Managing Editor

Jason D Pavorattikaran

Editor

John Antony

Director (Finance)

Ceena

Associate Editor

Carl Jaison

Senior Editorial Coordinator

Jacob Deva

Senior Correspondent

Bina Menon

Creative Visualizer

Bijohns Varghese

Photographer

Anish Aloysious Office Assistant

Alby CG

Correspondents

Bombay: Rashmi Prakash

Delhi: Anurag Dixit Director (Technical)

John Antony

Publisher

Jason D Pavorattikaran

Editorial & Business Office Cochin: 36/1924 E, Kaloor-Kadavanthra Road, Near IGNOU, Kaloor, Cochin-17. Ph:0484- 2345876, 2534377, 2340080 Mob. 09947141362

Delhi: H.No: P-108, Uppal Southend, Sector 48, Sohna Road, Gurgaon, Haryana – 122018 Ph: 9891771857|099471 41362

Mumbai: 202, Woodland Heights Building, St. Martins Road, Bandra West, Mumbai400 050 Mob: 919947141362

Bangalore: House No: 493, Block 3 3rd Main, HBR Layout, Bangalore-4209731984836, Email:skmagazine@gmail.com www.seasonalmagazine.com

UK Office: “CRONAN”, Boundaries Road Feltham, Middlesex, UK TW13 5DR Ph: 020 8890 0045, Mob: 00447947181950 Email: petecarlsons@gmail.com

Reg No: KERENG/2002/6803

Printed & Published by Jaison D on behalf of PeteCarlson Solutions Pvt. Ltd. at Cochin. Printed at Rathna Offset Printers, Chennai-14. All Rights Reserved by PeteCarlson Solutions Pvt. Ltd. No part of this publication may be reproduced by any means, including electronic, without the prior written permission of the publisher.

As articulated well by Prime Minister Narendra Modi, India has a stated goal of achieving developed nation status (Viksit Bharat) by 2047, the centenary of Indian Independence. While India is progressing well on the GDP front, a key area where India needs to improve is its Investment-to-GDP ratio.

This ratio is a key economic indicator that reflects the proportion of a country’s economic output (GDP) dedicated to investment. It’s calculated by dividing gross capital formation or total investments by GDP, and is expressed as a percentage. It helps assess a nation’s performance in investment, which is crucial to achieve developed nation status.

Let us delve more into this key ratio. The numerator here, Gross Capital Formation, encompasses all investments in fixed assets like machinery, buildings, and infrastructure and changes in inventories. While these terms are just accounting speak, what is essential here is knowing that it is an umbrella term for new investments.

In 2023, India’s gross capital formation or total new investments amounted to a massive $1.11 trillion. But how did our competitors

fare? We outpaced Japan by a slim margin - they came in at $1.10 trillion in investments in 2023, and later, in 2025, we outperformed them in GDP too to emerge as the 4th largest GDP.

But when it comes to our other competitors, the story is quite different. The United States of America’s gross capital formation or total investments in 2023 was $5.47 trillion, nearly 5 times that of India! This leadership in investments through most decades after WW2 is what made the USA the world’s economic leader with a GDP over $30 trillion.

But don’t expect the USA to remain a leader, as its archrival in economic leadership, the People’s Republic of China, has been growing on the investment front at a faster pace. In 2023, China’s total investments stood at $7.5 trillion, nearly 7 times that of India, and 37% higher than the US. In GDP too, China is closing the gap with over $19 trillion now.

So, it is clear that India needs to invest at a higher quantum if it has to keep pace with these nations and emerge as a developed country. Mind you, even China is yet to acquire the developed nation status, as its massive rural areas still witness much economic hardship. Xi Jinping is also fine with the ‘developing’ tag as it brings many benefits.

China’s leadership in investments is not an absolute figure alone. Even when it comes to the crucial investment-to-GDP ratio, the Asian giant has outpaced all, with its 41.1% against America’s 20.7%. While India fared better than the US, clocking 31.3%, the World Bank has calculated that we need to rise above 40% of GDP by 2035.

But how can India garner more investments?

Economic policies matter a lot, as tax incentives, infrastructure spending, and regulations can encourage or discourage investment. Lower interest rates can incentivize borrowing and investment, while business confidence through a framework of optimism can drive businesses to invest more.

Easy availability of financing or credit is also critical, as access to capital plays a crucial role in investment decisions. In the modern age, equally important is embracing breakthrough technologies like AI,

biotechnology, and renewable energy, that can spur investments as businesses upgrade their equipment and processes.

Then comes the qualitative aspects, as investments alone can’t ensure quality or efficiency. For eg. Germany, which invested only $0.98 trillion in 2023 against India’s $1.11 trillion, still has a higher GDP. Also, innovation matters a lot, as is seen in Chinese firms like DeepSeek that took on ChatGPT, and BYD & Xiaomi Auto that took on Tesla.

We also need to focus on Per Capita Gross National Income (GNI), as against just Gross National Income. While India’s per capita income was $2,650 in 2024, China’s per capita was $13,660 which is over 5 times higher, which makes the World Bank classify them as an Upper Middle Income Economy, whereas India is a Lower Middle Income Economy.

When it comes to the United States of America, the contrast is even higher, as America’s per capita is a whopping $83,660, which is over 31 times higher than ours! This makes the World Bank classify the USA as a High Income Economy, an elite group of 62 nations.

However, the situation is not as dire as it seems. When viewed through the lens of purchasing power parity (PPP), China’s per capita is only 2.5 times higher than ours and the USA’s is only a little over 8 times higher. What this reveals is also the need to tame inflation as well as income inequalities that drive it in part.

In any case, India first has to break into the mid-tier segment of Upper Middle Income Economies, led by China - which alone has 54 nations - before it can aspire along with China to become a High Income Economy and a developed nation. It is possible, as many of these 54 nations are either smaller nations or plagued by wars and challenges.

India has unique advantages playing for it, like its vibrant democracy, strong political leadership, youthful demographics, vast and untapped resources, and a value system that has provided current CEOs for global giants including Microsoft, Google, IBM, Adobe, Palo Alto Networks, Chanel & World Bank.

John Antony

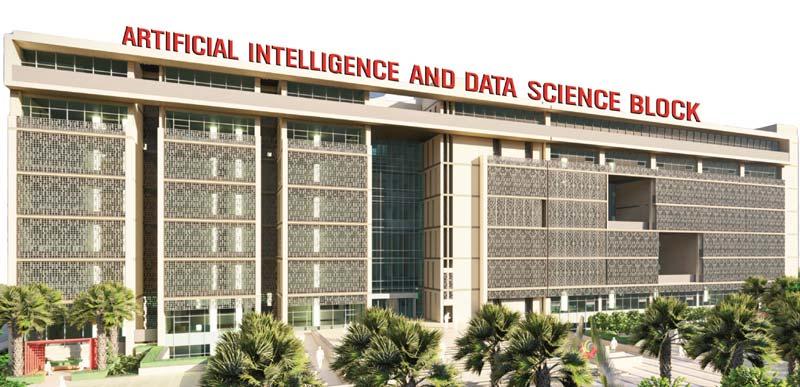

In the vibrant heart of Hyderabad stands the ICFAI Foundation for Higher Education (IFHE), a deemed-tobe-university that is redefining the contours of modern higher education in India. Recognized by the University Grants Commission (UGC) as a Category-I institution and accredited with an A++ grade by NAAC, IFHE has emerged as a powerhouse of innovation, academic excellence, and..

For employers, upskilling and certifications are valuable indicators of a candidate’s job readiness. They now increasingly evaluate professionals on these as part of their broader hiring matrix apart from formal degrees.

WHY CHECKING EXPENSE RATIOS BEFORE CHOOSING A MUTUAL

Experts caution that this fees can have a significant impact on longterm returns, especially when compounded over decades.

