2022 REVIEW

2022 has been a successful year for InRento’s investors, even though the whole financial system was impacted by the war in Ukraine, rising inflation rates worldwide, and the start of a global recession. While different investment products yielded different returns this year, InRento ranked first based on the average interest rate in the whole Lithuanian market and recorded 0 late projects.

ABOUT INRENTO

InRento is the EU’s first and largest regulated buy-to-let crowdfunding platform. With InRento, investors can invest in rental properties, earn monthly interest, and receive capital gains once the property is sold.

Since the company’s foundation, the InRento community has grown to over 14,600 investors. More than 50 various buy-to-let investment opportunities have been financed on the InRento platform, recording an average annual return of 13.84%. Out of the total number of projects, 0 properties were late to pay interest or principal. Due to such stellar performance, InRento ranks as the #1 crowdfunding platform by investment return in the whole Lithuanian market and records the fewest late projects — according to recent market research carried out by a leading business media Verslo Žinios.

https://manopinigai.vz.lt/investavimas/palyginome-sutelktinio-finansavimo-platformas-g razas-investavimo-sumas-ir -kt/

Unlike other investment platforms, InRento offers the option of a timeshare — with selected properties and large investment tickets. Thus, investors can not only get financial benefits but also stay in tourist rentals they invested in.

Over the years, InRento has been recognized not only locally but also internationally. In 2022, InRento was awarded as the #1 investment tech of the year at the Europe FinTech Awards.

Watch a video explaining how InRento works.

https://www.youtube.com/watch?v=eECWhFUETJQ

NUMBERS

2022 IN

https://inrento.com/ www.inrento.com www.inrento.com 13.49% Average annual return 0 Late projects 31 Number of projects +182% Annual growth in number of projects 5 133 167 Amount funded (EUR) +206% Annual growth in amount funded 16 Number of sold properties 416 829 Total earnings paid to investors (EUR) 400% Growth of investor community in 2022 14 621 Investor community

EXITED PROJECTS IN 2022

InRento’s numbers speak louder than any advertisements. Below you can see the track record and investment results of fully or partially completed investment opportunities. What makes InRento unique is the structure of the earnings investors receive: a fixed interest is paid by the project owner to investors on a monthly basis; then when the property is sold, investors earn either fixed or variable capital gains, which depend on the profit the sale of the property has generated.

February: A buy-to-let project — Modern Office at Ateities str. — was sold for EUR 130,000. As a result, investors earned EUR 15,400 as capital gains or a return of 14.26% in addition to the monthly rental interest of 6.06%. In total, investors earned a 20.31% ROI. 6.06%.

March: A buy-to-let project — S11-A, Vilnius — was sold. As a result, the investors earned EUR 6,387 and capital gains or a return of 10.59% in addition to the monthly rental interest of 6.89%. In total, investors earned a 17.48% annual return.

August : A buy-to-let project — S47, Kaunas — had one out of two apartments sold. The total capital gains for the project were EUR 41,000, of which EUR 18,946 was paid out to the investors. Investors earned 7.3% p.a. from monthly interest payments and an additional 12.89% as capital gains. In total, investors earned a 20.19% annual return.

October: Full completion of both stages of a buy-to-let project — V3, Palanga. Investors earned double-digit returns. The average annual return was 16.04% in the first stage and 27.24% in the second stage.

November: A buy-to-let project — A19, Vilnius — was partially sold (two out of seven properties), and investors earned double-digit annual returns. The average annual return was 36.11% in the first stage and 163.22% in the second stage.

November: A buy-to-let project — S7, Vilnius — was partially sold (a third of all premises). Investors earned fixed capital gains and interest for early return penalties. On average, investors earned 12.55% p.a.

November: A buy-to-let project — two micro offices — was partially sold. On average, investors earned a 7.66% annual return.

December: A buy-to-let project — T101-5, Klaipeda — was sold. As a result, the investors earned 6.84% of annual interest and annual capital gains of 1.62%. On average, investors earned an 8.46% annual return. Additionally, the principal, interest, and capital gains were repaid for two more premises of the S7 project.

