VIBRANT FLAVOUR, REFRESHINGLY LIGHT.

CREDITS

PUBLISHER The Drinks Association

www.drinksassociation.com.au

All enquiries to:

The Drinks Association Locked Bag 4100, Chatswood NSW 2067 ABN 26 001 376 423

The views expressed in Drinks Trade are those of the respective contributors and are not necessarily those of the magazine or The Drinks Association. Copyright is held by The Drinks Association and reproduction in whole or in part, without prior consent, is not permitted.

EDITORIAL

PUBLISHING EDITOR Ashley Pini ashley@hipmedia.com.au

EDITOR Melissa Parker melissa@hipmedia.com.au

DIGITAL EDITOR Ioni Doherty ionid@drinks.asn.au

STAFF WRITER Cody Profaca cody@hipmedia.com.au

CONTRIBUTORS Caroline Ashford

DESIGN

SENIOR DESIGNER Jihee Park jihee@hipmedia.com.au

ADVERTISING

NATIONAL SALES MANAGER Jenny Park jenny@hipmedia.com.au

PRODUCTION MANAGER Sasha Falloon .........sasha@hipmedia.com.au

Produced and contract published by:

ACCOUNTS: accounts@hipmedia.com.au

For new product or current releases in Drinks Trade magazine send a sample to:

HIP Media

12 Cudgee Street, Turramurra NSW 2074 www.hipmedia.com.au | facebook.com/drinksmedia ABN: 42 126 291 914

Living in the southern hemisphere means summer in Australia coincides with the festive season and the new year. That’s a triple whammy for the Australian liquor industry. The heat calls for copious amounts of cold refreshments, the holiday season says relax, enjoy your favourite tipple, and your well-earned time off, while the new year prompts us to contemplate the year that was and anticipate the one ahead. And we can only do that with a glass of Champagne or a cocktail.

To celebrate summer, we look at three beverage categories that beautifully slot into our lives in the warmer months – Pale Ale, Gin and Ready to Drink. On page 24, Cody Profaca’s Pale Ale piece advises which products should already be on your radar and those you should be adding to your pale ale repertoire and ranges.

As for Ready to Drinks, they have been transitioning from UDL to seltzer to the premium bottled signature cocktail. We are calling it the RTD renaissance. We are not suggesting they ever went out of fashion, but there was something about endless lockdowns and the loss of time at the local bar with our favourite mixologist that had us turning to premium RTDs. Turn to page 30 for the latest on this ever-evolving category.

We all love a long summertime G&T, and Australia produces some of the best gin in the world. Caroline Ashford, aka The Gin Queen, reports on where the gin category in Australia is heading and whether the gin bubble is being muscled off its top spot by other white spirits such as Agave. Read her revealing story on page 38.

Drinking in the heat and the sun is never a good idea. Just add this to the plethora of good reasons why the burgeoning non-alc category is just that. This booming sector is proving to be something of a reckoning for the drinks industry. It reflects society’s sentiment toward sober curiosity and the increasing obsession with health as wealth. We look at the many faces of zero alcohol on page 46.

Publishing Editor, Ashley Pini speaks with the managing director of Lion Australia, David Smith to discuss about the direction he is taking the business, from its many exciting and iconic brands to its position as one of the liquor industry’s most progressive companies. Read the interview on page 20.

Finally, we tasted some delicious Grenache samples and asked, is this wonderful Southern Rhône variety the new Pinot Noir? (page 61).

You will have noticed that this copy of Drinks Trade was delivered with your edition of our Annual Drinks Guide. First published in 1976 in its then guise as Thomson’s Guide, the Drinks Guide still proves a valuable tool for the liquor industry and one we are proud to continue. It’s a damn lot of hard work, but worth every page for the value it provides.

As we say goodbye to 2022, the team at Drinks Trade wish you all a prosperous and happy new year.

Melissa melissa@hipmedia.com.au @drinkswithmelparker

REFRESHINGLY PERFECT

PATRÓN MARGARITAS

THE PERFECT WAY TO ENJOY PATRÓN IS RESPONSIBLY. PATRÓN, ITS TRADE DRESS AND THE BEE LOGO ARE TRADEMARKS.

THE PERFECT WAY TO ENJOY PATRÓN IS RESPONSIBLY. PATRÓN, ITS TRADE DRESS AND THE BEE LOGO ARE TRADEMARKS.

Available at all good liquor stores. For more information contact your [yellow tail] Representative.

*Compared to [yellow tail] Shiraz, Sparkling, and Chardonnay.

Paramount Conference Connecting Distributors and Retailers

In mid-October, Byron Bay bore witness to more than 100 of the sharpest minds in Australia’s liquor industry for a few days of learning, motivation, recognition, and celebration.

Key moments included Michael McQueen’s speech about AI’s likely impact on the drinks industry over the coming five years, the on-premise panel discussion, and the interactive game show segment: think spending a day in the shoes of a delivery driver. A second panel dissected trends in technology, sustainability, flavour, and premiumisation.

Paramount is Australia’s largest family-owned on-premise liquor wholesaler and carries over 11,000 products across beer, wine, spirits and non-alcoholic drinks. The conference also discussed Paramount’s recently launched Evolution Rewards program that allows businesses to accumulate points for every dollar spent: an industry first.

Roll With It

Coopers, Australia’s largest family-owned brewery, is rolling into 2023 with a new campaign to ‘bring back the roll.’

The process of rolling a Coopers product— whether a keg, bottle, or can—before opening is a longstanding tradition that best incorporates the beer’s natural sediment, resulting in a cloudy pour that reaches its full flavour potential. Coopers is afraid its consumers have become less aware of this useful technique.

The sediment is a natural biproduct of Coopers’ secondary in bottle fermentation, a process that better retains the beers’ flavour profile and eliminates any need for pasteurisation. In addition to this, it also extends shelf life.

The integrated digital and social media campaign will run over summer and includes a short film and augmented reality game; prizes are up for grabs for anyone who can nail the perfect virtual roll.

Mumm Tasmania: Champagne Down Under

Meet Australia: the world’s sixth largest Champagne market. Now meet Maison Mumm: Pernod Ricard’s flagship Champagne house, pretty much a household name in Australia. Fresh off the back of the recently launched Marlborough Brut Prestige, Mumm has added a new edition to its Terroir Series range with the launch of Mumm Tasmania Brut Prestige. The result of close collaboration between Pernod Ricard sparkling winemaker Trina Smith and G.H. Mumm Chef de Caves Laurent Fresnet, the new release takes cues from their collective experience to create a product that embodies the Tasmanian terroir. “With Mumm Tasmania, we are revealing a new expression of Pinot Noir, with the same quest for the utmost quality, and in line with Maison Mumm’s style,” Fresnet said. Smith says most of the grapes will be sourced from Tasmania’s Northern Rivers area. It is now available nationally at an RRP of $40.

Great Taste. Low Carbs.

Taittinger’s Limited Edition Sparkling

Available nationwide exclusively through Emperor, the limited-edition sparkling retails for $129 and aims to capitalise on the rare occurrence of a World Cup taking place during Australia’s summer. With Australia being the world’s sixth largest Champagne consumer and proudly sport-fanatical, Emperor Champagne CEO Kyla Kirkpatrick is expecting a lot of demand for the new product.

“The timing of the special FIFA World Cup edition Champagne release from Taittinger is perfect with summer around the corner and the silly season in full swing!

While a first for Emperor, 2022 marks the third consecutive partnership between footballs biggest stage and the largest family-owned Champagne house, firmly cementing Taittinger as ‘the Champagne of the World Cup.’ Managing Director Clover Taittinger, an avid soccer fan, believes the partnership is an important opportunity for brand growth and recognition.

“This is our third cycle partnership with FIFA™ and for Champagne Taittinger, it is a big honour and mark of trust to be affiliated with a major global tournament. Football is part of our universal culture and it brings people together. Every bubble carries a dose of emotion.” Kirkpatrick advises interested parties to get in quick before the limited run sells out.

“We have a limited allocation of 2500 bottles of the Special Release FIFA edition Champagne in Australia, so it won’t go far!

“Some Champagne lovers may choose to cellar the Champagne and ultimately keep the collection as they are released over time with each [World] Cup.”

Home to the largest Champagne collection in the Southern Hemisphere, Emperor functions as both a direct-to-consumer eCommerce destination alongside distributing to retailers. “Emperor Champagne is unique in the market in that we are Champagne specialists. We have our own climate-controlled state of the art storage facilities, our own in-house marketing and design teams and a huge database of Champagne lovers. You will see more limited and rare release campaigns coming from Emperor, this year and beyond. We have some very exciting releases coming up.”

The Taittinger Brut Réserve FIFA World Cup 2022 edition is available at www. emperorchampagne.com.au .

