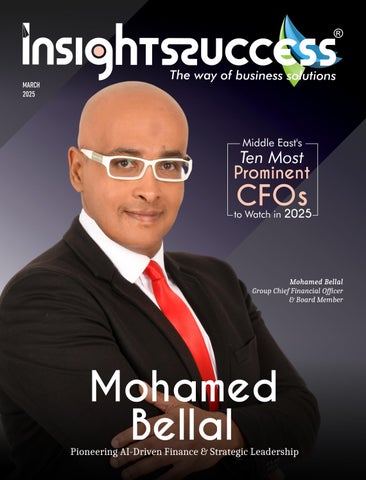

Mohamed Bellal Group Chief Financial Officer & Board Member

Mohamed Bellal Group Chief Financial Officer & Board Member

Successful CEOs are those who have the ability to inspire and motivate others, to build strong teams, and to lead by example.

- Cyril Ramaphosa

Intoday’srapidlyevolvingbusinesslandscape,ChiefFinancialOfficers(CFOs)aremore

thanjustfinancialgatekeepers—theyarestrategicleadersshapingthefutureoftheir organizations.Witheconomicshifts,technologicaladvancements,andanincreasingfocus onsustainability,CFOsplayapivotalroleindrivingfinancialstability,operationalefficiency, andlong-termgrowth.

Inthe Middle East’s Ten Most Prominent CFOs to Watch in 2025,werecognizethefinance leaderswhoareredefiningcorporatestrategyandfinancialmanagementinoneoftheworld’s mostdynamicregions.ThesedistinguishedCFOsareattheforefrontofdigitaltransformation, leveragingadvancedfinancialtechnologies,AI-driveninsights,andriskmanagementstrategies tonavigatecomplexchallenges.Theirabilitytoadapttoevolvingmarketconditionswhile ensuringfinancialresiliencemakesthemkeyplayersinthecorporateworld.

TheMiddleEastremainsathrivinghubofeconomicgrowth,andtheseCFOsareinstrumental inshapingitsfinancialfuture.Whethermanagingbillion-dollarinvestments,drivingmergers andacquisitions,orspearheadingsustainabilityinitiatives,theyexemplifyexcellencein leadership.Theircontributionsextendbeyondtheboardroom,influencingeconomicpolicies, fosteringinnovation,andsettingnewstandardsforfinancialgovernance.

Aswestepinto2025,theseteninfluentialCFOscontinuetopushboundaries,ensuringtheir organizationsremaincompetitiveinanincreasinglydigitalandinterconnectedworld.Their expertise,vision,andstrategicacumenareshapingthefinanciallandscapeoftheMiddleEast andbeyond.

Joinusincelebratingtheseoutstandingfinancialleaderswhoaretransformingbusinesses, industries,andeconomies—pavingthewayforafuturedefinedbyinnovation,resilience,and sustainablegrowth.

C O V E R S T O R Y

Mohamed Bellal

Pioneering AI-Driven Finance & Strategic Leadership

A R T I C L E S

22. 26.

How to Excel as a CFO in Modern Finance

Innovative Trends and Strategic Approaches That Are Reshaping the Future Responsibilities of a CFO

Business

Business

Marketing

Mohamed Bellal f Financial Officer d Member

SNASCO Holding KSA& UAE snascoinvestments.com Company

einberg

Gabi Al Far CFO oun

John Macedo Finance Execu�ve

Julien Espirito Santo CFO & Finance Advisor

Karim Khan Finance Analyst

Rao Faisal CFO

Sherif El-Agwany

Group CFO

Messe Frankfurt Middle East GmbH ae.messefrankfurt.com

Virtugroup virtugroup.ae

Mohamed is commi�ed to op�mizing financial performance, enhancing opera�onal efficiencies, and suppor�ng SNASCO’s long-term strategic vision.

Benjamin plays a key role in op�mizing financial performance, driving opera�onal efficiency, and suppor�ng Messe Frankfurt’s mission to foster global business connec�ons through world-class events.

Elias is commi�ed to leveraging financial insights to support Virtugroup’s innova�on and expansion, contribu�ng to the company’s success in a compe��ve market.

Black Spoon blackspoon.me

Dubai Islamic Bank dib.ae

Ethic It ethic-it.com

Damanat damanat.com.sa

With extensive experience in corporate finance, budge�ng, and financial governance, Gabi Al Far plays a key role in op�mizing financial performance and suppor�ng the company’s strategic vision.

