RAYSEARCH | 2024

2024 IN NUMBERS

ABOUT RAYSEARCH

RayCare centers in 13 countries

RayStation centers in 46 countries RaySearch employees employees in research and/or development approved patents around the world nationalities among RaySearch staff

RaySearch offices around the world

All key figures are as of December 31, 2024.

KEY FIGURES

RaySearch Laboratories AB (publ) is a medical technology company that develops innovative software solutions for improved cancer treatment. The company develops and markets the RayStation®* treatment planning system and RayCare®* oncology information system to clinics all over the world and distributes products through licensing agreements with leading medical technology companies. The company also develops RayIntelligence® and RayCommand®*. RayIntelligence is an innovative cloud-based oncology analytics system that cancer centers can use to gather, structure and analyze data. The RayCommand treatment control system is designed to link the treatment machine and the treatment planning and oncology information systems.

RaySearch’s software has been sold to over 1,000 clinics in more than 46 countries to date. The company was founded in 2000 as a spin-off from the Karolinska Institute in Stockholm and the share has been listed on Nasdaq Stockholm since 2003. More information is available at raysearchlabs.com.

* Subject to regulatory clearance in some markets.

VISION AND MISSION

The company’s vision is a world where cancer is conquered and RaySearch’s mission is to provide innovative software to continuously improve cancer treatment.

JOHAN LÖF,

CEO

CEO COMMENTS

AND FOUNDER

2024 was a very good year for RaySearch, during which we continued to strengthen our position as a leading innovator in medical technology and software for cancer care. Through technological advances, strategic partnerships and a favorable financial performance, we took important steps towards our vision of a world where cancer is conquered. Our successes over the past year provide us with a solid foundation for the next stage of our development.

last year, Trento Proton Therapy Center in Italy became the first clinic in the world to optimize for discrete proton arc therapy in RayStation in combination with an IBA radiation therapy machine. Proton arc is a method that has the potential to provide significant treatment benefits to patients and we are very proud that it is now in clinical use.

Innovation is at the heart of our business. During the year, we made significant investments in research and development and launched new functionality and several important updates to our products to ensure that we remain at the forefront of technological developments in cancer care.

RayStation has been further enhanced with new features that improve the precision and efficiency of radiation therapy using machine learning. We also launched new adaptive radiation therapy features, which allow healthcare providers to adjust treatment plans based on changes in patient anatomy.

A new module for image-guided liver ablation in RayStation was launched during the year. This means that RaySearch is now taking a step beyond the field of radiation therapy. The new module was developed in collaboration with the prominent MD Anderson Cancer Center in Texas, US, which also conducted a clinical trial with RayStation that demonstrated that the method significantly improves precision in liver ablation. Read more on page 20.

Another area in which RaySearch has been a pioneer and played a crucial role in development is proton arc therapy. At the end of

We introduced many feature updates during the year that improved RayCare’s usability and efficiency. An important milestone was reached in September 2024, when Iridium Network in Belgium became the first clinic in the world to use RayCare together with TrueBeam to treat patients. Interoperability with different therapy systems is a key feature of RayCare, and its clinical use with TrueBeam has revolutionized the product’s prospects and led to a significant increase in customer interest.

In early 2024, we acquired the DrugLog product from Pharmacolog in Uppsala to complement our offering and take further steps towards providing software support for all types of cancer treatments, including chemotherapy and surgery. In January 2025. we received our first order for DrugLog through the Polish company Medim, which secured a contract with the Children’s Memorial Health Institute in Warsaw, Poland.

In June, the first clinical treatment was performed using RayStation and Hitachi’s new OXRAY linac, which enables treatments with high precision and flexibility. The machine was developed by Hitachi in collaboration with Kyoto University Hospital and integrated into RayStation through close cooperation. This signifies a significant technological advance and shows how our solutions can be integrated with the latest equipment to deliver better treatment outcomes for cancer patients.

STRATEGIC PARTNERSHIPS AND MARKET EXPANSION

RaySearch’s success is based on strong partnerships with leading players in medical technology and healthcare. In 2024, we entered into new strategic partnerships that further strengthened our market position. For example, we partnered with C-RAD to integrate advanced patient positioning and monitoring solutions into our systems. This improves the precision and safety of radiation therapy and creates added value for our customers.

We also strengthened our partnerships with several leading hospitals and cancer clinics worldwide. Raigmore Hospital in Scotland, which has used RayStation for several years, chose to implement RayCare to optimize its oncology operations, and the New York Proton Center in the US decided to expand its RayStation installation, which will provide most of the center’s proton therapy treatment planning in the future. Our partnership with the French Unicancer network was also strengthened during the year through several new RayStation orders, with the renowned Institut Curie being one of the new customers.

In March 2025, RaySearch received its third largest order ever, with a total order value of approximately SEK 77 M, when Heyou Hospital in China ordered RayStation. The prominent carbon ion cancer therapy center is our first customer with a combined Hitachi carbon ion and proton machine.

FUTURE PROSPECTS

THE FIGHT AGAINST CANCER

Modern cancer care is based on a complex interplay between various advanced technological systems and long-term partnerships between different actors in the sector as well as with clinics and hospitals. In addition to these types of partnerships, we are also committed to supporting research and training in radiotherapy and oncology. Through partnerships with universities and research institutions, we help to advance progress and ensure that the next generation of healthcare providers has access to the latest technology.

Our financial stability allows us to continue to invest in developing new and existing strategic partnerships that strengthen our longterm competitiveness. We will also continue to invest in research and development to drive technological progress.

For us, cooperating and being involved in the fight against cancer in different ways is a given. We were therefore pleased to reach out to the Help Ukraine Group, which gave us the opportunity to support cancer care in Ukraine by donating ten RayStation systems. The systems were delivered to Ukrainian cancer centers that lacked access to treatment planning systems, where staff have had to treat patients with very limited resources during the war. The donation also included a package of systems given to a university for educational purposes. Read more on page 13.

During the year, we advanced our market positions in all regions – Americas, Europe and Asia – and we are seeing interest in our solutions from both established and emerging markets, giving us a strong foundation for further expansion. Global demand for advanced cancer care software solutions is growing, and we are well positioned to meet that demand.

I would like to conclude by thanking our staff, customers and partners. It is through your commitment and hard work that we can continue to make a difference in cancer care. Together, we are building a future where more patients have access to better and more effective treatments.

Johan Löf, CEO of RaySearch

THE YEAR IN BRIEF

In 2024, the positive trend for RaySearch continued with increased sales, several new key customers and a large number of new orders from customers worldwide. The milestone of 1,000 radiation therapy centers using RayStation worldwide was passed during the year.

The number of radiation therapy centers that have chosen RayStation for treatment planning exceeded 1,000. The highest number of RayStation clinics, over 285, is found in the US, followed by Japan with around 220 clinics and China as the third largest market, where over 90 clinics have purchased RayStation.

The Royal Marsden NHS Foundation Trust, a specialist cancer center in the UK, became the first center in the world to implement online adaptive radiation therapy (OART) using RaySearch’s RayStation treatment planning system and RayCare oncology information system – as well as the new ARTemis OART solution currently under development – in combination with Accuray’s Radixact treatment system.

RaySearch acquired the product DrugLog from Pharmacolog. DrugLog is a cost-effective solution for quickly and efficiently verifying the identity and concentration of compounded injectable medications, used for cancer treatment with cytostatic drugs (chemotherapy).

SIGNIFICANT EVENTS DURING THE FIRST QUARTER SIGNIFICANT EVENTS DURING THE SECOND QUARTER

The world-leading carbon ion cancer therapy center National Institutes for Quantum Science and Technology (QST) in Japan placed an order for RayStation. Raysearch and QST already had a research collaboration focused on advancing ion beam therapy via the pencil beam scanning technique.

