*Customary for Seller to Pay

TypeofFinancing

RealEstateAgentCommissions

Reconveyance/ReleaseFees

PrepaymentPenalties(IfApplicable)

Owner'sTitleInsurance

EscrowFee

TaxProrations

LienSearch(ifapplicable)

Mortgages&Encumbrances

AnyPropertyTaxDue

Buyer'sLenderFees(variesbylender)

*Customary for Buyer to Pay

TypeofFinancing

AppraisalFee

LoanOriginationFee/Discount

CreditFee

MortgageInsurance(ifapplicable)

ReserveSetUpFee(ifapllicable)

FireInsurance1year(homeownerspolicy)

Floodinsurance(ifapplicable)

FloodandTaxCertifications

PrepaidInterest

HomeOwnersAssociationFees(ifapplicable)

VAFundingFee

RecordingFee

TaxProration

EscrowFee

LendersTitleInsurance

* Items listed are intended to represent only what may be customarily charged and may not reflect actual charges at closing. Consult with your real estate professional or title company representtaive for actual charges specific to your transaction.

Seller to pay full escrow fee (includes buyer escrow fee)

This week the median list price for Prineville, OR 97754 is $499,999 with the market action index hovering around 31. This is less than last month's market action index of 32 Inventory has decreased to 123.

This answers “How’s the Market?” by comparing rate of sales versus inventory.

Median List Price $499,999

Median Price of New Listings $459,000 Per Square Foot $304

Days on Market 114

Days

The market remains in a relative stasis in terms of sales to inventory and prices have been relatively stable for a few weeks. However, inventory is sufficiently low to keep us in the Seller’s Market zone so watch changes in the MAI If the market heats up, prices are likely to resume an upward climb

Each segment below represents approximately 25% of the market ordered by price.

We continue to see prices in this zip code bouncing around this plateau. Look for a persistent up-shift in the Market Action Index before we see prices move from these levels.

$700K

In the quartile market segments, we see prices in this zip code have settled at a price plateau across the board. Prices in all four quartiles are basically mixed. Look for a persistent shift (up or down) in the Market Action Index before prices move from these current levels.

The market plateau is seen across the price and value. The price per square foot and median list price have both been reasonably stagnant. Watch the Market Action Index for persistent changes as a leading indicator before the market moves from these levels.

Inventory has been relatively steady around these levels in recent weeks.

The market remains in a relative stasis in terms of sales to inventory and prices have been relatively stable for a few weeks. However, inventory is sufficiently low to keep us in the Seller’s Market zone so watch changes in the MAI. If the market heats up, prices are likely to resume an upward climb.

Three of the four quartiles of this zip code are in the Seller’s Market zone with relatively low amounts of inventory given the current levels of demand. It’s not uncommon that the premium segment of the market takes longer to sell than the rest of the group.

The properties have been on the market for an average of 113 days. Half of the listings have come newly on the market in the past 71 or so days. Watch the 90-day DOM trend for signals of a changing market. 7-Day Average

It is not uncommon for the higher priced homes in an area to take longer to sell than those in the lower quartiles.

SiteAddress

12040SEJuniperCanyonRd PrinevilleOR97754

16036

AgeDistribution

SUBJECTPROPERTY

16036

CrookCounty

ADDRESS

12040SEJuniperCanyonRd Prineville,OR97754

OWNER DotyFamilyTrust

DATE 11/21/2024

PREPAREDBY DanettaRider danettar@deschutestitle.com

Parcel#:16036

TaxLot:161612D000300

Owner:DotyFamilyTrust

CoOwner:

Site:12040SEJuniperCanyonRd

PrinevilleOR97754

Mail:12040SEJuniperCanyonRd PrinevilleOR97754

LandUse:401-TractLandImproved

StdLandUse:100-Residential(nec)

Legal:Lot:27,Township:16S,Range:16E,Section:12 Twn/Rng/Sec:T:16SR:16ES:12Q:SEQQ:

ASSESSMENT&TAXINFORMATION

MarketTotal:$239,210.00

MarketLand:$178,540.00

MarketImpr:$60,670.00

AssessmentYear:2023

AssessedTotal:$108,930.00

Exemption:

Taxes:$1,323.06

LevyCode:0021

LevyRate:121459

SaleDate:01/01/2001

SaleAmount:$68,00000

Document#:162205

DeedType:Deed

LoanAmount: Lender:

LoanType:

InterestType: TitleCo:

PROPERTYCHARACTERISTICS

YearBuilt: EffYearBuilt: Bedrooms: Bathrooms:

#ofStories: TotalSqFt: Floor1SqFt: Floor2SqFt:

BasementSqFt: Lotsize:1070Acres(466,092SqFt)

GarageSqFt: GarageType:

AC:

Pool:

HeatSource: Fireplace: BldgCondition: Neighborhood: Lot:27

Block: Plat/Subdiv: Zoning:RRM5-RecreationalResidential

SchoolDist: CrookCounty Census:1021-950401

Recreation:

SentryDynamics,Inc anditscustomersmakenorepresentations,warrantiesorconditions,expressorimplied,astotheaccuracyorcompletenessofinformationcontainedinthisreport

Report Date: 11/21/2024 8:41:57 AM

information and maps presented in this report are provided for your convenience. Every reasonable effort has

the data and associated maps. Crook County makes no warranty, representation or guarantee as to the

or completeness of any of the data provided herein. Crook County explicitly disclaims any representations and warranties, including, without limitation, the implied warranties of merchantability and fitness for a particular purpose. Crook County shall assume no liability for any errors, omissions, or inaccuracies in the information provided regardless of how caused. Crook County assumes no liability for any decisions made or actions taken or not taken by the user of this information or data furnished hereunder.

Please send only a check or money order with your payment stub. DO NOT mail cash. Your cancelled check is proof of payment.

Property tax payments MUST be credited to the earliest year that taxes are due.

Tax statements for less than $40 must be paid in full.

Discounts/payment schedule (choose one)

To receive a discount, payments MUST be delivered, U.S. postmarked, or transmitted by private express carrier on or before November 15. Returned checks may cause a loss of the discount.

To receive any applicable discount you MUST make:

•Full payment— Receive a three percent (3%) discount on the amount of current year tax, as shown on your tax statement, if full payment is delivered, U.S. postmarked, or transmitted by private express carrier by November 15.

• Two-thirds payment—Receive a two percent (2%) discount on the amount of current year tax paid, as shown on your tax statement, if two-thirds payment is delivered, U.S. postmarked, or transmitted by private express carrier by November 15. Pay the final one-third (with no discount) by May 15 to avoid interest charges.

•One-third payment— No discount allowed. Pay one-third by November 15, followed by another one-third payment by February 15. Pay the final one-third balance by May 15.

Interest is charged at a rate of 1.333% monthly, 16% annually. Interest is accrued on past due installment payments accordingly:

•First one-third installment payment, interest begins accruing on December 16.

•Second one-third installment payment, interest begins accruing February 16.

•Remaining one-third payment, interest begins accruing on May 16.

If the 15th falls on a weekend or legal holiday, the due date will be extended to the next business day.

All personal property tax is delinquent when any installment is not paid on time. The responsible taxpayer can be served with a warrant 30 days after delinquency. Personal property can be seized and other financial assets can be garnished.

