International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 10 | Oct 2025 www.irjet.net p-ISSN: 2395-0072

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 10 | Oct 2025 www.irjet.net p-ISSN: 2395-0072

Prof. Kalpana Sonval1, Mr. Krushna Gore2 , Mr. Prashant Jadhav3 , Miss. Vishakha Kadus4 , Mr. Shreetej Mohite5

1Assistant Professor, Department of Computer Engineering, Zeal College of Engineering & Research, Narhe, Pune – 411041, Maharashtra, India 2345BE Final Year, Department of Computer Engineering, Zeal College of Engineering & Research, Narhe, Pune – 411041, Maharashtra, India

Abstract - Effective personal financial management is a critical skill in today’s digital era, yet many individuals struggle due to low financial literacy, reliance on manual methods, and lack of intelligent tools. This paper presents BudgetBuddy – Digital Finance Assistant, an AI-powered platformdesignedtoautomateandoptimizeexpensetracking, budget planning, and savings management. The system leverages Next.js for responsive front-end development, Supabase for secure database and authentication management,PrismaORMforscalabledatahandling,Optical Character Recognition (OCR) for automated receipt processing, and AI/ML models for intelligent expense categorization and personalized recommendations. Key features include automated receipt scanning, multi-account support, budget threshold alerts, and AI-driven financial reports. The methodology follows the Agile Software Development Life Cycle (SDLC) to ensure iterative development and continuous feedback. Experimental evaluation highlights advantages such as real-time insights, secureauthentication,andintelligentrecommendations,while limitations include dependency on internet connectivity and OCR accuracy. Future enhancements include mobile app integration, multi-currency support, advanced predictive analytics,andexplainableAIfortransparencyandtrust.This work demonstrates the potential of AI-driven solutions to bridge the gap between technology and financial literacy, therebyimprovingpersonalfinancemanagement,increasing user engagement, and promoting long-term financial discipline.

Key Words: Artificial Intelligence (AI), Machine Learning (ML), Personal Finance Management, Expense Tracking, Budget Planning, Optical Character Recognition (OCR)

In today’s digital economy, effective personal finance managementhasbecomeanessentialskill.However,many individuals,particularlystudentsandyoungprofessionals, strugglewithbudgeting,saving,andtrackingtheirexpenses due to low financial literacy, inconsistent record-keeping, and reliance on inefficient manual methods such as spreadsheetsornotebooks.Traditionalapproachesareoften time-consuming, error-prone, and unable to provide meaningfulinsightsintospendinghabitsorfinancialtrends.

Thisgapcreatesapressingneedforintelligent,user-friendly toolsthatcansimplifyfinancialmanagementandpromote betterfinancialdecision-making.

BudgetBuddy – Digital Finance Assistant isdevelopedto address these challenges. It is an AI-powered platform designed to automate expense tracking, budget planning, andsavingsmanagementwhileenhancingfinancialliteracy. The system integrates advanced technologies, including Next.js forresponsivefront-enddevelopment, Supabase for secure database and authentication management, Prisma ORM for efficient and scalable data handling, Optical Character Recognition (OCR) for automated receipt processing, and AI/ML models for intelligent expense categorizationandpersonalizedfinancialrecommendations. The primary goal of BudgetBuddy is to simplify money management by providing automated categorization of expenses, threshold-based budget alerts, multi-account support, and actionable recommendations tailored to individual users. Unlike existing applications that focus solely on tracking expenses, BudgetBuddy incorporates explainable AI, offering transparency in its recommendationsandintegratingeducationalguidanceto improve financial literacy. By combining automation, intelligent insights, and educational support, the platform empowers users to monitor spending habits effectively, makeinformedfinancialdecisions,anddeveloplong-term financialdiscipline.

ThroughBudgetBuddy,thisresearchaimstodemonstrate how AI-driven solutions can bridge the gap between technology and financial literacy, creating a practical, accessible, and intelligent approach to personal finance management.

Low Financial Literacy: Asignificantnumberofindividuals lack the necessary knowledge and tools to manage their personal finances effectively. This often leads to poor budgeting, insufficient savings, and uninformed financial decisions, particularly among students and young professionals.

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 10 | Oct 2025 www.irjet.net p-ISSN: 2395-0072

Inefficiency of Manual Systems: Traditional methods of expensetracking,suchasusingspreadsheetsornotebooks, arenotonlytime-consumingbutalsopronetohumanerrors. Thesemanualapproachesfailtoprovideactionableinsights into spending patterns, making it difficult for users to optimizetheirfinances.

Overspending and Poor Savings Habits: Withoutreal-time monitoring and proactive alerts, users frequently exceed theirbudgetsandstruggletoachievefinancialgoals.Thislack of guidance and oversight can result in poor financial disciplineandlimitedsavingsovertime.

