DAMIEN PAGE

TALKS RETAIL

THE INSPIRED UNEMPLOYED ON BETTER BEER

A WSET DIPLOMA JOURNEY

BORN NOBLE, ACTING REBEL.

DAMIEN PAGE

TALKS RETAIL

THE INSPIRED UNEMPLOYED ON BETTER BEER

A WSET DIPLOMA JOURNEY

BORN NOBLE, ACTING REBEL.

Embracing 200 years of heritage with a forward-thinking approach.

STEP INTO THE WORLD OF BISQUIT & DUBOUCHÉ COGNAC WHERE TRADITION HAS MET WITH INNOVATION SINCE 1819.

WHAT SETS BISQUIT & DUBOUCHÉ APART IS OUR UNIQUE DOUBLE DISTILLATION METHOD. WE EXTEND THE EXTRACTION PERIOD, CAREFULLY CUTTING THE DISTILLATE AT A LATER STAGE TO OBTAIN AN ‘EXTRA HEART’, A TECHNIQUE RELIANT ON THE EXPERIENCED SENSES OF OUR SKILLED DISTILLERS, WHO PATIENTLY AWAIT THE PRECISE MOMENT TO MAKE THE CUT.

THE RESULT? AN EXQUISITE COGNAC THAT BOASTS A MORE PRONOUNCED AROMATIC PROFILE AND AN EXCEPTIONALLY SMOOTH STRUCTURE.

Get ready for Winter and Father’s Day sales with one of Australia’s #1 selling fortified producers, backed with a national marketing campaign. Talk to our team about our ‘Fire up with Fortified’ promotion on offer this winter.

“These are magnificent, old wines - crafted to last. They will be a fantastic gift for someone to savour and enjoy a glass of Australian wine history.”

PUBLISHER The Drinks Association

www.drinksassociation.com.au

All enquiries to:

The Drinks Association

Locked Bag 4100, Chatswood NSW 2067

ABN 26 001 376 423

The views expressed in Drinks Trade are those of the respective contributors and are not necessarily those of the magazine or The Drinks Association. Copyright is held by The Drinks Association and reproduction in whole or in part, without prior consent, is not permitted.

PUBLISHING EDITOR Ashley Pini ashley@hipmedia.com.au

MANAGING EDITOR Melissa Parker melissa@hipmedia.com.au

DIGITAL EDITOR Rachel White rachel@hipmedia.com.au

STAFF WRITER Cody Profaca cody@hipmedia.com.au

DESIGN

SENIOR DESIGNER Jihee Park jihee@hipmedia.com.au

ADVERTISING

NATIONAL SALES MANAGER Jenny Park jenny@hipmedia.com.au

PRODUCTION MANAGER Sasha Falloon .........sasha@hipmedia.com.au

CONTRIBUTORS

In late April, I had the privilege of travelling to France and the Loire Valley. The trip was five days of delicious Loire Valley wine tastings, meeting passionate producers and enjoying the sites of this picturesque region, particularly the majestic chateaux.

The Loire is proud of its heritage, terroir and diversity. It is the third largest wine region in France and one of the few producing not only exceptional sparkling wines, but white, red and, of course, rosé. Its marketing campaign features the Four F’s, highlighting the wines’ fruity, fresh, floral and fair credentials. Interloire spokesperson Pierre-Jean Sauvion said; they might need to make that Five F’s and add ‘fun’. Why not? Turn to page 52 for our Special Loire Valley Report, including a feature on its rosé and the heavenly expression of Chenin Blanc from the Savennières appellation.

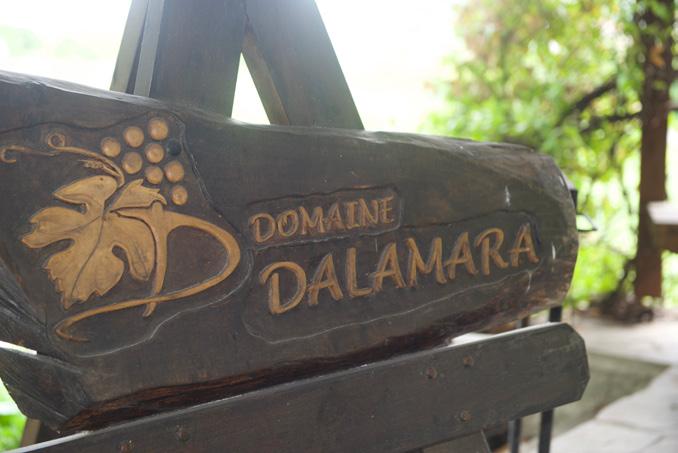

We are a team of travellers for this edition. Publishing Editor, Ashley Pini took a trip to the wine regions of Greece accompanied by David Messum from Just the Drop. Turn to page 50 for his report on the fascinating wines and varieties found in this ancient wine regionbonus reader points if you can pronounce them correctly. The timing presented a perfect opportunity to dash across the Ionian Sea to join the crew from Liquor Barons at their conference in Italy—Ashley’s report on the retailer’s conference is on page 20.

Our Viewpoint features Damien Page, General Manager Marketing and Merchandise, Liquor Marketing Group (LMG) on page 16. After his impressive presentation at The Drinks Association Breakfast event with Simon Ford from Shopper Intelligence, Damien shares further detail on LMG marketing initiatives and what makes them successful.

Finally, the winter edition also comes with the highly anticipated Hottest 100 Brands Report. This valuable and industry-worthy initiative allows us to celebrate brands standing triumphant. And not just in terms of dominating the market with sheer volume sales, but also paying attention to those growing exponentially over the past 12 months, even if off a small base. For a quick view of the 100 Brands for 2023/4, turn to page 37.

Produced and contract published by:

ACCOUNTS: accounts@hipmedia.com.au

For new product or current releases

in Drinks Trade magazine send a sample to:

HIP Media

20 Gillian Parade, West Pymble, NSW 2073 www.hipmedia.com.au | facebook.com/drinksmedia

ABN: 42 126 291 914

6 drinks trade

Our congratulations go to the Hottest 100 Brands for 2023/4. Keep the fire burning. Until Spring, stay well and warm, Melissa melissa@hipmedia.com.au @drinkswithmelparker

Speaking at the Australia-China Relations Institute (ACRI), Tim Ford, CEO of Treasury Wine Estates (TWE), said that even if tariffs were lifted tomorrow, TWE would need years to build up their operations again.

Hosted in collaboration with the University of Technology (UTS) Business School, the event took place on the heels of Trade Minister Don Farrell’s landmark visit to China this week.

The first visit from an Australian Trade Minister since 2019, Ford said Farrell’s recent visit was a “hugely significant” step on the journey to resuming bilateral trade.

Although Farrell returned without any concrete concessions for Australian exporters, Ford said from his point of view the meeting was a success and another step in the right direction.

And while trade is still curtailed, Ford said TWE had become adept at planning different scenarios and diversifying its global presence as they wait for the two countries to resolve their trade disputes.

“It’s going to take us two, three, four years to start building up the Australian side of it again,” said Ford, adding that they’d never again return to a business model that relies on trade with just one market.

Luiz Schmidt will take over as Managing Director of Bacardi in Australia and New Zealand after more than two years in Panama working as Regional Marketing Director for Bacardi in Latin America and the Caribbean.

A University of Technology MBA graduate and FMCG marketing specialist with over 20 years of international experience, Schmidt will lead Bacardi’s sales, marketing, finance and supply chain functions, as well as expand the company’s premium portfolio and market share in the region.

Vijay Subramaniam, Regional President for Asia, Middle East & Africa and Global Travel Retail at Bacardi, said Schmidt is uniquely qualified to take over as Managing Director as a dual Australian and Brazilian national with a wealth of experience.

“The appointment of Luiz Schmidt as our new Managing Director marks an exciting chapter for Bacardi in Australia and New Zealand,” he said.

Yesterday afternoon newly appointed Coles Group CEO Leah Weckert announced former Coles Express chief Michael Courtney as the new Chief Executive of Coles Liquor.

From July 1 Courtney will replace outgoing chief Darren Blackhurst, who announced he’d be stepping down from the role to return to the UK to spend time with his children and ageing parents last month.

Weckert said she’s delighted with Courtney’s promotion and welcomes him to the Executive Leadership Team at Coles along with Amanda McVay, the newly recruited Chief Customer Officer.

“Michael has spent the past six months immersing himself in the eCommerce business and transforming our customer offer. Michael is exceptionally well placed to lead Liquor in delivering the strategy and transformation plans underway. He is committed to building a strong culture and team who are passionate about being local drinks specialists,” she said.

Coles’ third quarter sales results released this month revealed a 2.6 per cent rise in liquor sales revenue, rising to $801 million this quarter.

Endeavour Group has named GIVIT as its community giving partner for the next three years, with 100% of funds raised through customer and team events to be distributed

by GIVIT to Australians in need.

The partnership has seen more than $2 million in corporate and customer contributions donated since 2019.

Dan Murphy’s has donated more than half a million dollars of in-store advertising to GIVIT over the last 12 months, creating direct connections with customers at their point of purchase.

Funds raised through the initiative have assisted thousands of people doing it tough across Australia, including single parents looking to put food on the table and clothing for those who lost everything as a result of flood events in recent years.

Endeavour Group CEO and Managing Director Steve Donohue said the company’s relationship with GIVIT first came about in 2019 for drought relief and has continued in response to other recent natural disasters including the devastating Northern Rivers floods in 2022, which destroyed its Dan Murphy’s store in Lismore.

