George Thomas

The CIO is no longer just a . They are a TECHNOLOGIST strategic , BUSINESS LEADER driving digital transformation and .INNOVATION

The CIO is no longer just a . They are a TECHNOLOGIST strategic , BUSINESS LEADER driving digital transformation and .INNOVATION

TheCaribbeanhaslongbeenavibranthubofculturalrichnessandentrepreneurial

spirit.In2025,itsbusinesslandscapeisthrivingmorethanever,drivenbyvisionary leaderswhoareredefiningindustriesandpropellingtheregiontonewheights.These leadersarenotjusttransformingbusinesses—theyarefosteringeconomicgrowth, innovation,andsustainabilityacrosstheCaribbean.

Inthisfeature,TheCIOWorldproudlypresentsthe Most Influential Caribbean Business Leaders to Know in 2025.Fromtourismandfinancetotechnologyandsustainable development,thesetrailblazersrepresentthebestofwhattheregionhastooffer.Their unwaveringcommitmenttoexcellence,bolddecision-making,andabilitytoadapttothe globalmarket'sevolvingdemandsmakethemexemplaryleaderstowatch.

Theseinfluentialfiguresarenotonlyadvancingtheirrespectiveindustriesbutalso championinginitiativesthatempowerlocalcommunitiesandpreservetheCaribbean’s uniqueidentity Throughstrategicthinking,resilience,andaglobaloutlook,theyaresetting benchmarksthatresonatefarbeyondtheregion.

Asyoudelveintotheirstories,youwilldiscovertheinnovationsandleadershipprinciples thatdefinetheirsuccess.TheirjourneysinspireconfidenceintheCaribbean’sabilityto competeandthriveinaglobalizedeconomy,whilestayingrootedinitsdistinctivevalues.

Wecelebratetheseoutstandingbusinessleaders,recognizingtheirimpactontheCaribbean's growthandtheirroleinshapingabrighterfuturefortheregion.

20. P R O F I L E

A R T I C L E S Why Fin-Tech Architecture is Essential for Modern Banking Solutions Why User Experience Should Drive Your Fin-Tech Architecture Decisions 08. C O V E R S T O R Y George Thomas The Unlikely Programmer

