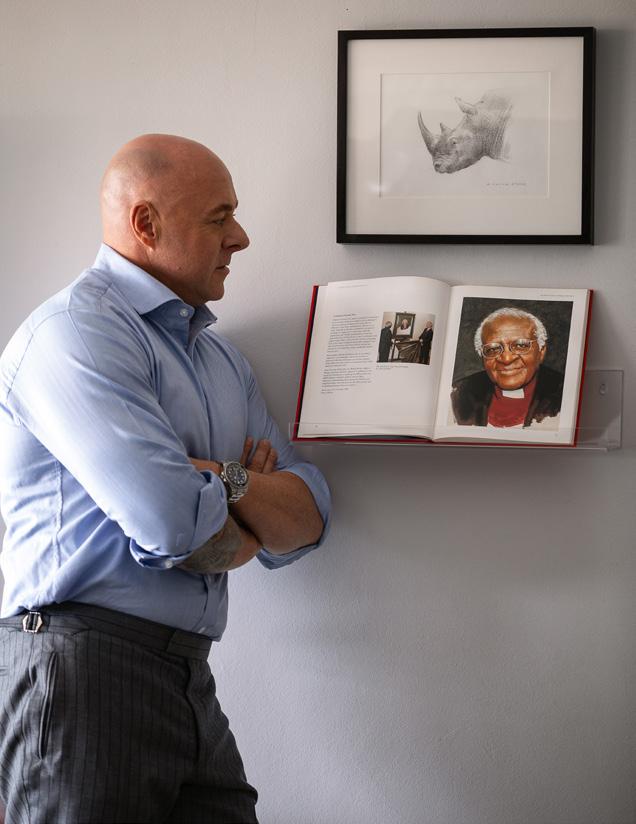

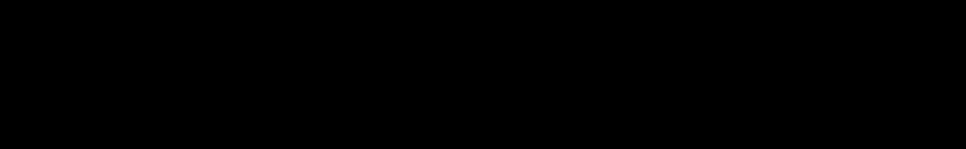

That someone else is Pieter Brundyn, CEO of In Residence, the company he founded in 2015 to manage some of the most superb properties in South Africa and let them on behalf of their owners to some of the most discerning visitors from around the globe.

But In Residence’s offering also extends far beyond South Africa and includes exquisite properties to rent in exotic destinations ranging from Sicily to Miami, the Caribbean, Mexico, Croatia, and the Greek islands, among more. Brundyn also offers his clients villas in other African locations ranging from Kenya to Mauritius,

14 | Issue 1 | www.forerunner.co.za | FORERUNNER

Mozambique, Seychelles and Tanzania.

The service provided by Brundyn’s company encompasses the ultimate encounter with luxury well above the 5-star level, together with watertight privacy and flawless service in some of the most beautiful settings in the world. In South Africa, In Residence manages and lets some fifty beautifully designed, superbly appointed and equipped, and professionally maintained and serviced luxury villas and apartments that can be rented for short or longer terms around the Cape Peninsula and in some other sought-after South African locations.

“Our exceptional top-50 collection of villas and other luxurious properties have certainly increasingly become the accommodation of choice for discerning, affluent travellers,” says Brundyn.

The experience starts when your aircraft touches down and you are whisked away in a private helicopter or in your chauffeured luxury vehicle, yours for the duration of your stay. Your stay can be for a few days for business, or a few weeks for a family holiday, or anything in-between or longer.

LIFESTYLE FORERUNNER | www.forerunner.co.za | Issue 1 | 15

You are quickly taken, with VIP protection if you so wish, to your accommodation. Being among the most acclaimed residences in South Africa, they are all architectural masterpieces set in exquisite surroundings. In fact, you will struggle to find anything better anywhere on the continent or even around the world.

World-famous locations

You can choose your location but may have a hard time doing so as they are all so alluring. You may settle for the spectacular ocean and mountain views along Cape Town’s Atlantic Seaboard high above world-famous beaches where the beautiful, the young, the global travellers and the wealthy come to play. Or you can opt for the elegant tranquillity of a Cape wine estate with more than 300 years of fascinating history behind it plus some of the world’s best wines to sample.

Or you may prefer to be surrounded by the spicy-smelling African bushveld where the silence is broken only by cicadas, birds and wild animals that come to visit just meters away from your pool on a famous private game reserve. Another excellent option is to be tucked away within the regal beauty of the Garden Route with views of its ageless mountains, lakes, forests and the ocean. Here the only unauthorised visitors will be seagulls, dolphins and whales.

Service excellence

Awaiting you at your villa will be premier in-house concierge services, a personal chef and your own sommelier (optional), to provide mouth-watering cuisine washed down with the best Cape and international wines. You may also opt for a personal butler plus 24-hours security and full-service attendance.

Everything is taken care of for the guests, from their travel and event bookings, to flower arrangements, cleaning, linen services, driving, shopping, real-time monitoring of water flow, electricity use, pool levels and inside temperatures and almost anything else that comes to mind.

And your daily itinerary may include – apart from your own business or leisure activities – a tour of the winelands, scenic helicopter flips, visits to top-class

restaurants or art galleries, private game viewing drives, chartered yacht cruises, attending major concerts or sports events, or simply relaxing around your villa with every possible need taken care of.

Elegant simplicity

“Our signature villas are nothing short of extraordinary, while our investment in people, skills, technology, and infrastructure is unrivalled in the exclusive villa rental market. Our services are rendered through smart technology to ensure maximum privacy and discreet interactions. Elegant simplicity is at the heart of our success,” Brundyn says.

Many of the properties in Brundyn’s portfolio have been designed by award-winning architecture firm, SAOTA. Reflecting their belief in the strength of contemporary, aesthetic design, the properties are sculpture on a grand scale. They are built to be noticed through the use of featured concrete, glass and other bold aspects that make them highly attractive and sought after.

A valuable partnership evolved when Pieter and his varsity sweetheart, Elana, got married. Sharing his

