POWDER METAL

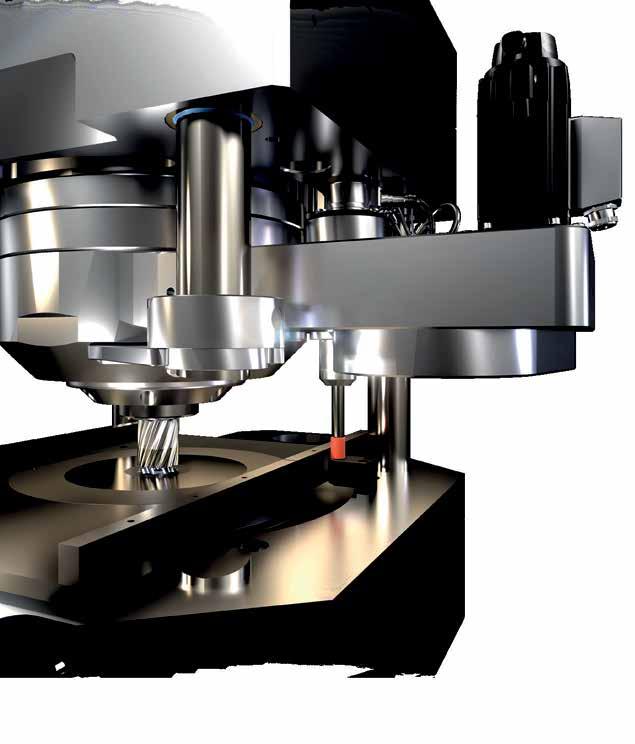

Starmix Nova from Höganäs is designed to meet the demanding requirements of cost-efficient manufacturing for high-performance components. Perfect for producing taller and more complex-shaped parts, it excels in compacting components with narrow sections. Starmix Nova has proven its superiority through rigorous trials by numerous satisfied customers, delivering outstanding results every time.

Main product benefits

Excellent fillability: Achieve optimal material distribution in every mold.

Excellent lubrication: Ensure smooth operations and extend the life of your machinery.

Efficient compaction: Benefit from higher apparent density and faster compaction, leading to more consistent, higher-quality products.

Experience excellence. Experience Starmix Nova.

Publisher & Editorial Offices

Inovar Communications Ltd

11 Park Plaza

Battlefield Enterprise Park Shrewsbury SY1 3AF

United Kingdom

Tel: +44 (0)1743 469909 www.metal-powder.tech

Managing Director & Editor

Nick Williams, nick@inovar-communications.com

Group News Editor & Director

Paul Whittaker, paul@inovar-communications.com

Advertising Sales Director

Jon Craxford, jon@inovar-communications.com Tel: +44 (0)207 1939 749

Assistant News Editor

Charlie Hopson-VandenBos charlie@inovar-communications.com

Editorial Assistants

Amelia Gregory, amelia@inovar-communications.com Emma Lawn, emma@inovar-communications.com

Consulting Editor

Dr David Whittaker

Technical Consultant

Dr Martin McMahon

Marketing Lead Mulltisa Moung, mulltisa@inovar-communications.com

Production Manager

Hugo Ribeiro, hugo@inovar-communications.com

Operations & Partnerships Manager

Merryl Le Roux, merryl@inovar-communications.com

Office & Accounts Manager

Jo Sheffield, jo@inovar-communications.com

Subscriptions

Metal Powder Technology is published on a quarterly basis. It is available as a free electronic publication or as a paid print subscription. The annual subscription charge is £150.00 including shipping.

Accuracy of contents

Whilst every effort has been made to ensure the accuracy of the information in this publication, the publisher accepts no responsibility for errors or omissions or for any consequences arising there from. Inovar Communications Ltd cannot be held responsible for views or claims expressed by contributors or advertisers, which are not necessarily those of the publisher.

Advertisements

Although all advertising material is expected to conform to ethical standards, inclusion in this publication does not constitute a guarantee or endorsement of the quality or value of such product or of the claims made by its manufacturer.

Reproduction, storage and usage

Single photocopies of articles may be made for personal use in accordance with national copyright laws. All rights reserved. Except as outlined above, no part of this publication may be reproduced or transmitted in any form or by any means, electronic, photocopying or otherwise, without prior permission of the publisher and copyright owner.

Design and production

Inovar Communications Ltd.

ISSN: 2977-5892 - PRINT

ISSN: 2977-5906 - ONLINE

© 2025 Inovar Communications Ltd.

While traditional Powder Metallurgy markets – such as highvolume automotive components for internal combustion engines – are contracting, the opportunities highlighted in this issue show that the story of metal powder-based manufacturing is far from one of decline. Instead, metal powder technologies are increasingly positioned at the heart of the most important shifts in mobility.

Take Mercedes-AMG’s embrace of Soft Magnetic Composites in its new AMG.EA platform. For decades, axial flux motors were a research ambition; now, SMCs are enabling production-ready designs with unprecedented power density and efficiency. This is more than a new motor – it is proof that PM can sit at the centre of brand-defining innovation in the electric age.

Elsewhere, we shine a spotlight on brake technology. With Euro 7 regulations bringing strict limits on non-exhaust emissions, surface-coated rotors produced using advanced metal powder processes are emerging as a key solution. As in so many applications, metal powders are not just improving the performance of applications, but delivering tangible environmental benefits, from reduced material usage to ensuring cleaner air in our cities.

These examples illustrate the resilience and adaptability of the metal powder industry – volumes may shift, but where performance, efficiency, and sustainability are demanded, metal powder technologies are indispensable.

Nick Williams Managing Director Metal Powder Technology

Cover image

The Mercedes-AMG GT XX is powered by metal powder-based axial flux motors (Courtesy Mercedes-Benz)

65 Mercedes-AMG unleashes the power of metal powder: SMC motors and the new Electric Architecture platform

Mercedes-AMG’s new Electric Architecture (AMG.EA), unveiled in the CONCEPT GT XX, is driven by YASA’s axial flux motors featuring Powder Metallurgy Soft Magnetic Composites (SMCs). First explored decades ago, SMCs now allow motors to be lighter, more compact, and more resource-efficient than traditional radial flux designs.

As Nick Williams and Emma Lawn report, Mercedes-Benz will scale in-house production at its Berlin plant and YASA’s UK facility – marking the shift of axial flux technology from research promise to industrial reality. >>>

77 The brake dust challenge: Metal powder surface coating of automotive brake rotors for Euro 7 compliance

The forthcoming Euro 7 regulations set unprecedented limits on non-exhaust vehicle emissions, placing brake dust at the centre of clean mobility challenges. Brake wear-derived particulate matter is now recognised as a major health and environmental concern, driving demand for innovative mitigation strategies.

This article explores surface coating of grey cast iron brake rotors using advanced metal powder technologies. As Indo-MIM’s Dr Paul Davies explores, processes such as thermal spray, Cold Spray, and high-speed laser deposition have been assessed for durability, emission reduction, and scalability, offering practical solutions for Euro 7 compliance. >>>

As the industry leader in debind & sinter batch furnaces and equipment, Elnik Systems is known for precision, performance, and reliability. Our hand crafted furnaces are the gold standard for the MIM and Metal AM industries, delivering superior results for your production needs. When you think Debind & Sinter - Think Elnik. More than a furnace company.

12004 Carolina Logistics

elnik.com

for expert process engineering and toll services

Remote or In-person process, engineering, metallurgy support

Debind and Sinter Services

You Print It, You Mold It - We Debind & Sinter It”

In person facility walk through, process evaluation, and educational programs

For 25 years, DSH has been the best source for Metal Powder part making process support, Debind and Sinter Services and educational resources.

Our mission is to empower you with the knowledge and expertise to master part processing and unlock your path to success

The 21 st Plansee Seminar, held in Reutte, Austria, in June 2025, once again confirmed its reputation as the leading international forum for refractory metals and hard materials. Bringing together more than 530 participants from industry, academia, and research, the event delivered over 280 presentations spanning sustainability, Additive Manufacturing, nuclear fusion, and critical raw materials.

In this review, Bernard North highlights selected advances in tungsten, molybdenum, cemented carbides, coatings, and cermets, reflecting both the seminar’s technical depth and its forward-looking strategic outlook. >>>

105 Sustainability, innovation, and market realities: The state of the Powder Metallurgy industry in North America

At PowderMet 2025, Michael Stucky, President of the Metal Powder Industries Federation, underscored the challenges facing Powder Metallurgy as North American powder shipments fell 4.7% in 2024. While the industry is contending with declining volumes in key materials, select areas such as aluminium, molybdenum, and tungsten carbide show promise.

PM remains vital across the automotive, aerospace, defence, and energy sectors, where innovation and sustainability can help offset headwinds. The PM sector’s path forward, it appears, lies in resilience, adaptation, and seizing niche opportunities. >>>

Metal powders designed for mission-critical, high-temperature applications.