The Balvenie x Lennox Hastie

The Balvenie whisky, from the house of William Grant and Sons, brought together members of the trade, bartenders and media, to enjoy an evening of paired whisky and food made by renowned chef, Lennox Hastie of Firedoor Restaurant in Sydney.

Masterfully emceed by Creative Collaborations Lead, Ross Blainey, the event brought together a whisky and a chef that both have an enduring passion for their craft. The food prepared by Hastie was cooked using staves from two Balvenie casks, transported from Scotland for the evening and infusing the fivecourse degustation with flavours normally reserved for those enjoying one of the Balvenie range.

Pick of the evening: the Kangaroo dish paired with Balvenie DoubleWood 12 Year Old. Pick of The Balvenie range: the Caribbean Cask 14 Year Old.

Lark Distilling Co Appoints Satya Sharma as CEO

Lark Distilling Co has announced Satya Sharma, currently the Regional Managing Director South East Asia and Australasia for William Grant & Sons, as their new CEO, effective from May 1, 2023.

The fulfillment of this role has been a critical objective for the business, which celebrated turning 30 earlier this year with an industry wide event held in Hobart. The company’s current interim Managing Director, Laura McBain, will continue to serve as interim CEO until May 1, 2023, following which she will remain as a Non-Executive Director.

LARK Chair, David Dearie, said, “This is an exciting new phase in the company’s growth. The board has been working on CEO succession, and we are delighted to secure a CEO of Satya’s calibre and experience to lead the company through its next phase of growth and expansion. Mr Sharma was recently honoured as a Keeper of the Quaich for his services to the Scotch Whisky industry.

Free “Phy-gital” Alsace Wine Trade Show for Wine Professionals

February 27, February 28, and March 1 of 2023 are dates all wine professionals worldwide should be scratching into their calendars as the largest “phy-gital” wine trade show organised by an appellation makes its return.

The inaugural Millésimes Alsace Digitasting took place in 2021 and involved more than 10,000 tasting boxes distributed to more than 4,000 visitors across 55 countries. The event is an opportunity to better understand France’s Eastern-most region, and all Australian wine professionals are eligible to select five tasting boxes of four 30mL samples from producers they would like to try. In addition to these, DigiTasting will automatically include two ‘discovery boxes’ and a ‘so trendy’ box.

Live masterclasses will be conducted by leading industry and Alsace professionals across two compatible time zones and will explore current trends. Partakers can also schedule virtual meetings with any other producer present at the show.

The samples are kept fresh by unique technology developed by DigiTasting in 2021 with the help of l’Institut Français de la Vigne et du Vin (The French Institute of Vine and Wine) and independent laboratories.

To register, visit www.millesimes-alsace. com/ (strictly wine trade professionals only). Tasting boxes will be delivered free of charge.

BrewDog Unleashes Sydney Venue

If you’re down at the pub and hear wolves howling don’t be alarmed: BrewDog has just announced the opening of their first Sydney venue. Set to be unveiled to the public on the 2nd of December, expect growing BrewDog brand presence nationwide both in on-premise and off-premise settings. The $3.2 million venue follows the success of BrewDog Brisbane, opened in 2019, and is expected to quickly become a hallmark of Sydney’s craft beer circuit. Set in the iconic Locomotive Workshop in Sydney’s South Eveleigh precinct, the venue intermingles antique machinery with bold neon signs, polished concrete floors, industrial-styled lighting, and an eclectic mix of seating spaces. The venue will accommodate 720 patrons inside and 190 outside. BrewDog already operates more than 100 bars across 60 countries and was the world’s first carbon neutral brewery, following their mission to be recognised as a leading symbol of sustainability in the drinks category.

Environmental Excellence Awards: Taylors Wins Large Winery Category

Despite having a relatively low carbon footprint compared to other agricultural practices, it is refreshing to see the wine industry continually pushing to become greener.

The South Australian Wine Industry Association’s Environmental Excellence Awards are hosted at its annual luncheon to celebrate industry leaders in sustainable innovations. Category winners include Taylors (Large Winery), Henschke (Small-Medium Winery Category), and Treasury Wine Estates and Hayes Family Wines (joint Viticulture Category). Family winery Taylors won its category ahead of finalists Pernod Ricard, Treasury Wine Estates, and Accolade Wines. Third generation Winemaker and Managing Director Mitchell Taylor says he is proud to support a business with a “passion for leaving our land and the planet in a better place than before.”

“We also commend all the other finalists and winners at this year’s awards. It’s a testament to our industry leaders who recognise this issue’s importance and the scale of work that needs to take place to create change.”

The SAWIA awards recognised Taylors for its emissions reduction targets and results, its environmental management systems implementation, its use of low-carbon flat EcoBottles, and its active involvement in the conservation of the endangered White’s seahorse found in Sydney Harbour.

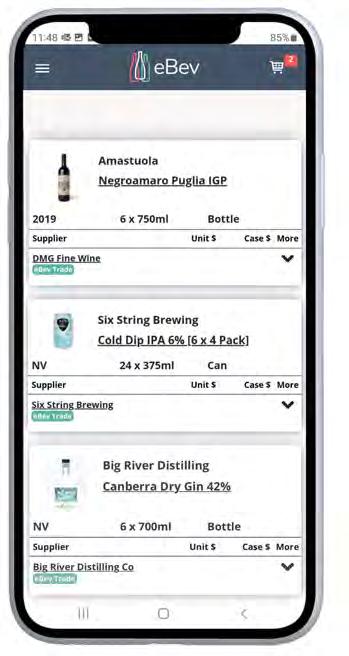

FROM 3 HOURS A WEEK TO 16 MINS – REDUCE YOUR ORDERING TIME BY 91%

THE EBEV ORDERING AND INVOICING PLATFORM IS WELL KNOWN FOR ITS STREAMLINING OF BOTH SIDES OF THE WHOLESALE DRINKS BUSINESS. AS WE END THE YEAR, WE SHINE THE LIGHT ON ONE OF OUR ORIGINAL FUNCTIONS AS IT IS SO RELEVANT IN THE HOSPITALITY INDUSTRY RIGHT NOW, THAT OF WEEKLY ORDER TIME SAVINGS.

If you have to do the weekly beverage ordering, you know the issues. From time consuming stocktake, logging onto multiple order portals, sending emails to your suppliers just to get those orders in. eBev is the original order consolidator, you can order everything from one platform, yes even kegged beers from CUB and mixers from ALM, its all in the platform.

Better yet, the system holds all previous orders, meaning a few clicks to reorder and you are done. Have a new staff member taking over the purchasing? No problem, all your previous orders, sales rep contacts and unique pricing is all there for your new team member.

Efficiency is the name of game, not only can you reduce your order time, saving valuable staff resources, but as all invoicing is done by eBev and we integrate with most accounting and FOH systems, numerous manual data entry tasks are removed too.

As part of a project to ensure our venues are getting the most from their ordering experience with eBev, we have done a study on the time taken on ordering and venue benefits. In this we looked at over 250 pubs and restaurants of all shapes and sizes. Pre-eBev it took a dedicated staff member three hours a week just to do the ordering, (stock take not included), with eBev this reduced to 16 mins. That’s 142 hours a year or 19 days of staff time saved, the savings mount up quickly. When you add to this the digital invoicing through to the POS, there are another two hours per week of savings.In a time when resourcing is stretched and scarce, eBev can make your hospitality or off-premise business significantly more efficient.

Contact us at admin@ebev.com or 1300 556 081

Bacardi Limited Preparing for a Summer of Cocktails

Bacardi Limited’s premium vodka brand GREY GOOSE is rolling into Australia’s summer with the release of the Essences range in three flavours: Strawberry and Lemongrass, Watermelon & Basil, and White Peach & Rosemary.

The botanically infused spirits are made using real fruit picked at peak freshness, resulting in pure non-confected flavours begging for cocktail use. The GREY GOOSE Essences Spritz is one such example, mixing 3 parts tonic and 1 part Essences vodka for an effortlessly refreshing summer drink made possible by the quality of the spirit. More adventurous bartenders will enjoy the flexibility offered by the range, whilst vodka purists will enjoy drinking the spirit neat over ice or with soda water. GREY GOOSE has a multitude of recipes published on their website.

Essences is one of the first super-premium flavoured spirits to land in the Australian market, where GREY GOOSE has long been a leading vodka brand. Low in calories and gluten free, Bacardi Limited expect their flagship flavoured vodka range to adapt effortlessly to many Australian occasions from picnics and backyard barbecues through to rooftop drinks.

The Essences range hits the shelves at $73.99 with an abv of 30%.

In addition to spritzes, Bacardi Limited is preparing for a summer of Tequila cocktails with Patrón’s ‘Refreshingly Perfect Margarita’. All about easy to make cocktails (three or fewer ingredients), the campaign will inform about Tequila’s flexibility as a base in refreshing summertime cocktails and includes a cocktail recipe database published to Patrón’s website.

