are what breaths life into our association. With 9 active committees there are at least 100 people actively serving the association with their unique skills. We are always looking to put your skills to use to further drive the association’s mission forward. No matter what your skills are, or what you are passionate about, we likely have something of interest to you. The end result is to better the industry we all serve. Join a Committee today and become part of the mission.

Where has 2022 gone?? It seems that just yesterday we were kicking off 2022 and hoping that COVID would be in our rear view mirror. Well, the good news is that even though COVID may not be gone, it is in most people’s rear view mirror.

Thanks to all for a wonderful 2022. I think that it was an awesome year in so many different ways. I think that 2023 will be even better as the IIAH celebrates it’s 99th year as an organization.

Thanks to all of the people that have helped make this year so great. We could not have done it without the many volunteers who make our organization what it is! All of the folks that serve on the board and committees, thank you. All of the people that help with all the events that are so popular, thanks, we hope that you had as much fun as we did! And please come back for all of the events in 2023!

2022 was a big year for IIAH as we moved to a new office space, even if it was just 500 yards from the old one. Please come see us in our new offices, we love to show them off.

I hope that everyone will have a wonderful and safe holiday season!

David Wuthrich IIAH Executive Director

Brookwood Community is a God-centered educational, residential, and entrepreneurial community for adults with disabilities. Through the Grace of God, Brookwood Community provides an educational environment that creates meaningful jobs, builds a sense of belonging, and demands dignity and respect for adults with disabilities.

Its purpose is to provide opportunity through education so that Brookwood citizens will:

- Acquire meaningful job skills and hold real jobs in the Community’s own business enterprises

- Experience the pride that accompanies the ability to contribute to one’s own support

-Grow socially, emotionally, and spiritually

Many TWIA policyholders impacted by Hurricane Nicholas live in areas where, if certain conditions are met, a TWIA eligibility requirement to obtain flood insurance is triggered. This is mandated by law in the Texas Insurance Code Chapter 2210 and TWIA’s Plan of Operation. Repairs do NOT trigger this requirement. Please review the summary below to learn about what does.

The flood insurance requirement is triggered when ALL of the following conditions are met: Any part of the property is located in a V, VE, or V1-V30 flood zone, as defined by the National Flood Insurance Program (NFIP). You can look up flood zones by property address on the FEMA website. Flood insurance is available for the property from the NFIP. The structure is constructed, altered, remodeled, or enlarged after September 1, 2009. This does not include repairs. Here are some examples of the third condition, above:

-Re-roofing or re-siding a house*

-Interior changes to plumbing or fixtures

-Replacing windows with the same size as were there before

*Will require a windstorm Certificate of Compliance.

Windstorm Certificates of Compliance (WPI-8/WPI-8-E)

-Changing the pitch of the roof*

-Building an addition; adding attached porches, patios, or carports*

-Enclosing a garage*

-Installing larger windows than were there before*

Although repairs will not trigger the flood insurance requirement, many repairs will still need a Certificate of Compliance for the property to remain eligible for TWIA coverage. These certificates show that the structure meets the windstorm building code requirements for the area. The TWIA website provides more information, including examples of what does and doesn’t need to be certified.

As a reminder, the Texas Department of Insurance (TDI) can provide a free windstorm inspection during the repair process. This is handled through their Windstorm Inspection Program, which issues all Certificates of Compliance. Any interested property owners are encouraged to contact TDI as soon as possible.

If you or your clients have any questions or concerns about TWIA flood insurance requirements, more information is available at www.twia.org/ twia-flood-requirements. Another helpful resource for the TWIA claims process is www.twia.org/claimscenter, which includes deadlines, dispute options, and guides about repairs, fraud, estimates, and more.

The National CPCU Society has recently opened the door to non-CPCUs with additional membership categories. This is an exciting breakthrough that allows property casualty professionals, students, academics and retirees the chance to participate in the benefits of the national organization, and provides the opportunity for those members to join the Houston chapter to participate in monthly meetings and social events. All membership categories receive the following benefits:

-Unlimited free monthly webinars, complimentary subscription to Insights, our quarterly professional journal, and free quarterly online course from The Institutes

-INteract which hosts our online community, member directory, Mentor Match program and volunteer opportunities

-Access to local chapter benefits and eight Special Interest Groups

-Access to Career Center tools and resources (not available to Post Career Members)

-Exclusive member discounts on events including In2Risk plus MemberDeals (special travel and entertainment discounts)

In addition to these benefits, each category receives a additional benefits tailored to that category. The current CPCU Professional Membership category as well as all the new categories, their respective additional benefits and dues are as follows:

-Unlimited access to all current CPCU online courses plus waiver of the CPCU in Good Standing $189 reporting fee.