HEADQUARTERS

130 Innovation Drive SW McDonald, TN 37353

REGISTRATIONS AND CERTIFICATIONS

Explore Amaero’s innovative, high-performance materials, specifically engineered to meet the demanding needs of industries such as Defense, Space, Aerospace, Oil & Gas, Industrial, Heavy Industry, Medical, and Energy.

Partner with us to harness cutting-edge solutions for your most challenging applications.

PM-HIP (Powder MetallurgyHot Isostatic Pressing)

Near-net-shape components with reduced lead times, ideal for high-mix, low-volume demand.

SEE AMAERO AT THE UPCOMING SHOWS:

ASTM ICAM | Las Vegas, NV Oct. 6-10

AUSA | Washington, D.C. Oct. 13-15

DMC | Orlando, FL Nov. 17-20

Formnext | Frankfurt, Germany Nov. 18-21

FOLLOW US CONTACT SALES

The Metal Powder Industries Federation (MPIF) has announced the winners of the 2025 Powder Metallurgy (PM) Design Excellence Awards, presented during the PowderMet2025 conference in Phoenix, Arizona.

Each year, these awards highlight innovative achievements in PM component design and manufacturing, recognising companies that push the boundaries of efficiency, performance, and creativity. The 2025 recipients showcase the versatility of PM across automotive, military, medical, consumer, and industrial applications, reflecting the industry’s growing role in advanced engineering solutions. >>>

Formerly PM Review, Metal Powder Technology is the essential international resource for the entire metal powder value chain — from production and processing to applications in PM, hardmetals, PM-HIP, batteries, magnetic materials, coatings, and beyond.

Through our magazine, website, weekly newsletter, social media channels and webinars, we connect industry innovators with a truly global audience.

Our platforms deliver trusted news, in-depth articles, and expert analysis to engineers, designers, researchers, and business leaders worldwide.

• Have industry news to share? Submit it > paul@inovar-communications.com

• Want to showcase your expertise? Pitch a feature article

> nick@inovar-communications.com

• Be visible: Ask about advertising opportunities

> jon@inovar-communications.com

• Stay connected: Follow us on LinkedIn

> www.linkedin.com/company/ metalpowdertechnology

NASA Glenn’s GRX-810 alloy has been named Commercial Invention of the Year by NASA’s Inventions and Contributions Board (ICB). The alloy has been adopted by both NASA and commercial users for additively manufactured parts required to withstand extreme conditions.

GRX-810 is an oxide-dispersionstrengthened alloy, meaning that oxygen atoms are dispersed throughout to enhance the material’s strength. This type of alloy is particularly suited for use in aerospace parts that will undergo high temperatures (e.g. those within aircraft and rocket engines), because the material can withstand harsher conditions before reaching a breaking point.

Currently, most additively manufactured superalloys favoured for heat resistance can withstand temperatures up to 1,093ºC. According to NASA, GRX-810 is twice as strong, over 1,000,000× more durable, and twice as resistant to oxidation.

In May 2024, NASA licenced GRX-810 to four North American companies, with the goal of bolstering the US economy and providing a return on investment for publicly funded research. The co-exclusive licence agreements allowed the companies to produce and market GRX-810 to aircraft and rocket equipment manufacturers, as well as the entire supply chain.

The licencees announced in 2024 were:

• Carpenter Technology Corporation, Reading, Pennsylvania

• Elementum 3D, Inc, Erie, Colorado

• Linde Advanced Material Technologies, Inc, Indianapolis, Indiana

• Powder Alloy Corporation, Loveland, Ohio

“Adoption of this alloy will lead to more sustainable aviation and space exploration,” stated Dale Hopkins, deputy project manager of NASA’s Transformational Tools and Technologies project, at the time of the licence announcement. “This is because jet engine and rocket components made from GRX-810 will lower operating costs by lasting longer and improving overall fuel efficiency.”

www.nasa.gov

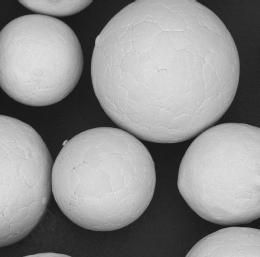

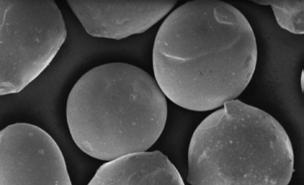

Elmet Technologies, Lewiston, Maine, USA, has received US Patent No 12,359,290, ‘Tungsten Heavy Metal Alloy Powders and Methods of Forming Them,’ its fifth patent for powders for powder bed Additive Manufacturing technologies such as Binder Jetting as well as other Powder Metallurgy applications.

The newly patented process leverages advanced spray drying and optional plasma densification techniques to produce spherical, flowable, and highly densified composite particles. This material structure is intended to improve powder bed uniformity and thermal conductivity during sintering –advantages when manufacturing parts for aerospace, defence, and industry where mechanical strength and precision are critical.

“This patent reinforces Elmet Technologies’ commitment to materials innovation,” stated Mike Stawovy, co-inventor and Director of Research & Development at Elmet Technologies. “Our approach enhances the production of tungsten heavy alloy powders with exceptional flowability and chemical uniformity – features essential to achieving repeatable, high-quality parts through Additive Manufacturing.”

The new patent covers tailored alloy compositions, including 90% tungsten with carefully controlled additions of nickel, iron, copper, cobalt, or manganese.

Compared to other processes, Elmet’s latest process is said to produce substantially spherical particles with a reduced porosity and enhanced flow rate (as low as 7

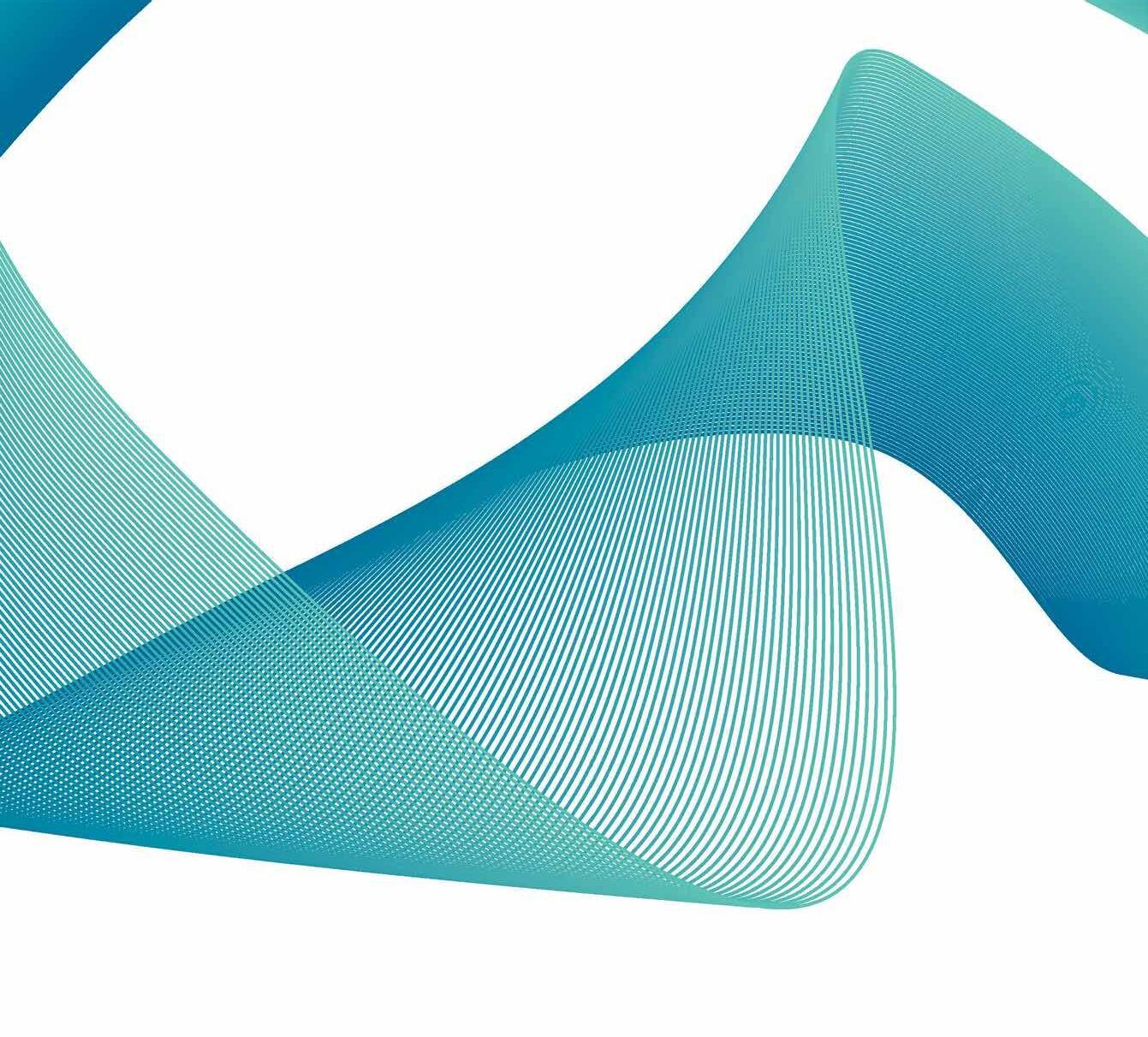

Sandvik AB, headquartered in Stockholm, Sweden, has introduced Osprey MAR 55, a versatile tool steel powder that aims to bridge the gap between maraging steels and tool steels. The new alloy is intended to provide manufacturers with both good weldability of carbon-free maraging steels and the performance of carbonbearing steels. Osprey MAR 55 provides high mechanical properties and wear resistance already in the as-built condition.

