TAKE A LOOK See what TAX MEMO 2023-2024 looks like on the inside 2020 2023-2024 TAX

Part1:Corporationtax

Part2:Incometax

Part3:PAYEandNIC

Part4:Capitalgainstax

Contents

1000 Generalprinciples 2000 Whatisabusinessactivity? 3000 Chargeableprofits 4000 Capitalallowances 7000 Otherincomeandexpenses 9000 Chargeablegains 11000Computation 13000Groupsofcompanies 15000Specialsituations 17000Overseasissues 18000Administration

20000Generalprinciples 21000Tradingincome 23000IncomefromUKlandandproperty 24000Savingsandinvestments 26000Employmentincome 30000Pensionsandstatebenefits 32000Miscellaneousincomeandanti-avoidanceprovisions 34000Overseasissues 36000Computation 37000Administration

40000Payasyouearn 42000Constructionindustryscheme 43000NationalInsurancecontributions

45000Generalprinciples 46000Computation 47000Capitalgainstaxlosses 48000Specifictypesofdisposal 49000Specifictypesofasset 51000Reliefs 53000Administration VII

Part5:Inheritancetax

55000Generalprinciples

56000Lifetimetransfersofvalue

57000Transfersondeath

58000Nationalheritageproperty

59000Reliefs

61000Overseasissues

62000Anti-avoidancemeasures

63000Administration

65000Generalprinciples

Part6:Trusts,settlementsandestates

66000Taxationofestates

67000Incometaxandtrusts

68000Capitalgainstaxandtrusts

69000Inheritancetaxandtrusts

71000Overseastrusts

72000Administration

75000Firstprinciples

76000RegisteringforVAT

77000Supplies

79000Inputtax

81000RoutineVAT

82000Specificsituations

Part7:Valueaddedtax

83000Specialaccountingmethods

84000Landandbuildings

85000Cross-bordertransactions

87000Administration

90000Stampdutylandtax

92000Stampduty

93000Stampdutyreservetax

Part8:Stamptaxes

Part9:Harmonisedtaxadministration

95000Scopeofharmonisation

96000Penalties

97000Powersandprocedures 98000Otherreforms

99000Appendix 99990Tableofcases Index

Generalinformation

VIII

Whydistinguish?

Taxablebusinessprofitsarecomputedsolelybyreferencetorevenueitems.Nodeduction isallowedforcapitalexpenditure,unlessthecashbasisisbeingused(¶21010+).Itis thereforeessentialtoidentifywhetherreceiptsandexpensesarecapitalorrevenuein nature.

MEMOPOINTS 1.Capitalitemsgenerallyfallwithinthechargeablegainsregime,andcapital allowances(¶4000+)mayalsobeavailable.

2.Abortiveexpenditureincurredonacapitalassetwillstillconstitutecapitalexpenditure.For example,expenditureincurredbyabrewerintryingtoobtainnewlicenceswasconsidered capital,eventhoughtheattemptwasunsuccessful.SouthwellvSavillBrosLtd[1901]

3.Itemsthataretakenintoaccountwhencalculatingincomecannotalsobetakenintoaccount whencomputingachargeablegain.Thisensuresthatnoreceiptcanbesubjecttotaxmorethan onceand,correspondingly,reliefcanonlybegivenonceforanitemofexpenditure

Whatiscapitalexpenditure?

Acommonmetaphorusedtodistinguishbetweenrevenueandcapitalisthatcapitalitems arelikeatreewhereasrevenueitemsarethefruitthatitbears.Assuch,capitalitemstend tobesingularinnature,whilstrevenueitemsarerecurrent

Adistinctionmustalsobemadebetweenfixedandcirculatingcapitalofabusiness. Expenditureonfixedcapitalwillusuallybecapitalexpenditureandwillconsistofassets whichareacquiredandretainedbythebusinessandeither: –produceincomewithoutfurtheractivity(e.g.investments);or –areusedtogenerateprofits(e.g.machinery).

Expenditureoncirculatingcapitalwillusuallyberevenueexpenditure,consistingofassets whichareacquiredinthecourseofabusinessandeithersoldorconsumedinthe productionofotherarticlesforsale

MEMOPOINTS Itispossibleforanassettobefixedcapitalforonebusinessandcirculatingfor another.Forexample,acompanycarryingonabusinesswillhavedebtors,whicharepartof circulatingcapital.Ifthosedebtsaresoldtoanotherbusiness(otherthanadebtcollectionfirm), thenanyrecoveryofthosedebtswillbeinrespectoffixedcapitalandthereforeacapitalreceipt. CromptonvReynoldsandGibson[1952]

Althoughthedistinctionbetweencapitalandrevenuewillingeneralbefairlyeasytodraw therewillalwaysbeanumberofcaseswherethedistinctionisnotsoclear Inthesesituationsitisnecessarytoconsiderboththenatureoftheitemandthebenefitto thebusiness.