“We are committed to leaving a positive imprint on the communities we serve, and this partnership is evidence of that,” Donohue said.

“We know that some Aussies are doing it tough at the moment and this is just one way we can help give back.

Guided by the expert hand of Master Blender Patrick Leger, Bisquit & Dubouché Cognac strives for not just harmony but unwavering consistency in every drop.

What sets Bisquit & Dubouché apart is its unique double distillation method. With an extended extraction period and careful cutting of the distillate at a later stage, an ‘extra heart’ is reached, abundant in aromatic components. This technique relies on the experienced senses of our skilled distillers, who patiently await the precise moment to make the cut.

The result is an exquisite Cognac boasting a pronounced aromatic profile and an exceptionally smooth structure.

V.S.O.P. Made almost exclusively of four crus – Grande Champagne, Petite Champagne, Fin Bois and Bon Bois. Slowly matured in French oak barrels for a minimum of four years.

Nose: An aromatic bouquet focused on a core of ripe fruit, including dry apricot and honey – as well as sweet spices – cinnamon and cloves – underlined by floral nuances, including rose.

Taste: Smooth and mellow with a lasting finish, characterized by honeysuckle, citrus and mango notes.

X.O. A silky, sumptuous, high-end Cognac crafted using prestigious eaux de vie from Grande and Petite Champagne Crus. Slowly matured in French oak barrels for a minimum of 10 years.

Nose: A bouquet of aromas focused on a core of woody and smoky notes of tobacco and cocoa and fruity notes of candied fruit and prune.

Two gals from Sydney’s Bondi, Laura Cracknell and Madeleine Downs have created the Saltist shot glass made from 100% Himalayan Salt sourced from Pakistan’s mountain ranges. With sustainability and the joy of tequila at the brand’s core now we can all enjoy that desirable salty taste with every sip.

The brand has a big giving back philosophy and has partnered with i=Change to support three charities including Save the Children, Greening Australia and the National Breast Cancer Foundation. Go ahead, sip your favourite tequila with a salty essence and feel good about it. The Saltist Range includes both black and pink Himalayan Salt glasses, and come in a set of 2, a set of 4, or our ‘Sip with Saltist’ gift set - that includes 2 glasses, Patron Tequila and a fresh lime.

Wild Turkey, the iconic American bourbon brand, recently unveiled its new creative territory, Wild Turkey Music 101, giving the brand a new experiential platform that allows them to tap into real consumer passion-points and build upon their wellestablished global platform, “Trust Your Spirit”.

With a new campaign starring the ARIA Award winning musician, Matt Corby, Wild Turkey began rolling out their through-the-line activity this month. With significant media investment, the brand launched a multi-channel campaign that aims to reach a wide audience across a variety of touchpoints, including the globally developed hero TV spot, radio ads, PR, podcasting, digital video and more.

At the centre of the experiential activity is a custom Airstream designed to be partbar part-recording studio that will take great Aussie talent to fans through brand-owned intimate live music moments across the country.

Not only have Wild Turkey created a number of brand-owned gigs in the wild, but the custom Airstream gives the brand a hero asset to leverage in the on and off premise. Wild Turkey have some incredible performances planned in the near future that aim to connect live music with fans. Beyond live music moments, of which there will be over 53 throughout 2023, both big and small, Wild Turkey Music 101 has partnered with Corby and other revered Aussie artists to offer mentoring opportunities to aspiring Australian artists, as Music 101 extends into a bespoke national mentorship program.

A final selection of aspiring artists will get the opportunity to be mentored by Matt Corby and other leading Australian musical talent. The program will also indirectly support more than 50 local artists across Australia via the live music moments in the on-premise environment, giving consumers the a place to experience great music, great

talent, alongside the smooth taste of Wild Turkey Bourbon.

Through Music 101, Wild Turkey now have the opportunity to show, not tell a new audience what Wild Turkey stands for and kickstart a new journey for the bourbon brand and its essence, Trust Your Spirit.

For more information contact info.australia@campari.com

Fever-Tree’s importance to the mixer category is unrivalled. Fever-Tree has consistently been considered the world’s number-one premium mixer by volume and value since its conception.

Above all else, Fever-Tree’s success should be attributed to its quality: and the latest doing the rounds is Fever-Tree’s Distillers Cola.

Much like the rest of the Fever-Tree range, the Distillers Cola has been designed explicitly with mixing in mind. Balance is the key: less sweet and more delicate, FeverTree Distillers Cola is a product that will help shine a fresh perspective on your timeproven favourite whisky or rum.

Beyond balance, the quality of ingredients is also integral to the mixer, something that has been at the core of Fever-Tree since its conception. Featuring a combination of 11 naturally sourced ingredients, including Caribbean kola nuts

the Distillers Cola is as tied to traditional cola heritage as it is to its purpose as a mixer.

Fever-Tree is filling a demand that has always existed and continues to grow. BevTrack and IWSR data shows that mixing with Scotch and Irish whisk(e)y is increasing

at a rate of 47 per cent, whilst mixing with US whiskey is growing at 58 per cent.

The Premium Ginger Beer and Dry Ginger Ale are also forming part of the Fever-Tree dark spirit portfolio. In typical Fever-Tree fashion, these ‘gingers’ go beyond what one might expect, with ingredients and provenance playing a crucial role. Most important of all are the varieties of ginger used. Fresh Green ginger from the Ivory Coast imparts a lemongrass-like freshness, Nigerian ginger builds up the aromatic intensity, and Cochin ginger from India is uniquely warm and spicy. Each mixer in the range is carefully considered and crafted with different spirits and cocktails in mind.

Fever-Tree is continuing to progress forward, carrying with it not just the company’s success but the entire premium mixer category as well. And, in the wake of its every step are ripples of change that are steadily affecting the industry as a whole.

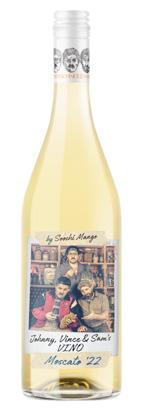

THEY’VE AMASSED A STAGGERING 115K INSTAGRAM FOLLOWERS SINCE THEY LAUNCHED THE BRAND IN NOVEMBER 2021 AND ACHIEVED AN EYE-WATERING $50MILLION+ RETAIL SALES

VALUE IN THE FIRST 12 MONTHS- SELLING 10 MILLION LITRES IN THEIR FIRST YEAR.

SO WHO’S BEHIND BETTER BEER?

Better Beer is brought to you by Aussie comedians, Matt Ford and Jack Steele (The Inspired Unemployed) and Nick Cogger- a health-conscious drinks enthusiast, publican, and founder of Torquay Beverage Co.

Over the past few years, like many health-conscious Aussies, they were on the hunt for a new beer that was better all-round and still held up in quality and taste.

“There were not many zero carb beers out there at the time, so we thought launching a crisp, refreshing and healthier alternative for us and our mates was the best idea ever!” said Matt Ford.

So they got together to create the Better Beer Co. and brewed their first beer in Griffith, NSW: Better Beer Zero Carb, Zero Sugar.

Better Beer has already proven itself to be hugely popular across Australia, and not just on social media, with their first beer Zero Carb twice being voted as the 6th best beer in the GABS Hottest 100 Aussie Craft Beers Awards, for two consecutive years

Due to the popularity of their first brew, they’ve expanded their range of beers: a lower sugar, gluten free alcoholic Ginger Beer; a Zero Alc lager; Middy, a mid strength lager and most recently a sessionable Pacific Ale style of beer - Arvo Ale

They don’t take themselves too seriously, but when it comes to brewing beer- they mean business-their Ginger Beer cracked the Top 50 in this year’s GABS Hottest 100 Aussie Craft Beers Awards and Middy just picked up a Silver at the 2023 Royal Queensland Beer Awards.

“There were not many zero carb beers out there at the time, so we thought launching a crisp, refreshing and healthier alternative for us and our mates was the best idea ever!” - Matt Ford.

Check out their website for more info: www.betterbeer.com.au

@betterbeer

@betterbeeraustralia

If you’re keen to range Better Beer in your bar, please contact your Mighty Craft rep or email newcustomers@mightycraft.com.au

The Better Beer range is available to buy in 355mL cans, Zero Carb is also available in 330mL stubbies and all alcoholic beers are available in 50L kegs.

LIQUOR MARKETING GROUP (LMG) IS AUSTRALIA’S LARGEST MEMBERSHIP-OWNED RETAIL LIQUOR GROUP, REPRESENTING OVER 1400 OUTLETS. IT OPERATES NATIONALLY, SUPPORTING MEMBERS UNDER RETAIL BRANDS BOTTLEMART, SIP ‘N’ SAVE, THIRSTY CAMEL (WESTERN AUSTRALIA) AND HARRY BROWN. LMG HAS NO OUTSIDE EQUITY (COMPANY LIMITED BY GUARANTEE). THE OBJECT OF THE COMPANY IS TO INVEST ALL FUNDS DERIVED FOR THE BENEFIT AND ADVANCEMENT OF MEMBERS FROM RECOGNISED AND TRUSTED RETAIL BRANDS THROUGH TO MARKETING AND PROMOTIONS, DATA AND INSIGHTS AND RETAIL AND EXECUTION SUPPORT.