Osprey MAR 55 is primarily designed for use in Laser Beam Powder Bed Fusion (PBF-LB) Additive Manufacturing, without the need for plate preheating. This makes it ideal for tooling applications requiring >50 HRC hardness and wear resistance beyond 18-Ni class maraging steels. Its ultrahigh fracture toughness also suits defence and aerospace use.

Ingemar Bite, R&D manager at Seco, shared, “To me MAR 55 is the material with the most interest and

attention today. It has now, after evaluations and extensive testing, been implemented in our production. We have used it both for prototyping and field testing, and products that are running today in our customers’ production.”

Faraz Deirmina, Principal Metallurgist at Powder Solutions, Sandvik stated, “Before MAR 55, customers had to choose between good weldability and performance. This new alloy bridges the gap between maraging steels and carbon bearing tool steels. It means that the alloy is easily weldable, with exceptional toughness. Also, it can be heat-treated without the need for prior costly solution annealing (austenitisation) or cryogenic treatments. At the same time its wear and fatigue resistance are similar to the carbide-strengthened tempered martensitic microstructures of medium carbon tool steels.”

The main characteristics of Osprey MAR 55 include:

Elmet has received a US patent for tungsten alloy powders and their creation (Courtesy Elmet)

seconds/50 g by Hall flow method).

The plasma-treated particles are capable of reaching up to 65% of theoretical density, minimising shrinkage and defects during sintering.

In addition, Elmet has positioned the technology to address a longstanding challenge in metal Additive Manufacturing: producing highly pure, flowable powders that retain their shape and properties under extreme processing conditions. www.elmettechnologies.com

• Excellent processability by Laser Beam Powder Bed Fusion (PBF-LB) and laser Directed Energy Deposition (DED), without the need for plate or platform preheating

• Optimised for excellent weldability similar to maraging steels, while showing improved wear and fatigue resistance similar to carbon bearing tool steels

• Higher thermal conductivity compared to maraging steels and martensitic stainless steels

• Exceptional hardness/toughness combination in as-built and heat-treated conditions, and exceptional toughness at cryogenic temperatures

In addition to its use within Additive Manufacturing, Osprey MAR 55 is suitable for Cold Spray, Hot Isostatic Pressing (HIP), Metal Injection Moulding (MIM), Micro-MIM, sintered metal filters and foams. The patent-pending alloy is produced in a VIGA atomiser to ensure low oxygen and contamination levels. www.metalpowder.sandvik

Amazemet Sp zoo, based in Warsaw, Poland, has announced the launch of its on-demand atomisation service, designed to provide researchers with cost-effective, small-batch production of high-quality, custom metal powders.

“We saw a clear challenge in materials innovation,” explained Dr Łukasz Żrodowski, CEO of Amazemet. “Researchers with brilliant ideas were being held back by prohibitive costs and the inability to procure small, experimental batches of high-

quality spherical powders. Our new service directly removes that barrier, enabling faster discovery and development.”

The development of new materials for Powder Metallurgy technologies, especially Additive Manufacturing, is a complex and expensive process. This requires powders with qualities such as sphericity, flowability, lack of satellites, narrow particle size distribution (PSD), and low oxygen content.

SK On, based in Seoul, South Korea, has signed a Memorandum of Understanding (MoU) with L&F, Daegu, on the supply of lithium iron phosphate (LFP) cathode materials as the company aims to accelerate its battery business by moving into the North American energy storage system (ESS) market. Details of the agreement, including supply volume and period, are laid out in the MoU and

intend to build to a mid-to-long-term partnership.

As AI data centres expand, ESS installations in the US are projected to increase from 19 GW in 2023 to 133 GW by 2030, and 250 GW by 2035, according to Bloomberg. To support this growth, the demand for LFP batteries is also expected to rise sharply. Per the International Energy Agency (IEA), LFP batteries accounted for ~80% of the global ESS market in 2023, driven by their cost competitiveness and strong safety profile.

SK On, part of South Korea’s second-largest conglomerate SK Group, plans to establish LFP battery production capacity by repurposing

Optimised for large-scale production, conventional atomisation methods, such as gas or plasma atomisation, require minimum feedstock quantities of tens of kilograms. This can make them uneconomical for the small, experimental batches needed in R&D, stated the company. The challenge is even bigger when developing next-generation alloys that incorporate high-value elements like scandium, hafnium, or rhenium, where material costs can exceed €1,000 per kilogram.

Amazemet’s ultrasonic atomisation service directly addresses this challenge, providing an alternative that enables researchers to rapidly and economically explore innovative compositions.

The new atomisation service is reported to offer:

• Low barrier to entry

• High process efficiency

• Advanced material capability

• Unique recycling options

• Pre-alloying service

• Multi-material orders

It was stated that all relevant processing parameters are shared with the client, and Amazemet’s application team, consisting of materials science experts, is also available to support those preparing research papers.

www.amazemet.com

existing production lines as part of its localisation strategy. Currently, the company operates two battery plants and is building four more with partners in the US. Once fully operational, the company’s annual production capacity in the US is expected to exceed 180 GWh.

The company has been actively developing LFP batteries as part of its battery chemistry diversification strategy. It debuted its first LFP battery prototype at InterBattery 2023, followed by the introduction of the Winter Pro Battery designed for improved low-temperature performance in 2024 and a long-life LFP battery in 2025.

www.eng.sk-on.com

Sweden’s Höganäs AB has launched a new range of sustainable metal powders under its re-portfolio brand.

Inspired by the principles of reduce, reuse and recycle, the new product line will feature a ‘re-’ prefix and meet at least one of the company’s

Höganäs AB has launched a new range of sustainable metal powders under its re-portfolio brand (Courtesy Höganäs AB)

four defined sustainability principles.

To support environmental credibility, all materials in the re-portfolio will be backed by fact-based documentation, such as a life-cycle assessment (LCA) study or similar.

“At Höganäs, we are committed to driving positive change through material innovation that meets our customers’ evolving sustainability needs,” stated Catharina Nordeman, VP Group Sustainability at Höganäs.

“The re-portfolio helps customers more easily identify which of our products actively support their own sustainability goals.”

re-Astaloy 85 Mo

The first product in the new range is re-Astaloy 85 Mo, developed for Powder Metallurgy applications. It is reported to offer the same high

Continuum Powders, Houston, Texas, USA, has announced the availability of its OptiPowder M247 and M247LC nickel superalloy powders, providing users with a high-performance alloy historically limited to investment casting. By optimising M247 for Binder Jetting and other non-PBF-LB Additive Manufacturing platforms, Continuum states it is enabling engineers to leverage its hightemperature performance without the long lead times and tooling costs of traditional casting.

M247 is a precipitation-hardenable, nickel-based superalloy engineered for service in extreme environments. It offers superior creep resistance, thermal stability, and oxidation resistance at temperatures up to 980°C (1,800°F), making it ideal for hot-section components in gas turbine engines and power systems.

“Mar-M247 has always been a powerful material - but it’s been locked behind slow, expensive casting for too long,” stated Rob Higby, Chief Executive Officer at Continuum Powders. “By offering OptiPowder M247, a binder-jetready version made from certified aerospace scrap, we’re giving manufacturers a faster, more flexible, and ESG-aligned alternative— while maintaining the mechanical strength and consistency they depend on.”

Through its proprietary Melt-toPowder (M2P) process, Continuum transforms high-value reclaimed aerospace-grade scrap into powder that meets stringent cleanliness and particle morphology standards. The process preserves alloy integrity while minimising oxygen pickup, ensuring consistent performance across multiple builds.

compressibility, uniform microstructure and hardenability as the original Astaloy 85 Mo. By replacing natural gas with biogas for both energy and feedstock through a verified mass balance approach, re-Astaloy 85 Mo achieves a 14% reduction in product carbon footprint (PCF).

