“The biggest risk of all isnot taking one.”

“The biggest risk of all isnot taking one.”

Inaneraofeconomicuncertainty,shiftingmarket

dynamics,andrapidtechnologicalevolution, investmentofficersplayanincreasinglycrucialrolein shapingfinanciallandscapes.Theirabilitytoanticipate trends,managerisk,anddriveinnovationmakesthemnot justfinancialstewardsbutvisionarieswhoredefinethe futureofinvesting.

Aswestepinto2025,CIOLookinthisspecialeditionof The 10 Most Visionary Investment Officers to Follow in 2025 highlightsindividualswhohavedemonstrated extraordinaryforesight,resilience,andadaptability These leadersarenotonlyleveragingdata-drivenstrategiesand emergingtechnologieslikeAI,blockchain,andalternative assets,buttheyarealsochampioningsustainableinvesting andimpact-drivenportfolios.Theirvisionextendsbeyond merereturns—theyareshapingamoretransparent, ethical,andfuture-readyinvestmentecosystem.

Inthisedition,weexplorethestrategies,philosophies,and game-changingdecisionsthatsettheseinvestmentofficers apart.Throughin-depthprofilesandexclusiveinsights,we uncoverhowtheyarenavigatingmarketvolatility, embracingdigitaltransformation,andunlockingnew opportunitiesinacomplexglobaleconomy.

Whetheryouareanindustryveteran,anaspiring investmentprofessional,orakeenmarketobserver,this issueservesasaninspirationandaroadmaptothefuture offinance.Weinviteyoutodiveinanddiscoverthe brilliancebehindthesevisionaryleaders.

Happy Reading!

Deputy Editor Anish Miller

Managing Editor Prince Bolton

www facebook.com/ciolook/ www.x.com/ciolookmagazine

Visualizer Dave Bates

Art & Design Director Davis Mar�n

Associate Designer Jameson Carl

Senior Sales Manager Wilson T., Hunter D.

Customer Success Manager Nelson M. Sales Execu�ves Tim, Smith

TECHNICAL

Technical Head Peter Hayden

Technical Consultant Victor Collins

Copyright © 2025 CIOLOOK, All rights reserved. The content and images used in this magazine should not be reproduced or transmi�ed in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior permission from CIOLOOK. Reprint rights remain solely with CIOLOOK.

Research Analyst Eric Smith

SEO Execu�ve Alen Spencer

CarolSchleif ChiefInvestment

Officer

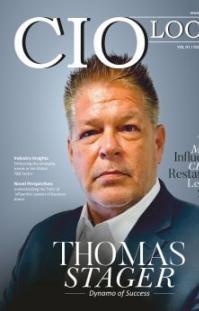

CorradoPistarino ChiefInvestment

Officer

DamianGraham ChiefInvestment

Officer

IanCoulman ChiefInvestment

Officer

IsabellaAppiana AmericanExpress GlobalBusinessTravel

BMOFamilyOffice bmoprivatebank.com

ForestersFriendlySociety forestersfriendlysociety.co

AwareSuper awaresuper.com

PoolRe htpoolre.co

AmericanExpress GlobalBusinessTravel amexglobalbusinesstravel.com

JaydenBasha InvestmentDirector

MayVang ChiefInvestment

Officer

SimoneGrasso ChiefInvestment

Officer

TrevorPersaud GroupHeadof InvestmentStrategy

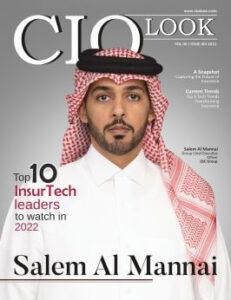

VijayValecha ChiefInvestment

Officer

Investible investible.com

BlueCrossandBlue ShieldofMinnesota bluecrossmn.com

VenaEnergy venaenergy.com

Schleifisthoughtleaderinfinance,shecombines macroeconomicanalysiswithinnovativestrategiestoachieve long-termfinancialobjectives.

Pistarinoisknownforhisdeepunderstandingoffinancial markets,heexcelsincraftingdynamicstrategiestobalancerisk andreturnacrossdiverseassetclasses.

Grahamisastrategicthinker,heappliesrigorousanalysisto optimizeinvestmentportfolioswhileensuringalignmentwith corporateobjectives.

Coulmanisarenownedforhisleadershipskills,heintegrates riskmanagementwithstrategicforesighttoensurerobust investmentperformance.

