INDEPENDENT PRACTITIONER

THE BUSINESS MAGAZINE FOR DOCTORS WITH A PRIVATE PRACTICE

In this issue

Become a patient magnet How to become more attractive to patients by embracing the power of smartphones P24

Become a patient magnet How to become more attractive to patients by embracing the power of smartphones P24

Don’t fall into debt spiral

An expert outlines three key areas of financial stress and how to avoid them P32

The private sector hits back at a scathing report on safety in independent hospitals n Turn to page 18

The independence vote

What are the financial implications for all doctors if Scotland breaks away? P40

By Robin Stride

The Federation of Independent Practitioner Organisations (FIPO) has expressed ‘serious concerns’ over an AXA PPP bid to cut many consultants’ fees by around 20% and persuade more specialists to agree tie-in contracts.

Letters sent from last month to an initial batch of doctors who have no formal agreement with the insurer invited them to sign up –and more specialists can expect to be contacted in the next few months with wording customised to their circumstances.

The insurer also announced a new fee schedule from 1 October 2015, which means lower fees overall, although it said some would rise and others would be frozen.

There will be two consultant categories recognised by the insurer: fee-approved (contracted) and feelimited (not contracted – and so subject to the new schedule).

FIPO’s deputy chairman Mr Richard Packard said: ‘According to AXA PPP, the first group is being offered potentially better access to

In association with

patients through a so-called “fasttrack” referral system. However, if the majority of consultants sign up to AXA PPP’s fee-approved contract, this will cease to be of any added benefit, as the pool of private patients is finite.

‘Fee-limited consultants will still be able to charge at their normal rates, but reimbursement from AXA PPP will be limited, meaning patients will have to make up the shortfall.’

FIPO said its initial analysis of over 40 most common procedures indicated a benefit cutback of around 20%.

A new surgical consultation, for example, would be £125, with £95 for follow-up.

It advised consultants to ‘be wary of engaging with insurers and losing their contract with the patient, for what may be short-term, if any, gain.’

AXA PPP refused to say how many specialists it had agreements with or was writing to, calling this ‘commercially sensitive’.

It claimed its initiative would secure cost-effective, quality treatment for members for the foresee-

able future. Fee-approved specialists would enjoy the reassurance that their fees would be paid in full in accordance with their contract, ‘removing any financial consideration from their relationship with their patients’.

The insurer said fee-approved specialists could also get preferred access to patient referrals from its fast-track appointments service,

now available to all members, where it ‘takes the lead on directing members to a suitable specialist for treatment’.

It argued that because it was sending patients to specialists through this service, it needed effective contracts with those consultants to back a guarantee that members’ fees would be paid in full.

➱ Continued on page 4

SURGICAL SUPPORT: A breast surgeon has turned his strongly-held belief about wrongly-fitting bras into a thriving business. Mr Atul Khanna, who is based in Birmingham, found that many of his patients seeking breast-reduction surgery were suffering from health problems caused by poorlymeasured bras. So he has teamed up with two likeminded entrepreneurs to form a company that manufactures and fits made-to-measure garments.

n See feature on page 14

Public attack on private safety providers respond to a controversial report on patient safety in the private sector P18

star in your own movie doctors are turning to video so patients can see them before they meet P26

Hone in on the target: money as private doctors won’t admit they’re in it for the cash, they’re less successful P29

investing for your offspring

Financial experts give advice on how to invest money for your children P36

don’t let it come to a fight our resident legal eagle tells you how to resolve your partnership disputes P38

what if scotland goes its own way?

We explore the ramifications for all doctors of scotland becoming independent P40

Plus our regular columns

Business Dilemmas: neurosurgical ethical issues P44

ediTorial commenT

TV celebrity doctors have been doing very nicely, thank you, in front of the cameras for many years now and it is rewarding work if you have what it takes.

But now more and more private doctors are at last waking up to the fact they can enhance their business by starring in their own movie for patients on private hospital and personal practice websites.

Video gives a fresh perspective, as we report in our feature starting on page 26. It allows short presentations of important information and lets the patient hear and see the doctor they are considering.

It also allows explanation and demonstration of complex procedures in an easily understandable way for consumption on computer, tablet or smartphone.

We also publish some useful tips to bear in mind for any Independent Practitioner Today reader appearing in front of the camera. In fact, many of these are handy to remind yourself of in each patient encounter.

They will help you present yourself in the best possible light and, even though you might not be recording or filming, these days it pays to be aware your patient might be!

Tell us your news Editorial director Robin Stride at robin@ip-today.co.uk

Phone: 07909 997340 @robinstride

To adverTise Contact advertising manager Margaret Floate at margifloate@btinternet.com Phone: 01483 824094

To subscribe lisa@marketingcentre.co.uk Phone 01752 312140

Publisher: Gillian Nineham at gill@ip-today.co.uk Phone: 07767 353897

Head of design: Jonathan Anstee chief sub-editor: Vincent Dawe 12,000 circulation figures verified by the Audit Bureau of Circulations

by a staff reporter

New industry billing guidelines aim to help independent practitioners get their invoices right first time and avoid unnecessary payment delays.

