After 16 years of ownership our Vendors are Southbound creating an opportunity for you to move into their pride and joy !

Immaculately presented 3 bedroom, 2x living room double storey townhouse in popular Alec Craig Way, Gulf Harbour.

Top notch modern kitchen with stone benchtop, double S/S sink and quality Stainless Steel appliances and AEG gas cooktop.

Generous lounge and dining areas with feature gas fire along with a separate living room space off the side of the main lounge for extra living or library etc.

For further information, contact:

Michelle Kennedy 021 886 089 michellek@jameslaw.co.nz

For outdoor relaxing and entertaining there’s a choice of spaces to suit the sun.

From the dining area you can open up the ranchsliders for the complete private al fresco experience or pull back the large bifolds to take advantage of the large deck area out front.

Kim Diack 021 755 007 kim@jameslaw.co.nz

Please note that this information is provided from external sources and third parties. Review our disclaimer here: jameslaw.co.nz/disclaimer.

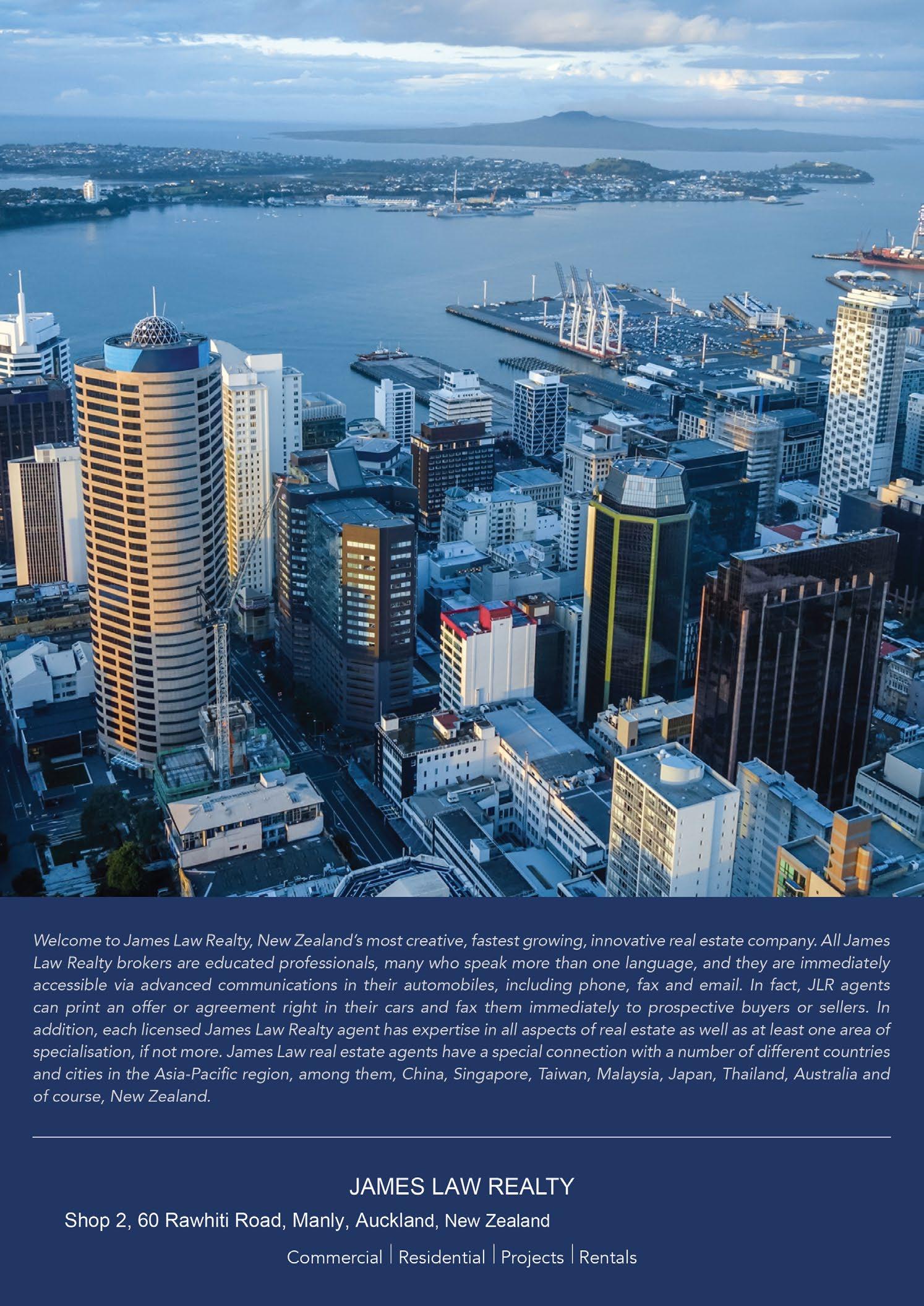

For customers who expect more from their real estate agent

Introducing Kim Diack and Michelle Kennedy, award-winning agents from James Law Realty, proudly serving the community from our Manly Village office.

Having spent several successful years listing and selling properties through James Law branches on the North Shore, we are now excited to bring our expertise closer to home. As longterm residents of the Coast, we are dedicated to serving our local community with passion and commitment. Michelle’s journey has come full circle, starting many years ago at the original Bayleys Manly Office.

Our real estate experience is extensive and varied. We have successfully sold residential housing, commercial and residential land, commercial buildings, apartments, lifestyle properties, historic buildings. Additionally, we are proud to be the company’s top commercial leasing agents.

James Law Realty stands out as one of New Zealand’s premier residential project sales agencies. We offer the opportunity to work with a personalized, non-franchised business, backed by highly experienced agents dedicated to achieving the best outcomes for our clients.

This magazine provides a brief overview of our services. For more detailed information or to discuss your property needs, please feel free to contact us for an informal chat.

Best regards,

Kim Diack and Michelle

Kennedy

By Michelle Kennedy

If you’re considering selling your home, understanding its value is crucial. Knowing what someone might be prepared to pay for the property and what factors influence its price can guide your decisions.

You might start by considering an appraisal or a registered valuation. What’s the difference, and which one should you choose?

