International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 05 | May 2024 www.irjet.net p-ISSN:2395-0072

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 05 | May 2024 www.irjet.net p-ISSN:2395-0072

Saloni Thakkar

Texas A&M University, USA

Numerous domains, including finance, can benefit from the probabilistic modeling and inference capabilities of Bayesian Networks(BNs).Thisarticleexploresthefoundation,principles,andapplicationsofBayesiannetworks,focusingontheir potential to revolutionize the process of financial decision-making. The comprehensive case study conducted regarding theutilizationofBayesianNetworksincreditscoringdemonstratestheirsuperiorpredictivecapabilitieswhencompared totraditional methods,aswell astheirabilitytocapture complexinterrelationshipsamongcreditrisk factors.Thepaper highlights the advantages of Bayesian networks, such as their capacity to incorporate expert knowledge, represent uncertainty, and produce results that are straightforward to comprehend [1]. In addition, challenges associated with integrating Bayesian networks with alternative machine learning techniques, concerns regarding scalability, and the scarcityofdatainpracticalfinancialcontextsarediscussed[2].Potentialfutureresearchandinnovationavenuesarealso deliberated, with particular emphasisontheutilization ofbigdata andalternativedata sourcesto enhancethe precision and robustness of Bayesian Network models within the finance sector. In an effort to assist academics and professionals whowishtomakeinformedfinancialdecisionsusingBayesiannetworks,thisarticleendeavorstobridgethegapbetween theoryandpractice.

Keywords: Bayesian Networks, Financial Decision-Making, Credit Scoring, Probabilistic Modeling, Machine Learning Integration

The approach to complicated problems involving uncertainty has been greatly influenced by the emergence of Bayesian Networks(BNs),a powerful framework forprobabilistic modelingandinference.Rootedinthegroundbreaking research of 18th-century Thomas Bayes [3], and further advanced by pioneers like Judea Pearl [4] and Richard E. Neapolitan, Bayesiannetworkshavebeenwidelyadoptedinindustriessuchasartificialintelligence,healthcare,andfinance.Bayesian networksprovideacompellingsolutiontothechallengesofmodelinganddecision-makinginthefinancesector,especially when dealing with uncertainty. Due to the intricate relationships between various factors such as economic indicators, company performance, and investor sentiment, financial markets are inherently complex. Traditional financial models often struggle to incorporate the probabilistic nature of financial events and capture their complexities [5]. Through the use of a logical method, Bayesian networks assist analysts in understanding uncertain events and reaching informed conclusions [6]. Bayesian Networks (BNs) utilize Bayesian inference and a directed acyclic graph (DAG) to illustrate probabilistic dependencies [7], facilitating the integration of expert knowledge and data-driven insights. In recent years, therehasbeenasignificantriseininterestintheapplicationofBayesiannetworksinthefieldoffinance.Researchersand experts have explored the use of BNs in various areas such as credit risk assessment, fraud detection [8], portfolio optimization, and financial forecasting. Bayesian Networks have become increasingly popular in the financial domain because of their ability to handle incomplete data, model causal relationships, and produce understandable results [9]. This article aims to provide a comprehensive introduction to Bayesian networks and their applications in finance. The fundamental ideas of Bayesian networks are outlined, including directed acyclic graphs, conditional probability, and inferencealgorithms.TheuseofBayesianNetworksfor creditscoringisthoroughly examinedthrougha casestudy.This study demonstrates the effectiveness of these models in predicting outcomes and representing complex relationships betweencreditriskfactors,whencomparedtomoreconventionaltechniques.

In addition, we cover the advantages of Bayesian networks in finance, including their capacity to interpret findings and incorporate uncertainty and expert knowledge. The discussion includes an exploration of the challenges and possible directions for future research and innovation. It highlights the advantages of integrating machine learning and Bayesian network techniques with large datasets and alternative data sources. This article aims to bridge the gap between theory and practice in order to assist researchers and practitioners in making well-informed financial decisions using Bayesian networks.Thegoalistocontributetotheongoingdiscussionandadvancementsinthiscaptivatingfieldbyexploringthe principles,applications,andpotentialfuturesofBayesiannetworksinfinance.

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 05 | May 2024 www.irjet.net p-ISSN:2395-0072

DEFINITION AND KEY CONCEPTS

BayesianNetworks(BNs)representasetofrandomvariablesandtheirconditionaldependenciesusingadirectedacyclic graph (DAG), making them probabilistic graphical models. The edges of the graph depict the probabilistic relationships betweentherandomvariables,whilethenodesofthegraphrepresentthevariablesthemselves.BNs,whichofferaconcise and comprehensible way of encoding the joint probability distribution of the variables [10], facilitate effective reasoning andinference.

ImportantideasinBayesiannetworksinclude:

● Two variables are considered conditionally independent if their independence is maintained regardless of the valuesoftheirparentvariablesintheDAG[11].

● When considering the parents in the DAG, it is important to note that a variable can be independent of its nondescendantsundertheMarkovcondition[12].

