Part1:Corporationtax

Part2:Incometax

Part3:PAYEandNIC

Part4:Capitalgainstax

Part5:Inheritancetax

55000Generalprinciples

56000Lifetimetransfersofvalue

57000Transfersondeath

58000Nationalheritageproperty

59000Reliefs

61000Overseasissues

62000Anti-avoidancemeasures

63000Administration

65000Generalprinciples

Part6:Trusts,settlementsandestates

66000Taxationofestates

67000Incometaxandtrusts

68000Capitalgainstaxandtrusts

69000Inheritancetaxandtrusts

71000Overseastrusts

72000Administration

75000Firstprinciples

76000RegisteringforVAT

77000Supplies

79000Inputtax

81000RoutineVAT

82000Specificsituations

Part7:Valueaddedtax

83000Specialaccountingmethods

84000Landandbuildings

85000Cross-bordertransactions

87000Administration

90000Stampdutylandtax

93000Stampduty 94000Stampdutyreservetax

Part8:Stamptaxes

Part9:Harmonisedtaxadministration

95000Scopeofharmonisation

96000Penalties

97000Powersandprocedures 98000Otherreforms

99000Appendix 99990Tableofcases Index

Generalinformation

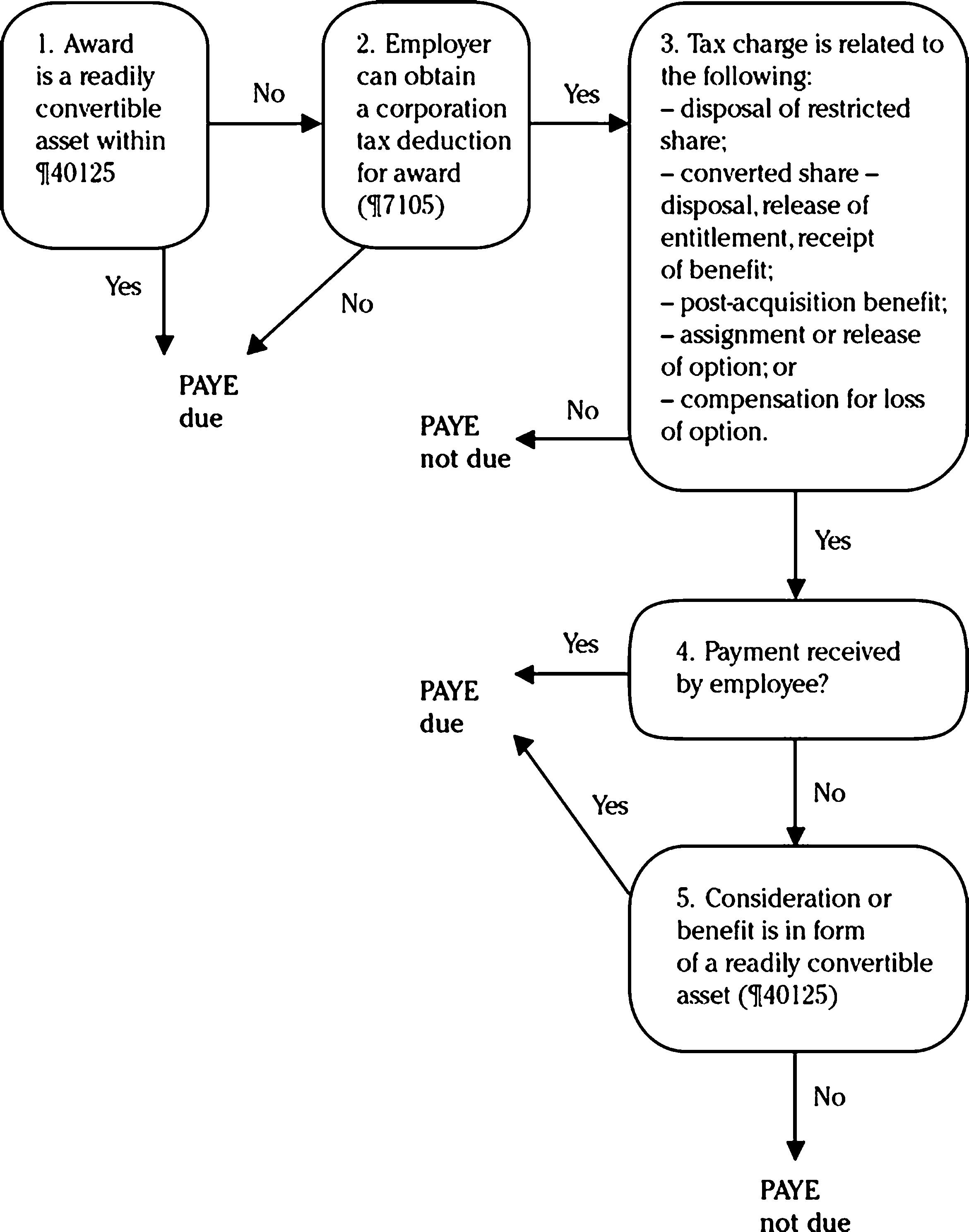

ThefollowingdecisiontreeisusefulwhendecidingwhetheraneventcreatesaPAYE liability:

Notionalpayments

Anemployeewhoreceivessharesotherthanunderatax-advantagedscheme(including options)willbetreatedasreceivinganotionalpaymentwhichisliabletoPAYE. WherethereisinsufficientincomefromwhichtodeductthenecessaryPAYEforthe particularpayinterval(¶40155),theemployermustpaytheextraPAYE,andthenrecoverit fromtheemployee.TheemployeemustmakegoodtheextraPAYEwithin90daysafterthe endofthetaxyearinwhichthenotionalpaymentistreatedasmade.Ifnot,additional incometaxandNICwillbedueontheextraPAYEpaidbytheemployer,whichitself effectivelybecomestaxableincomeoftheemployee.