A property appraisal estimates a property’s worth based on various factors, many of which are external and not directly related to the property’s features. This type of appraisal is often called a market appraisal and is conducted by a real estate agent.

Several factors influence a property’s value, including:

The value of nearby homes recently sold in your area influences your property’s valuation. We are able to provide you with free reports of sales in your area showing the sales price, land size and whether the section is cross lease/freehold or leasehold , number of bedrooms / bathrooms, the CV of the Sold Properties, list price versus sales price, method of sales i.e. private treaty, price,

auction or tender and how many days the property was on the market and how many days it took to sell the property.

• The property’s location significantly impacts its value. Including what is the area such as beaches, parks, service providers, school zones, shopping centres, supermarkets, restaurants / cafes, sporting facilities and entertainment.

• School Zones: The quality and reputation of nearby schools.

• Proximity to Transportation: Homes near public transport or major routes are often valued higher.

• Land Size: Larger sections generally have higher value, especially if the land can be subdivided.

• Land Condition: Properties on flat land or with sea views are usually more valuable than those with no views.

• Orientation/Aspect: North-facing properties, which get more sunlight, are typically more desirable.

• Condition/Quality of Build: Homes needing repairs or maintenance are valued lower than newer or recently renovated properties or properties

that have been well maintained. It is a good idea to keep a property file with all maintenance receipts and a diary timeline of when the works were completed.

• Market Conditions. A housing bubble, like a sharp increase generally begins with a jump in demand and a limited amount of housing inventory for sale. The demand grows as more buyers jump into the market. Then, the speculators show up, snapping up investment properties and flipping fixer-uppers. With limited supply and so much new demand, prices go up. Housing crashes are generally caused by recession, high interest rates or tightening credit conditions (which make it more difficult to get a home loan).

Appraisals can be done in person or online. Online appraisals provide a rough estimate, while in-person appraisals are much more accurate. We recommend an in-person appraisal if you’re serious about selling your property. We will visit your home and consider its size, condition, orientation, location, and many other relevant factors. We will also analyse market trends and recent sales in the area. Based on this information, we can provide you with a detailed appraisal report.

Kim and I offer free/complimentary property appraisals.

