Nicholas Abbott

Kyle Addington

Sean Agahi

John Almaguer

Ryan Ansted

Ian Arrowsmith

Jammie Avila

Kirk Badii

Kevin Barrett

Jeb Bashaw

Kenneth Beber

Nick Behnke

Gary Benson

Gregory Bernhardt

Brandi Blanchard

Dustin Blodgett

Peter Blok

Rich Bolek

Blake Bonner

Eric Bowdler

Jeff Boyd

Scott Brady

Jim Braziel

Pat Brennan

Jeffery Bricker

Cathy Brown

Skylar Brown

Steve Carlton

Karalyn Carlton

James Chang

Yong Chang

Mike Childs

Brett Clarke

Kelly Clyde

Karl Cole

Doug Corey

Cindy Couyoumjian

Jesse Cox

Ari Crandall

Alex Creede

Darrell Delphen

Con Dempsey

Scott Dickerson

Michael DiGaetano

Chris DiVito

Alex DiVito

Dillon Dougherty

Daniel Dougherty

Ittai Dvir

Mark Ealy

Jay Eng

David Ethell

Rod Evans

Jim Fahy

Jeff Fisher

James Flanagan

Jim Fratello

Christopher Gleason

Joshua Goldsmith

Ryan Gorski

Robert Gunning

Tim Hayes

Marcus Henderson

David Herman

David Hill

Bob Hill

Rachel Hoang

Joel Hooper

Bryan Hopkins

Shane Hopkins

Lawrence Huh

Mary Huntley

Michael Hyat

Richard Kasher

Moss Kaufman

Jacob Kavaya

Kathy Keadle

Diane Kimbro

Kyle Kirwan

Josh Koehnen

Michael Kolacz

Leo Kowalski

Rich Krafcik

Dan Lang

Suzy Lawrence

Joe Leblanc

Josh Lee

John Lee

Jonathan Lennox

Rebecca Leonard

Marc Lord

Matthew Lum

Scott Machen

Daniel Mann

Kristin Mata

John Mata

Bryan Mazza

John McKeon

Deepen Modi

Art Molloy

Kelly Morris

Anthony Napolitano

Zoe Ng

James Noto

Greg O'Donnell

Denis Obrien

Melissa Ocean

Gregory Ostrowski

Thomas Otten

Amrish Patel

Lance Patton

Jim Patton

John Pearson

James Petrizzo

JD Phillips

Scott Pilchard

Peter Prescott

Grant Prescott

Jim Reopelle

Nancy Rhew

Kirk Riding

Mark Rothstein

Jon Sanchez

Chad Schiel

Jason Segawa

Jeff Senglaub

Jim Senglaub

Julie Shen

Herb Shiraishi

Rick Soennichsen

Brian Solomon

Jay Sprinkel

Larry Steckler

Lane Steel

Peter Stratton

Steve Sutley

Jonathan Szostek

Josh Szyman

Michael Tannery

Joyce Thomas

Yahaira Torres-Siaca

Joshua Tschirgi

Jacob Tujian

Jerry Tuma

Robert Turley

Gail Urban

Chris Vizzi

Michelle Vizzi

Shawn Walker

Charles Wareham

Bryan Wertzer

Kevin Williams

Dean Wilson

Frank Wong

Jay Wurtzler

Clifton Yasutomi

Timothy Yee

Looking forward to seeing you!

By Lauren Goettsche Vice President, Operations

Smart liability management is turning liability into borrowing power. A standing line of credit available to clients allows for liquidity without portfolio disruption. Traditionally, opening a line of credit would involve going to a bank, signing stacks of paperwork, and rigid repayment schedules. LoanAdvance, offered by Pershing, is a competitive solution that provides both simplicity and flexibility.

Securities-based lending is a way to support a client’s financial needs without compromising their current portfolio and investment objectives

that may result from liquidating assets. It could also potentially help avoid unintended tax consequences or missed market opportunities.

What can a Securities-based loan through LoanAdvance be used for?

• Real Estate Purchases

• Business Expenses

• Medical Bills

• Vacation

• Tuition/Education Expenses

• … and to support a number of other personal and financial goals!

While it may not be suitable for all investors, understanding what options are available for your clients is another tool in your toolbelt.

LoanAdvance is a line of credit that uses your clients’ existing Pershing accounts as collateral. The borrowing power is up to 70% of the market value of qualified equity, mutual funds, and bonds; as well as up to 90% of the market value for US Treasury Securities. Multiple accounts may be combined to increase the approved loan amount. Using a client’s own securities as collateral allows for competitive interest rates compared to traditional banks or credit card advances. LoanAdvance also provides flexibility by maintaining a loan indefinitely. As long as the required level of equity is maintained in the collateral account, the line of credit may remain an open loan and available to the client as needed. Additionally, there is no set payment schedule providing the client the convenience of repaying the loan on their terms.

For the client, access to their funds couldn’t be easier. Standing ACH instructions are allowed to easily withdraw funds or make payments toward the loan. The client may also request a check to the address on file with no additional paperwork. This flexibility and availability of funds for the client provides peace of mind when there is an urgent need or an unexpected expense arises.