The radiation therapy center at Raigmore Hospital in Inverness, Scotland, is the northernmost radiotherapy clinic in the UK, treating nearly 1,000 patients a year. The clinic, which has been using RayStation clinically since 2016, placed an order for RayCare in April.

RaySearch and C-RAD AB signed a collaboration agreement aiming at jointly developing innovative solutions and products to enhance the quality of radiation therapy. The focus of the collaboration is to investigate how the C-RAD surface scanning technologies can be utilized during treatment planning in RaySearch’s treatment planning system RayStation.

One result of joint testing activities between RaySearch and Varian Medical Systems in 2024 was that the oncology information system RayCare® 2024A was certified to be interoperable with Varian TrueBeam® linear accelerators, version 3.0.

The new version RayCare 2024A was launched in May. RayCare 2024A brings an enhanced experience for treatment course management with additional features and a fully integrated workflow from treatment prescription to treatment delivery and the review of treatment delivery results.

RayStation was used for the first-ever radiotherapy treatment with Hitachi’s OXRAY system. The event took place in June at Narita Memorial Hospital in Toyohashi, Japan.

The New York Proton Center (NYPC) in the US expanded its RayStation installation, which will provide most of the center’s treatment planning. NYPC is the first and only clinic to perform proton therapy in New York State.

The Connecticut Proton Therapy Center in the US placed an order for RayStation.

RayStation 2024B, the latest version of the treatment planning system, was launched in July. The new version comes with automation of important clinical workflows, such as automatic image import directly followed by deep-learning segmentation and rapid automated plan adaptation.

SIGNIFICANT EVENTS DURING THE THIRD QUARTER SIGNIFICANT EVENTS DURING THE FOURTH QUARTER

GenesisCare in the UK placed an order for RayStation. GenesisCare is the UK’s leading independent cancer care provider, operating 14 specialist outpatient cancer centers.

RaySearch passed the milestone of 100 radiation therapy centers in China, which is RaySearch’s third largest market in terms of clinics after the US and Japan.

Iridium Network in Belgium became the first center in the world to use RayCare and TrueBeam to treat a patient. The treatment was successfully carried out on September 2, 2024.

Three centers in the French Unicancer framework selected RayStation for treatment planning. Unicancer is a French network of hospitals specializing in oncology, treating more than 600,000 patients each year. 787 clinical trials are ongoing across the network.

Institut Curie chose RayStation for proton treatment planning in November. Institut Curie is also part of the French hospital network Unicancer.

Optimization for discrete proton arc therapy in RayStation, combined with standard delivery techniques and treatment workflows, was put into clinical use with RayStation at the Trento Proton Therapy Center in Italy.

VISION

A world where cancer is conquered.

MISSION

To provide innovative software to continuously improve cancer treatment that improves quality of life for patients and saves lives.

BUSINESS MODEL

RaySearch’s main revenue is generated by customers paying an initial license fee for the right to use the company’s software and an annual service fee for access to updates and support. The company’s software is developed at RaySearch’s head office in Stockholm, and distributed and sold by the company’s global marketing organization.

STRATEGIES OVERALL STRATEGY

A radiation therapy center essentially needs two software platforms for its operations: one information system, and one treatment planning system. With RayStation and RayCare, RaySearch will further strengthen its position and continue to grow with high profitability. The strategy is based on a strong focus on innovative software development with leading functionality, support for streamlined workflows –including via digitization and automation with machine learning – broad support for a wide range of treatment modes and types of radiation therapy machines, close collaboration with world-leading cancer centers and industrial partners, and extensive investment in research and development.

INNOVATIVE SOFTWARE DEVELOPMENT

Extensive investment in R&D with a strong focus on leading functionality, streamlined workflows and broad-based support for many different treatment techniques and radiation therapy machines. During the 2020–2024 period, average investment in R&D was 29 percent of net sales annually.

ATTRACTIVE EMPLOYER

Attract committed and talented employees by maintaining a culture characterized by innovative thinking, and guided by social sustainability and high business ethics.

STRATEGIC PARTNERSHIPS

Close collaboration with world-leading cancer clinics, research institutes and medical device suppliers.

RAYSEARCH AROUND THE WORLD

1,101 RayStation clinics in 47 countries

27 RayCare clinics in 13 countries

Cancer centers all over the world use RaySearch’s software. To always be able to offer local service in local languages, RaySearch has formed a global organization with offices and distributors in three regions – Americas, Europe/Africa and Asia-Pacific & Middle East.

All figures on this spread are from March 2025.

AMERICAS

RAYSTATION RAYCARE

EUROPE/AFRICA

RAYSTATION

RAYCARE

RAYSEARCH CLINICS (1,101)

RAYSEARCH OFFICES (13)

RAYSEARCH DISTRIBUTORS (19)

MARKET 2024

Radiation therapy is the treatment mode that has increased most since the turn of the century, compared with the two other major cancer treatment methods – surgery and chemotherapy. More than half of all cancer patients now require radiation therapy.

The need for efficient cancer care continues to grow at an ever increasing people under 50 increased by 79 percent (BMJ Oncology).

Interest in proton therapy is growing. Despite the high costs of proton therapy centers, investment is growing sharply in many countries and new centers are under construction. Roughly 2 percent of all cancer patients are now treated with protons, while about 20 percent would benefit from this type of treatment.

RAYSEARCH’S STRONG GROWTH CONTINUES

RaySearch’s position is strong. At the same time, the product portfolio and functionality offered by the products are well aligned with the needs of most of the world’s cancer centers.

Two global trends are the preference for increased automation and the continued introduction of adaptive treatment in clinical practice, areas where RaySearch is investing heavily and is also on the leading edge.

There are now about 8,500 radiation therapy centers worldwide. In 1,082 of these centers – across 46 countries, including all major markets – RayStation and the system were established as one of the leading and most advanced treatment planning systems as of December 2024. In 2024, RayStation was sold to 94 new clinics. RayStation supports more types of radiation therapy machines and treatment techniques than any competing treatment planning system. This creates major synergies for clinics with a mixed machine park, which are mainly large clinics, and also the type of clinic where

The new version of RayStation, launched in July 2024, includes image import automation and deep learning-based segmentation that makes it possible to have all patients automatically segmented right after image acquisition, saving time in the planning process for each patient and reducing the need for repetitive manual work.

Adaptive treatments are individually optimized for each patient, taking anatomical differences into account, and the treatment plan can then be re-optimized. RayStation has provided support for this for many years and actively pursued the development of this treatment method. The latest version brings a new workspace for fully automated treatment follow-up and plan adaptation and features a multi-step automated workflow.

In mid-May, RayCare was certified for interoperability with Varian TrueBeam linear accelerators, and in September, Iridium Network in Belgium became the first center in the world to use RayCare and TrueBeam to treat a patient. These two important milestones contributed to a steady increase in interest in RayCare throughout the year in every region.

In September, Iridium Network in Belgium became the first center in the world to use RayCare and TrueBeam to treat a patient, an important milestone that has contributed to steadily growing interest in RayCare in every region during the year.”

RayCare 2024A was launched shortly after the signing of the interoperability agreement. In addition to interoperability with TrueBeam, this version also provides an enhanced experience for treatment course management, improving both usability and efficiency. Other feature updates in this version include enhancements and usability updates to patient chart and task management features as well as support for more external systems interfaces for improved coexistence with other hospital systems.

The first version of the RayIntelligence system was released at the end of 2020. The latest version, RayIntelligence 2024B, was released in July and has been integrated with RayCare, enabling workflow analysis and the ability to link RayCare data with RayStation data. Together, this creates entirely new opportunities for data-driven decisions, facilitating daily clinical tasks as well as long-term process planning.