A property valuation is a more thorough assessment conducted by an independent, registered property valuer. This document, often required and requested by banks and insurance companies, they provide detailed and specific information about the property.

Valuations must be done in person by a registered valuer. They will thoroughly assess the home’s condition, size, number of rooms, recent improvements, needed repairs, land size, and recent sales of similar properties in the area.

The cost of a property valuation varies prices generally start from around $1200 due to the detailed nature of the assessment conducted by a professional.

Property appraisals and valuations serve different purposes, so you typically do not need both.

• Appraisal: Used by sellers to understand market value and set an asking price.

• Valuation: Used by buyers for detailed property information, aiding in purchase decisions, financing and insurance.

You can request a property appraisal from us anytime. By law, we must provide an upto-date appraisal before you sign an agency agreement with us.

Having our experience as local real estate agents a home appraisal gives you insight into what to expect during then house sales process. It also helps identify potential improvements or repairs that could enhance your property’s market value. We can suggest whether renovations/works or beautification is worth completing before listing your home.

Please pop into our Manly Village Office or contact Michelle or Kim for a confidential chat and Free Property Appraisal.

At the core of our marketing prowess lies our cutting-edge, in-house AI technology. This remarkable innovation supercharges our real estate sales and marketing efforts, making them exceptionally efficient.

Imagine this: it seamlessly uploads new property listings to a multitude of real estate platforms, instantly creates a comprehensive set of marketing materials for all our dedicated salespeople, and, in the context of project marketing, effortlessly keeps everyone informed about property statuses. With this technology, our team operates at lightning speed, ensuring success like never before.

Every team member is instantly notified whenever there is a new update on the property’s status such as booked, under contract, or unconditional to enable everyone to work more effectively without waiting around for the latest availability and to avoid double-booking or confusion.

An automation feature that automatically uploads and maintains listing information to 11 real estate portals. Including:

Emails to every James Law Realty team member. Personalised Marketing Collateral Creation for the entire team. Personalised Links and Instant Invites for referrals, conjunction agents, and others for easy collaboration.

CONJUNCTION & REFERRAL INVITATION

Proactively send invitations to conjunction agents from other agencies and referrals who have signed up with us.

We have no hesitation in thoroughly recommending Michelle Kennedy in the selling and marketing of your home.

We found Michelle to be professional and dedicated to the needs of the vendor, kept us informed at all times, and was totally supportive and understanding.

Michelle has a thorough knowledge of the local real estate market, which inevitable leads to a successful conclusion.

Once again our sincere thanks to Michelle for the sale of our property.

8 September 2006 of 52 Brixton Rd

Manly Whangaparaoa

By Matthew Edginton Prendos

It’s easy to be pessimistic on the state of the market at the moment. Interest rates are at levels many new property owners have never seen, household budgets are stretched and that dreaded ‘recession’ word is everywhere. But there are a bunch of reasons why a more optimistic outlook on the market is warranted. Irrespective of whether we actually want this as a city, we might be much closer to another strong run in property prices than most are saying.

Granted, the immediate term is shaky, as listing numbers continue to rise and buyers are being very selective. But here are a few reasons why it might be a very different story by the end of the year.

Pent up demand – investors and movers have been sidelined for quite some time due to high rates, tight credit and lack of listings. I don’t believe Kiwis have suddenly gotten over their property obsession in the last 2 years just because of a rates cycle. Which means, property investors are still there, they are just waiting for the right environment to come surging back.

And the ingredients are almost all there. Rents are rising and look like they are going to keep rising.

• We’ve seen significant rental growth over the last two years – up over 8% in Auckland in 2023, well above the longterm average of 4.5%.

• The prospects for further rental growth look good due to high net migration. There was a net inflow of 111,000 migrants to the country for the year to March 2024. Most of that migration

lands in Auckland and most will be looking for rental accommodation.

• Building Consent numbers have dropped sharply. This means there will be fewer new homes coming to market over the next couple of years. The effects of more renters with fewer available rental properties are obvious.