As the financial advisor, visibility to the loan summary is available in NetX360 by going to the Loan tab within the client profile. The loan tab provides daily dashboard of the credit limit, outstanding loan balance, current interest rate, month and year to date interest charged, and the loan payoff amount. In the event the client has exceeded the maximum loan value on the account, or if the securities used to secure the loan drop in value and there is a house call, that may be viewed in NetX under Items for Attention. You’ll also be notified by IFG that action is needed.

In the case of a house call, action may be taken to satisfy the call with a journal from the collateral or other client accounts with Pershing, or through a deposit from a linked bank account.

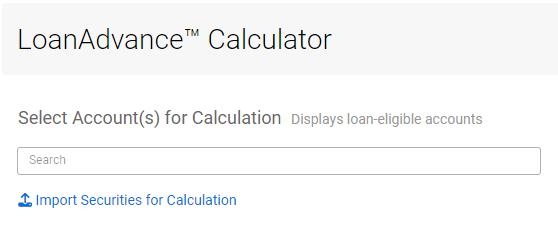

Curious to see what amount your client may be approved for? Pershing has a calculator for that! Navigate to the LoanAdvance Dashboard by going to:

NetX360 > Tools > Client Tools > LoanAdvance then select Loan Calculator

This tool allows you to calculate the loan amount available for a client along with each individual security and the borrowing power by position. NetX also provides a dashboard that will allow you to manage all existing loans in one convenient place. From the dashboard, you can go directly to an existing loan account to check available credit, outstanding balances, accrued interest, and payoff amounts.

In summary, key takeaways to LoanAdvance Securities Based Lending:

• Liquidity without Portfolio Disruption

Securities-based loan account allowing financial flexibility without having to liquidate assets.

• Open Line of Credit

Client may pay off the loan and keep the line of credit open indefinitely.

• No Fees or Penalties

Here are no fees associated with the line of credit. Client is only charged interest

on outstanding loan balance. No need to worry about late fees, nor fees related to open, maintain, or close the account.

• Payment Flexibility

No set repayment dates nor minimums. Client may pay off loan as they choose.

• Borrowing Power

Up to 70% of the market value of qualified equity, mutual funds, and bonds; as well as up to 90% of the market value for US Treasury Securities, may be used to determine the loan valuation.

Another key benefit to using securities-based lending through Pershing, as opposed to an outside (non-Pershing) lender, is that the collateral account does not need to be blocked. Any current check writing capabilities, periodic instructions, or RMDs may remain active on the collateral account, providing even more flexibility for the client.

As with any financial tool, the risks and restrictions associated with securities-based lending should be evaluated and discussed with your clients to determine if this is a suitable option for their financial situation.

For additional information on the LoanAdvance application process, current rates, and questions regarding securities-based lending, please contact Lauren Goettsche at LGoettsche@ifgsd.com

Help yours prepare for retirement with some of the highest rates 2 in the industry

Whether your clients are looking for income security, added growth potential or a way to fill an income gap in retirement, you can meet their individual needs with an annuity that delivers flexibility, choice and some of the highest rates in the industry.

Offer Nationwide Destination® B 2.0 or Nationwide Destination® Navigator variable annuities with the Nationwide Lifetime Income Rider+® (Nationwide L.inc+®) living benefits suite available at an additional cost.

• Up to 100% equity exposure

• 110+ investment options with 45 highly rated funds1

• Rates as high as 9.10% (L.inc+ Max, Single Life, Age 80+)2

1 Morningstar, 2023

2 Based on taking income at age 80 or older as of February 12, 2024.

This material is not a recommendation to buy or sell a financial product or to adopt an investment strategy. Investors should discuss their specific situation with their financial professional.

When evaluating the purchase of a variable annuity, your clients should be aware that variable annuities are long-term investment vehicles designed for retirement purposes and will fluctuate in value; annuities have limitations; and investing involves market risk, including possible loss of principal. All guarantees and protections are subject to the claims-paying ability of Nationwide Life Insurance Company.

Variable products are sold by prospectus. Carefully consider the investment objectives, risks, charges and expenses. The product and underlying fund prospectuses contain this and other important information. Investors should read them carefully before investing. To request a copy, go to nationwide.com/prospectus or call 1-800-848-6331.

Learn how your clients can benefit from some of the highest rates in the industry with the L.inc+ Suite.

By Chris Weber, CFP®, ChFC®, MSBA Sr. Advisory Sales Specialist

In the dynamic and ever-evolving world of wealth management, the complexities of economic data and investment news can be overwhelming for any one person to track. As the Lead Advisory Consultant here at IFG, I have worked with many advisors across the country who are looking for investment solutions that best suit their client’s needs. Advisors often question if they should continue to manage their client’s assets themselves or outsource to a 3rd party manager, and that decision can be a game-changer.

For advisors, this choice isn’t just about delegating tasks; it’s about leveraging specialized expertise, creating efficiencies within their practice, and ultimately freeing up their time to meet with clients. For clients, it’s the opportunity to invest into institutional caliber portfolios designed to be low cost, well diversified, and easy to understand.

In this Blue Chip article, I wanted to highlight the AccessPoint Models that are available on the Envestnet platform and how IFG advisors have

successfully incorporated them within their own unique practices.