● Factorization: The joint probability distribution can be factored into a product of conditional probability distributions,dependingonthestructureoftheDAG[13].

Inprobabilitytheory,theBayestheoremisabasicconceptthatexplainshowtoupdatetheprobabilityofahypothesis(H) givenobservedevidence(E):

P(H|E)=P(E|H)×P(H)/P(E)

where P(H|E) is the posterior probability of the hypothesis given the evidence, P(E|H) is the likelihood of the evidence giventhehypothesis,P(H)isthepriorprobabilityofthehypothesis,andP(E)isthemarginalprobabilityoftheevidence.

Theabilitytoquantifytheprobabilisticrelationshipsbetweenvariablesmakesconditionalprobabilityafundamentalidea inBayesiannetworks.Accordingto[14],theconditionalprobabilityofaneventAgivenaneventBisasfollows:

P(A|B)=P(A∩B)/P(B)

whereP(A∩B)isthejointprobabilityofeventsAandB,andP(B)isthemarginalprobabilityofeventB.

A directed acyclic graph (DAG) graphically illustrates the probabilistic dependencies between a group of variables in a Bayesiannetwork.ADAG'sdirectededgesdisplaytheconditionaldependenciesbetweenthenodes,whichstandinforthe randomvariables.Giventheirparentnodesinthegraph,theabsenceofanedgebetweentwonodesindicatesconditional independence.

In the structure of the DAG [15], the Markov condition is stored. This condition says that a variable is conditionally independentofitsnon-descendantsgivenitsparents.Thischaracteristicpermitslocalcomputationsduringinferenceand facilitatesthejointprobabilitydistribution'seffectivefactorization.

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 05 | May 2024 www.irjet.net p-ISSN:2395-0072

Bayesian Networks involve the calculation of posterior probabilities of variables using observed data for inference purposes. Various algorithms have been developed to efficiently carry out inference, depending on the complexity of the networkandthetypeofqueries.

Byutilizingthenetwork'sconditionalindependencefeatures,thetechniqueof"variableelimination"effectivelyeliminates eachvariablefromthejointprobabilitydistributionindividually[16].Thealgorithmoperatesbymultiplyingtherelevant factorsandeliminatingnon-queryvariablesuntilthedesiredposteriorprobabilityisachieved.

Working with a factor graph representation of the Bayesian Network, belief propagation, also known as sum-product message passing, is an exact inference algorithm [17]. The algorithm updates the beliefs about the variables based on incoming messages that are exchanged between nodes in the graph. Belief propagation is particularly efficient for networkswithatree-likestructure.

Some types of Markov chain Monte Carlo (MCMC) methods, like the Metropolis-Hastings algorithm and Gibbs sampling [18],choosesamplesbasedonhowthevariablesarelikelytobedistributedinthefuture.Whencontinuousvariablesare presentorthenetwork'scomplexitymakesexactinferenceimpossible,MCMCmethodscanprovidevaluableassistance.

Aspect

Modeling dependencies

Handling uncertainty

Bayesian Networks

Captures complex relationships amongvariables

Explicit models and reasons withuncertainty

Incorporation of expert knowledge Allows integration of domain expertise

Interpretability Provides transparent and explainableresults

Handling missing data Can perform inference with missingvalues

Traditional Methods

Often assumes independence or linearrelationships

Limitedabilitytohandleuncertainty

Relies primarily on data-driven approaches

It can be difficult to interpret, especiallywithlargemodels

Often requires complete data or imputation

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 05 | May 2024 www.irjet.net p-ISSN:2395-0072

