21 15 29 38 Managing Workforce In The Age Of Legalized Drugs And The Opioid Epidemic - Brett M. Gelbord, Dykema 8 Steps To Build An Effective Workplace Drug Policy - Brett Farmiloe, Terkel.io “Fixing” The Term Of Employment - Ashley Mulrooney, Stikeman Elliott LLP How To Navigate The Growing Patchwork Of Pay Equity And Transparency Laws - Andrew Turnbull and Sadé Tidwell, Morrison Foerster APRIL 2022 • Vol.10 • No.04 (ISSN 2564-2022) IN THE WEEDS - Abtin Mehdizadegan, Partner, Hall Booth Smith

On the Cover INDEX HR Legal & Compliance Excellence APRIL 2023 Vol. 10 No.04 (ISSN 2564-2022) In The Weeds Approaches to marijuana in the workplace in a post-pandemic labor market - Abtin Mehdizadegan, Partner, Hall Booth Smith 07 Articles 10 Confidentiality And Non-Disparagement Clauses: Implication Of NLRB's Guidance On Employers Exclusive interview with Andrew R. Turnbull, Partner, Morrison Foerster 18 Pregnant Workers Fairness Act: How It Will Impact Employers The dos and don’ts - Ann Kuzee, Vice President, U.S. Absence & Disability Management, TELUS Health 26 SB 1162: CA Pay Data Reporting For Workers What you need to know as the May 2023 reporting deadline fast approaches - Lynne Anne Anderson, Partner and Sylvia Bokyung St Clair, Associate, Faegre Drinker Straight Talk with HR.com 34 Reductions In Force In Europe: Top Questions From U.S. Multinationals The dos and don’ts of relieving European workers

Daniel

Waldman

Seyfarth Shaw LLP

-

E.

, Partner,

Managing Workforce In The Age Of Legalized Drugs And The Opioid Epidemic

Updating workplace policies in the post-war-on-drugs era

- Brett M. Gelbord, Senior Counsel, Labor & Employment Group, Dykema

8 Steps To Build An Effective Workplace Drug Policy

Learn how to create a workplace drug policy that aligns with state laws and protects your business

- Brett Farmiloe, Founder and CEO, Terkel.io

“Fixing” The Term Of Employment

Fixed-term agreement defends against wrongful dismissal claim

- Ashley Mulrooney, Associate, Employment & Labour Group, Stikeman Elliott LLP

TOP PICKS 15 21 29 38

How To Navigate The Growing Patchwork Of Pay Equity And Transparency Laws

Employers should assess their compliance strategies to mitigate the risk of pay discrimination claims and compliance violations

- Andrew Turnbull, Partner and Sadé Tidwell, Associate, Morrison Foerster

INDEX

How are our Legal & Compliance Products and Services helping to make you smarter?

Legal & Compliance Excellence - Monthly Interactive Learning Journal

This monthly interactive learning experience showcases solutions to deal with the latest legal and compliance issues facing corporations and legal departments.

Legal and Compliance Webcasts for Credit

HR.com offers various informative webcasts on a variety of topics including the latest HR compliance updates and legal considerations for employers and all HR professionals. Webcasts are available live online with a downloadable podcast and a copy of the slides (PDF) available before and after each webcast. Earn all of the required recertification credits for aPHR, PHR, SPHR, GPHR, and SHRM Certifications. HR.com’s one-hour webcasts, in every HR specialty including Legal and Compliance, are pre-approved for HRCI and SHRM credit (excluding Demo webcasts).

Legal and Compliance Community

Join almost more than 30,000 HR.com members with a similar interest and focus on compliance on legal regulations in HR. Share content and download research reports, blogs, and articles, network, and “follow” peers and have them “follow” you in a social network platform to communicate regularly and stay on top of the latest updates. This well established Legal and Compliance Community is an invaluable resource for any HR professional or manager.

SEP 2017 Vol. No. 09 Use these invaluable Legal & Compliance resources today! For more information phone: 1.877.472.6648 | email: sales@hr.com | www.hr.com

Editorial Purpose

Our mission is to promote personal and professional development based on constructive values, sound ethics, and timeless principles.

Excellence Publications

Debbie McGrath CEO, HR.com - Publisher

Sue Kelley Director (Product, Marketing, and Research)

Babitha Balakrishnan and Deepa Damodaran Excellence Publications Managers and Editors

Deepak S Senior - Design and Layout

HR Legal & Compliance Excellence Team

Deepa Damodaran, Editor

Nataraj Ramesh Design and Layout (Digital Magazine)

Vibha Kini, Chandra Shekar Magazine (Online Version)

Submissions & Correspondence

Please send any correspondence, articles, letters to the editor, and requests to reprint, republish, or excerpt articles to ePubEditors@hr.com

For customer service, or information on products and services, call 1-877-472-6648

HR Legal & Compliance

Excellence (ISSN 2564-2022)

is published monthly by HR.com Limited, 56 Malone Road, Jacksons Point, Ontario L0E 1L0

