Rai e pon o hip do a Se ect venue to ho t event

O ganize down to the ve y a t detai Make a p an of action execut B ing you fun in a ec eationa envi oment

The Recreation Committee is the embodiment of FUN! Each year, we organize, host, and promote fun events giving our current and prospective members opportunities to fellowship and network. Our events include, the Spring Golf Classic, and Texas Hold’em Poker Tournament. These events are not only fun, but they are also charitable and allow us to give back to the community. What are you waiting for, get recreational with us!

For more info contact, ccole@texasmutual.com

are what breaths life into our association. With 9 active committees there are at least 100 people actively serving the association with their unique skills. We are always looking to put your skills to use to further drive the association’s mission forward. No matter what your skills are, or what you are passionate about, we likely have something of interest to you. The end result is to better the industry we all serve. Join a Committee today and become part of the mission.

Charitable Projects/ Fire Prevention

Vice Chairman: Sarah Beck

Education, I.T., CE

Chairman: Michelle Dennis

Vice Chairman: Katrina Masek

Houston Insurance Day

Chairman: Ashley Newton

Vice Chairman: Nancy Euginio

Vice Chairman: Matt Romano

Legislative

Chairman: Kyle Dean

Vice Chairman: Wes Kurtz

IMPACT

Chairman: Wes Kurtz

Recreation

Chairman: Amber Stevenson

Vice Chairman: Carisa Cole

Young Insurance Professionals

Chairman: Derek Pierce

Vice Chairman: Grant Pierce

PR/Media Matters

Chairman: Scott West

Social Media

Chairman: Daphne Clark

Vice Chairman: Cassie Shanks

Houston Insurance News

Chairman: Amy Weimer

Vice Chairman: Cassie Shanks

It has been a wonderful year at the IIAH! We have had some great events, the last one being the annual Golf event. We had 47 teams play in the event, too many for one course I know, sorry for the six-hour round. We will correct that next year with your help. We need all the teams to sign up early so that we can reserve both courses at Blackhorse and therefore play in 4 hours! I have already requested the second course, so please make sure that we have at least 47 teams next year.

I am looking forward to our annual Charity Bowling event on July 8th. We hope to have 44 teams this year, which would allow us to take over the entire bowling alley. This is such a fun event for everyone, and the good news is that it is inside during our hot Houston summer! And anyone can bowl, you don’t have to be any good, it is just a fun event to be a part of and raises money for our three charity partners.

We are busy working on the events for our Centennial year in 2024! We will have a wonderful concert to kick off the year in January and end with an over-the-top Gala at the Houston Museum of Natural Science in October. You will not want to miss any of the events, and they will be special as we celebrate 100 years of IIAH!

At the end of each fiscal year, I am thankful for the leadership of your organization. Thanks to the IIAH Board and the Executive Committee for all of their time and hard work throughout the year. We will miss Past President Jim Drew and board member Tony May as they roll off the board on September 1. However, we know that they are just a phone call away and are always there to help in whatever way they can to make the IIAH better.

And of course, thanks to all our members, without you the IIAH would not exist! As always, Renee, Ayla and I are here for you, so please give us a call and let us know how we can help!

Executive Director David Wuthrich

I can’t believe it is already July! Where has the time gone?

Titanium Elite Sponsors

Imperial PFS

Burns & Wilcox, Ltd.

CRC Group

Southwest Adjusters

Platinum Partners for Excellence

RT Specialty

Texas Mutual Insurance

UFG Insurance Company

WSG Specialty Underwriters

Gold Patron Sponsors

Chubb

CNA Insurance Companies

Jencap | Delta General Agency

Travelers

WRIGHT Flood

New Agency Members:

True Insurance Agency

Vertex Insurance Group

New Affiliate Members:

neRhino IT Solutions

SERVPRO of Katy/Cypress

Jason Nybakken

Adam Harris

Jason Knecht

Susan Zipperer

Jesse Sanchez

David Wuthrich

Jim Drew

Ryan Beavers

Kevin Comiskey

Laurie Dempsey

Matt Leicht

William Peachey

Wes Weatherred

President President Elect

Vice President

Treasurer

Treasurer Elect Executive Director Past President

David Wuthrich

Renee Stager

Ayla Benavides

Deb McRae

Sarah Beck

John Collado

Tom Fitzpatrick

Tony May

Executive Director

Sr. Managing Director

Managing Director

Advertising/Membership

By: Priscilla Oehlert

By: Priscilla Oehlert

2023 RIMS RISKWORLD Conference– The Spencer Educational Foundation awarded the UHD IRM Center a grant to support student travel to the 2023 RIMS National Conference. Fortunately, four IRM majors attended and received an insurmountable amount of value from the experience as noted in their below comments.