Real property tax is delinquent if not paid by May 15. Foreclosure proceedings on real property begin when taxes have been delinquent for three years.

Real property tax accounts with an unpaid balance for any tax year marked with an (*) on the front of this statement are subject to foreclosure if not paid on or before May 15. Payments MUST be applied to the oldest tax first.

If you think your property value is incorrect or if there has been a change to the value that you did not expect or understand, review it with the county assessor’s office. Many assessors provide value information online. Visit your county assessor’s website or call them for more details.

If you think the VALUE of your property as shown on this statement is too high, you can appeal. Your appeal is to the county board of property tax appeals (BOPTA), except for state appraised industrial property. To appeal industrial property appraised by the Department of Revenue, you must file a complaint in the Magistrate Division of the Oregon Tax Court.

If you disagree with a PENALTY assessed for late filing of a real, personal, or combined property return, you may ask the county BOPTA to waive all or a portion of the penalty. See www.oregon.gov/dor/ programs/property/pages/property-appeals.aspx.

File your petition by December 31 with the county clerk in the county where the property is located. You can get petition forms and information from your county clerk, or at www.oregon.gov/ dor/forms.

Follow the payment schedule to avoid interest charges and to receive applicable discounts. If your tax is reduced after appeal, any overpayment of property tax will be refunded.

Tax statement information is available in alternate formats, in compliance with the Americans with Disabilities Act (ADA). Contact your county tax collector.

Mailing address change request

(Mailing address changes only. An address change requires the owner’s signature. Additional documentation may be required for name changes.)

Date:

Phone:

Email:

Signature: X

������� ��� ������������ ��������� ������� #73212

Summary information is displayed for the selected property. More detailed information and maps are available using the menu on the left side of the screen.

Account: 73212

SitusAddress: 12040 SE JUNIPER CANYON RD, PRINEVILLE OR 97754 X Number: X218600

RealAccount #: 16036

Map and Taxlot: 161612D0-00300-73212

Unit: Park Name:

Ownership

Owner(s): DOTYFAMILYTRUST

MailingAddress: 14677 W HWY26 #301 MITCHELL, OR 97750

Taxes

Property Tax (CurrentYear): N�

Get Current Balance Due (PDF) Tax Information & History PayYour PropertyTaxes

Assessment & Valuation

As of Jan.1, 2024 Veterans Exemption : $0

Mailing Name: DOTYFAMILYTRUST

Map and Taxlot: 161612D0-00300-73212

Account: 73212

SitusAddress: 12040 SE JUNIPER CANYON RD, PRINEVILLE OR 97754

Tax Status:Taxable

Review of digital records maintained by the Crook County Assessor’s Office and Tax Office indicates that there are no special tax or assessment related notations associated with this account.

Independent verification of the presence of other Crook County tax, assessment, development, and additional property related considerations is recommended. Confirmation is commonly provided by title companies, real estate agents, developers, engineering and surveying firms, and other parties who are involved in property transactions or property development. In addition, County departments may be contacted directly to discuss the information.

Report Date: 11/21/2024 10:21:16 AM

The information and maps presented in this report are provided for your convenience. Every reasonable effort has been made to assure the accuracy of the data and associated maps. Crook County makes no warranty, representation or guarantee as to the content, sequence, accuracy, timeliness or completeness of any of the data provided herein. Crook County explicitly disclaims any representations and warranties, including, without limitation, the implied warranties of merchantability and fitness for a particular purpose. Crook County shall assume no liability for any errors, omissions, or inaccuracies in the information provided regardless of how caused. Crook County assumes no liability for any decisions made or actions taken or not taken by the user of this information or data furnished hereunder.

Subdivision:

Property Class: 019

Error: Subreport could not be shown.

Error: Subreport could not be shown.

Related accounts apply to a property that may be on one map and tax lot but due to billing have more than one account. This occurs when a property is in multiple tax code areas. In other cases there may be business personal property or a manufactured home on this property that is not in the same ownership as the land.

No Related Accounts found.

Error: Subreport could not be shown.

The Crook CountyAssessor's Office is responsible for the appraisal and assessment of all taxable property within the County. Contact this department if you need additional information or if you have questions.

Mailing Name: DOTYFAMILYTRUST

Map and Taxlot: 161612D0-00300-73212

Account: 73212

SitusAddress: 12040 SE JUNIPER CANYON RD, PRINEVILLE OR 97754

Tax Status:Taxable

There are no SpecialAssessements for this account.

Web: mhods.oregon.gov

State of Oregon

Department of Consumer and Business Services

Building Codes Division 1535 Edgewater St NW

Salem, OR 97309-0404 (503) 378-4530

Email:mhods.bcd@dcbs.oregon.gov

Certificates of title are no longer issued for manufactured homes. This ownership document reflects all owners and security interests recorded as of the print date listed below. For the most current recording status, please check the website mhods.oregon.gov or call the Department of Consumer and Business Services at (503) 378-4530.

Home ID Number: 269649

Inactive Status: Home Information

Manufacturer:

Dwelling Type: SKYLINE Manufactured Dwelling Manufacture Year: 1993 Model: UNKNOWN

Date of

Square Footage: Roofing Material:

Siding Type:

Section Information

Serial Number

HUD Number 1 01910160F 225495

Site Information 12040 SE JUNIPER CANYON RD PRINEVILLE, OR 97754

Right of Survivorship: No

Owner

County: Crook

Owner Type

DOTY FAMILY TRUST Trust 14677 W HWY 26 #301 MITCHELL, OR 97750

ParcelID:16036

TaxAccount#:161612D000300

12040SEJuniperCanyonRd, PrinevilleOR97754

Thismap/platisbeingfurnishedasanaidinlocatingtheherein describedlandinrelationtoadjoiningstreets,naturalboundariesand otherland,andisnotasurveyofthelanddepictedExcepttotheextent apolicyoftitleinsuranceisexpresslymodifiedbyendorsement,ifany, thecompanydoesnotinsuredimensions,distances,locationof easements,acreageorothermattersshownthereon

ParcelID:16036

TaxAccount#:161612D000300

12040SEJuniperCanyonRd, PrinevilleOR97754

Thismap/platisbeingfurnishedasanaidinlocatingtheherein describedlandinrelationtoadjoiningstreets,naturalboundariesand otherland,andisnotasurveyofthelanddepictedExcepttotheextent apolicyoftitleinsuranceisexpresslymodifiedbyendorsement,ifany, thecompanydoesnotinsuredimensions,distances,locationof easements,acreageorothermattersshownthereon

ParcelID:16036

TaxAccount#:161612D000300

12040SEJuniperCanyonRd, PrinevilleOR97754

Thismap/platisbeingfurnishedasanaidinlocatingtheherein describedlandinrelationtoadjoiningstreets,naturalboundariesand otherland,andisnotasurveyofthelanddepictedExcepttotheextent apolicyoftitleinsuranceisexpresslymodifiedbyendorsement,ifany, thecompanydoesnotinsuredimensions,distances,locationof easements,acreageorothermattersshownthereon