WHY PROJECTS ON LESS RESOURCES IS MORE LIKELY TO SUCCEED REMARKABLY

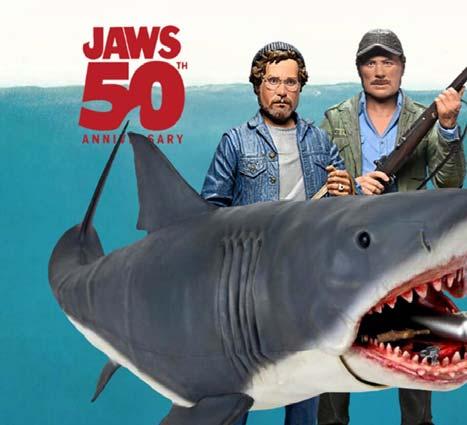

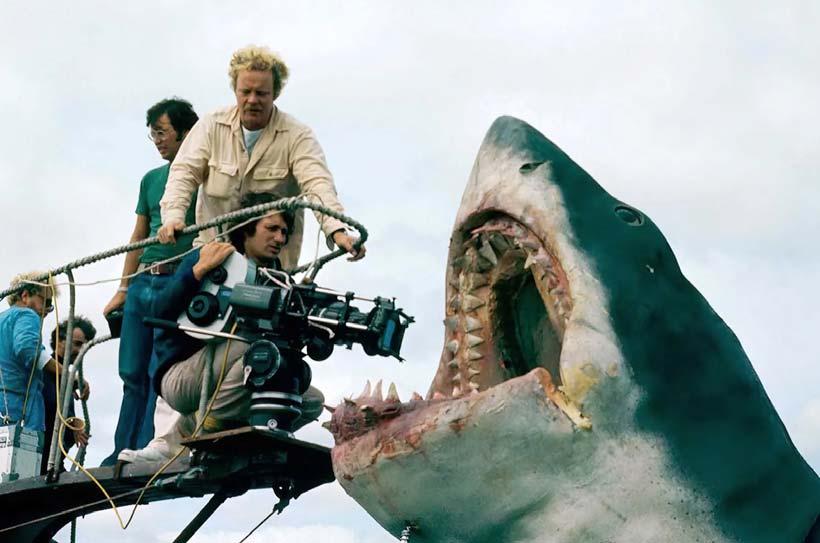

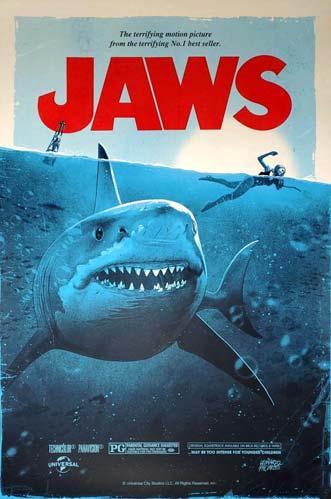

Can what you don’t have actually be your competitive advantage? Yes, only if you let it, proved Hollywood ace Steven Spielberg 50 years back in filming ‘Jaws’, one of the first movies to collect over 1 billion in ticket sales. Here is that fascinating, almost unbelievable

As AI systems expand their already impressive capacities, there is an increasingly common belief that the field of computer science (CS) will soon be a thing of the past. This is being communicated to today’s prospective students in the form of well-meaning advice, but much of it amounts to little more than hearsay from individuals who, despite their intelligence, speak outside of their expertise.

5 PHRASES FOR SUPERB EMOTION CONTROL

Emotionally Intelligent People

Use 5 Short Phrases to Control Their Emotions and Strengthen Their Relationships, says Justin Bariso, author of noted book,

EMOTIONALLY INTELLIGENT PEOPLE USE 5 SHORT PHRASES TO CONTROL THEIR EMOTIONS AND STRENGTHEN THEIR RELATIONSHIPS, SAYS JUSTIN BARISO, AUTHOR OF NOTED BOOK, EQ APPLIED. USE THESE FIVE PHRASES TO RESTORE BALANCE TO YOUR EMOTIONS, SO YOU CAN THINK MORE CLEARLY.

How do I control my emotions? I get asked that question a lot. As an emotional intelligence coach, I’ve received thousands of emails from readers over the years who get caught up in a cycle of emotional thinking, which leads them to say or do things they later regret. Often, this results in harm to their closest relationships, professional and personal.

Here’s the thing: Emotions aren’t bad. They’re what make us human, and that’s a good thing. The key isn’t taking emotions out of the equation. Rather, you want to balance emotions and rational thinking, so you can look back and be proud of what you’ve said or done.

To help with this, I recommend using simple self-talk expressions. These can help shake you from that vicious cycle of overly emotional thinking and restore balance. Here are five short phrases that will help you develop your emotional intelligence, the ability to understand and manage emotions effectively.

When you face an emotionally charged situation, it’s easy for emotions to cloud your judgment and cause you to say or do something you later regret. But when you ask yourself, “What advice would I give someone else in this situation?” you take yourself out of the hot seat. You think more clearly, with more balance. To help you use this framework effectively, try to imagine yourself a few years down the road. Whether you faced the challenge successfully or not doesn’t matter; it’s past you. Now, imagine how you handled it and what consequences it led to. This will help

you stimulate your thinking and answer the question more effectively.

Everyone makes mistakes. But when you view mistakes not as failures but as part of the process of learning, you manage expectations and help others to benefit from them. When you train others, this framework can help you prepare for mistakes. For example, you might allocate more time or resources, because you know mistakes are coming. It’ll also help you be more patient with those you are training, which helps build trust and psychological safety.

Additionally, reminding yourself that mistakes are part of the process helps you and the people you train to see the bigger picture. You both see mistakes as learning opportunities, and leverage them as such.

This expression is usually attributed to Mahatma Gandhi, who said ‘Be the change you want to see.’ The basic lesson goes like this: You can’t force someone else to change. But you can provide a model for them to learn from. This is effective because researchers

have shown that people learn not so much through reinforcement (rewards and punishments), but much more through observing others.

When you remind yourself to be the change, not only do you set a positive example, you focus on what you can control (your own behavior) instead of getting frustrated by what you have no control over (the actions of others). At the same time, though, you increase the chances that those around you will change over time, too.

As a business owner with four kids, I’ve found that by prioritizing experiences over things you can learn more, remember more, and get more out of life. To be clear, “things” aren’t bad in themselves. The problem is the more stuff you have, the more stuff you want. (I like to call this “more disease.”) This sends you down a cycle of always wanting more, and that’s a recipe for unhappiness because you’re never satisfied.

In contrast, experiences become a part of you. You create memories that change what you think about, how you act, the decisions you make. When an experience is over, its effects continue— they mold who you are as a person. You can use that three-word motto to reframe your view of work. It’s not just to provide things; it’s to provide time for more experiences. But you also have to use that time, because once it’s gone, it’s gone forever. So, don’t buy more stuff. Do more stuff.

I hate to admit it, but I tend to be passiveaggressive. Maybe you struggle with the same habit, or you know someone who does. You know, someone who says they’re OK when they clearly aren’t. Or, they pout or give the silent treatment when they don’t get their way. Or, they simply agree to a decision but then don’t do their part to make that decision a success.

There’s a reason people like me start heading down that passive-aggressive path. Usually, I’m trying to cope with negative feelings like frustration or disappointment. This phrase reminds me that my behavior isn’t helping the situation; worse yet, it’s harming my relationship. Here’s where this short phrase can be extremely helpful: Attack the problem. Not the person. This phrase helps me focus on being more active—attacking the problem—by telling the person why I feel the way I do. What’s more, I can now work with them to find a solution to the problem. Or, at least I feel better at supporting the decision we’ve agreed upon because I’ve had the chance to fully express my feelings. So, the next time you find yourself becoming a victim of your own emotions, remember the following phrases: 1) What advice would you give? 2) Mistakes are part of the process. 3) Be the change. 4) Experiences over things. 5) Attack the problem. Not the person. Do so, and you’ll bring your emotions back to balance. You’ll make better decisions. And you’ll reduce regrets as you make emotions work for you, instead of against you.

(Credit: Inc.)

WHAT IT TAKES FOR CREATIVE PROBLEM SOLVING? JUST 20 MINUTE NAPS!

UNIVERSITY OF HAMBURG RESEARCHERS FOUND THAT A 20MINUTE NAP WITH DEEP N2 SLEEP BOOSTS CHANCES OF CREATIVE BREAKTHROUGHS AND INCREASES THE LIKELIHOOD OF EXPERIENCING A TRUE ‘EUREKA MOMENT.’

Arecent study published in the journal PLOS Biology revealed that taking a short 20-minute nap, especially reaching the deeper N2 sleep stage, can enhance creativity and problem-solving abilities. Researchers at the University of Hamburg conducted experiments showing that such naps increased the likelihood of experiencing a ‘eureka moment’, offering scientific backing to the old adage of “sleeping on it.”

The study was conducted by Anika Löwe, Marit Petzka, Maria Tzegka, and Nicolas Schuck from the University of Hamburg, Germany. They designed an experiment involving volunteers aged 18 to 35. The participants were asked to

perform a visual task that required tracking a series of dots moving across a screen and responding by pressing a keyboard. Unbeknownst to them, there was a hidden trick involving the color of the dots that could make the task easier.

After four rounds of trials, some participants were instructed to take a 20-minute nap while their brain activity was monitored using an electroencephalogram (EEG). Participants were also told to sleep about 30 percent less than usual the night before and were prohibited from consuming caffeine on the day of the test to ensure they could fall asleep more easily during the experiment.

As AI systems expand their already impressive capacities, there is an increasingly common belief that the field of computer science (CS) will soon be a thing of the past. This is being communicated to today’s prospective students in the form of well-meaning advice, but much of it amounts to little more than hearsay from individuals who, despite their intelligence, speak outside of their expertise.

