futurebuilding

Keynote address | The Hon. Catherine King MP, Minister for Infrastructure, Transport, Regional Development and Local Government 13

Keynote interview | Shemara Wikramanayake, Managing Director and Chief Executive Officer, Macquarie Group 24

Keynote address | The Hon. Rob Stokes MP, Minister for Infrastructure, Cities and Active Transport, New South Wales

Managing Editor: Brendan Pearce Infrastructure Partnerships Australia E: contact@infrastructure.org.au

Future Building is published by: Executive Media Pty Ltd ABN 30 007 224 204 PO Box 256 North Melbourne VIC 3051

Tel: +613 9274 4200

E: media@executivemedia.com.au W: www.executivemedia.com.au

Advertising: Peter Anderson peter.anderson@executivemedia.com.au Tel: +613 9274 4200

Business Development Manager: David Haratsis

Tel: +613 9274 4214

E: david.haratsis@executivemedia.com.au

The images contained herein are courtesy of Infrastructure Partnerships Australia, Shutterstock, and Istock.com

Panel discussion | Respected leaders –Australia’s infrastructure bodies 40 Panel discussion | Super-sized super: Where to now on infrastructure? 50 Panel discussion | Delivering a pipeline under pressure 60 Fireside chat | Common challenges outside infrastructure 67 Panel discussion | Do PPPs need a rebrand?

The editor, publisher, printer and their staff and agents are not responsible for the accuracy or correctness of the text of contributions contained in this publication, or for the consequences of any use made of the products and information referred to in this publication. The editor, publisher, printer and their staff and agents expressly disclaim all liability of whatsoever nature for any consequences arising from any errors or omissions contained within this publication, whether caused to a purchaser of this publication or otherwise. The views expressed in the articles and other material published herein do not necessarily reflect the views of the editor and publisher or their staff or agents. The responsibility for the accuracy of information is that of the individual contributors, and neither the publisher nor editors can accept responsibility for the accuracy of information that is supplied by others. It is impossible for the publisher and editors to ensure that the advertisements and other material herein comply with the Competition and Consumer Act 2010 (Cth). Readers should make their own inquiries in making any decisions, and, where necessary, seek professional advice.

© 2022 Executive Media Pty Ltd. All rights reserved. Reproduction in whole or part without written permission is strictly prohibited.

I am delighted to present the 2022 edition of Future Building, Infrastructure Partnerships Australia’s annual journal of insights from Partnerships, Australia’s most prestigious gathering of infrastructure leaders.

Ahead of you is a comprehensive examination of how respected industry leaders believe the infrastructure sector can refocus its proven capacity for innovation and delivery against a backdrop of continuing economic and geopolitical uncertainty, surging labour demand and supply chain pressures, and the challenge of delivering the decarbonisation of our sector.

This year’s program saw Australia’s leading political, public service, and business figures share their insights on how the infrastructure sector can meet these challenges and opportunities to deliver a record infrastructure pipeline, and provide ongoing economic and social benefits to Australians.

New South Wales Infrastructure Minister the Hon. Rob Stokes MP opened the conference with an address on the role infrastructure must play in decarbonisation. Respected leaders Jim Miller, Tony Shepherd AO and Nicole Lockwood, in their capacities as i-body chairs, shared their reflections on the impact of current macro-economic settings on project delivery, how we can make the most of Australia’s new emissions reductions targets and the potential outcomes from the independent review of Infrastructure Australia.

Federal Minister for Infrastructure, Transport, Regional Development and Local Government, the Hon. Catherine King MP, made her first significant address to the sector as the new Federal Government finalised its forward agenda. Managing Director and CEO of Macquarie Group Shemara Wikramanayake presented her thoughts on the outlook for the Australian economy, the state of the infrastructure

investment market, and how Australia is placed to achieve its decarbonisation agenda.

This year’s Partnerships conference also saw senior leaders consider crucial topics ranging from Australia’s growing superannuation investment pool and the opportunities for deployment in infrastructure, to delivery of a pipeline increasingly under pressure. Discussion also covered the role of private capital and whether Public Private Partnerships need a rebrand. Our colleagues in the property and business sector also joined us to share on the common themes and challenges across our respective sectors.

With a multitude of insights and ideas contained in these transcripts, my hope is that they contribute to the collective efforts we must make to meet common challenges and to seize shared opportunities.

Sir Rod Eddington AO Chairman Infrastructure Partnerships Australia

New processes for project delivery can quicken the decarbonisation of economies.

State governments must urgently unlock the innovation potential of infrastructure construction if Australia is to meet its carbon emission targets.

That is the view of Bede Noonan, CEO of ACCIONA Australia. The infrastructure leader has called on governments to overhaul its pricing and procurement processes for major projects, and to expand its collaboration with construction providers.

‘Australia is missing groundbreaking opportunities for carbon reduction,’ says Noonan. ‘Our country will never meet its 2050 net zero target, let alone the 2030 emissions-reduction target, if current practices in infrastructure procurement continue. Too many projects run over time and budget, and deliver suboptimal carbon outcomes. We can’t afford that with climate change.’

Noonan has considered views on this issue. ACCIONA is a global pioneer in sustainable infrastructure solutions and renewable energy projects. The

Spanish infrastructure giant has delivered projects in more than 60 countries on five continents.

In Australia, ACCIONA is building major projects. These major projects include Australia’s largest wind farm, the MacIntyre Wind Energy Precinct in South East Queensland; the Western Sydney Airport runway; tunnel projects for WestConnex and Sydney Metro West; and the Level Crossing Removal Project in Melbourne.

Noonan says that Australia is falling further behind in infrastructure delivery.

‘In Madrid, ACCIONA is working on a tunnel project that has half the cost and half the carbon emissions of a like-for-like tunnel project in Sydney. Australia’s maze of planning requirements and lack of carbon pricing are holding back innovation,’ Noonan says.

These impediments are also slowing the delivery of projects essential to decarbonise our economy.

‘We will need three times as much renewable energy for Australia to even get close to its 2030 emission targets,’ says Noonan. ‘That means incredible investment in new transmission lines that will have to run across farms, parks and other environments. That alone will take years just for approvals.’

Noonan does not want lower governance on projects. ‘We must maintain strict standards on the environment, safety and other areas. But we also need a serious discussion on what are acceptable trade-offs given the urgency of the response required for climate change mitigation. We have to ask why Australia continues to design infrastructure far more conservatively than many other nations.’

A recurring problem in infrastructure delivery is the timing of collaboration with construction providers. Typically, governments engage in costly and

time-consuming design work and planning approvals before appointing a construction firm.

‘It makes no sense that the people best placed to do things better on an infrastructure project – the construction engineers – are not in the room at the start,’ says Noonan. ‘By the time we get involved, it’s too late to make major changes.’

The result, says Noonan, is missed opportunities. ‘On one project, ACCIONA identified a way to save $700 million on a $4-billion spend. The client acknowledged we presented a superior option, but didn’t act on our advice because the project was too far down the planning and approval processes. Had we been involved earlier, we could have delivered a better outcome for taxpayers and the environment.’

ACCIONA’s work on level crossing removals in Melbourne shows the benefits of involving construction firms earlier in the project design phase. In 2018, ACCIONA’s specialist rail infrastructure business was awarded the Southern Program Alliance on the Frankston railway line. ACCIONA has now worked on six packages, having been awarded extra contracts.

‘To its credit, the Victorian Government has worked closely with contractors on the level crossing projects,’ says Noonan. ‘ACCIONA has found ways to save money and improve community outcomes. So far, the level crossings have got through the design and approval process efficiently. They should be a template for other projects.’

Lack of carbon pricing in infrastructure projects is another impediment to innovation, says Noonan. ‘Governments talk about embedded carbon in infrastructure materials and a project’s future operations. But it’s just tinkering around the edges on the “feel-good stuff”. We are yet to see a comprehensive commitment to measure carbon outcomes in infrastructure projects, and incorporate that into project selection.’