DAMIEN PAGE IS GENERAL MANAGER OF MERCHANDISE AND MARKETING AT LIQUOR MARKETING GROUP (LMG) AND IS INTEGRAL TO MAKING THESE OBJECTIVES HAPPEN FOR THE LMG MEMBERS. HERE HE DISCUSSES HOW FOCUSSING ON MEMBER SUCCESS IS A

Members are integral to the LMG business model. How does LMG support its members, and how important is the community to how LMG does business and works with its members? LMG was founded in 1977 to allow independent members to operate their liquor stores with the benefit of leading marketing, consumer insights and retail environments that enhance the shopping experience. The group’s formation was, in part, a recognition of the chain retailer’s entry into liquor (at the time, they held a market share of less than 15%) and the need for coordination and collaboration. The vision of LMG’s founders has delivered two of the great assets which set LMG apart today:

1. LMG is operated solely for the benefit of members. This provides a clear focus for the entire LMG team on what success is and who we work for;

2. LMG’s focus is on the customer.

From its origins, LMG recognised the opportunity derived from engaging and retaining the customer and how if you win with the customer, you win for all stakeholders.

There are different models and structures in the market, but this clarity of purpose, set out 46 years ago, remains the primary driver of LMG’s success.

While the methods, tools, and competitive landscape has changed over this period, the focus remains:

• Supplier negotiation and partnership to derive optimal promotional and pricing programs for the customer and retailer

• Marketing through both the more traditional medium of catalogues and with leading social and digital marketing, direct marketing, loyalty and in-store promotions

• Retail execution and store enhancements through our field teams (BDMs), who are business partners for our members.

• Enhancing all the items above and challenging the LMG team with the extensive data and insights we derive from our network.

The retail landscape is changing. How does LMG ensure its members are ahead of the competition in terms of the retail space?

It’s about empowering and supporting our members to enhance their physical retail space (bricks) and, more recently, their online digital stores (clicks). LMG supports our members with both their bricks and clicks stores in these ways:

• The in-store environment requires consistent insights and the discipline of reviewing current market trends. Our BDMs continuously act as advisors, a fresh sets of eyes, and a support to relay and refit stores as required. LMG has, for instance, recently completed over 160 full retail refresh store enhancements for members. The results in terms of physical appearance have been incredible. But even more importantly, we have seen increases in both customer count and premiumisation in the refreshed stores versus benchmark

• The other critical retail space is our members’ digital stores. We know through industry insights more than half of shoppers will review a planned purchase online before transacting in-store. We applied this insight when developing our online platform, so the digital store became a true representation of the physical store by showcasing the full range and ensuring current pricing was reflected online via POS connection. This structure was more challenging to develop but rewards retailers who tailor their range and offer extended or premium products for their customers.

The second most important player to LMG after its members is the shopper. How does LMG learn from and implement its shopper insights and data to improve business?

We are all shoppers. We all know what we like and what we don’t. However, you need to be careful not to apply your preferences to the programs. This is where data, insights

“Catalogues remain the highest driver of pre-store purchase planning, with printed catalotues evolving into digital form.”

and consumer engagement surveys, like Shopper Intelligence, are critical. They provide the confidence to push forward with an initiative or the challenge to review a current program.

Our focus is to support our members to cater to the needs and preferences of their customers. Shopper insights help us do that with product assortment, pricing, promotions, store layout, and targeted marketing campaigns.

We have clearly segmented our shoppers so that we can tailor different programs and different messages to them depending on what we are trying to achieve. It also allows our suppliers to leverage their brands with a clear shopper in mind, creating effectiveness and eliminating wastage of message.

For example, if shopper insights reveal a trend toward more health-conscious products like zero-alcohol beers, organic wines and zero-sugar mixes, we can help members execute both pre-store and in-store with the right marketing collateral and the best products to meet those needs.

A couple of campaigns from Shopper Intelligence’s data have been the Premium Wine Campaign and the Celebrate with Bubbles. Can you explain how they worked and why they were successful?

The success of these campaigns came through a focus on customer basket data and Shopper Intelligence insights.

In the case of Premium Wines, basketsize analysis helped us identify the customers willing to pay more for a premium product and pinpoint how much more they would pay. This, in turn, allowed us to supply our members with products at the optimum price point. Ultimately the Premium Wine program drove an increase of +19.5% of the total wine category growth.

In the case of Celebrate with Bubbles, we combined a strong pre-store campaign which leveraged geo-targeting to reach the right customers with a dedicated catalogue, press and point-of-sale collateral and competitive offers. We saw champagne growth of 111.5% over three years.

Last year you trialled and implemented the Zen Global Platform. How has the broader application of the program rolled out this year, and what has been the impact on your members’ businesses?

The insights and value of consumer data from their activity within our stores are immense. Being able to connect the transaction to the customer ID and other interactions with that shopper allows us to improve our offer to that individual and many others with similar trends.

Zen platform has unlocked this capacity for LMG. We are working in parallel to enhance further the Zen platform along with testing and trialling loyalty scheme options for wider deployment.

You have spoken about the importance of social media and the necessity of print catalogues to your business. How do you see pre-store marketing evolving in the future?

Catalogues remain the highest driver of pre-store purchase planning, with printed catalogues evolving into digital form. We are fortunate to have a great social and digital presence, allowing us to engage consumers who prefer digital with our digital catalogues and still deploy physical catalogues for key selling periods. We know through market data that physical catalogues continue to drive market share gains and remain a critical component of our program.

The great thing about the digital catalogue is there is less space limitation and more opportunity for consumer engagement, whether that is click through to an article on the product or click through to our eCommerce store to purchase the product.

We will continue to monitor the effectiveness of both catalogues, but we still see results derived through both.

Since Covid, e-commerce has exploded, but LMG were ahead of the game. Can you explain how this has benefited the business in this period and how LMGs digital and social media strategy will play out for LMG moving forward?

We benefited from having e-commerce capabilities already in place before COVID and by rapidly rolling out new digital initiatives to support our members, including our digital ordering platform and virtual produce tastings. We also ramped up investment in digital marketing, leveraging targeted campaigns and social media to drive traffic to our members’ online stores. We will maintain this success by focusing on digital solutions going forward. This includes increasing the scope of our e-commerce platforms and implementing store-specific geo-targeted social media campaigns. Digital innovation will remain a key part of our growth strategy.

What are the challenges for the future of off-premise liquor retail?

Our challenge to ourselves is to be better than yesterday. That means staying competitive and always offering our members the most innovative and agile support so they are equipped to handle the pressures associated with supply chain issues, regulatory requirements or just the business of always meeting their shoppers’ needs.

What has been your career highlight at LMG?

I always go back to the people, our members. When you are invited into their homes, meet their families and see them flourishing, you really appreciate the positive impact you can have.

SOURCING THE HIGHEST QUALITY INGREDIENTS AROUND THE WORLD.

FEVER-TREE CRAFTED A RANGE OF DELICIOUS MIXERS FOR THE ULTIMATE MIXED DRINK WITH DARK SPIRITS SUCH AS WHISKIES, BOURBONS AND RUMS.

Held across ten days, the conference kicked off at the Westin Hotel in Rome with a full day of conferencing and an informative Italian Wine Masterclass.

General Manager Liquor Barons Chris O’Brien welcomed delegates attending this year’s international conference and presented the current trading environment including the outlook for the year ahead.

Liquor Barons’ impressive performance, particularly in an increasingly difficult trading environment, highlighted the work that has been done during and immediately post the impact of COVID.

“During COVID, it was clear consumers tried their local retailers, and they are staying. Our performance is ahead of our counterparts, and it’s a credit to you [the store owners] and your stores. You knew your customers’ names and carried their purchase to the car, and they have remembered that” O’Brien said whilst addressing the members.

On general market conditions and how Liquor Barons has performed, O’Brien said, “We are starting to see the move to value, whilst our positioning remains premium and specialist.

The majority of the banner groups’ head office staff attended the conference, reconfirming Liquor Barons commitment to their team and the engagement with the store owners and understanding of the cooperative.

