Completion Resource Toolkit

What you need to know! The goal:

The FAFSA is administered by Federal Student Aid, a division of the U.S. Department of Education that also oversees federal grants and loans for students. The FAFSA is the first step in the financial aid process to unlock many types of aid-not just loans or need-based aid. Even students who don’t think they’ll qualify for aid should complete it because 1. You never know! And 2. The FAFSA is also used by colleges and many other programs as the application for scholarships.

Decrease the time it takes to complete the FAFSA.

Increase the number of applicants and successful completions.

Increase the number of students receiving Pell Grants.

Increase focus on other aspects of planning and enrollment.

Reduce the amount of questions (108 to 36 questions).

| 2 hesc.ny.gov 2024-25 FAFSA Updates

EFC (Expected Family Contributions) to SAI (Student Aid Index). Tuition Assistance Program Don’t wait for FAFSA to apply for the Apply today! Register for your Studentaid.gov Account studentaid.gov/fsa-id USERNAME: ************ PASSWORD: *******

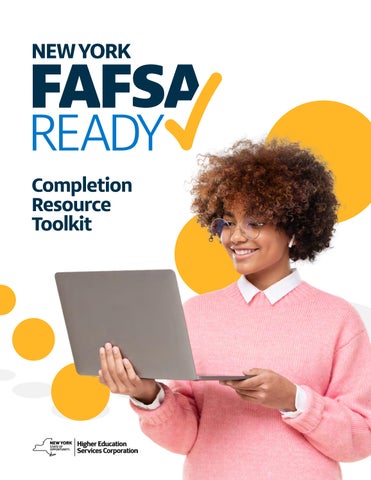

Creating & Using your StudentAid.gov Account

What’s a StudentAid.gov Account?

The Studentaid.gov Account is a username and password combination you use to log in to U.S. Department of Education (ED) online systems. The Studentaid.gov Account is your legal signature and shouldn’t be created or used by anyone other than you—not even your parent, your child, a school official, or a loan company representative. You’ll use your Studentaid.gov Account every year you fill out a Free Application for Federal Student Aid (FAFSA®) form and for the lifetime of your federal student loans.

How do I get an Account?

Visit studentaid.gov/fsa-id/create-account/launch to create an FSA ID. You’ll need your Social Security number, full name, and date of birth. You’ll also need to create a memorable username and password, and complete challenge questions and answers so you can retrieve your account information if you forget it.

FSA ID Tips

• If you need to provide information about your parents on the FAFSA® form, one of your parents will need an FSA ID to sign the form. Your parent can create an FSA ID and then sign the FAFSA form electronically using that FSA ID.

• Check out studentaid.gov/dependency. Remember: You create your own FSA ID, and your parent creates their own FSA ID. Also make sure to use the correct FSA ID when signing the FAFSA form electronically.

• When you first create your FSA ID, the use of your FSA ID will be restricted to completing, signing, and submitting an original (first-time) FAFSA form. You’ll have to wait one to three days for your information to be confirmed by the Social Security Administration (SSA) before you can use your FSA ID for other actions, such as submitting a FAFSA Renewal or signing a Master Promissory Note. You’ll receive an email letting you know that your info was successfully matched with the SSA, and you can begin using your FSA ID.

• If you forget your FSA ID username or password, look for the “Forgot My Username” and “Forgot My Password” links on log-in pages. These links will direct you to web pages where you can request a secure code to be texted to your verified mobile phone number or emailed to your verified email address. The secure code will allow you to retrieve your username or reset your password. You can also retrieve your username or reset your password by successfully answering your challenge questions. Remember: If you verified your email address or mobile phone number during account creation, you can enter your email address or mobile phone number instead of your username to log in.

You’ll be required to provide either your email address or your mobile phone number when you make your FSA ID. Providing a mobile phone number and/or email address that you have access to will make it easier to log in to ED online systems and allow additional account recovery options.

Learn more about how you can use your FSA ID at studentaid.gov/help-center/answers/article/howcan-i-use-my-fsa-id-username-and-password. Find this fact sheet at StudentAid.gov/resources.

| 3 hesc.ny.gov

Log onto studentaid.gov/fsa-id 1 You’ll need a: SSN#, Full Name, and DoB 2 Create a username of password. 3 Provide email address and number. 4 Important: A Social Security number, email address, and mobile phone number can only be associated with one FSA ID. If you share an email address with someone else, then only one of you will be able to use that email address to create an FSA ID.

FAFSAFAQS

FAFSA Timeline

This new process is being referred to as “FAFSA Simplification.” Is the new form really simplified?

The number of questions on the form has been reduced. The new form will also allow for a much larger percentage of students andparents to have their fi nancial information transferred from the IRS directly into the FAFSA. This enhanced process should make FAFSA submission a more efficient process.

Q: With the form opening in December, when should FAFSA assistance workshops begin?

We suggest scheduling FAFSA assistance events starting in January 2024. If the FAFSA opens in early December, it may be possible to host events prior to the holiday break.

Financial Aid Calculation Changes

Why did Expected Family Contribution (EFC) rename to Student Aid Index (SAI)?

The EFC has been renamed the Student Aid Index (SAI) to better reflect that this number is an indicator that colleges can use todetermine the need level for the student.

Will the number of family members in college still be used in determining the SAI?

No. The new legislation removed the number of family members in college from the formula. However, the question will remain on theform and will be required to be answered. This information may be used by the colleges if they wish to take it into consideration whenawarding institutional aid.

Studentaid.gov Account

Will a student or parent be able to access the 2024-25 FAFSA without a Studentaid.gov Account?

No. Every student, parent, or spouse that wishes to log in and complete or sign the FAFSA will need to have a verified Studentaid.gov Account. It takes one-to-three days for an Account to go through the verification process. Everyone should anticipate setting up their Studentaid.gov Account at least one week prior to starting the FAFSA.

Will individuals without Social Security numbers (SSN) be able to secure an Studentaid.gov Account to use with the 2024-25 FAFSA?