Appianaisavisionaryincorporatetravelsolutions,she leveragesdata-driveninsightstoenhanceoperationalefficiency andclientsatisfactioninglobalbusinessenvironments.

Bashaisadeptatmanaginghigh-stakesinvestments,he employsablendofquantitativeandqualitativeanalysisto maximizereturns.

Vangisknownforherprecisionandadaptability,shenavigates complexfinanciallandscapestodeliverconsistentportfolio growthandstability

Grassoisadistinguishedforhisabilitytoidentifyemerging markettrends,heintegratesforward-thinkingstrategiesto drivesustainableinvestmentgrowth

Persaudisrecognizedforhisholisticapproach,healigns investmentstrategieswithorganizationalgoalswhilefostering collaborationamongstakeholders. AIA aia.com

CenturyFinancial century.ae

Valechaisarenownedforhisstrategicacumen,hecombines analyticalexpertisewithinnovativeinvestmentapproachesto optimizeportfolioperformanceandmanageriskseffectively.

“ “

My academic foundation in engineering and finance provided me with essential analytical and macroeconomic skills. Throughout my career, I expanded this knowledge through certifications and hands-on experience.”

VijayValecha’sjourneyinthefinancialsectorhas

beenoneofperseverance,learning,andstrategic decision-making.Withabackgroundinboth engineeringandfinance,hehascultivatedadeepunderstandingofnumericalanalysisandmacroeconomictrends. Hisabilitytoanalyzemarketconditionswithprecisionhas allowedhimtodevelopawell-roundedapproachto investmentmanagement.Overtheyears,hisexperiencein globalfinancialmarketshasstrengthenedhisabilityto navigatecomplexinvestmentlandscapes.Hisexpertisein financialderivatives,riskmanagement,andassetallocation hasplayedapivotalroleinhiscareeradvancement.

Theever-evolvingnatureofthefinancialmarketscontinues tochallengeandmotivatehim.AsChiefInvestment OfficeratCenturyFinancial,heremainsdedicatedto helpingclientsachievetheirfinancialobjectiveswhile ensuringthefirmstaysattheforefrontofinvestment innovation.Hisleadershipphilosophyrevolvesaround continuouslearning,strategicdecision-making,and fosteringacultureofadaptabilitywithinhisteam.

Valecha'spathtobecomingtheChiefInvestmentOfficerat CenturyFinancialhasbeenmarkedbycontinuouslearning andstrategicforesight. “My academic foundation in engineering and finance provided me with essential analytical and macroeconomic skills. Throughout my career, I expanded this knowledge through certifications and hands-on experience.”

Adefiningmomentinhisjourneywasthe2007-2008 GlobalFinancialCrisis,whichdeepenedhisinterestin marketdynamics.Thisperiodhighlightedthe unpredictabilityoffinancialmarketsandtheopportunities withinvolatility.Hisabilitytonavigatesuchchallenges propelledhimtowardleadershipatCenturyFinancial.

AsChiefInvestmentOfficer,Valechaisresponsiblefor identifyingmarketrisksandshapinginvestmentstrategies. Hisroledemandsanagileandproactiveapproach,utilizing toolssuchasBloombergterminalsandclientinsightsto makedata-drivendecisions.

Ensuringclientsachievetheirinvestmentobjectivesisatop priority.Valechaplacesgreatimportanceonaligningfirmwidestrategieswithapositiveorganizationalculture.

“Digital tools like artificial intelligence, and big data analytics have reshaped how investment strategies are developed and executed. I ensure that Century Financial stays ahead by integrating the latest financial technologies into its operations. By utilizing AI-driven risk assessments and data analytics, the firm can provide clients with more accurate insights and personalized investment strategies.”

Success in finance requires perseverance, intellectual curiosity, and adaptability. By developing a deep understanding of financial principles and building strong professional networks, aspiring professionals can excel in the industry.”

HIsopen-mindedleadershipandwillingnesstolearnfrom pastexperiencesenablehimtomanagemarketcomplexities effectively.

Valechaadvocatesforabalancedapproachtomarket analysis,integratingbothfundamentalandtechnical methodologies.Fundamentalanalysisprovidesinsightsinto long-termtrendsbyassessingmacroeconomicfactorsand corporateperformance,whiletechnicalanalysishelps identifyshort-to-medium-termopportunities.

Adynamicinvestmentstrategyrequirestheflexibilityto adapttovaryingmarketconditions.Byleveragingboth approaches,Valechaensuresawell-roundedinvestment framework.