Now for a statement that sounds controversial. Rents in Auckland are more affordable than any time in the last 20 years. Despite all that rental growth I just mentioned, rents as a percentage of household income are actually at a more affordable level than any time in the last 20 years. That might surprise you, it definitely surprised me when I read Corelogic’s housing affordability report. But the numbers are pretty clear. Because growth in wages has also been so strong, the percentage of average gross income required to pay the average Auckland weekly rental has actually fallen to 19%, down from its range of 21% - 23% over the last 2 decades.

What does this mean for investors? It means the ceiling for rental growth has

not yet been reached. There is a limit to how high residential rents can get, which is tied to the income of renters. Contrary to what the new government tells us, there isn’t much evidence that rents are tied to landlord costs. Long-term rental growth tracks income growth pretty closely. So, with rent as a percentage of income at the lowest level in 20 years, there is room for more upside in rents.

The Government has come to the party.

The brightline test has been cut back to two years, interest deductibility is being reinstated and tenancy laws are being adjusted to make it easier to find good tenants. The message is pretty clear –residential property investment is safe again. On a related note, LVRs are set to loosen and credit rules have been relaxed, so it’s becoming easier to get approved for borrowing.

Yields are their most attractive in many years.

Rising rentals plus declining prices equals much healthier looking yields. Average gross yields in Auckland bottomed at a ludicrously low 2.5% at the peak of the market in 2021 (what were we thinking?). They’re now back to around 3.4%. Still not great, but you have to go all the way back to 2015 to find higher average yields on Auckland property. With a 3.4% yield, you need interest rates at around 5.7% or lower for the rent to cover the interest payments. I haven’t accounted for other costs here, so it’s not entirely accurate, but you get the idea. We’re not *that* far away from the average investment breaking even.

The missing ingredient is lower interest rates.

Despite everything above, it is tough to make the sums work for anyone considering an investment property, upsizing or getting into the market for the first time. We probably need rates to start falling before any real momentum is likely to take hold of the market.

The good news is, any talk of rates going

higher has died out. They’re going to come down. Unfortunately, I can’t tell you when. My guess is, rates will be cut earlier and more aggressively than the Reserve Bank tells us. They will keep parroting the “higher for longer” line for as long as they can but at some point, as they always do, they will cut aggressively.

When rates drop, there will be a two-fold impact on the property market.

One – mortgage repayments become cheaper. For investors, the rent goes closer to covering the payments, or maybe even leaves a bit left over at the end. Movers can afford the payments on that bigger/newer/flasher home they’ve been putting off.

Two – returns on other fixed income investments get worse. Those bonds that would-be property investors flocked to as they spiked to 5%+ are no longer available at those levels. Suddenly, the rental yield, plus tax-free long-term capital growth offered by residential property starts to look much more attractive.

To close off, to those looking to get into the market, your timing is pretty good. Listings are up, you’ve got more choice than in recent times and you’re competing against a smaller pool of other buyers. Most investors aren’t buying again – yet. Most movers are delaying their decision and staying put. But I think both groups will be back, in relatively short order, and the question is, do you really want to be competing with them?

Matthew Edginton Director + Registered Valuer

Matt has undertaken an extensive range of valuation assignments across a broad variety of commercial and residential properties. He has experience with substantial subdivision and townhouse projects and has been involved with a number of the country’s largest developers. Matt has extensive experience valuing high value residential assets being a high value panel valuer.

So you’ve found the property, for your home, or rental or maybe a commercial investment and need to get the finances sorted.

Unbelievably over 40% of people who go to their bank and are either declined or don’t get what they want, quit. That’s nuts!

There are a lot of options in the lending space and all banks are not created equal. There are also huge opportunities in the non bank space with some products now competing with the banks, some don’t require bank statements too.

Whatever the situation you will get straight professional advice from one of New Zealand’s top brokers Jeff Royle. Jeff is local to the Coast, has 30 years experience in property funding and drives the local Coastguard boat when not sorting out peoples financial affairs.

‘Financial Paramedic’ is his title, seems about right!

Jeff can be contacted on 021 765 016, help@ilender.co.nz or drop into 65 Karepiro Drive for a chat, he’ll even make the coffee.

