We believe insurance should sound like a conversation, not a contract. So, we skip the jargon and meet you where you are—with tools, insights, and people who know your customers’ industries inside and out, from manufacturers and contractors to breweries and wineries.

That’s how partnerships work. And that’s how we work. Because at EMC, we’re all about Keeping insurance human®

Let’s get to know each other at emcinsurance.com

Phone 615.385.1898

Toll Free: 1.800.264.1898

Email: marketing@insurors.org

Editor: Kristen Gulson

Publisher: MarketWise, Inc

President .......................................................................Bobby Sain

IIABA National Director ........................John McInturff III, ARM

VP Region I, President-elect .............Battle Bagley, III, CIC, CPA

VP Region II .................................................................Portis Tanner

VP Region III ................................................................Kevin Ownby

Treasurer ......................................................Richard Whitley, CIC

Secretary ................................................................Brandon Clarke

Director, Region I ............................................Andrew Maddox

Director, Region I ............................................Pam Lofton-Wells

Director, Region I ............................................Sam Bradshaw, IV

Director, Region II ................................. Matt Felgendreher, CIC

Director, Region II ................................................... Jessica Govic

Director, Region II .....................................Cameron Winterburn

Director, Region III ...................................................Josh Gibbons

Director, Region III ....................................................David Clark

Director, Region III .................................................. Stuart Oakes

Director, Young Agents ...................................Clark Kelman, CIC

Immediate Past President ................. Kym Clevenger, CPCU

Display advertising rates, deadlines and specifications may be obtained by writing to Insurors of Tennessee, 2500 21st Avenue South, Suite 200, Nashville, TN 37212, calling 615.385.1898, e-mailing marketing@insurors.org or online at www.insurors.org

Tennessee Insuror is provided to all Insurors of Tennessee members and associate members as a member service.

INSURORS OF TENNESSEE

2500 21st Avenue South, Suite 200 Nashville, TN 37212-0539

www.insurors.org

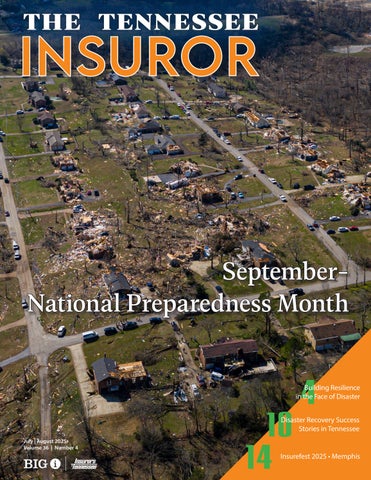

National Preparedness Month: Every September, the United States observes National Preparedness Month, a campaign led by the Federal Emergency Management Agency (FEMA) to encourage individuals, families, and communities to prepare for disasters and emergencies. The initiative underscores the importance of readiness in the face of natural disasters, pandemics, technological failures, and other unexpected events that can disrupt lives and livelihoods.

The theme for National Preparedness Month often revolves around empowering people to take proactive steps to safeguard their homes, businesses, and communities. In an era of increasing climate volatility, cyber threats, and public health challenges, preparedness is not just a recommendation—it is a critical shared responsibility.

Gov. Bill Lee and the Tennessee Emergency Management Agency (TEMA) are recognizing September 2025 as Preparedness Month with a commitment to helping all Tennesseans become “Ready to Recover” from emergencies and disasters.

This initiative reflects Tennessee’s mission to equip individuals, families, businesses, and communities with the tools they need to prepare for emergencies and recover stronger, with an emphasis on long-term resilience and financial preparedness.

“Preparedness Month is about more than weathering the storm – it's about ensuring Tennessee families, communities and businesses can recover and thrive,” said Gov. Lee. “I’m grateful that the Volunteer Spirit is alive and well across our state and encourage all Tennesseans to plan ahead and build resilience now, so they’re ready to recover stronger after a disaster.”

National Preparedness Month, a component of the Ready Campaign spearheaded by the Federal Emergency Management Agency (FEMA), reminds everyone that preparing for emergencies and disasters can keep them, their families, and their communities safe. This year, Tennessee is emphasizing the importance of planning not only for the immediate impacts of disasters, but also for what comes after.

“Being prepared isn’t just about getting through a disaster or emergency safely, it’s about recovering afterward,” said TEMA Director Patrick C. Sheehan. “Recovery can take weeks, months, or years. Our goal is to empower individuals, families, and communities to prepare, respond, and bounce back stronger after disasters.”

Throughout September, TEMA is partnering with the Tennessee Department of Commerce & Insurance (TDCI), Tennessee Chamber of Commerce and Industry (TN Chamber) and the Big “I” of Tennessee to share tips and tools for becoming recovery-ready.

In Tennessee, the Tennessee Emergency Agency (TEMA) under the leadership of Director Patrick Sheehan stands ready to support Tennesseans in their efforts to plan for and re -

spond to disaster events across the state. The importance of preparedness in saving lives, property, and making certain communities can respond and recover is vital to the citizens of the state. Moreover, it is about building resiliency in households, businesses, and communities across Tennessee.

TEMA Director Sheehan encourages individuals, businesses, and communities to prepare for the unexpected. Director Sheehan states it is important to remember, “past is not prologue.” Just because a disaster or event has not directly impacted you or your location at any given time does not mean you or your community will avoid the next disaster. He encourages cities, towns, and communities across Tennessee to work together with state and federal partners to formulate plans, tactics, and strategies that can quickly be implemented.

The Big I provides agencies with a range of support to help your agency be successful. Perhaps one of the most important things an agency can do is prepare to operate through catastrophic events. Please visit the link below to download your Agency Disaster Planning Guide.

https://www.independentagent.com/disaster-plan/

TEMA is prepared and will always be there to support impacted communities across Tennessee. From its state-of-the-art Emergency Operations Center (EOC) in Nashville including other assets across the state, it can work with local communities to assess damage and marshal the resources to help communities get back on their feet, recover and thrive.

TEMA offers an array of tools and resources via the Ready to Recover and Ready TN portions of the TEMA website at https://www.tn.gov/tema. More specifically, you can access preparedness sections of the website as follows:

Tennessee Ready to Recover – https://www.tn.gov./prepare/ ready-to-recover

TN Ready – https://www.tn.gov./tema/ready-tn.html

You can also access the preparedness resources by following the QR codes associated with this article.

The insurance industry, including professional independent insurance agents and agencies has long been a critical piece of helping families, business, and communities manage and mitigate the risk associated with disasters and other major events. From the consultations provided by insurance professionals to clients helping them to understand their risk and the insurance coverage they need to insurance company claims response in the aftermath, the insurance industry is a key component of the disaster preparedness and recovery.

"As part of creating a preparedness plan, I urge Tennesseans to meet with a licensed insurance professional and evaluate

their insurance needs - especially learning more about flood and earthquake insurance policies,” said TDCI Commissioner Carter Lawrence. “Many people mistakenly believe that they will be covered by their homeowner’s policy if they are flooded. A traditional homeowner’s policy will not cover the costs of rebuilding after a flood; only a flood insurance policy can help. A flood insurance policy cannot stop flooding, but it can help you avoid financial disaster.”

As Carter Lawrence suggests, the role of the insurance agent is key to helping insureds understand their exposure and the insurance coverage available to them to manage and mitigate risk. Professional insurance agents need to work with clients in regular consultation about their specific exposure to flood, earthquake, and other perils to make certain they understand the risk and can make the right decisions to protect their property and assets in advance of a catastrophic disaster.

Another vital role the insurance industry plays in the aftermath of disasters is the deployment of insurance company claims adjusters, independent adjusters, and in some cases catastrophe teams to help insureds begin the process of recovery. In communities across Tennessee, the in-flow of insurance claims dollars that help families and businesses recover in the immediate aftermath also serve as an important stimulus to local economies dislocated by major disaster events.

Disasters can strike with little or no warning. Whether it is a tornado tearing through a neighborhood, a flood inundating homes, or a cyberattack crippling infrastructure, the consequences can be devastating. Preparedness helps mitigate these impacts by:

• Reducing loss of life and injury

• Minimizing property damage

• Speeding up recovery efforts

• Strengthening community resilience

Preparedness is also a form of empowerment. When individuals and communities are equipped with the knowledge and tools to respond effectively, they are less likely to panic and more likely to act decisively.

