Bahrain BD 1.50 Kuwait KD 1.50 Oman OR 1.50, Saudi Arabia SR 12.00 UAE DH 10.00 UK £ 3.00, US $ 3.00 VOLUME 22 ISSUE 3 MARCH 2024 22 YEARS Rs. 50

www.seasonalmagazine.com

EDITORIAL

Managing Editor

Jason D Pavorattikaran

Editor

John Antony

Director (Finance)

Ceena

Associate Editor

Carl Jaison

Senior Editorial Coordinator

Jacob Deva

Senior Correspondent

Bina Menon

Creative Visualizer

Bijohns Varghese

Photographer

Anish Aloysious Office Assistant

Alby CG

Correspondents

Bombay: Rashmi Prakash

Delhi: Anurag Dixit Director (Technical)

John Antony

Publisher

Jason D Pavorattikaran

Editorial & Business Office

Cochin: 36/1924 E, Kaloor-Kadavanthra Road, Near IGNOU, Kaloor, Cochin-17.

Ph:0484- 2345876, 2534377, 2340080

Mob. 09947141362

Delhi: H.No: P-108, Uppal Southend, Sector 48, Sohna Road, Gurgaon, Haryana – 122018

Ph: 9891771857|099471 41362

Mumbai: 202, Woodland Heights Building, St. Martins Road, Bandra West, Mumbai400 050 Mob: 919947141362

Bangalore: House No: 493, Block 3 3rd Main, HBR Layout, Bangalore-4209731984836, Email:skmagazine@gmail.com

www.seasonalmagazine.com

UK Office: “CRONAN”, Boundaries Road Feltham, Middlesex, UK TW13 5DR Ph: 020 8890 0045, Mob: 00447947181950

Email: petecarlsons@gmail.com

Reg No: KERENG/2002/6803

Printed & Published by Jaison D on behalf of PeteCarlson Solutions Pvt. Ltd. at Cochin. Printed at Rathna Offset Printers, Chennai-14. All Rights Reserved by PeteCarlson Solutions Pvt. Ltd. No part of this publication may be reproduced by any means, including electronic, without the prior written permission of the publisher.

WHILE MARKETS SOAR, A PIECE OF MUNGER’S WISDOM THAT HAS BEATEN THE MARKET FOR 45 YEARS!

Finally it happened. Jerome Powell backed off from destroying the American economy and the world economy further by not only pausing from an interest hike yet again, but by hinting that 2024 might witness up to three rate cuts.

It was the perfect excuse that the Indian markets needed to move even further up. Our nation already had structural strengths due to the ongoing economic reforms and infra push, plus the booming mutual fund inflows, and this move by the US Fed is surely a long-term positive.

Did someone mention long-term just now? Yes, and it was intentional, as there is now a chorus that the market will only go up and up. A little more conscientious souls are saying that only the large-caps may move up now, and not the mid or small caps, which are way too heated up already.

But this too has become a chorus now, and everytime such a chorus is emerging, beware, a correction might just be around the corner. A 10-15% correction is a healthy norm in a bull market, but it can catch most traders and investors on the wrong foot, as this time around it may involve Nifty diving down by over 3000 points and Sensex by over 10k.

In Warren Buffet’s words, yes, it is a time to be fearful. As the Oracle of Omaha said in near perfect words - “To be fearful when others are greedy and to be greedy only when others are fearful.” But such a dip too is sure to be bought in rapidly, giving you a fruitful opportunity to be greedy.

So, this kind of rapid buys against sharp falls is what the long-term qualifier is all about. And not that the markets will go only up and up. Of course, long-term has much more positive implications in the capital markets. Charlie Munger who passed away on November 28 was one of the best practitioners of it.

It is said that many of the quotes and wisdom that people attribute to Warren Buffett were actually from his long-term business partner Munger. One such quote where Munger likely had a great role was this - “Our favorite holding period is forever.” Such was his conviction about a unique advantage that only comes from the long-term holding of stocks - the power of compounding.

Compounding is no rocket science. At its heart, it is only middle school arithmetic. But 99% of investors in stocks and mutual funds do not get to reap its benefits. In fact, Munger excelled in it precisely because it was only basic math. Despite his towering intellectual capabilities - lawyer, architect, analyst, investment strategist, business head & thinker - he was careful to choose only simple generalized knowledge from the various domains.

Munger had a well-known disdain for specialists and their too specialized knowledge. His argument was that specialists tend to focus too much on their specialized knowledge, while ignoring what a multidisciplinary approach could have easily solved, by bringing together basic knowledge from all connected domains.

Anyway, compounding was one such basic skill that Buffett and Munger excelled

Subscriptions Available on iPhone/iPad & Android All health related articles are for first information purposes only. Always consult your doctor before taking any decison affecting your health.

Seasonal MAGAZINE

MEMBER

MAGAZINE

SEASONAL

in, that it won’t be an exaggeration to state that this strategy had more than a 50% role in their astounding success at Berkshire Hathaway which they together grew into the world’s largest holding company worth nearly $800 billion.

Munger’s appreciation for the power of compounding is evident from one of his best known quotes - “The big money is not in the buying and the selling, but in the waiting.” Indeed, what he achieved for Berkshire Hathaway by way of compounding can never be overstated.

In fact, Munger’s strategies including his reliance on long-term compounding was central to Berkshire Hathaway shifting away from Buffett’s philosophy of investing in fair companies at wonderful prices (which he learned at Columbia University from his professor Benjamin Graham, the Father of Value Investing).

Instead, Munger - who never attended any b-school unlike Buffett - convinced Buffett that what they should be doing is investing in wonderful companies at fair prices. Since this involved buying at higher prices than in value investing, it invariably required the power of compounding to work, and it proved to be so, as most of these companies proved to be really wonderful in the long-term!

Buffett himself has gone to great lengths to credit Munger for this complete strategy shift and for creating a new blueprint for Berkshire, often saying that “it was Charlie who straightened me out” and that “listening to Charlie has paid off.”

Between 1978 and 2023, that is, for 45 long years, Berkshire Hathaway grew investors’ wealth at a compounded annual growth rate (CAGR) of 20%. Most people don’t readily realize what this achieved for their public shareholders - it multiplied their wealth by 3700 times within these 45 years!

It is a feat never done before and never likely to be done again in the future. This is especially so as despite this intervening period being witness to America’s largest ever economic growth, that sent its benchmark S&P 500 index over the roof at 163 times wealth creation, Berkshire Hathaway’s performance beat even this superlative returns by nearly 23 times!

So, what exactly is this power of compounding in layman terms? It would be best to describe it with an example. Suppose you have Rs.10 lakhs to invest in 2023. And you invest all that in a stock priced at Rs.50, after a careful study. So you get 20,000 shares.

For this stock to double your wealth, it has to go to Rs. 100 or go up by 100%. Suppose it does that within a year or two. So now you have doubled your wealth to Rs. 20 lakhs. Now, to triple your wealth you know the stock has to triple in value, that is, become Rs. 150 per share. But do you know how much it has to grow now in percentage terms to reach Rs. 150 from Rs. 100? It has to grow only 50%, and it will triple your investment to Rs. 30 lakhs!

If it is an excellent stock in an excellent market, it will achieve that within the next year. So now you have tripled your wealth. You know that if it adds another Rs. 50 to its value, it will quadruple your wealth to Rs. 40 lakhs, that is increase it fourfold. But do you know how much that growth is in percentage terms - from Rs. 150 to Rs. 200? It is merely 33.33%! And similarly for your investment to grow fivefold - from Rs. 200 to Rs. 250 and from Rs. 40 lakhs to Rs. 50 lakhs - all it takes is a 25% up move, which can sometimes happen within a week!

Now suppose you were really fortunate that your chosen stock was one of the best growth stocks in the market, maybe within the top 1% of the best small caps, that becomes a 100X multibagger by 10 years, that is, by 2033. So now your Rs. 50 stock is trading at around Rs. 5000, and your Rs. 10 lakh investment is now worth Rs. 10 crore. What happens now is the real magic.

Do you realize how much your stock has to move up now for it to add one more times in return, that is to add one more 10 lakhs (your original investment), or in other words to move from 100X to 101X? If you are quick at arithmetic, yes, you guessed it right, it should just rise by 1%. Imagine, a stock moving up by merely 1%, and you adding one more times of your original investment to your wealth!

This is what the magic of compounding is all about. Do you think this is a far fetched idea? Absolutely not. Even in the Indian market, there are dozens of stocks that have done this within the last 10 to 20 years, and now with the kind of better quality companies and startups hitting the IPO street, there will be hundreds of companies achieving such feats in the 2023-33 period.

This is why Buffett and Munger always held seemingly boring stocks like Coca Cola and American Express in Berkshire’s longterm portfolio without ever divesting them. These stocks continue to be incredible wealth compounding machines for early investors like them, who have also used their high dividends to reinvest! And this magic of compounding is what drove this remarkable duo to state counterintuitive stuff like, “Our favorite holding period is forever” and that “The big money is not in the buying and the selling, but in the waiting.” It is a wisdom that runs diametrically opposite to the current trend of dangerous practices like only microseconds long algorithmic overtrading, futures & options and heavily leveraged bets.