-25% discount on all Institutes’ course materials (individual copies only) and 35% discount on all CEU.com online courses, annual dues $200.

-Full-time undergraduate students working towards or interested in risk management and insurance careers, and who have not yet been employed in the industry.

-Be the first to know about upcoming CPCU Society financial aid opportunities through our NextGen Scholarships and Loman Internship Financial Aid program, annual dues $20. (Gamma Iota Sigma (GIS) student members are eligible to receive free membership. Please contact Member Resources for details.)

-Any risk management or insurance professional who has not earned the CPCU designation (includes those in the process of completing courses).

-Member-only access to virtual, facilitated study groups where you’ll learn how to apply key concepts and discuss key questions (space limited), annual dues $200.

-Full-time college or university faculty members in a risk management, insurance or related program who have not earned the CPCU designation.

-New Virtual Educators Forum, a semi-annual, half day virtual meeting to share insights, ideas, and new challenges, annual dues $200.

-For retired risk management and insurance professionals who are no longer in practice but want to stay in touch with the industry.

Limited fellowship member opportunities in recognition of industry and CPCU Society contributions.

25% discount on all Institutes’ course materials (individual copies only) and 35% discount on all CEU.com online courses

-Unlimited access to all current CPCU online courses (for CPCU designees only), annual dues $100.

to join the CPCU Society. By joining the Society, you will automatically be referred to your local chapter, which you can also join to be included on their mailing list and receive the benefits of attending monthly meetings which offer Continuing Education (CE) credits toward licensing requirements, networking opportunities as well as valuable information, resources and fun social events with industry professionals in the Houston area, which are free to members who pay annual chapter dues, which are Professional Members & Academic $150; Pathways & Post Career $75; Students Free.

Happy New Year to Everyone and Welcome to 2023! Hopefully you haven’t indulged too much before reading this! IIAH is starting the new year with several events to continue the spirit of giving, both to our charities and back to you as members and partners.

Our legislative luncheon will take place at Maggiano’s Little Italy on January 19th. You can register at IIAH.org to get the scoop on legislative impacts on the insurance industry. On Saturday January 21st we will be holding our annual Charity One Pot Cook-Off. Bring your friends and family as this event is for all ages.

