By Abbey Eastham Director, Advisory

In the ever-evolving world of wealth management, women have been making incredible strides, showing that success isn’t bound by gender. This article highlights the exceptional contributions of women in the industry by focusing on the top sales strategies from advisors and experiences shared from the home office. With expertise, empathy, and the ability to build trust, they are all thriving in a competitive industry and are here to share the tips they have for others looking to follow in their footsteps.

First, we have Rachel Hoang, the founder and CEO of Mathematics Wealth Management, Inc. She is a Wealth Specialist with over 25 years of experience offering comprehensive financial services, primarily serving Aerospace Engineers in the SoCal beach cities area and beyond. In her leisure time, she loves learning karate with her young son, discovering new destinations with her husband, enjoying small talk over a cup of tea with her parents, and playing catch in the backyard with her fur kid.

How do you approach client acquisition, and how has that evolved over the years?

RH: My company’s motto for connecting with clients has always been the original golden rule: “Treat people the way you would like to be treated.” Over the years, I’ve learned that showing genuine care and interest can go miles with people. Thus, I focus on deepening my advisor-client relationships by dedicating significant effort to client care. In return, we receive numerous referrals from satisfied clients.

How do you keep clients engaged during times of market volatility or uncertainty?

RH: We guide our clients’ financial journey from start to finish by personalizing our engagements with them. With dedicated focus upon understanding their concerns, we develop long-term financial strategies to meet those needs. In addition, we’ve built strong relationships with our clients based on trust, reinforced by providing ongoing financial education. Reassured by this, our clients understand that while market volatility can be unsettling, it’s a normal part of the market cycle.

Behind every great advisor is a dedicated team that provides essential support and guidance. We spoke with Sarah Kreisman, Senior Vice President & General Counsel from the IFG home office, whose experiences offers a unique perspective on how IFG supports women in the field.

As a female leader in the financial industry, what key strategies or mindset shifts have you found most important in achieving success in the field?

SK: Having encountered my fair share of obstacles in my career, many of them related to being a woman in a traditionally male-dominated industry, one of the most valuable things I have learned is that earning respect is about who you are and how you treat others. I focus on being the best human I can be, and I let my performance do the talking.

Women often get a bad rap for being “emotional” (or too emotional). I have the double whammy of

being a woman in compliance (to some, the business prevention department). I have never bought into either of those stereotypes, but as they say, saying it and doing it are two different things. I work to lead by example and would never ask anyone to do something that I myself would not or could not do. For me, it is not emotion – it is passion. I love what I do, and I have the great honor of being part of the IFG family and creating an environment where people work to say “yes” and support our representatives in a way that allows them to do what they do best – serve their clients.

In your role, how do you support financial advisors, especially women, to navigate the complexities of the industry thrive in their careers?

SK: One of the things I always think about is people’s innate need to feel heard and supported. I carry that into my day-to-day and work to ensure everyone knows that they have a voice and that I am always available to listen. Sometimes, that is all someone needs. Also, I am not one to avoid a difficult conversation or tiptoe around in fear that I might say something someone does not want to hear. At the end of the day, people tend to appreciate (or at least respect) honesty, even if it does not feel that way in the moment.

We all make mistakes; we are human. I encourage representatives to admit their mistakes and to not be afraid to say they do not know. One of my mantras is: find your passion, find your purpose, and stay true to yourself. And, of course, be reliable and be dependable.

The stories shared by these women — a thriving advisor and successful home office leader — serve as a powerful reminder of the impact that women can have in the industry and with their peers. Their strategies, experiences, and advice are invaluable for anyone looking to succeed in a fast-paced and everchanging environment.

By Madison Turbeville Manager, Alternative Investments

The Institute for Portfolio Alternatives (IPA) is the preeminent trade organization in the alternative investment industry, dedicated to advancing and expanding opportunities in this space. With an exclusive focus on alternative investments, IPA hosts innovative events and conferences, provides educational resources, and addresses policy issues through impactful advocacy at both the federal and state levels.

This past February, I had the privilege of representing IFG at IPA’s Private Markets conference in Newport Beach, joining an esteemed panel alongside executives from LPL, Bank of America, and CAM Advisors. Our discussion centered on how each of our firms evaluate private investments, identifies emerging opportunities, and adapts to the evolving landscape of alternative investments.

One of the most valuable insights from the event came from conversations with my fellow panelists. We discussed the products we are currently evaluating, our strategy for expanding access to alternatives, and the critical role that education plays in driving broader adoption. What became abundantly clear is that IFG is uniquely positioned to offer financial advisors and their clients unparalleled access to alternative investments, setting us apart from larger broker-dealers and wirehouses. Here are a few examples:

• Exclusive Access: IFG provides access to a broader range of alternative investment offerings, including opportunities like Oil & Gas drilling programs, which are not available to many of our competitors.