What are AccessPoint Models?

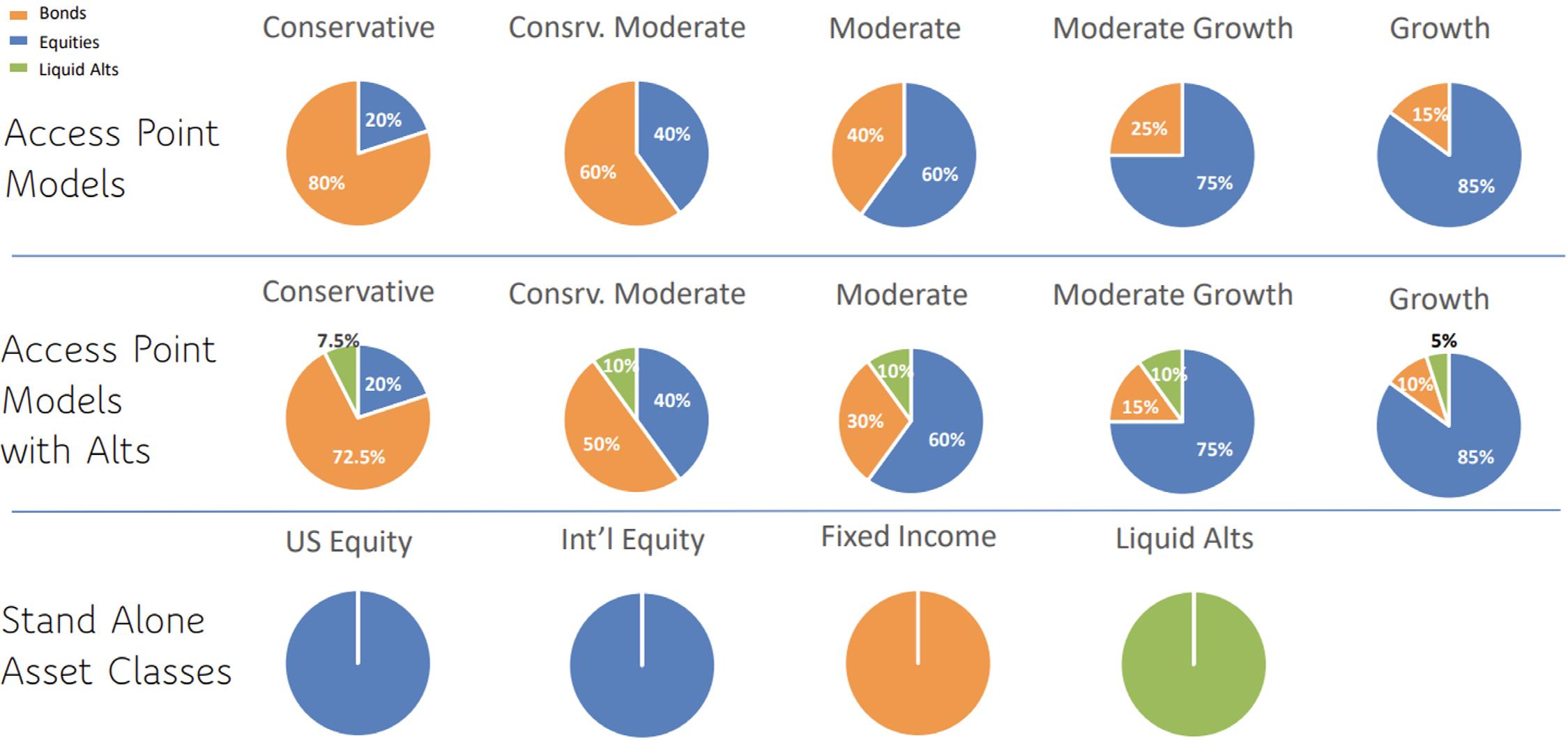

In Fall 2023, IFG launched a series of 14 model portfolios called the AccessPoint Models on the AccessPoint (Envestnet) platform to provide advisors with a full turnkey, well diversified investment solution for their clients.

How are the AccessPoint Models constructed?

Partnering with State Street, one of the largest asset management firms in the world, IFG and State Street collaborate on the asset allocation mix based upon our CAPM assumptions. From there, IFG screens through the universe of mutual funds and ETFs to find the best-in-class security to fulfill the desired asset class. This process includes over 15 different screening processes and includes active mutual funds, active ETFs, and passive ETFs.

Overall, IFG has two main suites of fully outsourced models. One suite is designed to include liquid

alternatives, while the other suite does not. Each suite has five risk-based portfolios that move up in aggressiveness with higher equity allocations ranging from conservative (a 20% allocation to equities) to aggressive (an 85% allocation to equities).

For those advisors that do not want to fully outsource the full investment management function, we’ve created four stand-alone models: US Equity, International Equity, US Fixed Income, and a Liquid Alternative model that you can utilize within the UMA platform. This gives advisors the opportunity to mix and match the various strategies to their desired preference or incorporate other strategies within the same account.

What is the minimum cost to use the AccessPoint Models?

With one of the lowest portfolio minimums available, clients can invest into the AccessPoint Models with as little as $5,000 on AccessPoint. The

program fee begins at 30 basis points and tiers down depending on the account size.