No CC&R’s for this property

ParcelID:16036

TaxAccount#:161612D000300

12040SEJuniperCanyonRd, PrinevilleOR97754

Thismap/platisbeingfurnishedasanaidinlocatingtheherein describedlandinrelationtoadjoiningstreets,naturalboundariesand otherland,andisnotasurveyofthelanddepictedExcepttotheextent apolicyoftitleinsuranceisexpresslymodifiedbyendorsement,ifany, thecompanydoesnotinsuredimensions,distances,locationof easements,acreageorothermattersshownthereon

ParcelID:16036

TaxAccount#:161612D000300

12040SEJuniperCanyonRd, PrinevilleOR97754

Thismap/platisbeingfurnishedasanaidinlocatingtheherein describedlandinrelationtoadjoiningstreets,naturalboundariesand otherland,andisnotasurveyofthelanddepictedExcepttotheextent apolicyoftitleinsuranceisexpresslymodifiedbyendorsement,ifany, thecompanydoesnotinsuredimensions,distances,locationof easements,acreageorothermattersshownthereon

ParcelID:16036

TaxAccount#:161612D000300

12040SEJuniperCanyonRd, PrinevilleOR97754

Thismap/platisbeingfurnishedasanaidinlocatingtheherein describedlandinrelationtoadjoiningstreets,naturalboundariesand otherland,andisnotasurveyofthelanddepictedExcepttotheextent apolicyoftitleinsuranceisexpresslymodifiedbyendorsement,ifany, thecompanydoesnotinsuredimensions,distances,locationof easements,acreageorothermattersshownthereon

Prinev

Coun

Po well Butte F ir e Statio n

Ochoco State Scenic Viewpoint

Prineville Golf and Country Club

Meadow Lakes Golf Course

BIG MEADOW GOLF COURSE

ASPEN LAKES GOLF COURSE

EAGLE CREST RESORT COURSE

JUNIPER GOLF COURSE

TOM FAZIO COURSE AT PRONGHORN

AWBREY GLEN GOLF COURSE

BROKEN TOP GOLF CLUB

WIDGI CREEK GOLF CLUB

WOODLANDS GOLF COURSE AT SUNRIVER

MEADOWS GOLF COURSE AT SUNRIVER

QUAIL RUN GOLF COURSE

ParcelID:16036

TaxAccount#:161612D000300

12040SEJuniperCanyonRd, PrinevilleOR97754

Thismap/platisbeingfurnishedasanaidinlocatingtheherein describedlandinrelationtoadjoiningstreets,naturalboundariesand otherland,andisnotasurveyofthelanddepictedExcepttotheextent apolicyoftitleinsuranceisexpresslymodifiedbyendorsement,ifany, thecompanydoesnotinsuredimensions,distances,locationof easements,acreageorothermattersshownthereon

ParcelID:16036

TaxAccount#:161612D000300

12040SEJuniperCanyonRd, PrinevilleOR97754

Thismap/platisbeingfurnishedasanaidinlocatingtheherein describedlandinrelationtoadjoiningstreets,naturalboundariesand otherland,andisnotasurveyofthelanddepictedExcepttotheextent apolicyoftitleinsuranceisexpresslymodifiedbyendorsement,ifany, thecompanydoesnotinsuredimensions,distances,locationof easements,acreageorothermattersshownthereon

Deschutes

Police Dept. (Non-Emergency) ........................ 541.388.0170

Post

Redmond Library .............................................. 541.312.1050

Redmond

Hugh Hartman ................................................... 541.923.8900

John Tuck ........................................................... 541.923.4884

M.A. Lynch ......................................................... 541.923.4876

Sage .................................................................... 541.316.2830 Terrebonne

SubjectParcel

SiteAddress 12040SEJuniperCanyonRd PrinevilleOR97754

Parcel 16036

SchoolDistrict CrookCounty

AssignedPrimarySchool BarnesButteElementary

AssignedMiddleSchool CrookCountyMiddleSchool

AssignedHighSchool CrookCountyHighSchool

PrimarySchool

CrookedRiverElementary School

HighDesertChristian Academy

SteinsPillarElementary

BarnesButteElementary

MiddleSchool

Coic-Prineville

HighDesertChristian Academy

CrookCountyMiddleSchool

ReportDetail

QueryDistanceFromParcel 10miles

SchoolsInQuery 11

HighSchool

CrookCountyHighSchool

PioneerSecondary AlternativeHighSchool

HighDesertChristian Academy

InsightSchoolOfOregon PaintedHills

DestinationsCareerAcademy OfOregon

OtherSchool

PioneerSecondary

AlternativeHighSchool

Coic-Prineville

HighDesertChristian Academy

CascadeVirtualAcademy

SchoolMap

School#1

SchoolDistrict CrookCountySD

DistFromSubject779miles

School CrookCountyHighSchool SiteAddress 1100SELynnBlvd City Prineville Zip 97754

Type 1-Regularschool Students 830

Charter No Magnet

Title1Elig 2-No

Title1 6-NotaTitleIschool

Free/Reduced Lunch 250 FTETeachers Count 4120

Student/Teacher Ratio 2015

GradeLevels 9thGrade-12thGrade

Male 445 Female 382

School#2

SchoolDistrict CrookCountySD

DistFromSubject779miles

School PioneerSecondaryAlternativeHighSchool SiteAddress 1200SELynnBlvd City Prineville Zip 97754

Type 4-AlternativeEducationSchool Students 68

Charter No Magnet

Title1Elig 2-No

Title1 6-NotaTitleIschool

Free/Reduced Lunch 50 FTETeachers Count 400

Student/Teacher Ratio 1700 GradeLevels 9thGrade-12thGrade

Male 42 Female 24

School#3

SchoolDistrict

DistFromSubject810miles

School Coic-Prineville SiteAddress 2321NE3rdSt City Prineville Zip 97754

Type Students 28

Charter Magnet

Title1Elig Title1

Free/Reduced Lunch FTETeachers Count

Student/Teacher Ratio GradeLevels -

Male Female

School#4

SchoolDistrict CrookCountySD

DistFromSubject811miles

School CrookedRiverElementarySchool SiteAddress 1400SE2ndSt City Prineville Zip 97754

Type 1-Regularschool Students 506

Charter No Magnet

Title1Elig 1-Yes

Title1 5-TitleIschoolwideschool

Free/Reduced Lunch 325 FTETeachers Count 3193

Student/Teacher Ratio 1585

Male

GradeLevels Kindergarten-5thGrade

School#5

SchoolDistrict

DistFromSubject828miles

School HighDesertChristianAcademy SiteAddress 839SMainSt City Prineville Zip 97754

Type Students 139

Charter Magnet

Title1Elig Title1

Free/Reduced Lunch FTETeachers Count

Student/Teacher Ratio

GradeLevels -

Male Female School#6

SchoolDistrict CrookCountySD

DistFromSubject829miles

School CrookCountyMiddleSchool SiteAddress 100NEKnowledgeSt City Prineville Zip 97754

Type 1-Regularschool Students 617

Charter No Magnet

Title1Elig 1-Yes

Title1 2-TitleItargetedassistanceschool

Free/Reduced Lunch 219 FTETeachers Count 3915

Student/Teacher Ratio 1576

GradeLevels 6thGrade-8thGrade

Male 302 Female 314 School#7

SchoolDistrict CrookCountySD

DistFromSubject855miles

School SteinsPillarElementary SiteAddress 640East3rdSt City Prineville Zip 97754

Type 1-Regularschool Students 280

Charter No Magnet

Title1Elig 2-No

Title1 6-NotaTitleIschool

Free/Reduced Lunch FTETeachers Count 1525

Student/Teacher Ratio 1836

GradeLevels Kindergarten-5thGrade

Male 129 Female 151

School#8

SchoolDistrict CrookCountySD

DistFromSubject855miles

School BarnesButteElementary SiteAddress 1875NEIronhorseDr City Prineville Zip 97754