John is dedicated to op�mizing financial performance, ensuring regulatory compliance, and suppor�ng the bank’s growth in the dynamic finance sector.

Julien is commi�ed to leveraging financial insights to support innova�on, scalability, and long-term success.

With exper�se in financial forecas�ng, risk assessment, and performance evalua�on, he plays a key role in op�mizing financial efficiency and ensuring data-driven insights.

Emirates Na�onal Copper Factory LLC nuhas.ae

Rao's leadership contributes to strengthening Emirates Na�onal Copper Factory’s market posi�on and delivering value to stakeholders.

Medmark Egypt medmark.eg

Sherif is commi�ed to leveraging financial insights to support Medmark’s expansion, innova�on, and market leadership in the insurance and healthcare solu�ons sector

Yusaf Ali CFO

Emircom emircom.com

Yusaf's leadership and financial acumen contribute to the company’s con�nued success and market expansion in the IT and telecommunica�ons sector.

Mohamed Bellal Group Chief Financial Officer & Board Member

Mohamed emphasizes that strategic success lies in adopting a tech-driven, data-centric, and stakeholder-focused financial approach while fostering agility and innovation.

Withadynamiccareerspanningcorporate

finance,strategicleadership,andfinancial innovation,MohamedBellalservesasthe GroupChiefFinancialOfficerandaBoardmember. LeveraginghisexpertiseinAI-drivenfinanceandemerging technologies,hehassuccessfullyoptimizedcorporate growthstrategiesanddrivenshareholdervalue.

HavingachievedhisgoalofbecomingaGroupCFOby theageof46ataholdinggroup,Mohamedisnowfocused onadvancinghisstrategicleadershipjourney,transforming financefromatraditionalfunctionintoadynamic,AIdrivenengineforbusinessgrowth.Hisleadership philosophyemphasizesdiscipline,delegation,and resilience,empoweringfinanceteamswithcleardecisionmakingauthoritywhilesteeringhigh-levelstrategic initiatives.

Throughouthiscareer,Mohamedhasledcomplexfinancial consolidationsacrossmultipleentities,developedinsightful board-levelfinancialdashboards,andplayedapivotalrole inaligningfinancewithbusinessgrowth.Ashecontinuesto shapethefutureofcorporatefinance,hisvisionremains centredoninnovation,efficiency,andlong-termvalue creation.

MohamedBellalisaseasonedfinanceexecutivewitha distinguishedcareerinmultinational&publiclylisted corporationsacrossdiverseindustries,including manufacturing,energy,pharmaceuticals,realestate,and

trading.Hisjourneyinfinancehasbeenmarkedbystrategic leadership,operationalexcellence,andfinancial transformation,positioninghimasadrivingforcebehind corporategrowthandshareholdervaluecreation.

Mohamed'sleadershipphilosophyisrootedinstrategic foresightandadaptability:

“Expectthebest,planfortheworst,andbereadytobe surprised.”

Hiscontinuousadaptationtoemergingtechnologies, particularlyAI-drivenfinance,hasenabledhimtodrive financialinnovation,optimizecorporategrowthstrategies, andmaximizeshareholdervalue.

Navigatingcomplexindustriesrequiresproactiverisk assessment,agilefinancialplanning,andtechnology-driven decision-making—allofwhichheactivelychampions. Throughhisexpertiseandforward-thinkingleadership, Mohamedcontinuestodrivecompaniestowardfinancial excellenceandlong-termgrowth

Mohamedbelievesthatsuccessfulfinancialleadershipis builtonseveralcoreprinciples:

• Strategic Foresight: Anticipatingmarkettrends, identifyinggrowthopportunities,andpreparingfor economicshifts.

As a recognized finance leader, he continues to advocate for the integration of AI, sustainability, and cross-industry collaboration to redefine the future of corporate finance.

Throughout his career, Mohamed Bellal has successfully navigated complex financial challenges by leveraging strategic foresight, technology adoption, and leadership excellence.

• Digital Adaptability: LeveragingAI-drivenfinance andautomationtoenhanceefficiencyanddata accuracy

• Risk-Optimized Decision-Making: Strikingabalance betweenaggressiveexpansionandprudentrisk mitigationstrategies.