EXAMPLE MrCreceivessharesfromhisemployeron1SeptemberandisliabletorelatedPAYEof £5,000.Hisnormalsalaryis£3,000permonth,whichleavesashortfallof£2,000astheusual50% limitonPAYEdeductions(¶40510)doesnotapplyhere.

MrCreimburses£2,000tohisemployeron5May,withinthe90-daylimitaftertheendofthetax year,andsonoothertaxchargesarise.

However,ifMrConlyreimbursedhisemployeron8July,outsideofthe90-daylimit,the£2,000 itselfwouldbedeemedtobeemploymentincome,withincometaxandNIC(atindicativerates) dueasfollows(assumingheisahigherratetaxpayer).Hewouldneedtodeclarethisincomeonhis self-assessmenttaxreturn.

5.Highincomechildbenefitcharge(HICBC) TofallwithintheHICBC’sscope,therearetwoconditionswhichmustbesatisfied,both lookingatdifferentperiodsoftimeandpotentiallydifferenttaxpayers:

a.someoneinthefamilyunitreceiveschildbenefitforatleastoneweekinthetaxyear. Therecipientmightbethetaxpayer,theirpartner,orathirdpartywhocontributestothe welfareofachildlivingwiththetaxpayer(e.g.anex-partnerwholiveselsewhere);and b.theclaimantortheirpartnerhasadjustednetincome(¶36340)inthetaxyearofmore than£60,000for2024/25(2023/24:£50,000).

MEMOPOINTS 1.Partnersforthispurposemeanspersonswhoareeither: –married,orlivingtogetherasiftheyweremarried;or –civilpartners,orlivingtogetherasiftheywerecivilpartners.

2.Ifthechildisnotlivingwiththeclaimantandtheclaimantisnottaxableonthebenefit,the personwithwhomthechildlivesbecomesliableiftheiradjustednetincomeexceeds£60,000.

3.ChildbenefitentitlementisnotamatterdealtwithbyHMRC.Anagentortaxadvisortherefore needsaseparateformofauthorityinordertodealdirectlywiththeChildBenefitOffice.Aform CH995hasbeenpublishedforthispurposeandisavailableonlineattiny.cc/tm30490.

4.Benefitsarisingafterthedeathofthechildareignored.