Governments continue to choose providers mostly on price, says Noonan.

‘That stifles carbon-reduction innovation because competition boils down to which firm can dig a hole slightly cheaper or faster. Firms should be incentivised to compete on carbon-reduction innovation and outcomes in infrastructure.’

Noonan says that this cannot happen without a carbon price. ‘Whether it’s a formal carbon price or some other mechanism, there must be a way to measure, value and compare carbon in Australia. We need better ways to account for carbon outcomes and enable rational decisions in infrastructure projects. We need to incentivise construction providers to continue finding ways to lower emissions on projects.’

ACCIONA has focused on sustainability innovations for 40 years. In 2016, the business became carbonneutral and continues to invest in technologies in Australia that enable year-on-year reductions in its carbon emissions.

Governments also need to ‘disrupt’ traditional processes in infrastructure procurement, says Noonan.

‘How can we condense five years of planning and approvals into one year, while maintaining an appropriate level of project governance? How can our infrastructure checks and balances become more agile and robust, so that we deliver projects faster to help meet our emission targets?’

Noonan says that Australia’s bureaucratic infrastructure processes are nobody’s fault. ‘It’s a system problem. We’ve just had layer after layer of approval processes build up over time. Today, we have to comply with 700 pages of specifications, and the community wonders why projects inevitably take longer and cost more. I question if procurement approaches are still fit-for-purpose, given the urgency to decarbonise economies.’

Noonan acknowledges the challenges of changing current infrastructure approval processes.

‘It will take courage, foresight and trust. It’s not easy for governments to change the way things are done in infrastructure. But if we don’t change, Australia won’t even get close to its emission targets.’

The key, says Noonan, is revolutionising the relationship between governments and construction firms.

‘ACCIONA is incredibly passionate about sustainability in infrastructure. We have the people, knowledge and experience to improve carbon outcomes on projects. But like other construction firms, we are constrained by endless layers of infrastructure bureaucracy. It’s time to peel back that process and unleash innovation that addresses climate change.’ ♦

To learn more about ACCIONA in Australia, visit www.acciona.com.au.

ACCIONA is incredibly passionate about sustainable infrastructure. And when we talk sustainability, we’ve got decades behind us.

We have the people, experience and Sustainability Master Plan to improve carbon outcomes on every project.

• Federal infrastructure investment should be clear in its purpose, and directed in a way that is mindful of current capacity and fiscal constraints.

• Infrastructure has a key role in achieving net zero emissions by 2050, and there is a strong interest in developing a consistent approach to accounting for carbon embedded in major infrastructure projects.

• The current skills shortage is in large part due to a lack of strategic focus on developing the domestic skills capability; the sector also needs to embrace strategies that attract and retain women in the industry.

extend my respects to First Nations people participating in today’s event.

I do want to thank Adrian and Infrastructure Partnerships Australia, not only for the invitation today, but for the level of engagement you’ve had with me over the course of the past few years. It was actually really important as we developed our understanding of where the sector was up to and where some of the opportunities were. Relationships are incredibly important, and being able to build those at an early stage and carry those into Government is very important. I also want to acknowledge Mark Birrell AM, founding Chairman of Infrastructure Partnerships Australia, who’s here with us today, and Adrian Kloeden, Kerry Schott AO, Tony Shepherd AO, Jim Miller, Mike Mrdak AO, and a number of other people who’ve been involved in this space for a very long period of time.

► Adrian Dwyer, Chief Executive Officer, Infrastructure Partnerships AustraliaThe Hon. Catherine King MP (CK): I’ll start by acknowledging the Gadigal people of the Eora Nation, the traditional custodians of the land that we’re gathering on today. I pay my respects to elders past, present and emerging, and I

Despite many of the challenges we have faced as a nation – and I don’t think you all need a reminder of those (we are still going through many of them) – infrastructure investment and development remains very strong. The delivery of infrastructure projects played an incredibly important and large role in Australia’s fiscal response to COVID-19, and to catastrophic bushfires and flooding, and it continues to do so. Our investment has rebuilt communities, created jobs and kept the economy going. Public investment and transport infrastructure alone has increased 17.5 per cent over the past two years from $20.6 billion in 2019 to $24.2 billion in 2021.

The scale of this investment has caused its own stresses for the industry. Last year, I addressed Infrastructure Partnerships Australia’s Queensland symposium as shadow minister, and then I posed a number of questions, identified a number of issues and outlined where we would go as a government. I spoke about how we had to work far more collaboratively with the states and territories, and the process to take some of the politics out of infrastructure spending. I spoke about how we had to get inland rail to a place where its benefits better accord with our entire national freight task. And I considered how we can invest to get the most out of our regions. I spoke about how we needed to invest in the projects that make our cities more productive and livable, how we plan and deliver smart infrastructure, and how we ensure our investments help tackle the challenges of climate change while contributing to growing the skills of Australian workers. It’s been a pretty busy few months.

We have been in government for just over 100 days, but we’ve done a fair bit in that time. The most topical challenge to industry at the moment is skills shortages. Our closed international borders reduced migration opportunities, and intermittent restrictions across state borders compounded resources and workforce shortages. But it isn’t COVID-19 alone that contributed to those. In our view, it has actually been a lack of strategic focus on actually developing those skills in this country that’s been a missed opportunity. These challenges are being faced across the economy, and they’ve been a key focus of the early days of our Government.

You would’ve seen what happened in Canberra at the Jobs and Skills Summit, with our Government bringing together unions, workers, business, industry, and the not-for-profit sector to chart a new path forward when it comes to jobs and skills. We do want secure, well-paid jobs across the economy. And we want to work with unions and industries to actually secure them. It’s in our interests to do so. The announcements around fee-free TAFE and the shorter-term measures of increased skilled migration are examples of this. It’s a pact between sectors. As a Government, we are keen to understand how we can work together to mitigate the key risk factors impacting market capacity, and work with states and territories to deliver our significant infrastructure co-investment. We’re engaging with industry and state, territory, and local governments in response to these challenges, including how to build and sustain a skilled and diverse workforce. I’m acutely aware of an untapped workforce that our construction and infrastructure sectors could lean on: women.

Women currently make up less than 12.7 per cent of construction occupations and less than two per cent of related trade jobs. It’s always going to be hard to overcome skills shortages with statistics like that; we’ve all been trying. We all know that there are insufficient pathways for women into the industry, and a lack of strategies to actually help attract and retain women. I know many of you are working on these with plans to address that shortfall. I’m keen to work with you to actually bring those together.

I’ve heard your voices through the Jobs and Skills roundtables, and the Summit itself, and I would encourage you to participate in the employment white paper process being run under Treasurer Jim Chalmers. One of the key outcomes of the Jobs and Skills Summit is the Government’s decision to establish a National Construction Forum. The forum is to consider key issues facing the building and construction industry, such as mental health, diversity and gender equality. The forum will assist government to develop policies and programs to address challenges, and to actually support the industry. As the minister responsible for delivering billions of dollars of Australian Government investment in infrastructure, I’ll participate in the forum, and I look forward to consulting closely with industry, unions, and state and territory counterparts through this mechanism. It will be an important initiative to help set the sector up for the future, and I look forward to participating in that.

When we’re talking about challenges facing the sector and the economy across every facet of our lives, we can’t ignore climate change. I know that has been central to many of the discussions you are having today, including the contribution particularly that infrastructure can and should make towards achieving net zero. One of the surprises to me in coming to government was to find that there was no dedicated unit within my portfolio specifically tasked to look at how the infrastructure and transport sectors could contribute to the net zero target. That’s despite those sectors being some of our largest sources of emissions, as well as some of the greatest opportunities to transition to net zero. A dedicated unit has now been established within the department, reporting directly to new Secretary Jim Betts, to look at ways to help infrastructure and transport, and innovate the ways you are working to achieve net zero.