The free guide has been produced by Healthcode, the official medical bill clearing company for private healthcare in the UK.

It is endorsed by all the main private medical insurers including Aviva, AXA PPP healthcare, Bupa, PruHealth and Simplyhealth.

The industry’s guide to private medical billing is expected to be an invaluable tool for practices who want to make their billing process as professional and efficient as possible.

It sets out the information that should be included on invoices to self-pay patients and private medical insurance companies so that the payer has sufficient information about what they have been charged and why.

Healthcode said this would help practitioners meet their ethical duty to be open in their financial and commercial dealings. And it would also ensure patients had a positive experience following an episode of care.

In addition, the growing number of providers that have made the transition to electronic billing can generate invoices which satisfy the insurers’ criteria, so they are paid as soon as possible, maximising their cash flow.

Healthcode managing director Peter Connor said: ‘The number of electronic invoices from healthcare providers that Healthcode clears has increased by 25% year on year in the last two years, proving that this is fast-becoming universal practice in the sector.

‘When done properly, electronic billing is undoubtedly

more efficient for practices. But mistakes cost precious time to resolve and have a knock-on effect on the practice business, so we have worked with insurers to find a simple solution.’

Starting from the basics such as provider recognition and payment instructions, to more detailed information about the patient and the treatment provided, practitioners and their administrative staff now have access to an annotated step-bystep guide to completing an invoice.

They can also download the two invoice templates, one for billing organisations and the other for self-pay patients, for use in their practice.

Alex Perry, director of health and benefits management, Bupa, said: ‘Electronic billing is quicker, better for the environment, safe and secure.

‘As one of the UK’s trusted providers of secure online billing to the private healthcare market, Healthcode has used its expertise to develop a guide that will help providers ensure they supply all the information we need to process their bills smoothly and that they are paid quickly.’

See the guide at: www.healthcode.co.uk/billing-guide

Criticism is forcing increasing numbers of doctors to wish they could turn back the clock and have aspects of their past wiped from websites.

Now a European Court ruling heralds some good news for them, as it means they could get some search results removed.

The Court of Justice of the EU found that search engine operators are data controllers and individuals have the right to ask them to remove certain search results on privacy grounds. These include results that appear to be inaccurate, inadequate, irrelevant or excessive.

According to Dr Caroline Fryar, MDU head of advisory services, doctors are increasingly seeking advice about how to deal with critical online coverage.

She said: ‘They may have found to their distress that an online search of their name brings up an unfavourable or unflattering story such as a news report about a patient complaint or a past GMC investigation, which may have happened many years ago.

‘The recent European Court ruling is good news for doctors, as it means they can apply to Google and other search engine operators to request the removal of certain results on privacy grounds.’

But Dr Fryar urged caution, because she said it remains to be seen if requests to remove results will be successful, given that decisions will be taken on a case by case basis, balancing the public interest with the right to privacy.

She said: ‘It is also important to remember that the actual web pages and documents will not be removed from the internet, only the opportunity to access them via a search engine link.’

Users may still be able to navigate to the page by using a different search term or the same search term entered into a search engine outside the EU, she warned.

by robin stride

Specialist medical accountants are continuing talks with the taxman aimed at preserving independent practitioners’ right to incorporate their businesses.

Nearly 30 accountancy firms are now backing plans to form a special interest group to represent consultants’ and private GPs’ financial interests in talks with HM Revenue and Customs (HMRC).

The group, first unveiled in an Independent Practitioner Today front-page story three months ago, was set up informally after a wing of HMRC claimed independent practitioners were reaping unfair tax advantages by incorporating their businesses and, additionally, selling goodwill.

Accountancy firms then agreed to set up a new working party to strengthen their negotiating arm

with HMRC on tax matters affecting independent practitioners and to agree accounting standards for consultants.

A draft constitution is now being circulated and the HMRC is reportedly keen to have a forum through which it can talk to the profession’s representatives.

But at a meeting with consultants’ accountants over the summer it emerged that all professions who use companies as a trading vehicle are being scrutinised.

Specialist medical accountant Ray Stanbridge said: ‘Basically, the Revenue said they don’t believe any profession can trade as a company – that includes doctors, accountants, solicitors and vets.

‘But we said there are something like six million companies run by professionals in the UK and they employ 14m people.

‘If they’d had to build these

firms up and pay 50% tax instead of 20%, then they wouldn’t have had the money to do it. There are a whole lot of other reasons why people go into companies too.’

He said accountants at the meeting ‘were incredulous’ at what they heard from the tax officials, who are operating the Government’s new anti-avoidance policy.

Mr Stanbridge said successive governments had encouraged people to go into companies because they wanted to encourage businesses.