High-profile figures like Nobel Prize-winning economist Christopher Pissarides have made this argument, and as a result it has taken root on a much more mundane level – I have even personally heard high school careers advisers dismiss the idea of studying CS outright, despite having no knowledge of the field itself.

These claims typically share two common flaws. First among them is that the advice comes from people who are not computer scientists. Secondly, there is a widespread misunderstanding of what computer science actually involves.

It is not wrong to say that AI can write computer code from prompts, just as it can generate poems, recipes and cover letters. It can boost productivity and speed up workflow, but none of this eliminates the value of human input.

Writing code is not synonymous with CS. One can learn to write code without ever attending a single university class, but a CS degree goes far beyond this one skill. It involves, among many other things, engineering complex systems, designing infrastructure and future programming languages, ensuring cybersecurity and verifying systems for correctness.

AI cannot reliably do these tasks, nor will it be able to in the foreseeable future. Human input remains essential, but pessimistic misinformation risks steering tens of thousands of talented students away from important, meaningful careers in this vital field.

AI excels at making predictions. Generative AI enhances this by adding a user-friendly presentation layer to

internet content – it rewrites, summarises and formats information into something that resembles a human’s work.

However, current AI does not genuinely “think”. Instead, it relies on logical shortcuts, known as heuristics, that sacrifice precision for speed. This means that, despite speaking like a person, it cannot reason, feel, care, or desire anything. It does not work in the same way as a human mind.

Not long ago it seemed that ‘prompt engineering’ would replace CS. Today, however, there are virtually no job postings for prompt engineers, while companies like LinkedIn report that the responsibilities of CS professionals have

actually expanded.

What AI provides is more powerful tools for CS professionals to do their jobs. This means they can now take concepts further – from ideation to market deployment – while requiring fewer support roles and more technical leadership.

There are, however, many areas where specialised human input is still essential, whether for trust, oversight or the need for human creativity. Examples abound, but there are 10 areas that stand out in particular:

1) Adapting a hedge fund algorithm to new economic conditions. This requires algorithmic design and deep

understanding of markets, not just reams of code.

2) Diagnosing intermittent cloud service outages from providers like Google or Microsoft. AI can troubleshoot on a small scale, but it cannot contextualise large-scale, high-stakes troubleshooting.

3) Rewriting code for quantum computers. AI cannot do this without extensive examples of successful implementations (which do not currently exist).

4) Designing and securing a new cloud operating system. This involves high-

level system architecture and rigorous testing that AI cannot perform.

5) Creating energy-efficient AI systems. AI cannot spontaneously invent lower power GPU code, or reinvent its own architecture.

6) Building secure, hacker-proof, realtime control software for nuclear power plants. This requires embedded systems expertise to be mixed with the translation of code and system design.

7) Verifying that a surgical robot’s software works under unpredictable conditions. Safety-critical validation exceeds AI’s current scope.

8) Designing systems to authenticate email sources and ensure integrity. This

is a cryptographic and multidisciplinary challenge.

9) Auditing and improving AI-driven cancer prediction tools. This requires human oversight and continuous system validation.

10) Building the next generation of safe and controllable AI. Evolving towards safer AI cannot be done by AI itself –this is a human responsibility.

One thing is certain: AI will reshape how engineering and Computer Science is done. But what we are faced with is a shift in working methods, not a wholesale destruction of the field.

Whenever we face an entirely new problem or complexity, AI alone will not suffice for one simple reason: it depends entirely on past data.

Maintaining AI, building new platforms, and developing fields like trustworthy AI and AI governance therefore all require CS.

The only scenario in which we might not need CS is if we reach a point where we no longer expect any new languages, systems, tools, or future challenges. This is vanishingly unlikely.

Some argue that AI may eventually perform all of these tasks. It’s not impossible, but even if AI became this advanced, it would place almost all professions at equal risk. One of the few exceptions would be those who build, control, and advance AI.

There is a historical precedent to this: during the industrial revolution, factory workers were displaced at a 50 to 1 ratio as a result of rapid advances in machinery and technology. In that case, the workforce actually grew with a new economy, but most of the new workers were those who could operate or fix machines, develop new machines, or design new factories and processes around machinery.

During this period of massive upheaval, technical skills were actually the most in-demand, not the least. Today, the parallel holds true: technical expertise, especially in CS, is more valuable than it ever has been.

Let’s not confuse the next generation with the opposite message.

(Credit: By Ikhlaq

Sidhu,

Decano de IE School of Science and Technology, IE University)

How well did you sleep last night? The answer could determine whether the darker side of your personality comes out at work the next day, researchers say. A team from Vrije University Belgium asked working adults in Belgium and Argentina to complete a pair of surveys each day over a 10-day period – in the morning to gauge sleep quality and duration the night before, and in the late afternoon to rate how they felt throughout the day.

The afternoon survey helped gauged the participants’ levels of ‘the dark triad states’ - narcissism or desiring excessive admiration, Machiavellianism or using others for personal gain, and psychopathy or lack of remorse.

Findings show negative associations between sleep quality and quantity and each of the dark triad states. The researchers say that the results suggest sleep-deficient employees are more prone to exhibit these dark traits.

The traits can fluctuate in day-to-day work life, and recognizing the factors that bring them about could help prevent them from developing into more persistent behavior patterns, said lead study author Evy Kuijpers, a postdoctoral researcher at Vrije. Kuijpers and her fellow researchers recommend that corporate companies promote healthy sleep habits and foster a positive work culture.

The study was published in the Journal of Organizational Behavior.

FOR EMPLOYERS, UPSKILLING AND CERTIFICATIONS ARE VALUABLE INDICATORS OF A CANDIDATE’S JOB READINESS. THEY NOW INCREASINGLY EVALUATE PROFESSIONALS ON THESE AS PART OF THEIR BROADER HIRING MATRIX APART FROM FORMAL DEGREES.

n India’s evolving job market, a quiet but clear transformation is underway—a college degree alone may no longer be the golden ticket to a job as employers increasingly seek job-ready talent who showcase skills and certifications.

Recent studies suggest that 80 percent of employers prioritise practical skills over formal degrees when hiring, while at least 30 percent of Indian companies have shifted to skills-based hiring, above the global average of 19 percent, according to Shantanu Rooj, founder and chief executive officer of TeamLease Edtech, an employability solutions provider.

Professionals, too, have realised that keeping pace with industry demands will now require more than just academic excellence and experience.

A survey by TeamLease Edtech in June reveals that 84 percent of Indian employees took up upskilling courses in the past year. Additionally, 64 percent reported that learning initiatives had a positive impact on appraisals, and 42 percent saw a promotion, enhanced roles and salary hikes within 18 months.

Organisations across sectors are facing a significant talent crunch—not just in technical domains but also in essential soft skills. According to a September 2024 study by TeamLease Degree Apprenticeship, the skills gap in India is projected to reach over 47 million by FY27.

The electronics sector alone faces a 10 million-talent gap, while the semiconductor industry projects a shortfall of nearly 300,000 professionals by 2027, informs Nipun Sharma, chief executive officer of TeamLease Degree Apprenticeship.

While industries such as electronics manufacturing, semiconductors,

automotive and health care are leading the demand for practical, job-ready talent, clients across pharma, BFSI and capital-intensive industries are also now hiring for demonstrated capabilities rather than degrees, says Sharma. There is especially high demand for expertise in emerging technologies such as artificial intelligence (AI), machine learning (ML), data science and cybersecurity, as qualified professionals in these areas are in short supply, says Sonal Arora, country manager at GI Group Holding, a global HR solutions company.

“Given the limited availability of talent, many organisations are showing greater flexibility,” says Arora. “They are more willing to consider candidates with nontraditional educational backgrounds, or allied industry experience provided they demonstrate the required capabilities and potential.”

While this trend is especially noticeable in roles requiring technical or quasitechnical expertise—particularly in sectors like technology and

engineering—experts say organisations are also exploring this approach for functional areas such as human resources, marketing and supply chain.

“The bottom line is that market demands evolve faster than traditional curriculum can adapt,” says Ankit Agarwala, managing director of recruitment services company PageGroup India.

“With exceptions in FMCG, financial services and consulting industries, we’ve observed that Tier I college credentials are no longer considered essential for most roles.”

Talent solutions company NLB Services is also seeing a growing openness among clients in fintech and digital-first enterprises to hire candidates from nontraditional or non-degree backgrounds, provided they can demonstrate strong functional skills, says Sachin Alug, chief executive officer.

What’s changed is the weightage— hands-on capabilities, certifications and real-world problem-solving are now being valued over academic pedigree, he adds. “Clients are increasingly asking

us to build talent pipelines through boot camps and certification-led sourcing models, which reflects a deeper shift toward outcome-driven hiring rather than resume-driven screening,” Alug says.

