SEPTEMBER 2023 • Vol.10 • No.09 (ISSN 2564-1980) 24 10 30 35 Revolutionizing Health Benefits: A Strategic Approach To Open Enrollment 2024 - Amy Spartz, Gravie Is Your Organization Prepared For The Looming Child Care Cliff? - Lynn Perkins, UrbanSitter Preventing, Detecting, And Addressing FMLA Leave Abuse - Calvin Gower, Stiira Navigating The Maze: How Employer-Based Education Benefits Address Student Debt Concerns - Jeremy Walsh, AllCampus BALANCING HEALTH CARE COSTS AND EMPLOYEE BENEFITS: 5 BEST PRACTICES - Brett Farmiloe, CEO and CHRO, Featured BALANCING HEALTH CARE COSTS AND EMPLOYEE BENEFITS: 5 BEST PRACTICES - Brett Farmiloe, CEO and CHRO, Featured

Articles Balancing Health Care Costs And Employee Benefits: 5 Best Practices Insights from industry leaders – Brett Farmiloe, CEO and CHRO, Featured 07 On the Cover INDEX Employee Benefits & Wellness Excellence SEPTEMBER 2023 Vol.10 No.09 33 Addressing The Interplay Of Neurological Conditions And Mental Health It’s time for employers to look below the surface of mental health – Elizabeth Burstein, CEO and Co-Founder, Neura Health 38 Revolutionizing Gig Worker Benefits With Lifestyle Accounts Why companies should start providing benefits to their independent contractors – Bob Gaydos, Founder and CEO, Pendella (ISSN 2564-1980) 13 Reducing Employee Stress Through Digital Wellness – The HR Research Institute, powered by HR.com 27 Maintenance is a Good Investment –Especially With Chronic Diseases Like Diabetes – George Huntley, CEO of the Diabetes Leadership Council Sponsored Articles

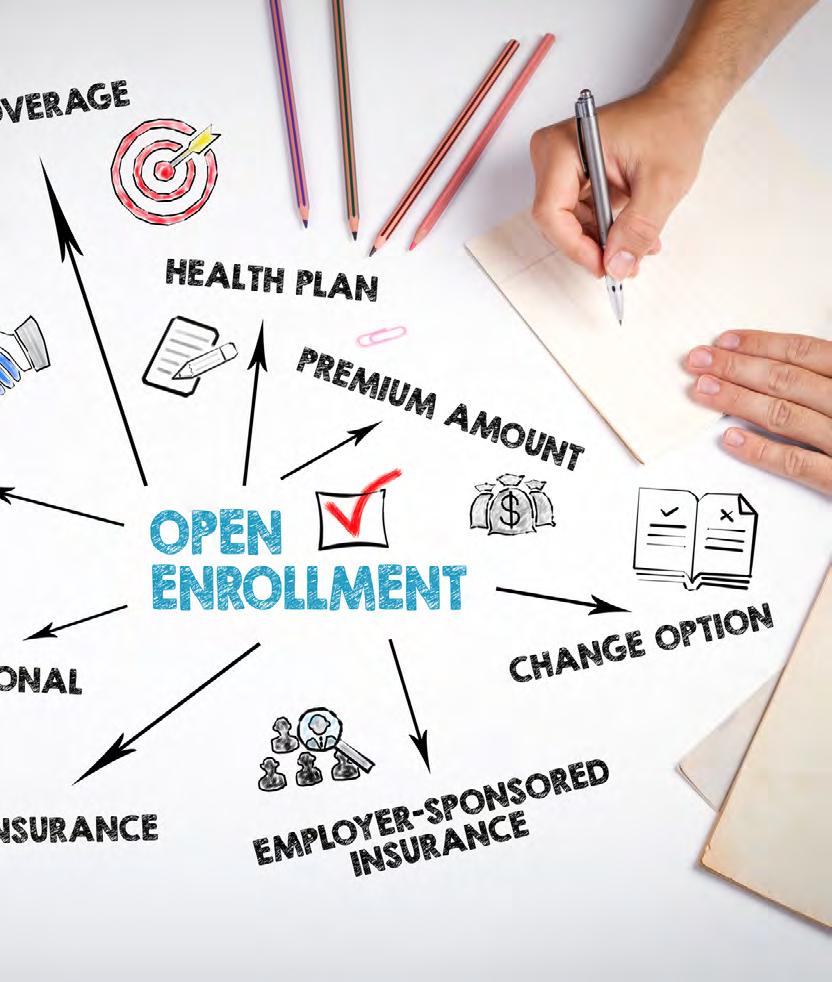

Revolutionizing Health Benefits: A Strategic Approach To Open Enrollment 2024

Prioritizing modern and valuable health benefits

- Amy Spartz, Chief People Officer, Gravie

Top Picks 10 24 30

Is Your Organization Prepared For The Looming Child Care Cliff?

Strategies to keep parents in the workforce amidst child care challenges

- Lynn Perkins, CEO and Co-Founder, UrbanSitter

- Lynn Perkins, CEO and Co-Founder, UrbanSitter

Preventing, Detecting, And Addressing FMLA Leave Abuse

Strategies for employers to maintain transparency

- Calvin Gower, President & Founder, Stiira

- Calvin Gower, President & Founder, Stiira

35

Navigating The Maze: How Employer-Based Education Benefits Address Student Debt Concerns

The essential ABCs for building customized programs in changing times

- Jeremy Walsh, Executive Vice President, AllCampus

INDEX

How are our Employee Benefits & Wellness Products and Services helping

Benefits & Wellness Excellence - Monthly Interactive Learning Journal

This monthly interactive learning experience captures key metrics and actionable items and keeps you focused on your Benefits and Wellness planning goals and solutions.

Benefits and Wellness Virtual Events

Employee Benefits and Wellness Virtual Events ensure attendees stay compliant and up-to-date with the latest changes to employee benefits and wellness regulations. Each event varies on topics such as healthcare legislation and compliance related to employee benefits and workplace wellness programs including COBRA, FMLA, Medical Benefits, the Affordable Care Act (ACA), Outsourcing Benefits, Retirement Benefits, Voluntary Benefits and Work-Life Programs. Wellness topics encompass injury prevention, battling obesity, disease prevention, how technology is affecting wellness. Each Virtual Event consists of up to 10 credit webcasts.

Benefits and Wellness Webcasts for Credit

HR.com webcasts deliver the latest Benefits and Wellness industry news, research trends, best practices and case studies directly to your desktop. Webcasts are available live online with a downloadable podcast and a copy of the slides (PDF) available before and after each webcast. Earn all of the required recertification credits for aPHR, PHR, SPHR, GPHR, and SHRM Certifications. HR.com’s onehour webcasts, in every HR specialty including Benefits and Wellness, are pre-approved for HRCI and SHRM credit (excluding Demo webcasts).

Benefits and Wellness Community

Join more than 100,000 HR.com members with a similar interest and focus on Benefits or Wellness. Share content and download research reports, blogs, and articles, network, and “follow” peers and have them “follow” you in a social network platform to communicate regularly and stay on top of the latest updates. This well established Benefits and Wellness Communities are an invaluable resource for any HR professional or manager.

to make you smarter?

For more information phone: 1.877.472.6648 | email: sales@hr.com | www.hr.com

Use these invaluable Employee Benefits & Wellness resources today!

Editorial Purpose

Our mission is to promote personal and professional development based on constructive values, sound ethics, and timeless principles.

Excellence Publications

Debbie McGrath CEO, HR.com - Publisher

Sue Kelley Director (Product, Marketing, and Research)

Employee Benefits & Wellness Excellence

Babitha Balakrishnan Editor

Koushik Bharadhwaj Jr. Editor

Arun Kumar R Design and Layout (Digital Magazine)

Vibha Kini Magazine (Online Version)

Submissions & Correspondence

Please send any correspondence, articles, letters to the editor, and requests to reprint, republish, or excerpt articles to ePubEditors@hr.com

For customer service, or information on products and services, call 1-877-472-6648

email: sales@hr.com

Employee Benefits & Wellness Excellence (ISSN 2564-1980)

Babitha Balakrishnan Editor, Employee Benefits & Wellness Excellence

Striking the Balance: Employee Benefits, Healthcare Costs, and Organizational Success

Inour rapidly evolving landscape of employee benefits and healthcare expenditures, the quest for a finely tuned balance between fiscal prudence and employee satisfaction has taken center stage. As organizations vie to offer all-encompassing benefits packages to both attract and retain top talent, the significance of harmonizing cost management with employee well-being cannot be overstated. This multifaceted challenge calls for innovative strategies and insights sourced from industry leaders, providing a guiding light through the intricate terrain of healthcare costs and employee perks.

In this context, the September edition of Employee Benefits & Wellness Excellence is a valuable resource, offering insightful articles that shed light on key aspects of this ongoing mission.