What marketing materials are available?

Advisors can access details regarding the AccessPoint Models under the Research Tab of Envestnet that includes monthly and quarterly updates. In addition, IFG publishes Metrics that Matter, which highlights key economic data and model positioning.

The AccessPoint Models offer clients a structured and systematic approach to investing, providing numerous benefits such as diversification, professional management, cost efficiency, and risk management. By leveraging these models, advisors can help their clients achieve their financial goals with greater confidence and peace of mind. To get started or for additional information, please contact myself or another member of the Wealth Management team at 800269-1903 or WealthManagement@ifgsd.com

Our RILA offers investment growth potential and downside protection with lower portfolio costs designed to help your clients stay in control of their retirement.

The exclusive ‘See the Advantage’ webinar details how our RILA may help you grow your business. Get the inside track on:

► Finding RILA client opportunities

► Three easy steps to building a client’s RILA

► Tools to deliver this compelling solution

Get the ‘Advantage’ for your clients today. Call: Transamerica Annuity Sales Desk at 800-851-7555

Annuities issued in all states except New York by Transamerica Life Insurance Company, Cedar Rapids, Iowa. Annuities are underwritten and distributed by Transamerica Capital, Inc., 1801 California St., Suite 5200, Denver, CO 80202, Member FINRA. References to Transamerica may pertain to one or all of these companies.

Registered Index-Linked Annuities are long-term, tax-deferred vehicles designed for retirement purposes and are not for everyone. They are subject to possible loss of principal and earnings due to market fluctuation, investment risks as a result of fees and charges under the policy including surrender charges, other transaction charges, and periodic charges.

Your clients cannot directly invest in an index and the annuity does not participate directly in any stock or equity investments. Stock dividends on the index are not included as a component of the Index Value.

All guarantees, including optional benefits, are based on the claims-paying ability of the issuing insurance company. The policy may be referred to as a variable annuity in some states. Not available in Missouri, New York or Oregon.

All policies, riders, and forms may vary by state and may not be available in all states. TPVA1400-0720, TRIA1000-R0821 TPVA14FL-0720 (SC), TPVA14OR-0720 (SC), TRIA10OR-R0821

Your clients should consider the annuity’s investment objectives, risks, charges, and expenses carefully before investing. Go to transamerica.com for prospectuses containing this and other information. Encourage them to read carefully. For Broker Dealer Use Only, Not for Use With the Public.

Paul Larrabee, RICP Director, Insurance Solutions

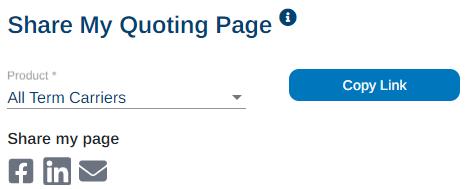

Like a perfect 10 happening in the Olympic Games on the gymnastics floor routine or when Whitney Houston sang the National Anthem at the 1991 Super Bowl, it is incredible to see perfection and completeness, end to end without missing a detail. I believe Simplicity Life has pulled off a similar performance with their life insurance technology tool, Simplicity LifeLink.

Advisors finally have the tool available in their hand-held device to quickly quote competitive term life insurance rates and drop the client ticket in a matter of minutes to start the life insurance process. If a couple minutes is too much time to be allocated to providing clients with life insurance coverage, you can elect to send the client your unique URL link for a do-it-yourself process, enabling your client to quote and apply without your attention. It takes 30 seconds or less to send out your link, and you get full commission for the term product sale.

The LifeLink system is coupled with instant issue and express issue underwriting programs, enabling your healthiest clients to have their life

insurance approved, issued, and placed in just a few hours after submitting their online application.

It’s important for advisors to provide clients with advice on coverage amounts and appropriate term durations of the life insurance. It’s now no longer necessary for advisors to spend a lot of time completing applications for insurance, which this system has completely removed from you.

Use your unique URL link to attract new and younger clients to your book. Anyone in the cyber universe that clicks on your unique link for a life insurance quote and completes the drop ticket process will be registered on your dashboard where you can track all activity. Encourage young clients to share your link on social media with their

circles to ensure their friends and families have access to protection and your planning guidance.

You asked for an efficient sales process to help your clients obtain term life insurance. You now have the most efficient system ever conceived. The system includes prescreen underwriting tools as well as a product center to review product details and highlights.

You will only find this incredible term technology at Simplicity Life.

The secondary market for life insurance gives policyowners powerful options for managing their life insurance. Through transactions like life settlements and retained death benefit , you and your clients now have the tools to tap into the market value of policies that are no longer needed or simply underperforming. The result is new planning strategies where value is maximized and choices abound.

Consider this recent example:

$1,500,000 Universal

The policyowner purchased a Universal Life policy at preferred rates more than 20 years ago. Still in excellent health for his age, he no longer wished to fund the policy. Through Coventry’s non-medically underwritten life settlement program, he was able to sell the policy for $196,000. He used the proceeds to purchase a long-term care insurance policy for his spouse. His advisor received a commission on the life settlement transaction.