• People-Centric Leadership: Cultivatinghighperformancefinanceteamsdrivenbycollaboration, continuouslearning,andaccountability.

• Ethical Financial Governance: Upholding transparency,integrity,andcompliancetoensure investorconfidenceandsustainablegrowth.

TheroleofCFOsintheMiddleEastisundergoinga fundamentaltransformation,evolvingfromtraditional financialoversighttostrategicbusinessleadership. AccordingtoMohamed,keytrendsshapingthisshift include:

• Digital Finance Transformation: AIadoption, predictiveanalytics,andblockchain-ledfinancial operationsarebecomingessential.

• Sustainability-Driven Finance: ESGcomplianceand sustainableinvestmentmodelsarenowintegralto long-termfinancialplanning.

• IPO-Readiness & Investor Relations: WithSaudi Vision2030drivingIPOopportunities,CFOsmust focusoncorporaterestructuringandcapitalmarket engagement.

• Cross-Functional Collaboration: Financeleadersmust workalongsideoperations,IT,andHRtodrive holisticbusinesstransformation.

Mohamedemphasizesthatstrategicsuccessliesinadopting atech-driven,data-centric,andstakeholder-focused financialapproachwhilefosteringagilityandinnovation. Asarecognizedfinanceleader,hecontinuestoadvocatefor theintegrationofAI,sustainability,andcross-industry collaborationtoredefinethefutureofcorporatefinance.

Throughouthiscareer,MohamedBellalhassuccessfully navigatedcomplexfinancialchallengesbyleveraging strategicforesight,technologyadoption,andleadership excellence.Someofthekeychallengeshehastackled include:

• Complex Debt Restructuring: Lednegotiationswith banks,securedoptimalfinancingterms,andmitigated liquidityriskstoensurefinancialstability.

• Digital Transformation Resistance: Fosteredaculture ofinnovation,implementedERPsolutions,andtrained teamsonAI-drivenfinancetoenhanceefficiency.

• Market Volatility: Managedrisksthroughscenario planning,agilecoststructures,andinvestment diversificationstrategies.

• Regulatory Compliance Complexities: Proactively adaptedtoevolvingfinancialregulationsand strengthenedgovernanceframeworksforcompliance andtransparency.

MohamedremainsattheforefrontofAI-drivenfinanceand digitaltransformation,ensuringcontinuousgrowthand adaptationthrough:

• Continuous Learning & Certifications: HoldsanIPO ReadinessCertification(CFOUniversity,USA–2023)andAdvancedFinancialModeling(Traccert Canada),enhancingexpertiseincorporatestructuring andfinancialdecision-making.

• AI & Automation in Finance: LeadsAI-drivenfinance implementations,integratingmachinelearning, predictiveanalytics,androboticprocessautomation (RPA)toimproveforecastingaccuracy,financial reporting,andcostoptimization.

• ERP & Digital Transformation Initiatives: SuccessfullyimplementedERPsystems(SAP,Oracle Fusion,Oddo,etc.)acrossmultipleorganizations, ensuringreal-timefinancialvisibilityandprocess automation.

• Industry Networking & Thought Leadership: Aregular speakeratinternationalfinancesummits(CFO International,MENACFO,DubaiFintechSummit), engagingwithfintechleadersandAIspecialiststostay aheadofevolvingfinancialtrends.

• Participating in International Conferences: Asa speaker,MohamedparticipatedintheInternational 15thAnnualCFOConferenceheldinDubaiin2024

andtheMECACFOConferenceinRiyadhin December2024.Inaddition,hewillbeattendingthe DubaiFintechConferenceinMay2025andtheExitos ConferenceinRiyadhinApril2025.

WithAIanddigitalfinancereshapingtheCFOlandscape, Mohamedisactivelypreparingforhisnextcareer milestone—whetherthroughadeeperstrategicleadership role,broadeninghisinfluencebeyondfinance,ortakingon challengesthatblendstrategy,finance,andvaluecreation. Hisgoalisto:

Thisapproachhighlightsyourambitionforstrategicgrowth andleadershipwhilekeepingyourcareerpathflexibleand opentovarioushigh-impactroles.

• Drivebusinessgrowthstrategiesbeyondtraditional finance.

• Leadinvestmentinnovationandcorporateexpansion.