Tennessee has experienced 116 major disasters between 1980 and 2024, resulting in estimated economic losses of $20–$50 billion. These events include:

• Sixty-eight severe storms (tornadoes, hail, high winds)

• Sixteen droughts

• Fifteen winter storms

• Nine tropical cyclones

• Four floods

• Three freezes

• One wildfire

The human toll is also significant. For example, the August 2021 flood in Waverly killed twenty people and caused $90–$100 million in damages. According to the Tennessee Advisory Commission on Intergovernmental Relations, the state

incurs an average of $343.5 million annually in property damage and economic losses from natural disasters. This figure is projected to double to $595 million per year by 2055.

Here are five of the most recent federally declared disasters in Tennessee:

• April 2025 Severe Storms and Tornadoes

Affected 28 counties, caused ten fatalities, and led to widespread infrastructure damage.

• May 2024 Storms and Flooding

Triggered federal assistance for multiple counties due to tornadoes and flash floods.

• December 2023 Tornadoes

Resulted in significant destruction across several counties, prompting federal aid.

• March 2023 Severe Weather

Included heavy rainfall and flooding, leading to both Individual and Public Assistance declarations.

• February 2023 Winter Storms

Caused power outages and hazardous conditions, with federal support for recovery.

Preparedness begins at home. Here are key steps individuals can take:

• Create an Emergency Plan - Families should develop a communication and evacuation plan. This includes identifying safe meeting spots, emergency contacts, and routes out of the home or neighborhood.

• Build an Emergency Kit - A well-stocked kit should include:

• Non-perishable food and water (3-day supply)

• Flashlights and batteries

• First aid supplies

• Medications

• Important documents

• Hygiene items

Sign up for local alerts and monitor weather reports. Apps like FEMA and local emergency management tools provide real-time updates.

Reinforce windows, doors, and roofs. Install smoke detectors and carbon monoxide alarms. Know how to shut off utilities in case of emergency.

Conduct regular fire, earthquake, or tornado drills to ensure everyone knows what to do.

While individual actions are vital, community-wide preparedness amplifies resilience. Here’s how communities can get involved:

Local governments should collaborate with emergency services, schools, and businesses to create comprehensive response strategies.

Community Emergency Response Teams (CERT) train volunteers in basic disaster response skills, such as fire safety, search and rescue, and medical operations.

Communities should prioritize resilient infrastructure— storm water systems, reinforced buildings, and reliable communication networks.

Hosting workshops, distributing materials, and engaging with schools can raise awareness and encourage participation.

Partnerships with FEMA, the Tennessee Emergency Management Agency (TEMA), and other organizations ensure access to resources and expertise.

Tennessee has already taken steps to improve resilience. For example, Pigeon Forge adopted wildfire mitigation strategies like curb side brush removal. Nashville invested in storm water improvements and property buyouts after the 2010 flood. Lake County built a 600-person storm shelter in a public school.

Hurricane Helene caused historic damage to East Tennessee in late September 2024, particularly in counties like Unicoi, Washington, and Greene, with five bridges destroyed and extensive flooding and road closures. The Tennessee government, led by Governor Bill Lee, responded with an emergency declaration, the Helene Emergency Assistance Loans (HEAL) Program, and provided tax relief. Federally, the government provided millions in emergency funding for road and bridge repairs.

National Preparedness Month serves as a powerful reminder that readiness is not a one-time effort but an ongoing commitment. The recent disasters and statistics from Tennessee illustrate how quickly lives can be upended and how crucial it is to be prepared before disaster strikes.

By taking proactive steps—both individually and collectively—Tennesseans can build a culture of preparedness that saves lives, protects property, and fosters resilience. Whether it is assembling a go-bag, attending community training, or simply checking in on a neighbor, every action counts.

Preparedness is not just about surviving the storm—it is about thriving after it. u

Following the devastating tornado outbreak in Middle Tennessee in December 2023, communities in Clarksville, Nashville, and surrounding areas demonstrated remarkable resilience. Despite the destruction of homes, businesses, and churches, residents immediately began cleanup efforts. Volunteers from across the state arrived to help neighbors’ clear debris and salvage belongings.

In Clarksville, over fifty people gathered to help the Burnham family search through the rubble of their destroyed home. Many were coworkers from a local Toyota dealership. Governor Bill Lee and First Lady Maria Lee personally visited affected neighborhoods, offering support and encouragement. Their presence underscored the state’s commitment to recovery and highlighted the strength of community bonds.

In Nashville, Mayor Freddie O’Connell praised first responders and volunteers for their tireless work. Twenty-two structures collapsed, and power was out for 160,000 residents, yet the city mobilized quickly to restore services and support displaced families.

In the aftermath of Tropical Storm Helene in September 2024, FEMA and state agencies launched a robust recovery operation in Eastern Tennessee. The storm caused widespread flooding, power outages, and infrastructure damage across eight counties. FEMA approved $16.4 million in aid, including housing assistance, disaster unemployment benefits, and funding for debris removal.

A mile-long curtain was installed in Douglas Reservoir to protect the dam from one million cubic yards of debris. FEMA also deployed mobile units to restore internet access in remote areas and counter misinformation about assistance programs. More than 140,000 meals were served by the American Red Cross and Salvation Army, and 24,000 cubic yards of debris were cleared in the first month.

Penn National Insurance sells property-casualty insurance in 12 states by partnering with more than 1,200 independent agency operations.

Penn National Insurance has an A.M. Best Rating of A (Excellent). This rating is assigned by A.M. Best to companies that have an excellent ability to meet their ongoing insurance obligations.

Penn National Insurance has achieved a “Superior Rating” for Personal Lines Claims Customer Experience for five consecutive years.

We are looking for select commercial lines agencies in Tennessee.

n Jane Kinard • 615-889-2740 ext. 7158

n Carmen McIntosh • 615-889-2740 ext. 7528

The East Tennessee Foundation (ETF) has played a pivotal role in advancing long-term recovery following Hurricane Helene. The foundation invested $4.8 million in disaster recovery grants across six counties: Carter, Cocke, Greene, Johnson, Unicoi, and Washington.

These funds supported:

• Formation of Long-Term Recovery Groups (LTRGs) to coordinate case management, emotional support, and reconstruction.

• Grants for home repair materials, volunteer resources, and community outreach.

• Restoration of household essentials and landscaping in affected areas.

• Local nonprofits like AIDNET of Greene County and Frontier Health received targeted support to sustain operations and rebuild homes. ETF’s Neighbor to Neighbor Disaster Relief Fund continues to provide gap funding for families whose needs are not met by other sources.

These stories illustrate how collaboration between federal agencies, state governments, nonprofits, and local communities can lead to effective and compassionate disaster recovery. They also reinforce the importance of preparedness, not only to survive disasters but to recover and rebuild. u

Each fall we convene to acknowledge the many successes in the independent insurance industry in Tennessee. This 'crown jewel' of our events features many enjoyable activities and engagements within our association. We strive to host a quality trade show for our carriers and vendors to exhibit their new products to our agency members. Along with our trade show, we host speaker sessions, free time activities, tours, CE opportunities, social hours, football parties, live music, and our longstanding association breakfast where we recognize the agents and company representatives who are making tremendous impacts with the Insurors of Tennessee!

Schedule - Central Time Zone - Details are subject to change

SATURDAY, October 11

5:00 PM - 7:00 PM | Registration Hub Open | Southeast Ballroom Foyer

5:00 PM - 7:00 PM | Welcome Social | The Lobby Bar (Hilton Memphis)

SUNDAY, October 12

9:00 AM - 4:30 PM | Registration Hub Open | Southeast Ballroom Foyer

9:00 AM - 10:30 AM | Board of Directors Meeting (Private) | Director 3 | Invitation Only | Lunch Included

11:00 AM - 1:00 PM | Annual Meeting & Keynote Speaker | Southeast Ballroom

• "M&A Trends in Independent Agency Marketplace" presented by Carey Wallace

12:00 PM - 1:30 PM | Exhibitor Setup | Tennessee Ballroom

1:30 PM - 4:30 PM | Tradeshow | Tennessee Ballroom

• Door prize winners will be announced at 3:00 PM

4:30 PM - 5:30 PM | Exhibitor Breakdown | Tennessee Ballroom

6:30 PM - 9:30 PM | Shine & Dine - Awards, Dinner & Live Music | Southeast Ballroom

•Live performance by Ghost Town Blues Band

MONDAY, October 13

8:00 AM - 1:30 PM | Registration Hub Open | Southeast Ballroom Foyer

8:00 AM - 9:00 AM | Breakfast & Networking | Southeast Ballroom

9:15 AM - 10:15 AM | Education Session | Director 6

• "Valuation Drivers in Your Agency" presented by Carey Wallace

10:30 AM - 11:30 AM | Education Session | Director 6

• "Ten Challenges for Your Agency and How to Navigate Them" presented by Kelly Donahue-Piro

11:45 AM - 1:15 PM | Lunch & Learn: Curated by the WINS Committee | Southeast Ballroom

• MORE INFORMATION COMING SOON

1:30 PM - 3:00 PM | Part I: Martin & Zerfoss Activity - Education Session | Lakeview I 3:00 PM - 5:30 PM | Part II: Martin & Zerfoss Activity - Murder Mystery | Lakeview II

•Please note: You must attend Part I in order to join Part II

6:30 PM - UNTIL | Company Night - Dinner on own

8:30 PM - 10:30 PM | Rhythm & Risk: The After-Hours Singo Social | Southeast Ballroom

TUESDAY, October 14th

7:00 AM - 9:00 AM | To-Go - Fast Track Breakfast Bar | Southeast Ballroom Foyer u

Don't Miss the Sunday Night Live Performance of the Ghost Town Blues Band!