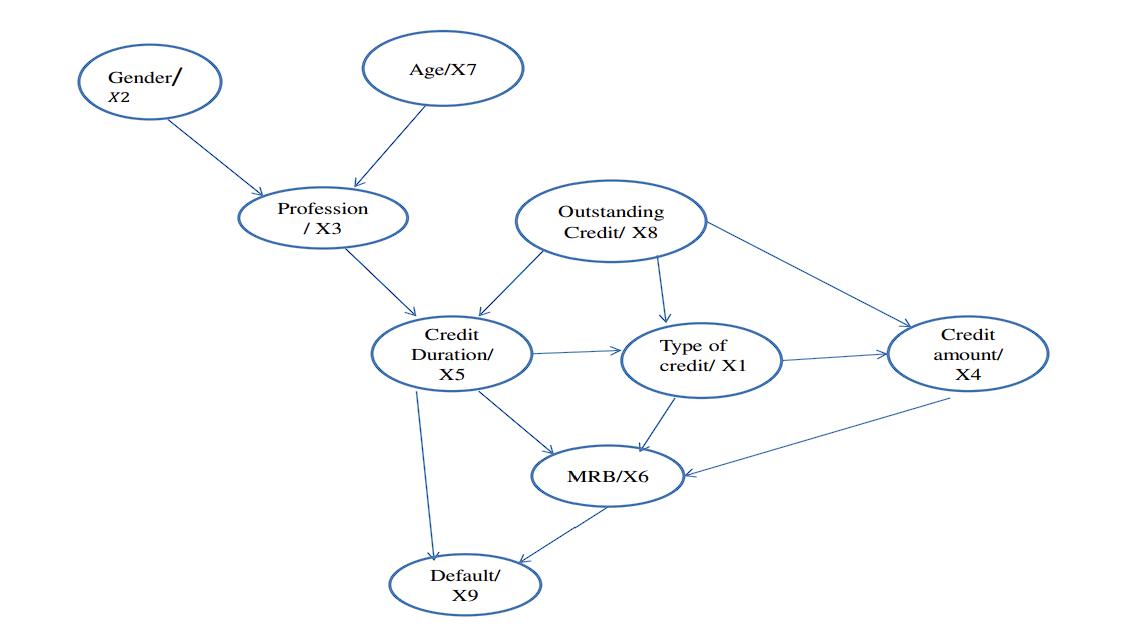

Credit scoring is a crucial procedure in the financial sector that helps lenders make informed decisions about loan approvalsandinterestrates[19].Byutilizingareal-worlddatasetcontainingborrowercharacteristics,credithistory,and loanoutcomes,ourfocusisonemployingBayesianNetworkstoaddressthecreditscoringprobleminthiscasestudy[20].

Thedatasetincludesabinarytargetvariablethatindicatesiftheborrowerdefaultedontheloan,alongwithvariousother features such as age, income, employment status, credit history, and loan amount [21]. The objective is to develop a Bayesian Network model that can accurately predict the probability of default for new loan applicants based on their characteristics.

Inthepast,statisticaltechniquessuchasdecisiontrees,discriminantanalysis,andlogisticregressionhavebeenutilizedto score credit [22]. These techniques have been widely adopted by the financial industry due to their interpretability and simplicity.Theymaynot,however,fullycapturetheintricatedependenciesfoundinreal-worlddatasincetheyoftenmake strongassumptionsabouttherelationshipsbetweenvariables[23].

Inaddition,dealingwithmissingdataisacommonissueincreditscoringdatasets,andtraditionalmethodsoftenstruggle toaddressit[24].Additionally,theremightbea lackofclarityinexplainingtheunderlyingcausal relationshipsbetween variablesandadifficultyinincorporatingexpertknowledge.

The first stage in building the Bayesian Network model involves selecting the relevant variables from the dataset and ensuring they are properly preprocessed. Encoding categorical variables, discretizing continuous variables, and handling missingvaluesareallimportantstepsinthisprocess[29].Atthispoint,itisimportanttoincorporateexpertknowledgeto ensurethattheselectedvariablesaremeaningfulandalignwithdomainexpertise.

Afterpreprocessing,thedatacanbeusedtodeterminethestructureoftheBayesianNetworkinthenextstage.Adirected acyclic graph (DAG) can be created by utilizing structure-learning algorithms like the PC algorithm or the hill-climbing algorithm.Thesealgorithmshelpinidentifyingtheprobabilisticdependenciesbetweenvariables[25].

By employing techniques such as maximum likelihood estimation or Bayesian parameter estimation, the conditional probability distributions, or the parameters of the Bayesian Network, can be estimated from the data after the structure hasbeenlearned.

OncetheBayesianNetworkmodelisconstructedandparameterized,inferencecanbeusedtoassessthecreditriskofnew loanapplicants.Byemployinginferencealgorithmssuchasvariableeliminationorbeliefpropagation,themodeliscapable ofdeterminingtheposteriorprobabilityofdefaultbasedontheinputvariablevaluesforanewapplicant.

Decisions regardingcredit, suchasloanapplicationacceptanceorrejection,ordeterminingtheappropriateinterest rate basedonrisktolerance,canbemadebyutilizingthecalculatedprobabilityofdefault[26].

It is possible to compare the performance of the Bayesian Network model to more established credit scoring techniques suchaslogisticregressionordecisiontrees.Techniquessuchascross-validationcanbeutilizedtocomparethemodelsin termsofaccuracy,precision,recall,andotherrelevantmetrics[27].

The findings of the comparative analysis can provide insights into the pros and cons of using the Bayesian Network approach compared to more traditional techniques. This information can help determine the feasibility of using it for creditscoringpurposes.

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 05 | May 2024 www.irjet.net p-ISSN:2395-0072

The case study results showcase the effectiveness of the Bayesian Network model and its ability to accurately evaluate credit risk, allowing for a comprehensive discussion. Investigating the conclusions drawn from the model allows for the identificationofimportantriskfactorsandabetterunderstandingoftheprobabilisticrelationshipsbetweenvariables.

Discussionofpotentialdownsides,futureresearchdirections,andtheimplicationsoffindingsforcreditriskmanagement in the financial industry is possible. The case study is avaluable resource for practitioners and researchers interested in applyingBayesianNetworkstosolvecreditscoringandotherfinancialriskassessmentproblems.

AsperthestatisticscapturedinGraph1,thereisanincreasingdemandforBayesianNetworksinFinancialInstitutions.