• HarnessAI-drivendecision-makingtooptimize enterprise-widestrategy.

Bycontinuouslytransformingfinanceintoagrowthenablingstrategicfunction,Mohamedisshapingthefuture ofcorporatefinanceandbusinessleadershipinanera definedbydigitaltransformation.

Mohamed believes that effective leadership requires discipline, delegation, and resilience.

By continuously transforming finance into a growth-enabling strategic function, Mohamed is shaping the future of corporate finance and business leadership in an era defined by digital transformation.

Throughouthiscareer,MohamedBellalhasledstrategic financialtransformationsthathavesignificantlyimpacted organizationalgrowth,profitability,andinvestment performance.Someofhismostnotableachievements include:

• Debt Restructuring for Sigma Group (AET – Oil & Gas): StructuredSAR300Minfinancing,optimizing liquidityandsecuringlong-termgrowth.

• Financial Transformation at SPIMACO (Publicly Listed Pharmaceuticals): Ledacompletefinance transformation,integratingAI-powereddashboardsto enhanceinvestmentstrategiesandshareholdervalue.

• Cash Flow Optimization at Evyap Egypt (FMCG): ReducedDSOfrom140daysto35days,significantly improvingworkingcapitalefficiencyandcash management.

• Cost Optimization & Risk Mitigation at Rawabi Holding: Implementedrisk-adjustedinvestment strategies,minimizingfinancialexposurewhile maximizingprofitabilityandcapitalallocation.

• AI-Driven Finance Implementation at SNASCO Holding: Spearheadeddigitalfinancetransformation, integratingAI-poweredpredictiveanalyticsand automationtoeliminateinefficiencies.

• Board-Level Financial Reporting & Strategy at Al Muhaidib: Successfullyalignedfinancial consolidationandreportingacrossmultipleentities, enablingstrategicboard-leveldecision-making.

• IPO Readiness & Investor Relations: Acrossmultiple roles,preparedorganizationsforIPOreadiness, strengtheningcorporategovernance,financial transparency,andinvestorconfidence.

EachofthesemilestonesreflectsMohamed’scommitment tofinancialleadership,digitaltransformation,and sustainablebusinessgrowth.

FinancialLeadershipwithPersonalWell-Being

Mohamedbelievesthateffectiveleadershiprequires discipline,delegation,andresilience.Hisstructured approachtomaintainingthisbalanceincludes:

• Strategic Delegation: Empoweringfinanceteamswith cleardecision-makingauthority,allowinghimtofocus onhigh-levelstrategicinitiatives.

• Work-Life Harmony: Prioritizingqualitytimewith familyandengaginginpersonalgrowthactivitiesto staymotivatedandenergized.

• Continuous Learning & Self-Development: Pursuing executiveeducationprograms,includingtheNext-Gen CFOLeadershipProgramatLondonBusinessSchool, tostaysharpandadaptablewhilepreventing professionalburnout.

• Health & Fitness Routine: Maintainingastructured fitnessregimentoenhancementalclarityand resilienceinhigh-stakesdecision-making.

• Mindfulness & Leadership Resilience: Followingthe philosophy:“Expectthebest,planfortheworst,and bereadytobesurprised.”

Thismindsetenableshimtostaycomposedunderpressure, turnfinancialchallengesintoopportunities,andleadwith bothstrategicforesightandpersonalfulfilment.Through structuredleadership,timemanagement,andselfimprovement,Mohamedcontinuestoredefinefinancial excellenceandcorporatestrategy

Foraspiringfinanceprofessionalsaimingtotransitioninto leadershiproles,MohamedBellalemphasizesthe importanceofstrategicthinking,adaptability,and continuouslearning.Hiskeyadviceincludes:

• Master Core Financial Expertise: Buildasolid foundationinfinancialanalysis,riskmanagement, corporatefinance,andIFRScompliancetoestablish credibility.

• Develop Digital & AI Competencies: Withfinance shiftingtowardsAI-drivenautomation,professionals mustlearnpredictiveanalytics,ERPsystems,and fintechsolutions.

• Think Beyond Numbers – Become a Strategic Business Partner: Today’sCFOsarenotjustfinancialstewards butalsogrowthenablerswhounderstandinvestment strategies,M&A,anddigitalfinancetransformation.