By Stuart Hennessey Director, Business Development

Over the Years, I have frequently been asked, “What do I need to ask when purchasing a business?” To address this, we’ve compiled a comprehensive worksheet of must-ask questions.

This guide serves as an excellent starting point for advisors looking to buy a business and a valuable resource for individuals considering selling their business.

1. Timeline for Sale

• How soon is the FA looking to sell their practice?

2. Sellers Priorities

• What is important to the FA selling their practice?

3. Ideal Practice Transition

• What is the ideal practice transition?

A. Introduction to clients

B. Paperwork completed

C. How long will it take?

4. Health of the Business

• Has there been a professional evaluation done on the business?

• Number of households

• Note Top 20 Clients break down

• Average Age of Clients

• Average Account GDC

• GDC (last 3 years)

• AUM

• Book Make Up

1. Fee Based

2. Commissions

3. Trails

4. What products and fund companies

5. Planning - do they charge for plans?

6. Insurance

a. Annuity (companies and states)

b. Life (companies and states)

c. Long term care (companies and states)

(dates policies written, trails, surrender periods)

• Any outstanding Legal Issues

5. Included in the Sale of the business

• Staff - are the key employees staying with the business?

• Office

o Selling office equipment

o Taking over lease

o Transfer of files

6. Professional

• State License

• Exams passed

• Designations held

resources

• Sample purchase agreement and buyout agreement

• Sample contingency agreement

• Transition checklist

If you are looking to buy or sell a business or if you are building a contingency plan, feel free to reach out to Stuart Hennessey, Director of Business development at (858) 436-3180 or shennessey@ifgsd.com

We are your mission control

Our promise to you is simple: We have your back. We know how difficult your job is. We also know we both win when you’re successful. That’s why we’ve built our entire business model around helping you reach new heights. So let’s get ready for liftoff!

Fixed Annuities | Fixed Index Annuities | Variable Annuities

Annuities built for real-life retirement needs:

• Straightforward contracts and no surprises down the road

• Growth potential

• Guaranteed lifetime income options

• Flexibility to adapt as needs change

You and your clients can feel secure in our history—and our future together.

Years of recognition from industry experts

Barron’s, DDW, and Ward’s provide independent third-party rankings and determine rankings based on a variety of factors. For information on the specific rankings and factors please visit their independent sites which are not affiliated with Delaware Life Insurance Company. Delaware Life Insurance Company is not affiliated with DDW, Barron’s®, or Ward,® and has not independently validated any information contained within the article(s). Therefore, the accuracy, reliability, or completeness cannot be guaranteed. Annuities are issued by Delaware Life Insurance Company (Zionsville, IN), which is authorized to transact business in all states (except New York), the District of Columbia, Puerto Rico, and the U.S. Virgin Islands. Variable Annuities are issued by Delaware Life Insurance Company and distributed by its affiliated broker-dealer, Clarendon Insurance Agency, Inc. (member FINRA) located at 230 3rd Avenue, Waltham, MA 02451. Both companies are subsidiaries of Group 1001 Insurance Holdings, LLC (Group 1001).

Guarantees are subject to the claims-paying ability and financial strength of the issuing insurance company, Delaware Life Insurance Company. Products and features may vary by state and may not be available in all states. This communication is for informational purposes only. It is not intended to provide, and should not be interpreted as individualized investment, legal, or tax advice. FOR

Annuities can be used for market value growth! It’s time to lock in the best rates for guaranteed growth!

Erick Montiel Director, Annuity Solutions

The federal reserve officially started lowering interest rates! The first rate cut of 50bps took place this month! It is imminent that insurance carriers will begin decelerating the product manufacturing race. However, there is still time to lock in the highest rates in a generation to provide your clients with great guarantees. Here are THREE MUST KNOW TIMELY IDEAS for today’s market… based on rates as of 9/16/24:

Growth Idea in the Fixed Index Annuity Space:

Delaware Life Growth Pathway 7-year FIA:

• Delaware Life allows you to lock in a great cap rate based on today’s historical highs for the next 7 years.

• A guaranteed renewal rate lock (with no renewal risk) on their S&P500 12-month point-to-point ($100k+) investment of 8.85% cap per year for the entire 7-year surrender period.

o If the market is negative that year, the client will not see any negative performance.

o If the market is positive that year, the client will participate 100% up to the 8.85% cap.

• Guaranteed minimum growth of 21% in 7 years for the market value regardless of how the market performs.

• The two features above therefore guarantee the client will perform 21% to 81% if they hold it for 7 years.

• No fee

Delaware - Growth Pathway 5 & 7 - Rate SheetClient Use - Link

Delaware - Growth Pathway 5 & 7 - BrochureClient Use - Link

Delaware Life Financial Strength and RatingsClient Use

Growth Idea in the Registered Index Linked Annuity (RILA) Space: Principal Group Strategic Outcomes RILA

• Principal Group is offering 6-year pointto-point with leverage up performance segments in their 6-year surrender product with no caps and 10% buffer protections. Principal Group will cover the 1st 10% of market loss during the 6-year period.