RiskmanagementisatthecoreofCenturyFinancial’s operations.Valechaoverseesmultiplelayersofrisk assessment,implementingstringentprotocolsacrossclientfacingandinternaldepartments.Thesemeasuresinclude riskidentification,mitigation,andongoingmonitoring.

“With increasing market volatility, I prioritize proactive client communication, ensuring investment strategies remain aligned with evolving conditions. My collaborative work with top financial minds further enhances risk management practices within the firm.”

BeforejoiningCenturyFinancial,Valechaheldkeyrolesat EdelweissandHiraGlobalDMCC,specializingasaquant analyst.Thesepositionsprovidedhimwithin-depth technicalexpertiseinfinancialmarketsandriskassessment.

HisexperienceinIndia’sdynamicfinancialsectorplayeda crucialroleinshapinghisanalyticalandstrategicapproach. Theskillsgainedintheseroleshavecontributed significantlytohisleadershipatCenturyFinancial.

ValechaholdsanMBAinAssetManagementfromMumbai University,aqualificationthathasbeeninstrumentalinhis financialcareer.Hiscertifications,includingtheFinancial RiskManager(FRM)designation,havestrengthenedhis conceptualunderstandingofriskmanagementand investmentstrategies.Whileacademiccredentialsare valuable,Valechabelievesthatpracticalexperienceand clientinteractionsofferthemostprofoundinsightsinto investmentmanagement.

Theglobalfinanciallandscapeisconstantlyevolving, makingadaptabilityessential.Withmarketvolatilityand vastinformationsources,identifyingreliabledataand derivingactionableinsightsisachallenge. “At Century Financial, I and my team embrace technological advancements and continuous learning. By analyzing historical market trends and leveraging innovative tools, they refine investment strategies to stay ahead.” Says Valecha.

Valechaisastrongproponentofprudentmoney management,aprincipleheactivelypromotesthrough CenturyFinancial’seducationalinitiatives.Hebelieves financialsuccessislessaboutstartingcapitalandmore aboutstructuredsavingandinvesting.

Throughseminars,blogs,andclientinteractions,he emphasizestheimportanceofinvestmentplanning, emergencyfunds,anddisciplinedfinancialhabits.His outreachextendstoindividualsfromnon-financial backgrounds,fosteringgreaterfinancialliteracy.

Forthoseaspiringtobuildacareerininvestment management,Valechahighlightsthreekeyprinciples: acquiringrelevantqualifications,maintainingfocus,and continuouslyimprovingskills.Hewarnsagainst complacencyandstressestheimportanceofsurrounding oneselfwithknowledgeableprofessionals.

“Success in finance requires perseverance, intellectual curiosity, and adaptability. By developing a deep understanding of financial principles and building strong professional networks, aspiring professionals can excel in the industry.” StatesValecha.

CenturyFinancialhasbeenaleadingfinancialservices providerinDubaisince1989.Lookingahead,thefirmaims toexpanditspresenceacrosstheGCCregionandsolidify itspositionasthetopfinancialservicesproviderwithinthe nextfiveyears.

Valechaplanstoleveragethefirm’sknowledgebaseand talentedteamtoachievethisvision.Byfostering innovation,enhancingclientexperiences,andmaintaininga robustinvestmentstrategy,heiscommittedtodriving CenturyFinancial’sgrowthandsuccessintheyearsahead.

Technologyhasrevolutionizedthefinancialsector,and Valecharecognizesitssignificanceinmoderninvestment management. “Digital tools like artificial intelligence, and big data analytics have reshaped how investment strategies are developed and executed. I ensure that Century Financial stays ahead by integrating the latest financial technologies into its operations. By utilizing AI-driven risk assessments and data analytics, the firm can provide clients with more accurate insights and personalized investment strategies.”

Furthermore,blockchaintechnologyhasalsobegun influencinginvestmentmanagementbyincreasing transparencyandsecurityinfinancialtransactions.Valecha activelyexploresemergingtechnologiestoenhance efficiencyanddriveinnovationwithinthefirm.Hebelieves thatleveragingtechnologyallowsfinancialinstitutionsto adapttomarketfluctuationsmoreeffectivelywhile providingclientswithoptimalinvestmentsolutions.