To learn more visit https://www.patrontequila.com/cocktails

Magic? More-ish? … Masterful – The Macallan M Collection

The Macallan is widely considered Speyside’s most consistent producer of high-quality single malt scotch. Hence, it is no surprise the release of their coveted Masters Decanter Series is once again causing a stir in the mash bill of whisky afficionados worldwide.

The three-bottle flagship release is a celebration of The Macallan’s six defining pillars: Natural Colour, Mastery, Curiously Small Spirit Stills, The Estate, Exceptional Oak Casks and Sherry Seasoning. In addition to the returning M and M Black is the all new Macallan M Copper: an ode to the famously small stills used. Macallan, founded in 1824, resisted the industry’s shift to larger, higher production copper stills in order to maintain their focus on quality. Pouring a vibrant gold, M Copper has a buttery, viscous mouthfeel and is bursting with fruitiness and sweet malt flavours. It presents in a handcrafted Lalique copper coloured crystal decanter that oozes opulence.

Also in the line-up are the M 2022—a celebration of sherry oak casks—and the M Black—a celebration of mastery using rare, black ended casks that once held peated spirit.

The Macallan Masters Collection is a unification of three masters of their trades: Fabien Baron is a master crystal maker and creative director, Nick Knight is a master photographer and filmmaker, and the whisky making team headed by Kirsteen Campbell are the best at their craft. The Macallan M retails for US$6,750, the Macallan M Black at US$7,600, and the Macallan M Copper at US$8,500.

Tempus Two launches popup gin and wine bar at Melbourne’s David Jones

Iconic Hunter Valley wine brand, Tempus Two has launched a unique pop-up bar at Melbourne’s flagship David Jones for shoppers to experience over the festive period. Open Wednesday to Sunday, the ‘Go Beyond’ gin and wine bar on level one of the new-look department store will serve Tempus Two gin-based cocktails and Copper series wines, as well as a cold, hot and dessert menu designed for sharing and pairing.

The innovative wine brand expanded into spirits in May with its Copper series gin range including a world first Prosecco Gin, a Shiraz Gin and Wild Botanical Gin. The wine brand creatively repurposed the alcohol extracted from their lower-alcohol range to create spirit.

Open on level one of David Jones Bourke Street, Melbourne until early 2023. Opening hours: Wednesday (11am-6pm), Thursday (11am- 8.30pm), Friday (11am-8.30pm), Saturday (11am-6pm), Sunday (11am-6pm).

Benriach The Twelve

Creating the Twelve, Rachel Barrie says she was looking to make a whisky that was “refined and rich, and incredibly smooth.” To do that she has used three different cask matured whiskies: Sherry Cask, Bourbon Cask and Port Cask. These are fused together creating layers of flavours from each; big fruits and a honeyed character from the Sherry casks, a creamy elegance from the Bourbon, and forest fruit characters from the Port. When asked what the master blender herself thinks about as she enjoys the fruits of her labour, Barrie said, “I imagine a beautiful day at Benriach, eating a wonderful forest fruit cake with a little cup of caramel macchiato. Just like the richness of the Sherry casks combined with the Port and the creaminess of the Bourbon, so I hope that people will enjoy that experience too.”

We did. Thank you, Rachel.

Benriach The Twelve retails at $90 and has an abv of 46%. A non-peated whisky, expect a honeyed nose and bright forest fruits coming through with a touch of cocoa.

The palate builds on this with more cocoa and nutmeg, baked fruits, pineapple, and orange before spiciness and hazelnut on the finish. Put simply, a multilayered gem.

without compromise, featuring Four Pillars, Regal Rogue, Casa Orendain, Crawley’s Syrups, Broken Bean, Oscar 697 and Select Aperitivo

Phone: Orders: Socials:

1300DRINKS orders@vanguardluxurybrands.com @moderncocktailco

THE HAHN REFRESH:

Lion Championing Australia’s Original Low-Carb Beer

LEADING AUSTRALIAN BREWER LION HAS ANNOUNCED ITS FIRST BRAND CAMPAIGN IN A NUMBER OF YEARS TO REFRESH THE INNOVATIVE HAHN BRAND. THE MULTI-CHANNEL MEDIA CAMPAIGN WILL RUN ACROSS TV, RADIO, OUTDOOR AND DIGITAL CHANNELS, AND THROUGH VARIOUS TO-BE-DETERMINED SPONSORSHIPS, INCLUDING A PARTNERSHIP WITH SYDNEY’S CITY 2 SURF.

The program will coincide with a major packaging update that aims to reinforce Hahn’s reputation as being a beer with both low carbs and great taste.

“Our campaign taps into several ‘win-win’ moments; Hahn, a beer which is both low-carb, yet doesn’t compromise on taste whatsoever,” said Hahn Brand Director Ed Jamison.

The brand campaign comes at a time when Australian consumers are increasingly seeking out lower carb options. Hahn has

undeniably established itself as Australia’s go-to beer in this category, offering midstrength, gluten-free and light alternatives.

The Great Taste, Low Carb, How Good campaign will be rolled out nationwide by Sydney’s Thinkerbell Creative Agency.

“The work will connect with Australian drinkers increasingly keen to find more mindful beverage choices.”

Sydney-based Lion is one of Australia’s most important beverage companies. With

a history dating back more than 180 years, Lion has been at the forefront of brewing innovation for multiple generations, including recently becoming the first largescale carbon neutral brewer in Australasia.

Its core beer portfolio includes brands such as XXXX, James Boag, Tooheys, Little Creatures, and James Squire, to name a few. In September last year, Lion also acquired the Fermentum Group, which includes the ground-breaking Stone & Wood brand.

Beyond Australia, Lion has also developed an extensive North American portfolio including breweries such as New Belgium and Bell’s along with a number of fine wine businesses.

Lion also has a minority stake in Australian craft spirits distribution arm Vanguard Luxury Brands and has 50% ownership of Four Pillars Gin.

An Unwavering Focus TO DELIVER

WORDS BY Ashley PiniThe retail landscape had never been more competitive. What do you see as the key challenges for LION and what are the key focus points for you in this role? Firstly, can I say how wonderful it is to be back in the Australian drinks industry. I have been lucky to spend a lot of time in pubs, clubs, bars and bottle shops this year, meeting with our teams and customers across the country. I have been reminded once again of what a fantastic drinks and hospitality industry we have in this country – it really is a privilege to be back here, now as an Australian citizen and leading the Lion Australia business.

In saying that, there are some real challenges at present, with the huge increases in input, logistics and excise costs, together with a continuation of strong competition to beer from other categories. Against this backdrop, our focus is clear. We will put the consumer at the heart of everything we do, invest significantly behind our brands and the beer category to create value for our customers and the business.

Customers have told me they love the potential in our portfolio with the leading position in craft beer, the number one brand in mindful choices with Hahn, the leadership in non-alcohol beer, and our core beers of XXXX, Toohey’s, the fast-growing premium beer in Byron Bay and the State Classics of Emu, Swan, West End and Boags. Our focus is to invest in these brands. Whether it’s at the tap bank at the local pub, club, bar, or the fridge or cool room at the bottle shop, we want to be first choice with

consumers to help our customers and the beer category grow.

We are also focused on being easy to do business and grow with. For example, the launch of the award-winning Lion Marketplace app has redefined our digital ordering platform, making life simpler for our customers. The fantastic customer feedback it has received validates our ongoing investment in our digital customer experience.

At the end of the day, our business is about great brands, an unwavering focus on delivering for our category and customers and building an outstanding team operating in a culture that helps them be at their best.

One of the highest profile purchases in recent history has been that of Fermentum (producers of Stone and Wood). How excited are you to have that brand in your portfolio and what role does it play alongside your other craft beer brands?

We are thrilled to have Fermentum as part of the Lion stable. It’s a wonderful business with a fantastic team and I think we are both learning a lot from each other.

Craft beer is a vibrant and exciting part of the drinks landscape and importantly, it drives engagement and premiumisation in

DAVID SMITH, MANAGING DIRECTOR OF LION AUSTRALIA, IS BACK ON AUSTRALIAN SOIL AND AT THE HELM OF SOME OF THE COUNTRY’S MOST LOVED BRANDS. SOME MORE ESTABLISHED THAN OTHERS, BUT ALL WITH A ROLE TO PLAY IN AN EVOLVING MARKET.the beer category – which is important for Lion and for our customers.

With Stone & Wood and Little Creatures as the number one and two brands respectively in craft beer here in Australia, we feel we have a lot to offer our customers here.

We’re really pleased with how Stone & Wood is going 12 months in. Pacific Ale continues to delight more and more consumers many trying the brand for the first time. I know it also delights our customers. For instance, we consistently hear that when Pacific Ale goes on tap in an outlet it quickly becomes a high margin top seller.

