www.x.com/insightssuccess

Theimportanceofcomplianceinwealthmanagementcannotbe

overstated.Compliancereferstotheadherencetolaws,regulations,and guidelinesthatgovernfinancialpractices.Asfinancialmarketsbecome morecomplex,integratingcomplianceintowealthmanagementsolutionsis essentialforprotectingbothclientsandfirms.

Tosuccessfullyincorporatecompliance,wealthmanagementfirmsmustfirst assesstheregulationsthatapplytotheiroperations.Thisincludesunderstanding local,national,andinternationalregulations.Bystayinginformedaboutthese laws,firmscanensurethattheirpracticesalignwithcurrentexpectations.

Technologyplaysasignificantroleinthisintegration.Advancedsoftwarecan automatecompliancemonitoring,makingiteasiertotracktransactionsand identifypotentialrisks.Thesetoolsenablefirmstomaintaindetailedrecordsand generatereportsthatdemonstrateadherencetoregulations,encouraging transparencyandaccountability

Additionally,educatingemployeesaboutcomplianceiscrucial.Regulartraining programscanhelpstaffunderstandtheirresponsibilitiesandtheimplicationsof non-compliance.Aculturethatprioritizesethicalpracticesnotonlyprotectsthe firmbutalsobuildstrustwithclients.

Toputitbrifely,integratingcomplianceintowealthmanagementsolutionsis vitalfornavigatingthecomplexfinancialenvironment.Byleveragingtechnology andemphasizingeducation,firmscancreatearobustcomplianceframework. Thiscommitmenttoadherenceensuresthelong-termsuccessofboththefirmand itsclients,establishingafoundationoftrustandprofessionalisminthewealth managementindustry

