Leadership is not about titles, positions, or owcharts. It is about one life inuencing another.

Leadership is not about titles, positions, or owcharts. It is about one life inuencing another.

Wecanallagreethatleadershipstylesseverelyimpactemployee

productivity,inter-departmentalcommunication,andproduct andbusinessdevelopment.Leadersareessentiallymeantto enhanceemployees'commitmenttowardsreachingtheirfullpotentialby achievingavalue-addedsharedvisionwithintegrityandpassion. Theroleofprogressiveandvisionaryleadershipisall-importantwhenit comestonewsectorslikefintech.Leadershipneedstobeabletoenvision thefutureandbeaheadofthecurvewhenitcomestotakingbold businessdecisions.Thefutureofbusinessliesindigitaltransformation, anditrequiresapragmaticleaderwiththeforesighttosettheenterprise ontherightpath.Financialservicesbusinesseshaveundergonemore changeinthelastthreeyearsthaninthelastthreedecades.It'svery importantforpeopleleadingengineeringandproductteamswithin financialinstitutionstorespondquicklytomarketdynamics,underlying technicalchanges,andimprovementstotheirservices.

Leadersalsohavetoshowalotofempathytowardscustomersandtheir needs,whichhasbecomeoneofthemostimportantfactorsinthesuccess ofnewfinancialservicescompanies.Overall,beingresponsibleforother people'smoneyisachallengingtask,andbeingapersonwithalotof integrityandempathyisoftheessence.

Leaderscomeindifferentshapesandsizes,andpeoplefromdifferent backgroundsandexperiencestendtobringuniqueperspectivesonthings. Thefintechlandscapeisevolvingrapidly Weneedpeoplewithmoreand morediverseideasonhowtomakefinancialtoolsuniversallyavailableto empowerpeopletowardstheirindividualprogress.Thisrequiresagood understandingofhowtechnologyisevolvingintermsofpayments, banking,investing,andlending,amongothers.Atthesametime,onealso needsgoodobservationskillstowardconsumerbehaviorandtrends.

Mappingthejourneyofthevisionaryleaderswhoaretransformingthe futureofthefintechsector,InsightsSuccessshedslighton ‘Top Influential Fintech Leaders Redefining the Finance & Banking Industry in 2024.’

Flipthroughthepagesandindulgeyourselfintheodysseyofprolonged excellence.

HaveaDelightfulRead!

Business

08. Khang Pham Ngoc

Redefining the Boundaries of Conventional Banking

18.