GTBB's new album Shine debuted at #1 on the Billboard Blues Chart. Recently headlining the blues stage at The Montreal Jazz Festival and appearing at The Lucerne Blues Festival in Switzerland, Beale Street’s latest success story, Tennessee Music Award Winner, 5-time Blues Blast Music Award Nominee and International Blues Challenge Runnerup is Ghost Town Blues Band. Their live show has been captivating audiences in the U.S., Canada and Europe with their "second-line horn entrance," cigar box guitars and electric push brooms to Allman Brothers style jams. The band's stage show and energy is unparalleled and has been called the best new, live blues shows in the world.

Monday Night Join Us For Rhythm & Risk: The After-Hours Singo Social!

What is a Singo Social ? ? ? ? ? ? Singo is a modern twist on traditional bingo where players mark off song titles or artists on their bingo cards after hearing a short music clip, rather than numbers. Sound like fun? We think so! Please join us Monday night in the Southeast Ballroom from 8:30-10:30. We've got prizes!!

We’re right here to do more.

To help support both your physical and mental health while giving back to our communities is to go beyond what is expected from a health insurance company. And that’s exactly why we do it.

Martin & Zerfoss - MGA

Bailey Special Risks

Safeco Insurance Company

North Point Underwriters, Inc.

Jencap Insurance Services Inc.

Small & Rural Services, Inc.

FFVA Mutual Insurance Co.

Arcus Restoration

The Service Insurance Company

Arlington/Roe

Travelers

Glatfelter Insurance

AmTrust

American Collectors Insurance

Penn National Insurance

Frank Winston Crum Insurance

CGI Digital

Enterprise

Pennsylvania Lumbermens Mutual

CRC Group

Frontline Insurance

MEM

MidSouth Insurance Company

Liberty Mutual Insurance

Markel Specialty

The National Security Group

Stonetrust Workers' Compensation

Imperial PFS

TAPCO Underwriters

Commercial Sector Insurance Brokers

RLI Insurance

Wholesure

Kevin Davis Insurance Services

Southern Pioneer P & C Ins. Co.

RT Specialty

Southern Trust Insurance Company

Venture Insurance Programs

McGowan Companies, The

Hagerty

Applied Systems, Inc.

ePayPolicy

Church Mutual Insurance Company

PLRisk Specialty

Berkley Small Business Solutions

Premium Logic

ICW Group Insurance Companies

Society Insurance

Builders

Openly

Arbour Specialty

And many more! (registration still open)

By Carey Wallace, Founder & CEO of AgencyFocus, Key Note Speaker at 2025 Insurfest,

July 9, 2025

Buying another agency might be one of the fastest ways to grow, but it can also be one of the easiest ways to get yourself into trouble. Too often, we see agency owners jump in before they’re ready. They get excited about the opportunity and forget that buying a business is not the same as building one.

In the first session of our Buying an Agency webinar series, we talked about the things that smart buyers think through before they make an offer. If you missed it, here are some of the biggest takeaways that came out of the conversation.

Start by knowing your agency inside and out

Before you start reviewing someone else’s financials, you need to make sure yours are in order. That means more than just being profitable. You need clean, organized data that tells the story of your business.

At a minimum, you should know:

• Your EBITDA and profit margin

• How your revenue breaks down by line of business

• Your retention and loss ratios

• Where you land compared to industry benchmarks

If you don’t get your financials in order first, it will be difficult to identify expenses that can be eliminated, reduced or changed and you will miss out on the opportunity to maximize the combined profitability of the deal. Not knowing your number could cause you to lose a strong deal. Preparation puts you in control.

Be clear about why you’re buying

Not every deal that comes across your desk is a good one. Sometimes we get excited because there’s an opportunity in front of us, but we forget to ask whether it actually fits the direction we’re trying to go.

Before you look at anything, ask yourself:

• Are you looking to grow geographically?

• Do you want to acquire talent or leadership?

• Are you trying to build a niche you don’t currently serve?

• Is this about revenue, relationships, or operational scale?

If you don’t know what you’re trying to accomplish, you’re more likely to chase something that looks good on paper but causes friction down the road.

Build your buyer team early

I cannot stress this enough. Do not try to do this on your own. Surround yourself with the right people, and get them involved early.

Here’s who you need:

• An advisor or consultant who understands insurance M&A

• A CPA who knows this industry and has experience with deal structure and tax implications

• Legal counsel who has handled agency transactions

• Someone internal who can lead integration and assess operational readiness

If you try to take this on without a team, you’ll miss things. You’ll also slow down the process and potentially make promises you can’t deliver on.

Fit matters more than financials

You are not just buying a book of business. You’re buying relationships, workflows, expectations, and team dynamics. If the cultural or operational fit is off, the numbers won’t matter.

Ask yourself:

• Does this agency operate in a similar way?

• Are their producers paid like yours?

• Do they use technology in a way that aligns with how your team works?

• Will their staff be able to integrate with yours?

• Do their clients look like your clients?

The most successful acquisitions I’ve seen are the ones where the fit made integration easier and culture was aligned from day one.

Know what to ask for and when

This came up a lot during the session. There’s a rhythm to how you gather information. Asking for everything up front is overwhelming. Asking too little means you’re flying blind.

Here’s a breakdown of what to ask for at each stage:

Initial Fit

Documents to Request:

• Org chart

• Basic financial summary

• Staff list with tenure

Questions to Ask Yourself:

• Do we align culturally and operationally?

• Are there early red flags?

• What are the seller’s goals?

Preliminary Review

Documents to Request:

• P&L and balance sheet

• Book of business summary

• Producer compensation structure

Questions to Ask Yourself:

• Do the numbers tie together?

• Is there risk in concentration or staff structure?

Valuation Stage Documents to Request:

• 3–5 years of financials

• Payroll records

• Full book of business export

Questions to Ask Yourself:

• What are the opportunities and risks?

• Will it cash flow?

• What synergies can we model in?

LOI Prep Documents to Request:

• Staff and location assumptions

• Deal structure ideas

Questions to Ask Yourself:

• Are we aligned on terms?

• What would be a deal breaker?

• Is this realistic for both sides?

Due Diligence Documents to Request:

• Carrier reports

• Employee agreements

• Contracts and compliance documents

Questions to Ask Yourself:

• Can we verify everything we assumed?

• Do we need to adjust the deal before closing?

Smart buyers don’t just collect documents. They use the right questions to figure out whether this deal actually makes sense for their agency.

Some things should make you pause immediately. Declining revenue with no clear reason. Books of business that aren’t clearly owned. No employment agreements. Lack of data or bad data. Unrealistic price expectations from the seller.

These are the kinds of issues that slow things down or tank a deal all together. On the flip side, there might be real upside in a book that hasn’t been cross-sold or an agency that needs a better operational backbone. But make sure you understand the risks before you get attached to the potential.

One of our clients looked at 22 different opportunities before acquiring two that truly made sense for their business. That’s what intentional buying looks like.

If you get your own house in order, define what you’re looking for, ask the right questions, and build the right team around you, you’ll be able to move quickly when the right deal comes along and you’ll have a whole lot more confidence in the decisions you make. u

Bobby Sain

After a long hot and humid Summer here in Bolivar in West Tennessee, the cooler and crisper days of Fall are rapidly approaching. If you’re like me, you’re looking forward to cooler weather, football, tailgates, marching bands, community festivals and all that comes with this time of the year.

Another event that happens every Fall is the Insurors of Tennessee Annual Meeting also known as InsureFest. This year it is being held in the Memphis area at the Memphis-Hilton located in East Memphis where I-240 intersects with Poplar Avenue. The hotel has excellent amenities, conference facilities, comfortable rooms, and great service that should create the conditions for an exceptional conference.