This is one of the issues in which industry has moved far ahead of where government has been over recent years. Many of you are well down the path of determining how you can cut your emissions and are actively achieving those goals. We want to do this because not only is climate change a threat to our way of life, especially to already stretched supply chains, but because it’s a great opportunity for jobs across our sectors. By tackling climate change, we can create a new generation of clean, green, sustainable and well-paid jobs. Tackling emissions in building resilience won’t be easy, but it does need to be done.

At the heart of tackling climate change and making decisions about where the Commonwealth invests money is the way we do make decisions. It’s incredibly important, and it’s why I have asked Nicole Lockwood and Mike Mrdak AO to undertake a review of Infrastructure Australia. I’m happy to take some questions about that. Government investment needs to support the vision we have for Australia and deliver better outcomes for our people. With this in mind, I have been sitting down with my state and territory counterparts to identify those projects

that are transformational within each jurisdiction, and looking to ensure the current investment pipeline is actually sustainable and meets those goals. I want to see and ensure that we have a coherent, transparent pipeline of infrastructure investment from the Commonwealth. In New South Wales, the Commonwealth is currently investing $18.9 billion in 43 different transport infrastructure projects over the next decade. In our partnership with New South Wales and local governments, we are also funding $1.7 billion of smaller projects, from bridge renewals to Roads to Recovery, to Black Spot programs. Being very clear about what that Commonwealth investment is seeking to deliver, ensuring the pipeline is fit for that purpose, and ensuring it is sustainable in the current capacity environments is a key task for me.

To guide future investments, we’ve already commenced work to revitalise and restore Infrastructure Australia as the expert adviser to the Commonwealth on nationally significant infrastructure priorities. That is what it was set up to do, and I think many of you, as you talked to the reviewers, will have been talking about how it may have changed a little over time. Seven weeks ago, as you know, I asked Nicole and Mike to look at Infrastructure Australia, and I couldn’t think of two better people to actually do that. I thank them very much for the work and the anticipation of their recommendations to me. I know many of you have already engaged with them, and I do want to thank you for that.

It is very important to me that we do restore and change the role Infrastructure Australia has, and make sure it actually does provide the Commonwealth with the advice we need to make those investments. Ensuring a coherent, targeted, strategic and transparent pipeline of Australian Government investment in infrastructure is critical. It means focusing on building things like Metronet and Western Sydney Airport, and also sealing those important freight routes in remote and regional Australia, particularly in the Northern Territory. It means getting Inland Rail right to deliver for our regional communities, and contributing to the national freight task. It means starting work, as I did, on high-speed rail. I’m eager to get on with delivering our election commitments in partnership with the states and territories, including investing in the Suburban Rail Loop in Melbourne, upgrading key road corridors in Tasmania, and removing level crossings in Adelaide and Brisbane. I also want to thank you for the work you have done throughout COVID-19. I look forward to working with many of you individually and collectively through Infrastructure Partnerships Australia in the months and years ahead. I’m delighted to be here with you and am very happy to take any of your questions. Thanks for having me.

Adrian Dwyer (AD): Thank you very much, Minister King. You very kindly agreed to take questions. I’ll kick off by asking you to expand a bit on your reflections from the Jobs and Skills Summit.

CK: I think the fact that it happened in and of itself was actually really telling. I think there was a real sense of this actually being how you have to work as Government. This is what governing is about. It’s about understanding the different and contested positions that exist on a range of issues. Obviously the focus was jobs, but really it was about skills and the way in which we actually train more people. We have the opportunity to make sure we’ve actually got the workforce that’s needed today and into the future. That’s really what governing is about. It’s actually trying to bring people together, looking at those contested positions, and trying to come up with a pathway forward. To the Treasurer’s credit and the Prime Minister’s credit, in particular, they weren’t seeking a consensus statement out of this, because that’s not realistic. We know there are people who are never going to change views about particular things. What we’re trying to do is find a pathway that we can actually move forward together on.

So, those 36 outcomes that came out of the Summit are concrete things, such as an increase to permanent migration for next year to 195,000. We’ve been talking about the pathways to permanent residency to actually get more people living in this country, extracting commitments around fee-free TAFE, training more Australian workers here and setting that up for the next decade, and some of the industrial relations issues, which are still going to be contested as we work our way through. I think that this is what Government should look like. Even if things are hard, we should talk about that. They’re hard, but we should try to make a pathway forward. I don’t really want to be overly political at this forum, but that’s something that’s been missing from our Federal discourse for a while now. To me, that was the real outstanding part of the Jobs and Skills Summit – actually seeing what government should look like.

AD: Thank you. There has been a lot of talk about the review of Infrastructure Australia. That’s ongoing, but what do you want from that review? What do you want it to give you?

CK: I don’t want to be predictive with both Nicole and Mike in the room, but I’ve had early conversations with them. For me as an incoming federal infrastructure minister, there are big questions. I look at the billions of dollars of investment we are making. As I said, I didn’t know we were spending $18.9 billion in New South Wales on 43 different projects. There’s a couple of websites you can look at, but how is that pipeline worked out? How is it contributing to our national freight task? How is it making our roads safer? How is it actually providing regional communities opportunities for better connectivity? I don’t get a sense about what that strategic direction is when I look at that investment. When I have questions about the problems of resilience on our freight network, how do I actually help communities in transition as an infrastructure minister? I’ve got a narrow scope. There’s energy, energy and water infrastructure, and other pieces. What are the investments I

should be making? I don’t get that information from the reports of Infrastructure Australia today.

A couple of things have happened. The first is that when it was set up, the state bodies weren’t in existence. So, it had to cover some of the state jurisdictions, as well. I’ve got a view, it’s the Commonwealth’s body, it’s the Commonwealth’s infrastructure that’s really got to advise me, in partnership with the states and territories. It really is about that Commonwealth investment. There might be opportunities for other sectors, but it’s really about where those big billions of dollars from the Commonwealth go. The other is attempting to find some relevance. It broadened itself out to the extent that there’s not a local council in the country that does not come to me saying that their project is on the Infrastructure Australia priority list and is therefore going to get money. So, there’s been this massive expectation created that because it’s on the priority list – which is almost 170 projects long – Infrastructure Australia is able to, A, be a funds holder and Infrastructure Australia is going to fund it, and, B, if they don’t, then the Commonwealth’s just going to give them money. That’s a terrible thing for local councils to be thinking because it’s beyond the means of most levels of government – local, federal or state – to fund all of those 170 projects. Are they the projects we should be concentrating on? I really want to see it lifted up to those of larger scale. Two or three big-scale strategic investments that are transformational need to be made in each state and territory so that governments can invest in them.

There has to be a separate pathway, and probably not through Infrastructure Australia, whether it’s our Regional Development Australia networks or something like that, for those local government, social and regional projects. I think there needs to be a different pathway for those. Then, in terms of other infrastructure, whether it’s water or telecommunications, it’s about finding another pathway through Infrastructure Australia for those. That’s sort of how I see it, but I shall await advice and not pre-empt and see if it occurs. You may be telling me something different. The reason I’ve asked for it is, as infrastructure minister, I need advice. I get it from my department. I get it from other bodies, but I really need Infrastructure Australia to be able to say for the next budget, for the next decade, this is where you need to be investing Commonwealth money in nation-building projects.

AD: But we’d all agree, it’s a hell of a swimming pool in Geelong. Jim Miller?

Jim Miller (JM): Jim Miller from Infrastructure Victoria. Well done; you’ve hit the ground running and it’s great to hear. So fantastic. Following up on Infrastructure Australia and, more broadly, the Federal Government, you mentioned the investment the Federal Government is already making and that’s very significant; but the needs – be it with the Infrastructure Australia

priority list or just more generally – keep growing because of all the things that we know. Where it’s a little bit different now is the fiscal constraints the Treasurer is talking about, and so forth. So, you are going to be right in the middle of those discussions as the first budget comes through, and with subsequent budgets. Obviously it’s early days and there is a lot to do, but I am just interested in how you’re thinking about that over and above the work that Infrastructure Australia will hopefully be doing.