Sales of the RayCommand treatment control system are mainly focused on various machine manufacturers. Previously, each of these manufacturers had to develop their own control system, with basically the same features. RayCommand enables a more uniform environment for the user, regardless of therapy machine. This also makes it easier for new manufacturers to enter the market, because they do not need to develop their own treatment control system.

During the year, further important orders for RayStation were received from Sutter Health, Stanford Health Care and Avera Health, the latter of which was won in a tender.

RaySearch primarily sells products through its own subsidiary, RaySearch Americas Inc. There are two offices in the region, one in New York and one in California, with about 40 employees in total.

EUROPEAN/AFRICAN MARKET

RaySearch’s product portfolio was expanded during the year, through both the acquisition of the product DrugLog and through a module in RayStation that can be used for liver ablation. Read more on pages 19.

AMERICAS MARKET

The US and Canadian markets comprise more than 2,600 radiation therapy centers, of which roughly 327 used RayStation as of December 2024. RaySearch’s market share is highest in proton therapy, with 43 of 46 clinics in the US and Canada now using RayStation. Both the US and Canada are stable and mature markets and mainly driven by two factors – the fact that the Philips treatment planning system is currently being phased out and replaced by more modern systems, and the rapid development of emerging technologies, such as online adaptive radiation therapy and AI.

Interest in proton therapy is growing, and six new proton centers are under development in the US. The New York Proton Center is the first, and so far the only, clinic to perform proton therapy in New York State. The center has been a RaySearch customer since 2022, when it purchased its first RayStation licenses in order to evaluate the advantages of the system. After a thorough evaluation, the center decided during the past year to expand its use of RayStation, and will use it in the future for most of its treatment planning for proton therapy.

The European market comprises about 1,500 radiation therapy centers, of which roughly 301 used RayStation as of December 2024. RayStation is a well-established product with significant market share in Belgium, France, the Netherlands, the UK and Germany in particular. Since relatively few new radiation therapy centers are being built in Europe, the market is mainly driven by the need that centers see for upgrades or to replace their existing systems. Sales are largely characterized by public tender processes, where requirements are often focused on system functionality.

Many

clinics particularly appreciate RayStation’s most advanced features for improved planning quality and a higher degree of automation, such as machine learning and algorithms that can automatically plan.”

Another new customer in the proton area, which is also a RayCare customer, is the Connecticut Proton Therapy Center in the state of Connecticut. The center is a collaboration between Yale New Haven Health, Hartford HealthCare and Proton International, and will be the first of its kind in the state. The center placed an order during the year for RayCare, which will be used together with RayStation, which was purchased in 2023. The objective is to put both systems into clinical use in 2026, when the center opens.

RaySearch’s market share is highest in proton therapy, with 43 of 46 clinics in the US and Canada now using RayStation.”

Many clinics particularly appreciate RayStation’s most advanced features for improved planning quality and a higher degree of automation, such as machine learning and algorithms that can automatically plan. There is a shortage of skilled staff across the region, and automation increases planning capacity and frees up time for the most complex cases.

During the year, sales increased satisfactorily across the region, mainly driven by major continued success in France. Cancer care in France is generally highly advanced and extremely thorough evaluations of the technical capabilities of the various systems are carried out, which is one of the reasons for the strong growth. RaySearch has also been building up a strong local support business for a long time, which is considered crucial for success in the French market. Over the last four years, a total of 14 of the 20 centers in the French Unicancer oncology specialist hospital network, as well as two state-run hospitals, purchased RayStation under RaySearch’s framework agreement with Unicancer. Four of these orders were placed in the second half of 2024: Institut de Cancérologie de Lorraine, Centre Jean Perrin, Centre Hospitalier Universitaire de Limoges and Institut Curie. As of August 2024, a new framework agreement had been signed that includes both RayStation and RayCare.

Raigmore Hospital in Scotland has been using RayStation clinically since 2016 and chose to add RayCare during the year. The radiation therapy center at Raigmore Hospital is facing increased patient pressure, and thus a greater workload. They see the advantages of improved integration with RayStation and the ability to automate tasks and improve workflows.

Another leading player that chose the RaySearch system during the year is GenesisCare, the UK’s leading independent cancer care provider which operates 14 specialist outpatient cancer centers. GenesisCare plans to fully replace its current Pinnacle radiotherapy treatment planning system with RayStation.

used in the world’s first clinical treatment using OXRAY, which took place at Narita Memorial Hospital in Toyohashi, Japan.

The world-leading QST in Japan placed an order for RayStation during the year. RaySearch and QST (previously NIRS) began a partnership back in 2018, which was followed by a research collaboration agreement focused on advancing ion beam therapy via the pencil beam scanning technique. QST’s purchase of RayStation is a logical step and the result of this long and fruitful research collaboration.

ASIAN MARKET

Proton therapy is one of the most advanced forms of radiotherapy, utilizing very localized energy deposition that can be steered to precisely treat the tumor. These treatments are conventionally delivered from a limited number of directions. In discrete proton arc therapy, the protons are instead delivered over 20 to 30 directions. Optimization for this type of proton therapy was put into clinical use with RayStation at Trento Proton Therapy Center in Italy in the autumn. The clinical use of proton arc therapies is an important milestone in proton therapy.

RaySearch continued to display a strong performance in the Asian radiation therapy market in 2024, with a clear focus on the main markets Japan and China. RayStation was used in 448 clinics in the region as of December 2024. The company has also further strengthened its position as a supplier of software solutions to Asian radiation therapy machine manufacturers.

The region is still characterized by major differences between countries in terms of the total number of radiation therapy machines, the level of advanced radiation therapy and access to cancer care with radiation therapy. RaySearch is well positioned, with a presence in all major markets and a product portfolio tailored to different needs.

Japan is still RaySearch’s largest market, with around 235 clinics as of December 2024. The partnership with Hitachi works very smoothly, both because Hitachi distributes RayStation in Japan and because the companies work closely together on product development. One result of the development partnership is that OXRAY, Hitachi’s new treatment machine developed in cooperation with Kyoto University Hospital, has been integrated into RayStation. During the summer, RayStation was

An important milestone was achieved in China during the autumn, when the number of radiation therapy centers that use RayStation for treatment planning passed the 100 mark. China is RaySearch’s third largest market in terms of clinics after the US and Japan. China Japan Friendship Hospital, one of China’s leading hospitals, became the one hundredth customer. RayStation is part of the hospital’s installation of the first proton therapy system in the Beijing region, marking a major advance in cancer care in the region.

RAYSEARCH’S COMPETITORS

Since launching its proprietary treatment planning system in 2012, RaySearch has been working actively to convince clinics about the importance of making their own decisions about software and radiation therapy machines. This strategy has often been successful, especially in clinics with advanced treatments, or clinics in need of streamlining. However, it is still relatively common that customers opt for a total solution, where machines and software are sold as a package. Furthermore, when it comes to package solutions, companies like Varian and Elekta sometimes offer very low prices for software components which, despite superior functionality in some cases, can make it difficult for RaySearch to compete.

The climate for treatment planning is relatively open, which enables RaySearch to develop support for new machines and upgrades. Due to advanced and relatively high development capacity, RaySearch has often been both faster and more successful than the actual machine manufacturers in utilizing the flexibility of the machines and therefore been able to offer better and more advanced treatments.

RaySearch continued to display a strong performance in the Asian radiation therapy market in 2024, with a clear focus on the main markets Japan and China.”

The interoperability agreement between RaySearch’s RayCare and Varian’s TrueBeam in May, and the clinical implementation a few months later, provides new opportunities for RayCare to gain market share in the oncology information market.

The UniteRT network is RaySearch’s attempt to change the mindset of players in the industry and create a more open climate. The reception from clinics has been very positive since the network began in 2023, and many believe that this is a necessary step to ensure that progress in cancer care can continue. UniteRT consisted of more than 30 companies as of February 2025.

