Let the Big Dogs Eat. Join top business and community leaders at top-tier courses across the US in the #1 Charity Event In Golf.™

Make a Difference. Earn Rewards. Compete as a foursome or sponsor a local event for a chance to earn rewards, including a trip to the Applied Underwriters Invitational National Finals at Big Cedar Lodge.

Contact an Applied rep at 877-234-4450 or email invitational@auw.com to get started.

Follow us for a shot at even more rewards. Applied Underwriters Invitational® | #BigDogGolf invitational.com

Come Golf With Us Events Nationwide 75+ Golfers Participating 11k+ National Finals One ©2024 Applied Underwriters, Inc. Rated A- by AM Best. | www.auw.com

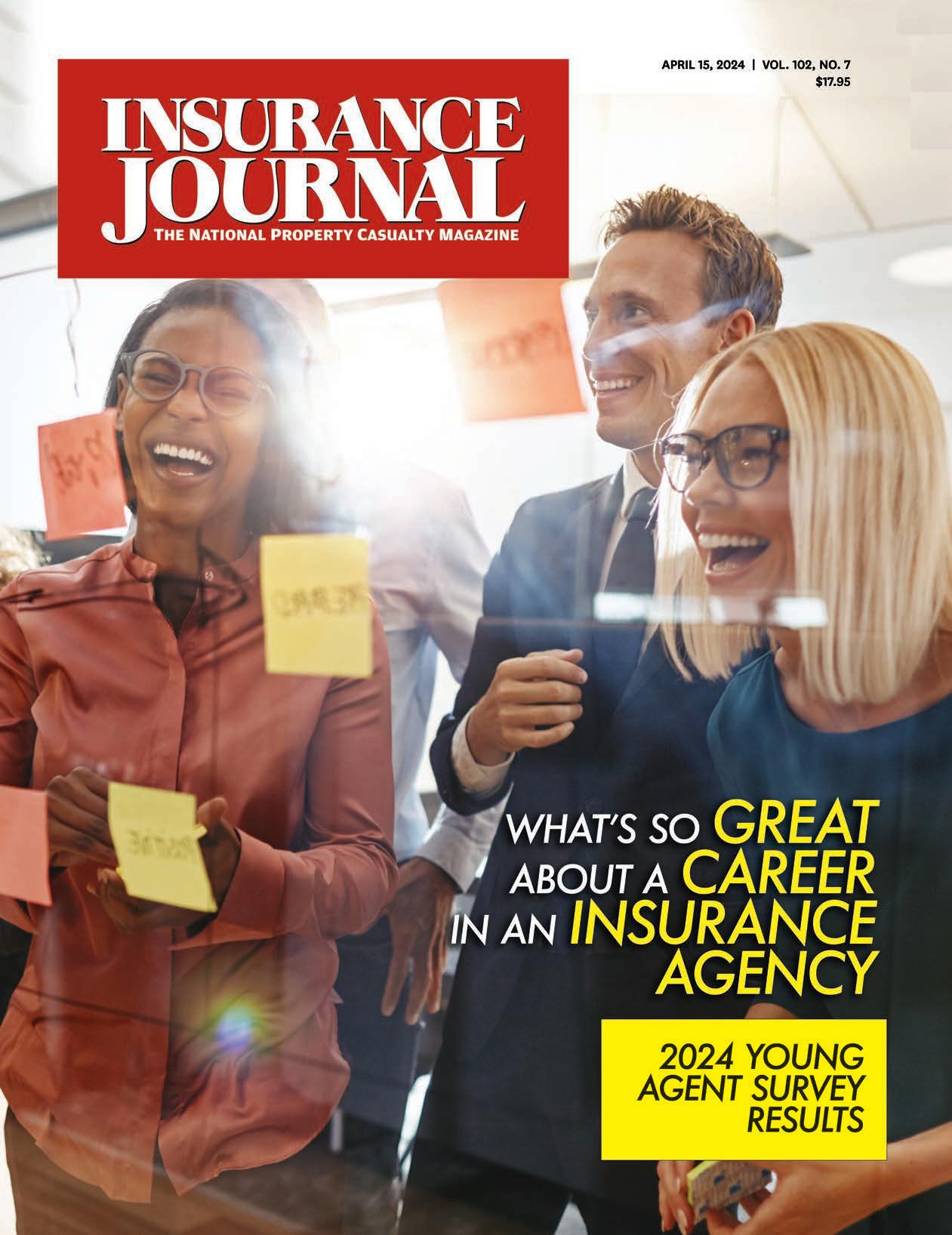

4 | INSURANCE JOURNAL | APRIL 15, 2024 INSURANCEJOURNAL.COM Contents Departments 6 Opening Note 12 Figures 13 Declarations 18 People 20 Business Moves 27 My New Markets News & Markets 8 AIG Sues Newly Launched Dellwood Insurance and Its Founders 10 Chief Risk Officers Say Cybersecurity Most Pressing Risk: Survey 14 The New Norm? Global Insured Losses for Nat Cats Keep Breaking Records: Swiss Re 15 2023 Underwriting Losses Improve but Persist in US P/C Industry 22 Middle-Market Companies Post Record Gains: Chubb Idea Exchange 38 Cyber Risk Strategies to Minimize Business Disruption, Control Liability and Litigation Exposure 40 The Competitive Advantage: Insurance Agency Trust Accounting – More Important than Ever 42 Is It Covered?: Designated Premises, Operations and Projects Endorsements 45 Ask the Insurance Recruiter: Key Attributes to Help You Choose an Insurance Recruiter 46 Weathering the Storm: The Impact of Climate-Driven Risk Reassessments on the Housing Market 48 5 Strategies for Managing Carrier & Client Relationships in a Hard Market 50 Closing Quote: Is IRS Abusing its Authority in Micro-Captives Investigations? Special Report 16 Closer Look: Materiality Matters: D&O Insurers Seek Clarity On SEC Disclosure Rules 24 Spotlight: D&O Risks to Consider When Exploring the New Frontier of Gen AI 28 Special Report: What’s So Great About a Career in an Insurance Agency 28 Special Report: 2024 Young Agents Opinion Survey 34 What Young Agents Think Makes a Good Work Environment 35 What Young Agents Like Most and Least About Their Careers 36 Worst Is Over: Most of Casualty Reserve Hole May Be Filled, Analyst Says April 15, 2024 • Vol. 102 No. 7

THINK AGAIN. Now known as HudsonPro®, our full-service professional lines underwriting and claims handling facility is stronger than ever. Our existing suite of products has been expanded to cover more exposures, from small to large and from conventional to cutting-edge. We proudly serve private companies, non-profits, financial institutions, public companies, groups and individuals, and our seasoned team will craft personalized solutions that fit your needs. When there’s no room for error, THINK HudsonPro.

Admitted coverages underwritten by Hudson Insurance Company and non-admitted coverages underwritten by member companies of Hudson Insurance Group. MANAGEMENT LIABILITY FINANCIAL INSTITUTIONS LIABILITY GENERAL PARTNERS’ LIABILITY PROFESSIONAL LIABILITY MEDICAL PROFESSIONAL LIABILITY CYBER CANNABIS MANAGEMENT LIABILITY Rated A+ by AM Best, FSC XV

HudsonInsPro.com

Opening Note

What Young Agents Want

This issue of Insurance Journal features exclusive results from the 2024 Young Agents Survey where young agents nationwide shared their views on the insurance industry and their experiences as agents. (See page 28 for the full report.)

Optimism overall seems to be struggling among the young agents responding to the survey.

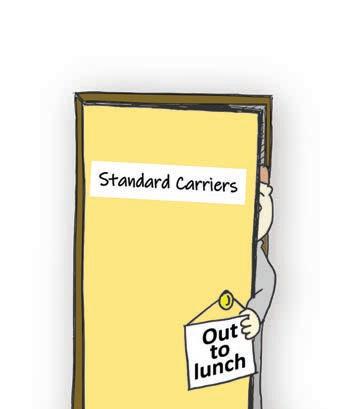

According to the survey’s results, young agents said they felt less optimistic about the future of the agency system as well as their career choice compared to last year’s survey. The tough insurance market may play a role.

According to the survey, 35.0% of the young agents responding to the survey feel that finding new markets for their clients in today’s hard market is their biggest challenge.

“Finding insurance companies that actually write insurance,” “maintaining business based on budgets,” and “rising premiums and finding affordable coverage” were mentioned by young agents as the most pressing challenges today.

One agent wrote: “My markets have been suffering a lot lately …. I don’t have a positive outlook right now for policies and my ability to maintain them, or to get new policies on the books. Prices are high and my insureds and our books are suffering hard because of it.”

Despite their concerns, more than half (55.2%) of young agents reported feeling “very optimistic” that their income will be greater in 2024 than in 2023 with another 28.4% feeling “optimistic” that their income will rise again this year over last year’s.

Like in previous years, young agents overwhelmingly report each year that they would still recommend a career in insurance to other young people entering the workforce, even with their concerns.

“Everyone will always need insurance and it takes no true schooling to become an agent. Once you get your license what you do with it is up to you,” one young agent wrote.

‘Everyone will always need insurance and it takes no true schooling to become an agent. Once you get your license what you do with it is up to you.’