Ubaldo Silva stated “The conference solidified that I want to pursue a career in risk management. I have some experience in risk management; however, this conference confirmed it is a career for me. The conference showed me many different avenues and job opportunities in the risk management industry. Additionally, insurance gives even more options for different paths in the industry. I met a senior director of risk management for a luxury vacation company. I never thought someone could work for a vacation company as a risk manager. I also met a risk and claims analyst who works for a company that produces tractors, agricultural machinery, construction equipment, vending machines, pipe, valves, equipment for water purification, etc. The company is international and was something I never thought would have a risk management team. There is a need in every industry for risk management to be successful.

Rosario Banillo stated “It was my first conference in the industry, and the exposure to the industry made me want more knowledge. I now enter places of establishments wondering if they have a risk management program, and I wouldn’t think of that before the conference.”

Fabian Padillo stated “After the conference, I am convinced I made the right decision to stay in the risk management industry. Now I see everything as a risk, from a large hazard such as a flood to a small paperclip. Although learning to eliminate hazards is not everything, being up to date with laws and regulations was also a topic at some of the sessions. As risk managers, we must know what is changing and how it will affect the organization and employees.

Bryan Alvarado stated “This conference reassured me that the industry I entered was right for me. During the conference, I heard amazing stories from multiple risk managers that made me feel I would fit in. Although there were some instances where we, as students, felt undermined, most professionals were ready to share their wisdom with the next generation of risk management and insurance professionals. It also impacted my understanding of this industry thanks to others sharing their work, such as medical risk management or real estate risk management. Before this conference, it seemed as if I had a block about what can be managed within risk and how they are mitigated. Now I have a better understanding of the world of RMI and how I can make an impact.”

Spring Graduation – The UHD IRM Center is very excited to announce that four IRM majors graduated on May 20, 2023 with the BBA in IRM degree, which brings the total IRM alumni to 130 since the inception of the program in 2009.

University Associate Certified Risk Manager Designation – The UHD IRM Center is also proud to announce 15 students recently earned the University Associate Certified Risk Manager (UACRM) designation, the highest university-level risk management industry credential. These students have joined an elite group of 300 university students in the US who have earned the designation offered by The National Alliance for Insurance Research & Education. The Certified Risk Manager (CRM) designation requires successful completion of five courses; UHD offers students the opportunity to earn credit for three of those while simultaneously earning up to six credits toward completion of the BBA in IRM degree.

Based in Houston, TX Mission K9 Rescue provide assistance and support for Working Dogs worldwide Our organization’s purpose for existence is to serve retiring and retired Military Working Dogs, ontract Working Dogs, and other Dogs who Serve as they may fit into our mission and scope.

OUR MISSION

To Rescue, Reunite, Re-Home, Rehabilitate and Repair any retired working dog that has served mankind in some capacity

Rescue – Any and all WDs and MWDs as well as any other working dog that may need our help Mission K9 Rescue is committed to saving them and giving them the retirement they deserve; whether it be bringing them back from overseas or rescuing them out of a poor environment stateside

Reunite – Any retired working dog that has a handler that wants him, and has proven that they are the right home (handlers always get first preference) Mission K9 Rescue will see to it that the dog is transported to the handler

Re-Home – Any retired working dog that does not have a designated handler, Mission K9 Rescue will work to find the perfect loving home for the dog

Rehabilitate – Often retired working dogs have been in situations that can cause them severe anxiety and stress Many retire with issues such as Post Traumatic Stress Disorder These dogs need time with us to decompress and reintegrate into society

Mission K9 Rescue works with these dogs in order to get make the suitable for adoption

Repair – Working dogs train like professional athletes their entire career Often times when they retire, they have extensive medical issues that can become quite costly Since they don’t receive retirement benefits, Mission K9 Rescue provides much needed funding to assist handlers/ and or adopters with medical bills