At Plum Benefits, a B2B startup in the health insurance and employee benefits space, it has always been about finding the right person for the role, regardless of background, says Priya Sunil, vice president-people success, Plum Benefits.

“Our founders don’t come from an insurance background, and some of our earliest and most successful salespeople come from fields like software as a service (SaaS), fintech and others, with most of the technical expertise learnt on the job,” says Sunil. “We typically look for attitude and proficiency in a candidate.” Some of these would include identifying and solving a core problem proactively, showing the capabilities to lead the function in the future, and the ability to thrive in ambiguity.

At IT company Happiest Minds Technologies, while the skills-first approach to hiring has been in practice since its inception, there has been a steady increase in candidates presenting industry-recognised certifications. “We see this as a welcome trend because certifications often reflect a strong commitment to continuous learning and staying aligned with evolving industry standards,” says Sachin Khurana, chief people officer.

“While we view certifications as a valuable part of a candidate’s profile, our hiring framework is anchored in strong skill-assessment criteria. What matters most is the ability to demonstrate relevant skills aligned with the role,” he adds.

M Lakshmanan, chief human resources officer at L&T Technology Services (LTTS), says at the engineering research and development organisation, they have not moved away from degrees, but beyond them. “Degrees are foundational, but skills are transformational,” he says.

Given the nature of the company, he explains that they continue to hire

qualified core engineers because deep domain knowledge, systems understanding, and academic rigour are essential to the work they do.

But, today, the nature of engineering itself has evolved and innovation lives at the intersection of core engineering and digital technologies like AI/ML, cloud, Internet of Things and cybersecurity.

“That’s where a skills-first mindset becomes critical. What differentiates talent at LTTS is not just their degree, but how effectively they adapt, specialise and apply their learning to solve realworld problems,” he says.

Like LTTS, consumer goods company Zydus Wellness also follows a contextual approach shaped by the role’s requirements, but a skills-first approach is a priority. “What has shifted is the weightage of the degree in our decision-making process. It is no longer a gatekeeper but one of several indicators,” says Tarun Arora, chief executive officer and whole-time director.

He adds, “The shift was less about moving away from degrees and more about realigning with the pace of change. In an environment where consumer habits shift rapidly, digital disruption is constant and innovation cycles are shorter, traditional degrees no longer guarantee role-readiness.”

Upskilling platform upGrad has seen 1.6 lakh learners globally in the past year enrolled in its partner-led certifications

and boot camps with India leading in the learner volume compared to the US, Canada, the UK and others. For its twomonth-old U&AI certification course launched in partnership with Microsoft and the National Skill Development Corporation, the platform has recorded 35,000-plus sign-ups so far.

“Learners are increasingly opting for modular, high-impact certifications that deliver real-world outcomes,” says Anuj Vishwakarma, chief operating officer, upGrad. Contrary to popular belief, Vishwakarma says the user base comprises not just freshers, but also early and mid-career professionals, along with leadership talent. This is because, “there’s a growing urgency to stay relevant, switch roles or lead in digitalfirst environments,” he explains.

The platform is also registering a strong intent from global enterprises and global capability centres in India which are partnering with them to power largescale skilling internally. “AI today is a transformation enabler, and the skilling conversation has also evolved. It’s no longer about if employees need to upskill, but how fast they can do it and how contextual is upskilling to their roles,” he adds.

Arati Porwal, senior country head at CFA Institute, says India is the largest market for the chartered financial analyst certificate globally, reflecting strong demand for skilled finance professionals.

“We have seen several companies in

India supporting their employees in gaining the CFA Charter, with additional time off to prepare, reimbursing or paying for their course/learning fee,” Porwal says. “Through our work, we have observed several employers prioritising qualifications such as the CFA Charter among fresh graduates and even using qualifications as filtration mechanisms while hiring.”

According to TeamLease’s Sharma’s experience and observation, skills-first hires—particularly those who’ve undergone structured apprenticeships— often outperform traditional degreeholders on key metrics like retention, productivity and job adaptability.

For Khurana of Happiest Minds, a skillsbased approach has resulted in visible and tangible results. He says that especially in areas such as UI/UX design and creative technology, several hires made purely on the strength of their portfolios and applied skills, without conventional academic degrees, have demonstrated a high degree of innovation, user-centric thinking, and delivery excellence.

Additionally, on an organisational level, he feels, this approach opens up the talent pool by creating equitable access. However, while the shift towards a skillsfirst approach is gaining ground, companies are still grappling with key challenges in its implementation.

Sharma of TeamLease says many of these obstacles are rooted in systemic gaps in India’s education and skilling ecosystem. “While the government’s recent Rs 60,000 crore investment to upgrade Industrial Training Institutes is commendable, foundational issues persist. Only 4 percent of the workforce has received formal vocational training, and a majority of skilling still occurs informally, without standardised outcomes or assessments,” says Sharma.

Another challenge is validating these skills because unlike degrees, which offer a standardised credential, skills must be assessed through more complex and customised methods— such as simulations, practical tests or work portfolios. “Many employers lack the tools and frameworks to do this at scale,” Sharma says.

And cultural biases remain. “Degrees continue to be perceived as proxies for intelligence and employability, especially in legacy sectors and senior roles,” he adds. Agrees Lakshmanan of LTTS. “Implementing this model has not been without challenges. It required cultural shifts, robust frameworks for assessing skill proficiency and recalibrating expectations across our global delivery units.”

The head of sales at job search portal Indeed, Sashi Kumar, has observed the same. He says many organisations report that leadership teams require convincing, and hiring managers often need guidance on how to define and assess competencies without a degree proxy. Some leaders also worry about inconsistency in evaluation criteria, which can slow early recruiting cycles. “However, these challenges tend to ease as standardised assessments and training frameworks take hold, and as confidence grows in non-degree benchmarks of candidate quality,” Kumar says. For this approach to succeed, companies need to ensure that the right rubrics and processes are in place, reckons Sunil of Plum Benefits.

This means robust training of hiring managers, clear documentation on what the ideal candidate looks like, objective parameters and

documentation during the interview process, she says. That said, while universal adoption will take time, for operational, technical and mid-level roles, Sharma of TeamLease foresees skills-first hiring becoming the default model by 2027.

Arora of GI Group also says skills-first hiring is here to stay. “Staying current with emerging technologies, evolving skill sets, and industry best practices is now essential—not optional. Even candidates with traditional degrees will increasingly need to invest in continuous upskilling and certifications to remain relevant.”

For candidates, new and existing, adaptability is the most critical asset they can bring to the table, says Vishwakarma of upGrad. Individuals entering the workforce today should pair their degree with an industry-aligned microcredential, advises Prashasti Rastogi, director at upskilling platform Coursera for Campus and Government, India. She explains, “Micro-credentials let you prove what you know, apply it fast, and stay in step with the future of work. It’s one of the most effective ways to stay relevant, stand out to employers, and build real momentum in a fast-changing job market. That’s your edge.”

(Credit: Anubhuti Matta for Forbes India)

EXPERTS CAUTION THAT THIS FEES CAN HAVE A SIGNIFICANT IMPACT ON LONG-TERM RETURNS, ESPECIALLY WHEN COMPOUNDED OVER DECADES.

magine two friends, Ramesh and Neha, who each invested Rs 10,00,000 in mutual funds 20 years ago. Ramesh chose a fund with a 2 per cent expense ratio, while Neha opted for one with a 0.5 per cent ratio. Both funds delivered the same gross return of 10 per cent annually. Today, Neha’s portfolio is worth around ~62,00,000, about ~15,00,000 more than Ramesh’s. A huge difference, right. Actually, expense ratio fees nibbled into Ramesh’s wealth over the course of 20 years.

This quiet wealth killer is the expense ratio, the annual fee charged by mutual funds. For most mutual fund investors, expense ratios are an often-overlooked detail. But experts warn that these fees can have a significant impact on longterm returns, especially when compounded over decades.

“Expense ratios are the annual fees that mutual funds charge for managing your money. These may range from 0.2 per cent to around 2 per cent,” says Arjun Guha Thakurta, executive director at Anand Rathi Wealth. While passively managed index funds tend to have lower expense ratios (0.2 per cent-0.7 per cent), actively managed funds can go as high as 2 per cent.

“Over the long term, even a 1 per cent difference in costs can erode wealth substantially. If a fund consistently delivers returns above its benchmark, a higher expense ratio may be justified. Otherwise, that extra 1 per cent is simply a drag on your wealth,” Thakurta explains.

Navy Vijay Ramavat, managing director at Indira Group, agrees. “Expense ratios are deducted daily from fund assets, reducing NAV and lowering returns. For example, a fund generating 10 per cent returns before expenses with a 2 per cent expense ratio delivers only 8 per cent net returns. Over 20 years, that small difference could result in

~267000 less wealth per ~1000000 invested, a 43.6 per cent difference in final accumulation,” he notes.