I encourage you to take advantage of the opportunity to visit the Insurefest Trade Show at the start of the conference. It is your one-stop opportunity to meet with a wide array of insurance company representatives, insurance service vendors, and others all in one place. These are the folks that power the success of many agencies and contribute to a growing and vibrant insurance industry in Tennessee. So, please be sure to set aside some time to explore the InsureFest Trade Show on Sunday afternoon.

Sunday night the Shine & Dine Awards Dinner & Live Music Event will be presented where we all have the opportunity recognize those who have been a part of this association’s success. Entertainment will be true to the Memphis Sound with Ghost Town Blues Band performing for the members.

The 2025 Annual Meeting is content rich featuring a slate of exceptional speakers who will address important topics for insurance agency staff and company representatives. On Monday there are three education sessions offered to members

designed to provide you with takeaways that will contribute to the growth and development of your business. This year Martin & Zerfoss is once again supporting an education session. Their education session is offered in two parts with part 1 starting at 1:30PM and part 2 beginning at 3:00PM. Part 2 involves a murder mystery. Yes, you read that right, a murder mystery. However, you must attend part 1 to participate in part 2 and the intrigue that will no doubt ensue.

Another important part of the conference is the actual annual meeting that is required by statute where the business of the association is conducted, officers are selected, and board measures are ratified. While this part of the conference may be less than exciting for some members, it goes to the very renewal and perpetuation of the association each year. These meetings or some variation of these meetings have been conducted for more than 130 years. Please refer to the Schedule Events provided in this magazine or on the events page of the Insurors of Tennessee website at www.insurors.org.

As communicated in this magazine and other media, September is National Preparedness month sponsored at the national level by Federal Emergency Management Agency (FEMA) and at the state level by the Tennessee Emergency Management Agency (TEMA), the Tennessee Department of Commerce & Insurance (TDOCI), the Tennessee Chamber of Commerce and Big I TN (Insurors of Tennessee). The reasons for being prepared are critical for families, business, and communities across our state.

The details about what preparedness means, why it is important, and how to prepare are provided in the detailed resource materials provided by FEMA and TEMA through their websites. I strongly encourage families, businesses, and

communities to use the information provided.

Too many times, we fall victim to the mentality that “it” can’t happen here, or “it” will not happen to me. The reality is that disasters of various types and magnitudes strike more often than contemplated by most people. Most recently, ask the people of Western North Carolina and East Tennessee in the wake of hurricane Helene last Fall or the people of Kerr County, Texas after historic flooding along the Guadalupe River just weeks ago what they think. Sadly, the lessons learned after such events can be hard to take.

I can tell you as a former mayor, it is so important for communities to take preparedness and emergency management seriously. We simply cannot bury our heads in the sand and ignore the threat. As someone quite wise once said, “Hope is not a plan.” Ask your community leaders, county commissions, city councils in a constructive way what your community is doing from a preparedness perspective and how they are becoming “Ready to Recover” in the event of a disaster or catastrophic event.

I can assure you that TEMA Director Patrick Sheehan and Tennessee Department of Commerce & Insurance Commissioner Carter Lawrence and their teams stand ready to help your community enhance and improve their preparedness efforts. Encourage your community leaders to reach out to both organizations for assistance and make sure your community is “Ready to Recover.” u

Providing the insurance industry with a single platform for innovative premium financing and payment technology solutions to

Access the Agency Dashboard on ipfs.com for insights into how insureds use IPFS services. Available information includes activity data and electronic communication enrollment. Create a range of reports in PDF or Excel workbook formats.

Access quotes online at ipfs.com, by email, or by phone. All quotes can be viewed and amended online, and renewal quotes load the prior year ’s

device at any time. Electronically collect a signature and submit it online to reduce paperwork.

Highlight your brand and help insureds recognize important IPFS communications by co-branding or white labeling insured-facing points of contact. With custom branding you will create brand awareness and recognition,

interrupted due to a missed payment.

Paying for premiums has never been easier. IPFS offers many ways to pay including the ability to make payments in installments, in full, or anytime. Payments can be made by interactive voice response, check or money order to a secured lockbox, bank bill payment, pre-authorized account debit, and credit Credit Advantage®

Eliminate busy work by integrating with IPFS. Integrations provide powerful reporting, automated data entry, and tracking opportunities with minimal manual integrate with most Agency Management Systems.

Avoid insurance coverage disruption with timely payment due date reminders, cancellation notices via text message and email, impending cancellation reports provided to agents, and the ability for agents to place accounts on hold to delay cancellation.

Access account information 24 hours a day, seven days a week via mobile app. Agents and insureds can make payments, check account status, update account

Quickly and easily manage all your payment needs with a single vendor: IPFS. Our robust platform is capable of handling Payments can be used in combination with or separately from

colors.

See transactions in real-time for better visibility into account activity.

Prebuilt user interface components that allow you to build native

transaction descriptors for your insureds.

*Payments are processed and facilitated by IPFS Corporation’s technology provider and payment facilitator AndDone, LLC.

Kristen Gulson

September is National Preparedness Month where across the nation individuals, businesses, and communities are encouraged to prepare for the unexpected that can come in the form of hurricanes, tornados, fires, earthquakes, severe storms, and other disasters. The Federal Emergency Management Administration is leading the charge at the national level while Tennessee Emergency Management (TEMA), and the Tennessee Department of Commerce & Insurance. Working in partnership with these elements of state government are the Tennessee Chamber of Commerce and the Big I of Tennessee. Together we are working to educate and communicate to citizens, businesses, and communities across Tennessee about the importance of being prepared for disasters and unexpected events.

From an insurance industry perspective, professional independent insurance agents are key in collaborating with their clients to make certain they understand the exposures they face and the solutions available to them to manage and mitigate risk. Clearly, part of the prevention and recovery calculus for individuals and businesses in almost any disaster scenario involves having the right insurance protection and risk management strategies in place.

Perhaps most importantly, it is making certain clients understand their exposure to perils not covered under typical homeowner’s policies such as flood and earthquake for example. In today’s environment due to changing weather patterns, real estate development, and other factors, areas that may not be technically in a flood plain may be prone to flooding now.

At a time when some in the industry might suggest that insurance is a commodity that can simply

be delivered by algorithms, binary code, and a few keystrokes, the consultative services offered by professional insurance agents relative to evolving and complex exposures suggests otherwise. This is specifically true in helping clients understand the exposure they have to floods, earthquakes, and other perils that arise in disasters or catastrophic events. I encourage professional agents who are members of the Insurors of Tennessee to have honest conversations this month and throughout the year with clients who may by vulnerable and exposed to disaster events. It is smart business and more importantly it is the right thing to do.

