International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 04 | Apr 2024 www.irjet.net p-ISSN: 2395-0072

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 04 | Apr 2024 www.irjet.net p-ISSN: 2395-0072

Vikas Mishra1, Neepun Patil2, Shivam Shukla3, Rohan Bhatia4 , Prof. Prajakta Khelkar5, Prof. Praveen Shinde6

1Student, Department of Computer Engineering, VPPCOE&VA, Mumbai

2Student, Department of Computer Engineering, VPPCOE&VA, Mumbai

3Student, Department of Computer Engineering, VPPCOE&VA, Mumbai

4Student, Department of Computer Engineering, VPPCOE&VA, Mumbai

5Associate Professor, Department of Computer Engineering, VPPCOE&VA, Mumbai

6Associate Professor, Department of Computer Engineering, VPPCOE&VA, Mumbai ***

Abstract - Our project, “The Cryptobase Blockchain Platform on Web 3.0” aims to revolutionize Decentralized finance (DeFi). It is a blockchain-powered Web 3.0 platform fordecentralizedcryptocurrencyexchange(DEX)andpeer-topeertransactions,cryptomarketanalysis,andinvestment.The platform's key features include: decentralization, transparency, security, user-friendliness, scalability and blockchainintegration. Platformalsooffers a varietyof other features such as real-time market data; charting tools; integrationofexistingcryptocurrencywallets;buying,selling, transferring & storing cryptocurrency; a built-in chat-bot to foster a collaborative community.

Key Words: DecentralizedExchange(DEX),Decentralized Finance,Cryptocurrency,Blockchain,Web3.0,Centralized Exchange(CEX).

The financial landscape is undergoing a transformation driven by the emergence of cryptocurrency and decentralizedfinance(DeFi).Cryptocurrency,adigitalasset utilizing cryptography for security, has challenged traditionalnotionsofmoneysincethelaunchofBitcoinin 2008[6]. Unlike traditional currencies issued by central banks,cryptocurrenciesoperateondecentralizednetworks like blockchains, which are distributed ledgers recording transactions publicly and immutably. This innovation eliminatestheneedforintermediarieslikebanksinfinancial transactions,potentiallyfosteringgreatertransparencyand security.

FollowingthesuccessofBitcoin,numerouscryptocurrencies withdiversefunctionalitieshaveemerged.Thisecosystem hasspurredthedevelopmentofDeFi,acollectionoffinancial applicationsbuiltonblockchaintechnology.DeFiprotocols aim to replicate traditional financial services like lending, borrowing, and asset management in a decentralized manner, again bypassing the need for centralized institutions.

TheriseofDecentralizedFinance(DeFi)hasintroducednew paradigmsforcryptocurrencytrading,notablythroughthe

emergence of Centralized Exchanges (CEX) and Decentralized Exchanges (DEX). While both serve as platformsfortradingdigitalassets,theydiffersignificantly in their operational models and implications for the DeFi ecosystem.

Centralized exchanges mandate that users deposit their currencies into hot wallets, which function as centralized repositories. The private cryptographic keys that unlock thesewalletsaremeticulouslymaintainedbythecentralized exchange.Thisoffersconveniencebutposesasecurityriskif theexchangeishacked.Transactionsarefasterandeasierto execute on CEXs. Conversely, decentralized exchanges operateonapeer-to-peerbasis,withoutacentralauthority in a non-custodial manner, meaning the cryptocurrency remains securely within the confines of each user's individual wallet. Transactions on DEXs are facilitated through smart contracts, essentially computer programs programmedtoexecuteautomaticallyuponthefulfillmentof predetermined conditions. DEXs offer greater control and securityforusersbutcanbemorecomplextouseandmay have lower liquidity. Unlike centralized exchanges, DEXs don’tallowforexchangesbetweenfiatandcryptocurrency instead, they exclusively trade cryptocurrency tokens for othercryptocurrencytokens.

Inthisresearchpaper,wewilldiveintothedetailsof"The CryptobaseBlockchainPlatformonWeb3.0,"focusingonits roleasadecentralizedexchange(DEX)andtheneedforsuch platformsinthecryptocurrencyecosystem.Thisplatformis designed to facilitate decentralized cryptocurrency exchanges(DEX),peer-to-peertransactions,cryptomarket analysis,andinvestment,allwhileprioritizingkeyprinciples such as decentralization, transparency, security, userfriendliness, scalability, and blockchain integration. Moreover,itisnotjustaplatformforfinancialtransactions; it is a community-driven ecosystem that fosters collaborationandengagementamongitsusers.Throughits built-in chatbot and community features, Cryptobase provides a space for users to interact, share insights, and support one another, thereby creating a vibrant and inclusivecommunity.