Opportunities with Artificial Intelligence(AI): AIpresents significant potential to transform personal finance management. Through predictive analytics, personalized recommendations, andautomation, AIcan help users plan budgetsmoreefficiently,trackexpensesaccurately,andmake informedfinancialdecisions.Byleveragingmachinelearning algorithms,financialtoolscanadapttoindividualspending patternsandprovideactionableinsights.

Need for Security and Scalability: As financial services become increasingly digital, ensuring robust data privacy, secure authentication, and scalable system architecture is critical.Usersmusttrustthattheirsensitivefinancialdatais protected, and platforms must be capable of handling growing volumes of transactions and users without compromisingperformanceorsecurity.

Although several personal finance applications exist, they arelimitedinscopeandfunctionality.Mostplatformsonly track expenses without providing personalized or explainable insights. Features such as receipt scanning, automatic categorization, and literacy support are rarely integrated into a single system. Privacy and security concerns also reduce user trust in existing financial platforms.Therefore,thereisaneedforaholisticsolution thatcombinesbudgeting,saving,literacysupport,andsecure datamanagementwithinasingledigitalfinanceassistant.

The literature survey highlights the advancements and limitationsofexistingAI-poweredpersonalfinancesolutions. Abbreviations such as AI (Artificial Intelligence), ML (Machine Learning), OCR (Optical Character Recognition), andNLP(NaturalLanguageProcessing)aredefinedherefor thefirsttimeandwillbeusedthroughoutthepaper.

SeveralstudieshaveexploredapplicationsofAIinpersonal financemanagement:

Budget Buddy (Javeed et al., 2025): ProposedanAIbased finance tool integrating expense tracking and

categorization. While effective in simplifying recordkeeping, it lacked explainable AI and advanced personalization.

Unlocking Financial Literacy with ML (Zhu, 2025): Used supervised ML models to predict literacy levels among youth. However, it did not integrate these predictionswithbudgetingorsavingsfeatures.

AI-Powered Personal Finance Assistant (Agarwal et al., 2024): DevelopedaprototypeusingNLPforfinancial recommendations. Scalability and security remained challenges.

AI as Financial Advisor (Liu, 2024): HighlightedAI’s abilitytoactasa24/7digitalfinancialadvisor,butraised concerns about privacy, explainability, and trustworthiness.

Explainable AI and Adoption of Financial Advisors (Ben David et al., 2021): Found that transparency in recommendationsincreasesusertrust,thoughpractical implementationinfinanceremainslimited.

Author(s) Year Focus Area Research Gap

Javeedetal. 2025 AI-powered expensetracking Limited personalization;lacks explainableAI

Zhu,A.Y.F. 2025 MLforfinancial literacy Not integrated with budgeting/savings

Agarwal et al. 2024 NLP-driven financeassistant Scalability and securitychallenges

Liu,Z. 2024 AI as 24/7 financialadvisor Privacyandreliability concerns

Ben David etal. 2021 Explainable AI in finance Lack of real-world implementation

Fromtheabovereview,thefollowinggapsareidentified:

Limited integration of explainable AI into financial recommendationsystems.

Lack of comprehensive platforms that combine budgeting,saving,andliteracy.

Weakhandlingofprivacyandsecurityinmanyexisting solutions.

Minimalvalidationonlarge-scale,real-worlddatasets.

The system is developed using the Agile SDLC model, ensuring iterative development, continuous testing, and feedback-drivenimprovements.

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 10 | Oct 2025 www.irjet.net p-ISSN: 2395-0072

TechnologiesUsed:

Frontend:React.js,Next.js,TailwindCSS

Backend:Supabase(PostgreSQL),PrismaORM

APIs: OCR for receipt scanning, AI for categorization, Resendforemailalerts,Clerkforauthentication

DevTools:GitHub,VSCode

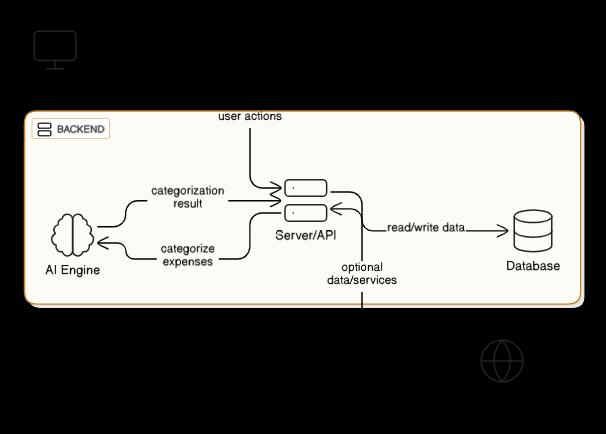

3.2 System Architecture

3.3 Functional Requirements

ExpenseTracking&OCR:Automaticdataextractionand categorization

Budget Planning & Alerts: Real-time threshold notifications

AI Insights & Reports: Personalized tips with explainablereasoning

Multi-AccountSupport:Consolidationofwallets,banks, andcards

Authentication & Security: Role-based access, encryption,andbotprotection

3.4 Non-Functional Requirements

Real-timeperformance:<3secondsresponse

Availability:99%uptimewithcloudhosting

Scalability:Supportslargeuserbase

Security:Securedatastorageandrecovery

4.1 Results

Expense Tracking:

Thesystemsuccessfullyalloweduserstorecord,update,and remove daily expenses across multiple categories such as food,travel,shopping,andutilitybills.Eachtransactionwas stored securely and made available on the user’s personalized dashboard, ensuring organized financial records.