Type 1-Regularschool Students 476

Charter No Magnet

Title1Elig 1-Yes

Title1 5-TitleIschoolwideschool

Free/Reduced Lunch 304 FTETeachers Count 3246

Student/Teacher Ratio 1466

Male 244

School#9

SchoolDistrict MitchellSD55

GradeLevels Kindergarten-5thGrade

Female 232

DistFromSubject893miles

School InsightSchoolOfOregonPaintedHills SiteAddress 340SEHighSt

City Mitchell Zip 97750

Type 1-Regularschool Students 170

Charter Yes Magnet

Title1Elig 2-No

Title1 6-NotaTitleIschool

Free/Reduced Lunch FTETeachers Count 1124

Student/Teacher Ratio 1512

GradeLevels 7thGrade-12thGrade

Male 69 Female 100

School#10

SchoolDistrict MitchellSD55

DistFromSubject893miles

School DestinationsCareerAcademyOfOregon SiteAddress 603NW3rdSt

City Prineville Zip 97754

Type 1-Regularschool Students 89

Charter Yes Magnet

Title1Elig 2-No

Title1 6-NotaTitleIschool

Free/Reduced Lunch FTETeachers Count 526

Student/Teacher Ratio 1692

GradeLevels 9thGrade-12thGrade

Male 38 Female 51

School#11

SchoolDistrict MitchellSD55

DistFromSubject893miles

School CascadeVirtualAcademy SiteAddress 603NW3rdSt City Prineville Zip 97754

Type 1-Regularschool Students 731

Charter Yes Magnet

Title1Elig 2-No

Title1 6-NotaTitleIschool

Free/Reduced Lunch FTETeachers Count 3021

Student/Teacher Ratio 2420

GradeLevels Kindergarten-12thGrade

Male 360 Female 370

Students We Serve

PRINCIPAL: Taylor Trautman | GRADES: K-5 | 1875 NE Ironhorse Dr, Prineville 97754 | 541-416-4150

Students

Barnes Butte Elementary is a school that focuses on highlighting students’ strengths and leveraging student achievement. We work to foster a school environment where students are eager to attend daily and engage in their growth as a student. It's our goal that students feel valued. Each child is not just a name. They are a unique and important part of our Barnes Butte family. We are committed to providing an environment where every child succeeds and student voice is an integral part of our school.

The Oregon Department of Education is partnering with school districts and local communities to ensure a 90% ontime, four year graduation rate by 2027. To progress toward this goal, the state will prioritize efforts to improve attendance, provide a well-rounded education, invest in implementing culturally responsive practices, and promote continuous improvement to close opportunity and achievement gaps for historically and currently underserved students.

At Barnes Butte Elementary, we welcome students as they exit the bus or enter the front doors each day. We have our staff visible to greet each child as they enjoy breakfast or time to visit with fellow students before they start the day. The school building and systems are designed with features that allow a sense of community and safety in everything we do from the beginning of the day to the conclusion of each exciting day.

We put safety as our number one priority. Our building procedures are founded in safety for children from the beginning of the day to the end of the day. We have district and school policies that come to life in our all school training, small group classes and individual work with our counselor. We use Kelso's Choices and Character Strong for our proactive all-student training. These strategies are reinforced through the year and as data indicates for whole grades, individual classes and student to student conflict resolution. All our visual resources mirror these practices and we work intentionally with staff to develop them to the fullest annually.

Our extracurricular activities reflect our commitment to the whole person. At Barnes Butte, we believe that academic and social growth are equally as important. Students across the grades experience learning events both on campus and off. Our core curriculum guides our academic standards and then the staff looks for ways to bring that learning to life. Students can take on leadership roles, they often are out in the field for hands-on learning and every grade attends a variety of trips that gets the students connected to the world around them.

Engaging families is central to our work at Barnes Butte Elementary. We want families to feel welcome as they drop off their student in the morning, volunteer at school or trips, attend school sponsored evening events, or join the PTO. Raising a child is a partnership and doing this work to the best of our ability is best done together.

Connecting with our community is part of our central mission. We believe that the more the community connects with and supports the local educational systems, the more future stewards we are able to shape. Our students benefit from guest speakers, interactive presentations, and various exciting and engaging field trip destinations. Through the year there are family events. We offer support services in both English and Spanish.

Students We Serve

PRINCIPAL: Marques Hase | GRADES: 6-8 | 100 NE Knowledge St, Prineville 97754 | 541-447-6283

Students

The goals of Crook County Middle School support our commitment towards each individual student being valued, feeling safe and connected to school, while believing that they can be successful in school and life. They include delivering a comprehensive academic support program, providing highly effective instruction, creating a 21st Century learning environment, offering multiple opportunities to engage students, and operating on the foundation of positive relationships. This is all part of our commitment to every child, every day.

The Oregon Department of Education is partnering with school districts and local communities to ensure a 90% ontime, four year graduation rate by 2027. To progress toward this goal, the state will prioritize efforts to improve attendance, provide a well-rounded education, invest in implementing culturally responsive practices, and promote continuous improvement to close opportunity and achievement gaps for historically and currently underserved students.

Crook County Middle School strives to cultivate an environment of inclusion, safety, and acceptance where all students can discover their unique niche within the school. Whether greeting students at the door for class, maintaining an intentional servant mindset within our approach, or embedding the needs of the whole child in our professional practice, it is our desire for students to feel valued and enjoy their educational opportunities at CCMS.

Crook County Middle School implements the following systems, protocols, and procedures in regards to the overall safety and wellbeing of students: CCMS Building Management Plan, Standard Response Protocol, Safe Schools Alliance, Peer Conflict Mediation Program, Bullying Tip Hotline, Individual & Group Counseling Services, School Resource Officer, Student Threat Assessment System, Positive Behavior Intervention System, & CharacterStrong Advisory curriculum.

In attempt to enrich student development and establish connections to school, Crook County Middle School offers the following extra-curricular activities: Art Club, Drama Club, STEM Club, Math Club, Choir, Band, National Honor Society, Leadership, Football, Cross Country, Volleyball, Basketball, Soccer, Wrestling, and Track & Field.

Growing and developing young teens demands a positive and effective partnership between families and schools. At Crook County Middle School we strive to include parent volunteers when applicable, encourage attendance at extra-curricular activities, collect and value parent input, and maintain regular communication and updates regarding student performance and progress.

Building partnerships and relationships within the community is important to the success of students at Crook County Middle School. Our school collaborates with the following community partners to support and deliver services: City of Prineville, Crook County Health Department, Prineville Police Department, Department of Human Services, Crook County Juvenile Department, Crook County Coalition, and Crook County Sheriff Department, and multiple private business partners.