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 04 | Apr 2024 www.irjet.net p-ISSN: 2395-0072

Theaimof "TheCryptobaseBlockchainPlatformonWeb3.0" project is to revolutionize decentralized finance (DeFi) by providingablockchain-poweredplatformfordecentralized cryptocurrency exchange (DEX) and peer-to-peer transactions, crypto market analysis, and investment. The project strives to prioritize key principles such as decentralization, transparency, security, user-friendliness, scalability, and blockchain integration. Additionally, the project aims to create a vibrant and inclusive community through its built-in chatbot and community features, fosteringcollaborationandengagementamongusers.

The primary emphasis of "The Cryptobase Blockchain Platform on Web 3.0" lies in its role as a decentralized exchange(DEX).Thisaspectoftheprojectiscrucial inthe contextoftheevolvingcryptocurrencylandscape,wherethe need for secure, transparent, and user-centric trading platformsisparamount.

TheemphasisontheDEXaspectoftheprojecthighlightsits commitmenttodecentralization,transparency,andsecurity. Through the implementation of innovative blockchain technologyandsmartcontracts,theplatformaimstoprovide users with a reliable and efficient decentralized trading experience.

Thecurrentcryptocurrencyecosystemisfraughtwithrisks andlimitationsassociatedwithcentralizedexchanges(CEX). Theseexchangesrequireuserstotrustacentralentitywith their funds, exposing them to the risk of hacks, theft, and regulatoryinterference.Additionally,centralizedexchanges oftenlacktransparencyandmaycompromiseuserprivacy bycollectingandstoringsensitiveinformation.Thishasled to concerns about the security, privacy, and autonomy of usersinthecryptocurrencytradinglandscape.

Moreover,existingdecentralizedexchanges(DEX)havenot fully addressed these concerns. While DEXs offer greater securityandprivacybyallowinguserstoretaincontrol of their funds, they often suffer from low liquidity, complex userinterfaces,andlimitedfeatures.Thishashinderedtheir widespread adoption and usability, leaving many users reliantoncentralizedexchangesdespitetheirinherentrisks.

NumerousCentralizedExchanges,suchasBinance,CoinBase, Bitstampandotherplatformsofferexchangeservices,from simplewalletstolarge-scaletradinghubs.However,acrucial concern exists - trusting these platforms with your funds. Every transaction requires users to relinquish control, potentiallyexposingtheirassetstoexchangevulnerabilities. Centralizedcryptocurrencyexchangesholdontoyourassets duringconversions.CentralizedExchanges(CEXs)streamline

cryptocurrency participation for everyone by offering a convenient and comprehensive experience. Their userfriendlyfeatures make themideal for beginners, while the widerangeofintegratedservicestransformsthemintoonestop crypto hubs, providing users with seamless access to trading, staking, NFT marketplaces, launchpads, P2P exchanges, and more – all within a single platform. This eliminatesthe need to juggle multipleservicesand fosters accessibility for new entrants into the crypto world. But centralizes control, makes your money susceptible to exchange failure or cyberattacks. The infamous Mt. Gox incident in 2014[9], where millions of dollars in Bitcoin vanished,servesasastarkreminderofthisrisk.Accordingto the study by Moore and Christin (2013)[5], 18 out of 40 Bitcoinexchangesexaminedwereclosedwithinathree-year period,withadditionalclosureslikelyaftertheirstudy(e.g., Mt. Gox). This instability highlights the security risks associatedwithcentralizeddigitalcurrencyexchanges,where assetsarestoredoncentralizedserversandarevulnerableto attackerintrusions.FTX,amajorcryptocurrencyexchange, experienced a sudden collapse. Allegations suggest that mismanagementbycompanyleadersmayhaveplayedarole, with potential misuse of customer funds linked to an affiliated hedge fund. The dominance of centralized cryptocurrencyexchanges,suchasBinanceandCoinbase,is being challenged by regulations implemented by a major financialauthority.Centralizedexchanges(CEXs)aresubject to regulatory challenges, including compliance with antimoney laundering (AML) and know your customer (KYC) regulations. These challenges can impact users by limiting accesstocertainservicesormarketsandcanalsoaffectthe overallstabilityofcentralizedexchanges.Compliancecosts associatedwiththeseregulationscanbesignificant,further complicating the operation of centralized exchanges. CEXs have lost billions in successive waves of attacks: external hacks (Mt. Gox), internal misuse of funds (FTX) and regulatory crackdown (Binance and Coinbase). Their decentralizedcounterparts,DEXs,defendagainstallthree.