In his article, Balancing Health Care Costs and Employee Benefits, Brett Farmiloe (CEO and CHRO, Featured), gathers valuable insights from industry leaders to assist organizations in navigating the intricate realm of healthcare costs and employee benefits. The article underscores the critical importance of finding a nuanced equilibrium between managing healthcare expenses and providing enticing benefit packages to employees.

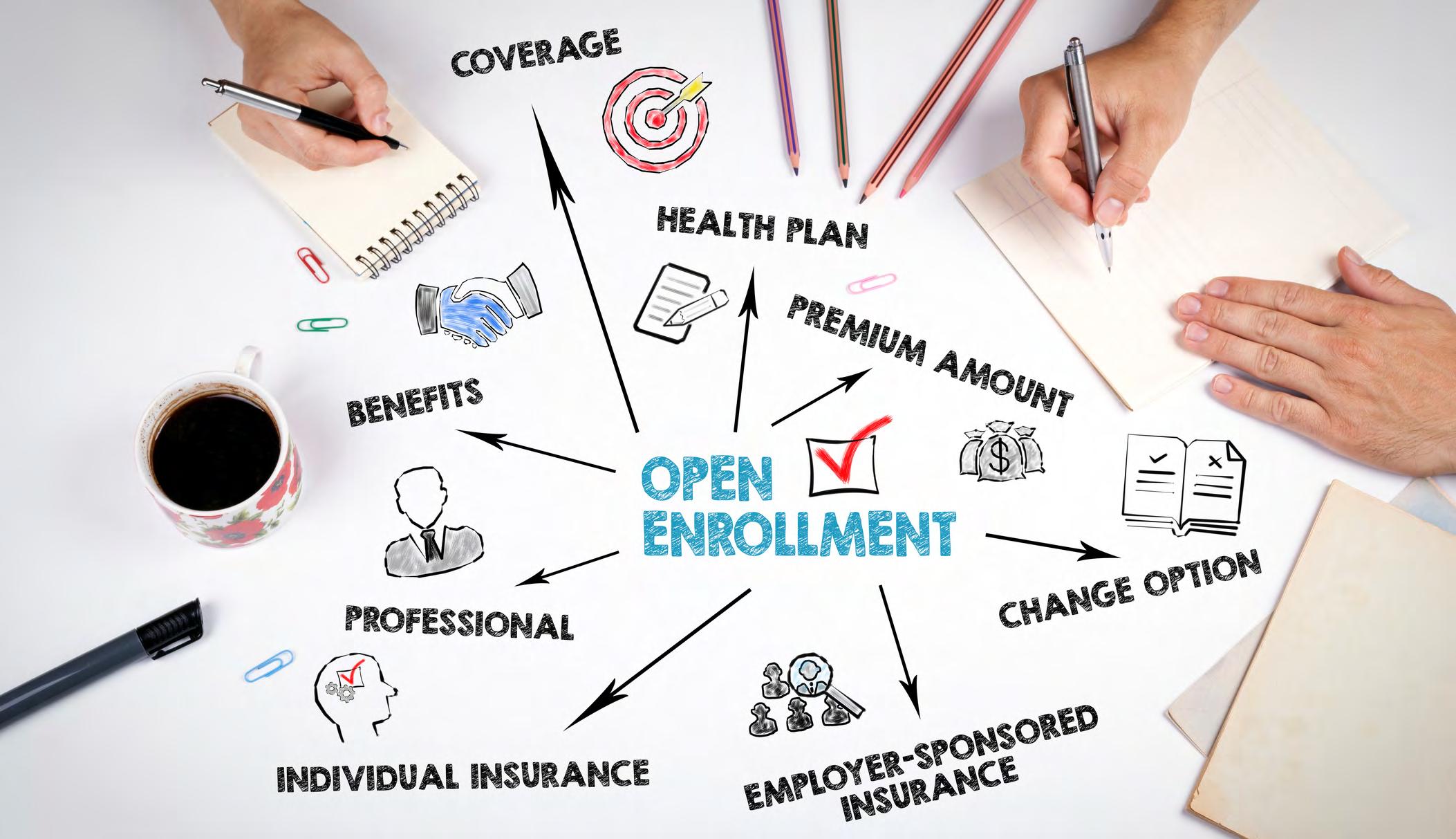

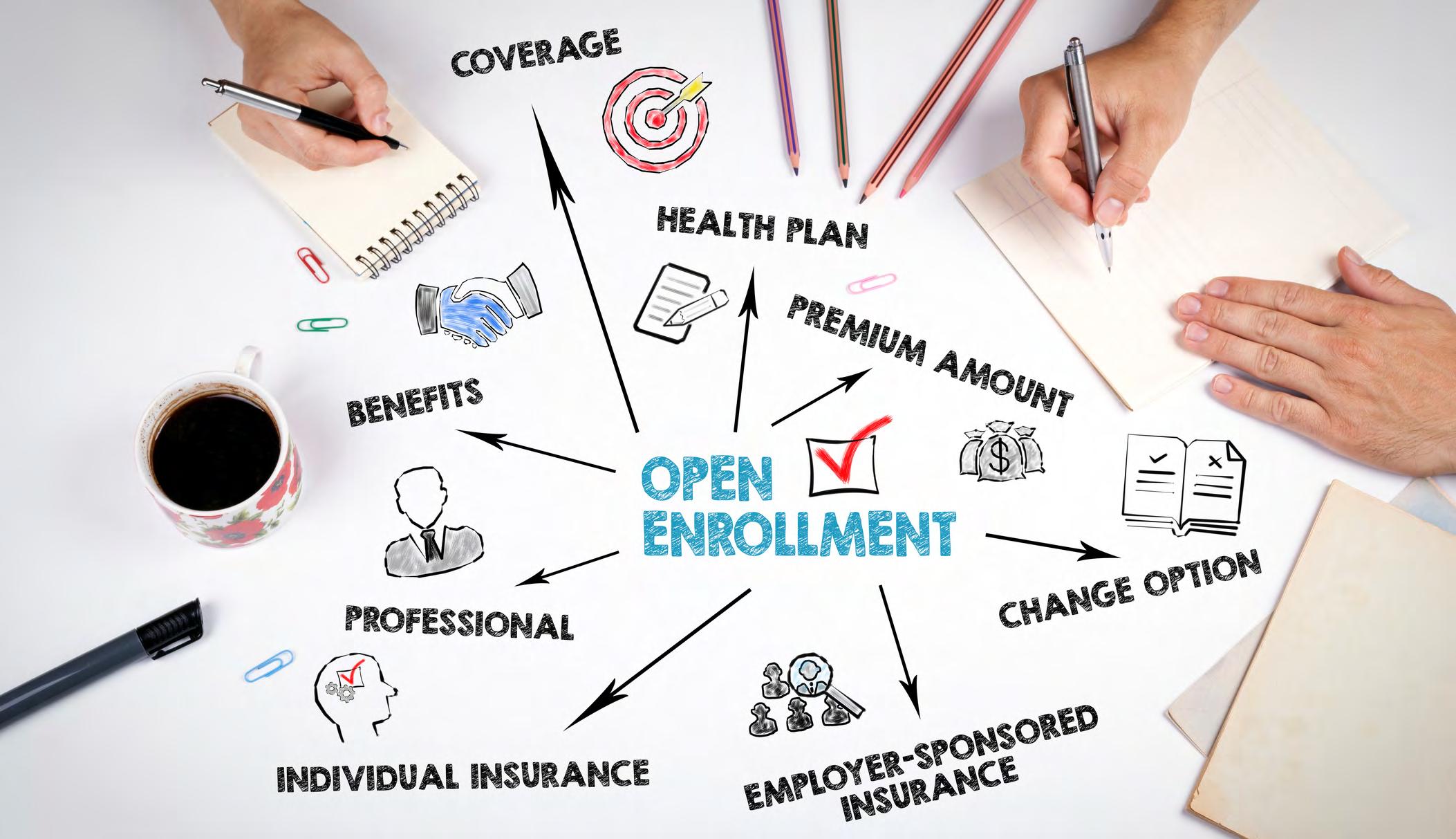

Gravie's Chief People Officer, Amy Spartz, offers a compelling perspective in her article, Revolutionizing Health Benefits: A Strategic Approach To Open Enrollment 2024. She advocates for a strategic reevaluation of open enrollment processes, emphasizing the need for organizations to prioritize contemporary and valuable health benefits, including telemedicine, mental health support, and wellness incentives. By aligning their benefit offerings with the ever-evolving needs of employees, Spartz contends that organizations can simultaneously boost employee satisfaction and master the art of cost-effective management.

Lynn Perkins (CEO, and Co-Founder, UrbanSitter) discusses the urgent issue of childcare challenges in her article titled Is Your Organization Prepared For The Looming Child Care Cliff? She offers a range of strategic

solutions designed to empower organizations to keep parents engaged in the workforce.

Leave abuse can cost organizations millions each year. Calvin Gower (President and Founder, Stiira) sheds light on the importance of preventing employee leave abuse in his article, Preventing, Detecting, And Addressing FMLA Leave Abuse. Gower suggests implementing clear policies, effective leave tracking systems, and proactive communication to prevent and address potential abuse while ensuring that legitimate employee needs are met.