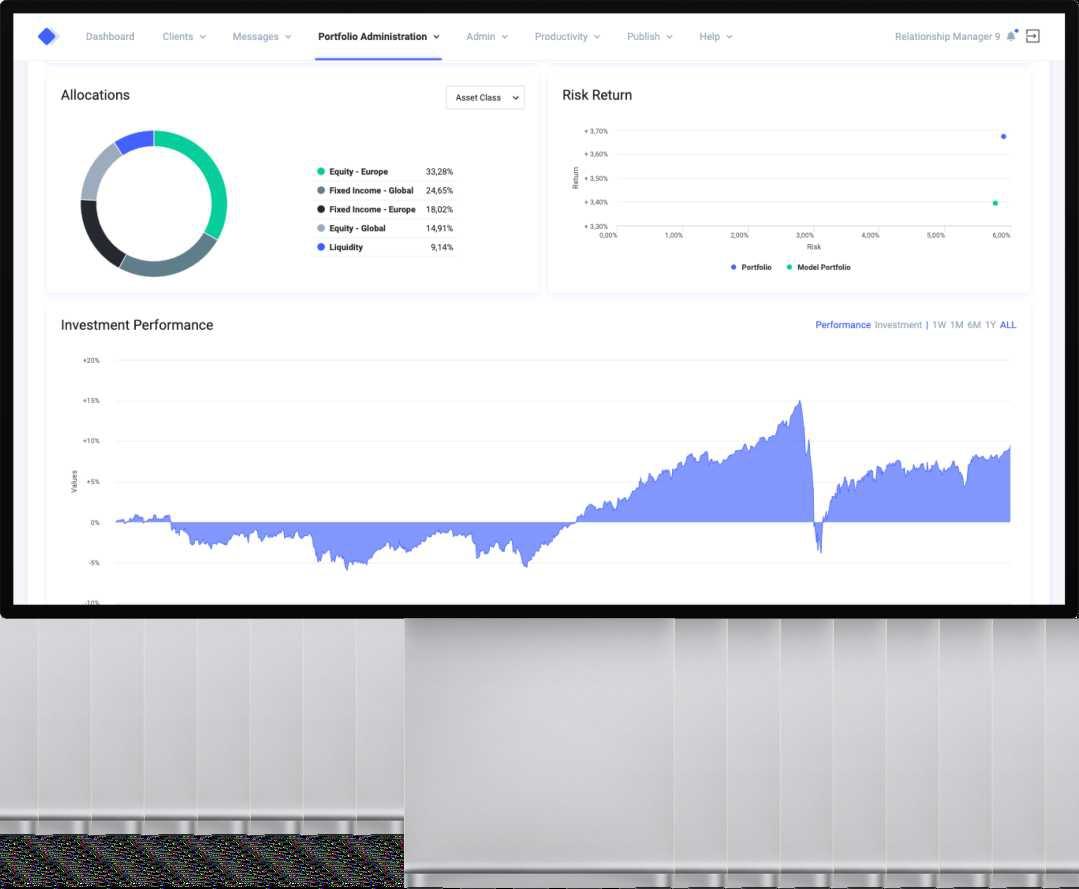

The Right TechnologyPartner for your Digital Wealth and Investment Management

24. Asignio

EmpoweringFinancial Institutions with Secure Autentication Solutions

32. Bank One Limited

A Robust Commercial Bank for the Digital Age

36. FinMKT

EmpoweringCompanies with Best-in-class Technologyfor Scalable Growth

44. FinLocker

KeepingCustomers and Business FinanciallyFit

28. 40. Additiv

Fintech Frontiers

BridgingGapsin the Financial Landscape

Fintech Unleashed

Pioneering the Future of Financial Services

Company Name

Bart Vanhaeren CEO & co-founder

Brian Vieaux President & Chief Opera�ng Officer

Bruce Lowthers CEO and Execu�ve Director

Chris�ne Schmid Head Strategy

David Jarvis Founder & Chief Execu�ve Officer

Julian Mwika Head of Digital Services

Khang Pham Ngoc General Director

Kyle Rutherford Founder & CEO

Luan Cox Founder, Chief Execu�ve Officer

Paul Kawtal CEO

www finlocker.com

www.addi�v.com

www.griffin.com

Bart Vanhaeren is a co-founder of InvestSuite, passionate about delivering innova�ve investment solu�ons that empower financial ins�tu�ons and enhance customer engagement in wealth management.

Brian Vieaux is an opera�ons strategist at FinLocker, dedicated to developing user-centric financial tools that simplify personal finance management and enhance customer engagement.

Bruce Lowthers is a strategic leader at Paysafe, focused on driving growth and innova�on in payment solu�ons to enhance user experiences and support businesses in the digital economy.

Chris�ne Schmid is a strategic leader at Addi�v, driving innova�ve embedded finance solu�ons to empower wealth managers and enhance client experiences in the financial services sector

David Jarvis is a forward-thinking entrepreneur at Griffin, dedicated to building a pla�orm that simplifies financial services and enhances accessibility for businesses and individuals alike.

Julian Mwika is a digital services expert at Bank One Limited, focused on leveraging technology to enhance banking experiences and drive digital transforma�on within the financial sector

Rising from Chief Finance Officer at Home Credit Vietnam to leading one of Vietnam’s most innova�ve financial ins�tu�ons, he is pioneering new fron�ers at the intersec�on of banking and socioeconomic impact.

Kyle Rutherford is a visionary entrepreneur behind Asigno, dedicated to transforming the digital landscape with cu�ngedge solu�ons that streamline processes and enhance user engagement in various industries.

Luan Cox is an innova�ve leader at FinMkt, commi�ed to crea�ng efficient financial solu�ons that empower businesses and individuals to navigate the complexi�es of modern finance.

Paul Kawtal is a dynamic leader at Till Payments, focused on revolu�onizing payment solu�ons to enhance customer experiences and drive business growth across various sectors. InvestSuite www.investsuite.com

The only limit to our realization of tomorrow will be our doubts of today. , ,

- Franklin D. Roosevelt

Khang Pham Ngoc

General Director

Home Credit Vietnam

Finance Company Limited

Top Influential Fintech Leaders Redefining the Finance & Banking Industry in 2024

Financeisaboutfarmorethan justnumbersonabalance sheet.It'saboutdiscovering humanpotentialandcreatinginclusive economicopportunitiesthatempower peopleandupliftcommunities.

Thisforward-thinkingphilosophyfrom

KhangPhamNgoc,GeneralDirector ofHomeCreditVietnamFinance CompanyLimited,captureshis

frontiersattheintersectionofbanking andsocioeconomicimpact.

HomeCreditVietnam’sethoshinges onsustainableandcommunity-driven financialsolutions.Thecompany supportspeopleunderservedby traditionalbanks.Thisalignsdirectly withthegovernment'sfinancial inclusionstrategy,openingdoorsto newopportunitiesforthesecustomers. “Ourmissiongoesbeyondjustoffering financialproducts,”Khangaffirms. “Weempowerourvulnerableand unbankedcustomerstoaccesssimple

Vietnam'sdigital-firstbusinessmodel. Byleveragingcutting-edgefintech capabilities,theteammeetsconsumers onthedigitalplatformstheyfrequent most,offeringcustomizedlending optionstailoredtotheiruniqueneeds andmeans.

Let us learn more about his journey:

ThepathtoHomeCreditVietnam

Khang'sjourneytoHomeCredit Vietnamwasn'trandom,asheharbored avisionforthefuturefromayoung

Atjust12yearsold,heidentifiedhis ambition:BankerorCEO.Thisearly aspirationplantedtheseedthatwould guidehiscareerpath.

