INDEPENDENT PRACTITIONER

THE BUSINESS MAGAZINE FOR DOCTORS WITH A PRIVATE PRACTICE

In this issue

Show value of your practice

Find out about the network that can help you meet requirements to publish your fees P14

Show value of your practice

Find out about the network that can help you meet requirements to publish your fees P14

Embassy charging affairs

Helpful billing and collection advice for those providing services to embassies P25

By Robin Stride

Many independent practitioners will face intensified verbal grilling from both patients and the press following the launch of a campaign to get the public to probe the true value of new product claims and procedures.

Surgeons themselves called in national journalists to their annual scientific meeting in London to brief them on what they and their readers should look for to try and ensure treatment transparency.

The British Association of Aesthetic Plastic Surgeons also warned of possible financial or conflicts of interest among those involved in some clinical businesses.

Consultant plastic surgeon and new BAAPS president Mr Michael Cadier said new so called ‘clinicallyproven’ treatments promising unbelievable results were launched almost daily. ‘We believe that asking the right questions, doing a bit of research and engaging in a dose of scepticism is the

In association with

healthiest approach for the public.’

Outgoing president Mr Rajiv Grover described a huge rise in media reporting of aesthetic treatments, but he urged the press and patients to ‘cut into bombastic claims – even from surgeons’.

He said consumer press journalists had their work cut out keeping pace with many issues in the sector. ‘I don’t envy the challenges of reporting credible developments from such a murky field, but that doesn’t mean the cosmetic surgery sector should be allowed to stitch people up.’

BAAPS is calling for the media and public to use a measuring system similar to those used in surgical journals which ‘grade’ the levels of evidence behind new procedures and claims.

Prestonbased consultant plastic surgeon Mr Reza Nassab, who conducted studies presented at the conference entitled ‘EvidenceBased Hype’ and ‘Cosmetic Surgery in the Press’, called the evidence supporting many new devices ‘lowlevel’.

‘If insurers, hospital operators and privately practising doctors worked together on better developing and demonstrating the quality of care to patients, jointly creating new services and delivering better value for money, spending on the private health care sector could return to growth.’ n See booklet inside

Pulling in the patients

Independent practitioners could do more to make themselves a magnet to patients P31

He said increased education was needed to ensure people understood treatments might not be as effective as portrayed in their marketing materials.

His evaluation of high profile noninvasive liposuction technologies showed the number of patients studied varied wildly: from just two cases to a few hundred. Only 16% involved more than 100, and more than half involved under 50. All but one were based on under six months’ followup.

Only one trial followed patients – just two people – for five years.

BAAPS said 36% of authors disclosed a financial or conflict of interest, ‘which means the device company either made a payment, provided the equipment or the author has a financial interest in the business’.

BAAPS said media reports of complications and regulation in cos

metic surgery rose by over 17,000% and 20,000% respectively since 1991. Threequarters of consumer press coverage involved publicity driven by a commercial provider or practitioner offering the treatment and 15% involved celebrity endorsements.

Mr Grover said in the clinical world a widespread use of ‘tiers’ allowed determination of how much research actually backed the findings, thus enabling informed decisions based on evidence that went further than just skindeep. But without a similar filter for cosmetic devices, there were pitfalls for those who might be swayed by weak data, manipulated photos or paidfor celebrity endorsements. ‘There urgently needs to be a traffic light or warning system for new devices and techniques promoted to the public,’ he said.

➱ continued on page 8

October 2014

www.independent-practitioner-today.co.uk

is selling a practice devoid of goodwill? accountants argue that the taxman has to recognise goodwill in practice sales P10

Transparency of perks and fees private doctors are being told to be more transparent. What does that mean? P12

Fall-out of early retirement our accounting guru advises on a smooth break-up due to early retirement P16 your old folks at home advice on how best to make decisions for the care of your elderly loved-ones P18

a recipe for defensive practice a new criminal offence for doctors, ‘wilful neglect’, will soon affect your practice P34 button it!

be careful what you say to your staff or it could cost you thousands of pounds P36

Plus our regular columns starting a private practice: tax and ‘green’ cars P42 Business Dilemmas: ethical issues on genetic testing P46

ediTorial commenT

Shameless! That’s what leaders of the British Association of Aesthetic Plastic Surgeons (BAAPS) have branded the so-called science behind some of the claims made in the cosmetic arena about products and techniques promoted to the public.

A good number have few, if any, scientific articles behind them and, as our front-page story reports, trials are littered with conflicts of interests.

BAAPS’s campaign message to the public, ‘Don’t let cosmetic surgery stitch you up’, is a clever and timely one that’s hit the headlines.

A by-product, as the Comp-

etition and Markets Authority forces through greater private sector transparency on consultants’ fees and rewards, will inevitably be deeper questioning about everything independent practitioners offer.

Patients and consumer journalists clearly need to ask deeper questions about many devices, products and procedures.

The suggested evidence pyramid is a valuable contribution to help people cut through bombastic claims. All credit to BAAPS for launching the campaign. And the fact surgeons were left to do it, not a regulatory body? Shameless!

Tell us your news Editorial director Robin Stride at robin@ip-today.co.uk

Phone: 07909 997340 @robinstride

To adverTise Contact advertising manager Margaret Floate at margifloate@btinternet.com Phone: 01483 824094

To subscribe lisa@marketingcentre.co.uk Phone 01752 312140

Publisher: Gillian Nineham at gill@ip-today.co.uk Phone: 07767 353897

Head of design: Jonathan Anstee chief sub-editor: Vincent Dawe 12,000 circulation figures verified by the Audit Bureau of Circulations

by leslie berry

Independent Practitioner Today readers who have received letters from the NHS Pensions Agency detailing their annual pension savings for the tax year 2013-14 could be in for a shock.

They may be puzzled to find they have saved substantially more than the applicable annual allowance cap of £50,000.

Simon Bruce, managing director of financial planners Caven dish Medical, said: ‘The figures will come as a surprise to many because the HM Revenue and Customs’ calculations for pensions’ contributions are based on the deemed growth of the pension in the year and bear little resemblance to the amount a doctor has actually paid into their pot.’

And he warned independent practitioners that many of the letters his clients had received had been found to be wrong – mainly down to the NHS Pensions Agency allocating a back-dated award to the wrong tax year.

Mr Bruce advised: ‘It is imperative to check the calculations carefully to avoid generating an unnecessary tax bill.’

If doctors have breached the annual allowance limit, they may

be able to use ‘carry forward’ from the previous three tax years. If there is still any excess, this will be added to their income and taxed at their marginal rate.

Mr Bruce said: ‘The difficulty is that these letters are received long after the 2013-14 tax year has closed, so there is little that can be done retrospectively.

‘Planning ahead in terms of managing contributions to your private pensions as well as your NHS pot is crucial to avoid future mistakes.’

Cavendish Medical said any resultant tax charge has to be paid via self-assessment by amending the previously filed tax return or choosing to use ‘Scheme Pays’, if the tax sum is greater than £2,000. To apply for the NHS Pension Scheme to pay the tax charge for 2013-14 in return for reduced eventual retirement benefits, the ‘Scheme Pays’ nomination must be made to the NHS Pension Agency by 31 July 2015.

Doctors are being advised to avoid waiting until next year to organise their pensions’ savings.

Pensions’ advisers warned this problem could occur again, as the newly reduced annual allowance figure of £40,000 would now apply.

The Medical Defence Union is calling for the repeal of a 1948 law which means compensation must be calculated to pay for private, rather than NHS care.