Jeremy Walsh (Executive Vice President, AllCampus) addresses the escalating issue of student debt in his article, Navigating The Maze: How Employer-Based Education Benefits Address Student Debt Concerns. He champions the idea of employer-based education benefits as a powerful solution to assist employees in handling and diminishing their student debt

To wrap up, effectively managing healthcare costs alongside delivering valuable employee benefits demands a comprehensive and strategic perspective. The wisdom shared by industry leaders highlights the significance of harmonizing benefits with employee requirements, tackling childcare obstacles, proactively addressing leave abuse, and extending education benefits. By embracing these best practices, organizations can establish a mutually beneficial environment in which both cost management and employee welfare take center stage, resulting in a contented and highperforming workforce.

We hope you find the articles in this edition useful. Please share your thoughts on these topics, and let us know how we can continue to provide content that empowers you and your organization.

Happy Reading!

Write

Disclaimer: The views, information, or opinions expressed in the Excellence ePublications are solely those of the authors and do not necessarily represent those of HR.com and its employees. Under no circumstances shall HR.com or its partners or affiliates be responsible or liable for any indirect or incidental damages arising out of these opinions and content.

EDITOR’S NOTE

For Advertising Opportunities,

Copyright © 2023 HR.com. No part of this publication may be reproduced or transmitted in any form without written permission from the publisher. Quotations must be credited.

Babitha Balakrishnan and Deepa Damodaran Excellence Publications Managers and Editors

Team

is published monthly by HR.com Limited, 56 Malone Road, Jacksons Point, Ontario L0E 1L0 Internet Address: www.hr.com to the Editor at ePubEditors@hr.com

Debbie Mcgrath Publisher, HR.com

In a world of unparalleled challenges (global pandemic, racial injustice, political rivalry, digital 4.0, emotional malaise), uncertainty reigns. Finding opportunity in this context requires harnessing uncertainty and harnessing starts with reliable, valid, timely, and useful information. The Excellence publications are a superb source of such information. The authors provide insights with impact that will guide thought and action.

Excellence publications are my ‘go-to’ resource for contemporary and actionable information to improve leadership, engagement, results, and retention. Each edition offers rich and diverse perspectives for improving the employee experience and the workplace in general.

Winkle

Winkle

I regularly read and contribute to Leadership Excellence and Talent Management Excellence. I use many of the articles I read to augment my own presentations and I often share the articles with my clients. They are always quick, right on target for the latest issues in my field, and appreciated by my clients. If you want to stay up to date on the latest HR trends, choose a few of the different issues from the Excellence series of publications.

We’re eager to hear your feedback on our magazines. Let us know your thoughts at ePubEditors@hr.com

Dave Ulrich

Rensis Likert Professor, Ross School of Business, University of Michigan Partner, The RBL Group

Dave Ulrich

Rensis Likert Professor, Ross School of Business, University of Michigan Partner, The RBL Group

WHY EXCELLENCE PUBLICATIONS?

Julie

Giulioni Author, Virtual /Live Keynote Presenter, Inc.’s Top 100 Leadership Speakers

Dr. Beverly Kaye CEO, BevKaye&Co.

Balancing Health Care Costs And Employee Benefits: 5 Best Practices

Insights from industry leaders

By Brett Farmiloe, Featured

Balancing healthcare costs and competitive employee benefits is a challenge for many human resources (HR) and benefits leaders. To help you navigate this, we’ve gathered five insightful tips from founders and Chief Financial Officers. From partnering for employee-directed spending to shifting to a quality-focused plan design, discover how these leaders

optimize cost-effectiveness while meeting the needs of their workforce.

● Partner for Employee-Directed Spending

● Leverage Long-Term Healthcare Partnerships

● Embrace Creative Benefits Solutions

● Maximize Flexibility in Health Budgets

● Shift to a Quality-Focused Plan Design

Employee Benefits & Wellness Excellence presented by HR.com September 2023 7 Submit Your Articles

COVER ARTICLE

Shift to Quality-Focused Plan Design

When we first started working with a PEO, our strategy was maximum optionality. This was great for learning the needs of our employees, but it came with a higher cost. In the last year, we have moved to a plan design that emphasizes quality but has fewer choices. Not only has this lowered the cost for the company, but most employees are less overwhelmed when open enrollment comes around.

Trevor Ewen, COO, QBench

Maximize Flexibility in Health Budgets

The best way to approach health budgets is to provide as much flexibility as possible. With flexible budgets, you eliminate the costly waste of providing blanket services to employees who might only use one or two perks without touching the rest. Trying to make everyone happy with the same benefits package is an impossible game to win—you either end up overspending to offer more options or over-providing benefits that half your team doesn’t really need.

Flexible services allow you to give your team ample benefit budgets and the freedom to choose how their money gets funneled through each service. If you offer $20K in more stringent health benefits, but a particular employee can only make use of $5K, neither the employee nor management will be totally satisfied with the program. But if you give every teammate a $20K pot to use as they need on healthcare, you’ll maximize satisfaction while minimizing waste!

Gillian Dewar, Chief Financial Officer, Crediful

Partnering for Employee-Directed Spending

We found a way to be generous, but be generous in a very calculated, plannable way. We partnered with a company called Gravie.com, which allowed us to decide how much to spend on each employee. Then, the employee decides how to spend those dollars. Gravie took the headache and logistics off of our plate so that HR could focus on higher-leverage things like recruiting and retention.

Casey Allen, Founder, Headcount

Employee Benefits & Wellness Excellence presented by HR.com September 2023 8 Submit Your Articles Balancing Health Care Costs And Employee Benefits: 5 Best Practices

Embrace Creative Benefits Solutions

There are so many creative benefits solutions for small businesses and startups! These include federal and state tax credits for offering 401(k) and other benefits, as well as smartly designed health plans that include only the provisions needed for each individual employee and their dependents.

By further making benefits flexible with HRA, HSA, and/or FSA options, employees can contribute or get reimbursed for the benefits that matter most to them, like mental health support and childcare.

Susan Snipes, Owner and Principal Consultant, Employ HR Pro, LLC

Leverage Long-Term Healthcare Partnerships

Leveraging long-standing partnerships is beneficial. Over the decades, relationships with healthcare companies have been built that have provided significant discounts. This approach ensures the team receives top-tier healthcare while remaining fiscally responsible.

If a long-term partnership with a healthcare company has been established, it should be leveraged to negotiate better terms and discounts. If there hasn’t been a long-term partnership with a healthcare company, building relationships and exploring various options to ensure optimal terms in future collaborations is recommended.

In a rapidly changing healthcare landscape, these solid partnerships prove invaluable, allowing the workforce’s needs to be met efficiently. Fostering and maintaining such strategic relationships is essential for any HR leader aiming to provide both quality and cost-effective benefits.

Fred Winchar, Founder, Certified HR Professional, MaxCash

Brett Farmiloe is the Founder and CEO – and currently CHRO - of Featured , a platform where business leaders can answer questions related to their expertise and get published in articles featuring their insights. Brett is a former SHRM Influencer and has also been a keynote speaker at several state SHRM conferences around the topic of employee engagement.

Would you like to comment?

Employee Benefits & Wellness Excellence presented by HR.com September 2023 9 Submit Your Articles

Balancing Health Care Costs And Employee Benefits: 5 Best Practices

Revolutionizing Health Benefits: A Strategic Approach To Open Enrollment 2024

Prioritizing modern and valuable health benefits

By Amy Spartz, Gravie

Aswe gear up for 2024 and turn the corner on another health plan year, it’s time once again for employers to weigh one of the biggest investments they face in a given year: health benefits.

Amy Spartz is a human resource leader with more than 20 years of executive experience and is currently the Chief People Officer at Gravie, an employer health benefits company. In the Q&A below, Amy reflects on key issues that we face in the current market with insights for employers as we head into open enrollment season.

What issues are on the minds of both employees and employers these days?

We can all agree that the past few years have been a whirlwind – navigating the pandemic and global health crisis, an economic downturn, and the rise of hybrid and remote working left employers clamoring for stability in staffing and laser-focused on making smart investments.

Employees have also sought stability amidst the uncertainty – making benefits, particularly those related

to health and wellness, front and center when it comes to taking or leaving a job.

Several research studies have shown that health benefits are more important to people now than ever:

According to Pew Research, one of the top reasons roughly half (43%) of U.S. workers quit their job in 2021 was due to “not having good benefits such as health insurance and paid time off.”

A 2023 study by Forbes Advisor stated that 67% of employees believe employer-covered health care is the most important benefit.

Despite its importance, health insurance has had painfully low consumer satisfaction ratings for decades, especially as costs continue to rise and consumer experiences remain fragmented and challenging on traditional health plans. According to a recent Gallup poll, 38% of Americans say they delayed medical treatment due to cost – the highest percent in the survey’s 22-year trend report.

