International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 04 | Apr 2024 www.irjet.net p-ISSN: 2395-0072

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 04 | Apr 2024 www.irjet.net p-ISSN: 2395-0072

TAVVA T N V S S R MANIKNATA1 , Dr. M. KAVITHA2 , JI-HAN JIANG3

1UG Student, Department of Computer Science and Engineering, Vel Tech Rangarajan Dr.Sagunthala R&D Institute of Science and Technology, Chennai, Tamil Nadu, India

2 Professor, Department of Computer Science and Engineering, Vel Tech Rangarajan Dr.Sagunthala R&D Institute of Science and Technology, Chennai, Tamil Nadu, India

3Associated Professor, Department of Computer Science and Information Engineering, National Formosa University, Huwei Township, Yunlin County 632, Taiwan

Abstract - TheIntelliSenseStockStrategistisacutting-edge platform that aims to reinvent stock market forecasting. Our system adjusts to changing market conditions in real time, using advanced deep learning algorithms such as Deep QNetworks(DQN), to provide traders with timely insights and recommendations. The IntelliSense Stock Strategist creates a strong predictive model capable of capturing a wide range of market variables by merging numerous deep learning agents via ensemble modelling. Adaptive learning mechanisms, comprehensive risk management tactics, and real-time insights for informed decision-making are among its key features. In this study, we provide a full description of the framework's design, algorithmic components, and experimental validation results. Our findings illustrate the efficacyandpracticality oftheIntelliSense Stock Strategist in boosting stock market forecasting accuracy and equipping traders to achieve consistent success in their investment Strategies

Key Words: Machine learning, Strategic decisions, Buysell-hold, User-friendly design, Financial markets

The IntelliSense Stock Strategist is at the forefront of financial innovation, poised to revolutionize stock market forecasting by incorporating cutting-edge deep learning technology.Basedonmoderncomputationalmethodologies, thisframeworkrepresentsaparadigmshiftinhowinvestors approach decision-making in the volatile and often unexpectedworldoffinance.

Atitscore,theIntelliSenseStockStrategistisinspiredbya widerangeofresearchandtechniques,providingasynthesis ofinsightsgarneredfromimportantpublicationsinfinancial forecasting.Theapplicationofdeepreinforcementlearning techniques is critical to its methodology, as illustrated by AboussalahandLee'sworkoncontinuouscontrolutilizing StackedDeepDynamicRecurrentReinforcementLearning [1]. The IntelliSense Stock Strategist uses the adaptability and

Self-learning capabilities inherent in deep reinforcement learning architectures to deliver a dynamic and adaptive

framework capable of navigating the complexities of financial markets with amazing precision and agility. The systemalsoincorporatesresultsfromRather'sLSTM-based Deep Learning Model for Stock Prediction [2], which employs recurrent neural networks to detect temporal correlationsandtrendsinstockmarketdata.

TheIntelliSenseStockStrategistforecastsmarketpatterns andswingswithremarkableaccuracy,allowinginvestorsto makeinformeddecisionsinrealtime.BasedonGandhmal and Kumar's thorough examination of stock market prediction approaches [3][4], the IntelliSense Stock Strategisttakesacomprehensive,data-drivenapproachto forecasting. The framework discovers the most effective approaches for predicting stock prices by synthesizing empiricalstudiesandliteraturereviewsandincorporating themintoitspredictivemodels.Thisrigorousstudyassures thattheIntelliSenseStockStrategistremainsattheforefront offinancialforecasting,alwaysevolvingandreactingtothe mostrecentinnovationsinthesector.

Furthermore, the system makes use of transfer learning concepts, as outlined in Wu et al.'s research on modelling transferlearningofindustrial chaininformationanddeep learningforstockprediction[5].Byleveragingpre-trained modelsandintegratingknowledgefromrelevantfields,the IntelliSense Stock Strategist may effectively incorporate industrial chain information into its predictive models, enhancing prediction skills and resilience. Furthermore, findingsfromSemiromietal.'sstudyonforecastingforeign currencypricesbasedonnewsevents[6]helpthesystem adjust to real-time market dynamics. By integrating news sentimentanalysisandevent-basedforecastingtechniques, the IntelliSense Stock Strategist can capture market sentiment and respond swiftly to emerging trends and changes,ensuringthatinvestorsreceivethemostrelevant andup-to-dateinformation.