* Exact returns of each investor in a given project depend on the amount they have invested and may vary.

https://inrento.com/ www.inrento.com

Since InRento's inception in 2020, the company has recorded 0 late projects. This data has been checked and vetted not only by the leading national media sources but also by an official regulator — the Bank of Lithuania. The full report can be found here.

https://www.lb.lt/uploads/publications/docs/35714_1b585b141ee036bd3930f8f7ef675fba.pdf?f bclid=IwAR0wZ8yFPt4gurAXrA0qcwzJFcaPmzxTPFY7D 7YF2pWeuMlHq4-ZTJG3xFI

LATE

ZERO

PROJECTS

https://inrento.com/statistics/ https://inrento.com/ www.inrento.com www.inrento.com

For more information, please visit the statistics page

the

website. 0 late projects –DEFAULTED LOANS NO. OF DEFAULTS Risk Ratings Number of defaults 0 A B C D 0 0 0 0% | 0 / 5 0% | 0 / 31 0% | 0 / 5 0% | 0 / 31 0% | 0 / 4 0% | 0 / 4 0% | 0 / 0 0% | 0 / 0 Actual rate of default Predicted default rate ACTUAL DEFAULT RATE 0% | 0/40 PREDICTED DEFAULT RATE 0% | 0/40 0 LOAN PORTFOLIO IN Funded 0.7M 6.9M 0M 0M 0M Repaid Late In default Capital lost PROPERTY TYPES IN Residential 3.2M 4.5M 0.5M 1.7M 0M Commercial Medical Hotel Other LOAN PORTFOLIO IN Funded 10% 100% 0M 0M 0M Repaid Late In default Capital lost PROPERTY TYPES IN Residential 27% 52% 7% 14% 0% Commercial Medical Hotel Other

on

InRento

#1 INVESTMENT TECHNOLOGY IN EUROPE

InRento was acknowledged as the #1 investment tech of the year 2022 at the Europe FinTech Awards. The ceremony took place on July 7 in London.

The finalists for this year's Europe Fintech Awards were selected from hundreds of submissions. They were chosen by an independent judging panel featuring representatives of the European Digital Finance Association, Payments Europe, Icelandic Fintech Cluster, Copenhagen FinTech, Spanish Fintech and Insurtech Association, and European FinTech Association.

This is a very important recognition for the InRento team. It shows that InRento’s services have found their fit not only nationally but internationally as well.