Whenconsideringthenatureoftheitem,thefactthatitislikelytorecuristhekeyfactorin distinguishingrevenueexpenditure(notwhetheritactuallydoesrecur).Forexample,a businessmayincurlegalexpensesoneyearforsuingtorecoverbaddebts.If,inthe followingyear,nosuchexpenseisincurred,thatwouldnotpreventtheinitialexpense beingrevenueexpenditureasitisofatypethatwouldbelikelytorecur. Similarly,capitalitems,althoughsingularinnature,mayactuallyrecur.

EXAMPLE Ashipbuildingcompanyincurredexpenditureondredgingachannelforadeepwater berth.Thisactivitymayhavehadtoberepeatedafteranumberofyears,butthatdidnotchange thefactthatitwasacapitalexpense.OunsworthvVickersLtd[1915]

Whereasinglelumpsumpaymentismadeasanalternativetoregularannualpayments,it willnotchangearevenueitemintocapitalexpenditure.

EXAMPLE

1.Afirmreceivedalumpsuminreturnforcancellinganagreementunderwhichcommissionwas received.Thiswasheldtobearevenuereceipt.ShovevDuraManufacturingCoLtd[1941]

2.Acompanydecidedtocommuteitsregularannualpaymenttoanexistingpensionfundintoa singlepayment.Thiswasheldtobearevenuepayment.GreenvCraven’sRailwayCarriageandWagon CoLtd[1951]

24CTCHARGEABLEPROFITS 3415 s53CTA2009;s33 ITTOIA2005; CM¶13000+ 3420 CM¶13210+ 3425 3430 3435

Capitalitemstendtoprovideanenduringbenefittothebusinessasawhole(incontrastto revenueitemswhichtendtofocusonthecreationofprofit).However,itispossiblethatan itemofcapitalexpenditurewillprovetohaveashortlifespan.Similarly,anitemofrevenue expendituremayprovetobelonglasting.Thereisnosettimelimitforanitemof expendituretobeconsideredenduring,andeachcaseshouldbeconsideredonitsmerits. Forexample,a3-yearlicencetoundertakeaspecifictradewasheldtobeacapitalitem. HenriksenvGraftonHotelLtd[1942]

MEMOPOINTS Anenduringbenefitoftenentailsthecreationofanassetoradvantageforthe business.Forexample,alumpsumpaymenttoestablishapensionfundforstaffwasheldtobe capitalasthepaymentcreatedanassetforthebusiness.AthertonvBritishInsulatedandHelsbyCablesLtd [1925]

Similarly,paymentstoextractacompanyfromaleasewithoneroustermswereheldtobecapital, asrenegotiatingtheleasesecuredalong-termadvantageforthecompanyTuckervGranadaMotorway ServicesLtd[1979]

2.

Revenueexpenditure

Purposeofthetrade

Revenueexpenditureisonlydeductibleincomputingachargeableprofit/lossifitis incurredwhollyandexclusivelyforthepurposesofthetrade,andnotspecifically prohibitedbystatute.

MEMOPOINTS Unlessthecashbasisisbeingusedforincometaxpurposes(¶21010+),capital expenditurewillnotbedeductible,althoughcapitalallowances(¶4000+)maybeavailable Expenditureisincurredforthepurposesofthetradeifitenablesapersontocarryonthat tradeandearnrevenue.Therefore,expenditureisonlyallowableifitrelatestothetrade beingcarriedonbythetaxpayerincurringtheexpense

EXAMPLE 1.MrA,asoletrader,incursexpenditureonstationeryforhiswife’sbusiness. NodeductionwouldbeavailableforthecostsofthestationeryincomputingtheprofitsofMrA’s trade,asitprovidesnobenefittohistrade.Norwouldadeductionbeavailableincalculatinghis wife’stradingprofits,asshedidnotincurtheexpenditure.