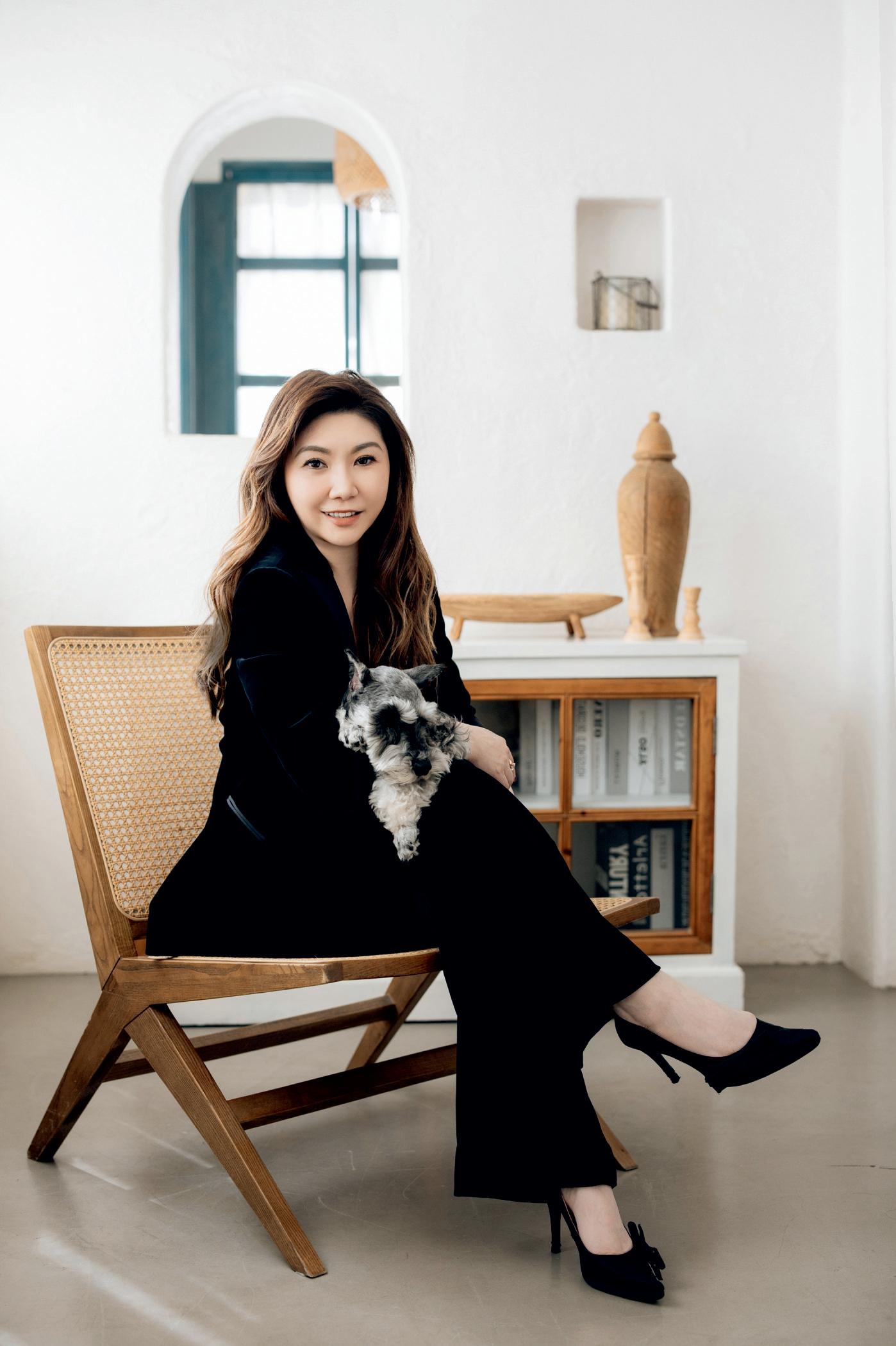

Inthelatesteditionof Insights Success,titled"TheMostInfluentialWomanto Followin2024,"KenixRosieChanshinesasaprominentfigureinthefinancial industry.Withdecadesofexperienceinlegalandcompliancerolesatleading financialinstitutions,shehasdevelopedaremarkablecareerdedicatedto navigatingintricateregulationsandensuringthatorganizationsremainproactive inthefaceofchallenges.Yet,beneathherimpressiveachievements,acompelling desireemerged,onethaturgedhertotransitionfromherback-officepositionto takeamoreprominentroleattheforefrontofcapitalmarkets.

Haveagreatreadahead!

Kenix Rosie Chan Balancing Regulatory Adherence with Growth Strategies in Finance

Key Considerations for Regulatory Compliance in Finance

to Integrate Regulatory Compliance into Growth Plans

Kenix reflects on a challenging hypothetical scenario involving a cybersecurity breach at a mid-sized financial institution.

Kenix Rosie Chan Chief Partner and Executive Director, Asset Management, Private Equity and Venture Capital

Capital Global Company Limited

Everyaccomplishment,bigorsmall,beginswitha single,courageousdecision,thedecisiontotakethe firststep.It’sthatleapintotheunknown,fueledby faithinyourself,thatsetsthefoundationforsuccess.Think aboutthepioneersofinnovation,thecreatorsofart,orthe buildersofempires.Noneofthemhadguarantees,butthey hadonethingincommon:thewillingnesstoactdespite uncertainty.Thefirststepisneveralwaysperfect;it’s messy,challenging,andoftenscary.Butit’salsothemost important.

ForKenixRosieChan,thisdecisioncameasshe approachedher40thbirthday Withdecadesofexperience inlegalandcompliancerolesatleadingfinancial institutions,shehadbuiltanimpressivecareernavigating complexregulationsandensuringorganizationsstayed aheadofchallenges.Butdeepdown,shefeltthepull towardsomethinggreater,adesiretomovefromabackofficeroletotheforefrontofcapitalmarkets. ThisdriveledhertoestablishRainForestCapitalGlobal CompanyLimited,whereshenowservesasChief PartnerandExecutiveDirector.RainForestCapitalwas bornoutofhervisiontoprovidecomprehensiveinvestment servicesforfamilyoffices.Itreflectshercommitmentto blendingexpertisewithinnovationtohelpfamilies safeguardandgrowtheirwealth.

