Nick Abbott

Kyle Addington

Sean Agahi

John Almaguer

Ryan Ansted

Ian Arrowsmith

Jammie Avila

Kirk Badii

Kevin Barrett

Jeb Bashaw

Michael Bateman

Kenneth Beber

Nick Behnke

Gary Benson

Brandi Blanchard

Dustin Blodgett

Peter Blok

Rich Bolek

Blake Bonner

Eric Bowdler

Jeff Boyd

Scott Brady

Jim Braziel

Pat Brennan

Jeffery Bricker

Cathy Brown

Tatyana Bunich

Steve Carlton

Karalyn Carlton

Michael Carlucci

James Chang

Yong Chang

Brett Clarke

Kelly Clyde

Karl Cole

Cindy Couyoumjian

Chris Covert

Jesse Cox

Ari Crandall

Robert Davidson

Darrell Delphen

Con Dempsey

Scott Dickerson

Chris DiVito

Alex DiVito

Jigar Doshi

Daniel Dougherty

Dillon Dougherty

Ittai Dvir

Mark Ealy

Mark Elmore

Jay Eng

Brad Epstein

Lauren Estes

Rod Evans

Jim Fahy

Andrew Fairchild

Jeff Fisher

James Flanagan

Troy Folk

Michael Fruth

Shunsuke Fukushi

Marian Geohegan

Christopher Gleason

Joshua Goldsmith

Sharon Green

Robert Gunning

Grant Hansen

Marcella Harkness

Timothy Hayes

Marcus Henderson

David Herman

David Hill

Rachel Hoang

Joel Hooper

Bryan Hopkins

Lawrence Huh

Mary Huntley

Michael Hyat

Erich Imphong

Jaqueline Jacobsen

Rich Kasher

Jacob Kavaya

Kathy Keadle

Donovan Kelly

Kurt Kennedy

Diane Kimbro

Kyle Kirwan

David Koehler

Josh Koehnen

Michael Kolacz

Leo Kowalski

Rich Krafcik

Dan Lang

Jeremy Laub

Suzy Lawrence

Joe Leblanc

John Lee

Josh Lee

Jonathan Lennox

Rebecca Leonard

Marc Lord

Matt Lum

Scott Machen

Bernard Makino

Daniel Mann

Matthew Marcom

Rourke Martin

John Mata

Kristin Mata

Bryan Mazza

Edwin McClure

Gregory Meyer

Mark Militello

Deepen Modi

Art Molloy

Kelly Morris

Anthony Napolitano

Zoe Ng

James Noto

Greg O’Donnell

Melissa Ocean

Greg Ostrowski

Thomas Otten

Amrish Patel

James Patton

Lance Patton

John Pearson

Chelsea Petrizzo

James Petrizzo

Scott Pilchard

George Pitra

Peter Prescott

Grant Prescott

Nancy Rhew

Kirk Riding

Matthew Scanlon

Chad Schiel

Jason Segawa

Jeff Senglaub

Jim Senglaub

Julie Shen

Herb Shiraishi

David Sizemore

Richard Soennichsen

Jay Sprinkel

Larry Steckler

Lane Steel

Bill Steward

Steve Sutley

Jonathan Szostek

Joshua Szyman

Michael Tannery

Conrad Tarte

Joyce Thomas

Bradford Tom

Yahaira Torres-Siaca

Joshua Tschirgi

Jacob Tujian

Jerry Tuma

Robert Turley

Todd Turner

Gail Urban

John Velez

Chris Vizzi

Shawn Walker

Charles Wareham

Ray Weldon

Bryan Wertzer

Kevin Williams

Brice Willoughby

Rick Willoughby

Dean Wilson

Kristen Wilson

Frank Wong

Jason Wong

Jay Wurtzler

Michael Wynns

Timothy Yee

Celia Zhang

Brian Zimmerman

Looking forward to seeing you!

By Andrew Barnett VP of Technology Innovation Financial Independence Group

Whether you’re excited about AI’s potential or sick of the media buzz, digital advancements will continue to actively disrupt the financial advisory landscape.

Financial professionals are discovering the benefits of AI in creating more personalized, efficient, and effective business success strategies. By integrating AI into their workflows, they can better target prospects, enhance client engagement, and improve overall business results

believe AI can help increase their book of business by more than 20%

plan to use AI to automate time-consuming tasks

https://www.advisorhub.com/resources/leveraging-ai-for-financial-advisors/

believe AI will revolutionize the future of financial advice by 2027

Digital advancements are changing how advisors work and increasingly helping them work “better, faster, and smarter.” Optimal tech structures can ensure efficiency, so clients receive the experience they were promised.

Picture this: a world where your annuity and life policies can be seamlessly managed on one unified platform. No more toggling between countless carrier websites or searching through disparate systems. Just one intuitive interface to rule them all.

You’ve just been introduced to our Lifecycle Manager platform!

Thanks to the partnership between Financial Independence Group and IFG, you now have access to digital advancements such as scaling your data, organizing it into sets, and identifying ideal prospects

Four ways you can integrate technology into your practice management strategy:

#1: Start with Data Collection

Output is a direct reflection of input. The first step toward successful AI output is ensuring a robust system for collecting and organizing client data. This includes client profiles, goals aligned with product sales, and communication interactions. By gathering this data, you create a foundation for AI tools to analyze and generate insights.

Using a CRM platform with digital integrations to store client data, track engagement, and monitor the success of marketing campaigns sets you up to pinpoint optimal business opportunities.

With a solid data collection system in place, you can use AI to automate personalized campaigns triggered by specific client behaviors, such as downloading a financial guide or attending a webinar. AI can then tailor the follow-up content to align with the client’s expressed interests.

According to Dimensional Fund Advisors’ 2025 Global Advisor Study [2], 61% of financial professionals believe that a sense of security is more important than other ways clients measure the value they receive from their advisor. However, when clients were asked about this, only 31% agreed, while 24% indicated that understanding their personal financial situation was the key factor.