Internet Address: www.hr.com

Debbie Mcgrath Publisher, HR.com

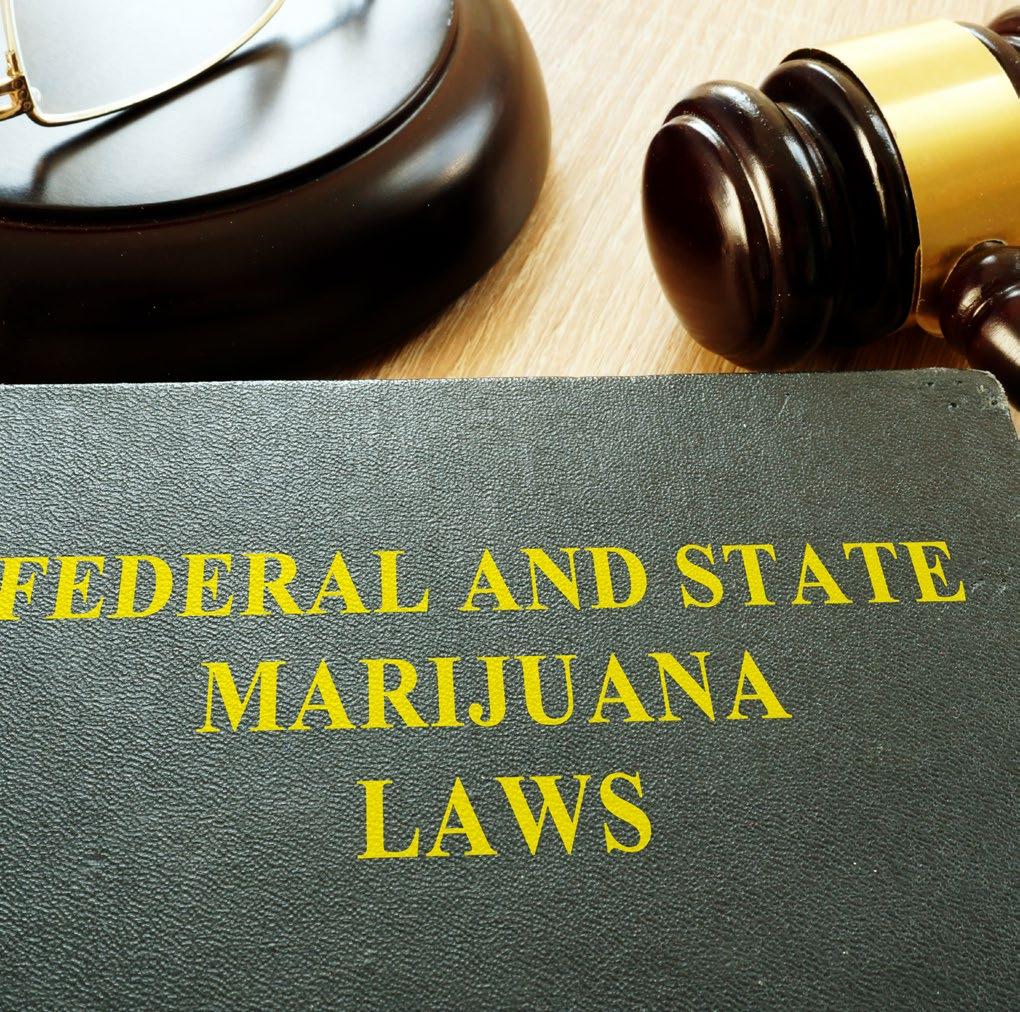

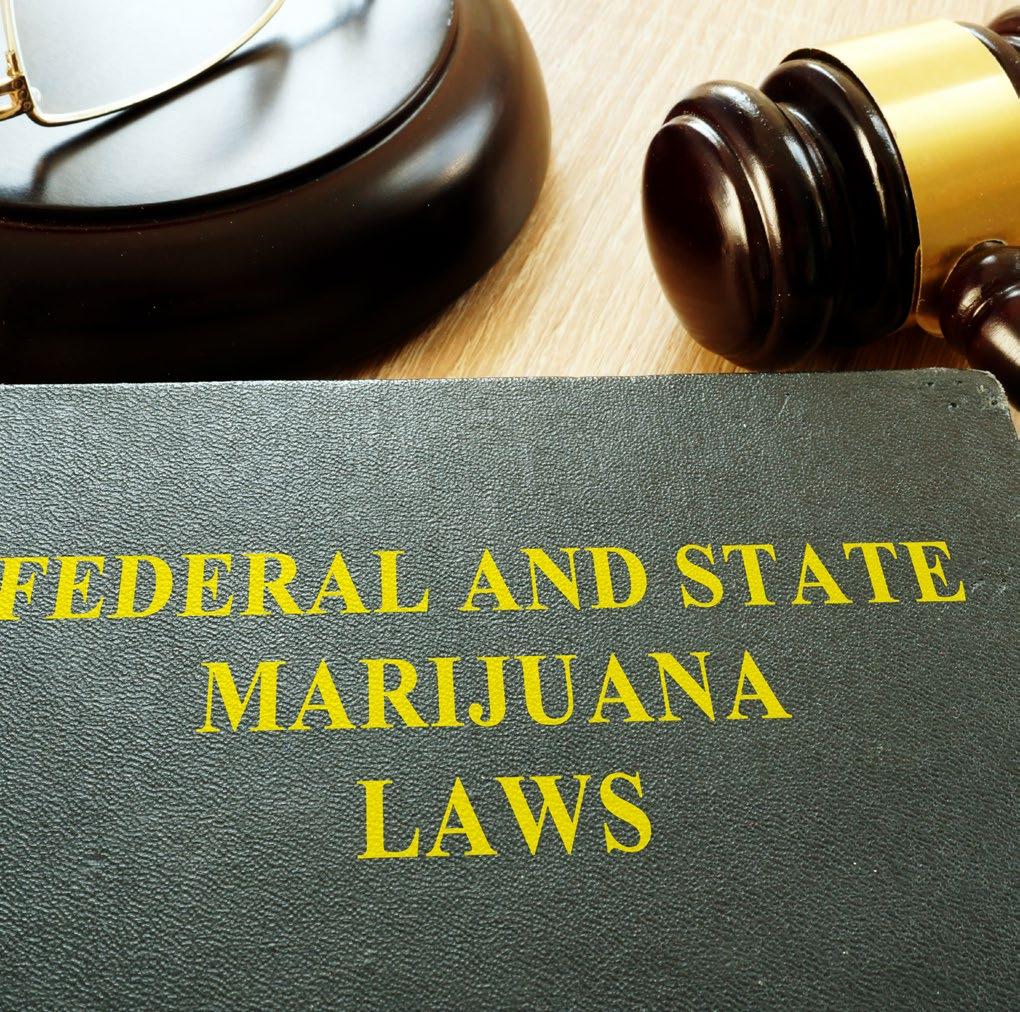

Thenational conversation surrounding drug policy has gained momentum as marijuana legalization and the decriminalization of certain psychedelics have become more widespread. As society moves towards a more open attitude towards mind-altering substances and addiction-related issues, it is essential for workplace policies to be updated and aligned with this shift.

In the absence of a national standard, employers must navigate the varied state laws pertaining to marijuana in the workplace. It is crucial to rely on basic principles and to seek legal advice before making any changes to policies or taking adverse employment actions related to marijuana.

To gain a deeper understanding of how employers should approach marijuana in the workplace, read In The Weeds by Abtin Mehdizadegan, Partner at Hall Booth Smith. Additionally, Brett M. Gelbord, Senior Counsel in the Labor & Employment Group at Dykema, explains, in Managing Workforce In The Age Of Legalized Drugs And The Opioid Epidemic, why updating workplace policies is crucial in the post-war-ondrugs era to avoid legal issues. Brett Farmiloe, Founder and CEO of Terkel. io, provides insights on creating an effective workplace drug policy that aligns with state laws and protects businesses in his article,

Deepa Damodaran Editor, HR Legal & Compliance Excellence

8 Steps To Build An Effective Workplace Drug Policy

This edition also features an exclusive interview with Andrew R. Turnbull, Partner at Morrison Foerster, who provides an in-depth analysis of The McLaren Macomb decision and NLRB’s General Counsel Memorandum GC 23-05, and its implications on employers.

Furthermore, Ashley Mulrooney, Associate in the Employment & Labour Group at Stikeman Elliott LLP, shares insights on “Fixing” The Term Of Employment, while Andrew Turnbull, Partner, and Sadé Tidwell, Associate at Morrison Foerster, provide guidance on navigating the growing patchwork of pay equity and transparency laws in their article, How To Navigate The Growing Patchwork Of Pay Equity And Transparency Laws

This is not all! This issue of HR Legal & Compliance Excellence also focuses on other legal aspects and highlights that should help you keep your workforce healthy, safe, and secure.

Happy Reading!

Write

ePubEditors@hr.com

Disclaimer: The views, information, or opinions expressed in the Excellence ePublications are solely those of the authors and do not necessarily represent those of HR.com and its employees. Under no circumstances shall HR.com or its partners or affiliates be responsible or liable for any indirect or incidental damages arising out of these opinions and content. EDITOR’S NOTE Updating Workplace Policies in the Post-War-On-Drugs Era: Navigating Marijuana and Psychedelics Subscribe now for $99 / year And get this magazine delivered to your inbox every month Become a Member Today to get it FREE! SIGN UP OR For Advertising Opportunities, email: sales@hr.com

©

HR.com. No

of

publication may be reproduced or transmitted in any form without written

publisher.

Copyright

2023

part

this

permission from the

Quotations must be credited.

to the Editor

at

In a world of unparalleled challenges (global pandemic, racial injustice, political rivalry, digital 4.0, emotional malaise), uncertainty reigns. Finding opportunity in this context requires harnessing uncertainty and harnessing starts with reliable, valid, timely, and useful information. The Excellence publications are a superb source of such information. The authors provide insights with impact that will guide thought and action.

Dave Ulrich

Rensis Likert Professor, Ross School of Business, University of Michigan Partner, The RBL Group

I have really enjoyed both reading and contributing to HR.com’s magazines over the past year. As a scholar-practitioner, it has been a wonderful outlet to share my current academic research with a broader practitioner audience, in a very timely manner. If you want to reskill and upskill your workforce, point them towards the wide array of offerings from HR.com.

Jonathan H. Westover, Ph.D., MPA, SFHEA, AFCIPD Chair/Professor | Organizational Leadership Academic Director | Center for Social Impact Faculty Fellow | Center for the Study of Ethics Utah Valley University

Jonathan H. Westover, Ph.D., MPA, SFHEA, AFCIPD Chair/Professor | Organizational Leadership Academic Director | Center for Social Impact Faculty Fellow | Center for the Study of Ethics Utah Valley University

During the COVID pandemic, I have learned that I need a source that provides high-quality, cutting-edge, and timely information on a wide-variety of topics. HR.com’s Excellence Publications has been that source for me.

Ryan Gottfredson, Ph.D.

Consultant/Trainer/Speaker/Coach Assistant Professor - California State U. Fullerton

Ryan Gottfredson, Ph.D.

Consultant/Trainer/Speaker/Coach Assistant Professor - California State U. Fullerton

ePubEditors@hr.com WHY EXCELLENCE PUBLICATIONS?

We’re eager to hear your feedback on our magazines. Let us know your thoughts at

In The Weeds

Approaches to marijuana in the workplace in a post-pandemic labor market

By Abtin Mehdizadegan, Hall Booth Smith

By Abtin Mehdizadegan, Hall Booth Smith

Anapplicant for a new position discloses that she holds a state-issued medical marijuana patient card during her interview. The applicant goes on to explain that she is a recovering opioid addict, who developed severe anxiety during the pandemic, and that medical marijuana helps with her condition.

In this discussion, the candidate — who is well-qualified for the position and who was the only applicant to arrive for an interview — asks your company for a reasonable accommodation from its substance abuse policy to allow her continued off-duty use of marijuana.

COVER

Submit Your Articles HR Legal & Compliance Excellence presented by HR.com APRIL 2023 7

ARTICLE

Human resources practitioners in the post-pandemic era encounter these situations daily; and although these issues are not novel, the surrounding context — a labor economy, where two positions exist for every unemployed worker, a marked increase in substance abuse, and the prevalence of recreational and medical marijuana across the country — has prompted employers to reconsider their substance abuse policies and compliance efforts under the Americans with Disabilities Act (ADA).

This article outlines employer best practices in workplace marijuana regulation and substance abuse detection.