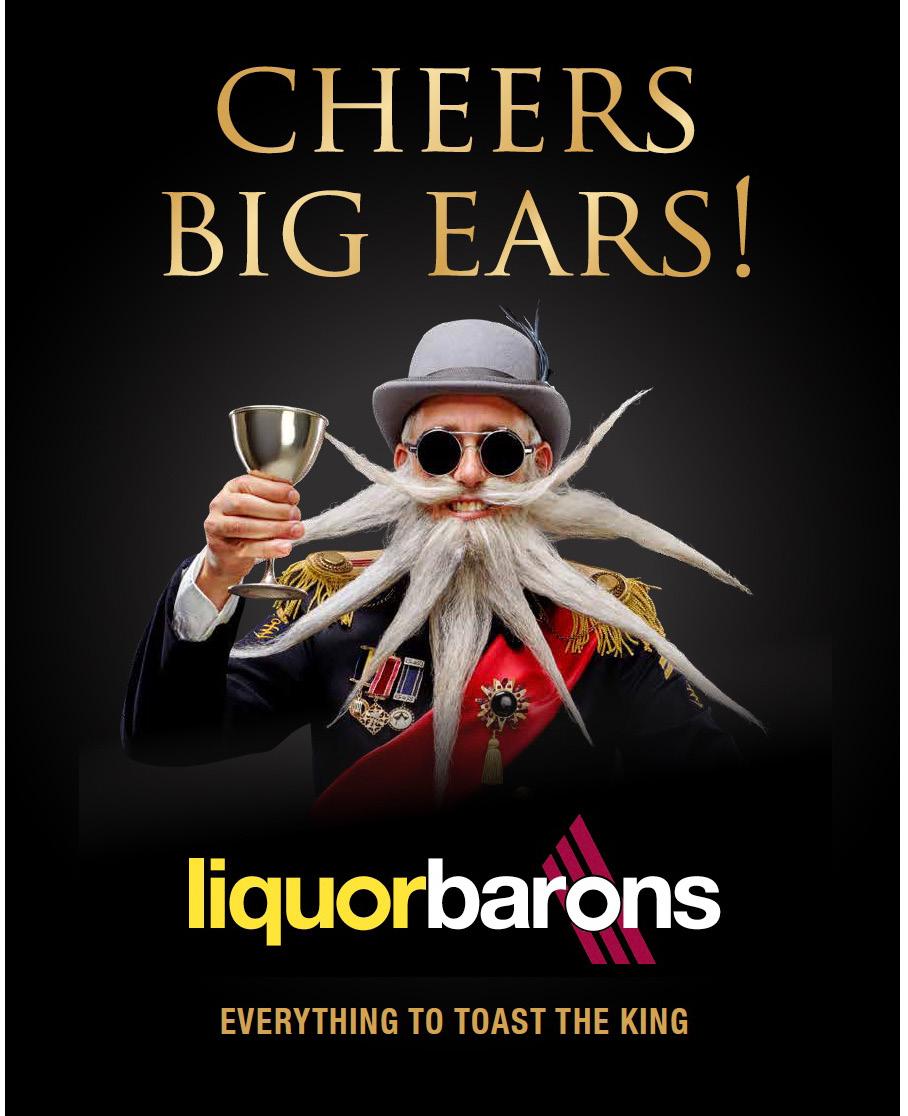

The marketing team gave a sneak peak of the 2023/24 brand campaign alongside some of the incredible engagement the brand receives from its current positioning. The coronation advertisement, for example, benefitted from multiple complementary prime outdoor media placements due to its entertainment factor featuring ‘The General’ toasting King Charles.

Liquor Barons now offers its members one-on-one digital and social media support helping to keep the banner at the forefront of, and engaged with, the local community. The merchandise team showcased category performance using market leading data and it was evident this innovative approach was translating to data-led decisions, positioning them at the forefront of the industry.

Winding down from the day of conferencing, retailers enjoyed an evening looking over the rooftops of Rome and enjoying the operatic voices of ‘three tenors’ at Casina Valadier, courtesy of Montenegro, Malfy Gin and Peroni.

After the Rome conference more than 150 delegates moved up to Florence for the second part of the trip, and welcome drinks served up by Samuel Smiths & Sons, a chance for the group to examine the opportunity around imported wines.

Throughout the trip, WSET trainer Foni Pollitt, from Foni T Pollitt’s Wine School, ran education classes covering the wines of Italy, supported by individual retailer visits to wineries in the Tuscany region. The international wine flavour was further studied on the second last evening with Franklin Tate’s Tatelbaum range of wines at an evening of Italian food and wine hosted at Hotel Calimala.

The Tatelbaum range is already available in Western Australia via some retailers, and this was a chance to meet famed Italian winemaker Alberto Antonini – named one of the top 5 most influential winemakers in the world by Decanter magazine. Antonini works in concert with Australian-based winemaker, Emiliano Secco, producing a Prosecco, Grillo, Montepulciano and a Chianti.

“The Tatelbaum range has been based on generations of women in our family, each of them with larger-than-life personalities. Through our European roots, we embody this family story in our Italian wines, packaged with hand-drawn illustrations that represent the women’s names and their stories,” said Tate.

The conference wrapped up with a visit to Villa Cora in the hills above the city of Florence to enjoy classic Negroni’s and a local twist, presented by Campari. Florence, as home to the globally popular cocktail, has

The marketing team gave a sneak peak of the 2023/4 brand campaign alongside some of the incredible engagement the brand receives from its current positioning.

perfected the art of the Negroni, and twists, as well as the Aperol Spritz.

In conclusion Chris O’Brien said, “Now more than ever, West Australian consumers know to support their local everything. Liquor Barons has invested largely in bigimpact marketing campaigns that educate consumers on supporting the little guys (us!), and that’s been hugely successful.

“The marketing efforts focus on promoting our 70-plus store owners and the advantages of shopping local, as well as articulating what the benefits of being independent are to our customers. We’ve communicated that our co-op model allows us to use our combined buying power to offer a huge range of their favourite alcohol brands at competitive prices.

“But most importantly, we’ve communicated that Liquor Barons cooperative has a grassroots approach, with community at the heart. Our cooperative model is something to be proud of. We are unique in WA and one of only two in Australia. It allows decisions to be made by retailers for retailers. We are nimble, entrepreneurial and focused on being at the front edge of the curve.”

CHECK THE 7-DAY POURCAST

FROM ULTRA-PREMIUM RELEASES TO LOCAL TREASURES, KEN GARGETT LOOKS AT THE PERENNIAL APPEAL OF GRAPE SPIRIT AND REVEALS WHY BRANDY AND COGNAC WILL ALWAYS HAVE A STRONG PLACE IN THE DOMESTIC AND GLOBAL SPIRIT MARKET.

Brandy and Cognac might not be the highprofile spirits hitting headlines, like Gin, expensive and limited-edition Single Malts, Mezcals and premium Rums, but it remains solidly popular. The global Brandy market is estimated to come in at US$1.2 billion in 2023 and growing at an estimated 5.92% up until 2027. As we move to 2024, volume is anticipated to rise a further 2.8%. To ensure clarity, Brandy refers to distilled spirits, made from fermented fruit juice, though that is most commonly grapes. It includes both Cognac and Armagnac. As with the Rum sector, Covid has thrown statistics and predictions into some chaos, but even more than with Rum, the Russian invasion of Ukraine has contributed to the confusion with Brandy/Cognac.

In January of 2023, the five leading markets for Brandy were the US, India, Philippines, China and Thailand.

More recently, Australia has been seen to be a popular market for the style with an anticipated rise in revenue across the sector of 8.6%. It has long been a strong sector in this country. For the period from 2012 to 2017, the annual rate of growth was 7.67%. The value of the category in 2017 was A$248.47 million. The rate of growth has been steady – in the final two years of that survey, the annual growth was 7.89% and 7.28% (the highest and lowest figures for that period, so fairly consistent).

One aspect of the Brandy sector that seems perennially healthy is the ultrapremium releases we see from the Cognac

Houses. A perfect example is Remy Martin. Not content with their extremely popular elite Cognac, Louis XIII, this June will see the release of the Louis XIII ‘Rare Cask 42.1’. This limited-edition Cognac is their first Rare Cask release since the 42.6, a decade earlier. Prior to that, Rare Cask 43.8 was released back in 2004. The nectar for this release came from a tierçon identified by their fifth-generation Cellar Master, Baptiste Loiseau. Only 775 decanters, handcrafted by Baccarat, will be released.

Tierçons were something that, until recently, the House had not looked to replace. The last of their famous tierçons was made during the First World War in 1917. A tierçon is an oak barrel, larger than usual, longer though slimmer, which were

so named as they could fit, three side by side, on a horse-drawn cart for transport. Until they started making new ones half a dozen years ago, to maintain those they had required taking staves from one to repair another.

The trees, from the Limousin forest in France, take between 150 and 180 years to reach the requisite size. The staves are air-dried for three years before the barrel is completed. After fifty years of use, the House notes that they will then be “filled with our older, finest and richest Grande Champagne

samples were a little thin on the ground.

If one wanted to look to something a little more modest – $59 – the Tamborine Mountain Distillery, in southeast Queensland, just won a gold medal for Best Brandy at the 2023 London Spirit Competition, with their Apricot Brandy Liqueur.

Perhaps the Brandy most revered locally is St Agnes, which has been going solidly for many years, as Dr William Angove established a distillery in Renmark in 1910. But it was William’s son, Carl, who looked to a new style of Australian spirits, Brandy that was lighter than that which the locals were used to. His efforts are approaching their centenary with the St Agnes versions of VS, VSOP and XO dating back to 1925. Carl spent time in Cognac to perfect his craft.

Recently, the range has expanded, though as Matt Redin from St Agnes notes, they have been so successful that they reached a point “where we had to allocate certain expressions due to shortness of supply of sufficiently aged material for a while. We are now through the worst of this shortage but some of our older statements will be limited in volumes over the next few years.”

A fresh take on brandy locally, at 44% ABV, it is made from a blend of Colombard, Chardonnay and Doradillo grapes, which have been matured in a mixture of ex-wine, tawny port and sherry casks for a minimum of eight years. Sipping over ice works well, but this is a brilliant brandy for quality cocktails. This is richly flavoured with notes of glacéd orange rind, chocolate, Christmas pudding and florals. Dried fruits, a hints of sweetness and a powerful finish.

eaux-de-vie which will reach the perfect ageing development and which will be part of the Louis XIII blend in the future”. Since 2017, they have made fifteen new tierçons a year, though just how many of us alive today will get a chance to enjoy the rewards of this seems rather to be a moot question.

Mind you, not many of us will ever get to try this latest release, and at US$50,000 for each decanter, needless to say that tasting

Matt expanded on the reasons for the growth. Included in those factors are those who were “initially spurred on by people making more mixed drinks at home during Covid and experimenting with spirits they otherwise would not have tried – including brandy. We also witnessed consumers moving up the premium ladder and purchasing more of our St Agnes XO, Bartenders Cut and VSOP.” That they also won ‘Distillery of the Year’ at the Tasting Australia Spirit Awards, won’t have hurt. Consistency is crucial for brandy production and the fact that St Agnes has had only five master distillers in almost a century is testament to that.