Leverage

AI can also help recommend the types of content your clients want to see. By analyzing their online behavior, AI can suggest topics for blog posts, webinars, or newsletters that are likely to resonate with your audience.

In the 1980s, the first Baby Boomers turned 35, and 78 million Americans began investing in a market that seemed overly confident and positive. Fast-

[1] https://www.advisorhub.com/resources/leveraging-ai-for-financial-advisors/ [2] https://podcasts.apple.com/us/podcast/managing-your-practice/id1548054179

forward to the 2000s, and the Great Recession caused an entire generation to become skeptical of messages that were overly positive. Today, robust digital platforms analyze external influences and can empower you better target your messaging.

One of the most powerful aspects of digital advancements is the ability to monitor and adjust in real time. The FIG Team and Lifecycle Manager can dive deep into accounts for inaccuracies, set crucial reminders, and help uncover alternate solutions, allowing you to pivot strategies for optimal results.

Using Lifecycle Manager, one financial professional reviewed their in-force contracts to proactively identify better-fit solutions for their clients and uncovered eight policies that could collectively increase the policyholder’s income by 30% to 50% Several other clients benefited from vastly improved cap rates leading to significant overall client satisfaction and improved retention.

Digital advancements are about uncovering opportunities

Embracing AI and other digital advancements isn’t about jumping on buzzword trends—it’s about staying ahead in a rapidly evolving industry to improve your practice and provide unparalleled value to clients. By combining your financial expertise with these tools, you can deliver personalized, data-driven solutions that attract and retain clients for the long term.

As an IFG advisor, your client-account data is currently live in Lifecycle Manager and ready to be reviewed.

Contact the Financial Independence Group’s Institutional Team to unlock opportunities to grow your book of business! (888) 652-1473 or BDTeam@ figmarketing.com.

Registered indexed-linked annuity (RILA)

The balance doesn’t get much better than this. Athene Amplify 2.0 is designed to help clients better equalize index-linked growth and protection in down markets. With attractive rates and a dynamic set of features, Amplify may be a sound choice for today’s long-term investor.

Discover the potential. Athene.com/IFG

For financial professional use only. Not to be used with the offer or sale of annuities.

Athene Amplify 2.0 is designed to be a long-term investment product used to help provide income for retirement. It is not suitable as a short-term investment. There is a risk of substantial loss of principal and related earnings depending on the Segment Option(s) to which your client allocates their Purchase Payment. In the event of negative index performance, Segment Credits may be negative after application of the Buffer Rate and your client agrees to bear the portion of loss that exceeds that rate. This material is provided by Athene Annuity and Life Company (61689) headquartered in West Des Moines, Iowa, which issues annuities in 49 states (excluding NY) and in D.C. Product features and availability may vary by state and/or sales distributor.

Athene Amplify 2.0 ICC24 RIA II (05/25), ICC24 RIA II (05/25) NF, ICC24 CS II (05/25), ICC24 CW II (05/25), ICC24 TIW II (05/25), ICC24 SCS II (05/25), ICC24 SCS II (05/25) NF, ICC24 Fixed II (05/25), ICC24 Buffer II (05/25), ICC24 Buffer II (05/25) NF, ICC24 Buffer MI II (05/25), ICC24 Buffer MI II (05/25) NF, ICC24 Buffer MSTN II (05/25), ICC24 Buffer MSTN II (05/25) NF, ICC24 Trigger II (05/25), ICC24 Trigger II (05/25) NF, ICC24 Dual Trigger II (05/25), ICC24 Dual Trigger II (05/25) NF, ICC24 Dual Direction II (05/25), ICC24 Dual Direction II (05/25) NF, ICC24 GMDB II (05/25), ICC24 GMDB II (05/25) NF, ICC24 Performance Lock II (05/25), ICC24 Interim II (05/25) or state variation RIA II (05/25), RIA II (05/25) NF, CS II (05/25), CW II (05/25), TIW II (05/25), SCS II (05/25), SCS II (05/25) NF, Fixed II (05/25), Buffer II (05/25), Buffer II (05/25) NF, Buffer MI II (05/25), Buffer MI II (05/25) NF, Buffer MSTN II (05/25), Buffer MSTN II (05/25) NF, Trigger II (05/25), Trigger II (05/25) NF, Dual Trigger II (05/25), Dual Trigger II (05/25) NF, Dual Direction II (05/25), Dual Direction II (05/25) NF, GMDB II (05/25), GMDB II (05/25) NF, Performance Lock II (05/25), Interim II (05/25) issued by Athene Annuity and Life Company, West Des Moines, IA, and distributed by its affiliate Athene Securities, LLC, West Des Moines, IA, member FINRA/SIPC, a registered broker-dealer. Product features, limitations and availability vary; see the prospectus for details. Product not available in all states.

INVESTMENT AND INSURANCE PRODUCTS ARE: • NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, THE BANK OR ANY OF ITS AFFILIATES • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED

Registered index-linked annuities can only be marketed and sold by securities licensed financial professionals. Any discussion of this product must be preceded or accompanied by a Prospectus.

53122 (09/25)

By Alex Pape Chief Technology and Product Officer AssetMark

For a long time, AI was the stuff of science fiction. But times have changed. No longer a far-off concept, AI has arrived, and it’s reshaping virtually every industry, including financial advising. If you’re a financial advisor—and you believe trust and personal connection are everything—AI is emerging as a powerful tool not just for automation but for transforming your practice.

And it couldn’t have arrived at a better time. Today, clients want more personalization, faster communication, and deeper insights, all while markets have grown more complex and regulations more demanding. The reality is that advisors are being asked to do more with less time. And that’s where AI offers real promise.

While the first wave of AI for financial advisors focused primarily on reclaiming valuable time, including automating meeting preparation, followup tasks, and administrative responsibilities, the next frontier promises to be even more exciting.

In the future, AI won’t just give advisors more time; it will make client engagement smarter, more personal, and more proactive. Soon, AI tools will help advisors identify which clients to reach out to, when

the timing is right, and which topics will matter most. Concepts like conversation “talktracks” are early signs of this shift.