ForKhang,thepathtorealizinghis childhooddreamwasnotwithoutits challengesandobstacles.Overthe courseof23years,henavigated throughthefinanceindustry,diligently honinghisskillsandaccumulating invaluableexperiencesalongtheway

BeforereturningtoVietnamtowork forHomeCredit,hehadspentalong careerinvariousfinancial managementandplanning

rolesinFrance.Thisbreadthof experiencehasnotonlyhonedhis skillsasafinanceprofessionalbuthas alsoimbuedhimwithaprofound understandingofbusinessoperations andstrategy.Fromnavigatingthe complexitiesofcorporatefinanceto spearheadingstrategicinitiatives,his multifacetedcareerpathreflectshis versatilityandagilityinadaptingto diverseenvironmentsandchallenges.

However,hisjourneybacktoVietnam andintoconsumerfinancewasn't entirelypreordained.Bychance,his previousmanagersoughtaCFOin

needtoreturntoVietnamforfamily reasons.Thisconfluenceoffateand opportunityledhimtohiscurrent positioninthisindustry,andhehas nowbeenwithHomeCreditVietnam forover6years.

Inhisposition,Khangrecognisesthe profoundsignificanceofnumbersin shapingorganizationalstrategyand execution,andholdsadeep-seated desiretoforgemeaningfulconnections betweenfinancialdataandbusiness objectives–thereforeassumesa

Attheheartofhisroleliesadual mandate:toactasbothadefenderand anenableroftheorganization's financialhealth.Inhiscapacityasa defender,Khangensuresdisciplineand effectivenessinoperationalprocesses. Thisinstillsconfidenceinstakeholders andmitigatesrisks,therebyfortifying thefoundationuponwhichthe organization'ssuccessrests.

Conversely,asanenabler,hecatalyzes innovationandstrategicempowerment, creatingacultureofcontinuous improvementandforward-thinking withintheorganization.

CentraltoKhang'sapproachisafocus onstrikingthedelicatebalance betweenshort-termobjectivesand long-termgoals.Leveraginghis financialacumen,hedeftlyallocates resourcesandcapitaltomaximize returnswhilesafeguardingthe organization'slong-termsustainability Byadoptingastrategiclensthat reachesbeyondimmediategains,he ensuresthateveryfinancialdecisionis alignedwiththeoverarchingvision andmissionoftheorganization.laying thegroundworkforenduringsuccess andprosperity

Hehasalreadydemonstratedanability togobeyondexpectationsby encouragingopencommunicationand collaborativepartnershipswithinternal teamsandexternalstakeholders. Khangcultivatesanenvironmentof trustandmutualrespect,wherediverse perspectivesarevalued,and constructivedialoguethrives.

NavigatingChallenges,Embracing Opportunities:TheFutureof FinanceinVietnam:

Khang'spositionasGeneralDirectorat HomeCreditVietnamgrantshima uniquepositiontoobserveand anticipatethefuturetrajectoryofthe financeindustryinVietnam.Inthis ever-evolvinglandscape,heidentifiesa myriadofchallengesandopportunities thatwillshapetheindustry'scoursein theyearstocome.

Attheforefrontofopportunitieslies Vietnam'srapidlygrowingmiddleclass andtheirincreasingembraceofdigital technologies.Withapopulationthatis becomingincreasinglyconnectedand tech-savvy,themarketpresentsvast opportunitiesforfinancialinclusion anddigitalinnovation.Asconsumers

seekconvenientandaccessible financialsolutions,thereisagrowing demandfordigitalbankingservices andmobilepaymentplatforms,driving theneedforagileandcustomer-centric fintechsolutions.

Moreover,Vietnam'srobust macroeconomicfundamentalsand favorabledemographictrendsfurther bolstertheoutlookforthefinance industry Withayounganddynamic population,coupledwithsustained economicgrowth,Vietnamstands poisedtobecomeakeyplayerinthe globalfinanciallandscape.Asthe countrycontinuestoattractinvestment andencouragesinnovation,thefinance sectorisprimedtoplayapivotalrole indrivingeconomicdevelopment.

However,amidsttheseopportunities, heacknowledgesthepresenceof significantchallengesthatmustbe navigatedtoensuresustainablegrowth andresilience.Onesuchchallengeis theissueofmarketfragmentation, characterizedbythepresenceof numerousplayersoperatinginsilos, oftenresultingininefficienciesand duplicationofefforts.Inafragmented market,achievingscaleandnurturing collaborationbecomesincreasingly challenging,hinderingtheindustry's abilitytorealizeitsfullpotential.

Furthermore,globaleconomic uncertaintiesandgeopoliticaltensions presentadditionalheadwindsforthe financeindustry,posingrisksto stabilityandgrowth.AsVietnam's economybecomesincreasingly interconnectedwiththeglobalmarket, itbecomessusceptibletoexternal shocksandvolatility,necessitating prudentriskmanagementpracticesand strategicforesight.

Despitethesechallenges,Khang remainsresoluteinhisoptimismabout thefutureofconsumerfinanceof HomeCreditandtheeconomyof Vietnamingeneral.