Students We

PRINCIPAL: Michelle Jonas | GRADES: 9-12 | 1100 SE Lynn Blvd, Prineville 97754 | 541-416-6900

Students

Students

Students earning a diploma within four years. Cohort includes students who were first-time ninth graders in 2018-19 graduating in 2021-22

Students earning a high school diploma or GED within five years. Cohort Includes students who were firsttime ninth graders in 2017-18 finishing in 2021-22

Students enrolling in a two or four year college within 16 months of completing high school in 202021. Data from the National Student Clearinghouse.

from

Crook County High School prioritizes college and career readiness for students. We have increased our offerings in career and technical education. These classes prioritize job skills and give students opportunities to learn things applicable in the workforce. Crook County High School is an AVID showcase school. Collaborative structures focusing on rigor, engagement, and college readiness are implemented in all classes. We place a high importance on connecting students with sports, clubs, or extra curricular activities. We focus on student well-being and understand each student has a unique story that needs to be heard and honored.

The Oregon Department of Education is partnering with school districts and local communities to ensure a 90% ontime, four year graduation rate by 2027. To progress toward this goal, the state will prioritize efforts to improve attendance, provide a well-rounded education, invest in implementing culturally responsive practices, and promote continuous improvement to close opportunity and achievement gaps for historically and currently underserved students.

Crook County High School is a place where all students are welcome. It is our priority that all students feel seen, heard, and supported. Our staff uses Positive Behavioral Interventions and Support to support our school wide values and norms. We have created student to staff and staff to staff culture teams to collect input around school climate and culture. We strive to continually improve how we can support students in our schools. Our welcome center supports non english speaking families with a bilingual staff. All communication sent home is translated for parent access and interpreters are available for parent meetings.

Career and Technical Education is a high priority for us and we place value on relevant, real world skills. We have eight programs of study that inlude:

· Agriculture Sciences

· Business Marketing

· Construction Technology

· Mangufacturing and Engineering

· Robotics

· Culinary Arts

· Graphic Design

· Health Sciences

We know when students feel connected with adults and peers in something other than class, they have a better attitude toward school. A better attitude increases their likelihood of happiness and academic success. Our CC Connect program empowers students to find something of interest. They are free to create their own club. We have over 30 clubs currently. With our CC Connect programs and all of the other offerings we have over 65% of our student body involved in something. Other extra curricular opportunities include:

· 18 interscholastic athletic programs

· 4 service clubs

· Perfrorming Arts incuding Drama, Band, and Choir

· Leadership

· Link Crew

We want to continue to get creative finding ways to engage our parents and communities. We offer a variety of events encouraing parents and community to participate. These include:

· Beyond High School Night

· FAFSA Night

· AVID showcase nights

· Career Fair

· Fall and Spring Conferences, rebranded to Conference+

· Freshmen Orientation Night

· Cowboy Kick Off

· Involvement in the senior part planning committee

· Parent surveys

· Invovlement in Booster Club

Crook County Christian School

Crook County High School

Crook County Middle School

https://www.visitbend.com/food-drink/restaurants/food-carts/

https://www.google.com/search?q=food+carts+near+me&rlz=1C1GCEU_enUS874US875&oq=food+ca rts+&aqs=chrome.2.69i57j0i512j0i457i512j0i402j46i175i199i512l2j0i512l4.9132j0j15&sourceid=chrom e&ie=UTF-8

https://www.menupix.com/oregon/cn/158/370037/Food-Trucks-Prineville

https://www.google.com/search?q=food+trucks+in+sisters+oregon&rlz=1C1GCEU_enUS874US875&ei =nMxVYpS4Ns2dkPIPufeDoAg&oq=food+trucks+in+Sisters&gs_lcp=Cgdnd3Mtd2l6EAEYADIFCAAQgAQ yBQgAEIYDMgUIABCGAzoLCC4QgAQQxwEQrwE6BggAEBYQHkoECEEYAEoECEYYAFAAWPcKYNAiaABw AXgAgAHRAYgBugmSAQUwLjYuMZgBAKABAcABAQ&sclient=gws-wiz

https://www.google.com/search?q=food+trucks+in+madras&rlz=1C1GCEU_enUS874US875&ei=nMxV YpS4Ns2dkPIPufeDoAg&ved=0ahUKEwiU9pOLm4_3AhXNDkQIHbn7AIQQ4dUDCA8&uact=5&oq=food +trucks+in+madras&gs_lcp=Cgdnd3Mtd2l6EAMyBggAEBYQHjIFCAAQhgMyBQgAEIYDOgcIABBHELADO goIABBHELADEMkDOggIABCABBDJAzoFCAAQkgM6BQgAEIAEOgsILhCABBDHARCvAUoECEEYAEoECEYY AFDeEliMGmDVHGgBcAF4AIABrQGIAZoHkgEDMC42mAEAoAEByAEHwAEB&sclient=gws-wiz https://www.google.com/search?q=food+trucks+in+culver+oregon&rlz=1C1GCEU_enUS874US875&ei =bM1VYqjDC_bTkPIP_Zuj2AY&ved=0ahUKEwioqYDum4_3AhX2KUQIHf3NCGsQ4dUDCA8&uact=5&oq =food+trucks+in+culver+oregon&gs_lcp=Cgdnd3Mtd2l6EAMyBQghEKsCOgoIABBHELADEMkDOgcIABB HELADOgYIABAWEB46BQgAEIYDOgUIIRCgAUoECEEYAEoECEYYAFD2BljNDmCFEGgBcAF4AIABswGIAcQ JkgEDMC43mAEAoAEByAEEwAEB&sclient=gws-wiz

https://pdx.eater.com/maps/best-restaurants-bend-oregon-guide

https://www.visitbend.com/food-drink/restaurants/vegan-vegetarian-gluten-free/

https://www.google.com/search?q=healthy+eats+in+central+oregon&rlz=1C1GCEU_enUS874US875& ei=Vs5VYo6xJp_TkPIPjIqV4AI&ved=0ahUKEwiOtOXdnI_3AhWfKUQIHQxFBSwQ4dUDCA8&uact=5&oq =healthy+eats+in+central+oregon&gs_lcp=Cgdnd3Mtd2l6EAM6BggAEAcQHjoICAAQBxAFEB46BQgAEI YDSgQIQRgASgQIRhgAUABYjyhg6D5oAnABeAGAAe8DiAHND5IBCjIuMTAuMS4wLjGYAQCgAQHAAQE &sclient=gws-wiz

https://forgetsomeday.com/things-to-do-in-bend-oregon-with-kids/ https://www.cascadiakids.com/things-do-kids-bend-oregon/

https://oldmilldistrict.com/things-to-do-with-kids/

https://www.visitbend.com/things-to-do/activities/kid-family-friendly-activities/

https://visitcentraloregon.com/dining/food/farmers-market/

https://www.localharvest.org/prineville-or/farmers-markets

https://hdffa.org/its-farmers-market-season/

https://redmondoregonfarmersmarket.com/

https://www.sistersfarmersmarket.com/

https://www.localharvest.org/redmond-or/farmers-markets

https://www.madrassaturdaymarket.com/

https://www.visitbend.com/food-drink/restaurants/brewery-pub/

https://www.google.com/search?q=breweries+in+central+oregon&rlz=1C1GCEU_enUS874US875&oq =&aqs=chrome.0.69i59i450l8.68566434j0j15&sourceid=chrome&ie=UTF-8