The earliest adopters of AI in financial advisory firms sought quick efficiencies, automating routine tasks like meeting preparation, transcription, and follow-up communications.

By automatically generating briefing documents based on client data and transcribing conversations in real time, advisors can offload the mechanical work and reclaim precious hours each week. Similarly, AI-driven tools for drafting follow-up emails and tasks have reduced what used to take 30 to 45 minutes down to a matter of minutes.

Freed from these time-consuming chores, some advisors today have found more room in their schedules to engage directly with clients, ask thoughtful questions, and build rapport rather than wrestle with paperwork and administrative encumbrances.

Yet, saving time is just the tip of the iceberg.

When AI handles the mundane, advisors gain bandwidth to deliver an elevated client experience characterized by anticipation, empathy, and tailored guidance. With the support of AI, you can be in tune with your clients – whether they are approaching a life event, grappling with a financial decision, or emotionally stirred by market events – and reach out proactively with insights that feel timely and relevant. That level of proactive engagement transforms the advisor–client relationship from reactive service provider to strategic partner.

At its core, financial advice revolves around understanding people’s dreams, fears, and personal goals. Effective advisors offer empathy during market downturns, clarity when complex financial concepts arise, and personalized strategies aligned with each client’s long-term vision. While AI can’t replace genuine warmth or human intuition, it can surface the data-driven signals that enable these human qualities to flourish.

In the near future, AI that leverages advanced analytics will use behavioral clues—portfolio shifts, transaction patterns, or life-event triggers—to suggest clients who might appreciate a check-in or a portfolio review. By leveraging these insights, advisors will be able to deliver empathetic, relevant outreach that strengthens trust and fosters deeper connections.

Similarly, personalized conversation prompts—or “talktracks”—will help advisors lead more meaningful discussions. Instead of generic talking points, AI will help analyze a client’s historical communications, highlight recent achievements or concerns, and suggest conversation openers that resonate on a personal level. The result? Dialogues that go beyond standard portfolio reviews and delve into each client’s unique situation, reinforcing the sense that the advisor truly understands and cares.

The long-term AI journey for financial advisors looks even more promising.

Future innovations may include the ability to detect subtle emotional signals, analyzing voice inflections or facial expressions to identify client anxiety or enthusiasm in real time. Adaptive learning systems will refine AI-suggested actions based on each advisor’s distinct style and client feedback, aligning recommendations more closely with best practices. Integrated ecosystems will streamline workflows across CRM platforms, financial planning software, and AI engines, creating a unified hub where data, insights, and client interactions converge smoothly.

As these capabilities mature, advisors will unlock entirely new ways to empathize, anticipate needs, and deliver strategic value.

While some advisors may be reluctant to jump on the AI bandwagon, the conversation should not revolve around AI versus human judgment; it should focus on how AI amplifies advisor expertise and humanity.

Those who embrace this mindset will experiment boldly with new tools, build confidence in their use of AI, and maintain transparency with clients about how technology enhances—not replaces—the advisory experience. By weaving AI into the background of their practice, advisors spotlight their human strengths: compassion, ethical judgment, nuanced understanding, and personalized advice.

The truth is that AI won’t displace you; it will help to amplify your humanity. By automating repetitive tasks and illuminating opportunities for meaningful engagement, AI empowers advisors to focus on trust-building, personalized guidance, and strategic foresight. That’s the future of financial advice: a human-centered practice supercharged by intelligent technology.

Ready to experience this transformation? Learn how AssetMark solutions can help you spend less time on administrative work and more time doing what you do best: serving and guiding your clients.

Whether you’re a financial professional or a client, you can rely on our exceptional customer service standards and user -focused improvements that help reduce the complexity of retirement planning.

our Customer Care Center is one of the best in the business.*

Highest first call response rating in each specific industry/sector.

World Class First Call Resolution (FCR) certification

At least 80% of customers’ issues are resolved on the first call. seconds average speed of answer† calls handled per day†

Same-day servicing for all new business cash and variable annuity/registered index-linked annuity financial post issue requests

Our wide variety of self-service tools, e-delivery capabilities, and additional resources are at your fingertips.

designations, access contract documents and tax statements, withdrawal requests, trading capabilities, address changes, product performance

By Camryn Bolek Specialist, Annuity Solutions

For decades, the 60/40 portfolio has been the gold standard for retirement investing. Its historical performance, averaging 10% annualized returns since 1981, made it a reliable strategy for both growth and income. But as we look ahead, with the volatile environment that has been among us, there may be more challenges faced to continue the historical average returns. AllianceBernstein, a nonannuity-selling asset management firm, produced a whitepaper suggesting the importance of a Fixed Index Annuity (FIA) in a retiree’s portfolio and where an enhanced FIA portfolio could provide better average returns than the classic 60/40 portfolio.

Studies from AllianceBernstein project a 10-year outlook of lower returns, 5.7% for stocks and 5.0% for bonds, paired with increased market volatility. This signals a new reality for retirees, where traditional strategies may fall short. The classic 60/40 portfolio model may no longer deliver the stability and income needed for a secure retirement. In response, AllianceBernstein’s whitepaper proposes that FIAs could emerge as a new core asset class for retirement savings. FIAs are gaining momentum as a strategic enhancement, or even a partial replacement, for the bond allocation in retirement portfolios.

Fixed Index Annuities are insurance products designed to offer:

• Principal protection from market losses

• Tax-deferred growth

• Index-linked interest, often tied to benchmarks like the S&P 500

• Optional lifetime income riders for guaranteed retirement income

Unlike traditional bonds, FIAs don’t lose value when interest rates rise. And unlike stocks, they don’t expose investors to full market risk. This makes them uniquely positioned to enhance portfolio resilience.