Keith Davies Modernizing the Bahamian Finance Industry

Editor-in-Chief

Deputy Editor

Managing Editor

Assistant Editor

Visualizer

Art & Design Head

Art & Design Assitant

Business Development Manager

Business Development Executives

Technical Head

Assitant Technical Head

Digital Marketing Manager

Research Analyst

Circulation Manager

David

Mia

Richard

Donnica Hawes-Saunders Senior Manager

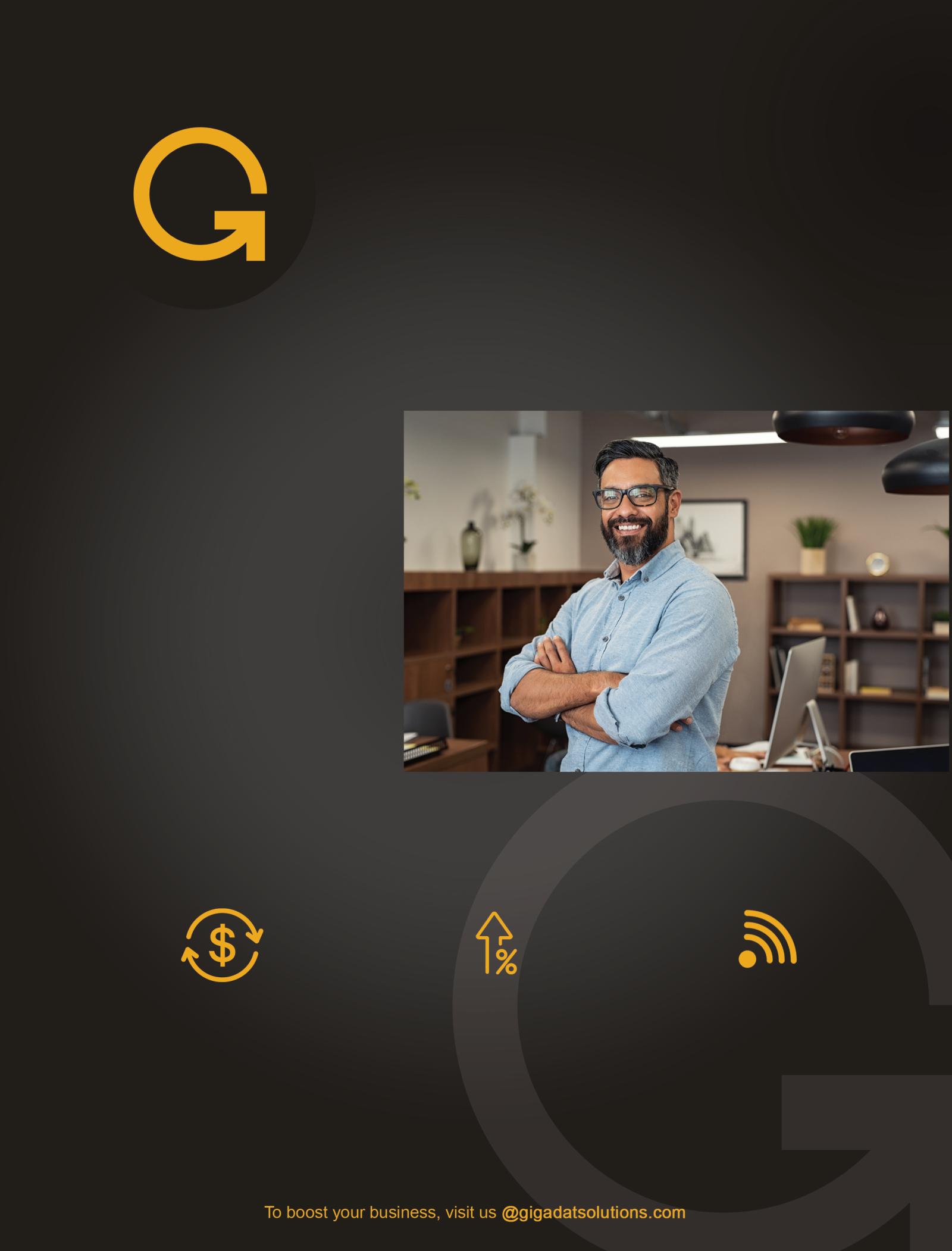

George Thomas

CEO

Jenifer (Dillon) Namestka CEO/Principal Consultant

Keith Davies

CEO

Pauline Parry

CEO and Founder

Philip Morris Interna�onal pmi.com Company Name

Sagicor Bank Barbados sagicor.bank

Avo Solu�ons, Inc. avosolu�ons.com

Kanno Pays kanoopays.com

Good Gracious! Events goodgracious events.com

Donnica develops and oversees global and U.S. public affairs outreach and external communica�on engagements for the company in civil society as PMI moves out of the cigare�e business and towards a smoke-free future.

George's leadership is characterized by a commitment to opera�onal efficiency, customer-centric strategies, and building high-performance teams.

Jenifer Namestka of Avo Solu�ons brings over 20 years of experience developing strategies, overseeing large program implementa�ons.

Keith’s approach to leadership emphasizes integrity, customer sa�sfac�on, and long-term success, enabling his organiza�on to thrive in a compe��ve market.

Pauline is turning gatherings into memories, leaving an indelible mark on the hearts of those who par�cipate.

Withover30yearsofexpertiseinfinanceand technology,GeorgeThomas,aself-defined redoubtableFin-TechArchitect,isoptimally positionedasCEOofSagicorBank(Barbados)Limited, spearheadingthedigitaltransformationoffinancialservices inBarbadosandtheCaribbeanregion.Hispassionfor,and expertiseindigitalinnovation,areevidentinthejourney thatdefineshisextraordinarycareer.

George'smotherwasaneducatorwhohadamassedavast anddiverselibrarywithintheirhome.Georgeimmersed himselfinawidegamutoftopicsincludingliterature, phycology,sociology,history,andpoliticalscience.Years later,hewouldrecognizehowthisearlyintakeofmaterial ofsuchdepth,openedhismindallowinghimtoembrace andunderstandpeopleandthingsinasimplebutprofound way.

Bythetimehewasateenager,heaspiredtobeanengineer andfollowinhisfather'sfootsteps.Simultaneously,his talentasapromising400Mtrackathletefueledambitions ofsecuringanathleticscholarshiptoaprestigious Americanuniversity.Hisvisionwastwo-fold;tobeaworld classathleteandbeanElectricalEngineer.

Aseriesofinjuriesthwartedhisathleticdreamsbutdidnot diminishhisresolvetomakehismark.Undeterred,George pivotedtoComputerScience,earningadegreefromthe UniversityoftheWestIndies,CaveHillcampusin Barbados;layingthefoundationforhisjourneyintothe globaltechnologyindustry.

ItwasatBarbadosExternalTelecommunications(aCable &Wirelesscompany)thatGeorge'scareerstartedinthe areaofprogramming(COBOLtobespecific)andwherehe honedhissoftwaredevelopmentandanalysisskills,And discoveringhisnaturaltalentfortranslatingbusiness stakeholderstrategiesintoclearactionablebusiness requirement,technologysolutionsandproducts.Thisinnate abilitytobridgethechasmbetweenbusinessneedsand complextechnologysolutionswouldbecomeacornerstone ofhiscareersuccessovertheyears.Afterayearwiththe company,GeorgeelectedtopursueaMaster'sdegree, howeverdeferredmatriculationfortwoyears.Duringthis time,helecturedataprivatetertiaryinstitutionforashort periodbeforebeingrecruitedintoaSoftwareEngineering role,workingforanoffshorecompany(SoftKey International)thatwasfoundedbybillionaireKevin O'Leary,wellknownforhisconnectiontothepopularTV seriesSharkTank.SoftKeyprovidedGeorgewith invaluableexperienceacrosseveryaspectoftheglobal

softwareproductdevelopmentindustry: concept,design, contractualnegotiations,softwaredevelopment,quality assurance,productpackaging,retailsupplychains,after salessupportandquantificationofproductlineP&L. ThoughhistitlewasthatofEngineer,thisiswherehis leadershipacumenwasignited.