The ADA and Substance Abuse: A Refresher

The ADA’s prohibition against disability discrimination is broad and decidedly reaches substance abuse disorders. As it relates to medical examinations and inquiries — an issue closely regulated under the ADA — the ADA undoubtedly allows employers to test employees for both alcohol and illegal drugs; however, the law does not treat all substance disorders alike.

While both recovering alcoholics and recovering drug users are protected under the ADA’s prohibition against discrimination because of a record of a disability, active alcoholics can be regarded as “disabled” under the ADA, while active users of illegal drugs cannot. Why? Because alcohol is not an illegal substance.

Following this logic, the ADA protects active alcoholics, who are not in recovery (so long as they are not drinking at work), entitling them to reasonable accommodations like unpaid leave to attend a rehabilitation program. However, the ADA does not require employers to reasonably accommodate current unlawful drug uses because the use of illegal drugs and unauthorized use of legal (prescription) drugs are both unlawful.

Now the question many employers are facing is, “Does the ADA consider marijuana an illegal substance?”

The Changing Legal Landscape of Marijuana

Many jurisdictions with some form of legalized marijuana prohibit discrimination against off-duty marijuana use. In New York, for example, where recreational and medical cannabis use are legal, employers are prohibited from testing current and prospective employees for the presence of marijuana absent a special circumstance. Other legal states, such as Nevada, prohibit job denial based on a positive cannabis test result.

Despite these state-level protections, marijuana is still classified as an illegal drug under the Controlled Substances Act. Additionally, the Drug Free Workplace Act still requires certain federal grant recipients and contractors to adopt “zero tolerance” drug and alcohol policies and the U.S. Department of Transportation’s (DOT) regulations require testing for all so-called “safety-sensitive” positions. The DOT’s regulations wholly reject use of medical marijuana, even if approved under state law, as an explanation for a positive drug test result.

Under the ADA, federal law is surprisingly clear: Employers need not reasonably accommodate employees using marijuana under the ADA, regardless of whether the employee has a medical marijuana patient card. Disclosure of this status, like in the opening hypothetical, can certainly place an employer on notice of an underlying condition; however, active marijuana users, including patients with medical marijuana cards, are “current” drug users under the ADA and beyond the sweep of its protections. Therefore, they are neither “qualified individuals with disabilities” nor entitled to any reasonable accommodation — at least not solely due to their status as a medical marijuana patient.

What constitutes “current” use of marijuana, however, is much less clear. In some cases, a drug screen can detect marijuana as long as 100 days after ingestion. Courts are not particularly convinced that urinalysis can truly prove whether an individual is “under the influence.” And following the passage of the 2018 Farm Bill, which legalized the production and sale of hemp-derived products, such as delta-8 THC,

In The Weeds

Submit Your Articles HR Legal & Compliance Excellence presented by HR.com APRIL 2023 8

the question of whether a substance qualifies as marijuana is also unclear.

Contemporary drug screening technology is not sophisticated enough to differentiate between legal delta-8 THC found in hemp and regulated delta-9 THC found in marijuana — both of which reportedly have similar psychoactive effects — and employers are frequently presented with claims of “false positive” test results accordingly.

How to Update Policies to Address the Changing Landscape

To keep up with the shifting sands of marijuana legalization and substance abuse prohibitions in the workplace, employers should first consider modifying drug testing policies to permit “the use of drugs that can be legally prescribed under both federal and state law” rather than permit the use of “legally prescribed” drugs; and, in consultation with counsel, consider addressing marijuana explicitly, stating that marijuana is a prohibited substance, even if prescribed under a state medical marijuana law, because it remains illegal under federal law.

Second, employers should conduct a comprehensive position classification analysis to identify all safety-sensitive functions. What constitutes a safety-sensitive job function outside of the federal context (e.g., DOT-regulated workers) will vary from state to state. In Arkansas, for instance, carrying a firearm, performing life-threatening procedures and working with foods are among those duties that constitute safety-sensitive functions.

Mere access to confidential information is sufficient for a position to be classified as safety-sensitive. But most states, Arkansas among them, require a written designation that the position is safety-sensitive. Accordingly, employers should revise job descriptions to avail themselves of potential defenses under state law.

Third, because drug tests typically cannot identify active marijuana impairment, employers should revise substance abuse policies to account for circumstances in which reasonable suspicion exists

to believe an employee is intoxicated at work. Indicia of impairment include changes in speech, agility, coordination, demeanor and odor, among others.

However, a policy alone is not enough. It is imperative that supervisors receive reasonable suspicion training, especially to avoid liability under a “regarded as” theory of ADA discrimination. Along with training, employers should develop reasonable suspicion observation forms that identify specific, objective and observable conduct.

Contemporaneous written observations, along with comprehensive reasonable suspicion training, should assist employers in supporting a good faith belief defense.

Finally, employers should continue monitoring state and federal regulation of marijuana and hemp-derived products. All but 13 states permit some form of recreational or medical marijuana sales, and the federal government has indicated an interest in removing marijuana from Schedule I of the Controlled Substances Act before the 2024 election cycle.

Until a national standard is adopted, employers must continue navigating the patchwork of state laws affecting marijuana in the workplace. Relying on fundamentals is key; and in all cases, employers should consult with counsel before modifying policies or taking an adverse employment action based on marijuana.

In The Weeds

Would you like to comment? Submit Your Articles HR Legal & Compliance Excellence presented by HR.com APRIL 2023 9

Abtin Mehdizadegan is a Partner in Hall Booth Smith’s Little Rock, Arkansas office and represents employers in traditional labor and employment law matters.

Confidentiality And Non-Disparagement Clauses: Implication Of NLRB's Guidance On Employers

“The McLaren Macomb decision and NLRB’s General Counsel Memorandum GC 23-05 will undoubtedly affect employer practices for using confidentiality and nondisparagement provisions with employees. However, the exact impact will depend on the employer’s preferences, risk tolerance, and employees at issue,” said Andrew R. Turnbull is a Partner at Morrison Foerster. Andrew represents companies on a broad range of labor and employment litigation and counseling matters.

“Some risk averse employers may wish to remove non-disparagement and confidentiality provisions from their employment agreements. Other employers, however, may wish to take a more surgical approach to these provisions in consultation with experienced counsel,” added Andrew in an exclusive interview with HR.com

Excerpts from the interview:

What should employers do on an immediate basis now that the National Labor Relations Board (NLRB) ruled that companies can no longer offer severance agreements that include non-disparagement and confidentiality clauses?

Andrew: The McLaren Macomb decision (“McLaren”) does not outlaw all confidentiality and non-disparagement provisions, instead finds that those provisions with employees covered by the National Labor Relations Act (“NLRA”) are unlawful if they are not “narrowly tailored.”

Unfortunately, the NLRB declined to provide clear guidance for when such provisions could meet that standard, and the NLRB’s General Counsel Memorandum GC 23-05 (the “Memorandum”) provides no examples of lawful provisions and expands the reach of McLaren beyond the facts of that case to other types of employment agreements and provisions.

Straight Talk with HR.com

Exclusive interview with Andrew R. Turnbull, is a Partner at Morrison Foerster.

Submit Your Articles HR Legal & Compliance Excellence presented by HR.com APRIL 2023 10

Q.

Employers should revisit their use of non-disparagement and confidentiality provisions in severance and other employment agreements in light of the McLaren decision and Memorandum.

Depending on the employer’s preferences, risk tolerance, and employees at issue, employers may want to consider removing those provisions or taking a more surgical approach to narrowing or limiting non-disparagement and confidentiality provisions in agreements with employees.

Q.What will the short-term and longterm implications of this ruling be? What is the scope of this memo?

Andrew: The long-term impact of the decision remains to be seen as the appeals process for the McLaren decision is not over. Pending such challenge, the McLaren decision will likely remain the law unless or until a new Republican-controlled NLRB overturns it.

In the short-term, employers should consider reviewing their non-disparagement and confidentiality provisions with employees since the NLRB appears to be taking an expansive interpretation of McLaren. Indeed, the following points from the Memorandum show that the NLRB is taking a broad view of McLaren.

● Employment agreements, such as offer letters, and “communications” that contain non-disparagement and confidentiality provisions are subject to McLaren. The General Counsel concludes that overbroad provisions in “any employer communication to employees” that tend to interfere with, restrain, or coerce their exercise of NLRA Section 7 rights would be unlawful “if not narrowly tailored to address a special circumstance justifying the impingement on workers’ rights.”

for refusing to violate the NLRA, including for refusing to proffer an unlawfully overbroad non-disparagement or confidentiality provisions that limit the supervisor’s participation in NLRB proceedings.

