TAKE A LOOK See

2020 Accountancy and Financial Reporting

what ACCOUNTANCY AND FINANCIAL REPORTING MEMO 2024 looks like on the inside

Part1:Generalaccountingframeworkandprinciples

1Accountingrules,principlesandconventions

200Regulatoryframeworkandgovernancestructure

Part2:Profitandloss

350Statementofcomprehensiveincome

550Revenuerecognition

Part3:Statementoffinancialposition(SOFP)

700Statementoffinancialposition:overview

800Intangibleassetsandgoodwill 1000Researchanddevelopment

1100Property,plantandequipment

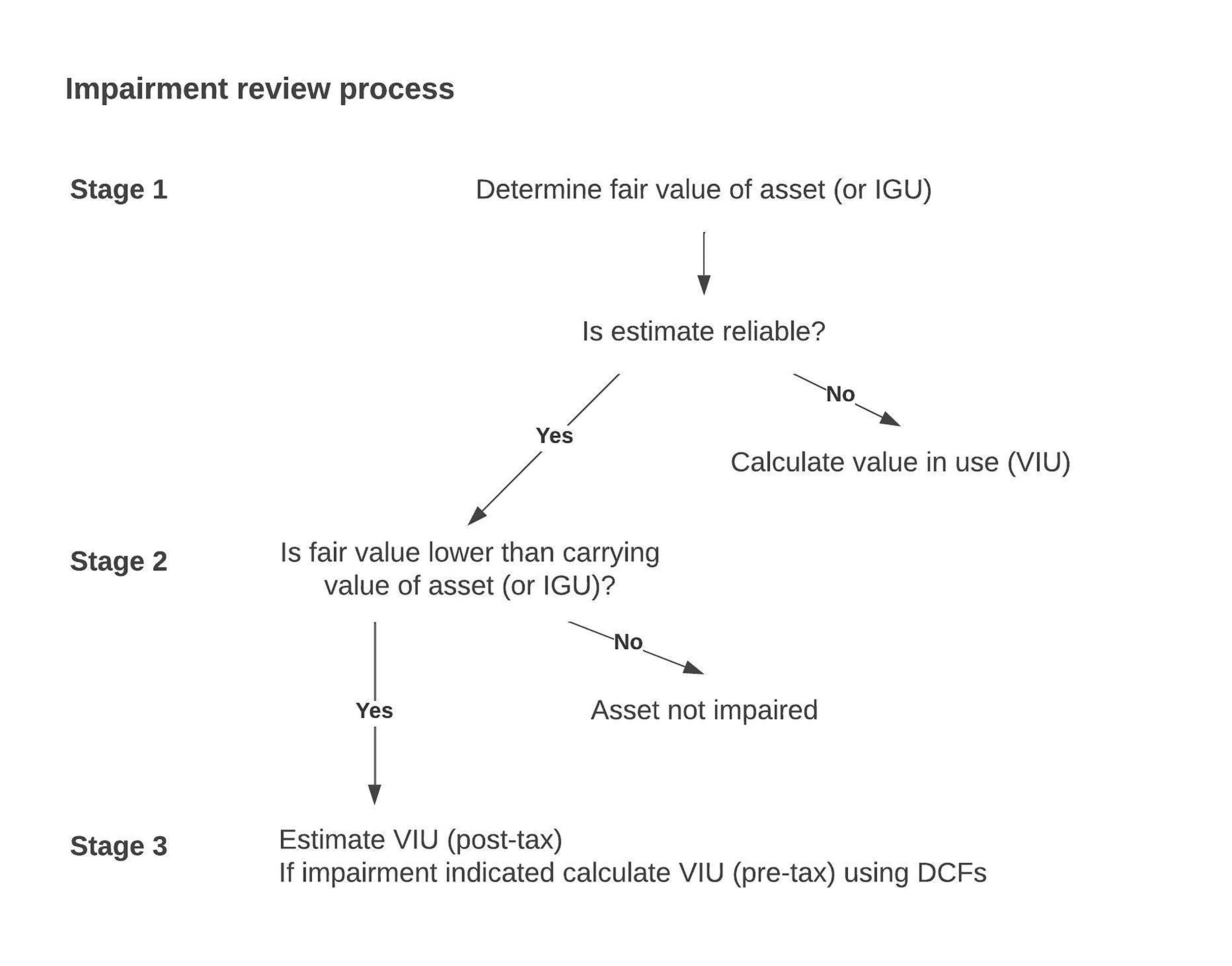

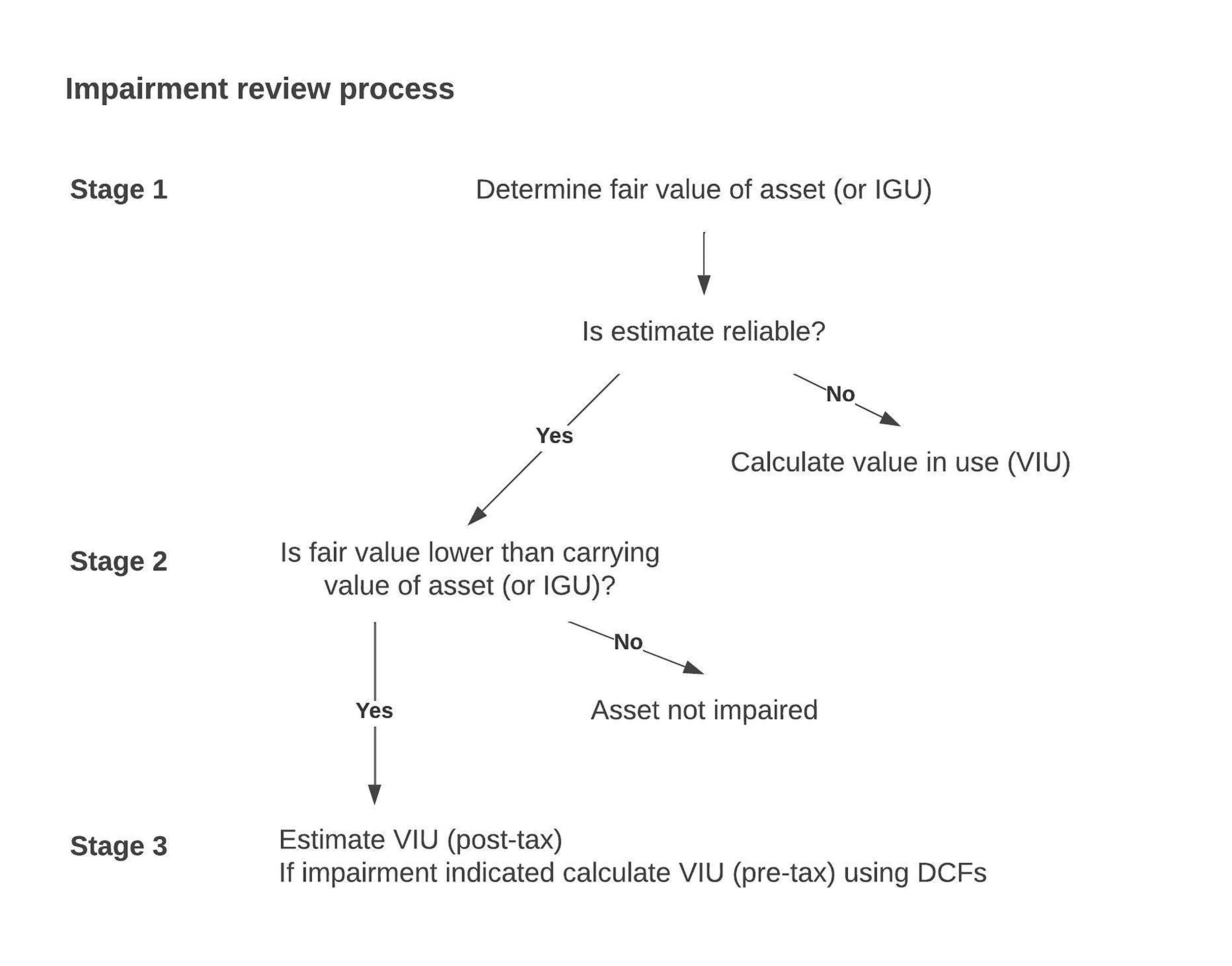

1500Impairmentoffixedassetsandgoodwill 1800Investmentproperties

1950Inventories

2200Long-term(construction)contracts

2400Governmentgrants

2600Borrowingcosts

Part4:Financialinstruments

3000Classificationoffinancialinstruments

3100Basicfinancialinstruments(FRS102)

3700Complexfinancialinstruments

3850Micro-entitiesandfinancialinstruments(FRS105)

Part5:SOFP–Otherliabilities

4000Provisionsandcontingencies

4200Leasingandhirepurchasecontracts

4500Sharecapitalandreserves

Part6:Otherprimarystatements,reportsanddisclosures

5000Statementofcashflows