• Embrace a Growth Mindset & Leadership Resilience: Challengesshouldbeseenasopportunitiestodevelop problem-solvingskillsandfinancialinnovation strategies.

• Focus on Communication & Board-Level Influence: Financeleadersmusttranslatecomplexfinancialdata intoactionableinsightsforCEOsandboardmembers.

• Learn from Industry Leaders & Expand Your Network: Engaginginglobalfinancecommunities,attending summits,andnetworkingwithCFOsandfintech expertsacceleratesprofessionalgrowth.

Bycombiningtechnicalexpertisewithstrategicforesight, aspiringfinanceprofessionalscanpositionthemselvesas futureCFOsandbusinessleadersinanAI-drivenfinancial world.

Mohamed’scareerhasbeendefinedbytransformation, innovation,andlong-termfinancialsustainability.Looking ahead,hisaspirationsaretwofold:

Bytheendof2025:ExpandingtheCFOroletodrive holisticbusinessgrowth,leveragingAI,enhancingfinancial governance,andfosteringinvestmentinnovationfor sustainedsuccess.

• Pioneer AI-Driven Strategic Finance: Redefining CFOleadershipbyleveragingAIanddigital transformationtocreateafinancefunctionthat activelydrivesbusinessexpansionandrevenue growth.

For aspiring finance professionals aiming to transition into leadership roles, Mohamed Bellal emphasizes the importance of strategic thinking, adaptability, and continuous learning.

• Expand Influence as a Global Finance Thought Leader: Throughspeakingengagementsat internationalCFOconferences,hewillcontinueto shapethefutureoffinancialleadership.

• Mentor the Next Generation of Finance Leaders: Inspiringandcoachingyoungfinanceprofessionalsto navigatetheevolvinglandscapeofAI,automation, anddata-drivendecision-making.

PersonalAspirations:

• Maintain Work-Life Balance While Driving HighImpact Leadership: Committedtomaintainingmental clarity,resilience,andpersonalgrowthalongside professionalsuccess.

• Contribute to Societal & Economic Growth Through Financial Leadership: Leveragingstrategicfinance expertisetosupportsustainablebusinessecosystems andeconomicdevelopment.

Ultimately,Mohamed’sgoalistoreshapetheroleofCFOs intoafuture-ready,AI-poweredstrategicleadership functionwhileensuringsustainablebusinessgrowthand globalfinancialimpact.

He strongly believes that the future CFO must extend beyond finance, playing a pivotal role in business innovation and sustainable growth.

EmbracingGrowth,Innovation,andStrategic Leadership

Throughouthiscareer,MohamedBellalhasembracedboth successandsetbacks,recognizingthatfailureisanessential partofgrowth.Everychallengehasservedaseithera lessontolearnorasignaltoadapt,reinforcinghis commitmenttoresilience,strategicagility,andcontinuous improvement.

Asthefinancelandscapeevolves,Mohamedisdeeply committedtoleveragingAI-driventransformationand strategicleadership,withaclearvisiontoexpandhisrole intoabroaderbusinessgrowthandstrategyfocusbythe endof2025.HestronglybelievesthatthefutureCFOmust extendbeyondfinance,playingapivotalroleinbusiness innovationandsustainablegrowth.

Mohamedappreciatesthisrecognitionandlooksforwardto sharinghigh-resolutionimagestocomplementthisfeature.

TheCFOpositionhastranscendedthepositionof

traditionalfinancialmanagement.CFOstodaymust bestrategicbusinessleaders,possessingtheability tofuelbusinessgrowth,digitaltransformation,andrisktaking,aswellasfinancialprudence.Theimperativesof newfinancecallforCFOstobeasagileinacombinationof technicalexpertise,leadershipskills,andadaptabilityin makinggainsinachangingeconomiclandscape.Ittakes solidknowledgeoffinancialstrategy,technology, stakeholdermanagement,andlong-termvaluecreationin ordertosucceedinthisrole.

ThemodernCFOisnotjustinterestedincostcontroland financialreportinganymore.Instead,theyarekeyplayersin shapingbusinessstrategythroughprojectionsthatensure long-termgrowth.Planningmustbereconciledwith corporateobjectivesasawhole,sothatinvestment decisionsyieldprofitabilityandlong-termsuccess.The abilitytomeasuremarkettrends,weigheconomicrisk,and adjuststrategyaccordinglymakesCFOskeydecisionmakersinbusinesses.