Should investors prioritise low-cost index funds to minimise expenses? Not always, Thakurta says. “In a developing market like India, small and midcap companies offer significant growth potential. Here, active funds, despite higher costs, may justify their fees if they generate consistent alpha.”

Ramavat suggests a balanced approach. “For core portfolio allocations, low-cost index funds can provide broad market exposure at minimal cost. Active funds can be used selectively in niche segments where managers have a proven ability to outperform.”

As a rule of thumb, expense ratios below 1 per cent for equity funds and 0.5 per cent for debt funds are considered low in India. Ratios above 1.5 per cent for equity and hybrid funds or 0.75 per cent for debt funds are on the higher side, says Thakurta.

SEBI also prescribes upper limits based on fund type and size, providing a

regulatory framework to assess reasonableness.

“Switching from regular to direct plans can shave off 0.3 per cent to 0.7 per cent annually, adding up to meaningful savings over time,” Ramavat points out.

He also recommends using a coresatellite portfolio, combining low-cost index funds for the bulk of investments with carefully chosen active funds in specialised areas. “Regular monitoring is critical. If a fund’s expense ratio increases without an improvement in performance, consider switching,” Ramavat adds. However, he cautions against hasty exits. “For existing holdings, weigh tax implications before making a move.”

Expense ratios may look like a small percentage, but their impact on compounding is huge. By making informed choices and ensuring that every rupee paid in fees delivers value, investors can significantly boost longterm wealth creation.

(Credit: Amit Kumar for Business Standard)

CAN WHAT YOU DON’T HAVE ACTUALLY BE YOUR COMPETITIVE ADVANTAGE? YES, ONLY IF YOU LET IT, PROVED HOLLYWOOD ACE STEVEN SPIELBERG 50 YEARS BACK IN FILMING ‘JAWS’, ONE OF THE FIRST MOVIES TO COLLECT OVER 1 BILLION IN TICKET SALES. HERE IS THAT FASCINATING, ALMOST UNBELIEVABLE YET SCIENCE-BACKED STORY, FOR ALL WHO ARE PLANNING THEIR STARTUPS.

ecently, it was the 50th anniversary of Jaws, the first movie to generate over $100 million in theatrical rentals on its way to grossing an inflation-adjusted $1.5 billion in ticket sales alone. The film won three Academy Awards, and created the new business model of heavily marketed, widely released summer blockbusters. And it scared the crap out of 15-year-old me.

But its success, especially during filming, was hardly a forgone conclusion. Director Steven Spielberg started the film without a finished script or a working shark. He decided to film on the ocean rather than on a giant back lot tank, something that (for good reason) had never been done before. He didn’t get the actors he originally wanted. He didn’t film the story he originally envisioned. Once production started, few things went as planned.

Which may have been the best thing that could have happened. Few entrepreneurs wind up creating the products and services, much less the businesses, they originally envision. No matter how thoroughly you research, analyze, roadmap, and plan, it’s impossible to predict every possible outcome.

Planning is important, but your ability to work through challenges and adapt to changing conditions and needs often makes the difference between success and failure. Constraints can fuel creativity and innovation, and build forward momentum by eliminating the temptation to sift through seemingly infinite possibilities.

Spielberg’s ability to adapt to and make the best of a seemingly endless series of challenges, roadblocks, and constraints?

That’s what made Jaws the film it became. Here are some examples as described in the documentary The Making of Jaws:

Spielberg wanted to direct the film Lucky Lady instead of Jaws. Studio head (and Spielberg’s mentor) Sid Sheinberg “ordered” him to make Jaws instead. According to Sheinberg, Spielberg’s attitude for a while was, “You’re my friend. How can you make me do this fish picture?” But he kept his head down and did the work.

Spielberg’s decision to film on the Atlantic Ocean haunted the film’s production. Logistical difficulties, equipment problems, and weather delays resulted in the film’s taking more than twice as long to make as planned and costing three to four times what was in the original budget.

But the result was worth it: As Spielberg said, “Lake water, pond water, tank water … [don’t] have the same texture or violence that the ocean has. This needed to be a convincing story about a great white shark, because if it wasn’t,

no one would believe it.”

The shark was the star of the film. In the original storyboards, the shark plays a prominent visual role during the attack on the female swimmer in the opening scene. But the mechanical shark rarely worked, causing Spielberg to invent creative ways to “suggest” the shark rather than show it: character (and shark) points of view, partly submerged horizon lines, hurtling barrels, moving docks, etc. (In fact, the shark doesn’t appear onscreen until two-thirds of the way through the film.)

What seemed like a constraint actually helped the audience make a genuine emotional connection. Experiencing the shark through the eyes and emotions of the film’s characters caused viewers to put themselves in the same situation. The unknown is often scarier than the known; we’ve all been in the ocean and considered what might lurk below. As Spielberg said, “It’s what we don’t see that’s truly frightening.”

Spielberg wanted Lee Marvin to play Quint. Marvin turned him down. He turned to Sterling Hayden. Hayden turned him down. Actor after actor passed. Finally, he settled on Robert Shaw. But Shaw’s casting was problematic. The first time Spielberg tried to film the Indianapolis scene, Shaw was too drunk to perform well. He called Spielberg that night and asked, “How badly did I humiliate myself?”

Spielberg answered, “Not fatally.” The next day he tried again and, as Spielberg said, he “knocked it out of the ballpark.”

When an employee makes a mistake, it’s easy to forever view them through the lens of that mistake. Or decide to not give them another chance. Fortunately, Spielberg did neither, and that scene creates the emotional connection between characters—and provides the “why?” for Quint’s character—that gives the movie its heart.

The producers wanted real shark footage in the movie, so Spielberg hired Ron and Valerie Taylor to shoot footage of sharks off the coast of Australia. They built an undersize shark cage and used a 4’11" actor to play Hooper to make a 14-foot shark seem like a 25-foot shark. At one point, a shark got tangled in wires atop the cage, thrashing and rolling violently. But the actor playing Hooper — who was supposed to be killed by the shark — wasn’t in the cage.

So Spielberg changed the script: Hooper escapes the cage, swims to the bottom, and reappears after Chief Brody kills the shark. Even though not part of the plan, Spielberg was smart enough to embrace a happy accident.

Even after production was finished, Spielberg kept tweaking. He decided he wanted a scene where Ben Gardner’s head floats into the hole in the boat. Since the film was already well over

budget, the studio wouldn’t give him extra funds, so Spielberg used $3,000 of his own money to build the hull of a boat and a special effects head and fill a swimming pool with milk to make the water seem murky. The result? One more scream.

One more example. Since Spielberg and screenwriter Carl Gottlieb spent each evening of the film’s production working on pages for what they would film the next day, the process was more collaborative than autocratic. As Gottlieb said, “You could talk with the actors about what they were going to say and they could supply suggestions, because actors study (and know) their characters more than anyone.”

Who knows a job better than anyone?

The person who actually does that job. Spielberg’s willingness to let his “employees” have a say in how their jobs were done added immeasurably to the end result: Chief Brody’s iconic “You’re gonna need a bigger boat” wasn’t in the script, but was was adlibbed by actor Roy Scheider.

As Harvard Business School professor Howard Stevenson once said, “Entrepreneurship is the pursuit of opportunity without regard to resources currently controlled.” You may not have the “perfect” plan. Perfect employees. Sufficient funding. Extensive resources. But what you do have is yourself, and

your willingness to work hard, embrace challenges, overcome roadblocks, and keep pushing toward your goal—no matter what happens along the way. In a 2017 study published in Academy of Management Journal, researchers asked employees to rate their willingness to embrace contradictions. They were then asked to rate how often they experienced resource constraints: limited time, limited funds, limited resources, limited supplies, etc.

Meanwhile, their bosses rated each employee in terms of overall performance, creativity, and innovation. What happened? Employees who ranked on the low end of what researchers called “the paradox mindset” scale (meaning they disliked contradictions, much less embracing them) struggled with constraints: Their performance dropped whenever they felt resources were insufficient.

On the flip side, employees who found it challenging and even fun to overcome constraints were the better performers, especially when creativity and problemsolving were required. And here’s the kicker: The presence of constraints often caused the performance of those employees to improve.

Yep: Constraints made them better, not worse. The same is often true for startups. Nearly every successful founder I’ve spoken to is grateful for the lean days, the bootstrapped, scrappy, thankful-foranything-that-came-their-way days.

They didn’t have money to throw at problems. They didn’t have time to wait for the perfect solution. They didn’t enjoy the luxury of lingering over every decision. Instead, they had to be creative. They had to innovate. They had to make choices, and move on.