5300Statementofchangesinequity,incomeandretainedearnings

5400Directors’reports

5600Directors’remuneration

5800Relatedpartytransactions

6000Eventsaftertheendofthereportingperiod

6200Auditingandauditors’reports

6320Ratioanalysis

Contents

V

6500 Generalrequirements

Part7:Groupaccounts

6700 Formandcontentofgroupaccounts

6900 Businesscombinations

7100 Disposals

7300 Associates

7400 Jointventures

Part8:Miscellaneous

8000 Foreigncurrencytransactions

8500 Employeebenefits

8800 Share-basedpaymenttransactions

9000 Taxation

9400 Preparationandfilingoffinancialstatements

9600 Dormantcompanies

9700 Notforprofitorganisations

Part9:Modelfinancialstatementsandregulatoryarchitecture

10200Micro-entityfinancialstatements

10400FRS102Section1Aaccounts-smallcompanies 10600FRS102accounts(fullversion)

10800Accountingregulationsandstandards:lists 11000First-timeadoptionofFRS102orFRS105 11100Cashaccounting

Part10:Currenttopicsinfinancialreporting

11600Auditing:technologicaldevelopments

11700Greenfinance

12400Cryptoassets

12550Othertopicalissues

Index

VI

2.EntitiesadoptingFRS102

Thekeyelementsrelatingtorevenuerecognitionaresetoutinthetablebelow.