Recommittingtocompletinghisformalacademicgoalsand owingtotheeffortsofProfessorDr.KeithSandiford (retiredHeadofLSU'sEnglishfaculty,andformerEnglish teacheratCombermereSchool),Georgeearnedan assistantshipatLouisianaStateUniversity(LSU)topursue hisMaster'sdegree.InJanuary1996whileworkingonhis thesis,GeorgeacceptedajoboffertoreturntoSoftKey International,thistimetoworkwiththeminBostonasa SeniorSoftwareEngineer.Notably,whenhegraduated fromLSUinDecember1996withaMaster'sinElectrical Engineering,hebecameoneofafeweliteindividualsfrom thisregiontoachievethismilestoneatthattimeinthe University'shistory

George'scareertrajectorycontinueditsupwardmomentum ashewasrecruitedbyMonster.comasaSeniorSoftware Engineerwherehequicklytookonresponsibilityforlong termResearch&Developmentprojects.In1998KeaneInc. (nowNTTData)camecalling,andGeorgejoinedthe consultingfirmasaPrincipalConsultantandSoftware Architect.Withinsixmonthshisexceptionalperformance ledtoapromotiontoeSolutionsPracticeManagerforthe GreaterBostonandMassachusettsterritories,wherehe closedarecord-breakingmultimilliondollarsoftware developmentandoutsourcedmanagementdealwithPutnam Investments,oneofNorthAmerica'slargestmutualfund companiesatthetime.Thiswasthelargestsoftware developmentdealinKeane's35+yearhistoryuptothat point,anditwasGeorge'sintroductiontofinancialservices –onethatcouldberightfullysurmisedasabaptismbyfire. Hehadprovenhimselfdeservingofhisexecutive managementtitle.

Aftertheeventsof9/11andthedot-combubble evaporation,KeanerefocussedonApplicationOutsourcing, leadingGeorgetomovetoWashingtonDCasSenior EnterpriseArchitectfortheDistrictofColumbia Governmenttechnologymodernizationprogram.Inthat role,hewasresponsibleforthecreationofabestofbreed ERParchitecture.

In2003,atelephonecallfromaclosefriendinBarbados broughtnewsofanopportunitycreatedoutofamerger betweentwoofthelargestinternationalbanksoperatingin theCaribbean.Perhapsitwasacaseofhomedrums beatingfirstthatledGeorgetoapplyforaposition,which spawnedanexcitingappointmentatthisnewlymerged bankasaProjectManagerandSystemArchitect.Here,he implementedstate-of-the-artinternetbanking,mobile banking,onlinepaymentsandcorebankingtechnologies, andwaslaterappointedChiefArchitect,thenSenior DirectorofTechnologyInfrastructure,Architectureand Cybersecurity

George'sremarkablejourneytookanotherturnwhenhewas recruitedasChiefTechnologyOfficerandEVPofBanking Productsforamajorcompany'sEMEA(Europe,Middle East&Africa)region.Histimewiththiscompany sharpenednotonlyhisbusinessacumenandprofessional fortitudebutbroughtlaser-likefocusandstructuretohow heapproachedallaspectsoflife.Afterfouryearsbasedin Dubai,workingwithaUSfintecwithagoaltoenterthe mobilepaymentsindustryacrossAfrica,andhavinggained

“ “

valuableexperienceacrossgreenfieldandcorporate acquisitions,hereturnedtothebankwherehehadalready laidastrongfoundationtofinishhiswork,thistimeas DeputyCIOtoleaditstechnologydigitaltransformation. Georgeledthischangerecognizingthatbankingwas undergoingaseismicshifttowardsdigitalization,andthat competitorsintheretailbankingspacewouldneedtodo thingsdifferently.

Enter Sagicor Bank (Barbados) Limited…Having commissionedextensiveresearch,whosefindingsunearthed highlevelsofdiscontentamongcustomersofcommercial banksinBarbados,Sagicorrecognizedtheopportunityand theneedtoapproachbankingdifferently,createadynamic financialinstitutionwithaclearmissiontobedigital, employeeandclient-centricandprofitable.Itwas undeniablethatsuchanentitywouldrequireexceptional leadership,anindividualwithauniquecombinationofa financialandtechnologybackgroundwhocoulddefine, structure,anddifferentiatethebanktobethemarketleader Georgewastheconsummatechoiceforthepositionand wasrecruitedasCEOofSagicorBank(Barbados)Limited (SBBL).