Underherleadership,RainForestCapitaloffersaholistic approachtoassetmanagement.Supportedbyateamof seasonedprofessionals,eachwithover15yearsof experienceintopfinancialinstitutions,thefirmspecializes indiversifyingassets,mitigatingrisks,andensuring seamlesswealthtransferacrossgenerations.Beyond investments,RainForestCapitalextendsitsservicestotax planning,trustmanagement,andlegaladvisory,creatinga one-stopsolutionforfamilyofficeneeds.

Kenix’sjourneyfromlegalexperttoindustryleaderisan exampleofhercourageandvision.Herstoryremindsus thatit’snevertoolatetotakealeapoffaithandredefine success.WithRainForestCapital,she’snotjustmanaging wealth;she’shelpingfamiliesbuildlegaciesthatlast.

Let us learn more about her journey:

KenixRosieChan:ALeaderinFinanceand Compliance

Withanimpressiveeducationalbackground,sheholdsan MBAinfinancefromtheUniversityofManchesterandgot

herlegalqualificationinUKaswell.Hercareerspansover 20yearsinlegalandcompliancerolesacrossvarious prestigiouscorporations,includingPingAnAsset ManagementofHongkong,AvivagroupLtd,HSBC Singapore,PteLimited,etc.

BeforeshefoundedRainForestCapital,shepracticedin legalandcomplianceforover20years,andduringherlegal andcomplianceyears,shewasengagedintheseniorroles ofvariousreputablecorporations,includingPingAnof ChinaAssetManagement,PingAnofChinaSecuritiesHK, PingAnofChinaCapitalHK,PingAnofChinaFutures HK,HSBCFuturesSingaporePteLimited,AvivaPortfolio InvestmentServicesLimitedandAvivaLifeCompany InsuranceLimited,SunLifeFinancialHongKong,Maples andCalders,Linklaters,WooKwanLee&Lo,LilyFenn& Co.,PrimeInvestmentsHoldingsLimited(MainBoardof theStockExchangeofHongKong),etc.

Throughherwork,sheaspirestomakeasignificantimpact inthefinancesectorwhilefosteringinnovationand compliance.

Kenix'stransitionfromlegalandcompliancetostructuring financialvehicleswasdrivenbyherextensiveexperiencein thefinancialsector.Overtwodecades,sheobservedthe difficultiesfamiliesfacedinnavigatingcomplexregulatory environments.Whileadvisingclientsoncomplianceissues, sherecognizedanopportunitytohelpthemnotonly complybutalsothrivefinancially.

Apivotalmomentoccurredduringadiscussionwitha familyofficestrugglingtostructureinvestmentsamid increasingregulatoryscrutiny Thishighlightedthegapin expertiseneededforcreatingeffectivefinancialvehicles.

Herfirmfocusesonguidingfamiliesthroughfinancial regulationswhileoptimizingtheirwealthstrategies.Witha strongfoundationinbothlegalframeworksandfinancial markets,sheprovidesinvaluablesupport,ensuringthat familiescanconfidentlynavigatecomplexitiesandachieve sustainablefinancialsuccess.ThroughRainForestCapital, sheiscommittedtoredefiningwealthmanagementfor families,empoweringthemtoreachtheirfinancialgoals.

Kenixreflectsonachallenginghypotheticalscenario involvingacybersecuritybreachatamid-sizedfinancial institution.Theincidentcompromisedsensitivecustomer data,threateningtheinstitution’sreputationandtrust.

Kenix highlights a hypothetical successful financial structuring project involving the financing of a solar power plant.

“ “

Kenix outlines a systematic approach for structuring financial vehicles for both capital and non-capital market transactions.

Inresponse,shewouldimplementastructuredcrisis managementapproach.First,shewouldensureimmediate identificationandcontainmentofthebreachbyisolating affectedsystems.Next,shewouldestablishacrossfunctionalcrisismanagementteam,includingIT,legal,and communicationsexperts,tocoordinateeffortseffectively

Athoroughinvestigationwouldfollowtoassessthe breach'sscopeandvulnerabilities,engagingexternal cybersecurityspecialistsasneeded.Sheemphasizesthe importanceoftransparentcommunicationwith stakeholders,issuingtimelyupdatestoreassurecustomers andregulators.

