The Insight Series

Digitalisation is thriving but inclusion is easier said than done January 2023

This report is part of The Insight Series being published by Omidyar Network India and CRISIL Ltd

CRISIL

Aniket Dani Director aniket dani@crisil.com

Saurabh Prabhu Manager saurabh.prabhu@crisil.com

Omidyar Network India

Shilpa Kumar Partner shilpa@omidyarnetwork.in

Amol Warange Director amol@omidyarnetwork.in

Baani Bareja Associate baani@omidyarnetwork.in

Digital transformation in finance has undergone a tectonic change due to Covid-19 one that no business can now escape. But not every organization is looking at the same manner of transformation.

To be sure, there are commonalities.

Finance and technology have rapidly coalesced. Customer behaviour across the board has remarkably shifted, be it digital payments or online purchases of financial products. Sweeping internet and smartphone penetration has enabled this structural change.

Regulators have also tried to keep pace with this change. Keeping customer convenience in mind, they have been supportive of building robust infrastructure. For instance, the India Stack1 initiative can be cited as the single biggest reason for the increased adoption of application programming interfaces (APIs)2 in the banking, financial services and insurance (BFSI) sector.

Licensed financial service providers in the game including fence sitters have read the tea leaves and embraced transformation, given the choice between that and risking extinction. They are relooking their technology architecture and striking relevant partnerships with third parties. The intent is to enable easier integration with APIs offered by third parties, shorten time to market, widen the product suite, increase the target customer base and enhance operating efficiency.

Nevertheless, stark differences exist amongst BFSI players. Not every organization has the same starting point, faces the same limitations or advantages, or serves the same set of customers leading to different outcomes for different sets of players.

CRISIL Research assessed the impact of digitalisation and API adoption by 12 distinct cohorts of players in the BFSI industry. The study specifically sought to analyse it through two lenses of a) business growth, efficiency and customer experience, and b) financial inclusion

Our analysis shows that the pace of digitalisation and extent of collaboration with digital solution providers3 vary across players.

• Large private banks and, to some extent, large public sector banks (PSBs) are significantly ahead of their counterparts4 in terms of the impact of digitalisation and partnerships on their business.

• At the other end, while small and midsize lenders (banks and NBFCs included) have also ramped up their digital play, the impact on their business and operating efficiency is still modest, at best. For instance, around 70% of them still do not have partnerships with third-party APIs to help fetch bank account statements of loan applicants and standardise them for analysis and underwriting.

1 India Stack is a platform offering open set of APIs for different technology products and frameworks in the financial services space; the APIs/products on the platform are owned by different agencies & regulators

2 Refer to AnnexureI for more details on use cases of API

3 Digital solution providers include digital intermediaries, API providers, technology partners and neo-banks

4 Refer to Annexure II for more details

• Large insurance companies have also stepped up their focus on digitalisation and collaborations. However, with the sheer number of products on offer and the low awareness of insurance in India, the dependence on individual agents continues to be high, especially for life and health insurance.

• Mutual funds and brokerages have successfully leveraged technology and the increasing popularity of equity investments to dramatically expand their customer base.

That said, there still remains headroom for further growth by offering products and solutions relevant to the next rung of customers down the financial pyramid. Our study finds the following specific impacts of digitalisation on incumbents in the BFSI space:

1. Target market and product basket of incumbents has expanded, especially in respect of micro, small and medium-sized enterprises (MSMEs) or millennial customers.

2. Distinct improvement in operating efficiency across value chain: Customer on-boarding and credit underwriting have witnessed the highest level of digitalisation amongst processes in the lending value chain. Insurance players have improved their lead management system, digitalised their onboarding process, and implemented automated processes to validate death certificates and reduce the turnaround time in claim settlement.

1. Miles to go for financial inclusion: Access to credit remains a challenge for most MSMEs, as reflected in mere ~4% CAGR growth in active MSME loan accounts across licensed banks and NBFCs during 5-year period ending fiscal 2022. CRISIL Research estimates that less than 20% of the 70 million-odd MSMEs in India have access to formal credit of any kind as of March 2022. On the brighter side, the market has seen a phenomenal increase in disbursements of personal loans lower than Rs 50,000 ticket size, led by NBFCs, mainly on account of traction for BNPL products through online as well as offline channels.

2. Spreads charged to weaker borrowers has not come down: An example of this is the risk premium (as measured by the interest rate paid by them over and above the 10-year G-sec yield) for small-ticket home loans (less than Rs 10 lakh) has hardly witnessed any change in the last four years. This is despite a ~10% drop in operating cost per unit during fiscal 2018 to fiscal 2021 solely on account of digitalisation. This could be partly attributed to risk aversion consequent to the Covid-19 pandemic. Creditworthy customers, on the other hand, have seen a drop in interest rate spreads due to enhanced competition among lenders and extensive data availability.

Regulation is becoming more complex. The regulatory lines especially blur when technology players front-end the transactions while operating in collaboration with a regulated financial entity. For example, for loans extended through embedded lending or the checkout finance model, the digital platforms/mobile applications are front-ended by entities not under regulatory supervision.

As the market evolves, regulators will have to strike a balance between protecting customer interest through regulation and permitting innovation. The Reserve Bank of India (RBI)’s Working Group5 on digital lending, in its November 2021 report, suggested tighter norms for BNPL, recommending that they be treated as part of balancesheet lending. The Working Group has also advocated prohibiting licensed entities from entering into any arrangement involving synthetic structures such as first loss default guarantee (FLDG)6 with digital solution providers that do not bring in regulatory capital. These recommendations by the Working Group are still under consideration of the regulator However, with an aim to protect consumer interest, the RBI notified key rules in August 20227 such as establishing standard practices on responsible pricing through the mention of an annual percentage rate (APR) and setting up of a nodal grievance redressal officer to deal with digital lending related issues

Going forward, more steps to control any systemic risk posed by the rapid adoption of digitalisation and APIs and partnerships between licensed financial service providers and digital solution providers are likely. As seen in advanced countries such as the United States (US) and the United Kingdom (UK), this may result in some entities choosing to apply for a licence with the RBI to avoid any adverse impact due to change in regulations.

Adoption of digitalisation and APIs currently is at best moderate among licensed financial service providers, with larger enterprises leading the way. The pandemic has accelerated the process of digitalisation and building API capabilities among service providers, and we expect the traction to remain strong as service providers intensify efforts to build new revenue streams and/or reduce costs and enter into agreements under the co-lending model. Nevertheless, there is ample scope for leveraging digitalisation to enhance availability of financial products and reduce their cost for underserved or unserved customers, especially with technology lowering operating costs for financiers.

5Report of the Working Group on Digital Lending including lending through online platforms and mobile apps (RBI, November 2021)

6The originator provides guarantee to the licensed entity, which disburses the loan, against default by the borrowers; the quantum of guarantee (as a % of overall loan disbursed) is decided mutually by the two parties.

7 In August 2022, the RBI notified the rules/regulation for immediate implementation basis the recommendations of the Working Group report in November 2021

(On a scale of 1-10; 1 = low adoption and 10 = high adoption)

Has it expanded the addressable market? Has it enhanced operational efficiency?

Has it helped offer new products?

Has customer service and engagement gone digital?

Has it helped reach more unserved and underserved customers?

Has it lowered the cost for unserved and underserved customers?