2.Ataxpayerclaimedadeductionforapaymentmadefromhisshareofalimitedliability partnership’sprofit.Hewasrequiredtomakethepaymentinordertopayoffapersonalloanhe hadobtainedfromthepartnership,whichallowedhimtopayaclaimmadeagainsthimbefore beingadmittedasapartner.Thisclaimwouldhavemadehimbankrupt,stoppinghimfromtrading. TheCourtofAppealheldthepaymentwasnotanallowabledeductionasitdidnotrelatetothe tradethatwasbeingcarriedonwhenthepaymentwasmade.Ifithadrelatedtothepartnership tradethepartnershipitselfwouldhavepaidit,andnotmadealoanandreclaimedit.VainesvRevenue andCustomsCommissioners[2018]

Whollyandexclusively

Expenditurewillbedeductibleifitisincurredwhollyandexclusivelyforthepurposesof thetrade.Therecanbenodualityofpurpose(butsee¶3475fortheabilitytoapportion). Theonlyreasonforincurringtheexpendituremustbetobenefitthetrade Thequestionofwhetherexpenditureisexclusivelyforthepurposesofthetradeisbyits verynaturesubjectiveandhasledtoavolumeofcaselaw,witheachcasebeingdecided onitsownparticularfacts.Whatiskeyforeverydecisionisthetaxpayer’sintentionatthe timetheexpensewasincurred. Thefollowingcasesareexamplesofthetreatmentofcommonexpenses:

Expenditure Deductible? Reasoning

Overnightaccommodationand reasonablecostofmeals y Providedtheyareincurredona businesstripthatnecessarily involvesthisexpense

CHARGEABLEPROFITSCT25 3440 3460 s54CTA2009; s34ITTOIA2005; CM¶14510+ 3465 3470

Expenditure

Deductible? Reasoning

Donationsandsubscriptions y Ifincurredforthepurposesofthe tradeandnootherreason

Uniformsandprotectiveclothing y Necessaryfortheworkinquestion

Clothestomeetaspecificdress code n Peoplemustwearsomesortof clothingregardlessofthespecific requirementsofcertainprofessions

Mealseatenawayfromtheplace ofbusiness n Everyonemusteattolive

Strictly,wherethereisanyancillarybenefit,therecanbenodeductionofthewhole expense.However,wherepartoftheexpensecanbeidentifiedasrelatingwhollytothe trade,adeductionwillbeallowedforthetradeelement.

EXAMPLE IfMrBincurscostsingoingabroadforaweekwhichcomprisedbothholidayand business,noneoftheexpenditurewouldbedeductible.

If,whilstonholidayabroad,hewasrequiredtocancelhisreturnflightandbookanextranight’s accommodationtoallowabusinessmeetingtotakeplace,thecostrelatingtotheextensionofthe tripwouldbeadeductibleexpense.

Wheretheancillarybenefitispurelyincidentaltothetradepurpose,expendituremaybe deductibleMcKnightvSheppard[1999]Assuchthedecisionwilllargelybedependentonthe particularfactsofthesituation.

EXAMPLE

1.Aself-employedstockbrokerfellfoulofStockExchangerequirementsandwassuspended.To preservehisbusiness,heincurredlegalcostsinappealingagainstthesuspension.Itwasdecided thattherestorationofhispersonalreputationwasmerelyincidentaltothepreservationofthe business,andthereforedidnotpreventthelegalexpensesfrombeingdeductible.McKnightvSheppard [1999]

2.Twomembersofascrapmetaldealingpartnershipwerechargedwithhandlingstolengoods, andonewasconvictedatfirstinstancebeforetheconvictionwasoverturnedbytheCourtof Appeal.ThelegalcostsoftheirdefenceandsubsequentappealwereallowedbytheFirst-tier Tribunal,whichconcludedthatthemainimpactoftheallegationshadbeentotheoperationofthe business,astheirlandlordhadterminatedthepartnership’slease,anditwasalsoverylikelythey wouldlosetheirlicencewhenthetimecametorenewit.Bycontrasttheirpersonalreputationshad sufferedlittle,withonlyasmallfinelevied.Thetribunalfoundthatthepurposeoftheexpenditure waswhollyandexclusivelyfortradepurposes,despitethefactthatHMRChadarguedthatthe costswerealsoincurredtorestorepersonalreputationsandavoidapotentialprisonsentence.TR RogersandothersvHMRC[2021]