In a renewed attack on the spiralling costs of compensation awards against doctors, it warned everyone would suffer if nothing was done to reform the system where huge damages payments are common.

Chief executive Dr Christine Tom-

kins said damages awards in England were now higher than most countries, even many US states.

With compensation inflation rising 10% a year, the MDU wants caps on the level of damages for future care and damages for loss of earnings to be capped at three times the national average salary per year to ‘reduce large awards for lost future earnings which can run into millions of pounds’.

The number of subscribers to private medical insurance (PMI) schemes between 2009 and 2013 dropped 5.9% from 3.2m to just over 3m.

These latest figures on the state of private care are published by market intelligence provider Key Note in its Medical Insurance 2014

It reports the number of subscribers to corporate schemes did not fall to as great a degree as the total number of subscribers over this period, going down by 3.7%, from 2.24m to 2.16m.

The number of personal subscribers fell by 1%, from 971,000 subscribers in 2009 to 864,000 in 2013.

Market research in the report reveals that around one third of adults had less confidence in the NHS than they did in the past.

It said around a quarter of adults felt that PMI premiums were good value or money. But it added that insurance was a luxury product that both corporate and personal subscribers tended to turn their backs on at hard times, knowing they can fall back on the NHS for their healthcare needs.

by leslie berry

Doctors are facing beefed-up scrutiny by Care Quality Commission (CQC) inspectors in private facilities where they work.

This will include unannounced visits at nights and weekends when the watchdog claims people can experience poor care.

A new regime began this month and, from April next year, all providers will be awarded ratings –outstanding, good, requires improvement and inadequate.

The new-style inspections, starting with eight named hospitals, are welcomed by the Association of Independent Healthcare Organisations (AIHO).

It said visits would judge if care was safe, caring, effective, well-led and responsive to people’s needs. And generated data would be crucial to help patients make informed decisions about their care.

Chief executive Fiona Booth told Independent Practitioner Today: ‘We believe that so much more can be achieved if the independ -

ent and public health sectors work together, are held to the same standards and publish data in the same way. This new inspection framework is an important step towards that goal.

‘The independent sector puts the patient at the heart of everything it does. So we welcome anything that helps patients make informed choices about their care.’

individuals delivering singlespecialty services.

Inspection teams include clinicians from the NHS and the independent sector, CQC inspectors and members of the public who are ‘experts by experience’.

Prof Sir Mike Richards, CQC chief inspector of hospitals, said: ‘We need to hold the independent sector to the same standard as the NHS.

‘As we have seen in the NHS, these new-style inspections will allow us to get under the skin of the organisation to give us a much more detailed picture of independent hospital care in England than ever before.’

The independent sector covers large hospitals, which operate under a single corporation with multiple locations, to single specialties such as cosmetic surgery clinics or dialysis centres and

The first eight to be inspected are the Lister Hospital, London; The London Welbeck Hospital; Baddow Hospital, Essex; Spire Southampton Hospital; BMI Mt Alvernia, Guildford, Surrey; Peninsula NHS Treatment Centre, Devon; Oaklands Hospital, Salford; and Nuffield Health Tees hospital, Co Durham.

AIHO said members would continue working with the CQC to ensure useful results for patients, staff and the regulator. The sector wanted quality data from independent units published in an equivalent format to NHS hospitals to aid patients make more informed choices about their care. Private hospitals should be judged by the same standards as in the NHS.

The Competition and Markets Authority’s (CMA) final order following its private healthcare market investigation puts into force some changes it now requires.

These include a crackdown on benefits and incentive schemes provided to referring clinicians by private hospital operators, and better information for patients, from April 2015.

The CMA’s full plans to increase the availability of information to patients on consultant fees are subject to the findings of an appeal hearing at the Competition Appeal Tribunal next January.

From the beginning of this

month, the CMA adopted powers to review future arrangements where private hospital operators team up with NHS private patient units (PPUs) and ban any where it is considered they might substantially lessen competition.

The CMA said its decision to require HCA to sell one or two of its London hospitals, also being challenged at next January’s hearing, will be subject to a separate order.

In the authority’s final order, signed by its group chairman Roger Witcomb, he spells out the intention on fees, subject to the result of January’s appeal.

This would kick in by 1 December 2016, requiring consultants to publish:

Outpatient consultation fees, which may be expressed as either a fixed fee or an hourly rate;

The standard procedure fee for the 50 types of procedure most frequently undertaken by the consultant;

Standard terms and conditions, plus any exclusions or caveats, expressed in a standard form – yet to be determined.

Before an outpatient consultation, specialists would have to supply patients with information including:

l The estimated cost of the outpatient consultation or consultations, which may be expressed as a range, as long as factors determining the actual cost within the range are explained;

l Details of a consultant’s financial interests, of any kind, in the medical facilities and equipment used at the premises;

l A list of all insurers who recognise the consultant;

l A statement that insured patients should check with their insurer the terms of their policy, with particular reference to the level and type of outpatient cover they have.

➱ continued on page 4

By Robin Stride

Independent practitioners working in BMI hospitals are to be invited to give their input into the shaping of the business.

New chief executive-to-be Jill Watts told Independent Practitioner Today: ‘The relationships BMI Healthcare has with doctors are fundamental to BMI’s future and, once I am in post, I will be seeking the views of both clinicians and the wider medical community about how best to work together.’

She is moving across from her post as chief executive of Ramsay Health Care (UK) next month to the rival hospital chain General Healthcare Group (GHG), which operates as BMI Hospitals.

Ms Watts will take over from

A new outpatient clinic celebrated its opening with a launch party at its newly designed premises attended by over 150 consultants, allied health professionals, staff and private healthcare affiliates.

London Claremont Clinic (LCC), at 50-52 New Cavendish Street, offers adult and paediatric care in over 15 specialties including ophthalmology, endocrinology, dermatology, oncology, cardiology, gynaecology and rheumatology.

In addition, a range of tests and services are available, including a full range of ophthalmic tests including OCT and biometry, ultrasound and complex blood and endocrine tests.

Chief executive Lana Kopanja said: ‘We have brought top consultant specialists together from

Stephen Collier, who leaves the position at the end of the year (Independent Practitioner Today , June 2014).

Mr Collier said his successor would bring ‘a powerful combination of operational knowledge, experience and strategic insight’ to the group.

He said: ‘Jill already has an impressive track-record during over 30 years in the private hospital industry, where she has held several senior operational and executive positions in both Australia and the UK.

‘With her passion for delivering quality healthcare, I am extremely pleased at the appointment and am confident that Jill will make a real contribution to the next stage of the company’s growth.’

across London to offer a unique, patient-centred, one-stop-type of clinic. We have over 35 consultants on our team now and are planning to expand to 50.’

She worked with consultant ophthalmologists Mr Lyndon da Cruz and Mr Tom Williamson, and clinical operations manager Hannah Ward, to pave the way for the facility. It opened just 18 months after discussions began.

Mr da Cruz said consultants were attracted by the idea of collective ownership and management by staff and clinicians. He believed this was reflected in the quality of care.

Guests were offered tours of the three-story premises, which has eight consulting rooms, seven procedure rooms, a clean procedure room and two eye laser rooms.

Ms Watts, who was Ramsay’s boss for six years, added: ‘BMI has an excellent reputation for delivering high-quality care and I am looking forward to working with the senior team to identify new opportunities for growth and improvement of the business.’

After qualifying in the UK as a nurse, she attained numerous leadership and healthcare administration and related qualifications during her career. She is recognised as a leader in the UK’s health sector, having been voted the most influential leader in the private healthcare sector and as one of the most inspirational women within the health sector overall.