16 | Issue 1 | www.forerunner.co.za | FORERUNNER

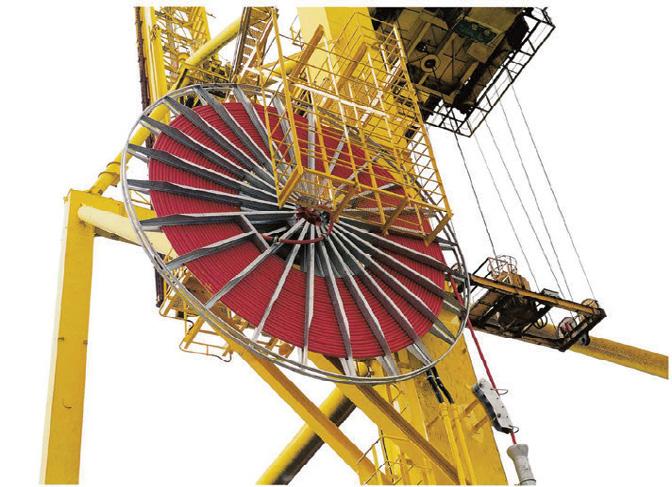

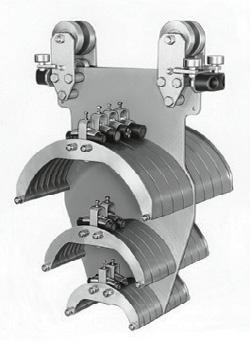

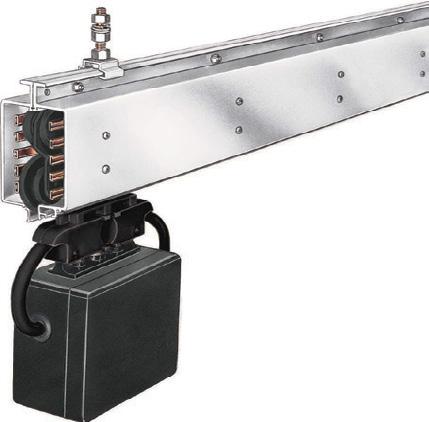

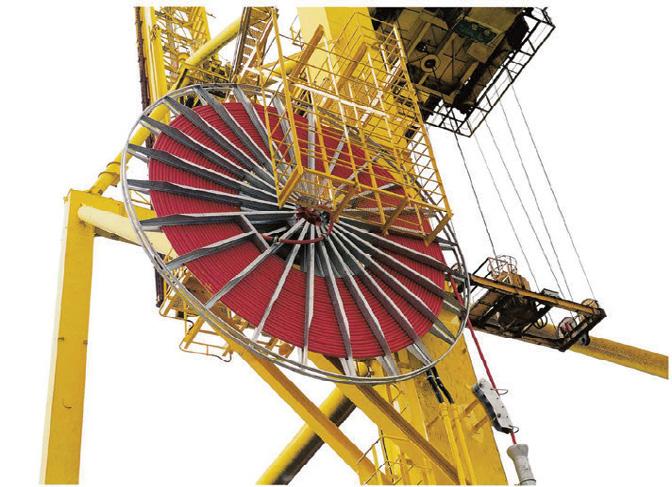

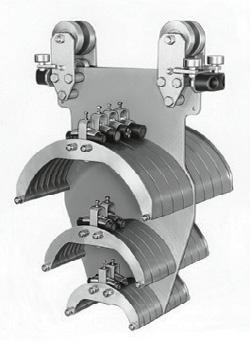

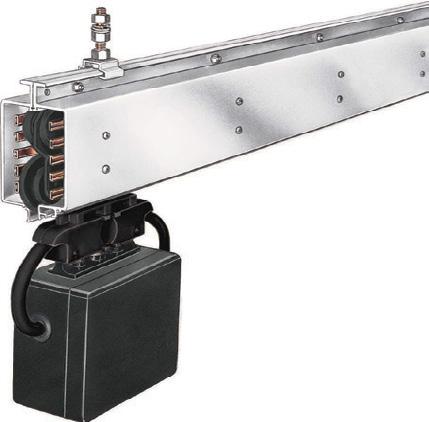

• Copperhead Rail Systems • Cable Reeling Equipment • Insulated Rail Systems • Festoon Systems • Battery charging system and more Tel: +27 11 392 5570/01 Cell: +27 65 880 9374 sales@mheequipment.co.za www.mheequipment.co.za aterials andling lectrification quipment

Working in such a high-powered, big-monied environment and interacting personally with the who’s-who of the world, Pieter Brundyn’s humble beginnings in business seem to be surprisingly unlikely. After studying accounting at Stellenbosch University, he joined his father in the family meat business – Cape Town’s iconic Libertas Meats in Goodwood - and became a butcher. But the entrepreneurial spirit ran strong in the family, and together they built the business into one of the most prominent wholesale meat suppliers in the Western Cape. A few other entrepreneurial ventures followed until Pieter finally launched In Residence in 2015. And the rest is history.

Pieter’s company. It adds a soul-enriching touch to any sojourn in one of these marvellous residences.

Exceptional villas

What makes these villas so exceptional? Each villa is a work of architectural excellence with interiors that incorporate the best in design, finishings, furniture and artwork. The full range of amenities differ from one property to the next but may include anything from curated private art collections to a wine cellar, a bar, pools, billiards room, private cinema, gym, sauna and plenty more. To get a better idea, the following are descriptions of some of these properties.

Pengilly House

interest in the fine arts, design and architecture, they were a natural fit. In 2004 Elana established the BRUNDYN gallery in Cape Town, before spearheading the establishment of the world-class Zeitz MOCAA gallery in the Silo District at the Waterfront – billed as Africa’s answer to the Tate Modern in London. Currently she is the CEO of another exceptional South African art enterprise, the Norval Foundation located on the outskirts of Cape Town.

Their shared love of art is reflected as a fundamental theme running through all the residences managed by

Described as one of Africa’s most iconic architectural homes, this stunning architectural creation is perched on the slopes of Lion’s Head above Clifton’s sandy beach coves. Designed by Peerutin Karol, this home in Cape Town’s swishest beach destination and one of the most exclusive stretches of real estate in Africa, pays homage to mid-century modernist architecture. Here discerning visitors can make themselves at home in Africa’s finest futuristic masterpiece, where urban living blends with nature and time stands still.

Capitalising on the drama of its 270-degree vistas of the Atlantic Seaboard, this home captures the zeitgeist of Hollywood’s jet-set era. Spread over four levels (accessed via two elevators or a spiral staircase), it boasts various entertainment areas; an extensive home spa with indoor heated swimming pool, sauna, steam room and Jacuzzi; a home theatre;

18 | Issue 1 | www.forerunner.co.za | FORERUNNER

Pieter Brundyn

Beyond

a home relaxation pavilion worthy of James Bond, with sunken bar, barbecue areas, and rim-flow swimming pool; digital-games set-up; and large open-plan living area with uninterrupted ocean views, long dining table, sleek kitchen-cum-bar area (plus a behind-the-scenes prep kitchen), all of which flow onto the lawn, outdoor barbecue area and the pavilion. The luxurious bedroom suites on the top floor are private sanctuaries, each with panoramic views and total privacy. Two separate bedroom pods above the entertainment pavilion are perfect for guests seeking extra independence.

Cape Kloof

Suspended over the highest point in Clifton, Cape Town, and with breath-taking views of the Atlantic Ocean, is where you’ll find Beyond, a six-level luxury villa, designed as a timeless wonder by leading South African architecture firm SAOTA. This incredible property is beyond anything you have seen before, with its six en-suite bedrooms, multiple, open-plan entertainment areas, including a bar on a glass floor, gym, sauna, steam room and rim-flow pool. Step into luxury and be amazed.

Set at the foot of Lion’s Head, with spectacular views of Table Mountain, across Table Bay, and of Cape Town city centre and harbour, this four-bedroom, luxury villa bewitches the senses. The superb, contemporary design and glorious wood-panelled interior, give this property so much warmth and hospitality that you’ll wish you could stay forever.

Surrounded by nature at its finest, Cape Kloof Villa provides guests with alfresco dining, a plunge pool and barbecue, elevator, fireplace and a fully equipped kitchen with breakfast bar. Included in your stay will be housekeeping service, concierge, and live-in housekeeping. Additional services available on request include activities and excursions, baby sitting and au pair, butler and/or chef, dry cleaning, personal security, personal shopping, personal trainer, spa and beauty treatments, and villa pre-stocking.