Subject AccountingtreatmentunderFRS102

Basicprinciples

Discounting

Fordetailonthescope,measurement(see¶575+below).

PermittedunderFRS102.C

Defaultrisk Wheretheriskofdefaultishighandsettlementindoubt, revenueshouldberecogniseduntilreceiptisprobable.

Contractsformultipleservices Revenueisrecognisedusingamethodrepresentingthe stageofcompletion.

MEMOPOINTS TheFRChasissuedaStaffEducationNote(SEN07)illustratingcertainkey requirementsofFRS102relatingtorevenuerecognition,designedtosmoothadoptionofthe standard.

a.Scope

FRS102coversrevenuegeneratedfromthetransactionsinvolving: –thesaleofgoods(internallyproducedorpurchasedforresale)(¶600); –theprovisionofservices(¶606); –franchisefees(¶612); –constructioncontracts(¶2200);and –incomeintheformofinterest,dividendsorroyalties(¶615).

Exclusions

RevenuederivedfromthefollowingsourcesistreatedinothersectionsofFRS102and AccountancyandFinancialReportingMemo,assetoutinthetablebelow

Topic Paragraphreference

Leases

Dividendsandotherinvestmentincomeaccountedforthroughuseof theequitymethod(e.g.associates)

Investmentproperty

Financialassetsandliabilities(changesinfairvalue)

Biologicalassetsandagriculturalproduceandactivity

Insurancecontracts

¶4200+

¶1800+

¶3100+

Beyondthescopeofthis book

Beyondthescopeofthis book

b.Measurement

Thegeneralruleisthatrevenueshouldbemeasuredatthefairvalueoftheconsideration received,afterallowingforanydiscountsorrebates(e.g.trade,volume,prompt settlement).

Onlythegrossinflowofeconomicbenefitsreceivedorthatwillbereceivedbytheentity itselfshouldbeaccountedforasrevenue.Revenuecollectedonbehalfofthirdparties shouldbeexcludedandincludesvarioustaxes(e.g.VAT,salestaxes,goodsandservices taxes).

Serviceagencies(e.g.lettingagents)shouldonlytreatcommissionasrevenueandnot incomecollectedonbehalfoftheprincipal(e.g.landlords)orincludetotalmediaspend intheirbillings(e.g.marketingandmediaagencies).

REVENUERECOGNITION71 570 FRS102 (23.1),(23.16) 575 FRS102(23.1) 578 FRS102(23.2) 580 FRS102(23.3)

MEMOPOINTS 1.Fairvaluerepresentstheamountatwhichgoodsandservicescanbe exchangedinanarm’slengthtransaction,betweeninformedandwillingparties.

2.Righttoconsiderationisdefinedasaseller’srighttotheamountreceivedorreceivablein exchangeforperformanceofacontract.

Multiplegoodsandservices:revenueallocation

FRS102coverstheallocationofrevenuewheremoregoodsandservicesareinvolved.Total revenuegeneratedfromasingletransactionshouldbeallocatedtoeachseparately identifiablegoodorservicecomprisingthistransaction,onthebasisoftheirrelative separatesellingprices,unlessamoreaccuratebasisfordeterminingthesubstanceofthe transactionisavailable

Exchangeofgoodsorservices

Thecriteriaforrecognisingrevenuederivedfromtheexchangeofgoodsorservicesareset outinthetablebelow.

Recognitioncriteria

Revenuecanberecognised where:

AccountingtreatmentunderFRS102

1.Goodsaresoldorservicesareexchangedfordissimilargoodsand servicesinacommercialtransaction.Theentityshouldmeasurethe transactionatthefairvalueofgoodsandservicesreceived, adjustedforthevalueofanycashorcashequivalentstransferred.

2.Wheretheamountcannotbeeasilymeasuredthenitshouldbe accountedforatfairvalueofgoodsandservicesexchanged, adjustedforanycashorcashequivalentstransferred.

3.Wherethefairvalueofeitherthegoodsandservicesreceivedor givenupcannotbereliablymeasured,thenthecarryingamountof thegoodsandservicesprovidedshouldbeusedadjustedforany cashorcashequivalentstransferred.