Another added: “It’s a career with endless income potential that can be shaped to look however you want it to look and can mirror passions you have in any field.”

This issue also highlights five successful young agents and why they chose a career in insurance. Each offer advice for other young agents. College, no college, second careers, and opportunities for working parents — their advice is as diverse as the industry.

6 | INSURANCE JOURNAL | APRIL 15, 2024 Write the Editor: awells@insurancejournal.com

Andrea Wells V.P. of Content SUBSCRIPTIONS: Call (855) 814-9547 or visit ijmag.com/subscribe Outside the US, call (847) 400-5951 Insurance Journal, The National Property/Casualty Magazine (ISSN: 00204714) is published 22 times annually by Wells Media Group, Inc., 3570 Camino del Rio North, Suite 100, San Diego, CA 92108-1747. Periodicals Postage Paid at San Diego, CA and at additional mailing offices. SUBSCRIPTION RATES: $17.95 per copy, $27.95 per special issue copy, $195 per year in the U.S., $295 per year all other countries. DISCLAIMER: While the information in this publication is derived from sources believed reliable and is subject to reasonable care in preparation and editing, it is not intended to be legal, accounting, tax, technical or other professional advice. Readers are advised to consult competent professionals for application to their particular situation. Copyright 2024 Wells Media Group, Inc. All Rights Reserved. Content may not be photocopied, reproduced or redistributed without written permission. Insurance Journal is a publication of Wells Media Group, Inc. POSTMASTER: Send change of address form to Insurance Journal, Circulation Dept, PO Box 708, Northbrook, IL 60065-9967 ARTICLE REPRINTS: Contact (800) 897-9965 x125 or visit insurancejournal.com/reprints

Chairman of the Board Mark Wells | mwells@wellsmedia.com Chief Executive Officer Joshua Carlson | jcarlson@insurancejournal.com ADMINISTRATION / CIRCULATION Chief Financial Officer Terry Freeburg | tfreeburg@wellsmedia.com Circulation Manager Elizabeth Duffy | eduffy@wellsmedia.com Staff Accountant Sarah Kersbergen | skersbergen@wellsmedia.com EDITORIAL V.P. of Content Andrea Wells | awells@insurancejournal.com Executive Editor Emeritus Andrew Simpson | asimpson@wellsmedia.com National Editor Chad Hemenway | chemenway@insurancejournal.com Southeast Editor William Rabb | wrabb@insurancejournal.com South Central Editor/Midwest Editor Ezra Amacher | eamacher@insurancejournal.com West Editor Don Jergler | djergler@insurancejournal.com International Editor L.S. Howard | lhoward@insurancejournal.com Content Editor Allen Laman | alaman@wellsmedia.com Assistant Editor Jahna Jacobson | jjacobson@insurancejournal.com Copy Editor Stephanie Jones | sjones@insurancejournal.com Columnists & Contributors Contributors: Elizabeth Blosfield, David Dawson, Matthew Ferguson, James Gammell, Travis Hodges, Brandon D. Hollinder, Esq., Susanne Sclafane, Van Carlson Columnists: Chris Burand, Mary Newgard, Bill Wilson SALES / MARKETING Chief Marketing Officer Julie Tinney | jtinney@insurancejournal.com West Sales Dena Kaplan | dkaplan@insurancejournal.com Romeo Valdez | rvaldez@insurancejournal.com Kelly DeLaMora | kdelamora@wellsmedia.com South Central Sales Mindy Trammell | mtrammell@insurancejournal.com Southeast and East Sales (except for NY, PA, CT) Howard Simkin | hsimkin@insurancejournal.com Midwest Sales Lisa Whalen | (800) 897-9965 x180 East Sales (NY, PA and CT only) Dave Molchan | (800) 897-9965 x145 Advertising Coordinator Erin Burns | eburns@insurancejournal.com Insurance Markets Manager Kristine Honey | khoney@insurancejournal.com Sr. Sales & Marketing Coordinator Laura Roy | lroy@insurancejournal.com Marketing Administrator Alberto Vazquez | avazquez@insurancejournal.com Marketing Director Derence Walk | dwalk@insurancejournal.com DESIGN / WEB / VIDEO V.P. of Design Guy Boccia | gboccia@insurancejournal.com Web Team Lead Josh Whitlow | jwhitlow@insurancejournal.com Ad Ops Specialist Jeff Cardrant | jcardrant@insurancejournal.com Web Developer Terrance Woest | twoest@wellsmedia.com Web Developer Jason Chipp | jchipp@wellsmedia.com Digital Content Manager Ashley Cochrane | acochrane@insurancejournal.com Videographer/Editor Ashley Waldrop | awaldrop@insurancejournal.com ACADEMY OF INSURANCE Director Patrick Wraight | pwraight@ijacademy.com Online Training Coordinator George Jack | gjack@ijacademy.com

more at aig.com

Learn

News & Markets

AIG Sues Newly Launched Dellwood Insurance and Its Founders

By Chad Hemenway

American International Group and a group of its excess and surplus lines subsidiaries have filed suit against Dellwood Insurance Group and three former AIG executives who launched the nationwide E&S lines insurance holding company earlier this year.

According to the lawsuit filed in U.S. District Court in New Jersey, AIG seeks to stop the “unlawful misappropriation of AIG’s trade secrets and confidential information” allegedly committed by Michael Price, Kean Driscoll and Thomas Connolly. AIG is also suing for alleged breaches of contract, breaches of fiduciary duty, unfair competition, and violation of the Computer Fraud and Abuse Act. The insurer is seeking injunctive relief and damages.

$250 million in capital and backed by RenaissanceRe, PartnerRe, Starr Insurance and Central Insurance. Individual investors include Dominic Addesso, David Delaney, VJ Dowling, Jim Hays and principals from Stone Point Capital. Howden Tiger Capital Markets & Advisory served as Dellwood’s financial advisor and Foley & Lardner served as Dellwood’s legal advisor.

Price was AIG’s CEO of North America General Insurance before leaving the company on June 30, 2023. Driscoll, AIG’s former global chief underwriting officer of General Insurance left effective March 3 — after his “garden leave” and just days before the launch of Dellwood was announced, according to the lawsuit. Connolly was formerly chief financial officer of AIG’s North America General Insurance.

middle-enterprise risks.

“This business is directly competitive with those of the AIG E&S Insurers,” said AIG. “AIG was at the forefront of a recent market trend of moving the E&S market from a dual distribution model to a wholesale-only model. AIG developed its own unique and proprietary version of the contract bind process that eliminated the need for hiring a fleet of sophisticated underwriters, a substantial cost. Dellwood appears to have adopted that strategy and, on information and belief, intends to leverage the relevant expertise that Price, Driscoll, Connolly, and other former employees learned at AIG to develop a company that competes against AIG not only in the E&S market but in other segments as well.”

New Jersey-based Dellwood announced its launch in early March with more than

Price and Driscoll are now CEO and CUO, respectively, of Dellwood, formed for P/C wholesale brokers with eye on small- and

According to AIG, Price and Driscoll each have agreements with the insurer that prohibit them from competing with AIG, soliciting customers, disclosing confidential information, or disparaging their former employer. AIG said the duo “breached their obligations to AIG long before their non-competes expired,” and raised capital to start Dellwood by actively marketing the start-up to investors — competing against AIG.

Furthermore, AIG said Price and Driscoll violated agreements not to solicit AIG employees by hiring Connolly. “Worse, Price and Driscoll convinced Connolly to work for Dellwood as a secret agent during at least his final month at AIG, which concluded March 15, 2024,” said AIG, adding that it has evidence Connolly did work for Dellwood while still employed with AIG, sent confidential information to his personal email, and tried to get coworkers to join him at Dellwood.

Insurance Journal reached out to Dellwood for comment but they said that they do not comment on active litigation.

8 | INSURANCE JOURNAL | APRIL 15, 2024 INSURANCEJOURNAL.COM

AM Best A++ Rating I Ward’s Top 50 2001-2018 I 96% Claims Satisfaction I 120+ Niche Industries “ AM Best A++ Rating I Ward’s Top 50 2001-2023 I 95.7% Claims Satisfaction I 120+ Niche Industries Philadelphia Insurance Companies is the marketing name for the property and casualty insurance operations of Philadelphia Consolidated Holding Corp., a member of Tokio Marine Group. All admitted coverages are written by Philadelphia Indemnity Insurance Company. Coverages are subject to actual policy language.

News & Markets

Chief Risk Officers Say Cybersecurity Most Pressing Risk: Survey

By Jahna Jacobson

In an inaugural EY/Institute of International Finance (IIF) global insurance risk management survey, cybersecurity was ranked as the highest concern for chief risk officers.

CROs surveyed said the top five risk types or risk management types for the coming year were:

• 53% – Cybersecurity risk

• 35% – Insurance risk (e.g., underwriting risk, including lapses, catastrophic [CAT] and longevity risk)

• 32% – Business model change/ transformation

• 26% – Credit risk (including country, sovereign and concentration risk)

• 24% – Tied between capital allocation, interest rate risk and technology risk (e.g., risk of inadequate management or maintenance of technology systems, networks, assets and applications)

Human capital risks (22%) also ranked high for the one-year outlook, reflecting a tightening labor market. Overall, 64% of participating CROs said attracting talent will become increasingly difficult in the long term. Third-party risk reflects scarce talent and the industry’s increased connectivity; more insurers seek to access specific capabilities and technologies via ecosystems and alternative sourcing models.