https://inrento.com/www.inrento.com www.inrento.com www.inrento.com

CEO and founder of InRento - Gustas Germanavičius

TIMESHARE

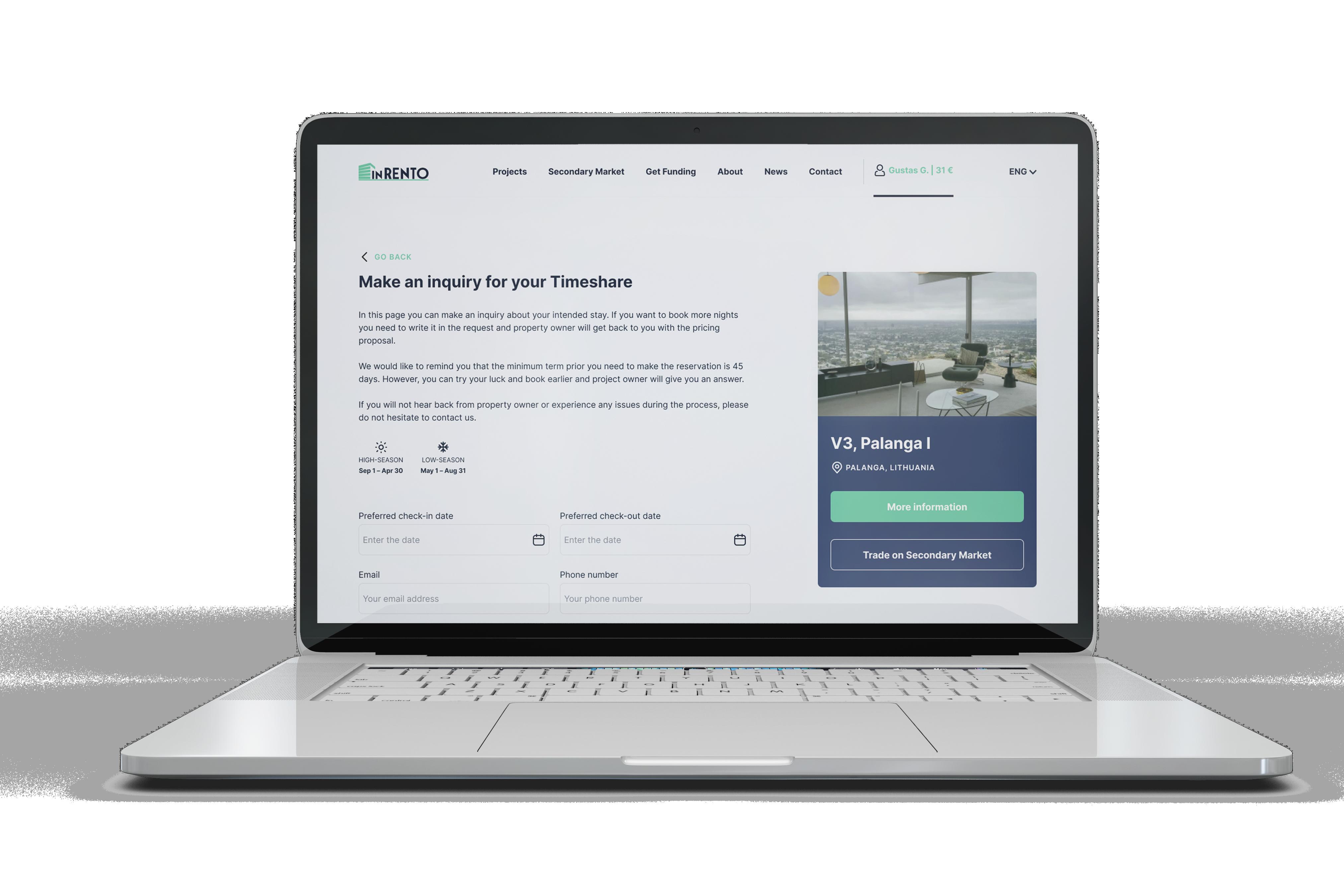

InRento offers a one-of-a-kind feature for selected investment options — timeshare. By investing a minimum amount, typically EUR 5,000, an investor can spend a number of nights in the property they put their money into. This way, on top of receiving financial returns, investors can also use and enjoy their investment.

Our investors have already used this possibility in projects such as I24, La Molina in Spain, Avanti Hotel and V3, Palanga in Lithuania.

In the year 2023, the InRento team is planning to present even more buy-to-let investment opportunities focused on tourism with timeshares offered — both in

and abroad. https://inrento.com/ www.inrento.com

Lithuania

INDEXATION OF INRENTO BUY-TO-LET PROJECTS

In 2022, the inflation in the European Union, as well as in Lithuania, was several times higher than the initial target set by the European Central Bank. This has caused much concern: both in regular life and the investment world. However, as the InRento product strives to produce a similar experience to investing in rental properties, inflation may not be a bad thing for our investors. As you may already know, long-term rentals usually have a tendency to be indexed to the inflation rate. In the same way, many of InRento’s investment opportunities offer a fixed interest rate that is indexed to inflation in the EU. This means that even if the inflation rate is rising quickly, the fixed interest on your investment is potentially not decreasing. Each year, the interest is recalculated and indexed to inflation. This is applied to selected buy-to-let projects on the InRento platform.

https://inrento.com/ www.inrento.com

France 24 7.1 7.3 7.4 8.4 8.6 9.4 8.8 9.5 9.8 10.3 10.6 10.6 11.4 11.5 11.5 11.6 12.6 12.7 13.1 13.5 14.5 14.8 15.5 16.4 16.8 21.7 21.9 22.1 22.5 22 20 18 16 14 12 10 8 6 4 2 0 Spain malta Finland Cyprus Luxembourg Ireland Greece Sweden Slovenia Euro area Portugal Denamark EU Austria Germany Italy Croatia Belgium Romania Slovakia Bulgaria Czechia Poland Netherlands Latvia Hungary Lithuania Estonia

Annual inflation rates (%) in October 2022 ec.europa.eu/eurostat

NEW PLATFORM DESIGN

In 2022, InRento introduced an improved platform UI with plenty of new features:

Enhanced user experience: Faster website performance, more attractive interface, and updated transaction information.

Increased website security: Updated operating system and new security features.

Advanced transparency: Introduction and improvement of the Statistics page; more insights and documents in each project regarding insurance policies, mortgages, and various other investment agreements.