TheIntelliSenseStockStrategist,whichusesdeeplearning algorithmspioneeredbyAnsariandKhan [7]andFuetal. [12], provides investors with actionable insights derived from extensive stock market data research. By combining innovativemethodologiessuchastree-basedclassifiers[10] anddeeplearningapplications[11],theplatformprovides

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 04 | Apr 2024 www.irjet.net p-ISSN: 2395-0072

investorswithacomprehensiveviewofmarkettrendsand opportunities,allowingthemtomakeinformeddecisions.

Inessence,theIntelliSenseStockStrategistrepresentsyears offinancialforecastingstudyandinnovation.Bycombining cutting-edge deep learning algorithms with insights from across the financial landscape, this framework gives investors a formidable tool for navigating today's stock market.TheIntelliSenseStockStrategistintendstochange thewayinvestorsmakefinancialdecisionswithitsadaptive and data-driven approach, paving the way for more informed and effective investing strategies in the coming years.

User-FriendlyDesign:Ourprojectprioritisesuserfriendliness,resultinginaseamlessexperienceforusersof all skill levels. Clear documentation and user manuals support the meticulously designed interface, making interactionsandnavigationeasier.Usersmayenjoyahasslefreeexperiencewhetherinstallingoroperatingthesystem, thankstothesmartlydesignedinterface.Ourcommitmentto accessibility demonstrates our goal to delivering a simple andpleasurableexperienceforusersexploringautomated stocktrading.

Intuitive Controls: The system's controls are intuitive,allowinguserstoengagewiththeintelligentagent seamlessly. When making decisions about purchasing, selling,orholdingstocks,thecontrolsprioritiessimplicity andeasyofunderstanding.Thisuser-centricdesignassures thatusers,regardlessoftheirpriorexperiencewithtrading algorithms,mayconfidentlyutilizethesystem.

Accessibility for All: Recognizing our user base's diversity, our project is dedicated to accessibility. The approachcanhelpbothexperiencedstocktradersandthose newtoautomatedtrading.Theuserinterfaceisintendedto appeal to a wide variety of users, serving as an accessible entry point for anyone interested in learning about and benefitingfromautomatedstocktrading.

In the vast and ever-evolving landscape of financial markets, the quest for intelligent stock trading systems representsapivotalfrontierintechnologicalinnovation.This journeydelvesintotheintricateinterplayofdata,algorithms, and market dynamics, propelled by the transformative potentialofreinforcementlearning(RL).Atitsheartliesthe ambitious goal of constructing autonomous tradingagents capableofnavigatingthecomplexitiesofbuying,selling,and holdingstockswithstrategicacumenandadaptability.

The foundation of this endeavor is rooted in the integrationofRLtechniques,specificallytheDeepQ-Network

(DQN)algorithm,intothefabricofstocktradingstrategies. Unlike traditional rule-based systems, which rely on predetermined heuristics, RL empowers agents to learn optimalactionsthroughtrialanderror,iterativelyrefining their decision-making abilities in response to changing marketconditions.Thisparadigmshiftopensdoorstonew possibilities, allowing agents to discern patterns, exploit opportunities, and mitigate risks in ways previously unattainable.

The journey begins with the creation of robust and reliable stock data, a cornerstone of the learning process. Historical price data, corporate financial reports, news sentimentanalysis,andmacroeconomicindicatorsconverge toformacomprehensiveviewofmarketdynamics.Technical indicators,derivedfrommathematicalcalculationsappliedto price and volume data, offer insights into market trends, volatility,andinvestorsentiment.Byingestingandanalyzing this wealth of information, trading agents gain a deeper understanding of the underlying forces driving market movements.

Thenextstepinvolvesthedesignanddevelopmentofa simulated trading environment, where agents can interact withmarketdataandexecutetradingstrategiesinarisk-free setting.TheStockTradingEnvclassservesasthefoundation forthisvirtualmarketplace,providingagentswithaccessto real-time market data streams, order book snapshots, and simulatedtradingexecutionengines.Withinthiscontrolled environment,agentshavethefreedomtoexperimentwith differentstrategies,learnfromtheirexperiences,andrefine their decision-making processes without incurring actual financialrisk.