Source: CRISIL Research

The financial services sector has changed beyond recognition in the past few years, with traditional licensed players increasingly leveraging technology to stay relevant and up their game. They are building APIs either inhouse or by partnering with third-party providers to offer seamless online financial and digital financial services to customers, expand their addressable market and enhance their operating efficiency.

APIs, which essentially facilitate easier sharing of information between two or more parties, have been around for over a decade now, but their importance in the financial services landscape has never been greater. To leverage their strength, APIs are now managed like a product one built on top of a potentially complex technical footprint that includes legacy and third-party systems, which can be shared, reused and monetised to extend the reach of service providers and open up new revenue streams.

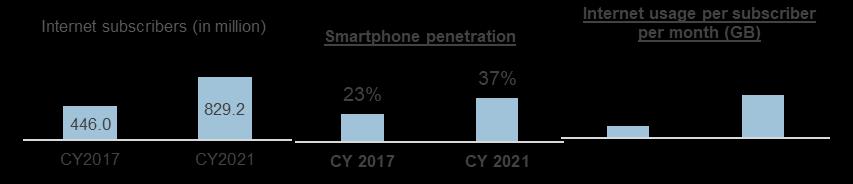

The figure below captures the main trends that has led to this accelerated disruption in the financial services ecosystem. These changes have resulted in financial service providers increasingly relying on open architecture and integration of their systems with third parties (both licensed and non-licensed) through APIs.

Rise in internet penetration, data usage and smartphone penetration

• Initiatives such as India Stack, which provides a set of public APIs on one platform, continue to push digitalisation

• The introduction of open-source and interoperable payment system – UPI – was a pivotal moment in accelerating the digital push

• The launch of Aadhaar-enabled Payment System (AePS) – a bank-led model that facilitates interoperable transactions at PoS (microATM) – has aided last-mile smallticket-size payments

• Launch of account aggregator ecosystem to enable consent-based sharing of data across financial service providers to further push for open banking architectures

• Include AA here

• Digital onboarding enabled through permission for OTP-based eKYC, video-based customer identification process (V-CIP)

• In May 2019, the RBI permitted use of Aadhaar card for OTP-based eKYC for limited KYC accounts

• In December 2019, the government announced zero MDR on all transactions on UPI and RuPay network

• India has one of the largest Gen Z1 and millennial2 populations; this segment has significantly higher receptiveness and preference for digital channels

• As of 2020, millennials constituted 24% (333 million) of the population, and Gen Z constituted 9% (123 million)

• India has 35% of its population in the 15-34 age bracket, compared with 27.5% and 27.3% for China and the US, respectively

in retail digital payments

Pressure on yields leading to enhanced focus on efficiency

• The continuous pressure on yields has forced players to reduce disintermediation costs through investments in technology, digital channels and partnerships

• The interest rate for large banks (public and private) on fresh home loans dropped ~160 bps to ~7.5% during the 4-year periods ended March 2022. The pressure on yields has been especially high for secured loans extended to customers with a healthy credit profile.

Note: *Basis volume of different retail payment modes; other includes AePS (Aadhar Enabled Payment System), NEFT (National Electronic Fund Transfer), NACH (National Automated Clearing House)

Retail digital payments include all digital payments except RTGS and paper clearing

1Gen Z is defined as the population aged between 20-24 years (as of 2020) and 2millennial is the population aged between 25-39 years

Source: TRAI, NPCI, CRISIL Research

Account aggregators (AA–NBFC), a new class of NBFCs approved by the RBI created to manage consent-based data sharing of users between financial entities, started operations in September 2021. All entities regulated by the RBI, the Securities and Exchange Board of India (SEBI), the Insurance Regulatory and Development Authority of India (IRDAI) and the Pension Fund Regulatory and Development Authority (PFRDA) can act as financial information users (FIUs)/financial information providers (FIPs) in the AA ecosystem. CRISIL Research finds that the AA ecosystem would lead to the following:

1. Reduction in the turnaround time for loan processing and optimisation of acquisition costs, as the entire digital footprint of the user will be available through a single window

2. Further streamlining and possibly automation of the underwriting process; data received through AA would be in a standardised and machine-friendly/readable format, thereby providing a push to cash-flow-based lending

3. Enhanced ability of even legacy players to adopt cash-flow-based lending, due to the availability of digitally signed documents, lending comfort on data authenticity

The launch of the AA ecosystem provides a further shot in the arm for the API ecosystem, as financial institutions would have to merely integrate themselves with the licensed AA-NBFC. Also, to ensure stability and interoperability of the system, all stakeholders will have to adhere to the common set of technical standards as prescribed by Reserve Bank Information Technology Pvt Ltd (ReBIT).

Not all incumbent players are adopting technology at the same pace

CRISIL Research’s analysis indicates that the pace of digitalisation and the extent of collaboration with digital solution providers vary across incumbent players8 .

To arrive at this, we compared the impact on 12 identified cohorts of players in the financial services industry, as defined below:

12

The analysis for players in each cohort has been done through two distinct lens:

1. The business, operating efficiency and consumer lens, encompassing assessment of the extent to which digital transformation and partnerships10 have expanded the addressable market catered to, enhanced operating efficiency

of businesses, enabled the launch of new products and more efficient cross-selling of existing products, and improved customer engagement and services

2. The financial inclusion lens, covering increasing reach in the unserved/underserved segment11, drop in

8 Refer to Annexure VI for more details on impact of digitalization across different cohorts of players

9Small and midsize NBFCs do not include fintechs and digital solution providers

10 Refer to Annexure II and Annexure IV for details of partnerships

11 Refer to Annexure III and Annexure V for more details

ticket sizes, and lowering of costs for consumers at the lower end of the financial pyramid

Through the business lens: While financial service providers across the board have made distinct progress towards adopting technology and partnerships, our analysis indicates large private banks and, to some extent, large PSBs are significantly ahead of their counterparts in terms of impact on their business.

Large regulated financial institutions are at an obvious advantage their vast customer base and wide product range opening up huge business opportunities for both the parties. From the perspective of financial service providers, open architecture enabling easier API integration and striking relevant partnerships has become critical as it offers the opportunity to accelerate digital foray, shorten time to market, widen product suite, increase target customer base and enhance operating efficiency.

The large new private banks were the early adopters of digital transformation. They have not only adopted open architecture to foster collaborations with thirdparty platforms but also implemented digital processes to create operational efficiencies and made significant investments to develop in-house products for a superior customer experience.

Through collaborations with third-party platforms, these banks are providing services and products such as virtual accounts, corporate credit cards and unsecured business loans. Further, many have adopted tech in various processes, such as robotic process automation (RPA), to automate reconciliation processes; video KYC for onboarding customers; automated credit underwriting; and e-stamping and e-signing of loan agreements.

Large banks have also extensively leveraged AI and ML to cross-sell fee-income products through their

digital platforms, as well as other loan products such as personal loans to their existing customers. For example, SBI through its digital platform (YONO) sells health insurance policies along with credit products such as personal loans.

Large insurance companies, too, have stepped up focus on digitalisation and collaborations. But given the nature of the business, the sheer number of products on offer and the low awareness of insurance in India, dependence on a large network of on-the-ground agents and banking partners to push the product as per its relevance to the consumer remains high, especially in the case of life and health insurance.