HELP UKRAINE GROUP IN PARTNERSHIP WITH RAYSEARCH – SUPPORTING CANCER CARE IN WARTIME

When war paralyzed cancer care in Ukraine, the Help Ukraine Group (HUG), co-founded by Professor Nataliya Kovalchuk, Stanford University, US, and Professor Natalka Suchowerska, Sydney University, Australia, took the initiative to make a difference. With a strong drive to support cancer centers during the conflict, HUG launched a campaign to show how radiation therapy patients in Ukraine were affected.

RaySearch recognized HUG’s efforts and Erik Traneus, Senior Research Scientist and Head of Sales Particle Therapy, contacted HUG and offered to help.

The result was a donation of ten RayStation systems. These were delivered to Ukrainian cancer centers that lacked access to treatment planning systems, where staff have had to treat patients with very limited resources. The donation also included a package of systems given to a university for educational purposes.

auto-segmentation and fallback planning when using different providers as well as an excellent treatment planning tool to use in resourceconstrained conditions,” said Professor Kovalchuk. “It provides hope and strengthens Ukrainian radiation oncology.”

The RayStation systems were delivered ready for clinical use and hospital physicists have been trained to start clinical use. In addition, the Master’s degree program in medical physics at Taras Shevchenko University in Kiev will now offer practical training in treatment planning, something that has never been available in Ukraine before.

“We hope that this generous donation will support Ukrainian radiation therapy in these difficult times of war by providing advanced tools for

“I believe the question ‘How can we help?’ is part of RaySearch’s DNA,” said Morta Marcinkute, Marketing Communications Specialist at RaySearch. “For me, the issue was how I could best help to speed up the delivery of the RayStation systems. Fortunately, many of my colleagues asked themselves the same question, and through our joint efforts the systems have been delivered and the staff at the Ukrainian clinics are now working to enable RayStation to contribute to the care of Ukrainians with cancer. Moments like these give hope for our common human DNA,” Morta Marcinkute concluded.

Together, HUG and RaySearch have shown that, even in the darkest of times, innovation and collaboration can save lives.

INDUSTRIAL PARTNERS

Modern cancer care is based on a complex interplay between various advanced technological systems. As an independent software vendor, it is only natural for RaySearch to collaborate with all industrial players whose systems are integrated with RaySearch’s systems. In addition to collaborations around the development of new treatment techniques and better system integrations, sales and customer support can also be facilitated by various partner relationships.

TREATMENT MACHINE MANUFACTURERS

VARIAN (US) is the treatment machine manufacturer with the largest market share in Europe and the US. RaySearch and Varian have an interoperability agreement that allows RayCare to be connected to Varian TrueBeam® linear accelerators. In September 2024, the first patient was treated in a clinic using the combination of TrueBeam, RayCare and RayStation. This interoperability significantly increases RayCare’s market potential, since TrueBeam is Varian’s most popular treatment machine and has been installed in thousands of radiation therapy centers all over the world since it was launched in 2010.

HITACHI has been manufacturing proton therapy machines for many years, and RaySearch is at the forefront of developing support for Hitachi’s new delivery method. In 2024, Hitachi launched OXRAY, a unique photon beam linear accelerator, which enables treatment where the beam is moved around the patient in a ring gantry. For the first treatment using OXRAY in June 2024, RayStation was used for treatment planning as it was the only clinical system that supported the technology.

BEBIG (GERMANY) and RaySearch have had a partnership for several years in brachytherapy, a type of radiation therapy in which small radioactive implants are placed in or near the tumor. Brachytherapy treatment plans can now be made in RayStation. At ESTRO 2024, Bebig also launched the SagiStar linear accelerator for external radiation therapy, which it markets together with RaySearch software.

IBA (BELGIUM), a world leader in proton therapy solutions, entered into a long-term strategic collaboration with RaySearch in 2016. RaySearch has since adapted RayStation and RayCare to IBA’s products in order to offer a comprehensive hardware and software solution. The collaboration also includes development of new techniques such as Conformal FLASH, proton arc therapy and online adaptive radiation therapy. IBA and RaySearch have been very successful together and about half of all RaySearch’s proton customers have IBA as their machine manufacturer.

MEVION MEDICAL SYSTEMS (US) is a leading manufacturer of compact proton therapy systems and has been collaborating with RaySearch since 2014. RayStation supports IMPT planning for Mevion’s HYPERSCAN system. In 2024, the focus was on developing support for Mevion FIT and establishing proton therapy enabled by Leo Cancer Care’s technology.

LEO CANCER CARE is developing a complete system for radiation therapy where the patient sits upright instead of lying on an examining table. Leo Cancer Care’s system works for both photon and proton therapy.

ACCURAY (US) and RaySearch have a long-term collaboration agreement to advance and market fully integrated solutions that combine RayStation and RayCare with the Radixact® and CyberKnife® radiation therapy systems.

IMAGING SYSTEM MANUFACTURERS

GE HEALTHCARE (US) is one of the world’s largest medical technology companies and builds imaging systems such as CT, MR and PET for diagnosis and cancer care. RaySearch has been collaborating with GE Healthcare since 2022. The partnership includes integration of the two companies’ systems, which could help to streamline workflows and lead to new applications.

SURFACE SCANNING SYSTEM MANUFACTURERS

Surface scanning technology is used for surface-guided radiation therapy (SGRT), including for patient positioning and monitoring patient movements.

VISION RT is a global SGRT supplier. Vision RT has developed MapRT, an advanced tool for computation and visualization of the area within which the treatment machine can move without colliding with the patient. Vision RT and RaySearch entered into a strategic partnership in 2019, with the main focus on using the information from MapRT to create collision-free plans in RayStation. The solution was demonstrated at ESTRO and ASTRO 2024.

VISION RT is a global supplier of surface scanning technology. In May 2024, C-RAD and RaySearch began a partnership to develop integration between the companies’ products and find new applications. An initial prototype where the C-RAD surface guides an image correction algorithm in RayStation was shown at ESTRO and ASTRO 2024.

UNITE RT

In spring 2023, RaySearch formed the organization UniteRT together with Accuray and GE Healthcare. The purpose of UniteRT is to bring players within the radiation therapy business together and to work for better and more balanced market conditions. UniteRT is based on three principles: open interface, open competition and open communication. In February 2025, a total of 33 companies were members of UniteRT. For more information, please refer to unitert.org

HI LAURA, COULD YOU TELL US MORE ABOUT YOURSELF?

“I’m a trained medical physicist with a PhD from Stockholm University. I began working at RaySearch’s service department in 2014. After that I worked as a Business Manager, which included working with both direct sales and distributors. Since 2024, I have a new role as Partner Manager, tasked with establishing and nurturing the company’s strategic partner relationships.”

WHAT IS YOUR ROLE AS A PARTNER MANAGER?

INTERVIEW WITH LAURA ANTONOVIC, PARTNER MANAGER

“My job is to manage everything related to our industrial partners, which includes three types of collaboration: interoperability between different systems, joint marketing of products and commercial partnerships. The work involves establishing, maintaining and evaluating our partnerships and coordinating all activities related to partners internally. I’m supported in my work by the partner team, which consists of the CEO, the Deputy CEO and me, where all strategic decisions are made.”

WHICH PARTNERSHIPS FROM 2024 DO YOU PARTICULARLY WANT TO HIGHLIGHT?

“The single most important event for RaySearch was when a patient at Iridium Network was treated for the first time with Varian’s TrueBeam together with RayCare in September. This milestone was preceded by a close collaboration between RaySearch and Varian, which is normally one of our competitors when it comes to treatment planning. Thanks to the partnership and hard work of everyone involved at both RaySearch and Iridium Network, the first treatment went very smoothly and now patient treatments are under way at several clinics in the network.”