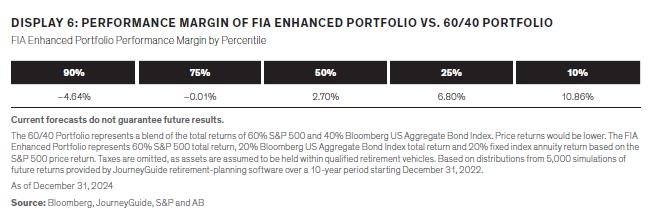

A recent simulation from a retirement planning software tool ran 5,000 scenarios of future returns over a 10-year accumulation phase starting 12/31/2024, comparing a traditional 60/40 portfolio with a FIA-enhanced mix (60% stocks, 20% bonds, 20% FIA).

Accumulation Phase Results:

• FIA-enhanced portfolio outperformed a traditional 60/40 portfolio in 67% of scenarios

• Average winning margin of an enhanced FIA portfolio: 6.3%

• Average winning margin of a 60/40 portfolio: 3.6%

While averages can be helpful to gauge the results of the study, it takes a deeper analysis to show the magnitude of differences on both extremes. For the 10th percentile of winnings when the FIA enhanced portfolio outperformed the 60/40, it won by a 10.86% margin. On the flipside, when the FIA enhanced portfolio lost to the 60/40, it only lost by a smaller margin of 4.64%, represented by the 90th percentile.

This study used FIAs with a cap rate of 10%, while MassMutual Ascend American Legend 7, an A++ rated company, has an annual S&P point-to-point cap rate of 10.50%.

If renewal rates have been a concern in the past, one way to mitigate that risk is by selecting a product with a locked cap rate for the duration of the surrender period. For example:

• Global Atlantic ForeAccumulation II (5-year): Offers a locked S&P 500 point-to-point annual cap rate of 7.50%.

• Delaware Life Growth Pathway (7-year): Offers a locked S&P 500 point-to-point annual cap rate of 8.50%.

Over a 40-year horizon (10 years accumulation + 30 years retirement), the FIA-enhanced portfolio delivered more guaranteed income focused on the retirement years.

• FIA enhanced portfolio outperformed the 60/40 model in 95.54% of scenarios

• Winning margin on the enhanced FIA portfolio of 8.81% more income

While averages are again important to consider, the article dives deeper into the concept of the safe spending rate for a retiree while maintaining a 90% probability of not running out of money during retirement. For the 60/40, annual “safe” spending equates to $27,552, while the enhanced FIA portfolio “safe” annual spending was $31,216. Based off the results of the study, choosing an FIA enhanced portfolio over a 60/40 allowed for 13.2% more retirement spending with the use of a guaranteed income rider.

These results suggest that FIAs can significantly improve wealth, accumulation and retirement income, especially when paired with lifetime income riders.

The income-phase FIAs studied had cap rates of 7%, while Midland Sammons LiveWell Preferred FIA (10year) currently offers a higher annual S&P point-topoint cap rate of 9.25%. Notably, Midland Sammons applies the same rates to both existing clients and new money, eliminating any “bait-and-switch” tactics where initial high rates are used to attract clients, only to be significantly reduced upon renewal.

Additionally, Athene Ascent Pro 10, available through IFG, features a 7.25% annual S&P 500 point-to-point cap rate and includes a potential LTC enhancement. If eligibility is met, guaranteed income can double for

up to 60 months or until the annuity’s Accumulated Value reaches zero—whichever comes first. Afterward, income reverts to the original amount and continues for life (not available in CA).

While FIAs aren’t suitable for every investor, they offer a compelling case for inclusion in retirementfocused portfolios. Their ability to limit downside risk, enhance income stability, and support higher spending makes them a powerful tool in today’s uncertain market environment.

As the traditional 60/40 model faces increasing pressure, it may be time to rethink what “core” means in retirement planning. For many, an FIA could be the missing piece.

By Nationwide’s Advisor Advocate Editorial Team

Dispelling these common myths can help your clients decide if investing in an annuity will help their retirement income planning and financial strategy.

Turbulent markets and their impact on retirement accounts are concerns for many investors. They’re looking for guidance to help safeguard their investments.

Annuities can be a solution, long-term products that can offer tax-deferred growth potential over time and options for guaranteed income in retirement. But some investors may be wary because of common misconceptions. Dispelling these myths can help you guide clients toward a product that can help secure their future financial plans.

With traditional pension plans on the decline, retirement planning is falling more on the individual client. You can help clients understand how an annuity may fit into their plans—including different underlying investment options, upside potential, downside protection, income guarantees—and the fees associated with each. While there are many types of annuities, you can help clients find one that’s right for their needs and works within their budget.

According to LIMRA data,1 fixed annuity sales saw rapid growth in recent years, as higher interest rates made them very attractive. However, variable annuities (VAs) and registered index-linked annuities (RILAs) may help your clients who seek more growth potential. VAs with living benefit riders have seen increased payout rates and can offer portfolio flexibility for your more aggressive investors. RILAs offer a combination of growth potential plus protection that may be attractive to your more moderate investors.

In fact, a study from the Alliance for Lifetime Income2 reported that the vast majority (71%) of investors ages 45 to 54 are interested in purchasing an annuity as part of their overall retirement income plan. A VA can help clients in their 40s and 50s with accumulation, while those nearing or entering retirement can use annuities for guaranteed income. A 401(k) may not be enough for some clients to prepare for retirement. Annuities can provide the potential for more tax-deferred saving and income in retirement, as well as options for legacy planning.

1Source: LIMRA, U.S. individual Annuities Survey, July 2025.

In any economy and at all stages of life, annuity solutions can be tailored to clients’ goals and unique needs. A VA with an income guarantee allows clients the opportunity to participate in equity market gains to help outpace inflation. High earners who max out qualified plans may want to use investmentonly variable annuities to accumulate more. Fixed indexed annuities can guarantee that clients won’t lose their principal or credited earnings due to index performance. Fixed annuities ensure that clients’ principal investment and a specified interest rate are both guaranteed.

Annuities have evolved. Many now include free withdrawal provisions, allowing contract owners to withdraw a designated portion of their funds— often 10 percent each year—without a surrender charge. Others have waivers that allow access to account values without penalties for events like hospital stays, nursing home admissions, or terminal illnesses. This can be a great conversation starter for clients who think annuities lack flexibility.

