International Wellness & Spa Tourism Monitor

International Wellness & Spa Tourism Monitor 2015

The Tourism Observatory for Health, Wellness and Spa proudly announces its 3rd benchmarking study on Spa and Wellness Tourism, titled the International Wellness & Spa Tourism Monitor. The Report provides industry insights for operators, managers, investors and advisors!

This path making report was prepared in cooperation with RLA Resources for Leisure Assets and enjoyed endorsement from global companies (e.g. Mandarin Oriental, Thermarium), and national and international organizations (e.g. PATA, ETC or Hungarian Bath Association).

The IWSTM 2014/2015 collected information from 56 countries.

We identified 17 different wellness and spa service operation types.Withthiswiderange offacilitiesweintended tohighlightthe complexity of the industry.

We believe that it is essential to highlight: spa and wellness facilities can come in numerous ways and types. The demand for these establishments is rather varied, too!

Not only facility typology was taken into consideration but IWSTM also introduces data and information by three major demand segments, local customers, domestic tourists and international tourists. No operator or investor should assume that ‘tourists’ or ‘customers’ can be uniform. The characteristics of the three major demand segments can and do differ greatly. We introduce separate data only if significant differences were identified.

Hotel spa (urban location)

Spa hotel/resort

Lifestyle oriented spa/retreat/resort

retreat

(spa)

Other (please specify)

The key objective was to identify the role tourism and tourists play at various spa and wellness facilities worldwide.

The IWSTM 2014/2015 Report provides intelligence regarding the following key themes:

▪ Wellness and Spa Facility Types Becoming Popular?

▪ Wellness & Spa Services Becoming Popular?

▪ Business Trend Changes for 2014, 2013 and 201

▪ Typology and Motivation of Customers

▪ Popular Services & Treatments

▪ Main Sender Regions (where tourists come from)

Signature Treatments & Product Packaging

The Tourism Observatory for Health, Wellness and Spa (TOHWS) was created in the Spring of 2012 by globally renown advisors and researchers. TOHWS provides platform for industry, investors and academics. To us travel for health means travel for total health, either medical, wellness, well-being,holistic, spiritual, spa or medical wellness travel. This holistic approach to health makes TOHWS the only global initiative looking at every aspect of the spectrum.

TOHWS experts have been involved in over 100 industry and academic projects in the field of health and travel during the last 20 years. We have written professional books and articles and participated in international and global, as well as very local research and development projects, and spoke over 50 professional and academic conferences worldwide in the last 3 years.

An Initiative from Xellum http://thetourismobservatory.org

This report would not have been possible without the cooperation with the RLA Resources for Leisure Assets . www.resourcesforleisureassets.com

Copyrighted Material

The International Wellness & Spa Tourism Monitor 2015 is prepared by Xellum Ltd. (Hungary). Information created or owned by Xellum and presented in this document is considered to be intellectual property of Xellum Ltd. It may not be distributed or copied in any way or form.

László Puczkó Melanie Smith Ivett

Sziva

Industry Partners

This benchmark research is endorsed by the following prestigious companies and organizations.

We thank you for your support!

Africa

The Americas

AustralAsia

Health, Wellness, Spa & Tourism

There is so much happening out in the market. The number of products and services being associated with health, wellness and spa is proliferating. The concept is being streched and we can observe saturation in many markets (e.g. What do you think the label of ‘Car Spa’ may cause to the spa industry or ‘Wellness Towels’ to the wellness industy?).

We believe that the spectrum of travellingfor health isverywide and it has man variations. The terminologies applied can differ greatly continent-by-continent or even country-by-country, culture-byculture. That was one of the key reasons why TOHWS decided to launch its global initiative.

Our 2014/2015 data shows that the role of tourists is significant in wellness and spa facilities (other that day spas or club spas), since 2/3 guests are non-locals.

Classification of Participating Facilities

The distribution of facilities in the two years compared differs somewhat. These differences, however have limited impacts on the actual results. We introduced a new category, ie. healthy hotels/resorts.

hotel/resort

spa

spa (urban location)

hotel/resort

hotel/resort/centre Other (please specify)

spa

springs spa/bath

spa

(spa) hotel/resort/centre

retreat

oriented spa/retreat/resort

hotel/spa/centre

Market Position

Participating facilities could define themselves in terms of market position: budget, midlevel and upmarket/luxury. It is no surprise that in spite of the so called ‘democratisation’ of wellness and spa services, the majority of provider still belong to the luxury/upmarket category.

of Facilities Type of customers

We applied the categorisation of the International Spa Association for the type of wellness and spa customers. According to ISPA Core customers are those who believe that spa/wellness is important part of their lifestyle, Mid-level customers are interested in learning about spa and wellness but have limited commitment, Peripheral customers enjoyspa andwellness services, but altogether show little interest. There is a clear indication of the strong growth of core customers in every segment: either in the local, domestic/intracountry or in the foreign/international guest segment.