John Antony

SEASONAL MAGAZINE

CONTENTS

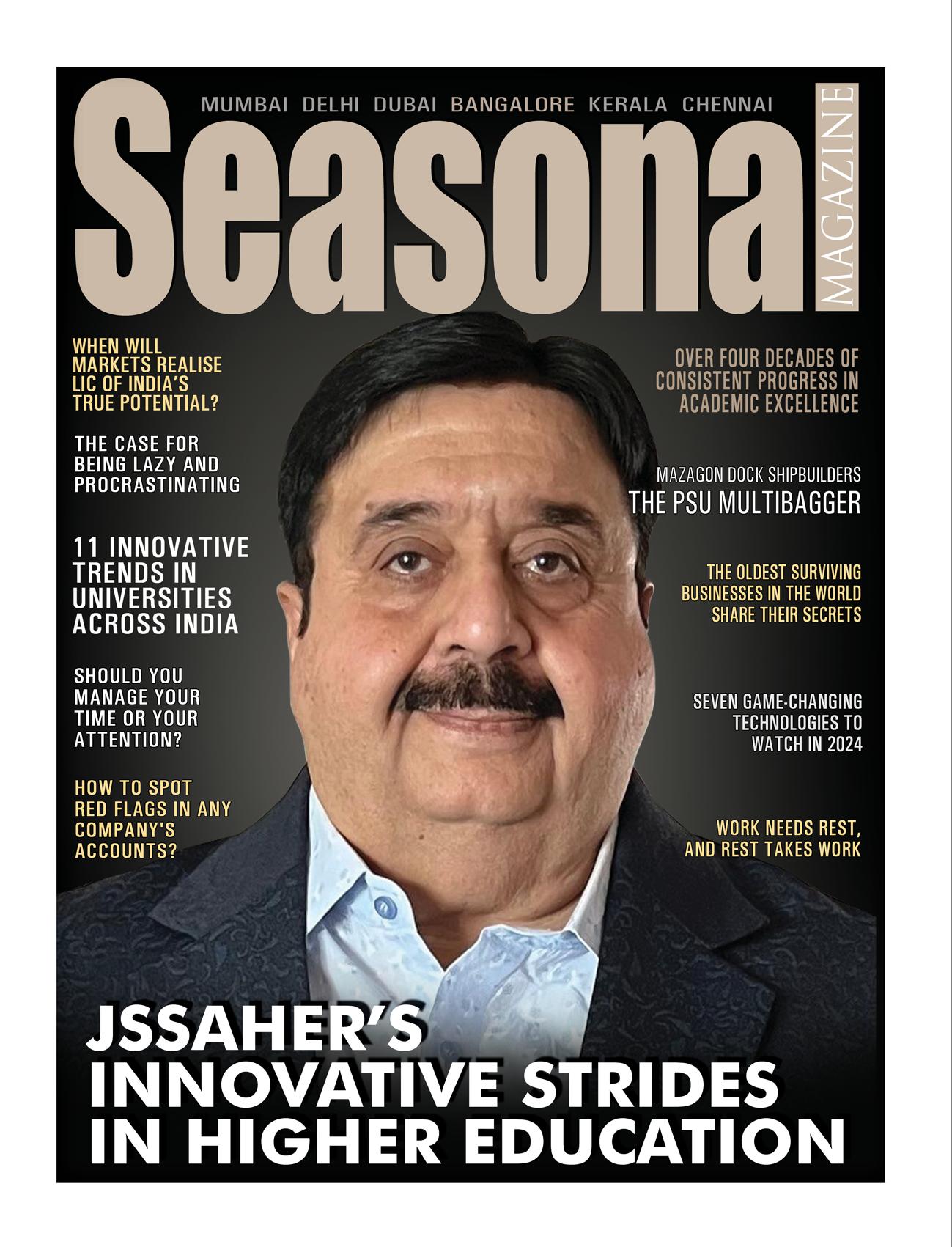

JSSAHER’S INNOVATIVE STRIDES IN HIGHER EDUCATION

HOW SAFE ARE OUR UNIVERSITIES COLLEGES AND SCHOOLS FOR OUR CHILDREN?

Since 2017, self-harm by students has been on the rise, and by 2021 itself, India has been losing around 13,000 students per year to suicide, which translates to over 35 student suicides a day. And in the last two

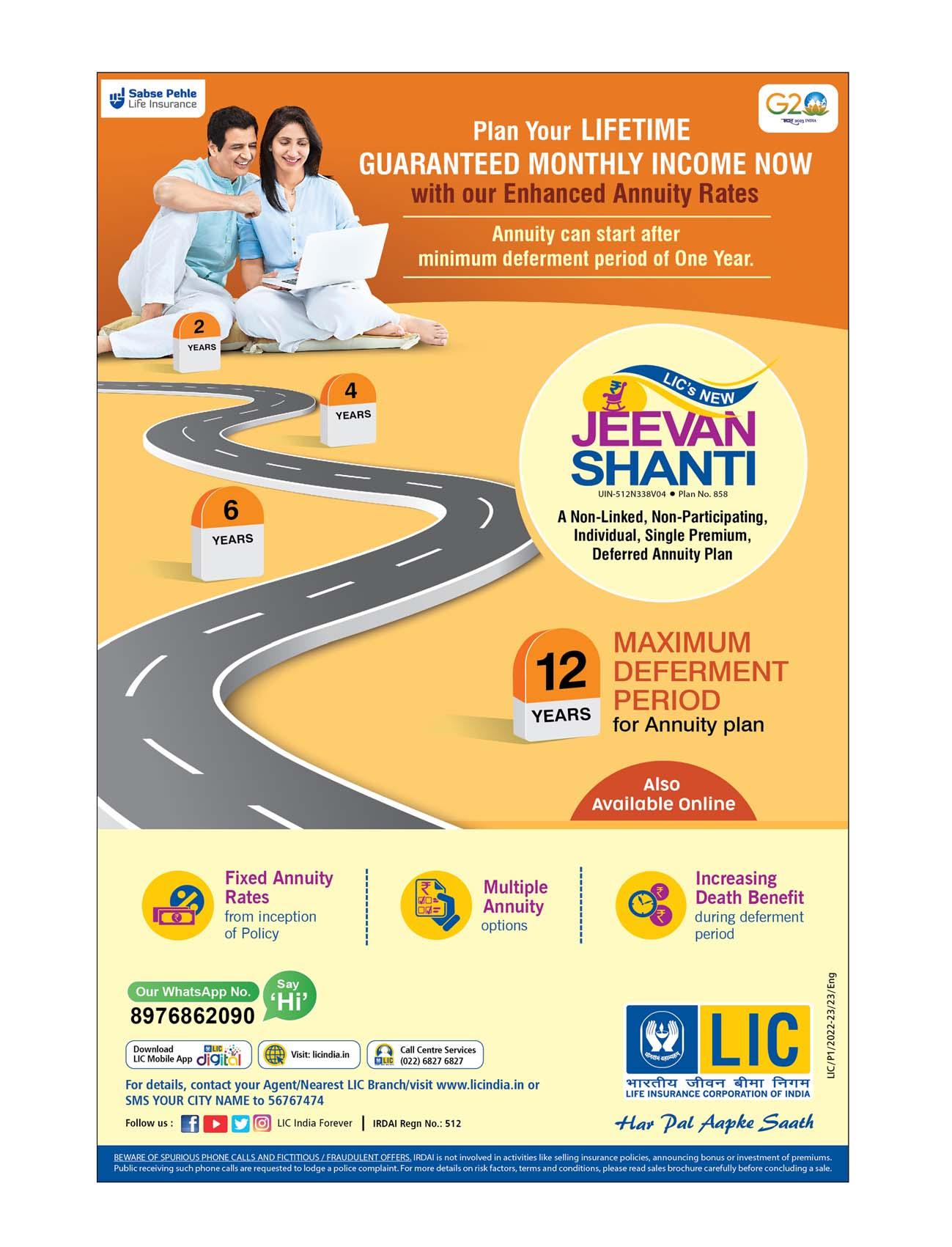

WHEN WILL MARKETS REALISE LIC OF INDIA’S TRUE POTENTIAL?

Life Insurance Corporation of India’s stock might not have performed as per investors’ expectations after its IPO. But the underlying organisation is fighting fit as it has never been, with its renewed focus on growing its nonparticipating products, tech-led customer acquisition and premium collection, growth in its

Mysuru headquartered leading deemed-to-be university, JSS Academy of Higher Education & Research (JSSAHER) is taking giant strides to push innovation in everything it does. From nationally recognized research labs to world renowned faculty members to playing host to coveted international scientific conferences to startup incubation to constant upgradation of infrastructure and facilities, JSSAHER is not leaving a stone unturned in its quest to stay ahead of the curve among health and life science universities in the country. JSSAHER’s visionary leadership includes JSS Mahavidyapeetha’s Head Sri Shivarathri Deshikendra Swamiji of Suttur Mutt, JSS Mahavidyapeetha’s Executive Secretary C.G. Betsurmath, JSSAHER’s Pro-Chancellor Dr. B. Suresh and its Vicechancellor Dr. Surinder Singh.

SHOULD YOU MANAGE YOUR TIME OR YOUR ATTENTION?

Curt Steinhorst, the bestselling author of "Can I Have Your Attention?" is the founder and CEO of Focuswise, with a proven track record of success working with industry leaders such as Deloitte, JPMorgan Chase, Nike, and AT&T, among others. Apart from being a highly regarded thought leader, author and keynote speaker, he works as the Head of People & Culture at Venus Aerospace, where

THE CASE FOR BEING LAZY AND PROCRASTINATING

What if laziness and procrastination could actually help you go further in life, and make you wildly successful?

WORK NEEDS REST, AND REST TAKES WORK

Modern life can be exhausting. Psychologist, author and fatigue expert Vincent Deary says the answer is to learn how to rest.

THE OLDEST SURVIVING BUSINESSES IN THE WORLD SHARE THEIR SECRETS

What does it take to stay open for the long haul - and not just for a few generations, but hundreds if not thousands of years?

CAN BEING PREGNANT CHANGE YOUR DNA?

Pregnancy changes so much about your body, from your hairline to what you dream about each night. When it comes to who you are as a person, motherhood is definitely going to make some changes there,

SEASONAL

SEASONAL

MAGAZINE

11 INNOVATIVE TRENDS IN UNIVERSITIES ACROSS INDIA

Higher education campuses across India

are innovating creatively for the benefit of their students, even as they wait patiently for the campus placements momentum to return.

HOW JGU STAYS AHEAD OF THE CURVE

Imagine a higher education institution in India that brings together faculty from over 50 countries. No, not visiting or parttime faculty, but full-time faculty. A campus where students themselves come from 70+ countries. This

HOW TO AVOID 5 BIG MISTAKES WHEN APPLYING FOR A JOB

Keep firing out CVs and getting zilch back? You might be making one of these five common job application mistakes.

BRIGADE ENTERPRISES EYEING EXPONENTIAL GROWTH NOW

On October 11 this year, Brigade Enterprises completed its first full year of operations under its new leaders - Managing Director Pavitra Shankar and Joint Managing Director Nirupa Shankar. While taking over the

12 INDIAN CITIES WITH THE BEST AIR QUALITY

Here are the 10 Indian cities with lowest Air Quality Index (AQI) to give your lungs a breathing heaven.

EVOKING AWE IN EVERYTHING IT DOES

Different leaders evoke different emotions in their followers as well as competitors. Some evoke respect, some evoke fear, yet others envy, and so on. But there are a very select group of leaders who evoke awe in everyone else, in everything they do. Jitu Virwani belongs to this select club of leaders. Embassy

MAZAGON DOCK SHIPBUILDERS THE PSU MULTIBAGGER

PSU Multibagger might sound like an oxymoron, as despite their best intentions, many listed PSU companies have traditionally struggled to emerge as multibaggers for their investors, as they try to do the delicate act of balancing their nation building

HOW TO SPOT RED FLAGS IN ANY COMPANY'S ACCOUNTS?