“I would also like to highlight our long and good relationship with IBA. They’ve chosen to focus on the development of therapy systems that they sell alongside third-party treatment planning and oncology information systems, especially from RaySearch. Our close collaboration on innovation and sales has provided both companies with great success in proton therapy, where we jointly have a market share. The number of centers in common, amounted to 56 at the end of 2024. These kinds of partnerships are very rewarding to work on.”

PRODUCTS

Comprehensive cancer treatment planning

Cancer radiation therapy is a highly complex treatment modality. RaySearch offers innovative software solutions to improve efficiency and treatment outcomes for cancer care through five products: the RayStation treatment planning system, the RayCare oncology information system, the RayIntelligence analytics system, the RayCommand treatment control system and the new DrugLog product, which reduces the risk of errors in drug preparation. A completely new module for imageguided liver ablation in RayStation was also launched during the year.

The next generation oncology information system

A unified treatment control system

Advancing cancer treatment through machine learning

RayStation is an advanced treatment planning system for radiation therapy and is established in all major markets worldwide. RayStation had a customer base of just over 1,000 clinics in 46 countries as of December 2024. In 2024, RayStation was sold to 94 new cancer centers.

In simple terms, a treatment planning system creates a model of the treatment machine and how the radiation is created, and a model of the patient based on magnetic resonance imaging and computed tomography. These two models are then combined using an optimization algorithm to generate a treatment plan to administer the optimal tumor dose, while avoiding exposure to other organs and tissue as far as possible.

RayStation’s main competitors are the treatment planning systems offered by manufacturers of radiation therapy machines such as Varian (Eclipse) and Elekta (Monaco). Compared with these systems, RayStation has several key advantages.

One obvious advantage is that the computation speed is higher. The difference is so significant for some computations that the computation time is measured in seconds in RayStation and in minutes in other systems. The significantly shorter waiting time between each step makes it easier for the user to test different variants and thereby create a better treatment plan.

RayStation’s optimization algorithm is market leading because, for example, it allows for the continuous exploration of possible treatment options in real time, which facilitates treatment planning and streamlines the workflow. RayStation supports more types of radiation therapy machines and treatment techniques than any other treatment planning system. This means that even cancer centers with machines from a range of manufacturers can still do all of their treatment planning on a single platform. This ensures maximum utilization of the equipment and extends the life of the treatment machines.

In 2024, the development of RayStation continued and a new version was launched, RayStation 2024B. The new version comes with automation of important clinical workflows, such as automatic image import directly followed by deep-learning segmentation and rapid automated plan adaptation. Adaptive radiation therapy involves continuous adjustment of the delivered radiation dose to account for changes in the patient anatomy throughout the course of treatment, which in most cases extends over several weeks. RayStation 2024B brings a new workspace for fully automated follow-up and plan adaptation. Image import automation and deep learning-based segmentation make it possible to have all patients automatically segmented right after image acquisition and before a user opens a patient’s data in RayStation. This saves time in the planning process for each patient and reduces the need for repetitive manual work.

RayStation 2024B also includes a wide range of new models for deep learning-based segmentation, such as guideline-based models of lymph nodes in the head and neck and of the brachial plexus. In addition, the speed of this type of segmentation has been significantly increased. Another highlight of the new release is a tool used to plan stereotactic radiosurgery – a tool that helps reduce the dose that reaches healthy tissue when treating multiple tumors simultaneously.

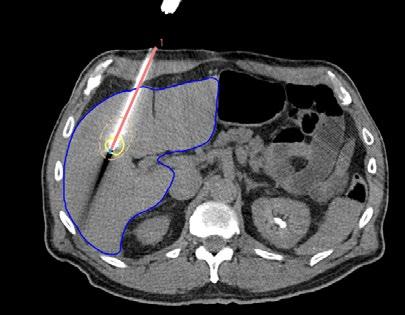

In liver ablation, a needle is inserted into the tumor, and the needle then burns away the tumor proceeding from its tip. RayStation 2024B includes an image guidance feature that ensures the needle is in the correct position so that the entire tumor is covered by the heat. The method was developed in a collaboration between RaySearch and MD Anderson Cancer Center, and showed considerably improved precision during liver ablation in a clinical trial.

NEW MODULE FOR IMAGE-GUIDED LIVER ABLATION IN RAYSTATION

A new module for image-guided liver ablation in RayStation was launched during the year. This means that RaySearch is now taking a step beyond the field of radiation therapy. Liver ablation is a treatment method in which a needle is inserted into the tumor, after which the tumor is destroyed by heat generated by microwaves or high-frequency radio waves.

One challenge of today’s method is that the tumor is not visible on the CT images taken after the needle is placed, and because the liver is deformed during needle insertion it is difficult to ensure that the needle is correctly positioned. This means there is risk that parts of the tumor could be left untreated.

The new module was developed in collaboration with the MD Anderson Cancer Center, which conducted a clinical trial with RayStation to test the method. The study was originally randomized, but after only a few patients had been treated, the researchers found that precision was significantly improved with image guidance, so they chose to remove the control group from the study prematurely. The results demonstrate that the method significantly improves precision in liver ablation.

The RayStation module supports image-guided liver ablation through three steps:

1. PLANNING

1. PLANNING – Before the needle is inserted, a contrast-enhanced CT image is taken to segment the tumor. The user can simulate the needle insertion to optimize the placement.

2. TARGETING – After the needle is inserted, but before the ablation is performed, a new CT image without contrast is taken. In this image, the needle is visible, but not the tumor. Through deformable image registration in RayStation, the position of the tumor from the previous contrast- enhanced image can be transferred to the current image, making it possible to verify that the needle is correctly positioned. If the tumor is not completely covered, the needle can be adjusted or an additional needle planned.

3. VERIFICATION – After treatment, a postoperative contrast-enhanced CT image is taken in which the ablation zone is visible as a darker area. On this image, the ablation zone is segmented and the tumor is transferred from the planning image to check that the entire tumor has been treated. Additional treatment can be carried out as needed.

2. TARGETING

Liver ablation is a growing treatment technique and there is great potential to improve both treatment outcomes and patient care with this innovation.

3. VERIFICATION

An oncology information system supports clinical activities in cancer care with features such as patient charts and notes, workflow support, machine and doctor scheduling, image archives and reviews.

RayCare is closely integrated with RayStation and provides seamless access to all of the powerful planning tools in RayStation and RayCommand. The system efficiently coordinates activities in radiation therapy and offers advanced features for clinical workflow automation and adaptive radiation therapy. Cancer patients are often treated with a combination of radiation therapy, chemotherapy and surgery. Because RayCare has been designed to handle combined treatments, the system increases opportunities for clinics to manage combinations of these three treatment methods.

The development of RayCare continued during the year and a new version, 2024A, was released in May. RayCare 2024A brings an enhanced experience for treatment course management with additional features and a fully integrated workflow from treatment prescription to treatment delivery and the review of treatment delivery results. Combined with the active workflow support and treatment and QA scheduling capabilities in RayCare, as well as the deep integration with RayStation, this brings efficiency and safety in the clinical workflow by reducing the number of manual actions required. Other feature updates in RayCare 2024A include enhancements and usability updates to patient chart and task management features as well as support for more external systems interfaces for improved co-existence with other hospital systems.

interoperable with Varian TrueBeam® linear accelerators, versions 3.0, 4.0 and 4.1.

On September 2, 2024, Iridium Network in Belgium became the first center in the world to use RayCare and TrueBeam, when the first treatment of a patient was successfully performed.