CAPTURING COMPLEX RELATIONSHIPS AND UNCERTAINTY

Bayesian networks excel in capturing complex relationships and uncertainties among variables, making them highly advantageousinthefinanceindustry.Modelingfinancialsystemsusingconventionaltechniquescanbechallengingdueto their frequent complex dependencies and non-linear interactions. Through the utilization of conditional probability distributions and a directed acyclic graph (DAG), Bayesian networks provide a versatile and intuitive framework for illustratingtheseinterdependencies.

The ability of Bayesian Networks to integrate expert knowledge into the modeling process is another important benefit. Expertsinthefinancialdomainfrequentlyhaveinsightfulknowledgeofthecorrelationsbetweenvariables,which canbe usedtoenhancethemodels'interpretabilityandaccuracy.

With the specification of prior probabilities and the DAG's structure, Bayesian networks offer a natural method for extracting and encoding expert knowledge. Specialists possess the necessary knowledge and experience to assist in determining the pertinent variables, defining the causal connections among them, and offering approximations of the conditionalprobabilities.Byincorporatingexpertknowledge,themodel'sperformancecanbeimproved,anditsalignment withthedynamicsofthefinancialsysteminreallifecanbeguaranteed.

BayesianNetworksofferahighlevelofinterpretabilityandexplainability,whichiscrucialinfinancialapplicationswhere transparency and trust are paramount. The graphical representation of the model in the form of a DAG provides a clear andintuitivevisualizationoftherelationshipsbetweenvariables.Thisvisualrepresentationallowsstakeholders,suchas

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 05 | May 2024 www.irjet.net p-ISSN:2395-0072

financial analysts, regulators, and customers, to understand the reasoning behind the model's predictions and decisions [28].

Moreover,BayesianNetworksallowfortheanalysisofcausalrelationshipsandtheidentificationofkeydriversoffinancial outcomes. By examining the conditional probability distributions and performing sensitivity analyses, practitioners can gaininsightsintothefactorsthatcontributetospecificfinancialeventsorbehaviors[29].Thisinterpretabilityisessential for validating the model's assumptions, communicating the results to non-technical audiences, and ensuring compliance withregulatoryrequirements.

BayesianNetworksarehighlyscalableandcomputationallyefficient,makingthemideal formanagingextensive financial datasets and real-time applications. The joint probability distribution can be decomposed into factors using the DAG structure. Efficient inference algorithms, such as variable elimination and belief propagation, can be utilized as a result. The algorithms are able to leverage the conditional independence properties of the network to conduct probabilistic reasoninginacomputationallyfeasibleway.

Furthermore, techniques such as model simplification, parameter tying, and approximate inference methods can be employed to reduce the computational complexity and improve the scalability of Bayesian Networks [30]. This is particularlyimportantinfinance,wherethevolumeandvelocityofdatacontinuetogrowandreal-timedecision-makingis oftenrequired.

Advances in hardware and software technologies, like parallel computing and GPU acceleration, have significantly improvedthecomputationalcapabilitiesofBayesianNetworks.Theirapplicationhasproveneffectiveinaddressinglargescale financial problems, including credit risk assessment for massive portfolios, high-frequency trading, and real-time frauddetection.

Challenge

Scalability

Data sparsity

Integration with machine learning

Potential Solutions

Approximate inference, model simplification, and distributedcomputing

Smoothingtechniques,regularization,anddataimputation

Structurelearning,parameterestimation,hybridmodels

Big data and alternative data sources Datapreprocessing,featureextraction,anddatafusion

Interdisciplinary collaboration

Knowledge sharing, joint research projects, industryacademiapartnerships

SCALABILITY ISSUES AND POTENTIAL SOLUTIONS

Scalability poses a significant challenge when it comes to applying Bayesian Networks to financial problems. When the numberofvariablesandthe complexityofthenetwork structureincrease,thecomputational requirementsfor inference andlearningcanbecomequitechallenging.Infinance,itisimportanttoconsidertheprevalenceoflargedatasetswithhigh dimensionality.

One possible way to tackle scalability issues is by employing approximate inference techniques, such as variational inference or sampling-based methods [31]. These techniques trade off some accuracy for improved computational efficiency, allowing Bayesian Networks to handle larger and more complex models [32]. Another approach is to employ model simplification techniques, such as node aggregation or edge removal, to reduce the size of the network while preservingitsessentialstructure.

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 05 | May 2024 www.irjet.net p-ISSN:2395-0072

Financial datasets often suffer from data sparsity and missing values, posing challenges for learning and inference in Bayesian networks [33]. Data that is sparsely populated with variable value combinations that are rarely or never observed can result in overfitting and inaccurate probability estimates [34]. On the other hand, the presence of missing valuescanleadtobiasandreducetheeffectivenessofthemodel[35].

Regularizationandsmoothingaretwoeffectivetechniquesforaddressingsparsityindata.Smoothingtechniques,suchas Dirichlet priors or Laplace smoothing, adjust the probability estimates to consider uncommon or unseen events [36]. Limiting themodel parameterscan help preventoverfitting, asdemonstrated by regularizationtechniquessuchasL1or L2regularization[37].