The current bull market is causing many new stock market investors to think that they have become experts at spotting multi baggers. What they don’t realise, and probably will, much later, is that rising stock prices are not always a reflection of

JSSAHER’S INNOVATIVE STRIDES IN HIGHER EDUCATION

Mysuru headquartered leading deemed-to-be university, JSS Academy of Higher Education & Research (JSSAHER) is taking giant strides to push innovation in everything it does. From nationally recognized research labs to world

NITTE DEEMED UNIVERSITY

OVER FOUR DECADES OF CONSISTENT PROGRESS IN ACADEMIC EXCELLENCE

Under the visionary leadership of its Founder Chancellor N Vinaya Hegde, Pro Chancellors Vishal Hegde and Prof. Dr. Shantharam Shetty, and Vice Chancellor Dr MS Moodithaya, Nitte Deemed-to-be

SEASONAL MAGAZINE

INDIA IS A FOREIGN THREAT, INTERFERED IN CANADIAN ELECTIONS: CANADA INTEL REPORT

Canada has named India as a ‘foreign threat’, while accusing the country ofinterfering in their elections, months after they alleged India’s role in the killingof pro-Khalistan separatist Hardeep Singh Nijjar on Canadian soil. Theallegation was made by Canadian Security Intelligence Service in adeclassified intelligence report on election meddling. India is yet to respondto the allegation.

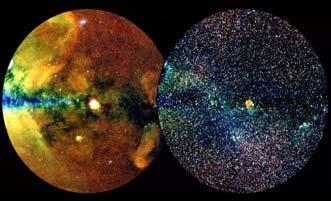

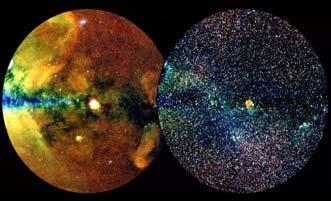

MOST DETAILED X-RAY IMAGE EVER OF THE UNIVERSE RELEASED

Astronomers have unveiled the most detailed X-ray image of the universeever. The newly released data from the eROSITA All-Sky Survey reveal thelight of more than 7,00,000 black holes and hundreds of thousands of otherdeepspace objects. The release also details the largest known structures inthe universecosmic web filaments of hot gas that connect galaxies inclusters.

FRESHER HIRING BY INDIAN IT COMPANIES DROPS TO 20-YEAR LOW: REPORT

ROCKY’ ACTOR CARL WEATHERS PASSES AWAY IN HIS SLEEP AT76

Actor Carl Weathers, who starred as Apollo Creed in ‘Rocky’ movies, passedaway aged 76. The cause of his death is not known, however, his familystated that he died in his sleep. Weathers appeared in more than 75 films andTV shows during a career in Hollywood spanning more than 50 years, as perDeadline.

INDIA TO REPLACE TROOPS AT 3 AVIATION PLATFORMS INMALDIVES BY MAY 10: MALDIVES GOVT

After second meeting of India-Maldives High Level Core Group, Maldivesgovernment said that both sides agreed that India will replace troops at 3aviation platforms in the island nation by May 10. Meanwhile, India said, “Bothsides...agreed on set of mutually workable solutions to enable continuedoperation of Indian aviation platforms that provide humanitarian and medvacservices to...Maldives.”

Indian software services companies are expected to end current financialyear with the lowest intake of fresh engineers in over two decades, EconomicTimes reported. The companies are poised to end the year with 70,000 to80,000 freshers, compared to six lakh freshers in FY22. The hiring slumpcomes amid declining global demand for technology services in the post-COVID-19 era.

BENGALURU’S MOUTHWATERING MASALA DOSAS

Masala Dosas are inextricably linked with the ethos of Bengaluru. Iconicrestaurants that serve these hot and crispy delights have achieved cult statuswith each having its own loyal clientele. Many of these are almost a centuryold. One of these is the Central Tiffin Room or simply CTR, which is known forits Benne(Butter) Masala Dosas, since 1920.

PICS TAKEN FROM SPACE SHOW SANDSTORM CROSSING THERED SEA

Astronaut Sultan AlNeyadi has shared pictures of the Earth taken from theInternational Space Station. The photos show a large sandstorm crossing theRed Sea, while the cumulus clouds over certain regions of Yemen indicate athunderstorm, he said. AlNeyadi made history after completing a 6-monthmission on the Space Station last year, marking the longest ever Arab spacemission.

ACTRESS DOLLY SOHI QUITS TV SHOW DUE TO CERVICAL CANCER

Actress Dolly Sohi, who was diagnosed with cervical cancer in September2023, has quit the show ‘Jhanak’. “I was working during...chemotherapy, butnow I’m undergoing radiation and that takes a lot out of me. It was notpossible to continue working for a daily soap,” she told ETimes. “I should givemy body enough time to recover,” Dolly added.

SEASONAL MAGAZINE

LK ADVANI TO BE CONFERRED BHARAT RATNA, ANNOUNCES PM MODI

PM Narendra Modi has announced that veteran BJP leader LK Advani will be conferred Bharat Ratna. He wrote on X, “One of the most respected statesmen of our times, his contribution to the development of India is monumental.” He added, “His is a life that started from working at the grassroots to serving the nation as our Deputy Prime Minister.”

OUR RESPONSE BEGAN TODAY: PRESIDENT BIDEN AS US BOMBS IRAQ, SYRIA AFTER 3 SOLDIERS DIE

Following strikes in Iraq and Syria, US President Joe Biden in a statement said the US doesn’t seek a conflict in the Middle East but if any American is harmed, the country will respond. “Our response began today. It will continue,” Biden added. The Syrian Observatory for Human Rights said at least 13 proIran fighters were killed in the attack.

MARK ZUCKERBERG GETS RICHER BY ¹ 2.33 LAKH CRORE IN A DAY

Meta CEO Mark Zuckerberg’s net worth has surged by $28.1 billion (¹ 2.33 lakh crore) in a day, making him the richest he has ever been with $170.5 billion wealth. He is now the fourth richest person in the world, said Bloomberg. Shares of Meta rose by 20% on Friday after the company declared better-than-expected quarterly results and its first-ever dividend.

META ADDS $197 BILLION IN MARKET VALUE, BIGGEST ONE-DAY GAIN IN MARKET HISTORY

Facebook and Instagram’s parent company Meta has recorded the biggestever one-day increase in a company’s market value. The social media group’s market capitalisation increased by $197 billion to $1.2 trillion after it closed 20.3% higher on Friday. Meta surpassed the previous record that saw SAmazon and Apple each jump about $190 billion in a single day in 2022.

BJP MLA GANPAT SHOOTS AT SHINDE SENA LEADER MAHESH AT MAHARASHTRA POLICE STATION

BJP MLA Ganpat Gaikwad allegedly opened fire at Shiv Sena (Eknath Shinde faction) leader Mahesh Gaikwad on Friday night at Hill Line Police Station in Maharashtra’s Ulhasnagar. Five bullets have been taken out from Mahesh Gaikwad’s body, but his condition remains critical. “Mahesh Gaikwad and Ganpat Gaikwad had differences about something...An investigation is underway,” DCP Sudhakar Pathare said.

WORLD’S MOST SUBSCRIBED YOUTUBER MR BEAST REVEALS HE HAS ASTIGMATISM

World’s most subscribed YouTuber Jimmy Donaldson, also known as MrBeast, revealed that he has astigmatism. “This might sound crazy, but Ithought things far away looking super blurry was normal...I got my eyeschecked and apparently have a bad astigmatism,” he wrote. “Started wearingcontacts recently...My eyesight is 3x better and I don’t squint/can...open myeyes normally,” he added.

IRAQ WARNS OF DISASTROUS CONSEQUENCES AFTER US ATTACK

After US attacked Iranian-backed groups in Iraq and Syria over killing of three US soldiers by Iran-affiliated militias in Jordan, Iraq warned of disastrous consequences. A spokesperson for Iraq’s Prime Minister Mohammed Shia’ Al Sudani said the US strikes are a violation of Iraq’s sovereignty. Our response...will continue at times and places of our choosing,” US President Joe Biden said.

SEASONAL MAGAZINE

SELF-HELP

The Dark Side of the Obsession With Focus

The New York Times bestselling author and contrarian self-help writer Oliver Burkeman talks to host and ace podcaster Derek Thompson about his new audio essay series on work, focus, and interruptions - and how, too often, our emphasis on eliminating distractions ironically takes us away from the most important things in life. What do we get wrong when trying to eliminate all distractions and interruptions while working? And why it can be harmful to categorize all interruptions to your focus as problems.

erek Thompson: I want to talk about two audio essays that you recently recorded on the Waking Up app that really hit me in a very deep way. I have written and read and podcasted so much about productivity, and for most of my writing and reading and podcasting career, maybe the most persuasive idea in the space of productivity that I keep coming back to again and again is this: If you want to get anything worthwhile done, you need deep focus, deep work, deep attention, and that means that it is, above all, essential to minimize what is sometimes called “context switching,” bouncing between tasks and shedding precious focus in the act of switching. These principles of eliminating interruption, eliminating distraction are so commonly repeated that they’re almost obvious to the point of being trite, and that’s why I was stopped in my tracks

by the persuasiveness and the wisdom of your recent audio essay, which said, “No, there is actually a subtle problem with these pieces of ancient wisdom.” So tell us, what is the problem with living life with a strong emphasis on eliminating interruptions?

Oliver Burkeman: I find it very appealing to be contrarian about these things, but I also want to make sure I’m being truthful about them, so I feel like I have to say, I don’t think that this is false, the idea that context switching imposes this drain on focus and attention. But I think that the subtle problem that underlies all of this is that the more you go through your day with a very clear, conceptual, intellectual plan for how it should go, for what the boundaries of your time are, for what you’re doing for the next three hours and what will be a problem if you get interrupted or blown off course, the more

you bring that to your day, the worse it is when you are interrupted. Because reality collides with this brittle overlay that you are placing on top of it. And even more subtly, perhaps, more things end up getting defined as interruptions and as problems.

Thompson: Can you give me an example of this idea that we are quietly driving ourselves crazy by over-defining interruptions as problems?

Burkeman: If I’m working from home and it’s the afternoon and it’s part of the day when my arrangement with my partner that day is that I’m working and she is hanging out with our 7-year-old son, if he bursts into the room to tell me excitedly about something that happened to him at school that day—as he may do in the middle of this podcast recording, just as a warning—there may be contexts where I can’t entertain that interruption, but I don’t want to be deliberately signing up to an approach to productivity that, first of all, defines that lovely moment as a bad thing because it doesn’t fit my scheme when I’m someone who does have the good fortune and the privilege to be able to entertain that interruption. Obviously, if I was not working at home or working for a terrible boss who would fire me the moment I was distracted, I couldn’t do that, but I can, and I risk this self-imposed desire to turn it into a problem because I’ve got my little schedule drawn up, and it contradicts that schedule.