• 0.95% enhanced rates fee.

o This is a great way to potentially OUTPERFORM the market (indices) in both positive and negative 6-year total return scenarios.

o In all scenarios, if the market is negative -10% or less in 6 years, the client will see no loss.

o If the index is negative -11%, then the client will only see -1% loss.

o S&P500 130% participation. The client will earn 1.3X whatever the S&P500 Index performance for the next 72 months.

• If the S&P500 is positive 50% in 6 years, the client will earn 65%

o Russell 2000 140% participation. The client will earn 1.4X whatever the S&P500 Index performance for the next 72 months.

• If the Russell 2000 is positive 50% in 6 years, the client will earn 70%

o MSCI EAFE 155% participation. The client will earn 1.55X whatever the S&P500 Index performance for the next 72 months.

• If the MSCI EAFE is positive 50% in 6 years, the client will earn 77.5%

Principal Group Rate Sheet Link

Growth Ideas in the Fixed Annuity or Multi-Year Guaranteed Annuity (MYGA) Space: CALIFORNIA

• Americo Platinum Assure

o 3 years: 4.85% ($25,000+)

o 5 years: 5.20% ($25,000+)

• Athene Max Rate ($100,000+)

o 7 years: 4.90%

• Oxford Life Multi-Select 10 ($20,000+)

o 10 years: 4.80%

Growth Ideas in the Fixed Annuity or Multi-Year Guaranteed Annuity (MYGA) Space: Most States

• Ibexis (exclusively with FIG Marketing FMO/IMO)

o 3 years: 5.15% ($100,000+)

• Americo

o 5 years: 5.20% ($25,000+)

• Athene Max Rate ($100,000+)

o 7 years: 4.90%

• Oxford Life Multi-Select 10 ($20,000+)

o 10 years: 4.80%

For the latest rates, ideas, changes, and news in annuities, please reach out to the annuity department:

Erick Montiel Director, Annuity Solutions emontiel@ifgsd.com

Michael Spence Specialist, Annuity Solutions mspence@ifgsd.com

By Advisor Capital Management

Arecent study by JP Morgan reveals a significant trend: 75% of employer plan participants seek professional guidance for investment decisions, and 60% are ready to completely delegate their retirement planning and investing to a financial advisor.1 For independent financial advisors, this presents a unique opportunity. By advising on clients' heldaway retirement accounts—such as 401(k), 403(b), 457, or 401(a) plans—you can solidify your role as their primary financial advisor.

Offering compliant advice and management for these held-away accounts not only enhances client relationships, but also increases your practice's fee revenue and assets under management (AUM). This approach can lead to further business opportunities, including 529 plans, life insurance, rollovers, and inheritance planning, ultimately boosting the enterprise value of your firm.

For many Americans, their 401(k) or other employer-sponsored retirement plans represent their largest financial asset, aside from their home. Despite this, only 16% of participants managing their own 401(k) feel very confident in their investment strategy2, and just 19% are likely to follow computer-generated financial advice.3 This gap highlights the critical need for trusted, professional guidance. Once participants receive advice from a knowledgeable source, advisors can gain a larger share of the household’s financial planning.

Historically, financial advisors have faced challenges in providing compliant advice on these held-away accounts, due to scalability issues and fee-billing complexities. ACM’s PathFinder platform offers a solution to this dilemma. Designed as a participant-level service, PathFinder allows financial advisors to advise and manage active held-away retirement accounts without requiring an account rollover or external fee billing.

1 J.P. Morgan Plan Participant Research 2024.

2 4Q 2023, Cerulli Associates - 401(k) Managed Accounts: A Misunderstood Value Proposition

3 Peterson, M., & Taylor, C. (2024, July 24). Schwab 401(k) study: Confidence among workers improves as inflation and market volatility concerns soften | Charles Schwab. Charles Schwab. https://pressroom.aboutschwab.com/press-releases/press-release/2024/Schwab-401kStudy-Confidence-Among-Workers-Improves-as-Inflation-and-Market-Volatility-Concerns-Soften/default.aspx

Introducing ACM’s PathFinder Platform ACM’s PathFinder platform serves as a bridge between financial advisors and plan participants, facilitating advice and management of heldaway retirement accounts. PathFinder is available across tens of thousands of 401(k), 403(b), 457, and 401(a) plans, from Fortune 500 companies to small businesses, major health centers to local hospitals, and universities to local public schools. It’s also available in thousands of municipal plans, including state, county, and city deferred compensation plans.

PathFinder operates within the plan participant’s Self-Directed Brokerage Account (SDBA), which is available in over 100,000 defined contribution plans. Because ACM is approved at the custodial level, there’s no need for advisors to log in as the plan participant. Participants continue to access their accounts through their usual portal, retaining all plan benefits, including contribution matches and loan provisions.

Currently, over 100,000 plans with more than $3.5 trillion in assets offer a Self-Directed Brokerage

Account (SDBA) option, giving millions of Americans the ability to access a broader range of investment choices and the opportunity to hire an advisor to manage their accounts. Despite the prevalence of this option, many participants are unaware it even exists within their plan. PathFinder is available on most plans offering an SDBA option, through nearly every major recordkeeper.