Decentralized exchanges (DEXs), like Uniswap[8], 1inch, SushiSwap and other have fundamentally different architecturesthancentralizedexchanges.

DEXs operate on a peer-to-peer basis, without a central authority in a non-custodial manner, meaning the cryptocurrencyremainssecurelywithintheconfinesofeach user'sindividualwallet.TransactionsonDEXsarefacilitated through smart contracts, essentially computer programs programmedtoexecuteautomaticallyuponthefulfillmentof predeterminedconditions.DecentralizedExchanges(DEXs) offerseveraladvantagesovertheircentralizedcounterparts (CEXs).DEXsaremoreresistanttolarge-scaletheftsbecause usersretaincustodyoftheircryptocurrenciesintheirown wallets, eliminating the risk of funds being held in a centralizedhotwalletvulnerabletohacking.DEXshavelower transaction fees compared to CEXs. Operating on a global peer-to-peernetworkwithoutacentralauthority,DEXsmay

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 04 | Apr 2024 www.irjet.net p-ISSN: 2395-0072

evade traditional regulations and associated compliance costs.

A study by Christos A. Makridis, et al. [3] investigate the factors contributing to the growth of DEXs, particularly compared to centralized exchanges. Their study highlights several potential advantages of DEXs, including enhanced security due to their non-custodial nature and potentially lower fees. Additionally, they explore the role of airdrops (distributionsoftokens)andgovernancetokensindriving userengagementandmarketcapitalizationforDEXs.Their findings suggest that airdrops, particularly those with governancetokens,areassociatedwithpositivegrowthfor DEXs.

It's important to acknowledge that DEXs are not without drawbacks.AstudybyBergJanetal.[4]investigatesmarket inefficiencies in Uniswap and SushiSwap, two major decentralizedexchanges(DEXes).Theauthorsanalyzetrade dataandidentifythatnearly30%oftradeswereexecutedat unfavorable rates, indicating price inaccuracies within the markets[4].Theseinefficienciesareparticularlyprevalent duringperiodsofhighcryptocurrencypricevolatility[4].The study also explores cyclic arbitrage opportunities, which exploit price discrepancies across DEXes. The presence of theseopportunitiessuggeststhatthemarketsarenotalways efficientinreflectingallrelevantinformation[4].However, theauthorsfindthatthemarketinefficiencyhasimproved overtime,especiallywhencryptocurrencypricesarestable [4].

OurProjectusesReactandTailwindCSSforFrontEnd.

A]Swap

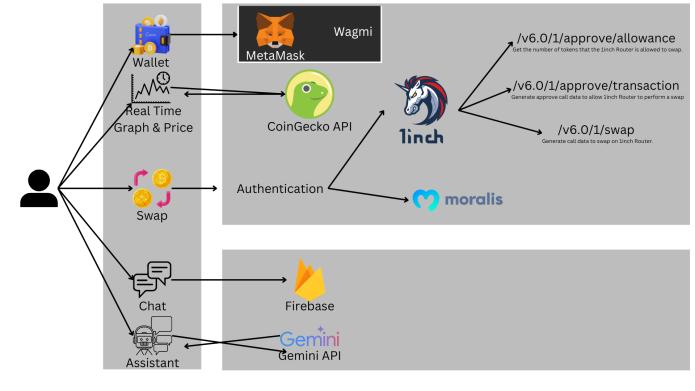

InBlockchainWehaveused MetaMaskandWagmiforthe userwalletandfortheuserauthentication,theuserwillonly able to swap the crypto currency if he is authenticated, wagmiisadevelopmenttoolforEVM-basedblockchainsthat providesover20Reacthooksforinteractingwithwallets, contracts,andtransactions.Ithasbuilt-inwalletconnectors for popular wallets like MetaMask, WalletConnect, and CoinbaseWallet.Inbackendwehaveusedexpressandnode jswhichfetchesthelatestexchangepriceofthetokens or cryptocurrencies from Moralis API getTokenPrice, for the swaptohappen, to determine theswapisvalidornot we haveuse1inchapis

1)/v6.0/1/approve/allowance

IsusedtoGetthenumberoftokensthatthe1inchRouteris allowedtoswap.

2)/v6.0/1/approve/transaction

To Generate approve call data to allow 1inch Router to performaswap.