She has served on the boards of several industry and commercial

associations across various sectors, including the NHS Partners Network.

Ramsay said she had helped to guide the company ‘to the strong position it is in today’.

The company has announced that the new chief executive of Ramsay UK will be Mark Page, whose previous job was chief executive of Greenslopes Private Hospital in Brisbane, Queensland, Australia. He takes up his new role in the UK in December.

➱ continued from page 3

The Competition and Markets Authority has ruled that, before further tests and treatment, a consultant would be required to give:

m The reason for the relevant further tests or treatment;

m An estimate of the cumulative consultant cost of the treatment pathway which has been recommended.

The order says: ‘This should either include all consultant fees that will be charged separately from the hospital fee or should include contact details for any other consultants whose fees are not included in the quote or, where applicable for self-pay patients, the total package price for treatment, where the consultant has agreed this with the operator of the relevant private healthcare facility’;

m A statement of any services not included in the estimate – for example, arising from unforeseeable complications.

The order says that where alternative treatments were available but the appropriate treatment can only be decided during surgery, the estimate should set out the relevant options and associated fees. It states that for tests or treatment given on the same day as the consultation, the information may be given verbally rather than in writing.

Hospitals would be required to get privately-funded admitted patients to sign a form confirming consultants have given them the information required.

Check our website www.independent-practitioner-today. co.uk for further developments

See feature on page 12

By Charles King

Consultants’ involvement in private treatment delivery needs to change if private healthcare is to become more affordable, an industry commentator claims.

Private Healthcare UK managing editor Keith Pollard claimed costs needed to be curtailed by doctors delegating some care to nurses.

He pointed to some NHS services which are moving to delivery by nurse practitioners – at lower cost – under the guidance of a supervising consultant.

He said: ‘“Old school” consultants may see these changes as a major threat to their autonomy, but the newer consultants coming into private practice may be more open minded and view such

changes as an opportunity to grow their private practice income quickly.’

Mr Pollard said affordable private healthcare options will be essential for future private healthcare sector growth.

He was speaking at the launch of The Affordable Private Healthcare Guide , which aims to help patients understand the complex private healthcare market, find information about price and quality, and make an informed decision about any medical treatment or cosmetic procedure.

for a 15% cut in charges in the private healthcare sector (Independent Practitioner Today, May 2014) saying the cut was needed.

He said: ‘People are living longer, creating greater demand for healthcare and making more use of private medical insurance. More use means higher premiums but personal and corporate purchasers baulk at the steep increase in premiums, so we’re seeing a fall in the number of people covered by private medical insurance, which is now at its lowest level in 20 years.’

minimally invasive surgical procedures have helped to reduce costs, reducing the length of stay and associated care costs.’

Mr Pollard said the guide was needed now more than ever. ‘The options for private healthcare are enormous, from the treatments available to the sheer number of hospitals and doctors offering them.

The guide looks at the pros and cons of going private, how to choose a hospital or doctor and how to get a better deal.

Mr Pollard backed Bupa’s call

Another challenge was healthcare costs. ‘New and effective treatments often cost more than existing ones. Thus the “cost per case” often goes up, although new

Independent practitioners and their managers should be prepared for possible changes to the way holiday entitlement is calculated for staff who work overtime.

A number of practice managers have been seeking advice on whether staff working overtime should receive additional holiday pay.

Statutory holiday pay is currently based on an employee’s basic pay, but, according to defence body employment law advisers, a couple of recent employment tribunal cases have ruled that holiday pay should reflect all elements of pay received by the employee including allowances and overtime.

MDDUS employment law adviser Janice Sibbald said: ‘Annual leave, overtime and holiday pay are particularly complicated, ever-changing and contentious areas of employment law.

‘We are currently advising practices that there is no need to alter

internal policies at present, although this may change as a result of the two tribunal cases, one of which is under appeal.

‘We do advise that practices with a high amount of overtime may wish to think about contingency planning and set aside some budget for this.’

In the recent case involving Neal v Freightliner Ltd, the Birmingham tribunal held that a freight worker was entitled to have overtime payments and shift premiums counted towards the calculation of his holiday pay, not just basic pay as previously thought.

Ms Sibbald said: ‘It was commented that the payments were “intrinsically linked” to the performance of the tasks he was required to carry out under his contract of employment and consequently should be taken into account when calculating his holiday pay.’

Another recent case, Lock v

British Gas Trading Ltd, was heard at the European Court of Justice. This ruled that Lock’s right to paid annual leave under the Working Time Directive (WTD) was infringed, as his future salary was reduced because he was unable to generate commission while on holiday.

It was claimed that these financial implications might deter him from taking annual leave, contrary to the purpose of WTD. And it was argued that the commission was directly linked to the claimant’s work and should therefore form part of his holiday pay calculations.

Ms Sibbald added: ‘Practices may wish to advise employees that they are aware of the issue concerning whether or not statutory holiday pay should reflect all elements of their pay and will monitor the consequences of the appeal. There has been no guidance so far as to back-payments attached to this ruling.’

‘While treatment choices should never be based purely on price, it’s essential that patients have an independent guide telling them how to do their research and make the decision that’s right for them – without paying over the odds.’

The guide can be found at http://issuu.com/johnnyfdesigns/ docs/aphg_digital?e=13000637/ 8877996

Initial building work has now completed on a new medical facility at No.1 Penny Lane for Spire Hospital Liverpool, to which it is linked via a glass corridor.

The centre will house nine consultation rooms, two treatments rooms, a dermatology and cosmetic unit, the Liverpool Eye Centre – a major new facility –and a private GP service led by TV doctor Dr Arun Ghosh.

The London Clinic has donated 23 defibrillators to South Mid Sussex Community First Responders, a charity of trained volunteers who respond to 999 calls within a three-mile radius of their home.

Emergency care support worker

Lee Carr said the independent non-profit hospital had provided ‘a fantastic opportunity to save lives’.

By a staff reporter

Independent healthcare providers have been urged to take inspiration from other business sectors and help patients to make more of an informed choice.

According to the boss of online solutions specialist Healthcode, the sector’s lack of investment in information technology makes it difficult to collect meaningful information about available services, prices, quality and outcomes.

Managing director Peter Connor told LaingBuisson’s Independent Healthcare Forum the dearth of data risked undermining the strong case for private healthcare.

He said: ‘I think we all know instinctively that the quality of care in the independent sector is top-class. The problem is that we still don’t have the tools to prove it.

‘And that’s because the information resources, which should be supporting our excellent medical technology and facilities, are still in the dark ages.’

Mr Connor referred to service encounters in other industries such as booking airline flights, car servicing and restaurants.

‘The consumer now expects to be able to use their tablets, mobile phones or laptops to find, choose, book and pay for services when it is most convenient for them. They can do this for virtually everything else. So why should healthcare be different?

‘The independent health sector’s approach to information technology should be shaped by what we already understand about the needs and preferences of consumers.’

The company is providing data processing services to the Private

Southend’s Spire Wellesley Hospital has selected Bourn Hall Clinic’s Colchester wing to be its fertility service provider.

Consultant in obstetrics and gynaecology Mr Jitendra Jadhav explained that patients will have the convenience of their initial consultations, scans and investigations at Wellesley and then go to Bourn Hall for the egg collection and embryo transfer.

Wellesley hospital director Roger Lye said the collaboration would ensure patients could access some of the best treatments for infertility without the need to constantly travel out of the Essex area for their appointments.

Bourn Hall Clinic was established by the IVF pioneers Steptoe and Edwards after their success with the world’s first ‘test-tube baby’ Louise Brown.