Additionally,shewouldinitiatecustomeroutreachto informaffectedindividualsandprovidesupportservices likecreditmonitoring.Finally,acomprehensivepostincidentreviewwouldidentifylessonslearned,enhancing futurepreparedness.Throughthesesteps,sheaimsto restoretrustwhilestrengtheningtheinstitution's cybersecurityframework.

Kenixprioritizesunderstandingrelevantlaws,including securities,tax,andanti-moneylaunderingregulations, whilestayingupdatedonchanges.Stringentduediligence isessential,involvingriskassessmentstoidentify compliancerisksandthoroughdocumentationreviews.

Sheadvocatesfordevelopingrobustinternalcompliance policiesandregularlytrainingstafftofosteracultureof compliance.Additionally,utilizingtechnologysuchas compliancemanagementsoftwareenhancesmonitoringand reportingprocesses.

RainForestCapitalremainsadaptabletoregulatorychanges byengaginginscenarioplanningtoanticipateimpactson financialstructuring.Byintegratingthesepractices,thefirm strengthensclients'complianceframeworks,minimizes risks,andensuresalignmentwithlegalrequirements, ultimatelysupportingsustainablebusinessgrowthand maintainingstakeholdertrust.

Kenixconsidersseveralkeyfactorswhenevaluatingthe suitabilityofinvestorsforstate-ownedinvestmentprojects. First,sheassessesfinancialcapability,ensuringinvestors haveadequatecapitalandastrongfinancialhistory.Next, experienceandexpertisearecrucial;investorsshouldhave relevantindustrybackgroundsandatrackrecordof managingsimilarprojects.

Regulatorycomplianceisalsovital,asinvestorsmust adheretolocallawsandinternationalstandardstoavoid legalrisks.Additionally,acommitmenttosocialand environmentalresponsibilityisessential,particularlyfor projectswithpublicimplications.

Sheevaluatesrisktolerancetoaligninvestorexpectations withtheproject’sriskprofile.Furthermore,alignmentwith nationalinterestsiscritical,ensuringinvestorssupport broadereconomicgoals.Finally,theproposedgovernance structuremustpromotetransparencyandaccountability, fosteringtrustbetweenpublicstakeholdersandprivate investors.

Kenixemphasizestheimportanceofbalancingdiverse stakeholderneedsinfinancialstructuring.Thefirststep involvesidentifyingallrelevantstakeholders,suchas investors,familymembers,regulatorybodies,and employees,tounderstandtheiruniqueinterests.

Toenhancecommunication,sheestablishesregularupdates andfeedbackmechanisms,ensuringstakeholdersfeel heard.Transparencyisalsocritical;clearobjectivesand honestdiscussionsaboutrisksandrewardsbuildtrust.

Conductingstakeholderanalysishelpsprioritizeneeds basedoninfluenceandinterest,allowingfortailored financialsolutions.Additionally,balancingshort-termgains withlong-termsustainabilityisessentialformaintaining strongrelationships.Finally,shecontinuouslyevaluates outcomespost-implementationtomeasureeffectivenessand informimprovements.

Analyticalskillsarecrucialforassessingcomplexdataand evaluatingrisks.Attentiontodetailensuresaccuracyin financialmodelsandcompliancewithregulations.Effective communicationskillsarenecessaryforconveyingcomplex conceptstodiversestakeholders,whilenegotiationskills helpsecurefavorabletermsandmanagerelationships.

Additionally,technicalproficiencyinfinancialmodeling softwareenhancesefficiency.Astrongunderstandingof regulatoryframeworksisessentialfornavigatinglegal landscapes.Tomaintaintheseskills,sheemphasizes ongoingeducationthroughworkshopsandnetworkingwith industrypeers,alongsidepracticalexperiencegainedfrom diverseprojects.

Kenixoutlinesasystematicapproachforstructuring financialvehiclesforbothcapitalandnon-capitalmarket transactions.Theprocessbeginswithdefiningobjectives, whereissuersidentifytheirgoals,suchasexpansionordebt repayment,whileinvestorsclarifytheirdesiredoutcomes, likeincomegenerationorliquidity.

