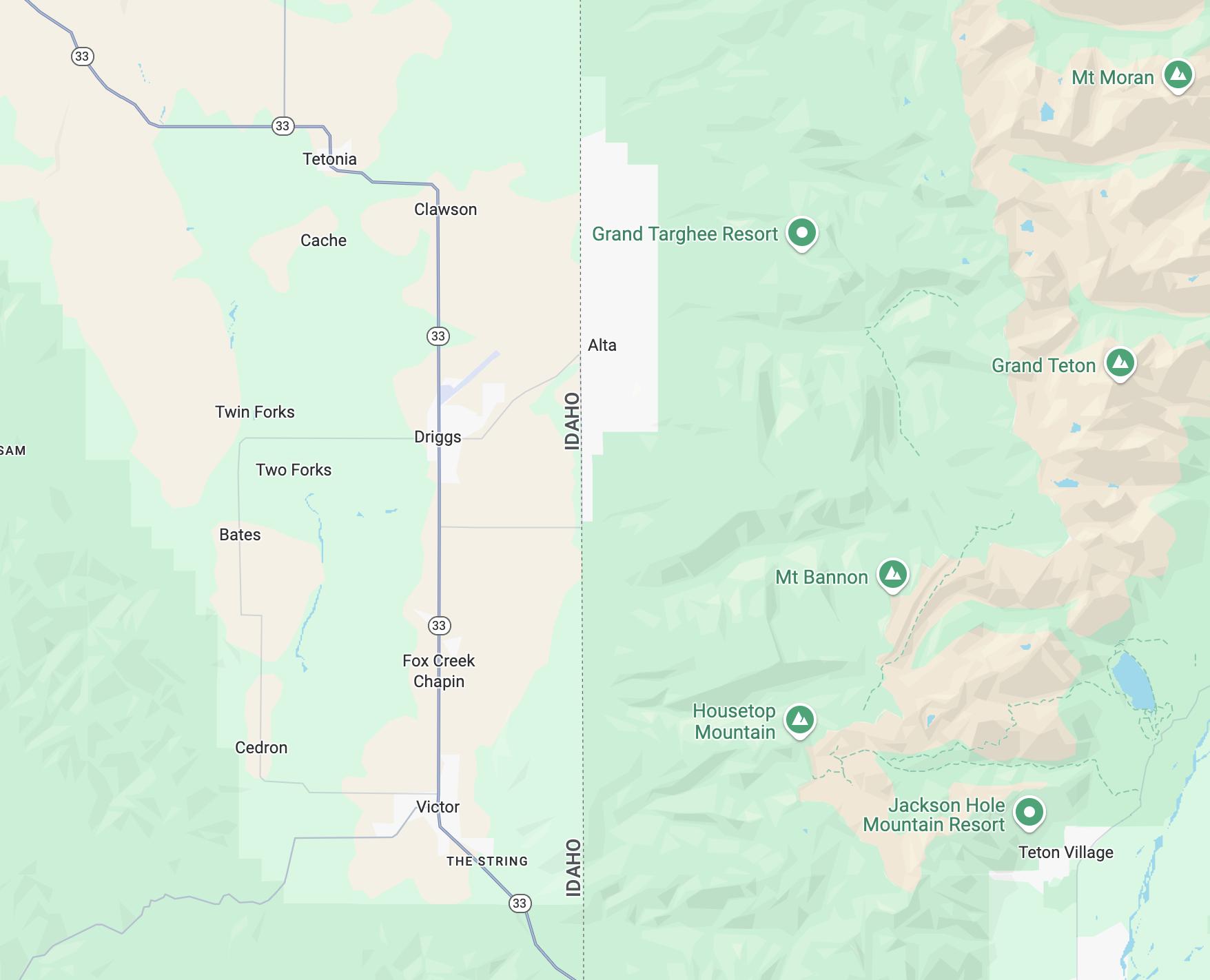

MID-YEAR 2025 • TETON VALLE Y, IDAHO

MID-YEAR 2025 • TETON VALLE Y, IDAHO

Q2 2025 brought both challenges and growth to the Teton Valley real estate market amid a backdrop of national economic uncertainty. Political volatility and fluctuating consumer confidence created hesitancy among some buyers and sellers Yet, the Teton Valley market demonstrated resilience, with an 18% increase in total dollar volume YOY and moderate price growth across several property segments. While many of the Q2 closings reflected deals made before the May 12 reversal of U S -China tariffs, which catalyzed a sharp stock market rebound, the full effects of that confidence boost may manifest in the coming quarters. Inventory levels increased 116%, pending listings more than doubled, and average time on market saw a modest dip, indicating growing interest, tempered by buyer caution.