3.Asaturationdiverincurredexpenditureonagymmembershipandvariousothertraining expenditure.Thisincludedthecostoftravellingtocertainoutdoorsiteswherehecouldrunonsoft groundinordertoavoidfurtherinjurytohisknee.TheFirst-tierTribunalheardthattheprofession requiresahighleveloffitnessinordertoreducetherisksarisingfromcompromisedlungandheart function,asthetaxpayerwouldoftenspendweeksinacompressedchamberaspartofhis contracts.Italsofoundthattheexercisesessionswereusuallyintenseandfrequent,totalling2or 3hoursaday.Thetribunalfoundthatthepurposeoftheexpenditurewastomaximisethe taxpayer’sphysicalabilitytocarryouthiscontractssafely,withanypersonalbenefitbeing incidental.Theyfurtherconcludedthatsuchaleveloftrainingwouldnotbecarriedoutforpersonal orleisurepurposes,especiallygiventhatthetrainingexacerbatedanexistinginjury.OsbornevHMRC [2020]

Withdrawalofcapital

Thewithdrawalofcapital,forexample,bywayofdrawingsordividend,isnotanallowable deduction.Thisincludessalariespaidtosoletradersorpartners,andanypersonal expensesbornebythebusinessinrespectoftheproprietors.Thesearenotwhollyand exclusivelyforthepurposesofthetrade,andsimplyformthewayinwhichtheproprietor obtainstheprofitmadebythebusiness.

26CTCHARGEABLEPROFITS 3475 s34ITTOIA2005 3480

Thefollowingtablesummarisesthemaincharacteristicsofregisteredschemes:

Factor Detail

Registration

Eligibility

MustberegisteredwithHMRC

Individualsuptoage75canobtaintaxreliefforcontributions Anindividualcanbeamemberofbothoccupationalandpersonal schemes

Contributions Amountwhichattractstaxreliefisrestrictedbytheannualallowance (see¶30670)

Relevantearningsrequiredifcontributionsaretoexceed£3,600p.a. Employercontributionsaredeductibleagainsttaxableprofits

Fund investments

Transactionswithconnectedpartiesallowed Prohibitiononloanstomembers(andconnectedpersons)

Residentialpropertyandsmallervaluableassetsallowedforlarger schemesonly

Schemeborrowingsarerestrictedtoamaximumof50%ofthevalue oftheschemeassets

Sizeof pensionfund

Retirement age

Limitedbyalifetimeallowancepriorto6April2023 Transitionalreliefexistsforlargerfunds,asmeasuredatvarious dates

Minimumageof55 Nomaximumage

Individualscandrawpensionbenefitswhileworking

Lumpsum Taxfreeupto(broadly)25%ofthevalueofthepensionfund

From6April2023,pensioncommencementlumpsumlimitedto £268,275subjecttoanyexistingprotectedrighttoalargeramount

D.Schemesize

Between6April2006and5April2023,thereisanupperlimitonthetax-advantagedlevel offundingimposedbythelifetimeallowance.Whilethelifetimeallowancetechnicallystill appliesin2023/24,andlifeallowancechecksstillneedtobecompleted,nospecifictax chargewillbeleviedonexcesspensionbenefits.Thelifetimeallowanceitselfwillbe abolishedfrom2024/25onwards,achangewhichisonlylikelytoaffectthosenearing retirement.

CommentTheremovalofthelifetimeallowancemayonlybetemporary.Those individualswithwell-fundedpensionschemesshouldtakeprofessionalfinancialadvice whenconsidering: –rejoiningtheiremployer’sscheme; –restartingcontributions;or –thedateofretirement.

Whatevertheincometaxconsequences,itshouldberememberedthatapensionscheme isausefulshieldfromIHT