Cheetah Plains

Cheetah Plains, in the Sabi Sands Game Reserve, is the ultimate South African luxury safari destination. Each property boasts a formal lounge, living room, dining area, expansive sun deck, heated swimming pool, wine gallery, chef’s kitchen and private suites. Cheetah Plains runs entirely ‘off-grid’, harnessing solar power to provide reliable, renewable energy and has a grey-water recycling system in place. Cheetah Plains is a sophisticated eco-luxe safari experience for the discerning traveller.

• For more information about In Residence by Pieter Brundyn, go to https://inresidence.co.za/

By Stef Terblanche

LIFESTYLE FORERUNNER | www.forerunner.co.za | Issue 1 | 19

Eskom… comeback or final burnout

Eskom has reached a critical stage with its electricity constraints. If loadshedding went to stage 8, a total blackout could follow… and could force the economy to its knees. Government has been engaged in emergency deliberations but is not saying much. Does it really have a plan? Can Eskom return from the edge or is this the final burnout?

With Day Zero knocking at South Africa’s front door, few people need to be told - with the possible exception of some government ministers perhaps - that the country faces an electricity catastrophe like none seen before.

Even between this article being written and its appearing in print, the lights could go out in a total blackout, and South Africa could grind to a crushing halt. That’s the worst-case scenario, but the best-case one is not much better as things stand at present.

Eskom, the monopolistic, previously captured, sabotaged, unmaintained, aging, crumbling, convulsing, and cashstrapped state-owned national power provider has never before been as terminally ill as now.

Debilitated enough to make President Cyril Ramaphosa

cancel his United Nations appointment in New York and rush home from Queen Elizabeth II’s funeral for another cabinet meeting and another plan. None of the previous ones have made a dent in Eskom’s downhill slide. And seven years of government and presidential promises that things are under control and will soon improve, appear all to have been either cynical lies or gross misjudgements. Either sin is unforgivable in light of the consequences.

This raises the question: can Eskom still be rescued and brought back to life, or is this the final burnout? Can government be trusted to turn it around at this late hour?

The potential upside of the latest situation – but don’t hold your breath - is that it may finally shock the ANC political elite out of their ignorant slumber to do the bold and decisive things required to rescue this public utility and the country. For if Eskom blows, the economy goes.

20 | Issue 1 | www.forerunner.co.za | FORERUNNER

For powerless days that seemed like weeks, South Africa came close to that as Eskom moved the country to Stage 6 loadshedding, while all the time flirting with Stage 8 – a situation not seen before. If it went there, it would be crunch time and a total blackout could easily be next.

of a blackout occurring. The fact that Eskom was able to manage the overburdened demand and supply situation through load shedding even at stage 6, was an assurance that the controlled rolling blackout system is working and preventing a total blackout. Which is what loadshedding was designed to do, by maintaining the frequency on the grid at 50Hz.

There have been similar blackout scares around the world before, but none accompanied by the same progressive deterioration of health as Eskom, built up over 15 years or more, without any effective measures implemented to arrest the degradation. In 2019 a blackout in Argentina left 48 million electricity users without power for almost a day; in 2003 some 55 million North Americans were left without power for a fortnight; and in 2012 a blackout in India left over 400 million users without power. However, compare these to South Africa in 2022 alone, when in just eight months South Africans were left without power for more than 1,300 hours and still counting – and that with controlled and managed load-shedding.

Uncontrolled Blackout

An uncontrolled blackout is quite possible. If loadshedding moves up to stage 8 where 8,000 MW is pulled off the grid and capacity pressures go beyond this level, a determination may have to be made to shut down more power per each province. But, says Eskom, a total collapse of the national grid – quite possible at that stage - would be an unforeseen event, and Eskom’s system operator would not be able to provide advance warning should it occur.

“A national blackout will have massive implications, and every effort is made to prevent this from occurring. Depending on the nature of the emergency, it could take several weeks for the grid to recover from a blackout,” says Eskom.

There may be some small comfort in Eskom CEO Andre de Ruyter’s assertion that for now there is no immediate threat

But, while load shedding was reduced to stage 5 at the time of writing, the grid remained incredibly volatile and vulnerable to further breakdowns, and there was no telling what would happen if the situation escalated to stage 8. Even just “a few weeks” of total blackout could bring the economy to its knees, an impact far worse than anything two-and-a-half years of the Covid-19 pandemic visited upon us. South Africa could effectively be destroyed and take years to recover.

But even if a total blackout can be avoided this time around, Eskom’s problems are set to continue, and South Africans will continue having to live with loadshedding, while it slowly eats away at the economy. What can or will the government do about this, is the question on everyone’s lips.

Yet, as this nightmarish drama was unfolding in September, some of President Ramaphosa’s ministers – especially the ones directly responsible for Eskom as it lies in what could be its death bed – seemed blissfully unaware of the magnitude of the threat to South Africa, should Eskom finally suffer a complete breakdown.

For them it seemed to be business as usual without any urgency or a proper plan until Ramaphosa returned home and they hunkered down to try and find a solution. But before that, at the height of the latest Eskom crisis with stage 6 loadshedding and a threat of escalation to stage 8, the ministers responsible for Eskom, Gwede Mantashe and Pravin Gordhan, hardly deemed it necessary to address the public about the crisis as it worsened. Apart from some Eskom statements, the public was kept in the dark, figuratively, and literally. This continued even after Ramaphosa’s hasty return to South Africa.

The most shocking part is that the government has had 24 years of warning, 15 of them with intermittent loadshedding, in which it could have done something effective, but simply didn’t. And since at least 2015, when he was still deputy

ENERGY 1

FORERUNNER | www.forerunner.co.za | Issue 1 | 21

“A national blackout will have massive implications, and every effort is made to prevent this from occurring.”

president and put in charge of the energy crisis, Ramaphosa has promised that load shedding would “soon” be a thing of the past. But it simply wasn’t. No-one believes Ramaphosa anymore. This latter fact is borne out in countless social media posts, mainstream media commentaries and reports, statements by business and other leaders, and ordinary people across the country. The mood is ugly and turning sharply against the ANC and its leaders. And against Eskom.

“Ramaphosa has done nothing to stop this – he’s useless,” says Meschak, echoing the controversial words of millionaire entrepreneur Rob Hersov uttered in a speech at the recent BizNews Conference. Meschak is a waiter at the local Spur restaurant where I went for coffee during a spell of loadshedding. He may represent the opposite end to Hersov on the socio-economic scale, but when it comes to public opinion about Ramaphosa, the government and Eskom, they are on the same page.

“The ANC’s time is over. They only care about themselves. They cannot fix Eskom,” adds Meshak’s colleague, Precious. This is the mood wherever you go, whomever you speak to. Could it be that the latest Eskom crisis could be the final catalyst in the ANC’s fall from power?

We’ll have to wait for the 2024 elections for the answer. In the meantime, something has to be done about Eskom and electricity for South Africa. We need to get the lights back on, the factories and mines working full steam, trains running, digital communications working – everything that has been knocked out by loadshedding.

Privatisation

But whether the current government – representing the state as Eskom’s sole shareholder - can lead any effective turnaround of Eskom, is debatable. For the ANC its ideological dogma and racial policies appear to be more important than finding real, sustainable solutions to the Eskom crisis. Many prominent people, energy experts, and entities such as S&P global ratings agency, have publicly shared the opinion that only privatisation can save Eskom.