Concerns shift when the view is extended to emerging risks over the next three years, according to survey data from 68 insurance carriers across 15 countries. While cybersecurity risk still tops the list (68%) for all CROs surveyed, the top five concerns are rounded out with more global issues, including geopolitical risk (56%), environmental risk (50%), machine learning and artificial intelligence (43%), and skills shortage/re-skilling of the existing workforce (41%).

Political uncertainty in this U.S. election year heightens the risks; most survey respondents called out geopolitical risks as one of the most pressing over the next

three years. CROs see geopolitical risks mainly in terms of macroeconomic impact (79%), increased cyber warfare (67%) and regulatory changes (64%).

American survey respondents were twice as likely than their European counterparts to expect a focus on GenAI in the next five years. Roughly a quarter of firms have implemented core components of the necessary frameworks to address AI-related risks. Despite a reliance on growing ecosystems and alliances to drive efficiencies (43%) and acquire new customers (59%), almost half (46%) viewed managing third-party cyber risk as a threat to their operational resilience.

While confident managing emerging financial and regulatory risk, less than a quarter (22%) of respondents said they were implementing AI, Gen AI and machine learning. Those adopting AI are doing so pragmatically with guardrails in place — with 50% establishing controls to help ensure the responsible use of AI and ML in decision-making. Respondents cited heighted risk in modeling, including risk of hallucination and explainability, (61%), data privacy (49%) and consumer fairness and algorithmic bias (37%).

More than two-thirds (69%) of CROs surveyed are integrating ESG into their risk management framework, and 87% are incorporating ESG standards into investments. While many CROs feel confident in their organization’s ability to integrate ESG into their decision-making, only 3% of respondents have a complete understanding of their climate-change risk exposure, and just over a third (36%)

stated that climate risk is being integrated into business strategy — although positive action is forthcoming. Over half (53%) cited ESG-related investments and rewarding positive ESG behavior (34%) as the leading products or features with the most growth potential.

Still, 72% of CRO respondents are confident they have the capacity to manage change associated with increased risk, while 74% see budget as their most significant threat to accelerating critical digital transformation strategies.

“Insurance CROs continue to hunt for opportunities to drive growth and reduce the operational risk,” said Isabelle Santenac, EY global insurance leader.

“With record-breaking natural catastrophes in 2023, the pressure on carriers to tackle the increasing multibillion-dollar protection gap is compounded by shrinking budgets and scarce talent to tackle some of the most pressing climate-related disasters our generation has faced.”

Despite operating in a “quicksand environment,” she said, “CROs are meaningfully investing in ecosystems, utilizing AI to tackle the rise in fraud, and mitigating future risk by laying the groundwork to attract talent to an industry teeming with potential.”

Confidence remains despite facing what some call a “polycrisis.”

“Faced with complex risks, rapid technological advancements and resource and talent constraints, our survey results highlight the resilience and adaptability of insurance CROs and their strong commitment to digital transformation,” said Mary Frances Monroe, director, insurance regulation and policy at the Institute of International Finance.

The events of 2023 increased the pace at which insurance carriers have sought to strengthen their front line with risk management practices, with 59% of respondents improving their liquidity management policies, procedures and practices and more than half (56%) updating their asset liability management (ALM) framework, in the last 12 months.

10 | INSURANCE JOURNAL | APRIL 15, 2024 INSURANCEJOURNAL.COM

When you’ve been in business for as long as we have at UFG Insurance, you understand what matters most to your customers. For us, it’s our commitment to delivering deep underwriting expertise with the personal relationships and responsive service our partners and policyholders have come to expect and appreciate from UFG.

Think UFG for new business opportunities today — we deliver what matters most. ufginsurance.com

© 2024 United Fire & Casualty Company. All rights reserved.

INSURANCE MIDDLE MARKET SMALL BUSINESS CONSTRUCTION SPECIALTY E&S SURETY

THINK UFG Deep expertise. Personal relationships. Responsive service.

$10 Million Figures

The U.S. State Department is offering up to $10 million for information on the “Blackcat” ransomware gang who hit the UnitedHealth Group’s tech unit and snarled insurance payments across America. UnitedHealth said it was beginning to clear a medical claims backlog of more than $14 billion following the cyberattack, which caused wide-ranging disruption starting in late February, Reuters reported.

$253,515

The amount in penalties proposed by OSHA against ArcelorMittal Tubular Products USA LLC for failing to protect a 60-year-old employee from severe injuries after they became caught in a pinch point created by a bundle of steel tubes and a rotating roller conveyor in December 2023 at the company’s Shelby, Ohio, facility. ArcelorMittal Tubular Products USA operates manufacturing facilities in Ohio in Marion and Shelby.

20-25

The number of named storms

Accuweather meteorologists are predicting for this year’s Atlantic hurricane season. Accuweather predicts 2024 hurricane season will feature eight to 12 hurricanes, including four to seven major hurricanes. The all-time record of 30 named storms in one season could be broken this year, according to Accuweather.

19%

The average decrease in workers’ compensation insurance loss cost approved by Maine Insurance Superintendent Robert Carey. The new loss costs went into effect for new and renewing policies on April 1. Carey said that if all insurers fully adopt the decrease, Maine businesses could save an estimated $55 million.

12 | INSURANCE JOURNAL | APRIL 15, 2024 INSURANCEJOURNAL.COM

Declarations

Baltimore Bridge Collapse

“While the total cost of the bridge collapse and associated claims will not be clear for some time, it is likely to run into the billions of dollars.”

— Said Matilde Jakobsen, senior director, analytics, AM Best, commenting on the possible impact the collapse of Baltimore’s Francis Scott Key Bridge will have on insurers. The container ship Dali struck the bridge on March 26 after the ship lost power. The ship is owned by Singapore-based Grace Ocean and was chartered by the shipping giant Maersk, according to Bloomberg.

Louisiana Insurance Crisis

“If we don’t enact bold change this session, I believe our ongoing insurance crisis will not just stay the same — it will get worse.”

— Louisiana Insurance Commissioner Tim Temple said, urging state lawmakers to modernize Louisiana’s regulatory framework and address legal system abuse – or risk insurers leaving the catastrophe-prone state. Temple, who took over as state insurance commissioner in January, said insurers and reinsurers have repeatedly told him they have three major concerns for doing business in the state: catastrophe exposure, overregulation and a poor legal environment.

Rite Aid Bankruptcy

“We have reached an agreement on all key points with all key economic stakeholders.”

— Rite Aid attorney Aparna Yenamandra said at a bankruptcy court hearing in Trenton, New Jersey, after the pharmacy chain Rite Aid reached a settlement with its lenders, the U.S. Department of Justice, and drug supplier McKesson Corp. in its bankruptcy case. Before it filed for bankruptcy, Rite Aid faced over 1,600 lawsuits alleging that it ignored red flags and illegally filled prescriptions for addictive opioid medication

Amazon Drivers’ Suit

“Far too often, especially in the emerging gig economy, big and powerful companies like Amazon use the misclassification of employees as independent contractors to deny working people essential workplace rights like minimum wages, overtime pay, and unemployment insurance.”

— Stephanie Bloomingdale, president of the Wisconsin AFL-CIO, commented after the Wisconsin Supreme Court let stand a lower court ruling that declared some delivery drivers for Amazon were employees as the state argued, not independent contractors as the online retail giant contended.

NFIP Discounts Altered

“Without any prior notice, FEMA verbally informed Lee County and some of its municipalities … that it was altering discounts on National Flood Insurance Program (NFIP) premiums that allow residents to save up to 25%, delivering a blow to the community as it continues to recover from the devastation of Hurricane Ian.”

— Reads a statement from Lee County, Florida, officials, after FEMA said some property owners in southwest Florida will face 25% higher flood insurance rates because local officials reportedly allowed subpar rebuilding for flood-damaged homes.

Maui Wildfire Report Delay

“The purpose of this investigation is to make sure that this tragedy never happens again, period.”

— Hawaii Attorney General Anne E. Lopez’s office said in a statement, blaming the delay of the release of a key report into last year’s deadly Maui wildfires on county agencies that forced investigators to issue subpoenas. The Fire Safety Research Institute was selected to provide a scientific analysis of the fire. Its “team encountered unexpected delays when gathering the critical facts for review, which had a direct impact on the rescheduled Phase One report release date,” the AG’s office said.

APRIL 15, 2024 INSURANCE JOURNAL | 13 INSURANCEJOURNAL.COM

News & Markets

The New Norm? Global Insured Losses for Nat Cats Keep Breaking Records: Swiss Re

By L.S. Howard

By L.S. Howard

Global insured losses from natural catastrophes in 2023 exceeded US$100 billion for the fourth consecutive year — an indication of the new norm for nat cat losses, according to Swiss Re.