Chief executive Dr Mike Macnamee said: ‘The agreement with Spire will allow continuity of care. Treatment for infertility is improving all the time and we were delighted to announce our best results to date earlier this year.’

Bourn Hall’s latest figures show a 55.8% clinical pregnancy rate for women 37 or under. This is, according to the Human Fertilisation and Embryology Authority, ‘above the national average at a statistically significant rate’.

Healthcare Information Network, which enables it to produce and publish hospital episode statistics.

However, Mr Connor stressed that the NHS was already offering patients more information and services online, however imperfectly, and the pressure was on the private sector to up its game.

He concluded: ‘I hope independent healthcare providers and insurers will accept the challenge of investing in the information technology necessary to collect and process information which assists patient choice and access.

‘Otherwise we will be open to criticism, not just from the Competition and Markets Authority, but from our most important audience: the consumer. Healthcode is ready to work with industry stakeholders to ensure our information supports patient choice.’

healthcode has set out the different types of information it claims should be available to potential patients:

Care and treatment costs, including charges for selfpaying patients, confirmation of whether the treatment is covered by the patient’s medical insurance policy and top-up fees if applicable

Clear and meaningful quality and outcomes information, which can be compared with the alternatives, including the nhs

a basic directory of services showing who does what, where and for whom and the available appointment slots

a common and understandable language to describe the available services

patient reviews of their experiences with that provider, that treatment and that facility

harley street Fertility Clinic (hsFC) has invested £1.4m in new premises at no.134, enabling it to offer all diagnostic tests, services and treatments under one roof.

Founder dr Geetha venkat (pictured right) said the practice had grown significantly since she set it up in 2010. the new venture will enable it to treat more patients.

supported by a team of consultants in the fields of fertility, gynaecology, obstetrics and urology, the clinic offers a comprehensive range of treatments covering all aspects of fertility, including gynaecology, endoscopic surgery, urology, assisted conception and male infertility management.

hsFC said it aimed to give a particular emphasis on continuity

of care and a comprehensive holistic approach. treatments include egg/embryo freezing, follicular tracking, intrauterine insemination (iui), ivF, intra-cytoplasmic sperm injection (iCsi), surrogacy ivF treatments, surgical sperm retrieval, noninvasive prenatal testing and time-lapse imaging of embryos.

By Edie Bourne

Doctors are being ‘reminded’ by a defence body to respect patient autonomy and share decisionmaking where possible.

The MDDUS acted following recent stories in the media – relating to the NHS – highlighting the issues of consent and decisionmaking where there is a dispute between doctor and patient concerning the best course of medical care.

But it said the issue was as relevant to doctors working in the private sector as it was to the NHS.

The union cited cases where doctors have disagreed with a decision made by the parents of a child regarding its care. In other instances, there was disagreement with the decision made by a com-

petent patient regarding their own care.

Whenever these situations arise, doctors are faced with an ethical dilemma of balancing their duty of care with the patient’s right to autonomy.

MDDUS medical adviser Dr Naeem Nazem said the risks of facing conflicts in healthcare decisions could be minimised by working in partnership with patients, wherever possible, to enable them to make informed decisions about their care.

He said: ‘Nowadays, patients and their relatives have greater access to health information and seek to play a more active role in decisions about their care.

‘In the vast majority of cases, doctors and patients work together in a partnership based on

mutual respect. A shared decision, complete with a full and frank discussion of risks and benefits, is more likely to ensure a positive patient experience and outcome.’

But if no agreement could be reached, doctors needed to consider whether a competent patient was making a choice about their own care or an adult was making the decision on behalf of a child or under a power of attorney.

He said: ‘Doctors have a duty to raise concerns if they believe a parent is not acting in a child’s best interests. However, when it comes to a decision made by a competent patient, doctors must respect a patient’s autonomy and right to decide, even if they disagree.’

Dr Nazem said while doctors cannot force a patient to follow their advice, they are entitled not

BMI’s The Alexandra Hospital, Cheadle, Cheshire, has announced it is the first private provider in the UK to invest in the Toshiba Aquilion ONE Next Generation 320-slice CT scanner.

Philip Oehley, executive director of the 170-bed unit near Stockport, Greater Manchester, said: ‘The scanner will put us at the forefront of imaging and diagnostics services, enabling us to provide our patients with the most advanced clinical technology available.’

Manchester is currently seeing huge investment in private practice facilities, including a new Spire Healthcare private hospital and a Manchester Metropolitan University and Nuffield Health partnership ( Independent Practitioner Today, July/August).

The scanner is part of the Alexandra Hospital’s continued commitment to invest, which has seen £15m for new services over the last four years, including a £1.2m radiology unit, paediatric unit, urgent care centre, cancer unit and physiotherapy department.

Key patient benefits of the new 320-slice CT scanner include:

Minimal radiation dose: optimal imaging quality is produced at the lowest possible dose;

The super-fast scanning capabilities reduce the scanning time to seconds, minimising the length of time patients are required to hold their breath and be on the scanning table;

Exceptional 4D diagnostic imaging which can capture the whole head in one rotation and can record a moment in time or over multiple moments to image dynamic blood flow or the mechanics of joint movement;

The scanner width will also help reduce claustrophobia and anxiety, and be more comfortable for larger and bariatric patients.

to provide treatment requested by a patient that they do not believe is in their best interests.

‘In these situations, doctors must explain their reasons to the patient and the other options available – including the right to seek a second opinion.’

He said the union had dealt with many cases where patients had requested unlicensed or specialist medicines from their doctors following their own research on the internet. But doctors had an ethical duty to work within the field of their own knowledge and expertise, he said.

‘While patients are entitled to request medicines from their doctors, it is ultimately a doctor’s decision to consider whether any treatment or intervention is in the best interests of their patient.’

The growth in obesity is fuelling a new range of couches to help private doctors meet handling guidelines and minimise the risk of client and staff injuries.

Bariatric treatment couches and chairs developed by Plinth 2000 aim to ensure safe manual handling guidelines are observed.

It is offering two-, three- and four-section heavy-duty couches, a divided leg trolley, podiatry chair and the first fully-rated 50st (320kg) tilt table, as well as a bariatric leg ulcer package with an uprated treatment chair.

A bariatric gynaecology couch is also about to be launched for ‘plus size’ pregnant mums, while in development is a heavy-duty dialysis chair.

Managing director Niall Dyer said the firm was keen to engineer further bariatric designs, providing there was customer demand.

By a staff reporter

London Medical claims its new personalised Diabetes Care Plan looks set to revolutionise the diabetes care market and improve the standard of care available for patients.

The aim of the new programme from the Marylebone-based clinic is to offer ‘affordable and accessible’ care packages as an alternative to the current NHS offering, which is under pressure due to the alarming rise in the condition in the UK.

It provides a different approach to the management and care of diabetes, with personalised treatment plans individually tailored to each patient’s needs – not defined by Government or central guidelines.

The continuous care scheme offers patients constant support in managing their diabetes, as well as access to the latest in education and technological developments in diabetes and obesity management.

A dedicated expert team has been brought on board at London Diabetes to support patients taking part, headed up by consultant diabetologist and lipid specialist Dr Eva Palik.

Patients will benefit from complete care within a single location, with access to a wider in-house team including dieticians, diabetes specialist nurses, podiatrist, psychologists, cardiologists and ophthalmologists.

The deal is available at London Diabetes, a specialised diabetes centre based within the clinic.

It has designed a patient ‘route map’ outlining a number of options for people to access the plan, including a primary entry point for initial assessments and medical tests to assess risks, and a secondary entry point for those with an existing diagnosis to gain a second opinion.