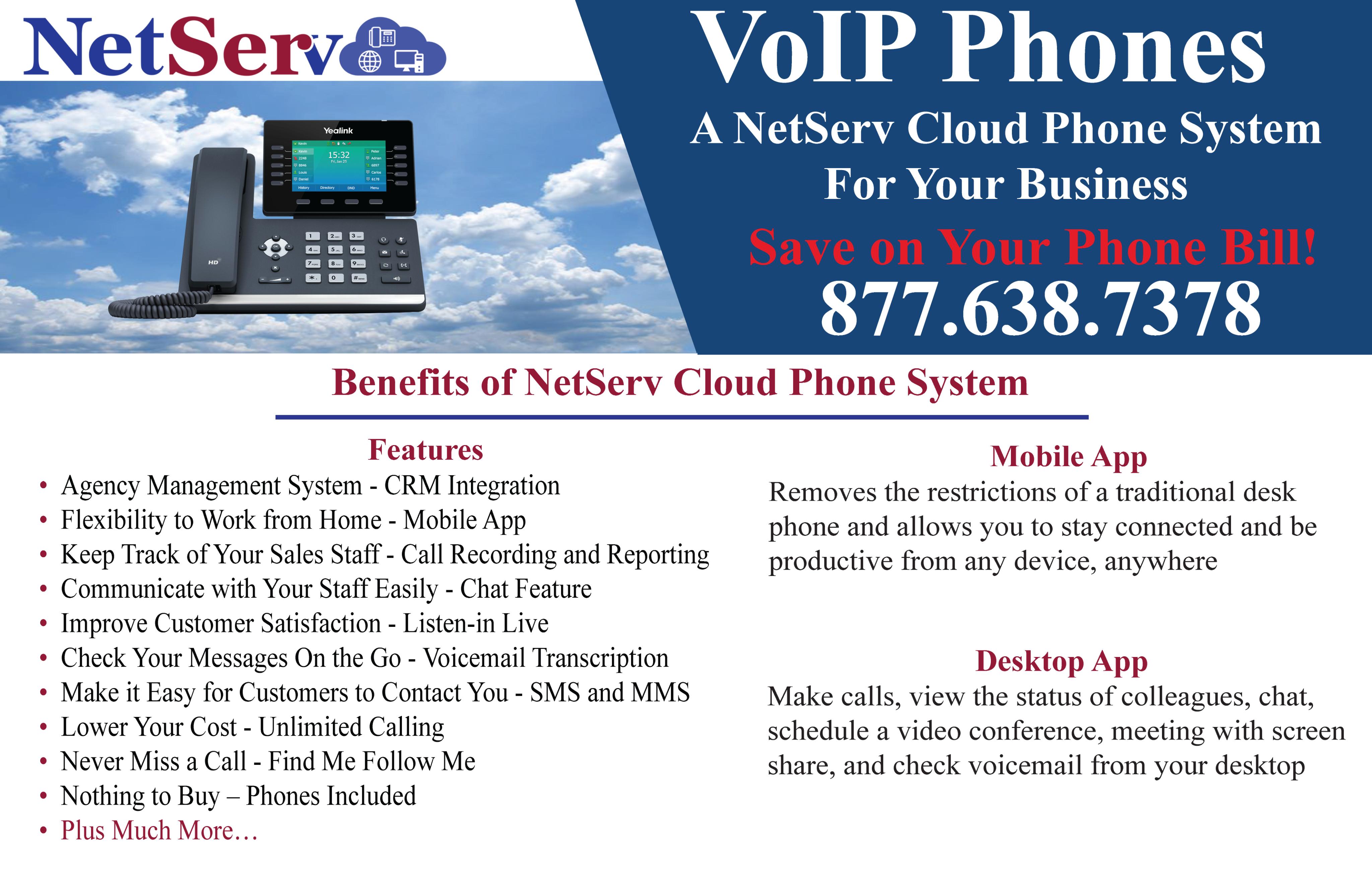

For the last 25 years, neoRhino IT Solutions has refined, adapted, and applied strategic technology practices to help businesses accomplish more. We apply best practices across all services for optimal efficiency and compliance. Our customer-centric approach allows us to tune into client needs which has allowed us to maintain long-term relationships across 30 different industries through results driven collaborations.