Next,athoroughmarketanalysisassessescurrenteconomic conditionsandcomparableinstruments.Sheemphasizesthe importanceofselectingtheappropriatetypeoffinancial vehicle,distinguishingbetweenequityanddebtinstruments forcapitalmarketsandshort-termdebtorsavingsproducts fornon-capitalmarkets.

Thetermsofthefinancialvehiclesarethenstructured, includinginterestratesandrepaymentschedules,while ensuringcompliancewithrelevantregulations.Risk assessmentfollows,identifyingpotentialrisksand implementingmitigationstrategies.

Pricingisdeterminedbasedonmarketdemandandrisk profiles.Atargetedmarketingstrategyisdevelopedto effectivelyreachpotentialinvestors.Finally,post-issue monitoringandongoingreportingensurethatperformance alignswithstakeholderexpectations.Byadheringtothis

comprehensiveprocess,sheensuresthatfinancialvehicles meettheneedsofissuersandinvestorsalike,fostering successfulcapitaltransactions.

Kenix'slegalandcompliancebackgroundsignificantly enhancesherfinancialstructuringwork.Thisexpertise ensuresthatalltransactionsadheretorelevantlawsand regulations,allowinghertoidentifypotentiallegalrisks andcomplianceissuesearlyinthestructuringprocess.

Herknowledgeenableshertonavigatecomplexregulatory environmentseffectively,ensuringthatfinancialstructures complywithsecuritieslaws,taxregulations,andantimoneylaunderingrequirements.Thisfoundationallowsfor thoroughduediligenceandtheimplementationofrobust compliancepoliciesthatmitigaterisks.

Moreover,herlegalperspectivefacilitatesbetter communicationwithregulatorybodiesandstakeholders, fosteringtransparencyandtrust.Byintegratinglegal considerationsintofinancialstructuring,shehelpscreate sustainablesolutionsthatalignbusinessgoalswith regulatoryintegrity,ultimatelysafeguardingthe organization’sreputationandlong-termsuccess.Her

commitmenttoethicalpracticesfurtherestablishesaculture ofcompliancewithinherteam,reinforcingtheimportance ofaccountabilityinallfinancialendeavors.

Kenixemphasizestheimportanceofeffectivelymanaging conflictsofinterestinfinancialstructuringtouphold integrityandtrust.Theprocessbeginswithidentifying potentialconflictsthroughathoroughanalysisofallparties involved,recognizingsituationswhereinterestsmay compromiseobjectivity

Onceconflictsareidentified,theyaredisclosed transparentlytorelevantstakeholderstopromoteopenness. Shehasestablishedclearpoliciesandproceduresfor managingconflicts,whichmayincluderecusalfrom decision-makingordelegatingresponsibilitiesto independentparties.

Additionally,acodeofethicsguidesprofessionalsin navigatingthesesituations.Regulartrainingprograms enhancestaffawarenessofconflictmanagement,whilea whistleblowerpolicyencouragesreportingconcerns withoutfearofretaliation.Continuousmonitoringand reviewofrelationshipsandtransactionshelpdetect emergingconflictsandassesstheeffectivenessof managementstrategies.

Kenixhighlightsahypotheticalsuccessfulfinancial structuringprojectinvolvingthefinancingofasolarpower plant.Therenewableenergycompanyaimedtoraise$100 millionforconstructionwhileensuringsustainability Keytotheproject'ssuccesswasacomprehensivemarket analysisthatidentifiedfavorablegovernmentincentivesand risingdemandforcleanenergy.Shestructuredamixof equityanddebtfinancing,securing$30millionfrom institutionalinvestorsandissuing$70millioningreen bonds,whichattractedenvironmentally-conscious investors.

RobustriskmitigationstrategiesincludedsecuringPower PurchaseAgreements(PPAs)toensurestablecashflows.A transparentgovernancestructureenhancedcompliancewith environmentalregulations,whileactivestakeholder engagementbuiltcommunitysupport.Effective communicationandmarketingstrategieshighlightedthe project'senvironmentalbenefits,attractingfurther investment.