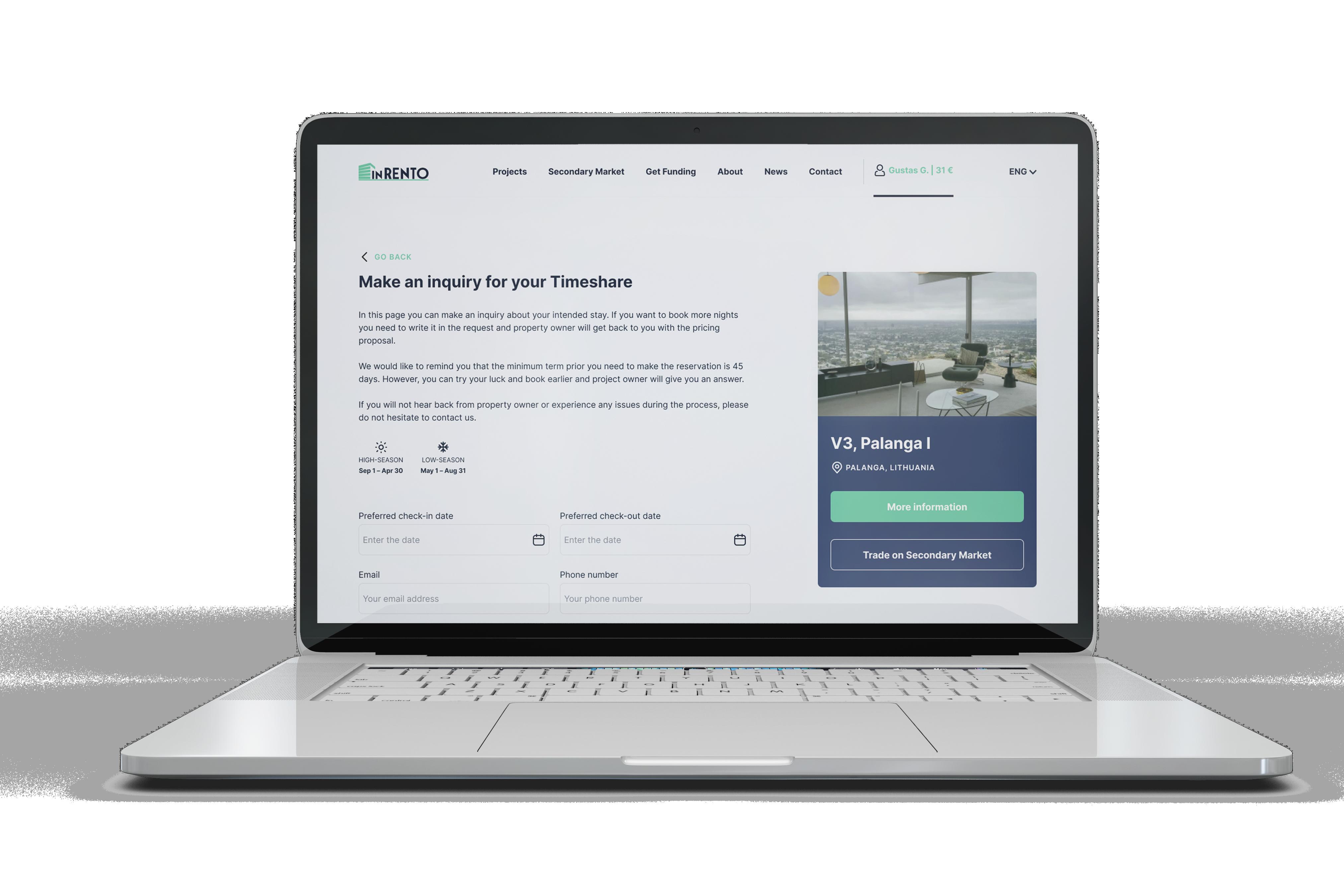

Timeshare booking functionality: The possibility to book your stay in a buy-to-let investment that offers a timeshare.

Opportunity to reduce withholding tax: New interface to simplify the process in order to reduce the withholding tax rate applied to non-Lithuanian residents. Find more information on taxes here.

https://inrento.com/blog/important-information-about-taxes

https://inrento.com/ www.inrento.com

WANT TO DISCUSS INVESTMENT OPPORTUNITIES? Book a time with one of our certified professionals — an experienced account executive Paulius Palevičius. He is a licensed investment advisor (IA) by the Baltic Asset Management Association. He is ready to answer all platform-related questions and support you on your way when investing in buy-to-let projects on the InRento platform. https://inrento.com/ www.inrento.com paulius@inrento.com +37060430043 https://inrento.com/ inrento.com https://www.linkedin.com/in/paulius-palevi%C4%8Dius-462807121/ Paulius Palevičius Account Executive BOOK A MEETING Paulius Palevičius