Bloomberg News reported S&P Global Ratings as saying that operational issues at Eskom pose a risk to South Africa’s economic outlook and the utility’s revenue is insufficient to reduce its R396 billion of debt. Shifting Eskom’s obligations onto the state’s balance sheet would, however, precipitate a marked deterioration in the state’s debt. It held that privatisation may be the best option to resolve the power crisis.

In an interview with Bloomberg News, Zahabia Gupta, S&P associate director of sovereign ratings in the Middle East and Africa reportedly said that “These utilities typically tend to be a problem, but then the ones that have done better are the ones that have done some kind of a wholesale privatisation. Then the problem at least is no longer the government’s and typically the utilities run better.”

But this was immediately shot down by Ramaphosa’s Employment and Labour minister, Thulas Nxesi, who reportedly said he would oppose any move to privatise

22 | Issue 1 | www.forerunner.co.za | FORERUNNER

T H E R E S I D E N C E S A T C R Y S T A L T O W E R S O F F E R S Y O U L U X U R I O U S S E L F - C A T E R I N G A P A R T M E N T S W I T H 2 4 H R O N S I T E S E C U R I T Y , S I T U A T E D D I R E C T L Y A C R O S S T H E C A N A L W A L K S H O P P I N G M A L L A L L T H E R O O M S O F F E R V I E W S O F C E N T U R Y C I T Y A N D A R E E L E G A N T L Y F U R N I S H E D W I T H F L A TS C R E E N T V ’ S A N D F R E E W I F I T H E K I T C H E N S A R E F U L L Y E Q U I P P E D W I T H R E F R I G E R A T O R S , M I C R O W A V E S , D I S H W A S H E R S , O V E N S , S T O V E S , E T C . T H E S T Y L I S H B A T H R O O M S H A S U N D E R F L O O R H E A T I N G A S W E L L A S H E A T E D T O W E L R A I L S W I T H I N T H I S S A F E E N V I R O N M E N T T H E R E A R E M A N Y R E S T U A R A N T S , B A R S , C O N V E N I E N C E S T O R E S , C O R P O R A T E O F F I C E S A N D C O N F E R E N C E C E N T E R S . T H E C A N A L V I E W F R O M O U R A P A R T M E N T S S E T S T H E T O N E F O R A B E A U T I F U L S T A Y . C E N T U R Y C I T T I N G L E T T I N G , O F F E R S V A R I O U S L U X U R Y A P A R T M E N T S A C R O S S C E N T U R Y C I T Y S U C H A S T H E I S L A N D C L U B , M A N H A T T A N S U I T E S , A N D C O N F E R E N C I N G A S W E L L A S B R I D G E W A T E R W I T H T H E M O S T A M A Z I N G V I E W S O U R M I S S I O N I S T O D E L I V E R A R E L A X E D A N D R E F I N E D L O N G T E R M R E N T A L E X P E R I E N C E . W E S T A N D O U T F R O M T H E R E S T W I T H O U R S T A N D A R D S O F I N T E G R I T Y , E X P E R T I S E A N D S O P H I S T I C A T I O N T H E A P A R T M E N T S A R E M O D E R N I Z E D , F U L L Y F U R N I S H E D , A N D S E L F C A T E R I N G . O U R F U R N I S H E D A P A R T M E N T S P R O V I D E Y O U W I T H M I C R O W A V E S , D I S H W A S H E R S , O V E N S , S T O V E S , A N D R E F R I G E R A T O R S , A L O N G W I T H T H E R E S I D E N C E S O U R A P A R T M E N T S A R E I N C L O S E P R O X I M I T Y T O T H E C A N A L W A L K S H O P P I N G M A L L . W E H A V E T H E I N T A K A I S L A N D , R A T A N G A P A R K , T H E B O A T C R U I S E T H R O U G H T H E C A N A L A N D S O M A N Y M O R E A D V E N T U R O U S A C T I V I T I E S T H A T C A N B E D O N E A R O U N D C E N T U R Y C I T Y . A S Y O U E X P L O R E O U R I N D I V I D U A L A P A R T M E N T S , I T F E E L S L I K E A L U S H , L U X U R Y T R A V E L M A G A Z I N E A T T H E R E S I D E N C E S A N D C E N T U R Y C I T Y L E T T I N G , W E E X U D E E N E R G Y , L U X U R Y A N D L E I S U R E . F R E E P A R K I N G I S A V A I L A B L E O N - S I T E A N D A N A I R P O R T S H U T T L E C A N B E R E Q U E S T E D A T A C H A R G E T O C A P E T O W N I N T E R N A T I O N A L A I R P O R T , 2 0 K M A W A Y . C E N T U R Y C I T Y I S A G R E A T C H O I C E F O R T R A V E L L E R S I N T E R E S T E D I N S H O P P I N G , T O U R I S T A T T R A C T I O N S A N D S I G H T S E E I N G . B U S I N E S S T R A V E L L E R S P A R T I C U L A R L Y L I K E T H E L O C A T I O N , T H E Y R A T E D I T 9 0 F O R A W O R K - R E L A T E D T R I P W E S P E A K Y O U R L A N G U A G E A N D P R O V I D E Y O U W I T H T H E L U X U R Y S T A Y C A T I O N Y O U D E S E R V E ! W R I T T E N B Y : L A U R E N W I L L I A M S BY

Eskom as it would be detrimental for the majority of South Africans. “It (privatisation) is going to be very expensive for them. That’s why government steps in when there is market failure,” he reportedly said. Government stepping in? Market failure? It seems someone is missing the plot.

For perspective and clarification, Nxesi is also a senior leader of the ruling ANC’s formal ally, the South African Communist Party (SACP). This party is the architect of the ANC’s central driving vision, the so-called National Democratic Revolution (NDR), whereby the ANC must obtain control of all levers of power in the South African state as the quickest route to creating a socialist and then communist state in South Africa. This, therefore, rules out any privatisation of state assets.

and not real structural reforms. They simply don’t go far enough or cover all the key bases.

Other ANC ministers have also rejected privatisation, including Mantashe. Yet, President Ramaphosa has over the last year opened the door a little by inviting the private sector to take up a slightly bigger role in electricity provision. Don’t be misled though. These ‘concessions’ only came when Eskom’s wheels seriously started falling off, when the crisis started spiralling out of control, and the government started looking at desperate measures to make it to the other end of the ever-darkening tunnel. It’s not a change of heart, ideology, or policy on the government’s part. Critics will say this shows just how out of touch the ANC is with the demands of a modern, dynamic economy.

And after President Ramaphosa’s hasty return and frantic deliberations behind closed doors in late September, the private sector was again roped in…well, partially so. The government made a big public relations event of its signing agreements for three projects and 420MW of wind power in the Renewable Energy Independent Power Producer Procurement Programme (REIPPPP). The truth, however, is that this was out of more than 2,500MW and 25 projects that were already supposed to have been finalised this year. Given South Africa’s dire situation, where is the urgency?

