Q1-2025

Q1-2025

The first quarter of 2025 reaffirmed Fairfield County’s reputation as one of the most economically and demographically diverse markets in the Northeast. From ultra-luxury enclaves along the Gold Coast to commuter-friendly towns inland, the region continues to reflect a range of buyer motivations, lifestyle preferences, and pricing thresholds.

What stood out in Q1 was a noticeable bifurcation in the market. The high end remained remarkably resilient, with trophy properties moving at record prices. Meanwhile, entry-level and mid-market activity softened as affordability pressures and inventory shortages limited options for many would-be buyers. Mortgage rates hovering in the high sixes continued to weigh most heavily on the lower brackets.

Across the county, the number of closed single-family sales declined modestly compared to the same period last year. However, prices moved upward, driven largely by strength in coastal towns such as Darien, Westport, and parts of Fairfield and Norwalk. These communities attracted a steady stream of buyers prioritizing lifestyle, school systems, and proximity to Manhattan.

One of the more notable themes this quarter was the persistence of demand for renovated or turn-key homes. In towns like New Canaan and Wilton, older inventory lingered while updated homes received multiple offers. Buyers appear willing to pay a premium to avoid the delays and unpredictability of renovation in today’s cost-sensitive and labor-constrained environment.

Fairfield County’s condominium market also showed signs of evolution. Demand was strongest in walkable downtown areas and transit-oriented neighborhoods, particularly in Stamford and Norwalk. While overall condo sales volume declined slightly, median prices rose in most markets as buyers sought more manageable, low-maintenance housing options amid rising utility and insurance costs.

On the new construction front, developer activity remained cautious. Land costs, permitting challenges, and elevated material prices continued to create friction. However, where projects did break ground, demand was often immediate. Communities offering modern design and energy-efficient features saw strong interest across all price points.

Looking ahead, market dynamics in Fairfield County will likely continue to mirror the broader economy. High-net-worth buyers remain less sensitive to interest rate fluctuations and more focused on lifestyle alignment. Conversely, first-time buyers and move-up families are navigating a market that requires tradeoffs, between space, location, and monthly cost.

As the spring season unfolds, a modest increase in inventory is expected. Sellers who have hesitated due to rate lock-in are slowly returning, especially those with substantial equity gains. At the same time, buyers are becoming more strategic. Value perception will matter more than ever, and success on both sides of the transaction will depend on pricing realism and property presentation.

In a county as multifaceted as Fairfield, no single trend tells the whole story. But one sentiment is clear: confidence has not disappeared. It has simply matured, becoming more selective, more calculated, and more focused on long-term value than short-term speculation.

At Houlihan Lawrence, we recognize that every home sale or purchase is a deeply personal and significant decision, and we remain uniquely positioned, with local expertise, market insight, and trusted relationships, to guide buyers and sellers through every step of the journey.

With Warm Regards,

Liz Nunan President and CEO

FIRST QUARTER 2025

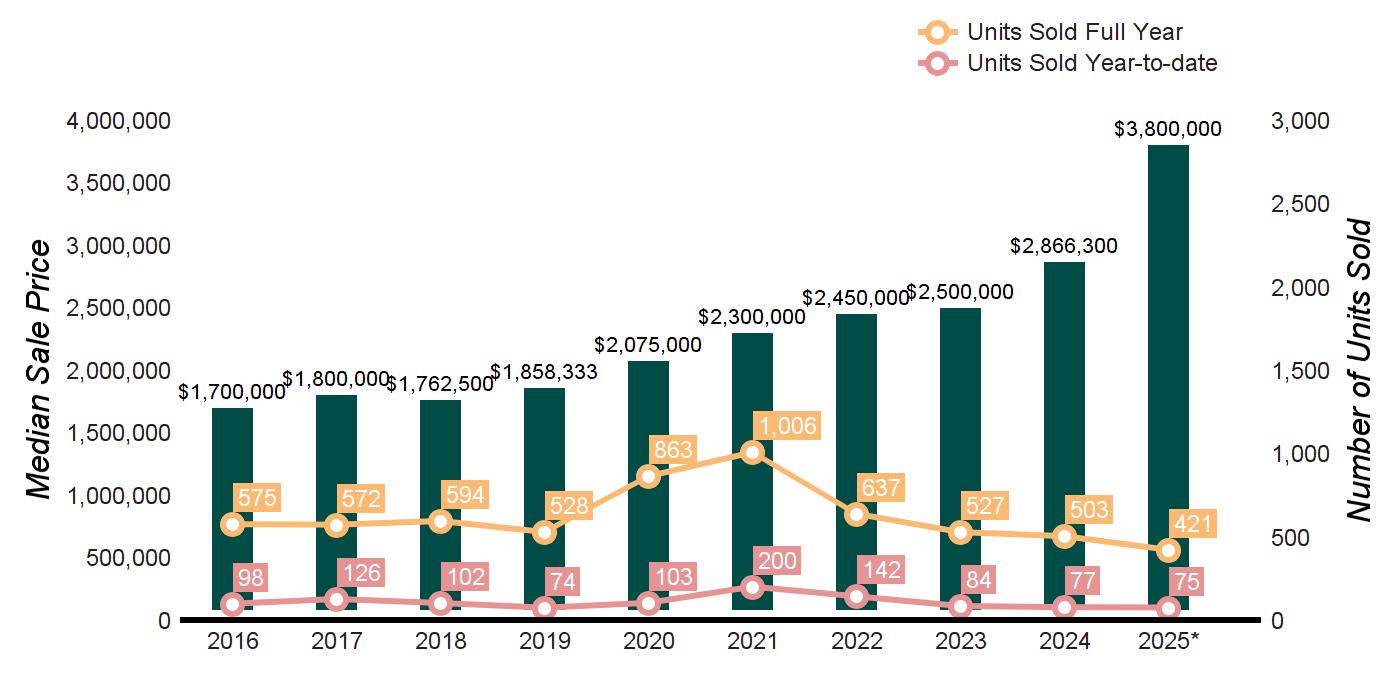

TEN-YEAR MARKET HISTORY

Source : Greenwich MLS, Residential / Single Family Homes * Homes sold for 2025 are annualized based on actual sales year-to-date

Demand Ratio Key 1-4: High Demand 5-6: Balanced 7-9: Low Demand 10+:

$10,000,000

Source : Greenwich MLS, Residential / Single Family Homes

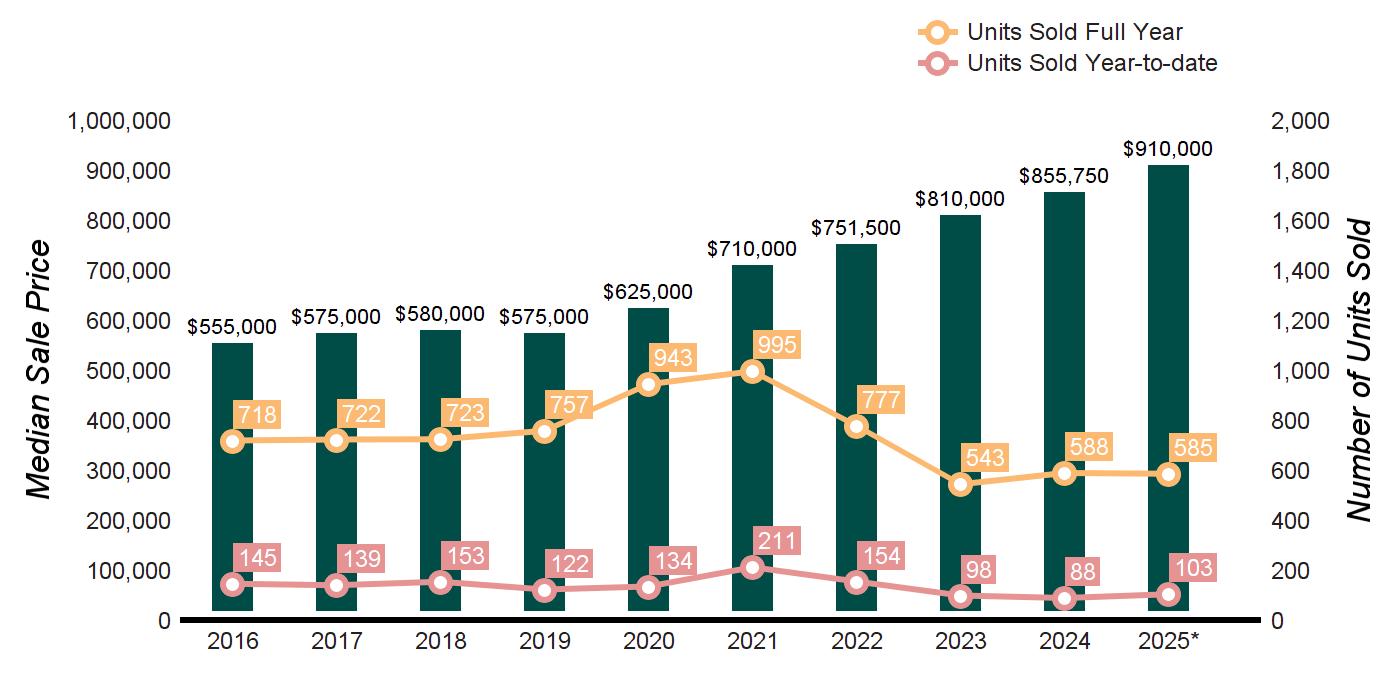

TEN-YEAR MARKET HISTORY

Source : Smart MLS, Single Family Homes

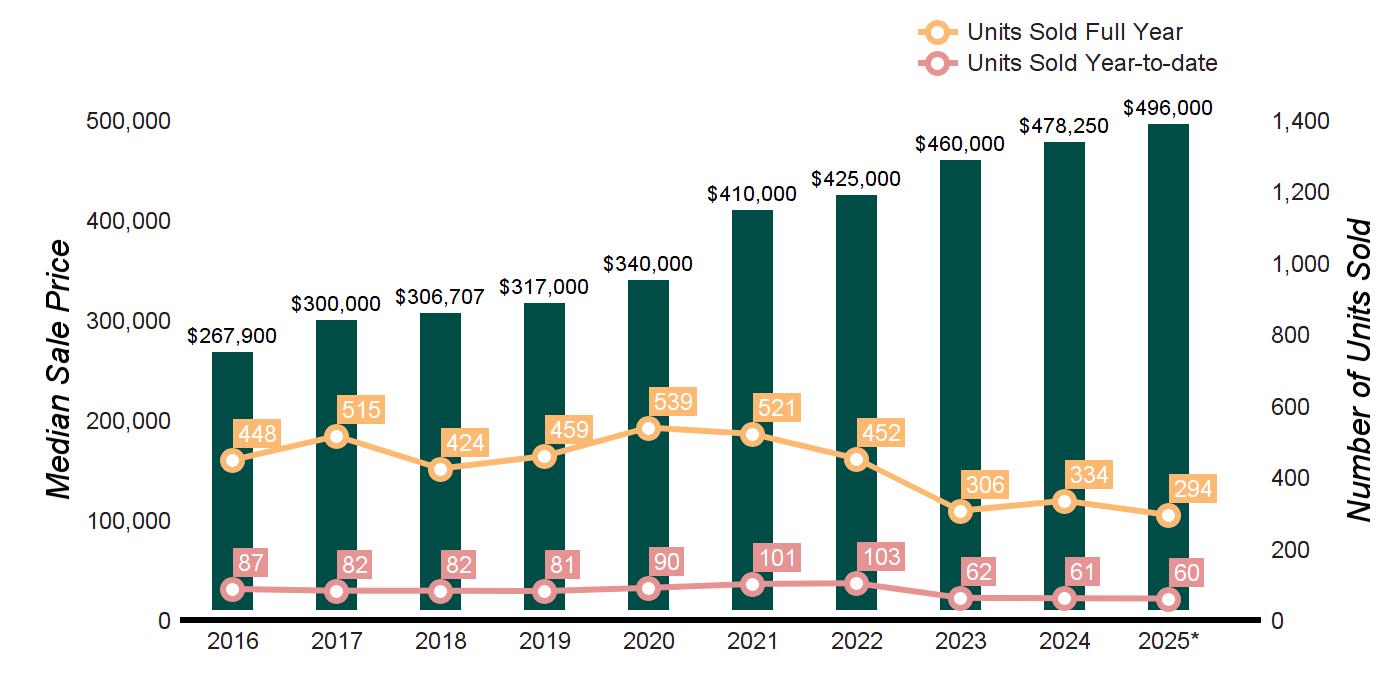

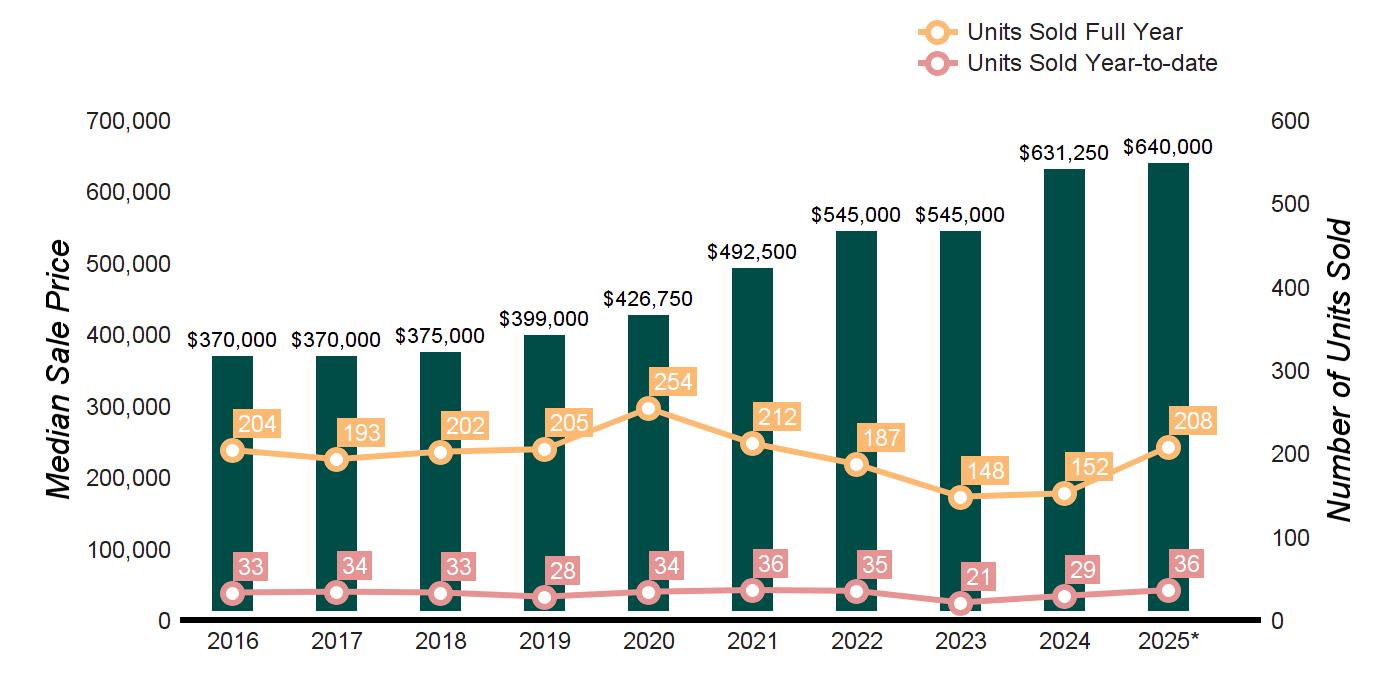

TEN-YEAR MARKET HISTORY

Source : Smart MLS, Single Family Homes * Homes sold for 2025are annualized based on the actual sales year-to-date