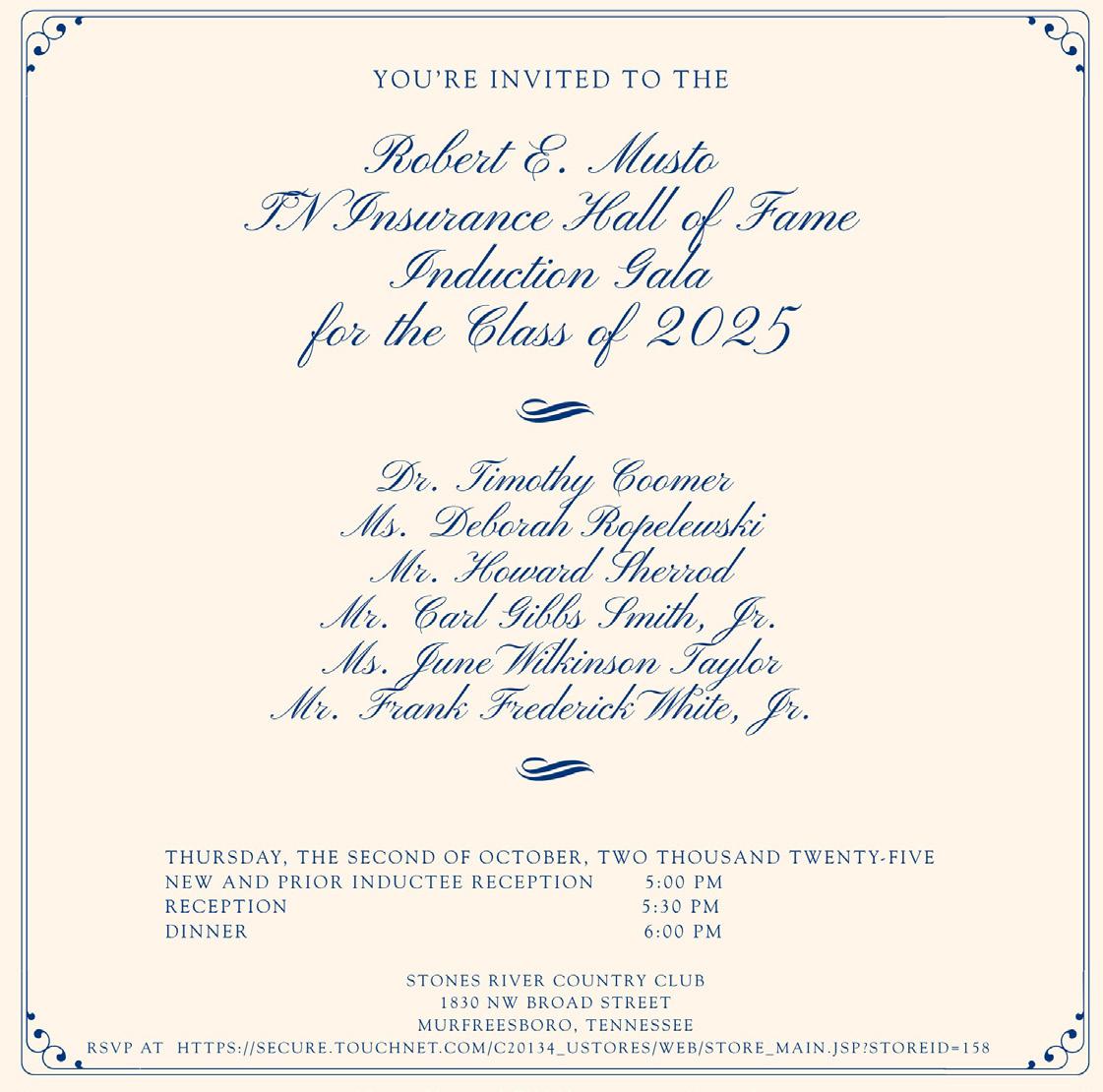

On another note, MTSU’s Robert E. Musto Tennessee Insurance Hall of Fame is holding its Induction Gala for the Class of 2025 on October 2, at the Stones River Country Club in Murfreesboro. Sponsorships are available for the event at the TN Insurance Gala and Sponsorship Page associated with MTSU’s website. You can also access the information via this QR code.

We are proud of the 2025 Class of Inductees who all contributed greatly to the success of the insurance industry in Tennessee and beyond. I would like to specifically recognize June Wilkinson Taylor of Wilkinson Insurance in White House, Tennessee who is one of the inductees. June is and has been an active member of the Insurors of Tennessee for many years. She is a proud graduate of MTSU and was a pioneer as a women owning and running an insurance agency at a time when that was atypical. We look forward to seeing you there!

As most of you are aware, the Insurors of Tennessee Insurefest is just around the corner being held at the Hilton –Memphis Convention Center from October 11-14, 2025. We have a great event planned this year with exceptional speakers, plenty of educational opportunities, great music, good food, and time to reconnect with your insurance industry colleagues from across the state.

If you have not registered yet, we encourage you to do so today. You can visit the Insurors of Tennessee website www.insurors.org and navigate to the Annual Convention page to register. Alternatively, this QR code will take you directly to the information and registration web page.

I am looking forward to seeing you in Memphis! u

Young Agents are a growing and active part of the success of the insurance industry in Tennessee and across the nation. The reality is that there is a passing of the torch from one generation to another in many agencies and organizations as it relates to key members of staff and leadership. Professional independent insurance agencies, insurance companies, and insurance related businesses continue to provide excellent career opportunities to individuals seeking employment.

Jacob (Jake) Haynes is a prime example of someone who took advantage of the career opportunities offered by a professional independent insurance agency in Tennessee. He now serves as a Managing Partner with Sprouse Insurance Group of Dunlap, located near Chattanooga. Jake is a May 2018 graduate of Middle Tennessee State University where he earned a Bachelor of Business Administration degree with an emphasis in marketing. While in college he took advantage of internship and went to work for Insurance Group of America in Franklin. He then accepted a position with the Memphis Grizzlies of the NBA selling tickets to individuals and organizations for the team. While he enjoyed working with a major professional sports franchise and his time in Memphis, the insurance business beckoned.

Jake became aware of a position with the Sprouse Insurance Group and joined the agency in 2019 as a producer, selling insurance to public entities and businesses. It should be noted that the Sprouse Insurance Group has specialized in the public entity space for many years. After learning the unique attributes of the public entities market and the insurance business in general, Jake became a Managing Partner in the business in 2023. Jake has the advantage of learning about the public entity segment of the insurance business from Larry Sprouse who founded the business in 1986 and is widely known as an expert in the public entity insurance space. Larry was instrumental in Jake’s development and is emblematic of the generational transfer of knowledge and leadership in the industry today.

The Sprouse Insurance Group specializes in safeguarding government entities with a commitment to excellence and a

wealth of experience. They take pride in being a trusted partner, offering tailored insurance solutions designed to meet the unique needs and challenges faced by government organizations. With a strategic focus on protecting the public sector, the agency brings a comprehensive understanding of regulatory requirements and the complexities associated with governmental operations. What sets the agency apart is not only specialization in government entity protection but also extensive carrier relationships. These connections enable the agency to manage risks of any scale, from the nuanced intricacies of public service to the challenges faced by large and small businesses.

Today, Jake is seeking to build on the success of the agency by growing their public entities book of business. His knowledge, experience, and commitment to professional development has equipped him with the ability to be a significant asset to any client seeking insurance and risk management solutions.

Jake is married to his wife Morgan who has a bachelor’s degree in speech pathology and audiology from Middle Tennessee State University and a master’s degree in communication disorders from Auburn. Morgan worked as a speech pathologist as an employee post-graduation and founded Haynes Therapy Group almost three years ago focused on providing Speech Pathology services to the North and Middle Georgia market areas.

Jake and Morgan live in Chattanooga and enjoy the many outdoor activities available to them in the area, golf and travelling. They have a daughter Eleanor who is almost two. This November, they are expecting the arrival of a son and excited to become a family of four.

While Jake and Morgan live in Chattanooga, Jake spends about eighty percent of his work week at the Sprouse Insurance Group office in Dunlap, just to the North of Chattanooga.

Jake and Morgan attend Restoration Southside Church in Chattanooga where he is involved in men’s outreach ministry serving the Chattanooga community. u

September 24, 2025 11:00 AM - 12:00 PM (CDT)

The Young Agents Committee in partnership with Imperial PFS bring us a CE approved three part webinar series with Chris Boggs at the Insurors of Tennessee in Nashville. This is a webinar event and links will be sent before each session.

Chris is the president of Boggs Risk & Insurance Consulting (BRIC) with a focus on education, training, risk and claims consulting with insurance agents and insurance carriers, began the practice of insurance in 1990. During his three-anda-half-decade insurance career, Boggs has authored over 2,000 insurance and risk management-related articles on a wide range of topics. Additionally, Boggs has written 15 insurance and risk management books. Boggs is a regular speaker at industry events, having taught or spoken nearly 1,000 times. This includes sessions for the National Association of Mutual Insurance Companies (NAMIC), the National Society of Insurance Premium Auditors (NSIPA), the American Association of Managing General Agents (AAMGA), the Institute of Work Comp Professionals (IWCP), the Chartered Property Casualty Underwriter (CPCU) Society and numerous independent insurance agent state association meetings. He has also earned numerous professional accolades including the 2017 Institute and Faculty of Actuaries (IFoA) Brian Hey Prize and the 2019 Casualty Actuarial Society (CAS) Charles A. Hachemeister Prize as part of a of professional collaboration with a diverse group of professionals.

This CE approved three part series has hand picked topics by our Young Agents Committee and sponsored by Imperial PFS.

Part 1: Extraterritoriality and Reciprocity- When to add a 3.A. State

Date: September 24, 2025

Time: 11am-12pm CST

Part 2: Strong Contractual Risk Transfer Requirements: What Makes the Best CRT Design

Date: November 12, 2025

Time: 10am-12pm CST

Part 3: TBD Date: TBD Time: TBD

Sign up for this educational opportunity at www.insurors. org on the Education page.

n Quick online quoting

n Manage applications and policies online using SFM Agency Manager (SAM)

ACUITY INSURANCE

AF GROUP

AMTRUST

ASSOCIATED INSURANCE ADMINISTRATOR

BERKSHIRE HATHAWAY GUARD INS.

