We offer a complete line of real estate services designed to help you achieve your home buying goals.

We offer a complete line of real estate services designed to help you achieve your home buying goals.

Jaqua Realtors is a full service residential and commercial real estate company providing a full complement of services to buyers. Jaqua agents offer a seamless real estate experience by providing all the personalized services you need every step of the way.

By leveraging our team of service professionals, our entire company works to see you through the home buying process. Our experts will answer your questions, provide direction and guidance to simplify your home purchase.

As a progressive company, Jaqua strives to provide our clients exclusive buying services, and strategies. We are dedicated to consistently refining our innovative services that extend well beyond the transaction.

Determine your preferences and evaluate your options to find the right home for you

Expert attention from a trusted national lender for your mortgage financing needs

A complete line of title services to ensure accuracy and proper documentation

Customized solutions for your insurance needs

Committed to delivering a seamless transaction

The benefits of working with a Dedicated Buyer’s Agent (DBA) are clear and compelling for the following reasons:

1 Has a fiduciary relationship with you which requires a high level of trust and commitment.

2 Is required to keep all of your matters and conversations confidential.

3 Has a responsibility to look out for your best interests.

4 Helps you maintain compliance with local, state and federal regulations.

5 Can offer advice and counsel you on all matters with the transaction.

6 Protects you by implementing risk reduction techniques.

7 Advocates for your position.

8 Negotiates on your behalf.

9 Helps you navigate the transaction process.

10 Focus on bringing the sale to a successful close.

| By: Julie Wildhaber | Realtor.com

Whether you’re buying, selling, or renting a home, a REALTOR® is your partner in the process. REALTORS® are local experts who can help you find the right home, negotiate price and terms, and navigate the reports and contracts to close the deal. REALTORS® are also committed to a Code of Ethics, professional development, and consumer advocacy that protects rights and saves money for home owners.

Every state, as well as the District of Columbia and Puerto Rico, requires real estate brokers and agents to hold a real estate license. That typically requires a test and preparatory coursework, but the requirements vary. Agents who want to go beyond basic licensing join the 1 million professionals in the National Association of REALTORS® (NAR) and earn the right to call themselves a REALTOR®. NAR requires members to train in – and adhere

to – a strict Code of Ethics to better represent the interests of customers, the public, and the industry. NAR offers continuing education and certifications for REALTORS®, and also lobbies for the interests of home owners.

Buying or selling a home is a legal transaction, a big financial investment, and a major life decision, that affects everything from your children’s quality of education to your family’s happiness in the community. Homeowners need to know they can trust the agent to guide them through that complex decision and treat them fairly and honestly –even if the customer is a buyer and the REALTOR® represents the seller.

That’s why the National Association of REALTORS® instituted its Code of Ethics and Standards of Practice. The code goes beyond requirements of the law to detail the ethical

responsibilities of REALTORS® to customers, the public, and other real estate professionals. For example, REALTORS® cannot hide, exaggerate, or misrepresent any facts about the property or the transaction; they must disclose when they have a financial stake in a property; and they must provide the same level of professional service to everyone, regardless of race, religion, handicap, or sexual orientation.

The Code of Ethics has been in force for 100 years, and it’s updated annually to ensure it reflects current social concerns and evolving business practices, such as the use of social media in marketing. Every member of the NAR receives training on the code.

| By: Julie Wildhaber | Realtor.com

The real estate field changes constantly, so REALTORS® freshen their skills and extend their knowledge through continuing education. REALTORS® can also train for specialized designations and certifications, such as becoming an Accredited Buyer’s Representative or earning NAR’s Green Designation to understand green building and sustainable business practices.

REALTORS® represent the interests of individual home buyers and sellers, while NAR represents the interests of all home owners through political advocacy at the local, regional and national level. The organization advocates for homeownership (get policy updates at Homeownership Matters), as well as for issues like tax benefits, affordable financing,

stronger support from the Federal Housing Administration for home loans, and tax relief for people distressed by mortgage debt. REALTOR®supported legislation saves home owners an average of $2,144 for the first year of their loan, or $38,936 over the life of the mortgage.*

Nothing is more personal than your home. When you work with a REALTOR®, you don’t just want someone to process the paperwork and hand over the keys; you want to establish a relationship with someone you trust. That’s why people often choose a Realtor® they already know or one who’s been referred by a friend or relative. If you’re a buyer, it’s easy to search for homes Online. Once you have a short list of properties, a REALTOR® can provide insight — about the neighborhood, the local market,

whether the home is correctly priced – as well as expertise to guide you through the legal and financial processes. If you’re selling a home, a REALTOR® can do all those same things, plus help you get a higher price. NAR research shows that in 2012, listings represented by Realtors® sold, on average, for $40,100 more than homes sold by their owners.

*Based on June 2013 NAR data: average sale price of $212,400, 30-year loan at 4.07 percent interest rate, and marginal tax bracket of 25 percent). Written on: Aug 13, 2013

I partner with service providers and contractors to assist with due diligence and to provide proper support after closing.

To: Property:

From:

Date:

Agent, Jaqua Realtors

This is to give you notice that the owners of Chuck Jaqua Realtor Inc. (“Jaqua”) have a business relationship with, and/or an ownership interest in, the following companies:

• The owner of Jaqua has a 50% ownership interest in Southwest Michigan Title Agency, LLC.

• The owner of Jaqua has 100% ownership of Arcadia Insurance Services, LLC.

• The owner of Jaqua has a 49.9% ownership interest in Summit Home Mortgage, LLC.

• Jaqua has a business relationship with and ownership interest in Southwest Michigan Community Resources, LLC and Distinguished Homes, LLC to provide referrals for moving companies or services related to home ownership and home maintenance as well as design and staging services.

• The owner of Jaqua has a business relationship with (but no ownership in) American Home Shield. Pursuant to a preexisting agreement, Jaqua will receive a modest fee when an American Home Shield warranty is purchased.

Because of these relationships, our referrals to these companies may provide the owners of Jaqua a financial or other benefit.

Set forth below is the estimated charge or range of charges for the settlement services listed. You are NOT required to use the listed provider(s) as a condition for the finance, sale or to insure your property or title to your property. THERE ARE FREQUENTLY OTHER SETTLEMENT SERVICE PROVIDERS AVAILABLE WITH SIMILAR SERVICES. YOU ARE FREE TO SHOP AROUND TO DETERMINE THAT YOU ARE RECEIVING THE BEST SERVICES AND THE BEST RATE FOR THESE SERVICES.

Arcadia Insurance Services, LLC Homeowners

$750-$1,200 annually (For replacement cost insurance on a $135,000 home.)1

1Exact premiums will depend upon various factors, including but not necessarily limited to: (a) detail of coverage, age, size and construction material of dwelling; (b) deductible: (c) location of property; (d) use of dwelling; (e) other pertinent conditions. Other products are available.

Summit Home Mortgage, LLC Loan Origination Loan Discount Points: 0% to 3% of loan amount depending on rate chosen Administrative Fee: $1,295

Southwest Michigan Title Agency, LLC

I/we have read this disclosure and understand that Jaqua is referring me/us to purchase the above-described settlement service(s) and may receive a financial or other benefit as the result of this referral.

Buyer(s):

Buyer(s)’ Address:

EXCLUSIVE AUTHORIZATION TO LOCATE PROPERTY (DESIGNATED AGENCY WITH LIMITED DUAL AGENCY)

Agreement Date: / /

1 PURPOSE AND TERM. Buyer appoints Jaqua Realtors® as Buyer's exclusive agent to assist Buyer to locate, negotiate and secure property as described in Paragraph 2, and Jaqua Realtors® accepts the appointment The parties agree that Jaqua Realtors’® services shall be limited to: consulting with Buyer regarding the desirability of particular properties, the availability of financing, formulating acquisition strategies, negotiating purchase agreements and facilitating the details of the transaction This agreement shall terminate at 11:59 p m on

2 DESIRED PROPERTY Buyer desires to purchase, lease, option, exchange or otherwise acquire property meeting the following general criteria: Type: [ ] Residential [ ] Residential Income [ ] Commercial [ ] Contract to Build [ ] Other

Preferred description and location:

Preferred price range: $ to $

3 ENTITLEMENT TO A BROKERAGE FEE. Buyer agrees to pay Jaqua Realtors® a brokerage fee if any of the following occur:

A During the term of this Agreement, Buyer purchases, leases or exchanges property of the general type described in Paragraph 2 above

B Within 12 months after the expiration of this Agreement (Protection Period), Buyer purchases, leases, or exchanges any property which, during the term of this agreement, Jaqua Realtors® or Buyer had negotiations relating to the property, or Jaqua Realtors® had shown or offered to show to Buyer or someone representing Buyer

C At any time in the future Buyer purchases any property of the general type described in Paragraph 2 which Buyer leased or on which an option was granted during the term of this Agreement

This fee shall be deemed to be earned by Jaqua Realtors® at the time Buyer enters into a binding Buy and Sell Agreement, regardless of whether Jaqua Realtors® located, negotiated and/or secured said property ultimately purchased or leased by Buyer

4 COMPENSATION OF BROKER: Buyer requests and Jaqua Realtors® agrees to seek compensation from the seller, the payment of which may satisfy Buyer’s full or partial compensation obligation under this agreement This may take the form of accepting the compensation offered by the listing broker If the listing broker is not offering compensation and seller refuses to pay Jaqua Realtors® full or partial compensation and Buyer still elects to purchase the property, Buyer shall be responsible for any remaining compensation due to be paid to Jaqua Realtors® Buyer acknowledges that broker commissions are not set by law and are fully negotiable Jaqua Realtors® may not receive compensation for brokerage services provided to Buyer from any source that exceeds the amount agreed upon herein or in a subsequent written agreement between buyer and Jaqua Realtors® The compensation due Jaqua Realtors® at the closing of the transaction shall be as follows:

A LISTED PROPERTIES: 3 5% of the purchase price plus $295

B UNLISTED PROPERTIES: 5% of the purchase price plus $295

5 JAQUA REALTORS’ AGENCY RESPONSIBILITIES AND LIMITATIONS: Jaqua Realtors®, named Supervisory Broker and Buyer’s Designated Agent agree to negotiate on Buyer’s behalf and take reasonable steps to preserve the confidentiality of information that Buyer has instructed Jaqua Realtors® in writing to keep confidential Buyer understands and acknowledges, however, that Jaqua Realtors®, named Supervisory Broker and Buyer’s Designated Agent have previously represented or may currently or in the future represent other clients, and have similar responsibilities to these other clients For instance:

Past Clients: Buyer may consider property owned by a party that Jaqua Realtors®, named Supervisory Broker or Buyer’s Designated Agent represented in the past Buyer agrees that Jaqua Realtors®, named Supervisory Broker or Buyer’s Designated Agent shall not be required to disclose confidential information concerning said party

Current or Future Buyers: Buyer may consider property that is also under consideration by other buyers working with Jaqua Realtors®, named Supervisory Broker or Buyer’s Designated Agent Buyer agrees that Jaqua Realtors®, named Supervisory Broker or Buyer’s Designated Agent shall not be required to disclose to Buyer interest in the same property by another buyer

Imputed Knowledge: Imputed Knowledge is knowledge attributed to a person because of the person’s legal responsibility for another’s conduct even though the person does not have actual knowledge. Buyer agrees that information related to the seller, the Property, or the transaction known by other licensees shall not be imputed to the Designated Agent Buyer further agrees that a Buyer’s Designated Agent’s knowledge of information relating to the seller, the Property or the transaction shall not be imputed to any other licensee affiliated with Jaqua Realtors®

6 OTHER TERMS:

7 JAQUA REALTORS’ AND DESIGNATED AGENT’S AGENCY RESPONSIBILITIES/POSSIBILITY OF DUAL AGENCY: Both Jaqua Realtors® and Buyer’s Designated Agent, from time to time, enters into agreements with sellers to serve as their agent for the purpose of arranging the sale of a seller’s property Buyer desires to be informed of such properties Buyer acknowledges that certain conflicts of interest will occur because Buyer and a seller have different interests to protect Buyer and Jaqua Realtors® agree that:

A If Buyer becomes interested in a property owned by a seller-client of Jaqua Realtors®, Jaqua Realtors® and Named Supervisory Broker will be Dual Agents, representing both Buyer and seller Buyer’s Designated Agent will continue to represent Buyer exclusively, and seller’s Designated Agent will continue to represent seller exclusively, unless Buyer’s Designated Agent is also the Designated Agent for seller In that situation, Buyer’s Designated Agent, Named Supervisory Broker and Jaqua Realtors® will all represent both Buyer and seller as Dual Agents

B If Buyer’s Named Supervisory Broker is also the seller’s Designated Agent, Jaqua Realtors® shall appoint another Supervisory Broker to represent Buyer The original Named Supervisory Broker will continue to be a Dual Agent Any confidential information previously disclosed to the original Named Supervisory Broker shall remain confidential, not to be disclosed to a seller without Buyer’s authorization Any time Jaqua Realtors®, Supervisory Broker or Designated Agent function as a Dual Agent, the following shall govern said party’s action:

1 They will not knowingly do anything or say anything which might place one party at a disadvantage, such as disclose personal confidences;

2 They will assume the role as an intermediary, facilitator and/or mediator to assist Buyer and a seller;

3 They will not disclose to Buyer that a seller might accept a price other than listing price, nor disclose to a seller that Buyer might be willing to pay a higher price without that party’s authorization

8

JAQUA REALTORS’® DISCLAIMER AND PROPERTY CONSIDERATIONS: Buyer acknowledges that Jaqua Realtors® is not serving as an attorney, tax advisor, surveyor, civil engineer, structural engineer, environmental expert or appraiser

A Buyer’s Responsibility: Buyer acknowledges that Buyer is solely responsible for determining the suitability of any desired property or transaction Buyer is not relying on Jaqua Realtors® or Buyer’s Designated Agent for such determination Buyer further acknowledges Jaqua Realtors® has advised Buyer that if Buyer has any questions or concerns beyond those outlined below, Buyer should seek the advice of appropriate professionals

B Property Suitability: In order to carefully evaluate a desired property’s suitability, Buyer is specifically advised to:

1 review the title commitment with Buyer’s attorney investigate any potential restrictions on the use of the property such as local zoning ordinances, plat and deed restrictions, easements, liens and other encumbrances

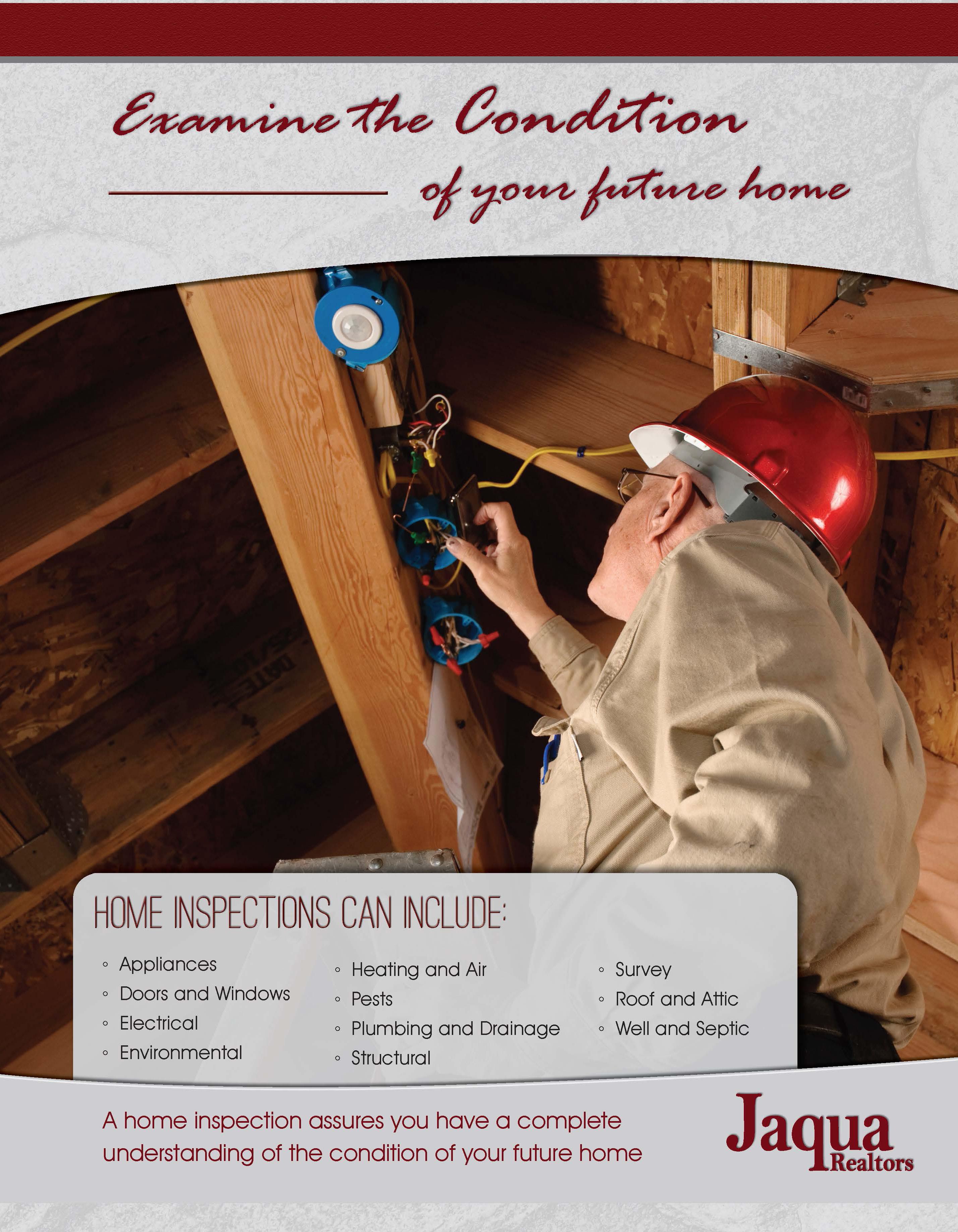

2 have the property inspected for: infestation by wood destroying insects; structural and mechanical defects; environmental and health and safety considerations, including the presence of radon, mold, or lead-based paint

3 have the location, boundaries and dimensions of the property verified by a surveyor, the size and value of buildings verified by an appraiser and verify whether building permits were obtained for construction, structural alterations, modifications or repairs

4 satisfy themselves that the property is able to provide and sustain a potable water supply and effective waste disposal system

C. Transaction Suitability: In order to carefully evaluate the suitability of a potential transaction, Buyer is specifically advised to:

1 read carefully all contractual agreements, Seller’s Disclosure Statements, Lead-Based Paint Seller’s Disclosure Forms, and closing documents

2 investigate the tax consequences of the transaction including an evaluation of property tax information and the potential for changes in the property taxes Buyer is aware that taxes can increase based on a new State Equalized Valuation, sale price, assessments, Personal Residence Exemption or tax rate increase

3 investigate historical sales data and/or obtain an appraisal

Buyer further acknowledges that Jaqua Realtors® has advised Buyer that if Buyer has any other questions or concerns, Buyer should seek the advice of appropriate professionals