Little Creatures has a huge year ahead with increased focus and investment behind the brand, kicking off with its role as the official beer of the Sydney Gay and Lesbian Mardi Gras and World Pride 2023.

These two brands, alongside our wider craft portfolio including the likes of Kosciusko and White Rabbit, as well as Panhead and Voodoo Ranger – makes for a compelling range of craft beer styles that caters to a wide range of consumers and venues.

How do you build upon the success of mainstay brands such as Tooheys and XXXX, while developing more success stories like Furphy?

The biggest trend that we are seeing in core beer is a trend towards what we call mindful consumption as consumers look to make more informed choices to suit their lifestyles.

We are lucky to have the number one brand in this segment in Hahn. We’ve just relaunched the brand with the core Hahn Super Dry & Hahn Super Dry 3.5 looking sharper than ever and the relaunch of Hahn Ultra as Hahn Super Dry Gluten Free. The range looks superb, and we really excited about the new advertising campaign, “How Good” celebrating the delivery of great tasting beer, low carb beer at full & midstrength and gluten-free.

We are also making a huge investment behind XXXX this year, developing the “Give a XXXX” campaign to celebrate the brand’s commitment to the good life.

XXXX also continued its legacy of giving back to Queensland as the first ever

Australian beer brand to team up with The Great Barrier Reef Foundation, entering into a $1 million partnership as part of a commitment to protect the environment for future generations.

We will also build XXXX Zero, Australia’s first carbon neutral, non-alcoholic beer. Extending the brand’s industry leading sustainability efforts, XXXX Zero has Climate Active carbon neutral certification, with the brand already pledging to use 100% renewable electricity by 2025.

I am glad you asked about Toohey’s. Travelling around regional NSW, I have experienced first-hand just much love there is for the Tooheys brand and I see opportunity to tap into this further.

Finally, Furphy, is fresh from its Melbourne Cup Carnival sponsorship. With Furphy Original & Furphy Crisp lager we have great liquids that we will support and grow with a focus on their Victorian homeland.

Are you now happy with your portfolio offering or is there potential for further purchases?

We are really energised by our current portfolio, which includes plenty of category leading brands. It’s going to be a really exciting summer for brands like Hahn, Byron

Bay, XXXX, James Squire, Stone & Wood and Little Creatures – all supported by some amazing new campaigns and activations.

Lion’s commitment has always been to give our customers and consumers the products they want to suit a variety of occasions, and we’re confident our portfolio – across all categories – does exactly that.

What portion of your business does the Vanguard portfolio represent and is there a plan to increase that?

Vanguard is still a small part of the overall Lion business, but we are thrilled to have such an enviable portfolio of craft spirit brands – with our shareholding in Four Pillars Gin and the wider Vanguard Luxury Brands portfolio continuing to grow and meeting consumer demand for premium spirit options.

We see further opportunities for Vanguard to continue to grow and it’s great to have the brands now as part of the extended Lion business.

As the world moves more towards a greener future, what are you doing to drive environmental and sustainability projects?

I’ve been incredibly impressed with how advanced Lion’s sustainability agenda is

and it’s something we are all proud of and will continue to push further into 2023 and beyond.

As Australia’s first large-scale carbon neutral brewer, we continue to have a big focus on direct emissions reduction and that’s evident when I visit our sites across Australia.

At XXXX in Queensland we proudly harvest the sun to power the iconic brewery in Milton, having installed a significant solar array in 2019, which consists of more than 2,000 solar panels, which produce enough electricity to power 150 large homes in Brisbane for a year.

XXXX’s state-of-the-art reverse osmosis plant reuses wastewater – enabling XXXX Gold to be produced at a ratio of 2.8 litres of water for every litre of beer produced, which is approaching world-leading levels of efficiency for brewing.

Both the Tooheys and XXXX Breweries also utilise biogas which replaces natural gas and reduces scope 1 emissions.

In March, Tooheys New released NSW’s first electric beer truck in partnership with BevChain, removing at least 60 tonnes of carbon dioxide emissions annually from our roads and we announced the launch of XXXX Zero, Australia’s first carbon neutral, non-alcoholic beer.

Lion has also committed to a target of Net Zero in the Supply Chain by 2050, which will see us to tackle Scope 3 carbon emissions in earnest, so this is a major focus of our efforts moving forward and we look forward to working with our partners in the value chain as we all lean into this challenge together.

From a packaging standpoint, over 97% of our packaging is now recyclable and we are phasing out plastic shrink wrap in our secondary packaging by the end of 2025.

Our sustainability strategy is about more than the environment, and we also

want to make a positive contribution to the communities we touch right around Australia. Recognising the vital role that pubs play in their communities, we also continued our proud partnership with mental fitness charity ‘Gotcha for Life’ in 2022 to rollout their flagship ‘Tomorrow Man, Tomorrow Woman’ program across regional pubs and clubs with plans to continue this great partnership next year.

Can you outline what LION is doing to build an inclusive culture with both diversity and equal opportunities?

Lion has now been a Workplace Gender Equality Agency (WGEA) Employer of Choice for Gender Equality since 2017 and has done some fantastic work in driving gender diversity across the organisation.

Alongside simply being the right thing to do, we recognise the importance of diversity to things like innovation and growth. With this in mind, we have set a target to achieve gender balanced teams across all parts of the business by 2026 and are tracking well towards this. For instance my Executive team is more than 50% female and our broader Leadership Team that reports to this team, our top 40 leaders in Australia, are 50:50 male/female.

We have also made several meaningful policy changes, including evolving our parental leave policy to remove ‘primary’ and ‘secondary’ carer labels, moving to a model of shared care where the same parental leave provisions (12 weeks’ full paid parental leave) are provided to both parents without having to define their role in the caring arrangement. Offering flexibility in how that leave can be taken – either in a block or one day a week, for example, has also led to 50 per cent of people taking up that leave at Lion now being men – the first

time we’ve seen that level of uptake.

At the same time, we increased superannuation payments which are now paid up to 18 weeks. At Lion we already funded 12 weeks’ superannuation on the paid portion of parental leave so this means paying an extra six weeks’ superannuation at the minimum wage. This is an important policy change which aims to tackle the huge discrepancy in superannuation balances between Australian men and women.

We are also really pleased to be extending our commitments in this space to our sponsorships. Early this year, Furphy made a major play into the AFLW by ramping up its sponsorships of the Melbourne Demons, St Kilda Saints, Richmond Tigers and Sydney Swans alongside their AFL teams.

This is the first time a major beer club sponsor has matched its sponsorship commitment across AFL and AFLW teams. We believe it will go a long way to support the clubs and raise the profile of AFLW around the country.

Moving beyond gender, in 2020 we launched Pride at Lion – a group dedicated to driving visibility and equality for Lion’s LGBTIQ+ community and promoting an inclusive working environment in which all team members can be their best authentic selves.

Finally, if we were to have a similar chat in 2 years’ time, what would you like to have changed and what would success look like?

I have no doubt I’ll be reflecting proudly on our terrific brands and how we are executing brilliantly in the marketplace.

Beyond our brands and current portfolio, I think the big opportunity that really excites me is how we can make bring more vibrancy to the beer category - expanding beer’s appeal, making it inviting, appealing and exciting, tapping into the evolving trends and tastes to grow the category.

We have a terrific and diverse range of brands that are well placed to lead this and I’m excited about the work we have coming in 2023 and beyond to help shape the beer category for the future.

“We’re really pleased with how Stone & Wood is going 12 months in. Pacific Ale continues to delight more and more consumers many trying the brand for the first time.”

into

significance

ARE

BEERS YOU’VE DEFINITELY HEARD OF:

COOPERS PALE ALE

Coopers needs no introduction. The largest Australian-owned brewery, they have earnt a firm reputation for high quality and reliable brews made using the Natural Conditioning Method. This, in essence, is a secondary in-bottle fermentation that better retains the beers’ profile by eliminating the need for pasteurisation whilst also extending its shelf life. The Coopers Pale Ale is easy drinking in nature, pouring a deep golden with generous foam and texture. It is also vegan and entirely free of preservatives and additive: attractive sales note for the increasing number of health-conscious consumers.

ABV: 4.5% | RRP: $21.49 per 6-pack (bottles)

Distributor: ALM, Paramount (VIC, NSW), ILG (NSW, QLD),

4 PINES PALE ALE

The 4 Pines Pale is a quintessential example of an American-style pale ale: expect punchy fresh fruit aromas of pine and grapefruit intermingled with a malty biscuit note and a bitter finish. One of Aussie craft beer’s biggest success stories: 4 Pines started as a humble father-son post-surf chat back in 2006. Since then, the beer has built itself an impressive medal collection including gold at both the London International Beer Challenge and the AIBA.