Jeff Royle Financial Paramedic

help@ilender.co.nz jeff@ilender.co.nz

www.ilender.co.nz

Mobile: 021 765 016

Phone: 0800 536 337

“Kim is an official presenter for Kev & Ian’s Marine. Here is a bloke that I can call on at the eleventh hour, without any preparation and simply chuck him in the deep-end. Sink or swim is my motto, but somehow Kim Diack always pulls it off. And, when I say pulls it off, I mean he has achieved hundreds of thousands of Youtube hits on behalf of Kev & Ian’s Marine and accumulated millions of viewing hours. We can even start forgiving him (at a push) for being from the wilderness of the South Island.

Always the boatie and always ready to fish, Kim delivers his lines without a script and very little prodding from me. He engages our customers at a level which is informative, interesting and often quite funny, his wry sense of humor surfacing regularly.

Call him what you will, Kim, Kimbo, Diack or just Hey You, at Kev & Ian’s Marine, we call him a friend, a colleague and a highly valued part of our family.

Here’s to the next five years Kim!”

With gratitude

Hugo Schutte, Marketing Manager

Make the most of the last of the better inner Gulf fishing as a change of weather is on its way.

We have had excellent fishing weather which should continue for a little longer. Windless days and mirror calm seas means that you can extend your hunting area.

Fish around structure e.g islands, reefs and use berley with the current flow to drag those big boys out into your bait.

With Winter approaching, look at your boat and trailer and prioritize what maintenance or upgrades you can undertake to prepare your weapon to a max for the high season in Spring.

Winter is a good time to give your motor its annual service. As Spring all the dealers and boat technicians are too busy and you will incur longer wait times.

We are proud to offer to the market this modern 155m2 (more or less in size) Warehouse/Office unit in the Wairau Valley, Northshore.

Key Features:

• Zoned Industrial Zone C

• Mainly High Stud Warehouse

• Air Conditioned office

• Alarm

• Open Plan area with separate Room for Office/Boardroom/Meeting Room

• Electric Roller Door

• Two Car Parking Spaces included

• End Unit

$869,000 plus GST (if any)

The Wairau Valley is a suburb located between Sunnynook and Glenfield on Auckland’s North Shore. It is primarily an industrial and commercial area known for its numerous businesses, retail outlets and offices. NORTHSHORE INDUSTRIAL UNIT 155m2 FOR SALE

Wairau Valley is renowned for its shopping and retail offerings including the Wairau Park Home Centre which features a variety of stores selling furniture, electronics, appliances, and home improvement products. The location’s commercial nature has made it a natural hub for various businesses.

Transportation in the Wairau Valley is facilitated by a network of roads and motorways making it easily accessible from access directly from the Tristam Ave off ramp.

To arrange to view or for further details this please call:

Michelle Kennedy 021 886 089

michellek@jameslaw.co.nz

Kim Diack 021 755 007 kim@jameslaw.co.nz

Please note that this information is provided from external sources and third parties. Review our disclaimer here: jameslaw.co.nz/disclaimer.

This 359m2 (more or less in size) office is located at 55-57 High Street in Auckland CBD is accessible by both lift and stairs.

This premises is currently partially Tenanted, making itself an Investment Property with potential to add rental income or it could be perfect for an Owner/Occupier who can capitalize on the two tenancies currently in suites occupying part of the premises and paying rent whilst you occupy the other parts of this premises.

The office has recently undergone extensive refurbishment and beautification ensuring this is a stunning upmarket office environment to work in.

The office comes with seven partitioned offices in assorted sizes, with generous

sized shared facilities including an attractive reception area, a lounge zone, a beautiful kitchen with breakout lunch area, meeting room, toilets, alarm/CCTV monitoring. The office is well-lit with ample natural sunlight. Some of the suites offer fabulous views over Queen Street.

The location of 55-57 High Street is advantageous, and it provides easy access to Queen Street. The area is surrounded by various retailers, cafes, restaurants and service providers making it convenient for business needs and leisure activities. Additionally, the proximity to the Courts and University adds to the appeal of the location and it is a short distance to Auckland Council’s Victoria Street multistory carpark.

Get a head start by visiting open homes as soon as possible. If you find a property you love, you’ll have more time for a second visit and to conduct due diligence, such as reading reports, arranging inspections, securing finance and handling legal paperwork.