Depending on the results of these initial assessments, patients may be invited to join the care plan.

London Medical said the objective is to provide affordable pricing and payment options, with no hidden costs. There will be two options for payment, either a oneoff payment of £2,000 or a monthly payment plan with a cost of £100 for 17 months and a

joining fee of £500 (£2,200 total).

A new survey commissioned by London Diabetes to explore the needs of Type 2 diabetes patients found that two-thirds (66%) of Type 2 diabetes patients feel there is room for improvement in the management and understanding of their condition.

Eighty-three per cent of patients surveyed would like to have contact more than once a year with a health care professional to help manage their condition. And 33% would be prepared to pay for an improved level of care.

Clinic general manager David Briggs said: ‘The Diabetes Care Plan is a totally new concept, offering access to the highest level of care for a minimal cost. We have researched this launch very carefully, taking into considera -

the care plan offers:

annual consultation with a consultant diabetologist (foot check included) with goal-setting

one teaching course a year

regular updates and internet teaching modules and news

Biochemistry analysis

annual fundus examination with report and eye pressure measurements

annual consultation with the diabetes team member to be used for education, support or treatment changes

a carotid ultrasound (once every two years) if over 35 years old

free download of glucose meter readings three times a year

Discounted continuous glucose monitoring, if needed

10% discount on medication bought from london Medical pharmacy

two follow-up phone calls a year from a member of the diabetes team

Medicines review consultation with pharmacist

tion factors such as the pressure faced by the NHS from the UK’s ageing population and the associated rise in conditions such as diabetes and the lack of cover for chronic conditions from PMIs.

‘As a result, it was clear that a gap exists in the market to introduce a well-designed, care plan solution for patients, similar to the successful dental market model. We have ambitious plans for the programme and have designed a scalable model that can be rolled out nationally and internationally.’

He said private healthcare had long been perceived as exclusive and expensive, and this was an exciting opportunity for an independent provider to lead the way in creating a new type of service for patients.

Medical director Dr Ralph Abraham said: ‘We have a strong heritage in diabetes at London Medical, having pioneered and delivered personalised expert care for over 20 years.’

Dr Palik said: ‘Type 2 diabetes is a complex condition and patients face a number challenges in managing it and minimising the impact on their quality of life. It’s exciting to be involved in an initiative that offers such a supportive and comprehensive care package.

‘By offering patients more regular contact with the care team, in terms of both practical advice, education and support, we’re confident that we will help people achieve better outcomes for their health.’

➱ continued from front page

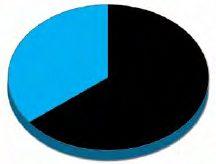

The British Association of Aesthetic and Plastic Surgeons (BAAPS) has devised a template to help press and public gauge the truth behind claims for cosmetic ops.

BAAPS is promoting use of an evidence pyramid shown below to stimulate questions such as:

When was the treatment launched?

How many people were involved in trials?

For how long were they followed?

Where has the data been published/presented?

Was it sponsored (paid for)?

Top tier: Has been studied for more than five years, easily researchable with over 50 nonsponsored studies in medical/scientific journals. Examples include botulinum toxin and cohesive gel implants.

Second tier: Studied two to five

years and has over 20 non-sponsored studies in medical/scientific journals. Examples include the CoolSculpt (fat freezing) device and surgical facial treatment ‘Silhouette Lift’

Third tier: Studied at least a year with a minimum of five non-sponsored papers in medical/scientific journals. Examples include novel fat transfer technique ‘nano-grafting’ and body-contouring filler Macrolane – taken off the market

after being promoted for use in the breast.

Below Surface level: Studied under a year and may be based on a single case study. Information on the treatment is found almost exclusively via promotional channels rather than presented to peers via scientific conferences or publications. Includes vague claims ‘Boob Job Serum’, ‘Electrode Facelift’, ‘[Celebrity Name] Lift’, ‘Fat dissolving/melting/zapping’.

There’s a 1-in-4 chance of someone developing shingles during their lifetime.1 The risk increases with age, as does the likelihood of complications. 2

ABRIDGED PRESCRIBING INFORMATION

ZOSTAVAX® powder and solvent for suspension for injection in a pre-fi lled syringe [shingles (herpes zoster)vaccine (live)] Refer to Summary of Product Characteristics for full product information.

Presentation: Vial containing a lyophilised preparation of live attenuated varicella-zoster virus (Oka/Merck strain) and a prefi lled syringe containing water for injections. After reconstitution, one dose contains no less than 19400 PFU (Plaque-forming units) varicella-zoster virus (Oka/Merck strain). Indications: Active immunisation for the prevention of herpes zoster (“zoster” or shingles) and herpes zoster-related post-herpetic neuralgia (PHN) in individuals 50 years of age or older. Dosage and administration: Individuals should receive a single dose (0.65 ml) administered subcutaneously, preferably in the deltoid region. Do not inject intravascularly. It is recommended that the vaccine be administered immediately after reconstitution, to minimize loss of potency. Discard reconstituted vaccine if it is not used within 30 minutes. Contraindications: Hypersensitivity to the vaccine or any of its components (including neomycin). Individuals receiving immunosuppressive therapy (including

Year 2 of the national shingles immunisation programme started on 1st September 2014* for eligible patients. For full programme details and support items visit www.shinglesaware.co.uk

Help prevent shingles disrupting peoples’ lives

*Programme details may vary for each country. Please refer to local guidelines.

high-dose corticosteroids) or who have a primary or acquired immunodefi ciency. Individuals with active untreated tuberculosis. Pregnancy. Warnings and precautions: Appropriate facilities and medication should be available in the rare event of anaphylaxis. Zostavax ® is not indicated for the treatment of Zoster or PHN. Deferral of vaccination should be considered in the presence of fever. In clinical trials with Zostavax ®, transmission of the vaccine virus has not been reported. However, post-marketing experience with varicella vaccines suggest that transmission of vaccine virus may occur rarely between vaccinees who develop a varicella-like rash and susceptible contacts (for example, VZV-susceptible infant grandchildren). Transmission of vaccine virus from varicella vaccine recipients who do not develop a varicella-like rash has also been reported. This is a theoretical risk for vaccination with Zostavax ®. The risk of transmitting the attenuated vaccine virus from a vaccinee to a susceptible contact should be weighed against the risk of developing natural zoster and potentially transmitting wild-type VZV to a susceptible contact. As with any vaccine, vaccination with Zostavax ® may not result in protection in all vaccine recipients. Zostavax ® and 23-valent pneumococcal polysaccharide vaccine should not be

given concomitantly because concomitant use in a clinical trial resulted in reduced immunogenicity of Zostavax ® Pregnancy and lactation: Zostavax ® is not intended to be administered to pregnant women. Pregnancy should be avoided for one month following vaccination. Caution should be exercised if Zostavax ® is administered to a breast-feeding woman. Undesirable effects: Very common side effects: Pain/tenderness, erythema, swelling and pruritus at the injection site. Common side effects: Warmth, haematoma and induration at the injection site, pain in extremity, and headache. Other reported side effects that may potentially be serious include hypersensitivity reactions including anaphylactic reactions, arthralgia, myalgia, lymphadenopathy, rash and at the injection site, urticaria, pyrexia and rash. For a complete list of undesirable effects please refer to the Summary of Product Characteristics. Package quantities and basic cost: Vial and pre-fi lled syringe with two separate needles. The cost of this vaccine is £99.96. Supplier: Sanofi Pasteur MSD Ltd., Mallards Reach, Bridge Avenue, Maidenhead, Berkshire, SL6 1QP Marketing authorisation number: EU/1/06/341/011

Legal category: POM ® Registered trademark Date of last review: 25 April 2014

References 1. Miller E, Marshall R, Vudien J. Epidemiology, outcome and control of varicella-zoster infection. Rev Med Microbiol. 1993;4: 222-230 2. Gauthier A, Breuer J, Carrington D et al. Epidemiology and cost of herpes zoster and post-herpetic neuralgia in the United Kingdom. Epidemiol Infect. 2008; 137(1): 38-47

Adverse events should be reported. Reporting forms and information can be found at www.mhra.gov.uk/yellowcard Adverse events should also be reported to Sanofi Pasteur MSD, telephone number 01628 785291.