Ethicalinvestinghasgainedprominenceasinvestors increasinglyprioritizeenvironmental,social,and governance(ESG)factorsintheirportfolios.Vijaystrongly advocatesforresponsibleinvesting,emphasizingthat financialsuccessshouldalignwithsustainabilityandethical considerations.HeencouragesCenturyFinancialto integrateESGprinciplesintoitsinvestmentstrategies, ensuringthatclientshaveaccesstosustainableandsocially responsibleinvestmentopportunities.

Valechaacknowledgesthatcompaniesdemonstratingstrong ESGcommitmentstendtoperformwellinthelongterm, benefitingbothinvestorsandsociety.Hisapproachto ethicalinvestinginvolvesthoroughresearchintocorporate governance,environmentalimpact,andsocial responsibility.Bypromotingsustainableinvestment options,heaimstocreateapositiveimpactwhileensuring profitablereturnsforCenturyFinancial’sclients.Valecha believesthatthefutureofinvestmentmanagementliesin balancingprofitabilitywithethicalresponsibility,shapinga financiallandscapethatprioritizeslong-termvalueover short-termgains.

“Don't look for the needle in the haystack. Just buy the haystack!”

CorradoPistarino'scareerintheinvestment

industryhasbeenatestamenttostrategic innovationandtransformation.Withextensive experienceacrossbanking,assetmanagement,and insurance,hehasconsistentlyredefinedinvestment approaches,movingbeyondtraditionalframeworksto embracestructuredfinanceandalternativeassets.Asthe ChiefInvestmentOfficeratForestersFriendlySociety, hehasspearheadedashifttowardsdiversifiedasset allocation,introducingprivatemarketsandexpandingthe organization’sinvestmentuniverse.Hisexpertisein structuredcreditandriskmanagementhasplayedapivotal roleinenhancingportfolioresiliencewhiledrivinglongtermfinancialsuccess.

Attheheartofhisinvestmentphilosophyliesanintellectual curiositytotranslatemacroeconomictrendsintoactionable strategies.Hebelievesinfosteringhigh-performingteams, challengingconventionalthinking,andleveragingdatadrivendecision-makingtonavigatecomplexmarket landscapes.Inthisdiscussion,Pistarinoshareshisjourney, leadershipprinciples,andinsightsintotheevolving investmentindustry,offeringaroadmapforfuture professionalsaspiringtoleadinadynamicfinancial environment.

Pistarino’scareerhasbeenshapedbyarelentlesspursuitof innovationininvestmentstrategyandfinancial transformation. “My journey began in financial modeling and structuring derivative products, followed by a transition into market making, which instilled a strong discipline in risk management. I later moved into asset management, leading a comprehensive transformation in portfolio management for insurance funds, shifting away

from traditional index tracking towards more strategic investment methodologies.”

Hisexpertiseinstructuredfinance,particularlystructured credit,positionedhimasakeyadvocatefortheintegration ofalternativeassets.Hechampionedastrategicshifttoward proprietarybilateraltransactionscharacterizedbyrisk, regulatory,andlegalcomplexity.AsChiefInvestment OfficeratForestersFriendlySociety,Pistarinohasfocused ondiversifyingtheSociety’sassetbasebeyondUKgilts, Sterlingcredit,anddomesticequitiestoincludeabroader allocationacrossglobalassetclassesandprivatemarkets.

Hisinspirationtostepintotheinvestmentindustrystemmed fromtheintellectualchallengeoftransformingfinancial theoriesintopractical,value-generatingstrategies.The opportunitytoleadinvestmentfunctionsthatdriveboth financialreturnsandindustryinnovationcontinuestofuel hispassionforthefield.Heremainscommittedtobuilding high-performingteams,fosteringcross-functional collaboration,andcontinuouslychallengingestablished investmentperspectives.

AstheChiefInvestmentOfficer,Pistarinoplaysapivotal roleindrivingstrategicinvestmenttransformation, optimizingriskandcapitalallocation,andstrengthening governanceframeworks. “A key focus of my mandate is expanding the organization’s asset universe by incorporating private markets and diversifying investments across asset classes and geographies. I develop asset allocation strategies that extend beyond traditional investments, aiming to enhance long-term returns and ensure financial sustainability. In leading both tactical and strategic portfolio management, I place a strong emphasis

I continuously assesses macroeconomic conditions to evaluate their impact on asset prices and investment strategies, ensuring that decisions are grounded in a comprehensive understanding of market dynamics. “ “

on liquidity forecasting, risk assessment, and performance evaluation.”