I was just going to say, alongside that, there’s always been this question in my mind when the costs of task switching, costs of interruption are discussed, often with reliance on neuroscience and stuff. I’m always wondering, Why is the conversation always about responding to that situation by trying to eliminate task switching and never about getting better at task switching? I mean, if all this stuff about neural plasticity is where it’s at, then maybe we ought to be able to get a little bit better at moving between tasks in that fashion.

(Credit: Derek Thompson) SEASONAL MAGAZINE

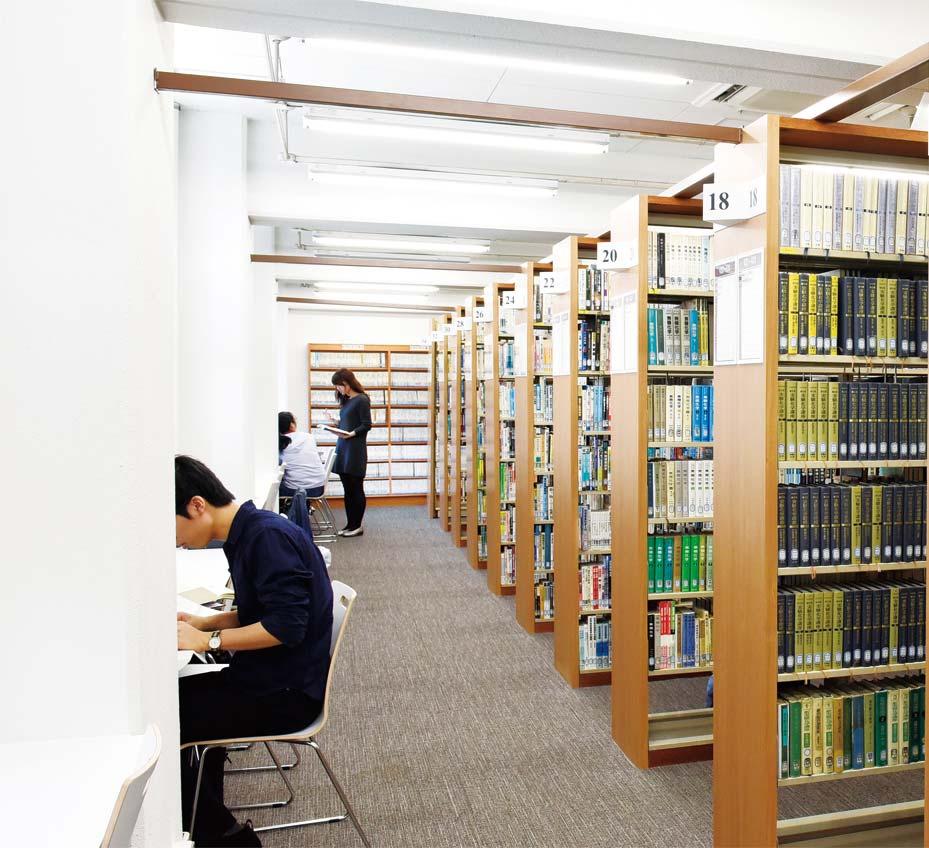

11 INNOVATIVE TRENDS IN UNIVERSITIES ACROSS INDIA

11 INNOVATIVE TRENDS IN UNIVERSITIES ACROSS INDIA

Higher education campuses across India are innovating creatively for the benefit of their students, even as they wait patiently for the campus placements momentum to return.

HIGHER EDUCATION SEASONAL MAGAZINE

SEASONAL MAGAZINE

It is a worldwide phenomenon that when growth goes on unabated in any sector or geography, innovation suffers. This is normal as when business-as-usual is enough, where is the incentive to innovate radically?

Soon into the academic year 2023-24, disaster had struck in the form of an impending recession in Europe and the US, which sent shockwaves across the world including in India, with mass layoffs especially in technology, the top employment generator.

This has drastically reduced the campus placements across India, making not only the students and their parents, but their universities nervous.

The tech majors also have a double excuse this year, as sector-specific Generative AI tools are making their presence felt in various industrial sectors.

Startups, on the other hand, are facing a funding winter which has forced them to curtail expansion plans and with it employment generation. Startups had been a significant contributor to the boom in campus placements in India, during the past few years.

While the US Federal Reserve has since then hinted at making a much needed course correction in interest rates, it will be more than a year or two before its positive impact trickles down from the banks and institutional investors, to the economy first, to the corporates and startups next, and then to the campuses worldwide including in India.

But one thing is for sure - this temporary lull in campus placements is sure to drive up innovation across universities, institutions and colleges across India. Already there are several such trends appearing across the higher education sector in the country. Here are 10 such innovative trends in universities across India:

SEASONAL MAGAZINE

SEASONAL MAGAZINE

1) AI & BIG DATA ENTER INTO MORE COURSES

The most evident emerging trend is of course the launch of courses with specialization in Artificial Intelligence, Data Science & Robotics. But an even greater trend is the inclusion of these subjects on a smaller scale in non-tech majors like business, law, medicine and more. For instance, Data Science is

fast emerging as a core course in most professional streams, as its applications are across the spectrum of all services, manufacturing and R&D sectors.

2) NON TECHIES WOULD NEED SOME TECH TRAINING

IBM’s Global Managing Partner for Generative AI, Matthew Candy recently remarked that thanks to AI, a computer science degree may no longer be necessary to get a job in the technology sector. Candy attributes it to AI enabling those without technical skills to develop, test and deploy products fast, on their own. But what is unsaid here is the fact that these non tech people would now need a basic to intermediate level of knowledge about how the Generative AI tools work their magic.

3) INTEGRATED PROGRAMS ARE BACK IN FAVOUR

Another emerging trend in the campuses is the slow but steady rise in popularity of integrated programs that go all the way up to PhD or at least

SEASONAL MAGAZINE

an MTech or MSc. With campus placements for undergraduate degree holders expected to face a continuing lull, more students may opt for integrated programs that guarantee their promotion to postgraduate and doctoral courses without undergoing competitive entrance examinations at each level.

4) FOUR YEAR DEGREES FACE UPHILL TASK

Efforts to expand India’s traditional arts, science & commerce degrees to four years with multiple entry & exit options have run into rough weather in higher education bastions like Karnataka. Most universities and colleges in the state opposed such a move recently, citing that it will only encourage more students to drop out from even basic degrees, thereby hitting the Gross Enrolment Ratio (GER) negatively.

5) PRIVATE UNIVERSITIES MAY ADOPT 4-YEAR DEGREES

Another reason cited against the four year degree by most institutions, especially the publicly funded ones, is the lack of extra resources by way of faculty and infrastructural facilities to accommodate one more year of education at the undergraduate level. But well performing private and deemed universities are not likely to face this problem, as they have both generous faculty

strength as well as extra built-up space and facilities to be used, if such a one-year extension is made mandatory for all institutions.