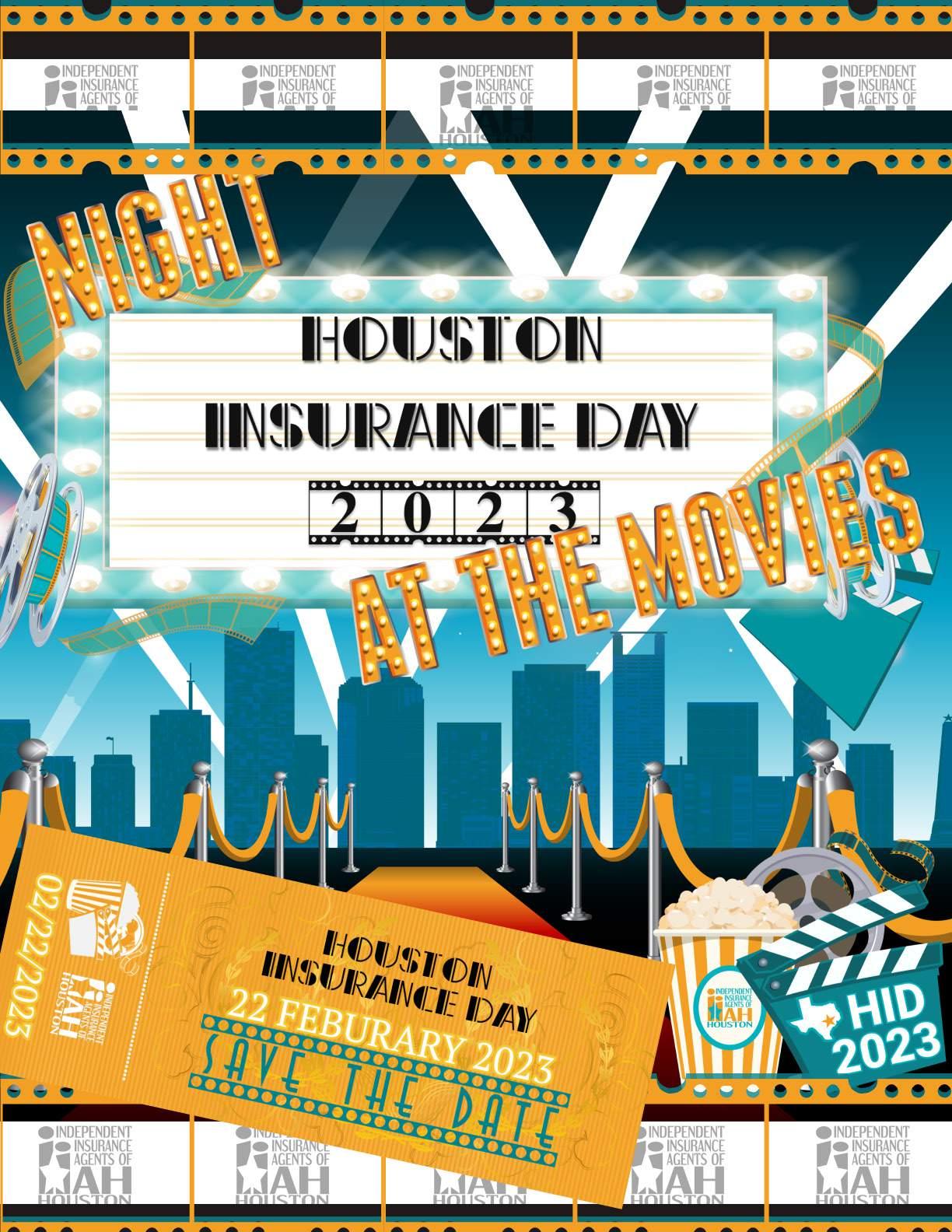

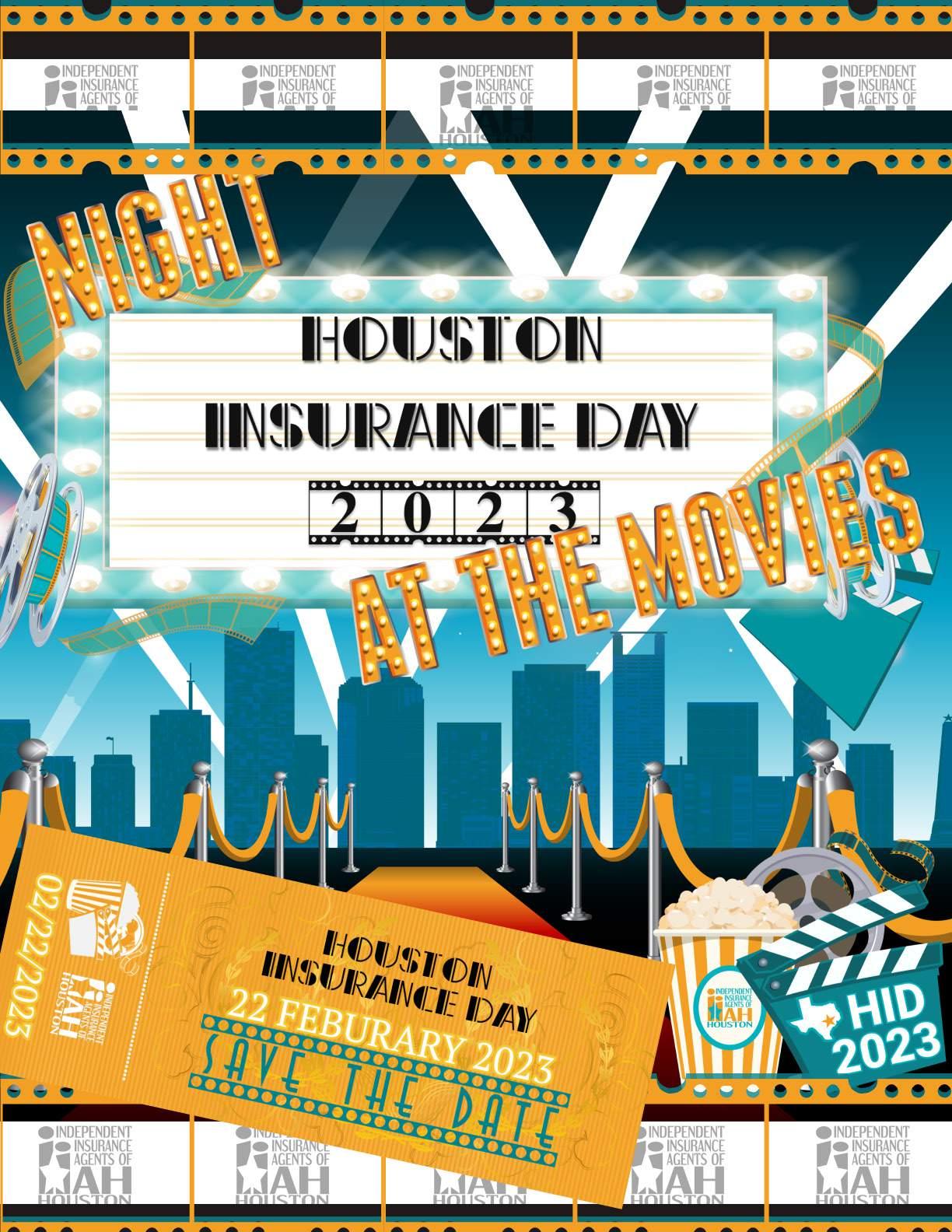

We continue on February 22nd with our marquee (literally) event of the year with Houston Insurance Day (HID). This year’s theme A Night At The Movies so register today to attend this box office smash! Looking to give back to your community and the insurance industry? Consider joining an IIAH committee or becoming an association partner. We need your help to move the association forward and continue to serve our members in a meaningful way. Please contact one of our association staff for more information.

I hope everyone has a great start to the year and looking forward to seeing you soon.

COVU is an Insurtech startup founded and advised by a team of world-renowned insurance, finance, and tech industry leaders with a passion for transparent and unbiased advice. COVU’s mission is to help independent insurance agents and carriers better manage risk and make smarter insurance decisions through AI-driven policy recommendations, business services and sales support.

As the only all-in-one AI-enabled digital platform for independent insurance agencies, COVU takes ownership of front and back-office tasks, giving insurance agents time to focus on strengthening customer relationships, growing their business, and embracing digital operations. A combination of technology and services help agents generate higher customer satisfaction rates, boost cross-selling opportunities, and achieve higher profit margins.

“The U.S. insurance industry is progressively falling behind, so we’ve designed and implemented a unique end-to-end experience to make insurance more convenient and affordable for consumers and more profitable for agencies,” expressed Ali Safavi, chief executive officer COVU. “To make COVU’s vision come to life, we needed to recruit a team of visionaries that understood the industry, the challenges encompassing it, and most importantly, a passion for revolutionizing an already stagnated industry for the better of mankind.”