Yes. FSA is in the process of enhancing the Studentaid.gov Account process so that individuals without SSNs will be able to establish an Studentaid.gov Account to access and sign the FAFSA. Complete details of those newsteps have not yet been released. FSA will use TransUnion services to ask knowledgebased questions to help with identity verification like current or former address, a previous phone number, and employers.

What if the parent cannot successfully set up an Studentaid.gov Account in the new process?

If an individual’s identity cannot be verified through the online process, there will be an option to contact FSA and submit documentation (unspecifieded at this point) to help establish identity and therefore create an Studentaid.gov Account. If both processes do not allow for establishing an Studentaid.gov Account, the student and parent(s) will need to complete the paper version of the form and submit it via the regular mail process.

The Studentaid.gov Account login process requires a two-step verification (i.e., multifactor authentication) process to access the FAFSA. What if the email, text, or authenticator application verifi cation does not work? When establishing your Studentaid.gov Account or when you last logged in, you should have been provided a one-time back up code. This code can be used when all other forms of verification fail. Make sure to write this code down and keep it in a secure location in case you need to use it.

| 4 hesc.ny.gov

The 2024-25 FAFSA Checklist

Complete the Free Application for Federal Student Aid (FAFSA) at studentaid.gov to apply for federal, state, and college-based financial aid. Dependent students must include both student and parent data on the FAFSA. Determine your dependency status by answering the questions on the back.

REQUIRED INFORMATION

Student and parent 2022 Federal Income Tax Forms and all schedules

Student and parent Studentaid.gov Account usernames and passwords

Student and parent email addresses

Student and parent Social Security numbers

Student and parent dates of birth

Student and parent savings/checking account balances

Student and parent investments (ie. stocks, bonds, mutual funds, 529 plans, rental properties) excluding home and retirement

Current net worth of all businesses

Current net worth of all farms

Child support received from the LAST complete calendar year

Student Alien Registration Number/ USCIS Number for eligible non-citizens

WHERE TO FIND IT

Personal records or visit irs.gov/transcript

Create student and parent Accounts at studentaid. gov - allow five days for the Social Security Administration to verify the Account

Student: __________________________________ Parent: __________________________________

Personal records or call the Social Security Administration at 800-772-1213

Student: ___/___/_____ Parent 1: ___/___/_____ Parent 2: ___/___/_____

Student: $______________ Parent: $______________

Student: $______________ Parent: $______________

$______________ or contact your accountant

$______________ or contact your accountant

$______________ or contact Nebraska Payment Center at 877-631-9973 or https://childsupport.nebraska.gov

Contact U.S. Citizenship and Immigration Services at uscis.gov

| 5 hesc.ny.gov

Dependency Status Questions

Answer the following questions to determine if parental data is needed on your FAFSA.

If you answer “no” to every question, you are dependent and must provide parental information on the FAFSA. If you answer “yes” to any question, you are independent and should not include parental information on the FAFSA.

Were you born before January 1, 2001?

Are you married?

Will you be working on a Master’s or Doctorate program at the beginning of the 2024-25 school year?

Are you a Veteran of the U.S. Armed Forces or currently serving on active duty?

Do you have children who live with you and will receive more than half of their support from you from July 1, 2024 to June 30, 2025?

Do you have dependents (other than your children or spouse) who live with you and receive more than half of their support from you, now and through June 30, 2025?

At any time since you turned age 13, were both your parents deceased, were you in foster care, or were you a dependent or ward of the court?

As determined by a court in your state of legal residence, are you or were you an emancipated minor?

Does someone other than your parent or stepparent have legal guardianship of you, as determined by a court in your state of legal residence?

At any time on or after July 1, 2023, did your high school or school district homeless liaison determine that you were an unaccompanied youth who was homeless?

At any time on or after July 1, 2023, did the director of an emergency shelter or transitional housing program funded by the U.S. Department of Housing and Urban Development determine that you were an unaccompanied youth who was homeless?

At any time on or after July 1, 2023, did the director of a runaway or homeless youth basic center or transitional living program determine that you were an unaccompanied youth who was homeless or were self-supporting and at risk of being homeless?

| 6 hesc.ny.gov

Y N Y N Y N Y N Y N Y N Y N Y N Y N Y N Y N Y N

FAFSA® Simplification Fact Sheet

Students With Unusual Circumstances

FAFSA® Simplification Act

On Dec. 27, 2020, Congress passed the Consolidated Appropriations Act, which included provisions that amended the Fostering Undergraduate Talent by Unlocking Resources for Education (FUTURE) Act and included the FAFSA Simplification Act—a sweeping redesign of the processes and systems used to award federal student aid. The FAFSA Simplification Act also provides guidance for institutions to assist students with unusual circumstances in applying for student financial aid when they cannot provide parental information on their Free Application for Federal Student Aid (FAFSA®) form.

What are unusual circumstances?

Beginning with the 2023-24 Award Year, institutions of higher education will have additional flexibility to assist students with unusual circumstances by adjusting their federal student aid eligibility to reflect their unique situation more accurately. These adjustments may include updating the student’s dependency status (commonly known as a dependency override) and the information the student must provide on their FAFSA form.

Students with unusual circumstances are defined as:

• A student for whom a financial aid administrator makes a documented determination of independence by reason of unusual circumstances and in which the student is unable to contact a parent or where contact with parents poses a risk to such student, which includes circumstances of—

• Human trafficking, as described in the Trafficking Victims Protection Act of 2000 (22 U.S.C. 7101 et seq.);

• Legally granted refugee or asylum status;

• Parental abandonment or estrangement; or

• Student or parental incarceration.

Other students will continue to qualify as independent on their FAFSA form and not required to provide parental information if they:

• Were an orphan at the age of 13 or older;

• Were a ward of the court;

• Are or were in foster care;

• Were an emancipated minor or in a legal guardianship as determined by a court in the student’s state of legal residence; or

• Are an unaccompanied homeless youth or unaccompanied, at risk of homelessness, and self-supporting.

What’s new?