Techniques such as data imputation or the expectation-maximization (EM) algorithm can be used to address missing valuesinBayesiannetworks[38].TheEMalgorithmiterativelyestimatesthemissingvaluesbasedonthecurrent model parameters and the observed data. Mean imputation and multiple imputation are two examples of data imputation techniquesthatutilizetheexistinginformationtofillinthemissingvalues[39].

IntegratingBayesianNetworkswithdeeplearningandmachinelearning methods[40]showspromiseinenhancingtheir performance and applicability in the finance industry. Machine learning algorithms such as support vector machines, randomforests,anddecisiontreescanbeusedtolearntheparametersandstructureofBayesiannetworksfromdata[41]. These algorithms reduce the reliance on specialized knowledge by automatically identifying relevant variables and their relationships.

In order to understand hierarchical representations of financial data, it is possible to combine Bayesian networks with deep learning techniques such as convolutional neural networks or deep belief networks [42]. Through the capture of intricate patterns and dependencies, these hybrid models are able to significantly improve prediction accuracy and generalizability. In addition, deep learning can be utilized to extract important features from unstructured data sources suchastextorimages.ThesefeaturescanthenbeincorporatedintoBayesiannetworks[43].

Infinance,theavailabilityofbigdataandalternativedatasourcespresentsbothopportunitiesandchallenges.Inorderto enablereal-timeanalysisanddecision-making,itiscrucialtohaveefficientdataprocessingandstoragetechniquesforbig data, which is characterized by its volume, velocity, and variety [44]. Exploring alternative data sources can provide valuable insights into consumer behavior and financial markets. Some sources that can be used include social media, satelliteimagery,andgeospatialdata[45].

Adjustmentsmustbemade forBayesianNetworkstoeffectivelyutilizebigdata andalternativedata sources[46].Largedataset processing and computation parallelization are facilitated by distributed computing frameworks such as Hadoop andApacheSpark [47].Data fusionmethodsare effectivein combininginformationfromvarious data sources,including multi-viewlearningandBayesiandatafusion.

Collaboration between researchers and practitioners from various fields is crucial for advancing the state-of-the-art in Bayesian Networks for finance. Collaborations among professionals in computer science, finance, statistics, and machine learningcanfosterthecreationofcutting-edgealgorithms,techniques,andapplications[48].

Collaborationsbetweeninterdisciplinaryfieldscanfacilitatetheexchangeofbestpracticesandknowledgeacrossvarious domains.For instance, techniques developed in the field of bioinformatics for analyzing large-scale genomic data can be adaptedtohandlefinancialbigdata[49].Similarly,tomakeBayesianNetworksmorerobustandinterpretable,advances inthesocialsciences'fieldsofcausalinferenceandcounterfactualreasoningcanbeappliedtothem.

Collaborationswithfinancedomainexperts,suchasriskmanagers,economists,andregulators,canensurethatthemodels developed align with the industry's practical requirements and limitations [50]. Partnerships can also assist in the validationandimplementationofBayesianNetworksinpracticalfinancialapplications[51].

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 05 | May 2024 www.irjet.net p-ISSN:2395-0072

Bayesiannetworkshavedemonstratedtheireffectivenessandadaptabilityinthefieldoffinance,servingasavaluabletool for probabilistic modeling and inference. Bayesian Networks provide a principled framework for representing and reasoningaboutuncertainty,makingthemacompellingreplacementfortraditionalfinancialmodelingtechniques.Within the realm of finance, this article thoroughly explores the principles, uses, and potential future developments of Bayesian networks.ThesessionbeganwithanoverviewofthefundamentalconceptsofBayesiannetworks,suchasdirectedacyclic graphs, inference algorithms, and conditional probability. Following that, a comprehensive case study was conducted on credit scoring, demonstrating how Bayesian Networks can enhance outcome predictions compared to traditional techniques by capturing intricate relationships between credit risk factors. The paper highlighted the numerous advantages of Bayesian networks in the field of finance, including their capacity to depict intricate relationships, incorporate domain expertise, and produce understandable results. The benefits of Bayesian Networks include their abilitytofacilitatecomplexdecision-making,enablescenarioanalysis,andeffectivelyhandleuncertainty.