In recent years, we have been at the forefront of the new cyber insurance landscape. Cyber criminals and bad actors have been innovating and changing tactics to wreak havoc in business networks and steal valuable data. This evergrowing issue has created new challenges in the approach to insuring businesses and their data. These changes bring uncommon terminology, shifts in business practices, and major changes in what an insurance policy will cover. At neoRhino, we are focused on creating IT solutions that help partners with powering their purpose. Feel free to contact us for more information at hello@neorhino.com!

By: Wendall C. Braniff

By: Wendall C. Braniff

June 2023July 2023

The kids are out of school and vacations are on our minds, but our IIAH staff continues to work hard to provide opportunities to get together. Please check your emails and the website for events in July and August to network and support the great charities we have the privilege to work with. I hope to see you at the Charity Hero Bowl on July 8th at Copperfield Bowl. We are hoping to sell the entire venue out and have it all to ourselves! Grab four friends and coworkers and dress as your favorite superhero to benefit The Brookwood Community, Texas Association of First Responders and Mission K-9.

The Young Insurance Professionals (YIPS) are also putting on an awesome networking event on August 10th at Loft 18. No golf experience necessary! You can play golf and several other sports and games. Bring your clubs or just yourselves for a great time. Only 50 spots are available for this event so sign up fast! If you are heading out of town this summer please travel safe. I look forward to seeing you soon. Take care!

IIAH President 2022-2023

Jason Nybakken

Jason Nybakken

JasonNybakken@ibc.com

IIAH President 2022-2023

Jason Nybakken

Jason Nybakken

JasonNybakken@ibc.com

Builders risk insurance covers materials, fixtures and equipment installed during the renovation or construction of a structure. Coverage is triggered if any of those items undergo physical loss or damage from a covered cause. Whether clients are personal lines or commercial lines, agents servicing course of construction accounts must grasp the importance of timing when it comes to securing coverage.

Generally, coverage should begin when building materials are delivered to a construction site. That requires the agent to stay in close contact with their client—especially as supply chain hiccups can delay the manufacturing and delivery of plumbing, electrical, lumber and other building materials.

However, being too early costs the client money. Securing an effective date before the owner or contractor is ready to begin building or remodeling starts the policy clock without insuring anything. By contrast, being too late can mean a shortage of coverage and an insured not having coverage for a loss that happens prior to policy inception.

In many cases, funding from a bank or other lending institution dictates the timing and coverage requirements. Oftentimes, a lender expects coverage as a condition of closing the loan. This means the policy inception date is the same as the loan's closing date.

In some instances, construction does not start on time due to unforeseen delays. If this is the case, the agent could request a cancelation and then issue a new policy—with the lender's consent—with a revised effective date. The policy term is then reset. If this can't be accomplished, the agent can let the policy term run its course, aiming to renew it. In this instance, it's important to select a provider who offers renewal options for the type of project. If construction begins without coverage, there's a lot of risk. Some builders risk carriers won't insure projects that are already underway. Most likely, additional underwriting will be required, which delays coverage and could result in the submission being declined.

On top of that, the client won't have coverage for a loss. One example is if building materials are delivered to a construction site and they are stolen. If a policy wasn't secured, there's no coverage for the replacement materials.

When securing a policy, it's also helpful to know the project's anticipated completion date, which is based on the length of time it takes to finish the job, not the scheduled policy term. Conversing with the client and reviewing the construction contract are the best ways to determine it.

The most important advice for independent agents is to stay in close contact with their clients, be curious about their projects and ask questions to ensure they get a policy with the right coverage.

IIAH hosted our annual Spring Golf Classic on May 23, 2023, at Blackhorse Golf Club. What an incredible turnout! We had a record breaking 47 teams play in our tournament, enjoying a sunny day filled with networking, snacks, and libations. Thank you to everyone who participated and to all our sponsors for making this event possible. We are reserving both courses for next year, so make sure to mark your calendars for May 2024 and make sure to register early. We'll see you then!