While small and midsize lenders (banks and NBFCs) have also ramped up their digital play, especially since the onset of the pandemic, there still remains significant scope for improvement. For example, most of them still do not have partnerships with thirdparty APIs to help them fetch bank account statements of loan applicants and standardise them for analysis and underwriting. SFBs, the newest set of banks to be licensed, have demonstrated fleetfootedness and agility to strike innovative partnerships to expand their business, but it may take a while for those to show results.

For smaller licensed service providers especially, partnerships and API integration for the right use cases, taking into account their target segment, would allow them to compete with larger players on a more even keel while reducing the need to have expensive branch networks.

Smaller players may look at all kinds of partnerships for this purpose, broadly grouped into three types: (i) technology partnerships, under which a third-party technology is deployed to enhance operational efficiency; (ii) customer-oriented partnerships, aimed at offering a wider suite of products to digital-savvy customers of the licensed service provider; and (iii) front-end partnerships, wherein a solution provider combines the service provider’s infrastructure with its technology to offer services through its digital

platform or mobile application (neo-banks, for example). An SFB, for example, has collaborated with an digital service provider (a neo-bank) to provide savings account and mutual fund investment products through a digital platform/mobile application designed and managed by the latter.

Through the financial inclusion lens: On this front, CRISIL Research’s analysis indicates that players have only scratched the surface, despite significant uptake of innovative offerings such as BNPL in the personal loan segment. While small NBFCs have been addressing newer customer segments and have also gone down the ticket size spectrum, banks across cohorts and larger NBFCs have been slightly slow in this regard.

The turnaround time for customers has reduced, and payment solutions are aplenty, but the cost of financial products has not yet been optimised for lastmile customers. For example, the delta between the average yields for low-cost housing NBFCs12 and 10year G-sec yields remained stagnant at ~6.7% over fiscals 2017-21, indicating risk premium for these customers has not reduced meaningfully.

Among non-lenders, while mutual funds and brokerages have successfully leveraged technology and the increasing popularity of equity investments to expand their addressable market there were ~129

million retail mutual fund folios and ~89.7 million demat accounts as of March 2022 these numbers pale in relation to the number of savings bank accounts (~1.8 billion as of March 2021), indicating the headroom for offering more innovative products and solutions to the next rung of customers.

The front-end consumer applications developed on UPI-enabled open architecture is dominated by GooglePay and PhonePe. In fiscal 2022, third-party digital solution providers such as PhonePe, Google Pay and Paytm had a share of 46%, 34%, and 14% respectively in volume of UPI transactions, leaving incumbent banks with a meagre market share. Further, in the B2B segment space as well, players such as RazorPay, Pinelabs, PayMate have managed to establish a strong presence. Incumbent players have collaborated with digital solution providers in these segments to enhance their customer base; some of them have also become more aggressive in areas such as merchant acquisition by creating applications that can be used by merchants to collect payments across bank cards and multiple payment applications through a single merchant payment app.

12 Eleven NBFCs with focus on low-cost housing loans of less than Rs 10 lakh average ticket size with a cumulative loan portfolio of ~Rs 1.35 lakh crore as of March 2021 consideredDifferent players/cohorts have adopted markedly different strategies to expand their addressable market size from developing in-house platforms (large PSBs), to collaborations (smaller banking cohorts, insurance), digital partnering (large private banks) or going digital (stockbrokers)

• Large private banks were the early adopters of digitalisation and remain trailblazers, forged collaborations with digital solution providers to not only offer a suite of banking products to target customer segments such as MSMEs or millennials13 but also embrace neo-banking architectures.

• Large PSBs have focused more on developing in-house platforms, whereas small and midsize banking cohorts and SFBs, on collaborations. While SFBs were slow of the blocks, they have

been extremely proactive in entering into relevant partnerships since the pandemic.

• Small and midsize banks still have significant ground to cover, as per our analysis of the depth and breadth of solutions adopted.

• Few large PSBs (State Bank India, Bank of Baroda and Union Bank of India) have developed their own super-app (Save, Invest, Borrow & Shop) and also carry out the entire loan processing cycle for specific products through the app. On the other hand, a few SFBs have partnered with digital platforms to offer MSME loans to merchants and savings products.

• ICICI Bank has collaborated with Open Financial Technologies (Open)14 to offer solutions such as invoicing, online payments and vendor payouts through a single platform. Further, ICICI Bank,

Federal Bank, South Indian Bank and Karur Vysya Bank have collaborated with online gold finance company Rupeek to widen their target market.

• Insurers saw strong momentum through the web aggregator channel, with sales increasing eight times over fiscals 2017-21. However, the share of the channel in new business premiums was negligible at 0.3% in fiscal 2021.

• The entry of new-age digital-only players caused a tectonic shift in stockbroking industry market share of digital discount brokers on NSE16 active client basis increased to a whopping ~60% in fiscal 2022 from ~5% in fiscal 2016. Further, the top two players in the industry in fiscal 2022 were digital discount brokers, accounting for ~32% share. Brokerages that hitherto had brickand-mortar models completely re-aligned their business models to make digital processes a key enabler in their value chain.

• However, unlike the banking and insurance segments, the industry has not seen any collaborations between new-age players and incumbents.

• Various incumbent players have collaborated with Gramcover17 – a technology led insurance broker with focus on rural India

• Sharekhan17, a full-service broker, launched its discount broking platform Espresso in September 2020 to compete with leading discount broking players

Automation in retail loan processing is high across cohorts. Availability of data with digital trails has made this possible. While document collection has

15 Includes insurance players, brokerage players & AMCs

16 National Stock Exchange

17 Company denoted by brand name

18 Please refer to Annexure VIII for more details

gone digital across groups, large new private banks have also taken substantial steps to automate their internal processes, such as reconciliation, treasury operations, and human resource management. Digitalisation has also optimised operating costs for brokerage and insurance players

Private banks and large PSBs have automated processes such as credit bureau score checks, bank statement analysis and ITRs, through API integration with digital solutions providers. As a result, employee intervention has declined by ~75%, especially for unsecured loans and automobile loans. For propertylinked loans such as home loans and loan against property extended to MSMEs, however, the relative penetration of digitalisation has been lower, due to the need for physical verification of property and physical assessment for ascertaining customer capacity and character for lower ticket size loans.

While automation and digital underwriting have gained ground in MSME banking, the extent of automation is still limited compared with retail loans, owing to non-standardisation of documents from prospective customers.

High share in mobile transactions of customers has aided efficiency of large new private banks; PSBs have also ramped up mobile transactions amongst their customer base effectively during fiscals 20172218

Small- and mid-sized PSBs have significant ground to cover to match their larger peers in digitalisation of the entire loan processing workflow, especially in credit underwriting, digital documentation and onboarding.

Though many players have adopted e-stamping and e-signing of loan agreements, the penetration of such arrangements still remains low.

CRISIL Research estimates that banks’ operating cost of loan processing for customers with strong income documentation and better credit profiles declined 30-50%19 as compared with offline processes. Similarly, cost incurred for opening deposit accounts has declined by a whopping 5070%1

The below section illustrates the technology adoption by the incumbents in different financial products. The colour of the block (highlighted below) indicates the level of automation and technology adopted by the player in the workflow.

Private Life Insurance players

• Private life insurers have adopted technology at various stages of their customer life cycle.

• The level of adoption is very high at customer on-boarding stage in processes such as document collection, automated KYC document verification through Optical Character Recognition (OCR) and payment collection. Even at surrender stage, technology adoption is high where customer can surrender a linked or non-linked policy or avail policy maturity benefits via mobile application or web based platforms of insurers.