Withalifephilosophyanchoredinthebeliefthatthereis alwaysaway,combinedwiththegritandperseverancewith whichGeorgeattackseachhurdle,heandhisteambuiltand

launchedtheneobankfromscratchinrecordtime.March 9th,2023,thedaythatSagicorBankwentlive,standsasthe pinnacleofGeorge'scareer,adaymarkedbyunparalleled prideandsignificance.Theyhadsuccessfullylauncheda bankcommittedtobringingaleveloffinancialservices, firsttoBarbadosthenthewiderCaribbean,whichisonpar withinternationalmarkets.ABankcommittedtobuilding andsustainingaculture,internallyandexternally,of excellenceanddedication.Deliveringtoclientswhatthey askedfor,howtheyaskedforit,andwiththebest technologybehindit.Affirmingtheircommitmentto makingthebankingexperiencesafeandsecurewith productseasytogetandeasytouse.SagicorBankis changingthewaypeoplefeelaboutbanking-whetheran individual,smallbusinessorlargecorporateclient.

Georgeembodiesthecredoofdoingbettertomorrowthan hedidtoday,andunderstandswhatthatmeansfortheBank andhisteam.Internallythattranslatestofosteringan environmentofpositivityandsupport.Forthebank'sclients itcentresaroundactivelistening,marketresearch,market engagement,andtheuseofmoderntechnologythat simulatenouslydrivesinnovationandsupportstheBank's strategyanditspeople.Thisblendofinternalandexternal focushasprovenefficaciousatthisjuncture.Havingbeenin themarketforjustoverayear,SagicorBankhasaclient basewhichalreadyencompassesmorethan10%ofthe localmarket,withdepositsexceeding110millionBarbados dollars.Thisisnosmallfeatparticularlyinahistorically traditionalandconservativemarketsuchasBarbados.

Havingsuccessfullycompletedtheinauguralyear,itisclear thattheinitialachievementsmarkonlythebeginningfor thebank.UndertheheadshipofthisBarbadiannative, SagicorBank(Barbados)Limitedispoisedtocontinueto leadthemarketindigitalinnovation,transforminghow financialservicesaredeliveredandexperiencedacrossthe Caribbean.George'sjourneyfromaspiringathletetoa trailblazerindigitalbankingisatestamenttohisresilience, intellect,andunwaveringdedication.Hisabilityto overcomeadversity,embracelearning,drivechange,and motivatehisteamhasnotonlyshapedhiscareerbuthas alsopositionedhimasaleadercapableofdrivingindustrydefiningresults.

George'sfinalnuggetofwisdomandinspiration-real leadershipisabouttransforminglimitationsinto possibilities,gobravelybeyondthelimits.

Successful CEOs are those who have the ability to inspire and motivate others, to build strong teams, and to lead by example.

- Cyril Ramaphosa

Architectureisoneoftheareasthatdetermine

modernbankingsolutions.Beyondsupportfor thefunctionalityofbankingsystems,fin-tech architectureservestoenrichthecustomerexperienceas wellasoptimizeoperationalefficiency.Asconsumer expectationskeepescalatingandtechnologytrendsare emerging,financialinstitutionslookingtobemore competitivehaveapressingneedtocatchontothe importanceoffin-techarchitecture.

TheBasicsofFin-TechArchitecture

Fin-techarchitecturedenotesthetechnicalbuilding blocksthatactasthespineoffinancialservices software.Severalelementsaregenerallyinvolved, namelymicroservicesandapplicationprogramming interfaces(APIs)forcloudanddataanalytics integration.Alltheelementscometogethertoestablish astrongecosystemthatcanworkunderthevagariesof emergingmarketdemands.

Microservicesaretheothermainelementinthis architecture.Breakingapplicationsintoanumberof independentservicesimprovesscalabilityand maintainability.Amicroservicecanbedeveloped, deployed,andupdatedseparately,thusallowing innovationcyclesthatworkfaster Thatisimportant becausespeedtomarketinthisindustrymeanssuccess orfailure.

APIsaretheconnectivetissuewithinfin-tech architecture.Theyallowdifferentsystemstospeakto andsharedatawitheachotherseamlessly

So,anAPI-firstapproachwillhelpbusinessesintegrateany third-partyserviceseasilywithoutmajorredevelopmentof whattheydo.Thisaspectisvitalbecauseitallowsbanksto createinnovationincollaborationwithfintechcompaniesin ordertoserveclientsbetter.

Cloudcomputinghasdramaticallychangedthemannerin whichfinancialinstitutionsoperate.Bankscanbenefitfrom cloud-basedsolutionstoavailofgreaterscalabilityand cost-effectiveness.Thecloudplatformcanstoremassive datawhileremainingaccessiblefromallcornersofthe world,whichishighlybeneficialforbankslookingto expandtheirserviceswithoutbuildingitsinfrastructure.