Ray Stanbridge and Vanessa Sanders (below) give an update after delving deep into the historical records to argue that the taxman has to recognise the sale of medical practice goodwill by consultants

The ongoing debate between the accountancy profession and h M Revenue and Customs (hMRC) regarding goodwill continues, with no clear sign of a resolution at present.

o ne view, expressed by some members of hMRC, is that medical practice goodwill has never existed. And there is an alternative Revenue view that even if it does exist, it is purely personal and cannot be transferred.

There is no statutory definition, and it is generally agreed that goodwill is a difficult concept to define, as each business is unique.

in the old case of iRC v Muller & Co Margarine Limited [1901] AC 217, Lord Mac n aughton said: ‘ g oodwill is the benefit and advantage of the good name, reputation and connections in the business. it is the attractive force which brings in customers. i t is the one thing which distinguishes an old business from a new business.’

he went on to say that goodwill comprised of a variety of elements. it differed in the composition of different trades and of different businesses in the same trade.

in the same case, Lord Lindley stated: ‘ g oodwill regarded as property has no meaning except in connection with some trade or calling. in that context, i understand the terms to include matters attributing to a business by reason of situation, name and reputation, connections, introductions to old customers and agreed absence from competition.’

Lord Lindley could be describing many professional practices.

History demonstrates that medical practice goodwill has indeed existed for many years – and continues to do so

Before the Second World War, there was a substantial market in the purchase and sale of medical practices. The situation was summarised by S. M. h erbert in his 1939 Penguin Special on Britain’s Health

substantial debt

herbert wrote: ‘entry into gP practices (1) by purchase of goodwill –the usual price being 1½ times annual income. gPs started with a substantial debt. on average, about 1,000 national insurance patients generated about £400-£500pa (sic) – an income boosted by the care of patients who were not covered by national insurance.’

n egotiations to establish the nh S, headed up by Aneurin Bevan (Minister of h e alth between 1945-46 and 1946-48) were focused heavily on the question of medical practice goodwill.

The BMA, for example, issued a resolution in 1946 stating: ‘As

essential to the freedom of patients and the profession is the right to buy and sell practices as at present.’

After considerable negotiation, it was agreed that consultants could retain private patients and have the right to private beds in nhS hospitals.

in addition, Bevan agreed that gPs could retain the freedom to run their practices as small businesses.

There was considerable discussion on the elements of compensation to be paid to doctors for the right to give up their goodwill.

A circular issued to medical practitioners by the Medical Practitioners Union in 1948, entitled You must decide, stated that figures for compensation had been agreed between the profession and the government.

The circular went on to say: ‘The government will pay a fair market value for your proprietary interest, a rate of remuneration which, if not generous, is reason-

able and sure, and a pensionable right which protects not only yourself but your wife.’

i t was estimated that Aneurin Bevan agreed to pay the medical profession £66m for the right to abolish the sale of practices in the state sector. This was followed by alleged claims that Bevan persuaded doctors and consultants to join the nh S by ‘stuffing their mouths with gold’.

Legislation introduced in 1948 prohibited gPs from selling their practices. There were never any restrictions on consultants.

This status quo was maintained for many years, until 2004, when the Primary Medical Services Regulations (Sale of goodwill and Restrictions on Sub-Contractors) were introduced. These regulations maintained the ban on sale of ‘essential services’, but relented on the sale of enhanced, out-ofhours and additional services.

These regulations demonstrated quite clearly that there was never any intention by legislation to ban sale of consultant goodwill –or indeed non-essential g P services. history therefore demonstrates that medical practice goodwill has indeed existed for many years – and continues to do so. goodwill is recognised as both an accounting and legal concept. The law envisages the transfer of medical practice goodwill by defining what cannot be transferred (essential services). other statute allows the transfer of professional goodwill in general.

For example, the 2007 income Tax Act s784 states: ‘This section applies if a capital amount is obtained from the disposal . . . of assets (including goodwill) of a profession or vocation.’

Case law also establishes the point that goodwill does exist in many businesses. indeed, as early as 1880, judges have acknowl -

edged that a professional can transfer goodwill as a matter of common law.

See for example Jessel M.R. in ginesi v Cooper (1880) 14 Ch.D. 596 to 599 – which takes the example of a solicitor or surgeondentist. The judge accepts that in those businesses the personal connection is a very large element of their success, but that nevertheless it is possible to sell the benefit of that goodwill.

The real problem is in determining an appropriate market value.

Two recent cases are particularly illustrative in this respect.

i n the 2006 case of Balloon Promotions Ltd v Wilson spc 524 (2006) STC (SLD) 267, the court ruled that goodwill was inseparable from the business from which it is generated. Thus if the business passed to another party, then the goodwill followed.

Yet another recent case concerned a sole trader accountant. in

this case of Wildin v h MRC TC03586 2014, hMRC accepted:

A sole practitioner business did have a goodwill value, notwithstanding that it was a one-man band;

A capital gain would result from a transfer of goodwill of this ‘oneman band’ to a limited company which continued the same professional business – albeit it as a trade of the company carried out by professional employees.

The court said that the method of valuation was important and relevant to agreeing a ‘market value’ on transfer and referred to the importance of using professional experts.

An even more recent case considering the transfer of business for a specific capital gains tax relief, was that of Roelich v hMRC TC03704 2014. in this case, they considered what was actually capable of transfer and came to a very interesting yet sensible conclusion:

‘We can see that many busi -

nesses might be started by one individual whose skill and contacts are particularly important at the beginning, but unless the nature of the business is such that no other person can learn those skills, this does not prevent the business being transferrable.

‘ i t might have been different if the appellant had been a portrait painter or a singer, but he was not. Most activities can be learned by others even if it takes time.

‘For example, an accountant may start in business on his own and use his experience and contacts to create a successful business, but there is no reason why he cannot transfer that business to another practice, particularly if he works in the new business for a period after the merger so as to facilitate the success of the merged activity.’

With more than 40,000 hospital consultants operating in the UK and a finely tuned training ground, we can assume that the skills of medicine can be learned and therefore passed on.

So where then are we? i t is agreed by all that medical practice goodwill is a difficult concept to define and measure.

h istory, the law and reality show that medical practice goodwill continues to exist.

And statute and case law confirms that it is capable of transfer. Case law and professional opinion confirms that goodwill generally exists in all business and is capable of transfer, even from ‘one-man bands’.

h opefully, these arguments will, at some point, be sufficient to convince the doubters in hMRC. The real difficulty lies in how to measure it.

Ray Stanbridge and Vanessa Sanders are directors of Stanbridge Associates, specialist medical accountants

Consultants in private practice are being ordered to be more transparent. So what will that mean in practice? Leslie Berry gives the low-down

Back in the Spring, the competition and Markets a uthority (cMa) published its final report into the private healthcare sector ( Independent Practitioner Today , april 2014).