To conclude, a look at some of the wonderful St Agnes brandies.

ST

A perennial trophy winner, with a minimum age of fifteen years, this is 40% ABV. This brandy moves to aromas in the spectrum of cedar, tobacco leaf, orange marmalade, stonefruits, a little more oak and a glorious raisiny note. These flavours explode across the palate. Balance, a lingering finish and no let up of the intensity is key. Fabulous stuff.

ST AGNES XO IMPERIAL

A stunning brandy with an ABV of 40%, this is blended from material which is a minimum of twenty years of age, with the oldest components dating back to 1970. Incredible complexity. More nuts, toffee, white chocolate, florals and vanilla with touches of caramel weaving throughout. This is a little more spicy than the previous pair. Balance, subtle power, impressive length. Wonderful.

ST AGNES

An extraordinary privilege to taste an Australian spirit of this age and complexity. An ABV of 43%, the oldest material here also dates back to 1970. Amazing array of aromas here. Lemon butter on fresh toast, florals, tropicals, vanillin oak notes, spices, raisins, honeycomb, stonefruit and more. Every taste sees more emerge. Majestic length here. Balance, harmony and incredible complexity. Should be on every spirit lover’s bucketlist.

One aspect of the Brandy sector that seems perennially healthy is the ultrapremium releases we see from the Cognac Houses.

The biggest wholesaler to independently owned liquor retailers in Australia

We want to help you create the best store in your town

1 Through famous brands with unique character

2 By being frictionless from order to cash

3 By building programs, which create growth for you and your shoppers

KEN GARGETT DIVES INTO RUM’S SUGARY DEPTHS AND REVEALS A SPIRIT THAT REFUSES TO FADE DESPITE GLOBAL PANDEMICS AND ECONOMIC DOWNTURNS. WHITE RUM IS RAISING THE BAR OVERSEAS AS A GIN/TEQUILA ALTERNATIVE WHILE DARK RUM CONTINUES TO DOMINATE AT HOME, INFLUENCED BY THE WELL-KNOWN LOCALLY DISTILLED VERSION IN QUEENSLAND, AND AUSTRALIAN ARTISAN RUMS MAKE A MARK.

Figures, statistics and projections in recent years have been somewhat askew and rather difficult to pinpoint as the world has dealt with Covid and, more recently, the Russian invasion of Ukraine, but in 2021, the global rum market was worth a staggering US$11.26, moving to US$11.77 billion in 2022. Expectations are that the

compound annual growth rate for rum over 2022 to 2028 will be 5.2%, which will see the rum market worth US$16.08 billion in 2028. While a considerable proportion of this worldwide is white rum, Australia bucks that trend with consumption of dark rum approaching nearly 80%. Of course,

as anyone not living in a cave would know (and probably most of those who do), one producer in Australia dominates the market in a manner which happens in no other sector. Bundaberg Rum rules the category in Australia to an unprecedented extent. We are seeing slow growth in the white

rum sector, which is coming from the spinoff to the white spirit explosion, most notably seen with gin, increased interest in cocktails and millennials looking to “unique and authentic alcoholic drinks”. That latter contribution is not rum lovers showing their unwavering support for Bundy, legion in numbers, but rather those looking to explore new products, imported and local, new styles – look to the Agricole-influenced rums of Husk Distillers as an example – and new and emerging craft distillers. While they are not such a high percentage of the category as the elite malt whiskies are when one looks at the whisky sector, premium rums are definitely on the increase and attracting serious attention. It seems that aged premium rums are finely getting the attention they deserve as a sipping spirit and an inclusion to top-shelf cocktails.

Yes, Covid threw results and predictions into more chaos than usual. The closure of and restrictions upon, not just in Australia but worldwide, bars, hotels, nightclubs, restaurants and their ilk greatly impacted the sale of rum, spirits and alcohol in general. We saw a move to increase sales over the Internet. How much they balanced each other is probably never going to be exactly clear, but rum was an exciting sector before Covid (and the Ukraine invasion, though that applies more to exports and is perhaps not terribly relevant to rum sales in Australia) and remains an emerging one these days, on top of established producers.

We have certainly seen a number of new product releases in this sector. We also see more and more of the world’s great rums, especially from the Caribbean, reaching our shores. Flavoured rums are making their presence felt, as well, and are anticipated to increase their market share faster than any other in the category. Look also to the recent inclusions of ‘Canned Cocktails’, such as Bacardi with drinks like their Bahama Mama, Mojito, Sunset Punch and Rum Punch’.

Outside Australia, the Asian Pacific markets dominated with 40% of the global revenue in 2021, expected to increase in the coming years. Rum is proving to be very popular with younger generations (as always, each new generation wants to

move away from the drinks enjoyed by their parents). India and the Philippines are major contributors, both in consumption and production. In 2021, Bacardi reportedly noted a 30% growth in sales in India, which is fast proving to be one of their best markets. Overall, however, the North American market is expected to see the most serious growth in the run-through to 2028. The UK and France are also proving key

markets for emerging rum drinkers. The top five countries for rum consumption are the US, Spain, the UK, India and Canada.

If we turn to Australia, the anticipated rum sector in 2023 should be worth US$117.9 million, an annual increase of 7.7%, with the compound annual growth rate expected to be 4.09% up to 2027. The increase is slightly slower than enjoyed between 2013 and 2018, which was 8.78%. The average volume of rum each Australian consumes in 2023 is anticipated to be 0.07 litres – clearly, some of us are not pulling our weight!

What we are also seeing is distilleries which began with a dream of offering top malts or rums but found that the tyranny of time and commercial reality meant that they had to exist by producing gin are finally seeing those dark spirits which have been maturing away in the corners of their

“Australian rums aren’t acknowledged around the world. And in our opinion, it’s time they were.”

- Matt Hobson.

distilleries finally approaching maturity. Archie Rose is an obvious example. Husk Distillers is another.

Whilst dry statistics, even allowing for Covid variances, paint part of the story, nothing comes close to the experiences of a new distiller trying to carve a niche in the market, one which a single producer so heavily dominates, and we have thoughts from a couple of them.

In 2012, Paul Messenger and his family moved to the gloriously scenic Tweed Hinterland (if you are anywhere near here at any time, the distillery is a must-visit – and if you are hoping to dine, make sure you book), specifically Tumbulgum, in the middle of sugar cane country and established a new rum distillery, Husk Distillers. Paul was a great fan of the agricole rums from Martinique, their complexity and representation of terroir. Indeed, their lack of availability here in Australia was one of the driving factors in Paul establishing Husk. This style of rum was very different from what Australians traditionally drank, which Paul was keen to offer. Rhum Agricole is made from freshly squeezed sugarcane juice rather than traditional molasses.

As Paul has detailed, when they established the distillery at Tumbulgum, the Australian market had 21 producers offering 38 rums which sold 995,000 cases. By 2021, that had expanded to 48 producers with 111 different rums and sales of 1,143,000 cases. If we look closer, in 2012, five Aussie brands offered 11 rums, but they covered 667,000 cases – 70% of the market. In 2021, the percentage of Australian rum had dropped to just 46% of the market, with seven brands offering 12 rums for 528,000 cases. In other words, an overwhelming interest in imported rum has driven the change. Paul does note the emergence of spiced rums, which are almost totally from offshore. In 2012, they were just 5% of the market. By 2012, they were 30% of that market. Over that period, white rums sat at 19%, then down to 18% –black and gold rums suffered.

If we turn to the elite sector of the category, in 2012, three rums sat within the “Super Premium plus” price band, just 1,500 cases or a mere 0.16% of the total market. By 2021 that had grown to 56 products, 47,500 cases, or a little over 4% of the market.

This was the outlook for Paul and his team when he entered the market, but by 2022, their sales of top-shelf rums more than exceeded the total of top-shelf rums sold in 2012 – 2,500 cases, with the aim to increase that to 3,500 this year. As Paul says, “The much talked about premiumisation of the rum category in Australia is now undeniable, and while total growth in the spiced sub-category has eased, we are now seeing the biggest growth in super-premium and above quality rums”.

Finally, after a ‘long and challenging road’, learning from ‘first principles, experiment, progressively scale up production and perfect our liquid before taking products to market’, they have their core range of rums, with the exciting addition of a new rum, Rare Blend, a premium unspiced rum (is it just me or is there something wrong when we start nominating rums as ‘unspiced’?) produced by blending barrels of rum made from 100% fresh cane juice with others produced from evaporated cane juice, which they call cane honey. They will continue to release small batches of aged rums.

To succeed in such a difficult sector in these times says volumes about Paul and his team, including chief distiller Quentin Brival from Martinique, who just happened to be touring the region, looking for a

Rhum Agricole is made from freshly squeezed sugarcane juice rather than traditional molasses.

challenge; at the same time, Husk was after a new distiller. Their rums are now exported to various countries throughout Europe. France is a key, though difficult market, but there is one advantage – they are far more familiar with Agricole rhum than local consumers.

Head a little further up the Pacific Highway to the Sunshine Coast in Queensland, and an even newer operation, Sunshine & Sons, is producing a new rum called Nil Desperandum. It is the first in Australia to be made from certified organic molasses. They had the misfortune to attempt opening just before Covid sent tourism and hospitality into a tailspin, but they have withstood the challenge and are forging ahead (many may remember their location as the former site of the Big Pineapple). The head distiller is a man who is no stranger to a great many in the alcohol industry, Adam Chapman. For many years, Adam was the chief winemaker at Sirromet and has worked extensively throughout Australia and beyond. Clearly, distilling suits him.