Italsoenhancessecurity.Cloudcomputingprovides financialinstitutionswithadvancedsecuritymeasures offeredbythecloudprovider.Suchsecuritymeasures protectsensitiveinformationofcustomers,especiallyina worldwherecyberattacksarerampantandcompliancewith regulationsiskey

Thesecondcrucialaspectofthearchitectureinfin-techis dataanalytics.Throughtheanalysisofcustomerdata,banks willknowmuchaboutthebehaviorandpreferenceof consumers.Thisinformationmakesitpossibleforfinancial institutionstotailortheirproductsandservicestoward meetingindividualneedseffectively

Inaddition,predictiveanalyticsenablesbankstorecognize potentialrisksandopportunitiesintheirportfolios.Theuse ofmachinelearningalgorithmscanhelpinstitutions anticipatemarkettrends,whichcanberespondedto accordingly Thisproactiveapproachnotonlyhelps mitigaterisksbutalsoenhancescustomersatisfaction throughpersonalization.

Inthedigitalworld,customersexpectbankstobeboth efficientandpersonal.Fin-techarchitectureallowsthemto dojustthatbybeingabletoofferuser-friendlyinterfaces andseamlesstransactionsacrosschannelsofdistribution. Whateverthechannelordevice,customerfinancial informationneedstobeinstantlyavailable.

RPAalsohelpsfacilitateoperationsthroughintegrationasit automatesroutinetaskstohelpfreeuptimefortackling complexissuesthatnecessarilywouldrequirehuman

inputs.Efficiencyincreasesoverall.RPAalsofacilitates paperverificationprocessessuchasdocumentverification inaloanoriginationorcustomeronboardingprocess, therebyspeedinguptheprocessesofprocessing.

BaaSisoneofthemostprominenttrendsinfintech architecture.Itprovidesthird-partycompanieswithAPIs offeredbyestablishedbankstoaccessbanking functionalities.Thisallowsbusinessestomakebanking servicesavailablethroughtheirownplatforms,bypassing theneedtoconstructafull-fledgedbankingsystem.

WithBaaS,firmscanofferbankingservices,beitpayment processingorlendingcapabilities,nativelyintheir application.Thisbenefitsthetraditionalbanknotonlyto increasetheirownscopebutalsocreatesaplayingfieldfor innovativefintechplayerscompetingtouniquelyservice particularsegments.

Itwouldthusbecomecriticalforbankstotakeastep forwardandbuildanevenmoreresilientfin-tech architecturethatwouldprovecapableoffightingthe challengesaswellasopportunitiesemanatingfromthe future.Modularstructuressupportseparateupgradesand developmentwithoutnecessarilyalteringexistingservices. Thisflexibilityiswhatensuresthebanksareresponsiveto changesoccurringintherealmoftechnology

Securitybydesignprinciplesisanotherimportantelement incorporatedintothearchitecturetoprotectsensitive informationfromcyber-attacks.Automatedcodereview andstaticanalysisensurehigh-securitystandards throughoutthedevelopmentprocess.

Inconclusion,thefin-techarchitectureisthebackboneof modernbankingsolutions,asitallowsforinnovation, efficiency,andbettercustomerexperience.Withtheuseof microservices,APIs,cloudcomputing,dataanalytics,and emergingmodelssuchasBaaS,financialinstitutionscanbe well-positionedforsuccessinacompetitivelandscape.

Astheexpectationsofconsumersincreasedueto technologicaladvancements,investinginawell-designed fin-techarchitecturewillbeimperativeforbankswhowant toremainsuccessfulinavolatileenvironment.Inthis respect,thecapabilitytoevolvewiththesecurityfeaturesof financialsolutionsbasedonthecustomerwouldhelp navigatethecomplexnatureofmodernbanking. CIO

On a Mission to Position The Bahamas as a Global Leader in Digital Currency!

TheBahamas,likemanysmallislandnations,facesa

uniquechallengeintherapidlygrowingworldof finance:howtomodernizeitsfinancial infrastructurewhilemaintainingeconomicsovereigntyand improvingthelivesofitscitizens.MeetKeithDavies, CEOofKanooPays,avisionaryleaderwhohasmadeit hislife'smissiontosolvethiscomplexpuzzle.

Keith,aveteranintheBahamianfinancialindustry,has devotedhisexpertisetotransformingthenation'sfinancial framework.Hiseffortsaredrivenbyacommitmentto preservingeconomicindependenceandimprovingthewellbeingoftheBahamianpeople.

AsCEOofKanoo,hehasledtheintegrationofthenation's firstCentralBankDigitalCurrency(CBDC)-enabled paymentservicesintothecompany'splatform.Byworking closelywiththeCentralBankofTheBahamasandother financialinstitutionsfromthestart,thisinitiativeis revolutionizinghowBahamiansmanagetheirfinances, contributingtoamoreinclusiveandprogressiveeconomic landscape.

Thisgroundbreakinginitiativeisjustthelatestinhislong careeroffinancialinnovation.Fordecades,hehasbeenthe drivingforcebehindTheBahamas'financialevolution.His fingerprintscanbefoundonvirtuallyeverymajor developmentinthecountry'sfinancialsector,fromcrafting theregulationsthatgovernthesecuritiesindustryto buildingthenation'sstockexchange.