3)/v6.0/1/swap

ToGeneratecalldatatoswapon1inchRouter

If all things satisfy and get correct response then swap is Done

WehaveusedReactandTailwindCSSforFrontEnd,ituses CoinGecko Api to fetch the real time data of the cryptocurrencies

C]Chat

WehaveusedReactandTailwindcssforFrontEndChat,and forbackendwehaveusedFirebase

D]Assistant

we have used React and Tailwind css for Front End, and GeminiAPI

To ensure a smooth user experience, the prototype underwent rigorous testing. This included evaluating functionality, performance, and security across various devices,operatingsystems,andwebbrowsers.Thetesting coveredaspectslikeuserinterface,blockchainintegration, data handling, and performance under load. Manual and automated testing methods were employed to thoroughly assess the prototype. Valuable insights from the testing team,suchassuggestionsforimprovingresponsetimes,will be implemented in the next version. Following successful acceptancetesting,therefinedprototypewillbereadyfor end-userdeployment.

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 04 | Apr 2024 www.irjet.net p-ISSN: 2395-0072

The Cryptobase Blockchain Platform on Web 3.0 has the potential to become a major player in the evolving DeFi landscape.Bystrategicallyaddressingitscurrentlimitations and incorporating innovative features, the platform can significantly enhance user experience and broaden its appeal.Herearepotentialfuturedevelopment:

Developing a Native Wallet: Currently, it integrates with MetaMask & Wagmi for user authentication and wallet management. Creating a native crypto wallet within the platformwouldoffergreatercontrol,security,anda more seamlessuserexperience.Thiswouldeliminatetheneedfor externalwalletintegrationandpotentiallyimprovesecurity bystoringprivatekeysdirectlyontheplatform.

Introducing a Cryptobase Token: Launching a platformspecifictokencouldincentivizeuserparticipationandcreate a more robust ecosystem. This token could be used for various purposes, such as: Granting users discounts on transactionfees;Rewardingusersforprovidingliquidityor participatingingovernancedecisions;Facilitatingpeer-topeertransactionswithintheplatform'schatorcommunity features.

Expanding Feature Set to Rival CEXs: While it focuses on coreDEXfunctionalities,incorporatingfeaturescommonly foundonCentralizedExchanges(CEXs)couldattractawider userbase.Thiscouldinclude:MarginTrading;Stakingand LendingServicesandotherfeatures.

Enhancing Interoperability: Currently, Cryptobase likely operates on a specific blockchain network. Expanding interoperabilitywithotherblockchainnetworkswouldallow userstoseamlesslyswaptokensacrossdifferentecosystems. Thiswouldcatertouserswhoinvestinadiverserangeof cryptocurrencies.

Advanced Security Measures: The future of Cryptobase shouldprioritizecutting-edgesecuritymeasurestoensure userconfidence.Implementingmulti-factorauthentication, secure storage solutions for private keys, and robust bug bounty programs can significantly enhance platform security.

Byincorporatingthesefuturedevelopments,TheCryptobase Blockchain Platform on Web 3.0 can position itself as a comprehensiveanduser-friendlyDeFisolution.

"TheCryptobaseBlockchainPlatformonWeb3.0,"addresses acrucialneedforsecureandtransparentDeFitransactions byleveragingDEXfunctionalities.Theplatformprioritizes user-friendliness and integrates features like real-time marketdataandcommunitychat,fosteringacollaborative environment. It integrates with established services like

MetaMask and Wagmi, promoting secure wallet management.

The analysis of the current cryptocurrency ecosystem revealed significant challenges and limitations associated withcentralizedexchanges(CEXs),includingsecurityrisks, lack of transparency, and privacy concerns. Existing decentralized exchanges (DEXs) have not fully addressed theseissues,oftensufferingfromlowliquidity,complexuser interfaces,andlimitedfeatures.

"TheCryptobaseBlockchainPlatformonWeb3.0,"facesstiff competition from established DEXs like Uniswap and SushiSwap. To carve out a niche, it needs to leverage its uniquefeatures.Theuser-friendlyinterfaceandemphasison community building can attract users seeking a more approachable and interactive platform compared to the technicalcomplexityoften associated with DEXs. Additionally, it could explore niche functionalitiesbeyondsimpletokenswaps.Integrationwith lendingandborrowingprotocolscouldfurtherenhanceits appealtousersseekingacomprehensiveDeFiexperience. Despite its focus on decentralization, security remains a paramount concern for any DeFi platform. While it integrateswithestablishedserviceslikeMetaMaskforwallet management,potentialvulnerabilitiescanstillexistwithin smart contracts that facilitate transactions. Implementing additional security measures, such as multi-factor authentication and robust bug bounty programs, would bolsteruserconfidenceandmitigatepotentialsecurityrisks. Furthermore,fosteringacultureoftransparencybyopenly disclosing security audits and actively addressing user concerns can further strengthen trust within the it ecosystem.Currently,itreliesonexternalwalletsandAPIs. Developinganativewalletandexploringin-housesolutions might enhance security and user experience. It might not catertousersseekingadvancedfeatureslikemargintrading orstakingcurrentlyofferedbyCEXs.

