MARKET REPORT

Q3 2025 • TETON VALLEY

MARKET REPORT

Q3 • THE TETON VALLEY MARKET

The Q3 2025 Teton Valley real estate market reflected continued stability, with steady sales activity and balanced pricing trends despite ongoing affordability pressures and a higherrate environment. Overall momentum held firm, underscoring the valley’s resilience and growing appeal as a lifestyle-driven alternative to Jackson Hole.

Single-family homes remained the cornerstone of market activity, though signs of normalization emerged. Sales rose 14%, while total dollar volume climbed 37%, supported by sustained interest in high-end resort communities such as Teton Springs, Tributary, and Teton Reserve— which continue to elevate overall price metrics. The average sale price reached $1.57 million, and the median rose to $1.07 million, though these figures are notably skewed upward by luxury product within these developments. Days on market averaged just over 90 days, down from earlier in the year, reflecting steady absorption but also slightly slower decision-making among buyers as new inventory entered the market.

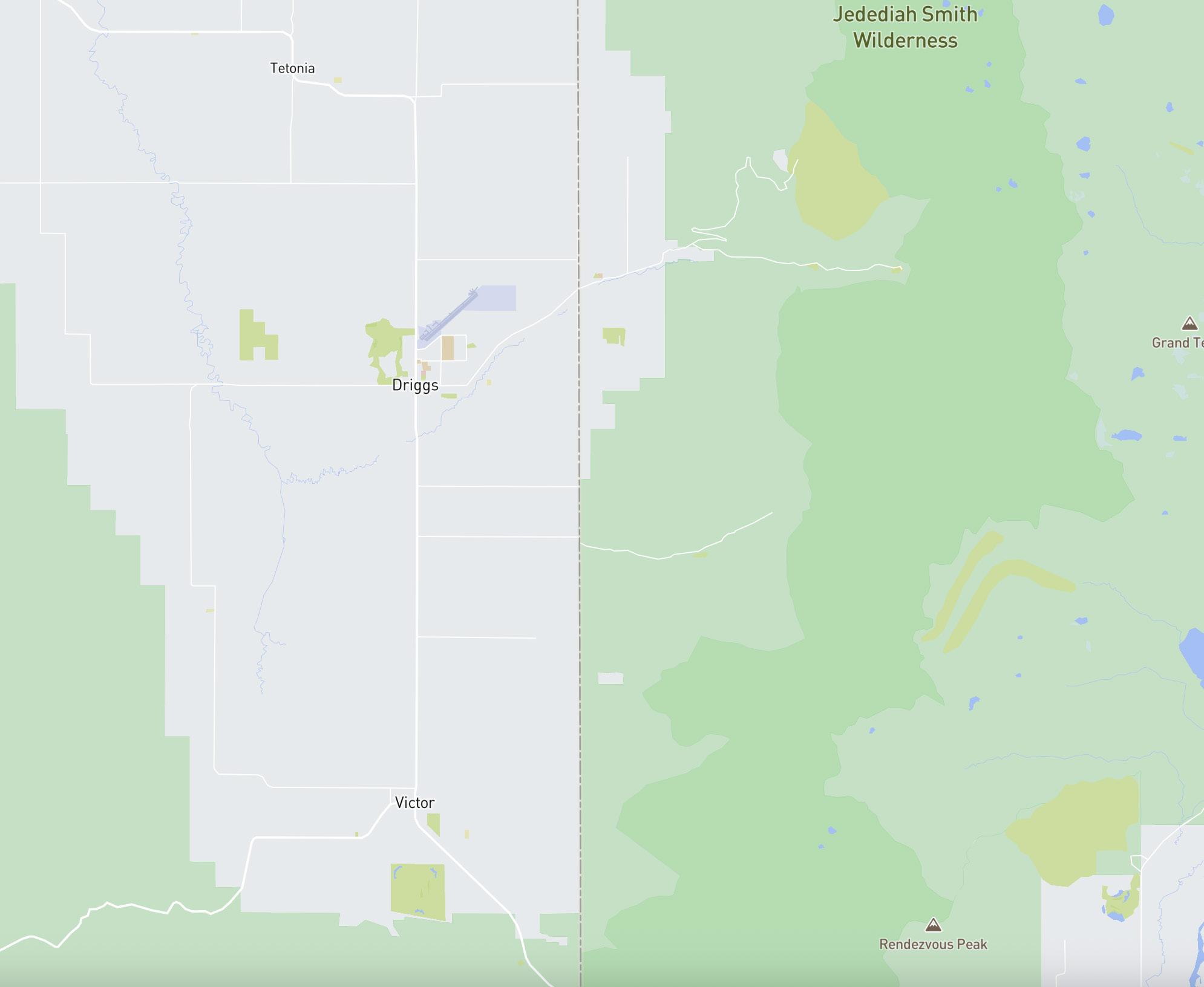

Market conditions have transitioned closer to a modest buyer’s market, with more balanced negotiation power between buyers and sellers. Pending transactions dipped slightly heading into Q4, suggesting some seasonal cooling and buyer selectivity, particularly outside premium enclaves. Still, Driggs and Alta drove much of the quarter’s volume, offsetting softer activity in Victor and Tetonia, and continued to capture demand from both full-time residents and second-home buyers

seeking access to recreation, views, and newer construction.

Condominiums and townhomes continued to perform strongly, with sales up 71% and total dollar volume rising 56%, even as prices eased modestly due to a greater share of sales in the $400K–$700K range. The segment’s appeal remained anchored in its convenience and value, particularly for regional buyers seeking low-maintenance, centrally located properties near ski areas and town centers. This sector was bolstered by the performance of a new condominium development located in Driggs.