Keith'sjourneyisanexampleofhiscommitmentto progress.Hehasbeeninstrumentalindevelopingthe

As a leader, you must sometimes make unpopular decisions to protect the future of the business, staying true to the principles that guide you. This commitment helps you navigate tough choices, knowing it's for the greater good.

clearingandsettlementsystemsforcapitalmarketsand creatingthegovernment'stradingplatform.Eachstepofhis careerhasbeenmarkedbyadedicationtopushing boundariesandembracingnewtechnologies.

Butit'shisworkwithKanoothattrulyshowcaseshisvision forthefuture.ByembracingCBDCtechnology,he'snot justkeepingTheBahamasrelevantintheglobalfinancial conversation;he'spositioningthecountryasapotential leaderinthedigitalcurrencyspace.Thismovecouldhave far-reachingimplications,notonlyforTheBahamasbutfor smallnationsworldwidegrapplingwithsimilarchallenges.

Forhim,thisisn'tjustabouttechnologicaladvancementor keepingupwithglobaltrends.Attheheartofhisworkisa deep-seateddesiretoimprovethelivesofhisfellow Bahamians.Heseesfinancialinnovationasameanstoan end—awaytocreatemoreopportunities,increasefinancial inclusion,andboosteconomicgrowthinhishomeland.

AsKanoocontinuestorolloutitsinnovativepayment solutions,theeyesofthefinancialworldareonThe Bahamas.WithKeithatthehelm,thissmallislandnationis poisedtomakeabigsplashinthefutureoffinance.His blendofregulatoryexpertise,innovativespirit,and commitmenttosocialgoodmakeshimauniquefigurein theworldoffinance.

Davies'storyisapowerfulreminderthat,withtheright leadershipandvision,eventhemostdauntingchallenges canbecomeopportunitiesforgroundbreakinginnovation.

AsTheBahamasstepsintothespotlightoftheglobal financialstage,itdoessowithaleaderwhounderstands thattrueprogressismeasurednotjustintechnological advancementsbutinthepositiveimpactonpeople'slives.

Below are the interview highlights:

Pleasetellusaboutyourselfandwhatinspiredyouto jointhissector.

Mycareerisatestamenttomypassionforinnovationand growth.I'veplayedapivotalroleinshapingtheregulations thathavepropelledthesecuritiesindustryandThe Bahamas'StockExchangetotheircurrentreputablestatus. I'vealsomadesignificantcontributionsbybuildingour capitalmarketsclearingandsettlementsystems,and creatingthegovernment'stradingplatform.Ialsolaunched thefirstCentralBankDigitalCurrency(CBDC)-enabled paymentserviceproviderinthecountry

Theinspirationcamefromtheopportunitytoworkon transformativeprojectsthatimprovethelivesof Bahamians.

Itwasanaturalprogressionformetotakeonthese challengesandgivemybesttoachieveourgoals.

Canyougiveourreadersaninsightintoyourcompany anditsinceptionstory?

Kanooisadigitalpaymentserviceproviderlicensedbythe CentralBankofTheBahamas.Ourdigitalwalletallows merchantsandconsumerstotransactdigitallybasedonthe corevaluesofsecurity,prosperity,empowerment,and convenience.

Ourinceptionbeganwhenourchairman,NicholasRees, introducedmetoatechnologycontactin2016or2017.We quicklystarteddiscussingwhatwecouldachieveandbegan developingaprojectplan.NicholasandIworkedclosely, puttingtogetherthepiecestobringKanootolife.Since then,we'vebeenworkinghandinglove,andtherestis history.

Whatmotivatesyoutoleadandinspireyourteam towardsachievingbusinessgoals?

Asaservantleader,Imeasuremysuccessbythesuccessof thoseinmycharge.Itakeresponsibilitywhenthingsgo wrongandupliftmyteamwhenthingsgoright.Myfocusis onlearningandimprovement,encouragingmyteamtosee mistakesasopportunitiesforgrowth.It'saboutcontinuous progressandhelpingothersrecognizeandachievetheir potential.Ifindjoyinseeingotherssucceedandexceed theirownexpectations.

Howdoyoubalanceshort-termsuccesswithlong-term success?

Inthisbusinessandmanyothers,it'samarathon,nota sprint.Whilequickeruptionsofenergyaresometimes needed,it'sessentialtofocusonyourultimategoaland workbackwardfromthere.Balancingshort-termsuccess withlong-termsustainabilityrequiresconsistent,positive steps.Short-termwinsandlossesarelessimportantthan maintainingsteadyprogress.Failuresarepartofthe learningprocess,andrecognizingfleetingopportunitiesis crucial.Stayinggroundedandunderstandingbothshorttermandlong-termgoalsiskeytoasuccessfulbusiness strategy

Canyoushareasignificantchallengeyouhavefacedas abusinessleaderandhowyouovercameit?

Ihadtopivotastrugglingbusinessmodelearlyinmy careerafterraisingsubstantialcapital.Duetovarious misstepsanduncontrollablefactors,wefacedfinancial trouble.Ihadtoquicklychangeourcorebusiness

At Kanoo, we aim to move at the speed of life, whether walking, jogging, or running, providing tools that make life easier.

elements—staff,practices,products,services,and technology—tomakeitwork.

