OsakaOffice MarketSummary

TheMarchTankanSurveyforGreaterOsaka showedthatbusinesssentimentdroppedto6 pointsfrom13forlargemanufacturersandto30 pointsfrom35forlargenon-manufacturers.

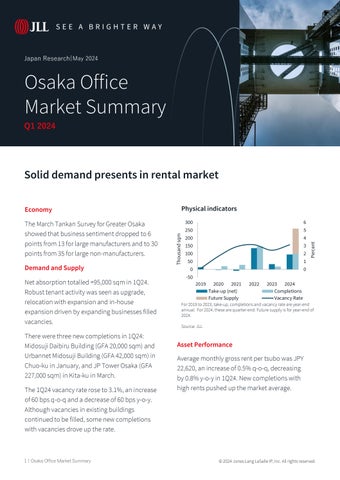

Netabsorptiontotalled+95,000sqmin1Q24. Robusttenantactivitywasseenasupgrade, relocationwithexpansionandin-house expansiondrivenbyexpandingbusinessesfilled vacancies.

Therewerethreenewcompletionsin1Q24: MidosujiDaibiruBuilding(GFA20,000sqm)and UrbannetMidosujiBuilding(GFA42,000sqm)in Chuo-kuinJanuary,andJPTowerOsaka(GFA 227,000sqm)inKita-kuinMarch.

The1Q24vacancyrateroseto3.1%,anincrease of60bpsq-o-qandadecreaseof60bpsy-o-y. Althoughvacanciesinexistingbuildings continuedtobefilled,somenewcompletions withvacanciesdroveuptherate.

Take-up(net) Completions FutureSupply VacancyRate

For2019 to2023,take-up,completionsandvacancyrateareyear-end annual. For2024,thesearequarter-end.Futuresupplyis foryear-endof 2024.

Source:JLL

AveragemonthlygrossrentpertsubowasJPY 22,620,anincreaseof0.5%q-o-q,decreasing by0.8%y-o-yin1Q24.Newcompletionswith highrentspushedupthemarketaverage.

Capitalvaluesincreased1.0%q-o-qbut decreased1.6%y-o-yin1Q24,duetocurrent renttrends.Capratesremainedstable.

TheofficeinvestmentvolumeinOsaka Prefecturein1Q24wasJPY103.5billion,an increaseof470.9%andof116.5%y-o-y.

AnotabletransactionwasSekisuiHouse Reit’s dispositionofHommachiGardenCity forJPY44.5billion.TheappraisalNOIyield was3.4%.Thepurchaserwasnotdisclosed.

AccordingtoOxfordEconomicsforecastasof March,OsakaCity’srealGDPisexpectedto growto0.4%in2024andto0.1%in2025. Downsiderisksincludeeffectsofrawmaterial pricetrendsandlabourshortagestoward domesticeconomy.

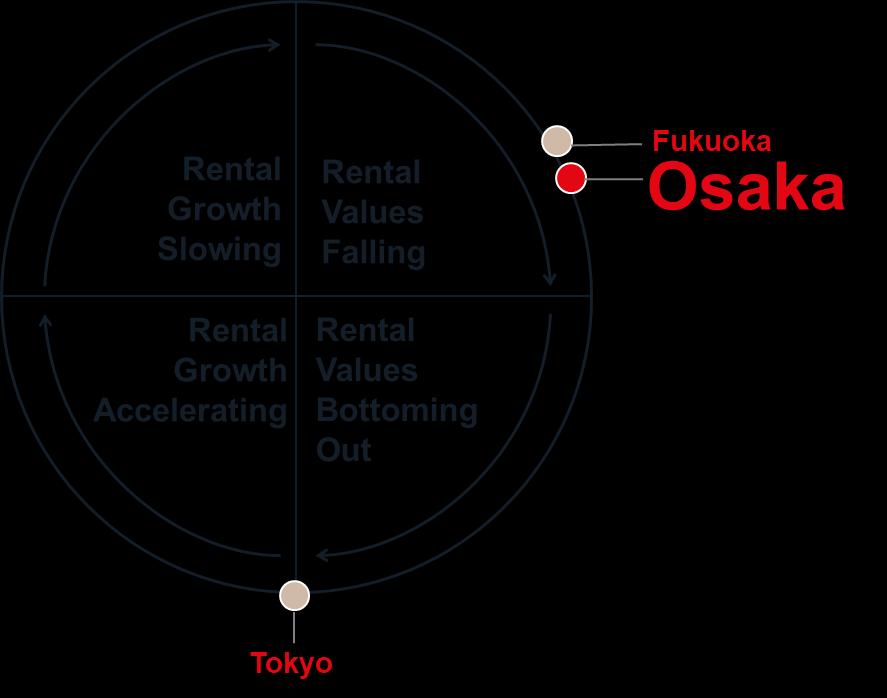

Althoughdemandisrobust,forthcomingnew completionswithhighrentsexceedingmarket averagearelikelytohavemanyvacanciesdue toscarcityofpotentialtenants.Withloosening supplyanddemand,landlordsofthebuildings withlargevacanciesareexpectedtodecline rents.

Theinvestmentmarketisexpectedtoraise liquiditywithincreasedsalesactivitiesand investorappetiteforcompetitiveassets.

Source:JLL,1Q24

Tokyo Headquarters KioiTower, Tokyo Garden Terrace Kioicho 1-3Kioi-cho Chiyoda-ku, Tokyo 102-0094 +81343611800

FukuokaOffice

DaihakataBldg. 2-20-1Hakata-ekimae, Hakata-ku,Fukuoka-shi Fukuoka812-0011 +81922336801

OsakaOffice Nippon Life

Yodoyabashi Building 3-5-29KitahamaChuo-ku, Osaka541-0041 +81676628400

NagoyaOffice

JPTowerNagoya 1-1-1Meieki, Nakamura-ku,Nagoya-shi

Aichi450-6321 +81528563357

Contact

TakeshiAkagi HeadofResearch Research -Japan takeshi.akagi@jll.com

Takeshi Yamaguchi ResearchDirector JLLJapanOsakaOffice takeshi yamaguchi@jll.com

YukiMatsumoto Manager Research -Japan yuki.matsumoto@jll.com

About JLL

For over 200 years, JLL (NYSE: JLL), a leading global commercial real estate and investment management company, has helped clients buy, build, occupy, manage and invest in a variety of commercial, industrial, hotel, residential and retail properties. A Fortune 500® company with annual revenue of $20.8 billion and operations in over 80 countries around the world, our more than 108,000 employees bring the power of a global platform combined with local expertise. Driven by our purpose to shape the future of real estate for a better world, we help our clients, people and communities SEE A BRIGHTER WAYSM. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. For further information,visit jll.com

AboutJLLResearch

JLL’sresearchteamdeliversintelligence,analysisandinsightthrough marketleadingreportsandservicesthatilluminatetoday’scommercialreal estatedynamicsandidentifytomorrow’schallengesandopportunities.Our morethan550globalresearchprofessionalstrackandanalyzeeconomicand propertytrendsandforecastfutureconditionsinover60countries, producingunrivalledlocalandglobalperspectives.Ourresearchand expertise,fueledbyreal-timeinformationandinnovativethinkingaroundthe world,createsacompetitiveadvantageforourclientsanddrivessuccessful strategiesandoptimalrealestatedecisions.