Practicalimplications

Whereeitherindividualinacouplehasadjustednetincome: –below£60,200,noHICBCwillariseduetotheroundinginthecalculation;or –ofatleast£80,000,thefullamountofanychildbenefitclaimedwillbewithdrawnbythe HICBC.Inmanycases,parentschoosetooptoutofchildbenefitpayments(¶30498).

OneofthecommonissuesaffectinghigherpaidemployeesisignoranceoftheHICBC, especiallyforthosewhoonlypaytaxunderPAYEandhavehadnopreviousneedtonotify liabilitytoincometaxorindeedanyspecificinteractionwithHMRC.

Unfortunately,discoveryassessmentsareviableinrespectofcaseswhereachildbenefit claimanthasfailedtonotifyliabilitytoHICBC.Thisstatutorychangewasintroducedwith retrospectiveeffectbutexcludingthosewhosubmittedarelevantappealtoHMRConor before30June2021.

EXAMPLE

1.HMRCraiseddiscoveryassessmentsinrespectoftheHICBCeventhoughthetaxpayerdidnot submitaself-assessmenttaxreturnfortheyearsinvolved.

ItwasheldthatastheHICBCisnotincomewhichoughttohavebeenassessedtoincometax,it isoutsidethescopeofanydiscoveryassessment(beingafreestandingcharge)underthelawas itstoodatthetime.HMRCvWilkes[2022]

2.InanappealagainstapenaltyfornotnotifyingtheHICBC,itwasheldthatthetaxpayerhada reasonableexcusedefence.EventhoughHMRChadsentanudgeletter,thetaxpayerstatedhe hadneverreceiveditandthereforewasneverspecificallyinformedaboutthepossibilityofthe charge.Goodall[2023](TC08680)

3.ThetaxpayerwastoldbyHMRCthathecouldnotappealadiscoveryassessment.Asaresult, hemissedthecrucialdateof30June2021.

Itwasheldthathehadbeenmisdirected.Asaresult,thejudgeadvisedHMRCtotreatthetaxpayer asifhehadmadeavalidappealbeforethedeadline.Kensall[2023](TC08673)

4.Ataxpayerwasunawarethathispartnerwasalreadyclaimingchildbenefitinrespectofachildfrom apreviousrelationship.TheymaintainedcompletelyseparatefinancesandwerebothwithinPAYE.When aHMRCnudgeletterabouttheHICBCwasreceivedin2019,hepassedittohispartnerwhorangHMRC tocancelherchildbenefitclaim.Bothindividualsthoughtthatwastheendofthematter.

However,HMRCsubsequentlyraisedHICBCassessmentsonthetaxpayerfor2016/17to2019/20 whenhistaxableearningsexceededthethresholdof£50,000.

ItwasheldthatthetaxpayerhadareasonableexcusefornotdeclaringtheHICBC,ashewas unawareofhispartner’sfinancialpositionandhadnotbeencareless,whichhadthefollowing results: –thepenaltiesforfailuretonotifywerecancelled;and –theassessmentsfor2016/17and2017/18wereoutoftime.Lee[2023](TC08872)

5.Ataxpayerhadfailedtoregisterforself-assessmentdespitereceivingchildbenefitandearning incomeinexcessof£50,000inseveraltaxyears,soHMRCraisedassessmentsforHICBC. However,althoughanofficerofHMRCwasidentifiedasthepersonwhohaddiscoveredthelapse, hewasnotnamedontheassessmentswhichwereissuedbytheHICBCteam. Itwasheldthatastheofficerwhomadethediscoverymustissuetheassessment,allthe assessmentswereinvalid.Thetaxpayer’sappealwasallowedinfull.Brown[2024](TC09914)

Sch9paras125,126 FA2024

Sch9paras125,127 FA2024

D.Schemesize

Between6April2006and5April2023,therewasanupperlimitonthetax-advantagedlevel offundingimposedbythelifetimeallowance.Whilethelifetimeallowancetechnicallystill appliedin2023/24,andlifeallowancechecksstillneededtobecompleted,nospecifictax chargewasleviedonexcesspensionbenefits.