Source : Smart MLS, Single Family Homes

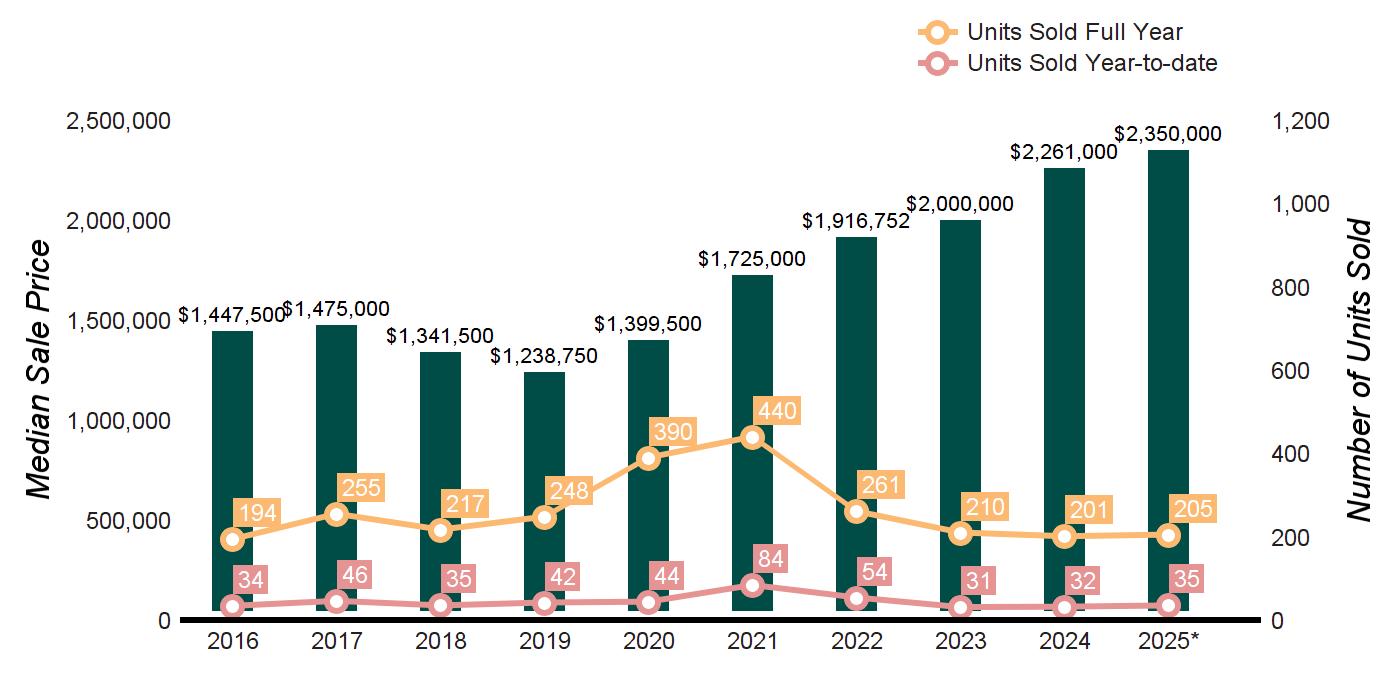

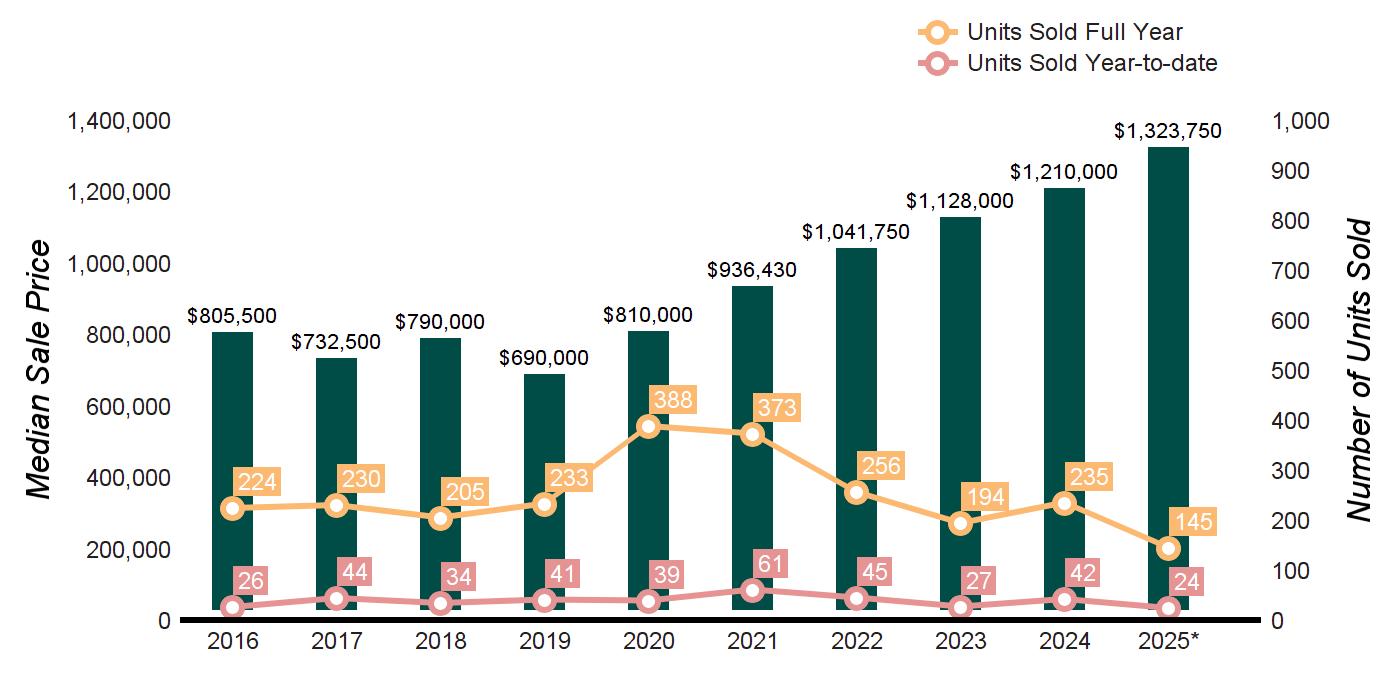