Their latest release is the Nil Desperandum Special Two-Year-Old, with the Premier Three-Year-Old to follow later this year. One of the teams behind Nil Desperandum is an old friend, Michael Conrad, well known throughout the Queensland hospitality industry. I remember him dropping by for a drink quite a few years back and telling me that he and his new partners planned to make the best rum that this country had ever seen. Their first release was a bare 476 bottles, Australia’s first ‘certified organic molasses rum’, containing only organic molasses, with Woombye water and wild yeasts.

The team have used former sherry, wine and bourbon barrels in production. In time, they expect that Nil Desperandum Rum will also make an impact in international markets. As one of the founders, Matt Hobson, says, “Australian rums aren’t acknowledged around the world. And in our opinion, it’s time they were.” Matt later made the point that Covid had its silver lining. Spirit consumers had become far more discerning about their choices, and this benefited premium producers such as themselves.

The point of difference? “What makes this rum different is that we are an artisan distillery that spares no expense or time to make spirits that are truly exceptional. We distil with love, patience, art and science, and the results are incredible.” Their inspiration has been the best from the Caribbean. As Adam says, “It tastes like rum should.”

Husk and Nil Desperandum are far from the only new faces on the rum scene, but they reflect the innovation and the march to quality we see across the industry. No doubt, there is more excitement coming in the next few years. Meanwhile, take advantage of the opportunity to enjoy these two cracking rums. For both, pouring over a single ice cube is the perfect way to go.

The fabulous new-look labels convey the lifestyle of the Tweed Coast in northern NSW, part of the deepest caldera to be found anywhere in the southern hemisphere. It is named Rare Blend as it blends two styles, Husk’s traditional rum from freshly crushed sugar cane juice and the second, from what they call Tweed Valley cane honey, which is evaporated cane juice. This is the best rum I have seen from Husk. The aroma is light and fresh, quite vibrant. Florals, orange rind, vanilla, honeysuckle and tropical notes. The palate moves more to hints of Christmas cake, citrus, honey and spices. There is a very gentle touch of oak supporting the flavours. There is sweetness, but more importantly, excellent balance, length and suppleness, making this rum very easy to drink. Love it.

This latest rum shows how quickly and impressively the team is establishing itself as one of Australia’s premier rum distillers. As always, 100% certified organic. Two years in ex-bourbon casks which had also seen sherry and port. I realise that many people will think that two years seems extraordinarily brief, but the reality is that two years of maturation in oak based in Queensland’s warm and humid Sunshine Coast is a very different proposition from two years in a bitterly cold Scottish cellar. Maturation proceeds much faster in the warmer climate. This rum is beautifully elegant. Subtle tropical notes, florals, cinnamon, caramel hints and frangipani petals. Fresh and intense, with power and a lingering finish. Gentle sweetness and fine balance. For me, this rum represents a thoroughly enjoyable rum to drink now and the promise of even better things ahead. KBG

How long has Chapel Hill been committed to sustainability?

Rachel Steer: Chapel Hill has always had a sustainable approach, both in the vineyards and winery due to our sensitive location, surrounded by the Onkaparinga River National Park and perched above the Onkaparinga Gorge. Chapel Hill have been members of SWA (previously called SAW) since its inception more than 10 years ago. SAW was developed as a regional program in McLaren Vale and has since been taken on by the Australian wine industry as the national sustainability program. As part of our SWA membership we have a detailed Sustainability Action Plan (SAP) which looks at all aspects of our business and is reviewed quarterly to ensure we are meeting our goals. We also have a Biodiversity Action Plan (BAP) which has identified suitable areas on the property for clearing feral woody weeds and revegetating with local indigenous species.

Water for vineyard irrigation is sourced from the Willunga Basin reclaimed water scheme. Continuous soil moisture monitoring and automated irrigation are used for optimum efficiency. All winery waste both liquid and solid is treated and reused on site. Solid winery waste (skins, seeds and bunch stems) is composted and used back on the vineyard. All other waste streams are carefully monitored with reuse and recycling options in place wherever possible. Both winery and vineyards are operated with low input strategies. Chapel Hill have recently installed solar systems for both the winery and vineyards.

Can you outline the strategies and programs in place at Chapel Hill that contribute to its sustainable profile?

Rachel Steer: Chapel Hill is certified with Sustainable Winegrowing Australia (SWA) for both its vineyards and winery. You can find information about the program in the following link: https:// sustainablewinegrowing.com.au/

What is Chapel Hill’s view on glass bottles in the wine industry?

Michael Fragos: When it comes to sustainability, glass bottles are the elephant in the room. We are keeping an open mind on the development of glass bottle alternatives. In the first instance we are moving as many of our wines over to locally produced bottles to replace imported glass to limit the environmental impact of freight. Does Chapel Hill plan to adopt any new technology in the future to strengthen its sustainable status?

Rachel Steer: Our focus now is on capturing all fuel, water and energy usage data and feeding it into the online platform Trellis to establish a carbon footprint for the business. We are continually looking at ways

to reduce our impact. https://yourtrellis.com/ How much does Chapel Hill’s sustainable commitment on the label impact the marketability of Chapel Hill products both at home and overseas?

Rachel Steer: Whilst we have always been committed to sustainability, we have not previously felt the need to communicate it to our customers. However, with the recent interest from customers and our SWA certification, we will begin labelling our estate produced wines with the SWA certified logo from vintage 2022 onwards. We are now working with our external grape growers to become SWA certified also. This will enable us to label a larger range of our Chapel Hill wines with the SWA logo.

“When it comes to sustainability, glass is the elephant in the room. We are keeping an open mind on the development of glass bottle alternatives.”

- Michael Fragos.

THE SUPPLY OF ALCOHOL TO MINORS.

Jonathan Russell , Head of Policy & Advocacy, Retail Drinks Australia is an award-winning advocate for policy and legislative change. He brings a non-partisan approach and deep knowledge of industry associations to collaborate for change.

It is not typical for an underage teenager to drink alcohol, despite what many adults may think. Since about 2000, the number of 16- and 17-year-olds who drink alcohol has declined, according to the 2017 Australian Secondary Students’ Alcohol and Drug (ASSAD) Survey. This is supported by new data from DrinkWise. This social change organisation works towards creating a healthier and safer national drinking culture and shows 72.5% of today’s Australian underage teens have not consumed alcohol in the past 12 months.

While the data suggests that behavioural change is heading in the right direction, some children do drink, and a minority of adults buy it for them. We can all help address this risk by implementing Retail Drinks’ industry responsibility initiatives, ID25 and “Don’t Buy It For Them.”

A misplaced assumption heard in meetings with politicians and some people in the sector is that kids who drink all use technology to buy alcohol.

But the data tells a different story. The ASSAD Survey showed that 88% of alcohol underage teens drink is provided for them by parents, friends, siblings, or ‘someone else’ (including strangers). The rest is ‘taken from home’, with a small percentage bought by the minor from both on- and off-premises venues.

Retailers and hospitality workers, therefore, have a very important job: prevent direct and secondary supply to minors.

A couple of operating principles are available to support that work.

ID25 is a simple measure to combat direct supply. If a customer looks under 25 years of age, ask for ID. Use signage to set expectations visibly and consistently in-store, especially at the point of sale, and help staff feel confident to apply the rule even if they feel uncertain about making a ‘marginal call.’ Retail Drinks has signage available that any business can download and display in their store to set customer expectations and support staff in fulfilling their obligations to the community.

Staff have been checking IDs for aeons, and ways to spot fake cards are well known. Digital IDs, however, are new and appear to

be causing some angst. Simple and effective advice on how to spot a fake digital ID is available from regulators, and the same principle applies. If there is uncertainty that a customer is 18+, service should be refused.

“Don’t Buy It For Them” is a measure to discourage secondary supply. It educates customers on the shared responsibility not to supply underage teens and highlights the penalties for doing so.

According to DrinkWise’s research, 87% of parents do not supply their children with alcohol. Nevertheless, some do, along with other adults like siblings and strangers. It isn’t always easy to spot someone attempting to buy alcohol for a child. Staff should look for signs, such as the adult consulting a minor on product selection.

Many parents of young teens left high school in the 80s and 90s when underage drinking was rising. The misconception that many underage kids drink might stem from their experience. But while underage consumption is becoming less normal, there is still a cohort who drink. The focus must remain on these children.

Retail Drinks Australia is the industry association for packaged liquor retailers. The association created resources to support the ID25 and Don’t Buy it For Them initiatives is available at https://www.retaildrinks.org. au/policies-advocacy/id25-dont-buy-it-forthem. Retail Drinks holds a position on the DrinkWise board as an Industry Nominee Director.

We craft Shiraz that celebrates the magical Barossa terroirs

DRINKS

Welcome to the new Hottest 100 brands in Australia for 2023/4. You will notice we have upped the ante and boosted the numbers because, well, we needed to. Drinks are so hot right now. Brands are launching as fast as we can stack them on the shelves. Hell, even the celebrities have exchanged TikTok antics with launching their own signature drinks brand. Quite frankly, there are so many new innovative and creative brands hitting the shelves it’s hard to keep up.

The new bigger and better Hottest 100 Brands represents big name brands and lesser-known newcomers. So how do we compile the list?

We start with Circana (formerly IRI MarketEdge) data MAT to 05/3/23 and the best-performing brands in

2023/4

eleven categories, searched by volume growth (in litres) and volume growth in percentage.