Vacant land activity moderated from last year’s highs but maintained steady engagement, with sales down 19% and total dollar volume off 9%. Prices remained firm—average up 13% and median up 6%—as buyers continued to pursue well-sited, infrastructure-ready parcels in Victor and Driggs, though higher construction costs kept some would-be builders on the sidelines.

Overall, Q3 2025 reflected a balanced, maturing market in Teton Valley—one defined by continued activity, steady pricing, and more deliberate pacing after several years of rapid growth. As the valley moves into year-end, modest inventory expansion, ongoing interest in luxury resort communities, and resilient lifestyle demand position the market for a stable transition into Q4 2025.

TOTAL DOLLAR VOLUME 39% INCREASE YOY $396M

AVG SFH SALES PRICE 21% INCREASE YOY $1.6M

MEDIAN SFH SALES PRICE 7% INCREASE YOY $1.1M

TOTAL TRANSACTIONS 14% INCREASE YOY 134

ACTIVE LISTINGS 25% INCREASE YOY 141

VICTOR, IDAHO (163)

DRIGGS,

IDAHO (200)

ALTA, WYOMING (67)

TETONIA, IDAHO (9)

SINGLE FAMILY HOMES

SOLD · LISTED AT $4,850,000 · DRIGGS REPRESENTED BY CARL STRUTTMANN

Single-family homes remained the cornerstone of market activity in Q3 2025, with steady demand but a slower sales pace as buyers took longer to act. Sales rose 14% to 134 transactions, led by gains in Driggs (+64%) and Alta (up from 2 to 4 sales), offsetting softer results in Victor (–14%) and Tetonia (–5%). Total dollar volume increased 37% to $210.7 million, underscoring ongoing upper-tier strength despite broader market moderation.

Performance was heavily influenced by luxury resort communities like Teton Springs, Tributary, and Teton Reserve, which continued to skew pricing upward. The average sale price climbed 21% to $1.57 million, and the median rose 7% to $1.07 million, with

most appreciation concentrated in these high-end enclaves.

Days on market extended to 132, roughly double year-over-year, reflecting a more deliberate buying environment and a shift toward a buyer’s market. While resort properties maintained steady absorption, broader segments saw longer listing times and greater pricing sensitivity.

Pending sales eased heading into Q4, suggesting typical seasonal cooling and growing selectivity among buyers. Overall, Q3 reflected a measured and maturing single-family market, driven by consistent lifestyle demand, high-end influence, and a gradual return to balance heading into year-end.

MARKET STATS

MARKET STATS BY AREA

VICTOR DRIGGS TETONIA ALTA

CONDOS/TOWNHOMES

Condos and townhomes in Teton Valley saw limited overall market activity in Q3 2025, with most of the quarter’s movement stemming from a single development—The Flats at Teton Peaks in Driggs. This community, positioned at a lower price point, accounted for the majority of sales, giving the appearance of stronger volume even as broader market engagement remained subdued.

Transactions rose 71% to 70 closings, and total dollar volume increased 56% to $37.6 million, but these gains were largely isolated to that one project. Outside of The Flats, activity was muted, and buyer conditions improved as inventory expanded and market times stretched. The average sale price fell 8% to $537,000, and the median declined 12% to $509,950, both influenced by the concentration of lower-priced units

rather than widespread value shifts across the valley.

Days on market lengthened, and pending sales softened heading into Q4, signaling that buyers now have greater flexibility and negotiating power. Many are taking additional time to compare options, explore incentives, or wait for price adjustments— especially as developers compete for attention in a slower fall market.

Overall, Q3 2025 highlighted a narrowly driven and increasingly buyer-oriented condo and townhome sector, defined by concentrated activity in one project and more deliberate buyer behavior elsewhere. As the year closes, sellers and developers will need to price competitively and adapt to a market where value and patience outweigh urgency.

SOLD · LISTED AT $475,000 · VICTOR REPRESENTED BY MOUNTAIN STANDARD

MARKET STATS

VACANT LAND

SOLD LISTED AT $250,000 TETON SPRINGS REPRESENTED BY PAUL KELLY

The vacant land market in Teton Valley remained steady but showed clearer signs of slowing absorption in Q3 2025, as buyers became more selective and timelines stretched. Total transactions declined 19% to 207 sales, while total dollar volume slipped 9% to $78.6 million, signaling a measured pullback following several active years.

Days on market increased noticeably, reflecting longer decision cycles and greater scrutiny from buyers facing high construction and financing costs. Pending sales trailed last year’s pace, pointing to a more deliberate approach to land purchases and fewer speculative transactions. While demand for well-sited, build-ready parcels persisted, much of the current activity centered around smaller lots or those with existing infrastructure.

Pricing held relatively firm amid slower absorption. The average sale price rose 13% to $379,500, and the median increased 6% to $237,500, reflecting the sustained value of developable land in key corridors. Victor and Driggs continued to anchor market strength—Victor’s dollar volume rose 11% to $30.2 million, while Driggs held nearly flat at $27.6 million— contrasting with Tetonia (–38%) and Alta (–8%), where activity cooled after a strong run earlier in the year.

Overall, Q3 2025 reflected a stable but slower land market, shaped by extended listing times, cautious buyers, and fewer pending deals. While long-term demand for quality parcels remains intact, current conditions favor buyers who can act strategically and negotiate value amid a more patient, inventory-rich environment.

MARKET STATS

Experience the Compass Real Estate difference by working with Jackson Hole’s leading real estate experts. We are a team of trusted advisors working collaboratively to leverage our collective knowledge and expertise to deliver fundamentally different services. For us, nothing matters more than creating a legacy of excellence that honors and celebrates our people and the exceptional place we call home.

To start your search of all active Jackson Hole listings, scan the QR code.