Once you address these five myths, your clients should feel more confident in deciding if an annuity is right for their financial goals. Although annuities won’t fit into every financial plan, they can be beneficial to many clients, in any economy and at all stages of life.

For more relevant expertise on annuities and other timely topics that matter most to financial professionals and their clients, visit Nationwide’s Advisor Advocate Blog: https://www.nationwide.com/ financial-professionals/blog/

2Source: Alliance for Lifetime Income, Protected Retirement Income and Planning (PRIP) Study, June 2023. FOR FINANCIAL PROFESSIONAL USE — NOT FOR DISTRIBUTION TO THE PUBLIC

• Not a deposit • Not FDIC or NCUSIF insured • Not guaranteed by the institution

• Not insured by any federal government agency • May lose value

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should discuss their specific situation with their financial professional. Guarantees are subject to the claims paying ability of the issuing insurance company. NFM-23179AO.1

By Colby Taylor Director, Alternative Investment Consultant

As we approach the final quarter, sophisticated financial advisors like yourself are intensifying their search for legitimate tax mitigation strategies that deliver both immediate benefits and long-term value. But, year-end tax planning isn’t just about charitable giving and retirement contributions; it’s also the season when sophisticated clients begin asking: “What else can I do to mitigate my 2025 tax bill?”

Oil and gas drilling funds present a compelling opportunity that many advisors overlook, despite their potential to generate substantial tax advantages while addressing critical energy infrastructure needs.

Oil and gas drilling partnerships offer unique tax benefits that are not available in traditional investments. One of the most compelling advantages of these programs is the deduction of Intangible Drilling Costs (IDCs). Through IDCs, investors can typically deduct 65-80% of their investment in the first year, if not more¹. For a highnet-worth client in the top tax bracket investing $100,000, this translates to potential first-year deductions of $65,000-$80,000, creating immediate tax savings of approximately $26,000-$32,000.

Additionally, depletion allowances provide ongoing tax advantages throughout the investment’s productive life². The December 31 deadline for current-year tax deductions creates urgency that savvy advisors can leverage to help clients avoid yearend tax surprises.

Modern drilling fund sponsors recognize that different clients require tailored tax solutions. Strategic partners like U.S. Energy Development Company exemplify this approach by offering three distinct investment structures3:

General Partnership (GP) Units: Designed specifically for offsetting ordinary income, these units are ideal for high-earning professionals, business owners, and executives with substantial W-2 or business income. The GP structure maximizes IDC benefits against ordinary income rates.

Limited Partnership (LP) Units: Structured to offset passive income, these units serve real estate investors, business owners with passive income streams, or clients with significant investment income. LP units help balance passive income and losses for optimal tax efficiency.

Specifically engineered for Roth conversion strategies, these units provide tax-efficient vehicles for clients executing sophisticated retirement planning while maintaining underlying oil and gas tax benefits.

This multi-structure approach allows advisors to match specific client tax situations with appropriate investment vehicles rather than forcing clients into one-size-fits-all solutions.

Existing Book Analysis

Systematically review your current client roster for year-end opportunities. Target clients with:

• Significant ordinary income from business operations or professional practices (GP units)

• Passive income from real estate or business investments requiring offset (LP units)

• Roth conversion planning needs where tax-efficient vehicles are essential (LLC units)

• Recent liquidity events or consistently high tax brackets

• Previous experience with alternative investments

Companies like U.S. Energy Development Company’s multiple unit structures allow you to address diverse client needs within a single sponsor relationship, streamlining due diligence while expanding solution sets.

Oil and gas investments naturally attract sophisticated investors—precisely the demographic most advisors seek to cultivate. By developing expertise in energy tax strategies with multiple unit options, you differentiate yourself from competitors while attracting clients who value specialized knowledge. Consider hosting educational seminars, positioning yourself as the local expert on structured energy-related tax strategies.

These investments require substantial due diligence discussions, naturally extending client meeting times and strengthening advisor relationships. Use this opportunity to conduct comprehensive financial reviews, uncovering additional planning needs.

Due Diligence Protocol: Establish relationships with reputable drilling fund sponsors who provide comprehensive reporting and transparent fee structures. When evaluating sponsors like U.S. Energy Development Company, verify their ability to offer multiple structures that address different client needs while maintaining consistent operational standards.

Client Education Framework: Develop standardized presentation materials explaining how different unit types address specific tax planning needs:

• GP units for high-earning professionals with substantial ordinary income

• LP units for investors with significant passive income to offset

• LLC units for clients executing Roth conversion strategies

Documentation Standards: Ensure proper suitability documentation and risk acknowledgment forms, particularly when matching unit types to client tax profiles.

Many advisors hesitate to recommend oil and gas investments due to unfamiliarity with the sector. However, domestic drilling programs have evolved

1.

significantly, with modern techniques reducing geological risks while increasing success rates4

The current energy landscape presents compelling fundamentals: domestic energy security remains a national priority, and energy infrastructure demands continue growing5

Focus on established operators with proven track records and diversified drilling portfolios to mitigate individual well risks. When in doubt, reach out to a member of IFG’s Alternative Investment team to dive in deeper on any client questions.

While many advisors focus solely on traditional yearend strategies—charitable giving, retirement plan contributions, or equipment purchases—oil and gas drilling funds with multiple unit structures offer differentiated solutions for clients seeking substantial tax benefits. This specialization creates referral opportunities from CPAs and tax attorneys who recognize your expertise in matching investment structures to specific tax situations.

The convergence of year-end tax planning pressure, attractive energy sector fundamentals, and sophisticated unit structures creates an exceptional opportunity for proactive advisors. By December 31, clients will have made their tax mitigation decisions, with or without your guidance.

Successful advisors recognize that expertise in specialized strategies like oil and gas drilling funds, particularly those offering multiple unit structures for different tax objectives, transforms them from ordertakers to strategic partners, commanding higher fees while delivering greater client value.