Withshiftingdynamicsoftheglobaleconomy,CFOsmust beproactiveandnotreactive.Theymustanticipatemarket disruptions,inflationarypressures,andgeopoliticaltensions thattestfinancialstability Thefinanciallystormproof companiesareoftentheoneswithCFOswhoemploy financialvisionintheirdecision-making,enabling companiestochangedirectionwhennecessaryandbenefit fromnewmarkets.

Digitalizationhasrevolutionizedfinance,andCFOsmust embracetechnologytoenhanceefficiencyandaccuracy. Artificialintelligence,advancedanalytics,andautomation haverevolutionizedfinancialprocessestofacilitaterealtimedecision-making.Cloud-basedfinancialsystems, predictiveanalytics,andblockchaintechnologyoffer greatertransparencyandimprovedfinancialoperations.

AneffectiveCFOisawareofhowtoadopttechnologyto streamlineprocessesandminimizetheriskofhumanerror. Throughautomationoftaskslikefinancialreporting, compliance,andriskmanagement,CFOscanfocuson strategicactivitiesratherthanonrepetitivetasks.Fintech innovationsalsoimplythatCFOsmustlookaheadtofuture trendsandintegratedigitaltoolsthataffectfinancial performance.

Therehastobeabalancebetweenmanagingfinancialrisk andenablingbusinessgrowthbyCFOs.Goodgovernance structuresarecrucialinensuringthatcompaniesare regulatory-compliant,andwell-informedrisk-takingby companiesallowsthemtotakewiserisksandexpandthe business.Stewardshipfinanceinvolvesanalyzingdebt management,optimizingworkcapital,andcrunching economicrecessioncontingencyplans.

Transparencyinfinancialreportinghelpstocreate stakeholdertrustinthecaseofinvestors,boardmembers, andregulators.GoodCFOsestablishopenfiscalpolicies, conductregularaudits,andembracegoodfiscalethics.A compliance-defyingattitudecanprovidereputationaland legaldamagesduringaperiodofstrictregulatory compliance.AforcefulCFOwillstayaheadofriskandput thecompanyinapositionforlong-termsuccess.

Financialdecisionsmustbeguidedbyreliableinformation andactionableinsight.EffectiveCFOsinmodernfinance leveragekeyperformanceindicators(KPIs)anddata analysistoguidedecisionmaking.Monitoringrevenue trends,coststructure,andprofitabilitymetricsenables CFOstoidentifyinefficienciesandoptimizefinancial performance.

Astrongfinanceleaderreshapesthefinancefunctionasa back-officeentitybutanequallystrategicbusinesspartner CFOsarecapableofinfluencingpricestrategies, investmentsinproducts,andgrowthstrategybasedonfactdrivencounsel.Businessintelligenceisrenderedby translatingfinancialdataintoactionablebusinessinputsthat makeCFOscentralactorsinplanningforthecompany's future.

Today'sCFOneedstobeasuperbcommunicatorcapableof describingfinancialstrategytodiversestakeholders.Open financialinformationinfluencessounddecisionsamong investors,boardmembers,staff,andexternalpartners. Uncomplicatingtechnicalfinancialinformationand presentingitinaninteractiveformatboostscredibilityand trust.

Financialexpertiseisnotthesolerecipeforleadership greatness.AgreatCFOconstructsastrongfirmculture, workscooperativelywithotherC-suiteexecutives,and alignsoperatingandfinancialgoals.Leadershipinvolves mentoringfinanceemployees,developingleadersforthe future,andpromotinginnovationinmanagingfinance. CFOspropelcompaniestowardsuccessinthecompetitive marketplacethroughdevelopingacultureofteams.

Sustainabilityistodayabusinessimperative,andCFOsare leadingthechargeindevelopingenvironmental,social,and governance(ESG)initiatives.Consumersandinvestorsare increasinglylookingtoinvestincompanieswithasenseof corporateresponsibility,sosustainablefinancialplanningis essential.CFOsmustbeabletobalanceESGthinkingwith financialdecision-making,weighingprofitabilityagainst ethicalandsustainablebusinesspractice.