Employee Benefits & Wellness Excellence presented by HR.com September 2023 10 Submit Your Articles

Top Pick

These insights set the stage for how important designing and choosing the right benefits are in this current climate.

In light of these issues, what are some tips for employers in selecting health benefits plans?

Across the industry, we typically see that 90% of employers’ healthcare expenditures end up benefiting less than 10% of all employees. This is because many health insurance plans are designed only as safety nets for the very sick rather than as a true benefit for all employees at any point on their wellness journey. This is where it’s helpful for employers to distinguish between solutions that offer “insurance” for some versus a true benefit for all throughout the year.

Employees want health benefit plans that will cover their individual and family’s unique health needs without breaking the bank. The following are characteristics of health plans that make both employees and employers feel like their benefits are valuable and give them protection:

1. A plan with a simple and straightforward design – Too many members of employersponsored health plans walk into their doctor’s appointments unsure of how much it will cost them. We’ve simplified that process for our own employees by offering our Gravie Comfort® plan that provides 100% coverage on most common healthcare services from day one, with zero deductible or copays. The benefits are easy to understand and straightforward to use, without all the complicated jargon and fine print.

2. A plan designed to be used often – Another hallmark of value is something that is used frequently. For example, if you have a gym membership and you rarely go, that membership isn’t very valuable. However, if you’re there every day taking advantage of the amenities, you feel like you’re getting your money’s worth and want to hold on to it.

Unfortunately, the traditional model of health insurance has deterred utilization and is not empowering individuals to pursue preventive care. At Gravie, we’re helping turn the tide for health benefits – recognizing that incentivizing people to use the health system in a proactive and responsible way is best not only for a member’s health but also for the pocketbooks of everyone involved.

3. A plan with more coverage of the services that keep members healthy – While straightforward plan designs can make it easier to navigate healthcare, coverage is what counts most. You usually don’t have to go far to hear people grumble about medical services that aren’t covered. Plans that provide coverage on everything from specialist visits to generic prescriptions incent members to pursue the care that keeps them healthy to avoid those higher-cost claims down the road.

With numerous vendors and point solutions available, how can employers best prioritize them to control costs? Where can employers see some of the biggest returns on investment (ROI)?

There’s an influx of new vendors and point solutions available today, so it’s best to focus on a few key priorities that best reflect the needs and desires of your employer group. Offering too many add-on benefit options during open enrollment may result in confusion and low utilization of these services.

Brokers can also help you better understand how your company’s health plan is being used, what services are being utilized most, and where additional solutions could complement them. Claims data can lend insight into the most highly used health services, such as prenatal, mental health, preventive care, and beyond. These may give an indication of what point solutions will help cover any gaps and help round out your offerings.

Employee Benefits & Wellness Excellence presented by HR.com September 2023 11 Submit Your Articles

Revolutionizing Health Benefits: A Strategic Approach To Open Enrollment 2024

For Gravie employees, we offer our Comfort health plan, in addition to fully covering areas like mental health care. Plus, we offer point solutions, including virtual services like Sword for musculoskeletal health, FitOn Health virtual fitness, and Teladoc Health for remote doctor visits.

It takes time and resources to set up a new point solution provider, so working with a trusted broker and staying focused on key priorities will give your employees and company the best ROI.

What advice do you have for other employers heading into open enrollment?

Now is not the time to renew your status quo traditional health benefits plan just to keep things easy.

Costs are rising, and employees are hungry for more modern and useful health benefits. Solutions are available to help control costs and delight employees and their families. If your broker isn’t bringing you innovative and creative solutions, find a broker who will!

Change can be hard, but sometimes it’s necessary. HR (human resources) leaders at DCI, a stainlesssteel manufacturer based in Minnesota, had been struggling with high health plan costs for several years and were getting desperate for a change when they turned to a new broker. In 2020, they were introduced to Gravie’s Comfort plan, and it’s helped them realize 30% savings while giving their employees with high-risk jobs and medical conditions peace of mind and affordable coverage.

Would you like to comment?

Employee Benefits & Wellness Excellence presented by HR.com September 2023 12 Submit Your Articles

Amy Spartz is the Chief People Officer of Gravie , an employer health benefits provider.

Revolutionizing Health Benefits: A Strategic Approach To Open Enrollment 2024

Reducing Employee Stress Through Digital Wellness

The epidemic of employee stress in today’s workplaces is caused, in large part, by technology-related trends and issues. We believe that one way to help address such stress is by increasing the digital wellness of employees, a topic we explore in this article.

Just how prevalent is stress among workers? When the HR Research Institute asked HR professionals what work-related challenges their organizations currently face, the most widely chosen response was “dealing with employee stress in the workplace,” cited by 73% of respondents.

The Role of Technology

The relationship between employee stress and technology is multifaceted. On one hand, technology solutions can provide employees with ways to manage their stress and well-being. These technologies range from fitness trackers to mental health apps. For instance, September is National Yoga Awareness Month in the U.S. Thanks to technology, we can choose to celebrate this from the comfort of our homes through a variety of online classes and apps

On the other hand, technology itself can be a source of employee stress. Today’s ever-evolving technologies often come with associated stressors such as always being connected to the workplace, potential invasions of privacy, data overload, and security threats. Moreover, there’s stress associated with trying to keep abreast of today’s fast-evolving technologies.

The Role of Wellness Programs

Organizations primarily deal with employee stress through wellness programs and initiatives. Wellness programs can improve employees’ welfare, performance, and sense of self-efficacy. There are various types of wellness programs these days, with the most common ones focusing on:

● physical well-being

● mental/emotional well-being

● well-being associated with the work environment

● social well-being

● financial well-being

13 ARTICLE

The HR Research Institute, powered by HR.com

Enter Digital Well-being

Today, however, the well-being paradigm is being expanded into the area of digital well-being. After all, many people are now spending the majority of their work and personal lives in front of screens of some sort. The average time spent using the Internet is 6.37 hours globally, and the average American spends nearly 7 hours looking at a screen per day.

Although people enjoy much of the time they spend online and on screen, it can also take a toll on both their physical and mental health. In fact, numerous reports have highlighted the detrimental effects of too much screen time on a range of areas such as sleep, mood, and communal interactions.

So, it makes sense that more employers are thinking about well-being from the perspective of employees’ digital lives. For a recent study that the HR Research Institute conducted (see sidebar), we defined digital wellness as follows:

A healthy state of digital wellness means people are protected from weak spots in their security, their privacy is protected, and they remain in control

of their personal data—who can access it and how it’s used. It can also mean they have a healthy, nonaddictive relationship with technology.

The Impact of Stress

Employee stress is a pressing organizational problem because it leads to burnout and disengagement. This translates to lower productivity and overall organizational performance. In addition to impacting productivity, declining mental health and well-being at work also lead to mental health disorders. This has become a pervasive problem. In the U.S. alone, 42.5 million people suffer from anxiety disorders.

The Costs of Stress

One of the effects of this increase in employee stress is the increase in healthcare costs. A recent study estimates that “more than 120,000 deaths per year and approximately 5%–8% of annual healthcare costs are associated with and may be attributable to how U.S. companies manage their workforces.”

The American Institute of Stress estimates that when considering “absenteeism, turnover, diminished productivity, increased medical costs, and legal costs,” the total economic impact of stress on US employers is estimated at $300 billion

About the Research

In this article, we allude to data from the HR Research Institute’s survey on Digital Wellness that was fielded in 2023 in partnership with McAfee, the global computer security software company. The survey had 204 respondents from a wide range of industry verticals, all of them being HR professionals from large organizations (at least 1,000 employees) in the United States.

14 ARTICLE

The Rise of Technostress

Gadgets and technologies have become an indispensable part of many employees’ professional and personal lives. On the plus side, these technologies have made our lives more comfortable and allowed us greater connectivity than ever before through Internet banking, telehealth services, and online shopping just to name a few. However, these technologies are also incredibly addictive. In fact, an average person taps or swipes their phones approximately 2,600 times per day. This sometimes leads to stress caused by the pressure to remain connected, resulting in an overall decrease in mood and well-being.

In the workplace, the introduction of newer technologies and having to adapt to them has led to what is commonly called “technostress.” This is caused by expectations to learn new and complex tools in a short period. Further, technology often

causes work interruptions in the form of instant messages and emails. Newer technologies can also cause job insecurity for employees who fear being replaced by technologies or by more techsavvy employees.

Why the Future Digital Landscape Could Become Even More Stressful

The Role of Remote Work and Personal Devices

Today many employees are engaged in remote or hybrid work. This can cause an increased reliance on technologies for everyday work life. Two-fifths of the respondents to our survey indicate that over half of their employees work remotely at least some of the time every month. An overwhelming majority (96%) also agree or strongly agree that the increase in remote and hybrid work has made digital wellness more important in their organizations.