Don’t hesitate to request a private viewing, even if open homes are scheduled. This allows you to have the agent’s full attention and you can inspect the property thoroughly at your own pace.

With the current changing market, it is important to ensure you have a clear understanding of your current lending power and requirements to avoid disappointments when you discover your dream home.

After touring multiple properties, it can be challenging to remember which features belong to which home. Salespeople typically provide brochures at open homes, or better still the properties full information memorandum.

Neighbours can offer valuable insights about the property and the local area that you might not get from the real estate agent.

If you’ve found a property you’re interested in, ask the listing agent these questions to gather more information:

How long has the property been on the market?

Is it an owner-occupied or rental property?

Have there been any alterations, and are they permitted & certified?

What have nearby properties sold for recently?

Where are the property boundaries?

Are there any known maintenance issues or damage?

Are there any zoning restrictions?

What schools is the property zoned for?

What is the current council valuation & rates?

Has the real estate agent received any offers for the property to date and if the agreement fell over, why did it fall over?

What is the vendor’s motivation for selling the property?

Which chattels are included in the sale?

Are there covenants or restrictions on the title?

Agents should have information packs available, so request one for detailed property information.

Legal advice is crucial when buying a property. Once you find a house you like, engage a lawyer. They can advise you during negotiations, review the sale and purchase agreement, and check documents like the LIM and Certificate of Title. Conveyancing specialists are particularly skilled in this area.

Include appropriate conditions in your agreement to purchase to allow for thorough inspections. After an offer goes unconditional, addressing any problems can be difficult. Consider hiring a professional for:

• Building materials inspection

• Insulation and heating checks

• Roof, walls, and ceiling assessments

• Identifying cracks or erosion signs

• Electrical wiring inspection

• Checking piles

• Paving condition

• Plumbing inspection

A builder’s report will give you a comprehensive understanding of the property’s structural and building condition. Some inspectors use noninvasive moisture meters to detect leaks, which is essential to avoid buying a leaky home. Ensure your inspector is a member of the NZ Institute of Building Surveyors.

If buying a unit or apartment, understand the body corporate rules, body corporate minutes and pre disclosure documents. Discuss these with your lawyer before signing anything.

A LIM (Land Information Memorandum) report summarises council-held information on the property. If the property has had work done requiring consent, like a garage or sleepout, ensure these changes are documented. Ensure you have your lawyer review the LIM report.

For properties on challenging sites, such as cliff tops or unstable land, an engineer’s report can be invaluable.

Buying a home is a significant investment. Ensure you have home insurance in place, as required by most home loan agreements, before finalising your loan.