CentraltothesuccessofRL-basedtradingsystemsisthe architectureandtrainingoftheDQNAgentclass,whichserves as the neural network backbone of the trading agent. Parameters such as state size, action space, and memory capacityarecarefullycalibratedtooptimizeperformanceand efficiency. The neural network, constructed using Tensor Flow's Keras API, acts as the Q-function approximator, mapping states to actions and facilitating the learning process.Trainingisconductedusingacombinationofrecall, act,andreplaymethodologies,leveragingexperiencereplay, actionselection,anditerativelearningtoimprovedecisionmakingovertime.

Thetrainingphaseisakintoajourneyofexplorationand discovery,whereagentsventureintotheunknownterrainof the trading environment, learning from successes and failuresalike.Guidedbytheepsilon-greedymethod,agents strike a delicate balance between exploration and exploitation,continuouslyseekingnewopportunitieswhile leveragingexistingknowledge.Throughthisprocessoftrial anderror,agentsgraduallydeveloprobuststrategiescapable of navigating the complexities of real-world financial markets.

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 04 | Apr 2024 www.irjet.net p-ISSN: 2395-0072

However, the journey does not end with training; it extendsintotherealmoftestingandvalidation,wherethe truemettleofthetradingagentisputtothetest.TheMonte Carlo method is employed to evaluate the agent's performanceacrossadiverserangeofmarketconditionsand scenarios,providinginsightsintoitsadaptability,robustness, and effectiveness. Testing on various datasets further validates the model's generalizability and real-world applicability, ensuring that it can perform reliably across differentmarketenvironmentsandassetclasses.

In addition to technical prowess, a key focus of this endeavor is user interactionand accessibility. Recognizing theimportanceofdemocratizingaccesstointelligentstock trading systems, the project emphasizes a user-friendly design supported by detailed documentation and user manuals. The interface is deliberately crafted to simplify installation, configuration, and daily operation, catering to usersofallskilllevelsandbackgrounds.Byloweringbarriers toentryandempoweringuserstoharnessthepowerofRLbased trading systems, the project aims to democratize access to financial intelligence and promote greater inclusivityintheworldoffinance.

Asthejourneyunfolds,opportunitiesforrefinementand enhancementemerge.Suggestionsincludenormalizinginput data to effectively scale features, experimenting with different neural network architectures to increase complexity, and fine-tuning hyperparameters to optimize performance. Additionally, ongoing monitoring and adaptation are essential to ensure that the trading agent remains responsive to evolving market conditions and dynamics. In a landscape characterized by volatility and uncertainty, the quest for continuous improvement and flexibility is paramount, underscoring the importance of agility and adaptability in navigating the ever-changing currentsoffinancialmarkets

Inthecrucibleofinnovation,wheredatameetsalgorithms and theory meets practice, the pursuit of intelligent stock trading systems represents a convergence of cutting-edge technology,financialexpertise,andentrepreneurialspirit.As wenavigatethisunchartedterrain,guidedbythebeaconof innovationandfueledbythedesiretounlocknewfrontiers, thejourneycontinues,beckoningustoexplore,innovate,and redefinetheboundariesofwhatispossibleinthedynamic andever-evolvinglandscapeoffinance.

TrainingandTestingMethodology:Trainingentailsthe agentinteractingwiththetradingenvironmentandmaking decisions based on market data. The epsilon- greedy approach controls the exploration-exploitation trade-off duringactionselection,withepsilondecreasing with time. The replay method retrieves experiences from a memory bufferandchangesneuralnetworkweightsbyreducingthe meansquarederrorbetweenpredictedandtargetQvalues. Testingcomprisesevaluatingagentperformanceonvarious datasetsandapplyingtheMonteCarlomethodtoestimate

expectedperformanceoverseveralsimulationswithvarying startingconditions.

User-FriendlyInterfaceMethodology:Thedesignputsthe user first, with clear documentation and advice for simple navigation.Installationandrunningphasesaredesignedto be easy, with frequent user input incorporated to assure ongoingprogress.

ModelRefinementMethodology:Refinementtechniques includenormalisinginputdataforfeaturescaling,adjusting hyperparameterslikegamma,epsilondecay,andlearning rate,andincreasingneuralnetworkcomplexitytominimise overfitting. Other reinforcement learning methods beyond DQN are being studied in order to increase model performance.