This quite significant difference between the three major demand segments leaves both managers and investors with serious decisions to be made. It does not seem to be an easy conceptual and management issue to develop and run facilities and services for a very mixed clientele. Expectations, activities and interests of local customers and foreign visitors are not the same. This anticipation and experience is confirmed by the global benchmark data.

TOHWS team has seen in many occasions that wellness and spa operations that let local customers into facilities primarily built for tourists struggled to provide services and quality at the expected levels!

Motivations of customers

The key motivations of local customers, domestic and international tourists tend to show similarities, but still, several and quite important differences can and have to be highlighted.

There is a clear change in the key motivations. Brands and reputation became more important for domestic travellers and local guests. Treatments remain to be the most important motivation for international guests.

Location is a relevant factor for international/foreign guests. The importance of therapists changed significantly, losing grounds in the decision making of guests.

Probably a little unexpectedly, technology, design or fashion have no impact on or motivating power in the decision making. This is a very telling information since many facilities keep investing large sums in technology/equipment and/or design in the hope that they could attract more guest. For second time running IWSTM could not find any grounds for such often very pricey developments.

Source countries for tourism of customers

In our previous benchmark we identified the key sender countries in wellness and spa motivatedtravel.These weretheUSA, UK, Germany, Russia, China, Austria and France were the leading wellness and spa tourism generating countries.

Southeast Asia has moved away from the traditional receiving region status to a more balance receiver as well as sender region position.

TOP Sending Markets in 2014

In the 2014 study we could identify some changes in the demand. Whereas Europe, especially Western and Central Europe still is the most important sender regions in wellness and spa motivated travel, North America and Southeast Asia are now of similar importance, i.e.

Popular services

Popular services are where we can see the three guest groups being the most similar. In 2013 not unexpectedly, massages are the most popular services on offer in wellness and spa facilities. Saunas and steamrooms are not that significant for international tourists, but they show a growing interest in medical services at wellness and spa facilities. Interestingly as we saw it before, lifestyle-oriented facilities are getting popular, but this is not case for lifestyle programmes and workshops!

2012-2013

Medical services/treatments

2014

Spiritual programmes/workshops

(e.g. New Age/Esoteric)

Lifestyle programmes/workshops

(e.g. stress management, nutrition)

Body-Mind-Spirit/Holistic programmes (e.g. yoga)

Complementary and alternative treatments

Fitness & sport services

Facial and other beauty treatments

Body treatments (other than massages)

Massages

Pool(s)

Saunas/steamrooms of any kind

Healthy options/services during stay

Outpatient medical services

Natural/organic productbased services

Thermal experiences

Services based on local resources/traditions

Fitness and sports

Spiritual workshops (e.g. New Age/Esoteric)

Lifestyle-oriented workshops (e.g. nutrition)

Active and antiageing/longevity workshops

Body-MindSpirit/Holistic workshops(e.g. yoga) Fusion treatments(e.g. aquaveda)

Occupational/corporate wellness

Complementary,alternat ive therapies(e.g. TCM)

Natural elements based therapies(e.g. thermal water)

for LOCAL customers for DOMESTIC tourists for FOREIGN tourists

Based on inputs from industry partners we changed the services category in 2014. It is now understood that the new list provides a better map of the current supply of services in wellness and spa facilities. Massages are certainly the most populat forms of treatment and services, but we wanted to know which other treatments or services can also be considered as popular.

The popularity of Complementary treatments as well as Body-MindSpirit has grown significantly from 2012-2013.

Interesting to see that the relatively new category, ie Healthy Options gained popularity very quickly especially for foreign/international guests/tourists whose interests are wider than that of the other two segments. That means international guest who arethe coremarketrequire ratherwiderangeofservcies duringtheir wellness or spa motivated travels.

Length of stay

Business performance is very much linked to the average length of stay at wellness and spa facilities. This is one of the planning and management areas that is often overlooked! Local customers tend to spend rather short time at wellness and spa facilities (2/3 spend less than 2 hours).

The short average length of stay remain to characterize domestic guests. Data show a typical pattern of weekender domestic tourists and one week long stay international tourists.