CommentTheremovalofthelifetimeallowancemayonlybetemporary.Those individualswithwell-fundedpensionschemesshouldtakeprofessionalfinancialadvice whenconsidering: –rejoiningtheiremployer’sscheme; –restartingcontributions;or –thedateofretirement.

Whatevertheincometaxconsequences,itshouldberememberedthatapensionscheme isausefulshieldfromIHT.

1.2024/25onwards

From6April2024,thelifetimeallowanceisabolished.Insteadofalimitonthepension funds,therearespecifiedlimitsonlumpsumbenefits(¶30912+)only.Allbenefit crystallisationeventsrelatingtotakingincomeandtheage75testareremoved.

Takingbenefitsin2024/25

Whilethepreviousregimereliedonthelimitingfactorofthelifetimeallowance,thishad theunintendedimpactofdiscouraginganycontinuationofworkforthosenearing retirementage.

From6April2024,onlylumpsumbenefitsmustbecheckedagainstthetax-freeallowances asshowninthetablebelow.Eachlumpsumwillreducetheallowancesavailableforfuture benefits.Theseamountswillalsobedependentonanytransitionalprotections(¶31100+) andwhetheranybenefitshavealreadybeentakenbefore6April2024.

MEMOPOINTS 1.Thereisnoprovisioninthelegislationfortheupratingoftheseallowancesto takeaccountofinflationetc

2.Everytimealumpsumistaken,thisisofficiallyknownasarelevantbenefitcrystallisation event

3.Fortheoverseastransferallowance,see¶31358.

Benefitsalreadytakenbefore6April2024

Anybenefitstakenbefore6April2024willreducetheavailableLSAandLSDBA Ifanylifetimeallowancewasunutilised,theLSAwillbereducedby25%ofthelifetime allowanceused.Wherenolifetimeallowanceremainsat6April2024,noLSAwillapply

However,itmightbebeneficialforthetaxpayertoapplyforacertificatetoconfirmthe previousamountspaidouttaxfreeasthiscouldresultinanimprovedLSAi.e.wherethe tax-freeportionwasactuallylessthanthedefaultcalculationof25%(¶30995).

CommentAsthelegislationiscomplex,itisvitalpensionmembersobtainexpert financialadvice

EXAMPLE By6April2024,MrAhasused40%ofhislifetimeallowanceof£1,073,100.

Calculation

Whereanindividualhasaself-employmentandisalsoemployed,thefollowingexample showsthestepswhichshouldbefollowedinordertocalculatethemaximum contributionsdue

EXAMPLE MrCisemployedandearns£44,000.Heisalsoself-employed,withprofitsof£60,000. MrCwillhavepaidthefollowingNICin2024/25: Employment-Class1

Self-employment Class4

ThemaximumNICliabilityforMrCiscalculatedasfollows:

Step1:Calculatethenotionalmaximum

Step3:CalculatetheamountofClass1 paidat8%:

Asthisresultifnegative,thisstepistreated asnil

Step4:MultiplyStep3by100/6

Step5:Subtractthelowerprofitslimitfrom theupperprofitslimit,ortheactualprofits ifthisislower:

Step6:SubtractStep4fromStep5 37,700-Nil

Step7:Take2%ofthefigureinStep6 37,700@2%

Step8:Calculatetheamountbywhichthe profitsexceedtheupperprofitslimitand take2%

Step9:AddSteps3,7and8toobtainthe maximumClass4liability

Step10:AddintheClass1NICdue: Class4perStep9

MrCwillthereforebeduearefundof£1,508.(4,971.00-3,463.00)

SI2001/1004 reg100; NIM24175,24176

CHAPTER5 RoutineVAT

ThischaptercoversthebasicVATcompliancerequirementsforrecord-keeping,aswellas someofthesimplificationoptions.ForfurtherdetailandanalysisseeVATMemo

TheVATliabilityofconstructionservices,andsuppliesinthecourseofrefurbishment, reconstruction,repairandmaintenance,dependsonthetypeofbuildinginvolvedandin somecasesonthecustomer

ThefollowingtablesummarisestheVATliabilityofcommonsupplies:

Property involved Typeofsupply Details

New buildings

Suppliesinthe courseof construction

Supplies involvingthe property

Landand existing buildings Workscarried outonthe property

Commercialproperty(less than3yearsoldtobe“new”)

Domesticproperty1

Freeholdsalesofcommercial propertylessthan3yearsold

¶84225

¶84230+

¶84430

Grantofleaseorother interestincommercial property Exempt,unlessoption totaxapplies2 ¶84650

Firstsaleorgrantoflong leaseindomesticproperty1 Zero-rated ¶84435

Suppliesinthecourseofthe conversionofa non-residentialpropertytoa residence

Suppliesforaresidential conversionwhencustomeris ahousingassociation

Suppliesforthe refurbishmentofempty premisestoprovidea residence

Supplies involvingthe property

¶84585

¶84590

¶84600

Constructionservicestoalter aprotectedresidential building Standard-rated ¶84610

Chargingfortheprovisionof: –sleepingaccommodation; –parkingspaces;and –seasonalpitchesfortents andcaravans

¶84645

Freeholdsalesofcommercial property3yearsoldormore Exempt,unlessoption totaxapplies2 ¶84690

Leaseofcommercial property Exempt,unlessoption totaxapplies2 ¶84650

Saleoffreeholdindomestic property1 Exempt

Leaseofdomesticproperty1 Exempt

Firstsaleorlongleaseofa convertedresidence

Firstsaleorlongleaseofa substantiallyreconstructed protectedresidence

¶84720

¶84725

Note:

1.Forthispurpose,domesticpropertymeanseither: –abuildingdesignedasadwelling; –apropertyusedorintendedtobeusedforarelevantresidentialpurpose;or –apropertyusedorintendedforusebyacharityfornon-businesspurposes.

2.Itispossibletoopttotaxanon-domesticpropertysothatanyfuturesuppliesrelatingtothatpropertyare standard-ratedratherthanexempt.Forfurtherdetailssee¶84755.

Calculationofthecharge

TheSDLTcalculationisdeterminedbyreferenceto:

a.theeffectivedateofthetransaction; b.theconsiderationpaid;and

c.whethertheusemadeofthepropertyisresidentialinwhichcasetherearefurther criteriainvolving: –naturalornon-naturalpersons;and –thepurchaser’sresidency

Specialrulesapplyfor: –linkedtransactions(¶90830); –aseriesoftransactionswhichresultinareducedSDLTcharge(¶90860);and –transactionswheretheconsiderationincludesrenti.e.leases(¶90900+).

MEMOPOINTS 1.ScotlandandWaleshavetheirownratesofLBTT(¶92260+)andLTT(¶92360+) respectively 2.WherealandtransactionissubjecttoacombinationofSDLT,LBTTand/orLTTthe considerationshouldbeapportionedonajustandreasonablebasistodeterminethecorrecttax payable(¶90090).

I.Saleandpurchase

TheratesofSDLTdifferdependingonthecircumstancesofthepurchaserandwhetherthe landisresidentialornon-residential.

A.Determiningthetypeofuse

Definitionofresidential

ForSDLTpurposes,residentialpropertyisdefinedas:

a.abuildingthatisusedas,orissuitableforuseas,adwelling,orisintheprocessof beingconstructedoradaptedforsuchuse;and b.landthatformspartofthegardenorgrounds,andanyoutbuildings.

MEMOPOINTS Undevelopedlandisessentiallynon-residentialbutmayberesidentialpropertyif, attheeffectivedate,aresidentialbuildingisbeingbuiltonit.

Dwellings

Thedefinitionofdwellingsincludesresidentialaccommodationfor:

a.schoolpupils; b.membersofthearmedforces; c.students(excludinghallsofresidence);and d.accommodationwhichisaninstitutionthatisthesoleormainresidenceofatleast90% ofitsresidentsexcluding: –children’shomes; –residentialinstitutionsforthecareofpersonswhoareold,disabled,haveadrugor alcoholdependency,orhaveapastorpresentmentaldisorder; –hospitalsorhospices; –prisons;

–hotels,innsorsimilarestablishments;and –studenthallsofresidence

MEMOPOINTS 1.Wheresixormoreseparatedwellingsarethesubjectofasingletransaction, thetransfersaretreatedasnonresidentialtransactionsforSDLTpurposes.