Witharelentlessdrivetoexcellence andafocusoncreatingvaluefor customersandcommunities,Home Creditbelievesthattheindustryhasthe resilienceandadaptabilitytoovercome obstaclesandthriveinthefaceof adversity

ArecentreportbyDecisionLab,in collaborationwithHomeCredit Vietnamhasshownthatdespitethe greaterdemandforconsumercredit andpersonalfinanceproducts,notall consumerscanborrowfrombanks.

Thereportsaysthatthoseonlow incomesmightnothavethepaperwork requiredforabankloan.Aboutathird ofpeopleeitherdonothaveorwould notbecomfortableprovidingtheir labourcontract(31%)orwageslip (33%)aspartofaloanapplication.

Thislackofaccesstoloansis increasingtheappealofcreditcards andbuy-now-pay-later(BNPL)plans. Almosthalf(44%)ofpeopleuseda creditcardoverthelast12months. Meanwhile,BNPLhasamasseda16% shareoftheconsumercreditmarket despitebeingarelativenewcomerto Vietnam.

Consumerfinancecompaniessuchas HomeCreditcanhelptobridgethe gapsinaccesstocreditandfinancial literacy.Unlikebanks,consumer financecompaniescanmakeiteasier forpeopleonlowincomestoaccess creditthroughsimplerapplication forms,fasterapprovalprocedures,and moreconvenientdigitalplatforms.This helpsthemachievetheirdailyfinancial goalstoenablethemtofeelgoodand positiveaboutlife.

Meanwhile,consumerfinance companiesareinapositionto empowerpeopletotakecontroloftheir moneythroughstrengtheningfinancial literacy.Educatingcustomerson

borrowing,budgeting,andsavingcan helpthemavoidirresponsiblelenders andachievetheirlong-termfinancial goalsandavoidbaddebt.

SustainableFinanceforaBrighter Future:

HomeCreditVietnam'smissionisto empowerpeopletolivethelifethey want.Theyachievethisbyproviding accessibleandresponsiblefinancial solutions.Thesesolutions,including servicecashloans,installmentloans formotorbikes,andconsumergoods through16,000points-of-sales nationwide,empowerpeopletopursue theirdreams,achievetheirgoals,and buildabrighterfutureforthemselves andtheirfamilies.HomeCredit Vietnamstrivestomakeameaningful impactinthelivesofitscustomers.

However,thecompany'sobligationto sustainabilitygoesbeyonditscore businessoperationsandputs environmental,social,governance (ESG)attheheartofitscommitment toresponsiblebusinessinVietnam. HomeCreditisalsothepioneering consumerfinancecompanyinVietnam, applyingESGprinciplestoall activities

Forexample,toimprovefinancial literacy,HomeCredithasaccompanied theCommunicationsDepartmentunder theStateBankofVietnamtodevelop theSmartMoneyseriesontelevision andradio.Inaddition,thisdigi-finance companyalsocollaboratedwith Vietnamesefinancialexpertstopublish thebook“NowyouKnow-AGuideof SmartMoneyManagement.”

Tosupportthecommunity,ithas embarkedontheHomeforLife project,inwhichHomeCredithelps womentakecontroloftheirlives.For nearly10years,HomeCredithas coordinatedwithlocalwomen'sunions

todeployloanpackagesaswellas financialandlivelihoodsupport programmesfordisadvantagedwomen inlocalitiesnationwide.Asaresult, hundredsofdisadvantagedwomenand theirfamilieshavereceivedsupportto improvetheirincomeandqualityof life.

Withintheframeworkoftheproject, HomeCreditalsoorganisestraining sessionsonfinancialmanagementand livelihoodskillsforwomenunder HomeCredit'scomprehensivedigital financialmodel.

Moreover,HomeCreditVietnam embracesdigitalizationasameansto enhanceitssustainabilityeffortsand delivergreatervaluetoitscustomers. Byleveragingprogressivetechnologies anddigitalplatformsliketheHome AppandHomePayLater,thecompany aimstostreamlineprocesses,improve efficiency,andenhancetheoverall customerexperience.Fromdigital onboardingandloanapproval processestoonlinefinancialeducation resourcesandmobileservices,Home CreditVietnamisattheforefrontof drivingdigitaltransformationinthe financeindustry.

LedbyKhangPhamNgoc,Home CreditVietnamisdrivingpositive socialimpactin2024byproviding accessibleandresponsiblefinancial solutions.

"Wedothingsrightbyfocusingonthe customer,"emphasizesKhang.This translatestoprioritizingcustomer needsacrossboththeirfinancial servicesandonlineofferings, ultimatelyservingthewell-beingofthe Vietnamesecommunity

Leadership is not about being in charge, Its about taking care of those in your charge.

- Simon Sinek

Top Influential Fintech Leaders Redefining the Finance & Banking Industry in 2024

Thefinanciallandscape,oncearigidtapestrywoven frombrick-and-mortarbanksandpaperstatements, israpidlyunravelingandreweavingwiththreadsof codeandalgorithms.Thistransformation,spearheadedby theaudaciousandagileexplorersofthefintechfrontiers, aimsnotonlytomodernizebutalsotofundamentally bridgethegapingholesthathaverenderedcertain populationsandeconomiesfinanciallyunderserved.