15 ARTICLE

Further, employees often use their personal devices for work purposes. More than 7 in 10 HR professionals surveyed believe over half of the employees in their organizations rely on personal devices such as computers, and mobile phones for work purposes. This raises concerns about exposing the organization’s confidential information. In 2022, an alarming 83% of organizations experienced more than one data breach.

While employers are liable for any data breach, three-fifths of respondents say their organizations have dealt with cybersecurity breaches caused by employee/human error. This can cause stress and loss of morale among employees in the event of such a breach.

The Role of Generative AI

Another potential factor is the rise of what’s known as generative AI, such as OpenAI’s well-known ChatGPT. That widely used AI reportedly exposed payment-related and other sensitive information of 1.2% of subscribers. There were also concerns

when employees at Samsung accidentally leaked company information when using ChatGPT.

Despite the utility of generative AI for business growth, there remain concerns surrounding data security while using such technologies. For example, there are risks associated with incorrect or biased information. Further, generative AI can be misused to create and deliver malware and other malicious cyberattacks. Naturally, these contribute to increased stress for employees who now have to contend with these newer technologies.

Identity Theft and Other Security Concerns

Identity theft is another potential stressor. More than half of the respondents to our survey indicated that employees in their organizations are very concerned about identity theft. Potential outcomes of such an event range from fear about financial safety (58%), reduced work performance (54%), financial loss (48%), and mental health issues such as stress (46%). We believe that organizations offering a digital wellness solution to employees can address issues of identity theft proactively, all the while adding a cloak of protection over their cybersecurity measures.

16 ARTICLE

Survey Question: What do you view as the potential outcomes of identity theft for employees? (select all that apply)

Fear about financial safety

Reduced work performance (e.g., distractions at work)

Financial loss

More mental health issues (e.g., stress, depression)

Difficulties re-establishing credit

Diminished overall wellbeing

Higher rates of absenteeism

Nearly half of respondents (46%) say mental health issues may follow from identity theft

17 ARTICLE 0 10 20 30 40 50 60 58% 54% 48% 46% 40% 37% 32%

34%

Digital Wellness Rx for Stress Management

A digital wellness solution encourages data security, device safeguards, and identity protections as well as education in a variety of areas such as proper device usage, stress monitoring, technostress-management techniques, stressreduction exercises and more. Of course, the features of a digital wellness program will be influenced by the specifics of work processes and the work environment, but the goal is always the same: to boost employees’ well-being by helping them cope better with their modern digital lives.

Many organizations have, in fact, started offering a digital wellness solution as part of their organization’s current benefits package. The results of our research also indicate that more than 9 in 10 organizations offer some form of digital wellness

as part of their core or voluntary benefits offerings. Most organizations believe that a digital wellness solution improves employee safety and well-being to a high (39%) or very high (47%) degree.

As part of the digital wellness initiatives, threefifths of organizations surveyed say they supply virus, malware, or ransomware removal services or software, and more than half (57%) say they focus on educating employees about digital wellness best practices. Half or over offer personal data cleanup (53%), device protection for employees’ work devices (51%), and identity monitoring (50%).

A comprehensive digital wellness solution aims to offer all-in-one protection for employees from threats involving identity, security, and privacy. This reduces employee stress by proactively protecting them from digital risks and restorative support in the event of such breaches or theft.

18 ARTICLE

Survey Question: What digital wellness initiatives does your organization engage in? (select all that apply)

Supply virus, malware or ransomware removal services or software

Educate employees about digital wellness best practices

Offer personal data cleanup (i.e., removes personal data from websites)

Offer device protection for employee’s work device(s)

Offer identity monitoring (e.g., scans dark web for personal data)

Offer device protection for all devices in employee’s household (including family)

Offer credit monitoring (e.g., aler ts for new credit activities, such as a new line of credit)

Educate employees how to identify phishing scams

Supply a vir tual private network (VPN)

Restore an employee’s identity that has been stolen

We do not have any digital wellness initiatives

19 ARTICLE 0 10 20 30 40 50 60 60% 57% 53% 51% 50% 48% 48% 48% 46% 33% 1%

Conclusion

We believe that organizations can and should address employee stress through digital wellness approaches. Among the digital wellness practices, we recommend include:

● discover the ways in which digital-related factors are driving stress in your organization

● develop a digital wellness plan for addressing such stress based on your findings

● consider a variety of key features such as:

o device safeguards

o data security

o privacy and identity protection

● teach employees better habits related to technology use

● encourage work boundaries by making it clear that employees are not typically expected to respond to work-related communications outside of office hours,

● provide guidelines so that the usage of personal devices does not cause the types of cybersecurity issues that boost stress levels

● partner with IT on developing tactics that make technology usage less stressful and more user-friendly even while enhancing cybersecurity

By promoting healthy relationships with technology among employees and offering comprehensive digital security and protection, employers can reduce employee stress associated with technology. Not only can they safeguard organizations from cybersecurity threats, but they can also maximize employee productivity and engagement through digital well-being.

Would you like to comment?

20 ARTICLE

Complete Digital Peace of Mind. For Employees. For You.

All-in-One Digital Wellness Benefits from McAfee

Identity, privacy and award-winning device protection during work time and play-around time.

Keeping your employees safe online is our full-time job.

Learn more

Learn more

HRCI® & SHRM® CERTIFICATION PREP COURSES

GROUP RATES AVAILABLE

For HR Professionals

Show that management values the importance of the HR function, and has a commitment to development and improvement of HR staff.

Ensure that each person in your HR department has a standard and consistent understanding of policies, procedures, and regulations.

Place your HR team in a certification program as a rewarding team building achievement.

For Your Organization

Certified HR professionals help companies avoid risk by understanding compliance, laws, and regulations to properly manage your workforce.

HR Professionals lead employee engagement and development programs saving the company money through lower turnover and greater productivity and engagement.

A skilled HR professional can track important KPIs for the organization to make a major impact on strategic decisions and objectives, including: succession planning, staffing, and forecasting.

HR.com/prepcourse CALL TODAY TO FIND OUT MORE 1.877.472.6648 ext. 3 | sales@hr.com

1 Less expensive than a masters or PhD program, and very manageable to prepare with

2. legislation and best practices

3. Recognized, Industry benchmark, held by 500,000+ HR Professionals

Group Rate Options

We offer group rates for teams of 5+ or more for our regularly scheduled PHR/SPHR/ SHRM or aPHR courses.

For groups of 12+, we can design a more customized experience that meets your overall length of the course.

Groups rates for HRCI exams are also available as an add-on.

All group purchases come with 1 year of HR Prime membership for each attendee to gain the tools and updates needed to stay informed and compliant

CALL TODAY TO FIND OUT MORE 1.877.472.6648 ext. 3 | sales@hr.com | HR.com/prepcourse

1 2 3

Is Your Organization Prepared For The Looming Child Care Cliff?

Strategies to keep parents in the workforce amidst child care challenges

By Lynn Perkins, UrbanSitter

billion drop in economic activity, according to the Century Foundation.

Child Care Is Draining Working Families

According to the U.S. Department of Labor, families are spending 8-19.3% of their annual household income per child on child care. In addition, 57% of households with children under 18 have at least two kids, further compounding the child care burden to up to 39% of their annual income. Unfortunately, the Child Care Cliff will increase this financial strain as surviving centers raise prices due to reduced government funding.

TheUnited States is facing a pressing challenge

known as the Child Care Cliff as the end of government pandemic child care relief funds–which had been a lifeline for many child care centers–approaches. The funding amounted to $24 billion, and its absence jeopardizes access to child care for an estimated 3.2 million children.

With nearly 40% of U.S. employees being working parents, this looming crisis demands swift and strategic action from employers to staunch the economic drain and maintain stability. If unaddressed, this could force droves of parents out of work, causing a yearly loss of $9 billion in earnings and a $10.6

What’s more, caregiving challenges directly impact the job performance of working parents. More than half of parents (52%) reported missing 10 or more days of work last year due to caregiving issues, according to a recent study.

Additionally, mothers bear a disproportionate share of caregiving responsibilities, leading to a mental health crisis, with nearly half of mothers (46%) currently seeking therapy. Return-to-office policies are a major factor in this trend, with many mothers citing a lack of flexibility to manage school drop-offs and pick-ups during the day as a primary reason for leaving their jobs.

Employee Benefits & Wellness Excellence presented by HR.com September 2023 24 Submit Your Articles

Top Pick

Strategies for Employers: Navigating the Road Ahead

How can employers help to ease the burden on working parents while improving important factors like job performance and employee retention? Here are some key considerations:

1. Prioritize Child Care Benefits and Stipends: Working parents value child care benefits above all else, more so than 401(k) matching and unlimited PTO, according to a 2023 study of parents’ most wanted employer benefits. Employers can offer financial support, stipends, or access to trusted child care options, reducing the financial burden on parents.

2. Embrace Flexibility: Employers should aim to

provide remote work options, job shares, and flexible hours to empower parents to manage their responsibilities more effectively. Some companies have successfully adopted a four-day workweek, leading to increased productivity and employee satisfaction.