CK: Well, there are a few things happening at the moment. One is about assessing the quality of the spend and making sure that what we’re actually spending money on is actually delivering on the Government’s outcomes. So, running an eye over that is important. The capacity constraints that are in the sector at the moment are real. I think the absolute reality is that the timelines and budgets on all of the projects are going to blow out and we’re already seeing states trying to get on top of that. You’ve seen it in Western Australia and New South Wales; they have been trying to smooth that pipeline of investment out so that we can actually deliver it. The Commonwealth is not digging up the soil; we’re relying on states, territories and local government to do that. If we don’t do something about the underspends that occur each and every year, that will just continue. I don’t want to see that. That’s wasted money. It’s money that should be going out. It should be being delivered, and if it can’t be delivered, then we need to make sure it’s delivered in a way that is coherent. We’re not looking to cut. The previous Government made a whole range of commitments, so we are looking to try to deliver on those and obviously we’ll look at the time frames for those. What I’ve got to do is look at future investment, and then look a bit further at the Commonwealth’s strategic investment in infrastructure, as opposed to down in some of the weeds in terms of the elections and electoral cycles. That’s part of my job, but it is certainly a challenge.

Treasurer Chalmers talks about the trillion dollars of debt. When you look at what the Commonwealth has to spend money on, it’s demand-driven debt like Medicare and the NDIS, age pensions, our social security budget, and overall defence spending. The thing that is growing the quickest is government payment on debt. That’s the largest government expenditure – or the quickest-growing government expenditure – at the

moment. It’s costing all of you, as taxpayers, as much as it costs to fund the age pension at the moment, so we’ve got to get that debt down. Looking at the realistic delivery and capacity constraints is one of the ways we’re intending to do that.

AD: One final question: there’s a lot of talk today about net zero. You spoke in Parliament about the carbon base case idea, what do you think the Commonwealth’s role is in driving the outcome?

CK: So, at the last infrastructure and transport ministers’ meeting, there was an absolute desire, particularly from infrastructure ministers. We tend to focus a lot on the transport side as it’s a very complex regulatory environment, particularly around heavy vehicles. So, we are trying to think about how we can lift the infrastructure side back onto the agenda and we’ll be discussing that at the end of this month. There was a commitment to start talking about how you count embedded carbon in infrastructure projects and how we get some more consistency across the country on that. There’s been a lot of work done already, so that’s really important.

I think, looking at the role of infrastructure in net zero, I was really delighted to look under one of the city deals. Launceston has moved the University of Tasmania and combined all its sites in Launceston, and has really built some extraordinary buildings with very low-carbon footprints. That’s allowed them to actually fund their entire move of the Hobart Campus into Hobart on green bonds. They’ve raised $300 million in literally two days and will use that to fund infrastructure by building these really incredible buildings. I’m very interested in how we do that. I’m interested in how that might work in relation to high-speed rail and high-speed rail financing, as well. So, I think there’s lots to do, and I’m really delighted that infrastructure ministers across the country all want to focus on this issue, and they’re all talking about it.

AD: Brilliant. A great note to finish on. Please join me in thanking the minister. Thank you very much.

The

King held a similar portfolio in the previous term of opposition, while also serving for six years as Labor’s Shadow Minister for Health and Medicare.

King previously served as Minister for Regional Australia, Local Government and Territories; Minister for Regional Services, Local Communities and Territories; Minister for Road Safety; and before that as Parliamentary Secretary for Transport and Parliamentary Secretary for Health.

King holds bachelor degrees in social work and law, and a Master in Public Policy. Prior to entering Parliament, King was a senior manager at KPMG’s consulting practice.

• Australia continues to be an attractive investment destination, and infrastructure as an asset class is proving to be resilient in the context of inflation and monetary tightening.

• Australia is adding four to five times the solar and wind generation of the European Union, the United States, Japan or China, with that pace expected to accelerate further as investors focus even more on these projects.

• Australia continues to lead the way on recycling both existing assets and structures for drawing private capital into new assets.

Adrian Dwyer (AD): When we did this a year ago, we were discussing the prospects for national recovery off the back of COVID-19. We face a much more mixed set of challenges now. Small question: how did we get here?

Shemara Wikramanayake (SW): Yes, it’s amazing that last time we spoke, that was the world. I guess then we were facing something none of us had ever dealt with, where basically we had to shut down economies to protect people’s health. I think central banks and governments did the right thing in providing fiscal and monetary stimulus to help us get through it. But what surprised us all, happily, is how quickly the health profession was able to come up with vaccines to get us now to physically being together again so quickly. We had demand already increasing on the way into the lockdown, and now we’ve opened up with fuel to the flames in terms of the huge stimulus that has driven a massive increase in demand. Then, a range of supply shocks came through. I

know people have been saying central banks should have moved sooner, but I do think the supply issues were hard to anticipate in terms of China and the lockdowns there, which are hurting supply chains. The Russian invasion of Ukraine has really impacted the energy system, and, domestically, the tight labour market; it’s tight everywhere in the world, but the border closing means that we now have a much tighter supply of labour, as well.

All of these things have led us back to – and we haven’t had this for four decades – the days of double-digit inflation and interest rates. Central banks are now having to put the foot on the accelerator hard to rein in inflation and prevent a period of stagflation. So, yes, it’s amazing to think none of us would have thought even a year ago, let alone two years ago, that this would be the new environment now.

AD: I guess the obvious questions are: Can we break the back of inflation without breaking the economy? And in that

scenario, how well do you think Australia is placed to navigate those choppy waters?

SW: It takes a brave person to say they know the answer, especially given the huge amount of uncertainty we have just been through already. I think it’s looking like certainly that the US economy is proving to be incredibly strong, but the central banks all around the world are really showing conviction in terms of trying to rein in inflation and prevent stagflation. Everywhere in the world (here included), we had the 50-basis-point step

“

...central banks all around the world are really showing conviction in terms of trying to rein in inflation and prevent stagflation

up. The view is to go hard to rein this in, even though that may mean a mild recession. Chances are that in the United States, the economy just seems so strong that if they have a recession, they should be able to land it reasonably softly with a mild recession. Europe is a different kettle of fish altogether. The energy impacts there are huge.

The United States is self-sufficient in energy, and Europe hasn’t got there, so it will potentially face a bleaker recession. Here in Australia, we’re ever the lucky country coming into this, with a pretty good economic backdrop. Our household debt balance sheet – net debt – is actually in a pretty good place as we come into this. Also, our terms of trade, two of our three largest exports are liquefied natural gas (LNG) and coal, which at the moment are going very well. The Reserve Bank has said that it thinks the impacts from rate increases could be lagging, so it might monitor for a bit. But if they do go hard, I think we probably are one of the best-positioned countries to manage a really soft landing, potentially even avoiding a recession. The landing strip is pretty narrow to achieve that. I think we’re relatively well-placed, but it would be a brave person to call that.

AD: When you talk to your clients, what is this doing to their appetite to invest more broadly, but also specifically in infrastructure?

SW: With interest rates going up, obviously discount rates are going up and for four decades we have not had to deal with this environment. That is making asset prices not just come down, but be more volatile and clients are obviously suffering in their fixed-income and equities portfolios. Having said that, there’s a lot of money still being allocated to infrastructure funds. We are out there raising and are hitting our hard caps on all of the funds we are raising. Even our peers are sitting with a lot of dry powder.

We have released papers showing that infrastructure is a pretty good asset class in this rising inflation and rising rate environment, particularly if it’s nominal rates, because it is an essential service asset class. There is a degree of protection in the revenue line, be it a utility or toll roads, as you can pass on a lot of these. Historically, it is a much more resilient asset class than other classes and we have done a lot of research on this for our investors that we’d be happy to share. So, we are still seeing appetite to invest. If anything, the challenge is finding good, investible projects. I certainly suspect others in the room are finding the same, that this is an asset class that will continue to attract investment through this cycle.