● McLaren applies retroactively. Although the General Counsel recognizes the NLRA’s six-month statute of limitations for filing an unfair labor practice charge, the General Counsel says that “maintaining and/or enforcing a previously-entered severance agreement” entered six-months before the McLaren decision would be a continuing NLRA violation, which may provide a basis for a timely unfair labor practice charge. The memorandum notes that, “while it may not cure a technical violation of an unlawful proffer,” employers should consider remedying a prior violation by contacting former employees who received severance agreements containing overly broad confidentiality and/or non-disparagement provisions to advise them that the provisions are null and void and that the employer will not seek to enforce them.

● McLaren applies to overbroad agreements with supervisors. Despite recognizing that the NLRA does not apply to supervisors and managers, the General Counsel says that the NLRA prohibits employers from retaliating against supervisors

● Reinforces McLaren’s “narrowly tailored” standard, without providing examples of enforceable provisions. The Memorandum does not provide any examples of potentially lawful non-disparagement and confidentiality provisions. Instead, the General Counsel reiterates the vague guidance from McLaren that non-disparagement provisions should have a temporal limit and only include defamatory statements, such as statements that are “malicious untrue” or made with knowledge of or reckless disregard for their truth or falsity. The Memorandum also notes that confidentiality provisions that only prohibit disclosure of financial terms or disclosure of proprietary or trade secret information and have a temporal limitation may be lawful, without providing any further details on what provisions might be lawful. The Memorandum notes that clauses that prohibit employees from communicating with the NLRB, a union, a legal forum, the media or other third parties are unlawful.

Straight Talk with HR.com

.

Submit Your Articles HR Legal & Compliance Excellence presented by HR.com APRIL 2023 11

● Overbroad provisions are unlawful even if the employee requests them. The General Counsel says that non-disparagement and confidentiality clauses would be unlawful, even where the employee requests them, because “the NLRB protects public rights that cannot be waived in a manner that prevents future exercise of those rights regardless of who initially raised the issue.”

Q.How will it affect employers?

Andrew: McLaren and the Memorandum will undoubtedly affect employer practices for using confidentiality and non-disparagement provisions with employees. But, the exact impact will depend on the employer’s preferences, risk tolerance, and employees at issue. Some risk averse employers may wish to remove non-disparagement and confidentiality provisions from their employment agreements. Other employers, however, may wish to take a more surgical approach to these provisions in consultation with experienced counsel.

In addition to the employer’s preferences and risk tolerance, the approach employers take may be, in part, dependent on the employees at issue.

● Supervisors: The NLRA does not apply to most supervisors and properly classified independent contractors. Under the NLRA, supervisors generally include any employees having the authority to hire, fire, discharge, direct, and exercise other responsibilities relating to employees. Because most managers, executives, directors, and independent contractors are excluded from NLRA coverage, non-disparagement and confidentiality provisions with those individuals should not be affected by this ruling. Despite recognizing that the NLRA does not apply to supervisors and managers, the General Counsel says that the NLRA prohibits employers from retaliating against supervisors for refusing to violate the NLRA, including for refusing to proffer an unlawfully overbroad non-disparagement or confidentiality provisions that limit the supervisor’s participation in NLRB proceedings. Accordingly, employers may want to include some carveout language in confidentiality and non-disparagement provisions with these individuals since it is possible that a broadly drafted provision might be interpreted to unlawfully prohibit them from aiding or assisting in the NLRB’s processes and interfere with the rights of NLRA-covered employees seeking their assistance in unfair labor practice proceedings or investigations.

Straight Talk with HR.com Submit Your Articles HR Legal & Compliance Excellence presented by HR.com APRIL 2023 12

● Unionized Employers Must Be Mindful of Their Bargaining Obligations: Although the NLRA can apply to non-union employers, employers with unionized workforces are at a higher risk of potential NLRB enforcement actions. Unionized workers and their unions generally are more inclined to pursue unfair labor practice charges with the NLRB than non-unionized workers. Indeed, the employer in McLaren failed to notify the union about the decision to terminate 11 newly unionized employees, thereby depriving the union of the opportunity to bargain about the layoff and its effects, such as higher severance packages. Employers with unionized workers should generally provide notice to the union, and satisfy their statutory decision and effects bargaining obligations, when presenting severance agreements to union-represented employees.

Employers also should be mindful of the trend of federal and state laws restricting employers using confidentiality and non-disparagement provisions. Over the past several years, a growing chorus of states (e.g., New York and California) have passed laws restricting the use of confidentiality and

non-disparagement provisions in employment agreements. Although these laws vary in their requirements, they generally prohibit those types of provisions if they could be interpreted to restrict employees from discussing various unlawful acts related to the workplace or other potential claims, such as discrimination, harassment, and retaliation. In December 2022, the federal Speak Out Act was signed into law prohibiting enforcement of pre-dispute non-disclosure and non-disparagement provisions in sexual harassment or sexual assault disputes.

Q.Do you think the NLRB ruling could go so far as to discourage some companies from offering severance packages altogether? Please elaborate.

Andrew: Most companies are not likely going to ditch their practices for offering severance to employees in exchange for a release of claims and other protections, but they probably will reconsider their use of confidentiality, non-disparagement, and other provisions in those severance agreements to mitigate the risk of the NLRB finding those provisions unlawful.

Straight Talk with HR.com Submit Your Articles HR Legal & Compliance Excellence presented by HR.com APRIL 2023 13

On a positive note, the Memorandum acknowledges that employers may continue to offer, maintain, and enforce severance agreements as long as they do not have overly broad provisions that “affect the rights of employees” under the NLRA. The General Counsel also notes that if a severance agreement contains provisions that are overbroad and violate the NLRA, NLRB Regions would generally seek to have those provisions voided, as opposed to voiding the entire agreement, even if the agreement has no severability provision.

That being said, the Memorandum shows that when the NLRB receives unfair labor practice charges alleging non-disparagement, confidentiality, and other provisions in employment agreements violate employee NLRA Section 7 rights, the NLRB will likely scrutinize those provisions closely. Indeed, the Memorandum, without any apparent rationale, says that the NLRB will review other provisions in employment agreements that could be unlawful under McLaren if they could interfere with employees’ exercise of their NLRA Section 7 rights, including non-competes, non-solicits, broad releases, and cooperation clauses.

What are the aspects of the ruling that need further clarification or change?

Andrew: Neither the NLRB in McLaren nor the NLRB General Counsel in the Memorandum provides examples of lawful confidentiality and non-disparagement provisions or if a savings clause could remedy those provisions from being found unlawful.

The Memorandum does not provide any examples of potentially lawful non-disparagement and confidentiality provisions. Instead, the General Counsel reiterates the vague guidance from McLaren that non-disparagement provisions should have a temporal limit and only include defamatory statements, such as statements that are “maliciously untrue” or made with knowledge of or reckless disregard for their truth or falsity. The Memorandum also notes that confidentiality provisions that only

prohibit disclosure of financial terms or disclosure of proprietary or trade secret information and have a temporal limitation may be lawful, without providing any further details on what provisions might be lawful. The Memorandum notes that clauses that prohibit employees from communicating with the NLRB, a union, a legal forum, the media or other third parties are unlawful.

The General Counsel suggests that to the extent a savings clause is included in the agreement, it “should focus on Section 7 activities that are of primary importance” for NLRA purposes. Yet, the General Counsel does not provide an example of a savings clause that the NLRB finds acceptable.

In light of the Memorandum, employers should consider how and when they use these provisions with their employees. Where employers decide to use these provisions, they should review the General Counsel’s guidance to see if there might be ways to limit those provisions in a manner that would still meet their business objectives. For example, employers might consider adding a temporal limitation, limiting the definition of disparagement, and only having confidentiality clauses that cover financial terms and confidential information.

In addition, although neither the NLRB in McLaren nor the General Counsel in her Memorandum addresses whether a carveout of NLRA rights would be sufficient to save an otherwise overbroad non-disparagement and confidentiality provision, both left the door open for that possibility. Unfortunately, the General Counsel provides no clear guidance on what carveout might save such provisions. Instead, she identifies nine specific NLRA rights she views as being of “primary importance.” Employers will need to consider the scope and expansiveness of any saving clause for non-disparagement and confidentiality clauses in employment agreements.

Q.

Straight Talk with HR.com Submit Your Articles HR Legal & Compliance Excellence presented by HR.com APRIL 2023 14

Would you like to comment?

Managing Workforce In The Age Of Legalized Drugs And The Opioid Epidemic

Updating workplace policies in the post-war-on-drugs era

By Brett M. Gelbord, Dykema

The widespread legalization of marijuana across dozens of states – and the growing number of states that have legalized or decriminalized certain psychedelics – has accelerated the national conversation about ending the war on drugs.

As the nation moves off of a “war” footing with respect to mind-altering substances and the challenges posed by addiction, it is becoming increasingly important to implement updated policies in the workplace that reflect and support that change.