This included a range of ‘remedies’ to alter the market to put right the ‘adverse effects on competition’ the authority said it found.

in reality, that was not the end of the impact on the industry, but the end of the beginning. n ow the hard work continues to consider how to effect the changes that the cMa requires.

Everyone is still working out what the report really means in reality. But, for our new readers and any who missed the c M a’s report, it looks set to affect consultants in the following ways.

There are four key areas where specialists will need to adapt their practices to ensure they comply:

1 Transparent publication of consultants’ financial interests in facilities;

2 Transparency of consultant fee information;

3 Transparency of clinical performance information;

4 Restriction on certain benefits and incentive schemes.

1

Transparent publication of consultants’ financial interests in facilities a s and when the order takes effect, hospitals will need to publish on the hospital website a list of all consultants who have a financial interest in either the hospital or specific equipment in that hospital.

2 Transparency of doctors’ fee information in order to allow patients to make informed choices about their treatment, the doctors that they will be treated by and the hospitals where their treatment will take place, the c M a requires transparency of quality and price data.

The changes will mean that consultants will be required to provide patients with written confirmation of:

The cost of outpatient consultation – either a fixed fee or hourly rate and maybe a range;

Details of their financial interests in the facility where treatment takes place;

a list of all insurers which recognise that consultant;

a note advising insured patients to check terms of their policy with their insurer;

after the outpatient consultation, a written quote and confir

The Competition and Markets Authority’s report included a range of ‘remedies’ to alter the market to put right the ‘adverse effects on competition’

mation of diagnoses in advance of further treatment or tests – but not if this will take place on the same day.

in its current form, the cMa’s obligation requires that consultants must comply with the above as a condition of being granted practising privileges.

Transparency of clinical performance information

From September 2016, private hospital operators will need to provide patient episode data to an information organisation – most likely the Private Healthcare information network (see feature on page 14).

The reported metrics include:

Volume of procedures undertaken;

average length of stay;

c linical indicators (infection rates, readmission rates, revision rates, mortality rates, hospital transfers and adverse event rates);

Patient satisfaction/feedback;

GMc number of consultant;

nHS number of patient;

Diagnostic coding.

4

Restriction on certain benefits and incentive schemes

To ensure that competition for patients is based on quality of care without perverse financial incen

tives, this remedy aims to remove what are considered inappropriate incentives to clinicians.

High-value services:

Hospital operators who provide services such as consulting rooms, secretarial and admin services to consultants will be required to do so at full open market value.

Where consultants provide services such as consultancy or advisory services to private hospitals for a fee – such as chairing a committee or being a medical director – the fee must be reasonable and proportionate, and may also be required to be disclosed on the hospital’s website.

low-value services:

after comment from a number of industry players, hospital groups have convinced the c M a that some lowvalue services should be allowed, such as:

a) Ser vices intended to ensure

clinical safety – for example, relevant training;

b) Workplace basics such as free tea/coffee/snacks while working, stationery and free parking – as long as also available to all staff;

c) General marketing of the hospital, such as general promotional events and consultant directories; d) corporate hospitality not tied to referrals. if over £500, it must be published on the hospital’s website. Hospitals must disclose on their websites if they provide these ‘de minimus’ services to consultants.

Consultant equity participation:

c onsultant equity participation in hospitals or joint ventures (JVs) for facilities or equipment will be prohibited.

But some exemptions will be made on the following basis:

a) The consultant subscribes to a fair market value and pays up front for equity in the hospital or

Hospital operators who provide services such as consulting rooms, secretarial and admin services to consultants will be required to do so at full open market value

JV (this provision will not have retrospective effect);

b) The consultant owns 5% or less of the equity;

c) There is no requirement on the consultant to practise at the facility or to refer patients or to use specific equipment;

d) Dividends/profits must be shared on a pro rata basis in proportion to consultant’s stake;

e) n o non compete clauses are enacted;

f) Details of the consultants’ financial interests are disclosed on the hospital website.

The final cMa order out earlier this month has at least made some of the remaining uncertainties clearer. Independent Practitioner Today will be keeping you up to date with developments and their implications for private practice.

The role of the Private Healthcare Information Net work in helping you meet new requirements, see page 14

An easy to use software system, which fully supports the clinician and office staff and makes the whole process of running a busy Practice a lot easier.

Call now for a chat and ask about a free, no obligation demonstration of our comprehensive system that has been designed to save your Practice time and money.

pUblishing hEAlThcARE dATA

Consultants in private practice will also soon be legally required to publish information to demonstrate their own quality standards – and they will need to publish their fees. Matt James outlines the role of the Private Healthcare Information Network in helping them to do so

If you work in private practice, you’re probably well aware of how quick the press is to throw mud at private healthcare. you will also have seen how readily the public seems to accept, largely uncritically, that any allegations made are probably true.

This week, as I write, the national press ran stories of relatively small numbers of cataract patients suffering unspecified complications in one hospital, and suggested that the coming election should be fought on the issue of the privatisation of the NHS. That’s quite an extrapolation.

Similarly, last week I found myself doing interviews for BBC television and radio to defend the interests of the sector from criticism raised by a hitherto unknown thinktank that had investigated the standards of information available to private patients.

Happily, the BBC was sensible enough to listen to our views and present the facts in a balanced fashion, but we couldn’t prevent others, disappointingly including The Daily Telegraph, from falling for some headlinebaiting nonsense statistics. Some elements of the original report, I should concede, were fair (see September’s Independent Practitioner Today, page 18).

If there is a silver lining to this cloud, it is that such attention presents us with an opportunity to make our own case, and we must take it. unfortunately, private healthcare has historically been poorly equipped to defend itself with information.

Critics – for that’s what we have, where the NHS has ‘critical friends’ – are free to throw numbers at us that are pretty hard to bat back, along with general allegations of

‘not comparable to the NHS’ and ‘poor standards of reporting’.

Part of the problem is that we have not used or collected information in the same way as the NHS, using different coding standards and different processing routes. The NHS has also shown very little interest in better understanding private treatment, usually ignoring it completely when designing information flows.

The Private Healthcare Information Network (PHIN) aims to change all that.

In case you’ve not heard of us, we’re a not-for-profit organisation set up two years ago with the backing of the private hospital operators to collect and publish their data in a way that would be comparable with the NHS and meaningful for patients.

The need for independence

The hospitals wanted a way to convincingly demonstrate their high standards of care, but, importantly, they also recognised that if PHIN is going to be of any use in improving the public image of private healthcare, then it needs to be credible, and for that it needs to be independent and transparent.

As such, they encouraged us to set up at arms length with an independent board and objectives focused on patient and public benefit, not on sector promotion. They’re not always thrilled when we demonstrate our independence, but both they and we are learning how to manage that.

The private sector is not used to having critical friends, you see, as noted above. But that’s partly what PHIN must be.

We will not criticise clinical standards, as that’s not within our remit nor expertise, but we will point out where care providers are failing to produce the information required to prove the quality of care, and we will produce information that others can use to draw their own conclusions. u nlike other critical friends, however, we’ll actually give care providers the tools and encouragement they need to improve.

What this all means is that we will help to equip private healthcare with the material that it needs to make its case compel -

lingly, but we will first make sure that the facts are available and demonstrably fair.

The keen-eyed among you may have noticed that I used the term ‘care providers’ above, rather than ‘hospitals’.

That’s because consultants in private practice will also soon be legally required to publish information to demonstrate their own quality standards and, indeed, they’ll need to publish their fees.

PHIN’s role is to help them do so.