1st place Team: CRC Group Matt Doyal Tony Cugini Pinky Hartline Austin Scarmardo

2nd Place Team: Imperial PFS Mitchell Rowell Chris Coburn Stephen Bailey Clay Fullick

3rd Place Team: U.S. Risks Peter O’Connor Mason McEntire Tony Loricco Steve Cote

Th nk to our Annu l S ring Golf Cl ic S on or

Tit nium Elite Hole S on or

Im eri l PF

urn Wilco

C C Grou

Southwe t Ad u ter

Pl tinum P rtner of Excellence Hole S on or

T S eci lt

Tex Mutu l In ur nce Com n

UFG In ur nc

WSG S eci lty Underwriter

Gold P tron Hole S on or

Chu

CNA In ur nce Com nie

Jenc Grou

Tr veler

W IGHT Flood

Th nk to our S ring Golf Cl ic S on or

ll Dro S on o

Im eri l PF

Hole In one S on o

CP O A oci te

eer C rt S on or

erkley M n gement Protectio

ICW In ur nce Com nie

Service Lloyd

Vint ge Underwriter

Driving nge S on o

Velocity i k Underwriter

Hole S on or

Amwin Acce

Argo Grou U Underwriter

Com ined Grou In ur nce Service

Progre iv i k Pl cement Service

Southwe t i k, L

Goodie g S on o

NFI

Peo le Premium Fin nce

The Independent Agents and Brokers annual Legislative Conference was once again well attended by Texas agents. It’s an opportunity to meet with our elected reps in their D.C. offices, building or reinforcing relationships while discussing our needs and interests. Our D.C.-based IIABA leadership depends on agent’s active participation in this event to do their job effectively. It’s a physical impossibility for any one person to have relationships with 435 members of the House and 100 senators, so agents from every state attend this gathering, many of whom have established relationships with one or more members of Congress. This article is focused on just the Houston “contingent”. Our meetings started early Wednesday, Jim Drew and I represented the Independent Agents of Houston during the 4/25-28 conference, meeting with 8 house members and/or their staffs during the crucial debt ceiling vote-week. The first two Representatives we met with that day were Wesley Hunt, HD 38 (west and northwest Houston) and Randy Weber, HD 14 (Galveston, coastal, Beaumont). They both had major floor votes that interrupted the visits, but good meetings.

Wednesday afternoon, we sat in on a Homeland Security committee meeting. Sausage was being made, votes on numerous amendments being taken, along party lines. While we didn’t stay more than 45 minutes, the committee concluded its business at 2 a.m.

Wednesday afternoon had up to 40 members of Congress plus aides, and a national contingent of agents. A group of the Texas agents posed with Capital building as a backdrop. Featured from left to right in the photo –Josh Andrajack, Scott West, Regan Ellmer, Drew Brown, Gaylon Brown, Chester Dalton, Jim Drew and Don Whitaker.

On Thursday we dropped by Pete Sessions (HD 17, Waco and central Texas) office on an unannounced visit, were met by his chief of staff and then with senior counsel, Tucker Anderson. During our bullet point conversation with Tucker, Representative Sessions joined us. During the balance of the day, we met with 4 other aides. Congressional aides are often the best means to convey independent agent positions in an environment where Representatives and Senators are always on the go.

The final meeting was in Sheila Jackson Lee’s (HD 18, central Houston) office, whose staff representative took us via the congressional member tram to the Capital. We met the Representative in the Sam Rayburn room of the capital, had a frank discussion about NFIP extension and other topics. After which she had her staff member show us to the members only exit from the House side of the capital, with the press waiting below. Doubt we’ll show up in any press photos, but it was entertaining.

Scott West, CIC

CEO, Pathfinder/LLD Ins.Group,LLC

The Library of Congress is adjacent to the Capital, between the House and Senate office buildings, and adjacent to the Supreme Court building. The view from the 3rd floor of the Capital is amazing!

Scott West, CIC

CEO, Pathfinder/LLD Ins.Group,LLC

The Library of Congress is adjacent to the Capital, between the House and Senate office buildings, and adjacent to the Supreme Court building. The view from the 3rd floor of the Capital is amazing!

On

The amazing interior of the Library of Congress, infrequently opened for the general public, on Thursday we were allowed in. Jim

is in the foreground, should have gotten him to pose, but did get a good back side of his head.

Representative Hunt posed for photo at the Insurpac Major donor gathering at the Big I rooftop.

the steps of the Capital, Jim and Regan posed after a long day of meetings.

Drew

Representative Lee with Jim Drew and Scott West, in the Capital

Representative Hunt posed for photo at the Insurpac Major donor gathering at the Big I rooftop.

the steps of the Capital, Jim and Regan posed after a long day of meetings.