9 EXCLUSIVE AGENT: Buyer agrees that during the term of this Agreement any and all inquiries and/or negotiations relating to the acquisition of any property by Buyer shall be through Jaqua Realtors® Buyer agrees to refer to Jaqua Realtors® any inquiries from any other broker, salesperson or any other source

10 FAILURE TO CLOSE TRANSACTION If Buyer enters into a binding Buy & Sell Agreement, and seller fails to close the transaction with no fault on the part of Buyer, Jaqua Realtors® agrees not to pursue compensation from Buyer provided for that transaction; however, Jaqua Realtors® reserves the right to pursue compensation from the seller If such a transaction fails to close because of any fault on the part of Buyer, the total amount owing as compensation shall be immediately due and payable to Jaqua Realtors® by Buyer

11 COST OF SERVICES OR PRODUCTS OBTAINED FROM OUTSIDE SOURCES. Buyer agrees to promptly pay for products or services from outside sources ordered by Jaqua Realtors® at Buyer’s request (examples: surveys, environmental studies, inspections, soil tests, title reports, engineering studies, etc ) In the event Jaqua Realtors® provides to Buyer names of sources for such assistance, Buyer acknowledges and agrees that Jaqua Realtors® does not warrant or guarantee the services and/or products

12 CONSENT TO DISCLOSURE: Buyer authorizes Jaqua Realtors® to disclose Buyer’s identity and any pertinent facts Jaqua Realtors® has regarding Buyer’s financial ability to purchase the Desired Property

13 NON DISCRIMINATION Buyer acknowledges Jaqua Realtors® are required to obey Federal and State non-discrimination laws pertaining to the sale or rental of real estate

14 CONSENT TO FEES Buyer acknowledges that Jaqua Realtors® may be offered placement fees, finders’ fees and other consideration from home warranty companies, mortgage brokers and others who become involved in the transaction Buyer hereby grants Jaqua Realtors® permission to receive such fees and/or consideration

15 COUNTERPARTS/SIGNATURES: This Agreement may be signed in one or more counterparts, each of which will be deemed to be an original copy of this Agreement and all of which, when taken together, will be deemed to constitute one Agreement The exchange of copies of this Agreement and signature by personal service, email, facsimile, or other electronic means commonly in use, or other means permitted by applicable state or federal statute shall constitute effective execution and delivery of this Agreement as to the parties, and may be used in lieu of the original Agreement for all purposes Copies shall be deemed to mean any duplicate, reproduction or similar exact imitation of the original executed Agreement Signatures of the parties delivered as described above shall be deemed to be their original signatures for all purposes and shall be deemed valid and binding upon the parties as if their original signatures, initials and modifications were present on the documents in the handwriting of each party Buyer shall not assert the statute of frauds or n on-enforceability or validity of this Agreement because of facsimile or similar electronic device copies being used, and Buyer specifically waives and relinquishes any such defense Buyer agrees to provide an original signed document to Broker upon request

16 ARBITRATION: The parties acknowledge that they have been informed that any claim or dispute between them related to this Agreement, may be mediated or arbitrated if Broker and Buyer agree in a separate writing

17 ADDITIONAL PROPERTIES: Upon Buyer receiving notification that a seller has accepted Buyer’s offer to purchase a property, Jaqua Realtors® shall not be required to inform Buyer of additional properties that may otherwise be of interest to Buyer

18 CONFIDENTIALITY: Buyer acknowledges that the existence, terms, and/or conditions of Buyer’s offers, proposals, discussions, and/or agreements to seller may not be treated as confidential information by seller or seller’s representatives unless confidentiality is required by law, regulation or any confidentiality agreement between Buyer and seller and/or seller’s representative

19 AFFILIATED BUSINESS DISCLOSURE: Buyer acknowledges Buyer has been informed that Jaqua Realtors® has business relationships with Southwest Michigan Title Agency, L L C , Arcadia Insurance Services L L C, and Summit Home Mortgage Because of these relationships, Jaqua Realtors® may receive a financial or other benefit There are other companies with similar services Buyer is free to shop around to determine that Buyer is receiving the best services and best rate for these services

20 RECEIPT, ACKNOWLEDGEMENT AND ACCEPTANCE: These 2 pages contain the entire terms and provisions of the Agreement between the parties. No modification of any of the terms of this Agreement shall be binding upon the parties unless said modification is in writing and signed by the parties Buyer acknowledges that all terms have been reviewed, understood and accepted, and further acknowledges receipt of a copy of this Agreement In the event any portion of this Agreement is found to be unenforceable, said clause shall be severed from the Agreement and the remainder of the Agreement shall remain in force and in effect

This contract accepted by agent(s) for Jaqua Realtors® and Buyer’s Designated Agent Jaqua Realtors® further appoints Lee Crossley as Named Supervisory Broker Jaqua Realtors® may appoint additional licensees as Buyer’s Designated Agent(s) or Supervisory Broker(s) The original Buyer’s Designated Agent and all additional Designated Agent(s) and original Supervisory Broker and any additional Supervisory Broker shall continue to represent Buyer for the duration of this Agreement

Signature(s)

This is to inform potential Sellers or Buyers of the various agency choices available to them. Michigan law requires real estate licensees to advise the potential Sellers or Buyers with whom they work of the nature of their agency relationship. As used here, a “Service Provision Agreement” is a Buyer Agency Agreement or Listing Agreement executed by a Real Estate Broker and a Client that establishes an agency relationship. As used here, a “Limited Service Agreement” is a Buyer Agency Agreement or Listing Agreement executed by a Real Estate Broker and a Client that establishes an agency relationship, together with an additional written agreement, such as a Limited Service Waiver, wherein the Client agrees to waive one or more of those services set forth in paragraph (2)(b), (c), and (d), below.

A Real Estate Broker or Real Estate Salesperson may function in any of the following capacities.

• Represent the Seller as an authorized Seller’s Agent or Subagent

• Represent the Seller as an authorized Seller’s Agent or Subagent pursuant to a Limited Service Agreement

• Represent the Buyer as an authorized Buyer’s Agent

• Represent the Buyer as an authorized Buyer’s Agent pursuant to a Limited Service Agreement

• Represent both the Seller and Buyer as a Dual Agent, authorized by both Seller and Buyer

• Represent neither the Seller nor Buyer as an Agent, but provide services authorized by the Seller or Buyer to facilitate a transaction as a Transaction Coordinator

Before you disclose confidential information to a real estate licensee regarding a real estate transaction, you should understand what type of agency relationship you have with that licensee. A real estate transaction is a transaction involving the sale or lease of any legal or equitable interest in real estate consisting of not less than 1 or not more than 4 residential dwelling units or consisting of a building site for a residential unit on either a lot as defined in Section 102 of the Land Division Act, 1967 PA 288, MCL 560.102, or a condominium unit as defined in Section 4 of the Condominium Act, 1978 PA 59, MCL 559.104.

(1)An Agent providing services under any Service Provision Agreement owes, at a minimum, the following duties to the Client:

(a)The exercise of reasonable care and skill in representing the Client and carrying out the responsibilities of the agency relationship.

(b)The performance of the terms of the Service Provision Agreement.

(c)Loyalty to the interest of the Client.

(d)Compliance with the laws, rules, and regulations of this state and any applicable federal statutes or regulations.

(e)Referral of the Client to other licensed professionals for expert advice related to material matters that are not within the expertise of the licensed Agent.

(f)An accounting in a timely manner of all money and property received by the Agent in which the Client has or may have an interest.

(g)Confidentiality of all information obtained within the course of the agency relationship, unless disclosed with the Client’s permission or as provided by law, including the duty not to disclose confidential information to any licensee who is not an Agent of the Client.

(2)A Real Estate Broker or Real Estate Salesperson acting pursuant to a Service Provision Agreement shall provide the following services to his or her Client:

(a)When the Real Estate Broker or Real Estate Salesperson is representing a seller or lessor, the marketing of the Client’s property in the manner agreed upon in the Service Provision Agreement.

(b)Acceptance of delivery and presentation of offers and counteroffers to buy, sell, or lease the Client’s property or the property the Client seeks to purchase or lease.

(c)Assistance in developing, communicating, negotiating, and presenting offers, counteroffers, and related documents or notices until a purchase or lease agreement is executed by all parties and all contingencies are satisfied or waived.

(d)After execution of a purchase agreement by all parties, assistance as necessary to complete the transaction under the terms specified in the purchase agreement.

(e)For a Broker or Associate Broker who is involved at the closing of a real estate or business opportunity transaction, furnishing, or causing to be furnished, to the Buyer and Seller, a complete and detailed closing statement signed by the Broker or Associate Broker showing each party all receipts and disbursements affecting that party.

SELLER’S AGENTS

A Seller’s Agent, under a Listing Agreement with the Seller, acts solely on behalf of the Seller. A Seller can authorize a Seller’s Agent to work with Subagents, Buyer’s Agents and/or Transaction Coordinators. A Subagent of the Seller is a licensee who has agreed to work with the Listing Agent, and who, like the Listing Agent, acts solely on behalf of the Seller. Seller’s Agents and their Subagents will disclose to the Seller known information about the Buyer which may be used to the benefit of the Seller. Individual services may be waived by the Seller through execution of a Limited Service Agreement. Only those services set forth in paragraph (2)(b), (c), and (d) above may be waived by the execution of a Limited Service Agreement.

A Buyer’s Agent, under a Buyer’s Agency Agreement with the Buyer, acts solely on behalf of the Buyer. Buyer’s Agents will disclose to the Buyer known information about the Seller which may be used to benefit the Buyer. Individual services may be waived by the Buyer through execution of a Limited Service Agreement. Only those services set forth in paragraph (2)(b), (c), and (d) above may be waived by the execution of a Limited Service Agreement.