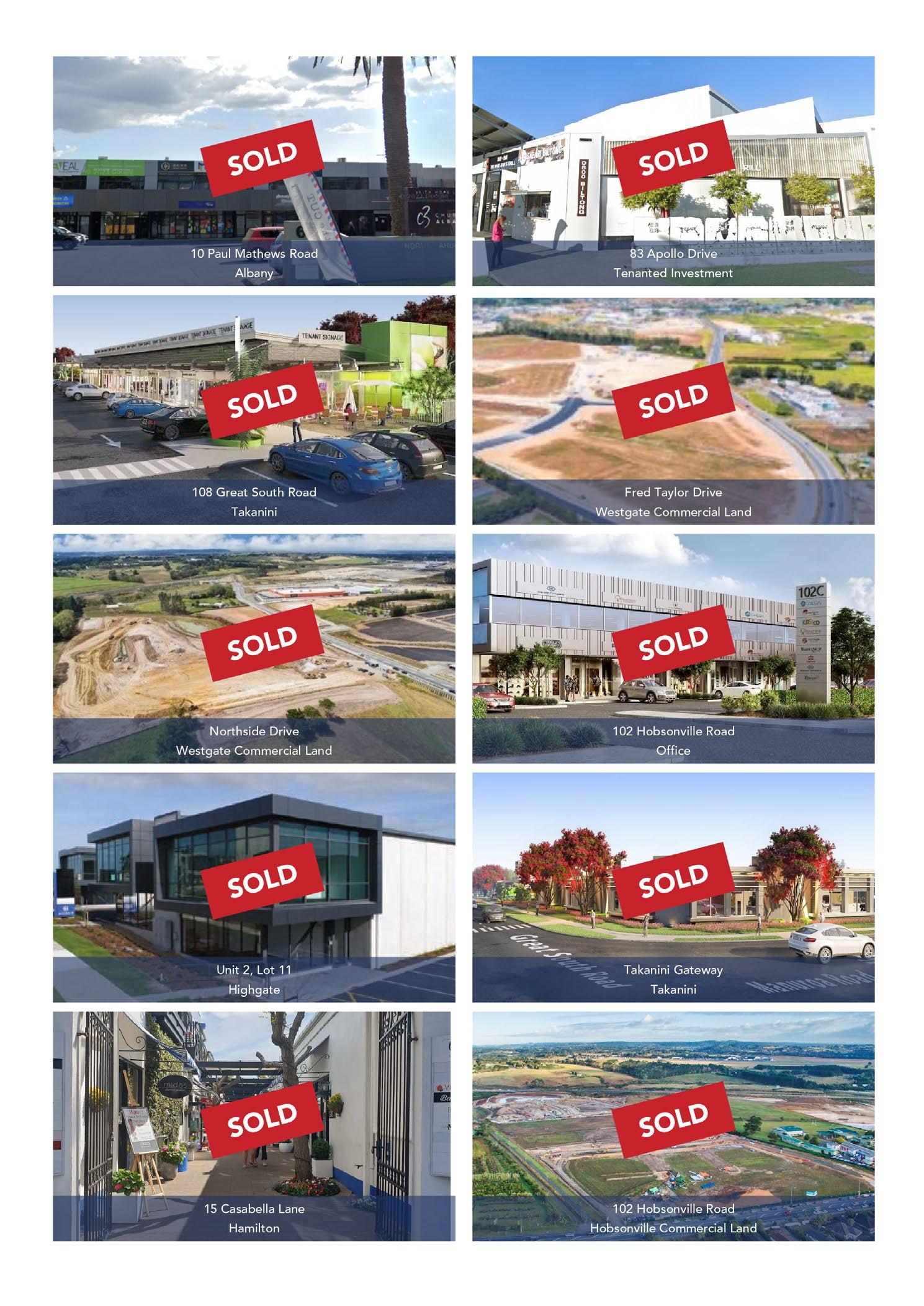

Having leased/sold hundresds of properties in Auckland, the following are a few unconditional transactions by Michelle Kennedy & Kim Diack.

As Real Estate Specialists, our areas of expertise are:

• Residential Sales

• Project Sales

• Commercial Sales & Leasing

We have sold numerous Commercial Properties off plan, titled and pre-titled including a mix of the following:

• Tenanted Investments

• Retail Units

• Industrial and Light Industrial Warehouse/Showroom/Offices

• Standalone Buildings

• Offices

• Mixed Use - Commercial/Residential Properties

• Large sites of Commercial LandPre-titled and titled

• Hospitality - Restaurants / Cafes and a Bed and Breakfast

• Medical Centre

• Historic Commercial Building

www.jameslaw.co.nz

0800 88 0000 09 973 4965 admin@jameslaw.co.nz

Follow our socials:

/HibiscusCoastRealEstate /jameslawrealtynz

/@JamesLawRealtyNZ /jameslawrealty

DISCLAIMER:

The information provided in this document, including all prices where mentioned, is being passed to you for your informational purposes only and is subject to change without notice. All the information in this document is sourced from and originates from third parties. James Law Realty Limited, MREINZ, Licensed under REAA 2008 and its affiliates, which includes its salespersons, agents, employees, staff, contractors and any other party acting on behalf of James Law Realty Limited, makes no representation, assurance or warranty of any kind in relation to the completeness, accuracy or adequacy of all information provided in any document that any third party passes over to you. James Law Realty Limited and all its affiliates as described above, do not warrant that the material herein from any third party is free from errors, commissions or other inaccuracies, or is fit for any particular purpose. James Law Realty Limited and all its affiliates expressly disclaim all warranties, express or implied. As an intending purchaser, you should avail yourself of a reasonable opportunity to seek legal, technical and other advice or information.