Formillions,navigatingthefinancialsystemfeelslike scalingasheercliffface.Lackofaccesstotraditional bankingservices,limitedfinancialliteracy,andstringent creditrequirementsleavemanystrandedonthefringes, unabletobuildwealth,weatheremergencies,orparticipate intheburgeoningdigitaleconomy.Fintechventures, however,arescalingthesecliffswithinnovativetools, aimingtoextendabridgeoffinancialinclusiontoevery corner

Imagineaworldwhereyourphonedoublesasyourbank, yourwallet,andyourfinancialadvisor.Fintechismaking thisarealitywithmobilemoneysolutions.Inregionswhere bankbranchesarescarce,theseplatformsareenabling unbankedpopulationstosave,send,andreceivemoney throughtheirmobilephones.InKenya,M-Pesa revolutionizedruraleconomies,whileBangladesh'sbKash empoweredwomenwithfinancialindependence.These mobilemarvelsarenotjustbridgingthegeographicalgap;

theyarechippingawayatthestigmaassociatedwith financialexclusion,pavingthewayforgreatereconomic participation.

Accesstocreditisoftenthemissingpieceinthepuzzleof financialwell-being.Traditionalbanks,however,oftenview smallloansasanunprofitablegamble.Entermicro-lending platformspoweredbyfintech.Theseplatformsleverage dataanalyticsandalternativecreditscoringmodelsto assessloanworthinessbeyondtraditionalmetrics.This allowsthemtocatertounderservedcommunities,enabling smallbusinessestoflourish,farmerstoinvestintheircrops, andindividualstofinancehealthcareemergencies.Kiva,in theUS,andZidisha,inAfrica,areprimeexamplesofhow micro-lendingisprovidinglife-changingaccesstocapital forthosewhohavelongbeenignoredbytraditional institutions.

Knowledgeispower,andnowhereisthistruerthaninthe realmofpersonalfinance.However,alackofawareness aboutfundamentalfinancialconceptsleavesmany vulnerabletopredatorypracticesandpoorfinancial decisions.Fintechissteppinguptoilluminatethepathwith financialliteracyinitiatives.Educationalapps,interactive games,andbite-sizedexplainervideossimplifycomplex financialtermsandempowerindividualstomanagetheir moneybetter.PlatformslikeMintandPocketGuardare helpinguserstrackexpenses,understandbudgeting,and

makeinformedinvestmentdecisions,whilerobo-advisors likeBettermentandWealthfrontaredemocratizingaccess toexpertfinancialguidance.

Evenwithinthetraditionalfinancialsystem,biasand discriminationcancreateinvisiblewalls,disadvantaging certaingroupsbasedonfactorslikerace,gender,orcredit history.Fintechisusingitsanalyticalprowesstochallenge thesewallswithAI-poweredalgorithms.Byfactoringin alternativedatapointsandmitigatingunconsciousbiases, thesealgorithmsaimtoprovidefairercreditassessments, insurancequotes,andinvestmentopportunities.While concernsaboutalgorithmicbiasremain,responsible developmentandrobustoversightcanensurethat technologybecomesatoolforfinancialequity,not inequality.

Bridgingthegapsinthefinanciallandscaperequiresmore thanjustinnovativetools;itdemandscollaboration.Fintech partnershipswithestablishedfinancialinstitutionscan leveragethestrengthsofbothworlds.Bankscanprovide theregulatoryframeworkandphysicalinfrastructure,while fintechstartupscaninjectagility,innovation,andcustomercentricity.Suchpartnershipshavethepotentialtocreate hybridmodelsthatservediverseneedsandunlockthefull potentialoffinancialinclusion.

Therapidpaceoffintechinnovationmustbeaccompanied byacommitmenttoethicalpracticesandresponsible growth.Concernsarounddataprivacy,algorithmicfairness, andcybersecurityneedtobeaddressedproactively Regulatoryframeworksmustevolvetokeeppacewith innovation,ensuringconsumerprotectionwithoutstifling creativity.Responsibledevelopmentandethical considerationsarenotroadblocks;theyaretheguardrails thatwillensurethatthefintechrevolutionbenefits everyone,notjustaselectfew

Thefinanciallandscapeisnolongerastaticmap;it'sa dynamiccanvasbeingreshapedbythebrushstrokesof fintechinnovation.Thesedaringfrontiersmenandwomen arenotjustfillinginthegaps;theyarepaintingapictureof amoreinclusive,accessible,andempoweredfinancial

future.Byclosingthechasmsofexclusion,empowering individualswithknowledge,andtacklingthechallengesof biasandethics,fintechhasthepotentialtounlockaworld whereeveryone,regardlessofbackgroundorcircumstance, canfullyparticipateinthevibranttapestryoffinancialwellbeing.Thejourneyisongoing,butthepromiseisclear: throughcollaborativeefforts,responsibleinnovation,andan unwaveringcommitmenttoinclusivity,fintechcantruly bridgethegapsandbuildafinancialfuturethatworksfor everyone.