Domestic guests spent somewhat longer time at wellness and spa destinations in 2014 then they did in 2012-2013 and their very short visits (only 1-2 hours) decreased.

The benchmark information show that the average stay of foreign guests has become longer, especially the 8-10 nights length has grown significantly, but in alomost every category we can observe growth.

Complementary

products and services of customers

There are still heated industry discussions about with what kind of other services can wellness and spa be packaged together.

There are some changes during the last few years in the demand. The role of business events and wedding decreased, whereas the role of adventure activities has grown significantly.

This means a slow shift in the packaging of wellness and spa services moving away from the ‘traditional’ complementary services to a more diversified and most importantly active portfolio.

The position of business events has been questioned since is conference and meeting organizers had to recognize that participants of business events and congresses may not want to socialize with colleagues or bosses in a wellness facility or in a spa (or in the sauna!). Business events often organized in wellness or spa hotels and resorts. The use of wellness and spa facilities, however, is rather low.

Weddings and honeymoons, or golf or the sea have traditionally been strong ‘allies’ for wellness and spa services. Local specialities, e.g. ski and spa (during the skiing season) can create a very competitive package.

Conferences, congresses, business meetings

Wedding/honeymoon

& Festivals

sites and events

activities

Accreditation of facilities

Accreditation or certification still are two of the serious business questions many service providers have been considering.

One of the key challenges is how to apply general standards like ISO to the wellness and spa industry? Still, the industry is lacking global set of standards, but many believe that it is not needed at all.

The main objective of accreditation is to ensure certain level of quality based on the pre-approved protocols, which define how any element of the service would fit the whole picture. Some 50% of IWSTM participants have already gone through some kind of accreditation process.

Based on our research it seems that less and less wellness and spa facilities have not yet been accredited or certified so far. These accreditationscan comeeither from state (initiated) organizationsor third party companies and organizations (that are specialized to accreditation/certification). IWSTM participants named the following types of accreditation organizations:

▪ National bodies

Health ministries

National accreditation boards

State led medical/wellness association

Ecolabels

Tourism authorities

Country industry associations

▪ International initiatives, e.g.:

ISO standards

ISPA

Hotelstars Europe

Europespa Med/Wellness

by national accreditation board/certification

by national professional association

Yes, by international accreditation board/certification Yes, by international professional association

Signature treatments

Signature treatments and services are essential elements of creating unique and competitive brand and customer experiences. IWSTM data show that every third wellness and spa facility has already created at least one signature treatment or service.

Africa

The Americas

Asia

Very diversified: rituals, massages, detox treatments based on local ingredients

Mainly rituals, based on global brands, plus energizing massages, welcome packages

Mud treatments

Ayurvedic treatments

Mainly complex rituals (e.g. wraps, massages, scrubs, facials).

My spa experiences (special massage, treatments in own villas), as well as energizing treatments are usual, based on local products, specialities.

Luxury services, e.g. pearl powder

Australia/New Zealand

Europe

Mud and bath therapies based on local resources as well as underwater massages

Indigenous Aboriginal massage techniques

Local resource in treatments: Amber, thermal water, mud, Nordic plants

Holistic treatments: co-listening

Middle-East Local traditions incorporated: Camomile, mint

Business changes

Facilities reported close-to-zero increase in the main business indicators for 2012 over2011.Still,therelative growthoffirst time local customers was considered as really good news for 2012.

Number of first time customers? Locals Guests

Average revenue per customer?

Number of customers using spa/wellness treatments, programmes?

Number of customers (altogether)?

Average length of stay per visit?

Number of treatments sold per visit?

The positive changes are very clear from the market data since in every category industry reported robust growth.

The recovery of the market is indicated by the increased number of guests as well as the number of treatments sold per visit, which resulted in the growth of increased revenues per customer.

Especially good news was the high growth of first time guests!

Domestic Guests

Number of first time customers?

Average revenue per customer?

Number of customers using spa/wellness treatments, programmes?

Number of customers (altogether)?

Average length of stay per visit?

Number of treatments sold per visit?

Number of first time customers? International Guests

Average revenue per customer?

Number of customers using spa/wellness treatments, programmes?

Number of customers (altogether)?

Average length of stay per visit?

Altogether 43% of all spa & wellness customers are considered to be tourists, i.e. operators and investors need to take the needs and expectations of tourists into serious consideration. Spa and wellness facilities can count on tourists in 2013 in terms of length of stay and treatments sold. This is in contrast with what is forecasted for local customers!