¶¶

¶30585

¶30590

¶30620+

¶30750+

¶30775+

¶30915

¶30980+

614ITPENSIONSANDSTATEBENEFITS 30545 30775

ss828A-828D ITA2007

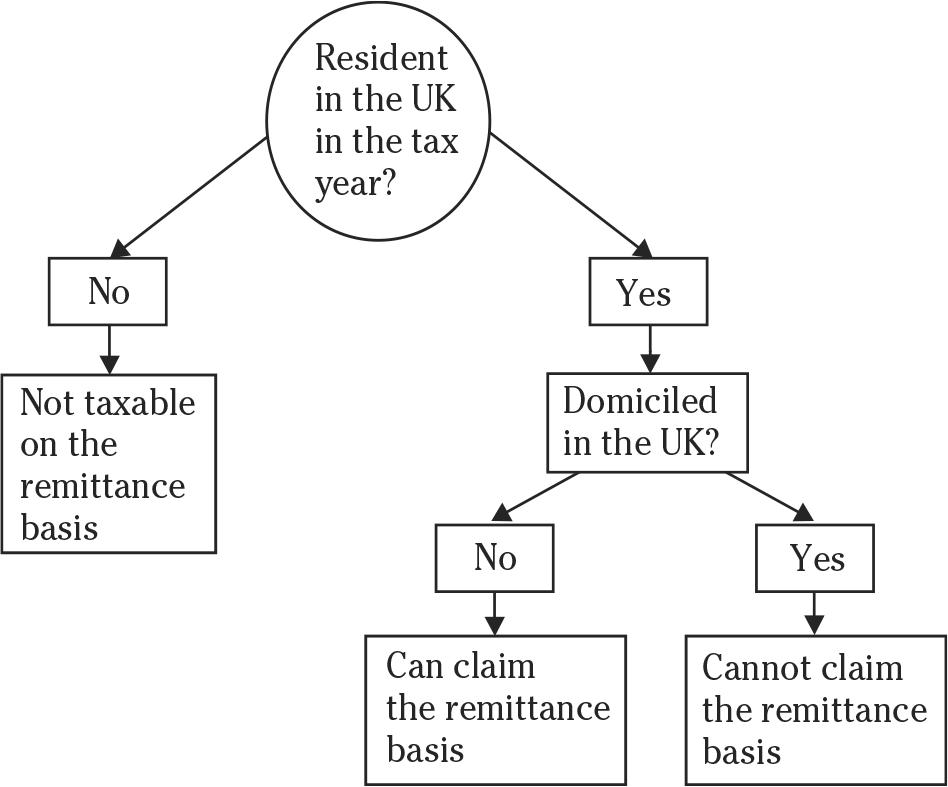

Claimingtheremittancebasis

Ingeneral,withoutaclaimfortheremittancebasis,thearisingbasiswillapply. Claimingtheremittancebasisinvolvesathree-stagedecision: Istheindividualeligiblefortheremittancebasis?

Ifso,doestheremittancebasisapplyautomatically,ormustaclaimbemade?

Ifaclaimismade,istheindividualrequiredtopaytheremittancebasischarge(¶34360+)? Thediagrambelowillustrateshowtodetermineeligibilitytoclaimtheremittancebasis.

Theremittancebasischarge

ss809B,809C ITA2007

s809HITA2007

Ifthequalifyingconditionsaremet,avariableremittancebasischarge(“RBC”)isapplied tocertainclaimantsoftheremittancebasis.TheRBCispayableinadditiontoanytax whichisactuallypayableundertheremittancebasis:itisineffectachargeforusingthe remittancebasis,andistreatedbyHMRCasataxchargeon“unremittedincomeorgains”. UnremittedincomeorgainsarestilltaxablewhenremittedtotheUK,irrespectiveofwhen theincomeorgainsarose,butataxcreditisavailableforRBCpaid(¶34365).

Since2017/18,theRBCappliestoanon-domiciledindividualwhoclaimstheremittance basisand:

–meetsoneoftworesidencetests,knownasthe7-yearand12-yeartests; –hasatleast£2,000ofunremittedforeignincomeorgainsintheUK;and –reachesorhasalreadyreachedtheageof18duringthetaxyear

Theresidencetests,andtheireffectontheamountoftheRBC,areshowninthefollowing table:

12-year1

Metinanytaxyearinwhichtheindividualhasbeen residentintheUKinatleast12ofthe14preceding taxyears2

Metinanytaxyearinwhichtheindividualdoesnot meetthe12-yeartest,buthasbeenresidentinthe UKinatleast7ofthe9precedingtaxyears2 30,000

Note

1.Priorto2017/18,therewasanadditionaltestwhereanindividualwhowasresidentintheUKinatleast17ofthelast 20precedingtaxyearswasliabletoaRBCof£90,000.Thishasnowbeenrenderedunnecessarybythe15-year deemeddomicilerule(¶34262).

2.AllyearsofresidenceintheUKcounttowardsthetimelimits.Thisincludessplityears,yearsspentintheUKbelow theageof18,oryearswhenataxpayerisdualresidentortreatyresidentinanothercountry.

Test

RBC(£)

Requirements

60,000

7-year

704ITOVERSEASISSUES

34355

34360

34363

CHAPTER4

Specifictypesofdisposal

Usually,thetransferofassetsbetweenspouses/civilpartnersismadeonanogain/noloss basiswithbothpartiesbeingtreatedinexactlythesamewayinthefollowingsituations: –wherethespouses/civilpartnersarelivingtogether; –duringthetaxyearofseparationandthefollowing3taxyears(fordisposalsonorafter 6April2023);and –anydispositionsbetweenthespousesofcapitalassetsthatareasaresultofacourtapprovedorder(withouttimelimit).