Other record-breaking numbers for 2023 included the total of insured-loss-inducing catastrophes (which hit a record 142), and the insured price tag for severe convective storms (SCS), which reached US$64 billion for the first time, said the report published by Swiss Re Institute, Swiss Re’s research unit. The report is titled “Natural catastrophes in 2023: gearing up for today’s and tomorrow’s weather risks.”

Although the earthquake in Turkey and Syria was last year’s costliest catastrophe with estimated insured losses of US$6.2 billion, event frequency from severe convective storms was the main driver of 2023’s nat cat losses, said Swiss Re.

The report describes SCS as an umbrella term for a range of hazards including tornadic and straight-line winds, as well as large hailstones.

The report said that 85% of total SCS insured losses originated in the United States and losses are growing the fastest in Europe where they have topped US$5

billion in each of the last three years.

Most of the record-breaking numbers of natural catastrophes were brought by medium-severity events, which Swiss Re defines as events with losses in the range of US$1 billion to US$5 billion. The number of medium-severity events, which can include SCS, has grown by an average of 7.5% each year since 1994, almost double the 3.9% increase of all catastrophes.

“After tropical cyclones, SCS have become the second largest loss-making peril. As with other perils, rising exposures due to economic and population growth, and urbanisation are the main forces driving SCS losses higher,” the report continued.

Hailstorms are the main contributor to insured losses from SCS, responsible for 50%–80% annually of all SCS-driven insured losses, Swiss Re reported, pointing to the example of northern Italy where storms with giant hail stones brought insured damages of US$5.5 billion in 2023.

Global Protection Gap

Last year, economic losses from natural catastrophes reached US$280 billion, meaning that 62% of the global losses were uninsured, amounting to a global protection gap of US$172 billion in 2023,

up from US$153 billion in 2022 and the previous 10-year average of US$134 billion. (Economic losses include all damage, both insured and uninsured.)

Swiss Re noted that global insured losses from natural disasters outpaced global economic growth over the past 30 years.

“From 1994 to 2023, inflation-adjusted insured losses from natural catastrophes averaged 5.9% per year, while global GDP grew by 2.7%. In other words, over the last 30 years, the relative loss burden compared to GDP has doubled,” said a press release accompanying the report.

Swiss Re forecasts that annual insured losses will grow by 5%-7% over the long term, which is in line with actual loss increases over the last 30 years.

“Several factors suggest losses will continue to rise: property exposures continue to grow, especially in areas of already high-value concentrations. Exposure growth also tends to be focused in areas of higher catastrophe risk such as flood plains or on coastlines,” the report said. “So far, the impact of changing climates has been small. However, we expect that the contribution from severe weather and other events will likely rise.

By extrapolating the aforementioned long-term growth trend, we estimate that

14 | INSURANCE JOURNAL | APRIL 15, 2024 INSURANCEJOURNAL.COM

today’s insured losses could double in 10 years.”

Accumulation of Assets in Vulnerable Regions

“Even without a historic storm on the scale of Hurricane Ian, which hit Florida the year before, global natural catastrophe losses in 2023 were severe,” commented Jérôme Jean Haegeli, Swiss Re’s group chief economist, in a statement.

“This reconfirms the 30-year loss trend that’s been driven by the accumulation of assets in regions vulnerable to natural catastrophes. In the future, however, we must consider something more: climate-related hazard intensification,” he added. “Fiercer storms and bigger floods fuelled by a warming planet are due to contribute more to losses. This demonstrates how urgent the need for action is, especially when taking into account structurally higher inflation that has caused post-disaster costs to soar.”

In its conclusion, the Swiss Re report stated: “To better deal with the losses of today and prepare for the weather of tomorrow, loss potential needs to be reduced so that insurance is more affordable, protection gaps are narrowed and the business of insurance remains sustainable. Lowering loss potential requires climate change mitigation, loss reduction, and prevention and adaptation actions to minimise exposure and vulnerability to hazards.”

Other findings from the report include:

• Total insured losses, which include natural catastrophes (US$108 billion) and man-made losses (US$9 billion) were $117 billion for 2023.

• Total economic losses for the year were $291 billion, which comprised natural catastrophes costing $280 billion, and man-made events costing $11 billion.

• The costliest industry event, the earthquake in Turkey and Syria, had insured losses of US$6.2 billion, but given the region’s low insurance penetration, 90% of all property damage was uninsured.

• The Turkey and Syria earthquake was the biggest humanitarian disaster of the year, claiming close to 58,000 lives.

2023 Underwriting Losses Improve but Persist in US P/C Industry

By Allen Laman & Susanne Sclafane

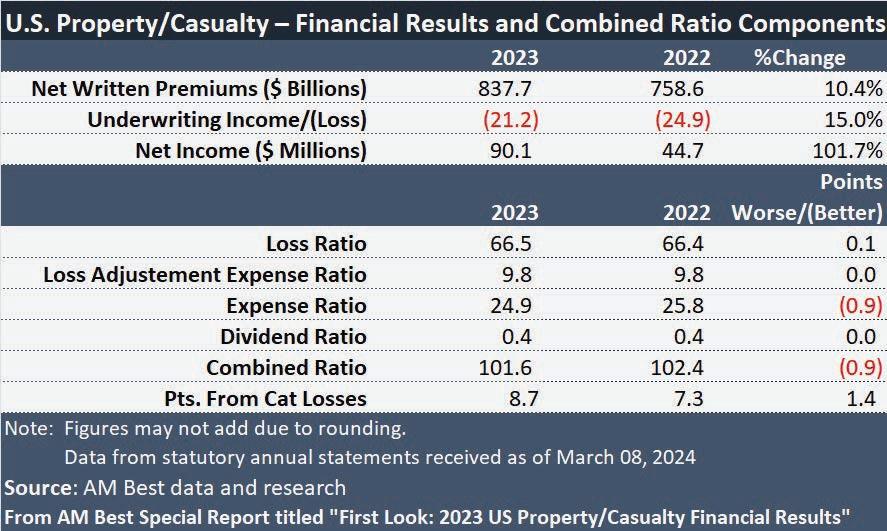

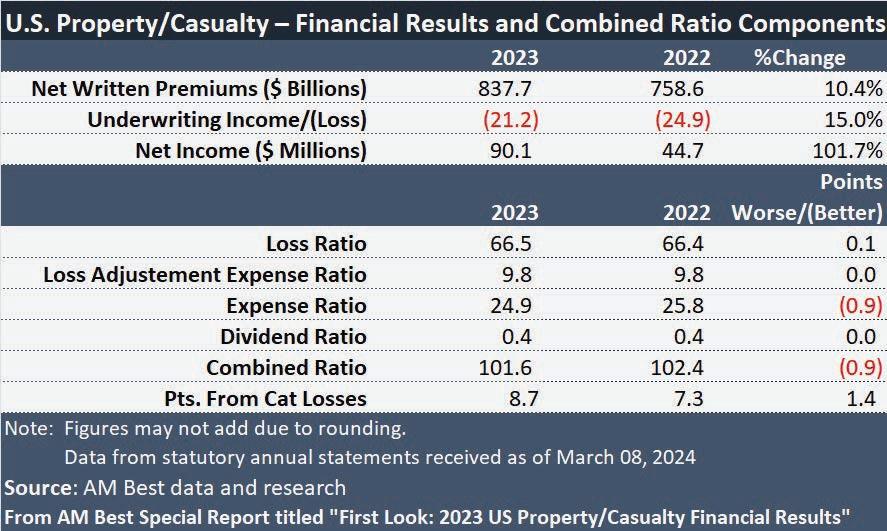

The U.S. property/casualty insurance industry recorded a slight underwriting improvement in 2023, but losses persisted, according to a new AM Best report.

Preliminary data from the global credit rating agency shows that the industry posted a $21.2 billion net underwriting loss last year. That was down from the $24.9 billion underwriting loss recorded in 2022.

AM Best’s figures are derived from annual statutory statements received as of March 8, 2024, and represent an estimated 97% of the total P/C industry’s net premiums written. The numbers show that the P/C industry’s combined ratio improved by 0.9 percentage points to 101.6 in 2023, according to the AM Best’s Special Report, “First Look: 2023 U.S. Property/Casualty Financial Results.”

“Catastrophe losses accounted for an estimated 8.7 points on the combined ratio, up from 7.3 points in 2022, driven by record severe convective storm losses,” AM Best said. “The underwriting loss came despite a 9.9% growth in net earned premiums, as this was countered by a 10% increase in incurred losses and loss adjustment expenses, a 6.4% rise in other underwriting expenses and a 4.5% increase in policyholder dividends.”

Net written premiums jumped 10.4% to $837.7 billion in 2023.

AM Best reported that with net investment income “virtually unchanged” from the prior year, the lower 2023 underwriting loss “boosted pre-tax operating income by 4.8% to $50 billion. A $51.1 billion change in net realized capital gains at National Indemnity Company resulted in net income for the industry more than doubling to $90.1 billion.”