BUILDERS INSURANCE GROUP

CENTRAL INSURANCE COMPANIES

CINCINNATI INSURANCE

EMC INSURANCE

FCCI INSURANCE GROUP

FFVA MUTUAL

FRANKENMUTH INSURANCE

FRONTLINE INSURANCE

GRAHAM -ROGERS INSURANCE

GRANGE INSURANCE

HARFORD MUTUAL

J.M. WILSON

KEYSTONE INSURERS GROUP

SAFEWAY INSURANCE COMPANY

WESTFIELD INSURANCE

ZENITH INSURANCE COMPANY

As summer winds down, Tennessee’s political and policy landscape continues to shift in ways that will directly impact our industry. Here are the key takeaways from this issue’s advocacy update:

• 2026 Governor’s Race: With Governor Bill Lee term-limited, the Republican primary is already underway, featuring U.S. Rep. John Rose and U.S. Sen. Marsha Blackburn.

• Open Congressional Seats: Tennessee’s 6th and 7th congressional districts are in flux following the departures of Reps. John Rose and Mark Green, setting the stage for competitive races that will shape our congressional delegation (with impact on the state house).

• TDCI Spotlight: TDCI celebrated Insurance Awareness Day by highlighting industry growth, including a 41% increase in licensed producers and more than $75 billion in total premium volume written in Tennessee.

• Federal Issues: The Big “I” continues its advocacy on two critical fronts—defending the state-based insurance regulatory system and ensuring small business tax reforms protect independent agencies.

• Key Election Dates: The statewide primary—covering federal and state races including governor and U.S. House—is set for August 6, 2026, with early voting, absentee windows, and candidate filing dates already defined.

With Governor Bill Lee term-limited, the race to succeed him in 2026 is already taking shape. U.S. Rep. John Rose (TN 06; R-Crossville) launched his gubernatorial bid earlier this year, framing his candidacy as a business minded conservative approach to state leadership. U.S. Sen. Marsha Blackburn (R-Brentwood) recently joined the race, setting up a high profile Republican primary.

For Tennessee’s independent insurance agents, this early movement matters. The governor’s office sets the tone on economic development, small business tax policy, and regulatory balance—all of which directly influence the insurance marketplace. And somewhat unique to Tennessee, the Commissioner of Commerce and Insurance is appointed by the governor, rather than popularly elected. Insurors of

Tennessee will continue monitoring the platforms and priorities of the declared and potential candidates as the field evolves.

The deadline for candidates to qualify is March 10. So, more candidates could still join the fray.

The governor’s race isn’t the only contest driving political attention. Tennessee now faces two open U.S. House seats that will generate considerable activity over the next year.

TN-06 (Middle Tennessee): Rep. John Rose’s departure to run for governor leaves an open field. Among the early contenders is State Rep. Johnny Garrett, a Goodlettsville conservative and current House Republican Whip charged with fundraising for the state house GOP. Former Congressman Van Hilleary has also entered the race, bringing both name recognition and prior federal experience. Hilleary most recently served as the Chief of Staff to Rose, giving him some familiarity with the district.

TN-07 (Clarksville and surrounding counties): Rep. Mark Green announced his retirement effective July 20, 2025, triggering a special election. Primaries are set for October with the general election on December 2, 2025. Republican contenders include state Reps. Jody Barrett and Lee Reeves, former Commissioner Matt Van Epps, and local officials; Democrats such as state Reps. Aftyn Behn, Bo Mitchell, and Vincent Dixie are also in the mix.

For independent agents, these federal elections matter because they determine who represents Tennessee in Congress on issues like regulatory authority, small business climate, and tax policy.

The Tennessee Department of Commerce & Insurance (TDCI) used June 28 to recognize Insurance Awareness Day. In a press release, Commissioner Carter Lawrence emphasized the importance of insurance literacy and consumer protection while highlighting the vital role insurance producers play in safeguarding Tennessee families and businesses.

“The insurance industry plays a quiet, if crucial part, in Tennessee’s overall economy, and I am proud to commemorate the work of thousands of hard-working, licensed insurance producers on Insurance Awareness Day,” said TDCI Commissioner Carter Lawrence. “Additionally, today is a good reminder to review your insurance policies, assess your risks, and make sure individuals and businesses have the coverage they need. I encourage Tennesseans to speak with their agent about their coverage needs and want to remind insurance consumers that they can always contact TDCI’s team for assistance.”

The press release also underscored just how central our industry has become to Tennessee’s economy:

• Tennessee now has over 340,000 active licensed insurance producers—a record high and 41% increase from just five years ago.

• Insurance companies domiciled in Tennessee wrote more than $26 billion in premiums in 2024, while all insurers writing business in the state generated over $75 billion, ranking Tennessee #17 nationally by premium volume.

For independent agents, these figures confirm what we see daily: insurance is one of Tennessee’s fastest-growing and most important industries. Beyond policy sales, these numbers highlight the growing influence of independent agents and the critical role we play in consumer education and financial resilience.

TDCI recently shared guidance for families preparing for the school year, including reminders about managing insurance for teen drivers. Parents are encouraged to review coverage options, consider higher deductibles or adjusted physical damage coverage for older vehicles, and explore student-GPA discounts.

Nearly 6 in 10 agents say customers are unaware of how legal system abuse affects their insurance costs. Yet the numbers are staggering:

$366.8 billion

$162.1 billion

$5,135 per year

Legal system abuse leads to:

2026 Election Calendar - Key Dates

Thursday, August 6, 2026 - Primary and General Election

Primary elections will be held for Governor, U.S. Senate, U.S. House, Tennessee Senate (odd numbered districts), Tennessee House, and Republican and Democratic State Executive Committees.

First Day to Pick Up Petitions

Qualifying Deadline

Withdrawal Deadline

Voter Registration Deadline

Early Voting

Absentee Ballot Request Deadline

Friday, January 9, 2026

Tuesday, March 10, 2026,12:00 Noon

Tuesday, March 17, 2026, 12:00 Noon

Tuesday, July 7, 2026

Friday, July 17 – Saturday, August 1, 2026

Monday, July 27, 2026

This election will include key contests such as Governor, the U.S. Senate and congressional races, state legislative primaries, plus local executive and legislative seats.

INDEPENDENT MEMBER AGENCIES PREMIUMS WRITTEN

2020 PROFIT SHARING DISTRIBUTED TO MEMBERS

INDEPENDENT AGENCY START-UPS ASSISTED $400M+ 140+ 20+ 5 $4M $3M

2020 BONUSES DISTRIBUTED TO MEMBERS WAYS TO EARN ON A SINGLE BOOK

Anderson, Bedford, Bledsoe, Blount, Bradley, Campbell, Cannon, Carter, Chester, Claiborne, Clay, Cocke, Coffee, Crockett, Cumberland, Davidson, Decatur, Dekalb, Dickson, Fayette, Fentress, Franklin, Giles, Grainger, Greene, Grundy, Hamblen, Hamilton, Hancock, Hardeman, Hardin, Hawkins, Haywood, Henderson, Hickman, Jackson, Jefferson, Johnson, Knox, Lauderdale, Lawrence, Lewis, Lincoln, Loudon, Macon, Marion, Marshall, Maury, McMinn, McNairy, Meigs, Monroe, Moore, Morgan, Overton, Perry, Pickett, Polk, Putnam, Rhea, Roane, Rutherford, Scott, Sequatchie, Sevier, Shelby, Smith, Sullivan, Tipton, Trousdale, Unicoi, Union, Van Buren, Warren, Washington, Wayne, White, Williamson, and Wilson MEAA

As federal attention turns to regulatory frameworks, the Big “I” continues to champion the state-based insurance regulatory model. Maintaining state primacy ensures Tennessee’s Department of Commerce & Insurance remains the key authority overseeing local insurance markets.

Federal tax discussions are on the upgrade. The Big “I” has published an executive summary outlining how proposed changes—especially to replacement provisions for passthrough entities and the Section 199A deduction—may affect independent agencies. Preserving favorable tax treatment is critical for agency growth and sustainability and the Big I has been critical in these efforts.

From gubernatorial primaries to open congressional races, state recognition of our industry’s growth to federal tax policy shifts, the months ahead are shaping up to be politically meaningful. Insurors of Tennessee is committed to keeping your voice heard across every relevant policy sphere.

This is also a moment to remember the importance of InsurPAC TN, our state political action committee. InsurPAC TN ensures that independent agents maintain a strong presence in Nashville, helping us educate candidates, build relationships, and support policymakers who recognize the vital role our industry plays.

As we head into an especially competitive election season, your support is critical. Every contribution—whether large or small—helps strengthen our collective advocacy voice.