As we approach year-end, the question is simple… Will you wait for clients to ask, or will you lead the conversation?

4. U.S. Energy Information Administration, “Drilling Productivity Report,” 2024

5. U.S. Department of Energy, “Strategic Petroleum Reserve Annual Report,” 2024

INVESTING ALONGSIDE LEADING ENERGY COMPANIES IN A DIVERSIFIED PORTFOLIO OF MINORITY EQUITY INTERESTS IN OIL & GAS PROJECTS IN THE BAKKEN SHALE IN NORTH DAKOTA & PERMIAN BASIN OF SOUTHEASTERN NEW MEXICO

• INCOME: 10% Initial Return Accrued and Paid from NOI

• GROWTH: Reinvest Excess NOI to Acquire Additional High-Quality Assets

• TAX BENEFITS: Tax Sheltered Income

• PROJECTED HOLDING PERIOD: Sale of Portfolio in 3 to 5 years

• SUITABILITY: Accredited Investors Diversified across multiple operators, basins, and well vintages.

By Greg Fox CEO Mill Green Capital, LLC

The U.S. housing market is at a turning point. Elevated mortgage rates, limited construction, and a persistent housing shortage have pushed millions of Americans toward rental options, fueling demand for both multifamily communities and single-family homes built for rent. Against this backdrop, Mill Green Opportunity Fund X, LLC has been launched to capture these powerful trends and deliver attractive, risk-adjusted returns for investors.

Mill Green Opportunity Fund X was formed to raise up to $150 million in equity for investment in highgrowth real estate projects across the Sunbelt and select U.S. markets. The Fund focuses primarily on multifamily developments, with a smaller allocation—expected to be 10% or less—toward buildto-rent single-family housing.

Each investment will be structured as a partnership with established, well-capitalized development companies that have long-standing relationships

with Mill Green. These developers handle the heavy lifting—acquiring land, entitling sites, managing construction, and leasing up properties—while the Fund provides the equity capital needed to bring these projects to life.

The goal is straightforward: develop high-quality rental housing, stabilize it through successful leasing, and then sell to institutional buyers, delivering returns to investors along the way.

Several macroeconomic and demographic factors make today a compelling moment for a strategy like Mill Green’s:

• A severe housing shortage – Freddie Mac estimates that the U.S. is short nearly 4 million housing units, while a 2024 Zillow study identified 8 million “missing households.” Demand far exceeds supply, creating upward pressure on rents.

• Declining construction starts – After years of new building, multifamily starts dropped in 2024 to their lowest level since 2012, a direct consequence of tightening capital market conditions. This slowdown is expected to generate significant pent-up demand by the time this current vintage of development reaches the market in three to four years – strategically positioning them for strong performance.

• Sunbelt population growth – The South and Southeast continue to lead the nation in population and job growth. From Atlanta to Tampa to Charlotte, these markets combine affordability, lifestyle appeal, and businessfriendly climates that keep attracting new residents.

• Shift to suburban living – Millennials forming families and Baby Boomers downsizing are driving demand for suburban rental housing. These areas offer affordability, good schools, and growing “live-work-play” communities that rival urban cores.

Together, these trends create a long runway for new rental housing development, particularly in the regions where Mill Green has deep experience.

Mill Green is not new to this space. Since 2015, the firm and its affiliates have launched nine prior real estate funds, raising more than $500 million in capital and investing in over 40 development projects. Of the funds that have fully liquidated, investors realized strong returns, with multiples ranging from 1.19x to 1.93x.

This experience, combined with strong partnerships with leading developers, provides a solid foundation for Fund X’s future investments.

Mill Green Opportunity Fund X offers investors two classes of membership units:

• Class G Units – Higher preferred return (12% annually) but no current cash distribution. Best suited for investors seeking higher longterm gains.

• Class I Units – Slightly lower preferred return (10% annually) but with a current-pay distribution of 6% per year. Designed for investors who value consistent income during the life of the fund.

The minimum investment is $100,000, and the Fund is open only to accredited investors. The offering is being conducted on a best-efforts basis, with subscriptions held in escrow until the initial closing.

The Fund is managed by Mill Green Capital, LLC, led by CEO Greg Fox, who brings nearly 40 years of real estate and capital markets experience. He is joined by a seasoned leadership team including Jeff Sherman (Chief Investment Officer), Brian Grasso (Chief Financial Officer), and Stuart Coleman (Executive Director of Investments). Collectively, they have overseen billions of dollars of multifamily investment, development, and financing activity.

With Fund X, Mill Green is positioned to invest in six to eight multifamily projects and up to three buildto-rent communities over the next several years. These investments will be concentrated in growth markets where strong demand, limited supply, and favorable demographics converge.

For investors, the Fund represents an opportunity to participate in the development of much-needed housing in some of the most dynamic regions of the country—while benefiting from Mill Green’s proven strategy, developer relationships, and track record of success.

Client referrals are often one of the most effective yet underutilized levers for firm expansion, and they matter now more than ever. In fact, firms with a dedicated referral strategy acquire 1.4x more new clients and 1.5x new assets than those who don’t have one.* To successfully take advantage of this untapped potential, it’s important to understand what drives referrals and how to frame the referral conversation. Designing a strategic framework for referrals will help you take your strategy from passive to proactive.

Want to learn how to expand your firm authentically and sustainably?

Read our Unlocking Organic Growth: A Strategic Approach to Client Referrals in Wealth Management thought piece to discover how you can cultivate a culture of growth within the client experience and business planning process.

By Abbey Eastham Director, Advisory Solutions

At Independent Financial Group, one of our most important priorities is helping advisors grow stronger, smarter, and more sustainable practices. Growth isn’t simply about adding assets; it’s about refining the way we work, deepening client relationships, and creating capacity to serve more people effectively. As part of our commitment to this vision, IFG Advisory Solutions is proud to highlight the practice management expertise that Focus Partners brings to our advisors seeking to take their business to the next level.