“We see an increase in customer demand for solutions to reduce their Scope 3 carbon footprint. By integrating biogas into our production, we are supporting our customers in that ambition while also reducing emissions at source,” said Andreas Jähnke, Division President, Powder Metallurgy Technologies (PMT).

“This is another strategic step toward decarbonising our production processes.”

The ‘re-’ prefix is expected to help customers identify products that align with at least one of Höganäs’ four core sustainability principles: net-zero emissions; fit for circularity; resource productive; safe and ethical.

www.hoganas.com

OptiPowder M247 and M247LC can be adapted for other PM routes, including MIM and HIP (Courtesy Continuum Powders)

“Our M247 offering changes the economics and accessibility of this alloy for advanced manufacturing,” added Sunil Badwe, VP of Technology at Continuum Powders. “We’ve qualified specific powder recipes for leading Binder Jetting platforms, enabling OEMs to produce complex geometries and consolidated assemblies that were previously impractical with casting. These powders can also be adapted for other Powder Metallurgy routes, from Metal Injection Moulding to Hot Isostatic Pressing of near-net shapes.” www.continuumpowders.com

Gasbarre delivers servo-electric compaction systems purpose-built for refractory metals, hard materials, and technical ceramics. With over 50 years of experience in powdered material compaction, Gasbarre understands the unique demands of carbide and cermet manufacturing—down to the density control, precision tooling requirements, and production efficiency requirements that drive performance and cost.

n Full CNC control of upper punch, die, and core rod with flexible bottom punch/core rod arrangements

n Extraordinary productivity supported by multiple automation options, including process monitoring with 100% weight and length feedback

n Optimized energy efficiency through servo-electric drives

n Latest generation control software with programmability, real-time visualizations, and data collection

n Small footprint with no pit required for installation

n Maintenance-friendly design to maximize uptime and press life

Engineers from the Royal Melbourne Institute of Technology (RMIT) University, Melbourne, Australia, have developed a technique for producing a new type of additively manufactured titanium that’s reported to be around a third cheaper than commonly used titanium alloys. The team are reported to have used readily available and cheaper alternative materials to replace the increasingly expensive vanadium.

Using the new technique, the RMIT team was able to produce a titanium alloy with improved strength and performance compared to standard AM titanium alloys (Ti-6Al-4V). Through this design framework, the metal is also said to additively manufacture more evenly, avoiding the column-shaped microstructures that lead to uneven

mechanical properties in some AM alloys.

RMIT’s Centre for Additive Manufacturing (RCAM) PhD candidate Ryan Brooke, who has just accepted a Research Translation Fellowship at RMIT to investigate the next steps of commercialising the technology, explained that there are many chances for development in the field of additively manufactured titanium alloys.

“3D printing allows faster, less wasteful and more tailorable production, yet we’re still relying on legacy alloys like Ti-6Al-4V that don’t allow full capitalisation of this potential. It’s like we’ve created an aeroplane and are still just driving it around the streets,” he said. “New types of titanium and other alloys will allow us to really push the boundaries of what’s possible with 3D printing and

PhD candidate and study lead author Ryan Brooke inspects a sample of the new titanium (Courtesy RMIT)

the framework for designing new alloys outlined in our study is a significant step in that direction.”

The team’s research was recently published in Nature under the title. ‘Compositional criteria to predict columnar to equiaxed transitions in metal Additive Manufacturing’, recently published in Nature. The work outlines the

method of selecting elements for alloying to best leverage AM technology and provides a more transparent framework for predicting the grain structure of metal AM alloys.

“By developing a more costeffective formula that avoids this columnar microstructure, we have solved two key challenges preventing widespread adoption of 3D printing,” said Brooke.

Recently, Brooke completed market validation as part of CSIRO’s ON Prime programme, talking to aerospace, automotive and MedTech industry representatives about their needs. He explained, “What I heard loud and clear from end users was that to bring new alloys to market, the benefits have to not just be minor incremental steps but a full leap forward, and that’s what we have achieved here.”

“We have been able to not only produce titanium alloys with a uniform grain structure, but with

A team of researchers have published a paper on a newly developed technique for the creation of additively manufactured titanium alloys (Courtesy RMIT)

reduced costs, while also making it stronger and more ductile.”

Professor Mark Easton, the paper’s corresponding author, said that RMIT’s Centre for AM is currently focused on fostering collaborations to further the technology.

“We are very excited about the prospects of this new alloy, but it requires a team from across the supply chain to make it successful. So, we are looking for partners to provide guidance for the next stages of development,” he said. www.rmit.edu.au

Looking to convert an alloy to powder? At Metal Powder Works, we give you the freedom to work with the materials you need, when you need them, accelerating your path to production.

Amaero Ltd, based in McDonald, Tennessee, has announced a successful capital raise of approximately $32.3 million through a placement of 125 million new fully paid ordinary shares. The company will also offer up to around $1.9 million through a Share Purchase Plan (SPP), giving eligible shareholders the opportunity to invest at the same price as institutional participants.

While Amaero was already fully funded to deliver its $46.5 million capex programme and achieve positive EBITDA in FY2027, strong

investor demand, particularly from those aligned with defence and USA reshoring strategies, prompted the Board to accelerate its timeline. The fresh capital will allow Amaero to advance initiatives originally planned for later years, strengthening its competitive position in the fastevolving Additive Manufacturing landscape.

Amaero’s next phase includes ordering a fourth atomiser before year-end, progressing the design and build of an argon gas recycling unit, and pursuing additional corporate development opportunities. These

PyroGenesis Inc, headquartered in Montreal, Quebec, Canada, has announced that it is now contracted to provide Ti - 6Al - 4V powder, produced by its NexGen plasma atomisation process, to an undisclosed European-based engineering and science firm specialising in Additive Manufacturing.

This ‘coarse’ powder cut ordered was recently added to a major global aerospace company’s approved list of metal powders.

The unnamed client had previously received and tested samples of PyroGenesis’ metal powder; this latest contract marks the first commercial order with this customer. The company noted that the powder has already been produced and will be shipped to the customer over the next few weeks.

“This initial order comes after a successful review and testing process with this European customer. The high standard of

investments are aimed at securing its first-mover advantage, lowering costs, and ensuring long-term supply chain resilience.

Chairman and CEO Hank J Holland highlighted the strategic significance of the raise. “Over the past three years, Amaero has been deliberate with its corporate strategy, has made forward-leaning capital investments and has been disciplined with its allocation of capital. Prior to this placement, Amaero had raised A$98.5 million over three plus years and approximately A$70 million resides on the balance sheet in cash and tangible assets. The Board and our leadership team are focused on the long-term opportunity. As we view the re-shoring of sovereign manufacturing and supply chain capabilities as a generational opportunity, we will continue to make thoughtful and well-reasoned investments that differentiate our market position, address the needs of our customers and align with US priority policy initiatives.”

“We are gratified to have strong support of our existing institutional shareholders and to welcome new institutional investors onto the Amaero register. The placement allows Amaero to accelerate orders of long lead time capital assets and to build upon the progress to date,” added Holland.

www.amaeroinc.com

Ti64 metal powder produced at PyroGenesis Additive is the result of years of groundbreaking design and engineering work that went into developing our NexGen plasma atomisation process, and the commercial results of these efforts are starting to appear,” said P Peter Pascali, president and CEO of PyroGenesis.

“This customer is a key technology hub for their region, with state-of-the-art engineering and R&D. We hope to see further contracts that reflect the importance of the customer’s role within the industry.”

www.pyrogenesis.com

PGA Plasma Gas Atomizer

/ Designed to atomize any alloy that can be plasma melted.

/ Proprietary hearth melting technology for ultra-high purity.

SSA Small Scale Atomizer / Pilot Scale Atomizer

/ At about 10kg per batch, it is perfect for prototyping.

/ Shortcut long lead-times from toll-atomizers.

We offer our customers US-manufactured technologies and tolling services designed to meet powder development and production objectives at any scale.

/ Engineered to lead the industry in throughput and energy efficiency.

R-CIGA Retech-Ceramic Induction Gas Atomizer

/ Configurable for pilot-scale batches up to semi-continuous, high-output industrial powder production.

/ Suitable for alloys compatible with ceramic crucibles.

Following the announcement in January that American Axle & Manufacturing (AAM), headquartered in Detroit, Michigan, USA, had agreed terms to acquire Dowlais Group plc, the UK-based parent company of GKN Automotive and GKN Powder Metallurgy, shareholders of both companies have approved all proposals related to the combination.

Once completed, the combined AAM and Dowlais group will have an expanded and balanced geographic presence across multiple automotive segments supporting ICE, hybrid and electric powertrains and is expected to generate annual revenues of approximately $12 billion on a non-adjusted combined basis. The company also intends to seek a secondary listing and

The combined AAM and Dowlais group will support ICE, hybrid and electric powertrains (Courtesy GKN Automotive)

Lyten, a battery startup based in San Jose, California, USA, has agreed to purchase the majority of Northvolt AB, following the Swedish company’s bankruptcy announcement in March this year. The deal includes Northvolt’s projects in Sweden and Germany, as well as its intellectual property.