AD: We recently released some analysis on private capital opportunities in the Australian and New Zealand infrastructure pipeline. The analysis estimates that the total value of private capital opportunities of Government projects is at about $71 billion; $62 billion worth of projects and contracts

are strong candidates for private capital across that and the broader pipeline. What is the house view on where the best opportunities lie for private capital?

SW: Well, thematically, there are four areas we have been talking about. First, urbanisation continues around the world in developed and developing countries, so there is a need for investment in things like transportation, infrastructure, and utilities (water, gas and electricity). Another big area is social infrastructure where there’s a need for private capital to help in investment. The Federal Government allocated A$537 billion to healthcare in the 2022–23 budget over the next four years. Hospital Public Private Partnerships represent an opportunity, with a strong pipeline of potential projects nationally, including in Victoria and Queensland. So, basic urbanisation infrastructure is one area of investment.

Then, something we have been investing a lot in is digital infrastructure. That investment has been particularly accelerated by the pandemic; everything is getting disrupted by technology. People are doing a lot more online now, not just working remotely, but studying remotely and shopping from home. So, there is a lot more investment in things like hyperscale data centres, logistics, warehousing infrastructure, fibre optic networks, towers and telecommunications.

So, urbanisation and digitisation, but also obviously climate change and the energy transition are big areas where we’re seeing a lot of capital flow in terms of infrastructure investment. Apparently, we have four or five times the penetration per capita of wind and solar here already in Australia. We don’t think we are that big, but for the size of our population compared to the United States, Europe, China and Japan, we are. Having said that, the Australian Energy Market Operator has said that if we’re going to meet the growing electricity demand here and the mix that we want, then we’re going to need a massive nine times step-up in wind and solar. So, it’s about $320 billion of investment up to the 2050 plans.

The last area that is coming up is that the geopolitical backdrop is also now becoming very different. I mean, not since the fall of the Berlin Wall in 1989, or even prior to that, have we had geopolitical factors driving the whole world. We are potentially heading back to that world. For spending in defence, the new Government has said it’ll maintain at two per cent. So, there is about $565 billion there under the national guidelines that we need in defence spending. Investment in cyber is growing at an eight per cent compound annual growth rate. Also, with the demand for critical minerals, there will be a whole lot of supply chain change and investment there for geopolitical reasons, and those are obviously things like lithium, cobalt, nickel and graphite that are used in everything (batteries, solar panels and wind turbines). That’s just four big sectors off the top of my head. Frankly, when there’s change going on in the

community, infrastructure investment is needed to support that change across a range of sectors. So, there’s no end of places where we can all be responding to support that.

AD: It’s interesting, that sovereign resilience piece. That is conspicuous because we’ve not spoken about that at any point over the last few years, so it is a pretty marked change in the last 12 years or so.

SW: It will impact a lot of what’s going on, and alliances will develop.

AD: On the government side of the pipeline, how do we ensure governments are routinely exploring and considering the opportunities of using private capital to deliver against that pipeline?

SW: This backdrop is going to drive them to do that more. I was reading about the all the measures that are going to be taken in the United Kingdom and Europe in terms of energy. They are going to have to look at subsidising retail, and maybe some of the industrial and commercial as well, in energy demand. So, fiscal debt is going to go up a lot. It was already up at crazy levels in many of the big countries around the world, but they’re going to have to rely on private capital more and more to deliver on some of these community needs for infrastructure investment. Here in Australia, we’ve had a good track record of doing that. I think the New South Wales State Infrastructure Strategy does look to basically partner with private capital already in areas like social housing, trains and electricity. At a national level, the guidelines are for any project over $100 million to consider Public Private Partnership options. In Victoria, the VicRoads Modernisation joint venture, which Macquarie is part of, is a 40-year partnership providing A$7.9 billion in upfront proceeds for the state to invest in the new Victorian Future Fund and strengthen its budget position. I think, certainly here in Australia at the federal and state levels, they’re continuing to draw private capital. Globally, we’re a big investor in the United Kingdom, and they are going to need private capital with the new Prime Minister’s approach of cutting taxes, helping the community with funding a whole lot of things – the money is going to have to come from somewhere and I think private capital has a bigger role to play.

AD: What’s your sense? Is Australia still leading the way in this space or have we got some catching up to do?

SW: Yes, and maybe we have a biased view, but we all here pioneered infrastructure as an asset class during the early 1990s recession, and the privatisations that happened, have taken it now to be a global asset class. People here get it. The big pension funds have huge allocations like the Canadians. In the United States, investors are still allocated only one or two per cent to infrastructure. When I was working there between 2004 and 2008, we used to jokingly call the United States the ‘emerging market for infrastructure’, because they still hadn’t got into either allocating or bringing private capital into investment. Frankly, it still is an emerging market for infrastructure, relative to what’s happening here. All of the asset recycling that was done here is a very smart way to sell mature assets and draw new capital into development that the Government can then take the risk on, and catalyse further investment. All of that should happen in the United States, but still isn’t, and so I certainly feel Australia continues to lead the way on recycling both existing assets and structures for drawing private capital into new assets.

AD: We’ve seen the keys handed over, and a new Federal Government sworn in and setting the pace now. What change do you see from an infrastructure perspective?

SW: Well, Prime Minister Anthony Albanese actually was the minister when Infrastructure Australia was set up, so I think we have a prime minister that really gets the value of working with the private sector on infrastructure. We’re now focusing on a whole lot of small projects happening, and I get the impression there is a focus on trying to prioritise where that focus on new projects is. I know Mike Mrdak and Nicole Lockwood were working on this prioritisation. I think that will be a very valuable thing and getting the commitment is important, and then actually getting the projects prioritised, and putting structures around and getting them done. So, so far, we are seeing good things out of the new government.

AD: One of the big things that happened very recently is the passing of the legislation on 43 per cent emissions reduction by 2030, and net zero by 2050. What practical difference does that make from where you see it?

SW: First of all, it’s fantastic to have a roadmap. It is really important for us when we invest, because we’re trying to deliver for our investors. Michael Carapiet used to call it everything from the deadly boring, right through to the barely interesting in terms of what we offer in infrastructure. But it’s got to be defensive capital, protected income-yielding assets with a degree of certainty around them – which is why people invest with lower required returns. So, having the Government set pathways is really important and the targets that they’ve set by sub-sectors is also good. Ultimately, you then have

to

“

All of the asset recycling that was done here is a very smart way to sell mature assets and draw new capital into development…

get to specific projects and start looking at what can be done, and how you de-risk them and the structures. That’s where we need to break this down and get things done. Now, all the states are doing things. The infrastructure electricity investment plans here in New South Wales, where they’re trying to do 12 gigawatts of renewables, have identified the renewable energy zones that are very important. Queensland is coming out with its plans. The states have taken quite a lead on this historically, but I think now bringing that down to projects is going to be an important next step.

AD: One of the themes in our discussions over the years has been Macquarie’s efforts around fossil-fuel-intensive assets and what you’ve done to reduce exposure in those, and then the transition pathways. My sense is there has been a real maturation of that argument over the past few years. How’s that trending in your own portfolios and investments, and client appetite around renewables versus other assets?

SW: One of the good things the Federal Government has done by setting the 43 per cent target is they have said that we will need gas as a transition fuel. We have been saying for ages that in energy – and in transport, agriculture and industry – we’ve got to have this orderly transition, because until we have solutions of scale, we can’t transition off what we’re doing at the moment. Some of that is exacerbated now because in energy, you’ve got to thread the needle between a trilemma of availability, cost and climate impacts. When people haven’t got access to energy, or their cost of living is becoming untenable, you can sometimes lose the mandate for that transition, so we do need to think this through.