Looking back, they all say those constraints built the foundation for later success. Embracing constraints - like limited resources, opposing demands, or seeming contradictions - could help you look at old problems in entirely new ways.

Embracing constraints could help you find solutions just waiting to be discovered. Who knows: maybe even your own entrepreneurial version of Jaws.

(Credit: Jeff Haden for Inc.)

SEASONAL MAGAZINE

A FEW SMALL ACTIONS, GROUNDED IN THE BIOLOGY OF BEHAVIOR, CAN SHIFT NOT ONLY HOW YOU FEEL IN STRESSFUL SITUATIONS, BUT HOW OTHERS RESPOND TO YOU.

n high-stakes meetings or chaotic team moments, the person who stays grounded often becomes the one others follow. And this outcome isn’t about status or rank - it’s biological. Human groups are wired to seek cues of stability. In uncertain situations, people scan for behavioral signals of calm, control, and composure. Those who project these signals can influence group dynamics in powerful ways, whether or not they hold formal authority.

In my work on Leadership Biodynamics, a biology-based approach to executive

presence, I train leaders to tune their behavioral signals intentionally. The goal is not to fake confidence, but to engage practices that create real calm in the body and broadcast it to others. This is rooted in the biology of behavior. When your nervous system signals stability, others’ systems start to regulate in response. Here are three tiny behaviors that can make you the calmest person in the room.

One of the fastest ways to regulate your nervous system is through your breath. Specifically, focus on extending the exhale. A longer out-breath activates the parasympathetic nervous system, signaling to your body and brain that you are safe and in control.

In stressful moments, most people unconsciously shorten their breath, which heightens physiological arousal. By contrast, slowing your exhale lowers heart rate variability and helps maintain executive function under pressure.

Neuroscience research supports this. Controlled breathing patterns are shown to downregulate the amygdala, the brain’s threat detection center, and improve prefrontal cortex performance. In leadership terms, this allows you to think clearly and signal calm even when tension is high.

Facial expressions are among the most contagious signals in any room. Subtle cues of tension—tightened jaw, furrowed brow, compressed lips—trigger

mirror neuron responses in others, escalating stress contagion.

One of the simplest yet most powerful techniques is to practice what I call a neutral face. Relax your facial muscles, release tension from the jaw and brow, and let your gaze soften. This sends nonthreatening signals that calm others’ nervous systems.

A recent story on how fighter pilots maintain calm in high-stakes situations echoes this principle. Pilots are trained to maintain neutral, composed facial expressions because they know crew members will mirror their affect. The same applies in leadership settings.

Movement is another powerful signal. Rapid, jittery gestures broadcast anxiety. Deliberate stillness, on the other hand, projects control. In tense meetings, practice purposeful stillness. Rest your hands lightly on the table, slow your gestures, and allow silences to stand without rushing to fill them. This creates a grounding presence that helps regulate group energy.

Behavioral research confirms that leaders who demonstrate controlled stillness are perceived as more composed, credible, and trustworthy. The effect is amplified when combined with calm vocal tone and centered body posture.

These behaviors may seem small, but their effects are anything but. In group settings, emotional states are highly contagious. The person who maintains composure can anchor the emotional tone of the entire room.

This is especially critical in hybrid and remote environments, where subtle behavioral cues carry more weight. In my work with global leadership teams, I often see that those who can project calm consistently gain disproportionate influence, not through dominance but through stabilizing presence.

In Biohacking Leadership, my book of science-based techniques for better leadership, I emphasize that influence

is not about charisma alone. It is about biological signaling. When your own system is grounded, you help others selfregulate. That is what builds trust and followership in high-stakes moments.

The bottom line is this: if you want to become the calmest person in the room, start with these three behaviors. Slow your exhale. Relax your face. Use stillness strategically. These tiny actions, grounded in the biology of behavior, can shift not only how you feel, but how others respond to you. And in leadership, that is the signal that often matters most.

(By

Scott Hutcheson for Fast Company. Scott is a PhD holder and a Senior Lecturer at Purdue University specializing in technology and engineering leadership, and the co-founder of Hutcheson Associates, a consulting and corporate training firm helping leaders across industries build high-performing teams and resilient organizations through science-based insights and practice-proven tools.)

Scientists have unearthed in Arizona fossils from an assemblage of animals, including North America's oldest-known flying reptile, that reveal a time of transition when venerable lineages that were destined soon to vanish lived alongside newcomers early in the age of dinosaurs. The remains of the pterosaur, roughly the size of a small seagull, and the other creatures were discovered in Petrified Forest National Park, a place famous for producing fossils of plants and animals from the Triassic Period including huge tree trunks. The newly found fossils are 209 million years old and include at least 16 vertebrate species, seven of them previously unknown.

It's another morning in Delhi, and millions of people wake up to check the air quality index on their phones before deciding whether their children should play outside. The numbers are grim, again. In a city where breathing clean air feels like a luxury, officials are now turning to something that sounds almost like science fiction: making rain from scratch. Delhi is about to try something it's never done before—create artificial rain to wash the pollution out of its skies. The plan was supposed to kick off between July 4 and July 11 but with the monsoon already active, scientists had to push the experiment back to late August. The idea behind cloud seeding is surprisingly simple, even if the execution isn't. Scientists take substances like silver iodide, iodized salt, or rock salt and scatter them into clouds heavy with moisture.

IN THE VIBRANT HEART OF HYDERABAD STANDS THE ICFAI FOUNDATION FOR HIGHER EDUCATION (IFHE), A DEEMED-TO-BE-UNIVERSITY THAT IS REDEFINING THE CONTOURS OF MODERN HIGHER EDUCATION IN INDIA. RECOGNIZED BY THE UNIVERSITY GRANTS COMMISSION (UGC) AS A CATEGORY-I INSTITUTION AND ACCREDITED WITH AN A++ GRADE BY NAAC, IFHE HAS EMERGED AS A POWERHOUSE OF INNOVATION, ACADEMIC EXCELLENCE, AND INDUSTRY-READY EDUCATION. WITH A SPECTRUM OF CONSTITUENT SCHOOLS, INCLUDING THE RENOWNED ICFAI BUSINESS SCHOOL (IBS), ICFAITECH, ICFAI LAW SCHOOL, ICFAI SCHOOL OF ARCHITECTURE (ISARCH), AND THE ICFAI SCHOOL OF SOCIAL SCIENCES (ISOSS), THE UNIVERSITY IS SCULPTING FUTURE-READY PROFESSIONALS WHO ARE GLOBALLY COMPETENT AND SOCIALLY CONSCIOUS.

t the helm of this academic renaissance is Dr. C. Rangarajan, one of India’s most distinguished economists, serving as the Chancellor of The ICFAI Foundation for Higher Education. His intellectual legacy and governance philosophy continue to shape IFHE’s policies and vision. Under Vice Chancellor Prof. LS Ganesh, IFHE has diversified its offerings, digitized delivery systems, and strengthened its research capabilities.

The leadership team also includes, Prof. K S Venu Gopal Rao, Director of ICFAI Business School (IBS), who steered the school to renewed AACSB re-accreditation in 2025, and Prof. KL Narayana, Director of IcfaiTech, who promotes innovation-driven technical education.

Other key leaders at IFHE include Prof. P. Ravisekhara Raju, Director of ICFAI Law School, who leads the blending of legal theory with practice; Prof. Ar. Munavar Pasha Mohammad, leading ISArch with global design thinking; and Prof. Dr. C. S. Shylajan, directing ISoSS into

new realms of social science research.

Few metrics are as telling of an institution’s success as its placement record. IFHE’s 2024 placement season turned out to be a resounding success across its schools, showcasing its strong industry connect and the relevance of its curriculum.

At IBS Hyderabad, 94% of the MBA students have secured placements. Over 170 top corporates - including Deloitte, Google, EY, Amazon, KPMG, PwC, and TCS – regularly participate in the campus selections. IcfaiTech, the Faculty of Science and Technology, also recorded strong

numbers, with engineering graduates placed in top firms like Cognizant, HCL, Accenture, Capgemini, Mahindra, and Amazon, illustrating the School’s effectiveness in preparing students for real-world challenges. Admissions at IFHE are rigorous, transparent, and inclusive. For ICFAI Business School, the national-level IBSAT entrance test forms the gateway to admission, recently updated to replace traditional group discussions with micro presentations, reflecting a forward-thinking shift towards evaluating holistic communication and thought clarity.

At the undergraduate level, IcfaiTech and ISArch admit students through

various national and institutional entrance tests. The Law and Social Sciences Schools also attract diverse talent from across the country, maintaining academic diversity and interdisciplinary engagement at their core.

In line with global trends and the digital transformation of education, IFHE offers fully online MBA and BBA programs - ideal for working professionals and students seeking flexibility without compromising on quality. These programs provide 24/ 7 access through a mobile-friendly Learning Management System (LMS),

offer practical components like entrepreneurship practicums and internships, and cover a comprehensive curriculum that balances academic theory with industry relevance.