Please consider making a contribution to InsurPAC TN today by visiting www.insurors.org. Together, we are protecting our profession, the clients we serve, and the future of independent insurance in Tennessee.

About the Author—Trey Moore is the government and legal consultant for Insurors. He operates Trey Moore Consulting in Nashville and formerly served as senior public policy counsel for one of Nashville’s largest law firms. Trey has over a decade of experience in representing clients before the Tennessee General Assembly and state government. u

Lifting your business to new heights, with commission and bonus programs

Our business model is designed to support yours. With our transparent National Personal Auto Commission Schedule, you can earn more as you write more business with us. Then, as you grow, you’ll have the opportunity to unlock additional compensation and benefits with our partner programs.

Whichever path you choose to grow your business, we have a way forward and upward.

TO LEARN MORE

Search for us online at Agents of Progressive, Progressive Connect, or Progressive Appointment.

• Athens Insurance Agency

• BFS Insurance Group

• Boxwood Insurance Group

• Builtwell Insurance Agency

• Collier Insurance

• Commercial Insurance Associates

• Full-Line Insurance Agency

• Insurance Group of America

• Insurefit RM

• Martin & Zerfoss

• McDaniel-Whitley, Inc.

• Powell & Meadows

• RSS Insurance

• Sunstar Insurance Group

• Widener Insurance Agency

• Zander Insurance Agency

Every three years, Reagan Consulting and the Big “I” ask insurance companies, state association affiliates, and other industry organizations to nominate agencies they consider to be among the best in the industry for each of the Best Practices Study's revenue categories. Nominated agencies are then invited to participate in the Study by completing an in-depth survey detailing their financial and operational year-end results. These results are then scored and ranked objectively to determine which agencies earn the Best Practices Agency designation. These agencies' results serve as the foundation for the 2025 Best Practices Study and the next 2 years of the Best Practices Study.

For more than 32 years, the Big “I” and Reagan Consulting have studied the most successful independent agencies nationwide, uncovering key financial and operational benchmarks that drive performance.

Whether you’re looking to compare your agency to top performers, adopt proven growth strategies or get recognized as a Best Practices Agency, this study delivers real insights you can apply to strengthen your agency’s future.

The Middle Tennessee State University Musto Tennessee Insurance Hall of Fame is pleased to be hosting the Induction Gala for the Class of 2025. Registration to attend is open until September 15, 2025. You can register via the QR code provided at the right.

Sponsorship opportunities for the event are still available.

This year’s inductees at the Inductee Gala include:

Dr. Timothy Coomer

Ms. Deborah Ropelewski

Mr. Howard Sherrod

Mr. Carl Gibbs Smith, Jr.

Ms. June Wilkinson Taylor

Mr. Frank Frederick White, Jr.

We hope to see you at this celebration of the people who have and continue to propel the insurance industry in Tennessee forward.

Use the QR code for a direct link to event information and registration.

October 2, 2025

Stones River Country Club Ballroom

1830 NW Broad St

Murfreesboro

5:00PM Prior and Current Inductees Reception

5:30PM Reception

6:00PM Dinner

If you have not visited the Big I national website lately, now would be a good time to go to the site and browse through the content. The major new refresh offers professional independent insurance agencies a wealth of information to help drive success at your firm. Please visit https://www. independentagent.com/ at your earliest convenience. u

Running a successful small business is hard work, but finding the right insurance program for your client is easy with West Bend.

Our business insurance program covers liabilities and expenses specifically designed for small business operations.

• Great pricing and exceptional coverage

• Experienced claim representatives

• Convenient options for reporting losses – available 24/7

Learn more about the variety of business line coverages available through West Bend by visiting thesilverlining.com.

Marsh McLennan Agency (MMA), a business of Marsh and a leading provider of business insurance, employee health and benefits, retirement and wealth, and private client insurance solutions across the US and Canada, today announced the acquisition of Robins Insurance, a Nashville, Tennessee-based independent insurance agency. Terms of the acquisition were not disclosed.

Founded in 1976, Robins primarily provides business insurance and personal lines expertise to clients in the region, with niche expertise in real estate, construction, hospitality, community associations, and manufacturing. All Robins employees, including Chief Executive Officer, Van Robins, will remain working out of their existing Nashville office.

“This strategic move allows us to broaden our reach in the Nashville community, a rapidly growing market with flourishing businesses and individuals,” said Peter Krause, President and CEO of MMA’s Southeast region. “We admire the Robins team’s commitment to colleague development and excellent client service. Combined with their deep

industry expertise, they will be a valuable asset for our clients and colleagues."

Mr. Robins said: “Today’s risk landscape continues to evolve, and it requires a unique perspective to truly protect clients from the unexpected. We’re excited to tap into the vast network of MMA’s resources to bring superior solutions to clients in our footprint.”

Representatives from the Town of Henning and the BlueCross BlueShield of Tennessee Foundation recently gathered to break ground on the BlueCross Healthy Place at Henning Park. The BlueCross Healthy Place at Henning Park will provide residents with a gathering space as the community grows.

The BlueCross Foundation is investing $1.44 million in the project, and features will include:

• Inclusive play areas for ages 2-5 and 5-12

• Adult fitness equipment

• Community pavilion

• Sidewalk and Landscaping

“This investment by the BlueCross Foundation will benefit the residents of Henning by providing a healthy outdoor space and serving as a catalyst for the town’s revitalization,” said Isa Reeb, consultant with West TN Planning. “As we engaged the community for the town’s master plan, we saw both the need and the opportunity for parks and youth facilities to help bring Main Street back to its former glory. We are so excited for the residents to have a safe neighborhood park to gather, exercise, and play, and to see a great organization care about their health and wellbeing.”

Established in 2018, the BlueCross Healthy Place program creates and revitalizes public spaces that encourage neighbors to come together, connect with one another and enjoy healthy activity. Since the program launched, its 23 open parks have received more than 3 million visits.

The BlueCross Healthy Place at Henning Park is one of three projects the foundation is supporting in 2025. The others include the BlueCross Healthy Place at Erwin Fishery Park in Erwin and the BlueCross Healthy Place at the Chattanooga Airport.

The 2025 investments total just over $10 million and bring much-needed assets to communities across the state. “Our goal with the BlueCross Healthy Place program has always been to bring people together, in communities of all sizes, all across our state,” said Chelsea Johnson, director of community relations for BlueCross. “Our investment in the BlueCross Healthy Place at Henning Park will help to improve lives in the community and usher in an exciting new era of development for the area — something we’re excited to be part of.”

“There are a lot of great things on the horizon for the Henning area, and we’re glad the BlueCross Healthy Place at Henning Park will be part of the community’s transformation,” added Kevin Woods, BlueCross Memphis market president. “We’re excited to get work underway on this new community space, and we hope it serves the town for years to come.”

Below is just a broad listing If you don’t see what you’re looking for, please contact us.

• General Contractors

• Building Trade

• Services Contractors

• Building Cleaning & Contractors Maintenance Contractors

• Utility Contractors

• Land Improvement

• Construction Material Suppliers Contractors

• Manufacturing

• Pavement Maintenance-Non DOT Distributing

• Wholesale and

* All classes may not be available in all states.

• 24/7/365 loss reporting-including online •

• Accelerated auto and property estimating and repair options •

• “Fast Track” medical only claims handling program •

• Tele-emergent medicine program-connects injured workers to medical care, not “triage” •

Justin Lash, Regional Vice-President 1-855-610-4545 | jlash@berkleysig.com or your Middle Market Underwriter

To date, the BlueCross Foundation has invested $70 million in BlueCross Healthy Place projects throughout Tennessee. There are now 28 projects open or in progress statewide with more on the way.

ICW Group Insurance Companies has again earned a place on the prestigious Ward’s 50 list of top-performing property and casualty insurance companies. Marking the 11th consecutive year—and 19th time overall—the company has been honored for outstanding financial strength and long-term performance.

Each year, Ward Benchmarking, a division of Aon, analyzes the financial results of nearly 3,000 U.S.-based P&C insurers to identify the industry’s top performers. Companies selected for the Ward’s 50 list demonstrate stable financial results in the areas of safety, consistency, and performance over a five-year period. “Being part of the Ward’s 50 for well over a decade is a clear reflection of the extraordinary work and dedication of the entire team at ICW Group,” said Kevin Prior, CEO, ICW Group. “It also underscores the trust

our agents, brokers, and policyholders place in us, and our ongoing commitment to earning it every day.”