We have said that for our own balance sheet we will get out of coal in the next couple of years. Oil and gas are a teensy portion of our balance sheet. We have about a $200-billion balance sheet, and only a couple of hundred million in these areas, but we have been very much advocating that we will need these transitioned fuels. With super profits being earned in coal, we should try to encourage that to get invested in new solutions. I would’ve thought it’s in the interest of the coal companies, as well, to be in transportation rather than railroads, and to be in energy and think about where the new sources of energy are.

So, at Macquarie we do a lot of support. All the producers in Europe are going to need huge support in meeting the gap in demand and, now, sourcing supply. So, we do a lot for them, such as risk management, hedging, financing, transportation, and storage, and we will step up to continue to do that. At the same time, we really need a massive step up in investment in solutions and that’s where we’re doing a lot of work. Along with our partners, we have invested $75 billion since 2005 and over $30 billion just in the past five years. So, I think we have 30 gigawatts under construction and in development of renewable projects, and over 15 gigawatts operating. We are passionate about energy, but also transport; we’re doing a lot of things on electric vehicles and sustainable aviation fuels. In agriculture, it’s precision technology or low-methane-emission feedstock, and in industry it’s green steel. But at the same time, we’re very mindful when you ask about gas that it’s got to be a transition fuel for Australia; we need energy independence.

AD: There’s a lot of discussion among ministers around embedded carbon, and not just the transition of the energy sector, but the carbon that’s embedded in the things that we build. What can you and the other investors in this room do to push that argument and reduce the amount of carbon that’s in the projects we build?

SW: Yes, it’s an important area to focus on. I think 39 per cent of our emissions are from industry in that way and 28 per cent of that is from embedded carbon. So, we do need to be thinking about a whole lot of things in terms of procurement standards to try to address that, and we’re doing projects with partners like BP on this. We’re building our new premises at 1 Elizabeth Street that has the highest 6 Star Green Star rating, and we are really focusing on the embedded carbon in that building. It’s costing us a bit more to deliver that, but we’re getting higher rents for it. I think people in the property sector here doing office buildings will tell you that all the tenant demand is for these sorts of buildings as we come out of COVID-19. Demand has now reduced a bit compared to supply – that’s where the focus is. So, a lot of these things that are good for the community are also smart business.

AD: Over the years, we’ve attempted to end these interviews on a nice, positive note, but we’ve also discussed a lot of challenges today. So, if you cast your mind forward, what are you most optimistic about for Australia and the infrastructure sector?

SW: Look, we’ve covered some of the points that are really good in terms of where we’re positioned. We’re a country that understands that infrastructure can drive better growth for the economy if we’re investing well and ahead of time in transportation, infrastructure, utilities and communications. We also really understand working with the private sector. So, for all of us in the private sector who engage with government,

“

We’re a country that understands that infrastructure can drive better growth for the economy if we’re investing well...

it’s a well-trodden path at federal and state level. We are a bit of a lucky country in that our debt to GDP is only between 30 and 40 per cent, relative to some of our global peers. We are really well positioned, and for infrastructure to play a role in the industries of the future that Australia is going to need to think about.

Having been an iron-ore-, LNG- and coal-dependent economy, we’re actually going to have to now think about how we transition to the industries of the future. New infrastructure is going to be required; just like when the Pilbara was built, there was infrastructure required there. The new industries, if they’re in critical minerals, will require investment, infrastructure, transportation and grid investment as we move to renewable energy. The offshore wind projects that we are involved in now in Victoria will require a lot of infrastructure. I generally feel quite optimistic; I’m an optimist anyway, generally, but I feel quite positive about it.

AD: I don’t want to bring the tone down, but you’re sending my Deputy Chair, John Pickhaver, to the emerging market of New York for a few years. What’s the market opportunity there?

SW: Well, John is going to head up our infrastructure and energy investment business there, so he’ll be much more on the investing side and that is a huge opportunity for us. I talked about the United States being the emerging market in infrastructure. There’s huge opportunity for private capital to come in. In anticipation of his arrival, I think Biden has put in place a few changes like the Infrastructure Investment and Jobs Act 2021, and the Inflation Reduction Act 2022, all

geared to basically get more money to support investment in asset classes that John will be looking to invest in. He will be bringing the great Public Private Partnership technology that has been developed here in Australia, and they need it. You really have to go to every state, as John knows, to drive this for us all.

So, I’m sorry that it’s not win-win; it’s a lose-win for us. John is a great culture carrier and he’s wonderful at developing people, so there’s going to be a lot of team development over there, as well. On the win side for us, we have Tom Butcher and David Porter taking over on the infrastructure side. So, you’ve got really capable people that have been taking over from John here. We have also got Jo Spillane and Jeanette Royce on investor engagement, and Ivan Varughese, who’s now based in Singapore doing our Asia-Pacific investing. So, we will be looking after you.

AD: Well, thank you, Shemara. That brings our conversation to a close. Thank you for joining us today.

SW: Thank you, Adrian. Thanks, everyone.

Shemara Wikramanayake has been Macquarie Group’s Managing Director and CEO since late 2018. Wikramanayake joined Macquarie in 1987 at Macquarie Capital in Sydney. In her time at Macquarie, she has worked in six countries and across several business lines, establishing and leading Macquarie’s corporate advisory offices in New Zealand, Hong Kong and Malaysia, and the infrastructure funds management business in the United States and Canada. Wikramanayake has also served as Chair of the Macquarie Group Foundation.

As Head of Macquarie Asset Management for 10 years before her appointment as CEO, Wikramanayake led a team of 1600 staff in 24 markets. Macquarie Asset Management grew to become a world-leading manager of infrastructure and real assets, and a top 50 global public securities manager. In 2018, Wikramanayake was appointed a Commissioner of the Global Commission on Adaptation, a World Bank–led initiative to accelerate climate adaptation action and create concrete solutions that enhance resilience. In 2019, Wikramanayake was appointed by the UN’s Special Envoy for Climate Action, Michael Bloomberg, to the Climate Finance Leadership Initiative, which seeks a sixfold increase in climate mitigation investment from the private sector.

“ The offshore wind projects that we are involved in now in Victoria will require a lot of infrastructure. I generally feel quite optimisticShemara Wikramanayake, Managing Director and Chief Executive Officer, Macquarie Group

The project, just north of Adelaide’s CBD, has seen the level crossing replaced with an overpass.

Traffic was switched onto the overpass for the first time in June 2022, allowing motorists to drive up and over the train lines, as part of the $196-million project, jointly funded by the South Australian and Australian governments.

The project has resulted in a road bridge over the Adelaide Metro Gawler line and Australian Rail Track Corporation Freight line, with improvements also being made to the

Churchill

Jon Whelan, Chief Executive of the South Australian Department for Infrastructure and Transport, explains the difference that the overpass makes.

‘The overpass has removed the need for traffic to stop to allow for passing trains, reducing travel times and congestion for motorists,’ he says.

‘It has also improved public transport usage to north-west Adelaide, as buses will no longer need to stop at the boom gates. This has cut travel

times and increased both reliability and safety.’

Removal of the level crossing has also increased freight productivity and boosted safety for all road users –motorists, cyclists and pedestrians alike – by removing a road/rail crossing point.

The crossing sees an average of 21,300 vehicles pass through each day. Prior to the removal, the boom gates were down for approximately 22 per cent of the time during the combined morning and afternoon peak periods, significantly impacting passing traffic. This delay is now a thing of the past.

The South Australian Department for Infrastructure and Transport is delivering the project as part of the Public Transport Projects (PTP) Alliance with McConnell Dowell Constructors, Mott MacDonald Australia and Arup, meaning a collaborative approach has been taken to complete the works.

The consortium has previously completed major infrastructure works in South Australia as part of the PTP Alliance, including the Oaklands Crossing Grade Separation Project, and the Regency Road to Pym Street Project as part of the North–South Corridor.

Road users and the community have been watching the progression of the bridge construction during the build, as 16 South Australianbuilt, 100-tonne girders were craned into place.