ABV: 5.1% | RRP: $20.49 per 6-pack (bottles)

Distributor: CUB

JAMES SQUIRE ONE FIFTY LASHES

James Squire’s One Fifty Lashes is a cloudy pale ale designed with refreshment in mind. Malted wheat adds complexity whilst a four-hop profile creates fruity aromas with hints of passionfruit, grapefruit, and citrus. Expect a fruity, tropical beer that hasn’t lost its crispness. It’s comparatively low ABV also broadens the occasions it suits.

ABV: 4.2% | RRP: $23.99 per 6-pack (bottles)

Distributor: Lion, Barrel House

STONE & WOOD PACIFIC ALE

The only beer on this list that is arguably not a pale ale, Stone & Wood coined the term Pacific Ale to describe the slightly hazy, heavily sessionable beer brewed to be the ideal beach-side ale. Expect notes of passionfruit, citrus, and tropical fruit aromas and a defining crispness. Stone & Wood Pacific Ale includes a large portion of rolled wheat and is heavily dry hopped late in fermentation to capture the hop flavour but not the bitterness.

ABV: 4.4% | RRP: $23.49 per 6-pack (bottles)

Distributor: Lion, Direct

YOUNG HENRYS NEWTOWNER

First brewed in 2012 to celebrate Young Henrys’ home turf of Newtown, Sydney, their flagship beer has since made a name for itself nationwide. Made using Australian malts and hops, the Newtowner has a slightly weightier palate that blends fruitiness with bitterness; in other words, embodying Newtown’s music-centric grunge in place of being a beer for the beach.

ABV: 4.8% | RRP: $22.49 per 6-pack (cans)

Distributor: Direct, Kaddy

Beer BEERS YOU SHOULD’VE

HEARD OF:

Other than cost and batch size, the most important factor separating premium craft beer from the rest is beer’s fragility: from the moment a beer is canned, its fresh hop profile begins to deteriorate. There are various techniques larger brewers use to combat this, which—to put it simply—dull down the initial hop flavours in order to prolong its consistency. Being core-range, the beers below will have undergone some of these processes but to a lesser extent; resulting in much clearer fresh fruit flavours. The real deal in craft beers, though, is the constantly changing (and very rarely repeating) world of limited releases, where breweries such as the below make zero compromises.

ONE DROP HAZY PALE

This hazy pale is hazy in colour and juicy in flavour. Following on from the success of the hazy IPA category, hazy pales transplant the plush and juicy fruit sweetness of their bigger brothers into more sessionable styles. One Drop has added a heavy dose of oats to the mashbill to create a plush and silky mouthfeel bolstered by low bitterness: expect juicy mango and an intriguing malt character. Whilst this beer doesn’t push too many boundaries, One Drop has earnt the reputation of being one of Australia’s most experimental breweries: think Double Vanilla Custard Pancake Imperial Nitro Thickshake IPA!

ABV: 4.5% | RRP: $25 per 4-pack (cans)

Distributor: Direct, Kaddy

TWO BAYS GLUTEN FREE PALE

While some beers test as ‘gluten undetected’ due to a brewing process called Brewers Clarex (Wayward brewing, Bentspoke Barley Griffin), Two Bays are proudly gluten free with a Coeliac Australia endorsement to show for it. Two Bays uses a malt base of millet, buckwheat, and rice to support Citra and Cascade hops for a fresh beer with citrus aromas. Every Two Bays beer is vegan, gluten free, and Kosher certified; positioning it right at the forefront of premium options for gluten-intolerant customers. Two Bays offer an additional 6 beer styles along with the budget GFB lager.

ABV: 4.5% | RRP: $26.49 per 4-pack (cans)

Distributor: Direct, Kaddy, Paramount

BALLISTIC BEER CO. HAWAIIAN HAZE

This brew might be on a few more of your radars, but—on the off chance it isn’t—this is why it’s one of our favourites. Consistently placing in the top ten of Gabs’ Hottest 100, this hazy pale is similar to One Drop’s in that it has a soft and pillowy mouthfeel and bucketloads of tropical fruit flavour, however it wins out in terms of value: very few hazy pales at this price point share such luscious tropical fruit flavours.

ABV: 4.6% | RRP: $20.49 per 4-pack (cans)

Distributor: Paramount,

SAMUEL SMITHS ORGANIC OLD BREWERY PALE ALE

Whilst it sometimes feels that that the premium beer world is evolving by the second, Samuel Smiths is happy following tradition and hence appeals to import beer drinkers looking to try the trending style. Established in 1758, Samuel Smiths is Yorkshires oldest brewery and continues to use water drawn from a 25 metre well and conduct fermentation in traditional ‘stone Yorkshire squares.’

The result is a richer and fuller mouthfeel with a distinctly malty base. The brewery recommends a warmer serving temperature of 11°C.

ABV: 5% | RRP: $14.50 per single 550mL bottle

Distributor: Bidbeer

BRIDGE ROAD FREE TIME

The alcohol-free category is currently booming, and—in terms of tasting like the real deal—nonalcoholic beers are arguably leading the charge. This is largely due to the greater flexibility brewers have when brewing sans alcohol: whereas alcoholfree wine is generally just grape juice and water, beer is able to play with ratios of water, malt, hops, and yeast. Bridge Road’s Free Time is a vibrant and juicy pale ale with low bitterness, a clean finish and loads of tropical flavours. Great for any occasion.

ABV: <0.05% | RRP: $10.90 per 4-pack (cans)

Distributor: Kaddy

Pale Ales are on trend, and for good reason.

THERE’S NOTHING BETTER THAN A PERFECTLY BALANCED, DELICIOUS COCKTAIL MADE WITH TOP SHELF SPIRITS AND INGREDIENTS. BUT SOMETIMES THERE’S NOTHING WORSE THAN TRYING TO GET ONE AT A SUPER BUSY BAR AT THE PEAK OF SERVICE.

Enter MoCo. MoCo is all about delivering deliciously crafted cocktails on tap, ensuing world-class cocktails every time, without the stress or the wait.

We’ve brought together some of the world’s best local and international premium spirits, great ingredients, the best people, know-how and techniques to create an innovative range of ready-to-serve, handcrafted cocktails that bridge the gap between uncompromising quality and convenience for the perfect serve every time.

MoCo is available across 5 drinks to streamline your Summer service:

• FOUR PILLARS BLOODY SHIRAZ GIN SPRITZ: A refreshing, easy-to-drink spritz with a rich vibrant colour. Using a big base of Aussie favourite Four Pillars Bloody Shiraz gin, giving it a sweetness that is perfectly balanced by a dryer rose vermouth.

• PINK GRAPEFRUIT MARGARITA: An approachable twist on a classic Margarita using one of the oldest family-owned tequilas in Mexico, Casa Orendain.

• FOUR PILLARS NAVY STRENGTH GIN MULE: A local twist on the classic Moscow Mule, combining the worlds most awarded Navy Strength Gin from Four Pillars with Australian made ginger beer, fresh lime, and mint.

• FOUR PILLARS NEGRONI: A modern take on a classic that everyone can appreciate. Using Four Pillars Spiced Negroni Gin, designed specifically for

a Negroni, a perfect balance of spice and citrus while championing those classic bitter notes from premium Italian vermouth and bitters.

• ESPRESSO MARTINI: Is an allAustralian cocktail using Broken Bean coffee liqueur, cold brew from the experts at Onyx Coffee and Australian small batch wheat vodka from New South Wales.

Ground ZERO for non-alc wine

THIS YEAR HARDY’S RELEASED ITS FIRST ZERO-ALCOHOL WINE RANGE. HARDY’S ZERO IS PRODUCED USING STATE-OF-THE-ART DE-ALCOHOLISATION TECHNOLOGY, ZERO TECH X. EDITOR MELISSA PARKER PUT THE WINE TO THE TEST AND WITH HARDY’S ZERO WINEMAKER, VIKI WADE, TASTED HARDY’S ZERO SPARKLING, CHARDONNAY AND SHIRAZ AND DISCOVERED THERE IS A LOT GOING FOR THE LATEST TECHNOLOGY DELIVERING ZERO-ALC WINES WITH FLAVOUR AND VARIETAL NUANCE.

What makes Hardy’s ZERO stand out?

You dream about releasing a wine that’s going to be flavoursome and balanced and we hope, leading the market in quality. It’s also the lowest sugar of any of these zero alcohol varieties on the market. We think this range is very exciting. We hope people try it and fall in love with it.

Can you explain the winemaking process of making de-alcoholised wine with this new technology?

Let’s start with the Chardonnay. We identified a really bright varietal Chardonnay that we’re really proud of because we believe you must start with the fundamentals of a very good base wine before you de-alcoholise it. The one we chose has lovely ripe melon with everything in balance including the right texture with natural acidity.