Lyten is backed by automaker Stellantis and delivery company FedEx. To support this expansion, as well as other recent acquisitions, the company reported having secured over $200 million in additional equity from unnamed investors.

It was stated that Lyten plans to restart production at the Skel -

lefteå site, resuming deliveries of lithium-ion battery cells in 2026. Following this successful ramp-up, the plant will transition to dualchemistry production to enable the production of Lyten‘s own lithiumsulphur batteries. The company expects these investments to be profitable within the next eighteen to twenty-four months.

Lyten CEO Dan Cook outlined plans to focus on high yields for one customer in an effort to prove the quality of any new batteries. As demand for European-made batteries is still high, however, the company is in discussions with former Northvolt customers with

admission of shares of its common stock, including the new AAM shares, to trading on the London Stock Exchange.

“We are pleased that the investor community is aligned with the strategic rationale of combining these two outstanding automotive suppliers into a leading global driveline and metal forming supplier,” said David C Dauch, chairman and Chief Executive Officer of AAM, who will serve as the chairman and Chief Executive Officer of the combined company.

“We continue to work towards satisfying the remaining conditions to close the transaction and look forward to establishing a combined company with the powertrainagnostic product portfolio, global reach, commitment to innovation and financial strength to succeed in a dynamic market environment and create value for all stakeholders.”

The combination is expected to close in the fourth quarter of 2025, subject to the satisfaction of the remaining conditions, including antitrust and other regulatory approvals.

www.aam.com

www.dowlais.com

Lyten plans to begin deliveries from Northvolt’s flagship production facility in 2026 (Courtesy Northvolt)

whom it hopes to sign further commercial agreements.

Northvolt’s order book was said to have once totalled more than $50 billion from automakers such as BMW, Volkswagen and Audi. www.lyten.com www.northvolt.com

● WATER ATOMIZERS FOR MORE IRREGULAR POWDERS ideal for recycling/re ning process, press & sinter process and others.

● GAS AND ULTRASONIC ATOMIZERS FOR SPHERICAL POWDERS WITHOUT ANY SATELLITES for LPBF, MIM, Binder Jetting and other Additive Manufacturing applications. High purity, sphericity and wide range of reproducible particle size distribution.

● AIR CLASSIFIERS FOR THE PRECISE SEPARATION OF METAL POWDERS into ne and coarse powder fractions especially in the range < 25 µm

Osterwalder AG, headquartered in Lyss, Switzerland, has become part of the Picanol Group, a business unit of the Belgium-based Tessenderlo Group. Although financial details have not been disclosed, Osterwalder stated that preparations for the transition had begun in September 2024 but were delayed due to geopolitical tensions, a strong Swiss franc, and a generally challenging economic environment.

Osterwalder operates a production facility in Lyss and maintains sales and service organisations in

the United States, China, and Japan. The company employs approximately eighty people globally and will continue to operate under its own brand name.

Going forward, the team, contacts, and service will remain unchanged. Open contracts and performance obligations are being transferred to a newly designated entity, Osterwalder Technology AG.

“The acquisition of Osterwalder’s activities strengthens Picanol Group’s portfolio of high-tech machines and advanced solutions for

Now part of the Picanol Group, Osterwalder and its subsidiaries will continue to operate as independent entities (Courtesy Osterwalder Technology AG)

Concurrent Technologies Corporation (CTC), headquartered in Johnstown, Pennsylvania, USA, has announced the relocation of its Maryland-based operations from Annapolis Junction to a new, state-of-the-art office in Linthicum, Maryland, USA. The new facility became fully operational in June 2025. CTC had maintained a presence in Annapolis Junction for more than twenty years. However, with its lease due to expire, the

organisation sought a more modern facility with upgraded infrastructure that would also position its team closer to its primary customers.

“Relocating to Linthicum supports our strategic objective to operate efficiently while staying closely aligned with our clients’ missions,” stated Kevin Pudliner, Vice President, Digital Mission Solutions. “This modern facility enhances our ability to deliver innovative, technology-

the manufacturing industry,” stated Miguel de Potter, CFO of Tessenderlo Group. “We are delighted to welcome the employees of Osterwalder to our group and we are ready to further develop the company together.”

The Picanol Group consists of four other companies: Picanol (weaving machines), Proferro (foundry and mechanical finishing), Psicontrol (development and production of electronics), and Melotte (Additive Manufacturing and highprecision finishing).

“We are pleased and proud to be part of a group that shares our values and our strategy,” added Rolf Graf, Managing Director of Osterwalder. “This collaboration will allow us to further expand our product portfolio and strengthen our global services.”

In a statement, the company commented, “At Osterwalder, we believe in pioneering, partnership, and performance. With this new chapter, we are confident that we are even better-positioned to support our customers and partners for many years to come. With Tessenderlo Group as our parent company, we are ideally positioned to expand our product portfolio, invest in new technologies, and further enhance our global services.”

www.tessenderlo.com

www.picanolgroup.com

www.osterwalder.com

based solutions that strengthen national defence and support our clients’ needs.”

The new site features brandnew, purpose-built communications rooms as well as efficient and updated lab environments.

Chris Scott, CTC Senior Director, added, “We’re excited about what this move represents. The Linthicum office provides a superior environment for our employees and customers, while offering room for expansion as we grow through new contracts and partnerships.”

www.ctc.com

Velta Holding US Inc, a titanium feedstock company operating in the USA and Ukraine, has received a third patent from the United States Patent and Trademark Office (USPTO) for its Velta Ti Process technology. This new patent underlines Velta’s ability to produce high-quality titanium dioxide (TiO 2) – a key intermediate used in furthering the production of titanium powder using the Velta Ti Process, along with marketable titanium-, iron-, calcium-, and nitrogen-based by-products.

“We’ve received three US patents – all during the full-scale war,” said Andriy Brodsky, president of Velta Holding. “Our group has remained committed to our strategy of vertical integration through innovation, including Additive Manufacturing and 3D printing. I believe Ukraine has strong scientific potential, and these patents from the USPTO make me feel confident.”

Since 2017, Ukrainian chemists and metallurgists at the Velta RD Titan R&D centre have been working to develop, improve, and

Velta Holding has received a third US patent for its Velta Ti Process (Courtesy Velta Holding)

Wallwork Group, headquartered in Bury, Greater Manchester, UK, announced that its HIP Centre has achieved Nadcap accreditation. This follows the company bringing online its second Hot Isostatic Press (HIP) from Quintus Technologies.

“This achievement demonstrates our commitment to the highest standards in quality,

consistency and process control – especially for the aerospace, defence and advanced engineering sectors,” the company said in a statement. “We’re excited for what the future holds as we continue to grow and serve the most demanding industries with integrity and innovation.

Wallwork Group is said to be the largest privately-owned

patent a method for producing titanium metal powders and alloys via its Velta Ti Process. Velta Holding has invested over $7 million in this research.

Compared to conventional multi-stage production methods, the Ukrainian technology is said to be less energy-intensive, have a significantly reduced carbon footprint, and offer superior economic efficiency. The new method is also referred to as zero-waste, enabling the production of by-products used in coatings, polymers, paper, pigment, and metallurgy industries.

Since 2020, Velta Holding US has secured three US and three Ukrainian patents:

• Production of titanium powders and premium alloys using metallothermic methods

An original high-temperature process for titanium oxide reduction in molten salts

A zero-waste process for the cost-effective production of high-quality TiO 2 and valuable by-products designed to make the technology environmentally safe and commercially viable

Velta Holding plans to scale up from semi-industrial powder production at its R&D facility to a fully operational plant that will produce titanium powders and finished products based on its technology.

www.velta.us

company specialising in thermal processes and surface-engineered coatings in the United Kingdom. Started in 1959, Wallwork’s service offering has expanded to meet the varied needs and challenges of the industry; the company’s initial investment in Hot Isostatic Pressing technology was a response to requests from existing and potential customers. The Wallwork HIP Centre was opened formally in November 2023, supporting service demand across a variety of sectors.

www.wallworkht.co.uk

Ultium Cells LLC, a joint venture between General Motors and LG Energy Solution, has announced plans to upgrade its Spring Hill, Tennessee, USA, battery cell manufacturing facility to scale production of low-cost lithium iron phosphate (LFP) battery cells, building on a $2.3 billion investment announced in 2021. Conversion of battery cell lines at Spring Hill to produce LFP cells is scheduled to begin later this year, with commercial production expected by late 2027.

“At GM, we’re innovating battery technology to deliver the best mix of range, performance, and affordability to our EV customers,” said Kurt Kelty, VP of batteries, propulsion, and sustainability at GM. “This upgrade at Spring Hill will enable us to scale production of lower-cost LFP cell technologies in the US, complementing our high-nickel and future lithiummanganese-rich solutions and further diversifying our growing EV portfolio.”