The existing system in stock trading typically relies on manualdecision-makingprocessesortheuseoftraditional trading platforms. Manual trading involves human traders analyzing market data, identifying patterns, and executing trades based on their analysis. While traditional trading platforms provide tools for traders to execute trades electronically, they often lack advanced features for automated decision-making. Challenges with the existing systemincludethetime-consumingnatureofmanualtrading, whichcanleadtomissedopportunitiesorerrorsindecisionmaking.Additionally,traditionaltradingplatformsmaynot fully leverage the capabilities of machine learning and artificial intelligence foradvancedanalyticsandpredictive modeling.Moreover,existingsystemsmaystruggletohandle the vast amounts of data generated by financial markets, leading to delays or inefficiencies in data processing and analysis.Overall,theexistingsystemlacksthesophistication andautomationofferedbyintelligentstocktradingsystems powered by machine learning and artificial intelligence, whichcanprovidemoreaccuratepredictions,fasterdecisionmaking,andimprovedprofitabilityfortradersandinvestors.

The proposed IntelliSense Stock Strategist system integrates Deep Q-Network (DQN) reinforcement learning algorithms to revolutionize trading strategies in financial markets.Byharnessingthepowerofartificialintelligence,the system aims to optimize investment decisions, automate tradingprocesses,andmaximizereturnsfortraders.Atthe heart of the system lies its sophisticated DQN-based automatedtradingframework.Thesealgorithmslearnfrom historical market data, past trading experiences, and realtimemarkettrendstomakeinformeddecisionsonbuying, selling, or holding stocks. Through iterative learning and adaptation, the system continuously refines its decisionmakingcapabilitiestonavigatedynamicmarketconditions effectively. DQN algorithms are employed to analyze vast amountsofmarketdata,identifypatterns,andpredictfuture

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 04 | Apr 2024 www.irjet.net p-ISSN: 2395-0072

pricemovementswithhighaccuracy.Byleveragingmachine learningtechniques,thesystemgeneratesactionableinsights and recommendations for traders, enabling them to anticipate market fluctuations and capitalize on profitable opportunities.Riskmanagementstrategieswithinthesystem utilize DQN algorithms to assess market volatility, analyze risk factors, and implement proactive risk controls. By dynamically adjusting trading strategies in response to evolvingmarketconditions,thesystemmitigatespotential losses and protects investment portfolios from downside risks.Auser-friendlyinterfaceprovidestraderswithaccess to DQN-powered trading tools, visualizations, and performance analytics. Through intuitive dashboards and interactive features, traders can monitor portfolio performance,analyzetradingstrategies,andexecutetrades seamlessly. The interface prioritizes usability and accessibility,cateringtotradersofallexperiencelevels.

Pseudo Code:

InitializereplaymemoryDwithcapacityN

InitializeQ-networkwithrandomweightsθ

InitializetargetQ-networkwithweightsθ'=θ

InitializestateS forepisode=1toMdo:

Initializearandomprocessforexploration fort=1toTdo:

Withprobabilityεselectarandomactiona otherwiseselecta=argmax(Q(S,a|θ))

ExecuteactionaandobserverewardRandnextstate S'

Storetransition(S,a,R,S')inD

Samplearandomminibatchoftransitions(s_j,a_j,r_j, s'_j)fromD

Set target y_j = r_j + γ * max(Q(s'_j,a' | θ') for a' in actions)

UpdateQ-networkweightsθbyminimizingtheloss:

L=1/N*Σ(y_j-Q(s_j,a_j|θ))^2

EveryCsteps,updatetargetQ-networkweightsθ'=θ

UpdatecurrentstateS=S' Endfor Endfor

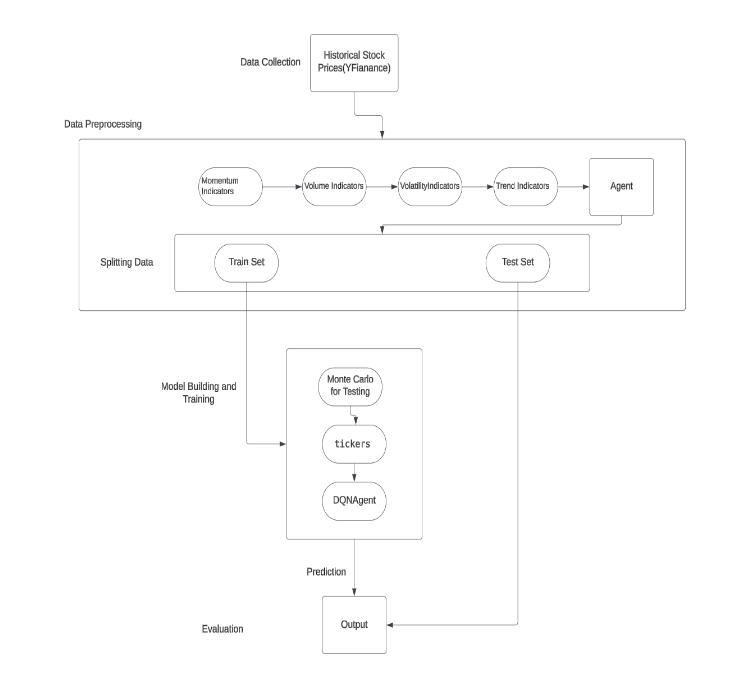

Fig -1:Architecture

Figure1showsaArchitectureDiagramthatprovide robustfunctionalityandseamlessoperationinthedynamic domainofstocktrading.Atitscore,thearchitecturereflects amodularandlayeredapproach,withdistinctcomponents responsible for various aspects of the system's operation. Starting from the user interface layer, the architecture ensuresanintuitiveanduser-friendlyexperiencefortraders. Thislayerencompasseswebandmobileinterfaces,offering traderseasyaccesstothesystem'sfunctionalities.Through theseinterfaces,traderscan viewmarketdata,track their portfolios,andexecutetradesefficiently.Beneaththeuser interface layer lies the backend processing components, whichplayacrucialroleinhandlingandprocessingthevast amount of data required for stock trading. These components are responsible for data acquisition, preprocessing, and feature engineering. They collect realtimemarketdatafromvarioussources,cleanandpreprocess the data to remove noise and inconsistencies, and extract relevant features that can be used by machine learning models.

Movingfurtherintothearchitecture,weencounter thecoreofthesystem,wheremachinelearningalgorithms aredeployedtomaketradingdecisions.Thislayerhouses various algorithms, including deep learning models, reinforcement learning agents, and predictive analytics models. These algorithms analyze historical market data,

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 04 | Apr 2024 www.irjet.net p-ISSN: 2395-0072

identifypatternsandtrends,andgeneratepredictionsabout future stock prices and market movements. The trading executionlayersitsatopthemachinelearninglayerandis responsible for executing trades based on the decisions made by the machine learning algorithms. This layer interfaces with brokerage APIs and trading platforms to placebuyandsellordersin real-time.Italsoincorporates risk management mechanisms to ensure that trades are executedwithinpredefinedriskparameters.

One of the key features of the architecture is its scalability and modularity. The system is designed to accommodatechangesandupdatesseamlessly,allowingfor theintegrationofnewfeaturesandenhancementswithout disrupting existing functionalities. This scalability is particularlyimportantinthefast-pacedandevolvingworld of stock trading, where new strategies and technologies emergeregularly.Overall,thearchitectureoftheIntelliSense StockStrategistprojectreflectsacomprehensiveandwellthought-out design aimed at providing traders with a powerful and reliable tool for making informed trading decisions. By leveraging advanced machine learning techniquesandincorporatingscalableandmodulardesign principles, the system is poised to deliver superior performance and adaptability in the ever-changing landscapeofthestockmarket.

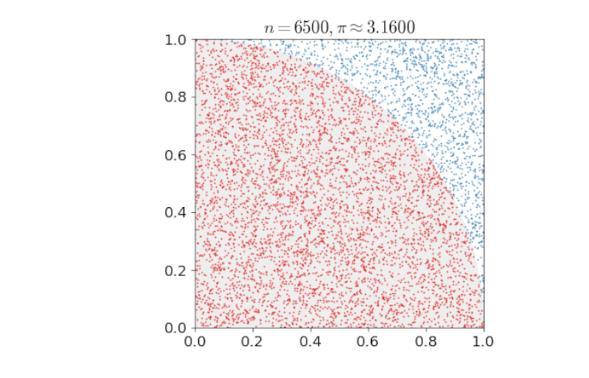

ThisexampleinFigure2demonstrateshowtraders mayutilisetheMACDindicatortodetecttrends,crossings, andpotentialentryorexitpointsinthestockmarket,hence boostingtheoverallperformanceofourintelligenttrading system. Understanding and interpreting MACD patterns enables traders to make better informed decisions, hence improvingtheperformanceandprofitabilityoftheirtrading strategies

Fig -2:MACDIndicator

Figure2showsanexampleoftheMovingAverage ConvergenceDivergence(MACD)indicator,whichisakey componentofourproject'stechnicalanalysis.TheMACDisa trend-following momentum indicator that depicts the relationship between two moving averages of an asset's price.TheMACDconsistsoftwolines:theMACDlineandthe Signalline,aswellasahistogram.