Additionally,Pistarinoforgedpartnershipswithatop-tier investmentfirmtoimproveexecutioncapabilities,broaden marketaccess,andintegratemiddle-andback-office operations.Tofurtherstrengthentheinvestment governance,heauthoredinvestmentpolicies,established monitoringsystems,andensuredalignmentofthe investmentfunctionwiththeorganization’sbroader objectives.Throughtheseinitiatives,Pistarinoensuresthat investmentdecisionsnotonlydrivefinancialsuccessbut alsopositionForestersasanindustryleaderinresilience andinnovation.

Pistarinoattributeshissuccessinthefinancialsectortofour coreleadershipprinciplesthathaveshapedhisapproachto investmentmanagement.“I actively foster a culture that challenges conventional thinking, encouraging professionals to question traditional investment methodologies and embrace forward-looking strategies. This mindset has played a pivotal role in expanding Foresters’investment capabilities into private markets.” Hiscommitmenttodata-drivendecision-makingensures thatallinvestmentstrategiesarebackedbyrigorous

quantitativeanalysis,marketinsights,andcomprehensive riskassessments,particularlywhenevaluatingnew investmentmanagersandmarketopportunities.

Additionally,heemphasizestheimportanceofempowering teamsbyrecognizingandnurturingtalent,creatingan environmentwhereprofessionalsareencouragedtotake ownershipanddevelopinnovativeinvestmentsolutions. Lastly,hemaintainsastrategicbalancebetweenriskand opportunitybyimplementingrobustgovernance frameworksthatstress-testnewinvestmentstrategies, ensuringalignmentwithlong-termfinancialobjectives.

Pistarino’sapproachtobuildingahigh-performance investmentteamiscenteredonempowerment, collaboration,andcontinuouslearning.Heprioritizes:

• TalentDevelopment–Ensuringteammembersare challengedandprovidedopportunitiesforownershipin keyprojects.

• Data-DrivenCulture–Integratingtechnologyand quantitativetechniquestoenhancedecision-making processes.

• KnowledgeSharing–Encouragingcollaborationwith industryexperts,externalmanagers,andthought leaderstobroadeninvestmentperspectives.

• Post-InvestmentReview–Conductingcomprehensive performanceevaluationstorefinestrategiesand continuouslyimproveoutcomes.

ByembeddingtheseprinciplesintoForesters’investment function,Pistarinofostersanagile,informed,andforwardlookingteamcapableofnavigatingmarketcomplexities.

Despitethedemandsofahigh-stakesfinancialcareer, Pistarinoemphasizestheimportanceofmaintaininga balancedlife.Heactivelyengagesinintellectualand physicalpursuitsoutsidework,valuessocialinteractions withfriends,andfindsrejuvenationthroughtravel.These activitieshelphimstaygroundedandenergized,ensuring heremainsfullycommittedtohisprofessional responsibilitieswhilemaintainingoverallwell-being.

Pistarinomaintainsadisciplinedandanalyticalapproachto stayingaheadofmarketfluctuationswithanemphasison

theUS,UK,andEurozone. “I make a concerted effort to assess macroeconomic conditions to evaluate their impact on asset prices and portfolio allocations, ensuring that decisions are grounded in a comprehensive understanding of market dynamics.”

Additionally,hecloselymonitorsdevelopmentsinprivate marketsacrosskeyassetclassestoidentifyemerging opportunities.Byemployingaresearch-driven methodology,Pistarinoensuresthathisinvestment decisionsarewell-informedandforward-looking,enabling aproactiveresponsetomarketshifts.

Forthoseaspiringtobecomeindustryleaders,Pistarino underscorestheimportanceofcontinuouslearning, technicalexpertise,andstrategicinfluence.Headvises:

• MasteringAdvancesinFinance–Stayingengaged withacademicresearchandevolvinginvestment methodologies.

• NavigatingOrganizationalDynamics–Understandinginstitutionalconstraintsandeffectively socializinginvestmentintuitions.

• BalancingInnovationwithPragmatism–Bringing newideastofruitionrequirespatience,adaptability, andadeepunderstandingofcorporateculture.

• DevelopingStrongCommunicationSkills–The abilitytoarticulatecomplexideasclearlydistinguishes industryleadersandfacilitatesmeaningfulchange.

Lookingahead,Pistarinoforeseesseveraltrendsshaping theinvestmentindustry:

• ExpansionofPrivateMarkets–Institutional investorswillcontinuediversifyingintoprivatecredit, infrastructure,realestate,andalternativeassets.

• ShiftinESGFocus–Greateraccountabilitywillbe demandedinESGstrategies,withamorepragmatic approachtosustainableinvesting.