GM’s EV platform has been architected to enable the quick integration of multiple cell chemistries and form factors. The Ultium Cells plant in Warren, Ohio, will continue producing cells with nickel cobalt manganese aluminium chemistry, which has been key to GM delivering a range of crossovers with more than 480 km (300 miles) of range on a charge. With LFP battery technology, GM is targeting significant battery pack cost savings compared to today’s high-nickel battery pack while increasing consumer EV choice.

“The upgrade reflects the continued strength of our part-

nership with General Motors and our shared commitment to advancing EV battery innovation,” said Wonjoon Suh, executive VP and head of the Advanced Automotive Battery division at LG Energy Solution. “We will bring our extensive experience and expertise in US manufacturing to the joint venture facility, further accelerating our efforts to deliver new chemistries and form factors

that effectively capture the unmet needs in the EV market.”

The Spring Hill facility currently employs about 1,300 people. With the ability to manufacture battery cells in multiple cell chemistries, Spring Hill is anticipated to help drive US battery development, manufacturing, and consumer choice in the EV market.

www.ultiumcell.com

www.ultra-infiltrant.com

MP Materials, headquartered in Las Vegas, Nevada, USA, has signed a multiyear deal to supply Apple with rare earth magnets manufactured in the United States using 100% recycled materials. Apple announced a $500 million commitment to buying American-made rare earth magnets developed at MP Materials’ flagship Independence facility in Fort Worth, Texas.

Under the agreement, the two companies will also work to establish a cutting-edge rare earth recycling facility in Mountain Pass, California, and develop novel magnet materials and innovative processing technologies to enhance magnet performance.

“American innovation drives everything we do at Apple, and we’re proud to deepen our investment in the US economy,” stated Tim Cook, Apple’s CEO. “Rare earth materials are essential for making advanced technology, and this partnership will help strengthen the supply of these vital materials here in the United States. We couldn’t be more excited about the future of American manufacturing, and we will continue to invest in the ingenuity, creativity, and innovative spirit of the American people.”

To support the initiative, Apple and MP Materials will install a series of neodymium magnet manufacturing lines specifically designed for Apple products at the Texas factory. The new equipment and technical capacity will allow MP Materials to significantly boost its overall production. Once built, the American-made magnets will be shipped across the country and all over the world, helping to meet increasing global demand.

Apple first introduced recycled rare earth elements into its products in 2019 with the iPhone 11’s Taptic Engine. Today, nearly all magnets used in Apple devices are made with 100% recycled rare earth elements.

For nearly five years, Apple and MP Materials have been piloting advanced recycling technology that enables recycled rare earth magnets to be processed into material that meets Apple’s performance and design standards.

When complete, the new recycling facility in Mountain Pass, California, will take in recycled rare earth feedstock, including material from used electronics and post-industrial

Introduction area at

where MP Materials develops and prototypes innovative magnet solutions for emerging technologies (Courtesy MP Materials)

scrap, and reprocess it for use in Apple products.

“We are proud to partner with Apple to launch MP’s recycling platform and scale up our magnetics business,” added James Litinsky, founder, chairman and CEO of MP Materials. “This collaboration deepens our vertical integration, strengthens supply chain resilience, and reinforces America’s industrial capacity at a pivotal moment.”

Rare earth magnets are essential components in smartphones, computers, wearables and other electronics, as well as in vehicles, robotics, and energy systems.

This collaboration supports MP Materials’ mission to restore the full rare earth supply chain to the United States, while raising sustainability standards through the recovery of critical elements from recycled sources.

The agreement is expected to reduce waste, conserve natural resources, and promote cost-effective domestic magnet production. It also aims to strengthen the resilience of the US supply chain and enhance the country’s capacity to process and retain strategic raw materials.

Magnet shipments are expected to begin in 2027 and ramp up to support hundreds of millions of Apple devices.

www.mpmaterials.com

www.apple.com

Globus Metal Powders Ltd, based in Middlesbrough, UK, has announced the successful completion of the Royce Industrial Collaboration Round 4 project: Segmented Hopper

for Rapid Improvement of advanced Metal Powders (SHRIMP).

“This project introduced the world’s first segmented powder hopper: a breakthrough design that

Aeramine, a UK-based advanced technology startup specialising in producing ultra-high-purity copper, showcased the use of its vacuum refinement process at the MT29 Magnet Technology Conference in Boston, Massachusetts, USA.

“We were well received, and with the US tariffs for copper potentially rising to 50%, we are exploring the possibility of establishing facilities to refine copper in the US,” stated Alex Lapis, Aeramine’s co-founder and Managing Director.

Aeramine recently completed a £1 million project, funded by Innovate UK, wherein the company transformed waste copper into high-purity copper powder for highvalue applications. Through refining, atomisation, and Additive Manufacturing processes, the company aims to establish sustainable, locally

based supply chains for copper and other high-purity metals increasingly recognised as critical materials by many countries. With low oxygen and impurity levels, ultra-high purity copper is designed for demanding applications. Although not magnetic itself, copper’s excellent electrical conductivity makes it vital for superconducting and resistive magnets, offering stability, efficient heat dissipation, and enabling the creation of powerful magnetic fields. In superconducting magnets, copper acts as a stabiliser, providing a current pathway if the superconductor fails and aiding heat dissipation. For resistive magnets, copper wire is the primary material used to produce magnetic fields. Although copper is not directly utilised in permanent magnets, it remains significant in

allows multiple adjustments to atomisation parameters during a single melt,” explained Gill Thornton, R&D Manager, Globus.

“It enables faster optimisation of particle size distribution (PSD) and powder properties, accelerating the development of sustainable metal powders.”

According to the company, only around 1% of alloys are available in a powder form that is suitable for net-shape and Additive Manufacturing, thereby limiting the technology’s adoption across industries. SHRIMP aims to remove that barrier by making alloy development faster and more accessible.

For the project, Globus worked alongside the Materials Processing Institute (MPI) on the hopper design, build and operation and Royce at the University of Sheffield for collaboration on Hot Isostatic Pressing (HIP), characterisation equipment and expertise.

www.globusmetalpowders.com

specific manufacturing processes and other magnetic applications.

“Our manufacturing approach minimises environmental impact, improves material efficiency, and offers cost-effective ultra-high-purity solutions for industries such as electronics, aerospace, and automotive,” added Lapis.

Based in the UK’s OxfordCambridge super-technology corridor, Aeramine benefits from a UK government-backed initiative aimed at fostering economic growth and innovation in the region. This initiative seeks to establish a worldleading science and technology hub, attracting talent and investment while encouraging collaboration amongst businesses, investors, and the ARC Universities’ cluster of nine universities.

The company finalised an initial £700,000 pre-seed funding round with angel investors, is preparing for its next fundraising. www.aeramine.com

In metal powder production, every detail matters. Our technical ceramic components made from Boron Nitride - HeBoSint® are specifically engineered to meet the demanding requirements of metal atomization.

Here‘s why they provide a competitive edge:

• Highest Precision: Achieve precise and repeatable control of particle size, leading to optimal yield and reduced rejects.

• Maximum Service Life: The excellent non-wetting behavior prevents clogging, while the high thermal shock resistance avoids unnecessary preheating and costly downtime.

• Efficiency and Cost Savings: Our robust, low-maintenance nozzles contribute to a significant reduction in overall process costs.

Henze Boron Nitride Products AG

Grundweg 1

87493 Lauben / Germany

Phone: +49 8374.589 97-0

E-Mail: info@henze-bnp.de

www.henze-bnp.de

Novamet Specialty Products Corporation, Lebanon, Tennessee, USA, has officially opened its new online store. The new platform is designed to streamline the purchasing process for manufacturers, engineers, researchers and industry professionals seeking metal powder solutions.

The online store features a selection of premium metal powders with detailed product specifications and datasets for each. Following completion of the secure ordering process, powders are shipped directly from Novamet’s facility.

“Our goal is to make innovation more accessible,” stated Jeff Peterson, Novamet CEO. “By opening our online store, we’re removing barriers and making it easier for customers to source the high-quality materials they need to drive manufacturing excellence.”

www.novamet.com

AMES, a Powder Metallurgy parts maker headquartered in Barcelona, Spain, has officially joined the HP Metal Jet Production Service network and is now featured as one of HP’s trusted contract manufacturers for scalable metal Additive Manufacturing.

The announcement follows the opening of an HP Metal Jet Adoption Center for the EMEA region at the AMES Barcelona factory in November 2024. The state-ofthe-art facility leverages AMES’ vast experience in the mass production of metal powder components and its deep understanding of the sintering and post-processing stages.