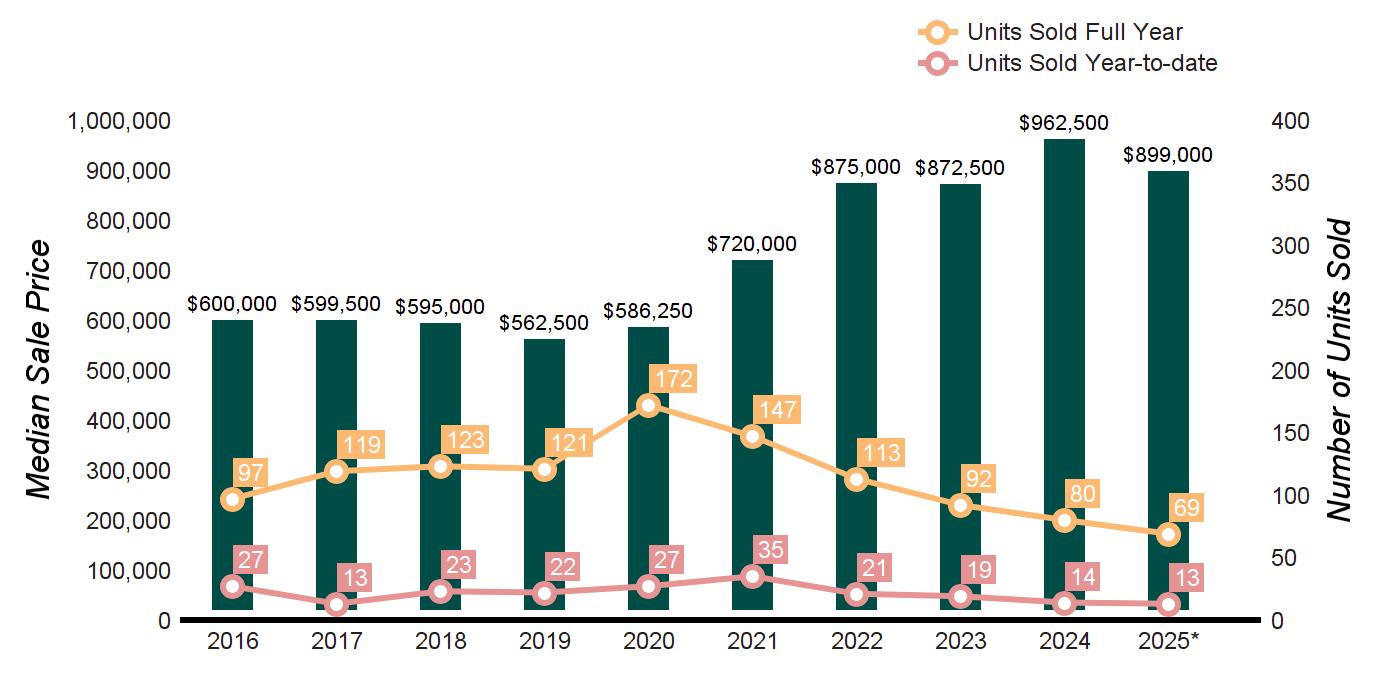

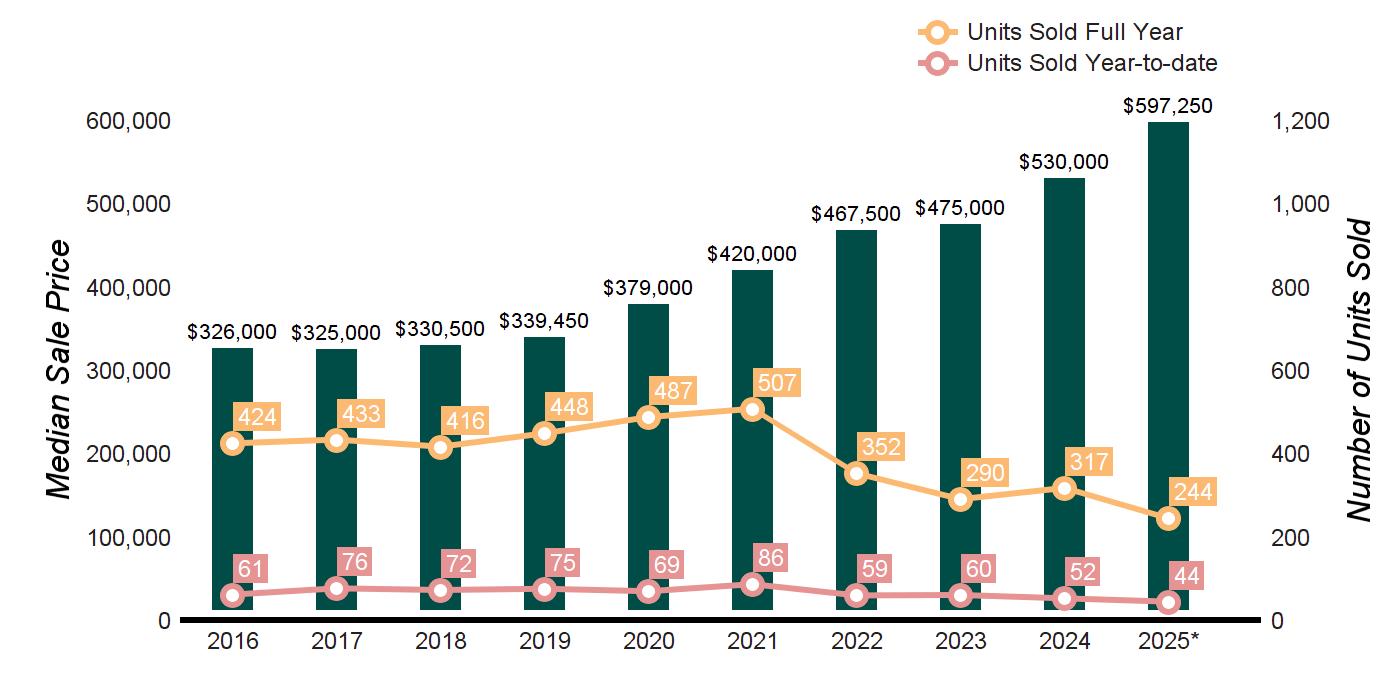

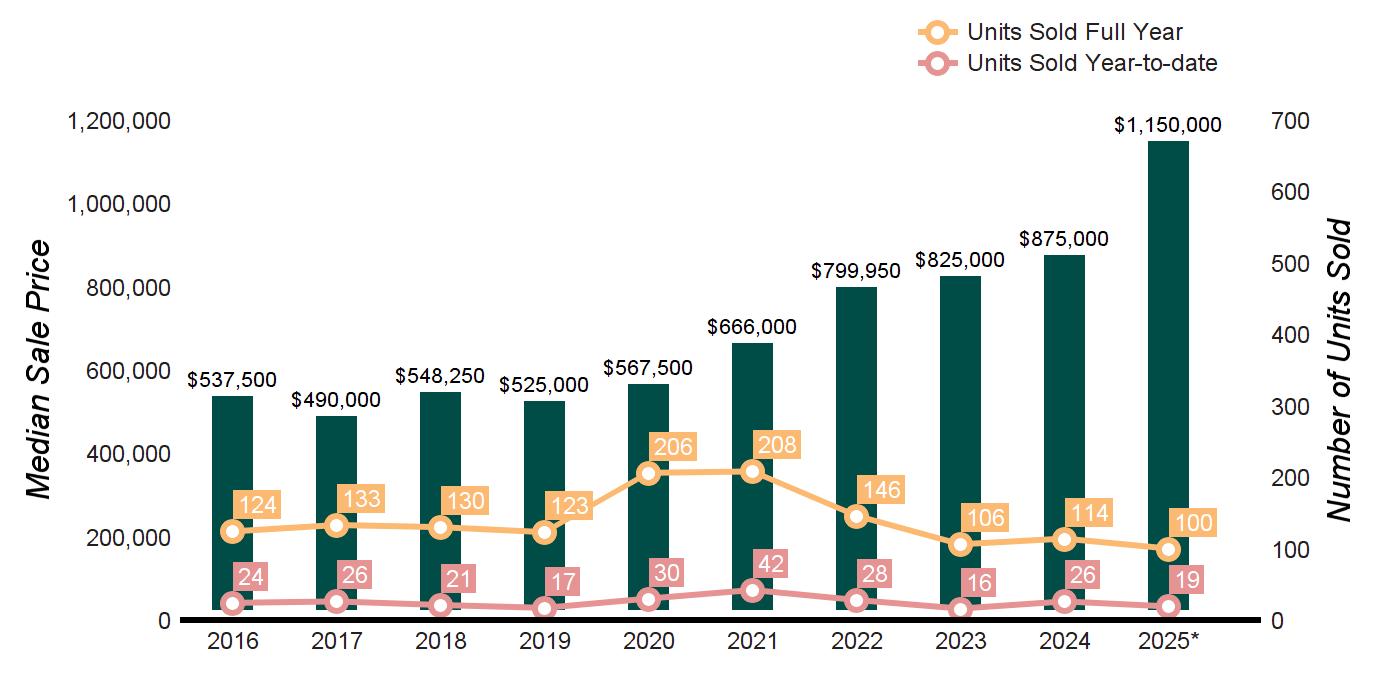

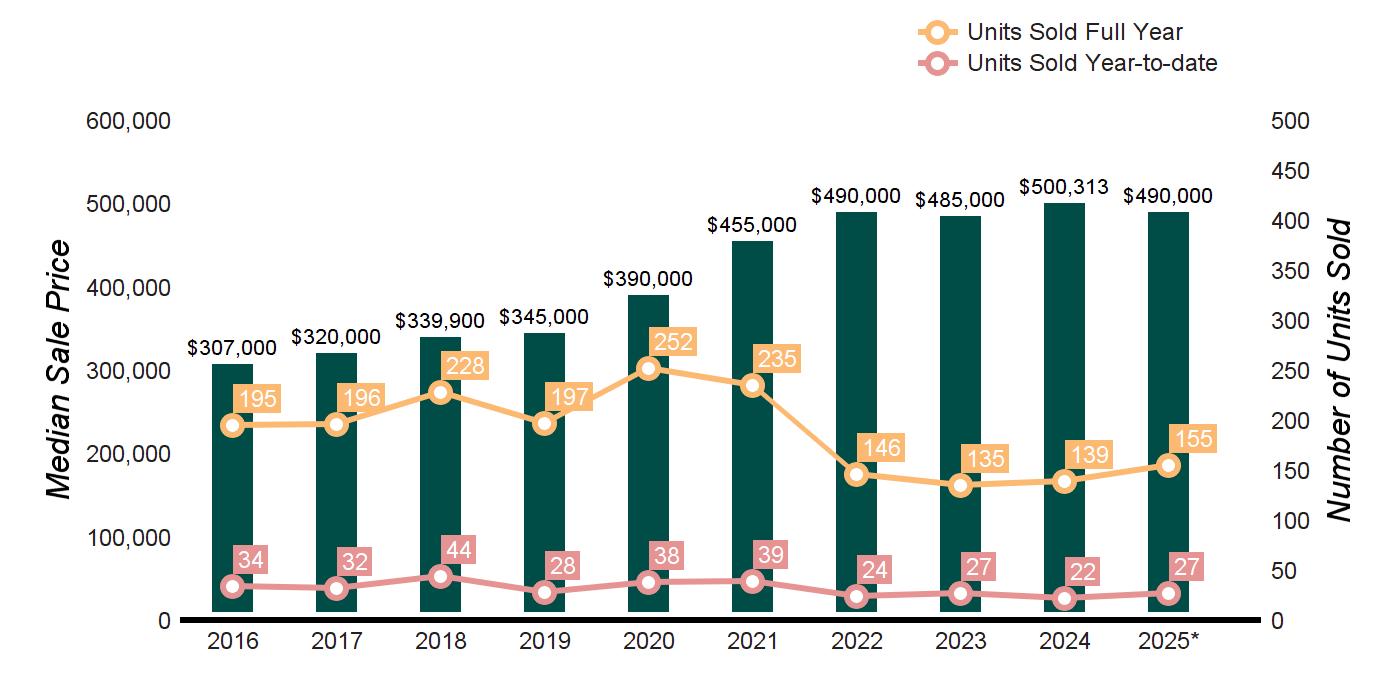

TEN-YEAR MARKET HISTORY

Source : Smart MLS, Single Family Homes * Homes sold for 2025are annualized based on the actual sales year-to-date