• Fee-Based Flexibility: Unlike larger firms that restrict private placements in fee-based accounts, IFG is taking a more adaptable approach for our advisors seeking these investment structures.

• Boutique, High-Performing Managers: Many of the top-quartile managers available at IFG are not accessible through larger firms, giving our advisors a distinct competitive advantage.

The feedback from attendees reinforced what we already know: IFG stands out among industry giants by delivering greater access, flexibility, and expertise in alternative investments. As financial advisors, this means you have a significant opportunity to differentiate your practice and provide your clients with investment solutions they won’t find elsewhere.

I am incredibly proud to represent IFG, an alternative investment leader in the broker-dealer space, and to support our advisors in leveraging alternative investments to enhance client portfolios and grow their businesses. By embracing alternative investment opportunities and understanding the competitive edge they provide, advisors can differentiate themselves, attract high-net-worth clients, and deliver customized investment strategies that drive long-term growth and client retention.

For any questions, please reach out to me at mturbeville@ifgsd.com or x237, or Colby Taylor at ctaylor@ifgsd.com or x239.

Waveland Energy Par tners provides accredited investors direct access to U.S. oil and gas investments through our Income & Grow th Strategy, backed by over 25 years of institutional-qualit y energy investing exper tise.

Invest ment Highlights :

• 10% Target Annual Cash Flow – Paid quar terly from producing wells operated by top global energy companies

• Significant Tax Advantages – Utilizing intangible drilling costs, depreciation, and depletion allowances — the tax-equivalent yield can reach bet ween 12.5% and 20% , depending on state residency and an investor’s specific ta x situation Please consult your ta x advisor

J. Greer, CEO & Co-Founder Waveland has strategically evolved with the

For details on our current offerings and subscription materials, please visit WW W.WAVEL ANDGROUP.COM or contact our team directly at info@wavelandgroup.com

This document does not constitute an offer or solicitation to buy or sell securities, which can only be made through a private placement memorandum. This is neither an offer to sell nor a solicitation of an offer to buy securities An offering is made only by a private placement memorandum. An investment in this product involves a high degree of risk and there can be no assurance that the investment objectives of the program will be attained.

By Paul Larrabee, RICP, CLTC Director, Insurance Solutions

An increase in marketing and consumer awareness campaigns in the life settlement industry is driving an upswing in activity, which is filtering down to IFG advisors who submitted more life settlements inquires in 2024 than any previous year. IFG is committed to providing a compliant platform for life settlement transactions to help our advisors meet their fiduciary responsibilities and provide access to the top settlement funders in the marketplace.

The life settlement industry has been evolving, requiring platform updates to comply with the regulatory environment, maintain access to key sources of funding, stay on top of licensure requirements, and provide appropriate E&O coverage for life settlement transactions. Previously, IFG has utilized The Norseman Group as our primary life settlement broker, which required both the IFG advisor and IFG to be licensed as life settlement producers with state insurance departments. As licensing requirements in the states increased and E&O coverages for the transactions changed, IFG has pivoted to a referral agreement relationship. This shift eliminates much of the state licensing requirements and enables advisors to guide their clients through the life settlement option without directly participating in the life settlement process.

IFG is excited to introduce the Ashar Group as our new life settlement platform partner. Based in Orlando, Florida, the Ashar Group is a family-run business comprised of siblings Jon, Jason, and Jamie Mendelsohn. They will support IFG advisors with a life settlement referral program. Ashar Group’s experienced team will assist IFG advisors in quickly qualifying or disqualifying a life insurance policy as a prospect for life settlements. If you have a strong prospect for a life settlement, a referral of that prospect will be made to the Ashar Group, which will assist the policy owner with the complete settlement process.

Ashar Group is a life settlement broker with access to the top institutional funders in the life settlement market. They work on behalf of the client to secure

an offer for the life insurance policy that reflects its real market value of the policy based on the policy cost and the life expectancy of the insured.

As a referral source to Ashar Group, the referring IFG advisor will receive a referral fee as a percentage of the gross settlement offer, greater than the policy cash value, which is passed through the IFG grid. Life settlements are a supervised activity requiring IFG supervision to pre-approve the life settlement transaction before the policy owner client can begin the life settlement application process. Updated IFG Life Settlement Written Supervisory Procedures and the Life Settlement Policy & Procedures are available to guide you through the life settlement referral and supervision process.

I recently connected with Ashar Group Founder and President, Jason Mendelsohn, for a Q&A session.