Adopting the HP Metal Jet S100 is reported to have expanded the company’s capabilities with Binder Jetting technology for production-grade metal parts. The platform enables AMES to offer enhanced design freedom for complex geometries and cost-effective series production of up to 50,000 units per year. The process also enables faster development cycles with no tooling needed, and material properties comparable to Metal Injection Moulding (MIM).

AMES is one of the leading manufacturers of sintered Powder Metallurgy parts, with production centres in Spain, Hungary, the USA, and China. Its worldwide sales and technical support network serves over 1,000 customers in more than fifty countries.

www.hp.com www.ames-sintering.com

• Simple, quick set-up • High accuracy

• Low scrap rate • Maximal machine utilization • Increased productivity Upper punch with Macro

www.system3r.com Lower punch with Macro Core rod

USA Rare Earth (USAR), based in Stillwater, Oklahoma, has signed a joint development agreement with ePropelled, located in Laconia, New Hampshire, to establish a strategic supply-and-purchase relationship for USAR’s sintered neodymium magnets.

USAR will immediately begin prototyping its magnets for use in ePropelled’s high-performance motors, controllers, generators, and power management systems. ePropelled’s systems are used in uncrewed vehicles (UAV) for air, land, and sea, from large-payload aerial drones and long-range defence applications, as well as for small surveillance and commercial drone designs.

“This agreement is another milestone in our efforts to fill our 2026 pipeline and work through the development and qualification process with customers across industries as we complete the commissioning of our Stillwater manufacturing facility,” stated Joshua Ballard, CEO of USA Rare Earth. “We are very pleased to partner with such an innovative company as ePropelled, a global leader in magnetics engineering and a proven pioneer in the design and production of electric propulsion solutions. We look forward to working with the ePropelled team to develop a true partnership in providing Made-in-the-USA designated high-quality, high-performance

USAR is building a sintered neodymium magnet manufacturing facility in Stillwater, OK, which is planned to be commercial in the first half of 2026 (Courtesy USA Rare Earth)

Epson Atmix Corporation, a group company of Seiko Epson Corporation based in Aomori, Japan, has completed construction of a new $38 million metal recycling facility at Kita-Inter Plant No. 2. The new centre will recycle used metals from the Epson Group’s operations and the local community to produce raw materials for Atmix’s metal powder products.

The recycling facility was first announced in 2022, with construction beginning in 2023.

Atmix will recycle out-of-specification metal powders, metal scraps from its own production processes, and used moulds and metal offcuts from Epson Group operations. These materials will be refined into highquality raw materials, which will then be used at Atmix’s headquarters and Kita-Inter Plant to produce metal powders suitable for Metal Injection Moulding.

Epson stated that it is committed to developing environmental technologies that support resource

USA Rare Earth will provide sintered magnets for drones (Courtesy ePropelled)

magnets for use in their pioneering and innovative solutions.”

“We’re thrilled to partner with USA Rare Earth to secure the rare earth materials essential to our uncrewed vehicle solutions,” said Nick Grewal, ePropelled founder, chairman and CEO. “Expanding our supply chain –both in the US and globally – is key to meeting the high expectations of our customers and staying ahead in this fast-moving industry.”

Operating worldwide, ePropelled serves a customer base that spans aerospace, defence, industrial automation, and maritime industries. The company’s technologies are used in mission-critical applications including long-endurance surveillance drones, robotic ground vehicles, and autonomous marine vessels. It manufactures components in compliance with international defence standards (e.g. NDAA) while focusing on US manufacturing.

www.usare.com

www.epropelled.com

circulation and carbon reduction, particularly through materials innovation. Its Environmental Vision 2050 outlines its goal of becoming carbon negative and underground resourcefree by 2050. Kita-Inter Plant No. 2 is expected to play a key role in advancing this goal.

Atmix produces a range of metal powders for a variety of manufacturing processes, including Metal Injection Moulding (MIM) and Additive Manufacturing. The company also produces magnetic powders for use in power supply circuits, as coils for IT equipment, and for hybrid and electric vehicles.

www.atmix.co.jp

Ready to take your AM operation to the next level? Partner with the industry leader:

• 135 years metallurgical expertise

• Consistent quality, batch to batch

• Manufactured to spec, on time

LG Energy Solution, headquartered in Seoul, South Korea, has begun mass production of lithium iron phosphate (LFP) batteries for energy storage systems (ESS ) at its plant in Holland, Michigan, USA.

The news follows the company’s $1.4 billion investment to expand the facility beyond its electric

vehicle battery production, which began in 2022. When the company first announced the expansion, it intended to continue the plant’s work of producing lithium-ion batteries for electric vehicles. However, as the US auto industry is witnessing less demand for EVs than expected, and as the coun -

LG Energy Solution’s expanded factory in Michigan has begun making lithium iron phosphate battery cells for energy storage systems (Courtesy LG Energy Solution)

Tekna Holding ASA, based in Sherbrooke, Quebec, Canada, has announced that it has received an order valued at CA $1.6 million for high-performance titanium powder for use in Laser Beam Powder Bed Fusion (PBF-LB) Additive Manufacturing.

The order is reported to represent a fivefold increase in monthly volume from an existing customer, a Tier-1 supplier to the US aerospace and defence industry. This expanded volume applies to deliveries scheduled for the second half of 2025 and reflects the customer’s growing demand for Tekna’s premium Ti64 titanium powder, particularly in the high-value prime particle size range.

“We are proud to deepen our relationship with a key aerospace

and defence partner,” said Claude Jean, Chief Executive Officer of Tekna. “This expanded order underscores the trust our customers place in the consistency and quality of our materials for mission-critical applications.”

“Laser Powder Bed Fusion is the most widely adopted Additive Manufacturing process today, and our Ti64 powder is optimised for performance in these systems,” added Rémy Pontone, Executive Vice President, Sales and Marketing, Additive Manufacturing Materials. “The increased monthly volumes point to higher machine utilisation on the customer side and reflect some improved momentum we’re seeing in the Additive Manufacturing sector.”

www.tekna.com

try’s energy grid becomes more strained in part due to AI data centres, it shifted the expansion to LFP batteries for energy storage systems. According to the company, the plant will produce 16.5 GWh of ESS batteries annually, while the remainder of the site has a capacity of 5 GWh for electric vehicle battery components.

These ESS-specific LFP batteries, said to be the first to be mass produced in North America, feature a long-cell, pouch-type design that delivers exceptional energy efficiency and safety while maintaining a highly competitive cost structure.

“Through this production milestone, we further strengthened manufacturing capabilities in North America and plan to provide stable product supply and prompt local support to key customers in the region,” David (Dong-Myung) Kim, LG Energy Solution CEO and President, stated in a post on LinkedIn. www.lgensol.com

Gevorkyan a.s., headquartered in Vlkanová, Slovakia, has announced the implementation of a share buyback programme for its employees. The scheme has been established to distribute the company’s shares to employees under an Employee Stock Ownership Plan.

The share buyback programme was approved at the Annual General Meeting held in December 2024. Following approval, the complexity of the legislative and regulatory framework, which ensures transparency and compliance with both internal and external rules, required several months of preparation ahead of the programme’s launch. It was added that the programme also extends to key employees involved in ongoing acquisitions. www.gevorkyan.sk

• Cost efficiency thanks to energy- and gas-saving design

• Highest product quality

• Shorter process times with intelligent debinding technology and powerful fast cooling

The Partner Companies (TPC), headquartered in Chicago, Illinois, USA, has acquired Precision Eforming, based in Cortland, New York, USA. The acquisition is expected to enhance TPC’s capabilities in microcomponent manufacturing, while expanding access to high-growth end markets, including aerospace, medical, defence, electronics and energy.

Precision Eforming specialises in sieve and mesh components used in applications that require precise control, repeatability, and versatility. Its products are employed in processes that separate and filter light, sound, air, or powdered materials.

“With a legacy spanning more than a century, Precision Eforming

brings unmatched expertise in 2D electroforming and long-standing customer relationships across more than sixty industries,” stated Christian Streu, Chief Financial Officer of The Partner Companies. “This addition is an ideal fit with TPC’s long-term growth strategy to expand our complementary manufacturing capabilities to best serve our customers’ needs, while also shaping the future of manufacturing.”

The acquisition marks TPC’s eleventh since its founding in 1997, demonstrating the company’s steady expansion strategy in speciality manufacturing. TPC operates facilities across the United States, China, Mexico and Wales, UK.

Precision Eforming’s core capabilities centre on electroforming, an

Additive Manufacturing process that builds high-precision metal parts via electrodeposition. The company’s proprietary techniques enable the development of ultrafine mesh products with precise features, tight tolerances and high reproducibility, setting the standard in critical applications from medical imaging and space exploration to superabrasives and fuel filtration. The company pioneered this now well-established process for manufacturing precision electroformed mesh.