Then you go about your dealcoholisation process. There are different types of de-alcoholisation, but the new innovation we are utilising is gentle. We have found through all of our innovation testing, competitor tasting, and group work that this form of technology delivers brighter, softer, and varietal wine. It’s done at lower temperatures; it’s done under vacuum and allows for skilful

blending afterwards. As a company, we use all different forms, but the one that we use specifically for ZERO gets the lowest possible result in alcohol at under 0.05 %. The result is the wine you are looking at today. We have done lots of low alcohol projects. We’d used state of the art technology before. But this brand-new technology that was identified to give the best possible results is really exciting and it’s the way of the future.

I must say, I really taste the varietal characters.

That’s what we wanted. We really wanted the nice bright melon, the soft integrated oak, nice balanced acidity and length that’s in the wine to carry over without the alcohol. We let them sit on the yeast lees and build up complexity and a little bit of texture and additional flavour that you get from not rushing the process. But for us the most important thing was balancing out the sweetness level because lots of (non-alc) wines on the market are cloying, excessively sweet, dominating the palate. You shouldn’t just be switching to sugar, otherwise you should be drinking grape juice. So, our wines are a good, healthy alternative to normal alcoholised wines because they are low in sugar too.

How do you think Hardy Zero measures up to other non-alc wines on the market?

We didn’t like what we saw on the market. We were not enamoured with the flavour profiles. They looked like dry white; they didn’t look like Chardonnay.

What else is important about producing non-alc wines?

As soon as you make it you have to bottle it. It needs to be packed within 48 hours.

Because it’s perishable right?

Yes, there is no alcohol to protect it. So, we schedule all our packing around ZERO because it is so subject to oxidation. So yeah, the most important thing is packaging it.

And then you’ve got to put the ingredients on the back of it and consume within three days and keep it in the refrigerator. It’s like a whole new world for a winemaker, isn’t it? Yeah, it is. When you see the label approval and the team looking at nutritional analysis and nutrition panel testing. We have a state-of-the-art lab here. It did put the microscope on us and our capacity to deliver to spec, to

standards. Because we have to approach it as a food. It was a new world and it really is another string to our bow.

What do you love most about making non-alc wines?

It’s highly scientific, and is all about collaboration between the departments, lots and lots of meetings, lots of tastings, but it has been a lot of fun to see the final product.

Every wine in this range starts with a selection of base wines. The most exciting part about being a winemaker is that blending and learning the skill of blending, the art of blending. Finding the balanced acidity and the sweetness levels. So that was critical for us, was delivering a wine that isn’t destroyed by removing the alcohol. It’s still got to be really, balanced and flavoursome.

What would you say to the consumer who is a non-believer in good quality non-alc wines?

I can totally sympathise with people who are sceptics. I really challenge these people to revisit and have an open mind. No one likes change but once you embrace it, it just becomes part of your mantra going forward. We need to get over that sort of traditional approach that we’re just going to keep doing what we’ve always done. I think that this is a real shift in the whole industry. I feel like it’s just the beginning of something big.

I’m really impressed with the sparkling. You would be hard-pressed to tell that apart from a light alcoholic sparkling like a Moscato. Yes, at our recent tasting in Sydney with marketing and sales the sparkling was the favourite. I thought that was the most sessionable; one that you could drink the most of.

And with the Shiraz, you can really taste the red fruit and nuanced oak. The persistence of fruit is something that we really want and after fermentation is some finishing low level oak maturation, but it should be all about spice and brightness. And the critical thing for me

finish sweet, you want it to finish with some structure with a little bit of tannin. And then of course you want it to be able to pair with food.

What’s the future? Are you going to start experimenting with other varieties?

We are looking at different varieties and styles such as rosé and sparkling rosé. Our category is going to grow from the current three. There was also some debate about blending a Shiraz and Cabernet. We can’t rush these things because we’re delivering a high-quality product but, there were lots of discussions about rosé, sauvignon blanc and additional varietals.

THE RTD RENAISSANCE

RTDS ARE THE MOST ROCK & ROLL OF DRINKS. NO RULES, NO LIMITATIONS, NO AWARDS CEREMONIES… JUST PURE PUNK ROCK FLAVOURS AND MARKETING AMPLIFIED LOUD. IT IS INDISPUTABLY THE DRINKS CATEGORY WITH THE GREATEST SCOPE FOR INNOVATION, CREATIVITY, AND DIVERSITY. DESPITE THIS, IT HAS ONLY JUST STARTED OPERATING TO POTENTIAL, WITH THE LAST FIVE YEARS REVEALING NOT JUST RAPID GROWTH AND UPDATED MIXES BUT ENTIRELY NEW SUBCATEGORIES AND FORMATS. WE HERE AT DRINKS TRADE ARE AWARE THAT MANY INDUSTRY PROFESSIONALS REMAIN UNENTHUSIASTIC ABOUT THE PREMIX REVOLUTION AND SO—WHETHER YOU WORK IN ON-PREMISE OR OFF-PREMISE—WE’VE PUT TOGETHER THIS ARTICLE TO HELP YOU GET DOWN AND DIRTY WITH RTDS RIGHT AS CALENDARS FLIP INTO 2023. BY CODY PROFACA

First things first, why you should care. The RTD category is on its way up: IWSR data shows that it has been the world’s fastestgrowing drinks category by volume for four years running, with the coming five years expected to bring in an additional US$11.6 billion of value. These trends are mirrored in Australia, where it was the only category that experienced growth post-lockdown between 2020 and 2021.

SELTZER SEASON

It will come as no surprise to read that alcoholic seltzer is largely responsible for RTDs recent revitalisation. Rising to popularity in 2019, IRI data reports that the Seltzer category is now responsible for 16% of Australian RTD sales and has a net worth $210 million, having grown 282% over the last year. As a result, seltzer shelves are fast getting heavy with 75 brands selling more than 500 SKUs in Australia. One such brand is Fellr, founded by ex-Pernod Ricard Will Morgan and Andy Skora on a shoestring budget in 2020. Andy believes the Seltzer category’s success can be attributed to its broad target market.

“[Seltzer is] pulling from beer for that sessionability and lower carbs and then pulling from RTD because of the sugar aspect of them,” said Andy.

“I think because everyone’s looking for that more-lower-calorie, health and wellness kind of drink I don’t think that trend is going anywhere so I think we will see this category continue to grow,” said Will.

With a seemingly endless array of samples flowing like water from reps to workers, the overwhelming array of seltzers being released from spirits companies and breweries is somewhat overwhelming. Whereas many seltzers are vodka sparkling water mixes, Fellr is brew-based.

“Will and I, we’ve developed a custom brewed base that’s quite different than other seltzers on the market, it has a bit more mouthfeel, bit more complexity in there, and it’s really well balanced.

“We’ve seen that some of our other competitors haven’t quite hit the mark with the liquid so we knew that that was going to be an important aspect.”

One type of seltzer set to boom in Australia is higher ABV options. Australia

was the first country outside North America to receive White Claw’s Surge 6.5% abv range, reflecting the potential for this style in Australia.

“High ABV is something that everyone is throwing their hats into at the moment which there’s definitely a market for,” said Will.

Andy also stressed the importance of onpremise sales for Fellr.

“We’ve seen our tap program really accelerate over the last year, we’ve got multiple venues where we’re the number 1 selling product outselling all beers on tap so I think there’s a lot of room to move in the on-premise space as well.”

“The tap market of seltzers is totally untapped and we think there’s going to be some explosive growth there because we’ve seen amazing response to our product on tap,” said Will.

“It’s definitely a very exciting space.”

Fellr Passionfruit was named Master Brewed Seltzer at the The Spirits Business Hard Seltzer Masters. In addition, Fellr Watermelon won gold, and Fellr Watermelon Margarita won silver. Other flavours in the Fellr range include Mango and Pineapple & Coconut. IWSR data reveals that most (56%) of RTD drinkers say that the regular release of new RTD flavours is the most important factor in establishing a premium image. Similarly, 70% consider flavour to be the key driving influence when purchasing RTD’s.

FLAVOUR FOCUS

While the Seltzer parade might have unlocked the gate, a whole army of new products and categories are following closely in its wake. Four Pillars’ cofounder Stuart Gregor thinks this could play in gin’s favour.

“People may well start looking for more flavour and more integrity.

“[This might be] a consumer that grows out of Seltzer and into something a bit more delicious, basically, and I think that’s where they might land with us.”

One of RTDs biggest strengths is its ability to adapt to markets and occasions. Premium gin and tonic is a prime example in that it hasn’t just encouraged RTD drinkers to trade up but has also attracted the bottled gin crowd.

“What we’re finding is a lot of our Four

“What we’ve ended up with is hyper concentrated gins and as much tonic as we think we need. You get a real hit of Four Pillars flavour.”

Another example is Suntory’s Minus 196, which first hit Aussie shelves in 2021 and has already established itself as a key player in the RTD sphere. The success of Minus 196 can be attributed to four key factors: a growing interest in RTD provenance, interest in calorie count, quality of flavour, and value. As a result, Minus 196 was the worlds 3rd best-selling RTD brand by volume in 2021 behind Part Time Rangers and White Claw.