This year we are also delighted to announce we have the top selling brands from Endeavour Group, not included in Circana data.

The data is then passed to our Hottest 100 Panel, experts that buy (and sell) products for thousands of stores in Australia, monitor

promotions plus experience innovations and brand launches that work. Their insights round off the Hottest 100 Brands Report for 2023/2024.

Finally, a note on the layout and format of the report. Some brands clearly stand out more than others. Drinks Trade is a free service to the industry, underwritten by the Drinks Association and supported by advertising. Within this report, products that made the list were offered the opportunity to sponsor and highlight their brand, thus ensuring the data and voting is not influenced.

The team at Drinks Trade is proud of this initiative and hope it will be valuable for you in your business to know what’s hot and what’s not.

The Annual Hottest 100 Brands would not be possible without the hard work of loads of people behind the scenes. Special thanks go to Circana senior consultants, Ishakya Gunaratne and Antonia Tolich for tirelessly pouring over these figures to deliver us this report including the category analyses. To Lizzy Bold and Lara Hyams for all their work delivering us the top performing brands for each category from the Endeavour Group. And extra-special thanks to our industry panel who give us valuable insights from the customer coalface on what’s on the up and up.

Chris O’Brien

General Manager | Liquor Barons

John Carmody

General Manager | Liquor Legends

Guy Bohan

General Manager | Liquor Stax

Aaron Howarth

Category Manager | ILG

Giuseppe Minisalle

Consultant | Porter’s Liquor, Australian Liquor Marketers

| Drinks Trade

Dark Spirits is seeing decline -$35M. Kentucky Bourbon and Single Malt Whisky are leading decline for total Dark Spirits. Other Whiskey with lower alcohol content is driving strong volume growth for the Dark Spirits. Majority of the growth is coming from 700ml bottles. Flavoured Whiskey and Rum gain popularity within the category.

LITRES GROWTH VOLUME (000) YEAR ANNUAL

Hottest Dark Spirit Brand (Glass)

1. SHEEP DOG

Sheep Dog's Peanut Butter flavour Whiskey 700ml (last year's NPD) overtook Fireball and drove 82% volume growth for the brand

Litres growth volume (000) Year Annual = 97

Runner up

2. FIREBALL

Fireball Cinnamon Canadian Whisky 1L continues to drive growth through its lower alc strength of 33%

Litres growth volume (000) Year Annual = 74

3. BALLANTINE’S

Ballentine's Blended Scotch Whisky 700ml has accounted for 57% of volume growth

Litres growth volume (000) Year Annual = 71

4. NED WHISKY

Ned Whisky 700ml is among the top three volume growth driving SKU within the 700ml pack

Litres growth volume (000) Year Annual = 52

Litres growth (000) % Year Annual = 89

LITRES GROWTH (000) % YEAR ANNUAL

Hottest Dark Spirit Brand (Glass)

1. BASIL HAYDEN

Basil Hayden Bourbon 700ml (NPD) was instrumental in driving the volume growth

Litres growth (000) % Year

Annual = 419.2

Runner Up

2. SHEEP DOG

Sheep Dog's Peanut Butter flavour Whiskey 700ml (last year's NPD) overtook Fireball and drove 82% volume growth for the brand

Litres growth (000) % Year Annual = 118.1

3. NED WHISKY

Ned Whisky 700ml is among the top three volume growth driving SKU within the 700ml pack

Litres growth (000) % Year Annual = 89

4. SUNTORY

Suntory's Toki brand with its Blended Japanese Whiskey 700ml (higher alcohol strength 43%) has been the driver of volume growth

Litres growth (000) % Year

Annual = 40.9

ENDEAVOUR GROUP TOP TWO DARK SPIRIT BRANDS

INDUSTRY PANEL TOP DARK SPIRIT MOVERS AND SHAKERS

Basil Hayden Bourbon Starward Whisky

21400 litres volume growth

78% of the brand’s vol growth is coming from Starward Two-fold Whisky 700ml

Light Glass spirits are growing well ahead of the total spirits category +2.4% value growth. Vodka is the #1 spirit for growth in the last year followed by Tequila both delivering a combined incremental $87M for the category, while Gin is leading decline for the category. Larger pack sizes are seeing solid growth with 751-1.5L +3.5% value growth >1.5L +11.6%. Classic brands Smirnoff and Absolut are leading the way for growth for light glass spirits delivering an incremental $29M for the category. Vodka brands account for over 50% among the Top 20 brands within White Spirits, followed by Tequila with brands driving strong volumes. Several classic brands were featured as both top growing and largest brands.

Hottest White Spirit Brand (Glass)

1. ABSOLUT

Absolut’s original Vodka 1L continued to deliver strong results along with the recently launched Absolut Vodka

Original Rainbow 700ml driving volumes for the brand

Litres growth volume (000) Year Annual = 156.8

Runner Up

2. ALTOS

Altos Tequila Plata 38% 700ml has been the main contributor of total volume growth for the Altos brand, top ranked volume driving SKU within Tequila

Litres growth volume (000) Year Annual = 151.6

3. FINLANDIA

Finlandia Vodka 700ml is currently ranked #2 volume driving SKU in Glass Spirits

Litres growth volume (000) Year Annual = 100.5

4. SKYY

Ranked #3 among the Vodka segment, Skyy Vodka 700ml drove strong volume sales for the brand

Litres growth volume (000) Year Annual = 135.9

LITRES GROWTH (000) % YEAR ANNUAL

Hottest White Spirit Brand (Glass)

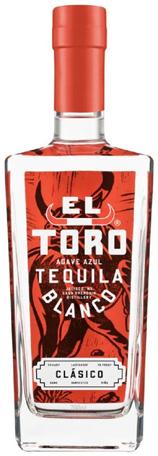

1. EL TORO El Toro Tequila Blanco 700ml drove exponential growth for the brand

Litres growth (000) % Year Annual = 927.5

Runner Up

2. FRIS

Fris Vodka Freeze Filtered Crisp Smooth 700ml has been delivering consistent volumes for the brand

Litres growth (000) % Year Annual = 223.1

3. CASAMIGOS

Over 60% of the brand’s volume was through the Casamigos Tequila Blanco 700ml SKU

Litres growth (000) % Year Annual =140.4

4. ALTOS

Altos Tequila Plata 38% 700ml has been the main contributor of total volume growth for the Altos brand, top ranked volume driving SKU within Tequila

Litres growth (000) % Year Annual = 95.8

ENDEAVOUR GROUP TOP TWO LIGHT SPIRIT BRANDS

O

INDUSTRY PANEL TOP LIGHT SPIRIT MOVERS AND SHAKERS

Baxter Vodka

El Toro Tequila

Within the ready-to-drink category Vodka based RTD is driving growth for the category +12.4% value growth vs YA while Seltzers are seeing value decline -11.7% in the last year. In terms of flavours Citrus & Grape are seeing strong growth in the last year driven by top performing brand -196, while more classic flavours Cola & Creaming Soda are also performing well driven by Billson’s and Jack Daniels. Cans are leading the way for growth +7.7% value growth vs YA while bottles are seeing decline and 24 packs, and 30 packs are driving the strongest performance. Vodka RTD through Citrus flavours is popular. Dark Spirits RTD -330ml packs in large pack formats - 24pk & 30pk are driving the strongest performance.

LITRES GROWTH VOLUME (000) YEAR ANNUAL

Hottest RTD Brand

1. -196

-196 Double Lemon Shochu Vodka & Soda

Can large packs (30pk & 24pk) have continued strong momentum driving 50% of the brand’s volume success

Litres growth volume (000)

Year Annual = 8425

Runner Up

2. BILLSON’S

Billson’s Vodka Fruit Tangle Can 355ml x 24pk is among the Top 3 SKUs driving RTD volumes

Litres growth volume (000) Year Annual = 4657

3. BROOKVALE UNION

Among the Top 5 Vodka RTDs, Brookvale Union Vodka Lemon Squash Can 330mlx24pk contributed to over 20% of the brands’ volume performance

Litres growth volume (000) Year Annual = 1905

4. JACK DANIELS

Jack Daniels & Cola Cans drove the strongest volume growth followed by Double Jack 375ml multipacks

Litres growth volume (000) Year Annual = 1902.6

LITRES GROWTH (000) % YEAR ANNUAL

Hottest RTD Brand

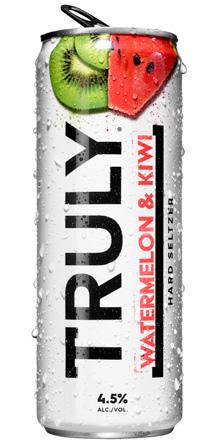

1. TRULY SELTZER

The NPD - Truly Seltzer Watermelon & Kiwi Can drove strong volume sales since launch through its 24pk

Litres growth (000) % Year Annual = 2911

Runner Up

2. BILLSON'S Billson's Vodka Fruit Tangle Can 355ml x 24pk is among the Top 3 SKUs driving RTD volumes

Litres growth (000) % Year Annual = 1453

3. FOUR PILLARS

Four Pillars Bloody Shiraz Gin & Tonic Can 250mlx4 dove a quarter of the brand's RTD volume sales

Litres growth (000) % Year Annual = 315

4. -196 -196 Double Lemon Shochu Vodka & Soda Can large packs (30pk & 24pk) have continued strong momentum driving 50% of the brand's volume success

Litres growth (000) % Year Annual = 270

Grainshaker Vodka Sunset Can 330mlx12 (NPD) has accounted for 35% of the brand's performance

Litres growth (000) % Year Annual = 221

ENDEAVOUR GROUP TOP TWO RTD BRANDS

1. Suntory -196 Double Grape

INDUSTRY PANEL TOP RTD MOVER AND SHAKER

Ned Whisky and Cola

Ned Whisky &Cola Can 375mlx10pk with low 4.8% ABV generated strong volume growth

Sparkling sub-segment excluding Champagne is the key driver of growth in the category driven by Prosecco +10.6%. Champagne growth is off the back of COVID highs and increased willingness to spend during COVID, +0.3% vs YA. Total Sparkling is in value growth, growing at 1.4% however volume growth is in declining at -2.1%. Total Sparkling has also managed to experience minimal share gains for Total Bottled Vs. YA. From a manufacturing perspective, Brown Family Wine is the front runner bringing in an additional $8m followed by De Bortoli bringing in $4.5m to the Category vs.YA. The growth is predominantly coming from Prosecco. The $15-$20 price tier has driven majority of the growth with Brown Brother and Petaluma being the Top 2 growth brands for Total Bottled White.