Revenuecannotbe recognisedwhere:

Deferredpayment

1.Goodsandservicesareexchanged(bartered)forgoodsand servicesofasimilarnatureandvalue

2.Goodsandservicesareexchanged(bartered)fordissimilargoods andservicesbutthetransactionlackscommercialsubstance.

Whencashreceipts(orcashequivalents)aredeferredtheyconstituteatypeoffinancing arrangement.Inthisinstance,theentitymustdeterminethefairvalueoftheconsideration involved,namelythepresentvalueofallfuturereceiptscalculatedbyusinganimputed rateofinterest.Thedifferencebetweenthepresentvalueoffuturereceiptsandthe nominalvalueoftheconsideration(goodsorservices)shouldberecognisedasinterest revenueinlinewiththerevenuerecognitioncriteriagoverninginterest(see¶615),aswell astherequirementsofSection11ofFRS102(basicfinancialinstruments)(¶3100+).

MEMOPOINTS

1.Afinancingarrangementisdeemedtobeinplacewhereanentityprovides interest-freefinancetothebuyer,oracceptsanotereceivablefromabuyer,promisingabelowmarketrateofinterestasconsiderationforthegoods.

2.AnimputedrateofinterestisdefinedinFRS102asthemoreapparentofeither: –theprevailingrateforasimilarinstrumentfromanissuerwithasimilarcreditrating;or –arateofinterestthatdiscountsthenominalvalueofaninstrumenttothecurrentcashpriceof thegoodsorservices.

c.Criteriaforrecognisingrevenue

Thegeneralruleisthatthecriteriafordeterminingrevenuerecognitionshouldbeapplied toeachtransaction.Forlargecontractsortransactions,comprisinganumberofseparate componentsorstages,thiscriteriashouldalsobeappliedwherenecessarytoreflectthe truesubstanceofatransaction.Forexampleifaproductincludesanidentifiableelement ofafter-salesservicing,thiscomponentshouldbeseparatelymeasuredandtherevenue deferredandthenreleasedtoincomeovertheperiodoftheagreement(seetableat¶610).

72 REVENUERECOGNITION

FRS102(23.6-8) 584 FRS102(23.5) 586

581 FRS102(23.3) FRED67(99) 582

Researchanddevelopment

AClassification...................................1002 BAccountingtreatment 1004

1CompaniesadoptingFRS102 1010 2Additionalguidance.........................1015

Thecostsofresearchanddevelopment(R&D)canbedistinguishedfromothernonresearchexpenditurebythepresenceorabsenceofanappreciableelementofinnovation. TheaccountingtreatmentofresearchanddevelopmentistreatedmainlyinFRS102. Micro-entitieselectingtoapplyFRS105mustrecogniseresearchanddevelopment expenditureinprofitorlosswhenincurred.

A.Classification

Researchanddevelopmentexpenditurecanbedefinedandgroupedunderthefollowing classifications:

Researchclassification Characteristics

Pureresearch

Appliedresearch

Developmentcosts

Pureresearchisexperimentalortheoreticalworkundertaken primarilytoacquirenewscientificortechnicalknowledgeforitsown sake,asopposedtoresearchdirectedtowardsaspecificaim.

Appliedresearchisanoriginalorcriticalinvestigationundertakento obtainnewscientificortechnicalknowledgeordevelopexisting knowledgedirectedtowardsaspecificcommercialobjective.

Developmentcostsarethecostsofusingscientificortechnical knowledgeinorderto: –produceneworimprovedmaterials,productsorservices; –installnewprocessesorsystemspriortothecommencementof commercialproductionorcommercialapplications; –design,constructandtestpre-productionprototypes,pilotplants, modelsanddevelopmentbatches; –designandtestproducts,services,processesorsystemsinvolving newtechnologiesorthatsubstantiallyimprovethosealready producedorinstalled; –substantiallyimproveexistingprocessesorsystems; –developnewsurveyingmethodsandtechniques;or –constructoracquirefixedassetstoprovidefacilitiesforR&D activitiesspanninganumberofaccountingperiods.

CHAPTER3

OUTLINE ¶¶

CTaxationissues...............................1040 1Capitalexpenditure 1042 2Revenueexpenditure 1044

125 1000 1002

1010

FRS102(18.14)

ExclusionsThecostsofthefollowingactivitiesshouldnotbeclassifiedasresearch anddevelopmentexpenditure:

1.Testinganalysiseitherofequipmentorproductforpurposesofqualityorquality control;

2.Periodicalterationstoexistingproducts,servicesorprocesses;

3.Operationalresearchnotdirectlylinkedtoaspecificresearchobjective;

4.Repairsandrenewalsexpenditurerelatingtoprocessesduringnormalcommercial production;

5.Marketresearch;

6.Expenditurerelatedtotheactualexplorationofoil,gasandmineraldepositsinthe extractiveindustries;