The girders – the first of which was lowered into place in November 2021 – were constructed by South Australian company Bowhill Engineering. Bowhill also constructed the girders for the Regency Road overpass for the North–South Corridor.

Bowhill Managing Director Jeremy Hawkes says that moving the 100-tonne, 50-metre-long girders was a major exercise in logistics.

‘We have developed good systems on our manufacturing site, and great

relationships with heavy transport companies that can safely move these large elements along the public roads – from Bowhill, over the Murray River at Blanchetown, and into Adelaide from the north,’ Hawkes says.

These projects have allowed the company to hire 10 new apprentices, and to invest in upgrades at its plant in the Murray Mallee.

The upgrade at Ovingham also involves the elevation of the western end of Churchill Road, which intersects with Torrens Road, approximately 100 metres from the Ovingham level crossing heading towards the city, so that it meets the elevated height of Torrens Road.

As part of the project, the PTP Alliance has delivered an upgrade to the Ovingham Railway Station.

The upgrade has improved the user experience and station access.

It includes:

► new shelters, seating and bins

► improved fencing, platforms and access paths

► improved communication equipment and lighting

► new CCTV

► landscaping and new on-street car parks nearby.

The Ovingham Railway Station reopened to passengers in November 2022. The station is

on the Gawler line, which services Adelaide’s northern suburbs.

With construction on the overpass complete, the area beneath the bridge is being developed into open space for community use, with the following features:

► a futsal court and a half basketball court

► Kaurna cultural heritage artwork

► a nature play area

► public artwork

► landscaping and revegetation

► pedestrian and cycle paths.

As part of this project, new landscaped areas are also being created. The garden bed landscape surrounding the area will comprise more than 21,000 individual plants.

The PTP Alliance has also engaged artists to paint murals on the bridge abutment walls and piers.

Among them is Mike Makatron and Harley Hall, who are painting the Kakirra ‘moon’ mural on one of the bridge abutment wallS. At the other end, Elizabeth Close, Shane Cook and Thomas Readett have painted the Tindo ‘sun’ mural.

Makatron is a full-time muralist with more than 20 years of experience, and will be collaborating in a mentorship with Hall, a Kaurna, Ngarrindjeri and Kokatha man who is an artist and social worker that is new to creating largescale public artworks.

Close is a Pitjantjatjara and Yankunytjatjara woman who is a contemporary Aboriginal visual artist based in Adelaide.

Cook is a Guwa (Koa) and Wulli Wulli man who grew up in Adelaide, and is internationally and nationally recognised as a prominent First Nations aerosol artist, as well as a youth and cultural mentor. Readett is a Ngarrindjeri and Arrernte artist based in Adelaide, who previously worked as the Tarnanthi education officer at the Art Gallery of South Australia prior to being a full-time artist.

According to Makatron, his and Hall’s striking mural showcases ‘the moon phases, but they’re looking down on top of the red landscape. The

totem animal for Kaurna is Tundra, the red kangaroo’.

He says that the process has seen him learn as much from Hall, as Hall has learnt from him.

‘You start with sketch lines, and then just a constant back and forth of making a mess, polishing it, making more mess, polishing it – and just constant push and pull with that,’ Makatron says.

Community engagement has been a core priority for the project team. Throughout the construction phase, students from local schools have been invited to become involved.

In March 2022, the project team and environmental consultants fauNature ran a bird box building workshop with students from Brompton Primary School. Ten boxes were built, and later painted,

before being installed in trees around the overpass.

According to one of the children involved, ‘There’s going to be 200 trees planted, so hopefully a lot of birds will make the bird boxes their new home. We’re really looking forward to seeing all the wildlife move into the bird boxes when we’re on our way to school in the morning.’

Other school programs included a First Nations Cultural Artefacts workshop in conjunction with the Kaurna Education Program, and a Butterfly Garden session.

Students from Bowden Brompton Community School also contributed artworks by painting on recycled corflutes to decorate the fence around the site office.

The project has been supporting 265 full-time jobs per year during construction. One of the challenges the project faced was dealing with the ongoing COVID-19 pandemic. Despite the global situation, hard work meant the majority of South Australian infrastructure projects, including the Ovingham Level Crossing Removal Project, were able to deliver key milestones on or ahead of schedule. ♦

For ANZ’s Darren Bradfield, the Brisbane 2032 Climate Positive Games will do more than deliver a carbonneutral event and energy-efficient infrastructure. It also has the potential to drive cross-sector collaboration and quicken the state’s decarbonisation.

Bradfield believes the Brisbane Olympic and Paralympic Games in 2032 will encourage innovation and investment in renewables that will benefit Queensland for generations, and position the state as a leader.

‘Brisbane 2032 is a catalyst for change,’ says Bradfield. ‘It’s an opportunity for people to work together and plan Queensland’s longterm decarbonisation. New thinking in renewables can create jobs and

businesses across the state. The conversations are already happening. You can feel the momentum starting to build.’

Bradfield is well-placed to comment on sustainable finance in Queensland. As ANZ Queensland’s Head of Corporate Finance and Joint Head of Institutional Banking, he works with organisations across sectors. He is an architect of ANZ’s strategic plan in Queensland, and has been an Executive Director at the bank for 16 years.

He says that Brisbane 2032 is strongly aligned with Queensland’s new plan on energy and jobs. ‘When investing in new or retrofitted assets in the lead-up to Brisbane 2032, we need

to ask if those assets help Queensland deliver on its clean energy plan, and how those assets align with the state’s broader decarbonisation vision.’

Having secured hosting rights last year, Brisbane 2032 is developing strategies to achieve a Climate Positive Games in partnership with the International Olympic Committee.

Brisbane 2032 has ambitious goals, including a carbon-neutral event, additional climate benefits for host communities, and leaving a long-term legacy that aligns with, and accelerates, Queensland’s emission reductions and renewable targets.

In October 2022, the Queensland Government released its Energy and Jobs Plan, which outlines a pathway

to a clean, reliable and affordable energy system by 2035 – and envisions providing power for generations and creating well-paid jobs.

Queensland has a target of 70 per cent renewable energy by 2032, and 80 per cent by 2035. The government says that private sector investment in new renewable energy generation, batteries and storage will be integral to the plan’s success.

‘A large amount of capital will be needed to fund this transformation,’ says Bradfield. ‘But it’s not just about finance. Banks such as ANZ can use their expertise in renewables to help organisations and encourage new conversations about what is required. Queensland has much work ahead, but there is so much potential in this state.’

Climate innovation legacy Bradfield says that Brisbane 2032 will require broader thinking across sectors, particularly in areas such as public transport. ‘For example, local councils might look at electrifying bus fleets. The next question could be: are the bus depots still in the right place as we move towards decarbonisation? How do we power those depots?’

Stadium retrofitting for Brisbane 2032 could be another opportunity, says Bradfield. ‘When The Gabba stadium is redeveloped to be the centrepiece of the Games, should a giant battery be installed to store solar energy? And how can clean energy infrastructure at The Gabba be designed to be easily upgraded as new technology is developed?’

Social housing should be another priority, says Bradfield. ‘When building Olympic Villages, we must consider their long-term sustainability and how they contribute to affordable housing in South East Queensland,’ Bradfield says. ‘Everything from housing materials to housing design must be aligned with the state’s decarbonisation goals.’

Bradfield believes the benefits from Brisbane 2032 will extend far beyond the city. ‘By using stadiums across South East Queensland, the Games will benefit the Sunshine

Coast, the Gold Coast and other areas. Brisbane 2032 is an opportunity to create new connections and collaborations on renewables across South East Queensland.’

Regional Queensland also has a vital role, says Bradfield. ‘A big part of the government’s energy strategy is about converting coal-fired power stations to clean energy hubs. Much of that work will be in regional towns in Central and North Queensland. As part of planning for Brisbane 2032, we should think about collaborations between urban and regional cities on renewables.’