In terms of visitor numbers Europe and Asia can count on spa and wellness tourists, which can provide a relief to Europan facilities, which are still affected by the recession in Europe.The product width is widest in Europe and The Americas, i.e. developers and managers from these markets can think of the most types of spa and wellness services, but with significant differences in regional focus points.

Family and eco-orientation are important on these markets, but natural (healing) resources will enjoy special attention in The Americas, but much less of in Europe (since it is already more established there)

ocals 2014 – 54 adat, kereszttáblához kevés, vannak új elemek a 2014esben !

Domestic travellers show similar patterns to local customers, which makes product development and facility management easier. Still, wellness hotels and destination spas are more; sport & fitness resorts are less popular among them.

Facilities Becoming Popular

Great to see that the market is moving on from the standard wellness hotels and spa hotels which were the leading facilities some 5 years ago.

As of 2013 destination spas are taking the lead and became the most attractive facilities for international tourists.

International tourists can also be attracted by spas based on natural (healing) resources. Eco-spas and wellness facilities have also gained significant role in the last couple of years.

Services Becoming Popular

There is a clear shift in the market to natural resources with proven impacts and evidence. This is particularly interesting, since in many parts of the world these resources have (not) yet been identified or tested for healing properties.

Local customers tend to look for services that can provide them with experiences and sensations that are important not only for short term but also has fit the total health concept. They want more than pampering but purchase body-mind-spirit, anti-ageing and longevity oriented services and programmes. This is great news for operators and investors. Spa and wellness facilities based on the total health approach can build firm loyal (and local!) customer base, since longevity and anti-ageing as concepts are meaningful for every age group and segment!

Domestic tourists show a somewhat different interest. Although therapies based on natural resources are clearly the most attractive ones, natural and organic products used in therapies and treatments are also play important role.

That is somewhat unexpected that domestic tourists do not find spirituality and fusion therapies and treatments too attractive. Interesting, however that occupational and corporate wellness programmesare moreand morecombinedwithtravellingawayfrom the workplace. International tourists seem to be primarily motivated bytreatmentsandtherapiesthat are somehowbasedonlocal assets, resources and traditions.

Healthy options/services during stay Thermal experiences

Outpatient medical services

Natural/organic product-based services

Fitness and sports Services based on local resources/traditions

Spiritual workshops (e.g. New Age/Esoteric)

Lifestyle-oriented workshops (e.g. nutrition)

Active and anti-ageing/longevity workshops

Body-Mind-Spirit/Holistic workshops(e.g. yoga)

Fusion treatments(e.g. aquaveda)

Occupational/corporate wellness

Complementary,alternative therapies(e.g. TCM)

Natural elements based therapies(e.g. thermal water)

Inernational toruists Domestic/intra-country guests Local customers/guests

Domestic Guests

Healthy options/services during stay

Complementary and alternative therapies

(e.g. Traditional Chinise Medicine)

Therapies based on natural resources with proven benefits (e.g. thermal…

Lifestyle-oriented programmes/workshops (e.g. stress…

Thermal experiences

Products/services based on local resources/traditions

Body-Mind-Spirit/Holistic programmes/workshops (e.g. yoga)

Fusion treatments (e.g. aquaveda)

Natural/organic product-based services

Active and anti-ageing/longevity programmes/workshops

Fitness & sports

Spiritual programmes/workshops (e.g. New Age/Esoteric)

Occupational/corporate wellness

Outpatient medical services

International Guests

Healthy options/services during stay

Therapies based on natural…

Products/services based on local…

Body-Mind-Spirit/Holistic…

Complementary and alternative…

Lifestyle-oriented…

Fusion treatments (e.g. aquaveda)

Outpatient medical services

Active and anti-ageing/longevity…

Thermal experiences

Natural/organic product-based…

Spiritual programmes/workshops…

Occupational/corporate wellness

Fitness & sports

segments

One industry rule-of-thumb for many year seems to become an old wisdom. Couples as most important target segments took over the leading position from single women.

Having a close look at the data we can see that the wellness and spa demand shifted to become a social consumption: couple, families, groups of friends give the majority of the demand. Several other segments, such as GenZ, Less able-bodied customers and mother & baby/child groups seem to be not at all important to operators. This is especially interesting since we know that 50% of the world’s population is under 30 years of age, i.e. GenZ should play much more important role that it actually does nowadays.