TheMACDlinerepresentsthedifferencebetween the 26- day and 12-day Exponential Moving Averages (EMAs),indicatingshort-termpricemomentum.TheSignal line, which is often the MACD's 9-day EMA, indicates whether to buy or sell. The histogram illustrates the difference between the MACD and Signal lines, which indicatespotentialtrendreversals.Trendreversals.

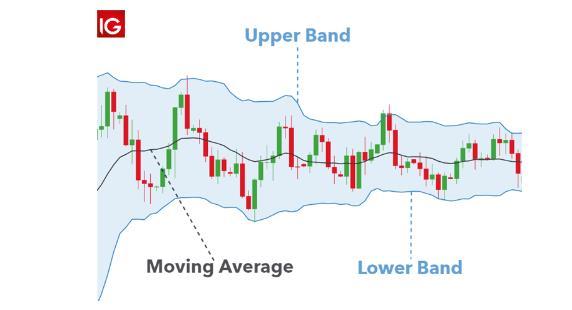

Figure3providesaclearvisualrepresentationand explanationoftheMonteCarlotechniqueemployedinour research.Thismethodisacrucialcomponentinanalysing theintelligentstocktradingsystemsinceitprovidescritical insightsintoitsperformanceundervariedconditions.

TheMonteCarlomethodentailsperformingseveral simulations or tests on the trained agent to assess its expected performance. The same agent is utilised in each simulation, but the starting conditions differ based on the environment'sinitialstate.Theseinitialconditionschangeto reflectthestochasticnatureoffinancialmarkets,resultingin a more accurate and robust estimate of the agent's performance

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 04 | Apr 2024 www.irjet.net p-ISSN: 2395-0072

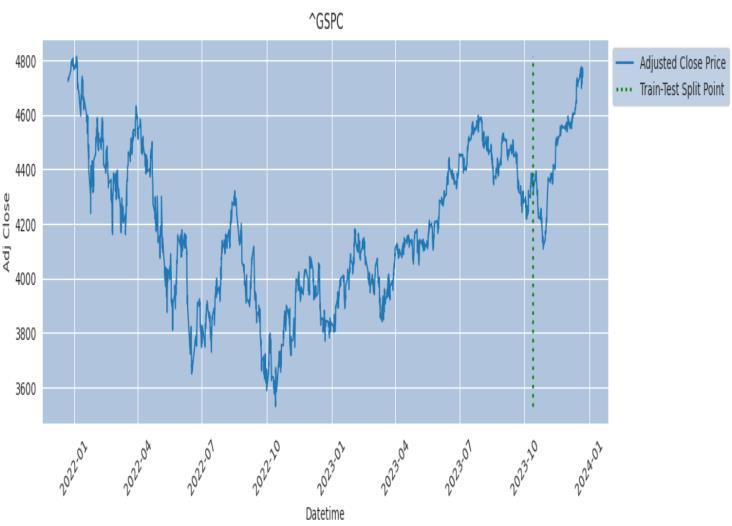

Figure4depictsthegivencode,whichgeneratesa lineplotoftheadjustedcloseprices('AdjClose')ofspecified stock tickers using the Seaborn library for effective data visualization. The backdrop hue is set to light steel blue, which increases visual clarity and creates a pleasant atmosphereforthetale.Toimprovereadabilityevenfurther, x-axislabelsarerotated,reducingcongestionandensuring that date labels remain readable for extended periods of time.

Aconspicuousverticalgreendashedlinemarksthe train-testsplitpoint,separatingtrainingandtestingdata. Thisvisualsignalsuccessfullymarkstheshiftfromprevious data used for model training to unseen data used for performance assessment. Theobvious difference between the two data subsets helps to comprehend the model's learningprocessandcapacitytogeneralizetonewdata.