7.Legalandadministrativeworkconnectedwithpatentapplications,recordsand litigationorthesaleorlicensingofpatents;and

8.Designorconstructionengineeringrelatingtotheconstruction,relocation, rearrangementorstart-upoffacilitiesorequipmentnotdirectlyconnectedtoany particularresearchactivity

B.Accountingtreatment

Thegeneralruleisthatresearchanddevelopmentexpenditureshouldbeexpensedas incurred,althoughcertaindevelopmentcostscanbedeferredifstrictcriteriaaremet.The accountingpoliciesforresearchanddevelopmentexpenditurearebasedonthe“accruals concept”,bywhichrevenueandcostsareaccrued,matchedanddealtwithintheperiod towhichtheyrelate.Researchanddevelopmentcostsmustnotbecarriedforward indefinitely.

1.CompaniesadoptingFRS102

Researchanddevelopmentistreatedgenerallyunderinternallygeneratedintangible assetsandthereisnocleardivisionbetweenpureandappliedresearch.

Initialrecognitiondependsonwhetheraninternallygeneratedintangibleassetsatisfies specificcriteriathatwillallowittobedividedintoeitheraresearchordevelopmental phase.Ifthesetwophasescannotbedistinguishedfromeachother,allcostsmustbe accountedforastheformerandexpensedintheprofitorloss.Costscanonlybe capitalisedandamortisedwhenitisfairlycertaintheinitialresearchwillproduceafuture revenuestream.

1012

Researchclassification Characteristics

Researchphase

Coversexperimentalortheoreticalworkundertakenprimarilyto acquirenewscientificortechnicalknowledge,including: –evaluationofresearchfindingsandprojectselection;or –thesearchforalternativematerials,devices,processes,systems etc.

Developmentphase

RecognitionofR&Dcostsasanintangibleassetispermittedifan entitycandemonstratethatallofthefollowingcriteriahavebeenor willbemet: –theprojectistechnicallyfeasible; –theintangibleassetwillbecompletedforcommercialuseorsale; –marketanalysissupportingsalesprojectionsorrevenuesgenerated frominternaluse;and –adequatetechnicalandfinancialresourcesexisttocompletethe developmentoftheintangibleasset. MEMOPOINTS See¶1022foramoredetailedlistofqualifyingcriteriaforthedevelopmentphase.

126 RESEARCHANDDEVELOPMENT

1003 1004

a.Determiningfairvalue

Fairvaluerepresentsthesaleproceedsfromanassetdisposedofinanarm’slength transactionbetweennon-related,knowledgeableparties,includingabindingcontract priceoractivemarketprice.Intheabsenceofanactivemarketpriceforguidance,or bindingcontractprice,fairvalueshouldbedeterminedwithreferencetothebestquality informationavailable,suchasrecenttransactionsofasimilarnatureinthesamemarket. Considerationmustbegiventoanylegalorcommercialrestrictionsthatcouldreasonably influencedeterminationofthefairvalueofanassetorindeeditssale.

MEMOPOINTS

1.FRED82(248)issuedinDecember2022,containsanamendmenttoparagraph 27.14FRS102,statingthat“fairvaluelesscoststosellissimplyameasurementbasedonfair value”.

2.Across-referencetoSection2A“FairValueMeasurement”providingguidanceon measurement,isalsogiven.FRED82(249)amendsparagraph14AFRS102,byremovingthetext concerninglegalorotherrestrictionsthatcouldinfluencethemeasurementoffairvalue.

3.FRED82appliestoaccountingperiodsbeginningon,orafter,1January2026.

Marketvalue(e.g.commercialvehicles,computers,plant andmachinery)

Benchmarkmaynotbeavailable-valuationbasedon experienceornegotiation

Difficulttodeterminewherenocomparativemarketexists. Forsomeintangiblessuchasbrandssophisticated valuationtechniqueshavebeendeveloped.

Stage1:Initialestimateoffairvaluelesssellingcosts Recoverableamountof Basedon Tangiblefixedassets

Othertangibleassets(e.g.specialist plantandmachineryorbuildings)