2.Notethatwheremultipledwellingsrelief(¶91610+)isclaimedthentheresidentialratesof SDLTapplytotheconsideration.Effectively,abuyercanchoosewhethertoapplythenon residentialratesorclaimmultipledwellingsreliefupuntil31May2024.

Whereabuildingisnotinuse,theuseforwhichitismostsuitablewilloverrideanyother. Apropertywhichisnotsuitableforoccupationasadwellingcannotbephysically habitable.

EXAMPLE

1.Asem-derelicthousewasfoundnottobe“suitable”foruseasadwellingasithadnoformof heating,oldelectrics,adatedkitchenandbathroom,andtherewasasbestospresent.PNBewley Ltd[2018](TC06951)

2.Incontrast,theUpperTribunalheldthatthesuitableforusetestdoesnotmean“readyfor immediateoccupation”andsodisrepairatthetimeofpurchase(heatingnotworking,damp problemsandflooringneededreplacing)didnotmeanapropertywasnotsuitableforuseasa dwelling.FianderandBrowervHMRC[2021]

3.Asimilarconclusionwasreachedinthecaseofavandalisedrodent-infestedpropertywithno utilitiesandrainwaterleakingintotheproperty.

Itwasheldthatthebarforapropertytobeunsuitableforuseasadwellingwassetveryhigh,and thatabuildingrecentlyusedasadwelling,capableofbeingsousedagain,andnotintheinterim adaptedforanotheruse,wasstilladwellingforSDLTpurposes.Mudan[2023](TC08777)

4.Defectivecladdingofabuildingdidnotrenderaflatunsuitableforuseasadwelling, notwithstandingtheGrenfelltowerdisasterandthe18monthsittookforremedialworkstobe completed.

Itwasheldthattorenderaproperty"unsuitable",defectsneededtobesufficientlyseriousthata reasonablepersonwoulddecideagainstoccupation.AflatwhichwasnotcompliantwithBuilding Regulationsdidnotmaketheflatunsuitableforuse,andneitherthelocalauthoritynorthefire authorityhadprohibitedoccupationoftheflat.FishHomes[2020](TC07666)

Gardenorgrounds

HMRCtakesintoaccountavarietyoffactorswhendeterminingwhetherlandformspartof thegardenorgroundsofadwelling,including: –theuseofthelandinrelationtothedwelling; –thelayoutofthelandandanyoutbuildings; –thephysicalproximityofthelandtothedwelling; –thesizeoftheland;and –anylegalconditions-whetherpublicorprivatelaw-thatinhibitorpermitcertainuses. LandfallingoutsideofthedefinitionofgardenorgroundswillbetreatedasnonresidentialandpotentiallybenefitfromthelowerSDLTrates.Inevitablythishasledtoa numberofcasesinvolvingresidentialpropertieswithextensivegrounds.

EXAMPLE

1.Inonecase,thetaxpayersacquiredafarmhousewith3.5acresofland,includingabarn housingatractor,afieldandpublicbridleway.ASDLTrepaymentclaimwassubmittedonthe basisthepropertywasmixeduse.Inajoinedcase,asixbedroomhousewassetin4.5acresof landwithastableyard,garageandpaddocks. TheCourtofAppealruledthatlandcanstillbe“gardenorgrounds”forSDLTpurposesevenifitis ofsuchasizethatforCGTpurposesitwouldnottoberequiredforthereasonableenjoymentofthe dwelling(¶51960).Thereforetheentiretyofbothpropertiesandsurroundinglandwereclassedas residentialforSDLTpurposes.HymanandanothervHMRC;GoodfellowandanothervHMRC[2022]

2.AtaxpayerhasalsobeenunsuccessfulinarguingthataleaseholdinterestinaLondonflatwas misclassifiedasresidentialbecauseitgavearighttoaccessacommunalgarden.Sexton[2023] (TC08708)

3.TheFirst-tierTribunalhasheldthatadwelling-houseandanindependentannexe,surrounded byapproximately39acresofgardens,fields,andwoodlands,wasmixeduseproperty. Inparticular,thecommercialgrazinglandandwoodlandsubjecttoa“rewilding”agreementwith

90570

theWoodlandTrustwerenotgardensorgroundsofadwellingastheydidnotsupporttheuseof adwelling.Withers[2022](TC08649)

Note:HMRChasstatedthatitdoesnotagreewiththefindingsinthiscaseandthatitdoesnotset anylegalprecedent.