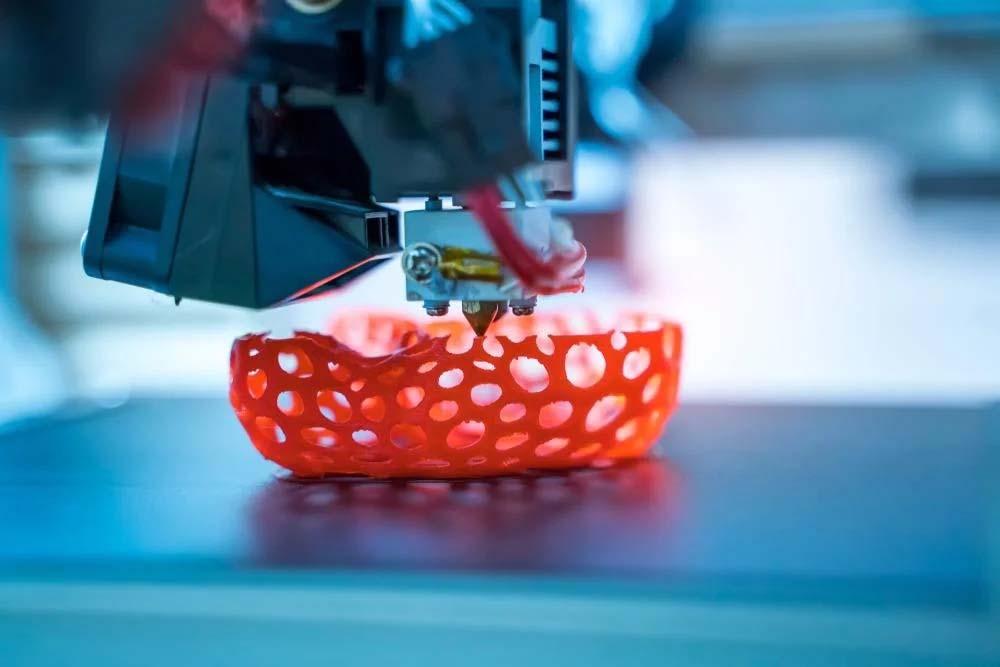

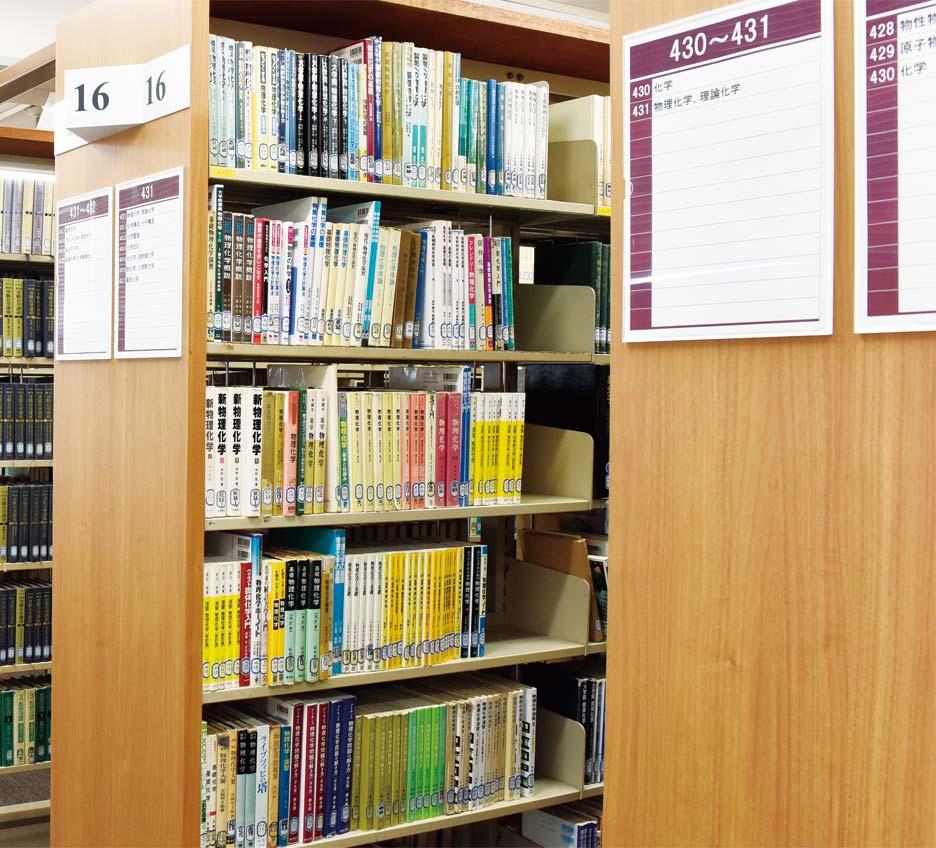

6) PRIVATE UNIVERSITIES ARE WAY AHEAD IN RESEARCH

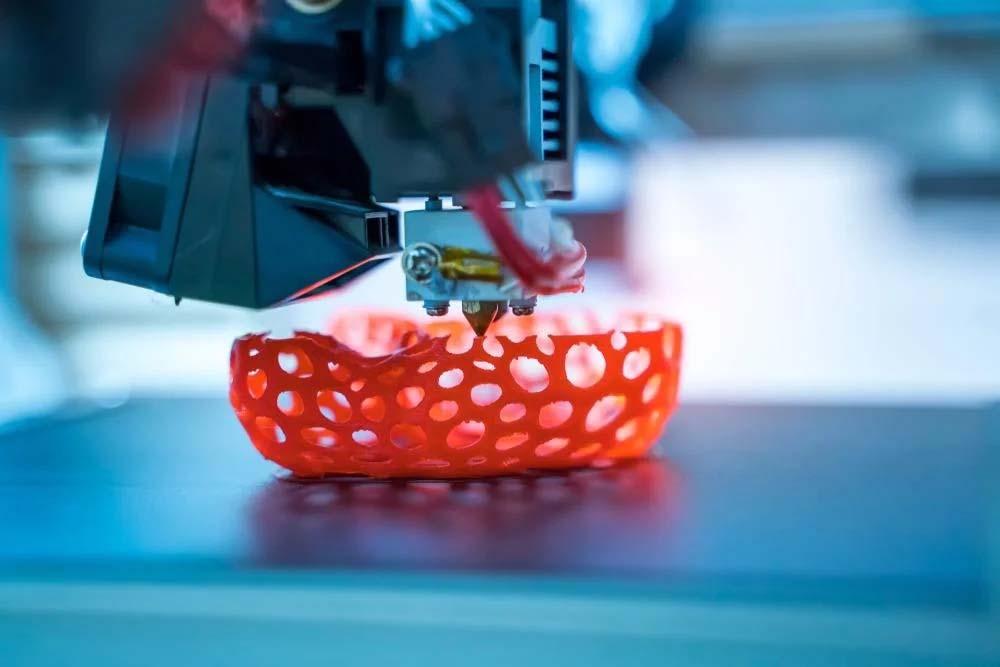

Private and deemed universities are also making their leadership felt in another domain - researchas public universities except for some notable exceptions are lagging far behind here. Private universities achieved this by investing heavily into recruiting research guides, and in building up specialized science labs and technical

MAGAZINE

SEASONAL

infrastructure like 3D printers and high performance computers and networks. Based on such capabilities, some of the leading private & deemed universities have been able to attract significant numbers of funded projects given out by CSIR and other government agencies.

7) TWINNING PROGRAMS ARE BACK WITH A DIFFERENCE

Several noted private universities have also launched twinning programs with renowned universities in developed nations. Despite false starts by multiple universities multiple times, authentic twinning programs are likely to thrive, and a big difference in recent years is that the twinning is often bi-directional with overseas students equally eager to study in India.

8) IT IS CURTAINS FOR DESI FOREIGN DEGREES

UGC has recently come down heavily on some universities and edtech brands for promoting ‘study in India and get a foreign degree’ programs. The regulator has warned that such new age degrees won’t be recognized in India.

9) DEGREES ARE GOING TAMPER PROOF

To combat the unregulated online degree menace, reputed institutions like Delhi University are bringing currency kind of authenticity to degree certificates, along with including mothers’ names in the degree records, as is the practice in tax and bank records.

10) WORLD IS COMING TO LEARN AYURVEDA

Apart from mutual twinning programs, several private universities in the health sciences sector are now experiencing heightened interest from foreign students to enrol for ayurvedic degree programs like BAMS in India.

11) YOU CAN STUDY ENGINEERING PART TIME

On the technical education front, AICTE has recently allowed its affiliated institutes to offer BTech/BE degree programs like evening courses to working professionals. This will go a long way in a scenario where students need to take up smaller jobs initially to support themselves and their families, after their degrees or diplomas, even while they are enabled to complete their graduate degrees in engineering to pursue better jobs.

SEASONAL MAGAZINE

JSSAHER’S INNOVATIVE STRIDES IN HIGHER EDUCATION

Mysuru headquartered leading deemed-to-be university, JSS Academy of Higher Education & Research (JSSAHER) is taking giant strides to push innovation in everything it does. From nationally recognized research labs to world renowned faculty members to playing host to coveted international scientific conferences to startup incubation to constant upgradation of infrastructure and facilities, JSSAHER is not leaving a stone unturned in its quest to stay ahead of the curve among health and life science universities in the country. JSSAHER’s visionary leadership includes JSS Mahavidyapeetha’s Head Sri Shivarathri Deshikendra Swamiji of Suttur Mutt, JSS Mahavidyapeetha’s Executive Secretary C.G. Betsurmath, JSSAHER’s Pro-Chancellor Dr. B. Suresh and its Vice-chancellor Dr. Surinder Singh.

INDIA’S MOST INNOVATIVE UNIVERSITIES IN COURSES, RESEARCH, STARTUPS & TIEUPS

SEASONAL

MAGAZINE

With over 1,61,000 members, the American College of Physicians (ACP) is undoubtedly the largest medical-specialty organization in the United States. In other words, it is the largest and the most esteemed professional group of doctors who are internists or physicians who are practitioners of internal medicine or general medicine as it is commonly called today. Research students even in India, even if they have not heard of ACP, must have surely heard of the weekly research publication, ‘Annals of Internal Medicine’, which is ACP’s core research journal, the highest ranked & cited journal for internal medicine, and regarded as one of the top five medical journals worldwide.

ACP selects and awards internal medicine specialists for a few key achievements in their work annually. In 2023 too ACP announced these annual awards, and the American College of Physicians Distinguished Mentor Award in 2023 was bagged by Dr. M Suresh Babu, who serves as Professor of Medicine, JSS Medical College & Hospital, JSSAHER, Mysuru. While giving away the award, the American College of Physicians noted that this award is in recognition of his outstanding mentorship

SEASONAL MAGAZINE

Jagadguru Sri Shivarathri Deshikendra Mahaswamiji Chancellor

in the field of clinical medicine. Dr. Suresh Babu is also a Fellow of the Royal College of Physicians, Edinburgh, UK. With such distinguished practitioners and researchers in its fold, it is no wonder that both JSSAHER’s medical college and hospital have been thriving as leaders in research and clinical practice.

Recently, the JSS Medical College also received a special recognition from the Government of India’s Indian Council of Medical Research (ICMR). This happened when JSS Medical College’s Centre of Excellence in Molecular Biology and Regenerative Medicine (CEMR)

at the Department of Biochemistry was recently recognised by ICMR as an ICMR-Collaborating Centre of Excellence (CCoE). While bestowing this recognition on CEMR for a period of five years, ICMR noted that this is in consideration of its scientific accomplishments.

Dr. Prashanth Vishwanath, JSSAHER’s Dean of Research and Dr. Akila Prashanth, Professor and Head of the Department of Biochemistry, received the recognition from Dr. Rajiv Bahlat, the Director General of ICMR, at the ICMR headquarters in New Delhi recently. As an ICMR-CCoE, this JSSAHER unit will engage in extensive

SEASONAL MAGAZINE

SEASONAL MAGAZINE

cooperation with ICMR to develop guidelines, undertake multi-centric projects, and enhance capacity building efforts in the country. The available resources in such centers will be shared with other centers for the purpose of student training, R&D, and capacity development for enhancing the national research talent pool for advancing medical research in India.

A prime advantage of studying at JSSAHER is the unique exposure students get from the depth and breadth of the international conferences it hosts. A recent example was the HEAL-BioTec 2023 hosted by the JSS School Of Life Sciences. This three-day International Conference on ‘One

Health: Biotechnology as a Catalyst for Sustainable Development was organized by the Department of Biotechnology and Bioinformatics, JSSAHER. This conference was funded by three Indian Government bodies including the Department of Science and Technology (DST), the Science and Engineering Research Board (DST-SERB) and the Department of Biotechnology (DBT), and it achieved its objective to discuss and further the new concept of ‘One Health’ which serves as a catalyst for achieving the Sustainable Development Goals (SDGs) by 2030.

Also included in the G20 agenda, the ‘One Health’ approach aims to improve disease management by bringing together health, food and environmental scientists as well as policy specialists from different parts of the globe, to help in achieving SDGs by this decade’s end. It was a never before opportunity for JSSAHER students, faculty members, and researchers to interact with world renowned experts in these contributing domains and gain integrated knowledge about the One Health approach. Sanjay Kumar Varshney, Advisor & Head, International Collaborations, Department of Science & Technology (DST), Govt. of India, was the chief guest and delivered the keynote address that described how Artificial Intelligence is speeding up clinical trials among other aspects.

Dr. Hans Jorgensen, Professor, University of Copenhagen, Denmark, who was the guest of honor, delivered a plenary lecture, with another plenary lecture by Dr. Anil Kaul from Oklahoma, USA. Other eminent scientists who delivered invited lectures

SEASONAL MAGAZINE

C.G. Betsurmath, Executive Secretary

include Dr. Jung-Hyun Kim (South Korea), Dr. Raj Kumar (Boston, USA), Dr. Claus Bang-Berthelsen (Denmark), Dr. S. Pradeep Kumar of Google and Dr. Manju Bansal from IISc. Apart from research scholars, faculty members and students, the attendees included leading industrialists from concerned sectors. Hosted both physically and in

online mode, the mega conference benefitted at least 500 students directly, apart from the thousands of viewers who tuned into it from the world over.