This article will briefly address some model policies and the underlying theory that should be considered by employers interested in being early

adopters of a post-war-on-drugs employment policy paradigm.

Here is a scenario that may sound familiar. A previously productive and valued employee becomes addicted to drugs and then gets a divorce, has a car accident, and eventually gets caught high at work, resulting in termination. That has been a predominant view of how drugs impact the workplace for decades, and is a direct result of viewing the problems posed by substance abuse through the lens created by the war on drugs.

Contemporary scholars and practitioners, such as Professor Carl Hart, the Chair of Columbia University’s Department of Psychology, have learned, however, that that narrative

actually has things backward, or at least is incomplete. People typically do not develop a life-changing addiction due to serious problems that caused them to turn to drugs in the first place, and the loss of a job will only compound those problems.

That said, to be clear, this article is not advocating for workplace policies that allow employees to show up to work visibly intoxicated or to consume drugs while at work. Rather, the goal here is to educate employers about the options currently available to assist those employees, who may be struggling with addiction so that they can maintain their status as productive members of a safe workplace.

Top Pick

Submit Your Articles HR Legal & Compliance Excellence presented by HR.com APRIL 2023 15

Addiction science has evolved since the war on drugs began, and it has provided us with a powerful tool to overcome the scourge of addiction: it is called harm reduction. Harm reduction refers to a broad set of principles, policies, and practices geared towards minimizing the negative consequences associated with drug use and improving physical and mental health outcomes for individuals struggling with addiction.

However, in order to properly implement harm reduction strategies, both in and out of the workplace, employers must adopt new ways of thinking about how to solve the problem of addiction. Overly punitive measures in response to non-violent drug offenses are guaranteed to have only one effect: they make the problem worse, thereby further entrenching the addiction.

Community support and access to mental health while

facilitating safe spaces for drug consumption combined with more traditional social services to help people overcome their underlying stressors are the key to solving the addiction problem. At this point, you may be asking yourself what does any of this have to do with employment policies? The answer is simple. If an employer wants to improve recruitment, retention, and productivity while providing a supportive workplace, where employees do not have to fear losing their job because of addiction, some harm-reduction-focused policy changes can be made.

First, zero-tolerance policies should be re-examined. As noted, while this article is not advocating for a workplace policy that allows employees to show up to work visibly intoxicated, should that happen, immediate termination is not the best response. Rather, a visibly intoxicated employee should be sent home. They can

use unscheduled PTO or it can be unpaid, depending on the circumstances and jurisdiction.

A visibly intoxicated employee should raise a red flag and prompt a member of human resources to inquire as to what led to the incident. HR departments should have information regarding local harm reduction resources available, and provide that information to the employee. The federal government provides a helpful starting point in that regard, for instance via the National Harm Reduction Technical Assistance Center, at https://harmreductionhelp.cdc.gov/s/

Engaging in the interactive process familiar with the disability accommodation paradigm is a useful next step in this scenario as well.

Second, making paid, reduced pay, or unpaid leaves available to employees dealing with addiction gives those employees an important advantage: stability. That advantage increases the likelihood that the employee will be able to safely return to work and continue to be a productive employee.

Referrals to employee assistance programs are useful. And in the parts of the country hardest hit by the opioid epidemic, it may make sense to have a trained, harm reduction specialist on staff. This does not have to be a dedicated employee. With proper training, a manager or a member of HR can fulfill this role.

Managing Workforce In The Age Of Legalized Drugs And The Opioid Epidemic Submit Your Articles HR Legal & Compliance Excellence presented by HR.com APRIL 2023 16

Third, drug testing should be phased out in favor of an observational, interactive assessment program. This guidance should be implemented regardless of whether an employer wants to take the more comprehensive harm reduction steps set forth above, as several jurisdictions have passed laws making it illegal to base employment decisions on drug testing results alone.

Those changes are in direct response to the widespread and ongoing legalization of marijuana. Of course, marijuana remains federally illegal, and any employers subject to specific drug-related federal regulations or federal contracts should continue to comply with those regulatory and/or contractual obligations.

Overall, an easily applied first step for employers in this regard is to update their employee handbooks to explicitly state that policies will be applied, where appropriate, through a harm reduction lens. Such a modification should make it clear that any conversations with HR or managers regarding addiction-related problems will be handled confidentially.

Additionally, the handbook modification can include a statement that, whenever possible, disclosures about drug use will not result in termination unless and until all other reasonable avenues have been explored. This simple policy change can go a long way in providing employers with the

flexibility needed to address addiction in the workforce while providing a greater sense of confidence and security to those employees who need it the most.

The foregoing only scratches the surface of the issues here. However, given the new developments in our understanding of how addiction works, and of the widespread economic damage caused by unmitigated addiction, it makes sense for employers to implement new policies with a better chance of having a net positive effect on the problem of addiction.

This makes both ethical and economic sense. Fewer people losing their jobs and spiraling into addiction, and more people climbing out of the depths of addiction without fear of not being able to secure or keep employment translates to more gainfully employed workers with more money to spend – a major driver of our economy. It also translates to a deeper pool of potential employees.

In short, even setting aside the social aspects of this issue, changing drug-related policies is ultimately a smart decision from a dollars-and-cents point of view. Please remember to consult an experienced employment attorney before making changes to any workplace policies.

Additional information regarding harm reduction and modern addiction science can be found here:

● U.S. Department of Health & Human Services: https:// www.samhsa.gov/find-help/ harm-reduction

● Dr. Carl Hart on The Psychology Podcast: https://owltail.app.link/ ehSgDIw0byb

● University of New South Wales National Drug & Alcohol Research Center: https://ndarc. med.unsw.edu.au/blog/ why-addiction-isnt-diseaseinstead-result-deep-learning

Brett M. Gelbord is Senior Counsel, Labor & Employment Group, at Dykema. Brett is an accomplished business attorney, who focuses on providing practical and efficient guidance to employers on all manner of workforce-related issues. Brett provides both day-to-day employment counseling and also represents employers in administrative proceedings and lawsuits at both the state and federal level on issues ranging from claims of employment discrimination and wrongful termination to the enforcement of non-competition agreements and the protection of trade secrets.

Would you like to comment?

Managing Workforce In The Age Of Legalized Drugs And The Opioid Epidemic Submit Your Articles HR Legal & Compliance Excellence presented by HR.com APRIL 2023 17

Pregnant Workers Fairness Act: How It Will Impact Employers

The dos and don’ts

By Ann Kuzee, Stikeman Elliott LLP

ThePregnant Workers Fairness Act (PWFA) goes into effect on June 27, 2023. Below is a summary of the new law along with three other related and important topics.

Pregnant Workers Fairness Act

Employers with 15 or more employees will have to provide pregnant workers with reasonable accommodations when affected by their pregnancy, childbirth, or related medical conditions.

Employer Requirements:

1. Make a reasonable accommodation for a known limitation related to pregnancy, childbirth, or related medical conditions of the qualified employee, unless it would impose an undue hardship;

2. They cannot require a qualified employee to accept an accommodation unless

it is arrived at through the interactive process;

3. They cannot deny employment opportunities to a qualified employee if such denial is based on the need to make reasonable accommodations;

4. They must not require a

qualified employee to take leave, if another reasonable accommodation can be provided to address the known limitations;

5. They must not take adverse action in terms, conditions, or privileges of employment.

Submit Your Articles HR Legal & Compliance Excellence presented by HR.com APRIL 2023 18

Known Limitation means a physical or mental condition related to, affected by, or arising out of pregnancy, childbirth, or related medical conditions that the employee has communicated to the employer.

Qualified Employee means an employee or applicant who, with or without a reasonable accommodation, can perform the essential functions of the employment position, except that an employee or applicant shall be considered qualified for this leave if:

(A) any inability to perform an essential function is for a temporary period;

(B) the essential function could be performed in the near future; and

(C) the inability to perform the essential function can be reasonably accommodated; and

The terms “reasonable accommodation,” “undue hardship,” and “interactive process” will have the meanings given such terms in the ADA.

Differences from Other Federal Laws and ADA Relationship

To appreciate this new law, let us look at the federal Pregnancy Discrimination Act (PDA) and the Americans with Disabilities Act (ADA).

The PDA prohibits discrimination because of pregnancy, childbirth,

or related medical conditions and requires accommodations for pregnant employees only to the extent that an employer provides those accommodations to other non-pregnant employees with similar abilities and inabilities to work.

The ADA requires employers to provide pregnant employees with reasonable accommodations only if the employee has a covered pregnancy-related disability. The PWFA does not have these limitations and expands coverage to include many other situations in which pregnancy, childbirth, or related medical conditions must be accommodated.