Theprojectwascompletedontimeandwithinbudget, generatingconsistentrevenueandstrongreturnsfor investors.Thissuccessstemmedfromthoroughanalysis, diversefinancingstrategies,effectiveriskmanagement,and strongstakeholdercollaboration,aligningfinancial objectiveswithenvironmentalgoals.

Kenixanticipatessignificantevolutioninthefinancial structuringlandscape,drivenbytechnological advancements,regulatoryscrutiny,andchangingeconomic conditions.Theriseoffintechinnovations,likeblockchain andartificialintelligence,willenhanceefficiencyand transparencyinfinancialpractices.

Toadapt,sheplanstoembracedigitaltoolsfordata analyticsandcompliancemonitoring.Thegrowing emphasisonenvironmental,social,andgovernance(ESG) criteriawillalsorequireintegratingsustainabilityinto financialframeworks.

Withtighteningregulations,sherecognizestheneedfor continuouseducationtostayinformedonemerging technologiesandregulatorydevelopments.Building relationshipswithtechpartnerswillfacilitateinnovative solutions,whilecollaborationwithcross-functionalteams willensurediverseperspectivesininvestmentstructuring. Byfosteringacultureofinnovationandcompliance,she aimstoenhancetheresilienceoffinancialstructures, positioningherworktomeetevolvingstakeholderneeds effectively.

Theworldoffinanceishighly

complexandrequiresoneto studymanyregulations.Itis, therefore,verychallengingto understandthesame.Allfinancial institutionsneedtoobeytheregulation tocarryontheiroperationsinalegally andethicallysoundway.Failureto complymayhaveseverepenaltiesin theformofheavyfines,andeventhe licensestocarryonthebusinessmay belost.Inthiscontext,itisvery importanttounderstandthekey considerationsthatgovernregulatory complianceinfinance.

SignificanceofRegulatory Compliance

Regulatorycomplianceistheprocess, rules,andguidelinesthatfinancial institutionsmustfollowsothatthey abidebythelawsandregulations formulatedbythegoverningbodies. Suchrulesaredesignedtoprotect consumers,provideintegritytothe financialmarkets,andmaintainfair practice.

Thelastfewyearshaveexperienceda lotofchangeintheregulationofthe financialsector,majorlycausedby changesintheeconomyandwiththe

advancementoftechnology.Compliancenotonlysavesone fromthelegalconsequencesbutalsomakesthecompany trustworthyamongthecustomersandinvestorsandhence increasesagoodreputationinthemarketplace.

Thefirststeptowardsreachingregulatorycomplianceis understandingtheregulatoryframeworkthatgovernsthe financialindustry.Thesedifferentorganizationsputforward differentrulesappliedtothevariousfieldsoffinance,that includebanking,securities,andinsurance.

Thekeyplayersinvolvedarethecentralbanks,the securitiesregulators,andfinancialoversightcommissions. Tothefinancialinstitutions,itisthuscrucialtoknowthese organizationsandwhattheyhaveforregulation.This impliesupdatedknowledgeofnewregulationsaswellas amendmentsinexistinglawsrelatingtohowtheyaffect operations.

Riskmanagementstrategyformsacriticalcomponentin termsofregulatorycompliance.Identification,evaluation, andriskprioritizationFinancialinstitutionsshould determinerisksarisingfromtheiractivities.Asmuchas creationofcompliancecultureinorganizationisas relevant.

Tothisend,eachandeveryemployeeoftheorganizationthehighestmanagementandfrontlineworkersshould understandwhatpreciselytheydotoensurethereis compliance.Thetrainingprovidedcaneducateoneabout therequirementsbyregulatoryandtheconsequenceofnonadherencetothoseregulations.Astrongcomplianceculture encouragesresponsibilityandensuresthateveryindividual doestheirpartinmaintainingtheintegrityofthe organization.