Starting with the 2024-25 Award Year, both first-time and renewal applicants who indicate on their FAFSA form that they have an unusual circumstance will be granted provisional independent status. They will be able to complete the form without providing parental information. They will also receive an estimate of their federal student aid eligibility, which will be subject to a final determination by the institution they attend. If a student’s institution approves their unusual circumstances, their independent status will carry over when they renew their FAFSA form in future award years and they will be considered independent for as long as they remain at the same institution and their circumstances remain unchanged.

| 7 hesc.ny.gov

Get Started

What will stay the same?

If a student pursues an adjustment for unusual circumstances and is not determined to be an independent student by their institution, the student will only be eligible for Direct Unsubsidized Loans unless they subsequently complete the FAFSA form as a dependent student by providing parental information. Institutions may use a previous determination from a financial aid administrator at another school as acceptable documentation of a student’s unusual circumstances. If a student had an adjustment for unusual circumstances approved by another institution (for the same or prior award year), the student should notify the financial aid office at their new institution.

What happens after the student submits their application?

Once they’ve submitted the FAFSA form, students will also need to provide supporting documentation of their circumstances directly to the institution they will attend. While students should contact their institution’s financial aid office if they have questions based upon their circumstance, institutions are now required to provide students with an overview of their review process, examples of supporting documentation, and estimated timelines for their request to be reviewed.

Examples of supporting documentation may include:

• A documented interview between the student and the financial aid administrator;

• Submission of a court order or official Federal or State documentation that the student’s parents or legal guardian are incarcerated;

• A documented phone call or written statement, which confirms the unusual circumstances with

⚪ A state, county, or Tribal welfare agency;

⚪ An independent living case worker who supports current and former foster youth with the transition to adulthood; or

⚪ A public or private agency, facility, or program servicing the victims of abuse, neglect, assault, or violence;

• A documented phone call or written statement from an attorney, guardian ad litem, or court-appointed special advocate (or similar) that confirms the circumstances and their relationship to the student;

• A documented phone call or written statement from a representative at an institution of higher education that confirms the circumstances and their relationship to the student; or

• Utility bills, health insurance, or other documents that demonstrate a separation from parents or legal guardians.

Additional Resources:

FSA Partner Emails - Subscribe to receive ongoing email updates from Federal Student Aid: outreach.fsapartners.ed.gov

Financial Aid Toolkit - Find outreach tools to help guide others through the FAFSA simplification changes: financialaidtoolkit. ed.gov/bfbf

FSA Training Center - Gain access to on-demand training courses, tools, and videos for financial aid professionals: fsatraining.ed.gov

Knowledge Center - Obtain official policy guidance and access to other FSA administrative websites for financial aid professionals: fsapartners.ed.gov/-center

Customer Service Center - Connect with FSA service centers to assist students, parents, and borrowers: fsapartners. ed.gov/helpcenter/fsa-customer-service-center

| 8 hesc.ny.gov

Understanding Financial Aid

The “sticker price” (maximum possible price tag) of most colleges is enough to knock your socks off. The good news is that many students don’t pay full price. Financial aid and scholarships can help make college more affordable. You might qualify for grants, federal loans, merit or athletic scholarships, need-based scholarships, work-study, or other programs that can help with college costs. Learn the steps to take before, during, and after college.

Before College During College After College

Now is the time to stay on top of forms and deadlines.

1. Apply for Financial Aid: Complete the FAFSA, CSS profile, and scholarship applications.

2. Review Your Financial Aid Offers: You’ll get offers from colleges with your acceptance letters.

3. Estimate Your Out-of-pocket Cost: Figure out what you’ll need to cover using our College Financing Tool.

4. Consider and Decide: Compare your options and financial aid packages. You don’t have to accept anything you’re offered, including student loans.

5. Accept Your Financial Aid Offer: Time to celebrate!

Note: If you decide to take a gap year, you can defer your college acceptance but not your financial aid offer. You’ll have to reapply for financial aid and file a new FAFSA when you’re ready to start school.

Don’t hit cruise control – you may need to stay on top of your GPA, credits, and your FAFSA requirements.

1. Maintain Your Financial Aid Eligibility: Merit-based scholarships usually require that you keep a minimum GPA. And watch your credits.

2. Re-file Your FAFSA Yearly: You may need to reapply for outside or private scholarships each year you’re in school.

3. Keep Looking: Continue to search for and apply for additional aid. Ask about scholarships from your college or program.

4. Have an Exit Strategy: Financial aid programs often have requirements for graduation, too. You may need to complete exit counseling with your school’s financial aid office.

It’s payback time! Loan repayment starts after you leave school. Federal student loans and some private loans give a six-month grace period before payments begin.

1. Get clear on who, what, and when, you owe. Make sure you understand the amounts, repayment terms, and schedules for all your loans.

2. Make a budget. Figure out how you’ll handle your monthly payments.

3. Update your information: Make sure your loan servicer(s) has your current address and contact information.

| 9 hesc.ny.gov

Financial Aid for Non-U.S. Citizens

Eligible non-citizens can qualify for federal aid. You may qualify if you’re a:

• U.S. permanent resident with an Alien Registration Receipt Card (I-551)

• Conditional permanent resident (I-551C)

• Holder of Arrival-Departure Record (I-94) stating:

⚪ Refugee

⚪ Asylum Granted

⚪ Indefinite Parole

⚪ Humanitarian Parole

⚪ Cuban-Haitian Entrant

If you’re an eligible noncitizen, you must file the FAFSA and provide your Alien Registration Number (ARN) on the form. For more information, please visit: studentaid.ed.gov/eligibility/non-us-citizens. Remember, the student’s status is what counts, not their parents’ status. If you’re an eligible non-citizen student with undocumented parents, you’re eligible for federal aid. This means you should file your FAFSA.

Undocumented Students

If you’re undocumented in the U.S., you are not eligible for federal financial aid programs, and you can’t file the FAFSA. But there are other forms of financial aid available. Check with your college, or search for private scholarships that support students who are undocumented.

International Students

Government Aid

The U.S. government does not provide loans, grants, or scholarship assistance for international students. But many countries offer grants or scholarships to fund foreign study for their own nationals. Check with your country’s higher education authorities to see if you might qualify.