In a previously published report, AM Best wrote that the U.S. P/C industry’s underwriting loss for 2023 reached a 10-year high of $38 billion, with a corresponding combined ratio of 103.7. According to an AM Best spokesperson, the data in the earlier report included third-quarter results and a fourth-quarter estimate based on historical data. The data in the new report is based on yearend filings to date. The spokesperson said the gap (from a P/C underwriting loss of $38 billion in earlier reporting to a loss of $21.2 billion now) might be explained by reserves. Analysts think it is possible that either a majority of P/C companies — or enough of the largest companies — decided they were overly conservative with reserves for prior accident year losses, and may have made significant enough adjustments to these reserves so the year-end total was decreased to a loss of $21.2 billion.

APRIL 15, 2024 INSURANCE JOURNAL | 15 INSURANCEJOURNAL.COM

Closer Look: Directors & Officers

Materiality Matters: D&O Insurers Seek Clarity On SEC Disclosure Rules

By Elizabeth Blosfield

By Elizabeth Blosfield

The U.S. Securities and Exchange Commission adopted final rules almost a year ago in July 2023 requiring public companies to disclose both material cybersecurity incidents and material information regarding their cybersecurity risk management. However, for directors and officers and their insurers, questions remain about how to actually define a material incident.

“What is material?” asked Rita Perez, head of financial lines claims, North America, at AIG. “We don’t know what the answer to that is, and I think that’s where the insurance

industry is struggling too from a coverage standpoint.”

Perez was speaking on a panel about the regulatory landscape and D&O coverage at the Professional Liability Underwriting Society’s 2024 D&O Symposium in New York City.

“I think in my experience since I joined private practice as a reform regulator, what I’m observing is people really struggling with making materiality determinations because it’s not always a quantitative assessment,” said Aliceson Kristina Littman, partner at Willkie Farr & Gallagher LLP. Prior to joining private practice, Littman served as chief of the Crypto Assets and Cyber Unit

in the Division of Enforcement of the SEC, where she said companies were struggling to define the materiality of an incident even prior to the new disclosure rules.

“Certainly, when I was at the SEC and I was talking to defense counsel, we were investigating a company for a failed disclosure, and they would always argue, ‘Oh, well this is a system that’s only used by this one business line, and that business line is a very small part of our revenue,’” she said. “And I would say, ‘I don’t think that matters that much. We’re talking about data relating to children.’ So if it’s a qualitatively material incident because of the nature of the

information that’s compromised, we may still need to make a disclosure. And I think that’s where those assessments just get really tricky.”

Litigation Volatility

The SEC rules, originally proposed in March 2022, not only require disclosure within four days of any cybersecurity incident a public company believes is material in nature, scope, timing and impact, but the rules also require public companies to describe their process for assessing, identifying and managing cyber risk, as well as the likely effects of a cyber incident on their company. This also means that companies will be required

16 | INSURANCE JOURNAL | APRIL 15, 2024 INSURANCEJOURNAL.COM

to describe their board of directors’ and management’s role in overseeing cyber risks.

Erik Gerding, director of the Division of Corporation at the SEC said in December remarks that the aim of the rules is to provide investors with timely, consistent, and comparable information about an important set of risks that can cause significant losses to public companies and their investors.

But the insurance industry sees challenges on the horizon. Jim Rizzo, product leader for U.S. D&O and executive risks at Beazley, predicted last year on The Insuring Cyber Podcast that for D&O insurers, the rules may create potential volatility in the form of litigation.

“I foresee underwriters sounding a little bit more like cyber underwriters in their meetings with the types of questions that we have to ask to get a better foundation and understanding of how our insureds are prepared both pre- and post-event,” he said, adding that companies could likely be scrutinized for their pre-event posture, their post-event disclosures, as well as the handling of the event itself. “All of these critiques will come from the benefit of hindsight, which can result in material litigation expense for our insureds as well as the carriers.”

Littman echoed these thoughts, adding that the SEC is likely to pursue cases against individuals at an increasing rate to drive corporate accountability around these issues.

“I think there’s a general view at the SEC right now among the leadership there that cyber incidents at public issuers — all companies really — are under-disclosed and that

‘What I’m observing is people really struggling with making materiality determinations because it’s not always a quantitative assessment.’

Aliceson Kristina Littman, partner at Willkie Farr & Gallagher LLP.

‘You have sometimes, with large public companies, 10 or 12 different firms involved in defending these SEC investigations, which gets really, really expensive. That just increases the cost astronomically.’

Rita Perez, head of financial lines claims, North America, at AIG.

represented by a different firm and ensuring that they are adequately represented by appropriate defense counsel. These conflicts often cost a lot,” she said. “You have sometimes, with large public companies, 10 or 12 different firms involved in defending these SEC investigations, which gets really, really expensive. That just increases the cost astronomically.”

This means determining adequate coverage is important, she said.

there are more incidents than investors know about and that investors are hearing about,” she said. “This isn’t new, but it’s certainly true of the current administration. This kind of perennial view that individual accountability drives corporate accountability.”

She said more companies are likely to see multiple SEC actions with charges brought against individuals.

“The view is that if you start bringing charges against individuals, you really start to affect change because if individuals think that their own neck is on the line then they might be more inclined to do a better job,” she said. “I do think they’re always looking for individuals. I mean that’s kind of the unfortunate reality, and I

think you’re going to hear a lot of CISOs making sure that their D&O policies are effective.”

Defense Costs

Perez said, however, that liability itself ultimately shouldn’t be the main question from a D&O carrier standpoint. “It’s the defense cost exposure,” she said. “You can easily eat through a primary policy with defense costs alone and probably go up the tower with defense costs alone.”

She said particularly in the regulatory space when an individual’s ability to find future employment or the likelihood of criminal charges is being questioned, cases are typically more heavily defended.

“You have multiple law firms, with each individual

“It’s really important that insureds and CISOs are working closely with their brokers and with their advisors on figuring out what exactly they have purchased,” she said. “It’s less about what coverage they have and more making sure they understand what coverage they have in advance of the issue arising. Because I think what we find in the claims arena is that CISOs often think they have coverage for things that they don’t, and that comes with surprise to them because they’re not thinking about it in advance of the issue.”

Whether coverage is available for a regulatory investigation depends on whether it’s a public or private company form, she said, adding that there is generally not coverage available in a public company form without the purchase of additional coverage or an endorsement. With respect to individuals, either type of policy will generally provide defense cost coverage for the regulatory investigation, she said.

Pre-inquiry coverage is also available, meaning an individual can gain some defense cost coverage from the time they start becoming a target of an

continued on page 23

APRIL 15, 2024 INSURANCE JOURNAL | 17 INSURANCEJOURNAL.COM

People

National

Lockton Re, the reinsurance business of independent insurance broker Lockton, added Brian Lewis as senior broker, leading the Cyber practice for North America. He is based in Lockton Re’s New York office.

Lewis has over 20 years of insurance broking and underwriting experience and was most recently cyber product leader at Zurich North America.

Sedgwick, the Memphis, Tennessee-based provider of claims management, loss adjusting and technology-enabled business solutions, named Emily Fink as its new chief marketing officer.

global head of analytics for financial, professional and cyber products, commercial risk. Ahmed previously led commercial risk data analytics for cyber programs. She is based in New York.

Ben Von Obstfelder has been named head of U.S. casualty analytics for commercial risk. Von Obstfelder, based in Chicago, previously served as director of analytics and innovation within Aon’s North America casualty team for commercial risk.

Farm in 1993 and has served in a variety of executive leadership roles. Farney succeeded Tipsord as president of State Farm Mutual Automobile Insurance Co. on Jan. 1.

Tipsord took the helm of the company in 2015. He began his State Farm career in 1988. He was elected chairman of the board of State Farm Mutual Automobile Insurance in 2016, and will continue to serve as chairman when Farney becomes CEO later this year.

East

Department of Justice administrative prosecutions unit. Since joining the NHID, she has served in various capacities.

California-based independent insurance broker Woodruff Sawyer is expanding its East Coast footprint with the addition of six executives.

Matthew Kelly, Robert Trager, Bob Kempner, Chris Iovino, Eric Wagner, and Michael Rella — who previously were with Acricure’s construction and commercial risk practice — will open Woodruff Sawyer’s first office in New York.

Fink joins Sedgwick with more than 20 years of experience in marketing and brand management. She spent the last 11 years at Liberty Mutual Insurance, most recently as president, Marketing and Distribution. Among her accomplishments at Liberty Mutual was creating the iconic mascots, LiMu Emu and Doug, and the “Liberty, Liberty, Liberty” jingle used in national advertising campaigns.

Aon plc, headquartered in London, named two new leaders in global and U.S. commercial risk.

Arshi Ahmed has been named

Tokio Marine North America, headquartered in Bala Cynwyd, Pennsylvania, promoted Caryn Angelson to executive officer at Tokio Marine Holdings and chief diversity and inclusion officer (CDIO). She replaces Mika Nabeshima who is taking over the role of chief sustainability officer.

Angelson currently serves as deputy CDIO, chief HR officer of Tokio Marine North America Services and chief legal officer.

State Farm Mutual named President Jon Farney as the company’s next chief executive officer. Farney will succeed retiring CEO Michael Tipsord on June 1. Farney joined State

EPIC Insurance Brokers & Consultants (EPIC), headquartered in San Francisco, named Jim Romanelli as executive vice president. Based in New York, Romanelli will focus on growth in the Northeast region.

Romanelli has over three decades of experience in the insurance industry.