Myprioritywasensuringmyteam'ssuccess,helpingthem findnewpositions,andtakingcareofthem.Thisapproach paidoff,asformeremployeescontinuedtosupportthe business.

Overcomingthischallengerequiredhardwork,dedication, focus,andtheabilitytopivot.Iimplementedalong-term, goal-orientedplan,stayingfocuseddespitethenormal businesscycle’supsanddowns.

Howdoyoufosterapositiveandinclusivework environmentinyourorganization?

Leadershipsetsthetoneforanorganization.Ifleadersaren't positiveandinclusive,itaffectseveryone.Ibelievein practicingwhatIpreach,alwayslookingforthebestinmy team,andneverblamingthemforhonestmistakes.Aslong assomethingisn'tintentionallyillegalorharmful,Iseeitas ajobwelldone.Idemonstratethisthroughmyworkethic andexpectthesamefrommyexecutives,ensuringthatit permeatestheorganization.

Whatroledoesinnovationplayinyourbusiness's growthandsuccess?

Innovationdrivesourbusinessgrowthandsuccess.In fintech,wesolveproblemsbyprovidingwhatpeoplewant, notwhatwethinktheyneed,andbyapproachingtheminan invitingway Wemeetpeoplewheretheyareandguide themtowheretheywanttobe.

AtKanoo,weaimtomoveatthespeedoflife,whether walking,jogging,orrunning,providingtoolsthatmakelife easier.Innovationiscrucial,soweconstantlythinkabout what’snextandhowtoimprove.Ourgoalistooffer solutionsthatpeoplefindessentialandcan'tdowithout.

Howdoyouadaptyourleadershipstyletodifferent personalitiesandworkstyleswithinyourteam?

Iinsistonhiringpeoplesmarterthanmewithdifferent personalitiesandleadershipstyles.Bringingindiverse perspectivespreventsfailureandpromotesgrowth.InThe Bahamas,wecomparethistoamixedconchsalad,whichis deliciousbecauseofitsvariety.

Wewantteammemberstoembracechange,bescrappy, shakethingsup,andthinkoutsidethebox.Myleadership styleiswelcomingandencouragesindividuality,allowing

ideasfromtheleftfieldtothrive.Thisapproachmakesusa strongerorganization.

Canyoudiscussatimewhenyouhadtomakeadifficult decisionasabusinessleaderandwhatfactorsinfluenced yourdecision-makingprocess?

Ioncehadtomakethedifficultdecisiontoscaledown operationsatacompanyIwasleading.Althoughitwas hardtosendpeoplehome,Iunderstoodthatthebusiness neededtosurvivetoeventuallygrowandhelpmorepeople. Ibalancedbusinessneedswithpersonalcare,ensuringthat employeesweresupportedastheytransitionedaway Asaleader,youmustsometimesmakeunpopulardecisions toprotectthefutureofthebusiness,stayingtruetothe principlesthatguideyou.Thiscommitmenthelpsyou navigatetoughchoices,knowingit'sforthegreatergood.

Whatdoyoumeasuretomeasurethesuccessofyour business,andwhatmetricsdoyoufocuson?

Inbusiness,theprimarygoalisprofit.AsCEO,myroleis tosafeguardapositivereturnoninvestmentforour investorsandshareholders.Achievingthisrequiresgood businesspractices,corporategovernance,anddeliveringa high-qualityproductatacompetitivecost.Ourproduct mustbesleek,scalable,andmeetmarketneeds.Wealso needaskilled,motivatedteam.Byfocusingonthese elements,weaimtogenerateprofitanddrivebusiness growth.

Whatadvicewouldyougivetoaspiringbusinessesthat wanttomakeapositiveimpactintheirindustry?

Goodworkcanbehard,butworkingsmartiskey Working foryourselfmeanslonger,harderhours,butit'srewarding whenyoureffortsbenefityoudirectly.Focusanddiscipline areessential.Yourvisionisunique,andnoteveryonewill seeitrightaway Youmustclearlycommunicateyour visiontootherssotheycanadoptandsupportit.

AtKanoo,we'recommittedtogivingpeoplethe'Powerto Prosper'.WhenItalktobusinessesaboutbecoming merchants,theyquicklygraspandfeelourvision. Manyhavetoldme,"I'msold.Iwanttobepartofthis," withinminutes.Thisemotionalconnectionmakesiteasy forthemtojoinus.Whenpeoplearesoldonyourvision, deliveringservicesbecomeseffortless,astheyareeagerto bepartofwhatyou'redoing.

UXhasnowemergedasacriticalfactorinthe

architecturedecisionsofthefintechcompanies.

Asthisfinancialtechnologysectorcontinuesto advanceandevolve,understandingandprioritizingUX willimpactcustomersatisfactionandretentiontoachieve successinbusiness.Thenextsectiontriestoexplorewhy UXshoulddrivearchitecturalchoicesinfintechandhow itcancreateacompetitiveadvantage.