Intangiblefixedassets

176 IMPAIRMENTOFFIXEDASSETSANDGOODWILL 1555 1556 FRS102(27.14) 1558

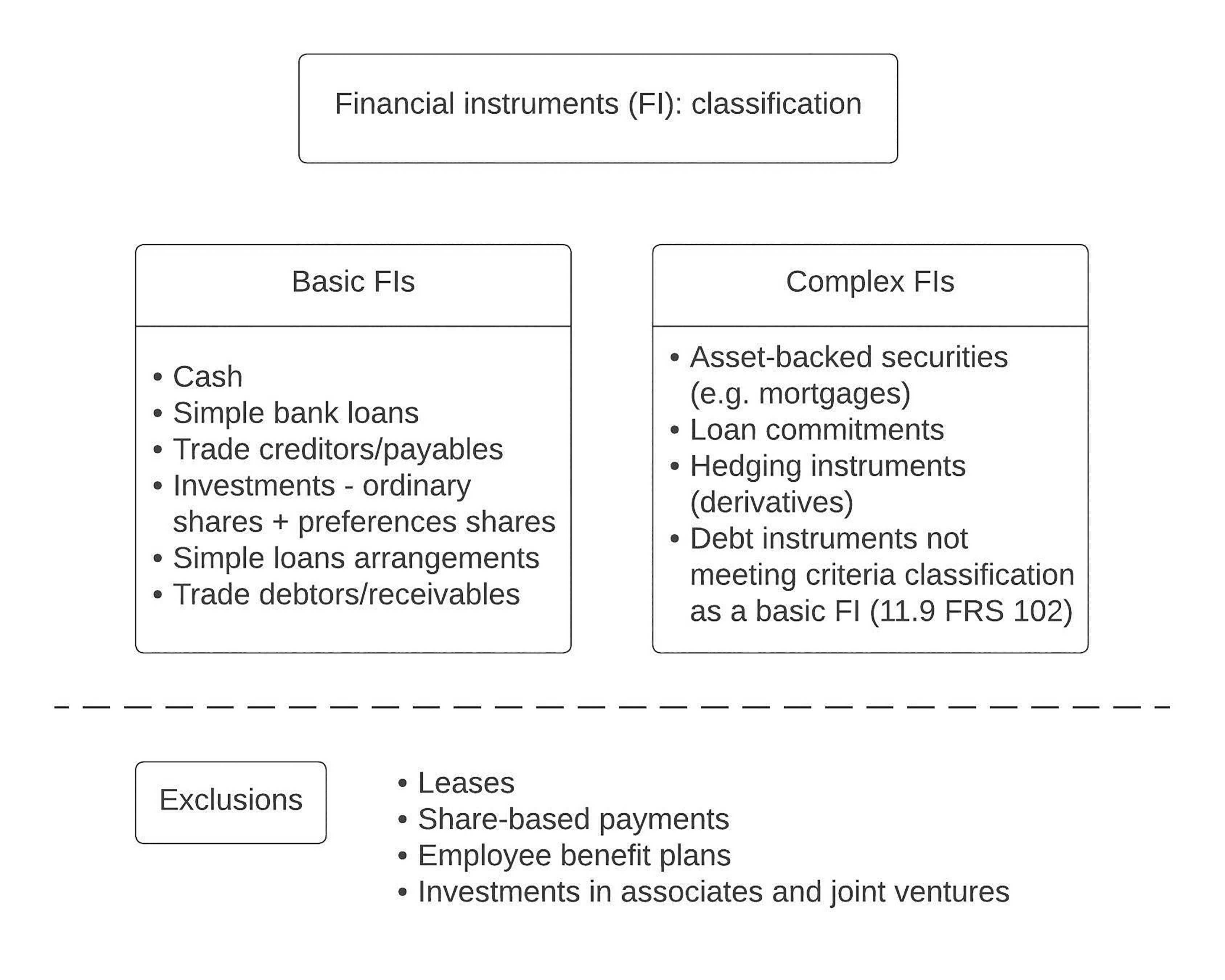

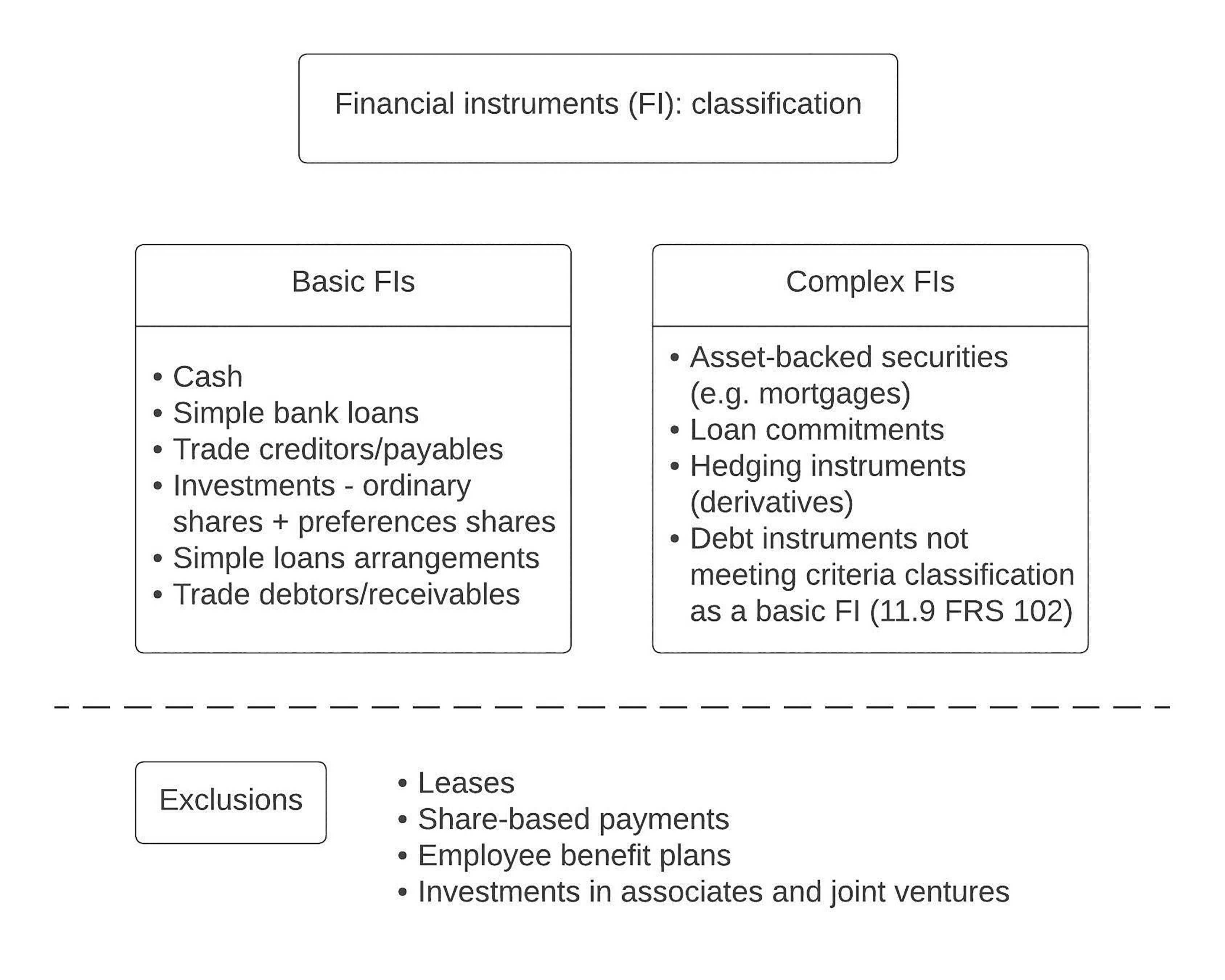

CHAPTER1 Classificationoffinancialinstruments

1Categoriesoffinancialinstruments

2Accountingpolicychoices

Afinancialinstrumentisbroadlydefinedasanycontractthatgivesrisetoafinancialasset ofoneentityandafinancialliabilityorequityofanotherentity.Themannerinwhich financialinstrumentsareaccountedfordiffersaccordingtothereportingregime applicabletotheentityNon-listedentitiesnowhavetoapplyFRS102“TheFinancial ReportingStandardapplicabletotheUKandRepublicofIreland”,whichmakesaclear distinctionbetweenbasicfinancialinstruments(¶3100+)andcomplexfinancial instruments(¶3700+),whilstmicro-entitiescanelecttoadoptFRS105(¶3850+).

MEMOPOINTS Listedcompanies,banksandinsurancecompaniesarebeyondthescopeofthis book.

OUTLINE ¶¶

...3002

3022 3OverviewofFRS102:financial instruments......................................3025 4Checklist:keyconsiderations 3030

CLASSIFICATIONOFFINANCIALINSTRUMENTS253 3000 3002

1.Categoriesoffinancialinstruments

Entity/arrangement