3. Go Hybrid vs. Full Return to Office: Employers that offer hybrid work models allow employees a mix of in-office and remote workdays. This option is especially valuable to working parents, who are often challenged by school pick-up and drop-off logistics.

4. Expand Holistic Support: Go beyond child care and offer support for tutoring, pet care, senior care, and

household services. This comprehensive approach benefits all employees by easing additional caregiving responsibilities they face outside of the workplace.

5. Mental Health and Wellness: Prioritize mental health and wellness resources, including counseling services and stress management programs. These initiatives support employees’ emotional well-being.

6. Educational Initiatives: Provide educational resources on time management, stress reduction, and financial planning. These programs empower working parents to navigate their responsibilities more effectively.

Employee Benefits & Wellness Excellence presented by HR.com September 2023 25 Submit Your Articles

Is Your Organization Prepared For The Looming Child Care Cliff?

The Business Case for Supporting Working Parents

Beyond providing working parent employees with the support they need and deserve, there are quantifiable benefits to employers for investing in parents. According to data from UrbanSitter’s Corporate Care benefits program, organizations can expect numerous advantages:

● Reduced Absenteeism: Employers that offer caregiving benefits saw a 68% reduction in workdays missed by parents.

● Enhanced Retention: 87% of working parents are more likely to stay with employers offering caregiving benefits.

● Improved Productivity: Companies with childcare benefits experienced a 77%

return-to-work rate after childbirth versus the 57% industry average.

● Competitive Advantage: Prioritizing working parents attracts and retains top talent.

● Positive Company Culture: Supporting working parents fosters a positive and inclusive company culture.

The Path Forward

By implementing these strategies and prioritizing the needs of working parents, businesses can diffuse the effects of the Child Care Cliff on their workforce and create a more empowering environment that ensures a brighter and more inclusive future for all. A workplace where employees can thrive professionally while nurturing

their families, ultimately leads to a stronger, more resilient workforce, and that’s a win-win.

Lynn Perkins is the CEO and Co-Founder of UrbanSitter, an app and website that’s solving the challenges families face when finding, booking, and paying for trusted care, from last-minute babysitters to full-time care. An Internet startup veteran, Lynn served as founder and CEO of Xuny.com and VP of Business Development at Bridgepath.com before founding UrbanSitter.

Would you like to comment?

Employee Benefits & Wellness Excellence presented by HR.com September 2023 26 Submit Your Articles

Is Your Organization Prepared For The Looming Child Care Cliff?

Maintenance is a Good Investment – Especially With Chronic Diseases Like Diabetes

George Huntley, CEO of the Diabetes Leadership Council

Maintainingour depreciable assets is typically a no-brainer. We learn early in adulthood that we have to change our car’s oil or face a potentially unaffordable repair bill. If we’re running a manufacturing operation, we invest heavily in equipment maintenance to avoid production delays or shutdowns. Airlines follow very strict and regulated protocols to ensure planes are safe since they know the cost of an inflight failure could be catastrophic.

We invest in maintenance because it’s far less expensive than not investing in it. It’s the same with diabetes. Insurance companies tell us that a well-managed patient with diabetes costs one-third of what it costs for someone who is suffering from the complications that frequently result when diabetes is not well controlled. Enabling employees to successfully manage their diabetes is an essential investment in their health and well-being while protecting the business’ bottom line.

Most employers know that diabetes is a major cost driver for their health plans. However, many don’t actually know how or why and, more importantly, what they can do about it.

So let’s first look at the prevalence of diabetes and your employee population. Approximately 1 in 10 adults have either Type 1 or Type 2 diabetes. That’s a significant portion of your employee base in addition

to any family members on your health plan who are also dealing with this condition.

Now let’s look at the cost impact across all those individuals, factoring in that diabetes is somewhat costly to manage, but much more expensive if not. For example, diabetes costs on average $10,000 per year for someone with well-managed blood sugars, but a whopping average cost of $30,000 for someone suffering from complications. In addition, diabetes costs employers $26.9 billion dollars in reduced productivity.

You can obviously lower the cost by reducing the number of patients with diabetes, which we’ll cover in a future article. Here, we’ll focus on how to reduce the cost per patient by first understanding what a person with diabetes is dealing with.

Very simply, a person with diabetes has high blood sugar usually driven by a lack of insulin or an inability to use insulin effectively. Insulin allows the sugar to leave the bloodstream and feed the cells for energy. Type 1 diabetes (5-10% of cases) is an auto-immune disease where a person doesn’t make any insulin. Those with Type 2 diabetes (90-95% of cases) typically have insulin resistance and need help to either make more of it, use it more efficiently, or take a supplemental dose of insulin.

Employee Benefits & Wellness Excellence presented by HR.com September 2023 27 Submit Your Articles

The high cost of diabetes comes more from the devastating complications that result from uncontrolled, high blood sugars – heart attack, stroke, kidney failure, nerve damage and amputations, and blindness. It also stems from acute episodes of low blood sugar that send too many patients on an expensive cab ride to the ER, resulting in an expensive “hotel” bill.

37 million Americans live with diabetes and generate approximately 16 million ER visits per year. That’s an alarming number! What’s worse is that roughly half of these ER visits turn into inpatient hospital stays. So we’re not “maintaining our equipment” very well and we’re paying the price both economically as well as in human suffering.

So why is diabetes so hard to manage? Adam Brown published a powerful chart illustrating the 42 factors that impact blood sugar. It basically shows that someone with diabetes needs to consider what they eat, medications they take and timing, amount, type

and timing of exercise, any physical or emotional stress, and so much more. Everyone struggles with managing their diabetes because it’s so complex and needs to be constantly monitored, 24 hours a day, 365 days a year. There’s no vacation from it.

Still, the good news is that diabetes can be managed with the right resources. To help those employees take care of their diabetes -- and reduce your plan costs -you need to first understand what they need:

● Insulin and other medications including SGLT2s and GLP1s to control blood sugar

● Insulin delivery devices such as pumps or pens and the supplies necessary to use them

● Blood glucose monitoring devices such as continuous glucose monitors (CGMs)

● Glucagon (rescue drug for low blood sugar that’s cheaper than the ER)

● Diabetes management training, nutritional therapy and mental health services.

Maintenance is a Good Investment – Especially With Chronic Diseases Like Diabetes Employee Benefits & Wellness Excellence presented by HR.com September 2023 28 Submit Your Articles

These should all be covered on your plans outside of the deductible. If not, and your employees ration their insulin, their largest expense, it’s bad for them and bad for the employer ultimately paying the higher health plan costs.

Express Scripts released a study in June 2022 showing that capping the cost of all diabetes medications at $25/month would result in a 16.3 percent reduction in a plan’s overall diabetes costs. Wouldn’t you like to reduce your plan costs by at least that much? This example clearly shows how maintenance is a good investment. And when you expand the same type of pre-deductible coverage to other chronic disease medications and treatments, the savings are even greater.

Employees are your most valuable asset. Make sure your plan supports them in their health journey.

To learn more about this and other ways to help boost employees’ health and your bottom line, visit the Employer Solutions section of our website.

George Huntley is a founding member of the Diabetes Leadership Council and currently serves as CEO of both the Diabetes Leadership Council and its affiliate, the Diabetes Patient Advocacy Coalition. He has been living with type 1 diabetes since 1983 and has 3 other family members also living with type 1. A passionate advocate for people with diabetes, George served as the National Chair of the Board of the American Diabetes Association (ADA) in 2009. George is also the Chief Operating Officer and Chief Financial Officer of Theoris Group, Inc., a professional services firm headquartered in Indianapolis, Indiana that provides engineering and information technology solutions. In his corporate role, George has been the plan administrator of a self-insured health plan for over 20 years.

Would you like to comment?

Maintenance is a Good Investment – Especially With Chronic Diseases Like Diabetes Employee Benefits & Wellness Excellence presented by HR.com September 2023 29 Submit Your Articles

Preventing, Detecting, And Addressing FMLA Leave Abuse

Strategies for employers to maintain transparency

By Calvin Gower, Stiira

Whetherdeliberate or accidental, misusing paid medical or family leave costs U.S. employers millions of dollars each year. In fact, research from the Society for Human Resource Management (SHRM) found that 52% of employers believe they have granted questionable FMLA (the Family and Medical Leave Act) leave. In today’s leave landscape, employees have more options than ever for taking leave, which can lead to confusion and missteps for employers. Employee leave abuse is when authorized time off from work is used without legitimate reasons or for personal gain. It can come in many forms, such as excessive or unauthorized absences, patterns of leave usage that may not be tied to qualified reasons for leave, and even providing false information to gain approval for leave. As an employer, being taken advantage of places strain on your organization and undermines confidence in leave programs and employee morale.

What Can an Employer Do to Prevent Leave Abuse?

While it is impossible to eliminate leave abuse entirely, the following strategies can reduce or prevent its occurrence significantly.