A real estate licensee can be an Agent of both the Seller and the Buyer in a transaction, but only with the knowledge and informed consent, in writing, of both the Seller and the Buyer. In such a dual agency situation, the licensee will not be able to disclose all known information to either the Seller or the Buyer, and Seller and Buyer are giving up their right to undivided loyalty. As a Dual Agent, the licensee will not be able to provide the full range of fiduciary duties to the Seller or the Buyer. The obligations of a Dual Agent are subject to any specific provisions set forth in any agreement between the Dual Agent, the Seller and the Buyer.

A Transaction Coordinator is a licensee who is not acting as an Agent of either the Seller or the Buyer, yet is providing services to facilitate a real estate transaction. The Transaction Coordinator is not an Agent for either party and therefore owes no fiduciary duty to either party. The activities of a Transaction Coordinator may include:

• Providing access to and showing of property

• Providing access to market information

• Providing assistance in the preparation of a buy and sell agreement

• Presenting a buy and sell agreement and any subsequent counter-offers

• Assisting parties in undertaking steps necessary to carry out the buy and sell agreement, such as execution of documents, obtaining financing, obtaining inspections, etc.

A real estate licensee does not have any expertise or responsibility in the following areas, and licensee recommends the parties seek assistance from professionals trained in these fields and other areas as the parties deem appropriate:

• Appraisal

• Engineering • Mechanical Systems • Hazardous Materials • Environmental Matters • Structural Conditions • Tax Matters

Financing

Law

Surveying

LICENSEE DISCLOSURE (check one or more as applicable)

I hereby disclose that the agency status I/we have with the Buyer or Seller below is:

Seller’s Agent

Seller’s Agent – Limited Service Agreement

Buyer’s Agent

Buyer’s Agent – Limited Service Agreement

Dual Agent

Transaction Coordinator (a licensee who is not acting as an Agent of either the Seller or the Buyer)

A Buyer or Seller with a Designated Agency Agreement is represented only by the licensees specifically named in the agreement. Any licensees of the firm not named in the agreement do not represent the Buyer or Seller. The named “Designated Agent” acts solely on behalf of his or her Client and may only share confidential information about the Client with the licensee’s Supervisory Broker who is also named in the agreement. A Supervisory Broker is one who assists and advises a Designated Agent for the benefit of the Agent’s Seller or Buyer. Other licensees in the firm have no duties to the Buyer or Seller and may act solely on behalf of another party in the transaction.

Two Designated Agents from the same firm may each represent a different party in the same transaction or potential real estate transaction and shall not be considered Dual Agents. In such a transaction, however, the Broker is considered a consensual Dual Agent for purposes of that transaction. If the Designated Agent for one party in a transaction is also the Designated Agent for the other party in the transaction, the Designated Agent is considered a consensual Dual Agent for purposes of that transaction.

A Designated Agent’s knowledge of confidential information of a Client is not imputed to any other licensee within the Designated Agent’s firm unless the other licensee also has an agency relationship with the Client. A Designated Agent does not breach any duty or obligation owed to the Client by failing to disclose to the Client confidential information obtained through a present or prior agency relationship with a different client.

AFFILIATED LICENSEE DISCLOSURE (check one)

DESIGNATED AGENT – Only the licensee’s Broker and a named Supervisory Broker have the same agency relationship as the licensee named below. If the other party in a transaction is represented by an affiliated licensee, then the licensee’s Broker and all named Supervisory Brokers shall be considered consensual Dual Agents. ALL affiliated licensees have the same agency relationship as the licensee named below.

Further, this form was provided to the Buyer or Seller before disclosure of any confidential information.

By signing below, the parties acknowledge that they have received and read the information in this agency disclosure statement and acknowledge that this form was provided to them before the disclosure of any confidential information.

THIS IS NOT A CONTRACT. The Undersigned ____DOES ____DOES NOT have any agency relationship with any other real estate licensee. If an agency relationship exists, the undersigned is represented as ____SELLER ____BUYER.

To set up your home search portal to receive homes currently for sale that meet your needs and preferences, please complete the following:

Price Range (If known): $ to $

Style: Bedrooms: Bathrooms: Sqft:

Lot/Land: Basement: Garage (Size):

Desired Features:

School District:

Age: Other Rural City Location: Suburb

New Construction? Foreclosure/ Short Sale? Condo

Special Needs: Under 20 years 1-10 years

Other:

Preferred Drive Time:

Rank of Importance:

Preferred Drive Time:

Rank of Importance:

Preferred Drive Time:

Rank of Importance:

Preferred Drive Time:

Rank of Importance:

Preferred Drive Time:

Rank of Importance:

Preferred Drive Time:

Rank of Importance:

Preferred Drive Time:

Rank of Importance:

Preferred Drive Time:

Rank of Importance:

Preferred Drive Time:

Rank of Importance:

Preferred Drive Time:

Rank of Importance:

Preferred Drive Time:

Rank of Importance:

Preferred Drive Time:

Rank of Importance:

Preferred Drive Time:

Rank of Importance: Lakes

Preferred Drive Time:

Rank of Importance:

Preferred Drive Time:

Rank of Importance:

Preferred Drive Time:

Rank of Importance:

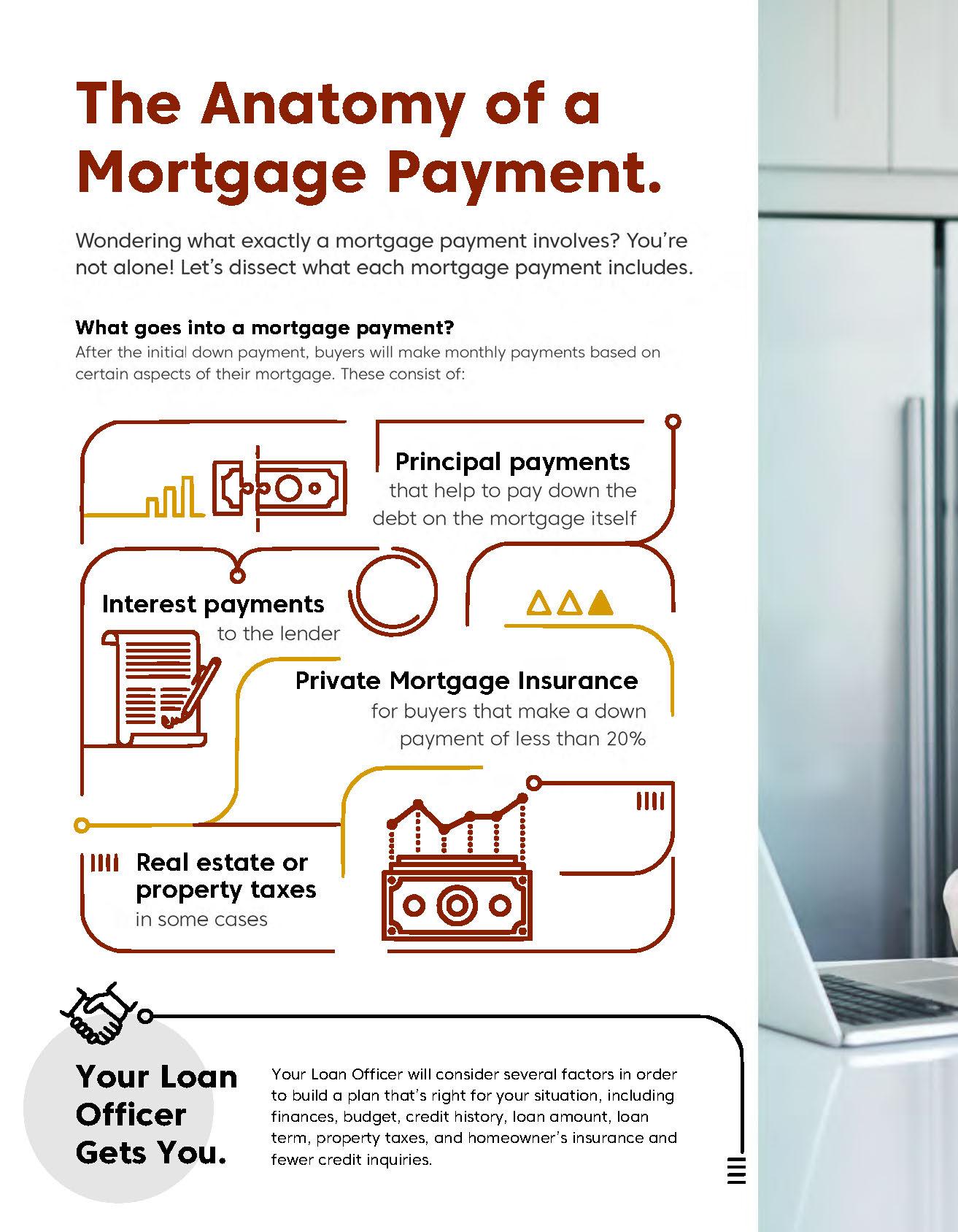

Buyers must consider one-time and ongoing costs of being a homeowner, based on national averages.

One-time home buying expenses - One-time expenses include a down payment, appraisal fee, inspection fee, buyer agent's commission and closing costs.

Ongoing homeowner expenses - Typical ongoing expenses include mortgage payment, property tax, homeowner’s insurance, mortgage insurance, homeowner association dues, maintenance and utilities.

Earnest Deposit

How much? 1% of sale price or more

Home Inspection

$400-$600 - Mechanical, Structural, Electrical, Health & Safety

Pest Inspection

$60 - $100

Radon Test

$150 - $175

Additional Inspections

Zoning, Well/Septic, Line Score, Soil Evaluation, Survey, Assessments

First Year Of Homeowner Insurance

Contact your insurance agent - call Arcadia Insurance

Down Payment

0%, 3%, 5%, 10% 20% or more

Appraisal Fee

$450 to $650

Closing Costs, Prepaids, Points, Buyer Pays/Seller Pays?