Relationship between PWFA and ADA:

● The PWFA requires employers to provide a pregnant employee or job applicant who has a temporary physical or mental limitation due to pregnancy, childbirth, or related medical conditions to be temporarily excused from performing the essential functions of their job if:

(a) any inability to perform an essential function is for a temporary period,

(b) the essential function could be performed in the near future; and

(c) the inability to perform the essential function

can be reasonably accommodated.

● The ADA does not generally require an employer to accommodate an employee by removing an essential function of an employee’s job.

● The PWFA covers medical conditions that are shorter in duration (e.g., temporary), while the ADA, generally does not cover a short-term illness or other temporary impairment unless it is severe enough.

● The PWFA covers pregnancy, childbirth, or related medical conditions when a known limitation exists that is defined as a physical or mental condition related to, affected by, or arising out of pregnancy, childbirth, or related medical condition whether or not such condition meets the definition of disability specified in the ADA.

● The PWFA adopts the ADA definitions of reasonable accommodation, undue hardship, and interactive process.

Mental Health of a Qualified Employee

A key benefit from this law is that it will allow pregnant individuals critical and necessary time off and/or temporary relief from essential functions of their job that will in turn help protect a pregnant individual’s physical and mental health.

Pregnant

Fairness Act: How It Will Impact Employers

Workers

Submit Your Articles HR Legal & Compliance Excellence presented by HR.com APRIL 2023 19

While this law expands a pregnant individual’s rights to accommodations for their physical wellbeing, it also expands a pregnant individual’s rights to accommodations for their mental health. According to the article, Does a Mother’s Mental Health Affect Pregnancy?

20% of pregnant people experience anxiety or depression during their pregnancy.”

Issues with mental health can also continue after childbirth. The CDC’s research shows that about 1 in 8 women with a recent live birth experience symptoms of postpartum depression. This law will likely allow qualified individuals to be better accommodated.

PWFA and Your Integrated Disability Absence Management Plan (IDAM)

With the addition of this new law, covered employers should incorporate it into their IDAM programs. An IDAM program involves the administration of all programs in a centralized and integrated structure. It is a well thought out process that is employer specific, and once designed and implemented, creates an efficient, effective, and coordinated business structure that addresses a variety of business needs, such as risk management, employee health and wellbeing, policy coordination, safety initiatives, financials, return-to-work/ stay-at-work programs, and absence, disability and claims’ management.

Building an IDAM program will help to ensure that all of your absence and disability related policies and programs are well coordinated and create an overall positive experience for your employees. Skills based training, such as the Certified Professional in Disability Management (CPDM) designation can help teams design cohesive IDAM plans. If you would like to read more about the top 3 reasons for integrating your disability absence management plan, check out my previous article on the topic.

Additional Resources:

1. Congress.gov, U.S. Congress. “H.R.2617—Consolidated Appropriations Act, 2023: Text,” Division II—Pregnant Workers. https//www.congress.gov/117/ hr2617/BILLS-117hr2617enr.pdf

(See pages 1626-1653).

2. U.S. Equal Employment Opportunity Commission.

“Enforcement Guidance on Pregnancy Discrimination and Related Issues”

3. U.S. Equal Employment Opportunity Commission.

“Disability Discrimination and Employment Decisions.”

4. Office of the Law Revision Counsel, U.S. Code, U.S. House of Representatives. “U.S. Code: Title 42, Chapter 126, Subchapter 1, §12111. Definitions.”

5. U.S. Equal Employment Opportunity Commission. “Fact Sheet for Small Businesses: Pregnancy Discrimination.”

6. U.S. Equal Employment Opportunity Commission.

“Enforcement Guidance on

Reasonable Accommodation and Undue Hardship under the ADA.”

7. U.S. Department of Labor. “What to Expect When You’re Expecting (and After the Birth of Your Child)…at Work.” https:// www.dol.gov/agencies/oasam/ civil-rights-center/internal/ policies/pregnancy-discrimination

8. Job Accommodation Network. “Interactive Process.” https:// askjan.org/topics/interactive. cfm

9. Grow by WebMD. “Does a Mother’s Mental Health Affect Pregnancy? https://www.webmd. com/baby/does-a-mothers-mental-health-affect-pregnancy

10. Centers for Disease Control and Prevention. “Reproductive Health.” https://www.cdc.gov/ reproductivehealth/depression/ index.htm

Ann Kuzee serves as TELUS Health’s (formerly LifeWorks) Vice President Legal for its U.S. Absence & Disability Management division and is a contributing faculty advisor for the Insurance Education Association, IEA’s, absence management curriculum. Among other responsibilities, she interprets regulations and other laws related to federal, state, and municipal leaves. Ann is a member of the Michigan Bar Association.

Would you like to comment?

Submit Your Articles HR Legal & Compliance Excellence presented by HR.com APRIL 2023 20

Pregnant Workers Fairness Act: How It Will Impact Employers

8 Steps To Build An Effective Workplace Drug Policy

Learn how to create a workplace drug policy that aligns with state laws and protects your business

By Brett Farmiloe, Terkel.io

Thelegalization of marijuana in a growing number of states has left employers concerned about the impact it will have on their businesses.

From setting up an employee assistance program to being clear in communication, here are eight answers to the question, “What are your most recommended tips that employers should take when creating a workplace drug policy?"

● Have a Clear Language

● Ask About Screening Panel Options

● Check Your State's Law

● Align Expectations and Hold People Accountable

● Clearly Outlined "Second Chance" Policies

● Provide Info on Disciplinary Actions

● Define Key Terms

● Add an Employee Assistance Program

Submit Your Articles HR Legal & Compliance Excellence presented by HR.com APRIL 2023 21 Top Pick

Have a Clear Language

As a trial lawyer, I would advise employers to include clear language in their workplace drug policy that specifically addresses the use of marijuana. This language should outline the employer's stance on marijuana use, including whether it will be tolerated in the workplace and what consequences may result from its use.

Employers should also consider implementing a drug-testing program to deter employees from using marijuana or other drugs in the workplace. This program should clearly define when drug testing will be conducted, what methods will be used, and what consequences will result from a positive test.

Besides these steps, employers should provide training and education to employees about the risks associated with marijuana use, particularly in safety-sensitive positions. By taking these steps, employers can create a safe and productive work environment while still complying with the laws and regulations regarding the use of marijuana.

Ask About Screening Panel Options

Although the 5-panel expanded DOT panel is the standard many companies follow for testing, if your company is non-DOT and your drug testing is corporate-mandated versus federally regulated, your organization can decide which substances to test for.

Many drug screening tests contain THC, yet there are also many without. With legalization, it is likely to become even more common for labs and testing centers to offer more panels without the substance. However, even if they do not offer it upfront, you can ask your provider, because they may order a special panel for you, even if they do not advertise it as an option.

The most logical step is to omit marijuana from the test entirely rather than simply ignore a positive THC result, as the latter option could open the company to potential legal troubles.

Check Your State's Law

Carefully review the laws in your state to see if testing employees for medical or recreational cannabis is prohibited. While most states allow employers to issue drug tests, some states that legalized cannabis use have restrictions on drug testing employees and job applicants in order to protect people from discrimination based on legal drug use.

Employers also need to look into their state's privacy laws to confirm if cannabis has been reclassified as a "lawful product." If it has been reclassified, then employers can not punish or discriminate against employees for the off-duty use of lawful products.

For how your company handles cannabis use in the workplace, make sure the drug policy you craft is precise and spells everything out. Define your company's expectations and discipline policy regarding marijuana use at work, as well as the drug testing you require and any exceptions under the policy.

Grace He, People and Culture Director, TeamBuilding

James DeZao, Attorney and Business Owner, The Law Offices of James DeZao

James DeZao, Attorney and Business Owner, The Law Offices of James DeZao

8 Steps To Build An Effective Workplace Drug Policy

Mike Schmidt, Civil Trial Law, Personal Injury Trial Law, and Civil Trial Specialist, Schmidt & Clark

Submit Your Articles HR Legal & Compliance Excellence presented by HR.com APRIL 2023 22

Align Expectations and Hold People Accountable

Employers should take time to create a comprehensive policy that clearly outlines expectations for employees regarding drugs and alcohol while on the job. This includes outlining specific definitions of "impairment”—for example, whether alcohol or marijuana is allowed before or during work hours — as well as standards for disciplinary action if an employee violates this policy.

It is important that all parties involved are familiar with these expectations so they can be held accountable accordingly.

Clearly Outline "Second Chance" Policies

Though you hope your policy works to prohibit drug use during working hours, you must clearly outline what happens with non-compliance. For example, employees caught using drugs might result in immediate dismissal, while other policies may offer rehabilitation programs and the chance to return to work once sober.

If you choose to offer employees treatment, you must outline which financial responsibilities fall on your business or the employee, along with clear timelines and required milestones during treatment.