Couples

Single women

Groups of friends (more than 2 together)

Hotel guests looking for healthy services

Families with children

Baby boomers/seniors

Different segments country-bycountry

Single men

Gen Y

Mother & baby/child

Mother & daugther

Less able-bodied customers

Same sex couples

Gen Z

Segment 2, 2014 Segment 2, 2012

Segment 1, 2014 Segment 1, 2012

Sustainable practices

Sustainable practices are really taking a big turn in wellness and spa facilities. We could map wide range of approaches and tools from staff training to fair trade food resources and CSR programmes.

Preferring local food

Recycled materials (e.g. paper)

Revenue share (óvatosan kezelendő, csak 47 válasz, és a sum érték a %-ok végén 130%)

Can you please indicate the share of the TOP 3 revenue sources in your facility? Please select the revenue source first, then indicate the share of that source out of the total?

and body treatments (e.g. facials, massages)

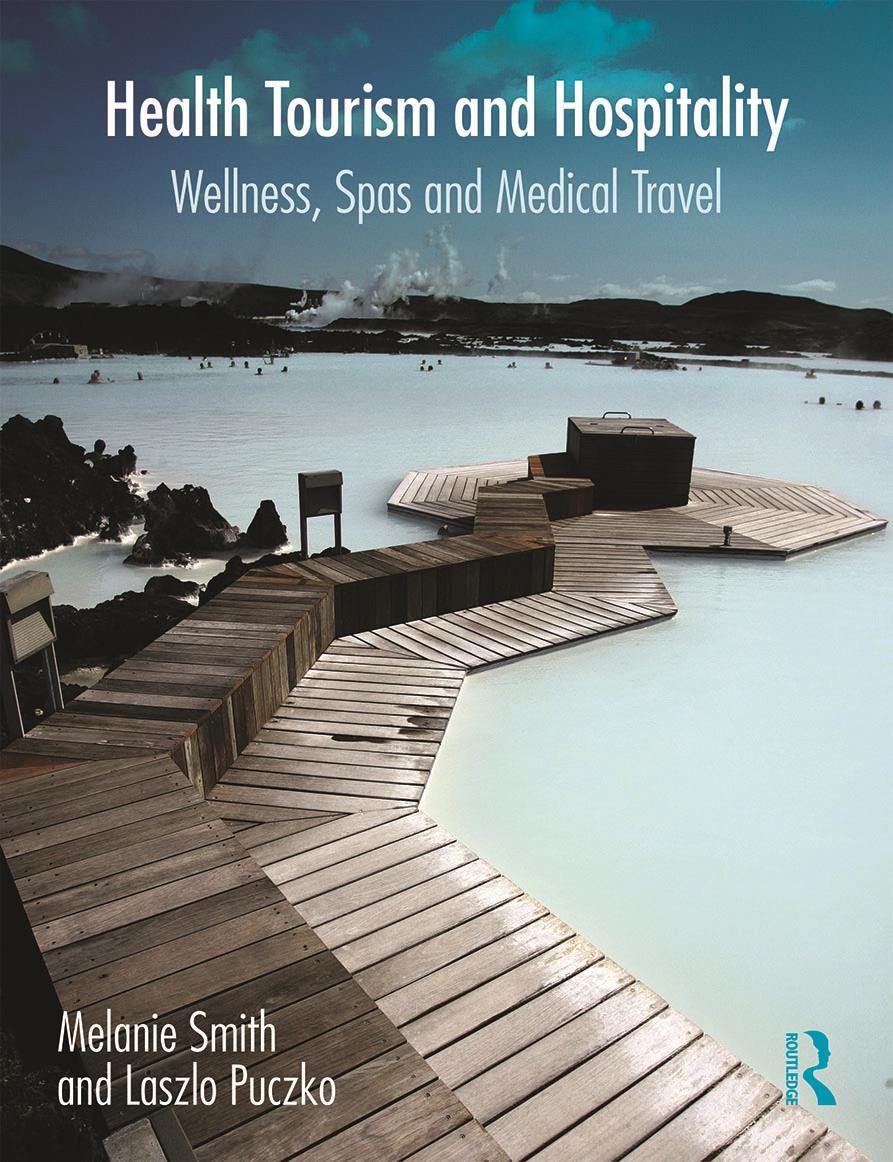

Should you wish to learn more about where and how the world of health tourism is going look for the second and revised edition of our book titled: Health, Tourism and Hospitality. Wellness, Spas and Medical Travel (published by Routledge, in Q4 2013).

Worldwide coverage, in-depth industry analysis, 40+countries, 50+ case studies