The majority of independent insurance agencies spend around 40% of total revenue and agents spend 70% of time on back-office and administrative tasks—instead of focusing on growth. Yet, these efforts have not translated into faster or easier journeys for customer insurance transactions. To retain customers and reduce wasted effort, the journey must be improved. COVU delivers this by matching the convenience of mobile self-service with on-demand service from professionals when needed, streamlined to create the ideal customer journey.

COVU’s holistic approach ensures agencies thrive by managing the business side of insurance operations to provide an extraordinary customer experience through a unique combination of AI technology, human intelligence, real-time service, and top-tier sales support.

Don’t let your agency run you. Take back control of your time and growth by partnering with COVU; if you want to see how we can help your agency, discuss partnerships and services, or to learn more about us in general, please reach out to Jeremiah Yutzy, Vice President of Agency Partnerships.

The November Luncheon honored our three Charity Partners, Brookwood, Mission K9 and Texas Association of First Responders. We were excited to have each of the organizations visit with us about their organizations and how we can help them.

As always, the food is the highlight of day and you can always go home with a doggie bag if you desire.

It is important to attend these luncheons, as it is a great place to network with a wide variety of our members. Just think, how much is it worth to you to visit with someone for 1 ½ hours who you have been trying to find a time to visit with?

Our January Lunch is our Legislative lunch, so please try to attend so that you can be up to date on what is happening this year in our Legislative session.

It was so great celebrating the holidays and networking at our annual Holiday Happy Hour at Kirby Icehouse Memorial. Thank you to everyone who attended, we had an amazing turnout with over 200 insurance professionals! Our guest enjoyed great company, drinks, tasty Torchy’s tacos and delicious sweets from Chery’s Cookies. We greatly appreciate all the donations brought for The Houston Food Bank. This makes a huge impact for our community during the holidays. A huge thank you to our sponsors who helped us to provide the sweets, drinks and food! We couldn’t host this event without you.