https://visitcentraloregon.com/dining/drinks/breweries/redmond/ https://beermebend.com/bend-oregon-brewery-locations/

https://www.google.com/search?q=prineville+breweries&rlz=1C1CHBD_enUS1025US1025&oq=prine ville+breweries&aqs=chrome..69i57j0i22i30j0i390i650.4688j0j7&sourceid=chrome&ie=UTF-8

https://www.google.com/search?q=breweries+in+madras+oregon&rlz=1C1CHBD_enUS1025US1025& oq=breweries+in+madras+oregon&aqs=chrome..69i57.6398j0j4&sourceid=chrome&ie=UTF-8

https://www.niche.com/k12/search/best-private-schools/c/deschutes-county-or/ https://movingtobend.com/relocation-blog/2021/a-guide-to-public-and-private-schools-in-bendoregon/

https://www.countyoffice.org/bend-or-private-schools/

https://www.visitbend.com/things-to-do/activities/winter-fun/

https://visitcentraloregon.com/things-to-do/activities/winter/

https://www.google.com/search?q=winter+activities+central+oregon&rlz=1C1CHBD_enUS1025US102 5&oq=winter+activities+central+oregon&aqs=chrome..69i57j0i22i30l2j0i390i650l3j69i60l2.14288j0j4 &sourceid=chrome&ie=UTF-8

https://www.riversplacebend.com/games

https://beermebend.com/bend-oregon-brewery-locations/

https://www.bendsource.com/bend/bingo-with-bren-supporting-saving-grace/Event?oid=16320982

https://www.visitbend.com/food-drink/astro-lounge/

https://theyardfoodpark.com/events/

https://www.silvermoonbrewing.com/events

https://www.bendsource.com/bend/tuesday-night-trivia-in-redmond/Event?oid=18829261

https://visitcentraloregon.com/calendar-of-events

https://www.bendsource.com/bend/EventSearch?v=g#grid

https://www.visitbend.com/event-calendar/

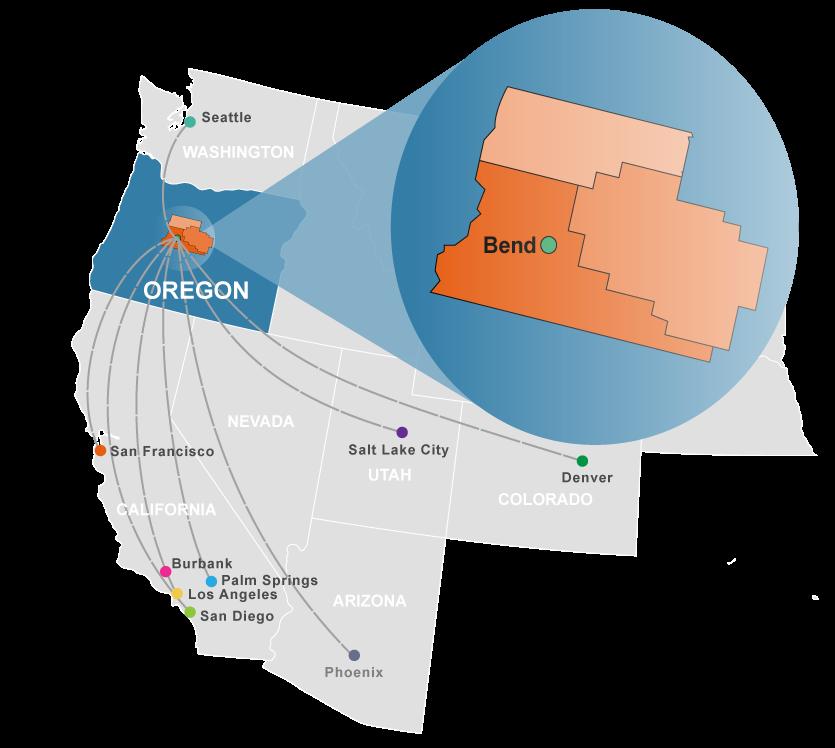

Where the commute times are short and breathtaking views await you at every turn. The region features dramatic snow-capped mountain ranges and high desert plateaus within Deschutes, Crook and Jefferson counties.

Located halfway between San Francisco and Seattle, one of the hottest small metropolitan markets in the U.S. is Central Oregon. In the last decade the region has seen some of the highest sustained GDP growth, job growth and population growth. With these factors in mind, The Milken Institute has named the region the best small metropolitan in the nation four years in a row – an unprecedented feat no other location has ever received.

Central Oregon is pulling extraordinary talent and capital, fostering a diverse and highly entrepreneurial business ecosystem. Deschutes County received the most investment in Oregon in 2022, according to Smartasset. Lured by natural scenic beauty and big city amenities without big city costs or hassle, people are learning that having a true work-life balance

possible. Employees are

and companies are more innovative and capital-efficient. All in a region dominated by small to mid-sized firms that compete

and win.

Regional Population: 253,761

(2021 estimates from Portland State University)

Regional Labor Force: 123,953

(Seasonally adjusted total for 2021 from Oregon Employment Department)

(2020 estimate from the Bureau of Economic Analysis)

*Bureau of Economic Analysis data is only available for the Bend-Redmond MSA

$54,390

Access to and from our region has never been easier with five national carriers flying up to 54 segments daily to nine international airports. Central Oregon is served by one of the most vibrant and successful regional airports in the country at Redmond (RDM).

In-migration has been the dominating factor in the region’s growth. With millions of visitors annually, Central Oregon continues to attract thousands of new residents from all over the country each year for it’s outdoor amenities, arts and culture opportunities, quality healthcare, and a growing education system.

“Central Oregon’s economic growth is stronger than the state and nation overall. The primary reason is the high quality of life that attracts new residents. Faster population growth means local businesses can hire and expand at a faster rate due to the influx of working-age migrants and the growing labor force.”

Josh Lehner Economist, Oregon Office of Economic Analysis

With over 4.5 million visitors flocking to Central Oregon each year, it proves a great introduction to our region’s culture, lifestyle and a great first impression for businesses. Central Oregon and the Bend-Redmond MSA continually top the nation in population growth. In fact, Bend has been among the 15 fastest growing cities in the U.S. five of the last six years. While our population grows, so does our workforce. We’re cultivating a community that has consciously decided to live here and attracting new talent pools to serve the increasing demand for labor.

We guide employers outside the region through the relocation process as a resource for regional data, incentives, talent, site selection, and A-Z problem solving.

Oregon offers more incentive programs to traded-sector* businesses than Washington or California. Even without taking those incentives into consideration, Oregon is still a more cost-effective choice for doing business. Contact EDCO for a detailed look at the business costs in Central Oregon. *companies that sell their products or services outside the area, bringing new jobs and capital investment to the area

Electricity Rate (¢/kWh)

Natural Gas Rate ($/kcf)

& Local Sales Tax Rate

Sources: Tax Foundation 2022, US Energy Information Association (Natural Gas) 2021, US Energy Information Association (Electricity) 2021

“While our move to Central Oregon may have started for personal reasons, it has allowed us to do more with our business than we thought possible. It has allowed us to hire amazing employees – the available talent here in Central Oregon has proven to be of the highest caliber and chocked full of integrity. Sometimes you feel like you can get lost in a big city. In Sisters we have been able to be part of a growing and nurturing business community.” - Wyatt Woods, President and Owner, Holy Kakow

Founded in Portland in 2009, Holy Kakow creates premium organic chocolate sauces and syrups that are used in coffee shops across the nation and globe. After running the business for nearly a decade, Founder Wyatt Woods decided a move to the City of Sisters would be beneficial for his family. The next step was to figure out how to move the successful business. After EDCO’s help with site selection, incentives, permitting, and more, Holy Kakow was able to move their operations into a new building in the Sisters Business Park. The relocation allowed them to scale for growth, even during the pandemic, expanding their employment from three to eight in the span of a couple months. Holy Kakow have their sights set on new product launches. With the backing of the community and the growing number of craft food businesses in Sisters, the company is surrounded by a strong business ecosystem to help them succeed.