Greenfinancing,carbonprintreduction,andsocial investmentsaregraduallybecomingpartofthecore corporatefinancialplanningnowadays.CFOswhogoahead withinitiatingsustainablefinancialmodelsnotonlycreatea positiveimageforthebusinessbutalsoensurelong-term financialstability.MeasuringESGperformanceand providingareportonthesameisabusinessbenefit nowadaysasfarasinvestorsandstakeholderswhopractice ethicalbusinessareconcerned.

Thebankingindustryisneverstatic,andCFOsmustbe flexibleiftheyaregoingtoremainattheforefrontof industrychange.Economicvolatility,technological advancement,andshiftingconsumerbehaviordemand constantlearningandflexibility.CFOswhotakethetimeto personallylearn,arecurrentwithglobalfinancialmarket trends,andareflexiblewhendealingwithchangehavethe greatestlikelihoodofguidingtheirorganizationsthrough transformation.

Resilienceislikelythemostimportanttraitofsuccessful CFOs.Financialcrises,regulatoryreforms,anddigital disruptionsaremetwithanentrepreneurialattitude.CFOs whoareabletoadjustandchangebeforeit'snecessaryset theirfirmupforsustainedgrowthandprofitability

TobeagreatCFOinthisdayandageistorequiremore booksmarts—itrequiresstrategicthinking,tech adaptability,leadership,andcommitmenttosustainable growth.CFOstodaymustshedtheconstraintsofnumbercrunchingtobecomedriversofbusinesssuccess.By integratingfinancialplanningwithinnovation,risk management,andstakeholderempowerment,CFOsarekey toshapingthefutureoforganizationsinanever-changing globaleconomy

,, Successisnotthekeyto happiness.Happinessisthekeyto success.Ifyoulovewhatyouare doing,youwillbesuccessful. - Epictetus

TheChiefFinancialOfficer(CFO)positionhas

undergoneradicalchangeinrecentyears, upgradingfromitshistoricalfunctionofmanaging financetoavisionary,future-facingrolethatrequires strategicinsight,technicalexpertise,andresponsiveness. CFOstodayarenolongeronlycustodiansoffinance;they arebusiness-definingleaderswhomustfacilitatebusiness transformationandsustainablegrowth.Asindustriesare disruptedasaresultofdigitalization,economicdisruption, andsustainabilityrequirements,CFOswillberequiredto adapttonewtrendsandstrategicvaluesinordertobe competitiveandchartthedirectionofthefutureoftheir organizations.

Thedigitalagehasprofoundlytransformedthemannerin whichcompaniesconductbusiness,andCFOsareatthe forefront.Theautomationtechnology,artificialintelligence, andanalyticshaveempoweredCFOstotransitionfrom manualreportingtoreal-timedecision-making.Cloudbasedfinancialsystemsoffereasyaccesstofinancial information,makeprocessesmoreefficient,andeliminate humanerrors.Withtechnologyhandlingmundane accountingtasks,CFOscanspendmoretimeonstrategic planning,businessgrowth,andriskmanagement.

Asmoney-makingleaders,CFOsarebeingaskedmoreand moretomanageinvestmentsinthedigitalandintegrate newtechnologyintofinancialoperations.Predictive analyticsandmachinelearningempowerthemtoforecast markettrends,streamlinecosts,andmakedata-driven decisionsmoreprecisely.Therevolutionindigitalfinance compelsCFOstoachieveaprofoundviewoftechnology anditsbusinessimplicationsinabidtomaketheirfirms nimbleinashiftinglandscape.

Today'sCFOshavetotranscendthepastoffinancialreports andtakeforward-lookingapproachesinabidtonavigate uncertaintyandtakeadvantageoffutureprospects. Technologyofadvancedanalyticshasbecomeintegralto financialforecasting,allowingCFOstoquantifypossible risks,analyzemarkettrends,andmaximizethedeployment ofresources.CFOscanhaveend-to-endvisibilityof businessperformanceusingbigdataandconnectfinancial strategywithcorporategoals.

Thecapacitytoderiveactionableinsightsfromdataalso enablesCFOstoincreaseprofitabilityandefficiency Financialmodelingandscenarioplanningenablefirmsto prepareforeconomicrecessions,supplychaininterruption,

andindustrytransitions.CFOswhospearheaddata-driven decision-makingplacetheirfirmsinapositionforlongtermsustainablegrowth,allowingthemtoactquicklyto changingmarketconditions.