Q: The Ashar Group came highly recommended to IFG. What sets you apart from other brokers in the life settlement market?

JM: Ashar Group has over two decades of experience exclusively in life settlements and life insurance valuation. As the largest full-service, turn-key auction platform for life settlements, our strategic partners can leverage our negotiation power to generate the most competitive offers for their clients.

Q: How can FAs be on the lookout for more life settlement opportunities?

JM: A proactive first step to identify potential life settlement clients is to include a question in their discovery process, such as, “When was the last time you had your life insurance policy appraised?” They can also include life settlement case studies (which we can provide) in their newsletters for clients and COI relationships. Lastly, sort their database by age, starting with the most at-risk policies for clients in their 80-90s who have outlived the original purpose for their coverage. Next, look at clients aged 79 and younger. Some of the most common situations are when they no longer have an estate tax need, sold their business and no longer need coverage

(including term policies), or are looking for funds to pay for caregiving or retirement needs.

Q: Why do most life settlement clients choose to settle their life insurance policies?

JM: They are looking for immediate liquidity to fund today’s planning and retirement needs. They do not want to be a financial burden to their adult children. Many times, the policy premiums have increased, and they would prefer to reallocate those dollars to other, more current needs.

Q: How has the life insurance settlement market changed over the past 10 years?

JM: The current life settlement market can purchase any size policy, including portfolios for family office clients with $50-$100M of coverage. The capital in today’s market can purchase policies with up to 20 years of life expectancy and uses institutional capital, pension plans, and global asset managers. Over 15-20 years ago, some individual investors only purchased policies with lower life expectancies.

Q: IFG has seen a noticeable increase in life settlement inquiries. Is the market as a whole seeing more activity?

JM: The market continues to generate awareness among consumers, with an increase in direct-toconsumer advertising each year and more fiduciaries realizing the requirement to disclose the life settlement option.

Q: How can an FA that is referring a client trusted relationship to you to support their life settlement process have confidence that their client’s experience with Ashar Group will reflect positively on them?

JM: We pride ourselves on being front-facing and demonstrating both warmth and competency when interacting with clients and the advisory team. We are available to guide the advisors and clients by joining conference/video calls and providing training to the advisors’ back-office team. We value a few thousand policies per year and have created billions for consumers over the last two decades. There is rarely a planning situation that we have not encountered previously. Ashar Group is proud to have presented at approximately 50 estate planning councils, Harvard Business School’s Family Office Wealth Management Events, Notre Dame Tax Institute, and the national AICPA Advanced Personal Financial Planning Conferences.

The IFG Insurance Solutions Department is fully committed to providing you and your clients with the best products and resources in the industry. The Ashar Group life settlement process provides an efficient, top-shelf experience that will ensure your clients receive maximum value for their life insurance asset on the secondary market. If you have questions about life settlements or are interested in learning more, please reach out directly to me at plarrabee@ ifgsd.com or x277.

Focus your time, and your business, on the things that matter most. If you’re ready to strategically grow, we can help.

ATTRACTING AND RETAINING CLIENTS

Clarify your message and focus your marketing

CONSTRUCTING COMPREHENSIVE SOLUTIONS

PERSONAL AND PROFESSIONAL GROWTH

Join our study groups to earn designations and make connections

Leverage our product and process expertise

FOCUSING ON STRATEGIC OPPORTUNITIES

Connect with what’s most important to your clients

TALK TO YOUR ASH RETIREMENT INCOME CONSULTANT TODAY!

Whether you’re expanding, marketing or protecting your business, our national network of Retirement Income Consultants can assist through conference calls, in-person consultations or keynote presentations.

By Kelsey Hasterlik, CFP® Senior Regional Advisor Consultant & Roger Smith,

RMA®,

Senior Regional Advisor Consultant

Our IFG Wealth Management Department continues to evolve with focus and intention under the strategic leadership of Chad Cristo, CIMA®, Senior Vice President of National Sales and Marketing. Chad’s innovative vision, coupled with his extensive experience, has laid a strong foundation for the team’s continued growth. Each division is headed by a seasoned professional(s), with outstanding support available to service IFG advisors.

We are proud to announce several strategic moves within the team that reflect both internal career growth and the attraction of top-tier talent:

• Abbey Eastham has joined us with over eleven years of experience at Cetera and now leads our Advisory Solutions team as the Director of Advisory. Abbey brings a robust background in advisor engagement and a fresh perspective to drive innovation within the advisory platform.

• Camryn Bolek has been promoted from her role as a wealth management specialist to the Annuity team, where she now serves as the Specialist, Annuity Solutions.