After joint testing activities between RaySearch and Varian Medical Systems in 2024, RayCare 2024A was certified on May 16 to be

RayIntelligence is RaySearch’s cloud-based system for analytics, monitoring and continuous enhancement of cancer therapy

and workflows in the clinic

RayIntelligence collects data from RayStation and RayCare, which is structured and harmonized to enable a user-friendly presentation. This enables a rapid identification of trends and the ability to see how workflow changes affect treatment outcomes and effectiveness in a clinical setting.

RayIntelligence 2024B, which was released in July, features integration with RayCare, enabling workflow analysis and the ability to link RayCare data with RayStation data. Furthermore, the functionality for authentication and for filtering data was improved.

RayIntelligence is offered on a subscription basis.

The RayCommand treatment control system serves as a link between the treatment machine and the treatment planning and oncology information systems. It coordinates and orchestrates the different systems involved, such as imaging systems, beam delivery systems and patient positioning systems.

RayCommand differs from RaySearch’s other products because the system is closely integrated with a wide range of therapy systems. This means that RayCommand is an essential component of various treatments and only sold together with the treatment machine that it is connected to.

DrugLog is RaySearch's cost-effective solution for quickly and efficiently verifying the identity and concentration of compounded injectable medications used, for example, in cancer treatment with cytostatic drugs.

Using DrugLog reduces the risk of errors in drug preparation. In just a few seconds, the pharmacist can determine whether a diluted or prepared drug has the correct properties, ensuring accuracy in each individualized preparation.

DrugLog is a unique combination of cutting-edge software and reliable well-established hardware for absorption spectroscopy. Whether the drugs are prepared by robots for hazardous or non-hazardous substances, manually or by outsourcing, DrugLog supports all of these processes.

RaySearch acquired the DrugLog product from Pharmacolog in Uppsala at the beginning of 2024 to complement its product range through the improvement and/or simplification of quality assurance in cancer treatment with cytostatic drugs. DrugLog was presented for the first time by RaySearch at the US trade fair RSNA in early December and will now continue to be integrated into RaySearch’s offering.

RaySearch received its first order for DrugLog at the end of 2024, through sales to the Polish firm Medim.

SUSTAINABILITY REPORT

BACKGROUND

t his Sustainability Report covers the 2024 fiscal year and concerns RaySearch l aboratories ab (publ) including its subsidiaries. t he Sustainability Report is prepared in accordance with the relevant provisions of the Swedish a nnual a ccounts a ct pursuant to the wording that applied before July 1, 2024, and is a complement to the a nnual Report. RaySearch’s sustainability work is integrated into its operations. i t is based on the double materiality principle, which means that we consider both how external factors impact our operations and how our operations impact society and the environment. t he first double materiality assessment (DM a) was conducted in 2024, and preliminarily identified our material sustainability areas as climate impact, own workforce, workers in the supply chain and business conduct.

t he purpose of the report is to provide a transparent view of RaySearch’s current and future sustainability work, and how well RaySearch is meeting its sustainability objectives. a s 2025 approached, RaySearch adapted its reporting to the european Sustainability Reporting Standards (e SRS) in accordance with the Corporate Sustainability Reporting Directive (CSRD), including a gap analysis. in the event of a future decision in accordance with the european Commission’s omnibus proposal, RaySearch will no longer be subject to the CSRD. RaySearch nevertheless intends to continue working proactively on sustainability matters and to develop its reporting with the aim of strengthening its sustainability efforts throughout the value chain.

Data compilation

non-financial information has been obtained from various reporting systems and from each of RaySearch’s operating segments. a ll sustainability reporting is conducted at Group level, covering both the p arent Company and all of its subsidiaries, providing a comprehensive view of our impact and contributions across all regions and business units. t he DM a is updated annually and subsequently approved by the b oard of Directors to ensure that the company’s sustainability work is in line with its strategy and changing stakeholder requirements. Comments in this report describe whether any data is limited due to, for example, a deficiency in internal control, it systems or internal documentation.

Responsibility for the report

Sustainability work at RaySearch is managed by a dedicated Sustainability Committee led by the Deputy Ceo t he Chief Financial officer (CFo) manages financial aspects and the Chief people officer (Cpo) monitors sustainability data related to employees. t he board of Directors is responsible for reviewing and approving the Sustainability Report, ensuring accountability, completeness and regulatory compliance.

RAYSEARCH FROM A SUSTAINABILITY PERSPECTIVE

RaySearch recognizes the importance of sustainability from a societal perspective, not only in terms of the environment but with respect to social responsibility and corporate governance as well. our sustainability strategy aligns with the double materiality principle, which means that we consider both how external factors impact our operations and how our operations impact society and the environment. our sustainability work encompasses the entire value chain, and our stakeholders include patients, health professionals, employees, investors and society at large. We strive to meet their expectations through long-term sustainability efforts that follow established sustainability practices and ensure compliance with applicable regulations.

Value offering

RaySearch provides innovative software to improve cancer treatment in terms of both efficiency and treatment outcomes. RaySearch currently has four main products: the RayStation treatment planning system, the RayCare oncology information system, the Rayintelligence analytics system and the RayCommand treatment control system.

Operations

RaySearch’s software is developed at the head office in Stockholm and is distributed globally through licensing agreements with leading medical technology companies and its own marketing organization. RaySearch’s software is distributed to over 1,000 clinics in more than 40 countries.

Customers and market

RaySearch’s customers comprise cancer centers all over the world and the business is driven by the need for effective cancer treatment. t he global market is divided into three geographic regions: a mericas, europe/a frica and a sia-p acific & Middle e ast.

Sales channels

RaySearch has formed a global organization with offices and distributors in our three regions. a n ethical supply chain is important to secure our distribution channels.

Business partners

RaySearch’s partners include leading cancer clinics, research institutes and medical device suppliers.

t he company’s material sustainability areas are presented below, together with the main risks, policies and key sustainability indicators (KS is) for each area.

MATERIAL SUSTAINABILITY AREAS AND SUMMARY TABLES

OWN ENVIRONMENTAL IMPACT

Main risks:

• C o2 emissions and energy consumption could negatively impact our carbon footprint.

p olicies and guidelines:

• e nvironmental management system (e MS)

RaySearch is reducing the energy consumption of its own operations by reducing the power consumption of computers, heating/cooling in premises, transport and business travel. Most of RaySearch’s employees work in environmentally certified premises, and flights are avoided for transportation and travel wherever possible, with consideration given to time constraints.

t he table below summarizes RaySearch’s GHG emissions. t he scope of reporting is the same as in previous years, with a selection made in the Scope 3 categories based on available data. e missions from company vehicles decreased in 2024 due to a reduction in the number of gas and diesel cars. e missions from external data centers increased because the figure for 2023 did not include emissions from cooling, which are included for 2024. by far the largest item is emissions from business travel by air, where we noted a continued increase due to expanded marketing activities, and we expect that this increase may continue.

sions

OWN WORKFORCE

Main risks:

• Risk of losing key employees and a poor work environment p olicies and guidelines:

• Code of Conduct

• Health & Safety p olicy

• Diversity policy

t he risks associated with losing key employees, a lower level of employee wellbeing and loss of innovation capability are managed by implementing RaySearch’s Code of Conduct, Health & Safety p olicy, Staff Rehabilitation p olicy, p olicy a gainst Discrimination, Harassment and Victimization, and Whistleblowing p olicy. t his ensures good working conditions for all of RaySearch’s employees.

RaySearch conducts annual employee satisfaction surveys for the entire company in order to measure and monitor the results of implemented activities, to identify areas for improvement, to monitor the work environment and to gather feedback from employees. e mployee engagement is tracked using tools such as the e mployer net p romoter Score (enp S), and the score for 2024 was +31, a significant increase over +14, which was the score for both 2023 and 2022. t he main driving

forces for working at RaySearch are work motivation and purpose, ambitious and talented colleagues, the work climate and a competitive benefits package. in 2025, RaySearch will continue to strengthen the company’s internal communication, as this was one area in the employee satisfaction survey that showed potential for improvement.