ANZ at the forefront of sustainable finance in Queensland Bradfield has watched ANZ’s focus on sustainable finance – and its expertise in renewables – grow significantly over the past two decades.

ANZ is targeting $50 billion of lending to renewable projects by 2025. It has already hit $31 billion. ‘Our customers have a growing demand for sustainable finance, and ANZ is well-placed to supply that capital. We can also use our expertise to help existing and new customers transition towards decarbonisation.’

ANZ’s work in corporate finance and institutional banking in Queensland continues to expand. As an example, this year the bank provided structured asset finance for the Kilcoy Global Foods Australia, a premium beef

processor and longstanding ANZ customer. The finance had facilities to support sustainability initiatives.

ANZ also provided capital for a regional bus operator to electrify part of its fleet and upgrade charging at its depot. In Queensland agriculture, ANZ supported a customer in replacing diesel generators on water bores with solar batteries.

In commercial lending, ANZ has a $200-million facility to support small and medium-sized businesses in buying assets in the clean energy transition. This is a joint national initiative with the Clean Energy Finance Corporation.

ANZ is also involved in two new large sustainability-linked loans for key Queensland infrastructure assets. ‘ANZ continues to fund more renewable projects and help more organisations across the state,’ says Bradfield. ‘That’s a result of ANZ’s long-term commitment to sustainability and its initiatives in Queensland.’

Bradfield is excited about Brisbane 2032’s potential to help Queensland communities, and ANZ’s ability to contribute. ‘ANZ has the people, expertise, relationships and capital to make a difference. Brisbane 2032 will be something very special, and a new benchmark for Olympic and Paralympics Games.’ ♦

To learn more about ANZ, visit www.anz.com/institutional.

futurebuilding

• While significant progress has already been made to reduce operational emissions, the sector’s ability to achieve further reductions will depend on success in lowering emissions in other areas that have proven harder to address.

• A greater focus on the early options analysis of projects will help develop more sustainable solutions at lower cost to taxpayers.

• Through the construction standards and certification requirements imposed on projects, governments play a key role in planning and procuring infrastructure more thoughtfully.

I want to acknowledge the traditional custodians of the land on which we meet and discuss today, the Gadigal clan, and thank elders past and present for their leadership, and their custodianship of Country. I also want to extend those respects to Aboriginal people in the room with us. It is so appropriate that we begin forums like this as a public representative to acknowledge Aboriginal people, because so often through our history they have been acknowledged last, if at all. That’s why it is so appropriate that someone like myself, in the office I hold, acknowledges their custodianship first.

Ladies and gentlemen, my speech this morning will focus on the national and state objective – a shared objective toward net zero. The New South Wales Government is enormously proud of, and focused on, delivering $112.7 billion of public infrastructure investment over the next four years. The scale of this investment is well known to everyone here. It is accountable for keeping more than 140,000 people in jobs in New South Wales and providing untold benefits to citizens wherever they live, across the length and breadth of this great state – and not just now, but citizens who don’t even exist yet. With that in mind – that temporal aspect of infrastructure provision and the idea that we’re providing not just for citizens now, but into the future – we are lead inevitably to a discussion of sustainability.

How do we reach our adopted goal of net zero emissions across the whole New South Wales economy by 2050 and, even more pressingly, a 50 per cent cut in emissions below 2005 levels by 2030? Infrastructure clearly has a key role to play in this transformation due to the embodied, operating and enabling emissions generated throughout a project’s infrastructure lifecycle. It’s an inherent challenge, but it provides all of us with an extraordinary opportunity, particularly in government, to encourage and support the private sector in the progressive decarbonisation of infrastructure supply chains.

Now I’m going to outline three specific initiatives I believe will help the infrastructure sector to achieve this shared objective of decarbonising our economy. I’m going to put forward a thesis, the three things we need to do collectively, and the things government needs to lead on. The first is to build more with less. The second is to procure and plan more thoughtfully. I think sometimes our procurement processes are almost done following the guidebook because that’s what we do, rather than question why we do things the way we have traditionally. The third is to construct more efficiently. So, to build more with less, procure more thoughtfully and construct more efficiently.

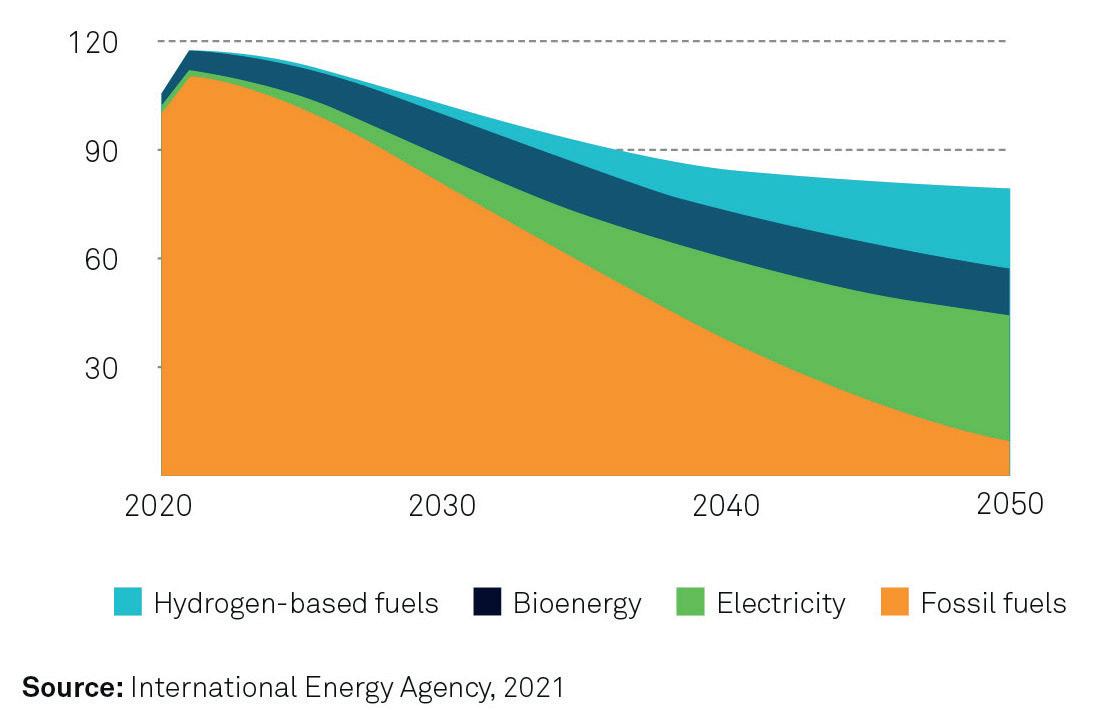

Efforts to reduce carbon emissions in infrastructure projects have traditionally focused on the operational energy of an asset. While significant progress has already been made to reduce the sector’s operational emissions, largely driven by the uptake of renewable energy, our ability to achieve further reductions will depend on success in areas that have proven harder to address.

Decarbonising the infrastructure sector requires a reduction in emissions right across asset stages, including emissions embedded during construction, generated by ongoing asset operations, and left behind through waste. It’s not just the spatial elements, but the temporal elements of infrastructure we need to address if we are going to decarbonise. In that sense, it’s fitting that the theme of today’s event is to refocus, because embodied carbon is the next frontier in our task to decarbonise the infrastructure sector. Embodied carbon in the production of building materials is estimated to be responsible for approximately five to 10 per cent of Australia’s total emissions, a frequently overlooked and under-measured part of the net zero discussion. With concrete, steel and aluminium considered some of the more difficult materials to decarbonise, our record levels of infrastructure investment have created additional challenges in reducing embodied carbon. We have a paradox of a massive infrastructure pipeline at the same time as we are trying to decarbonise – using carbon-intensive materials while at the same time having net zero ambitions. It poses a massive paradox and throws out a huge challenge for us to embrace.