Incorporating ACM’s PathFinder platform into your service offering can significantly enhance client engagement and practice management. Please contact us if you are interested in determining if your client’s plan qualifies for the PathFinder SDBA platform. Our job is to do the research and get back to you within one business day. If you would like to connect by phone, call us at 201-447-3400 or email us at PlanCheck@advisorscenter.com. Please do not send any client sensitive information. Don’t miss out on the opportunity to expand your role as your clients' most trusted advisor.

By Colin Andrews, CFA Senior Due Diligence Analyst

We are excited to announce that Mill Green Capital has joined our platform as a new strategic partner with their latest offering, Mill Green Opportunity Fund IX, LLC. With the recent addition, we wanted to introduce Greg Fox, CEO and ask him a couple of questions about the company, their latest offering, and what you should consider as you start to engage with them.

1. Greg let's start with the basics. Can you walk us through the company history and where you are today?

I founded Mill Green Partners in 2014, and we launched our first fund in January 2015. I was formerly the CFO of Post Properties,

Inc. (“Post”) based in Atlanta, GA. Post was listed on the NYSE, had a $4 billion market cap, and was a developer of Class-A multifamily properties in the major Sunbelt markets. After leaving Post in 2003, I ran a division within the Morgan Stanley Real Estate Fund business. That business had 26 funds with over $100 billion of real estate under management.

In 2014 the founder and former CEO of Post, John Williams, contacted me about starting a company to sponsor funds investing in common equity in development projects. That was how Mill Green started.

In the first eight years, our investments were in projects where PAC, founded by John Williams, also invested through mezzanine loans. Later, we pursued other reputable developers like Terwilliger Pappas, TDK, and Crossland Southeast.

Since 2015, we've made 41 investments in multifamily development projects and two in build-to-rent single-family projects. We've closed eight funds, liquidated five, and are now offering our ninth fund, Mill Green Opportunity Fund IX, LLC.

2. Can you walk us through your current strategy and the relative value you see in your asset class?

We target major markets in the Southeast with the select group of developers we have worked with over the past several years. Within those markets, the developers we work with target mature, suburban infill locations near major business and retail centers. The major markets in the Southeast have outperformed the national averages in both employment and population growth for several decades. This trend has been especially strong post COVID, and we believe this trend will continue.

Multifamily is a favored asset class for institutional investment. The ability to reset rents annually and the demonstrated resiliency over several business cycles supports this demand. Our developer group has extensive experience developing Class-A, multifamily properties in these markets. A secondary strategy is development in the Build-to-Rent (“BTR”) space with a seasoned development partner. We feel demand for this asset

1 Source: John Burns Research &

2 Source: The Linneman Letter- Summer 2024-Multifamily Market Outlook

class will grow in the coming years driven by Millennial household formation and supply constraints for single family housing. We intend to be opportunistic with this strategy while focusing on our core competencies of Class-A multifamily development.

3. What trends or market dynamics do you believe will impact the multifamily and BTR markets in the coming years, and how are you positioning your funds for any headwinds?

We feel there are several market dynamics favorable for multifamily and BTR markets, including:

• The Southeast will continue to outperform the nation in job and population growth.1

• Single-family housing shortages will persist.1

• New multifamily construction starts have declined significantly due to high interest rates and tight capital markets.2

• Deliveries of new apartment units will decline by 50% in many markets starting in 2025, allowing for rent increases and potential property value growth.2

• The Fed cut interest rates by 50bps in September 2024 and expectations are that additional rate cuts will be forthcoming, promoting property value growth and declining commercial mortgage rates.

Headwinds from rising costs and higher interest rates are nearing an end. Properties sold in 2023 and 2024 benefited from substantial rent increases in 2021 and 2022.

Our recent sales met target returns, and we expect similar results for properties sold through December 2024.

4. Beyond the potential returns, what are some other benefits that investors might see from investing in Opportunity Fund IX or future Mill Green Funds?

Our outlook for current investments, which won't sell until 2027-2028, is positive, as we anticipate the high inflationary economy and interest rate regime softening significantly, with more favorable market dynamics supporting our strategy.

Our funds have a 4–5-year lifespan, but investors can expect distributions sooner. Since we invest during the offering period and our typical lifecycle is three years, investors should see distributions from property sales, typically, less than three years after a fund closes. Most taxable income allocated to investors will be considered long-term capital gain for federal income tax purposes, benefiting from a lower tax rate compared to ordinary income.

5. There is a unique tax strategy here with the potential for a Roth Conversion. Can you walk us through how this works and the ideal client?

At the end of the first year after closing a fund, we engage a MAI-certified appraiser to value a $100,000 unit. Since the valuation assumes a sale, and our funds are private equity with restricted sales and no active market, the appraiser applies a significant

discount rate (typically 40%) to the projected cash flows. This results in a value typically ranging from $60,000 to $70,000 (per $100,000 investment).

We report this value to the custodians holding the Fund's investments through IRA accounts, usually around April of the following year. Investors can then convert their traditional IRA to a Roth IRA, paying taxes on the lower value rather than the future distributions. We then revert the value back to par ($100,000) approximately one year later, around April of the following year.

This strategy offers several benefits:

• Avoids mandatory redemptions

• Provides tax efficiency

• Allows investors to straddle conversions over two years

• Is ideal for investors nearing or in retirement

6. Is there anything else our advisors should know as they think through their clients that might benefit from investing in Mill Green sponsored multifamily projects?