Hotchkiss Insurance participated in the Greater Houston Builders Association annual Frank Aranza Adopt a Family Holiday Project. The Houston employees of Hotchkiss do this every year. This year they were able to not only adopt a family of 3 but they were also able to adopt a senior citizen as well! Hotchkiss collected over $2,100 on top of what employees purchased on their own in order to be able to provide a family and a senior citizen with some much needed joy this year. Along with the employees that wrapped all the presents, Shari Hunt, Cassie Shanks, Andrew Rohr and Spencer Starkey were the Hotchkiss elves that delivered all the presents to GHBA on December 2nd. If you are interested in joining GHBA next year in the Frank Aranza Adopt-a-Family Holiday Project 2022 | GHBA, please contact GHBA to see how your organization can get involved in this holiday event!

It wasn’t just Hotchkiss in an adopting mood either! Craig & Leicht adopted their own family too! See their video below of their event! Craig & Leicht recently held an ‘Adopt a Family’ event to help make the holidays a little brighter for those in need. The event consisted of Craig & Leicht generously sponsoring a family for Christmas, providing them with gifts. This uplifting event demonstrated the true spirit of the holiday season - that it is better to give than receive - and served as a reminder that even small acts of kindness can make a difference in someone’s life. Our members are truly the best when it comes to giving from the heart! Did your company do something special for the holiday season? We would love to publish it in the Have you Heard section of the Houston Insurance News online magazine.

Attending an annual seminar about E&O loss prevention is not enough to change the outcome for the agency. Just as we expect our customers to develop and implement effective loss control programs, so must we develop and implement our own program to control E&O losses.

- Conduct a Self-Audit

Complete the self-audit and determine which areas of the agency’s operations require the most immediate attention.

- Appoint an E&O Loss Control Manager

The Loss Control Manager will have responsibility for implementing and monitoring the program and who will take the lead in the event of an E&O claim.

- Staff Meeting

Hold a staff meeting to launch the program and explain that E&O is a major concern for the agency.

- Create Procedures

Establish written procedures for each core business process (see Read This First for a list of processes included in this guide and see How to Develop a Procedures Manual).

- Ongoing Monitoring

Monitor compliance with established procedures and determine appropriate action to take in the event of non-compliance.

Durward Richard (Dick) Anderson died peacefully at home in Houston, Texas, surrounded by family, on November 7, 2022, just a few weeks shy of his 97th birthday. Born on December 2, 1925, he was the much-loved only child of parents Ruth Miller Anderson and Durward Leon Anderson. Dick was a loving husband, father, grandfather and friend who will be remembered for his gentle heart, humility, unwavering integrity, good-natured humor and devotion to Christ.

A lifelong resident of Houston, Dick’s childhood enjoyments included riding his horse all over the city, visiting his cousins at their ranch in Eden, Texas, and going to festive family parties with his Miller family aunts, uncles and cousins. He attended Lamar High School and later the Schreiner Institute before enrolling at Texas A&M University where he volunteered for military service during WWII. Dick was called to active duty in the Army Air Corps and after training was assigned as a flight engineer and top turret gunner on the B-17 bomber. During his service he was stationed in the U.S. and on the Western Pacific islands of Guam and Saipan. Following the war, he was commissioned an officer in the Army Air Force Reserve until honorably discharged with the rank of first lieutenant.

Following his military service, Dick attended The University of Texas in Austin, where he became a member of the Sigma Alpha Epsilon fraternity and graduated with a BBA degree in 1950. That same year he married the beautiful love of his life, Bondu, and moved to Houston’s West University neighborhood where they started their family. In 1957 they built a home in the new Briargrove neighborhood, “out in the country,” where they raised five children and Dick lived the remainder of his long life.

After college, Dick joined his father’s insurance agency, D.L. Anderson & Company, and began a decades-long career, and was later on excited to have his son, Dudley, enter the family business with them. Dick served as a board member and president of the Independent Insurance Agents of Houston and a board member of the State Association, and was a founding director of Merchants Bank, now Regions Bank, and long-time director of Post Oak Bank.

Dick and Bondu worshipped God and enjoyed Christian fellowship with dear friends at St. Andrew’s Presbyterian Church; they were the oldest and longest members. Dick lived a Christ-centered life and loved his church, where he served as Deacon, Elder, Trustee and Stephen Minister. He was dedicated to his belief in prayer, especially for those who were suffering.