(JV,JCA,JCOs)

3.Accountingtreatmentbytypeofentity

Subsidiaries,AssociatesandJoint arrangements

Subsidiary(50%+)

Associate(20%+)

Jointlycontrolledentity(50%) (jointventure)(¶7425)

Jointlycontrolledassetsand operations (¶7414)

AssociatesandJointventures

Parentcompany-accountingtreatmentinindividualfinancial statements

Costlessimpairment.Choiceoffairvaluemodelwith movementstakentoothercomprehensiveincome(OCI)orfair value,withchangesrecordedinprofitorloss

Parentcompany-accountingtreatmentofinvestmentinthe consolidatedfinancialstatements

Consolidateassets,liabilities,resultsandcashflowsofits subsidiaries

Equitymethod (Costmodelorfairvaluemodel)

Asforassociate

Eachinvestoraccountsdirectlyforitsownshareoftheassets, liabilities,resultsandcashflows,anditsshareditemsasset outincontractualagreement

Non-parent-accountingtreatmentinindividualfinancial statements

Choiceofcostmodelorfairvaluewithmovementsrecordedon OCIorprofitorloss

Determiningtheinvestor-investeerelationship

MEMOPOINTS

1.JCO=Jointlycontrolledoperation(¶7416).

2.JCE=Jointlycontrolledentity(¶7425).

3.JCA=Jointlycontrolledasset(¶7420).