1. Clearly define your leave policies

When leave policies aren’t well-defined or

accessible to employees, processes, and expectations are left to interpretation. Establish comprehensive leave policies that clearly outline the types of leave available, eligibility criteria, the process for requesting leave, documentation requirements, and any restrictions or limitations. Make sure employees are familiar with these policies and have easy access to the information through your employee handbook or leave portal. By setting expectations from the outset, you create a transparent environment that discourages abuse.

2. Establish clear and open lines of communication Accidental misuse of paid leave is often the result of distrust or discomfort among employees. The circumstances surrounding leaves of absence are often sensitive; this can be mitigated by ensuring your employees feel comfortable and safe discussing their needs with the company representatives managing their cases. Foster a culture of open communication. Encourage employees to provide advanced notice for planned leaves or updates regarding unexpected circumstances. Implement best practices for consistent check-ins while an employee is out on leave.

Submit Your Articles Employee Benefits & Wellness Excellence presented by HR.com JUNE 2023 30 Top Pick

3. Maintain thorough documentation

Keep meticulous records of all FMLA-related interactions and documentation. Require employees to provide appropriate medical certifications for leave requests and maintain a consistent process for documenting leave durations. This helps verify the legitimacy of leave and minimizes the risk of abuse.

4. Leverage systems for tracking and reporting

Whether you are administering leaves via spreadsheets or a leave management software application, employers will benefit from tracking requests every step of the way and assessing their employee leave data to identify potential abuse. With a consistent approach to receiving requests and managing leave cases, red flags are identified in real time, and corrective actions can be taken to address different scenarios appropriately. Review leave data reports regularly to determine if some patterns or inconsistencies require further investigation.

How Can You Tell If an Employee Is Intentionally Abusing Family or Medical Leave?

Unfortunately, there are cases where leave abuse is intentional. To take appropriate action, employers should be aware of common red flags. These include

1. Frequent short leaves

Take note of employees who frequently request short-term FMLA leave. While intermittent leave is permissible for medical conditions, an excessive pattern of short leaves could indicate potential abuse.

2. Suspicious timing

Be cautious when an employee requests FMLA leave immediately before or after weekends, holidays, or scheduled days off. Such timing might signal an attempt to extend time off for personal reasons.

3. Unexplained absences

Employees who fail to provide adequate documentation or explanations for their leave may be engaging in abuse. Keep an eye out for incomplete or vague medical certifications.

4. Inconsistent patterns

Be vigilant about inconsistent patterns in an employee’s absences or requests. An abrupt change in the type or frequency of FMLA leave could warrant further investigation.

5. Alteration of medical certificates

This is falsifying a diagnosis or distorting a medical certification to qualify for or extend leave beyond what the medical professional has noted. This constitutes fraud on the part of the employee, which is grounds for termination.

Employee Benefits & Wellness Excellence presented by HR.com September 2023 31 Submit Your Articles

Preventing, Detecting, And Addressing FMLA Leave Abuse

6. Questions surrounding leave certification or recertification

You may receive information that casts doubt on the evidence provided by the employee to qualify for leave or some aspect of it, such as the recommended duration of the leave. An employee may fail to submit a medical certification or recertification within a mandated time frame or provide unclear details, making it difficult to determine if the specific circumstances and conditions meet a qualifying reason for leave.

7.

Performing similar tasks at another job

In some cases, an employee on paid leave from one job may work for another employer during the leave period. This alone is not necessarily leave abuse, but if the employee is performing the same or largely similar duties — indicating that the individual can accomplish the essential job duties and thus may not qualify for the leave — it may be a case of leave abuse.

How Should an Employer Address Leave Abuse?

If you suspect FMLA leave abuse has occurred, address it promptly in an objective and professional manner.

1. Open dialogue

If you suspect FMLA abuse, initiate a confidential conversation with the employee. Approach the discussion with empathy and inquire about the reasons behind their leave patterns. A respectful dialogue can help uncover any underlying issues.

2. Medical certification review

Request a review of the employee’s medical certification by a designated healthcare professional. This step ensures the legitimacy of the medical condition and validates the need for FMLA leave.

3. Documentation

Create a timeline of the entire leave case. Keep records of communication regarding the leave and potential abuse, including submissions, medical records, and any corroborating evidence

4. Progressive discipline

If abuse is confirmed, apply your organization’s disciplinary policies consistently. Depending on the severity of the abuse, progressive discipline measures may include verbal warnings, written reprimands, or suspension.

5. Seek external help

In cases of abuse that require severe disciplinary action or separation, consider seeking an investigator or legal counsel to ensure compliance with FMLA regulations. A third-party experienced in employment law can guide you through the appropriate steps and help you navigate potential legal implications.

Preventing and addressing FMLA abuse is essential for maintaining a balanced and productive work environment, mitigating financial losses, and fostering a healthy work environment. By establishing clear policies, promoting education, and facilitating open communication, you can reduce the risk of abuse while supporting your employees’ well-being. Recognizing red flags and addressing instances of abuse in a fair and consistent manner will not only protect your organization but also reinforce a culture of integrity and accountability.

Recommended Resources

1. Exploring the latest leave trends in the United States, Effective strategies for communicating with employees on leave

Would you like to comment?

Employee Benefits & Wellness Excellence presented by HR.com September 2023 32 Submit Your Articles

Calvin Gower is the President & Founder of Stiira , which is a technology company that offers leave management software for a seamless, intuitive, and processoriented approach to leave administration.

Preventing, Detecting, And Addressing FMLA Leave Abuse

Addressing The Interplay Of Neurological Conditions And Mental Health

By Elizabeth Burstein, Neura Health

Withmore than 1 in 5 U.S. adults living with mental illness, impacting more than 57 million people, it’s no wonder that institutions of all shapes and sizes, from employers to the federal government, are taking notice. The Biden Administration’s latest step in addressing the country’s mental health problems is a proposal to strengthen requirements for insurance plans to cover mental health services in the same way they cover physical health.

It’s a logical step, but implementation is proving challenging, given the nation’s lack of qualified mental health providers. Over 160 million Americans live in areas that don’t have enough mental health providers to meet their needs.

This provider shortage puts a greater onus on employers to support their employees with mental health issues. And while many have started implementing benefits designed to address mental health, most are still failing to address other factors that exacerbate mental health issues.

Addressing Underlying Issues

Mental health issues don’t exist in a vacuum, and many are worsened as a result of the challenges that stem from other comorbidities. One common example is neurological conditions, like migraines and sleep disorders, which affect one in three people and are closely linked to anxiety and depression. Migraine patients are nearly six times more likely to develop depression and four times more likely to develop anxiety than someone without a migraine. Additionally, a study from Australia found that 73 percent of sleep apnea patients had clinically significant symptoms of depression.

Nearly everyone with a chronic condition has some degree of added stress that can negatively affect their mental health, but there are a variety of reasons why neurological conditions specifically are linked to declines in mental health.

Employee Benefits & Wellness Excellence presented by HR.com September 2023 33 Submit Your Articles

It’s time for employers to look below the surface of mental health

For one, many neurological diseases, such as migraine, sleep disorders, chronic pain, epilepsy, or concussion, are invisible illnesses – meaning they don’t present visible symptoms. Because of that, coworkers often struggle to understand the lived experiences of a colleague with a neurological condition. Since many employees aren’t comfortable speaking about their condition due to fear that they may be stigmatized by their fellow colleagues and managers, many suffer in silence, to the detriment of their own physician health and mental well-being.

For those who do seek treatment for their neurological condition, many are underdiagnosed or misdiagnosed and, therefore, spend years cycling through different tactics that often don’t work. Even once a proper diagnosis is made, many neurological diseases lack cures and thus require ongoing management by the patient, including lifestyle modifications, physical therapy, new medications, or biologic injections, for example. Patients are then also tasked with following up with doctors and dealing with insurance companies in long, difficult cycles of trial and error.

With the unpredictable nature of attacks and the social isolation that can result, it’s easy to see how these factors can cause stress to mount and mental health to deteriorate.

Incorporating Digital Health Solutions for Common Chronic Conditions

Employers looking to help this population manage their neurological disease and, in turn, their mental

health should focus on making it easier to get timely, quality care so that employees can start the right treatment quickly. The traditional care model makes this a challenge, as getting time with a neurologist is a common roadblock to proper care.

The shortage of qualified neurologists in the U.S. means that the average wait time to see a neurologist is four to six months, causing delays in treatment that add stress and make it more difficult for a patient to manage their symptoms and attacks. To provide better support for those with neurological conditions, the first step for employers is finding a better solution to address this access gap, to get people the quality care they need in a timely manner.

Telehealth is essential in accomplishing this. With digital solutions, employers can ensure employees have access to qualified specialists with significantly lower wait times, down to days rather than months or years, so they don’t have to suffer for so long before getting the care that they need. Access to timely care can be the difference between a confident patient who feels comfortable managing their disease and one who is anxious about what’s next.