• Santiago de Paco started with IFG on Monday, April 21st as the Advisor Associate supporting all aspects of Wealth Management. He’s a graduate of the U.S. Naval Academy in Annapolis, MD, and has an impressive list of accomplishments in the short time since graduation.

• Kelsey Hasterlik, CFP® has been elevated to Senior Regional Advisor Consultant, expanding her influence across a larger territory that now includes the rest of Southern CA. She continues to leverage the resources of IFG partners and brings planning and capital markets knowledge to her advisors.

• Roger Smith, CFP®, CIMA®, RMA®, CPFA® has also been elevated to the role of Senior Regional Advisor Consultant, with

an expanded territory that now includes Minnesota, Utah, Arizona, and Hawaii. His reach now spans the Eastern, Central, and Mountain markets, bringing invaluable industry experience, insight, and knowledge of IFG’s platforms and product partners.

Elevating Field Support: Connecting You to the Home Office and Our Partners

Our Senior Regional Advisor Consultants (RACs) continue to bridge the gap between the field and the home office. The RACs differ from traditional wholesalers — they act as “growth consultants,” supporting IFG advisors by providing guidance across Annuity, Alternative Investments, Advisory, and Insurance channels. Their toolkit includes:

• Hands-on practice management resources

• Business development planning tailored to each advisor’s growth goals

• Succession planning support for long-term stability

• Seamless access to home office insights and external product partners

The RACs are instrumental in executing highimpact training, prospecting strategies, and client engagement events, ensuring each branch receives not only attention but also strategic intention.

Highlights from 2025: Best Practices in Action

So far in 2025, we’ve observed standout practices and momentum-building initiatives across the wealth spectrum, including:

• Annuity Analysis & Reviews — Uncovering best-in-class income and legacy strategies. These powerful annuity divisioncreated reviews are uncovering opportunities to upgrade existing policies with better features, increased income potential, lower fees, and more client-friendly outcomes. The Annuity Team also offers a complete analysis for new deposits, comparing features and benefits across all approved offerings.

• Annuity Paperless Processing — Firelight adoption continues to increase as advisors recognize the ease and efficiency of the platform.

• Alternative Ticketing — The migration to a seamless, paperless ticketing platform (AIX/ iCapital), integrated with DocuSign, has revolutionized how advisors engage with alternative investments. With virtual document delivery to clients and sponsors, advisors are saving time, elevating the client experience, and eliminating NIGOs.

• Virtual Assistant Program — Hiring and training support teams is time-consuming and expensive. IFG’s Virtual Assistant program

is a convenient way for advisors to outsource their support needs and continues to expand, supporting IFG advisors under the leadership of Stefany Schade.

Client and Prospect Engagement: Advisor-Led Events

Kelsey and Roger have participated in several advisor-led events that are memorable, educational, and deepen current client relationships, increase wallet share, and attract new clients. Some highlights include:

• Women’s Wealth Forum — A curated, highcaliber experience designed to empower female clients and prospects through dynamic storytelling, financial literacy, and community building. Hosted in a luxury setting, this forum reflects our commitment to elevating every demographic with tailored messaging and relevance.

• Client Education Event — A sophisticated and engaging evening centered around high-networth estate planning strategies, hosted in partnership with several sponsors. The event was a shining example of client appreciation that turned into deepened trust and future planning conversations.

• Golf Invitation for Prospective Clients — Hosted at a private course, this event combined financial education and golf lessons for prospective clients. Advisors were

able to connect with potential clients in a relaxed, yet professional setting that fostered relationship-building and opened doors to new business.

• Networking at an Upscale Restaurant — This event brought together IFG advisors and product partners at a well-known local venue in San Diego. The event fostered idea-sharing, networking, and engagement with local product partners and department heads.

• Shred & Sip with Tacos — A light-hearted, community-forward document shredding event designed to attract new prospects while providing value to existing clients. The addition of a local taco truck and festive beverages created a fun, casual atmosphere that fostered introductions, referrals, and visibility for the advisor.

Looking Ahead: Evolving, Partnering, Growing

Whether you are looking to enhance your practice with our cutting-edge platforms, host a creative event, or simply brainstorm ways to win new business, your Senior Regional Advisor Consultant stands ready to serve as your strategic partner and proactive conduit to our expansive network of product, marketing, and sales resources. Together, we can continue to elevate your client experience, grow your business, and position you as the financial professional of choice in your market.