Source : Smart MLS, Single Family Homes

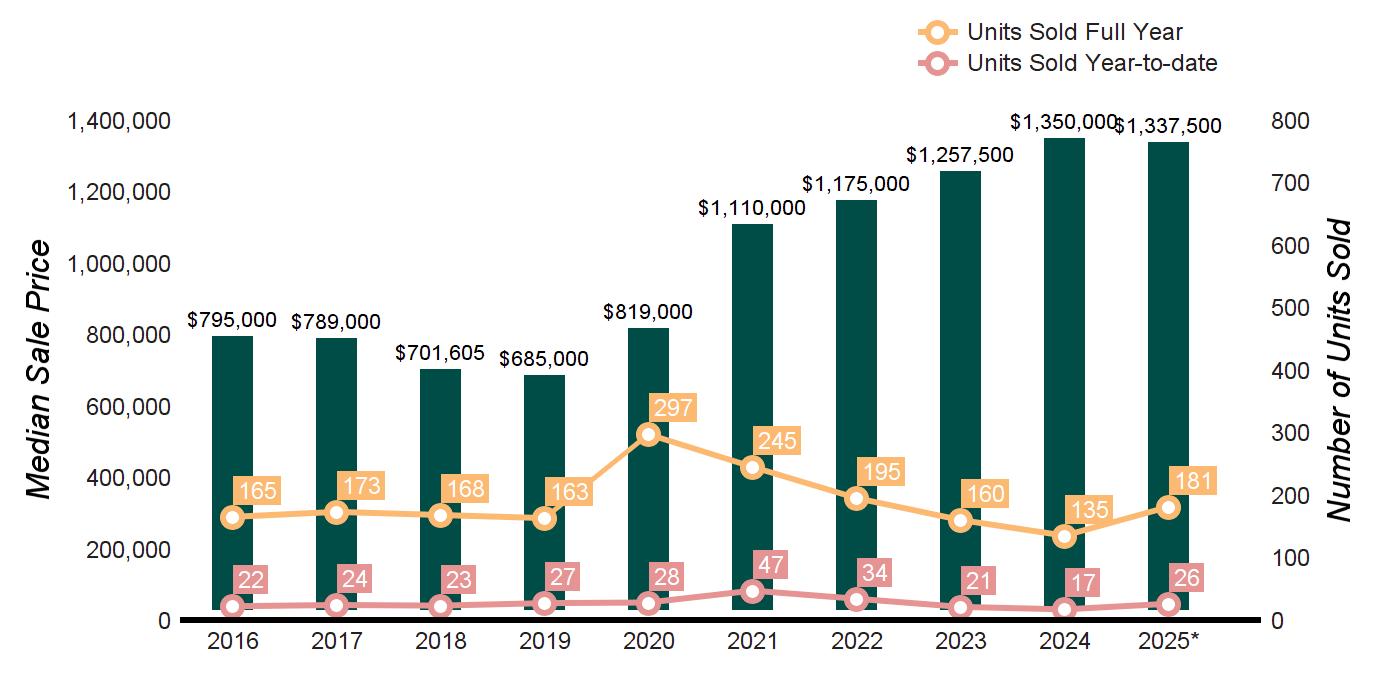

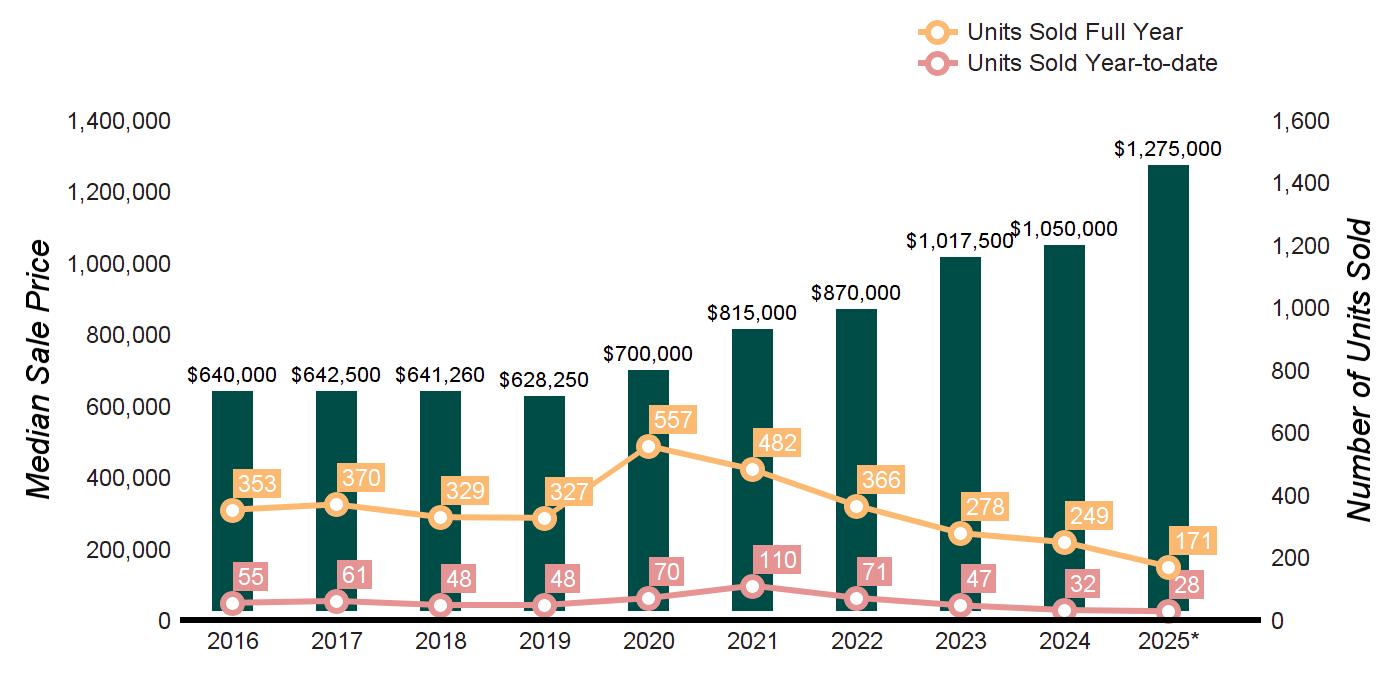

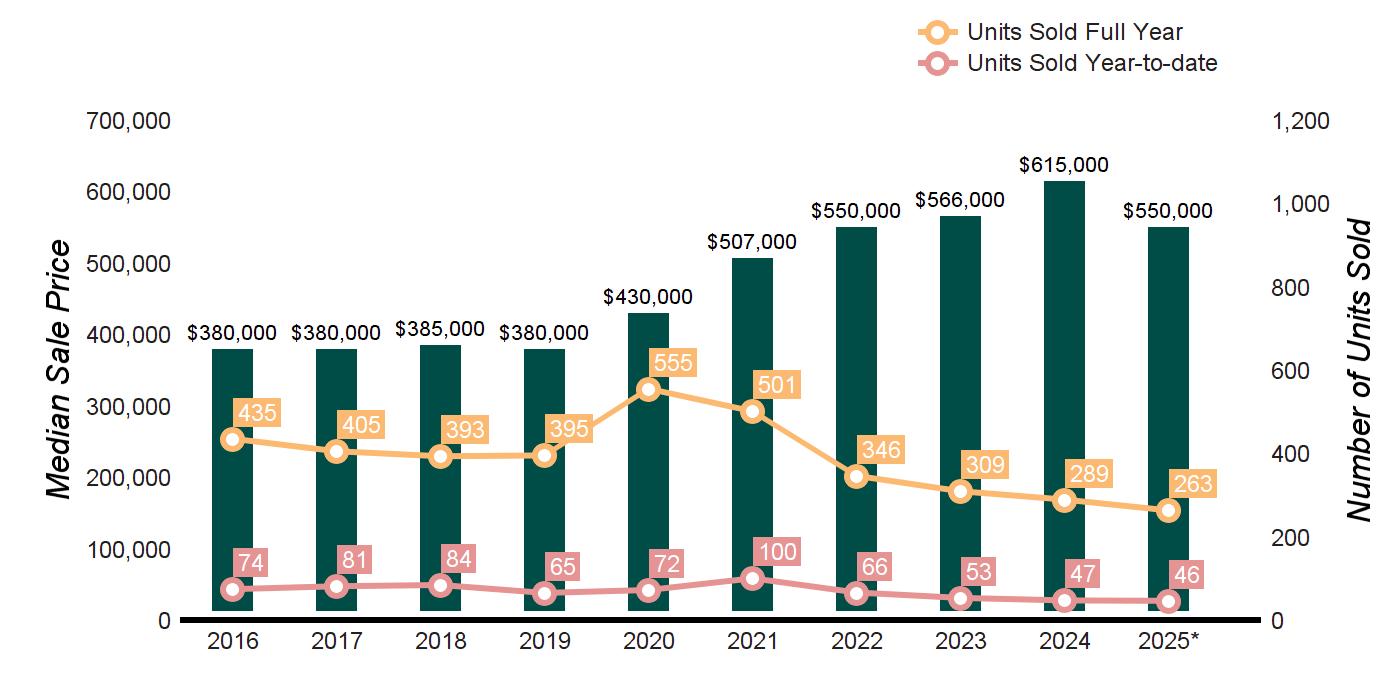

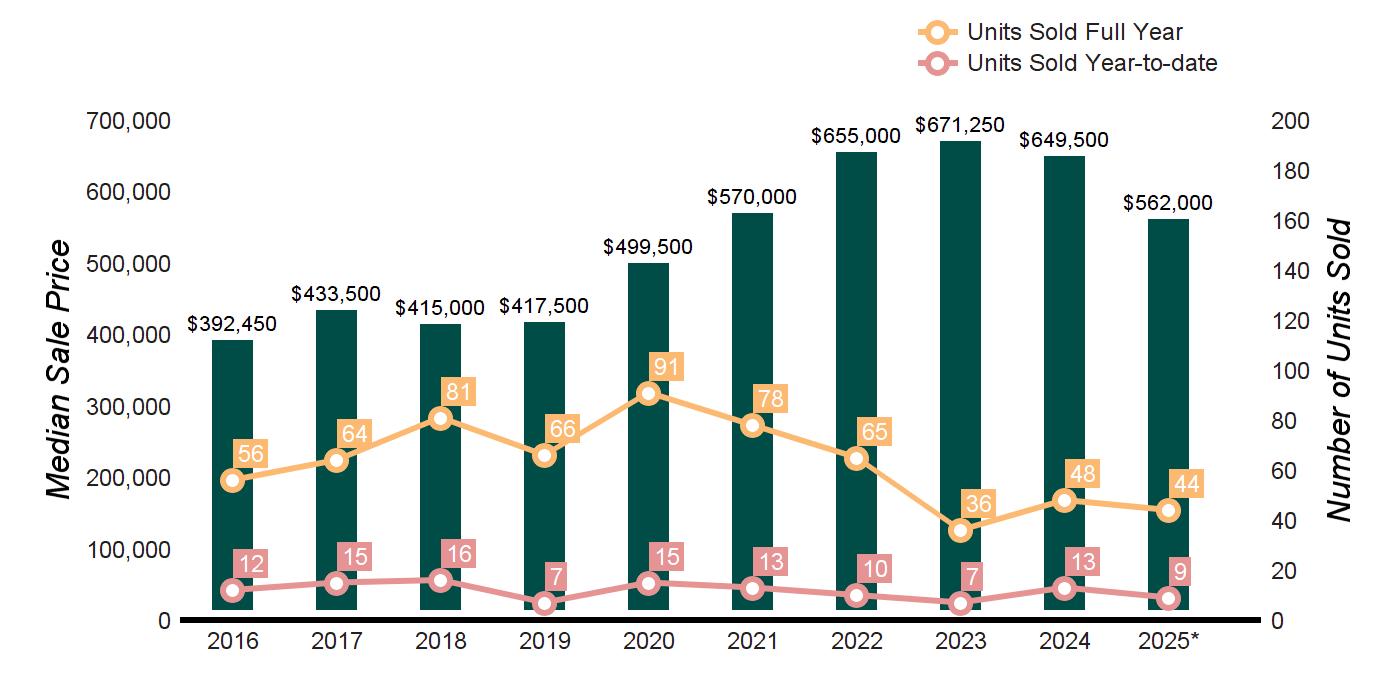

TEN-YEAR MARKET HISTORY