• In the underwriting process various workflow such as pre-conversion verification, medicals and counter offer/ further document requirement have witnessed high level of automation; Further, insurers have integrated the use of in-house mobile applications as well as partnered with third party applications for renewal payment collection; for large private life insurance companies, 75-90% of renewal premiums are collected electronically.

19 For large private banks, especially for products such as personal, business, home and education loans

• For incumbent brokerage players, digital lead generation and on-boarding have trimmed costs significantly. Pricing has also dropped due to competition from discount brokers.

• Incumbent AMC players have also ramped up focus on in-house digital platforms for customers as well as integration with partners. For one of the top five players by AUM as of March 2021, the percentage of digital transactions increased to 82% in fiscal 2021 from 41% in fiscal 2017.

New products launches enabled by open architecture are still at a nascent stage. Large private banks have effectively leveraged technology to cross-sell products. Tech integration has also enabled new theme-based customised products for retail investors to appear on the scene.

• Large new private banks as well as small- and mid-sized ones have begun offering banking products to MSMEs based on collaborations with digital solutions providers and API enablers.

• Large banks are also using data mining to drive their cross-sell strategy, especially for products such as personal loans, to their existing as well as non-bank customers. CRISIL Research finds that 70% of personal loans extended by large new private banks are to their existing banking customers.

• Through the API banking ecosystem, corporate clients of large new private banks are able to integrate their ERP with the bank’s CBS to facilitate payments and collections.

• Large digital-only NBFCs were the first movers in providing embedded lending products. However, large private banks and NBFCs have swiftly developed their digital infrastructure to offer such products.

• We are also seeing innovation on the liability side. For instance, Equitas Small Finance Bank announced its partnership with Google Pay in September 2021 for sourcing fixed deposits. The collaboration enabled the SFB gain access to a wider consumer base to build its liability franchise.

• Brokerage players have been collaborating with platforms such as ‘smallcase’ and ‘WealthDesk’, which provide customised theme-based investment products to retail investors, which has increasingly gained traction from fiscal 2018.

• Such product innovation has made it possible for retail investors to invest in customised products offered by PMS players, earlier restricted by the investment cut-off of Rs 50 lakh.

• These tie-ups are a win-win for all stakeholders, as product developers earn fees for their products, customers get to choose from a wide range of products, and brokerage ensure customers get to access the entire product suite through a single platform.

Large private banks and insurance players have leveraged digital channels to enhance customer engagement and query resolution

• Large private banks have set up AI bots to automate processes such as blocking of debit/credit card, issuance of new cards, and engage with customers on suspicion of fraudulent transactions.

• New virtual debit/credit cards are issued to existing customers by leveraging AI-based chat bots which can be used immediately for transactions.

• Large private banks have also started suggesting products relevant to customers on the basis of their transaction pattern.

• Insurers have set up AI-driven chat bots to solve customer queries, fill applications forms, and familiarise customers with various predefined process. Insurers are processing digital documents upload through chat-bot windows to ensure quick and efficient claims processing.

MSME access to credit has improved, but only marginally due to technology adoption by incumbent players. Large new private banks are providing innovative solutions to MSMEs through collaborations with digital solution providers. However, access to credit using alternative credit metrics and leveraging AI/ML in under-banked regions are yet to gain significant traction across cohorts

• Large private banks, in collaboration with digital solution providers, are offering solutions such as virtual accounts, corporate credit cards, automated tax, and vendor payments. MSMEs are also sanctioned instant business loans on the basis of their transaction history.

• With close to 15% of kirana stores’ revenues coming from digital payments (fiscal 2021 panIndia average, as per CRISIL Research estimates), incumbents have collaborated to leverage this data for granting loans to these outlets.

• The aggregate number of MSME loan accounts across licensed banks and NBFCs remain low in relation to the overall MSME universe: CRISIL Research finds, less than 20% of the ~70 million MSMEs in India have access to any formal credit, as of March 2022. That said, NBFCs saw active MSME loan accounts ramp up at a strong ~24% CAGR between fiscals 2017 and 2022. In comparison, they rose merely by 0.6% for private sector banks and recorded a negative CAGR of 1.5% for public sector banks

• But at the systemic level, the semi-urban and rural segments are yet to reap significant benefits from digitalisation of large, as well as small- and mid-sized banks. The share of credit accounts for private sector banks in these regions increased to 37.7% in fiscal 2021 from 33.4% in fiscal 2017 due to an increasing push through offline channels.

• A couple of leading private sector banks and two established NBFCs have partnered with an NBFC licensee to provide BNPL facility to unorganised retailers (or kirana stores20).

20 Kirana stores account for 89% of the food and grocery retail market in India (CRISIL Research estimates)

• In August 2021, HDFC Bank collaborated with Paytm to offer products such as corporate credit card, BNPL, and EMIs to business merchants with a focus on tier 2 and 3 cities. Further, the two companies also propose to market a cobranded PoS product to merchants in partnership.

• A player from the large PSB cohort launched an agri-gold loan product exclusively through its inhouse digital platform.

• Insurers have limited product offerings for the financially excluded customer segment. There is significant scope for product innovation, especially offering more smaller-sized sachet products and contextual and need-based insurance

• To offer these products at a competitive cost to last-mile customers, insurers need to leverage the digital ecosystem extensively by collaborating with digital service providers

Digital-only NBFCs are driving small-ticket loan growth through platform lending, BNPL products

A reinvention of old-style consumer credit, BNPL through offline and online channels has led to a massive jump in disbursements of small-ticket-size loans (below Rs 50,000), especially since 2020. The number of personal loans of this ticket size extended

by the industry in aggregate and by NBFCs as a player group rose a staggering 30 times and 42 times, respectively, over fiscals 2018-21. The growth gained further momentum in fiscal 2022 and on YTD basis (April 2021– December 2021) ~28.5 million loans were disbursed under the segment during the period as compared to 12.5 million loans in the whole of fiscal 2021. In volume terms, NBFCs’ share in small ticket size loans increased to 74.1% in fiscal 2022 (YTD basis) from 61.1% in fiscal 2018.

It is NBFCs and digital lenders that are mainly offering BNPL products offered through embedded lending and/or checkout finance in collaboration with e-commerce players.

Large, established public and private banks, however, are still testing the waters in segments such as BNPL or embedded finance, partly because of higher credit risk perception associated with credituntested customers jumping on to the bandwagon.

But here too, private banks are attempting to make their presence felt. Axis Bank launched its BNPL product in August 2021 through its subsidiary’s digital payment platform (Freecharge). The facility can be used for utility bills and other merchant payments. ICICI Bank also launched its PayLater product for utility bill payments through its mobile app and embedded the product on e-commerce platforms. However, these products are limited to the banks’ customers.

Trend in small-ticket-size personal loans

YTD: April-December 2021

Source: Experian Credit Bureau, CRISIL Research

Small-ticket size loan products originated by digital solution providers, including BNPL, have high demand from NTC (New to Credit) customers. These players leverage alternative data points to make credit decisions for such customers. Therefore, such products are pivotal in establishing digital presence and developing credit history of NTC customers. Further, the same eventually is likely to help them to avail big ticket-size products from licensed entities over the long term. In its working group report (Digital lending including lending through online platforms and mobile apps) in November 2021, the RBI recommended that all lending done through digital intermediaries even if interest-free, should be reported to the credit information companies (CICs) as they help develop credit history for the individuals.