Hottest Sparkling Wine Brand

1. BROWN BROTHERS

The Brown brothers 750ml Prosecco is the #1 growth SKU for the brand by far making up for 50% of the brand's sparkling porfolio. Most of the other growth generating SKUs are also Proseccos, predominantly playing in the $15 - $20 bracket

Litres growth volume (000) Year

Annual = 421.4

Runner Up

2. DE BORTOLI

For De Bortoli, the 200ml & 750ml Proseccos have driven the most growth, these SKUs also make up for 68% of the brand's volume

Litres growth volume (000) Year Annual = 370.1

3. PETALUMA

Petaluma Croser NV Brut 750ml is the #1 growth SKU for th brand making up for 87% of the brand's volume. The portofolio predominantly plays in Sparkling White & $20 - $30 price tier

Litres growth volume (000) Year Annual = 293.2

4.BRILLA

Brilla Prosecco 750ml is the #1 growth SKU for Brilla. The portfolio is made up of all Prosecco SKUs and $15 - $30 bracket

Litres growth volume (000) Year Annual = 276.1

YEAR ANNUAL Top Sparkling Brand

1. PEPPERJACKBOTTLE SHOT

Pepperjack Sparkling 750ml is the #1 growth generating SKU for the brand and is a Sparkling white playing in the $20 - $30 space

Litres growth (000) % Year Annual = 1624.3

Runner Up

2. BANDINI

Bandini True Illusions Prosecco 750ml is generating the most growth for the brand playing in the $8 - $15 space.

Litres growth (000) % Year Annual = 1316.1

3. BROWN BROTHERS

Brown Brothers Prosecco (250mlx4)X6 can is the #1 growth SKU for the Brown Brother's White portfolio and sits under White Sparkling. The #2 growth SKU is the Brown Brothers Moscato.

Litres growth (000) % Year Annual = 139.6

4.MUMM CHAMPAGNE NV

A large portion of the brand's growth is coming through from "Mumm Tasmania Brut Prestige 750ml", playing in the White Sparkling space and $30 - $50

Litres growth (000) % Year Annual = 73.2

ENDEAVOUR GROUP TOP TWO SPARKLING BRANDS

INDUSTRY PANEL TOP SPARKLING MOVERS AND SHAKERS

Mumm Champagne

Arras

1. Veuve Clicquot NVPinot Grigio was the top performing varietal for volume growth +670K litres while white cask is driving decline for the category -8.7% vs YA. The 750ml bottle format was a clear winner accounting for the majority of growth for brands while single pack formats, particularly in larger sizes (750ml +) continue to drive brands’ volume performance. Total Bottled White is in value growth, growing at 1.4% however volume growth is in declining at -2.1%. Bottled White has managed to gain share of Total Bottled Vs. YA. From a manufacturing perspective, “Other Mfrs” which consists of a combination of smaller manufacturers are leading this growth bringing in an additional $17m to the Category vs. YA with a helping hand from Delegat Australia. The growth is predominantly coming through from Pinot Grigio followed by Chardonnay. The $15-$20 price tier has driven majority of the growth with Oyster Bay and Squealing Pig being the Top 2 growth brands for Total Bottled White.

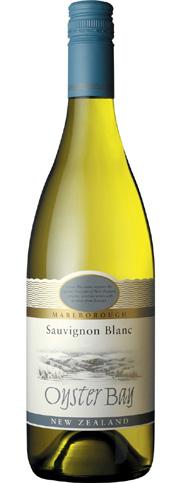

Hottest White Wine Brand

1. OYSTER BAY

Oyster Bay Sauvignon Blanc

750ml is the #1 growth SKI for the brand and makes up for 79% of the brand's volume. Almost all the SKUs in the portfolio is from the Marlborough and plays in the $15 - $20 bracket

Litres growth volume (000)

Year Annual = 312.3

Runner Up

2. YELLOW TAIL

Yellow Tail Semillon Sauvignon Blanc

750ml is the #1 SKU for brand making up 18% of the Brand's volume. A large portion of the Brand's success is coming through from Sauvignon Blanc and $8$15

Litres growth volume (000) Year Annual = 306.2

3. SQUEALING PIG

Squealing Pig Pinot Gris 750ml is the #1 growth SKU for the brand and the #3 SKU in total White category

Litres growth volume (000) Year Annual = 269.7

4. 821 SOUTH

821 South Sauvignon Blanc 750ml is the #1 SKU for the brand bringing in an additional 201k litres. It is also a Marlborough Sauvignon Blanc

Litres growth volume (000) Year Annual = 201.3

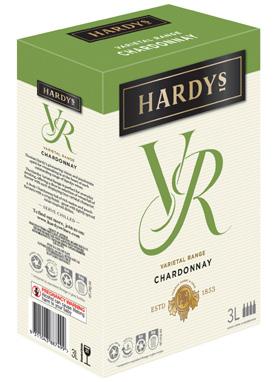

Hottest White Wine Brand

1. HARDYS

Hardys Vr Chardonnay

3L is the highest growth generating SKU for Hardy’s Cask and makes up for 64% of the brand's volume. There is some growth also coming through from the Sauvignon Blanc SKU

Litres growth (000) % Year Annual = 130.3

Runner Up

2. BELENA

"Belena Pinot Grigio 750ml" is the e#1 growth SKU and makes up 69% of the brand's volume. There is also another Moscato SKU that is generating growth for this SKU. Both SKUs play in $15-$20 price bracket.

Litres growth (000) % Year Annual = 86.8

Pepperjack Sauvignon Blanc 750ml is the #1 growth SKU for the brand and makes up 30% of brand's volume. A large portion of the portfolio is made up of the $20 - $30 price bracket

Litres growth (000) % Year Annual = 74

4. NEPENTHE

Nepenthe Elevation Sauvignon Blanc

750ml in the #1 growth SKU for the brand. It also makes up 49% of the brand's volume

Litres growth (000) % Year Annual = 73.9

ENDEAVOUR GROUP TOP TWO WHITE WINE BRANDS

INDUSTRY PANEL TOP WHITE WINE MOVERS AND SHAKERS

Hardy’s Cask

Taylors

Pink cask is seeing volume growth +104K, +15.1%, while pink bottled is in decline -0.7% driven by price points <$14.99 while $1519.99 is the largest volume contributor. Single pack formats, particularly in larger sizes (750ml +) continue to drive brand performance. Total Bottled Pink is in strong value and volume growth; with value growing at 5.3% ahead of volume at 3.6%. Bottled Pink has also managed to gain share of Total Bottled Vs. YA. From a manufacturing perspective, Treasury Premium Brands are leading this growth bringing in an additional $5m to the Category vs. YA. The growth is exclusively coming through from Still Rosé. The $15-$20 price tier has driven majority of the growth with La Vieille Ferme and Squealing Pig being the Top 2 growth brands for Total Bottled Pink.

Hottest Pink Wine Brand

1. LA VIEILLE FERME

La Vieille Ferme Rosé 750ml is also the only SKU within this brand bringing all the incremental volume growth of 42k litres for the brand. It is also the #3 growth SKU for Total Pink category

Litres growth volume (000) Year Annual = 97.6 Runner Up

2. 19 CRIMES

19 Crimes Snoop Dogg Cali Rosé 750ml is the only Rose SKU within the brand and is also a NPD within the $15- $20 price tier

Litres growth volume (000) Year Annual = 79.6

SQUEALING

Squealing Pig Marlborough Pinot Noir Rosé 750ml is the #1 SKU for the brand and makes up 89% of the brand's volume.

Litres growth volume (000) Year Annual = 77.3

4. DE BORTOLI

"De Bortoli Rose Rose Pale & Dry 750ml" is the #1 SKU growth SKU for the brand and #5 for the Total Pink Category, making up 45% of the brand's volume

Litres growth volume (000) Year Annual = 77.1

Hottest Pink Wine Brand

1. MINUTY

Minuty Cotes De Provence Rosé 750ml is a NPD and already sitting amongst the Top 20 brands of rosé

Litres growth (000) % Year Annual = 31680.9

Runner Up

2. BELENA

Belena Rosé 750ml brought in an additional $50k and is the only SKU within the Belena portfolio, playing in the $15- $20 space

Litres growth (000) % Year Annual = 297

3. CASK CASTAWAY

Caskaway Rosé 2.25l is the #1 Cask SKU for the category, bringing in an additional 71k in litres into the category. It is also the 6th largest growth SKU in the category