During the last two quarters itself, the students, faculty and researchers of JSSAHER have been blessed with the university hosting several such events. These included an international conference on the genetics & epigenetics of cancer, a two day fair on forensic and investigative science, a live hysteroscopy workshop for gynecologists & postgraduate students, an international conclave on the occurrence and prevention of tuberculosis, and a rally to educate people on the importance of adult immunization especially for the elderly and high risk patients, conducted by JSSAHER’s Adult Immunization and Travel Medicine Center.

JSSAHER also continued to fortify its already impressive facilities and infrastructure in its core School of Life Sciences at Mysuru. During the last quarter, the deemed university launched the School’s

Dr.B.Suresh, Pro Chancellor JSS Academy of Higher Education & Research

SEASONAL MAGAZINE

Dr.B.Suresh, Pro Chancellor JSS Academy of Higher Education & Research

SEASONAL MAGAZINE

new Lecture Hall Complex with the inauguration done by Karnataka’s Minister for Medical Education, Sharan Prakash Patil. The School of Life Sciences offers 14 post graduate programs, 6 undergraduate programs and 2 diploma courses

in the regular stream, as well as several courses in the Open & Distance Learning (ODL) mode.

During the occasion, Minister Sharan Prakash Patil also inaugurated the University’s incubation facility named ‘Sparkle Cine’ for boosting the start-up initiatives by students, faculty and interested entrepreneurs. Sparkle Cine has been active for some quarters now, but now it gets its own infrastructure and facilities, towards fulfilling its stated aim of furthering the start-up culture in the university by translating educational excellence into actionable ideas for entrepreneurship and innovations. Also launched during the event was a new pharmaceutical chemistry lab.

Over the almost one and a half decade of its existence, JSSAHER has steadily improved not only on the quality front, but on the volume of graduates and postgraduates it grooms in each batch. Last quarter was witness to this phenomenon once again, during the fourteenth convocation of JSSAHER. All together, 2,546 graduands were awarded their undergraduate, postgraduate & diplomas this year, apart from 49 candidates who were awarded PhD degrees. Chairman of UGC Prof. Mamidala Jagadesh Kumar was the chief guest who delivered the convocation address and gave away medals to 55 academic toppers.

Dr. Surinder Singh, Vice Chancellor JSS Academy of Higher Education & Research

SEASONAL MAGAZINE

Dr. Manjunatha B, Registrar JSS Academy of Higher Education & Research

OVER FOUR DECADES OF CONSISTENT PROGRESS IN ACADEMIC EXCELLENCE

Under the visionary leadership of its Founder Chancellor N Vinaya Hegde, Pro Chancellors Vishal Hegde and Prof. Dr. Shantharam Shetty, and Vice Chancellor Dr MS Moodithaya, Nitte Deemed-tobe University has been ranked among India’s Top 100 universities for the 5th consecutive year in the NIRF rankings, and it has also jumped 10 ranks this year to the 65th position. Two of Nitte’s eminent scientists Dr Indrani Karunasagar and Dr Iddya Karunasagar have also bagged top ranks of 11 and 13 respectively in the field of microbiology by Research.com. Nitte alumni like Vidya Kamath Pailodi and Dr. Saritha Arunkumar have brought global accolades to the university recently, while on the national stage two of Nitte students have won the 1st and 6th rank in the Joint CSIR-UGC NET Examination under the Life Sciences category.

NITTE DEEMED UNIVERSITY SEASONAL MAGAZINE

iebel Scholars program needs no introduction among cutting-edge universities in the world and their graduate students and startup entrepreneurs. Established by the Thomas and Stacey Siebel Foundation in 2000, the Siebel Scholars program selects around 90 graduate students each year from some of the finest universities in the world to be a Siebel Scholar. So far only 1800 Siebel Scholars have been selected and they form an elite club of researchers, entrepreneurs, engineers, scientists and top rung of managers.

There are only 16 universities from which Siebel Scholars have so far been selected and they include prestigious names like Harvard, Stanford, John Hopkins, MIT, Princeton, UC Berkeley, University of Chicago, Wharton, and University of Illinois Urbana-Champaign, which is also incidentally the alma mater of billionaire businessman Thomas Siebel, one of the world’s most successful tech entrepreneurs who founded Siebel Systems which was later acquired by Oracle.

Recently, the Siebel Scholars Foundation announced its 2024 Class of Siebel Scholars, honouring 83 exceptional graduate students from top universities around the world in the fields of bioengineering, business, energy science, and computer science. Five Computer Science students from the University of Illinois Urbana-Champaign were named to this year’s class, and among them is Vidya Kamath Pailodi, a second-year graduate student working with Professor George Chacko to explore the field of Computational Scientometrics.

Before arriving at the University of Illinois Urbana-Champaign, Vidya worked as a software engineer in the thermotechnology department at Robert Bosch Engineering and Business Solutions in Bengaluru, India. This was shortly after Vidya graduated as a Gold Medalist in ECE from the NMAM Institute of Technology in Nitte, India where she earned an undergraduate degree in Electronics and Communication Engineering.

Vidya’s achievement is something about

which Nitte Deemed University can be proud of as Nitte Mahalinga Adyanthaya Memorial Institute of Technology (NMAMIT) is a constituent engineering college of Nitte Deemed University. This achievement is all the more impressive as 4 out of the 5 students from University of Illinois who won this prestigious scholarship are from India, from prestigious institutions including IIT Indore, IIIT Hyderabad & Manipal Institute of Technology.

Vidya’s and Nitte Group’s achievement in this regard is by no means a one-off phenomenon on the world stage. Recently, Dr. Saritha Arunkumar who holds the position of IBM’s Public Cloud World Wide Technical Leader in Security, in the United Kingdom, won the prestigious award, The Princess Royal Silver Medal, often called the

Oscars of Engineering.

Bestowed by the United Kingdom’s Royal Academy of Engineering, the award was presented to Dr. Saritha by none other than HRH Princess Anne, Sister of King Charles, in London. The award was in recognition of this leading cyber-security expert’s invaluable and critical contributions to shaping security in emerging areas such as the cloud, blockchain, and biometrics.

Earlier, Dr. Saritha has been recognised as an IBM Master Inventor, an IBM Super Hero, Financial Times' Top 100 BAME Technology Leaders Award, and The Inc Magazine’s Top 10 Business Women to Follow in 2022. Her achievement of winning the The Princess Royal Silver Medal is regarded as an achievement for India, and of course for Nitte Group as

SEASONAL MAGAZINE

N Vinaya Hegde Chancellor

Dr. Saritha had graduated from the NMAM Institute of Technology in 2000 as an Electronics & Communication Engineer, and was also the topper of her batch.

Vidya’s and Dr. Saritha’s education and grooming at NMAM Institute of Technology happened much before it became a constituent college of Nitte University. But this only goes on to add further sheen to the farsighted vision and care accorded by Nitte Educational Trust led by its Chancellor N Vinaya Hegde, years or even decades before it became a formal university.

Nitte Deemed University is a part of Nitte Group run by Nitte Education Trust, which was founded in 1979 by Justice Kowdoor Sadananda Hegde, former Chief Justice of the Supreme Court and former Speaker of the Lok Sabha. Offering education in diverse areas of learning, Nitte today offers a total of 130+ programs including medicine, engineering, management, hospitality, allied health sciences, dentistry, pharmacy, nursing, physiotherapy, speech and audiology, media & communication and architecture. The Trust has established 40+ institutions spread across three campuses at Nitte, Mangalore and Bangalore and has over 20,000+ students and 4500+ faculty in its campuses.

Equipping its students for outperformance continues even to this day at Nitte University. In the national level Joint CSIR-UGC National Eligibility

Test (NET) exam conducted a few months back, a total of 78,168 students had appeared under the Life Sciences category. NET exam is conducted to determine the eligibility for Junior Research Fellowship (JRF) and Lectureship (LS) / Assistant Professor post in Indian universities and colleges.

Among these over 78,000 students who appeared under the life sciences category, there were students from the Nitte University Centre for Science Education & Research (NUCSER) too. And guess who won the national level top ranks? Twin sisters, Rhea Kishore and Reena Kishore, MSc Biomedical Science students at NUCSER, achieved the 1st

and the 6th Rank nationally!

It was an incredible performance by these Nitte students as Rhea scored a total percentile of 99.94 whereas Reena scored 99.66. Both of them were mentored at the university by Dr. Akshath US, Scientist G-II, and Dr. Anirban Chakraborty, Professor & Director of NUCSER, and the achievement of these twin sisters has become another proud moment in these recent times for Nitte University.

Such mentoring in both the academic and leadership aspects is a culture that permeates the entire university starting from the very top rungs. Vice Chancellor

Vishal Hegde Pro Chancellor

Prof. Dr. Shantharam Shetty Pro Chancellor

SEASONAL MAGAZINE

Vishal Hegde Pro Chancellor

Prof. Dr. Shantharam Shetty Pro Chancellor

SEASONAL MAGAZINE

N Vinaya Hegde and Pro Chancellor Vishal Hegde have been known to intervene for the student community at every appropriate forum. Such an instance happened during the university’s 2022 convocation, when Vinaya Hegde requested UGC Chairman and Chief Guest Prof. Mamidala Jagadesh Kumar to upgrade the Mechanical, Civil and Electrical Engineering courses with components from computing and electronics to make them relevant at the changing workplace.

NMAMIT that produced winners like Vidya and Dr. Saritha today offers both conventional and advanced engineering branches like Artificial Intelligence & Machine Learning, Robotics & AI, Biotechnology, Civil, Computer & Communication, Electrical & Electronics, Electronics & Communication, Information Science, Mechanical Engineering etc.

Pursuit of values is another dimension where the Nitte University leaders excel, starting right from the Chancellor. Recently, pioneering orthopaedic

Dr MS Moodithaya

Vice Chancellor

surgeon and Pro Chancellor of Nitte University, Prof. Dr. Shantharam Shetty, who was the Chief Guest of OASISCON 2023, a 3-day Conference Of Orthopaedic Associations Of Six South Indian States Hosted By Karnataka Orthopaedic Association, delivered such a value based lesson for fellow orthopaedic surgeons.

Said the Nitte Pro Chancellor, “During those years (when I started my practice),

there were only three to four orthopaedics, including myself, in Mangaluru, while at present, there are over 200 orthopaedics in the city, which is a tremendous growth in this field. Yes, we all want to earn money but always remember to serve your patient first and then think of money. Practice for need and not for greed,” added Dr Shantharam Shetty.

Startup incubation is another domain where Nitte University is starting to make impressive gains. Recently, an innovative betel leaf tea bag product was developed by young startup entrepreneur Sandeep Eshanya with the support of Nitte University’s DST Technology Enabling Center and Dr Mamatha BS, an expert in food technology and faculty at Nitte University Center for Science Education and Research.