• TechnologicalAdvancements–AI,machinelearning, andbigdatawillredefineinvestmentprocesses, enhancingriskmodelinganddecision-making efficiency.

• MacroeconomicandGeopoliticalInfluence–Factors suchasinflation,centralbankpolicies,fiscal challenges,andgeopoliticaltensionswillremain prominentindrivinginvestmentdecisions.

Thenextfiveyearswillrequireinvestorstobalance innovationwithdiscipline,leveragingtechnological advancementswhilenavigatingeconomicandpolitical complexities.Pistarino’sinsightsunderscoretheimportance ofadaptabilityandstrategicforesightinanever-evolving financiallandscape.

Pistarinoisknownforhisvisionaryleadershipandstrategic thinking.Heemphasizestheimportanceofdata-driven decision-makingandfostersacultureofcontinuous learning.Byintegratingadvancedfinancialmodelsand leveragingtechnology,hehassuccessfullyoptimized investmentportfoliosandmitigatedrisks.

Hisleadershipapproachfocusesonadaptability,ensuring thatbusinessesremainresilientinever-changingmarket conditions.

Pistarino’sinvestmentphilosophyrevolvesaround balancingriskandreward.Hebelievesinthoroughmarket research,scenarioanalysis,andinitiative-takingrisk management.Byincorporatingamixoftraditionaland alternativeinvestments,heensuresresilienceagainst marketvolatility

Hisforward-thinkingapproachincludesembracingsecular trendstotheextenttheycanbetranslatedintoviable investmentopportunities.Hisexpertiseinregulatory compliancefurtherstrengthenshisabilitytocreaterobust investmentframeworks.

Beyondhiscorporateachievements,Pistarinoisdedicated tomentoringaspiringfinanceprofessionals.Heactively contributestoindustrydiscussions,sharinginsightson evolvingfinanciallandscapesandriskmitigationstrategies. Histhoughtleadershiphasinfluencedpolicy-makingand bestpracticeswithintheinvestmentsector.Hispassionfor knowledge-sharingunderscoreshiscommitmenttoshaping thefutureoffinance.

Wealthgenerationisbeingtransformedin2025bythenextgenerationof

investorswhoareusingnewtechnologies,greenprocesses,andnovel strategies.TheseVisionaryInvestors2025arenotlookingforprofitsonlybut arechangingthesocialandobjectiveintentofwealth.Thisishowtheseinvestorsare remappingthelandscapeofthefutureofinvestmentandfinance.

The"VisionaryInvestors2025"arevisionaryinvestorsandinstitutionsshapingtheworld ofinvestment.Theyarecharacterizedbytheirabilitytoforeseetrends,beopento innovation,andguidetheirportfoliostowardsrespondingtoglobalagendassuchas technologicalinnovationandsustainability.Visionaryinvestorsunderstandthatwealth creationin2025ismoreaboutwealthcreationbutalsoaboutmakingtheworldabetter place.

1.AdoptingDisruptiveTechnologyTrends

VisionaryInvestors2025aresignificantlyinvestinginnext-generationnewtechnologies likeartificialintelligence(AI),blockchain,andcleanenergyinfrastructure.AIproducts aresimplifyingintelligentdecision-makinginportfoliomanagement,whileblockchainis facilitatinginvestmentinclusionthroughassettokenization.Inadditiontotransforming industries,thetechnologiesalsounlocknewuntappedgrowthprospects.

ThematicinvestingisasignatureofVisionaryInvestors2025.Long-termworldwide themessuchasrenewableenergy,healthscience,andtechnologyinnovationarewhatthey areinvestingin.Theyarenotonlygeneratingeconomicreturns,butalsosocialreturns. ESGinvestingisanothersupporttotheirstrategybecauseworldwideESGassetsare anticipatedtogrowover$50trillionthisyear

3.DiversificationAcrossNewAssetClasses

Diversificationisacenturies-oldscienceofriskmitigation,butVisionaryInvestors2025 aretakingitfurtherwithemphasisoncreatingassetclasseslikecryptocurrencies, fractionalrealproperty,andventurecapital.

Cryptocurrencies,buildingonthegrowthofblockchain technology,arebecomingadevelopedassetclassinthe midstofregulatorybattles.

1.RenewableEnergy

Theworlddecarbonizationdriveputcleanenergyon VisionaryInvestors2025'slistofpriorities.Itisnotjust dollars,butsense,toinvestingreeninfrastructure,solar, andwindaspartofthebattletoreversetheeffectsof climatechange.