Intoday'stime,technologyhasaveryvitalimpacton regulatorycompliance.Financialinstitutionscanuse diversecompliancetoolsandtechnologiesinordertomake theirjobeasierandmoreaccurate.Forinstance,data analyticscanbeutilisedtoidentifypatternsand irregularitiesthatmayindicatepossiblecompliancerisks. Similarly,transactiontrackingbyautomatedsystemsinreal timecandetectfraudoractivitiesthataresuspicious.

Hence,investingincompliancetechnologyenhancesthe efficaciesofanorganizationwhileensuringthat

organizationsarecompetentenoughtoobservesuch modifyingregulations.Theuseofsuchmoderntechniques ensuresthatanyfinancialinstitutionwouldfeelthatitmeets theregulatorycompliancenormsbecauseitisacore businessdone.

Periodicalauditsandassessmentsformoneofthecrucial factorsregardingmaintainingregulatorycompliance.It helpsininternalcheckingifanorganizationiseffectivein thecomplianceofthenormsofregulatoryrequirements. Regularityinassessmentswillhelptheinstitutionrecognize gapsorweaknessesinitscomplianceprocessandcantake remedialmeasuresbeforethematterbecomesworse.

Besidesthat,theseauditscanleadtoareasofimprovement, andcompliancestrategiescanberefined.Theintroduction ofobjectiveviewpointthroughthird-partyauditorsmay furtherstrengthenthecredibilityoftheassessmentprocess.

Anyfinancialinstitutionneedsagoodrelationshipwiththe regulator Agoodrapportwiththeregulatoryauthoritymay behelpfulinunderstandingcompliancebetterand expectationsfromit.Institutionsmustseekadviceand clarificationabouttheambiguousregulatorymatters.Also, attendingtheforumsanddiscussionsofindustrymighthelp themlearnaboutthebestpracticesandevenemerging trendsinregulations.Even,acollaborativerelationship couldbeeasiertoworkwithandalsoevenhelpsinstitutions understandbetterwaysaboutthecomplexregulatory landscape.

Regulatorycomplianceisanimportantaspectofthefinance industry,whichcannotbeignored.Financialinstitutions shouldfocusonknowingtheregulatoryframework, adoptingefficientriskmanagementpractices,utilizing technology,conductingfrequentaudits,andmaintaining goodrelationswiththeregulators.Thishelpsthe organizationbetternavigatecompliance,ensuringlongtermsuccessandsustainabilityinacompetitivemarket. Commitmenttocomplianceis,inthefinalanalysis,anact thatnotonlysafeguardsthelegalrisksofinstitutionsbut alsomakestheirreputationbetterandbringsthemmore trustfromstakeholders.

Better to die �ghting for dom then be a prisoner all the days of your life.

Companiesneedtohaveabalanceofgrowth

andcompliance.Growthinvolves innovationandscale,butlackof compliancewillhaveverydangerousconsequences: finesandlawsuits,nottomentionthelossof reputation.Inthisregard,itisnotjustprudentto havecomplianceaspartofthegrowthstrategybut alsonecessaryforsustainablesuccess.

Regulatorycomplianceistheimplementationof laws,regulations,ordirectivesthatapplytoagiven firm.Thiscanbewithinquiteanumberof parametersandlevels,suchasfinancialstandards, environmentregulation,dataprotection,andlabor laws,allofwhichensurelegalperformancebythe firminvolvedtoavoidanyriskofcausinglitigation and,therefore,thereistrustwiththeirclients, partners,orstakeholder.

Asbusinessesgrow,theytendtolookfornew markets,developnewproducts,orextendtheir operations.Eachofthesestepsmayrequireawhole rangeofregulatoryrequirements.Forexample, enteringanewgeographicmarketmayrequire knowledgeoflocallawsandregulations,whereas introducinganewproductmightrequireadherence toindustry-specificstandards.

Integrationintogrowthplanswouldnotalways comecheapifdone,andfailurewouldbepainful. Companieswillhavecostsorevenlitigationsthat bringbusinessoperationsanduseresources availabletoorganizationstotheground.Inaway, then,complianceshouldnotbeconsidered somethingrestrictivebutasabasefeaturein strategizing.