Typically 3% to 6% of sale price - call Summit Home Mortgage

Main Floor Primary

Bathtub in Primary Bath

Double Vanities/Dual Sinks in the Primary

Heated Primary Bath Floors

Bathtub in Other Full Bathrooms

Multi-generational Living Space/Area

Formal Dining Room/Area

Center Island in the Kitchen

Bar Area

Oversized Pantry

Specific Space for Appliances

Main Floor Laundry

Mudroom/Storage Near Garage Entrance

Gas Fireplace

Wood Fireplace

Hardwood Floors

Pet Space/Shower

Large Front Yard

Front Porch

Curbed Lot

Sidewalks

Finished Basement

High Speed Internet

Smart Home Technology

Solar Panels/Alternate Forms of Energy

Energy Efficiency Rating

Fenced-In Yard

Lawn Irrigation System

Deck or Patio Space in Backyard

In-Ground Pool or Above Ground

Hot Tub

Pole Barn (with electricity)

Shed or Outdoor Storage Space

Deliver a complete signed copy of the agreement to you

Process earnest money via check /wire /Earnnest (app) and open escrow for the sale

Submit sales agreement to the lender and title company

Order title insurance (mortgage policy)

Schedule inspections (home, pest, radon, etc) with you, seller and inspector

Coordinate access to the property with seller and inspectors

Attend inspections and receive written report for review

Review inspection reports with you and discuss concerns

Some inspections could reveal conditions that require additional inspections to determine the condition of the home. An advisable step is to get your homeowners insurance quote at this time and have their insurance agent pull a CLUE report to check for past insurance claims on the property

Arrange for contractor quotes for repairs if needed

Prepare and submit a repair addendum to negotiate repairs

Finalize repair negotiations and provide signed repair agreement to all parties

Other concessions are possible: price reduction, seller credits, home warranty

Confirm loan application is complete

Confirm well and septic inspection has been scheduled if necessary

Review well and septic reports with you

Prepare a repair addendum with you to negotiate repair for well or septic if any

Some well and septic repairs can create delays in closing or require that an escrow is established to complete repairs after closing

Receive and review the owner's title commitment with you

Confirm the legal description, deed or HOA restrictions that affect your intended use, and research unknown special assessments, or other parties with an interest in the property

Prepare and submit an addendum to negotiate any title related issues that need to be addressed

It is important to know what your intended use is ahead of time to avoid purchasing a home with use restrictions that negatively impact you

Coordinate the appraisal appointment with the listing agent

Confirm appraisal delivery and underwriting approval with the lender

Appraisers give an opinion of value which sometimes does not agree with the sales price. They also can comment on the condition of the house which can result in additional requirements by the lender

Request an update from lender on loan approval or any outstanding loan conditions

Lending may require additional documentation throughout the approval process from you

Confirm “clear to close” with the lender

Coordinate closing date / time with you, seller, listing agent, lender and title company

You or the seller may be out of town for closing. A remote closing can be scheduled to help accommodate everyone's needs

Confirm that you have secured homeowners insurance

Coordinate utility information and transfers between you and listing agent/seller

Schedule and conduct final walk through

Prepare an addendum to negotiate repairs for any new damage to the property or if there are any unexpected issues

Receive and review the final settlement statement with you

Deliver closing documents to you for review before closing, if interested

Attend closing

Follow up with you post closing

I will assist in negotiating the best price, terms and provide you with information to help you decide the appropriate offer. Additionally as an expert on the housing market, I keep up-to-date with housing trends, negotiating techniques and property intelligence which will help you draft the strongest offer with contingencies needed to protect your investment. I will always keep your position and strategies confidential.

• Your Interest - I help gauge how closely the house meets your needs

• Property Facts - I check the neighborhood, provide a comparable market analysis and verify property facts

• Seller Information - I try to gain as much information about the seller and their motivation

• Market Information - I provide you with information about other interest in the property

• Advocate for your needs and interest

• Use the gathered information to improve your position

• Concentrate on the terms that are important to you

• Utilized a variety of tools to help ensure a successful outcome

• Attempt a short back and forth

• Star t with an end in mind

• Use verbal and written tactics

• Establish who has the better position

• Maintain good faith to keep emotions low

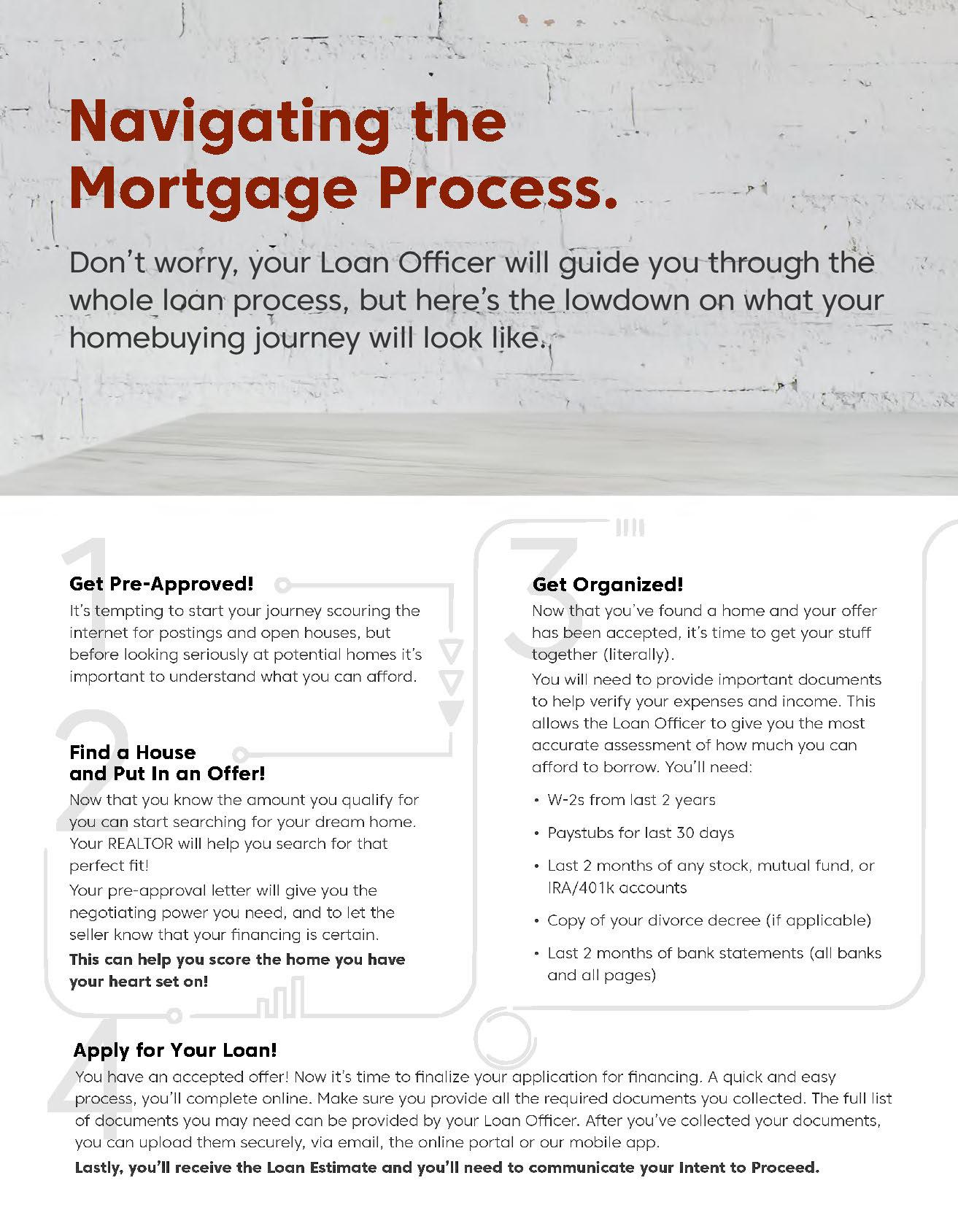

1 2

Interview

Initial meeting to review your needs

Secure Financing

Meet with a mortgage lender for pre-approval

3 4 5

View Properties

Set up MLS search, and provide access to properties

Submit An Offer

Negotiate on your behalf

Offer Accepted

Deposit earnest money, coordinate inspections, negotiate repairs and resolve contingencies

6 7 8

Lender Coordinates

Submit formal loan application and appraisal to underwriter

Title Review

Coordinate title search and commitment

Loan Approved

Loan documents sent to title company

9 10 11 CONGRATS Home Owner

Insurance & Utilities

Secure home owner’s insurance and set up transfer of utilities

Final Walk Through

Final walk through of home to confirm condition of home

Closing

Sign all paperwork and receive keys to home !

AUTHORIZED BUY & SELL AGREEMENT (“Agreement”) OF THE GREATER KALAMAZOO ASSOCIATION OF REALTORS® Form#:______

Date ___________________, 20_____ MLS No.

1.

A. EFFECTIVE DATE: This Agreement shall be binding on the date of: (1) delivery to Buyer or Buyer’s Broker of Seller’s written acceptance of Buyer’s offer; or (2) delivery to Seller or Seller’s Broker of Buyer’s written acceptance of Seller’s counteroffer. This date shall be referred to as the “Effective Date”.

B. DELIVERY: Delivery shall be effective at the time: (1) of personal service; (2) sent by email; (3) sent by facsimile with a successful confirmation page; (4) sent by any other electronic means then commonly in use; or (5) of any other means permitted by applicable state or federal statute

C. DAYS: Any reference to “days” in this Agreement refers to calendar days. The first calendar day begins at 12:01 a.m. on the day after the Effective Date.