However, the difficulties and constraints involved in using Bayesian networks in practical financial contexts were also recognized. It is important to address the need for effective learning and inference algorithms, scalability concerns, and data sparsity through further study and development. Various remedies were explored, such as techniques for approximating inference, approaches for simplifying models, and the integration of Bayesian Networks with machine learninganddeeplearningtechniques.Inthefuture,thefocuswillbeonhighlightingthepowerofBayesiannetworksin leveraging big data and other types of alternative data. The rapid growth of data accessibility and computational power presents exciting opportunities for enhancing the accuracy, robustness, and real-time implementation of Bayesian Network modelsin the financial field.Inaddition,thesignificanceof interdisciplinarycooperation wasemphasized, with specialistsincomputerscience,statistics,machinelearning,andfinancecomingtogethertofosterinnovationandaddress the unique challenges posed by financial data and applications. Bayesian networks offer a promising solution as the financialsectorencountersfreshchallengesandcontinuestoevolve.Financialinstitutionscanenhanceriskmanagement and decision-making by adopting probabilistic reasoning principles and utilizing the capabilities of Bayesian networks, whichcanprovidevaluableinsightsfromlargeandcomplexdata.BayesianNetworkscanplayacrucialroleinintegrating domainexpertise,statisticalrigor,andcomputationalpower,whichwillgreatlyinfluencethefutureoffinance.

In conclusion, this essay provides a comprehensive overview of Bayesian networks in finance, highlighting their theoretical foundations, practical applications, and possible future advancements. Despite the challenges that remain, Bayesiannetworksofferamultitudeofpotentialapplications.Majordevelopmentsinfinancialmodeling,riskassessment, anddecisionsupportareanticipatedasresearchersandpractitionerscontinuetopushthelimitsofwhatisfeasiblewith thesepotenttools.Bayesiannetworksplayacrucialroleinadvancingthefrontieroffinancialsystems,makingthemmore intelligent,resilient,anddata-driven.

[1] Abid,Lobna,etal."Bayesiannetworkmodeling:Acasestudyofcreditscoringanalysisofconsumerloansdefault payment." Asian Economic and Financial Review 7.9(2017):846-857.https://www.academia.edu/

[2] Constantinou, A. C., & Fenton, N. (2018). Things to know about Bayesian networks. Significance, 15(2), 19-23. https://doi.org/10.1111/j.1740-9713.2018.01126.x

[3] Pourret, O., Naïm, P., & Marcot, B. (2008). Bayesian networks: a practical guide to applications (Vol. 73). John Wiley & Sons. https://www.wiley.com/en-us/Bayesian+Networks%3A+A+Practical+Guide+to+Applications-p9780470060308

[4] Sun, J., & Vasarhelyi, M. A. (2018). Predicting credit card delinquencies: An application of deep neural networks. IntelligentSystemsinAccounting,FinanceandManagement,25(4),174-189.https://doi.org/10.1002/isaf.1439

[5] Pearl,J.(1988).Probabilisticreasoninginintelligentsystems:networksofplausibleinference.MorganKaufmann. https://www.elsevier.com/books/probabilistic-reasoning-in-intelligent-systems/pearl/978-1-55860-479-7

[6] Magdon-Ismail,M.,&Atiya, A.F.(2004).Amaximumlikelihoodapproachtovolatilityestimationfora Brownian motionusinghigh,lowand closepricedata.QuantitativeFinance,4(2),217-224.https://doi.org/10.1088/14697688/4/2/007

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 05 | May 2024 www.irjet.net p-ISSN:2395-0072

[7] Kou, G., Peng, Y., & Wang, G. (2014). Evaluation of clustering algorithms for financial risk analysis using MCDM methods.InformationSciences,275,1-12.https://doi.org/10.1016/j.ins.2014.02.137

[8] Neil, M., Fenton, N., & Nielson, L. (2000). Building large-scale Bayesian networks. The Knowledge Engineering Review,15(3),257-284.https://doi.org/10.1017/S0269888900003039

[9] Emeka,C.,&Mulder,J.(2019).Bayesiannetworkmodelsforcreditscoring:Asystematicliteraturereview.Expert SystemswithApplications,118,272-286.https://doi.org/10.1016/j.eswa.2018.10.015

[10] Kirkos,E.,Spathis,C.,&Manolopoulos,Y.(2007).Data miningtechniquesforthedetectionoffraudulent financial statements. Expert Systems with Applications, 32(4), 995-1003. https://doi.org/10.1016/j.eswa.2006.02.016

[11] Sun, J., & Vasarhelyi, M. A. (2018). Predicting credit card delinquencies: An application of deep neural networks. Intelligent Systems in Accounting, Finance and Management, 25(4), 174-189. https://doi.org/10.1002/isaf.1439

[12] Koller, D., & Friedman, N. (2009). Probabilistic graphical models: principles and techniques. MIT Press. https://mitpress.mit.edu/books/probabilistic-graphical-models

[13] Geiger,D.,Verma,T.,&Pearl,J.(1990).IdentifyingindependenceinBayesiannetworks.Networks,20(5), 507-534.https://doi.org/10.1002/net.3230200504

[14] Jensen,F.V.,&Nielsen,T.D.(2007).Bayesiannetworksanddecisiongraphs.SpringerScience&Business Media.https://www.springer.com/gp/book/9780387682815

[15] Ross, S. M. (2014). Introduction to probability models. Academic Press. https://www.elsevier.com/books/introduction-to-probability-models/ross/978-0-12-407948-9

[16] Zhang,N.L.,&Poole,D.(1996).ExploitingcausalindependenceinBayesiannetworkinference.Journalof ArtificialIntelligenceResearch,5,301-328.https://doi.org/10.1613/jair.305