The New Hampshire Insurance Department (NHID) promoted Jason Dexter to assistant commissioner and Michelle Heaton to director of life and health. Dexter joined NHID in 2019 as the life and health forms compliance administrator.

Heaton has nearly six years of experience as an attorney in the New Hampshire

The New York team members have backgrounds in construction, bonding, and surety.

The Hartford, headquartered in Hartford, Connecticut, appointed Matthew Massaro head of sales and underwriting for its middle and large commercial businesses’ Northeast division. Massaro has been with The Hartford for over 25 years, most recently serving as regional vice president for the Connecticut and Long Island, New York offices.

Alliant Insurance Services, headquartered in Irvine, California, hired Lou Spina as senior vice president with Alliant Specialty, bolstering the company’s New York-based surety team. The surety industry

18 | INSURANCE JOURNAL | APRIL 15, 2024 INSURANCEJOURNAL.COM

Brian Lewis Emily Fink

Arshi Ahmed

Ben Von Obstfelder

Jon Farney

Michael Tipsord

Jim Romanelli

Jason Dexter

Michelle Heaton

Lou Spina

Matthew Massaro

veteran brings more than 36 years of experience.

Alliant also added Branden Neal as senior vice president on the value-based healthcare solutions team within the employee benefits group. He is also based in New York.

Midwest

Brad Miller to vice president, information technology (IT).

Miller joined Farmers Alliance in 2001 and has held various leadership positions in data and technology. He was promoted to director of IT in 2021 and continues these responsibilities.

member. While his insurance regulatory practice is national in scope, he will primarily work from the Baton Rouge and New Orleans offices.

served as U.S. support manager at TrackMan and as omni sales and operations lead at Dick’s Sporting Goods.

Alliant Insurance Services hired Frank Ross as vice president within its Alliant Americas division.

LAUNCH, headquartered in Omaha, Nebraska, named JT Seger as chief technology officer. Seger’s experience includes being a co-founder at Sequel and a principal software engineer at Maptician and iN2L+LifeLoop.

KrausAnderson Insurance (KA), in Minneapolis, hired Andrew Creary and Joe Tietema as business risk consultants, and Shannon Strom and Nick Swanson as benefits advisors.

Creary comes to KA from Kansas City-based Lockton Cos., where he served as a business and risk consultant.

Tietema previously was a commercial lines advisor for Assured Partners of Minnesota.

Strom recently served as the vice president of growth at Elevate Advisory Group, an employee benefits firm based in Plymouth, Minnesota.

Swanson founded Ezra Insurance Group, an independent health insurance agency.

Farmers Alliance Companies, headquartered in McPherson, Kansas, promoted

Westfield, headquartered in Westfield Center, Ohio, named Stuart Rosenberg to the newly created position of president of standard lines.

With two decades of experience at Westfield, Rosenberg most recently served as enterprise leader for personal insurance, chief innovation and strategy officer, and interim head of commercial insurance.

JM Wilson, headquartered in Portage, Michigan, named Eric Chalus as transportation underwriter.

Chalus joined JM Wilson in 2021 as an assistant transportation underwriter.

South Central

Dallas-based Brown & Riding appointed Bill Stratico national professional liability practice leader.

Stratico has over 35 years of industry experience. He joined Brown & Riding in 2010 as a management and professional liability broker, and most recently served as senior vice president.

McGlinchey Stafford, headquartered in New Orleans, named former Louisiana Insurance Commissioner Jim Donelon, an attorney, as a

Donelon became commissioner in 2006 and was elected to four consecutive terms, ending in January 2024. He also has represented Jefferson Parish in the Louisiana House of Representatives.

Alliant Insurance Services hired April Files as senior vice president within the Alliant Americas division. She is based in Houston.

Files comes to Alliant with more than 24 years of experience as an industry generalist, including her most recent role as senior director of commercial lines at Marsh and previous roles at Arthur J. Gallagher and Lockton Companies.

Southeast

Atlas Insurance has named Jared Hawkins and Michael Howard partners in the Sarasota, Florida-based agency.

Howard is a third-generation insurance agent at the firm.

Hawkins is a second-generation agent who specializes in construction coverage. He has been with Atlas since 2011.

West

Winston Welch joined Crest Insurance Group in its Tucson and Scottsdale, Arizona, offices.

Welch has extensive experience in management and business development, both in the United States and internationally. He previously

Ross joins Alliant with a property/casualty insurance background encompassing risk management, cyber liability, and executive liability. Before joining Alliant, he was senior vice president at USI and senior vice president at Wells Fargo.

Willy Hammond joined the Alliant’s private client division as vice president, senior loss control specialist.

Hammond has 30 years of industry experience and previously served as national director of premier accounts at The Cincinnati Insurance Companies, and as vice president, platinum accounts, risk management services at AIG, private client group.

ICW Group Insurance Companies promoted Paul Zamora to chief underwriting officer.

Zamora joined ICW Group nearly 20 years ago to oversee its workers’ compensation underwriting business. He most recently served as senior vice president of workers’ compensaton underwriting. Zamora has more than 30 years of experience in the insurance and underwriting business.

ICW Group is headquartered in San Diego, California.

APRIL 15, 2024 INSURANCE JOURNAL | 19 INSURANCEJOURNAL.COM

JT Seger

Andrew Creary

Bill Stratico

Jim Donelon

Willy Hammond

Business Moves

National

Risk Strategies, H.W. International Global specialty brokerage Risk Strategies reported it has acquired the U.S. and Canadian operating entities of global insurance holding company, H.W. International B.V.

Based in New York City, Hugh Wood Inc. (U.S.) provides commercial lines, personal lines, and group benefits with a focus on real estate, marine, ports, metals, fine art, international, and Japanese global clients.

Hugh Wood Canada Limited is based in Toronto, Ontario, and is a niche specialty broker focused on complex commercial lines placements and personal asset protection.

HWI expands Risk Strategies’ practice in the commercial marine space, including in developing insurance for global cargo transit and inventory risks, blue and brown water marine hull, liability coverage for vessel owners, and marine liabilities for those clients involved within the marine industry.

HWI also brings specialty expertise to the Risk Strategies fine art practice in a variety of collectibles, including coins and stamps, for a wide range of clients from commercial dealers to private collectors.

The Canadian retail operation adds specialty expertise in several industry and commercial and private lines coverages.

The transaction marks the end of a strategic review, and subsequent sales process, by HWI of its North American operations, which started in 2021.

TAG Financial Institutions Group acted as advisor to HWI.

Risk Strategies has more than 30 specialty practices serving commercial companies, nonprofits, public entities, and individuals. It has more than 100 offices including Boston, New York City, Chicago, Toronto, Montreal, Grand Cayman, Miami, Atlanta, Dallas, Nashville, Washington D.C., Los Angeles and San Francisco.

Dellwood Insurance Group

Michael Price and Kean Driscoll, two former executives with American International Group (AIG) have launched a nationwide excess and surplus lines (E&S) insurance holding company, Dellwood Insurance Group.

New Jersey-based Dellwood will be dedicated to property/casualty wholesale brokers with an emphasis on small and middle enterprise (SME) risks.

Dellwood is backed by RenaissanceRe, PartnerRe, Starr Insurance, and Central Insurance, along with more than $250 million in capital.

Individual investors in the entity include Dominic Addesso, David Delaney, VJ Dowling, Jim Hays, and principals from Stone Point Capital, according to the company’s launch announcement.

Driscoll will serve as president and chief underwriting officer. Driscoll’s background includes serving as CEO and president of Validus Holdings from 2012 to 2019. He spent 2019 to 2023 at AIG in New York as global chief underwriter, global head of reinsurance strategy and global property chief underwriting officer.

Price spent almost five years from 2018 to 2023 at AIG in New York in various roles with General Insurance including CEO, chief operating officer, and deputy chief underwriting officer. Prior to AIG, he spent more than nine years at Arch Insurance in senior positions in underwriting and operations. Earlier in his career, he worked at The Hartford.

Addesso will serve as Dellwood Insurance Group’s non-executive chairman. He currently serves in advisory roles with Clearview Risk Holdings, Core Specialty Insurance Holdings, BMS Re and BMS Group.

Howden Tiger Capital Markets & Advisory served as Dellwood’s financial advisor and Foley & Lardner served as Dellwood’s legal advisor.

East

Alkeme, Wharton Lyon & Lyon

California-based insurance broker

Alkeme acquired Wharton Lyon & Lyon, a retail insurance agency headquartered in Livingston, New Jersey.

Founded in 1912, Wharton Lyon & Lyon is a third-generation insurance agency providing risk management services along with property/casualty, life, health and group insurance. The firm also provides banking and mortgage insurance consulting through a separate division created in 2009

The agency has an additional office in Eatontown, New Jersey.

The executive team includes Bruce Gilson, chairman; Robert Sileno, president; Phyllis Walsh, executive vice president; and Patricia Browne, secretary.

The deal expands Alkeme’s reach on the East Coast. Since its founding in 2020, Alkeme has completed more than 40 acquisitions and currently operates out of 35 locations in 16 states.

Alkeme is ranked by Insurance Journal one of the top 40 largest independent agencies.