4.Thetaxpayeracquiredafarmhousewhichhadadjoiningfieldsandextensiveequestrian facilities.

TheFirst-tierTribunalstatedthatitwouldbesufficientifitcouldbeshownthatatleastoneofthe fields,orindeedjustpartofone,didnotformpartofthegroundsofthefarmhouse.However,the fieldsprovidedanamenityfortheenjoymentofthedwellingandsoproperlyformedpartofthe farmhouse’scurtilage.Holding[2024](TC09141)

5.Aluxurypropertypurchaseincludedanadjoiningpaddockwhichhadaseparateregistered title.Onthedayofpurchase,butaftercompletion,thispaddockwaslettoaneighbourundera grazinglease.

TheFTTdecidedthepaddockwasnotpartofthegroundsforthefollowingreasons: –thepaddockcouldnotbeseenfromthedwelling; –theonlyaccessfromthepropertywasthroughasmallgate; –thepaddock'sseparatetitle;and –thelackofintegrationofthepaddockwithintheremitoftheproperty.

TheUpperTribunalagreed,statingthattheFTT'sdecisionwasnot“rationallyinsupportable”. Commentingonthepost-completionlease,althoughthisprovidedevidenceoftheland'snature andcharacteratcompletion,itisverymuchthestateofthelandatthepointofthepurchase transactionwhichisrelevant.Astheleasedidnotexistatcompletion,itcouldnotbepersuasive whendeterminingtheland'sstatusforSDLTpurposes.HMRCvSuterwalla[2024]

Non-residentialproperties

Non-residentialpropertymeansanypropertythatisnotresidentialpropertyCommon examplesinclude: –shopsandoffices; –forestsandagriculturalland; –propertywhichisnotsuitabletobelivedin;and –sixormoreresidentialpropertiesboughtinasingletransaction.

90575

Amixedusepropertyisdefinedasonewhichincludesbothresidentialandnon-residential elements,suchasashopwithaflatabove.Thenon-residentialSDLTratesapplytothe entireconsiderationfortheproperty’sacquisition.

EXAMPLE Auniquepropertywaspurchasedwhichhadthefollowingseparatelyregisteredtitles:

a.asemi-detachedhousewithgardens;and

b.adjoininglandwithabuildingcalledthe“OldSummerHouse”whichhadbeenpreviouslyused asagarageandanartist’sstudio.

Inabidtoensureamixed-usetransaction(asaresultofprofessionaladvice),acoupleofweeks beforethepurchase,a6-monthleasefornon-residentialoccupation(enforcedbyacovenant)of theSummerHousewasgrantedbythevendorstoaphotographybusiness.Theissuewaswhether theSummerHousewassuitableforuseasadwelling.

Ithadpreviouslybeenheldthatthebuildingwasnotresidentialbutfellwithinthescopeoftheantiavoidancerule(¶90860)sotheleaseshouldbeignored.ThereforetheSummerHouseremained aresidencebuttheentirepurchasewaspotentiallyeligibleformultipledwellingsrelief(MDR).

TheUpperTribunalheldthattheanti-avoidanceruledidnotapplyastheleasehadnoeffectonthe amountofSDLTdue.ThelegalconstraintsontheuseoftheSummerHousewerecontradictory: thecovenantbanningresidentialuseontheonehand,withit’sutilisationasastudioconstitutinga breachofplanningcontrollawsontheother.Asthephysicalcharacteristicsofthebuildingshould begivenmoreweight,itwasphysicallysuitableforuseasadwellingandsotheentirepurchase wasofaresidentialproperty.Onanotherpoint,MDR(¶91610+)wasnotduebecausenoclaimhad everbeenmadeonareturn.HMRCvRidgway[2024]