These digital solutions that provide better access to care, when accompanied by an expansive formulary list that ensures employees have access to the medications they need and an accommodating culture, can be instrumental in helping an employee manage their neurological disease. Employers will quickly see the impact that better management of neurological conditions has on the mental health of their employees.

Would you like to comment?

Employee Benefits & Wellness Excellence presented by HR.com September 2023 34 Submit Your Articles

Addressing The Interplay Of Neurological Conditions And Mental Health

Elizabeth Burstein is the CEO and Co-Founder of Neura Health , an all-in-one benefits solution for 1 in 3 employees with a chronic neurological condition.

Navigating The Maze: How Employer-Based Education Benefits Address Student Debt Concerns

By Jeremy Walsh, AllCampus

The landscape in higher education is anything but certain. The Supreme Court’s decision to strike down President Biden’s student loan forgiveness plan has left tens of millions of Americans reeling. Meanwhile, the Biden administration is moving ahead with other ways to alleviate student debt, including discharging $39 billion in debt for 804,000 borrowers.

Many employees are left to wonder: Will financial burdens limit opportunities for learning and career development?

While the promise of student debt relief remains in limbo, we can all agree on the importance of employer-based

education benefits and the pivotal role employers play in supporting employees’ educational aspirations.

By providing accessible, meaningful, and comprehensive educational benefits,

organizations can help alleviate financial barriers and provide new avenues for learning and growth. As the battle over student debt continues to play out, organizations can offer clear value and opportunities for employees in uncertain times.

Employee Benefits & Wellness Excellence presented by HR.com September 2023 35 Submit Your Articles

The essential ABCs for building customized programs in changing times

Top Pick

What Employers and Employees Stand to Gain

Employer-based educational benefits are more than just a perk. They demonstrate an employer’s commitment to nurturing employees’ well-being and career growth — and cultivating a culture of growth and continued learning within the organization.

At the same time, educational benefits contribute to the development of a workplace that attracts — and, equally importantly, retains — top-tier talent. Whether it’s tuition reimbursement, educational scholarships, professional development programs, educational counseling and advising, or partnerships with higher education programs, educational benefits provide crucial pathways for advancement and skill development. These offerings can also help build a motivated and engaged workforce committed to the company’s long-term success.

Starbucks, for example, offers full tuition coverage for employees to earn a bachelor’s degree online at Arizona State University. The highly successful program assists thousands of workers and enables the coffee giant to better attract top-tier talent and foster employee loyalty. Other companies have taken notice: Major brands like Amazon, Target, Lowes, and Chipotle have all launched free college programs in the past decade.

With a greater focus on higher education and its costs, employers are uniquely positioned to grow and redefine their educational benefit programs. The question is, will more companies capitalize on this newfound opportunity?

The “ABCs” of Successful Education Benefits Programs

Employees see value in education opportunities. In fact, 80% of employees are interested in going

to school while working. However, few employees know about their organization’s educational benefits, and even fewer actually end up using them.

Forward-thinking companies recognize that educational benefits are not just a checkbox on their benefits package but a business imperative that requires dedicated investment and a comprehensive strategy. So, how can organizations grow and refine their educational benefits in a way that makes sense for their business and their employees?

As you look to support employees’ education goals and professional development, the following steps — the “ABCs” of education benefits — can help you build valuable programs that advance individual growth, support organizational needs, and accommodate changing workforce demands.

1. Afford comprehensive and complementary benefits For employees to fully leverage the potential of education benefits, they need comprehensive, cohesive benefits that are easy to access and complement other training and professional development programs. It’s crucial to develop a clear strategy that aligns with your organization’s educational benefits, professional development programs, and career development opportunities.

Employee Benefits & Wellness Excellence presented by HR.com September 2023 36 Submit Your Articles

Navigating The Maze: How Employer-Based Education Benefits Address Student Debt Concerns

Consider the concept of a “learning wallet” that consolidates various development resources under a single umbrella. Given today’s dynamic workforce, a learning wallet is a practical solution to streamlining access to programs. It also enables employees to utilize their allocated development funds for a broader range of educational opportunities, such as traditional degrees and cutting-edge courses aligned with evolving industry demands. Whether it’s a boot camp, a Google AI program, or a conventional degree, a learning wallet offers the flexibility for employees to choose learning experiences that align with their career aspirations and learning goals.

2. Balance employer and employee-led approaches

Successful educational benefit programs require striking the right balance between employer-led and employee-led approaches. While offering employees freedom and flexibility is important, it’s equally important to ensure that the courses chosen align with the organization’s objectives and goals.

Consider curating a marketplace of pre-vetted educational programs that empower employees to make informed choices that benefit both their personal

growth and the company’s strategic objectives. You can support employees as they explore education options by ensuring that they are aware of your organization’s benefits and the process to access them. Throughout this process, lend support to employees and simplify arduous processes (e.g., navigating approvals, payments, and reimbursements) that can deter employees from utilizing those resources in the first place.

3. Collaborate with a trusted partner

Building valuable education benefits programs takes dedicated resources and investment over time. Fortunately, you don’t have to go it alone. Third-party partners can provide the necessary infrastructure and support for online learning and other professional development programs — providing greater options and flexibility for employees balancing work, life, and education.

You may want to consider partnering with a higher education institution or other learning partners who are willing to offer scholarships, education advising, and access to tutoring, guidance, and resources. These types of partnerships are mutually beneficial opportunities, providing employees with specialized training and

high-quality educational experiences and institutions with opportunities to position their programs to suit industry needs, attract more students, and foster a reputation for producing job-ready graduates.

As the landscape of higher education evolves, prioritizing educational benefits enables your organization to become an employer of choice — laying the foundation for a skilled, engaged, and growth-oriented workforce.

Just as importantly, you stand to make a tangible impact on employees’ lives. By investing in educational benefits, you send a powerful message: You are committed to employees’ growth, both personally and professionally. Now, more than ever, it’s a message your employees need to hear.

Employee Benefits & Wellness Excellence presented by HR.com September 2023 37 Submit Your Articles

Navigating The Maze: How Employer-Based Education Benefits Address Student Debt Concerns

you like to comment?

Jeremy Walsh is the Executive Vice President of Corporate Partnerships at AllCampus .

Would

Revolutionizing Gig Worker Benefits With Lifestyle Accounts

Why companies should start providing benefits to their independent contractors

By Bob Gaydos, Pendella

By Bob Gaydos, Pendella

Therise of independent contractors – sometimes referred to as gig workers – has shifted the employment landscape in dramatic ways. More people than ever before are now working as independent contractors, with some estimates projecting that by 2027, 86.5 million people will be freelancing in the United States.

For human resources (HR) professionals, the growing number of independent contractors has been something of a boon for their recruitment prospects. With so many people looking for contract positions, recruiters are spoiled for choice. Moreover, since these workers are typically classed as 1099s rather than employees, they normally

aren’t entitled to any benefits. This can save companies as much as 25 percent on their employment spending by not having to pay for things like unemployment insurance, workers’ compensation, and paid leave.

However, my feeling is that not offering benefits to gig workers will, in the long run, prove detrimental to a company’s recruitment prospects. People do not like being taken advantage of, and as time goes on, more gig workers will realize that they can get a better deal by choosing an employer that offers them competitive benefits.

That said, providing benefits to an independent worker is not as straightforward as providing them to an employee. HR professionals will need to get creative with their approach to benefits, and I believe the answer lies in using lifestyle accounts.

Employee Benefits & Wellness Excellence presented by HR.com September 2023 38 Submit Your Articles

Benefits for Contract Workers

It can be tempting to think that extending benefits to gig workers isn’t worth the effort. After all, freelancers are typically only contracted for a specific amount of time or until a particular project is completed. What, you might ask, is the point of trying to secure their long-term job satisfaction and loyalty?

Benefits are not just for building loyalty but also for attracting new workers and making them feel valued. Offering good benefits can give a company a powerful edge in attracting top talent. That’s just as true for independent contractors as it is for employees.

Regarding making contractors feel valued, this is a point that

many companies don’t appreciate, at least in my experience. Too many companies believe that the only reason workers would leave is because they found more competitive salaries elsewhere. However, from what I’ve seen, people are more likely to switch jobs because they don’t feel valued by their current employer. And this is just as true of freelancers: if they don’t feel like they are valued, then it’s unlikely they’ll want to work with you again in the future.

So, my advice to HR professionals would be to think about what kind of benefits you could offer that would attract freelancers and make them feel valued enough to continue working with you. Health insurance is probably

the first to come to mind. But honestly, most people can now get a far better health plan on the individual marketplace than from their employer.

That just leaves the remaining insurance products like dental, life, and disability. The last two would be highly attractive for gig workers as almost no one in the individual marketplace is talking to them about these products. Wellness programs can be another highly attractive benefit, especially when workers are allowed a lot of freedom in choosing different programs, such as leadership training or mental health classes. Ultimately, whatever benefits you can offer will come down to how your benefits system is structured.

Employee Benefits & Wellness Excellence presented by HR.com September 2023 39 Submit Your Articles