Private Support

Many U.S. schools offer resources to assist international students. Get in touch with the international admissions office at the schools you’re considering. Find out about financial aid application requirements. And ask if you’re eligible for any institutional or community support.

Financial Aid & Studying Abroad

Wondering how studying abroad might affect your financial aid? Find a list of international schools that participate in the U.S. federal student loan program at studentaid.gov. Read on to find out how financial aid is impacted in different study abroad scenarios.

• If you’re attending a study abroad program sponsored by a U.S. school:

• Federal student aid for a short period or study abroad program is processed by your U.S. school. Don’t apply for aid through the foreign school.

• You must file a FAFSA to get federal aid. Start early to get all the paperwork done on time at both your home school and foreign school.

If you’re enrolled as a regular student at a foreign school (working toward a degree from the foreign school):

• You may be able to borrow a federal student loan to attend the foreign school. To qualify:

• You must have a high school diploma, secondary school credential, or equivalent.

• You must be enrolled at least half time in order to receive aid.

• You must make satisfactory academic progress (SAP) as determined by the school.

• You must meet citizenship criteria.

• You must have a correct Social Security number.

• You must not be in default on any Title IV program loan (unless you have taken prescribed steps to cure the default), be in receipt of excess Title IV loan amounts or grant payments, or have property that is subject to a judgment lien for a debt owed to the United States (U.S.).

| 10 hesc.ny.gov

How to Get a Studentaid.gov Account

for Individuals Without a Social Security Number

The Studentaid.gov Account is required to complete the Free Application for Federal Student Aid (FAFSA) online as a student applicant or as a contributor (parent/stepparent or spouse of a student applicant.). While in the past, a Social Security Number (SSN) was required to obtain a Studentaid.gov Account, students’ spouses, parents, and stepparents who do not have an SSN can obtain an Studentaid.gov Account beginning in late December, 2023.

Enter Personal Information

• Check “I don’t have a Social Security number” and click “Continue”

• A warning will appear; click “Continue Without SSN”.

I don’t have a Social Security number

Communication Preferences

• Follow instructions and click “Continue”

Account Information

What you need before you apply for an Studentaid.gov Account:

• Your own email address.

Creating the Studentaid.gov Account:

• Start at studentaid.gov and select “Create Account” from the top right corner of the page.

• Follow instructions to create a username and password and click “Continue”.

⚪ Note: Email address is required and the email address cannot be associated with another account.

Challenge Questions

• Follow instructions to choose challenge questions you will be asked to answer if you forget your username or password and click “Continue”

Contact Information

• Enter address information and click “Continue”

⚪ Note: mailing address is required for anyone without an SSN

⚪ Foreign phone numbers are not accepted, so leave this field blank if applicable.

Foreign phone numbers are not accepted Challenge Questions:

Confirm & Verify

• Review information, edit incorrect information if necessary

• Check the box indicating you agree to FSA’s Terms and Conditions, then click “Continue”

| 11 hesc.ny.gov

STEP 1 STEP 4 STEP 2 STEP 5 STEP 6

USERNAME: ************ PASSWORD: *******

STEP

Continue

3

Enable Two Step Verification

• Follow instructions and click “Continue”

Enable Two-Step Verification

Identity Verification

• Answer knowledge-based identity verification questions and click “Submit”

⚪ You are ready to complete the FAFSA!!

• Note: if any identity verification questions are answered incorrectly (and only in this case), you will see an error message indicating your account was created but you still need to contact the Federal Student Aid Information Center (FSAIC) to verify your identity before you can use the Studentaid.gov Account to complete the FAFSA as an applicant or contributor (parent or spouse).

⚪ You will be asked by email to submit the following documentation:

• Attestation form (link will be included in the email)

⚪ ONE of the following:

• Driver’s license

• State/city ID card

• Foreign passport

⚪ OR a utility bill (with name and address matching what was entered in the Studentaid.gov Account request process) + one of the following:

• Municipal ID card

• Community ID

• Consular ID card

⚪ Identity verification will be confirmed within 1-3 days by email, after which the Studentaid.gov Account will be created and you will be ready to complete the FAFSA as a student applicant or contributor.

What is your favorite pet’s name?

What is your father’s middle name?

What was your high school mascot?

Attestation Form

Link provided in your email.

• Driver’s license

• State/city ID card

• Foreign passport

Provide one: Verification can take up to 5 days. OR Utility bill and:

• a municipal ID card

• a community ID

• a consular ID card

| 12 hesc.ny.gov

STEP 7 STEP 7 CONTINUED

Continue

Type answer here Type answer here

Toolkit Contents

FAFSA Overview

• What is the FAFSA?

• Why the FAFSA matters.

• Federal updates for 2024-25.

Who Fills Out the FAFSA?

Studentaid.gov Account

FAFSA Filing Prep

FAFSA Tips, Tricks, & FAQs

How to Host a FAFSA Event

New York FAFSA Graduation Requirement

• Summary.

• Letter to students and families of the Class of 2024.

• Strategies to track and fulfill the requirement.

Contact Information

Social Media

After the FAFSA

Links & Additional Resources

| 13 hesc.ny.gov

FAFSA Overview

What is the FAFSA?

The Free Application for Federal Student Aid (FAFSA) is a form to apply for federal financial aid, including grants, work-study, and loans. The FAFSA is also used by colleges and many private scholarship programs to determine eligibility for aid such as scholarships. It is free to complete and does not obligate the student or parent/guardian to anything.

Why FAFSA matters

The FAFSA is administered by Federal Student Aid, a division of the U.S. Department of Education that also oversees federal grants and loans for students. The FAFSA is the first step in the financial aid process to unlock many types of aid- not just loans or need-based aid.

Even students who don’t think they’ll qualify for aid should complete it because 1. You never know! And 2. The FAFSA is also used by colleges and many other programs as the application for scholarships.

The FAFSA does not obligate the student or family to anything. It’s simply an application. It’s still YOUR CHOICE how you pay for college. For example, even if you qualify for loans, you don’t have to take them.

If you don’t file the FAFSA, you definitely won’t receive any aid- even many scholarships!