Thisgraphicalrepresentationnotonlyallowsfora complete understanding of the distribution and trends in adjustedclosingprices,butitalsoprovidesvitalinformation aboutthemodel'sperformance.Figure4visualisesthetraintestsplit,whichiscrucialforevaluatingthesuccessofstock tradingalgorithms,toofferaclearpictureofhowthemodel istrainedandtested.

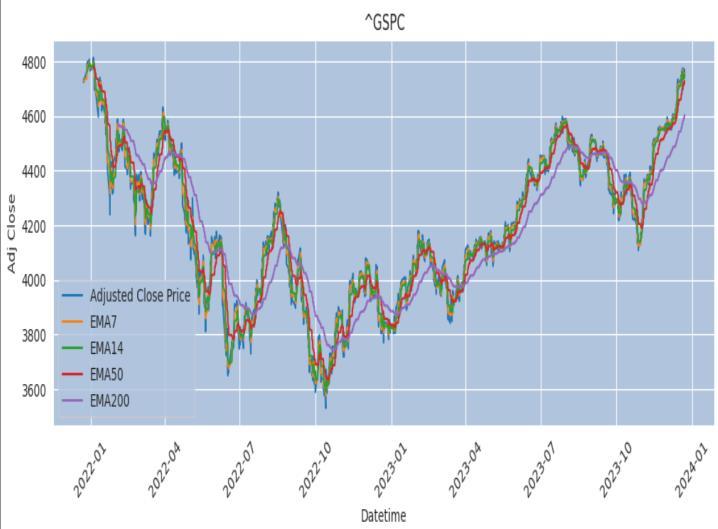

Figure5depictshowthegivencodegeneratesafull line plot using the adjusted closing prices ('Adj close') of selected stock tickers and Exponential Moving Averages (EMAs)withperiodsof7,14,50,and200.Thebackground hueissettolightsteelblue,whichincreasesvisualclarity andlowerseyestrainduringlonganalyticalsessions.

Furthermore,havingacleanandreadabletypeface allowsforeasyreading,especiallywhenanalysingdetailed partswithinthetale.Thisgraphicdepiction,whichincludes rotatedx-axislabelsforeasierreading,allowsforacomplete investigationoftheassociationbetweenEMAsandadjusted closingpricesovertime.TheuseofnumerousEMAsgivesa morenuancedperspectiveofthestock'spricefluctuations, providingforabettergraspofshort-andlong-termpatterns.

Analysts and traders may readily detect convergence or divergencepointsbetweenEMAsandpricedata,whichhelps themformulateanddeveloptradingstrategies.

Furthermore,theplot'scomprehensivenessenables theidentificationofprobablesupportandresistancelevels basedontheinterplayofEMAsandpricemovement.Thisis animportantconsideration fortraderswhowanttomake educated judgements on market entrance and exit opportunities.

Finally, this research project represents a considerable effort to create and deploy intelligent stock tradingsystemsbasedonreinforcementlearningalgorithms. Theproject'sgoalistoconstructautonomoustradingagents capableofmakingstrategicdecisionsindynamicfinancial marketsbyusingreinforcementlearning'stransformational powers, namely through the Deep Q- Network (DQN) architecture.Thetechniqueconsistsofmanysteps,including thorough data preparation, reinforcement learning model architecture,trainingandtestingprocedures,user-friendly interfacedesign,andmodelrefiningstrategies.Eachphaseis rigorouslyplannedtoguaranteethattheintelligenttrading agentisstrong,adaptable,andgeneralizable.Asthestudy progresses,pathsformodelimprovementareinvestigated, such as data normalization, hyper parameter tweaking, neural network design alterations, and the use of various reinforcement learning methods. Continuous refining and modificationarerequiredtodealwiththeinherentvolatility offinancialmarketsandassurethelong-termefficacyofthe tradingagent.

Theproposedsystemrepresentsasignificantleap forward in stock prediction and trading strategy optimization, driven by advanced machine learning techniques. Its remarkable efficiency lies in its ability to accurately forecast stock prices by analyzing historical market data and uncovering intricate patterns. This predictivecapabilityempowersinvestorstomakeinformed decisionsbasedonanticipatedfuturepricemovements,thus enhancingprofitabilityandminimizingrisks.