"The Cryptobase Blockchain Platform on Web 3.0," can empowerbothindividualsandinstitutionswithintheDeFi landscape. By prioritizing decentralization through DEX functionalities,itfostersasecureandtransparentfinancial environment,freefromcentralizedcontrol. Individualsgain greaterautonomyovertheirfinances,whileentitiesbenefit fromawideruserbaseandpotentiallyreducedrelianceon traditional financial intermediaries. Cryptobase's userfriendly design and educational features can further democratizeaccesstoDeFi,whileitspotentialtokencould incentivize participation and create a thriving ecosystem beneficialtoall.

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 11 Issue: 04 | Apr 2024 www.irjet.net p-ISSN: 2395-0072

Inconclusion,theCryptobaseBlockchainPlatformonWeb 3.0hasthe potential tobecomea prominentplayerinthe evolvingDecentralizedFinance(DeFi)landscape.Designed tofunctionasadecentralizedexchange(DEX),itprioritizes usercontrol,security,andtransparencythroughblockchain integration. By offering features like peer-to-peer transactions,cryptomarketanalysis,andinvestmenttools, Cryptobase aims to empower users within the DeFi ecosystem. This research paper explored the growing significanceofDEXsinthefaceoflimitationsassociatedwith CentralizedExchanges(CEXs). Wehighlightedthesecurity vulnerabilitiesandlackofcontrolinherentinCEXmodels, whereusersrelinquishcustodyoftheirfunds.Conversely, DEXs,likeCryptobase,addresstheseconcernsbyleveraging smartcontractsandpeer-to-peertransactions,placingusers in control of their crypto assets. Despite its strengths, Cryptobasehasroomforfuturedevelopment.Integratinga native wallet and introducing a Cryptobase token, prioritizinginteroperabilitywithotherblockchainnetworks andimplementingadvancedsecuritymeasuresarecrucial forlong-termsuccess.

WewouldliketosincerelythankProf.PrajaktaKhelkarand Prof.PraveenShinde,ourprojectguides,andtherestofthe computer office's teaching team for their significant suggestions, encouragement, and support during this research. Their knowledge and perceptions have been crucial in determining the course and extent of this undertaking.WealsoacknowledgetheDepartmentHead,Dr. Rais Mulla, for his unwavering encouragement and assistance.Hisleadershiphasservedasaninspirationtous. We also like to thank our peers and colleagues for their contributions,astheyhaveofferedinsightfulcriticismand recommendations.Theiradvicehassubstantiallyimproved ourjob.

[1] Adamik, Filip & Kosta, Sokol. (2019). SmartExchange: Decentralised Trustless Cryptocurrency Exchange. 10.1007/978-3-030-04849-5_32.

[2] Hallgren,J.,Hallgren,M.,Fisher,S.,Larsen,N.,Hautop,J., Ross, O.: Hallex: ATrust-Less Exchange System for DigitalAssets.SSRNElectronicJournal(22017).

[3] Christos A. Makridis, Michael Fröwis, Kiran Sridhar, RainerBöhme,Theriseofdecentralizedcryptocurrency exchanges: Evaluating the role of airdrops and governance tokens, Journal of Corporate Finance, Volume79,2023,102358,ISSN0929-1199.

[4] Berg, Jan & Fritsch, Robin & Heimbach, Lioba & Wattenhofer, Roger. (2022). An Empirical Study of MarketInefficienciesinUniswapandSushiSwap.

[5] Moore, T. and Christin, N. (2013). Beware the middleman:Empiricalanalysisofbitcoinexchangerisk. InInternationalConferenceonFinancialCryptography andDataSecurity,pages25–33.Springer.

[6] Nakamoto,S.(2008).Bitcoin:Apeer-to-peerelectronic cashsystem.

[7] Buterin, V.: Ethereum whitepaper (2013), https://ethereum.org/en/whitepaper/.

[8] Adams, H., Zinsmeister, N., Robinson, D.: Uniswap v2 core(2020).

[9] Popper,N.,Abrams,R.:ApparentTheftatMt.GoxShakes BitcoinWorld-TheNewYorkTimes(22014)