Drew

Representative Lee with Jim Drew and Scott West, in the Capital

By: Wes Kurtz

By: Wes Kurtz

A political action committee or PAC is a group that is formed to give money to the political campaigns of people who are likely to make decisions that would benefit the group’s interests.

We cannot afford to ignore government decisions that have profound effects on the independent agency system in Texas. Your contributions and participation in the political process are needed to ensure IIAT members continue to compete, innovate, and grow.

IMPACT funds help support pro-business candidates and elected officials who understand the importance of a vibrant independent insurance agency system in Texas. IMPACT’s strong reputation helps IIAT form productive relationships with state legislators who support the interests of independent agents.

IMPACT is your vehicle for political success as an independent agent. IMPACT collects voluntary contributions from independent insurance agency principals, producers, customer service reps and other staff members across the state.

These funds are pooled and contributed on a nonpartisan basis to candidates for public office who support the interests of independent insurance agents and the insurance industry. A full 100 percent of every dollar raised stays in Texas for state and local elections.

We are proud to announce that we have three wonderful couples that have agreed to serve as our Centennial Co-Chairs for all of the events during the Centennial year – 2024. They are Scott West and Laurie Dempsey, Ed and Betsy Schrieber and Dudley and Rebecca Ray. They are busy planning our Centennial events, so look for more information coming soon.

Matt & Megan Romano with CRC welcomes baby girl, “ Melanie Michelle Romano” into the world

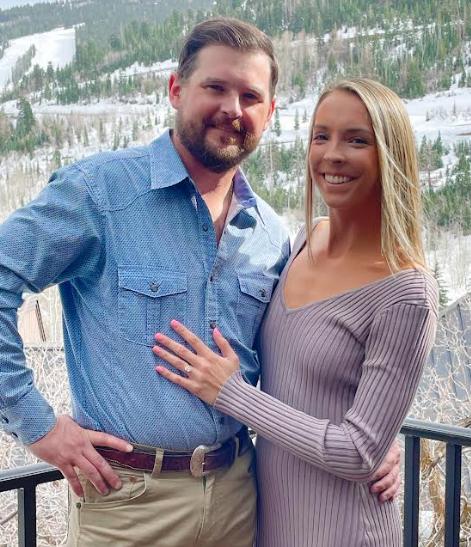

Congratulations to Stuart Ray, Higginbotham Marketing & IIAH Past President, who proposed to Ms. Jillian Lafore on April 16, 2023. The couple will tie the knot in Houston on June 24, 2024.

Catrina will be joining XPT’s Texas offices as Vice President and Broker in the Commercial Lines Division. As the newest addition, Catrina looks forward to using her extensive property and casualty experience to help widen XPT’s footprint, strengthen existing relationships, and aid in difficult placements using her extensive knowledge. Her specialties include Construction, Energy/Environmental, Transportation, Manufacturing, Marine, Habitational and hard-to-place risks.

CatrinaWilliams@xptspecialty.com

Adam Wuthrich (far left), son of David and Tara Wuthrich, has been appointed to The United States Naval Academy. He will be sworn in on Thursday, June 29th (I-Day) and go through six weeks of basic training before starting school on August 17th. Adam will be a member of the USNA Water Polo team as well.

Catrina Williams VP Broker

682.900.3103

Catrina Williams VP Broker

682.900.3103

A customer has requested a policy and you have procured a quote. The coverage looks good. The deductible looks good. Most importantly to your customer, the premium looks good. Coverage is bound.

Time goes by, a year or two. Maybe 10. Then there's a loss. A claim is filed and fortunately, there's coverage. But there's a snag: The policy limits don't cover the full loss amount—or what your customer thinks is the full loss amount—and a straightforward claim suddenly becomes an errors & omissions claim, with the spotlight on your agency and the question from your customer ringing in your ears: How am I not fully covered?

Limits—or rather, inadequate limits—are an all-too-common claim in independent insurance agency E&O. With inflation today outstripping even the inflation guards inserted on some policies, these claims are becoming more frequent.

But inflation is not the only reason for these types of claims. Often enough, a cost-conscious customer requests lower limits and is pleased to pay a lower premium ... until a loss occurs and they are faced with the gulf between the estimated loss and the coverage available to them. In these instances, the customer does not remember that they were happy with these lower limits or appreciate the relationship between higher limits and higher premiums, or even recall that they requested those limits in the first place.