Success is not how high you have climbed, but how you make a positive difference to the world.

- Roy T. Bennett

Thefinancialservicesindustry,onceshroudedinan auraofformalityandinaccessibility,isundergoing atectonicshift.Attheforefrontofthisrevolution standsfintech,apotentblendoffinanceandtechnology, redefininghowwemanagemoney,borrowfunds,and investforthefuture.Thisunleashedforceisnotmerely disruptingthestatusquo;it’sbuildinganentirelynew landscapewherefinanceisuser-centric,frictionless,and accessibletoall.

Oneofthemosttransformativeaspectsoffintechliesinits abilitytodemocratizefinance.Traditionalfinancial institutions,withtheirrigidstructuresandhighentry barriers,oftenexcludedlargesectionsofthepopulation. Fintechstartups,however,areleveragingtechnologyto bridgethisgap.Mobilebankingappshavebroughtfinancial serviceswithinthereachofeventhosewithlimitedaccess tophysicalbranches.Micro-investingplatformsallow individualstoparticipateinthestockmarketwithmere sparechange.Peer-to-peerlendingplatformsbypass traditionalbanks,connectingborrowersandinvestorsand democratizingaccesstocredit.Thisinclusivityisnotjusta moralimperative;it’salsoaneconomiccatalyst,unlocking thepotentialofmillionswhowerepreviouslyleftbehind.

Forgetwaitinginlongqueuesorfillingoutmountainsof paperwork.Fintechisallaboutfrictionlessexperiencesthat makemanagingfinanceseffortless.Imaginepayingbills, transferringfunds,orapplyingforloanswithjustafew clicksorvoicecommands.AI-poweredchatbotsanswer yourqueriesinstantly,whilemachinelearningalgorithms personalizeyourfinancialproductsandservices.Biometric authenticationeliminatestheneedforcumbersome passwords,addinganextralayerofsecurityand

convenience.Theseseamlessinteractionsnotonlysave timeandfrustrationbutalsofosterasenseofcontroland empowermentoverone’sfinances.

Unlikethelumberinggiantsoftraditionalfinance,fintech startupsarefueledbyagilityandinnovation.Theycan experimentwithnewtechnologies,adapttochanging consumerneeds,andlaunchnewproductsatlightning speed.Blockchaintechnology,forinstance,isbeing exploredtocreatesecureandtransparentplatformsfor cross-borderpayments,remittances,andassetmanagement. Artificialintelligenceisrevolutionizingfrauddetection, personalizedfinancialadvice,andautomatedwealth management.Fintechcompaniesareattheforefrontof thesecutting-edgeadvancements,constantlypushingthe boundariesofwhat’spossibleandensuringthatfinancial servicesremainrelevantanddynamicinthefaceofeverevolvingchallengesandopportunities.

Financialdecisionsaredeeplypersonal,yettraditional banksoftentreatcustomersasone-size-fits-allnumbers. Fintech,however,isusheringinaneraofpersonalized financialservices.AI-poweredalgorithmsanalyzeyour spendinghabits,financialgoals,andrisktolerancetooffer customizedinvestmentportfolios,loanoptions,and insuranceplans.Robo-advisorsprovidepersonalized financialadvicetailoredtoyouruniquecircumstances, democratizingaccesstowealthmanagementstrategiesthat wereoncetheexclusivedomainoftheaffluent.Thisshift towardspersonalizationensuresthatfinancialproductsand servicestrulymeettheneedsofeachindividual,leadingto betterfinancialoutcomesandastrongersenseoffinancial well-being.

Aswithanytransformativeforce,fintechcomeswithits ownsetofchallengesandconsiderations.Dataprivacyand securityareparamountconcernsasfintechcompanies handlesensitivefinancialinformation.Robustregulations arecrucialtoensureconsumerprotectionandprevent systemicrisks.Additionally,therapidpaceofinnovation canbeoverwhelmingforsomeconsumers,anddigital literacyneedstobeaddressedtobridgethegapandensure inclusiveaccesstothebenefitsoffintech.

Thefutureoffinanceisnotaboutfintechreplacing traditionalinstitutions;it’saboutcollaborationandcocreation.Banksandfintechstartupscanworktogetherto leverageeachother’sstrengths-theestablished infrastructureandregulatorycomplianceoftraditional bankscombinedwiththeagilityandinnovationoffintech. Thissymbioticrelationshipcanpavethewayforatruly user-centricfinancialecosystemwheretheneedsofthe individualareplacedattheheartofeverydecision.

Inconclusion,fintechisnotjustabuzzword;it’sa revolutioninthemaking.It’saboutempowering individuals,makingfinanceaccessible,andshapingafuture wheremoneyworksforeveryone.Byembracing innovation,fosteringcollaboration,andensuring responsiblegrowth,fintechhasthepotentialtotransform thefinanciallandscape,unleashingawaveofprosperityand inclusivityforgenerationstocome.Theracetopioneerthe futureoffinancialservicesison,andthosewhoembrace thepoweroffintechwillbetheoneswhoshapethecourse ofthisexcitingandtransformativejourney

Two roads diverged in a wood, and I—I took the one less traveled by, And that has made all the difference.