Inthefintechenvironment,whichthrivesontrustand security,auser-centricdesignisofutmostimportance. Customersaccesssensitiveinformationdaytoday rangingfrombankdetailstotransactionhistory.The beautyofusabilityinawell-designeduserinterfacelies ininstillingtheconfidenceoftheusertonavigatethe application.Whenausercanconfidentlynavigatean application,theyaremorelikelytouseitrepeatedly. Increasingsatisfactionleveloccurswhenusersfeelat easewiththeexperienceduringfinancialtransactions.

Moreover,agooduserexperiencecansignificantly contributetobrands’loyalty.Usersprefermostlytouse applicationsforwhichtheyreceivetheirdesired applications.

Fintechcompaniesputtingeffortintothedesignsofeasy applicationsareusuallyfavoredwithgoodreturnson customerretention.Usersofeasilyapplicableapplications don’tshifttoanyotherapplicationfortherestoftheirlives duetotheirrelianceonthatveryapplication.

ThebestUXdesignisnotonlyaestheticallypleasingbutit alsocreatesanexperiencethatconnectswiththeuser.A fintechcompanycanadjustitsproductsandservices accordingtospecificneedsthroughunderstandinguser behaviorandpainpoints.Forexample,apersonal dashboardorauto-financialadvisorycanempowerauserin themakingofappropriatefinancialdecisions.

Qualityisdirectlyproportionaltoengagement.Thebetter thestructuredapplication,themorefeaturesitencourages userstoexplore,hencethedeepertheinteractionswiththe platform.Itusuallyresultsinhigherconversionratessince userstendtouseserviceswhentheyaremadeaccessible.

Trustisoneofthecriticalaspectsofsuccessfulfintech applications.Itshouldreassuretheusersofthesafetyof theirdataandtheplatformfortheirfinancialrequirements. Theveryclearapproachtodesign,liketransparentprivacy policies,orvisiblesecuritymeasures,cangreatlyhelp increasetheconfidenceleveloftheuser.Featuressuchas multi-factorauthenticationorreal-timealertsfor transactionsworkasaformoftrustsignalthatwould reassuretheusersoftheirsafety.

Theeasyaccessibilityoflegalcontentandtermsofservice offersasenseofsecuritytousers.Themoreacustomer understandshowhisdataismanagedandprotected,the morelikelyhewillbetofullyengagewiththeplatform.

PersonalizationisanothervitalaspectofUXinfintech. Usershavediversefinancialgoalsandpreferences; therefore,offeringtailoredsolutionscangreatlyenhance theirexperience.Fintechapplicationsthatallowusersto customizetheirdashboardsorreceivepersonalizedfinancial recommendationscreateasenseofagencyovertheir finances.

Thislevelofpersonalizationnotonlyenhancescustomer satisfactionbutalsofostersrepeateduseoftheonline service.Whenfeaturesarealignedwiththecustomer’s objectives,whetherbudgetingtoolsorinvestmenttracking,

fintechcompaniescanformlong-termrelationshipswith theircustomers.

ExcellentUXinacrowdedmarketplacewillbetheonly differentiatorthatfintechcompaniescanboastabout.While lotsofappslooksimilarintheirfunctionality,it’stheones withgoodUXthatusersremember.InvestingingoodqualityUXdesignwillattractnewcustomersandretainthe existingonesforuniquevaluepropositions.

Forexample,inthefintechapplication,AIintegrationis optimizedtoenhanceuserexperiencethroughpredictive analyticsandpersonalizedinsights.AI-poweredchatbots guaranteeinstantsupportwhilemakingfinancialservices moreaccessiblewithoutovercomplicatingtheinterface.

Themostimportantfactorforausertotrustaserviceisthe absenceoferrorsintransactionsinthecorrectUXdesign.It makesnavigationeasierandinterfacesintuitive,sotheuser cancompletehisorhertaskwithoutconfusionormistakes. Suchefficiencynotonlyboostsuserconfidencebutalso overallsatisfactionwiththeservice.

Fintechappscan,onthecontraryactuallymaketheprocess muchmoreeffectivebystreamliningprocesses,which involvesimplifyingmodesofpaymentaswellas streamliningtransactionprocedures.Thediminutiverateof errorsleadstosmoothcustomerjourneyduringtheir interactionswithfinancialservices.

Thereisnomeansthroughwhichonecanoverstateuser experienceinfintech.Duringthegrowthandchangesofthe industry,prioritizingUXwillbevitalfortheperformance ofcompaniesinaverycompetitivelandscape.With intuitivedesignsencouragingtrust,engagement,andall typesofpersonalization,fintechfirmscancreatelong-term relationshipswiththeircustomers.

InvestmentinbetterUXdesignimprovesnotonlycustomer satisfactionbutalsoleadstobusinesssuccessbybuilding strongbrandpresenceinthemarket.Inaworldwhere consumersincreasinglyareturningtodigitalsolutionsfor financialneeds,it’sobviousthatuser-centricdesignwillbe thebeaconoflightatthehelminshapingthefutureof finance. CIO

www thecioworld.com