2.BiotechnologyandLongevity

Biotechnologyinnovationsarecreatingnewpossibilitiesfor personalizedmedicineandagingresearch.Trend-setting venturecapitalistsalsoinvestinsuchgroupsthatare workingonhumanlifespanextensionthroughgenomics andnovelwearablehealthtechnology

3.SpaceTechnology

Spacetravelisnolongerthedomainofgovernment organizations.Privatecompaniespilotingsatellite communicationandspaceflightareattractingmammoth investmentsfromtrend-settingfinanciers.

Long-TermWealthCreationStrategies

1.BalanceofRiskandInnovation

VisionaryInvestors2025understandthatstart-upindustries areactuallyevenneededwithinanenterpriseasarequired riskwithinanenterprise.Theybalancethattosomeextent insizebyaddingconservativeinvestmentinbondsand stocksandgreater,riskierinvestmentinnewmarkets.

2.ScaleoverReturn

Incontrasttothe"growthatanycost"ofthepastdecade, investorsundertoday'scircumstancesfocusonstart-ups withdirectroutestoprofitability Thatallowsgrowthto becomefeasibleandrelianceonexternalfinancing minimized.

3.AI-InspiredInsights

Despitetheirvisionarystrategy,VisionaryInvestors2025 facesomechallenges:

• RegulatoryChallenges:Tighterregulationofdigital assetsandESGreportingrequireagilenavigating throughthem.

• MarketVolatility:Unpredictablemarketslike cryptocurrencyrequirecomplexriskmanagement.

• TalentCompetition:Hiringthebestandbrightest acrossareassuchasAIandbiotechinvolves operationalcosts.

Artificialintelligenceapplicationslieatthebasisof VisionaryInvestors2025.Theysupportpredictiveanalytics androbo-portfolioswhilealsoenablingmoreinformed decision-makingandreturnsoptimization.

VisionaryInvestors2025arebeingfeltwellbeyondthe financialmarketsthemselves.Withtheirfocuson innovationandsustainability,theyaredrivinginnovations insuchfar-reachingareasasmitigatingclimatechange, greateraccesstohealthcareanddemocratizationof technology.Theyarenotjustmakingmoneybutare workingtowardsaworldthatisbothsustainableand equitable.

VisionaryInvestors2025representanewkindofwealth creationforanewworld.Spearheadinginnovation, spearheadingtheinternationalagenda,andspearheading thinkingforthelongterm,theyarerevolutionizingsuccess inglobalinvesting.Bytheircontinuinginfluenceonfinance inthefuture,itsechowillnotmerelyresonateincapital marketsbutinsociety

Vision-hoodforthetwenty-first-centuryinvestingisan optionnolongeravailablebutanecessityforthosewho aspiretothriveduringaperiodoftransformationhappening atlightningspeedandbequeathalegacytotheirgreatgrandchildrentodiscussthreecenturieshence.The VisionaryInvestors2025journeyhasonlyjuststarted,yetit willunmistakablydefinethedecadesahead.

Theyear2025marksapivotalmomentintheinvestment

landscape,wheretechnologicalinnovation,shifting economicparadigms,andevolvinginvestorbehaviors convergetoshapeatransformativeera.Visionaryinvestorsare redefiningstrategiestoadapttothesechanges,leveraging emergingtrendsandtoolstosecurelong-termgrowthwhile navigatingvolatility.Below,weexplorethemindsetrequiredto thriveinthisdynamicenvironment.

Technologyisnolongerjustanenabler;itisacornerstoneof investmentstrategyin2025.Artificialintelligence(AI)has becomeindispensableforidentifyinghigh-growthopportunities. InvestorsareusingAI-drivenanalyticstouncoverpatternsin sectorslikehealthcare,financialservices,andautomation.AI toolsprovidedata-backedinsights,helpinginvestorsmake informeddecisionsandstayaheadofcompetitors.

Moreover,blockchaintechnologycontinuestorevolutionize assetmanagementandtrading.TheriseofcryptocurrencyETFs hasbroughtinstitutionalinvestorsintothedigitalassetspace, signalingsteadydemandforBitcoinandEthereumwhilepaving thewayforothertokenslikeSolanaandXRP.Visionary investorsrecognizethatintegratingtechnologyintotheir portfoliosisessentialformaintainingrelevanceinthisfastevolvingmarket.