“Minus 196, via Strong Zero, is Suntory’s Number 1 RTD in Japan” said Stephanie Jericevich, Group Marketing Manager of Jim Beam RTD & Minus 196 at Beam Suntory.

“Aussie’s love Japan, number four travel destination, and many travellers have experienced the category whilst visiting.”

When asked what has driven Minus 196’s

Pillars drinkers who are not RTD drinkers are becoming RTD drinkers because they’ve now found a brand that they think they can trust.ALL flavour, no fuss.

success, Stephanie pointed to the allure of technology used.

“Minus 196 delivers to all of these broader category trends whilst also using Suntory’s unique Freeze Crush Technology that freezes and crushes real fruit capturing all-natural bold fruit flavour whilst also delivering to the better for you benefits consumers are seeking.”

Stephanie also believes the RTD category is more ‘direct to consumer’ in that it doesn’t rely as heavily on industry opinions and awards.

“Unlike full spirit or wine for example, many consumers seem to be more open to exploring based on their individual preferences. Potentially retailer led trial mechanics, single cans, small pack formats lower barriers to entry therefore limiting the need to rely on industry opinions or awards.”

In other words, it is more important for liquor industry workers to keep up to date with changes in the RTD category as there are less industry bodies dictating what’s hot and what’s not.

PREMIUMISATION

IWSR data reveals that premium priced RTDs have experienced more growth over the last two years than any other RTD category. This is in large part due to an increase in spirit-based offerings, higher ABVs, and the higher proportion of knownbrand products.

“If you look at the category now, you need to have a recognised brand,” said Stuart.

“People want to trust that the gin is the gin that they like to drink when they’re making one at home.”

The growth of premium priced RTDs is also due to changing customer expectations and a growing demand for premium products. Damian Huon, Director at MEXINK Margaritas, believes the MEXINK business model that is seeing massive successes today would have struggled ten years ago.

“I think in days gone by a product priced at this level might have struggled but the consumer is more educated today and is seemingly comfortable to pay the price of a premium-type product.”

“There’s an obvious trend for premiumisation, I think if you certainly look at the sales data, there is a movement of the consumer to move away from traditional beer/ wine drinking to a more premium product, so it’s certainly an in-trend category.”

MEXINK offer four different fullstrength Margaritas, all with the added convenience of being in a can. It is worth noting that canned cocktails aren’t only enticing home bartenders but also onpremise cocktail drinkers: cocktails at home generally require more capital and time compared to other premix drinks such as gin & tonics and whisky colas. Also, they’re way harder to get right. MEXINK’s hit the shelves at $55 a 4-pack (8 Margaritas).

“Our product is really almost a subcategory and effectively a new category within the RTD space and so there are plenty of cocktail mixing solutions but when you look at the ready to to drink canned cocktail—full bodied, premium mix—I think MEXINK is certainly up there as the number one product and has a significant advantage in the marketplace.”

Damian also predicts that kegged

cocktails will provide massive opportunity for on-premise venues moving forwards.

“We think again for the club or the bar that there’s great value in considering a keg for an on-premise venue. Essentially, you can serve and garnish a cocktail in sub one minute compared to maybe a five or ten minute production for a normal cocktail. There are higher margins associated with buying our kegs and it also may assist venues with staffing issues as they’re all experiencing in the hospitality industry today.

“We’ve had a number of on-premise venues pick us up and they’re doing exceptionally well.”

MEXINK was established in November 2021 and has reinvested its profits into expanding the business, including the construction of a $500,000 factory capable of producing 28,000 cans daily: a testament to growing demand. One of very few companies producing traditional-spec canned cocktails in Australia, it is completely alone in specialising on a single drink. This is likely to play in their advantage, however, with IWSR predicting Agave based spirits to grow 67% over the next four years. MEXINK’s Mexi-Shaken, Coco-Ho, Passion, and best-selling Jalapeño are currently available via ALM in NSW and QLD with plans in place to expand nationwide.

Key competitors to MEXINK include Curatif and Sophisticated Cocktail Co. The former produces a large range of single-serve cocktail cans at $45 a 4-pack and the latter produces 750mL cocktail casks starting at $55. This format has a lot of promise with casks keeping fresh in the fridge for up to six months. The svelte packaging with built-in carry handle has taken a leaf out of the Bagnum wine revolution and is begging for outdoor use, adding to its occasions.

Other emerging subcategories include premium dark spirit RTDs (e.g. Manly Spirits Whisky Highball) and non-alcoholic RTDs (e.g. Lyres and Monday).

THE TAKE

While RTDs may not excite retailers as much as customers, it can be argued that this is of little importance, as they have always benefited from innovative direct

to consumer marketing and innovation. It is also clear that RTDs are unmatched when it comes to adapting themselves to occasions—whether through ABV options, lower calorie products, bottle/can/cask format variations, 4/6/10-pack options, different price brackets or extensive flavour ranges— something retailers should be striving to capitalise on. In fact, unlike beer, wine, and whisky where products are all vying for the same customer base, the diversity of RTD means it targets the occasion as much as the person.

It is also clear that category boundaries are blurring. Stephanie has one take:

“Some categories currently cater better to certain needs or moments and whilst there is a lot of category blurring occurring—i.e. Seltzers, Fruity Beer—ultimately the consumer will decide if these offerings better deliver to their requirements and warrant a switch.”

Another take is that this crossover provides scope for opportunity: fruity beer could be placed alongside cherry cider and passionfruit seltzer to give customers a unique shopping experience: after all, these products were arguably designed with the same customer in mind.

RTDs are already ready to rock and rock the boat: just remember that there is often no guarantee of a premix product’s success until it is on the shelves. Not taking a few swings is more dangerous, however, as the RTD category thrives at rapid-fire pace.

BLIND TIGER ORGANIC GIN & TONIC

ADDING FURTHER APPEAL TO THE EXISTING RANGE OF BLIND TIGER ORGANIC GINS FROM SOUTH AUSTRALIA’S ST AGNES DISTILLERY, IS THE RELEASE OF A NEW, LOCALLY PRODUCED, PREMIUM CANNED RTD. BLIND TIGER ORGANIC GIN & PREMIUM TONIC IS AN EXCITING OPPORTUNITY FOR RETAILERS AND ON-PREMISE VENUES ALIKE TO TARGET MARKET SHARE IN THIS RAPIDLY GROWING CATEGORY.

Searching the world for the most sustainable, organic botanicals, Blind Tiger Organic Gin is an exotic blend of juniper berries, cassia, coriander, angelica root, citrus peel, summer savory and liquorice root. Blind Tiger Organic Gin & Tonic incorporates the same certifiedorganic gin as the core, bottled Blind Tiger Organic Gin, and is also vegan-friendly.

The handpicked organic botanicals are distilled individually through a small pot still, creating distinctive elements that are drawn on to craft and blend Blind Tiger Organic Gins. The unique components are then blended with organic wheat spirit to create a fine elegant London Dry-style of organic gin. This unique and individualised method for making gin allows the distiller to craft and control the flavours in a similar way a winemaker puts a wine blend together.

Organic farming means that no artificial herbicides, pesticides, or fertilisers are used in the growing of the grain or botanicals they use. This ensures minimal impact on the environment while crafting a spirit that speaks of the clean, green approach they take in making it. Producing locally further reduces the impact on the environment when compared to imported products.

The pack takes its cues from the original Blind Tiger Organic Gin glass bottle product, using the same familial blue tones, and Blind Tiger logo, with the added flavour cue of the cooler, citrusy yellow giving real stand on shelf and fridge.

The fresh spring forest and citrus notes of Blind Tiger Organic Gin are elevated in this fresh, clean moreish mix with premium specially crafted tonic. Heady citrus and unsullied juniper all come to the fore with an earthiness and hint of musk. The finish is long and elegant with a subtle minty-ness and light pepper.

ADAPTING TO CHANGES GRADUALLY, THEN SUDDENLY

ADAPTING TO CHANGE IN COMMUNITY EXPECTATIONS IS VITAL FOR A SUSTAINABLE INDUSTRY, AND RESPONSIBLE SERVICE OF ALCOHOL IS ALWAYS THE PRIORITY.

Jonathan Russell, Head of Policy & Advocacy, Retail Drinks Australia

Jonathan Russell is an award-winning advocate for policy and legislative change, bringing a non-partisan approach and deep knowledge of industry associations to collaborate for change.

With fingers crossed for good luck, this summer will be the first that isn’t affected by nationwide disasters in several years. We are, I think, collectively hoping to get the chance to just relax. Pure and simple.

The fires of 2019/20 were devastating. Then the global experience of COVID led to irreversible changes to how we live, work, and enjoy our favourite drinks.