RaySearch works in several ways to attract new workers who can meet tomorrow’s needs. employee dialogue has revealed that colleagues, an open culture, training opportunities and flexibility are valued highly by employees. in order to give all employees the right conditions to help achieve the company’s targets, regular meetings are held between managers and employees, and employees are encouraged to take on new roles.

RaySearch believes in a workplace culture and that working from the office maintains the company culture that we want to have. in 2024, therefore, we continued to promote increased collaboration on site in the office, while offering flexibility. a ll RaySearch departments conducted workshops in 2024 to raise awareness in the organization as part of the company’s efforts related to diversity and equal treatment, and against discrimination and harassment.

WORKERS IN THE SUPPLY CHAIN

Main risks:

• negative impacts of the electronics supply chain, including working conditions and environmental impacts

RaySearch has preliminarily identified the risk of negative impacts from electronics suppliers such as Dell and n V iDia in terms of working conditions and environmental impact, but has not yet begun any systematic evaluation of these suppliers or comparison with competing alternatives.

GOVERNANCE

Main risks:

• unethical business relationships and non-compliance p olicies and guidelines:

• a nti-corruption p olicy

• Code of Conduct

Responsible business is the key to success in all internal and external relationships. Responsible business refers to RaySearch’s ethical and sound business principles that follow local and international regulations and have zero tolerance of corruption, anti-competitive practices or human rights abuse. in order to incorporate this into the operations, responsibility has been spread across the company based on the a nti-corruption p olicy, Code of Conduct and a screening process for business relationships within the framework of RaySearch’s trade compliance program.

RaySearch’s Code of Conduct provides a framework for what RaySearch considers responsible and sustainable behavior. t he Code of Conduct covers all employees, b oard members, independent consultants and other people acting on behalf of RaySearch. t he Code of Conduct is available on the intranet and highlighted during the induction program for all new employees. t he Code of Conduct is also a key element of RaySearch’s compliance program training, which all employees complete every year. in 2024, 87 percent of employees completed this training, which is below the target of 95 percent. RaySearch monitors its business ethics measures by reporting the number of confirmed corruption incidents and actions taken during the year, as well as the number of legal disputes related to anti-competitive practices. in 2024, no confirmed corruption incidents or legal disputes related to anti-competitive practices were reported, nor any whistleblowing incidents.

AUDITOR´S REPORT ON THE STATUTORY SUSTAINABILITY REPORT

TO THE GENERAL MEETING OF THE SHAREHOLDERS IN RAYSEARCH LABORATORIES AB (PUBL), CORPORATE IDENTITY NUMBER 556322–6157.

Engagement and responsibility

i t is the board of directors who is responsible for the statutory sustainability report for the year 2024 on pages 23-26 and that it has been prepared in accordance with the a nnual a ccounts a ct according to the previous version applied before 1 July 2024.

The scope of the audit

our examination has been conducted in accordance with Fa R’s standard RevR 12 t he auditor´s opinion regarding the statutory sustainability report. t his means that our examination of the statutory sustainability report is substantially different and less in scope than an audit conducted in accordance with international Standards on a uditing and generally accepted auditing standards in Sweden. We believe that the examination has provided us with sufficient basis for our opinion.

Opinion

a statutory sustainability report has been prepared.

Stockholm in accordance with digital signature Deloitte ab

Signature on Swedish original Kent Åkerlund a uthorized p ublic a ccountant

ANNUAL ACCOUNTS AND CONSOLIDATED FINANCIAL STATEMENTS

ADMINISTRATION REPORT

The Board of Directors and CEO of RaySearch Laboratories AB (publ), Corporate Registration Number 556322-6157, hereby present the annual accounts and consolidated financial statements for the fiscal year of January 1–December 31, 2024. The Parent Company and the Group present their financial statements in SEK. The company’s Board of Directors is based in Stockholm.

OPERATIONS

RaySearch Laboratories AB (publ) is a medical technology company that develops innovative software solutions to improve cancer care. RaySearch markets the RayStation® treatment planning system (TPS) and the RayCare® oncology information system (OIS) as well as the latest additions to the product line, RayIntelligence® and RayCommand®. RayIntelligence® is an innovative cloud-based oncology analytics system that cancer centers use to gather, structure and analyze data. The RayCommand® treatment control system (TCS) is designed to link the treatment machine and the treatment planning and oncology information systems. The company was founded in 2000 as a spin-off from the Karolinska Institute in Stockholm and the share has been listed on Nasdaq Stockholm since 2003.

RaySearch’s vision is a world where cancer is conquered. A large part of development in cancer treatment is already driven by various software systems and the company’s mission is to provide innovative software to continuously improve cancer treatment that improves quality of life for patients and saves lives. RaySearch’s main revenue is generated when customers pay an initial license fee for the right to use RaySearch’s software and an annual service fee for access to updates and support. All software systems are developed at RaySearch’s head office in Stockholm and sold and distributed by the company’s global marketing organization.

The company’s strategy is based on a strong focus on innovative software development with leading functionality, support for streamlined workflows (including digitization, automation and machine learning) and broad support for a wide range of treatment modes and types of radiation therapy machines. The company also engages in close collaboration with world-leading clinics and industrial partners, and invests heavily in R&D.

RayStation is established in all major global markets as one of the most advanced treatment planning systems for radiation treatment of cancer. The company’s sales success is based on RayStation’s high calculation speed, support for adaptive radiation therapy, automated workflows, unique multi-criteria optimization and user-friendly interfaces. Another strength is the wide range of radiation therapy machines

supported by the system – more than any other treatment planning system. RayStation helps to improve the radiation therapy process and to extend the life of the treatment machines, which means they can be used more effectively. This means that clinics that want to improve and develop their care are no longer dependent on buying the latest treatment machines – they can achieve similar, positive outcomes by opting for RayStation as their treatment planning system. Overall, more and more highly regarded cancer centers can now confirm that RayStation is helping them to optimize their radiation therapy process and enabling more effective use of their existing radiation therapy machines.

Treatment planning for proton therapy (protons/carbon ions/BNCT) is a key area of focus for RaySearch. The company has a global market share of more than 50 percent in this advanced market segment. Less than 1 percent of all patients who receive radiation therapy receive proton therapy, but an estimated 20 percent could benefit from treatment with protons, which indicates significant growth potential in this field.

Ever since RayStation was first released, RaySearch has focused on and achieved major sales success in several of the world’s most advanced and renowned radiation therapy centers. To date, nearly 1,100 cancer centers in more than 46 countries have purchased RayStation. At the same time, there are more than 8,000 radiation therapy centers worldwide, so the company’s growth potential is still high.

Alongside of this, the company’s oncology information system (OIS), RayCare, is rapidly becoming the next-generation OIS. RayCare is fundamentally different to other OISs and has been designed to support and optimize various work flows at modern cancer centers. Many cancer patients are treated with a combination of treatments and unlike existing systems, RayCare is a comprehensive information system that supports the three main types of cancer treatment – radiation therapy, chemotherapy and surgery. It brings integrated cancer care within reach of many cancer centers, which will create clinical possibilities that are unachievable for competing systems. RayCare coordinates all activities efficiently and provides advanced features that include clinical resource optimization, digitization and workflow automation as well as adaptive radiation therapy. The system has also been developed to meet tomorrow’s need for advanced analysis and decision support. Since 2023, RayCare has been interoperable with Varian’s best-selling treatment machine, the TrueBeam® linear accelerator, which offers considerable market potential.The development of RayCare has been taking place for a long time, in collaboration with members of the RaySearch Clinical Advisory Board: MD Anderson Cancer Center, Princess Margaret Cancer Centre and Provision Healthcare in the US, Heidelberg University Hospital in Germany,

MedAustron in Austria, Swiss Medical Network in Switzerland, the University Medical Center Groningen in the Netherlands and Iridium Network in Belgium. In addition to these partners, the growing group of RayCare customers is also contributing to the development process. Solving the coordination, safety and efficiency needs of the world’s cancer centers is one of RaySearch’s most exciting challenges to date. The company’s collaborations with leading clinics provide good conditions for success by combining their extensive clinical know-how with RaySearch’s ability to develop innovative software.