Source : Smart MLS, Single Family Homes

TEN-YEAR MARKET HISTORY

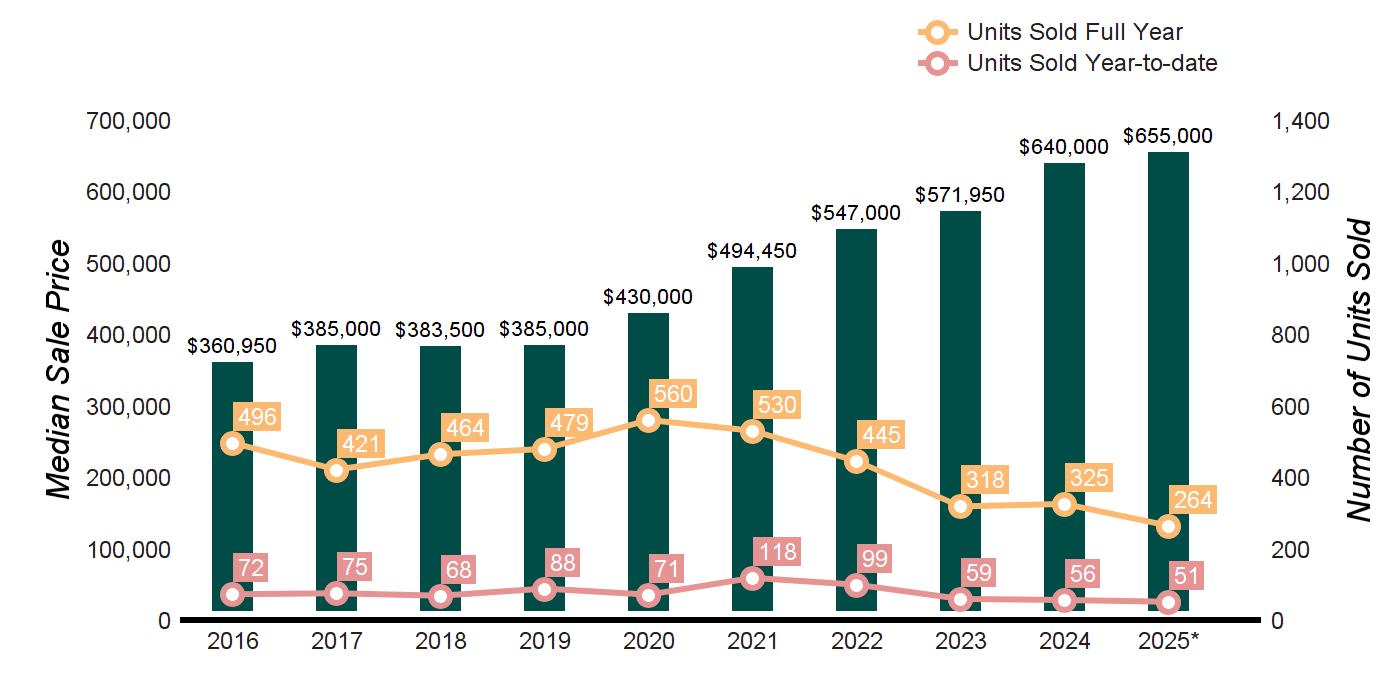

Source : Smart MLS, Single Family Homes * Homes sold for 2025are annualized based on the actual sales year-to-date