“Joining forces with TPC marks an exciting new chapter for Precision Eforming to accelerate innovation, expand into new markets and continue delivering the precision and reliability our customers expect,” said Griffin. “With TPC, Precision Eforming will have the resources it needs to continue to grow and evolve.”

www.precisioneforming-sieves.com www.thepartnercos.com

Showa KDE Co, Tokyo, Japan, has signed a collaboration agreement under which it will promote metal powder materials from CNPC Powder, headquartered in Vancouver, Canada, to the Japanese market. This collaboration is said to mark an important milestone in CNPC Powder’s global expansion strategy.

Through the agreement, Showa KDE will offer materials including titanium, aluminium, iron, and nickel-based alloys, as well as customised powder solutions.

In June 2025, a team of employees from Showa KDE’s Precision Metals Division visited CNPC Powder’s production headquarters in China’s Anhui province. The Showa team conducted an

turing workshop, and the quality control department. They were able to see firsthand the production processes and supply capabilities of SCS-certified metal powders, such as AlSi10Mg and Ti6Al4V.

Following the visit, Showa KDE noted the strength of CNPC Powder’s in-house developed AMP (Automated Metal Production) continuous production line and low-carbon circular process, noting that these features align with the Japanese market’s demands for high-quality, environmentally friendly materials.

Showa KDE is a leading Japanese supplier of industrial materials and technology solutions, specialising in R&D and

Showa KDE team members undertook a tour of CNPC Powder’s Chinese production facility prior to signing the collaboration agreement (Courtesy CNPC Powder)

facturing technologies. Founded in January 1934, the company brings extensive experience in manufacturing and the Japanese industrial landscape. Its collaboration with CNPC Powder is expected to accelerate the latter’s expansion into the East Asian market, advancing its strategic growth objectives. www.showa-hp.co.jp www.cnpcpowder.com

AMPAL, Inc, a subsidiary of United States Metal Powders, Inc (USMP) based in Palmerton, Pennsylvania, USA, recently held a ribbon-cutting ceremony for its new production line for nodular and spherical

aluminium powders. Full production is expected to commence in early August.

More than 100 people reportedly attended the event, including AMPAL staff, customers, suppliers,

Ribbon-cutting ceremony held at AMPAL’s new aluminium powder line in Palmerton, Pennsylvania (Courtesy US Metal Powders Inc)

The previously announced acquisition of GF Machining Solutions Division of George Fischer AG, Schaffhausen, Switzerland, by United Grinding Group, based in Miamisburg, Ohio, USA, has now been completed. The company has been renamed United Machining Solutions and joins United Grinding Group’s portfolio of fifteen brands, with sales totalling over $1.5 billion. The newly formed United Machining Solutions will retain its headquarters in Bern, Switzerland.

“There has been a long-standing desire to merge the two companies,” stated Stephan Nell, CEO of the new group and the United Grinding Group. “Lead shareholders Rosmarie and Martin Ebner expressed their full confidence in this strategically important step within the world of global machine tool manufacturing, authorising the necessary capital increase to make this vision into reality. It is rare for two compa -

nies to complement each other as well as United Grinding and GF Machining Solutions. This applies not only to our product portfolios, our international alignment, and our understanding of quality, but also to the culture and mindset of our employees. I am convinced that we can make a big difference together, for the benefit of our customers.”

The group’s board of directors closely monitored and supported the process. Fred Gaegauf, chairman of the Board of Directors at the United Grinding Group, stated, “The merger of these two companies has created a Swiss powerhouse in machine tool manufacturing.”

Ivan Filisetti, CEO of GF Machining Solutions and a member of the new group’s Management Board, added, “It is the best decision we could make. Our products do not overlap; they complement each other. This makes integration much easier. And as a Swiss company,

members of the Board of Directors, and public officials. USMP president, Eric Degenfelder, opened the event, stating, “This is not only about our new production line, but also a celebration of our strong team at AMPAL”.

To support the company’s expansion, AMPAL plans to add fifteen new jobs in 2025. Ryan Mackenzie, the US Congressman representing the facility’s location, stated that the production line is an “incredible expansion for the local community.”

Board member Patrick Ramsey stated, “We are thrilled to support this expansion. Production is the lifeblood of this company.”

During the tour of the facility, Degenfelder noted that the new line has implemented ‘state-ofthe-art’ technology as part of the company’s focus on safety alongside productivity and quality.

www.usmetalpowders.com

we share the same culture with a strong commitment to innovation and digitalisation. We will also keep after our goal of being the preferred partner for our customers, always ready with customised solutions and comprehensive expertise – in other words, able to offer much more than just high-end machines. The group helps us with its strong international alignment, employees on site at our customers’ premises, and our breadth of technological expertise.”

Through its System 3R brand, GF Machining Solutions provides a range of tooling for the Powder Metallurgy industry. When producing punches and dies, the tooling reduces setup times and is said to improve accuracy and quality with fewer rejections. When used in the powder compaction press, setup times are also drastically reduced, with improved accuracy and quality of parts.

For metal Additive Manufacturing, the company partners with 3D Systems to offer a range of machines, including the DMP Flex/ Factory 350 and DMP Factory 500. www.grinding.com www.gfms.com

Stronger Together. Powered by Global Excellence.

Building on our 140+ years of trusted expertise, Osterwalder Technology AG is now part of Tessenderlo Group - a diversified industrial group active in over 100 countries with 7,000+ employees worldwide.

Our partnership with Tessenderlo Group strengthens our unwavering commitment to maintaining and supporting your installed machine base. Every press in your facility remains our priority - with the same dedicated service teams, genuine parts supply, and technical expertise you‘ve always relied on, now reinforced by Tessenderlo‘s global industrial strength and resources. With our new owner, we continue pursuing our shared goal: being the most reliable press manufacturer and your most trusted partner. Our proven expertise in all kind of powders to press and your applications stays exactly the same, but with enhanced capabilities to serve you better. The stability of our new owner means stronger long-term support for your operations and investments. This partnership enables us to expand our service capabilities worldwide, accelerate parts availability, and continue to develop advanced press technologies - all while maintaining the personal partnership approach that defines Osterwalder. With enhanced resources across our locations in Switzerland, the United States, China, and Japan and as Part of Tessenderlo Group all over the globe we‘re better positioned than ever to be your reliable, long-term manufacturing partner.

Your trusted Osterwalder partner - stronger, more reliable, always committed to build your success – one perfect part at a time.

Patrick Lannagan and Conrad Pearson of Forvis Mazars LLP, a global professional services network, have been appointed joint administrators of GTB Components Ltd, St Helens, United Kingdom.

Established in 1981, GTB developed into a leading manufacturer of powder metal components, serving global sectors including automotive, building products and home and leisure. It currently employs forty-four.

As well as its UK headquarters, the company has technical offices in Germany, Hungary and Romania. Its facilities make use of thirty-five compaction presses (with capacity ranging from 6-350 tonnes) and eight sintering furnaces, including high-temperature and vacuum. It also offers

heat treatment, steam treatment, high energy polish, and comprehensive inspection.

GTB is IATF16949 and ISO 9001 accredited for the production of ferrous and stainless steel sintered components.

“The company has encountered cash flow challenges, resulting predominantly from challenging market conditions. After careful consideration of the financial position, the directors of the company have reached the difficult decision to place the company into administration,” stated Patrick Lannagan. “The company possesses a well-established manufacturing capability and dedicated and skilled workforce and continues to trade whilst a buyer for the business is sought by the administrators.

Powder Metallurgy component producer and heat treatment service provider GTB Components is seeking a buyer (Courtesy GTB Components)

“The administrators encourage anyone with an interest in acquiring the business and assets to e-mail Angela Ramzan at angela.ramzan@mazars.co.uk. The administrators will be writing to all creditors in the coming days.”

www.gtbcomponents.co.uk

Our high-performance VIGA systems deliver high-quality metal powders, engineered

Wall Colmonoy Corporation, headquartered in Madison Heights, Michigan, USA, has announced the opening of Wall Colmonoy (Suzhou) Co Ltd, a new facility located in Changshu City, Suzhou, China. Formed as a joint venture with longstanding partner Gredmann Taiwan Ltd, Taipei, Taiwan, this strategic expansion is said to underscore Wall Colmonoy’s commitment to the Asia-Pacific region and enhances its ability to serve customers where they operate.

“We’re bringing our global expertise closer to our customers to deliver local solutions. In an increasingly complex and regionally driven world, this approach helps us respond faster, improve service, and build greater resilience into our global supply chain,” said Nick Clark, president of Wall Colmonoy.

Customers across China and Asia are expected to benefit from shorter lead times, extended product shelf life through reduced transit time, in-region technical support, customer training, and responsive production aligned with local needs. They will also gain access to the complete portfolio of Wall Colmonoy products, including Colmonoy surfacing alloys, Nicrobraz brazing powders and pastes, and WallCarb HVOF tungsten carbide powders.