Racial policy and ideology

President Ramaphosa and the ANC take this very seriously. In July this year President Ramaphosa told the SACP’s 15th national congress that the ANC was determined to “defeat each and every effort to derail the NDR”, which he labelled as the “shared programme of the ANC and the SACP and the reason for the existence of our alliance”. That doesn’t sound like the words of a man who might opt for a reformist route, one who would pragmatically consider market dynamics as offering a way out, despite the recent lip service frequently paid to ‘structural economic reforms’. One can argue that the ‘reforms’ introduced so far as part of Ramaphosa’s Economic Reconstruction and Recovery Plan are perhaps little more than cosmetic adjustments

But it doesn’t end there. Another thing standing between the power crisis and Eskom’s possible recovery, is the ANC’s racial policies. It’s no secret that after coming to power, the ANC sought to secure total control of all levers of power via its policy of deploying ANC cadres to all key positions in the public service, municipalities, and stateowned enterprises including Eskom.

Those who were employed under the pre-1994 apartheid regime – mostly whites – were pushed out with early retirement packages. It was a serious mistake as decades of institutional memory and expertise was lost. Keeping them on to mentor a new generation of civil servants and other employees, especially in a sophisticated high-tech operation like Eskom, over a gradual transitionary phase of natural attrition to achieve racial transformation, would have been the better option. But that was never on the

24 | Issue 1 | www.forerunner.co.za | FORERUNNER

‘Eskom has suffered a serious shortage of suitably qualified and experienced personnel’

WWW.VALLEYHEIGHTS.CO.ZA ACCOMMODATION THAT FEELS LIKE YOUR HOME AWAY FROM HOME C E N T R A L L Y L O C A T E D G U E S T H O U S E C O M P E T I T I V E L Y P R I C E D A W A R D W I N N I N G & H I G H L Y R A T E D L O N G S T A Y G U E S T S W E L C O M E S E L FC A T E R I N G U N I T S A V A I L A B L E VALLEYHEIGHTS@MWEB.CO.ZA 36 OAK AVENUE KENILWORTH CAPE TOWN 021 797 9774

ANC’s mind – centralised control and power was.

As a result, Eskom has suffered a serious shortage of suitably qualified and experienced personnel – a major cause of its many problems. Nonetheless, in 2019 the trade union Solidarity provided Eskom and the government with a list of 480 qualified and experienced former Eskom engineers, technicians, and managers who were willing to return to Eskom immediately and save it from total collapse. After more than two years of procrastination, the Ramaphosa government eventually gave the go-ahead to Eskom CEO Andre de Ruyter this year to start re-employing people from Solidarity’s list, by then whittled down to 300.

However, after re-employing only 18 engineers out of the 300 former Eskom employees, the government stopped the process with instructions that employment must be racially “more inclusive”. De Ruyter had no choice but to turn to an online crowd recruitment platform to try and find the engineers, physicists, power station managers, plant operators, and senior technicians needed to save the country from total darkness. Solidarity head Dirk Hermann described it as “De Ruyter has to swim through political syrup before he can get anything done”.

In the meantime, Eskom nearly toppled over the brink. It seems for the government racial composition was more important than merit and suitability of those who could help to fix a critical problem. Transformation imperatives apart, this demand for more inclusivity should also be seen in the context of the NDR and cadre deployment, two issues that have brought untold harm to South Africa going far beyond just Eskom. The ANC has been told this from many different quarters over the years, but it remains wilfully deaf. Ramaphosa himself has emphasised that cadre deployment was here to stay…well, as long as the ANC remains in power, one would imagine.

Without cadre deployment the ANC would never have been able to capture the state as a means to fulfilling the NDR, and with the ANC having captured the state, further ‘state capture’ by corrupt and criminal elements during the Zuma administration, would hardly have been possible. This then again raises the question, can the ANC government be relied upon to lead Eskom out of the crisis and back to sustainable, efficient electricity provision?

At the end of July, President Ramaphosa did come up with a plan to rescue Eskom that included the creation of the

Energy Crisis Committee consisting of various ministers, including Minister in the Presidency Mondli Gungubele, Public Enterprises Minister Gordhan, Mineral Resources and Energy Minster Mantashe, Minister of Forestry, Fisheries and Environment Barbara Creecy, Minister of Trade, Industry and Competition Ebrahim Patel, and Minister of Police Bheki Cele. It was another of the almost countless committees, sub-committees, and task teams that are created every time there is a problem. Seldom if ever are they able to report any real progress with the tasks given to them.

Nonetheless, Ramphosa’s plan is supposed to focus on five stages, namely, fixing Eskom; reducing loadshedding and improving generation supply; speeding up procurement of new energy; enabling businesses and private homes to invest in solar power; and transforming the electricity sector to achieve long term energy security. The plan lacks critical detail and definitive timelines, while not much in the plan differs from previous plans and undertakings.

At the time Energy Minister Mantashe said he wouldn’t stand in the way of renewable energy – part of the plan - but that he was still pushing for the controversial Karpowership deal. The deal was halted over environmental concerns and allegations of corruption. It is also known that Mantashe, Gordhan and De Ruyter have had their differences over what is best for Eskom and South Africa’s energy outlook. Such differences are not very helpful in a crisis like this. Nonetheless, Mantashe kept his word as could be seen when he participated in the signing of the three new deals for IPPs to produce renewable energy.

Meanwhile Business Unity South Africa (BUSA) says South Africa’s economy, businesses and the people of South Africa cannot afford the havoc wreaked by load shedding, with the country losing an estimated R4 billion a day. BUSA said it stands ready to support immediate interventions to address the crisis and was awaiting government’s lead.

And that was, at the time of writing, what everyone was waiting for. President Ramaphosa had already been back in South Africa for four days, the cabinet had already held its weekly meeting, and still no plans to save Eskom and the economy were being announced. So, the question once again needs to be asked, will Eskom be rescued and turned around, or is this the final burnout?

By Stef Terblanche

26 | Issue 1 | www.forerunner.co.za | FORERUNNER

BLACK POLYESTER ACRYLIC DOUBLE SHELL WINTER GLOVES

• 13g Polyester

• Sandy Nitrile Palm Coated

• Crinkle Palm with good grip and anti-slip properties

• Comfortable, flexible gloves and suited for use in a cold environment

• Anti-bacterial and anti-odour treatment

PRIDE NITRILE COATED SANDY FINISH GLOVE

• Palm coated knitwrist

• Fit for protection

• Sandy finish for superior grip

• Polyester liner

• Cuff style knitwrist

• EN388: 2016

GREEN 5CM LINED LEATHER GLOVES

• Palm coated knitwrist

• Fit for protection

• Sandy finish for superior grip

• Polyester liner

• Cuff style knitwrist

• EN388: 2016

TANNED WELDERS GLOVE CHROME LEATHER (SUEDE) BOVINE SPLIT

• Palm coated knitwrist

• Fit for protection

• Sandy finish for superior grip

• Polyester liner

• Cuff style knitwrist

• EN388: 2016

PRIDE HIGH CUT AND ABRASION RESISTANT GLOVE

High level of cut resistance protection. The form-fitting, 10G, high performance polyethylene (HPPE) machine knit shell combines comfort and dexterity Features a premium micro-foam palm coating that channels away oils and adds flexibility, dexterity and grip

TANNED WELDERS GLOVE CHROME LEATHER (SUIDE) BOVINE SPLIT

• General Purpose

• Welders Glove

• For any high heat application

• Polyester liner

• EN388 .Cat 1

• Not for use above 50 degrees celsius

PRIDE HPPE FULLY DIPPED SHELL, HIGH CUT & ABRASION GLOVES

• Fully coated nitrile inner

• Sandy nitrile outer palm for great grip

• Great dexterity, sense of touch and high level of cut resistance

• Features a premium micro-foam palmcoating that channels away oil and adds flexibility, dexterity and grip