Source : Smart MLS, Single Family Homes

TEN-YEAR MARKET HISTORY

Source : Smart MLS, Single Family Homes

Source : Smart MLS, Single Family Homes

TEN-YEAR MARKET HISTORY

Source : Smart MLS, Single Family Homes

TEN-YEAR MARKET HISTORY

Source : Smart MLS, Single Family Homes

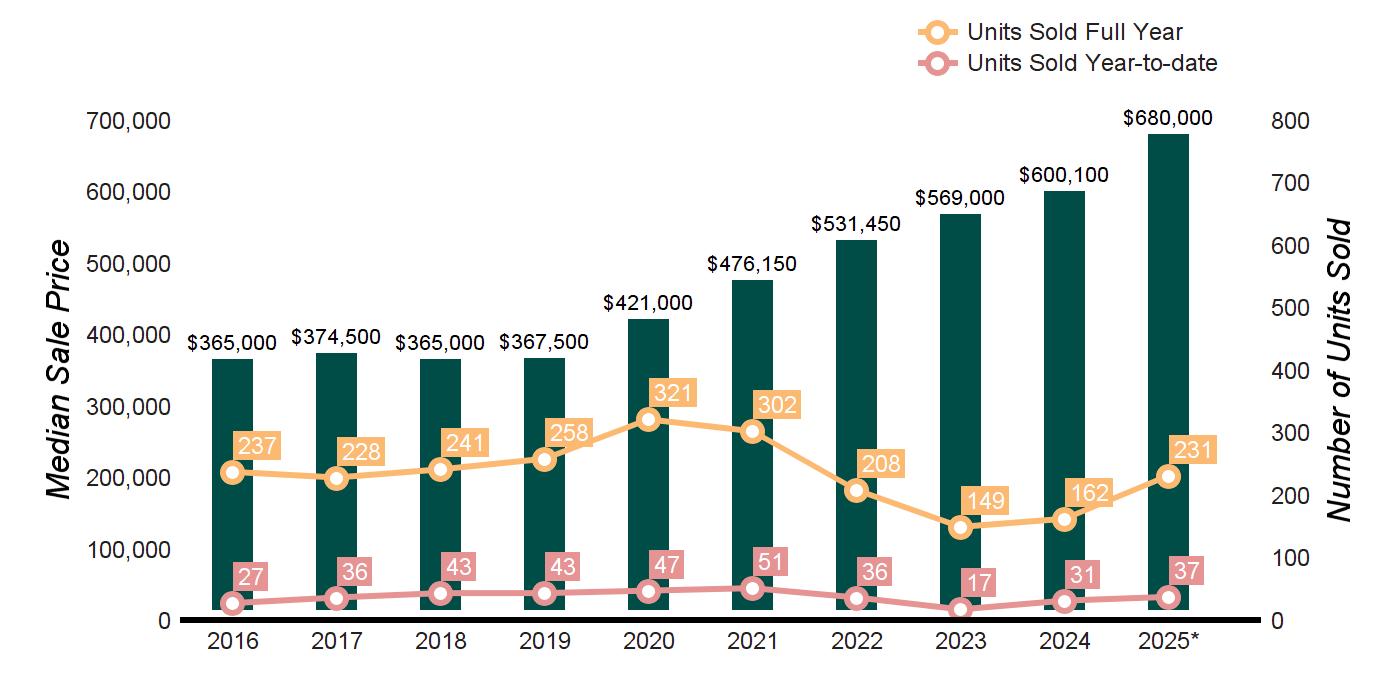

TEN-YEAR MARKET HISTORY

Source : Smart MLS, Single Family Homes * Homes sold for 2025are annualized based on the actual sales year-to-date

Source : Smart MLS, Single Family Homes

TEN-YEAR MARKET HISTORY

Source : Smart MLS, Single Family Homes

TEN-YEAR MARKET HISTORY

Source : Smart MLS, Single Family Homes

TEN-YEAR MARKET HISTORY

$2,000,000

Source : Smart MLS, Single Family Homes

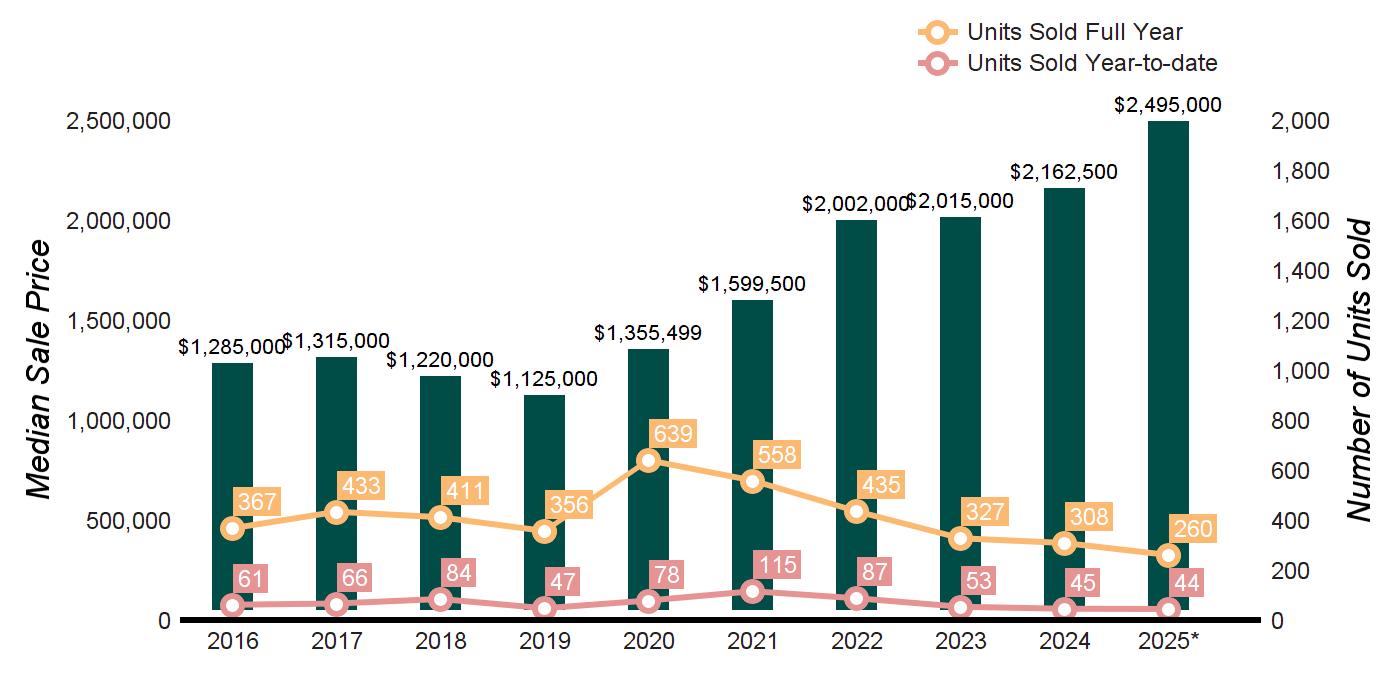

TEN-YEAR MARKET HISTORY

Source : Smart MLS, Single Family Homes

TEN-YEAR MARKET HISTORY

Source : Smart MLS, Single Family Homes * Homes sold for 2025are annualized based on the actual sales year-to-date

Source : Smart MLS, Single Family Homes

TEN-YEAR MARKET HISTORY

Source : Smart MLS, Single Family Homes

Source : Smart MLS, Single Family Homes

TEN-YEAR MARKET HISTORY

$2,000,000

Source : Smart MLS, Single Family Homes

TEN-YEAR MARKET HISTORY

Source : Smart MLS, Single Family Homes

TEN-YEAR MARKET HISTORY

$2,000,000

Source : Smart MLS, Single Family Homes

TEN-YEAR MARKET HISTORY

Source : Smart MLS, Single Family Homes

TEN-YEAR MARKET HISTORY

$2,000,000

Source : Smart MLS, Single Family Homes

TEN-YEAR MARKET HISTORY

Source : Smart MLS, Single Family Homes

TEN-YEAR MARKET HISTORY

Source : Smart MLS, Single Family Homes