D. TIME: Any reference to “time” refers to Kalamazoo, Michigan time.

E. BROKERS: The terms “Broker” and “Brokers” refer collectively to the listing and selling real estate brokers, the brokers’ officers, directors, agents, employees and assigns.

F. PARTIES: Buyer and Seller are collectively referred to as the “Parties”; singularly, “Party”

2. PRIOR OFFERS: This offer terminates any prior offers or counteroffers between The Parties for The Property.

3. CONFIDENTIALITY DISCLAIMER: Buyer acknowledges Buyer has been advised that Seller and Seller’s Broker are not required to keep the terms of Buyer’s offer confidential. The Parties further acknowledge that the sale price and terms will be disclosed to the Greater Kalamazoo Association of REALTORS® MLS, who may use it in the ordinary course of business.

4. SALE PRICE: ________________________________________________________________ ($ __________________) Dollars

5. PROPERTY DESCRIPTION: Buyer agrees to buy and Seller agrees to sell The Property, commonly known as, ___________________________, MI __ (Property Street Address Full Mailing Address) (Zip)

The Property is: located in the CITY VILLAGE TWP. of , ___________ County, (City/Village/Township Name) (County Name) Michigan; subject to existing zoning ordinances; and legally described as: (“The Property”) . TAX ID# ______

6. THE PROPERTY SHALL INCLUDE (if present at The Property on the above date):

A. All buildings, improvements, appurtenances, including all landscaping and plantings; and

B. All fixtures, including, but not limited to: plumbing; electrical; indoor & outdoor lighting fixtures and their bulbs and shades; heating and air conditioning equipment (excluding window units & portable units); garage door openers; antennas & satellite dishes; ceiling fans; wall-mounted hardware for TV’s (excluding TV’s); wood burners, fireplace inserts & gas logs; drapery & curtain hardware; window shades & blinds; wall-to-wall carpeting; stationary laundry tubs; water conditioning/filtration equipment (unlessrented); water heaters (unlessrented); sump pumps; LP tanks (unlessrented); water pumps & pressure tanks; underground sprinkling systems; built-in kitchen appliances; awnings; mail boxes; stationary outdoor grills; above-ground & underground pet fencing; and

C. The following items, if affixed: security systems; outdoor play equipment; work benches; cabinetry; shelving; mirrors; smoke/fire detectors; carbon monoxide detectors; thermostats & timers; under-cabinet appliances; sound system wiring & speakers; and

D. The following items, whether affixed or not: storage sheds; pools & pool equipment; hot tubs & spas & all related equipment; screens, storm windows & doors; fireplace doors, screens & grates; and

E. Other (list all appliances, controls, and other items that Buyer intends to be included in sale):

F. Fuel: Seller agrees that the existing supply of heating and cooking fuel (such as propane, fuel oil, firewood, pellets, etc.) shall be depleted only in the course of normal usage. Buyer shall be entitled to all such fuel owned by Seller and located or stored upon The Property at the time of possession. Buyer is advised that the fuel may be owned by Seller, a supplier, or anotherparty

G. Rented items shall be excluded: Seller shall supply Buyer a list of all rented or leased items within three (3) days after the Effective Date ALSOEXCLUDEDFROM THESALE:

8. CLOSING: Sale shall be closed on a day and time mutually agreeable to The Parties, not earlier than and not later than _______________________. Buyer and Seller shall each pay their title company closing fee, if any, except Seller shall pay Buyer’s closing fee and wood destroying insect inspection fee(s) if required by a VA lender. Seller shall pay real estate transfer taxes at the time the deed is delivered.

9. POSSESSION: Buyer shall be entitled to possession of The Property as follows: (Check one box)

At the completion of closing. OR

Seller shall pay to Buyer at closing, a non-refundable delayed possession fee of $______________________, and shall have the right to possession of The Property until 11:59 pm on the _______ day after the day of closing.

Seller shall not be entitled to possession after the time agreed above. Unless otherwise provided in writing and signed by The Parties, Seller shall provide possession of The Property free from the rights of any other person or entity, including, but not limited to, tenants. At the time of transfer of possession of The Property, Seller shall have removed all personal property (unless otherwise stated in this or an additional written agreement), made arrangements for final payment on all utilities, and shall deliver all keys to Buyer.

The Property shall be free and clear of trash and debris; buildings and improvements shall be left in broom-clean condition. Seller shall maintain The Property in its present condition until time of possession in this transaction, normal and reasonable wear excepted. Seller shall pay for utilities and for any repairs due to damage caused by the Seller to The Property after closing and before transfer of possession. Seller is responsible for obtaining any insurance Seller deems necessary

If Seller fails to give possession to Buyer as provided, Seller shall pay Buyer $ ________ for each day that Seller retains The Property beyond the agreed time and shall be liable for all court costs and reasonable actual attorney fees incurred by Buyer in obtaining possession and collecting the amount due.

10. SELLER’S REPRESENTATIONS: The following representations shall survive the closing and, except as otherwise disclosed in writing, Seller represents that:

A. There is no pending or threatened litigation, administrative action or claim relating to The Property.

B. Seller has not been notified of any assessments to be placed on The Property.

C. The Seller is the owner of title to The Property in the condition required for performance hereunder.

D. The Property is not a new landdivision under the Land Division Act and Seller owns no other contiguous, unplatted land unless otherwise disclosed in writing. Seller is transferring to Buyer all available divisions, if any, under Section 108 of the Land Division Act but makes no representations as to the number. Buyer has not relied on any information or opinions of the Brokers on this matter.

E. To the best of the Seller’s knowledge, there are no existing violations of any laws, statutes, ordinances, regulations, orders or requirements of any governmental authority affecting The Property.

11. LEASE OR RENTAL REPRESENTATIONS: If The Property is rented to tenants;

A. Seller shall notify Buyer in writing of the possession rights of any person or entity, including, but not limited to, tenants. Seller shall provide copies of all leases and security deposit information to Buyer within three (3) days after the Effective Date. This Agreement is contingent upon Buyer's written acceptance of those possession rights, leases and security deposit information within five (5) days after receipt of the notice and copies. If Seller does not provide notice and copies within three (3) days, Seller warrants that no other person or entity has possession rights. If Buyer receives notice and copies and neither accepts nor rejects these items within the five (5) days, Buyer shall be deemed to have accepted them and this contingency shall be deemed satisfied.

B. None of the tenants occupying The Property shall be entitled to any concessions, rebates, allowances or free rent for any period after the Closing Date.

C. After the date hereof, the Seller will not enter into any agreement pertaining to The Property or any modification of, or release from, an existing lease or rental agreement, without the prior written consent of Buyer.

12. SELLER’S DISCLOSURE STATEMENT: Buyer has HAS NOT received a completed and signed copy of Seller’s Disclosure Statement #____________dated or revised_____________. Seller hereby certifies that to the best of the Seller’s knowledge, the information contained in such Seller’s Disclosure Statement is current as of the date of this Agreement. Further, Seller agrees to inform Buyer in writing of any changes in the condition of The Property relating to the information contained in such disclosure statement.

13. LEAD BASED PAINT DISCLOSURE STATEMENT: Buyer has HAS NOT received BOTH an EPA PAMPHLET “Protect Your Family From Lead in Your Home” and a completed and signed copy of the Seller’s Lead Based Paint Disclosure Statement #_________________ dated ______________.If The Property was constructed prior to January 1, 1978, Buyer will not be obligated to the terms of this Agreement until ten (10) days after the above documents are received by Buyer. Seller is advised to complete a Lead Based Paint Disclosure regardless of the year the dwelling was built.

14. METHOD OF PAYMENT: All moneys must be paid in US funds by wire transfer, certified check, cashier’s check, or money order. The sale will be completed upon Seller’s delivery of a warranty deed conveying marketable title in accord with Buyer’s delivery of the sale price by the following method:

A. NEW MORTGAGE. This Agreement is contingent upon Buyer’s ability to obtain a(n)_______ (type) mortgage loan in the amount of $________ ______ or _______ % of the sale price. Buyer shall apply for the loan from ________ (name of financial institution–Lender) within ______ days after the Effective Date. Loan application shall include the payment of any appraisal fee, application fee, and all other costs customarily charged by Lender for loan approval. Buyer acknowledges that failure to complete the loan application as agreed shall constitute a default by Buyer. Buyer shall take no action that would impair Buyer’s credit or ability to obtain the loan and shall accept such loan if offered. Buyer may waive this mortgage loan contingency by written notice to Seller and pay cash as provided in subparagraph B below.

Seller may terminate this Agreement by written notice to Buyer if Buyer fails to provide Seller with evidence of loan approval by 11:59 pm ___________________ (“Loan Approval Deadline Date”). If Buyer is unable to obtain written verification of Lender’s approval, Buyer may provide oral verification from Lender to Seller. If said loan approval is acceptable to Seller, no response shall be necessary.

If Seller reasonably determines that the evidence of loan approval is inadequate or unacceptable and if Seller therefore wishes to terminate, Seller must deliver written notice of termination of this Agreement by 11:59 pm on the third (3) day after the Loan Approval Deadline Date. If Seller so terminates, Buyer may waive this mortgage contingency and void the termination by delivering written notice of such waiver to Seller by 11:59 pm on the third (3) day after Seller’s delivery of termination. If Buyer waives this mortgage contingency and subsequently fails to close due to Buyer’s failure to secure financing, Buyer shall be considered in default in this Agreement.

BUYER HEREBY INSTRUCTS LENDER TO RELEASE TO SELLING BROKER AND SELLER OR LISTING BROKER INFORMATION CONCERNING COMPLETION OF LOAN APPLICATION AND STATUS OF LOAN APPROVAL.