Since 2018, machine learning applications have been available in RayStation to automate organ segmentation and treatment plan generation. The development of the cloud-based RayIntelligence oncology analytics system continued during the year. The system was launched in December 2020 to make it easier for clinics to use their data to streamline, personalize and improve future treatments, and to train machinelearning models. RayIntelligence offers the stable data infrastructure that a clinic needs to personalize treatment protocols and thereby improve treatment outcomes. The system has tools for analyzing trends and performance, and also gathers and provides an overview of all clinical activities.

Back in 2022, a key milestone was achieved for the RayCommand treatment control system: clinical use at MedAustron in Austria. RayCommand offers uniform management, synchronization and control of important systems in the radiation therapy room. At MedAustron, RayCommand is used together with RayStation and RayCare, making MedAustron the first center in the world to implement such a solution. Combined use offers streamlined workflows and automated data transfers between the systems. RaySearch and MedAustron have been collaborating since 2012, a partnership that was further developed in 2023 with a new research agreement.

RaySearch is an R&D-oriented company in which about half of the company’s employees are engaged in R&D, and 29 percent of the company’s net sales over the past five years have been reinvested in R&D. Research activities form the basis for next-generation systems and products. Research is conducted in close collaboration with the Royal Institute of Technology in Stockholm, MD Anderson Cancer Center in Houston in the US, Leeds Teaching Hospitals NHS Trust in the UK, UMCG in the Netherlands, and Heidelberg University Hospital in Germany. Development is focused on transforming customer demands and the company’s innovations into commercial products. This takes place by creating new products, and by further developing and maintaining existing products. Development activities apply an agile approach and modern tools in close collaboration with leading clinics and industrial partners all over the world.

HIGHLIGHTS OF THE YEAR

RayStation in nearly 1,100 radiation therapy centers worldwide

In January, RaySearch announced that the number of radiation therapy centers that have chosen RayStation® for treatment planning had exceeded 1,000. At the end of the year, the figure was 1,082. The first version of RayStation was launched in 2009 and the system is now in use at cancer centers in 46 countries across the world.In 2024, several leading cancer centers chose the RayStation treatment planning system, including:

• The Froedtert & Medical College of Wisconsin hospital chain in the US

• National Institutes for Quantum Science and Technology (QST) in Chiba, Japan

• The New York Proton Center in the US, which expanded its RayStation installation

• GenesisCare in the UK

• Institut de Cancérologie de Lorraine, Centre Jean Perrin and Centre Hospitalier Universitaire de Limoges in France, which placed orders for the RayStation® treatment planning system within the Unicancer 2019 framework

• Institut Curie in France, which selected RayStation for proton treatment planning

• Trento Proton Therapy Center in Italy, where RayStation is in clinical use for proton arc therapy

Raigmore

Hospital in Scotland selects RayCare

After an extensive evaluation, the Raigmore center decided to select RayCare as their new, sole oncology information system. RayCare will cover the full patient pathway including treatment delivery using the Varian Treatment Interface for connecting RayCare to the Varian treatment console. RayCare went into clinical use at the beginning of 2025.

RaySearch acquires the product DrugLog from Pharmacolog for chemotherapy quality assurance

On February 9, the acquisition of the product DrugLog™ from Pharmacolog AB was announced. DrugLog™ is a cost-effective solution for quickly and efficiently verifying the identity and concentration of compounded injectable medications, used for cancer treatment with cytostatic drugs (chemotherapy). Through this agreement, RaySearch acquires full ownership of all rights to the product DrugLog for its application in the field of oncology, including the measuring device, calibration parameters, source code as well as intellectual property rights. The purchase consideration for the asset acquisition amounted to SEK 7 M.

RaySearch and C-RAD sign collaboration agreement

In May, RaySearch and C-RAD AB announced a collaboration agreement aimed at jointly developing innovative solutions and products to enhance the quality of radiation therapy. The focus of the collaboration is to investigate how the C-RAD surface scanning technologies can be utilized during treatment planning in RaySearch’s treatment planning system RayStation. Today, the surfaces from the C-RAD surface guided radiation therapy system, Catalyst+, are used during imaging and treatment. Making the Catalyst+ surfaces available in RayStation® has many potential applications. One such application is to extend a cone beam CT (CBCT) image that has a limited field-of-view by using information from the surface scanning. This will lead to more complete representation of the patient’s anatomy, which in turn results in a more dependable basis for clinical decisions.

RaySearch releases RayCare 2024A

In May, the company announced the release of the latest version of RayCare®, the next generation oncology information system. RayCare 2024A features interoperability with Varian TrueBeam linear accelerators and an enhanced experience for treatment course management,

improving usability and efficiency of treatment management. RayCare 2024A brings an enhanced experience for treatment course management with additional features and a fully integrated workflow from treatment prescription to treatment delivery and the review of treatment delivery results. Combined with the active workflow support and treatment and QA scheduling capabilities in RayCare, as well as the deep integration with RayStation, this brings efficiency and safety in the clinical workflow by reducing the number of manual actions required. Other feature updates in RayCare 2024A include enhancements and usability updates to patient chart and task management features as well as support for more external systems interfaces for improved coexistence with other hospital systems.

RayCare interoperable with Varian TrueBeam

In May, the oncology information system RayCare® 2024A was certified to be interoperable with Varian TrueBeam® linear accelerators, version 3.0. This was the result of joint testing activities between RaySearch and Varian Medical Systems during 2024. The interoperability certificate for 2024A was issued prior to the release of RayCare 2024A. TrueBeam is Varian’s most prevalent treatment delivery platform and has been installed in thousands of radiation therapy clinics worldwide since its launch in 2010. It supports all treatment techniques and capabilities that are provided by so called c-arm linacs, including IMRT, VMAT and electrons with flexible beam energy selection and non-coplanar beam arrangements. The interoperability certificate applies to linacs in the TrueBeam family equipped with kV imaging: TrueBeam, TrueBeam STx, Edge and VitalBeam.

RayStation used for first-ever radiotherapy treatment with Hitachi’s OXRAY system

In June, RaySearch’s RayStation® was used for the world’s first clinical treatment using OXRAY, a new treatment machine from Hitachi. The event took place on June 17 at Narita Memorial Hospital in Toyohashi, Japan. OXRAY represents a pioneering radiotherapy system featuring a Gimbal-mounted beam delivery system. RayStation was used to drive its motion tracking functionality, dual-source CBCT image-guided radiotherapy for precise patient positioning, and dynamic swing arc capabilities. Developed in collaboration with Kyoto University Hospital, the OXRAY system has been seamlessly integrated into RayStation through close collaboration between RaySearch and Hitachi.

RaySearch releases RayStation 2024B

In July, RayStation® 2024B was launched, the latest version of the company’s innovative treatment planning system. The new version comes with automation of important clinical workflows, such as automatic image import directly followed by deep-learning segmentation and rapid automated plan adaptation. Adaptive radiation therapy involves continuous adjustment of the delivered radiation dose to account for changes in the patient anatomy throughout the course of treatment, which in most cases extends over several weeks. The adjustments are made to ensure the best treatment every day. RayStation 2024B brings a new workspace for fully automated follow-up and plan adaptation. The automated workflow includes several steps: First, the daily image of the patient is enhanced to allow for accurate dose computation and the organs and