While the nutritional value of betel leaf is noteworthy, being rich in fibre, vitamins A, B, C and minerals like calcium, iron and potassium, it was an arduous and time-consuming process that took several iterations of laboratory studies and consumer acceptance trials to ready a process for preparing tea bags from betel leaves without losing nutrients, medicinal properties and in the original flavour as well as incorporating additional flavours as per user preference.

Entrepreneur Sandeep Eshanya was all praise for Nitte University’s support, when he said, “NITTE University boosted my confidence when I pitched my idea. They have been a constant support to convert my dream into reality. I have now sent samples to 10 countries such as Sri Lanka, United States, UK and many more.”

There is more to Nitte University’s support for such startup entrepreneurs than in product development. Under the guidance of Prof. Dr Iddya Karunasagar, Advisor - Research and Patents, at Nitte University, the process of producing the betel leaf tea bags has been protected by a shared patent, and Nitte University has authorised Eshanya Beverages, the concerned start-up to commercialise the technology through an agreement, so that the product is effectively made available in the Indian and overseas markets.

SEASONAL MAGAZINE

Nitte Deemed University also has a robust research program that offers Fulltime and Part time Ph.D Course in the faculties of Medicine (including PreClinical, Para-Clinical & Clinical), Dentistry, Pharmacy, Physiotherapy, Allied Health Science, Nursing, Biological Sciences, Speech & Hearing, Engineering, Commerce & Management, Applied Sciences, Business Administration and Humanities. Meritorious Full Time candidates receive Nitte PhD Fellowships of Rs. 20,000/- per month as per the University’s guidelines. Nitte takes the quality element of its PhD program quite seriously, and there is an impressive lineup of Research Guides, and the selection of candidates is based on a national-level entrance test, statement of purpose and personal interview.

Nitte University organises various workshops and seminars to bring industry experts right into the campus. A similar workshop to mark the World Food Safety Day was organised by Nitte DST Technology Enabling Center in association with CII, FSSAI & KCCI, and was moderated by Nitte faculty Dr. Indrani Karunasagar. She emphasised the need to understand the basis for food safety standards and the best practices that food business operators from farm to plate need to follow to comply with the standards. The discussions covered improving food hygiene and food safety in all segments of the food industry including street vendors, quality control, certifications and accreditations required by food

testing laboratories.

Nitte is also forever forging meaningful tie-ups with select industry majors in training and certification for the employability of its students. A few months back it forged such a tie-up with upGrad Campus, the higher education arm of upGrad, one of Asia’s largest integrated career skilling, workforce development & placement companies.Under this collaboration, UpGrad Campus will support Nitte BTech students with one of the hottest coding skills today - Full Stack Development (FSD) - so that they are adept with the tech requirements of the modern day workplace.

Spread over a period of 4 years, the FSD specialisation begins in the first year integrated within the university

curriculum and has been designed for engineering aspirants who aim to build a career in the Information Technology domain. It will cover around 1400 hours of learning content with over 300 live sessions, 11 projects and case studies, in sync with the B.Tech syllabus to ensure learners get higher experiential learning.

It will also encourage live & interactive faculty engagements, alumni networking, and industry-specific sessions/simulations to enhance the overall subject understanding to further enable them with the expertise required to succeed in the said industry. The tieup is aimed at making Nitte students stand out from the lakhs of Engineering students in India.

Management education is another domain where Nitte Deemed University is a force to reckon with, thanks to its longstanding experience through its Justice KS Hegde Institute of Management (JKSHIM). This highly ranked MBA institute recently welcomed its 26th batch of MBA students, with a unique value-add. A guest of honour at the event was former alumni Sajan Murali, who is now the CEO of Turtle Wax Media Ltd. Sajan belongs to the 1999-2001 batch of MBA at JKSHIM, and called upon the current batch of MBA aspirants to focus on imbibing the soft skills.

SEASONAL MAGAZINE

JKSHIM which recently celebrated its Silver Jubilee, had Dr. Debashis Chatterjee, Director, IIM Kozhikode, delivering the Silver Jubilee lecture on the theme of ‘Leadership Challenges'. Noting that Nitte Founder Justice KS Hegde was a visionary with values, Dr. Chatterjee said, “Principle and value centred leadership is the need of the hour. Life has no meaning without values and principles. Integrity is the hallmark of life. These virtues need to be imbibed during schooling and college days.”

Bengaluru based Nitte Meenakshi Institute of Technology (NMIT), which is promoted by Nitte Education Trust, but which is not technically part of Nitte Deemed University yet, recently hosted its 1st International IEEE conference on ‘Networks, Multimedia and Information Technology’, NMITCON 2023.

Sponsored by the AICTE, the conference brought together experts and enthusiasts from across the domain of information technology, including AICTE Chairman Dr. T. G. Sitharaman, Dr. David Camacho from the Technical University Of Madrid, Spain, and Ms. Namrata Dutta, Senior IT Auditor, from Mumbai, whose keynote addresses at the event was a great source of inspiration to the participants. Authors from countries including the USA, the UK, and Germany, and also from premier Institutions like IISc., IITs, IIITs,

and NITs presented their papers at this Conference.

Also marking the occasion was the inauguration of the AICTE-IDEA Lab by Dr. T. G. Sitharaman. The focus of the lab is to encourage students to apply Science, Technology, Engineering, and Mathematics (STEM) fundamentals on ideas for enhanced hands-on experience and even product development. The AICTE has also sanctioned Rs.15 lakh to NMIT to help establish the lab.

Nitte Institute of Communication (NICO), another constituent college of Nitte Deemed University, is also acing its game above peers with international industry certifications. Recently, it received the prestigious Godox Certification under which Godox, a world leader in professional and studio

quality lighting, will conduct workshops on lighting for students, where they will learn from the Godox Team about latest lighting techniques and practices. With this tie-up, NICO has become India’s Only Godox Certified Training Centre.

Besides the Godox partnership, NICO also hosts workshops by experts in photography, feature writing, video editing, VFX, and short filmmaking. These workshops give students exposure to real-world challenges and opportunities in the media industry.

Besides offering five comprehensive programs in media and communication, the institution also organises the Nitte International Film Festival (NIFF), which is one among the few student-managed film festivals in the country. Nitte communication students thus get an opportunity to interact with filmmakers, technicians, actors, cinematographers, scriptwriters who participate in the festival, which is so characteristic of the way Nitte Deemed University grooms all its students.

With such initiatives across the campus and all its constituent colleges, it is no wonder really that MNCs and large Indian corporates have been placing students from Nitte Campus. These include renowned names like Mercedes Benz, Toyota Kirloskar Motors, Hitachi, ABB Power Grids, Juniper Networks, Intel, Novo Nordisk, L&T Technology Services, Syngene International, JSW Group, Prestige Construction, JK Cement etc.

SEASONAL MAGAZINE

THE CASE FOR BEING LAZY AND PROCRASTINATING

WHAT IF LAZINESS AND PROCRASTINATION COULD ACTUALLY HELP YOU GO FURTHER IN LIFE, AND MAKE YOU WILDLY SUCCESSFUL?

s children we were told that we would never amount to anything if we were lazy and that hard work was the key to success. But what if laziness and procrastination could actually help you go further in life? There are a few reasons why being an eager beaver isn't always a good idea. Some problems may end up getting solved without any effort from you. And is a first-mover advantage all it's cracked up to be? It's the second mouse that gets the cheese. The hapless first mouse could end up getting trapped in its efforts to get ahead. Bill Gates once said that he would always "hire a lazy person to do a difficult job" at Microsoft. Why? "Because a lazy person will find an easy way to do it." Here are some of the ways you can use your laziness to your advantage and turn procrastination into an asset.

1) USING LAZINESS TO YOUR ADVANTAGE

Sometimes, laziness can be used to protect you from yourself. According to Karthick Venkatesh, who posts advice on question-and-answer network Quora, he has a 29-character password for Facebook and Twitter. "When I have to work, I just log off from these," he says. "So, whenever I feel like taking a break and using Facebook, I am just too lazy to type my password. "Eventually, owing to my laziness, I go back to work and have a really productive day."

Bill Gates once said that he would always "hire a lazy person to do a difficult job" at Microsoft. Why? "Because a lazy person will find an easy way to do it."

2) WHY PROCRASTINATION WORKS

If you wait until the last minute to complete a task, you are forced to focus on the project at hand. According to Quora poster Caroline Sin: "There’s nothing like not having enough time to complete a project to make you realise what’s critical, and what isn’t." "If I start early on a project and stick faithfully to my schedule, I almost always do more work than I need to," she explains. "A lot of that work I simply throw away. But if I wait until the last minute to work on something, the stress of it automatically narrows my focus to what’s important, and I quickly jettison the rest. I throw no work away, I work quickly and efficiently, and I get it done." Work will always swell to fill the amount of time allotted to it, argues another Quora user, so limit the space into which it can expand.

CONTRARIAN

SEASONAL MAGAZINE

3) MAKE THE MACHINE DO IT

Phones, lifts, cars, all these things were invented to avoid or minimise work. Lazy people automate as much as possible. Rather than tweeting throughout the day, for example, they will use a service like TweetDeck to schedule tweets for the whole day in one go. Job done; time for a cup of tea. Human beings were supposed to work less, not more, following the rise of the machines. In his 1930 work Economic Possibilities for Our Grandchildren, legendary British economist John Maynard Keynes who lived in the last century wrote that by 2030 he expected a system of almost total "technological unemployment" in which we'd need to work as few as 15 hours a week. Working less doesn't mean being less effective. Devotees of the "Pareto Principle" believe in the 80-20 rule: basically, just 20pc of your efforts deliver 80pc of the results - there is the "vital few and the trivial many". The idea was originally conceived in 1906 by Italian economist Vilfredo Pareto, who created the formula to describe the unequal distribution of wealth in his country (20pc of people owned 80pc of the wealth). However, it is now a muchvaunted time-management technique. Of the things you do during your day, only 20 pc really matter - in theory. Lazy people can cut down on 80 pc of their workload by identifying and focusing only on those things.

4) ARE YOU LAZY? OR JUST REALLY GOOD?

You may be lazy because you’re good at your job. Really efficient people will naturally have more downtime than their peers. If you finish a task, and find yourself watching cat videos or liking endless pictures on Facebook, is it because you've finished your work early? Are you twiddling your thumbs because you have nothing else left to do? Take Tobi Lütke, the CEO of the e-commerce platform Shopify, couldn't be bothered to work with difficult customers anymore, so he got rid of them. Lazy? Perhaps. But the result was that he could spend more time focusing on valuable

LAZY ENTREPRENEURS BUILD BUSINESSES THAT GENERATE REVENUE, EVEN WHEN THEY AREN'T ANYWHERE NEAR THEIR DESK.