Technology has enabled streamlining of seemingly complex processes involving various touch points and multiple stakeholders through digital platforms. The ability of fintech platforms to develop APIs with capability and flexibility to integrate across core

banking solution of various financiers and ERP of companies has further accentuated the digitalisation trend and streamlined the operational process involved in supply chain finance. The entire supply chain ecosystem of a particular anchor/corporate including its vendors is being on-boarded on digital platforms. Further, basis the purchase order generated by anchor, the MSME vendor is able to avail financing through bill discounting. The digital platforms have helped in increasing reach among MSMEs. Further, these platforms also work with MSMEs to help them on-board on their platforms.

Further, even TReDS (Trade Receivable Discounting System) platforms which commenced operation in 2014 has gained significant momentum over the last three years aided by digital processes adopted by businesses across supply chain.

Many incumbent banks have forged partnerships with digital platforms to drive their supply chain businesses. For example, Vayana Network has forged partnerships with Bank of Maharashtra, Axis Bank, Federal Bank & Tata Capital. 21

The digitalisation of the supply chain finance has helped in enhancing reach to MSME customers. Going forward as awareness among MSMEs further

increases, the trend is expected to continue with more players on-boarding on such digital platforms and also availing financing through TReDS

Though digitalisation has reduced interest rates for highly creditworthy customers, the underserved customers are yet to reap benefits. Going forward, it will be critical even for the smaller, local entities at the grassroot level to adopt technology.

• Despite the decline in operating costs across cohorts, especially in case of large banks, interest rate spreads for underserved customers with weak or limited access to formal credit have not been optimised. However, this can be attributed to risk aversion amid the pandemic.

• Small- and mid-sized NBFCs and small finance banks, which have a strong focus on catering to relatively unserved and/or underserved customers, have accelerated their focus on digitalisation and partnerships post pandemic.

• The operating cost per active loan for NBFCs catering in the affordable housing segment dropped by ~13% during fiscal 2017 to fiscal 2021; However, the risk premium (as measured by the interest rate paid by them over and above the 10-year G-sec yield) for small-ticket home loans (less than Rs 10 lakh), mostly availed of by self-employed customers with no formal income documentation, has hardly witnessed any change in the last four years

• However, these customers are yet to reap the benefits of lower interest rates amid digitalisation

• The adoption of technology by brokerage players especially in distribution has led to a steep drop in commission/brokerage cost across segments

• However, pricing benefits due to a leaner operating structure and streamlined workflows for players is yet to translate to optimised pricing for unserved and underserved customers in the insurance segment

Large financial institutions have taken the lead in digitalisation, which has already given them an edge over smaller peers. But it is critical for even smaller, local entities focused on serving a specific target segment, to adopt technology and enter relevant tieups with third parties after factoring in their consumer types. This would not only help them offer a wider suite of products and services, but also create efficiencies and eventually reduce product cost.

The small scale of operations of these institutions may restrict their ability to undertake substantial investment in technology. Nevertheless, the trust enjoyed by these smaller entities in their customer segment would also help them better connect with these customers with the most relevant offerings.

An illustration of the community banks in the US, which were the leaders in technology adoption, and how they reaped its benefits, is instructive here.

The US Federal Reserve defines community banks as those with consolidated assets of less than $10 billion. They accept deposits from local communities and deploy funds only in local businesses. As of December 2019, the US had 4,750 community banks compared with 427 non-community banks. The share of community banks in banking assets was ~12% as of December 2019, as per the FDIC22 .

Despite consolidation post 2008, the community banks have played a major role in helping local communities in the US, especially during the pandemic. The pandemic also prompted them to ramp up their technology investments through partnerships. According to the FDIC, community banks with high technology adoption witnessed substantially higher growth in assets post pandemic Further, banks with lower assets did not invest in technology, thereby further hampering growth and ability to provide solutions.

Community banks which were in the higher quartile based on IT spending to assets reported 60 bps higher loan growth in 2020 compared with players in the lowest quartile. Similarly, the community banks

that had incorporated technologies in their processes and were part of the highest quartile reported ~80 bps higher performance in loan growth, compared with players in the lowest quartile of technology adoption.

With a stated intention of coming together for a greater common good and in order to tackle capital constraints, a group of 66 institutions, majorly community banks in the US, have formed a venture capital fund with a purpose to invest in financial technology companies and start-ups. These investee companies are tasked with helping the digital transformation journey for the community banking ecosystem in the US.

The Indian financial ecosystem has evolved at a different pace from developed countries such as the US and the UK. In the US, evolution has been completely market-driven with digital solution providers and big tech taking the lead to develop new innovative products and business models. On the other hand, in the UK, the introduction of Open Banking Implementation Entity (OBIE) by the Competition and Market Authority (CMA) paved the way for adoption of open banking architectures across the ecosystem. In India, the path for digital disruption has primarily been determined by market forces driven by customer requirements. However, digital disruption has been equally fuelled by the government and its thrust on public digital infrastructure.

Customer demand is pushing innovation, leading to new business models through collaborations between banks and digital solution providers. But regulators have to maintain a fine balance between encouraging that and ensuring customer protection.

The fast-paced confluence of technology and finance has enhanced the complexities that regulators have to deal with. As technology/API providers only act as enablers to the financial institutions in most cases, they are not required to obtain specific licences and are out of the regulatory purview. The regulatory lines become blurred, especially when technology players front-end the transactions while operating in collaboration with a regulated entity. For example, in a collaboration between payment solution provider and a bank in India, the former provides all banking products to the customer through the bank. Further, the payment solutions provider also acts as a holistic

service provider (including banking solutions) to the customer and also indirectly providing liquidity facility to its customers, which is under the purview of RBI.

The RBI has expressed its concerns over the entry of big technology firms into the financial markets. In its Financial Stability Report (July 2021), the RBI has cited three main concerns with respect to such firms. One, is their presence in multiple lines of businesses (including non-financial), making it difficult to regulate their potential to become dominant players in financial services and network effects, due to which these players can achieve scale and thereby enhance systemic risks.

Two, is the loans being provided through digital apps, with lack of transparency on who the lender is and coercive recovery methods followed by some apps. The RBI, in its June 2020 notification on online origination of loans, has mentioned that the responsibility of compliance and adherence to fair practices code lies solely with the regulated entity, irrespective of the source of loan origination. Further, in August 202223, the RBI notified key rules with an aim to protect customer interest, such as establishing standard practices on responsible pricing through the mention of an annual percentage rate (APR) and setting up of a nodal grievance redressal officer to deal with digital lending related issues The RBI also stated that the transactions across the loan lifecycle shall be executed directly between the licensed entity and borrower without any pass-through account of any third party.

Even in the developed markets, such as the US, a similar model is followed, with the responsibility lying completely with the regulated entity. However, many large digital solutions providers in the US have applied for banking licences with the regulator to

23 In November 2021, the Working Group constituted by RBI submitted a report on ‘Digital Lending including lending through online platforms and mobile apps’. In August 2022, the RBI notified the rules/regulation for immediate implementation basis the recommendations of the Working Group report

operate on an independent basis. Square Financial Services – a payment solutions and financial solutions provider based in California received its industrial banking licence24 to operate in the US in June 2020. In March 2021, Revolut, a digital solutions provider headquartered in London, UK, also applied for banking licence for its operations in the US

In the UK, many digital financial solution providers have already received banking licences, with the first license granted in 2015. Atom Bank, Monzo Bank and Starling Bank – all based in the UK – started their journey as digital solutions providers, but received banking licenses from UK Prudential Regulation Authority (PRA) during 2015 and 2016. In January 2021, Revolut also applied for banking license in the UK.