- Robert Frost

Weareinanerawheretechnologyhas democratizedfinancialservices,giving customersunprecedentedaccesstoinformation, tools,andadvice.However,formanyfinancialinstitutions, it'sanuphillstruggletomaketheirproductscompetitivein thisnewage.

Asaresult,toremaincompetitive,theseinstitutionsare turningtotechnology Andpersonalizationistheholygrail thattheyneedtostayontopoftheircompetition.Buttoget there,they'llneedafreshapproachtousingtechnologyand datatochangetheircultureandworkflows.

FinLockerisonesuchorganizationthatishelpingfinancial institutionstodeliverfinanciallypersonalizedservices.The companyischangingthefaceofpersonalizedfinancing solutionsthroughanappthatgivesclear,concise,and engagingfinancialfitnessinformationinamobile-friendly format.

Inthefollowinginterview,BrianVieaux,Presidentand COO,talksaboutthecompany'sUSP,theneedforgoing mobileinmakingsoundfinancialdecisions,traversingthe pandemic,andhowtheorganizationisusheringintothe studentloanarea in the forthcomingyears.

Pleasebriefouraudienceaboutyourcompany,its UniqueSellingProposition(USPs),andhowitis currentlypositionedasaleadingplayerinthefinancial servicesspace.

FinLockeroffersthenextgenerationincustomer relationship-basedperformancemarketingtoempower mortgageoriginators,lenders,servicers,banks,credit unions,creditcounselors,andhousingadvocacynon-profits toprovidepersonalizedfinancialsolutionsandexperiences fortheircustomersthroughtheFinLockerfinancialfitness app.

FinLockerhaspartneredwithFannieMae,FreddieMac, Microsoft,andconsumerhousingadvocacygroupstohelp

first-timehomebuyersontheirjourneytoachieve homeownership.FinLockerisDay1Certaintyapprovedby FannieMaefordirectsourceassetverification.

Weprovidefinancialinstitutionswithacustom,whitelabeledinstanceofFinLockerwiththeirownbrand,sotheir consumerscanstaywithintheplatformfortheirentire homeownershipjourney Theconsumerdoesn'tneedtouse anyoftheotherdisparateappsonthemarkettobuildand monitortheircredit,managetheirfinances,budget,and savefortheirdownpayment,paydowndebt,andbegin theironlinepropertysearch.

FinLockerprovidesauniqueUSPforeachbusiness category.Forexample,theplatformenablesmortgage lendersandoriginatorstoconnectwithhomebuyersatthe topofthesalesfunnelandprovidesahigh-tech,high-touch solutiontomanagealargerpipelineofhomebuyersand recoverhomebuyersinitiallyturneddownforamortgage.

ThetoolsintheFinLockerplatformpreparehomebuyers foramortgageandhomeownershipandenablethe homebuyertoinitiateamortgageapplicationdirectlyfrom theappwiththeirlenderoncetheyhaveachievedmortgage readiness.Thisservicecontributestoanincreasedleadto loanpull-throughrateformortgagelendersandoriginators.

Oncehomebuyersbecomehomeowners,theycontinueto usetheirsponsoringmortgagelendersormortgage

servicer'swhite-labeledFinLockertomonitortheircredit, managetheirfinances,monitortheirhomeequity,andnet worth.FinLockerprovidesavaluableengagementplatform thatenablesfinancialinstitutionstocreatecustomersforlife andcross-selladditionalfinancialproductsviatheapp.

Whatothersolutionsdoesyourcompanyoffer,andhow arethesemakinganimpactontheindustryandyour clients?

Improvingthecrediteligibilityofourclients'consumers canhelpthemimprovetheireligibilitytoachievemultiple financialmilestones.Financialinstitutionswhousethe FinLockerplatformtostayconnectedwiththeirconsumers canhavetheopportunitytoserveandprofitfrom15 financialtransactionswithina10-yearperiodfromthe typicalconsumer:homepurchase,homeinsurance(annual), homewarranty,autoloan,autowarranty(annual),credit cards,refinance,homeequitylineofcredit(HELOC),debt consolidation,andanotherhomepurchase.

Beinganexperiencedleader,sharewithusyouropinion onwhatimpacthastheadoptionofmoderntechnologies suchasAI,bigdataandmachinelearninghadonthe financenicheandwhatmorecouldbeexpectedinthe future?

Theadventofthesefeaturesandfunctionswithtoolslike AIandtheanalysisofbigdataandmachinelearninghas createdamuchmoreintuitive,streamlinedmortgage processforconsumersgoingthroughthefinancialservices process,regardlessoftheloanproduct.Icomefroma mortgagebackground,andI'vewatchedlargemortgage companiesandmortgagetechprovidersfocusonhelping streamlinethemortgageapplicationprocess,whichrequires alotofdatagatheringfromtheirconsumers.