$200M

New York State students missed out on in federal financial aid during the 2022-23 year

Common FAFSA Myths

“FAFSA is only reserved for lowincome students and families.”

“Why

should we apply for FAFSA? Our family’s income is too high.”

| 14 hesc.ny.gov

Federal Updates for 2024-25

The Federal FAFSA Simplification Act passed August 2022, with the intent to streamline the FAFSA application process. There are many goals to this legislation, including:

Changes include:

Application changes:

• Fewer questions (108 to about 36)

• Decrease time needed to complete the form

• Increase the number of applicants and the proportion of complete applications

• Increase the number of students receiving Pell Grants

• Increase available time that students, parents, school counselors, and advisors can spend on other important aspects of postsecondary planning and enrollment

• IRS Data Retrieval Tool moving to a direct data exchange with the IRS

• The form will automatically pull in student/family’s financial information and only show relevant questions from there

• Consent to pull in IRS data is required to move forward; if consent is not given, the FAFSA is incomplete and student will not be eligible for federal aid

• Studentaid.gov Account moving to a two-step verification for identity + information security (see more below)

• Role-based form: the student and each contributor will have their own, unique parts of the form and will be unable to see each other’s

• Dependent student won’t see financial info; parents won’t see student’s gender selection, etc

Formula changes

• EFC (Expected Family Contribution) to SAI (Student Aid Index)

• Lowest EFC was 0; SAI could be as low as -1500 (no, they didn’t do anything wrong if they end up with a negative number!)

• Household size to family size

• Based on number of people claimed as exemptions on tax forms

• Families with AGI greater than $60,000 now required to provide asset info (prior minimum was $50,000)

• Net value of businesses and farms of any size counted as an asset

• Number of students/dependents in college no longer counts in SAI calculation; the question will still appear for institutional purposes and could influence institutional aid

Additional changes

• Due to the updates, the FAFSA opening is delayed from its usual October 1 to sometime in December. This document will be updated when we have an exact date.

• Students can now list up to 20 colleges on the FAFSA (prior limit was 10)

Transitions are always tricky, but once we get through this year, the FAFSA process should be easier, faster, and more straightforward!

| 15 hesc.ny.gov

Who fills out the FAFSA?

Every student who plans to attend post-secondary education of any kind (college, community college, technical or trade school, certificate program, etc.) should complete a FAFSA. The FAFSA must be re-filed EACH YEAR the student attends school.

Parent Information on the FAFSA

For dependent* students, parents have their own sections to complete and are called “contributors”. A “contributor” is anyone who has to include personal and financial information on the FAFSA. Each contributor will have to create their own Studentaid.gov Account and give consent to share their tax information on the form. For more information, see the “who is a contributor” section at FAFSA.gov.

Who’s MY PARENT When I Fill Out My FAFSA Form?

Are you parents married to each other?

Do you parents live together?

Did you live with one parent more than the other over the past 12 months?

Report the information for both parents on the FAFSA® form

Note: Dependent students are required to report parent information when competing the FAFSA® form. A parent means your legal (biological, or adoptive) parent, or a person that the state has determined to be your legal parent. A stepparent is considered a parent if married to a biological or adoptive arent and if the student counts in their household size.

Report the information for both parents on the FAFSA® form even if they were never married, are divorced, or are seperated

Report information for the parent you lived with more on the FAFSA® form.

Report information for the parent provided more financial support over the past 12 months or in the last year you received support on the on the FAFSA® form.

Has this parent remarried?

Report information for the parent you lived with more on the FAFSA® form.

Report information for the parent provided more financial support over the past 12 months or in the last year you received support on the on the FAFSA® form.

*To qualify as an independent student, the student must be 24 years of age or older, married, have a dependent of their own, have been in foster care or a ward of the court after turning 13, be or have been an emancipated minor, or recently been homeless or at risk of homelessness. For more information, visit FSA’s Dependency Status page.

| 16 hesc.ny.gov

Create Your Studentaid.gov Account

Who needs an Studentaid.gov Account?

Anyone who needs to enter information onto the FAFSA will be required to have their own unique Studentaid.gov Account. The FSA Account username is used to log in, complete, and edit your FAFSA.

STEP 1

Go to FSA’s Create Account Page.

STEP 2

Provide your personal information, following the prompts.

Everyone needs their own unique email; Students can’t use their parents’ email.

Students should not use their school email as they will need access throughout college and beyond.

STEP 3

STEP 4

Create a unique username and password for your account. Go to FSA’s Create Account Page.

What is your favorite pet’s name?

What is your father’s middle name?

What was your high school mascot?

STEP 5

Choose Security Questions for account recovery if you’re locked out.

Accounts must be verified before you submit your FAFSA

STEP 6

For more information, go to FSA’s Creating & Using the Studentaid.gov Account.

Go through verfication steps: Note: Verification can take up to 5 days

*Tip: Provide students and families with a worksheet to help remember their Studentaid.gov Account username and password. Students can keep this document with their other college app materials.

| 17 hesc.ny.gov

USERNAME: ************ PASSWORD: ******* Type answer here Type answer here

FAFSA Filing Prep

The student and all contributors* will need to come prepared with documents and information. The new FAFSA will automatically pull most financial information from the IRS, but having the info readily available guarantees a backup plan.

Studentaid.gov Account (username and password) for student and each contributor.

Full name (as it appears on social security card).

Social security number or alien registration number if not a U.S. citizen.

Email address.

2022 IRS federal tax return (all pages).

All W-2 forms for 2022.

Balances of checking and savings accounts.

Balances of all non-retirement investments (funds not in an IRA, 403B, 401K, or annuity) such as: money markets, mutual funds, CDs, stocks, savings bonds, 529 college savings accounts, UGMA or UTMA accounts.

If the family owns any property(s) in addition to primary residence (i.e. a vacation home, rental property, camp, time share, etc.), calculated equity (current value minus what you owe) of the extra property(s).

Records of untaxed income received in 2022, such as child support, interest income, and veterans noneducation benefits.

Net value of business and farm assets.