[17] Yedidia,J.S.,Freeman,W.T.,&Weiss,Y.(2003).Understandingbeliefpropagationanditsgeneralizations. In Exploring Artificial Intelligence in the New Millennium (pp. 239-269). Morgan Kaufmann. https://www.merl.com/publications/docs/TR2001-22.pdf

[18] Gilks,W.R.,Richardson,S.,&Spiegelhalter,D.J.(1995).MarkovchainMonteCarloinpractice.Chapman and Hall/CRC. https://www.crcpress.com/Markov-Chain-Monte-Carlo-in-Practice/Gilks-RichardsonSpiegelhalter/p/book/9780412055515

[19] Anderson,R.(2007).Thecreditscoringtoolkit:theoryandpracticeforretailcreditriskmanagementand decision automation. Oxford University Press. https://global.oup.com/academic/product/the-credit-scoringtoolkit-9780199226405

[20] Yeh,I.C.,&Lien,C.H.(2009).Thecomparisonsofdata miningtechniquesforthe predictiveaccuracyof probability of default of credit card clients. Expert Systems with Applications, 36(2), 2473-2480. https://doi.org/10.1016/j.eswa.2007.12.020

[21] Baesens, B., Van Gestel, T., Viaene, S., Stepanova, M., Suykens, J., & Vanthienen, J. (2003). Benchmarking state-of-the-art classification algorithms for credit scoring. Journal of the Operational Research Society, 54(6), 627-635.https://doi.org/10.1057/palgrave.jors.2601545

[22] Hand,D.J.,&Henley,W.E.(1997).Statisticalclassificationmethodsinconsumercreditscoring:areview. Journal of the Royal Statistical Society: Series A (Statistics in Society), 160(3), 523-541. https://doi.org/10.1111/j.1467-985X.1997.00078.x

[23] Lessmann,S.,Baesens,B.,Seow,H.V.,&Thomas,L.C.(2015).Benchmarkingstate-of-the-artclassification algorithmsforcreditscoring:Anupdateofresearch.EuropeanJournalofOperationalResearch,247(1),124-136. https://doi.org/10.1016/j.ejor.2015.05.030

2024, IRJET | Impact Factor value: 8.226 | ISO 9001:2008 Certified

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 05 | May 2024 www.irjet.net p-ISSN:2395-0072

[24] García,V.,Marqués,A.I.,&Sánchez,J.S.(2015).Aninsightintotheexperimentaldesignforcreditriskand corporate bankruptcy prediction systems. Journal of Intelligent Information Systems, 44(1), 159-189. https://doi.org/10.1007/s10844-014-0333-4

[25] Brown, I., & Mues, C. (2012). An experimental comparison of classification algorithms for imbalanced credit scoring data sets. Expert Systems with Applications, 39(3), 3446-3453. https://doi.org/10.1016/j.eswa.2011.09.033

[26] Spirtes, P., Glymour, C., & Scheines, R. (2000). Causation, prediction, and search. MIT Press. https://mitpress.mit.edu/books/causation-prediction-and-search-second-edition

[27] Thomas, L. C. (2000). A survey of credit and behavioural scoring: forecasting financial risk of lending to consumers. International Journal of Forecasting, 16(2), 149-172. https://doi.org/10.1016/S01692070(00)00034-0

[28] Bischl,B.,Kühn,T.,&Szepannek,G.(2016).Onclassimbalancecorrectionforclassificationalgorithmsin credit scoring. In Operations Research Proceedings 2014 (pp. 37-43). Springer. https://doi.org/10.1007/978-3319-28697-6_6

[29] Lacave, C., & Díez, F. J. (2002). A review of explanation methods for Bayesian networks. The Knowledge EngineeringReview,17(2),107-127.https://doi.org/10.1017/S026988890200019X

[30] Castillo, E., Gutiérrez, J. M., & Hadi, A. S. (1997). Expert systems and probabilistic network models. SpringerScience&BusinessMedia.https://www.springer.com/gp/book/9780387948362

[31] Borgelt, C., Steinbrecher, M., & Kruse, R. R. (2009). Graphical models: representations for learning, reasoning and data mining. John Wiley & Sons. https://www.wiley.com/enus/Graphical+Models%3A+Representations+for+Learning%2C+Reasoning+and+Data+Mining%2C+2nd+Editionp-9780470749555

[32] Daly, R., Shen, Q., & Aitken, S. (2011). Learning Bayesian networks: approaches and issues. The KnowledgeEngineeringReview,26(2),99-157.https://doi.org/10.1017/S0269888910000251

[33] Jordan, M. I., Ghahramani, Z., Jaakkola, T. S., & Saul, L. K. (1999). An introduction to variational methods forgraphicalmodels.MachineLearning,37(2),183-233.https://doi.org/10.1023/A:1007665907178

[34] Aggarwal, C. C. (2015). Data mining: the textbook. Springer. https://www.springer.com/gp/book/9783319141411