It is possible that different central banks around the world also look to regulate emerging consumer products, such as BNPL, which have been enabled due to the collaboration between big tech, digital solutions providers and licensed providers.

The UK government, for instance, released a consultation paper in October 2021 focussed on the regulation of the BNPL products. It stressed the need to standardise BNPL agreements and processes, as many customers are unaware about the exact nature of the product and interest rate charged. Further, other aspects, such as merchant discount rate (MDR) charged by the third-party lenders, the repeat transactions/BNPL option provided to consumer once on-boarded by the digital solutions provider, creating clear demarcation between BNPL, and other shortterm credit options were also under the focus in the consultation paper.

The RBI’s Working Group on Digital Lending, in its November 2021 report, too has suggested tighter norms for BNPL, suggesting that they be treated as a

part of balance sheet lending, if not in the nature of operational credit by merchants. Such transactions are currently not reported to the credit bureaus, as they do not fall under the definition of credit and are more in the nature of deferred payments at a zero per cent interest rate to enhance customer engagement.

The limits of compliance: While the onus of compliance and supervision lies with the regulated entity, any such entity can undertake oversight of the policies and processes of its technology partners only within the scope of collaboration between the two entities. For example, a technology player can be engaged in distributing multiple products across different regulated financial entities. Further, the entity may also offer other services, which do not require banking or NBFC licence. In case of products such as embedded and checkout finance, the digital platform’s primary business, i.e. retailing of products on a web platform, does not require any regulatory licence. Hence, the compliance by the regulated entity can only be ensured at the activity level.

Infrastructure of digital solution providers: Robust digital infrastructure and cybersecurity are critical to ensure uninterrupted and reliable service to the customers. In the past, the RBI has imposed penalties on regulated entities, which have experienced frequent system outages. In case of collaborations through open architectures, the regulated financial entity has to ensure the robustness of its partner’s infrastructure, systems and processes.

From a regulatory perspective, this represents a peculiar situation, as the regulators are responsible for protecting customer interest, but most digital intermediaries/technology firms are outside the regulatory purview. At the same time, any laxity on the part of the digital intermediary, technology partner

24 Industrial bank in the US is a insured state-chartered bank that is a, industrial loan company or any other institution that is excluded from the definition of bank in the Bank Holding Company Act; the industrial bank is not subject to supervision by the Federal Reserve Board

and/or API provider engaged with a regulated entity has direct repercussions on the customer experience as also the potential for customer data and privacy getting compromised.

FLDG arrangements: Certain digital solution providers provide a first loss guarantee up to a prefixed percentage on the loans generated and underwritten by them. This represents another area of regulatory concern. The solution provider, in this case, bears significant credit risk, but is not required to maintain any regulatory capital. The RBI’s Working Group on Digital Lending has recommended prohibiting licensed entities from entering into any arrangement involving synthetic structures, such as FLDGs, with digital solution providers.

Despite these material concerns, striking the right balance between innovation and mitigating risks would be imperative. It will not be possible to introduce a ‘one size fits all’ regulation for all digital solutions providers, given the wide range of services and solutions offered by them. At the same time, it is likely that certain steps to control systemic risk, due to products such as BNPL and FLDG arrangements, are put in place.

The RBI has been providing a platform to balance innovation, while also keeping in mind consumer interest through regulatory sandboxes25

25 A regulatory sandbox is a framework that allows live, time-bound testing of innovations with the oversight of the regulator. It allows both incumbents and challengers to experiment with products, solutions and designs that may seemingly lie on the edge of or even outside the current regulatory frameworks.

APIs are the bulwark on which India’s strong digital financial system is being built. Most licensed service providers were initially slow to explore collaborations with API providers, which is understandable, given they are answerable to the regulator for any lapses. Nevertheless, there has been a rapid acceleration, especially since the pandemic.

Currently, service providers are, at best, at a moderate stage of adoption in their digitalisation and API journey. Larger players are leading the way. The pandemic has accelerated the process of building API capabilities among service providers, and we expect the traction to remain strong, as service providers intensify efforts to build new revenue streams and/or reduce costs.

While digitalisation and APIs have led to runaway growth in low-ticket size personal loans to credituntested customers, we have only scratched the surface, and more can be done to propagate financial inclusion. With several banks entering into co-lending arrangements with NBFCs, enabled by API integration, we expect to see rapid progress on this side too, over the next 2-3 years.

On the regulatory front, we foresee more digital solution providers applying for a licence from RBI and bringing in the requisite regulatory capital to lend comfort from a systemic risk perspective.

• Virtual current account

• Automating payables and GST filings

• Corporate credit card and instant loans (basis eligibility)

In this collaboration, the bank operates on open architecture to provide virtual current accounts to all the users, who are on-boarded on the payment gateway’s digital platform. The data from ERP software is synced with the platform on a regular basis. Further, basis the bills raised on ERP, automated payment is being carried through bank’s UPI switch. The bank then provides other products, such as working capital loans, unsecured MSME loans, and corporate credit cards through integration with the digital platform. The eligibility of the customers for the loan products on offer is decided by the bank by leveraging the data from UPI-based transactions.

The banks need to ensure seamless integration of all their product switches with the digital platform’s API. Since 2016, many API integration players have entered the market to help the incumbents with their APIs and aid integration with third party platforms. For example, in case of a car loan, API integration for verification of PAN details of customer, vehicle registration details, and analysis of bank account statement of customer will streamline the entire underwriting process.

•

•

The above ecosystem is a bank-led model with the digital platform collaborating with a small finance bank. In this model, the bank aims to leverage on the digital platforms’ expertise in providing superior digital experience to distribute its product suite. Further, the higher interest rates provided by the small finance bank compared to peers

Savings Payment gateway players/digital solution provider Private sector bank ERP/Accounting management softwarealso provides the digital platform with favourable proposition to attract clients. The user also receives bank issued debit card. Further, the digital platform also provides investment facility in mutual funds through direct route. The platform does not charge any commission to its users for mutual fund investments.

Majority of the leading equity broking players and MF platforms have collaborated with players providing themebased investment products (investment product providers). A user can buy such investment products directly through the existing platform of his/her equity broking player/mutual fund platform. The same is being done through API of the investment product provider being integrated with investment platform providers’ platform. Therefore, all the new products provided by the product platforms are updated on investment platforms on a real-time basis. The distribution by such investment product providers is completely carried out through the digital medium. From the incumbent player’s point of view, the user will not be required to open a new account with other service providers to invest in such products and thereby, it helps the existing service provider enhance user stickiness and retention.

Banks/NBFCs/ MFIs

Tech-players providing video KYC and estamping solution

• Digital on-boarding of clients

• Online signing and stamping of loan agreements

With the RBI permitting digital on-boarding of customers through video KYC, several financial institutions have collaborated with players providing solutions, such as:

• Video KYC for on-boarding new customers

• e-stamping and e-signing solution for executing loan agreements digitally

The digital on-boarding solutions has helped incumbent players reduce operational costs. With video KYC, the time taken for on-boarding customers is also substantially reduced. Moreover, the need to open physical branches to expand geographical reach is also significantly reduced.