Names of every school where student is applying or currently attends (more can be added later).

| 18 hesc.ny.gov

Y Y Y Y Y Y Y Y Y Y Y Y N N N N N N N N N N N N

Tips, Tricks, & your FAQs FAFSA

I’m having technical issues accessing my account or completing the form- who should I contact?

Only Federal Student Aid has the ability to help with these issues.

When does the FAFSA open?

This year, the 2024-25 FAFSA will open sometime in December. We don’t have an exact date yet. Typically, the FAFSA opens on Oct. 1.

What do I need to prepare to file my FAFSA?

The student and each contributor needs an Studentaid.gov Account that has been verified. Next, follow the checklist in FAFSA Filing Prep to ensure you have all the necessary documents.

Can I submit the FAFSA before I’ve applied for admission at a college?

You can submit the FAFSA to any school ahead of the actual college application. It sits in waiting, until a student applies and gets accepted. If FAFSAs get to school without a student application afterwards, it gets discarded.

Do I have to complete a FAFSA?

It’s not required, no. If you’re a senior in high school, you might need to sign a waiver opting out as part of your graduation requirements (ask your school counselor for more information). However, we strongly recommend that every student who is or will be attending college soon should file the FAFSA!

How do I create a Studentaid.gov Account?

Go to studentaid.gov to get started. Both the student and each contributor need their own Studentaid.gov Account.

My parents are divorced - who goes on the FAFSA?

The parent who provides more (51% or more) financial support to the student will go on the FAFSA. Both households do not go on the FAFSAonly the parent who provides more financial support (and their spouse if they are currently married).

Note: This is a slight change for this year- previously, the FAFSA prioritized residency over financial support.

Okay, I’ve submitted my FAFSA - when will I get my financial aid offer?

You will receive a financial aid offer only if and when you are accepted to the college. The school may send the acceptance letter and offer letter together or separately. Be sure to check your email and your physical mailbox for updates. For most regular decision admissions cycles, students can expect to hear back by April 1.

| 19 hesc.ny.gov

How to Host a FAFSA Event

Gather your people

1. Think about who at your school/site needs to be in the loop about an event like this. Consider other school counselors, principals and administrators, 12th grade teachers, coaches with evening practices or games, etc. Also think about your facilities and IT folks who can help you with room set up needs. Bringing in these people early helps ensure their buy-in and they can help you get the word out!

2. Also think about who can support you in planning and executing this event. Reach out to your local college’s financial aid office. Many financial aid officers are happy to volunteer to help file FAFSAs for a one-time event.

3. Attend a professional development session with us about what school counselors need to know to help students file FAFSAs. You don’t have to be a financial aid expert! Also, most tax information will be transferred directly from the IRS and will not appear on the FAFSA itself, helping you to maintain healthy boundaries with your families.

Choose a date and time that works for your community

Consider a time that both students and parents/ guardians would be available- evenings are typically best. Check your school’s calendar to try to avoid conflicts for seniors (athletic events, class trips, etc.).

Determine event location

1. Pick a space that can accommodate a crowd- with computers!

2. Each FAFSA filer will need their own computer. That means setting up in a computer lab or communicating clearly that students/families will need to bring their own laptop.

3. Don’t have a space at your site that will work? Reach out to your local library or community college to see if you can reserve theirs!

4. Think about event structure, too. Will everyone arrive at one time (say, 6pm)? Will there be set appointments? Or maybe staggered groups to accommodate more people overall?

| 20 hesc.ny.gov

Want to host your own FAFSA Filing event? It’s easier than you think! 13 FAFSA Completion Event 5pm-6pm Community Center 21 FAFSA Completion Event 5pm-6pm Community Center 6 Registered 10 Registered 17 FAFSA Completion Event 5pm-6pm Community Center 26 Registered Local Colleges Library Community Centers High Schools

Promote, promote, promote!

When it comes to FAFSA events, it is critical to advertise not only the event itself, but also:

1. Why the FAFSA is important

• Many students don’t complete the FAFSA because they simply don’t know what it is or everything it can do. We recommend including some key messaging in your flyer or other promotional material, like:

• Unlock financial aid for college- file your FAFSA!

• Keep your options open- file a FAFSA!

• Did you know the FAFSA is required for many scholarships? Don’t miss out!

2. Families will need to set up their Studentaid.gov Account (log in accounts) at least 3-5 days before your event. If their accounts aren’t verified, they can work on part of the FAFSA, but they won’t be able to submit it

a. Go to studentaid.gov where students can set up their Studentaid.gov Account and invite their parents/guardians.

b. If possible, use class or advisory time to have students set up their IDs.

• Though a lot of information will fill in automatically, it’s best if families bring their financial documents with them as a backup. Share our FAFSA Checklist (above) to make sure families show up with everything they need.

Consider offering a raffle or swag for participants! Not in the budget? Reach out to local businesses, restaurants, or colleges to ask for donations or discounts.

Day of

1. Have resources ready for students and families, like a howto guide or additional information that you want to share with seniors.

2. Have a way for students/families to sign in and/or sign out when they are done. This way, you’ll be able to keep track of which students have completed their FAFSA (and who might still need help).

a. Follow your school’s plan to track the FAFSA as a graduation requirement - see section below.

3. Provide clear instructions on how participants should engage with the event. We recommend having everyone start at the same time so you can speak to the whole group and give an introduction. From there, folks can move through the FAFSA on their own, at their own pace, and raise their hand or a flag/paddle when they have a question.

• Share an instruction page with FAQs and resources when they come in.

After the event

1. Follow up with students who participated to see if they need any other support in completing their college and financial aid applications.

2. Reach out to students who did not participate- refer them to our organization for FAFSA help if needed.

3. Send thank you notes to your volunteers.

| 21 hesc.ny.gov

Contact List

| 22 hesc.ny.gov New York State

Name Title Email Name Title Email Name Title Email Name Title Email Name Title Email Name Title Email Name Title Email Name Title Email Name Title Email Name Title Email Name Title Email Name Title Email Name Title Email Name Title Email Name Title Email Name Title Email

Contact List:

Social Media

X/Twitter/Instagram

Facebook/LinkedIn

Generic Post 1

@NYSHESC

NYS Higher Education Services Corporation

The 2024-25 FAFSA is open! Be sure you’re ready with everything you’ll need - including your FSA ID - so you can apply without issues! Tap the link in the bio to learn more about how to file your FAFSA.