B. CASH. Buyer will pay the sale price by certified check, cashier’s check, or wire transfer.

C. LAND CONTRACT. See attached GKAR Land Contract Addendum # .

15. FINANCIAL CONTINGENCIES: If none of the boxes below are checked, Buyer represents that no sale, release of liability nor event of any kind, other than as specified herein, is required for Buyer to complete this Agreement. Further, Buyer represents that all of the funds necessary to complete this Agreement, on the terms specified, are currently available to Buyer in cash or an equally liquid equivalent. If any of the boxes below are checked, Buyer shall notify Seller in writing within forty-eight (48) hours of any changes that may delay or materially affect the consummation of this Agreement, such as, but not limited to, changes in the terms or progress of a pending sale upon which this Agreement is contingent or changes in the progress or likelihood of any of the items detailed in D below. In such an event, Seller may terminate this Agreement by written notice to Buyer within forty-eight (48) hours of receipt of said notice from Buyer. Failure of Buyer to notify Seller of such changes, or a default by Buyer in consummating the items checked below, shall be considered a default in this Agreement.

A. CLOSE OF PENDING REAL ESTATE SALE. This Agreement is contingent on the close of the pending sale of the property located at__________________________________________________________________________________.

A copy of the agreement to sell or exchange Buyer’s property is being delivered to Seller along with this offer, along with copies of any further pending sales upon which Buyer’s property sale is contingent.

B. SALE AND CLOSING OF REAL ESTATE. This Agreement is contingent upon Buyer entering into and delivering to Seller on or before 11:59 pm ________________(date) proof of a binding agreement for the sale of Buyer’s property located at _______________ ____________________________________________________________.

This Agreement is further contingent upon Seller’s review and acceptance of said agreement and any agreements upon which that agreement is contingent. Buyer is, therefore, advised to consider making acceptance of any such agreement contingent upon this Seller’s acceptance. If unacceptable to Seller, in Seller’s sole discretion, Seller shall notify Buyer in writing within twenty-four (24) hours of receipt of said binding agreement(s). If acceptable to Seller, Seller and Buyer acknowledge that this Agreement shall then be contingent upon the closing of the sale of Buyer’s property and any sales upon which Buyer’s property sale is contingent. Seller and Buyer are advised to detail in writing any changes in the terms of this Agreement necessitated by the pending sale of Buyer’s property.

C. APPRAISED VALUE. Buyer may terminate this Agreement in writing within three (3) days of Buyer being notified that The Property appraised below the sales price. The appraisal shall be conducted by a licensed appraiser and paid by Buyer. If Buyer indicates The Property appraised below sales price, Buyer shall provide a copy of the appraisal to Seller upon request.

D. OTHER: (check all that apply): Buyer’s ability to consummate this Agreement is contingent upon the following: Divorce settlement Legal settlement Withdrawal of retirement funds Receipt of gift Sale of personal property Receipt of inheritance Home equity line of credit Other:

FurtherExplanation:

16. DISCLAIMER: Buyer understands and agrees that the Brokers do not warrant: The Property’s boundaries, the size of the land, the size of the buildings and improvements; the condition of The Property or; that appropriate permits were obtained for repairs or other work performed on buildings or improvements. Buyer understands and agrees that the Brokers do not assume any responsibility for the representations made by Seller. It is further understood that no representations or promises have been made

to Buyer by the Brokers, or by Seller other than those contained in this Agreement or as otherwise made or given by Seller to Buyer inthewrittendisclosurestatement(s).ThePartiesunderstandthat Brokersarenotenvironmentalexperts.Unlessexpresslycontained in a written instrument signed by the Brokers, Brokers have no knowledge of and make no representations regarding the environmental condition of The Property, the existence of underground storage tanks at The Property now or in the past, whether The Property is, has been or may be listed as a site of environmental contamination, or whether any such sites are located in the proximity of The Property. If Buyer or Seller requests the Brokers to recommend inspectors, repairmen or other professionals, The Parties agree that the Brokers shall not be liable for errors or omissions made by said inspectors, repairmen or other professionals. 17.

A. Buyer Acknowledgment: Buyer acknowledges that Buyer has been advised to carefully evaluate The Property to determine its condition and suitability for Buyer’s intended use. Buyer is aware that inspectors and inspection services are available to aid Buyer in these evaluations. Items Buyer should evaluate include, but are not limited to: structural integrity; condition of mechanical systems; infestation by termites or other wood-destroying insects; environmental concerns such as underground storage tanks or abandoned uncapped wells; health or safety issues, including radon and mold; zoning; assessed valuation, including the Principal Residence Exemption status and any possible changes to that status; the size of the land; the size of the buildings and improvements; the availability of utilities, including the cost to extend or hook-up; soil erosion or settling; the existence of wetlands; location within a flood zone; the availability of homeowner’s insurance or flood insurance at a cost acceptable to Buyer; items on The Property that may be rented, including their rental terms & conditions, such as water conditioning equipment, water heaters & propane tanks.

B. Buyer Investigation Period: Buyer shall have until 11:59pm, ten(10) days afterthe Effective Date to investigate TheProperty (“Investigation Period”). During the Investigation Period, Buyer and Buyer’s investigators shall have reasonable access to The Property to conduct investigations as Buyer deems necessary. Buyer agrees to defend, indemnify and hold Seller harmless from any physical damage to persons or property resulting from such investigations. To the extent The Property is damaged due to any of Buyer’s investigations, Buyer agrees to restore The Property to its previous condition. Buyer is solely responsible for ordering and paying for any inspections and evaluations, except, if Buyer has elected to use VA financing, Seller shall pay for the wood destroying insect inspection at closing.

C. Seller Responsibility Concerning Utilities: Seller shall have the following utilities, if attached, turned on for Buyer’s investigations, appraisals and final inspection: electric, natural gas, propane, heating oil, sewer and water. Seller shall be solely responsible for de-winterization, re-winterization and any and all costs and procedures associated with this subparagraph.

D. Results of Investigations: If any investigation reveals a condition unacceptable to Buyer, then, prior to the expiration of the Investigation Period, Buyer may pursue one of the following resolutions (D1 or D2):

1. Buyer may Deliver to Seller a written request for corrective action(s) on the GKAR Investigations Addendum, or a similar notice, and may include any documentation, reports, and/or cost estimates that Buyer deems appropriate

a. Seller shall have until 11:59 pm, five (5) days after receipt of the Investigations Addendum, or a similar notice, to respond to Buyer in writing as to whether Seller will agree to pay for and/or perform said requested corrective action(s).

b. If Seller rejects any part of Buyer’s request in writing, Buyer shall have until 11:59 pm, three (3) days after receipt of Seller’s written rejection to terminate this Agreement in writing.

c. If Seller does not respond in writing, Buyer shall have until 11:59 pm, three (3) days after the expiration of Seller’s allowed five (5) day period to terminate this Agreement in writing. OR

2. Buyer may terminate this Agreement by providing written notice of the termination to Seller within the Investigations Period At Seller’s sole option and request, Buyer shall provide Seller with a copy of any inspection report or portion thereof or such other documentation obtained per this paragraph that Seller deems useful to Seller.

E. Waiver of Contingencies: BUYER AGREES THAT THE CONTINGENCIES IN THIS PARAGRAPH SHALL BE DEEMED TO HAVE BEEN WAIVED IF (1) BUYER FAILS TO DELIVER WRITTEN NOTICE OF BUYER’S PROPOSED RESOLUTION TO SELLER WITHIN THE INVESTIGATION PERIOD OR (2) BUYER FAILS TO TERMINATETHISAGREEMENTINWRITINGASPROVIDEDABOVE. IFTHESE CONTINGENCIES AREWAIVED, OR IF BUYER ELECTS TO CLOSE THIS TRANSACTION, BUYER SHALL BE DEEMED TO HAVE ACCEPTED THE PROPERTY IN ITS “AS-IS” CONDITION AS IT RELATES TO THIS PARAGRAPH AS OF THE DATE OF CLOSING, SUBJECT TO THE PROVISIONS OF PARAGRAPH 9

18. WELL/WATER/SEPTIC SYSTEM INVESTIGATIONS:

A. Buyer Acknowledgment: Buyer acknowledges that Buyer has been advised to carefully evaluate The Property for satisfactory well, water and septic systems. Buyer is aware that inspectors and inspection services are available through private companies and/or County Health Departments to aid Buyer in these evaluations. Items Buyer should evaluate include, but are not limited to: location of systems on The Property, availability and cost of municipal water and/or sewer services current or proposed, currentcoderequirements,wellconstructionandfunction,waterqualityandvolume,distancefromcontaminants,septicsystem construction and function, septic system sizing and life expectancy, and availability of space for relief systems.

B. Evaluations: If The Property is serviced by a water well and/or septic system, Seller agrees to order by 11:59 pm five (5) days after the Effective Date and promptly provide to Buyer, at Seller’s expense, evaluation report (s) from: _________________________________(Insert County or private inspection companies. If left blank Seller shall choose.) regarding the condition of the septic system and well and tests for nitrates and bacteria in the water. Any water evaluation beyond tests for nitrates and bacteria shall be Buyer’s responsibility and expense.

C. Results of Investigations: If the evaluation report(s) in any of the above circumstances disclose(s) a condition which Buyer reasonably deems unacceptable, Buyer shall notify Seller of such condition and requested corrective action in writing by 11:59 pm five (5) days after Buyer has received the applicable report(s). If Seller does not agree or fails to respond in writing by 11:59 pm fifteen (15) days after receipt of Buyer’s requested corrective action, Buyer shall have the right to terminate this Agreement by providing written notice to Seller within three (3) days after receipt of Seller’s written refusal (if any) or from the expiration of Seller’s allowed time, whichever first occurs.