Theexceptionstothisruleareasfollows: –where,untilthedateofdisposal,theassetformedpartofthetradingstockofatrade carriedonbythetransferorspouse/civilpartner(orwasacquiredforthepurposesofa tradecarriedonbythem),inwhichcasethedisposalvaluewillbedeemedtobethe marketvalue;and –wherethedisposalismadeincontemplationoftheapproachofdeath(donatiomortis causa),inwhichcasethedisposalistreatedastakingplaceatmarketvaluebutanygain arisingisexempt(¶48495).

MEMOPOINTS Fordisposalspriorto6April2023,nogain/nolossonlyappliedinthetaxyearof separationitself

OUTLINE ¶¶ SECTION1 Scope 48000 1Dateofdisposal 48005 2Partdisposals 48055 SECTION2Capitalsums derivedfrom assets 48115 AGeneralprinciples............................48115 BCompensationreceipts 48145 1Lostordestroyedassets 48165 2Damagedassets 48200 aPartdisposals 48210 bExceptions...................................48215 SECTION3 Special relationshipwith theseller 48280 ANogain/nolossdisposals 48285 BGifts................................................48345 CConnectedpersons 48400 1Scope 48405 2Disposalvalue................................48420 3Anti-avoidance 48430 SECTION4 Otherpotential disposals....................48485 ADeath 48490 BOptions 48550 1Disposalofanoption......................48570 2Exerciseofanoption 48590 CValueshifting..................................48655 1Situationsinvolvingsharecapital 48660 2Arrangementresultsintax-free benefit 48665 DNon-residentsdisposingofland.....48725 1Scope 48750 2Computation 48780 3Taxliability 48810

CGT913 48425 s58TCGA1992

Reviewsandappeals

Thecurrentsystemofappealstotribunalsandthencetothecourts,whichcoversalltaxes, wasimplementedon1April2009.Therearealsoproceduresforrequestinganinternal reviewbyHMRCifthetaxpayerdoesnotwishtogodirectlytoappeal.

MEMOPOINTS 1.Someoffencesdidnotcomeunderthecurrentpenaltyregimeuntil1April 2010butanyappealsagainstadecisionmadebyHMRCsince1April2009havehadtobemade underthecurrentappealsprocess.Fordetailsofthepenaltyregimesee¶96000+. 2.Appealscommencedunderthepreviousprocedurewereautomaticallytransferredtothecurrent system.

Structureoftheappealandtribunalsystem

ThetribunalsystemisunderthecontroloftheMinistryofJustice.ThereisaFirst-tier Tribunal,appealsfromwhich(ifpermitted)aremadetotheUpperTribunal.EachTribunal isdividedintochambersresponsibleformattersacrosslegislationformerlydealtwithin separatetribunals.DirectandindirecttaxmattersaredealtwithintheTaxChamber, whereastaxcreditsaredealtwithintheSocialEntitlementChamberandappeals concerninglandvaluationsmustbemadetotheLandsChamber(oftheUpperTribunal).

TheFirst-tierTribunalhearsmostappealsinthefirstinstancebuttheTribunalPresident candeterminewhethertheinitialappealshouldbeheardbytheUpperTribunalbecause ofitscomplexity.

TheUpperTribunalhearsappealsonpointsoflawfromdecisionsmadebytheFirst-tier Tribunal.AppealsagainstadecisionmadeintheUpperTribunalareheardbytheCourtof AppealbutconsentmustbegivenbytheUpperTribunalor,ifitiswithheld,directlybythe CourtofAppeal,beforeanysuchappealcanbeheard.AppealsfromtheCourtofAppeal aremadetotheSupremeCourt(formerlytheHouseofLords).

Witheffectfrom24April2017theFirst-tierTribunal(Tax)inScotlandwasabolished.Its functionsandmembersweretransferredtoanewTaxChamberwithintheFirst-tier TribunalforScotland(whichpreviouslyonlyheardcasesonlandandbuildings transactiontax).TheUpperTribunal(Tax)wasabolishedonthesameday;itsfunctions andmembersweretransferredtothenewUpperTribunalforScotland.