578 ASSOCIATES 7384 7386

Share-basedpaymenttransactions

AMicro-entitiesadoptingFRS105

2Equity-settledshare-based

4Share-basedpaymenttransactions

Share-basedpaymentsaredefinedaspaymentsthataremadeinsharesoronthebasisof thevalueofshares(orotherequityinstrument)andcantakedifferentforms.

Whydocompaniesoffersharesasaformofpayment?Theprimaryreasonisthatit providesanincentiveforemployeestostaywiththecompanyandgivesthemavested interestinthesuccessofthecompany.Share-basedpaymentschemesallowcompaniesto rewardstaffwithoutcreatingadrainoncashflow.

Companiesarerequiredtorecognise,intheirfinancialstatements,theeffectsofsharebasedpaymenttransactionsintheformofshareoptionsgrantedtoemployees. Morespecifically,acompanyisobligedtorecordanexpense(or,ifapplicable,anasset) measuredatfairvalueinrespectofits: –employeeshareoptionschemes; –sharepurchaseplans;and –anyothershare-basedpayments(i.e.paymentsmadeinsharesorotherequity instruments,orbywayofacashamountbasedonthevalueofthoseinstruments). Examplesofshare-basedtransactions

Entityreceivesgoodsorservices frompersonsotherthanemployees

•Paidbywayofshareoption(orotherequityinstrument);or •Settlesamountowingbycash(orotherassets)basedon thevalueoftheentity’ssharesorotherequityinstruments; or •Equityinstrumentsaretransferredbyshareholders, parent/sorothergroupmemberstosupplierofthesegoods orservices.

Businesscombinations(e.g. acquisitions,mergers) Issuessharesorotherequityinstrumentsdirectlyaspartof transaction.

CHAPTER3

OUTLINE ¶¶

.......8804 BCompaniesadoptingFRS102 8812

1Recognition:Generalcriteria 8820

payments

8822

3Cash-settledshare-basedpayments 8840

withcashalternatives.......................8844

8846

...8860 CAdditionalguidanceforequityand cash-basedtransactions 8872 1Transactionssettledbypaymentsof equity 8872 2Transactionssettledbypayments eitherofequityorincash 8900 3Summary 8920

5Disclosurechecklist

6FRED82amendmentstoFRS102

EXAMPLESOFSHARE-BASEDTRANSACTIONS Formofshare-basedtransaction

Paidbywayofshareissue.

Entityreceivesservicesfrom employees

SHARE-BASEDPAYMENTTRANSACTIONS641 8800 8801 8802

Othertopicalissues

1Genderpayanddiversityreporting

2Moneylaundering:disclosure

3Financialsanctions

5Brexitconsiderationsforfinancial

1.Genderpayanddiversityreporting

Undernewgenderpayreportinglegislation,employerswithmorethan250employees mustnowpublishannuallydetailsofanygenderpaydifferentialsbetweenmaleand femaleemployees.Theinformationmustberegisteredonagovernmentwebsiteand publishedontheemployer’sownwebsite,sothatitisavailabletothegeneralpublicand otherstakeholdersincludingemployees,customers,potentialrecruits,etc.

Workforcereporting:Inaseparateproject,theReportingLabisalsoexamininghow disclosuresrelatingtoacompany’sworkforcecanbeimprovedtocoverareassuchas: –genderdiversityandpay; –ethnicgroups; –anti-discriminationpolicies; –trainingprogrammes;and –humanresourcepolicies.

Genderpaydisclosures

Employersarebeingencouragedtoprovideanarrativetoaccompanythestandardpay gapcalculations,whichshouldbesignedoffbyaseniorofficerinthecompany.Details shouldbegivenonhowanypaygapshavearisenandwhatactionsarebeingtakento eliminatethepaydifferentialinthecomingyear.

Thecalculationsrequiredbylegislationincludetheaverageandmediangenderpaygap, plusdetailsofanybonusdifferentialsaswellastheproportionofmalesandfemales comprisingeachprinciplepaygrade.Guidanceisnowavailablefromthegovernment (Acas)websiteonwhoshouldbeclassifiedasanemployee,whichcouldincludesome self-employedoragencyworkers.

Employersshouldalsoaddasupportingnarrativeasagenderpaygapmaynotnecessarily meantheyhaveactedinappropriatelyorhavediscriminatorypaypolicies.Anysignificant differencesshouldbeexplainedwithdetailsgivenofanyplanstonarroworeradicatethe paydifferentials.

Amodeldisclosurenoteissetoutintheexamplebelow

CHAPTER4

OUTLINE ¶¶

..

12550

requirements 12600

12800

4Thedigitalfinancefunction 12900

reporting

6Coronavirusandfinancialreporting..13200 7Financialinstruments(FRS102): summary 13400 8FRCPeriodicReview-planned amendments 13500

thresholds 13600

13000

9SmallCompanyreporting-revised

OTHERTOPICALISSUES821

12550 12552 12554 12556