The resources available through Focus Partners aren’t just theoretical; they’re designed to be practical, actionable, and directly applicable to the challenges advisors face every day. They created a “Growth Workbook” that equips advisors with the tools to sharpen the value proposition and create a more intentional referral culture. Their approach provides a roadmap for growth rooted in clarity and execution.

Focus Partners center their practice management philosophy around three pillars: strategy, scale, and growth.

• Strategy: Advisors start by defining who they serve best and why. Building clarity around an “ideal client” and articulating a compelling value proposition gives direction to every other business decision.

• Scale: Efficiency isn’t just about technology; it’s about aligning processes, people, and time. Advisors who segment their clients and design service models accordingly can ensure that higher-revenue households receive the tailored, proactive advice they expect while still serving a broader client base efficiently.

• Growth: With strategy and scale in place, advisors can focus on what they do best: building meaningful relationships and expanding through referrals, centers of influence (COIs), and structured pipeline management.

This framework is simple, but powerful. It provides advisors with a repeatable process to clarify goals, refine the client experience, and position their practice for long-term success.

One of the most important exercises Focus Partners encourages is crafting a clear, written value proposition. Firms with a strong value proposition consistently outperform their peers in both client satisfaction and asset growth.

Advisors are guided to break this down into three parts:

1. Origin Story: Why you became an advisor and what motivates you.

2. Personal Value Proposition: The unique skills, empathy, and expertise you bring to each client interaction.

3. Firm Value Proposition: The broader support structure, resources, and professional community that back you up.

When clearly articulated, this narrative doesn’t just inform marketing; it becomes the foundation for referrals, COI conversations, and client loyalty.

Referrals remain the most powerful driver of advisory growth. Focus Partners helps advisors close this gap by teaching advisors how to create a culture of referrals, where clients understand the value you bring, know the type of people you serve best, and feel confident introducing you.

Equally important are COIs such as CPAs, estate attorneys, and business consultants. Highperforming firms treat COIs as strategic partners, not just casual acquaintances. Focus Partners provides structured tools to identify the right COIs, build mutually beneficial partnerships, and track results over time. These relationships often lead to highervalue introductions and strengthen your professional credibility.

Organic growth requires more than waiting for referrals to appear. Focus Partners emphasizes pipeline management as a discipline for tracking leads, prospects, and conversions with the same rigor as portfolio reviews. Advisors are encouraged to set SMART goals (Specific, Measurable, Attainable, Relevant, Time-bound) to ensure that their growth objectives are not only ambitious but also realistic and trackable.

For example:

• Generic Goal: “Get more clients.”

• SMART Goal: “Add 10 new households this year, averaging three per quarter, primarily through client referrals.”

This level of specificity helps teams stay accountable and celebrate milestones along the way.

The Focus Partners marketing approach recognizes that most growth comes from warm introductions rather than cold leads. Their strategies focus on aligning content, events, and communications with referred prospects and ideal clients.

Some examples include:

• Educational events such as tax planning workshops or economic outlook briefings, which both serve clients and attract prospects.

• Personalized content delivered through newsletters, blogs, or social posts, repurposed across channels for maximum reach.

• Human connections like client appreciation dinners, community involvement, or spotlighting personal interests on advisor websites.

By blending authenticity with structure, advisors can reinforce their brand and build familiarity while deepening trust with both clients and prospects.

Another practice development tool Focus Partners brings is client segmentation analysis. Instead of viewing relationships solely through the lens of assets under management, their model emphasizes household revenue and client/advisor alignment.

This helps advisors:

• Allocate time more effectively, ensuring that high-value clients receive appropriately proactive service.

• Develop tiered service models that balance scale with personalization.

• Gain confidence in transitioning mismatched clients while focusing energy on those who value and advocate for their guidance.

Ultimately, segmentation enhances both client satisfaction and advisor well-being by aligning time and resources where they matter most.

The tools and frameworks from Focus Partners are not about reinventing an advisor’s business overnight. Instead, they provide a structured yet flexible roadmap for continuous improvement. Whether you are clarifying your value proposition, refining your referral process, or rethinking how you allocate your team’s time, these resources are designed to meet you where you are and help move your practice forward.

For IFG advisors, leveraging these resources is more than just an exercise in growth; it’s an opportunity to build practices that are more intentional, more resilient, and more rewarding for both advisors and clients. For more information on the Focus Partners Growth Workbook, reach out Jeremy Heffernan, Strategic Accounts Director at Focus Partners, at jeremy.heffernan@focuspartners.com or Abbey Eastham, Director, Advisory Solutions at IFG, at aeastham@ifgsd.com

In an increasingly technological world, investors now place greater value in human relationships that include empathy and understanding1. Orion Advisor Academy stands on the cutting edge of education, psychology, communications, technology, and marketing to help financial professionals differentiate themselves in this new landscape, so you can strengthen their client relationships and their practices by utilizing an outcomes-focused engagement approach.

Course content ranges in topics from investment management, behavioral finance, practice management, and client experience. Our free platform even has an app so that you can take your learning on the go. With 30+ CE credits, including CFP Ethics, completing your annual continuing education requirements has never been easier.

The industry is amid digital transformation

Advisors need to add empathy to their skillset to differentiate themselves

Investing is emotion, and investment decisions are drawn from psychological factors

Advisors need to understand the importance of empathy and how they can act as an emotional coach to their clients

The most significant value in the advisor-client relationship is behavioral modification derived from a healthy, trusting relationship

Individuals who leverage an advisor have greater well-being and financial outcomes

The entirety of our FREE offering is designed to help you improve acquisition, increase referrals, increase your share of wallet, and drive efficiency through technology and outsourced investment solutions.

1

Click here to get started or scan the QR code to access the mobile-friendly platform.

By Nicola Sutton VP of Advisor Engagement

Beacon Capital Management, Inc.

Back in 2014, Michael Kitces highlighted a “crisis of differentiation” in the financial advisory industry, noting that as more advisors earned their CFP certifications, simply being a credentialed planner was no longer a unique selling point. In 2016, Kitces followed up by pointing out that “great service,” another go-to claim for many, isn’t a differentiator if everyone is saying it too (Kitces.com, 2016).