When the rubber meets the road, customers want their insurance claims paid in full and are willing to file a complaint with the Department of Insurance or trigger a lawsuit against their agents if they aren’t satisfied.

As with any E&O claim, documentation can be of great assistance to the agency. Assuming, of course, there was no agency error. Sometimes, the policy documents are enough to get an agency over the line, either because a state imposes a duty to read on policyholders or because the sheer weight of such evidence suggests the customer could not reasonably argue they wanted something different. For instance, a customer who purchased a $250,000 limit 10 years ago with incremental increases over time, may find it hard to argue they wanted a $500,000 limit instead.

The problem, however, is many states don't impose a duty to read on policyholders. Customers or their attorneys often find ways to argue around inconvenient facts, like a policy that's been in place for many years, and make the case that the customer requested higher limits over the phone or in person or that the customer requested the same policy as they had previously and it wasn't done. In these cases, the agency can still be successfully defended, but it takes substantially more time and money to do so. This is where good documentation comes in. Documents that clearly show an insured understands their policy and their limits can expedite the resolution of an E&O claim or prevent one altogether. In the event of a claim, a customer who signed a document stating that they have read their policy and agree with the limits at policy procurement or renewal will have a much more difficult time arguing that their limits were inadequate. Written correspondence, such as an email confirmation, can achieve something similar.

The point of these documents is to unequivocally show that an insured understood and agreed with their policy limits. Also, remember to never recommend a limit amount and always include a disclaimer that "higher limits are available upon request.” With policy limits, it is truly a matter of taking a little extra time now to save you lots of time—and headaches—in the future.

Allen D. Wilson

10/10/1951 - 05/22/2023

(2007-2008 Past IIAH President)

Allen Dale Wilson was born on the 10th of October 1951 in Athens, Ohio and exited this life on Monday, the 22nd of May 2023 in Houston, Texas. He was 71 years of age. In his own words: What a sweet ride.

From humble beginnings, I ended up with an awesome wife, Lisa, two wonderful sons, Robert and Michael, a perfect daughter-in-law, Linessa, and two incredible granddaughters, Clara and Isabella.Business was fun, friends were great, Houston is amazing. I've had numerous stunning adventures climbing and traveling with amazing people throughout the world.One philosophical point from Andre Gide, "Believe those who are seeking the truth, doubt those who find it."To all those who stay behind, thank you. Enjoy every day until we meet again. A get-together to celebrate my life will follow. Bye for now.I have now gone off to meet my maker. Be always at peace with yours.In lieu of customary remembrances, memorial contributions may be directed to The University of Texas MD Anderson Cancer Center, 1515 Holcombe Blvd, Houston, TX 77030.Please visit Mr. Wilson's online memorial tribute at GeoHLewis.com where fond memories and words of comfort and condolence may be shared electronically with his family.

Where do you work?

Brown & Brown Houston

What sound do you love?

Running Water in the outdoors

If you could paint a picture of any scenery, you’ve seen before, what would you paint?

Sunset across a body of water

What was the first thing you bought with your own money?

Baseball Cards

If you could choose to stay a certain age forever, what age would it be?

Late 30’s, still had energy like I was in my 20’s

What did you do growing up that got you into trouble?

Most likely that I thought I knew everything

What is something you learned in the last week?

That there are challenges in every phase of life, it is never easy

Weirdest thing you have ever eaten?

Opossum

What is your pet peeve in traffic?

Left lane is fast lane

Do you have any hidden talents?

What you see is what you get

What is your favorite flavor of jellybeans?

Cherry

What is your LEAST favorite electronic device?

Most likely my TV and all the 3rd party apps, speakers, sound bar, Wi Fi that come with it just to watch one series/movie

What is the longest car trip you have ever taken? Can vegetarians eat animal crackers?

From Houston going west all the way up to Washington

Yes, just like cows are vegetarians

Ninjas or pirates?

Looney Tunes

What was your favorite childhood television program?

Pirates – if victorious you can enjoy the water

Are you a collector of anything?

Nothing currently, work keeps me too busy.

At a movie theater, which arm rest is yours?

Either really would prefer one of the two but can make it with none if needed.