#FAFSA #FAFSAReady #HESC #NYS

Generic Post 2

Some terms are changing... Your message here

#FAFSA #FAFSAReady #HESC #NYS

| 23 hesc.ny.gov

X/Twitter/Instagram @NYSHESC

Facebook/LinkedIn

Generic Post 3

NYS Higher Education Services Corporation

Quick need to know updates that’ll get you ready to submit your FAFSA and TAP. Your message here

#FAFSA #FAFSAReady #HESC #NYS

Generic Post 4

On the fence about applying? Your message here

#FAFSA #FAFSAReady #HESC #NYS

| 24 hesc.ny.gov

After the FAFSA

4 Things College Advisors Should Know

FAFSA® Simplification Fact Sheet Students with Unusual Circumstances

Subscribe to receive ongoing email updates from FSA.

Find outreach tools to help guide others through the FAFSA simplification changes.

Gain access to on-demand training courses, tools, and videos for financial aid professionals.

Obtain official policy guidance and access to other FSA administrative websites for financial aid professionals.

| 25 hesc.ny.gov Links & Additional Resources FSA Partner Emails FSA YouTube Channel Financial Aid Toolkit Knowledge Center FSA Training Center

Key Terms and Systems under the FAFSA Simplification and FUTURE Acts:

FAFSA Processing

Account Username and Password (Studentaid.gov Account): username and password used to log in to all Federal Student Aid products and tools on StudentAid.gov.

Contributor: any individual required to provide consent and approval for federal tax information (FTI) along with their signature on the FAFSA® form, including the student; the student’s spouse; a biological or adoptive parent; or the parent’s spouse (stepparent).

Controlled Unclassified Information/Specified Tax (CUI//SP-TAX): the U.S. National Archives and Records Administration (NARA) classification for federal tax information (FTI) related to returns and return information submitted, gathered, or generated by taxpayers. In accordance with the confidentiality protections of Section 6103(l)(13) of the Internal Revenue Code (IRC) and in accordance with all applicable privacy laws, regulations, and policies, the Department will label FTI fields on the Institutional Student Information Record (ISIR) and the FTI must be labelled as CUI//SP-TAX by our partners. These labels must follow FTI wherever it is accessed, stored, or redisclosed with express written consent. For more information, see FTI definition below and NARA CUI Category: Federal Taxpayer Information.

FAFSA FTI Approval: formal approval granted by an applicant and any applicable contributors for a given FAFSA cycle (e.g., December 2023 to September 2025 for the 2024-25 FAFSA form) to retrieve and use FTI to determine an applicant’s federal financial aid eligibility as well as permit the redisclosure of FTI by the Department to an eligible institution; state higher education agency; or a designated scholarship organization for the application, award, and administration of student aid programs. An applicant and contributor (if applicable) must provide approval once each year. If FAFSA FTI approval is not provided, the student will not be eligible for any Title IV aid until the approval is provided by each contributor.

FAFSA Privacy Act Consent: formal consent provided by an applicant and any applicable contributor(s) for a given FAFSA cycle (e.g., December 2023 to September 2025 for the 2024-25 FAFSA form) that meets the statutory requirements of collecting and using an individual’s personally-identifiably information (PII) under the Privacy Act, as amended (5 U.S.C. § 552a). PII provided on the FAFSA (e.g., name, date of birth, social security number) with consent of the individual, will be provided to the IRS to conduct a match in order for the Department to receive FTI for purposes of determining an applicant’s federal financial aid eligibility and permit further redisclosure of FTI by the Department. For more information, see FAFSA FTI Approval above.

FAFSA Submission Summary: replaces the Student Aid Report (SAR) as the student’s output document providing a summary of data input on the FAFSA form.

Family Size: replaces the term “household size” on the FAFSA form. It captures the appropriate number of family members and dependents in the applicant’s household, within the meaning of section 152 of the Internal Revenue Code of 1986 or an eligible individual for purposes of the credit under section 24 of the Internal Revenue Code of 1986.

Federal Tax Information (FTI): is the data and information related to federal tax paying. It includes a return or return information received directly from the IRS or obtained through an authorized secondary source such as the U.S. Department of Education pursuant to 26 U.S.C. 6103(l)(13). FTI also includes any information created by the recipient that is derived from a federal return or return information received from the IRS or obtained through an authorized secondary source. Other return information considered FTI includes the taxpayer’s name; mailing address; identification numbers including Social Security number or employer identification number; any information extracted from a return, including names of dependents or the location of a business; information on whether a return was, is being, or will be examined or subject to other investigation or processing; information contained on transcripts of accounts; the fact that a return was filed or examined; investigation or collection history; or tax balance due information.

FPS C Flag: the new name for the SAR C flag. For more information, see FAFSA Processing System FPS definition below.

Manually Provided Taxpayer Information: information from a tax return or the return itself that is provided and entered by a taxpayer, applicant, or contributor on the FAFSA, either because the tax information was not received from the IRS, or because the contributor filed a foreign tax return.

Negative Student Aid Index (Negative SAI): the Student Aid Index (SAI) can be a negative number (down to -1500) which can be used by institutions in determining students who have the most financial need. Note that when packaging a student for Title IV need-based aid, a negative SAI is converted to a 0 SAI in the packaging formula. For more information, see Student Aid Index (SAI) definition below.

Primary or Custodial Parent: for a dependent student whose parents are divorced or separated, the primary or custodial parent is the parent who provides the greater portion of the student’s financial support and is required to provide their information (and if applicable their spouse’s information) on the FAFSA form.

| 26 hesc.ny.gov

Provisionally Independent Student: if a student indicates they have unusual circumstances or indicates for the first time they are unaccompanied and homeless, or at risk of being homeless (without a designation from a specified entity), the FPS will consider the student to be provisionally independent and will allow them to fill out the FAFSA form as an independent student. The SAI will remain provisional and not official until the student’s college or career school makes a final determination. The ISIR will have a specific reject code that will require the financial aid administrator (FAA) to review, and if applicable, confirm the student’s independent status. The FAA will determine if the student’s circumstances make them eligible to apply independently and, if so, make any necessary updates to formally make the student independent.