The single-family home segment experienced modest growth in both sales volume and prices Total transactions rose 3% from Q2 2024, and total dollar volume increased by 19% to over $105 5M Driggs led the market with a 43% increase in home sales and a 26% increase in average sale price Victor, by contrast, saw a 29% drop in unit sales and a 2% dip in average price. Median prices valley-wide rose 7% to $1.06M, and inventory nearly doubled With buyer confidence slowly rebounding and interest rates holding steady, this segment appears poised for further stabilization in the second half of the year

The condo and townhouse category posted the most robust growth of any sector, with sales increasing 64% YOY and total dollar volume climbing nearly 48% Driggs was the standout, thanks to a new condo development, tripling its number of condo sales from 17 to 45, although average sale prices there dipped 14%. Median prices fell 13% across the valley, suggesting buyers remain price-sensitive in this segment

Still, continued demand, particularly for more affordable and lowmaintenance housing options, has helped keep this sector strong, even amid broader economic uncertainty.

Vacant land sales cooled significantly in Q2 2025, dropping 66% in total transactions from the previous year Despite this, the average sale price increased by 24% to $387K. Notably, Alta experienced a sharp increase in both average and median prices, likely due to limited inventory and the sale of premium parcels The overall dollar volume fell 8%, reflecting the lower transaction count. With land listings still abundant and demand recovering unevenly, this segment may take longer to rebound fully, particularly as buyers weigh building costs and long-term investment timelines.

The commercial real estate sector saw an increase in activity, with five properties sold this quarter compared to three in Q2 2024, a 67% rise in transaction volume. Though average prices declined 27%, total dollar volume climbed 22% to $5 14M, driven primarily by sales in Driggs These numbers suggest growing investor interest in income-producing or redevelopment properties, especially in town centers. However, price sensitivity remains, and continued demand will likely be tied to broader economic confidence and small business growth

In summary, the Teton Valley market continued to show resilience in Q2 2025, buoyed by rising sales activity in single-family homes and condos, even as macroeconomic uncertainty lingered The steep drop in land sales underscores buyer caution amid longterm planning decisions, while the commercial sector’s modest rise hints at renewed investor confidence With interest rates holding steady, consumer confidence tentatively rebounding post-May, and inventory levels increasing significantly, the valley appears well-positioned to capitalize on renewed activity as we move into the second half of 2025

SOLD LISTED AT $795,000 TETONIA, IDAHO REPRESENTED BY CHLOE PIERCE

The vacant land sector in Teton Valley saw a significant contraction in Q2 2025, with total transactions down 66% compared to the same period last year. Despite this steep drop in volume, the average sale price rose 24%, indicating that buyers who are moving forward are targeting premium or well-positioned parcels, especially in Alta, where both average and median prices saw dramatic increases. Still, the valley-wide slowdown reflects broader caution in the face of elevated construction costs, interest rate stability without decline, and ongoing economic uncertainty.

Many prospective buyers appear to be hitting pause on long-term building plans, weighing the volatility in material prices and permitting timelines. With available inventory remaining high and demand uneven, the land market continues to offer opportunity for patient investors and visionaries, but will likely require stronger consumer confidence and economic clarity before fully regaining momentum.

SOLD LISTED AT $645,000 DRIGGS, IDAHO REPRESENTED BY ANDREA LOBAN

Commercial real estate in Teton Valley gained momentum in Q2 2025, with sales activity rising 67% compared to the previous year. Driggs led the movement with five closings, pushing total commercial dollar volume up 22% to just over $5.1 million. While the average sale price declined by 27%, this shift suggests a growing appetite for smaller-scale investments or redevelopment opportunities as buyers look to capitalize on the area’s increasing population and tourism flow

Inventory rose by 56%, providing more options for entrepreneurs and investors exploring footholds in the valley’s evolving business landscape. As downtown corridors and mixed-use zones continue to attract interest, the commercial sector is showing signs of renewed vitality, driven by strategic acquisitions and long-term confidence in the region’s growth potential.

Experience the Compass Real Estate difference by working with Jackson Hole’s leading real estate experts. We are a team of trusted advisors working collaboratively to leverage our collective knowledge and expertise to deliver fundamentally different services For us, nothing matters more than creating a legacy of excellence that honors and celebrates our people and the exceptional place we call home To

search of all active Jackson Hole listings,