In case you missed lots of previous issues of Independent Practitioner Today , one of the main results of the recently concluded investigation into private healthcare by the Competition and Markets Authority – formerly the Competition Commission (CMA) – were requirements for far greater publication of quality performance information for hospitals and consultants, and of consultants’ fees, and the establishment of an Information o rganisation to manage all that.

PHIN expects to be approved by the CMA as that Information o r gan i sation later this month, with a five-year remit to make the required changes.

So yes, we’ll be helping to make that move toward publishing information about individual consultants, because that’s what patients really care about.

don’t panic

But please don’t panic. We understand that producing information about consultants is new, difficult, imperfect and probably in many cases just not achievable. Consultants are not shy in telling us this.

And we will do our utmost to ensure that information is fair, complete and appropriately presented.

Consultants will not be required to make information available to publish until September 2016, and we’re not obliged to publish it until April 2017.

That’s plenty of time for us to work with specialist bodies, national clinical registries and, of course, hospital groups, to collect, understand, improve and prepare information. Which means that we can, and will, do this right.

o ur commitment to you is to ensure that every consultant has

We’ll be helping to make that move toward publishing information about individual consultants, because that’s what patients really care about

ample opportunity and the means to see, use, review, challenge and improve their data long before it is published.

In the final analysis, the legal duty to publish falls on consultants, not on the Information organisation, so you will be able to withhold your consent to publish if you so wish. And no, we will not be naming and shaming – although I can’t make such promises on behalf of the CMA.

This article will inevitably leave readers with questions, and the truth is that we won’t have all the answers. However, if the editor will permit (oh yes! – Ed), and if there is interest, I’ll be happy to give you more detail and guidance as it emerges from conversations with your colleagues over the coming months.

Matt James (right) is chief executive of the Private Healthcare Information Network

Question: ‘i’ve been running a private practice with my business partner for more than 15 years. but now he has decided to take an early retirement next year and move abroad.

‘What’s your advice to ensure the split goes as smoothly as possible?’

ConsUlTAnTs’ ACCoUnTAnT sUsAn HUTTER sAys: It’s best to ensure that there is some planning in advance of, and also during, the changeover.

Nowadays, more consultants work in groups, either by way of partnership or a more formal structure like limited liability partnerships (LLPs) and limited companies, as opposed to the traditional sole trader model.

In these cases, it is vital to have an agreement of either partner -

ship, members or shareholders, depending on the structure of the practice.

The agreement should be drawn up when everything is operating on a ‘friendly’ basis, as it is far easier to make an agreement before you have a disagreement.

In this context, the main areas that the partnership agreement should cover are:

Profit-sharing arrangements; Expense sharing;

Capital contributions;

What happens to patients if one of the principals leave?

What happens to the goodwill of the retiring principal?

Notice period.

Two main scenarios

The exact circumstances of the retirement of the principal will have an important bearing on how the matter is handled. The two main scenarios are retiring from the profession completely, or moving on to new pastures.

In the former case, one would expect that a reasonable notice period would be given and, hopefully, this is catered for in the agreement.

This would then mean there would be time to hand over patients, ‘know how’ – where applicable – and relevant administrative information.

In the case of a principal who is leaving to go either to join another practice or to set up on their own, the way this is handled

will very much depend on the agreement and the circumstances of the retirement – for example, is it on a friendly or hostile basis?

Either way, one cannot really force patients to stay with a doctor that they do not want to be with and one has to look at this in a practical manner.

If there is no partnership agreement governing the terms of a retirement, then it is important to behave as sensibly as possible, otherwise the issues will turn into a heated dispute and, in these circumstances, only the lawyers get rich.

One of the sticking points tends to be the valuation of the practice and whether or not the outgoing partner is entitled to be paid for their goodwill.

Incidentally, this is also relevant if they are retiring from the profession completely, as some may feel they are entitled to a pay out when they leave.

Many practices agree that on retirement, for whatever reason, the retiree would only be entitled to undrawn profits and nothing further.

This is the simplest way of dealing with the situation and at least everyone knows where they are.

You may be in a practice that has valuable tangible assets, such as laser machines or MRI scanners.

If these assets have a residual market value, then there may be scope in the agreement for them to be valued and the outgoing partner to receive a payment in lieu of their share.

However, it should be borne in mind that most assets depreciate at quite an alarming rate and therefore the valuations tend to be quite paltry after a few years. If the practice does have an agreement, it is important that all partners understand it.

There have been cases where the principals merely sign the agreement only to find that they have never really understood it and when it comes to the retirement of a partner, things do not pan out the way that was originally envisaged.

Therefore, it is wise to meet with the lawyers so that they can explain the agreement before it is signed.

In any event, you will need to take advice, from the legal and accountancy professions. In order to keep professional fees as low as possible, it is sensible to try and iron out any disputes prior to meeting with the professionals and do not allow personal emotions to get in the way of making business decisions.

Subsequent to the retirement of the partner, the remaining partners will need to look at the ongoing practice and agree the way forward.

Look at whether or not the expense base is still justified in the light of the partner retiring. If the patient numbers are unlikely to change, you may not need to adjust expenditure.

However, if the retiring partner was quite ‘expensive’ to service, it may be worthwhile looking at cost-cutting and potential redundancies. Once again, you will need to take advice.

Planning is key. And I cannot emphasise enough that the time to look into these issues is when your practice is in a ‘happy state’ to ensure that all the proper arrangements are in place.

Susan Hutter (right) is a partner at Shelley Stock Hutter, specialist medical accountants

A new concept providing real benefits to patients

• Weight-bearing scans and variable patient positioning enables a more precise diagnosis

• Truly open system is a solution for claustrophobic patients without compromise in image quality

Accusations of treating your parent as a ‘doctor’ rather than a son or daughter can lead to disharmony and frustration by all parties

The task of helping parents or other close relatives make decisions about their care is likely to come to many of us and, for doctors, this challenge can be far greater.

In the first of a series of three for Independent Practitioner Today, Penny Hibberd guides you through some options for consideration

In the UK, there are currently 10m people who are over 65 years old. The latest projections are that there will be 5.5m more elderly people in 20 years’ time and the number will have nearly doubled to around 19m by 2050.

Within this total, the number of very old people grows even faster. There are currently 3m people aged over 80 and this number is projected to almost double by 2030 and reach 8m by 2050. While one in six of the UK population is currently aged 65 and over, by 2050 one in four will be over 80.

The challenge of helping parents or other close relatives make decisions about their care is likely to come to many of us and, for those who are healthcare profes-

sionals, this challenge can be far greater.

Some assume that because they are a healthcare professional, the process of accessing care and meeting a loved-one’s needs should be simple.

Certainly, it can be easier with some knowledge of the services and processes within health and social care. But do take into account the emotional and relational tensions that arise from juggling a busy professional life and your own emotions.

Accusations of treating your parent as a ‘doctor’ rather than a son or daughter can lead to disharmony and frustration by all parties.

➱ p20

is continuously updated based on the latest medical research to bring you current evidence-based recommendations.

Our unparalleled team of physicians and editors places new research in the context of the existing body of medical knowledge using their professional expertise and first-hand clinical experience.

This combination of Evidence & Experience is invaluable in crafting point-of-care recommendations trusted by more than 850,000 clinicians worldwide.

To learn more or to subscribe risk-free, visit learn.uptodate.com/EXPERIENCE or call +1-800-998-6374 | +1-781-392-2000.

These tensions can exacerbate when the person’s condition deteriorates and their needs are compounded by pain, non-compliance to medication, multiple loss and isolation. Many people find it very hard to know where to start. When introducing care to a family member or friend, it is critical that they feel in control and are reassured that they will be able to maintain their independence.