OnespecificareaforFinLockerishowconsumer permissioneddirectsourcedatahasaidedassetdata collectionandverification.Byenablingconsumerstolink theirbankaccountsinsidetheirFinLockeraccount,the transactionaldatafromthosebankaccountscanbeusedto makecreditandlendingdecisions,asopposedtothe traditionalwayofprovidingastackofbankstatementsto theirlender

Anotherexamplewherewe'recontinuingtoseeexpansion isgoingbeyondtransactionalassetdatabyenabling consumerstolinktheirownpayrolldata,similartohowa consumerusingapersonalfinancialmanagementapp wouldconnecttheirbankaccountstoseeaholisticviewof

theirfinanciallife.FinLockerispreparingtoempower consumersalsotolinktheirpayrolldata.

Imagineaworldwhereconsumersarewalkingaroundwith anappontheirphonethat'sdigitallylinkedinreal-time,not onlytotheirfinancialtransactionaldatabutalsotheir incomeandemploymentdata.Weseeaworldwhere consumers,fromapushofabutton,cannotonlyapplyfor aloan;itcouldbeanautoloan,astudentloan,acreditcard, oramortgageloan,andbeapprovedinstantlybasedonthis directlysourceddata.

Takingintoconsiderationthecurrentpandemic,what initialchallengesdidyoufaceandhowdidyoudrive yourcompanytosustainoperationswhileensuring safetyofyouremployeesatthesametime?

TheCovid-19pandemicimpactedFinLockerinmanyways andcontinuestodoso.FinLockerisadigitalnative,asina fullydigitalbusiness.Atthestartofthepandemic, FinLockerrefocusedthecompany'sprioritiestoprovide safetyforourteambyimplementingaremoteworking environment,whichalsoaddedagilitytoourhiringand staffingprocess.Knowingthatwecouldsustainoperations andproductdevelopmentinaremoteworkingenvironment, overthepast12months,wehavecastawidernettoattract toptalenttofillvariouspositionsinallcompany departments.

Asafintechcompanyservingthemortgageindustry,digital transformationisabusinessimperative.Thepandemic impactedproductdevelopmentontheFinLockerappand ourgo-to-marketapproaches.FinLockeradjustedits productroadmaponwhenandhowwelaunchnewfeatures tocalibratewithourclient'spriorities,especiallyinlightof theextraordinaryrefinanceandoriginationvolumes experiencedbyourmortgagebankerandoriginatorclients.

Whatwouldbeyouradvicetobuddingentrepreneurs whoaspiretoventureintothefinancialservicesspace?

Buddingentrepreneurswhoaspiretoventureintothe financialservicesspacehavetwoopportunities.Theycan trulyinnovatebycreatinganewcategoryfortheirnew Fintechventurebydevelopingthenextgenerationfinancial servicessolution.Theyshouldstartbyidentifyingthe variousproblemsconsumershavethatrelatetotheir financesandhowtechnologycanhelpsolvethose problems,orataminimum,alleviateorlessenthose problems.

Theotherareawheremostnewbusinessestendtoexcelis takingacurrentsolutionforaproblemandmakingthat solutionbetterorfaster,orsomecombinationthereof. That'soneofthethingsthatwe'vedoneatFinLocker Initially,wedidn'treallycreateanewcategoryperse.

However,weunderstoodthefrictionthatconsumersfacein thetraditionalmortgageapplicationprocess,andthe FinLockerplatformhasmovedforwardfromthere.This conceptofleveragingconsumerpermissioneddataand lettingconsumersleveragetheirowndatainawaythatthey haven'tbeenabletobeforebyusingittoinitiatefinancial transactions.

Howdoyouenvisionscalingyourcompany'soperations andofferingsin2022?

FinLockerisaB2B2Cplatform,soscalinghappensintwo ways.Thefirstwaytoscaleistoaddmorecustomersby addingmorebusinessesthatwilldistributetheFinLocker platformtotheirconsumers.Wehavearobustpipeline withinthemortgagevertical,specificallylargemortgage lenderswhoareintheimplementationstagewithour productandwillbegindistributingtheirwhite-labeled FinLockerstotheircustomersandprospectsoverthenext 90days.That'sgoingtosignificantlyrampupouruserbase intermsofconsumersusingtheFinLockerplatform.

Secondly,wecontinuetolookattheFinLockerappasa holisticconsumerfinancialexperience,sowe'recontinually reviewinghowtoaddtoolsandfeaturesintotheappto solveconsumerproblems,whichalsoaddsvaluetoalender providingtheapptotheirconsumers.So,whilewefocus todayonmortgages,we'relookingatotherareastohelp solveproblems.

There'samassivepopulationofconsumerswhoareeither creditinvisibleorcreditlightthatneedhelpeithercreating acreditprofileorexpandingtheircreditprofiletoimprove theircreditscore.That'snotjustamortgageusecase.

Thatbroadlyappliestoconsumerstobenefitthemfor relatedfinancialserviceslikebuyingautoandhome insurancethataresomewhatpricedbasedonaconsumer's creditscore.We'vegotanotherfocusinthestudentloan areatohelpconsumerswithstudentloandebtswhomaybe eligibletoreducetheirpaymentsthroughadigital experiencethatwecanprovide.

Success consists of going from failure to failure without loss of enthusiasm.

- Winston Churchill