In2025,thefocushasshiftedtowardsectorswithdurable demandandsocietalimpact.Cybersecurityhasemergedasatop priorityduetoescalatingdigitalthreats.Investmentsin advancedthreatdetectionsystems,zero-trustarchitecture,and IoTsecuritysolutionsarenotonlylucrativebutalsosocially responsible.Similarly,healthcareinnovation—drivenbyAIand biotechnology—continuestoattractcapitalasglobalhealth challengespersist.

Investorsarealsoexploringenvironmental-benefit-linked securitiesandrenewableenergyprojectsassustainability

becomesacentralthemeincapitalmarkets.Thesesectors offeropportunitiesforbothfinancialreturnsandpositive societalcontributions,aligningwiththevaluesofmodern investors.

Investorbehaviorhasbecomeincreasinglyimpulsivein responsetomarketvolatilityandinformationoverload. Emotionaldecisions—suchaspanic-sellingorrushinginto gold—areoftentriggeredbyfear-inducingnewsorsocial mediacontent.Visionaryinvestorsunderstandthe importanceofmanagingthesebiasesthroughproactive strategies.

BehavioralAItoolsnowplayacriticalroleinidentifying patternsofclientanxietybeforetheyescalateintoharmful financialdecisions.Byleveragingtheseinsights,advisors canguideclientstowardrationalchoicesthatalignwith long-termgoals.Thisproactiveapproachnotonly strengthensrelationshipsbutalsomitigatesrisksassociated withemotionalinvesting.

Whileinnovationdrivesgrowth,italsointroducesrisksthat requirecarefulmanagement.Cryptocurrencyremainsa volatileassetclassdespiteitsgrowingadoption.Experts recommendallocatingonly5–10%ofportfoliostodigital assetstobalancepotentialrewardswithinherentrisks.

Similarly,visionaryinvestorsarecautiousaboutspeculative trendswhilefocusingonproventechnologieslikeAIand cloudcomputing.Diversificationacrossresilientsectors ensuresstabilitywhileenablingexposuretohigh-growth areas.

Thefutureofwealthmanagementliesinhyperpersonalizationandclient-centricmodels.Investorsdemand tailoredsolutionsthataddresstheiruniqueneeds, preferences,andriskprofiles.Firmsareadoptinghybrid advisoryapproachesthatcombinehumanexpertisewith digitaltoolsforseamlessclientexperiences.

Hyper-personalizationextendsbeyondportfolio managementtoincludediversifiedproducts,revamped distributionchannels,andend-to-enddigitaloperations.

Thisshiftreflectsthegrowingimportanceofunderstanding individualinvestorbehaviorsanddeliveringcustomized strategies.

Inaneradefinedbyrapidchange,trustbecomesacritical assetforinvestorsandadvisorsalike.Strategic communicationplaysavitalroleinpositioningfirmsas thoughtleadersinemergingsectorslikeAI,cybersecurity, andfintech.Bysharinginsightfulcontentandengaging withstakeholderseffectively,firmscandifferentiate themselvesincompetitivemarkets.

Visionaryinvestorsprioritizetransparencyandeducationto fostertrustamongclients.Clearcommunicationabout risks,opportunities,andstrategiesbuildsconfidenceand strengthensrelationships—akeyfactorforsuccessin2025.

Regulatorychangesarereshapinginvestmentdynamics globally.IntheU.S.,pro-cryptolegislationiscreating favorableconditionsfordigitalassets,whileotherregions focusonenvironmentalregulationsthatimpacttraditional industries.Visionaryinvestorsstayinformedaboutthese developmentstoadaptstrategiesaccordingly

Compliancewithevolvingregulationsrequiresagilityand foresight.Firmsthatproactivelyaddressregulatory challengesgainacompetitiveedgewhilesafeguardingtheir investmentsagainstunforeseendisruptions.

Thevisionaryinvestormindsetin2025isdefinedby adaptability,innovation,andresilience.Successliesin embracingtechnologyasastrategictool,prioritizing sectorswithdurabledemand,managingbehavioralbiases proactively,balancingriskwithopportunity,andfostering trustthroughstrategiccommunication.

Asmarketsevolverapidly,visionaryinvestorsremain focusedonlong-termgoalswhileleveragingemerging trendstonavigateuncertainty.Byadoptingthismindset, theypositionthemselvesnotjustasparticipantsbutas leadersinshapingthefutureofinvesting.

“If you aren't willing to own a stock for 10 years, don't even think about owning it for 10 minutes.”