One thing that hasn’t altered is the industry’s obligation to always focus on serving the community responsibly. This takes constant effort because public expectations keep evolving amidst macro factors that force change (to borrow from Hemingway) “gradually, then suddenly.”

Two trends illustrate this: e-commerce and no- and low-alcohol products.

E-commerce has been around for a long time but was accelerated by COVID, and its application to alcohol sales is also relatively new. Its usage is building fast but still has a lot of room for growth. With more and more people feeling comfortable socialising this Christmas holiday, many will likely become first-time users of the online sale and delivery option.

That it’s still a fairly new concept for many people highlights the need to fulfil the service in a way that maintains the expected high standards for responsible service and why the industry’s Online Alcohol Sale & Delivery Code of Conduct is so important.

As e-commerce matures, we’ll all keep focussing on effective age controls, preventing secondary supply, identifying intoxication, and ensuring deliveries aren’t made in alcohol-free zones (often by the beach).

Delivery partners have a particularly important role in the supply chain and are urged to ensure all riders and drivers know and abide by the rules for dropping off an order. Governments and anyone still undecided on a place for e-commerce in the market will see our collective vigilance over the summer as practical evidence of the commitment to serve responsibly, extending to the e-commerce environment.

A longer-term trend is that Australians are generally consuming less alcohol. This doesn’t mean people’s tastes have changed, but they often wish their preferred drink had less or even no alcohol! The no- and low-alcohol trend was slow to start—especially when compared to places like Germany with its longstanding norm for zero per cent beer—but has now taken off and is exciting to watch.

Being another relatively new concept, however, the community and regulators are still coming to grips with what it means. In NSW, for example, the Government is actively considering how to regulate alcoholfree products.

Alcohol-free products that, in all other senses, look and feel like normal beers, wines and spirits should only be marketed

and sold to adults and only consumed by adults. Luckily, this appears to be firming as the industry consensus. If that holds, the ever-widening range of no- and low-alcohol products will remain a good news story about an old industry innovating to meet the new needs of Australians.

These two examples highlight how all parts of the industry have a role in building on our social licence to ensure its long-term sustainability.

glendalough distillery

glendalough rose gin. glendalough wild botanical gin.

To make this special, small batch Gin we completely rebalance our Wild Gin recipe and redistill it with extra fruit, flowers, spices and, of course, a lot of fresh rose petals. Two varieties of rose are used: the rare and elusive Wild Rose from the Wicklow mountains and the large, fragrant Heritage Rose. They come together to make this light, floral and flavoursome gin. Given the delicate ingredients, it is distilled even slower and more gently than our Wild Botanical Gin with vapor distillation playing a bigger part extracting those essential oils and flavours. After distillation, it is further infused with even more roses to deepen the flavours and impart a lovely pink hue.

a unique & authentic rose petal gin. using fresh & wild roses. no artificial flavours or sweeteners.

HAND-FORAGED, WILD INGREDIENTS. We make gins of a very different quality, made from fresh, wild ingredients. Each day, GLENDALOUGH full-time forager Geraldine Kavanagh ventures into the Wicklow mountains to sustainably forage wild botanicals. The wild native botanicals she picks are quickly transported to the distillery where they are painstakingly slow-distilled to tease out delicate flavours, in very small batches of less than 250 litres. The cut-points are decided batch by batch, by smell and taste (never timed or automated) as if each batch is the first. This brings flavour to a whole other level. The knowledge, experience and hours put in to producing each bottle are what make this liquid so special.

wild irish gin. made from fresh, sustainably foraged botanicals. craft distilled in small batches.

State of the Gin Nation

CAROLINE ASHFORD, AKA THE GIN QUEEN, ASKS IF IT’S TIME GIN DID SOME SHAKING AND STIRRING TO RECAPTURE THE HEARTS OF AUSTRALIAN CONSUMERS IN A POTENTIALLY DWINDLING MARKET.

The new category presents opportunities for gin producers in other wine-growing countries, but to date, there are only a couple of other ‘grape gins’ produced outside of Australia.

Speak to any gin expert in the UK, and they will whisper gin is in decline, and the great Ginaissance is ending. Recent figures seem to bear this out, with a 30millionGDP ($53.8million) drop in export sales, highlighting the impact of Brexit and the pandemic. During the same period, tequila recorded a 94% increase in sales, suggesting that UK consumers have a new favourite tipple.

Australian distillers have taken inspiration from gin’s homeland but have given a distinct Aussie twist on this classic spirit. So, should we be concerned that our interest in gin is declining too?

Consumers are notoriously fickle, but Australia has several areas that have the potential to protect the gin category here.

DISTILLERY EXPERIENCES

Australians love nothing better than heading out to visit wineries at the weekend, and now they can visit a gin distillery or two along the way. The wine industry’s ability to create welcoming cellar doors has influenced

how distilleries are built around the consumer experience.

Visitors to distilleries gain a more detailed ‘behind the scenes’ experience than they might at a winery. Gin tastings are offered, often with the distillers themselves sharing the brand’s story, but so is the chance to make gin yourself to take home and share with friends.

One automatically thinks of Four Pillars in the Yarra Valley. In 2019, 5.9 million domestic and international visitors stayed overnight. It represented such a fantastic opportunity for the brand, it recently opened its larger, revamped distillery and now expects to welcome annual visitors of 150-200,000. They will enjoy gin & tonic flights, cocktails and food, and also the opportunity to peek behind the scenes at the bottling line and stills.

Sean Baxter of Never Never Distilling says tourism was a major factor in deciding where he built his home in McLaren Vale. “While it’s known as a wine region, it is also produce-driven with food tours and restaurants. We also benefit from holidaymakers to the area.”

Despite COVID restrictions, Never Never welcomed 85,000 visitors in 2021. Gin lovers spread blankets and took in the views over the Vale while enjoying gin and tonics.

Meanwhile, Western Australia’s Old Young’s Distillery created an approachable and ambitious restaurant ‘Old Young’s Kitchen’, with celebrated chef Rohan Park at the helm. Appealing to those who enjoy a long lunch, the smart-casual diner offers local wines alongside award-winning Old Young’s spirits.

Other distilleries have created an elevated cocktail experience within their distillery.

Naught Distillery in the suburban heights of Eltham in Melbourne has created a lush haven tucked away in the middle of a trading estate. At one end, through a cathedral window-style opening, sits Abigail, the beautiful copper Carl Still. On the left is a full-length bar with beautifully upholstered high stools, and to the right, a bank of cosy booths, perfect for a group of friends. Sipping a Naught cocktail here, you would be forgiven for thinking you were in a high-end city bar.

Hickson House Distilling in Sydney, owned by Mikey Enright and Julian Train of the Barrel House group, which operates The Barbershop and The Duke of Clarence has the Hickson House Bar, where the attention to detail and luxurious feel is showcased in its glittering chandeliers, elegant soft furnishings and a top-notch cocktail menu

Mikey is an industry stalwart with a passion for gin. He also has an eye for design, sourcing all the traditional pub paraphernalia for the fit-out of the Duke of Clarence himself, creating an English pub tucked away opposite the Baxter Inn.

INNOVATION

The recipe for making gin has remained the same for over one hundred years. Then came the “happy accident” when Cameron Mackenzie at Four Pillars gin added Yarra Valley Shiraz grapes to their Rare Dry gin.

When Four Pillars gin launched its Bloody Shiraz gin, it sold out immediately and from 250 kg in year one, Four Pillars is now the largest buyer of Shiraz grapes in the Yarra, purchasing up to 100 tonnes of fruit per year.

Where Four Pillars starts, others follow, and there are now almost 40 “grape gins” in Australia.

Never Never Distilling Co. turned to locally grown Grenache grapes. Head distiller Tim Boast set out to create a light, approachable grape gin that would “look good and work well in cocktails.”

The 2020 release of Never Never Distilling Co.’s Grenache gin — better known as “Ginache” — was made using one tonne of grapes from Chalk Hill Winery and is a fresher, lighter ‘grape’ gin with little tannin.

For Nicole Durdin, Head Distiller at Seppeltsfield Road Distillers, it was a nobrainer to produce a grape gin. “We always talked about the potential of using Shiraz grapes instead of sloe berries,” she says. “It would have been remiss of us not to use grapes from the Western Ridge of the Barossa, famous for its Shiraz.”

The beauty of these gins is consumers can

comfortably select bottlings based on their wine preference and have an idea of the flavour profile before purchasing. This is an exciting new category that has attracted plenty of attention overseas.

This year Seppeltsfield Road Distillers Barossa Shiraz scored 99 points at the International Wine and Spirits Competition, the first gin ever to do so.

The new category presents opportunities for

gin producers in other wine-growing countries, but to date, there are only a couple of other ‘grape gins’ produced outside of Australia.

ASIAN MARKETS

Asian markets have been huge whisky consumers for a long time, but gin is gaining ground, which is an excellent opportunity for Australian gin makers.