Alkeme was formed in 2018 when eight brokerages based throughout southern California left a cluster arrangement to create a new affiliate group. In early 2020, they merged together and found a capital

20 | INSURANCE JOURNAL | APRIL 15, 2024 INSURANCEJOURNAL.COM

partner in private equity manager GCP Capital.

Acrisure

Acrisure has formed a New England region, encompassing its businesses in Connecticut, Massachusetts, Maine, New Hampshire, Rhode Island and Vermont. Acrisure’s New England presence includes 27 office locations, with nearly 400 employees serving more than 57,000 customers.

The company also operates an office in Boston’s Back Bay, home to colleagues working in innovation, marketing and cyber services.

Paul Plunkett will serve as managing partner of the New England region. Plunkett is a Vermont native and former principal with Hickok & Boardman Insurance Group, which joined Acrisure in 2019. He has four decades of industry experience in commercial and personal insurance.

The creation of the New England region is one of the final steps in the company’s unifying all of its acquisitions and businesses under the Acrisure brand, according to Greg Williams, chairman and CEO of Acrisure. The company previously announced the formation of Southeast, Great Lakes, South and West regions.

Headquartered in Grand Rapids, Michigan, Acrisure also has locations in Europe.

Midwest

Plummer Insurance, Classic One Insurance

Plummer Insurance Inc. reported it has acquired Nebraska-based Classic One Insurance from Riverstone Bank.

Classic One Insurance will remain at its current Scottsbluff, Nebraska, location for the immediate future, but will eventually move to Plummer Insurance’s new location in Gering, Nebraska.

Plummer Insurance was established in 1984 by Steve and Helen Plummer. The agency currently has nine locations in western Nebraska and eastern Colorado and offers multiple insurance products, including home, auto, farm, life, health,

crop, bonds, business/commercial, truck, and specialty insurance, by several insurance companies.

Midwest Builders’ Casualty, Waypoint Mutual

Midwest Builders’ Casualty Mutual Co., a large, regional, specialized workers’ compensation insurance carrier, has changed its name to Waypoint Mutual.

Kansas City, Missouri-based Waypoint Mutual has served as a specialized niche workers’ compensation carrier for the last 42 years. The carrier will continue to be headquartered in Kansas City and maintain licenses in 31 states.

The name change aligns with the multi-state reach of the company and its continued expansion beyond the construction market.

Waypoint Mutual will remain a monoline workers’ compensation without changes in coverage, territory, or operational philosophy.

John Crowley, president and CEO of Midwest Builders’ Casualty, said the company will continue its commitment to exceptional service.

South Central

Higginbotham, Glenn Harris & Associates

Fort Worth, Texas-based independent insurance firm, Higginbotham, has doubled its presence in Oklahoma by adding Glenn Harris & Associates.

Glenn Harris & Associates of Oklahoma City was founded by Principal Glenn S. Harris in 1987. The firm provides customers with one-on-one service and education from dedicated teams offering the best available coverage at competitive rates.

Glenn Harris & Associates customizes solutions for each client’s needs from a range of carefully selected carriers. The agency provides all types of personal insurance coverage, such as homeowners’, auto, motorcycle, RV and renters’ insurance, and business insurance solutions, such as commercial property, umbrella, EPLI, errors and omissions, inland marine, and professional liability.

Higginbotham opened its first out-ofstate office in Oklahoma City in 2017.

APRIL 15, 2024 INSURANCE JOURNAL | 21 INSURANCEJOURNAL.COM Hard-to-place healthcare facility? We don’t hide. Find out how we can make “yes” happen. Book a call or get an instant quote. aiu-usa.com

us to o er smart,

healthcare facilities.

Our proven loss control process allows

competitive options for olderframe

News & Markets

Middle-Market Companies Post Record Gains: Chubb

By Allen Laman

Middle-market companies posted record economic growth and revenue gains in the second half of 2023, according to a recent indicator survey by Chubb.

A record 77% of companies reported performance improvement in the last six months of 2023 — the highest total in the 12-year run of Chubb’s joint survey with the National Center for the Middle Market at Ohio State University’s Fisher College of Business. The second half of 2023 marked the fifth consecutive six-month stretch that showed all survey respondents reporting profit increases of more than 12%. This came despite the backdrop of inflationary pressures, cybersecurity threats, natural catastrophes and insurance coverage gaps. Looking ahead, however, middle-market companies anticipate a one-third reduction in revenue growth in 2024.

Favorable momentum surrounding the segment’s growth and investment is not a new phenomenon.

“There are some themes that we’ve picked out, and the one that’s the most prominent, I would say, common in the middle market is [that] this sector tends to reside in this intersection between resilience and [a] good runway,” explained Ben Rockwell, division president of Chubb Middle Market.

Ninety percent of middle-market firms are privately held, Rockwell said, generally allowing them to think about investments and earnings on a longer-term basis than publicly traded companies that operate more on a quarter-to-quarter basis. And, unlike small businesses, those in the middle market companies have scalability.

“You’ve got a third of the private sector GDP in employment really sitting in this middle market space,” Rockwell said. “So, there’s a real scale there where these middle-market firms can make a real economic difference. And, interestingly, a lot of them have multi-national exposures, but not all of them do.”

This means the sector is less exposed to

the global marketplace and less likely to be jolted by geopolitical issues like wars and supply chain problems. The ability to invest in new technologies and innovation at a faster pace also sets the segment apart.

According to the report, employment growth slowed for all sizes of middle-market companies in the second half of 2023, with large companies breaking their uptrend for the first time since 2020. Middle-market companies overall expect employment growth to cool further.

Focus Points

According to the report, middle-market companies do recognize areas where they’re underinsured.

Only 36% of companies reported their multinational insurance needs are covered, and 40% said they are adequately covered for pollution liability. Evolving cyber risks also present a challenge for middle-market companies, which are known to invest and utilize new technology.

“It’s interesting, we saw it in the survey; there are still some coverage gaps, and cyber is actually one of them,” Rockwell said. “We saw in the survey, 47% of the clients said that they were adequately covered. But 52% indicated they needed more or additional cyber coverage.”

He later explained that these firms tend to operate lean. Rockwell underscored the importance of independent agents and

brokers working with clients to not only identify exposures but, more importantly, proactively plan to mitigate risks.

“And that’s not just the insurance programs you put together,” Rockwell said. “But these are really the risk management practices that they help enable in these firms. And I think that, for me, is a really big takeaway here.”

Climate change is on the middle market’s radar. It factors into where leaders choose to locate their businesses, Rockwell said, and it also plays a role in deciding how assets will be protected. Stability in the form of physical property resilience and business continuity planning are on their minds.

“When you see climate and you see catastrophic exposures and perils changing and evolving the way that we do, these firms are thinking about that,” Rockwell said.

Inflation remains a headwind for middle-market businesses, as do recession concerns and workforce challenges such as hiring and retaining talent. As inflation persists, Rockwell explained that Chubb’s research shows middle-market firms continue to value adequate limits and coverage because of the cost of replacing materials and wages.

The report notes that nearly threefourths of companies will consider increasing their insurance coverage in response to higher replacement costs of their assets due to inflation.

“When we talk about inflation and the pressure on costs, really where we’ve seen it is in two main areas,” Rockwell said. “We’ve seen firms continuing to evaluate the limits that they’re carrying on their programs.”

He later added: “The other area is we’re definitely seeing clients take more risk in the form of higher deductibles. So, as you feel that inflation pressure [and] cost pressure, as replacement goods are more expensive, we are seeing clients take higher deductibles as a way to kind of stabilize and manage their pricing as they work through their programs.”

22 | INSURANCE JOURNAL | APRIL 15, 2024 INSURANCEJOURNAL.COM

Closer Look: Directors & Officers

continued from page 17

investigation, she added.

Staying Prepared

Indeed, Rizzo said on The Insuring Cyber Podcast that the best way to avoid these extra expenses is to be prepared, engage experts, and examine the company’s suite of products to ensure there aren’t any coverage gaps. “Hopefully, this will improve the overall cyber posture and risk management practices of our clients,” he said.

Panelists at PLUS D&O echoed these thoughts.

“I’ll say, in practice, I kind of didn’t expect [the rules] to change much,” Littman said. “But I have observed — at

least among my clients when they have an incident, or even when they don’t have an incident but a vendor that they work with has an incident or someone that they provide services to has an incident — I’ve seen an uptick in the internal process around assessing materiality and making sure that, first of all, they’re approaching it from the right mindset because assessing materiality is difficult in these circumstances a lot of the time, but also that they’re documenting it internally (and) appropriately.”

While determining materiality is proving to be a challenge, she said a silver lining is

that these questions are making insurers and insureds think more carefully about the cyber procedures and coverage they have in place to protect themselves.

“[The SEC does] want you to make that determination without unreasonable delay. I don’t think anyone wants to be the poster child for what that means. So I recommend trying hard to figure out if something is material as quickly as you can and determining whether or not to make a disclosure,” she said. “It does make companies a little more introspective and make sure that they have adequate programs in place so that if they’re hit with a cyber incident, they have internal policies to assess the incident, determine the materiality, and assess whether or not they need to make a disclosure.”