Budget Management:

Users were able to set monthly budgets for selected categories. When spending exceeded the predefined thresholds,thesystemgeneratedtimelynotifications,thus enablingbetterfinancialdisciplineandawareness.

Visualization of Data:

The platform generated interactive charts, including pie chartsandbargraphs,whichprovidedaclearunderstanding ofusers’spendingpatterns.Reportscouldbegeneratedona daily, weekly, or monthly basis, offering flexibility in financialanalysis.

Authentication and Security:

The system ensured data privacy through secure login mechanismsandrole-basedaccesscontrol.Thisprevented unauthorized entry and safeguarded sensitive financial information.

System Performance:

The application was tested with multiple users and concurrenttransactions.Resultsindicatedefficientresponse times and smooth data handling, demonstrating the scalabilityandreliabilityofthesysteminreal-worldusage.

4.2 Discussion

The results indicate that BudgetBuddy provides an effective and user-friendly solution for financial management.

Comparedtomanualtrackingmethods(spreadsheetsor notebooks), the system saves significant time and reduceserrors.

The visual representation of expenses helps users identify overspending categories, promoting better financialplanning.

In comparison with existing expense-tracking applications, BudgetBuddy offers simpler navigation, category-basedbudgeting,andopen-sourceflexibility, whichmakesitadaptableforstudentandprofessional use.

However,certainlimitationswereobserved:

Thecurrentversiondoesnotsupportintegrationwith bankaccountsorUPIpayments.

Notificationsarelimitedtoin-appalertsandneedtobe extendedtoSMS/email.

BudgetBuddy – Digital Finance Assistant provides a comprehensivesolutionforpersonalfinancialmanagement by combining automation, AI-driven insights, and secure design.Itsimplifiesexpensetracking,promotessavings,and enhancesfinancialawareness.

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 12 Issue: 10 | Oct 2025 www.irjet.net p-ISSN: 2395-0072

FutureScope:

Multi-currencysupportforglobaluse.

MobileapplicationforAndroidandiOS.

IntegrationwithbankingAPIsforautomatedimports.

Advancedanalyticsforspendingpatternsandforecasts.

Improved AI for diverse receipt formats and personalization.

[1]D.BenDavid,A.Leung,andM.Siegel,“ExplainableAIand Adoption of Financial Advisors,” Journal of Financial Technology,vol.10,no.2,pp.45–58,2021.

[2] A. Agarwal, S. Kumar, and P. Sharma, “An AI-Powered Personal Finance Assistant,” International Journal of ComputerApplications,vol.120,no.4,pp.12–20,2024.

[3] Z. Liu, “Artificial Intelligence as Personal Financial Advisor,” in Proc. IEEE Int. Conf. on Multimedia and Expo (ICME),pp.30–42,2024.

[4]T.WangandR.Li,“AI-BasedExpenseManagementand BudgetOptimizationforIndividuals,”Int.J.ofSmartFinance, vol.4,no.1,pp.33–45,2024.

[5] R. Singh and M. Verma, “AI-Driven Personal Finance ManagementSystems:Opportunitiesand Challenges,”J.of FinancialInnovation,vol.5,no.1,pp.15–27,Jan.2025.

[6] L. Chen and H. Patel, “AI-Enabled Budgeting Tools for ImprovingFinancialPlanningandSavings,”Int.J.ofDigital Finance,vol.7,no.3,pp.40–52,Jul.2025.

[7]M.Javeed,R.Patil,andS.Deshmukh,“BudgetBuddy:An AI-PoweredFinanceTrackingSolution,”Int.J.ofAdvanced Research in Computer and Communication Engineering (IJARCCE),vol.14,no.7,pp.55–63,2025.

[8]A.Y.F.Zhu,“UnlockingFinancialLiteracywithMachine Learning,” Journal ofFinancial Educationand Technology, vol.12,no.3,pp.23–31,2025.

[9]N.Subasri,“AIPoweredPersonalFinanceManagement System,”Int.J.ofComputerScienceandTechnology,vol.11, no.2,pp.40–48,2025.

[10]P.KumarandS.Das,“MachineLearningApproachesfor PersonalFinancialPlanning,”JournalofAIinFinance,vol.6, no.2,pp.10–22,2025.