Travis Lindemoen, Managing Director, nexus IT group

Your responsibility is to craft a policy that ensures a returning employee is no longer a danger to customers, other employees, or themselves—otherwise, your negligent behavior becomes a legal issue.

Maximilian Wühr, CGO and Co-Founder, FINN

8 Steps To Build An Effective Workplace Drug Policy

Submit Your Articles HR Legal & Compliance Excellence presented by HR.com APRIL 2023 23

Provide Info on Disciplinary Actions

Your drug policy should clearly outline the disciplinary actions that will be taken against employees who violate the policy. The degree of impairment, severity of the offense, and the kind of substance used are all factors to consider when coming up with disciplinary actions.

Ensure that there are no gray areas left uncovered so that employees have a crystal clear understanding of the consequences and implications that come with abusing your drug policy.

Define Key Terms

Defining key terms related to drug use is crucial to a workplace drug policy. This includes providing clear definitions of what makes up drug use and possession and which drugs are prohibited.

Consider also providing definitions of key terms related to drug testing, such as "reasonable suspicion," "probable cause," and "positive test result. " This ensures all employees understand the criteria for drug testing and the potential consequences of a positive test result.

Dakota McDaniels, Chief Product Officer, Pluto

Add an Employee Assistance Program

Incorporate an employee assistance program (EAP) into your drug policy. Doing so serves multiple purposes. First, it lets employees know they are a valuable part of your business, making it in your best interest to offer them help. Second, it ensures that recovering employees can become productive members of your team.

Finally, although EAP programs are often overlooked by many businesses, they can identify problems in the early stages, decrease employee turnover, support employees, and show that their employer is caring.

The definitions in a workplace drug policy need to be clear and specific to avoid confusion and ensure that employees know the rules and expectations. This can help to create a safer and more productive workplace and reduce the risk of accidents or incidents related to drug use.

Peter Hoopis, Owner and CEO, Peter Hoopis

Brett Farmiloe is the Founder and CEO – and currently CHRO - of Terkel.io Brett is an SHRM Influencer and has also been a keynote speaker at several state SHRM conferences around the topic of employee engagement."

Would you like to comment?

Liza Kirsh, Chief Marketing Officer, Dymapak

8 Steps To Build An Effective Workplace Drug Policy Submit Your Articles HR Legal & Compliance Excellence presented by HR.com APRIL 2023 24

Sponsor any of this year’s state of the industry research topics and come away with your very own affordable and branded research report and infographic, establish yourself as an industry thought leader by presenting at a one-day Virtual Event, and bolster sales through the generation of qualified leads. See

The Future of Coaching and Mentoring

Apr 5-6, 2023

Learn more at: hr.com/ CoachingResearch

The Future of Payroll: New Trends and Global EORs Virtual Event

Apr 20, 2023

Learn more at: hr.com/newwaystopay

The Future of HR’s Role in Organizational Success

May 18, 2023

Learn more at: hr.com/organizationalsuccess

your brand with this year’s State of the

topics and

your expertise

Align

Industry hot HR

showcase

list of hot industry research topics below and give us a call to get started. A State of the Industry Research & Virtual Event Sponsorship Opportunity Contact us today to get started at sales@hr.com | 1.877.472.6648 | hr.com/industryresearch

SB 1162: CA Pay Data Reporting For Workers

What you need to know as the May 2023 reporting deadline fast approaches

By Lynne Anne Anderson and Sylvia Bokyung St. Clair, Faegre Drinker

The California Civil Rights Department (CRD) released amended FAQs providing guidance on compliance with the new pay data reporting requirements: PDR FAQs – 2022 Reporting Year | CRD (ca.gov). CRD also intends to issue regulations expected later this year.

As previously reported here and here, Senate Bill 1162 amended Labor Code section 432.3 and Government Code section 12999 as part of California’s ongoing efforts to promote pay transparency as a means to combat pay discrimination. Companies need to act now to be prepared to comply with the obligation to report data not only for their W-2 employees, but also the new obligation to compile and report data for workers supplied by staffing agencies and other third parties that are either working at or assigned to their California locations.

What Is the New Reporting Deadline?

May 10, 2023. The FAQs have a link to the online portal and templates to create reports. Additional resources will continue to come online for employers.

How Does Senate Bill 1162 Amend the Prior Pay Data Reporting Requirements?

● A private employer with 100 or more employees nationally, and one or more in California, must file a “Payroll Employee Report.” This new report must be filed in addition to the EEO-1 report.

● A private employer using 100 or more full-time (FT) or part-time (PT) workers supplied through labor contractors nationally and with one or more workers in/assigned to a California location must also file a “Labor Contractor Employee Report” (LCER).

● The Payroll Employee Report (and the LCER) must include the mean and median hourly rate of employees (or contract workers) grouped within the same establishment, job category, race, ethnicity and sex combination.

● CRD may obtain penalties and costs against employers that fail to file their reports and against labor contractors that fail to provide data to their client employers.

What Is a Labor Contractor?

An individual or entity that supplies, either with or without a contract, workers to perform labor within the client employer’s usual course of business.

Who Is a Labor Contractor Employee (LCE)?

An FT or a PT worker on a labor contractor’s payroll for whom the contractor is required to withhold federal social security taxes from wages and is assigned to perform work within the client employer’s “usual course of business.” For example, a cafeteria worker assigned to work at a tech company’s HQ would presumably be considered outside the “usual course of business.”

Submit Your Articles HR Legal & Compliance Excellence presented by HR.com APRIL 2023 26

What Time Period Is Used for the Data Collection?

A 2023 LCER will contain 2022 pay data from a “Snapshot Period,” which is a single pay period between October 1 and December 31 chosen by the employer. The FAQs encourage employers to use one Snapshot Period across all labor contractors.

What Data Is Reported in the LCER?

Labor contractors need to supply mean and median hourly rates by establishment, job category, race/ ethnicity and sex for the LCEs working at and/or assigned to the client’s California locations. The FAQs do not specify a deadline for providing this information to the client.

The employer must disclose the ownership names of all labor contractors used to supply LCEs. An employer only submits one LCER even if the employer uses multiple contractors and any of those contractors provide LCEs to multiple locations.

How Are Teleworkers Reported?

If an LCE is working at and/or assigned to an establishment in California, then the LCE should be included in the LCER. This includes an LCE working in California but reporting to a client establishment in a U.S. territory or foreign country. LCEs living in California but working at/reporting to an establishment outside of California would not be reported.

These same guidelines apply to the client employer’s remote W-2 employees for reporting on the Payroll Employee Report.

How Are the Mean and Median Hourly Rates Calculated?

The same method is used for W-2 employees as for LCEs. First, the hourly rate needs to be derived from an LCE’s total annual earnings for the entire Reporting Year, as shown on IRS Form W-2 Box 5. The FAQs then discuss how to calculate hourly rates for exempt and non-exempt employees and how to include paid time off in the calculation.

SB 1162: CA Pay Data Reporting For Workers

Submit Your Articles HR Legal & Compliance Excellence presented by HR.com APRIL 2023 27

SB 1162: CA Pay Data Reporting For Workers

For the mean hourly rate, LCEs should be grouped within the same establishment, job category, race/ ethnicity, and sex combination. The mean hourly rate is calculated by adding the individual hourly rates for each employee in the group, then dividing that sum by the number of employees in the group.

For the median hourly rate, LCEs are grouped in the same manner. Then, the median hourly rate is generally calculated by adding the individual hourly rates for each employee in the group, then ordering the rates by smallest to largest and using the middle number.

Can the Client Employer Ask the Labor Contractor to Certify the LCER?

No, an official of the client employer must certify the LCER. The client employer can have the professional employer organization, human resources outsourcing or labor contractor assist in the completion of the LCER but cannot delegate responsibility for certifying the accuracy of the report. However, a certifying official may authorize another person to electronically file the certification on their behalf.

What if the Labor Contractor Is Unable to Provide All of the Information Needed for the LCER?

Employee self-identification is the preferred method of identifying sex, race and national origin. Absent self-identification, employers are expected to use reliable employment records (e.g., an employee’s self-identified pronouns for sex or observer perception for race/ethnicity). For the 2022 Reporting Year only (filed in May 2023), the CRD is permitting client employers to submit LCERs that list gender/ race/national origin as unknown. However, the CRD cautions that employers and labor contractors should not expect this option in the future.

Does the CRD Enforce SB 1162’s Separate Pay-Scale Disclosure Requirements?

No. The Labor Commission’s Office of the Department of Industrial Relations has the responsibility for enforcing the obligation to disclose pay ranges in job postings or upon request to existing employees. That provision of SB 1162 was effective as of January 1, 2023.

Next Steps for Employers

Employers should now determine whether they must submit a separate LCER in addition to the Employee Payroll Report in May. If yes, they should immediately request the data needed for the LCER from their contractors. The responsibility to provide and maintain accurate data should be incorporated into contractor agreements.