[35] Chen, S. H., & Pollino, C. A. (2012). Good practice in Bayesian network modelling. Environmental Modelling&Software,37,134-145.https://doi.org/10.1016/j.envsoft.2012.03.012

[36] Little, R. J., & Rubin, D. B. (2019). Statistical analysis with missing data. John Wiley & Sons. https://www.wiley.com/en-us/Statistical+Analysis+with+Missing+Data%2C+3rd+Edition-p-9780470526798

[37] Bishop, C. M. (2006). Pattern recognition and machine learning. Springer. https://www.springer.com/gp/book/9780387310732

[38] Dempster,A.P.,Laird,N.M.,&Rubin,D.B.(1977).MaximumlikelihoodfromincompletedataviatheEM algorithm. Journal of the Royal Statistical Society: Series B (Methodological), 39(1), 1-22. https://doi.org/10.1111/j.2517-6161.1977.tb01600.x

[39] Schafer,J.L.,&Graham,J.W.(2002).Missingdata:ourviewofthestateoftheart.PsychologicalMethods, 7(2),147-177.https://doi.org/10.1037/1082-989X.7.2.147

[40] Bengio, Y., Courville, A., & Vincent, P. (2013). Representation learning: A review and new perspectives. IEEE Transactions on Pattern Analysis and Machine Intelligence, 35(8), 1798-1828. https://doi.org/10.1109/TPAMI.2013.50

2024, IRJET | Impact Factor value: 8.226 | ISO 9001:2008

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume: 11 Issue: 05 | May 2024 www.irjet.net p-ISSN:2395-0072

[41] Friedman,N.,Geiger,D.,&Goldszmidt,M.(1997).Bayesiannetwork classifiers.MachineLearning,29(23),131-163.https://doi.org/10.1023/A:1007465528199

[42] Hinton, G. E., & Salakhutdinov, R. R. (2006). Reducing the dimensionality of data with neural networks. Science,313(5786),504-507.https://doi.org/10.1126/science.1127647

[43] LeCun, Y., Bengio, Y., & Hinton, G. (2015). Deep learning. Nature, 521(7553), 436-444. https://doi.org/10.1038/nature14539

[44] Fan, J., Han, F., & Liu, H. (2014). Challenges of big data analysis. National Science Review, 1(2), 293-314. https://doi.org/10.1093/nsr/nwt032

[45] Jagadish,H.V.,Gehrke,J.,Labrinidis,A.,Papakonstantinou,Y.,Patel,J.M.,Ramakrishnan,R.,&Shahabi,C. (2014). Big data and its technical challenges. Communications of the ACM, 57(7), 86-94. https://doi.org/10.1145/2611567

[46] Zhu, C., Byrd, R. H., Lu, P., & Nocedal, J. (1997). Algorithm 778: L-BFGS-B: Fortran subroutines for largescale bound-constrained optimization. ACM Transactions on Mathematical Software, 23(4), 550-560. https://doi.org/10.1145/279232.279236

[47] Dean, J., & Ghemawat, S. (2008). MapReduce: simplified data processing on large clusters. CommunicationsoftheACM,51(1),107-113.https://doi.org/10.1145/1327452.1327492

[48] Zaharia,M.,Chowdhury,M.,Franklin,M.J.,Shenker,S.,&Stoica,I.(2010).Spark:Clustercomputingwith working sets. HotCloud, 10(10-10), 95. https://www.usenix.org/legacy/events/hotcloud10/tech/full_papers/Zaharia.pdf

[49] Rudin,C.,&Wagstaff,K.L.(2014).Machinelearningforscienceandsociety.MachineLearning,95(1),1-9. https://doi.org/10.1007/s10994-013-5425-9

[50] Swan,A.L.,Mobasheri,A.,Allaway,D.,Liddell,S.,&Bacardit,J.(2013).Applicationofmachinelearningto proteomics data: classification and biomarker identification in postgenomics biology. Omics: a Journal of IntegrativeBiology,17(12),595-610.https://doi.org/10.1089/omi.2013.0017

[51] Varian,H.R.(2014).Bigdata:Newtricksforeconometrics.JournalofEconomicPerspectives,28(2),3-28. https://doi.org/10.1257/jep.28.2.3

[52] Athey, S. (2017). Beyond prediction: Using big data for policy problems. Science, 355(6324), 483-485. https://doi.org/10.1126/science.aal4321

[53] Neil, M., Fenton, N., & Tailor, M. (2005). Using Bayesian networks to model expected and unexpected operationallosses.RiskAnalysis,25(4),963-972.https://doi.org/10.1111/j.1539-6924.2005.00641.x

[54] Neapolitan, R. E. (2004). Learning Bayesian networks. Pearson Prentice Hall. This book provides a comprehensive introduction to Bayesian networks and their applications, including a discussion of their advantagesinmodelingcomplexsystemsandhandlinguncertainty.

2024, IRJET | Impact Factor value: 8.226 | ISO 9001:2008