A.Directtaxmodel

Taxpayershave30daysfromthedateofataxassessment,orthedatetheyarenotifiedthat aself-assessmenttaxreturnhasbeenamended,tonotifyHMRCthattheydonotagreewith theassessment,oramendment.

IfitispossibletoreachanagreementwithHMRCatthisstage,nofurtheractionis required.Ifitisnotpossibletoreachanagreement,thetaxpayerwillhavethefollowing options: –appealtothetribunal;or –requestthatHMRCcarryoutaninternalreviewofthedecision. HMRCalsohasthepowertoofferaninternalreviewofthedecision. TaxpayerswhodonotwishHMRCtocarryoutareviewcanappealtothetaxtribunalat thesametimeasnotifyingHMRCthattheydonotagreewithHMRC’sdecision.

SECTION2

OTHERREFORMSHARMONISEDADMINISTRATION1631 98155 Tribunals,Courts andEnforcement Act2007; CM¶54125+ 98160 98225 ss31and49A-49I TMA1970

Internalreview

Aninternalreviewofthecasefordirectandindirecttaxesisconductedbyanofficerfrom HMRCwhoisunconnectedwiththecase Reviewsaretosomeextentsubjectiveandtheextentofthereviewofeachcasetakesinto accountthelevelofscrutinyreceivedbythefirstdecision.

Ifataxpayerrequestsaninternalreview,oracceptstheofferofareview,HMRChas45 daysfromthedateoftherequesttocarryoutthereview,unlessalongerperiodisagreed. Thetaxpayercannotappealtothetaxtribunalduringthe45-dayperiodofthereview.Itis onlypossibletoappealtothetribunaloncethe45-dayperiodhaselapsedor,ifearlier, oncethereviewhasbeencompleted.Inthiscircumstanceanyappealtothetribunalmust bewithin30daysofthedateofthenotificationofthereviewfindings,ortheexpiryofthe 45-dayperiod.

MEMOPOINTS TaxpayersshouldbeawarethatifHMRCdoesnotnotifythetaxpayerofthe outcomeofthereviewwithin45days(oranylongeragreedtimelimit),theoriginaldecisionis treatedasbeingtheoutcomeofthereview.The30-daytimelimitforappealingtothetaxtribunal thereforerunsfromthedaywhenthetimelimitforthecompletionoftheinternalreviewexpires.

Taxpayersandadvisorsneedtokeepthistimelimitunderreviewtoensurethatthedeadlinefor appealingtothetaxtribunalisnotmissedbecauseofalackofresponseonthepartofHMRC.

CommentGuidanceprovidedbyHMRCstatesthatthenatureandextentofthereview willdependonthecircumstancesineachcase.Theguidancestatesthatthereviewofficer willconsiderwhatlevelofscrutinytheoriginaldecisionreceivedandtheinputfrom specialiseddepartmentsbeforeitwasnotifiedtothetaxpayer.Thiswouldseemtosuggest thatthemorescrutinyandtimespentonthefirstdecision,thelessdetailedthereviewat thesecondstagewillbe.

Thereviewprocedurecoversallappealablemattersthatarecapableoffurtherreview.

Appealingtothetribunal

Anappealmaybemadebythepersonwhoisthesubjectofthedecision,orapersonal representativeortrustee.Incertaincasesotherinterestedpartiesmayalsobeableto appeal.Itispossibletoappealtothetribunalatvariousstagesthroughthenegotiation process,including: –atanytimeaftersendingHMRCanobjectiontotheinitialdecision,providedthatitis beforethetaxpayerhasrequested,oraccepted,theofferofareview;or –within30daysofthenotificationoftheconclusionofthereview,ortheexpiryofthe reviewperiod.

Itisalsopossibletoappealtothetribunaloncethestatutorytimelimitshaveexpired.The taxpayermustrequestpermissionfromthetribunaltograntleavetoappealoutoftime.

MEMOPOINTS

1.Anyappealtothetribunalmustbemadeinwriting

2.Thetaxpayer’srepresentativecanappealonthetaxpayer’sbehalf

3.TheappealmustbesentfirsttoHMRCbythetaxpayer(thisisdifferentfromtheindirecttax procedure-see¶98285+).

4.HMRCcannotaskforadirecttaxappealtobeconsideredbythetribunal.Itmustfirstoffera review

PaymentoftaxAtaxpayercanapplytoHMRCtopostponethepaymentofthedisputed tax.IfHMRCrefusestopostponepaymentofthetaxitclaimsisdue,itwillnotifythe taxpayer,whothenhas30daystoappealtothetribunalforapostponement(¶98380).