The online MBA, in particular, caters to graduates looking to upskill and transition into leadership roles. Meanwhile, the online BBA acts as a foundation for younger aspirants targeting careers in business, finance, and marketing.

Innovation thrives at IFHE - not just within labs and classrooms, but as a vibrant entrepreneurial culture. The

ICFAI Incubator’s recent MoU with T-Hub Foundation is a case in point. The partnership aims to support techdriven student startups through mentorship, infrastructure sharing, and investor networks.

Importantly, startups can now be part of students’ mandatory internships, allowing academic research to be transformed into viable commercial ventures. T-Hub, which stands for Technology Hub, is promoted by Telangana Government and several key institutions, and is home to over 2000 startups that have raised nearly $2 billion so far.

This approach helps students gain credit while building real-world solutions, fulfilling IFHE’s mission to bridge the gap between academia and industry and nurture a new generation of socially responsible entrepreneurs.

Research and policy dialogue are key pillars at IFHE. A two-day international conference recently hosted by ICFAI Law School, titled ‘Navigating the Future of Environmental Governance’, drew participation from legal experts, academics, and sustainability leaders. Emphasizing the integration of legal frameworks and finance in environmental policy, the conference illustrated IFHE’s commitment to shaping future-ready public leaders and legal scholars.

One of the standout additions to IFHE’s academic portfolio is its interdisciplinary PhD in Development Studies and Public Policy, a unique offering in India. Designed for working professionals,

this program emphasizes empirical research, data analytics, and qualitative methodologies. It aims to create thought leaders capable of designing and implementing development policies based on realworld data.

“This program is a game-changer in how we train public policy professionals,” says Dr. Sushanta Kumar Mahapatra, Associate Professor at ISoSS and a recipient of the NJ Yasaswy Best Teacher Award. His expertise and accolades underscore the caliber of faculty spearheading this new academic frontier.

A university’s true strength lies in its faculty, and IFHE boasts some of the most respected academic minds in the country. While Dr. Sushanta Kumar Mahapatra received the NJ Yasaswy Best Teacher Award for excellence in teaching, research, and industry engagement, IFHE’s administrative leaders too have won accolades.

Accreditation is the benchmark of quality, and IFHE stands tall with an ‘A++’ grade from NAAC and recognition as a Category-I institution by the UGC. IBS Hyderabad is among the select 24 institutions in India accredited by AACSB (Association to Advance Collegiate Schools of Business International) - placing it in elite global company with fewer than 6% of business schools worldwide holding this distinction.

Across 68 countries and territories, AACSB has accredited only 1,051 institutions with only 24 b-schools in India being accredited. by the AACSB. Recently, ICFAI Business School (IBS), Hyderabad, secured re-accreditation from AACSB in May 2025. IBS had received the first accreditation from AACSB in March 2020, when the peer review team, which visited IBS Hyderabad, assessed the school on nine distinct standards and granted the initial accreditation.

On the remarkable achievement of reaccreditation, IBS Director Prof. KS Venu Gopal Rao said the School successfully received an extension of

its AACSB accreditation for a period of six years after a positive recommendation from the peer review team and ratification by the AACSB Board of Directors.

This accreditation extension is strong proof of the strength of IBS across the academic processes, quality management programmes, societal impact, sustainability principles, faculty research and community engagement.

In the 2024 NIRF Rankings, IFHE’s flagship ICFAI Business School was ranked 39 in the Management category. These achievements are not just badges of honor - they validate IFHE’s holistic academic model that combines teaching excellence, research output, and industry relevance.

Education is not just about degreesit’s about nurturing responsible, aware, and healthy young citizens. IFHE’s ‘Niramaya Tarang’ antinarcotics initiative, launched in January 2025, is an inspiring example. With a powerful logo symbolizing wellness and positive ripple effects, this initiative includes awareness campaigns, street plays, workshops, and collaborative

programs to combat drug abuse on campus.

“The initiative is part of our broader mission to provide a safe and healthy educational ecosystem,” says Dr. S. Vijayalakshmi, IFHE’s Registrar. The student-led Nukkad Natak performances have become particularly impactful, creating awareness through art and storytelling.

With its commitment to academic excellence, inclusive access, and nation-building, IFHE is more than just a university, but a mission to secure the futures of its students. It is creating a diverse community of future business leaders, engineers, lawyers, architects, policymakers, and researchers who are ready to take on the world.

As the education sector in India undergoes seismic shifts driven by AI, global mobility, and digital transformation, IFHE stands at the vanguard, by innovating, evolving, and inspiring. With a growing alumni worldwide, strong industry linkages, and a growing global reputation, IFHE is poised to play a pivotal role in shaping India’s knowledge economy.

SEASONAL MAGAZINE

Manappuram Finance, a name synonymous with gold-backed lending in India, is poised for a transformational leap. With Bain Capital acquiring a significant stake in the company, the gold loan giant is shifting from a promoter-driven entity to a professionally managed non-banking financial company (NBFC) of global standards. This move, spearheaded by the visionary leadership of VP Nandakumar, Managing Director & CEO of Manappuram Finance, reflects a calculated strategy to enhance corporate governance, drive efficiencies, and attract global investors. The deal is widely hailed as a win-win for not only the current promoter group led by VP Nandakumar and Bain Capital, but for all stakeholders like employees and minority shareholders, as this paves the way for a possibly brighter future even while it removes a key overhang on the company future as well as its stock.

The significant stake acquisition by Bain Capital, a globally renowned private equity giant, in Manappuram Finance, marks a pivotal moment in the company’s history, as it transitions from a familypromoted business to an institutionally managed financial powerhouse. The infusion of capital and expertise from Bain is expected to propel Manappuram into a higher growth trajectory, with a sharper focus on diversification and digital transformation.

Bain Capital is acquiring an 18% stake in Manappuram Finance for Rs 4,385 crore ($525 million) at Rs 236 per share, representing a 30% premium over the then prevailing market price. Currently, Manappuram is trading near the issue price to Bain. The deal values Manappuram Finance at approximately Rs 20,000 crore ($2.4 billion).

The transaction has triggered an open offer as per SEBI regulations, which may allow Bain to further increase its holding depending on shareholder response. Thus Bain Capital will have the option to increase its stake to over 40%, securing a more influential role in the company’s strategic direction.

The VP Nandakumar-led current promoter group, which currently holds 35%, will see its stake diluted to

approximately 28.9% post-transaction. Bain Capital will also gain executive board representation and operational control, marking its position as a copromoter of the company alongside Nandakumar.

This shift underscores the transition of Manappuram from a traditionally managed lender to a modern, institutionally governed NBFC. The deal is especially hailed as a win-win for both parties, as initially Bain wanted to buy only the flagship gold loan business, and to buy it fully, whereas Nandakumar preferred a part stake sale of the whole listed firm.

While it can be thought that Nandakumar eventually prevailed over Bain in the negotiations, with the contours of the final deal appearing as more favorable to Nandakumar, reality is that it is a win-win for both, as Bain would have struggled without a seasoned gold-loan entrepreneur like Nandakumar as co-promoter and mentor. It is a win-win for Manappuram investors and employees too, as this deal secures a bright future for all stakeholders.

Under the leadership of VP Nandakumar, Manappuram has consistently demonstrated resilience and innovation. From expanding beyond gold loans to venturing into microfinance, housing finance, and vehicle loans, the company has shown remarkable adaptability. The Bain Capital deal underscores Nandakumar’s ambition to make Manappuram a major force in the financial services sector.

By welcoming Bain Capital as a strategic promoter, Nandakumar has taken a crucial step toward institutionalizing the management, improving governance structures, and ensuring sustainable long-term growth. This move aligns with global trends where financial institutions transition from being promoter-led to professionally managed entities, ensuring greater transparency and accountability.

Bain Capital’s investment in Manappuram Finance is not an isolated move. Bain has a strong track record of investing in and scaling up Indian

companies across sectors. Some of its key India portfolio companies include Axis Bank where Bain Capital’s investment played a significant role in strengthening the lender’s capital base and operational efficiencies.

Similarly, Bain had infused significant capital into L&T Finance Holdings, enabling it to improve its asset quality and digital capabilities, thus propelling the NBFC into the frontline of this highly competitive sector.

Hero FinCorp is another Indian financial services firm that has scaled with Bain’s support, by expanding its reach and diversifying its product offerings. Bain’s expertise was also visible in technology sector investing, with Genpact, the noted business process management major benefitting significantly from Bain’s operational expertise and global connections.

Given this impressive track record, Bain’s involvement in Manappuram Finance is expected to bring not just financial resources but also operational expertise, risk mitigation strategies, and access to a global investor pool.