There are two distinct share classes within the Fund with different goals. The I-unit is ideal for investors seeking regular income, providing a 6% annual distribution paid monthly. This unit type also features a 10% preference return in the fund waterfall. In contrast, the G-unit is geared towards investors focused on maximizing returns. Although distributions are only made upon property sales, the G-unit receives a higher proportion of proceeds due to its 12%

preference return and is expected to deliver a 2-4% higher annual return than the I-unit. Once investors have received their preference returns and return of capital, Mill Green Capital receives 25% of the remaining distributions.

It's worth noting that the G-unit's higher allocation stems from our investable contributions policy. Conversely, I-unit distributions are funded by reserves established during the offering process, which reduces their share of distributable proceeds from property sales.

To ensure investors stay informed, we provide quarterly update letters via email, which summarize the fund's investments, offer detailed updates on

each development project, and include aerial photos and market commentary. Our investor portal offers easy access to distribution history, tax documents, audited financial statements, and original subscription documents. Investment advisors with clients in the fund also receive advance notifications regarding quarterly letters and distributions.

For more information on Mill Green Capital and Mill Green Opportunity Fund IX, LLC, check out our IFG Offering Overview, contact a wholesaler, or reach out to member of the IFG Alternative Investments team.

According to a July 2023 PwC study, 16 percent of existing asset and wealth management organizations will cease to exist by 2027.1 Leaders who intend to maintain their current position must adapt to thrive in the evolving industry, which is riddled with new challenges. Anticipated shifts in generational wealth, investor mindsets, and big data analytics are expected.2 Attracting and maintaining high net worth (HNW) and ultra high net worth (UHNW) clientele now may ensure the longevity of advisory firms during this industry transition as a staggering 30 trillion dollars in investable assets will be passed down and possessed by baby boomers by 2030.3

HNW individuals, or those with a net worth between one million and 30 million dollars, comprise approximately 12.1 million US households, or 10 percent of the US population. UHNW individuals, or those with a net worth exceeding 30 million dollars, comprise less than one percent. Though limited in numbers, these wealth segments control a significant portion of the country’s wealth, and they choose to maintain relationships with financial advisors by an overwhelming majority for guidance on achieving increased returns to preserve and grow their wealth.4

Interest in alternative investments, specifically real estate, is growing among these key wealth segments and may appeal to those seeking sophisticated financial guidance. Nearly 50 percent of UHNW participants in a recent study allocate their money towards alternative investments.5 In fact, PwC forecasts that by 2027, over 25 percent of the global assets under management will be in alternative investment vehicles, as diversification with alternatives can buffer against market volatility and enhance overall portfolio performance.6

Industrial real estate, in particular, benefits from its universal appeal to a variety of industries and service providers and its essential involvement in supply chains. With the escalation of onshore and nearshore production, warehousing demand is unparalleled and is necessitated by heightened consumer demand for expedited delivery. As e-commerce and global trade continue to grow, the value of well-located, infill industrial properties may appreciate. Investing in areas with strong infrastructure and proximity to major transport routes can be particularly advantageous, a strategy Sealy & Company has been well-versed in for decades.

To learn more about industrial real estate as a tax-advantaged income and growth opportunity, please contact Sealy Investment Securities, the managing broker-dealer of Sealy & Company investment offerings. Contact: 888.732.5990 or SalesSupport@SealyInvestmentSecurities.com. For more information on Sealy and its industrial real estate offerings, please scan or click the QR code.

Scarborough Capital Management

Annapolis, MD

Gregory Ostrowski, Shawn Walker, Ryan Ansted, Ian Arrowsmith, Jeffrey Cardozo, Josh Goldsmith, David Herman, David Sizemore, Jay Sprinkel, Jonathan Szostek

Capital Growth, Inc.

San Diego, CA

Art Molloy, Jay Wurtzler, Pat Brennan, Scott Dickerson, Marcella Harkness, Erica Tanner, Matthew Belardes

Cornerstone Wealth Management

Las Vegas, NV

Jammie Avila, Kyle Kirwan, Daniel Mann, Anthony Napolitano

JTW Financial Services

San Gabriel, CA Joyce Thomas, Hui Zhang

Senglaub Financial Group

Delafield, WI

Jim Senglaub, Jeff Senglaub, Mike Senglaub, Craig Rusch

O’Donnell Financial Services

San Rafael, CA

Greg O’Donnell, Michael Nakano

Cambium Wealth & Legacy Strategies

Camp Verde, AZ

Mary Huntley, Heidi Bird, Joshua Szyman, Jodi Padgett, Joseph Glomski, Thomas Taylor

Cinergy Financial Tustin, CA

Cindy Couyoumjian, Kobe Couyoumjian, Leticia Hewko, Douglas Shaner

Premier Wealth Advisors

San Diego, CA

Ari Crandall, Josh Koehnen, Joseph Leblanc

Shiraishi Financial Group Advisors

Honolulu, HI

Grant Arita, Christopher Dang, Graham Enomoto, Kendall Kakugawa, Hans Medina, Herb Shiraishi, Jason Wong

(as of September 30, 2024)

– September 30, 2024