And today, a quick scan of advisor websites reveals just how common those claims still are: comprehensive planning, fiduciary duty, and personalized service dominate the messaging, leaving little room for real distinction. There’s a sea of polished taglines, clever websites, and “unique” value propositions, and yet the sameness remains.

Today, the real crisis in the industry isn’t differentiation itself; it is advisors trying to differentiate without first defining who they are trying to serve.

If you want messaging that lands, engagement that works, and a service model that sticks, stop trying to be different—and start getting specific about who you are here to help.

Your ideal client isn’t “people with $1M+ to invest.” That’s a filter, not a persona.

Your ideal client is someone whose life story, challenges, and aspirations match the kind of advisor you are and the type of work you love to do. Start by asking:

• What life stage are they in?

(Pre-retirement? Post-exit entrepreneur? Firstgeneration wealth creator?)

• What transitions or decisions are they facing?

(Selling a business, caring for aging parents, rethinking purpose in retirement?)

• What do they value most?

(Freedom? Family? Legacy? Simplicity?)

• How do they make decisions?

(Analytical? Emotional? Collaborative with family or spouse?)

• How do they want to be served?

(High-touch? Digital-first? Group-oriented? Behind the scenes?)

1. The Pre-Retirement Executive Who’s Losing Interest in the Grind

• Key Concerns: Identity after work, healthcare decisions, when to walk away

• Communication Style: Values research and credibility, prefers structured planning

• Messaging Cue: “You’ve mastered your career, now let’s help you master what’s next.”

2. The Legacy-Minded Grandparent

• Key Concerns: Passing values with wealth, avoiding family conflict, preparing heirs

• Communication Style: Family-oriented, relational

• Messaging Cue: “We help families talk about money, not just transfer it.”

3. The Recently Liquid Business Owner

• Key Concerns: Life after the liquidity event, tax efficiency, next act

• Communication Style: Fast-paced, resultsdriven, visionary

• Messaging Cue: “From entrepreneur to investor, let’s design your second chapter.”

the Message

Once your ideal client persona is clear, your message doesn’t have to do the heavy lifting. It just has to speak directly to their story.

Forget buzzwords. Use the language your clients use. Show that you recognize what they’re going through. Your message should answer:

• Why you understand them

• What you help them navigate

• What they’ll feel or accomplish with your help

Example: Instead of “We provide customized wealth management solutions,” say, “We help executives design a purpose-filled retirement, one that works for their finances and their sense of identity.”

Once your message resonates, build an engagement plan that feels natural to your ideal client.

Ask yourself:

• Where do they hang out (online or in person)?

• What kind of content or events would they care about?

• Who already has their trust (centers of influence, peer groups)?

• What is the best way to demonstrate value before they become a client?

For the legacy-minded client, it might be a family roundtable or estate planning workshop.

For the executive, it might be a retreat focused on the psychological side of retirement.

For the business owner, a post-exit playbook or small-group mastermind.

Finally, design a service model that speaks to your ideal client’s actual goals and challenges. This may go well beyond investment management or traditional planning.

A few examples:

• Retirement Coaching – Addressing the emotional and identity shift that comes with stepping away from a career.

• Family Education & Governance – Helping clients prepare heirs, host family meetings, and align values across generations.

• Life Design Services – Connecting clients with purpose coaches, travel planners, or health experts to create the life they want after financial independence.

If you’re struggling to differentiate, stop trying to sound different and start being clear and compelling.

Get specific about who you serve and build a message that reflects their world. Create an engagement plan they will care about and build a service experience that supports them.

In a sea of sameness, being clear and compelling could be your competitive edge.

If you would like additional resources to help build out your messaging plan, contact your Beacon representative now.

FOR ADVISOR USE ONLY. NOT INTENDED FOR CONSUMER SOLICITATION PURPOSES.

Beacon Capital Management, Inc. is an investment adviser registered with the Securities and Exchange Commission. Additional information about Beacon Capital Management is also available on the SEC’s website at www.adviserinfo.sec.gov under CRD number 120641. Beacon Capital Management only transacts business in states where it is properly registered or excluded or exempted from registration requirements.

Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments or investment strategies.

Sammons Financial® is the marketing name for Sammons® Financial Group, Inc.’s member companies, including Beacon Capital ManagementSM

Year-to-Date Office Leaders (as of September 30, 2025)

Scarborough Capital Management

Annapolis, MD

Gregory Ostrowski, Shawn Walker, Ryan Ansted, Ian Arrowsmith, Jeffrey Cardozo, Josh Goldsmith, David Herman, David Sizemore, Jay Sprinkel, Jonathan Szostek, Samantha Harris

Capital Growth, Inc.

San Diego, CA

Art Molloy, Jay Wurtzler, Pat Brennan, Scott Dickerson, Marcella Harkness, Erica Tanner, Matthew Belardes

Cornerstone Wealth Management

Las Vegas, NV

Jammie Avila, Kyle Kirwan, Daniel Mann, Anthony Napolitano, John Underwood

JTW Financial Services

San Gabriel, CA

Joyce Thomas, Hui Zhang, John Almaguer, Julie Shen

Senglaub Financial Group

Delafield, WI

Jim Senglaub, Jeff Senglaub, Mike Senglaub, Craig Rusch

Cinergy Financial

Tustin, CA

Cindy Couyoumjian, Leticia Hewko, Kobe Couyoumjian, Douglas Shaner

Shiraishi Financial Group Advisors

Honolulu, HI

Herb Shiraishi, Jason Wong, Kendall Kakugawa, Graham Enomoto, Grant Arita

O’Donnell Financial Services

San Rafael, CA

Greg O’Donnell, Michael Nakano

Premier Wealth Advisors

San Diego, CA

Cole Chodorow, Ari Crandall, Josh Koehnen, Joseph Leblanc

Sutley Wertzer

Sacramento, CA

Bryan Wertzer, Steve Sutley, Scott Machen, Joshua Hurd, Wade Gribaldo, James Dillon, Jack George