Blosfield is the deputy editor of Carrier Management, a sister publication to Insurance Journal.

APRIL 15, 2024 INSURANCE JOURNAL | 23 INSURANCEJOURNAL.COM

Spotlight: Directors & Officers

D&O Risks to Consider When Exploring the New Frontier of Gen AI

Is the world being overtaken by robots? While the answer to that question is clearly “no” — or at least, “not yet” — it seems that the focus of nearly every industry and business media outlet is artificial intelligence. This includes the insurance industry. Everyday life is

By Matthew Ferguson

By Matthew Ferguson

ingrained with AI, such as voice assistants, stock portfolios, news, and advertisements.

These more traditional forms of AI have seamlessly melded into the background of society. The future sits with newer and more advanced forms of generative AI, such as ChatGPT, which can create original content to transform the business world. It can also create new risks along with it.

A February 2024 report from management consultant McKinsey titled, “Beyond the hype: Capturing the potential of AI and gen AI in tech, media and telecom,” suggests that AI will add in excess of $2 trillion to the economy annually.

Accordingly, businesses are in a race to integrate AI into their processes. The risks that arise from the race to automation and machine intelligence will no doubt impact insureds in nearly every industry and sector.

How and Where AI Is Being Used

Most companies are seemingly using AI in some capacity and those numbers are probably understated with each passing day. Businesses are using generative AI to gather, analyze, and synthesize large sets of data that can cut down decision making time and actively assist in corporate

decision making and strategy. Some industries naturally appear to be adopting AI at a higher rate than others. These early adopters may experience higher levels of risk in the near term. For example, consumer goods and retail, tech, financial services, professional services and healthcare each experienced nearly double digit growth in the use of AI in the last several years, according to an August 2023 report by software company Magnifi titled, “Which Industries Are Adopting AI the Most and Least?”

Some of the uses for AI include analyzing data to set prices and manage inventory,

24 | INSURANCE JOURNAL | APRIL 15, 2024 INSURANCEJOURNAL.COM

and James Gammell

monitoring compliance and cybersecurity risk, analyzing submissions including patient data and claims, credit scoring, and even investment decisions. The common theme throughout all industries appears to be analyzing the specific data sets held by companies to produce faster or more accurate outputs to inform strategy and decision making.

This reliance on data analysis leads to potential risks posed by the use of AI. What happens if the data inputs are inaccurate or low quality? Whom does the data belong to and how is it being used? Is data being kept safe? Each of these questions leads to unique risks that companies and individuals will look to their insurers to cover.

The Insurance Risks Posed by AI

One of the biggest likely risks to insurers currently regarding AI is the unknown nature of potential liability. AI’s continued development and improvement and its ever-increasing uses make the extent and sources of liability unclear. With growing interest in this topic, and some risks coming to fruition, the future threats are seemingly becoming clearer for insurers. There is naturally some educated guess work.

For now, significant risk sits with AI developers, in addition to those developing AI systems and products. As such, we can expect more direct actions against AI developers and their directors and officers arising from how the AI products they have created are being used. These lawsuits are likely to take the form of intellectual property and privacy related lawsuits.

For example, generative AI

developers have been faced with copyright and trademark lawsuits arising from data used to train AI models, outlined in law firm K&L Gates’ September 2023 report titled, “Recent Trends in Generative Artificial Intelligence Litigation in the United States.”

The report points to one of the most well-known cases alleging copyright infringement with the use of generative AI: Andersen v. Stability AI Ltd.5. In this case, plaintiffs Sarah Andersen, Kelly McKernan, and Karla Ortiz, on behalf of a putative class of artists, alleged that Stability AI Ltd. and Stability AI Inc. and others scraped billions of copyrighted images from online sources without permission to train their image-generating models to produce seemingly new images without attribution to the original artists.

In February 2023, a trademark lawsuit arose against Stability AI with similar claims. In Getty Images (US), Inc. v. Stability AI, Inc., media company Getty Images Inc. filed suit against Stability AI asserting claims of copyright and trademark infringement. The complaint also claims that Stability AI scraped Getty’s website for images and data used in the training of its image-generating model, Stable Diffusion, with the aim of establishing a competing product or service, according to K&L Gates’ report.

Training AI models can be done with a variety of sources including text, images, or music. Training AI potentially involves types of work protected by copyright laws. A high-profile example is The New York Times lawsuit against OpenAI and Microsoft,

in which The New York Times Co. sued Microsoft Corp. and OpenAI Inc. for the use of content to help develop artificial intelligence services. Privacy lawsuits are being brought based on the same premise, that AI developers are using private information to train their AI models.

‘AI’s continued development and improvement and its ever-increasing uses make the extent and sources of liability unclear.’

Other lawsuits include data privacy from unauthorized facial scanning and libel lawsuits arising from AI hallucinations, a phenomenon in which generative AI creates false information and presents it as true. In some cases, these situations include convincing explanations of where the false information comes from.

These direct risks are expected to expand. More traditional economic pressures may arise, as well. As more AI developers join the frenzy, it is possible that those participants may come under great financial pressures to chase market leaders. Those late entrants and their backers may face multiple risks in a more crowded space.

The new frontier of risks appears to be against companies using AI in their own business. The main foreseeable danger is related to disclosures. Disclosure risks can take two contrary forms — either a lack of disclosure or overselling AI usage, now coined as AI-washing.

Likened to green-washing,

which is when a false impression or misleading information is given about how a company’s products are environmentally sound, AI-washing involves companies touting their use of AI to attract certain investors or attention. The reality may be that the company only uses AI minimally or not at all.

For example, imagine a financial services company advertising its extensive use of AI in its investment portfolio. This sounds like the company is using AI to inform investment decisions. Now suppose the company is actually using AI in investor communications or administrative tasks. A resulting claim could plausibly take the form of a securities fraud case.

In fact, securities class actions and regulatory investigations often stem from lack of or allegedly inaccurate disclosure of information to shareholders. AI-based securities class action lawsuits against companies and their D&Os for failing to fully disclose how they are using AI are likely on the horizon.

Another avenue of potential risk is based on breaches of fiduciary duty and lack of oversight by D&Os. As regulatory and legislative interest in AI increases, the burden on D&Os to understand new regulations and comply with them also increases. Regulatory investigations, and eventually lawsuits, could arise from the failure to comply with certain, and perhaps yet unknown, regulatory requirements. The risk of this increases where companies are racing to implement AI programs for a competitive advantage or perhaps to make up for lost ground. If and when continued on page 26

APRIL 15, 2024 INSURANCE JOURNAL | 25 INSURANCEJOURNAL.COM

Spotlight: Directors & Officers

continued from page 25

companies and their D&Os do rely on AI for processes or decision making, there is a risk AI will get it wrong or produce inequitable, discriminatory, or even absurd results. This is all dependent on the underlying programming and human input.

The issues are compounded by the reality that the AI will repeatedly make the same mistakes over time, leading to larger claims if problems are not identified quickly. Failing to adequately disclose or promptly address those issues can also lead to management liability challenges.

Other categories of risks can include employment-related risks related to hiring decisions and bias that can inadvertently be built into AI models based on historical data. Professional liability cases including lawyers, financial institutions, accountants, or healthcare providers may similarly face risks from relying on AI to cite cases, make investment decisions, or decide a treatment plan either without checking the veracity of the results produced by AI against human knowledge or from being fooled by AI hallucinations.

Examples of AI Risks

Many of the risks posed to insurers and their insureds are unknown and based on educated guesses.

Some of the examples mentioned, such as The New York Times lawsuit against OpenAI and Microsoft, are examples of common lawsuits that D&O and management liability insurers may already see. However, these examples happen to involve AI companies.

Two AI based securities class actions have also recently been filed.

The first was filed in February 2024 against Innodata, a data engineering company that assists clients with the use, management and distribution of their digital data, along with its directors and officers. The lawsuit alleges that the defendants made false and misleading statements about the extent of the company’s use of and its investments in AI. The lawsuit also alleges that rather than being powered by innovative and proprietary AI, the company was actually utilizing low wage offshore workers.

The second class action lawsuit was filed in March 2024

against Evolv Technologies Holdings Inc., a weapons detecting security screening company. Evolv allegedly held itself out as a leader in AI weapon detection and promoted its flagship product as being able to detect firearms, explosives and knives. The lawsuit alleges that Evolv overstated its use of AI or the effectiveness of the security results obtained of the AI. Specifically, Evolv allegedly hid test results showing failures to detect weapons in screening. The lawsuit also alleges that both the FTC and SEC had begun investigations into the company. These types of disclosure-based lawsuits involving AI companies may arise with increased frequency.

Finally, increased regulatory scrutiny is already developing into investigations and actions. This momentum will most likely develop into enforcement litigation concerning representations and disclosures concerning AI.

In March 2024, the SEC announced two settled charges against two investment advisers, Delphia (USA) Inc. and Global Predictions Inc. The two charges asserted that the advisers made false and misleading statements about

their use of AI, both marketing greater use of AI than was actually in place.

AI is becoming more of a risk to D&O insurers even though its current form of disclosure related risks will likely resemble many of the other risks those insurers face in other industries. AI is rapidly changing the business landscape as its growth and reach appear potentially staggering.