The family would like to express their deepest gratitude for the loving care provided by Houston Hospice and Caring Senior Service of Houston.

Dick was known for being a loyal and thoughtful friend, who enjoyed pulling the occasional prank, and for being a caring and friendly neighbor, who was often seen walking his precious dog Sadie throughout Briargrove in recent years. He was mechanically gifted and enjoyed tinkering with his boats, building model war planes, and making his own fishing lures. An avid reader, he was especially interested in books about WWII that highlighted the human experiences of his fellow comrades.

Dick was most fulfilled in his role as husband, father and grandfather. He adored his large family and cherished time spent with his wife and children: ski trips in Breckenridge, Colorado, piloting afternoon flights from Andrau Airpark, coaching little league sports, golf and family activities at Houston Country Club and summer vacations at his aunt and uncle’s ranch on the Guadalupe River in Hunt, Texas. Dick especially loved spending time at the family farm in Chappell Hill, Texas, and shared his passions for horses, fishing and hunting with multiple generations of family. Quick to entertain with a magic trick or share a piece of gum, he will be remembered by his grandchildren for his delicious homemade cinnamon rolls, enthusiasm for hand sanitizer and his endless love and kindness.

Dick is survived by his loving and devoted wife of 72 years, Margaret Bondurant Jarvis Anderson, and their five children and families: Richard Anderson (Jeanne), Dudley Anderson, Amanda Anderson, Steven Anderson (D’Anne) and Bongie Bracy (Rogers); grandchildren David Anderson (Jennifer), Melissa Silva (Jeff), Mary Stewart Anderson, Addie Winslow (Luke), Amberly O’Boyle (James), Ashley Pan (Windsen), Hayden Charter (Liz), Emily Beaudoin (Will), Lawton Anderson, Jennifer Bracy and Andrew Bracy; and eight great-grandchildren.Richard Burleson “Dick” Colvin, descended from an early Texas family, which came to Texas in 1848. He was born on December 20, 1951 in Houston and passed away on November 25, 2022.

Dick was preceded in death by his parents Jay Wallace Colvin, Jr. and Elaine Lester Colvin. He is survived by his wife of 31 years, Nancy Williams Colvin, his children Alice Bintliff Colvin and Richard Burleson Colvin, Jr., his stepdaughter Lisa Williams Glenn and husband Ronnie, his grandchildren Kennedy and

Brendan, Haylee, and Alexandra Glenn, and by his sister Elizabeth “Betsy”

Danny and their daughter Nicole Burdick and family. He is also survived by nieces Courtney Cervantes, Emily Colvin, nephew Jay Colvin IV, and many loving cousins and friends.

He attended The Kinkaid School, Lamar High School, and The University of Texas at Austin, where he was a member of the Kappa Sigma Fraternity. Dick was a life-long entrepreneur. Building his career in insurance, he became a well-known, nationally ranked, top performer. During this time, he was a member of Chapelwood United Methodist Church and River Oaks Country Club. He eventually sold his agency and he and Nancy retired to where his heart had always been – along the bank of the Guadalupe River.

Dick was a friend to everyone he met and loved being surrounded by people. He was always willing to help someone in need and will be remembered for his kind heart and generous spirit.

Finley Colvin, Dillon,

Colvin Feller, husband

Finley Colvin, Dillon,

Colvin Feller, husband

Where do you work?

EFG Insurance Agency, Inc.

What sound do you love?

Rain on a metal roof

If you could paint a picture of any scenery you’ve seen before, what would you paint?

Sun setting in the mountains of Montana

What was the first thing you bought with your own money?

A 45 or 12” vinyl record

If you could choose to stay a certain age forever, what age would it be?

Forever 39

What did you do growing up that got you into trouble?

What is something you learned in the last week?

You can never learn enough. Everyday is a learning opportunity.

Weirdest thing you have ever eaten?

Frog legs

Distracted drivers

What is your pet peeve in traffic? Do you have any hidden talents?

What is your favorite flavor of jellybeans?

What is your LEAST favorite electronic device?

What is the longest car trip you have ever taken?

Can vegetarians eat animal crackers? Ninjas or pirates?

It depends if they’re vegan friendly

I’m a pretty good cook. Grape Cell phone Houston, TX to Philadelphia, PA Pirates

What was your favorite childhood television program?

Mr. Rogers Breaking curfew

Are you a collector of anything?

Santa Clauses Left

At a movie theater, which arm rest is yours?