Get connected to our growing industry clusters that include: craft brewing/distilling, bioscience, outdoor products, technology, aerospace, and advanced manufacturing.

We link you to tools to help your company including: connections to the local supply chain, talent acquisition, incentives, business finance, market intelligence, and more.

Central Oregon offers a pro-business environment with several incentives and supportive business finance options to encourage economic growth. Oregon also allows corporate net operating losses to be carried forward for up to 15 years without a cap, which can meaningfully reduce your business’s tax liability.

We help you navigate the regional and local real estate market, infrastructure and permitting processes.

For businesses looking to relocate, Central Oregon has a reputation for welcoming new companies. The region offers a tightknit community without sacrificing talent, education opportunities, or quality healthcare. EDCO’s network can help your business streamline decisions when choosing a new home.

We mentor and advise scalable young companies from concept to exit on issues such as access to capital, critical expertise and business strategy.

“The support we’ve received from EDCO and other organizations has been tremendous and allowed us to grow and develop our network and further develop our business in a short time. Their proactive approach to assisting and encouraging entrepreneurship in this region has been paramount to some of the large strides we’ve taken this year.”

- Ryan Goodwin, Founder & Lead Designer Engineer, SherpTek

SherpTek was among the first tenants to take occupancy in the redeveloped Woodgrain mill site, re-branded the “Prineville Campus,” where they design and manufacture modular truck bed systems and accessories to improve the functionality and adaptability of pickup trucks for day-to-day use and outdoor adventures.

SherpTek is an innovator in the automotive/outdoor industry. Their Founder and Lead Design Engineer, Ryan Goodwin, uses composite aerospace materials and construction methods to create a lightweight, yet super durable, precision-engineered product. SherpTek was one of Prineville’s first companies to pitch at EDCO’s Central Oregon PubTalk, an event that showcases local entrpreneurs. The company has been and continues to be supported by EDCO as well as many local and State partners in areas such as business financing, incentive utilization, internship coordination, staffing, network connections, scalability, and pitch coaching. Despite having just moved their start-up to Prineville earlier this year, SherpTek has ingrained itself into the entrepreneurial fabric of the region. They are already expanding their manufacturing facilities, hiring additional employees and training local high school students on their specialized processes.

A driving force for our economic performance is a collaborative and inclusive entrepreneurial community. This is supported via the number of new business registrations, which has outpaced far larger cities. In 2022, AdvisorSmith ranked Bend fifth for Top Midsize Cities where Americans Start the Most Businesses at 3.79 businesses started per 1,000 residents.

The region is large enough to provide resources and access to capital that help new entrepreneurs get started, while still being small enough that those resources are interconnected to support businesses as they grow. Unique to Central Oregon, given its size, are the numerous community resources and assets that are available. Assets managed by EDCO include monthly Central Oregon PubTalks, the Stable of Experts mentorship program and the largest Angel Conference in the PNW, the Bend Venture Conference.

Source: WalletHub, April 2022.

Both Redmond and Bend made WalletHub’s Top 30 list for best cities to start a business at #16 and #17 respectively, based on an index of criteria that included business environment, access to resources and business costs. They were the only two Oregon cities to make it in the top 350 of 1,334 small cities ranked in the index.

We partner with local traded-sector companies to help them grow and expand, offering them the very same incentives and assistance as relocation projects.

“Our flagship manufacturing facility is located in Bend, nestled at the base of the Cascade Mountain Range, which also inspired the brand name. The views and outdoor amenities are unmatched, but the entrepreneurial and community support we have received from day one has been the driving factor in bringing our homegrown business sustainable success in Oregon and beyond. Our employees, customers and partners are what make Bend home and inspire continued growth.” - Affton Coffelt, Founder and CEO, Broken Top Brands

Broken Top Brands creates handmade, sustainable, eco-conscious candles and body products that have been featured in National media outlets such as BuzzFeed, Oprah Daily and HuffPost. Started in 2015 out of Founder Affton Coffelt’s kitchen in Bend as Broken Top Candle Co., the company has now blossomed to 19 employees and recently moved into an 18,000 SF manufacturing facility.

Broken Top Brands is currently selling an array of all natural, biodegadble and paraben-free lifestyle products in the USA, as well as Canada and parts of Europe. The brand’s market is primarily wholesale with an organically growing e-commerce presence. Customers can find their products in over 2,800 retail locations nationally and internationally, with Whole Foods being their largest account.

Broken Top Brands was attracted to starting a business in Central Oregon for its quality of life and supportive community. Due to it’s unique company culture and location, the business has had success retaining employees which has enabled its continued expansion. Although supply chain timelines and transportation costs have been challenges through the pandemic, Broken Top Brands has sustained steady growth and continues to partner with EDCO, 1% for the Planet, One Tree Planted, Opportunity Knocks, Bend Chamber, and Business Oregon to serve their loyal customer base.

- MILKEN INSTITUTE, 2022

Private sector employment grew by 47% in Central Oregon over the last 10 years, which is significantly faster than the statewide growth of around 20%. Employment in the private sector is projected to grow by 12% across the region between 2019 and 2029. -

Now in its fourth year, Youth CareerConnect (YCC) continues to connect employers and students with real work experience throughout Central Oregon. By supporting internships and experiential learning opportunities in the community, YCC has made it simpler for schools and employers to connect while fostering a work-ready labor force for years to come.

YCC Internship Coordinators host office hours at schools across the region to help students with professional goal setting, resume writing, interview skills, and internship placement for high school, college and alternative education students. Since its inception in 2017, YCC has built a rolodex

over 360 business partners and placed more than 493 students in meaningful internships. Personalization for both the business and the student is at the core of what YCC does, and why it continues to thrive. To get involved with Youth CareerConnect, visit: youthcareerconnect.org

“Central Oregon enjoys a truly collaborative environment. Everyone is not only supportive of each other, but excited to see one another grow. We share the same trails, rivers and slopes and ultimately share a similar vision to help the region succeed.”

- Scott Allan , Former CEO and GM, Hydro Flask

The combination of a collaborative culture, a supportive attitude among government and economic development partners, plus a location that attracts talent and investment all help Central Oregon compete nationally.

Redmond Municipal Airport (RDM; www.flyrdm.com ) provides commercial air service with an average of 27 daily outbound flights to Burbank, Denver, Los Angeles, Palm Springs, Phoenix, Salt Lake City, San Diego, San Francisco, and Seattle via five carriers (Alaska, American, Avelo, Delta, and United).