Equity broking players and MF platforms Theme-based investment products • Customised investment strategy for usersThe above architecture is led by the digital solutions provider. The payment aggregator/digital solutions provider acts as a distribution platform to a small-finance bank, mutual fund house and digital lender. The product APIs of all the partners are integrated with the digital solutions provider. The KYC process of users is carried out by the partners.

• Payment and collections

• Account reconciliation

• Supply chain finance

A few private banks have published their APIs on the public domain. Therefore, business clients can integrate their ERP (enterprise resource planning) with the bank’s tech stack by leveraging the latter’s API banking ecosystem. The API solutions streamline process, such as payments, collections and provides other services, such as payment enquiry, account balance and beneficiary addition through integration with business ERPs. Further, the banks adopting the API banking ecosystem are able to capture the entire customer value chain of its business clients and build an integrated supply chain portal, where it is also able to offer working capital finance to the client’s vendors and dealers.

Cohort-wise assessment of the impact of digital transformation on the business

• Players in the cohort have developed super-apps (save, invest, borrow and shop) and collaborated with digital platforms for specific products, such as education loan, housing loan and gold loan, to expand the market reach

• However, many players in the cohort are not a part of open banking architectures with third-party digital platforms

Large PSBs

• A bank in the cohort has developed automated risk scoring and decisioning for home, car, education, and gold loans through its super-app

• A player has launched ‘WhatsApp banking’ channel for its customers; further, a bank also provides value-added products, such as online marketplace for purchasing agriculture inputs and farm equipment

• The players in the cohort are yet to forge significant third-party partnerships or build their inhouse digital platforms to leverage tech capabilities; however, they have on-boarded on marketplace portals, such as TReDS26 for supply chain financing

Small and midsized PSBs

• They have launched their in-house digital platforms to serve existing users and for digital application and processing of loans. However, they lag their large peers in designing digital products across customer base and cross-selling of products through medium

• Through collaborations with third-party platforms, a player in this cohort is providing services and products, such as virtual accounts, corporate credit card and unsecured business loans basis cash flow data

Large new private banks

• The players in the cohort have adopted tech in various processes, such as RPAs, to automate reconciliation processes, video KYC for on-boarding customers, automated credit under-writing process, e-stamping and e-signing of loan agreements

• Two players launched their BNPL product in collaboration with a digital platform. Further, basis integration with neo-banking platforms to provide basic banking services, the players are able to effectively sell not only core banking products but also other fee-based products to customers

Small and midsized new private banks

• A few players in the cohort have adopted digital processes while customer on-boarding to substantially reduce their on-boarding costs. They have also leveraged data analytics to create efficiency in their underwriting processes

• The players have designed robust digital web and mobile applications to sell core banking as well as fee income-based products. However, they lag their larger new private peers in collaborations with platforms to offer innovative product solutions

TReDS (Trade Receivables Discounting System) is an RBI-approved electronic platform for facilitating financing/discounting of trade receivables

• The players in the cohort have taken substantial steps to ramp up their digital play from FY18

Large old private sector banks

• A bank in the cohort has created its own neo-bank/digital platform ecosystem in collaboration with Visa; further, a bank has partnered with a UK-based fintech player which provides digital platform to MSME segment

• A player sanctioned ~70% of home loans and car loans digitally in FY21; the users had applied for the loan through the bank’s digital platform

• A few have effectively leveraged AI and ML to cross-sell fee income-based products

• The players in the cohort have collaborated with digital lending platforms to generate new leads; however, the partnerships are yet to mature and are still in their nascent stage

Small and midsized old private sector bank

• They have taken steps to adopt digital processes for loan origination; however, the players are yet to take significant steps to adopt technology in their internal processes. Though players in the cohort have implemented digital channels for its customers, the adoption at back-end office channels lags its peers

• They undertaken very limited collaborations with digital platforms to launch new products. Further, a few players in the cohort do not participate on TreDS to offer invoicing discounting product to MSMEs

• A few players have developed very innovative products to build their liability franchise as well as asset book, due to a lower number of physical branches and lower ticket-size deposits through such branches, few players in the cohort have substantially leveraged the digital channel to build liability franchise

• They have also partnered with digital platforms to offer MSME loans to merchants and saving products

• Many players have swiftly built their digital infrastructure within a short period after receiving their SFB licences

• A player in the cohort launched its neo-banking platform in collaboration with fintech player offering deposit, insurance and investment products.

• The players have also collaborated with insurance players to provide solutions to rural customer base

• As NBFCs have a focussed product portfolio and cannot provide savings products, the collaborations are more outward (NBFCs trying to find right digital partner for products) rather than inward (platforms approaching NBFCs)

Large NBFCs

• A player in the offline BNPL space recently announced that it would launch its own super-app and provide similar products through the online channel as well

• An NBFC has its in-house digital platform for integration with OEM platform for lead flows

• A player in the cohort collaborated with a digital-only lender for providing loans in B2B BNPL space; the segment was completely new for incumbent NBFCs and aided diversification

Small and midsized NBFCs

• An NBFC has collaborated with a fintech partner which provides embedded BNPL solutions to build card-based credit products for merchants; its open architecture has enabled collaboration with other institutions to launch and deliver such products

• The sales field employees of an NBFC-MFI are equipped with mobile tablets to on-board employees in paperless manner

Cohort

Comments on players in the cohort

• Through collaborations with insurtechs, players are able to launch and underwrite products in niche segments such as crop insurance using AI capabilities and other micro-insurance products

Insurance players

• The players have developed automated underwriting capabilities in-order to develop robust risk practices and also enhance operating efficiency

• A top-five life insurance player processes ~40% of its life insurance policies through automated underwriting

• The on-boarding cost for a few leading incumbent brokers has dropped substantially for the incumbent AMCs

AMCs

• A few players have streamlined their in-house mobile application to make customer experience seamless during on-boarding and also during their investment process

• A large incumbent player has completely changed its business model from an offline full-service broker to a digital broker

Brokerage houses

• Thematic investment products are offered by digital investment platform in collaboration with brokerage players

• The wide distribution of such products through incumbent brokers has been enabled due to tech adoption by incumbents and the ability to integrate their core business platforms with the fintech players

Source: Company disclosures, CRISIL Research

Cohort-wise assessment of impact of digital transformation on financial inclusion

Cohort Comments on players in the cohort

• A player launched an agri gold loan product in 2019, exclusively through its digital platform. As of March 2021, ~Rs 450 billion was disbursed under this product. The product was available to customers in a multi-lingual option

Large PSBs

• Despite the drop in the cost of distribution, the last-mile customers have not enjoyed significant benefit

• Though the players in the cohort have played a significant role in financial inclusion by facilitating opening of PMJDY accounts, the role of technology to further deepen the relationship with such customers has been limited

Small and mid-sized PSBs

• On the MSME front, the players in the cohort have collaborated with supply chain financing platform to expand their vendor-financing portfolio. Majority of the players are also a part of the TReDS platform

• The digital adoption is yet to create significant positive impact on cost metrics for players in the segment

Large new private banks

• Through tie-ups with digital platforms for providing savings related products, the reach of the players in the cohort has expanded significantly. For e.g. two players in the cohort have collaborations with platforms which cater specifically to MSME clients with solutions such as automating tax payments, vendor payments, business reporting and instant loans

• Players have developed innovative credit products to cater to local merchants/kirana stores