PRIDE A-GRADE RED LEATHER GLOVES

• Palm coated knitwrist

• Fit for protection

• Sandy finish for superior grip

• Polyester liner

• Cuff style knitwrist

• EN388: 2016

SUPPLIERS OF HIGH-QUALITY PPE PRODUCTS, CHEMICALS AND ELECTRICAL EQUIPMENT TO THE MARINE, MINING, CONSTRUCTION & ENGINEERING INDUSTRIES AS WELL AS THE GENERAL PUBLIC

ORDER ONLINE ON WWW.SHIPSHOP.CO.ZA

SHIPSHOP

Cape Town 34 Auckland Street, Paarden Eiland Cape Town 7405 Mosselbay Shop 28, Bayside Shopping Centre Church Street, Mosselbay, 6500 Saldanha 27 Main Road, Saldanha, 7395 Tel: +27 21 5100 184 +27 82 442 9316 Email: orders@shipshop.co.za

THE ESKOM TIMELINE… Disaster In The Making

In late September South Africa’s long-running energy crisis pushed the country to the brink of disaster. Eskom, the now already 99-year-old public power utility, implemented loadshedding at stage 6, with much speculation that it could go to stage 8 – the highest ever. The spectre of a total, uncontrolled blackout loomed large.

President Cyril Ramaphosa had to cut short an important overseas trip to return home and deal with the crisis. At the time of writing, he had been back already for almost a week, yet no announcements were forthcoming regarding a rescue plan. Angry and frustrated, South Africans waited to hear what the plan would be – could Eskom be returned from the brink, or was the worst about to happen?

To fully grasp the whole picture, one should go back to the very beginning of this crisis.

From 1960 to 1990 Eskom increased its installed power production capacity from 4,000 MW to 40,000 MW to keep up with rapid economic growth. This included the building of the Koeberg nuclear power station which started in 1974. However, after the 1994 democratic elections, Eskom’s focus shifted to expanding electricity supply to previously neglected black residential areas. This period, under the Nelson Mandela and Thabo Mbeki governments, was also

a period of the strongest post-apartheid economic growth. Both events started putting much demand-side strain on the national power grid.

In 1998, the ANC pushed through legislation that would greatly expand the government’s powers to interfere and influence Eskom’s policy and investment decisions – by some measures a serious mistake. All the while the utility was struggling financially due to supplying cheap electricity at cost, so financing structures gradually changed, and debt started accumulating.

In the late 1990s the Mbeki government attempted to privatise Eskom and the utility’s requests for more budget to build new power stations were denied as a consequence. But as the privatisation never proceeded, this was another serious mistake that had adverse consequences for Eskom and the economy, as confirmed by Mbeki himself in 2007.

In December 1998, analysts and leaders in Eskom and the government submitted a report to government which predicted that Eskom would run out of electricity power reserves by 2007 unless immediate action was taken to prevent it. The report recommended restructuring Eskom into separate electricity generation and power transmission businesses. Despite the warnings of the 1998 report and

28 | Issue 1 | www.forerunner.co.za | FORERUNNER

requests by Eskom to be allowed to increase capacity, the national government took no action. Mbeki’s attempted privatisation of Eskom was given as the reason.

The report’s prediction was spot on, and by late 2007 until May 2008, Eskom resorted to loadshedding for the first time – the system to manage electricity shortfalls with rolling blackouts on a rotating schedule for different neighbourhoods and towns.

At about the same time, under the Zuma government, it was decided to embark on an aggressive programme to build new power stations. It was decided to build more 6-pack coal-fired power stations and work started on the giant Medupi and Kusile stations in 2007. The construction of these power stations quickly fell behind schedule and went way over budget, with shoddy workmanship and accidents setting things further back, and to date the two power stations are yet to be fully completed.

Fifteen power stations were commissioned between 1961 and 1996, adding a combined 35,804 MW of capacity to the grid. After 2000, only 9,564 MW of capacity had been added, most of it from those generators at Medupi and Kusile that had already been completed. Many Eskom power stations are almost 50 years old and near decommissioning.

All the while demand outstripped supply, with Eskom’s ageing fleet of power stations, and transmission and distribution infrastructure suffering more and more breakdowns. Eskom’s workforce had been vastly reduced and it lacked many qualified and experienced personnel to manage, maintain and repair its facilities and infrastructure. At the same time its debt was growing, and the situation became ever more desperate. At one stage the government of Jacob Zuma wanted to pursue more nuclear build as a solution, but this was abandoned due to the prohibitively high costs. In December 2014 Zuma appointed then deputy president Ramaphosa to oversee the turnaround of Eskom.

Among the many issues adding to Eskom’s supply problems, are ageing equipment and infrastructure, cable and equipment theft, sabotage, accidents, negligence, shortages of qualified and experienced engineers and other personnel, illegal and destructive strikes by workers (Eskom being a national key point and the workers designated essential workers), problems with coal supplies, diesel theft and shortages (for emergency generators during loadshedding), corruption and theft during the state capture period under the Zuma government, and insufficient new build. At the same time Eskom is under pressure to transition from coal to clean renewable energy, while more independent power producers (IPPs) are being brought into the mix.

FORERUNNER | www.forerunner.co.za | Issue 1 | 29

THE ESKOM LOADSHEDDING TIMELINE

1923 – Eskom was established 99 years ago

1974 – Construction starts on the Koeberg Nuclear Power Station, the only one in Africa

1994 – State mass housing projects, economic growth starts to rapidly increase demand for electricity

1994 – the governing ANC starts implementing its ‘cadre deployment’ policy and starts replacing employees in the public sector, including Eskom, with much expertise being lost

1998 – Eskom management, government officials, and energy experts warn the government that SA will run out of sufficient electricity by 2007 unless new power stations are built – government ignores the warning

2007 – South Africa experiences the first load shedding in late 2007 until May 2008

2014 – Load shedding – 121 hours of it - occurs for the second time.

2014 – President Jacob Zuma blames load shedding on apartheid.

2015 – More load shedding for most of the year, with 852 hours of no power.

2016 – President Zuma announced that load shedding was over and a thing of the past.

2018 – Load shedding returns after protesting Eskom workers put pressure on the network.

2018 - Eskom had accumulated debt of almost R400 billion

2019 - Preident Cyril Ramaphosa says stage 4 loadshedding was bad for the economy and must not happen again

2019 – Andre de Ruyter is appointed the new CEO of Eskom

2019 – In December load shedding went to stage 4 several times with 530 hours of load-shedding for the year

2019 - the Eskom council approves a 9-point plan to improve power generation and a stable power Network

2019 - It was announced that Eskom was to be split up into three distinct entities, a move already proposed to government by Eskom and energy experts back in 1998

2019 - Eskom is the largest emitter of sulphur dioxide in the power industry in the world

2020 – Jabu Mabuza resigns as Eskom chairman – he is one of a series of Eskom CEOs, board members and chairpersons coming and going at Eskom in the last decade

2020 – In August Eskom spokesperson Sikonathi Mantshantsha said load-shedding would no longer be necessary by September 2021

2020 - 859 hours of load-shedding occurred in 2020

2021 – Experts were warning in January of worse load shedding lying ahead

2021 – At the UN Climate Change Conference it was announced rich countries would fund South Africa’s transition from coal power to renewable energy

2021 – In June Ramaphosa announced increasing the threshold for private generation of power without a licence from the National Energy Regulator from 1 MW to 100 MW

2022 – Load shedding resumed in February and in April Eskom warned it could be applied for up to 100 days during the winter

2022 – In June stage 6 load shedding was introduced for the second time

2022 – On 25 July Ramaphosa announced a new rescue plan for the country’s power crisis

2022 – By August 1,300 hours of load-shedding had been applied for the year so far with the worst still to follow during September

2022 – In late September the energy crisis reaches critical levels, Ramaphosa cuts short an overseas trip, yet a week after his return no announcements about a turnaround plan have been made

By Staff Writer

30 | Issue 1 | www.forerunner.co.za | FORERUNNER

Namco Guarantees is one of the leading credit guarantees providers in South Africa. Operating within the structured legislative framework of the National Credit Act, we are a registered credit provider and a FIC Accountable institution. Our conservative approach based on strong business principles, has resulted in consistent growth and success over the years for both our business as well as that of our clients. This has enabled Namco to become the preferred guarantees specialist in the country.