Burlington Northern-Santa Fe (BNSF), Union Pacific (UPRR) and the City of Prineville Railway (COPR) provide direct connections for shipping to any market in the United States, Canada and Mexico.

U.S. Highways 97 and 20 are two of the State’s major trucking routes, with access to major metro areas with connections to Interstate 5 (N-S) and Interstate 84 (E-W).

SanFranciscoLosAngeles Seattle Portland Denver Bend

The Central Oregon average commute time is 24 minutes each way, saving the average worker nearly one work week per year !

Source: Census.gov 2021

Most of our region has been newly built in the past two decades, making Central Oregon’s telecommunications infrastructure one of the Northwest’s most technologically advanced. Businesses and telecommuters benefit from reliable fast data speeds and upload times.

Central Oregon is well-recognized for its high level of education, with some of the best K-12 public schools in the nation. In 2021, the Bend-La Pine school district’s average SAT scores surpassed the national average by over 180 points. Additionally, our higher education opportunities abound. From Oregon State University-Cascades’ ongoing expansion, to Central Oregon Community College’s four campuses in the region, there are opportunities for all to obtain a quality education.

St. Charles Health System is the largest healthcare provider in the region, and is also the largest employer with over 4,500 employees across the tri-county area. The hospital received HealthGrade’s 2021 Pulmonary Care Excellence Award™ and offers a network of more than 100 clinics and specialty practices throughout the community.

According to the Oregon Employment Department, 76% of Oregon establishments have between one and nine covered payroll employees and the average private establishment employs around 11 people.

Still, a number of large employers operate successfully here, tapping into Central Oregon’s ever-expanding workforce, the overall low cost of doing business and business-friendly local governments. This year, the top 50 private companies collectively employ nearly 21,000 Central Oregonians, or roughly 21.9% of the region’s current total employment.

• More than 100 businesses in advanced manufacturing make their own products here in Central Oregon, as well as provide a critical role in the supply chain for other OEM in aviation/aerospace, brewing & distilling, specialty food processing, and automotive.

• Additive and subtractive machining of metals and plastics, advanced welding and metal fabrication, specialty metals casting, production printing and publishing, as well as specialized machinery and equipment continue to advance locally.

• The largest employers in this industry group include Precision Cast Parts (PCC) Schlosser, Keith Manufacturing and BasX Solutions.

• The production of light aircraft in Central Oregon spans back more than 30 years and over that time, 25 aircraft have moved through the process of conceptual design to flight.

• Composite (carbon fiber) fabrication and innovation aircraft are the region’s specialty offering a cluster of world-class talent and capabilities here.

• Some of the most successful flight training programs in the country are located in the region with both fixed-wing and helicopter flight schools that serve the global industry, including Leading Edge, Hillsboro Aero Academy and Central Oregon Community College.

• Producing everything from titanium implants to cutting edge drug research, our bioscience industry has been experiencing year-over-year double digit employment growth for nearly a decade.

• Quietly, Central Oregon’s bioscience industry has proven capable of attracting world class scientific and technical talent that has made companies here competitive on a global scale.

• Swiss-based pharmaceutical research and manufacturer Lonza is the largest bioscience company in the region, and among the largest in Oregon, with two campuses and additional operations scattered across the region.

• Central Oregon is home to breweries both large and small, with Deschutes Brewery’s production placing it in the top 10 largest craft breweries in the U.S.

• For Oregon, which has 312 craft breweries, nearly one-third of the largest 30 brewers by volume, are located in Central Oregon – testimony to the quality of product produced here.

• The region is also home to a dozen craft cideries and distilleries, two of which, Bendistillery and AVID Cider, are the second largest in the state in their respective sectors.

• After 100+ years and considerable systemic change across the industry, the building products sector is still Central Oregon’s largest traded-sector employer.

• Businesses in this sector compete and win on a global scale, innovating and automating as global leaders in their respective sub-industries, including wood doors and windows, mouldings, cabinetry, furniture, and musical instruments.

• The region’s largest manufacturer and second largest private employer, Brightwood Corporation, is based in Madras, with operations in Redmond, Culver and Prineville. The company has been growing in Central Oregon for over a half century.

• Central Oregon is home to a diverse group of businesses in a variety of subsectors, including rock climbing, water sports, hydration, hiking, backpacking, recreational vehicles, road and mountain biking, outerwear, and software.

• The region is home to the Oregon Outdoor Alliance (OOA) and Oregon’s Office of Outdoor Recreation, both of which are dedicated to connecting and cultivating the industry.

• Bend Outdoor Worx is the country’s first dedicated startup accelerator for the industry and offers investment, exposure and access to vetted resources for outdoor innovators.

GREAT CITIES IN THE U.S. FOR OUTDOOR ADVENTURES - WASHINGTON POST, 2022

• Professional services are incrasingly being exported out of the tri-county region including engineering, architecture, accounting, HR, recruitment, creative services, advertising, and publishing to name a few

• The creative, marketing and advertising sub-sectors of this industry are particularly strong in Central Oregon with firms being attracted to the region from as far away as Barcelona, Spain.

• Including software companies, electronics manufacturers, alternative energy and data centers, the region has over 130 tech companies employing nearly 3,000 people.

• Five dozen software companies call the region home, more often than not locating their headquarter operations here.

• Prineville is a growing data center hub and is home to Meta’s first and largest data center campus, a 4.5 million square foot complex. Central Oregon offers a unique advantage for data centers due to its available infrastructure, affordable industrial land, multiple telecom carriers, desert climate, and globally competitive tax incentives.

Located on the eastern slopes of the Cascade Range, where vast forests give way to the arid high desert, Central Oregon boasts year-round adventure and a rare mix of city amenities and world-famous outdoor recreation. The region offers the slower speed of a small town with access to toprated healthcare and infrastructure to support continued economic growth.

-MONEY, 2019 & LIVABILITY, 2020

#2 MOST FITNESS FRIENDLY PLACE IN THE U.S.

-SMARTASSET, 2022

#10 BEST SMALL CITIES FOR BUSINESS

-U.S. CHAMBER OF COMMERCE, 2022

M T.

BACHELOR AMONG BEST SKI AREAS IN THE U.S. -AFAR, 2020

#10 BEST PERFORMING SMALL CITIES & #1 FOUR YEARS IN A ROW

-MILKEN INSTITUTE, 2022

30+ Golf Courses 31 Breweries & Counting Flourishing Arts & Culture Scene Miles and Miles of Trails

#4 BEST MOUNTAIN TOWNS IN AMERICA

-THRILLIST, 2021

300 Days of Sunshine

Founded in 1981, EDCO is a non-profit corporation supported by private and public members and stakeholders. Our mission is to create a balanced and diversified economy with a strong base of middle-class jobs in Central Oregon.

To do this, we focus on helping companies do the following:

MOVE. We guide employers outside the region through the relocation process as a resource for regional data, incentives, talent, site selection, and more.

START. We mentor and advise scalable young companies from concept to exit on issues such as access to capital, critical expertise and business strategy.

GROW. We partner with local traded-sector companies to help them grow and expand.

• Upcoming networking events, luncheons, conferences, and more

• EDCO Info Hub: current comprehensive data for Central Oregon

• Stable of Experts: a network of seasoned professionals with a passion for start-ups and small businesses

• Success stories from regional businesses