Employers should continue to prioritize privileged pay equity audits to review and analyze the data before reporting to agencies that use it for potential enforcement action. Also, in 2023 the CRD will begin publishing aggregate results – starting with the data collected in 2020. CRD expects employers to review these results and assess their own pay data and practices for purposes of compliance. Privileged pay audits are the best means to accomplish that review and proactively where remedial action and training may be warranted. The need for such audits is even more pressing given the salary disclosure obligations also required by SB 1162. Managers and HR professionals are being asked by current employees for explanations about why they are not placed higher in those ranges. Privileged pay equity audits can ensure that those questions are answered accurately to limit confusion and potential claims.

Would you like to comment?

Lynne Anne Anderson is a partner at Faegre Drinker

Submit Your Articles HR Legal & Compliance Excellence presented by HR.com APRIL 2023 28

Sylvia Bokyung St. Clair is an Associate at Faegre Drinker.

“Fixing” The Term Of Employment

Fixed-term agreement defends against wrongful dismissal claim

By Ashley Mulrooney, Stikeman Elliott LLP

In the recent Steele v. The Corporation of the City of Barrie, 2022 ONSC 7245 decision (“Steele”), the Ontario Superior Court of Justice provided some insight into when longer-term, fixed-term, contracts can be enforceable.

Background – Fixed-Term Employment Contracts

The distinction between a fixed-term and indefinite-term employment contract is critical because, typically, an employer is not liable for any notice or pay in lieu of notice upon the expiry of a fixed-term contract that has a term of less than twelve (12) months. Where a fixed-term

contract is longer than twelve (12) months, the employee will have statutory notice or pay in lieu entitlements upon expiry of the term, but the common law notice entitlements would be considered satisfied by the notice of the end date of the contract given upon commencement of employment.

Top Pick

Submit Your Articles HR Legal & Compliance Excellence presented by HR.com APRIL 2023 29

The Steele decision finds that an employee subject to an unambiguous fixed-term agreement with successive unambiguous renewals was not, by virtue of such renewals, an indefinite term employee, and thus entitled to notice of termination or pay in lieu thereof at the end of the term (as the employee argued he should have been).

This finding is noteworthy as it represents a departure from existing case law, where the courts have found that the use of successive fixed-term contract renewals may result in the creation of an indefinite term relationship. The court in the Steele decision relied on the fact that the contract in question and the subsequent renewal letters were unambiguous in providing for a fixed term, despite

the use of renewals, as further discussed below.

Key Facts

The Plaintiff, Greg Steele (“Mr. Steele”), a former employee of the Defendant, the City of Barrie (the “City”) commenced employment with the City on June 4, 2014. Mr. Steele’s initial terms and conditions of employment were governed by an employment agreement (the “Agreement”), which contained language that addressed the term of Mr. Steele’s employment as follows:

The expected duration of your temporary employment is expected to be from June 5, 2014, to June 3, 2016, (approximately 2 years).

Thereafter, Mr. Steele was provided with four (4) consecutive extension notices, which

expressly set out that (i) Mr. Steele’s position with the City was “temporary”, and (ii) outlined the relevant end date for each applicable extension notice (collectively, the “Extension Notices”). The final extension notice was set to end on December 31, 2017.

The City elected not to extend the Agreement and Mr. Steele’s employment ended on December 31, 2017. Mr. Steele commenced a wrongful dismissal claim against the City, arguing that he was, in fact, indefinitely employed and therefore entitled to pay in lieu of notice of termination, as well as punitive damages.

Decision

The Court found that there was no ambiguity under the Agreement or the Extension Notices that Mr. Steele’s employment with the City was for a fixed-term. While the Court noted that the Agreement only included an “approximately” two-year term, it was precise in setting out the exact dates for the employment’s initial duration. Moreover, while the Court noted that the Extension Notices were poorly drafted, they were nevertheless clear and unambiguous relating (i) to the nature of the arrangement as “temporary”, and (ii) that the Extension Notices set out the period of time for each successive extension. Accordingly, there was no breach of contract or wrongful dismissal and the Plaintiff was not entitled to recover any damages.

“Fixing” The Term Of Employment Submit Your Articles HR Legal & Compliance Excellence presented by HR.com APRIL 2023 30

Further, even if there was ambiguity in the Agreement or Extension Notices, the court found that the following factors would have resolved such ambiguity:

1. The job posting under which Mr. Steele was offered a position clearly described the position as temporary;

2. That same job posting provided that the position was for “2 years approximately”;

3. The Extension Notices were granted before the end of the respective term, which served as proof that absent those Extension Notices, the employment term would have expired;

4. The Extension Notices were pre-destined neither by the employment contract nor the words or conduct of the City;

5. Both the Agreement and the Extension Notices confirmed that Mr. Steele’s employment was “temporary”; and

6. The Extension Notices all provided a date “up to” which the employment would run. Thus, if there was any ambiguity in the Agreement, the Court found that it should be resolved by the relevant Extension Notice.

Finally, the court rejected the argument that the continuous service over many years, together with successive extensions, established an indefinite-term relationship irrespective of the fixed-term contract. More specifically, there was no ambiguity in Agreement or the

Extension Notice and no conduct or conversations involving Mr. Steele and the City, which could have objectively signaled any other arrangement but a fixed term of employment.

We note that the court distinguished prior case law on fixed-term agreements by relying upon the: (i) ambiguity in the contract, which included automatic or annual renewals; and (ii) the parties’ conduct and intentions, which assisted in establishing that the employees were hired on an indefinite-term.

Take Away for Employers

The Steele decision is helpful for employers as it confirms that a clearly and unambiguously drafted fixed-term agreement with successive renewals, coupled with consistent conduct of the employer signaling the temporary nature of the relationship, will not render the fixed-term nature of the relationship indefinite. This case also continues to demonstrate the risks and pitfalls associated with placing a prospective employee on a fixed-term agreement. Employers should continue to ensure that when electing to hire a prospective employee under a fixed-term, the employment agreement is clear and unambiguous regarding the temporary nature of the position and that the employer’s conduct supports the express fixed-term nature of the arrangement.

This article was first published on Stikeman Elliott LLP’s Knowledge

Hub and originally appeared at www. stikeman.com. All rights reserved.

Disclaimer: This publication is intended to convey general information about legal issues and developments as of the indicated date. It does not constitute legal advice and must not be treated or relied on as such. Please read our full disclaimer at www.stikeman.com/legal-notice

Ashley Mulrooney is an Associate in the Employment & Labour Group at Stikeman Elliott LLP. Ashley provides pragmatic advice to employers in all areas of employment and labor law, including employment standards, human rights, occupational health and safety, workplace policies, and employee terminations. Ashley has experience representing clients in proceedings before the Ontario Superior Court of Justice, administrative tribunals, grievance arbitrations, and collective bargaining.

Would you like to comment?

“Fixing” The Term Of Employment Submit Your Articles HR Legal & Compliance Excellence presented by HR.com APRIL 2023 31

HRCI® & SHRM® CERTIFICATION PREP COURSES

GROUP RATES AVAILABLE

For HR Professionals

Show that management values the importance of the HR function, and has a commitment to development and improvement of HR staff.

Ensure that each person in your HR department has a standard and consistent understanding of policies, procedures, and regulations.

Place your HR team in a certification program as a rewarding team building achievement.

For Your Organization

Certified HR professionals help companies avoid risk by understanding compliance, laws, and regulations to properly manage your workforce.

HR Professionals lead employee engagement and development programs saving the company money through lower turnover and greater productivity and engagement.

A skilled HR professional can track important KPIs for the organization to make a major impact on strategic decisions and objectives, including: succession planning, staffing, and forecasting.

HR.com/prepcourse CALL TODAY TO FIND OUT MORE 1.877.472.6648 ext. 3 | sales@hr.com

1 Less expensive than a masters or PhD program, and very manageable to prepare with

2. legislation and best practices

3. Recognized, Industry benchmark, held by 500,000+ HR Professionals

Group Rate Options

We offer group rates for teams of 5+ or more for our regularly scheduled PHR/SPHR/ SHRM or aPHR courses.

For groups of 12+, we can design a more customized experience that meets your overall length of the course.

Groups rates for HRCI exams are also available as an add-on.

All group purchases come with 1 year of HR Prime membership for each attendee to gain the tools and updates needed to stay informed and compliant

CALL TODAY TO FIND OUT MORE 1.877.472.6648 ext. 3 | sales@hr.com | HR.com/prepcourse

1 2 3

Reductions In Force In Europe: Top Questions From U.S. Multinationals

The dos and don’ts of relieving European workers

By Daniel E. Waldman, Seyfarth Shaw LLP

Layoffs in the technology sector continue to dominate headlines. Reports cite numbers already in the six figures as of early March 2023.