Sustainabilityisbecomingmoreandmoreimportantfor globalbusinessmanagement,andCFOsarethekeyto integratingEnvironmental,Social,andGovernance(ESG) componentsofbusinessstrategyintothemainstream. Investors,consumers,andregulatorsareaskingformore transparencyinreportingonsustainability,andtheCFOs' challengeisconstructingframeworksforquantifying environmentperformance,ethicalpractices,andcorporate socialresponsibilityinitiatives.

ItistheCFOs'jobtobalancefinancialperformancewith sustainabilitythroughinvestmentsinsustainablebusiness practicesandgreentechnologiesyieldingdividendsinthe longterm.Thatrequirescross-functionalcoordinationfrom operationstomarketingtoincorporatesustainable initiativesintoprofit-drivingoperationsforcompany reputationandcompliancebenefits.Havingtheabilityto balancepurposeandprofitabilitycharacterizesthefinest CFOsandisthekindofleadershiprequiredofresponsible businesspractices.

Economicdownturns,geopoliticaltensions,andregulatory risksareconstantchallengestoCFOsincreatingsoundrisk managementsystems.Financialresilienceisnolongera questionofcuttingcosts—itentailsscenarioplanning, diversifiedinvestment,andcrisismanagement.CFOsneed toscrutinizepotentialthreats,fromcyberattacksto inflationrisk,andputinplacemeasuresthatprotectthe financialstabilityoftheirfirms.

Inafast-forwarderaofchange,CFOswillhavetobattleon severalfronts,suchasbreakageinthesupplychainand movementintheworldmarket.Businessentitiesthatare engagedinglobalbusinessmustdevelopcontingency measuresthatcanmitigatetheeffectsoftariffs,regulatory changes,andcurrencyfluctuations.CFOswhopreparefor weaknessesandreducethreatsenabletheentitiestofeel stabilityandflexibilityeveninturbulentmarkets.

TheCFOisnolongerlimitedtofinancialreportingand budgetingalone;theyarealsobusinessstrategydrivers today Theyhavetheirpartincorporaterestructurings, mergersandacquisitions,andstrategicinvestmentchoices. CFOsarenowmoreheavilyinvolvedincross-functional teams,discussingwithCEOs,COOs,andtechCEOsto facilitateoperationalefficiencyandinnovation.

AstrategicCFOmusthaveeffectivecommunicationand leadershipskillstoconvertfinanceinformationinto profitablebusinessstrategies.Theymusthavetheabilityto offeradviceoncapitalallocation,revenuediversification, andcostoptimizationwithoutanycompromiseonlongtermfinancialwell-being.Byaligningthefinancial objectivesandcorporatevision,CFOscreateaplatformto anorganizationforcreatingacompetitiveedgethattriggers innovationandsustainablegrowth.

Withchangingbusiness,thetalentsetsofthefinance functionchangeaswell.CFOsareresponsibleforgetting talents,developingtalents,andkeepingtalentssothat financialprofessionalspossessappropriateanalysisand technologycapabilitiestoexcelinadigital-firstworld.The abilitytoattracttopfinance,datascience,andtechnology talentsisvitalinordertomaintainahigh-performing financefunction.

CFOsshouldalsoputacultureofcontinuouslearningand adaptabilitywithintheiremployees.Financefunctionsof employeesaremadecompetitiveandagilewithfinancial automation,AIanalytics,anddigitaltransformationskill development.TheCFOtodaynotonlywalksthetalkbut alsoprovidesspaceforprofessionaldevelopment,making theirorganizationfuture-proof.Conclusion

TheCFOpositionisbeingredefinedatitsveryessenceby theforcesoftechnologicaldisruption,decisioningbasedon data,sustainabilityinitiatives,andshiftingmarket dynamics.CFOsneedtobeagiletoinnovation,manage risksaheadoftime,andhavefinancialstrategiesthatare alignedwithdriversofbusinessgrowth.Withadditional responsibilityintheguiseofdigitaltransformation, integratingESG,andleadership,CFOsaredefiningthe futureoffinance.Thecapacitytoinnovate,adapt,andlead fromanoutside-inviewofthefuturewillbethehallmark oftheleadingCFOsinthecomingyears.

Success is not how high you have climbed, but how you make a positive difference to the world.

- Roy T. Bennett