• However, the lower ticket size personal loans has not gained significant traction for banks in the cohort

Small and mid-sized new private banks

Large old private sector bank

• The players in the cohort have collaborated with digital platforms, e-commerce websites and also leveraged their in-house digital platforms to cater to the unbanked population. API integrations with third party platforms has enabled create effective synergies. A player in the cohort has adopted assisted digital method wherein it trains people in rural pockets to use its mobile application and then on-boards them based on interest

• Through active collaborations with digital platforms, the players are looking to increase their penetration in retail and MSME space

• A player in the cohort is striving to provide a host of solutions to unbanked SME players through collaboration with UK-based fintech platform

Small and mid-sized old private sector bank

• Players in the cohort are giving push to financial inclusion through their business correspondent network. Through assisted digital approach – creating financial literacy through campaigns and then leveraging bank’s digital platforms – the players are serving the unbanked population

• On the other hand, the players in the cohort are yet to take significant strides in increasing reach through innovative solution for MSME and retail customers

• The players have collaborated with third party platforms to sell fee-income based products such as insurance and other investment products

SFBs

Large NBFCs

• The players in the cohort have effectively leveraged digital platforms to expand their customer base beyond the geography of their physical presence

• The benefits of the same have positively impacted them especially in their liability franchise

• In segments such as affordable housing, the players have swiftly expanded their presence in Tier 2 and 3 cities through a mix of physical offices and their in-house digital platform

• Through collaborations with e-commerce websites, the players are providing instant short-term EMI loans on products purchased on platform. The customers are majorly NTC or do not have significant credit history

Small and mid-sized NBFCs

Insurance players

• Many players in the cohort have collaborated with digital platforms to launch products, such as MSME loans and personal loans

• The digital play has enabled them underwrite higher risk-adjusted, yield-based personal loans

• The operating costs for the players have dropped because of increasing dependence on technology and fintech tie-ups for multiple operations

• However, Covid-19 led to insurers reworking their mortality assumptions and strengthening their underwriting norms. The pricing of product offerings, especially group term policies, has increased

• The expense ratio charged by mutual funds have dropped over the last few years; however, the same is due to confluence of regulatory amendments, higher AUM and lower cost due to digital distribution

• On the broking industry front, the lean model adopted by the digital-only brokers has forced incumbents to not only re-align their business models but also reduce their brokerage charges

• However, the brokerage cost has dropped significantly across investment ticket sizes during the past few years

Source: Company disclosures, CRISIL Research

Examples of partnerships entered by players across cohorts to increase addressable market size

Examples of partnerships in supply chain finance Platform Focus segment Banking/NBFC Partners

CredAvenue

Vayana

CashFlo

CredAble

C2FO

Finovate

Progcap

Note: Company referred by brand names

Source: Company websites

• Vendor Finance

• Dealer Finance

• Vendor Finance

• Dealer Finance

• Vendor Finance

• Dealer Finance

• Vendor Finance

• Dealer Finance

• Vendor Finance

• Dealer Finance

• Vendor Finance

• Dealer Finance

• Buy Now Pay Later (unsecured)

• Dealer Finance

• Kotak Mahindra Bank

• Bank of Maharashtra

• Axis Bank

• Federal Bank

• Tata Capital

• N.A

• HSBC India

• Kotak Mahindra Bank

• 15 Banking/NBFC Partners

• Star Finserv

• Muthoot Finance

• Kisetsu Saison Finance

• Ujjivan Small Finance Bank

Adoption of digital platforms by Millennials and GenZ population has further supported growth for ecosystem

• 80% of the clients on-boarded by Upstox – a digital broker and second-largest broker in India as of March 31,2021 – were from the age bracket of 18-36 years

• 80% of investors on Paytm Money – digital wealth management company – are below 35 years of age

• For ICICI Securities (third largest broker in the country), 71% of its clients on-boarded during FY19-21 belonged to millennial and Gen Z category

• 82% of customers on-boarded by NiyoX – a neo bank offering services to customers in partnership with Equitas Small Finance Bank and Visa – were below the age of 35

Source: CRISIL Research

Large new private banks dominate mobile banking transactions; however, PSBs have ramped up their digital payment offerings significantly

To decipher the extent to which banks have been able to persuade customers holding deposit accounts to transact through their mobile banking apps, we looked at the delta between their share in systemic deposits of the various cohorts and their share in mobile banking transactions (on value basis). A positive delta suggests a higher share in mobile banking compared with the cohort’s share in deposits, thereby signifying a healthy digital trend for the cohort. Further, we compared this data over two distinct time periods to analyse the extent of change in either the positive or negative direction.

Our analysis indicates the following:

• All 3 cohorts constituting private banks have positive mobile banking transactions delta large new private banks, small- and mid-sized old private sector banks and large old private banks

• Large new private banks have substantially high delta, suggesting high usage of its digital applications by its customers for payment

• Large PSBs and small- and mid-sized banks have seen a substantial improvement in their mobile banking transactions delta during fiscals 2017-22 although it remains in the negative category

Omidyar Network India invests in bold entrepreneurs who help create a meaningful life for every Indian, especially the hundreds of millions of Indians in low-income and lower-middle-income populations, ranging from the poorest among us to the existing middle class. To drive empowerment and impact at scale, we work with entrepreneurs in the private, nonprofit and public sectors, who are tackling India’s hardest and most chronic problems. We invest in the areas of Digital Society, Education, Emerging Tech, Financial Inclusion, Cities & Innovation and Property Inclusivity.

Omidyar Network India is part of the Omidyar Group, a diverse collection of companies, organizations and initiatives, supported by philanthropists Pam and Pierre Omidyar, founder of eBay.

CRISIL is a leading, agile and innovative global analytics company driven by its mission of making markets function better.

It is India’s foremost provider of ratings, data, research, analytics and solutions with a strong track record of growth, culture of innovation, and global footprint.

It has delivered independent opinions, actionable insights, and efficient solutions to over 100,000 customers through businesses that operate from India, the US, the UK, Argentina, Poland, China, Hong Kong and Singapore.

It is majority owned by S&P Global Inc, a leading provider of transparent and independent ratings, benchmarks, analytics and data to the capital and commodity markets worldwide.

CRISIL Research is India's largest independent integrated research house. We provide insights, opinion and analysis on the Indian economy, industry, capital markets and companies. We also conduct training programs to financial sector professionals on a wide array of technical issues. We are India's most credible provider of economy and industry research. Our industry research covers 86 sectors and is known for its rich insights and perspectives. Our analysis is supported by inputs from our large network sources, including industry experts, industry associations and trade channels. We play a key role in India's fixed income markets. We are the largest provider of valuation of fixed income securities to the mutual fund, insurance and banking industries in the country. We are also the sole provider of debt and hybrid indices to India's mutual fund and life insurance industries. We pioneered independent equity research in India, and are today the country's largest independent equity research house. Our defining trait is the ability to convert information and data into expert judgments and forecasts with complete objectivity. We leverage our deep understanding of the macro-economy and our extensive sector

coverage to provide unique insights on micro-macro and cross-sectoral linkages. Our talent pool comprises economists, sector experts, company analysts and information management specialists.

CRISIL respects your privacy. We may use your contact information, such as your name, address, and email id to fulfil your request and service your account and to provide you with additional information from CRISIL. For further information on CRISIL’s privacy policy please visit www.crisil.com/privacy