D. Waiver of Contingencies: BUYER AGREES THAT THE CONTINGENCY PROVIDED BY THIS PARAGRAPH SHALL BE DEEMED TO HAVE BEEN WAIVED IF (1) BUYER FAILS TO PROVIDE WRITTEN NOTICE OF A CONDITION DEEMED UNACCEPTABLE BY 11:59 PM FIVE (5) DAYS AFTER BUYER HAS RECEIVED THE APPLICABLE REPORT(S) OR (2) BUYER FAILS TO TERMINATE THIS AGREEMENT IN WRITING AS PROVIDED ABOVE. IF THESE CONTINGENCIES ARE WAIVED, OR IF BUYER ELECTS TO CLOSE THIS TRANSACTION, BUYER SHALL BE DEEMED TO HAVE ACCEPTED THE PROPERTY IN ITS “AS IS” CONDITION AS OF THE DATE OF CLOSING, SUBJECT TO THE PROVISIONS OF PARAGRAPH 9 19. TITLE EVIDENCE: Seller agrees to convey marketable title to The Property subject to conditions, limitations, building and use restrictions and easements of record (“Exceptions”). As evidence of marketable title, Seller shall furnish Buyer, at Seller’s expense, an expanded coverage ALTA Homeowner’s Policy of Title Insurance (“Expanded Policy”), if available, in the amount of the sale price. Seller shall order the commitment for such policy, along with copies of the Exceptions and supporting documents, and shall deliver same to Buyer within ten (10) days after the Effective Date of this Agreement. If a survey or mortgage report is required by the commitment, it shall be completed at Buyer’s expense If an Expanded Policy is not available or if Buyer declines any required survey or mortgage report cost, Seller agrees to provide and Buyer agrees to accept a standard coverage ALTA Owner’s Policy of Title Insurance including all standard exceptions.

If the commitment discloses any title defect(s) or anything in the Exceptions which would interfere with Buyer’s intended use of The Property, Buyer must notify Seller in writing of Buyer’s objections within five (5) days after Seller’s delivery of the commitment and Exceptions. Further, if, prior to closing, Buyer shall become aware of new title defect(s), Buyer must notify Seller, in writing, within five (5) days after Buyer becoming aware of such defect(s).

If Seller receives any such notification, Seller shall have either thirty (30) days after Buyer’s delivery of written objection(s) or until the latest closing date set forth in Paragraph 8 of this Agreement, whichever first occurs, to resolve Buyer’s objection(s). If Seller is unable to cure the title defects(s), or unable or unwilling to resolve Buyer’s objection(s) to Exceptions within this time period, Buyer may terminate this Agreement in writing or proceed to closing, accepting the status of the title “AS IS”.

20. LOCATION OF BOUNDARIES AND IMPROVEMENTS: Buyer may, at Buyer’s expense, obtain a survey or mortgage report of The Property. If the survey or mortgage report reveals material differences in The Property’s boundaries or land area from that which was represented by Seller in writing, or encroachments, setback violations, or matters which would interfere with Buyer’s intended use of The Property (“Survey Defects”), Buyer shall furnish Seller with a copy of the survey or mortgage report, along with a written request that Seller correct the Survey Defect(s). These must be received by Seller no later than fifteen (15) days after delivery of the title commitment referenced in Paragraph 19 to Buyer. Seller shall respond in writing to Buyer within five (5) days as to whether or not Seller will correct the Survey Defect(s). If Seller does not agree to do so or fails to respond, Buyer shall have three (3) days from receipt of Seller’s written refusal (if any) or from the expiration of Seller’s allowed time, whichever first occurs, to terminate this Agreement in writing.

BUYER AGREES THAT THIS CONTINGENCY SHALL BE DEEMED WAIVED IF BUYER FAILS TO PROVIDE SELLER WITH A SURVEY OR MORTGAGE REPORT OR BUYER FAILS TO TERMINATE THIS AGREEMENT IN WRITING AS PROVIDED ABOVE. IF THIS CONTINGENCY IS WAIVED AND BUYER ELECTS TO CLOSE THIS TRANSACTION, BUYER SHALL BE DEEMED TO HAVE ACCEPTED THE LOCATION OF THE PROPERTY BOUNDARIES AND IMPROVEMENTS, “AS IS”.

21. PRORATIONS: Items normally prorated in real estate transactions, including association fees and assessments, rental income, taxes as discussed below, interest on any existing land contract, mortgage, or lien assumed by Buyer shall be adjusted to the date of closing in accordance with the calendar year. All rental security deposits shall be paid to Buyer at closing.

22. REAL ESTATE TAXES: The calendar year proration shall include all taxes billed or to be billed in the year of the closing. Calendar year tax bills will be estimated, if necessary, using the taxable value and the millage rate(s) in effect on the day of closing Proration shall be calculated on a per diem increment and prorated to the date of closing Seller shall pay for January 1 through the day before closing. If The Property’s Principal Residence Exemption (“PRE”) status for the calendar year in which the closing occurs will change as a result of the closing, the new PRE status shall be used.

If the current PRE percentage claimed by Seller is greater than zero, Seller represents that such claim by Seller is accurate and lawful. Such representations shall survive the closing. Seller shall defend, indemnify and hold Buyer harmless from any loss, claim or damage resulting from any inaccuracy in such representations. Such loss, claim or damage shall include, but shall not be limited to, any loss, claim or damage resulting subsequently to Buyer from the tax proration calculation made at the time of closing or from the change in PRE status by the municipality for any prior years. Seller shall also be responsible for reasonable actual attorney fees incurred by Buyer in enforcing the provisions of this paragraph, regardless of whether suit is actually filed. The representations and obligations under this paragraph may only be terminated by a separate written document signed by The Parties specifically referring to this paragraph by number.

23. SPECIAL ASSESSMENTS: Special assessments levied on The Property shall be handled as follows:

A. Existing special assessments, whether there is a lien or not, which can be paid in full and permanently discharged shall be paid by Seller at close of sale.

B. Existing special assessments which have ongoing installments and cannot be paid in full and permanently discharged shall be prorated as referenced in the paragraph entitled Prorations. This type of assessment is generally for services or maintenance, including, but not limited to: street lighting, lake weed control, emergency services, etc.

C. Special assessments which are levied on The Property after the Effective Date shall be the responsibility of Buyer.

24. WATER/SEWER CHARGES: Seller shall be responsible for water and sewer charges until date of possession. The cost of water and sewer hookups after closing shall be paid by Buyer. If The Property is not presently served by these utilities, Buyer is advised to consult with the local units of government for information regarding when and if such hookup is or may be required, feasibility and cost of such hookup, and whether any assessment will be imposed at that time.

25. CASUALTY: In the event that, on or before the closing date, The Property becomes damaged by fire, storm or other casualty, and the cost to repair same is in excess of 10% of the sale price, either Party shall have the right to rescind this Agreement by written notice to the other Party within seven (7) days after receiving notice of such casualty, and Buyer shall be entitled to a refund of any earnest money.

26. HOME PROTECTION PLAN: The Parties have been informed that home protection plans are available. Such plans may provide additional protection and benefit to the Parties.

27. EARNEST MONEY: Buyer has delivered to Broker or shall deliver to Broker within forty-eight (48) hours of the Effective Date $ _________________________ (dollars) as earnest money evidencing good faith. Broker is required by law to deposit the earnest money in separate custodial or trust account within two (2) banking days after this Agreement is signed by The Parties. If the offer made is not accepted or if the sale is not closed due to a failure to satisfy a contingency specified herein for a reason other than default of Buyer, the earnest money shall be refunded to Buyer. The earnest money will be applied to the sale price at closing.

28. EARNEST MONEY DISPOSITION: If this Agreement is not closed in the time and manner provided, or if either Party terminates as provided in this Agreement, the disposition of earnest money may be resolved in any of the following ways:

A. The Parties may agree in writing to the disposition of the earnest money;

B. Either Party may file a lawsuit regarding the disposition of the earnest money;

C. Broker may deposit the funds by interpleader with a court of proper jurisdiction. The Parties agree to reimburse Broker for all costs incurred by Broker in filing the interpleader action, including actual attorney’s fees, regardless of the outcome; Broker shall continue to hold earnest money until it receives a written agreement signed by The Parties, a final Court Order, or the Broker has deposited the funds with the Court in accordance with an interpleader action In the event of litigation involving the earnest money, the non-prevailing Party, as determined by the court, shall reimburse the other Party and the Brokers for reasonable actual attorneys’ fees and expenses incurred in connection with the litigation.

29. DEFAULT: If Buyer defaults, Seller may enforce this Agreement, or may declare Buyer’s right to purchase terminated, retain the earnest money, and pursue Seller’s legal remedies. If Seller defaults, Buyer may enforce this Agreement, or may demand return of the earnest money and pursue Buyer’s legal remedies. Broker(s) have no responsibility for the performance of this Agreement by the Parties

30. ALTERNATIVE DISPUTE RESOLUTION: The Parties acknowledge that they have been informed that any claim or dispute between them related to this Agreement, may be mediated or arbitrated if Seller and Buyer agree in a separate writing.

31. LEGAL COUNSEL: Buyer acknowledges that Broker(s) have recommended that Buyer retain an attorney to review the marketability of title to The Property. The Parties acknowledge that Broker(s) have recommended that they each retain an attorney to ascertain that the requirements of this Agreement have been met.

32. DUE ON SALE: Seller understands that consummation of the sale or transfer of the property described in this Agreement shall not relieve the Seller of any liability that Seller mayhave under the mortgage(s) to which the property is subject, unless otherwise agreed to by the lender or required by law or regulation.

33. CONSENT TO FEES: The Parties acknowledge that Brokers may be offered placement fees, finder’s fees or other consideration from others who become involved in the sale of The Property. The Parties hereby grant Brokers permission to receive such fees and/or consideration, unless otherwise agreed in writing.