ONLINE PRODUCTS SUCH AS TRAINING VIDEOS, E-BOOKS OR SUBSCRIPTIONS TO ONLINE CONTENT OR SERVICES COULD ALL MAKE MONEY WHILE YOU SLEEP, AND REQUIRE MINIMAL INPUT FROM THE BUSINESS OWNER.

customers. "If you go into business school and suggest firing a customer, they'll kick you out of the building," he says. "But it's so true in my experience. It allows you to identify the customers you really want to work with." In 2007, Tim Ferriss published his book, The 4Hour Workweek, in which he extolled the virtues of the Pareto Principle and of working as little as possible. The self-help book was a worldwide success, selling 1.35m copies in 35 languages. According to Ferriss, to be truly productive, we must check our email just once a day and outsource every small daily task to virtual assistants, focusing only on those tasks that generate the largest return.

5) YOU CAN ONLY BE LAZY IF YOU'RE CLEVER

Kurt Gebhard Adolf Philipp Freiherr von Hammerstein-Equord was Germany’s chief of the army before the Second World War. He said that all his officers were two of the following: clever, diligent, stupid or lazy. According to the general, the most dangerous officer was one who was stupid and diligent. He couldn't be trusted with any responsibility because he would always make mischief. However, officers who were both clever and lazy were qualified for the highest leadership duties, because they possessed the intellectual clarity and the "composure" necessary for difficult decisions. They are masters at avoiding “busywork” such as pointless meetings, he claimed, they delegate to others to get things done efficiently, and they focus

on the essentials rather than being distracted by unnecessary extras.

6) MAKE MONEY WHILE YOU SLEEP

Lazy entrepreneurs build businesses that generate revenue, even when they aren't anywhere near their desk. Online products such as training videos, e-books or subscriptions to online content or services could all make money while you sleep, and require minimal input from the business owner. The explosion in peer-to-peer lenders has also offered lazy people the opportunity to make money by effectively doing nothing - just collecting the interest. Caveat: there is always risk involved in issuing loans. But there are even ways of making traditional business models successful while being lazy. If you are selling a product, for example, create a range that is like a McDonald's menu. Produce five things - burgers, fries, chicken, salad and soft drinks - and just package it all differently and sell them in different combinations to cut down on time and effort.

7) HOW TO BUILD A LAZIER SOCIETY

Working just four hours a week might seem ridiculous to many, but how about a four-hour workday? A shorter working week would have interesting theoretical benefits. If everyone worked fewer hours, more people would be required to get the job done, reducing unemployment. Less work would produce slower economic growth but it would also reduce the consequences of that growth, such as pollution. Work, as a commodity, would increase in valuesweat equity is frequently dismissed these days because everyone puts in such long hours. It would also solve the eternal question: how to achieve a work/ life balance. A four-hour workday would leave plenty of time for family and child care. There could also be resulting health benefits. Burn-outs, stress and inactivity would be reduced, which would reduce the risk of heart disease, diabetes and Alzheimer's. So should you be more lazy? We think so.

(Credit:RebeccaBurn-CallanderforThe Telegraph)

SEASONAL MAGAZINE

HOW TO SPOT RED FLAGS IN ANY COMPANY'S ACCOUNTS?

HOW TO SPOT RED FLAGS IN ANY COMPANY'S ACCOUNTS?

The current bull market is causing many new stock market investors to think that they have become experts at spotting multi baggers. What they don’t realise, and probably will, much later, is that rising stock prices are not always a reflection of sound fundamentals. And what you see in the balance sheet is not always what you get. Ashwini Damani, Senior Analyst at Manyavar Family Office, and a chartered accountant by training, specialises in forensic auditing. In an interview with Moneycontrol's Santosh Nair, Damani spoke about the accounting red flags that investors should keep an eye out for.

How did you get interested in How you get in How forensic accounting? forensic accounting? forensic accounting? forensic accounting?

How did you get interested in How you get in

Initially that was not my area of interest. Because I spent around 10-12 years in financial reporting and audit, and had gone through hundreds of financial statements, I was able to quickly spot when some balance ratios didn’t make sense.

What was the incident that got What the incident that got

What was the incident that got What the incident that got you started? you started? you started? you started? you

One of the firms that I was auditing had to pay a bribe to a politician. Since an expense of this nature cannot be officially disclosed, it would have to be hidden somewhere in the balance sheet. The basic principle of accounting is that for every debit, there is a credit. If you try to hide a profit or an expense, another part of the balance sheet will automatically bloat. It struck me that many companies would be doing similar things, and by focussing on ratios that did not make sense, one could get an idea if the account books were being cooked.

STOCKS

MAGAZINE

SEASONAL

Which was the first stock where

Which was the first you sensed that something was you that something wrong with the numbers? wrong with the

Opto Circuits. Firstly, the ratios were not making sense. As a chartered accountant, I was trained to observe the cash flows and not merely the profit and loss (P&L) statement. Making an entry into the P&L doesn't finish the loop, you need to tie it up to the cash flow statement I noticed the absence of cash flow from operating activities and the tax payments seemed bogus. It soon became evident that the management was just shuffling money around. Focussing on the tax actually paid and not provisions for tax, these are simple things, but most investors overlook it.

discussed on the forum. The more financial statements I looked at, the better was my ability at being able to spot patterns.

What was the experience like? What was the experience like?

Generally good, but there was this company, which I cannot name, where the promoter was running a privately held firm of a similar nature as the listed entity. Every time he wanted to get the market cap up, he would transfer sales from the private entity to the listed one. I was so convinced of being right in my assessment of the company that I could not spot the fraud when it was happening right in front of my eyes. I lost a packet in that stock.

retail store chain, I could see that the amount spent on air conditioners was inflated when comparted with the number of stores in operation.

Then there are some obvious red flags. Like a jewellery company should not have debtor days, because they don’t sell on credit. A media and entertainment company should not have receivables of more than 60-70 days. Why so? so? so?

How did you apply some of the

How did you of How did you apply some of the How did you of of lessons that you learnt as a lessons that you learnt as a you financial auditor? financial

For my own investments. I got a kick being able to spot issues in balance sheets and observing how they unfolded over the following years. I then joined Value Picker, a forum for value investors where people discussed investment ideas. The principles of financial statement analysis that I had developed for my personal investments came in handy for evaluating potential investments

What are the key numbers that are the numbers that you seek out as soon as you dive seek out dive you seek out as soon as you dive seek out dive into a balance sheet? into a balance a

Return on Equity (RoE), cash flow conversion (ability of a company to convert operating profits into ree cash flow), and balance sheet size. If the total on the asset side adds up to say Rs 50,000 crore, you need to check the number against each of the line items like plant and machinery, working capital etc and see if they make sense. For instance, in the case of a mid-sized

If you are an exhibitor, then the industry works on a weekly payment cycle. Check with peer group companies and see what their receivables are like. In fact, the thumb rule is to compare with peers and see the variation. If it is too much, you need to ask: why?

Can you elaborate on the cash elaborate on the the flow conversion?

I believe that on a long on a five to seven year basis if you just add up the operating profits of the company 60 to 70 percent at least should translate into cash flow from operations. I say 60-70 percent because you need to put some more money into debtors and inventory as you keep growing. There is always a timing gap, you may sell something in March

SEASONAL MAGAZINE

and it may get recovered in April. I don’t look at individual years, because things can go wrong once in a while. Also, it will vary across industries. For an EPC (engineering, procurement, construction) firm it could be closer to 60 percent and for an IT company it could be closer to 90 percent. Check how peer group companies are doing. If enough of the operating profits are not getting converting into cash flows, then you need to doubt the operating profits.

Which are common ways in Which are ways Which which managements try to which try to which managements try to which try to try mislead shareholders? mislead mislead shareholders? mislead

The most common method is to inflate profits, and when you do that, you also have to inflate reserves and surpluses, which is the liability side. That means you have to inflate the asset side as well. Overpaid acquisition is a good way to do that, as it bloats up your goodwill. Check if the company being acquired is in any way a related firm.

WHEN I WHEN I LOOK AT THE FINANCIAL STATEMENTS IT IS NOT ALWAYS WITH THE INTENTION OF FINDING A FRAUD. I JUST NEED TO BE AWARE THAT THERE IS A PROBLEM IN THE BALANCE SHEET.

inventory, which can get a bit tricky. Sometimes it is obvious that the company is fudging numbers. Like a diary company having an inventory of 200-300 days. But how do you know if the diamonds held by a jewellery company is actually worth the crores that the management claims it is. Capex bills can be inflated. There is no way an auditor can check each and every bill.

From a

retail

investors' a retail investors' From a retail investors' a retail investors' From a retail investors' perspective which are the easier which are the easier red flags to spot? red to

company does that often, it means you can’t take the numbers at face value.

Do you always go for the perfect you go the perfect Do you always go for the perfect you go the perfect the balance sheet? Or do you say I sheet? Or do you say balance sheet? Or do you say I sheet? Or do you say balance sheet? Or do you say I am fine with the imperfections in am with the in am fine with the imperfections in am with the in the balance sheet up to a certain the sheet to a certain the balance sheet up to a certain the sheet to a certain threshold? threshold?

When I when I look at the financial statements it is not always with the intention of finding a fraud. I just need to be aware that there is a problem in the balance sheet. Sometimes managements try to delay recognition of certain accounting items because they are under pressure from the investing community, or just trying to save their jobs. When the actual event happens, the market punishes the stock and that may actually be a buying opportunity because you know this was coming.

We are a massive up

We are seeing a massive run up in

We are seeing a massive run up in

How does one do that?

How one do that?

How does one do that?

How one do that? that?

The company must mention that, and if they fail to do that, there are sites like Zauba and Tofler that allow you to make a family tree and check if there are any common links. Sometimes there are obvious telltale signs. Like the company that was acquired for a hefty sum may not even have a functional website.

Earlier, fake receivables was a common place for inflating profits, but because of GST (good and services tax) that has become difficult. Auditors can easily corelate GST data with the receivables and check for genuineness.

Which are the other areas?

Which are other areas? are other

Loans and advances to group companies or third parties. Then there is

THE MOST COMMON METHOD IS TO INFLATE PROFITS, AND WHEN YOU DO THAT, YOU ALSO HAVE TO INFLATE RESERVES AND SURPLUSES, WHICH IS THE LIABILITY SIDE. THAT MEANS YOU HAVE TO INFLATE THE ASSET SIDE AS WELL.