Student Aid Index (SAI): replaces the Expected Family Contribution (EFC) as a formal evaluation of a student’s approximate financial resources to contribute toward their postsecondary education for a specific award year.

Packaging Aid

Food and Housing: replaces the terms “room and board” as a component within a student’s Cost of Attendance (COA).

Other Financial Assistance (OFA): term used in lieu of Estimated Financial Assistance (EFA) when factoring in other aid to determine the amount of a student’s need- and non-need-based financial aid.

Packaging Formulas: need-based formula includes the following new terms (COA minus SAI minus OFA = Need); while the non-need-based formula now includes the following (COA minus OFA = Non-Need Eligibility).

Federal Pell Grant Program Eligibility

Enrollment Intensity: the percentage of full-time enrollment at which a student is enrolled, rounded to the nearest whole percent used to determine a student’s annual Pell Grant award. For example, if full-time enrollment is 12 or more credit hours and the student is enrolled in 7 hours, the enrollment intensity would be (7 ÷ 12) × 100% = 58%.

Maximum Pell Grant Eligibility: ability of a student to receive a maximum Pell Grant (amount determined annually by Congress) which depends on annually published federal poverty guidelines; the U.S. tax return adjusted gross income (or the equivalent for foreign tax filers); state of legal residence; family size; and tax filing status.

Minimum Pell Grant Eligibility: ability of a student to receive a minimum Pell Grant depending on annual published federal poverty guidelines, Adjusted Gross Income (or the equivalent for foreign tax filers), state of legal residence, and family size.

Restoration for Discharge: Pell Grant eligibility restored in the Common Origination and Disbursement (COD) system due to an eligible borrower defense or other qualifying loan discharge. Eligibility is restored by the Department through an adjustment to the Lifetime Eligibility Used (LEU) percentage.

Special Rule for Pell Grants: replaces Iraq and Afghanistan Service Grant (IASG) and Children of Fallen Heroes (CFH) Awards with new or modified eligibility criteria for students whose parent or guardian died in the line of duty while serving on active duty as a member of the Armed Forces on or after September 11, 2001 or actively serving as and performing the duties of a public safety officer and is less than 33 years old as of the first January 1 of the processing year. Eligible students will receive a maximum Pell Grant regardless of their SAI.

Student Aid Index Calculated Pell Grant Eligibility: maximum Pell Grant minus the Student Aid Index rounded to the nearest $5 (not to exceed COA). For applicants with a calculated SAI that is greater than the corresponding award year’s maximum Pell Grant award or the calculated Pell Grant amount is less than the award year’s minimum Pell Grant, the applicant is not eligible for a Pell Grant unless they qualify for a minimum Pell Grant award.

Professional Judgement (PJ)

Special Circumstances: special or extenuating situations (such as the loss of a job) that impact a student’s financial condition and support a financial aid administrator adjusting data elements in the COA or in the SAI calculation on a case-by-case basis.

Unusual Circumstances: conditions that justify a financial aid administrator making an adjustment to a student’s dependency status, commonly referred to as a dependency override, based on an unusual situation (e.g., human trafficking or parental abandonment).

Prison Education Program (PEP) Program Eligibility

Advisory Committee: a group established by the oversight entity that provides nonbinding feedback to the oversight entity regarding the approval and operation of a PEP within the oversight entity’s jurisdiction.

| 27 hesc.ny.gov

Oversight Entity: the appropriate state department of corrections, other entity that responsible for overseeing correctional facilities, or the Federal Bureau of Prisons.

Prison Education Program (PEP): the educational program in which an individual incarcerated in a federal, state, or local correctional institution must be enrolled in order to qualify for Pell Grant funds. An eligible PEP must be offered by an eligible public or nonprofit institution. The PEP also must meet a variety of requirements including oversight entity approval, credit transferability, meeting the best interest of the students, and having no recent institutional compliance issues. Some exceptions to this definition exist for programs which are part of the Second Chance Pell Experiment.

Prison Education Program Application (PEP Application): The purpose of the PEP Application form is to provide a streamlined process for institutions of higher education or postsecondary vocational institutions applying to the Department for approval of a PEP. The application must be completed by schools wishing to apply for eligibility of a PEP and must be submitted as supporting documentation to the Electronic Application for Approval to Participate in the Federal Student Financial Aid Programs (E-App).

Department of Education Systems

FAFSA Partner Portal (FPP): a student-centered system that replaces FAA Access to CPS Online. It will allow FAAs to enter corrections, view processed records, compare multiple transactions, and provide identity verification results.

FAFSA Processing System (FPS): replaces the Central Processing System (CPS) to become an integral part of the entire FAFSA process and experience.

Federal Tax Information Module (FTIM): a system that receives, stores, uses, and controls individual FTI received from the IRS for federal financial aid eligibility determination.

FTI SAIG Mailbox: the new Student Aid Internet Gateway (SAIG) mailbox specifically designed to securely exchange batch data with Federal Student Aid Application Systems, which includes, among other things, FAFSA data and FTI that are provided to our partners via an ISIR. FTI provided via the SAIG mailbox will be labeled as CUI//SP-TAX. For more information see Controlled Unclassified Information/Specified Tax (CUI//SP-TAX) definition above.

FUTURE Act Direct Data Exchange (FA-DDX): the system replacing the IRS Data Retrieval Tool (DRT) to transfer an individual’s FTI to the Department. FA-DDX allows the Department to request, and the IRS to transfer, FTI to the FTIM system for use in determining a student’s federal financial aid eligibility. For more information see Federal Tax Information Module (FTIM) definition above.

| 28 hesc.ny.gov

CONNECT

www.hesc.ny.gov

WITH HESC AT @nyshesc