• Kelsey Hasterlik CFP® (858) 436 - 1215

khasterlik@ifgsd com Nor thwest

Roger Smith CFP®, CIMA®, RMA®, CPFA® (858) 436 - 2223

rsmith@ifgsd.com

Mountain, Central, and Eastern

By Erick Montiel Director, Annuity Solutions

The beginning of 2025 has presented significant challenges, with many clients seeking ways to protect themselves from downside risk while maximizing their upside potential. A Registered Index-Linked Annuity (RILA) offers a viable solution to this issue. In the first quarter of 2025, at IFG, RILA sales accounted for approximately 22% of the annuity market.

With the plethora of annuity products available, where should one start? While many annuity products are designed to provide income during retirement, accumulation products that hedge against downside risk are valuable assets in a portfolio. This is where the ForeStructured Growth II from Global Atlantic comes into play.

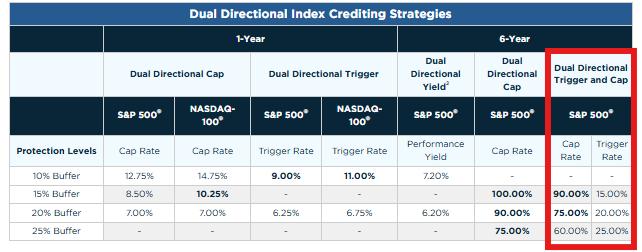

This RILA, like many others, offers multiple crediting strategies with varying levels of protection to suit different client needs. ForeStructured Growth II can provide index-linked performance up to a cap, participation, or trigger rate, diversification of crediting strategies, dual-directional strategies, upside potential in positive, flat, and even some negative markets, buffers, and floors that offer protection from loss – all with no upfront sales charges.

Our preferred strategy within this product is the dual-direction trigger and cap. For clients seeking maximum protection in down markets without significantly limiting their upside potential, the 25% buffer, 25% trigger, and 60% cap over 72 months offer a unique solution. The 25% trigger means that

when the index’s total performance is anywhere between negative twenty-five (-25%) to positive twenty-five (+25%), the client would automatically gain the full twenty-five (+25%). This product allows for financial gains on the client’s assets, while traditional investors might experience losses. Regarding upside potential, the client realizes all gains up to +60% during the six years. Refer to the photo below for a hypothetical dual-direction with trigger RILA scenario on a $100,000 premium over a 6-year (72-month) period.

Since the inception of the S&P on March 4, 1957, examining a six-year rolling daily period, it has only been down more than 25% 0.73% of the time. This means that with the 25% buffer for a six-year period, you are protecting the assets 99.27% of the time. The client can, therefore, make an educated risk call that 99.27% of the time they’ll experience a 25%-60% total return in a 6-year period, or 3.8% to 8.15% compounded for 6 years.

With over 400 products available, the annuity department at IFG is always here to offer insights into exciting new products, review any existing annuity assets, and collaborate on how annuities fit into clients’ portfolios. For further inquiries, please feel free to reach out to Erick Montiel at emontiel@ ifgsd.com, Camryn Bolek at cbolek@ifgsd.com, or Michael Spence at mspence@ifgsd.com

Year-to-Date Office Leaders (as of March 31, 2025)

Scarborough Capital Management

Annapolis, MD

Gregory Ostrowski, Shawn Walker, Ryan Ansted, Ian Arrowsmith, Jeffrey Cardozo, Josh Goldsmith, David Herman, David Sizemore, Jay Sprinkel, Jonathan Szostek 1 2 8 5 6 9 4 3 7

JTW Financial Services

San Gabriel, CA

Joyce Thomas, Hui Zhang, John Almaguer, Julie Shen 10

Cornerstone Wealth Management

Las Vegas, NV

Jammie Avila, Kyle Kirwan, Daniel Mann, Anthony Napolitano

Capital Growth, Inc.

San Diego, CA

Art Molloy, Jay Wurtzler, Pat Brennan, Scott Dickerson, Marcella Harkness, Erica Tanner, Matthew Belardes

Shiraishi Financial Group Advisors

Honolulu, HI

Herb Shiraishi, Jason Wong, Kendall Kakugawa, Graham Enomoto, Grant Arita

Senglaub Financial Group

Delafield, WI

Jim Senglaub, Jeff Senglaub, Mike Senglaub, Craig Rusch

O’Donnell Financial Services

San Rafael, CA

Greg O’Donnell, Michael Nakano

Premier Wealth Advisors

San Diego, CA

Ari Crandall, Josh Koehnen, Joseph Leblanc

Global Wealth Strategies

Scottsdale, AZ

Amrish Patel

Dougherty & Associates Financial Advisors

Buffalo, MN

Daniel Dougherty, Dillon Dougherty, Kerry Schmitz

YTD sales leaders are based on paid dates from January 1, 2025 – March 31, 2025