The financial world has taken note of this game-changing deal, with major credit rating agencies and brokerage firms weighing in on the implications of Bain Capital’s entry into Manappuram Finance.

S&P Global Ratings has suggested that the deal will likely enhance Manappuram’s governance and risk management frameworks, positioning it for sustained long-term growth, while Fitch Ratings sees the Bain Capital stake

as a positive development that could lead to a re-rating of Manappuram Finance’s credit profile, given the expected improvements in corporate governance and operational efficiency.

Brokerages such as Jefferies, ICICI Securities, and Motilal Oswal have issued optimistic outlooks on Manappuram Finance post-acquisition. They highlight the potential for improved asset quality, lower cost of capital, and a broader product suite, all of which could lead to higher valuations and stronger financial performance in the coming quarters.

As Manappuram Finance embarks on this transformative journey, the company stands to benefit immensely from Bain Capital’s expertise. The focus is expected to shift toward a stronger digital lending platform, enhanced credit underwriting models, and a diversified lending portfolio beyond gold loans.

VP Nandakumar’s leadership will be critical in steering this transition, ensuring that Manappuram retains its core strengths while evolving into a professionally managed, globally recognized NBFC. The Bain Capital stake acquisition is more than just a financial transaction; it represents a strategic pivot that could redefine the future of Manappuram Finance and set a precedent for other Indian NBFCs aspiring to achieve global excellence.

With the support of Bain Capital and the confidence of analysts and investors, Manappuram Finance is well on its way to establishing itself as a world-class financial institution, ready to compete on a wider stage.

SEASONAL MAGAZINE

FOR OVER A CENTURY, UNION BANK OF INDIA HAS BEEN A CORNERSTONE OF THE NATION’S FINANCIAL LANDSCAPE, EVOLVING FROM ITS MODEST ORIGINS IN 1919 TO A DYNAMIC, DIGITAL-FIRST INSTITUTION THAT MIRRORS INDIA’S ECONOMIC TRANSFORMATION. IN THE FISCAL YEAR 2024-25 (FY25), THE BANK HAS ONCE AGAIN DEMONSTRATED ITS RESILIENCE AND ADAPTABILITY, POSTING STELLAR FINANCIAL RESULTS, LAUNCHING INNOVATIVE PRODUCTS LIKE THE UNION WELLNESS DEPOSIT, AND REINFORCING ITS COMMITMENT TO SHAREHOLDERS AND COMMUNITIES UNDER THE VISIONARY LEADERSHIP OF ITS MANAGING DIRECTOR AND CEO A. MANIMEKHALAI. WITH STRATEGIC RECRUITMENTS, ROBUST ASSET QUALITY, AND A FOCUS ON DIGITAL AND SUSTAINABLE BANKING, UNION BANK IS NOT JUST KEEPING PACE WITH THE TIMES, IT’S SETTING THE PACE.

Union Bank of India’s financial performance in Q4 FY25 (January–March 2025) and the full fiscal year underscores its ability to thrive amid economic uncertainties. The bank reported a remarkable 51% year-on-year (YoY) surge in standalone net profit for Q4, reaching Rs 4,985 crore, up from Rs 3,311 crore in Q4 FY24.

This growth was driven by a combination of strong net interest income (NII), a significant rise in noninterest income, and reduced provisions, reflecting disciplined financial management. For the full year, the bank’s net profit soared to Rs Rs 17,987 crore, a 31.79% YoY increase, showcasing consistent profitability across quarters.

Total income for Q4 FY25 rose by 7.07% to Rs 33,254 crore from Rs 31,058 crore in the same quarter last year, fueled by a 6.3% increase in interest earned, which reached Rs 27,69,522 lakh.

Non-interest income, encompassing fees, commissions, treasury revenues, and recoveries, grew impressively by 23.21% YoY to Rs 5,559 crore, highlighting the bank’s success in diversifying revenue streams. This diversification has been a critical factor in bolstering financial resilience, especially in a challenging interest rate environment.

Net interest income for Q4 stood at Rs 9,514 crore, a modest 0.8% YoY increase from Rs 9,436.5 crore, but the bank faced pressure on its net interest margin (NIM), which dipped to 2.87% from 3.03% in Q4 FY24. This decline was attributed to the Reserve Bank of India’s (RBI) policy repo rate cuts of 25 basis points each in February and April 2025, which impacted lending margins.

MD & CEO A. Manimekhalai noted that 29% of the bank’s loan book is linked to the repo rate, making NIMs sensitive to rate fluctuations, while 44% is tied to the marginal cost-based lending rate (MCLR), with repricing expected over the next year. Despite these challenges, the bank’s operating profit rose by 2.78% quarter-on-quarter to Rs 7,700 crore, reflecting effective cost

management.

Asset quality improvements were a standout feature of FY25. The gross nonperforming asset (NPA) ratio dropped to 3.60% in Q4 from 4.76% a year earlier, while the net NPA ratio improved to 0.63% from 1.03%. The provision coverage ratio (PCR) reached an impressive 94.61%, signaling a robust balance sheet.

Provisions for non-performing assets increased marginally to Rs 1,675 crore from Rs 1,477 crore in Q3, but lower write-offs (Rs 1,230 crore in Q4 vs. Rs 4,059 crore in Q3) and controlled slippages contributed to the enhanced asset quality. The bank’s capital adequacy ratio (CRAR) strengthened to 18.02%, with the Common Equity Tier 1 (CET1) ratio at 14.98%, providing ample room for future growth.

Loan growth, however, fell short of the bank’s ambitious 11–13% target for FY25, achieving 8.62% YoY growth to Rs 9,82,875 crore. Deposit growth was also modest at 7.22% YoY, reaching Rs

13,09,750 crore. The retail, agriculture, and MSME (RAM) segments performed strongly, growing by 10.17% YoY, with retail advances surging 22.14% and MSME advances up 12.50%.

The bank’s focus on high-yield retail loans, which now constitute 56.20% of domestic advances, has been a strategic move to offset slower corporate loan growth amid competitive pricing pressures.

Analysts have lauded Union Bank’s performance, raising target prices, citing strong NII, fee income, and asset quality. The bank’s core return on assets (RoA) improved to 1.26% from 1.03%, and return on equity (RoE) rose to 17.20%, up 162 basis points YoY. With a valuation at 0.7x on March 2027 adjusted book value, the stock is seen as undervalued compared to peers like State Bank of India, reinforcing its ‘BUY’ rating.

In a bold move to blend financial security with healthcare, Union Bank launched the Union Wellness Deposit

SEASONAL MAGAZINE

scheme on May 13, 2025, setting a new benchmark in retail banking. This innovative term deposit product combines a competitive interest rate, health insurance, and lifestyle benefits, catering to customers aged 18 to 75.

With a fixed tenure of 375 days, the scheme offers 6.75% per annum interest, with an additional 0.50% for senior citizens, and requires a minimum investment of Rs 10 lakh, up to a maximum of Rs 3 crore.

The standout feature of the Union Wellness Deposit is its 375-day Super Top-up Health Insurance cover, providing Rs 5 lakh in cashless hospitalization benefits.

For joint accounts, the insurance applies only to the primary holder, ensuring clarity in coverage. The scheme also includes a RuPay Select Debit Card, offering lifestyle perks such as discounts and rewards, enhancing its appeal. Customers benefit from flexibility, with options for premature closure and loans against the deposit, making it a versatile financial tool.

MD & CEO A. Manimekhalai described the product as a “first-of-its-kind offering” that reflects the bank’s commitment to innovation. “The Union Wellness Deposit combines wealth creation with a range of healthcare benefits, delivering a premium banking experience,” she said.

By integrating health insurance with a fixed deposit, the bank is addressing the

dual needs of financial growth and medical security, particularly relevant in a post-pandemic world where healthcare costs are a growing concern. The scheme has been widely praised for its forward-thinking approach, positioning Union Bank as a trailblazer in the banking sector.

Union Bank’s commitment to shareholder value was evident in its announcement of a 47.5% dividend for FY25, translating to Rs 4.75 per equity share of Rs 10 face value - the highest in a decade. Approved by the Board of Directors on May 8, 2025, the dividend is subject to statutory and shareholder approvals at the 23rd Annual General Meeting (AGM).

This payout reflects the bank’s strong financial position and confidence in sustained profitability, balancing shareholder rewards with the need to maintain a healthy capital buffer. The record date for eligible shareholders will be announced later.

The dividend declaration aligns with Union Bank’s capital adequacy, with a CRAR of 18.02% and CET1 ratio of

14.98% as of March 31, 2025. Analysts note that the bank’s robust capital position eliminates the immediate need for external fund infusion, though Manimekhalai indicated readiness to tap markets if credit demand surges due to increased private capital expenditure. This strategic approach ensures the bank can sustain its dividend policy while funding growth initiatives.