Thisincludestheneedtobedetailedinthereviewof anyapplicableregulationssothatcompliancefits withingrowthstrategies.Inotherwords,itrefersto aninformedidentificationoflegalrequirementsthat applytobusinessacrossitsindustry,location,and operationalmodels.Referralstoprofessionalsare goodinsightsintoobligationspecifics,especially legalorcomplianceprofessionals.

Oncetheregulatoryenvironmenthasbeenunderstood, compliancefactorsaresupposedtobefoldedintostrategic planning.Itwouldthusensurethateveryeffortconcerning growthshouldincludesomemeasuresofcompliance.As such,forinstance,determiningwhattheappropriate standardoughttobelongbeforedesigninganewproductis astepthatismadelongbeforethatincaseswherechanges thatwillsavefutureexpensecanoccur.

Complianceshouldbetrainedonemployeessothatthe processiseffectivelyimplementedwithinbusiness activities.Theyshouldberegularlytrainedsothatthe complianceissuecanbeenlightenedtoallthemembersin theteamoftheirindividualresponsibility Thisleadsto complianceculturesincetheemployeesareempoweredto contributemeaningfullytowardsgrowthinitiativesthatare well-informedofthegeneralregulatorylandscape.

Clearcompliancepoliciesandproceduresshouldbe formulatedandimplemented.Thesepoliciesmustdefine thestepsthattheemployeesmusttaketoensurecompliance inalltheirdailyactivities.Thepoliciescanbereviewed periodicallytokeepthemrelevantandeffective,especially withchangesinregulationsornewgrowthopportunities.

Continuousmonitoringofcomplianceisrequired. Businessesshoulddevelopsystemswhichmonitor regulatorychangesandcheckforcompliancemetrics regularly Theprocessinvolvesestablishingreporting systemsthatallowemployeestoreporttheirconcernsto managementovermattersofcompliance.Throughsucha system,companieswouldbeabletoidentifythe compliancechallengesbeforetheybecomebigproblems.

Anotheraspectofembeddingcomplianceintogrowthplans isriskidentificationandmitigation.Inthisscenario, awarenessofpotentialcomplianceriskswithrespecttonew initiativesenablesthebusinesstodevisestrategiesfor exposuremitigation.Theriskmanagementframeworkmust beperiodicallyreviewedandupdatedtomaintainits effectivenessasthebusinessevolves.

Compliancestakeholderengagementiscrucialinareassuch asthecustomers,investors,andtheregulatorybodies.This canenhancethereputationofacompanyandincreasetrust inthestakeholdersbycommunicatingtransparentlyonthe complianceeffortsthatareinplace.Italsoprovidesa companywithchancestogatherpreciousfeedbackthat mightinformfuturedecisions.

Complianceinthedigitalagetodaycanonlybeachieved throughtechnology Therearemanysoftwaresolutionsto helpbusinessestrackchangesinregulatoryenvironments, managecomplianceaudits,andstreamlinereporting processes.Thus,compliancetechnologyinvestmentcanbe notonlyanefficiencyenhancerbutalsoacompetitive advantageingrowthinitiatives.

Thereareseveralbenefitsofintegrationwithgrowthplans. Firstandforemost,itsavescompaniesfromlegal implicationsarisingbecauseofnon-compliance.Finally, firmsthathavetakencareforcomplianceenjoyhigher operativeperformancesincethereisuncertaintywithless complexityinanyformofdecision.

Compliancehelpscompaniesbuildreputationinthemarket. Marketsrequireethicalbusinessesthatrespectthelaw such,customerswilllikelystickwithsuchafirmandpullin morenewcustomerswhocareaboutcorporatebehavior

Thisisnotjustadefensivegame;itisaproactiveprocess towardlong-termsuccess.Ifcompaniesunderstand regulations,embedcomplianceintostrategicinitiatives, educateemployees,andutilizeappropriatetechnologies, theywilleasilyovercomethecomplexitiesofarapidly changingregulatorylandscape.Indoingso,theirbusiness willberisk-minimizedandpositionedwithinanintegrity culturethatbodeswellforlong-termgrowthandsuccessin today'sandtomorrow'sfast-pacedmarket.

www.X.com/insightssuccess