Our Mission – is to assist the New Entrants and Small to Medium Contractors in complying with the Government Departments and Municipalities by acquiring the necessary Guarantee Facilities.

Our Vision – is to be the preferred choice when it comes to arranging construction guarantees to the small and medium contractors not only in South Africa but to Africa as a whole.

REQUIREMENTS FOR APPLICATION

• Company profile (including an organogram and copies of the current and previous Contracts)

• Two years’ financial statements and three months’ bank statements

• Letter of appointment

• Contract information

• Guarantee wording requirements, if any.

• Company registration documentation

• Copies of all members’ identity documents and income tax numbers

• Copy of letterhead

• Tax clearance certificate

• CIDB certificate

• Proof of residence of all directors/ members/partners.

SERVICES

• Performance Guarantees

• Retention Monies Guarantees

• Advance Payment Guarantees

• Maintenance Guarantees

• Bid Bonds / Letters of Intent

LETS GET WORKING

23 Carel Street, Bendor Park Polokwane, 0699

Tel: 015 297 0987 / 5691

Cell: 072 018 8880 / 083 648 8889

Fax: 086 535 5763

Email: admin@namcoguarantees.co.za

Namco Capital (Pty) Ltd t/a Namco

Guarantees

Reg No.: 2012/195030/07

NCR No. NCRCP8511

CRIMINALS ARE KILLING SOUTH AFRICA’S VITAL TRANSPORT SECTOR ANOTHER ESKOM TYPE ECONOMIC THREAT IN THE MAKING

In 2005 the government determined that October would be Transport Month in South Africa each year as part of a campaign to raise awareness of the important role of transport in the economy. This October, as the government, business and other stakeholders reflect on this vital sector, it’s clear that it is faced with many problems and challenges, none more destructive than the rampant criminal activities the sector must deal with daily.

Unless the government pays urgent attention to these issues and comes up with viable solutions in conjunction with other stakeholders and actors, this sector could well become a second “Eskom” in terms of its potential to destroy the South African economy.

It’s not that government is doing nothing – in fact the Minister of Transport, Fikile Mbalula, and the Department of

Transport have launched various worthy initiatives to improve matters in many respects. But industry experts believe some of these have been too little too late, while some good intentions have never come to fruition. One of the biggest problems, however, seems to be a lack of coordination with and appropriate action by other govermment departments that have vital roles to play in safeguarding the economic contributions of the sector, perhaps most notably so the South African Police Service (SAPS).

It appears government is not taking a holistic view and fails to see how crime across all the sub-sectors of the transport industry is killing the sector in South Africa. If transport came to a complete halt, the entire South African economy would grind to standstill, in the same way that the economy would crash if Eskom were to collapse and power supply came to a halt.

32 | Issue 1 | www.forerunner.co.za | FORERUNNER

Road, rail and sea freight have all suffered at the hands of criminals, with seeming impunity in many cases as the SAPS seems unable to get on top of it. Of course there are other factors too that place a heavy burden on the transport sector, such as spiralling fuel prices, inflationary pressures on assets and equipment, the after-effects of the Covid-19 lockdowns when air and other transport came to a halt and borders were closed, the adverse impacts of the global supply chain crisis, deteriorating road and rail infrastructure, policy and regulatory pressures or failures, labour strikes, road taxes and permits, to name but some.

It doesn’t help when government adds to the burden with policies and regulations that may have unintended consequences, such as the proposed antidumping tariffs on imported vehicle tyres that would drive up the cost of transport for both people and goods. It may be good to use tariffs and such to try and stimulate and promote local production with a view to growth and jobs, but government should be weary of the trade-off cost and unintended consequences.

Recently there has been the case of four large domestic tyre manufacturers (Continental, Bridgestone, Goodyear and Sumitomo) applying to the International Trade Administration Commission of SA (ITAC), to impose additional antidumping duties of up to 69% on passenger, taxi, bus and truck vehicle tyres imported from China. The move has the support of Trade, Industry and Competition Minister Ebrahim Patel while the application is being opposed by the Tyre Importers Association of South Africa, the National Taxi Alliance, and the Road Freight Association. It now seems the matter may have to be decided in court.

Crisis levels

Meanwhile, the situation with criminal attacks on and looting of road freight logistic vehicles that transport 80% of all goods in South Africa, has reached crisis levels. As a result, Gavin Kelly, chief executive officer of the Road Freight Association, has called on President Cyril Ramaphosa to deal decisively with the looting of trucks on South Africa’s roads.

Kelly has urged that the runaway level of opportunistic crime needs to be stopped by government – now. The criminal activity is harming the country’s investment potential and its reputation as an efficient logistics hub for foreign traders. In

Kelly’s words: “When trucks stop, South Africa stops.”

During the unrest in July 2021 in KwaZulu-Natal and Gauteng, rioters and looters attacked, looted and destroyed many trucks, killing truck drivers in the process, especially truck drivers who came from other African countries. Since then, such attacks and violence against truck drivers continue sporadically, especially on the main route from the Gauteng industrial heartland to the country’s biggest port in Durban, KwaZulu-Natal.

Criminal gangs also operate in the various ports where containers with valuable cargo are often stolen, looted, damaged or destroyed, and expensive equipment and cargo is also damaged invariably during protest actions, labour strikes or random criminal activities. The ripple effect of all of this is felt by many Southern African countries that rely on South Africa’s transport networks and ports for their own imports and exports. South Africa’s busy ports are gateway ports to at least 6 landlocked countries in the region that are connected to these ports by roads on which freight trucks have become extremely vulnerable.

And during the Covid-19 pandemic and lockdown, a shocking picture emerged of criminals looting railway infrastructure, stealing signals and communication copper cables, even carrying off sections of railway lines and sleepers, dismantling railway stations brick by brick, and taking everything, they could pry loose. In their stead came the squatters who erected their shacks on top of railway lines. These activities forced much of South Africa’s rail network to a standstill, whether used for freight, mineral exports, passengers or daily labour force commuting. According to Transnet some 1,500km of copper cable was stolen over the past five years, rendering the affected lines inoperable.

In September a video went viral showing how township residents were stealing containers full of chrome off a stopped train en route from a mine near the town of Witbank (Emalahleni Local Municipality) in Mpumalanga province. The failing national rail infrastructure is also costing the vital mining sector billions in export losses. The Minerals Council South Africa estimates its bulk mineral mining members lost revenue of R35 billion in this way in 2021 when deliveries are measured against targets. This includes R17 billion in iron ore, R16 billion in coal and about R2 billion in chrome.