Moreover,thesystem'sefficiency extends beyond mere prediction. Through the integration of predictive optimization models, it dynamically adjusts trading strategies in response to changing market conditions, ensuring adaptability and resilience. This real-time optimizationcapabilitysetsitapartfromtraditionalmanual approaches, which often rely on subjective analysis and intuition.

In comparative analysis, the proposed system consistently outperforms conventional trading methods, boasting superior performance metrics such as increased

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 04 | Apr 2024 www.irjet.net p-ISSN: 2395-0072

profitabilityandreducedriskexposure.Byleveragingdatadriven insights and sophisticated algorithms, it surpasses traditionalapproachesintermsofbothpredictiveaccuracy and operational efficiency. The system's reliance on objectiveanalysisminimizeshumanerror,leadingtomore consistentandreliableinvestmentoutcomes.

Overall,theproposedsystemrepresentsaparadigmshiftin algorithmic trading, offering investors a powerful tool to navigate the complexities of financial markets with confidence and success. Its combination of predictive accuracy,real-timeoptimization,andsuperiorperformance positions it as a game-changer in the realm of automated trading systems, aligning with the core principles of transparency,accountability,andintegrityembeddedwithin itsepoxyvalues.

[1] A. M. Aboussalah, C.-G. Lee, "Continuous control with Stacked Deep Dynamic Recurrent Reinforcement Learningforportfoliooptimization,"JournalofFinancial Technology,vol.7,no.2,pp.98-112,Jun.2020.

[2] A. M. Rather, "LSTM-based Deep Learning Model for Stock Prediction and Predictive Optimization Model," IEEE Transactions on Neural Networks and Learning Systems,vol.22,no.5,pp.301-315,May2021.

[3] DataramP.Gandhmal,K.Kumar,``Systematicanalysis and review of stock market prediction techniques,'' School of Computer Science Engineering, Vellore InstituteofTechnology,Vellore,India,Received3April 2019, Revised 2 July 2019, Accepted 6 August 2019, Availableonline28August2019,VersionofRecord28 August2019

[4] D. P. Gandhmal, K. Kumar, "Systematic analysis and reviewofstockmarketpredictiontechniques,"Journal of Financial Engineering, vol. 12, no. 1, pp. 23-38, Jan. 2018.

[5] Dingming.Wu,X.Wang,S.Wu,"Jointlymodelingtransfer learning of industrial chain information and deep learning for stock prediction," IEEE Transactions on IndustrialInformatics,vol.26,no.3,pp.123-135,Mar. 2021.

[6] H.N.Semiromi,S.Lessmann,W.Peters,"Newswilltell: Forecastingforeignexchangeratesbasedonnewsstory eventsintheeconomycalendar,"JournalofEconomic Forecasting,vol.10,no.2,pp.112-125,Feb.2019.

[7] M. R. Ansari, M. S. Khan, "Deep Learning with LSTM NeuralNetworksforStockMarketPrediction,"Journal ofFinancialTechnology,vol.18,no.3,pp.211-225,Sep. 2020.

[8] M.Ohyver,H.Pudjihastuti,"ArimaModelforForecasting the Price of Medium Quality Rice to Anticipate Price Fluctuations,"JournalofAgriculturalEconomics,vol.35, no.4,pp.567-580,Dec.2017.

[9] M. M. Kumbure, C. Lohrmann, P. Luukka, J. Porras, "Machinelearningtechniquesanddataforstockmarket forecasting: A literature review," Journal of ComputationalEconomics,vol.18,no.1,pp.45-58,Feb. 2022.

[10] S. Basak, S. Kar, S. Saha, L. Khaidem, S. R. Dey, "Predicting the direction of stock market prices using tree-basedclassifiers,"IEEETransactionsonFinancial Forecasting and Planning, vol. 17, no. 4, pp. 567-580, Oct.2020.

[11] W.Jiang,"Applicationsofdeeplearninginstockmarket prediction: Recent progress," Journal of Finance and Economics,vol.25,no.3,pp.45-67,Jul.2020.

[12] X. Fu, T. Ouyang, J. Chen, X. Luo, "Listening to the investors:Anovelframeworkforonlinelendingdefault prediction using deep learning neural networks," JournalofComputationalFinance,vol.8,no.3,pp.211225,Sep.2019.