Ifthematterissubjecttoafurtherappeal,totheUpperTribunalorbeyond,anytaxdue,or duetoberepaid,shouldbepaidbasedonthedecisionofthefirsthearing If,aftertheappeal,theresultisthattoomuchtaxhasbeenpaidbythetaxpayer,the overpaymentwillberepaidwithinterest.Iftoolittletaxhasbeenpaid,theexcessbecomes payable30daysafterHMRCissuesanoticeofthetotalamountpayable

1632HARMONISEDADMINISTRATIONOTHERREFORMS 98230 98235 98240 98245 SI2009/273rule20; ARTG8210 98250 98255

B.Indirecttaxmodel

Theindirecttaxmodelbroadlyfollowsthedirecttaxmodel. WhenHMRCnotifiesataxpayerofanappealabledecision,italsonotifiestherightto appealandoffersareviewofthedecision.Thetaxpayerhas30daysfollowingnotification toappealtothetribunal,oraccepttheofferofareview.Thetaxpayercannotdobothatthe sametime.

MEMOPOINTS

1.ThetimelimitforHMRCtonotifythetaxpayerofitsdecisionisthesameas underthedirecttaxmodel(¶98235).

2.Therulesforlateappealsarealsoinlinewiththedirecttaxmodel(¶98245).

3.Notethattheappealismadetothetribunal,whereasadirecttaxappealissentfirsttoHMRC (¶98245).

Undertheindirecttaxmodelitisnolongerrequiredthatallreturnsandpaymentsof outstandingVATaremadebeforeanappealcanbeheardbythetribunal.However, taxpayersmustpaythedisputedVATbeforethetribunalhearing,unlesstheycan successfullyshowthatpayingtheVATwouldleadtounduehardship. Thereareexceptionstotheabove,primarilyaimedatpreventingmissingtraderfraud (¶79320),includingwhere: –anNItraderisinvolvedinacquisitionsfromEUmemberstates(¶85080); –securityhasbeenrequestedbyHMRC(¶87805); –jointandseveralliabilityhasbeenestablishedinthesupplychain(¶87815+); –apenaltyhasbeenleviedundertheinformationpowers(¶97050);or –anassessmenthasbeenraised(¶87725).

UnderpreviouspracticeHMRCdidnotnormallyseekcostswhenrespondingtoanappeal attheVATtribunal,unlessitfeltthattheappealwasfrivolous,orthatitwasprotectingthe publicrevenue.Underthecurrentsystemthisisnolongerthecaseanditislikelythat HMRCwillseekcostsfromtaxpayerswhensuccessful.However,thatassumesthatcosts canbeawardedinthefirstplace.Thegeneralruleisthatnocostsareawardedbythe First-tierTribunalbutfurtherdetailsaregivenat¶98455.

AtaxpayerwholosesanappealintheFirst-tierTribunalbutisgrantedleavetoappealto theUpperTribunalmustpaythetaxdeterminedbyHMRCasaresultoftheFirst-tier Tribunaldecision.Paymentisduewithin30daysofHMRCnotifyingthetaxpayerofthe amountoftaxandinterestdue.Ifthetaxpayerissuccessfulatalaterappeal,thetax alreadypaidwillberepaid,withinterest.

IfHMRClosesanappealintheFirst-tierTribunal,itisrequiredtorepaythetaxpayerany taxthathasbeenwithheld.AsanexceptiontothisruleHMRCcanrequestpermissionfrom thetribunalnottopaythetax,subjecttoalaterappeal,onthegroundsofrevenue protection,orifsecuritywouldberequired.

SECTION3

Tribunalprocedure

Therulesfordealingwithanappealincludeanoverridingobjectiveforthetribunaltodeal withcasesfairlyandjustly.Thismeansthetribunalmustavoidunnecessaryformalityand delays(asfaraspossible),mustconsiderthecomplexityoftheissuesandresourcesofthe parties,anduseanyspecialexpertiseeffectively.Thereisanobligationonthepartiesto helpthetribunalinachievingtheoverridingobjectiveandtoco-operatewiththetribunal generally.Thetribunalshouldencouragethepartiestousealternativedisputeresolution methodsifthatwouldresolvethemattermorequicklyandcheaplythanpursuingthe disputethroughthetribunalsystem.

98295

98300

98350 SI2009/273 rules2,3; ADRG; CM¶54335+

OTHERREFORMSHARMONISEDADMINISTRATION1633

ss83-83G

98290

98285

VATA1994