Other sub-sectors of the transport sector, such as commuter bus services in cities or inter-city bus services, are also being targeted by criminals, mostly disgruntled minibus taxi operators or associations who want all the commercial action for themselves. Since last year there have been some 230 attacks, on Intercape long haul buses. And in August the Golden Arrow commuter bus company reported that four of its buses and other vehicles were attacked - petrol-bombed

‘Road, rail and sea freight have all suffered at the hands of criminals, with seeming impunity in many cases…’

TRANSPORT FORERUNNER | www.forerunner.co.za | Issue 1 | 33

and stoned - in the vicinity of Nyanga township on the Cape Flats. This violence followed after municipal law enforcement officers impounded illegal and/or unroadworthy Avanza taxis, also known as amaphelas.

All in all, there were 38 attacks reported on buses of Intercape, Golden Arrow and Mavumisa in August alone. Previously, Intercape had reported about 150 incidents of shootings, stonings, and other acts of violence and intimidation as well as losing millions of rands to extortion in the Eastern Cape.

A variety of smaller delivery vehicles – vital to the overall commercial and industrial logistics chain – are also being targeted by criminals who either steal, hijack or rob them. The most recent crime statistics released by SAPS showed a 14% increase in hijackings across the country, with 5,866 hijackings reported from April to June. These included 8 buses, 151 trucks under 3,500 tons, 338 microbuses, and 1,691 bakkies and panel vans – all commercial vehicles. The SAPS has become adept at collecting crime statistics, but it doesn’t seem to know how to bring those figures down and ensure social and economic safety and security.

Common denominator

The one common denominator in all of these criminal activities that sabotage the South African economy, has been the lack of effective policing and crime combating strategies by the SAPS. It is a void that has facilitated criminal destruction in other key economic sectors too, including –

• construction (construction mafia, equipment theft, extortion, violence)

• mining (criminal gangs and zama zamas, theft, illegal mining, smuggling, extortion)

• agriculture (farm murders, stock theft, crop destruction, land occupations)

• energy (cable and equipment theft, sabotage, coal and diesel theft, organised criminal gangs)

Other key economic sectors such as tourism and manufacturing are also seriously affected by crime such as hijackings, kidnappings, extortion, robberies, theft, corruption, fraud, vandalism and more. The banking sector suffers heavily from fraud, scams, corruption, ATM robberies and, most of all, deadly cash-in-transit heists.

After years of attacks on buses, Police Minister Bheki Cele finally in September took action after the problem had escalated dramatically in the Western Cape in recent months. A new multidisciplinary police task team was established to crack down on the interprovincial violence on long-distance bus services. But Cele still somehow felt that criminal attacks on the transport sector were not really a matter for the police. To this the opposition Democratic Alliance Western Cape spokesperson on transport, Ricardo Mackenzie, responded by accusing the police minister of attempting to shirk responsibility and deflect the blame away from the SAPS.

After the destructive riots of July last year, Gareth Newham of the Institute for Security Studies wrote that, “The July attacks on South Africa’s economic infrastructure exposed severe weakness in the police at a time of national crisis. Police were often missing in action as thousands raided malls and shut down transport, supply chains and logistics hubs.” Whether this will change anytime soon, is anyone’s guess. But most likely it will not.

By Stef Terblanche

34 | Issue 1 | www.forerunner.co.za | FORERUNNER

THE INTERVIEW

36 | Issue 1 | www.forerunner.co.za | FORERUNNER

Where to, South African mining?

We ask Roger Baxter, CEO of the Minerals Council, about the current state and future of SA mining

given its history and prominence in the South African economy, it stands to reason that the local mining industry will frequently feature in the news. In recent times, however, there have been a number of very concerning developments affecting the mining sector – from missed coal exports, to licencing backlogs, and more. These have implications for the economy and for people beyond the mining sector alone.

From its glory days as a leading force in global mining, some may think South Africa has slipped down the ranks to becoming a lesser player. Is this true? What does the future hold for mining in South Africa. To find out more, we spoke to Roger Baxter, CEO of the Minerals Council South Africa.

Q: How would you summarise the current state of mining in South Africa? What are the major challenges and successes?

RB: Although the industry has produced strong financial support for the economy in the past two years, bailing out the fiscus from a Covid19-related slowdown and disruption, there are concerns about production. In the MediumTerm Budget Policy Statement, it was shown mining contributed R92 billion of the R120 billion in extra taxes received in the 2021 fiscal year. Production has recovered 11.2% from the low base in 2020. However, the 20-year index of

mining production shows that sector production has not recovered since the 2000/2006 peak and is struggling to maintain 2015 levels. The bulk of investment in the sector is going into stay-in-business capital rather than new projects, which raises red flags for sustainable long-term production of minerals.

Q: In the global context, where do you see South African mining being positioned? Are we still a vital player of consequence, or are we increasingly being relegated to the margins?

RB: South Africa remains a leading source of minerals. It is the largest supplier of platinum group metals, chrome and manganese. It is a major supplier of high-quality iron ore, coal, gold, vanadium and other minerals.

Q: What are the key constraints on South African mining at present?

RB: Rail and port logistics are problematic. Rail constraints caused by theft of cable – Transnet says 1,500km of cable was stolen over the past five years; vandalism; and more than 100 idled locomotives that were bought in the tainted deals in the state-capture era, are costing the country dearly. The Minerals Council estimates its bulk mineral members lost revenue of R35 billion in 2021 when deliveries are measured against targets. This includes R17 billion in iron ore, R16 billion in coal and about R2 billion

THE INTERVIEW / MINING

FORERUNNER | www.forerunner.co.za | Issue 1 | 37

in chrome. In none of the years since 2016 have exports exceeded 15 million tonnes per month, except for 2019. High-level talks are continuing with Transnet - ports and rail - to resolve the operational, security and fixed investment backlog issues.

Electricity from Eskom has increased sixfold in price in the past 14 years, while supplies are constrained. Crime is a major concern. Deteriorating security, with illegal mining and theft of mine infrastructure like cables and steelwork, diesel, and products, have led to the industry spending R2.5 billion a year to secure their operations. Delays in processing more than 3,000 mining and prospecting right applications as well as mineral right transfers by the Department of Mineral Resources and Energy (DMRE) is holding up an estimated investment of R30 billion.

Q: Is there anything that sets South African mining apart from mining in other parts of the world, something that is unique that we can offer or on which we can build the future of mining in this country?

RB: South Africa is host to the world’s largest known deposits of platinum group metals (PGMs), which are used in antipollution devices in petrol and diesel engines, and which are critical minerals to electrolyse water to make hydrogen for hydrogen fuel cells, which also use PGMs. South Africa is the world’s largest source of chrome and manganese, which

are used in stainless steel and steel manufacturing. South Africa is one of the largest sources of primary vanadium, which is used in steel manufacturing and to make vanadium redox batteries, which are large stores of electricity that suit industrial applications as well as power plants. The Northern Cape is enormously prospective for base metals, including zinc and copper, and which is relatively unexplored and largely unexploited. South Africa has some of the best attributes for solar and wind-powered electricity generation, opening the way to green production and processing of minerals, as well as to develop a green hydrogen economy.