Recently, ICW Group announced the launch of ICW Specialty, a new business unit through VerTerra Insurance, ICW Group’s Excess and Surplus lines insurer. “Achieving a place on the Ward’s 50 list reinforces our strong market position as we advance our strategic priorities around growth and diversification of our offerings,” said Mark Moitoso, President, ICW Group. “As we broaden our scope to deliver even greater value to our partners and customers, this accomplishment signals that we’re well-positioned for future success.”

In selecting the Ward’s 50 top performers, AON identifies companies that pass financial stability requirements and measure their ability to grow while maintaining strong capital positions and underwriting results.

In July, Liberty Mutual Insurance published its 2024 Purpose & Impact Report, a comprehensive view of the company’s commitment to helping individuals and businesses embrace

Step by step, shot by shot, decision by decision. Behind every successful agent is a workers’ compensation partner they can trust completely.

today and confidently pursue tomorrow. This annual report illustrates how Liberty Mutual is delivering innovative risk solutions, advancing resilience, and driving positive change in communities around the world.

With nearly 113 years of insurance expertise, Liberty Mutual remains steadfast in its commitment to empowering people and societies through products, services, and investments. The report emphasizes the essential role insurance plays in building resilient economic systems, mitigating risk, fostering security, and enabling progress in an increasingly complex global landscape.

A few of the ways Liberty Mutual brought its purpose to life in 2024 include:

• Enhancing disaster response through innovative parametric insurance solutions that deliver faster payouts.

• Deploying capital through Impact Investing initiatives that support the development and preservation of affordable housing.

• Working to prevent misuse and unfair practices within the legal system to protect policyholders.

• Committing $67 million to support impactful programs addressing homelessness, job training, urban green space restoration, and more.

Earlier this year, Liberty Mutual also published its annual Task Force on Climate-Related Financial Disclosures (TCFD) report, which features more information on its climate strategy.

Acuity announced that AM Best has affirmed the insurer’s Financial Strength Rating of A+ (Superior) with a Stable outlook. This marks the 23rd consecutive year Acuity has earned an A+ Financial Strength Rating.

The affirmation of Acuity’s A+ Financial Strength Rating from AM Best follows a year in which Acuity surpassed $3 billion in revenue for the first time in its nearly 100-year history, reached an all-time high of $7.8 billion assets (GAAP), and grew policyholders’ surplus by over 11% to $3.2 billion (Statutory). The insurer also earned a combined ratio of 98.1 (Statutory).

Acuity’s impressive growth continues to span personal and commercial lines, reinforcing the company’s dedication to expansion while sustaining long-term success. With a

steadfast commitment to stability, growth, and customerfocused service, Acuity continues to set the standard for excellence in the insurance industry.

Acuity also has an A+ Financial Strength Rating from Standard & Poor's (S&P), offering independent agents and customers the financial security of two superior ratings and ranking Acuity in the top 19 carriers nationally based on financial strength ratings.

Arlington/Roe, managing general agent and wholesale insurance broker, is pleased to announce the addition of Todd Tarver as Practice Leader for the company’s newly established Specialty Accident & Health Practice Area. This strategic hire marks a significant step in Arlington/ Roe’s continued expansion into specialized markets, with a focus on delivering comprehensive solutions in the specialty accident and health insurance space.

Todd brings extensive insurance industry knowledge and leadership experience to his new role. With a diverse background spanning underwriting, brokerage consulting, and practice development, Todd has over 25 years of experience in the A&H sector.

He is a graduate of Rutgers University, and his entry into the insurance industry started in IT system testing before quickly transitioning into underwriting. After two years as a broker/ consultant, Todd relocated to the Midwest to open and build an A&H practice for Mercer. Most recently, Todd served as the National Practice Leader for Mercer’s Accident & Health division, where he was instrumental in developing and managing solutions across the Midwest and West regions. Todd is also an active member of the American Special Risk Association.

In his new role at Arlington/Roe, Todd will establish a fullservice accident and travel practice, offering a broad portfolio of products that includes global business travel accident coverage, voluntary and basic AD&D, participant accident plans, out-of-country medical coverage, K–12 student insurance, student study abroad programs, occupational accident coverage and travel assistance services, including both medical and security response. u

Your attorney clients know their firm inside and out. You know your markets and your competitors. At Swiss Re Corporate Solutions, we have the capabilities and the financial strength to meet the risk needs of insureds for Lawyer’s Professional Liability. Whether the risk is basic or complex, we believe there’s only one way to arrive at the right solution. And that’s to work together and combine your experience with our expertise and your strengths with our skills. Long-term relationships bring long-term benefits. We’re smarter together.

By Michelle Aguilar, Agency Performance Partners - firm of Kelly Donahue-Piro, a 2025 Insurfest speaker,

April 14,

2025

Insurance workload distribution challenges can sometimes come out of nowhere. Things are going along, and then bam… we are all backlogged. Now, in some instances, it’s situational (example: the stomach flu runs through your office), and sometimes it’s predictable. We believe at Agency Performance Partners that agency leadership’s job is to identify and predict problems and find solutions. Some workload issues are very predictable.

In our Agency Efficiency Program, we analyze insurance workload distribution and make recommendations on how to create a smooth-sailing environment. One of the key drivers of maintaining a good work environment is managing the workload and workflow.

Too many insurance agencies wing it when challenges arise. However, while most situations in an agency may not be predictable or preventable, they are routine. What do I mean by that? There are a handful of issues you will face every year or every few years. Top agencies have what we call an emergency plan. When the issue comes up, they are ready to ride at dawn—where the competition is scrambling to figure out what to do.

Here are some contingency plans you need to have in place:

• Office problems (electricity, wifi, inability to work at the office)

• Short staffed (illness, termination, someone leaves)

• Claims event (a natural disaster that forces everyone to be in claims)

• Leadership challenges (a leader who has to deal with a personal matter)

• Team medical challenges (a team member who has to deal with a personal matter)

• Carrier pulling out of the market

• Forced rewrites to other paper from a carrier

• Book roll

You need to identify a plan! If it happens, then you dust off the plan and get to town. It’s very hard to think strategically when you are in the middle of everything.

In our Agency Efficiency Program, we study book seasonality to identify when there is a productive season and a slow season. It’s not always crazy! However, what we know in advance, we can prepare for in advance. Too many agencies don’t know their numbers, so they aren’t prepared for a season with heavier renewals. You can find this by reviewing

your expiration report (be careful of 6-month policies — you can only look at 6 months at a time).

Here are some strategies you can adjust for in more productive seasons:

• Staff up 3 months in advance hire new people, VAs, or move roles

• Cross train

• Create a time-off/vacation plan for that time that works

• Modify agency standards during that time

• Limit any necessary meetings or projects

• Have a plan to provide stress relief for your team

Your team desperately wants a plan during the productive season. Be ready and give them one. If you need help, consider our Agency Efficiency Program.

Insurance workload distribution can also start with how books are assigned. Some agencies choose a round-robin method, where everyone picks up and helps whoever calls. Some agencies choose to assign books. We recommend both models. There is no one right way or wrong way.

If you assign books, you need to monitor them. We find that far too often your agency’s most loyal team members have the biggest burden. As time goes on, their book grows, and it becomes very unbalanced. We recommend that you annually review the book sizes and make updates. It’s essential to have a plan each year to keep things even and equal. You can do a few things to redistribute the book. You may want to take the bottom 10% and give them to a newer person or even change the alpha split. What I would not do is ask the account manager. Often, this process can be a bit emotional—it’s hard to choose. Instead, make it clear and factual, make the update, and reorganize the book!

Balancing workload distribution is essential for maintaining a productive and positive work environment in insurance agencies. By implementing contingency plans for predictable challenges, preparing for book seasonality, and regularly reviewing book assignments, agencies can create a smoother workflow and reduce stress on their teams.

Proactive planning ensures your team feels supported, efficient, and ready to tackle both routine and unexpected challenges. Remember, success comes from strategy, not scrambling. Whether it’s reassigning books, adjusting for busy seasons, or having an emergency plan in place, taking control of workload distribution helps agencies thrive.

As we like to say, “A prepared team is a productive team.” Let’s start planning for smooth sailing ahead! u

The Insurors of Tennessee offers education opportunities to member agents across a wide range of insurance specialties that satisfy individuals at many different experience levels. If you are looking to further your career, seeking a professional designation, or need to satisfy continuing education requirements, check out the variety of courses available. Additional course options and details of each class can be found online or by contacting Teresa Durham at tdurham@insurors.org or 615.515.2607.

Register for CISR & CIC at www.insurors.org under education. Classes with (*) have option for in person or webinar event.

11/6 Commercial Property Webinar

(insurors.aben.tv)