It is believed some smaller accountancy firms, who have limited experience of selling the goodwill in consultants’ practices, could be singled out for scrutiny. Could you be affected? Don’t miss Independent Practitioner Today’s special feature in next month’s edition

The Harley street clinic’s new chief executive, aida yousefi (left), has paid tribute to the people who have had a groundbreaking influence on making the hospital a private flagship. Formerly chief operating officer at the clinic, she called it ‘a huge privilege to be taking over one of the country’s leading private tertiary hospitals’.

ms yousefi said: ‘we have an outstanding team of some of the country’s most senior specialists, nurses and technical staff and a history of ground-breaking medicine both for adult patients and for children.

‘no other private hospital can match this record of bringing new treatments to the uK, particularly in the area of paediatric cardiac medicine.’

she was acting chief executive and succeeds neil buckley after his appointment as chief executive of The wellington Hospital, london.

ms yousefi added: ‘our specialist medical teams are supported with technology that is the most extensive in the uK and the demand for our services continues to grow. i cannot imagine a more exciting period to take over the reins of such an outstanding world-class institution.’

she was for some years the director of the Hca cancer network, the largest provider of cancer care outside the nHs

By a staff reporter

Medics are overwhelmingly backing calls for training in the cosmetic surgery sector to be the responsibility of existing professional associations.

New educational standards for procedures are expected this month from Health Education England following a Government review which concluded that practitioners performing aesthetic treatments must undergo ‘appropriate’ training.

But 500 surgeons, doctors and nurses surveyed by The Clinical Cosmetic and Reconstructive Expo, running from 10-11 October at London’s Olympia, strongly agreed that their professional bodies must be in charge of delivering training for procedures.

The associations would include

the British Association of Aesthetic Plastic Surgeons (BAAPS), the British Association of Plastic, Reconstructive and Aesthetic Surgeons (BAPRAS), the British Association of Cosmetic Nurses (BACN) and the British College of Aesthetic Medicine (BCAM).

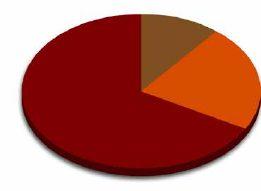

Under 3% of those surveyed felt it was the Gov ernment’s remit and less than 4% felt it should be private hospitals and clinics. One in five suggested a combination of the private sector and NHS could be successful.

As well as medics, OnePoll also surveyed 2,000 women on their views about minimum qualifications for aesthetic practitioners.

The views they expressed on different subjects are:

❐ Injections: Although one-day and weekend courses are the most prevalent educational programmes

Medical insurer AXA PPP claims it has to overhaul its fee schedule and introduce contracts with specialists in order to stop high costs depressing the market.

It wants to see 30% of its members using fast-track by the end of 2015, then later more than half, although it would not be drawn on a percentage.

The insurer added: ‘Fee-approved specialists who enter into a contract with us are required to charge fees in accordance with the fees they have agreed to, as part of their contract.’ These fees were higher than those in the revised schedule.

Commercial director Fergus Craig said private medical insurance demand had declined for a sustained period and premium affordability

look out for Independent Practitioner today’s stand at CCR expo.

Olympia will showcase more than 120 international exhibitors: from cutting-edge surgical equipment and supplies through to non-invasive products, business services, training and consultancy. It offers up to 14 days of content for continuing professional development, including workshops, conferences and live demonstration theatres. www.ccr-expo.com

for facial injectable treatments like dermal fillers and Botox, almost universally they were panned as inadequate by public and profession.

Twenty-nine per cent of the medical community felt a minimum three-month specialist course should be required and the public (27%) felt at least six months was needed.

❐ Lasers and non-surgical lipo: Three months was also overwhelmingly felt by the profession to be enough to train to be able to provide laser procedures such as for acne, skin rejuvenation and hair removal.

But opinion was split among clin icians on non-surgical lipo, such as radiofrequency or fat-freezing. Thirty-one per cent deemed a weekend to be plenty, but 29% said three-months minimum.

❐ Surgery: 74% of UK women said a procedure-specific credential – nose jobs, eyelid surgery or facelifts – would increase their level of confidence in undergoing surgery by plastic surgeons. Over a third of the profession agreed this would stop ‘jacks-of-all-trades’. Forty-eight per cent of the profession felt newly-qualified plastic surgery consultants were not competent enough to perform cosmetic surgery procedures. Fewer than 7% felt NHS training alone was sufficient.

Consultant plastic surgeon Mr Norman Waterhouse, CCR Expo’s medical advisory board chairman and a former BAAPS president, said: ‘It is essential that practitioners restrict themselves to procedures with which they are trained and familiar and, as the survey shows, patients expect no less.’

was a ‘challenge’ for individual customers and employers.

‘Alongside this challenge, the Competition and Markets Authority has called both for an improvement in the information available to patients on the clinical care they receive and for greater certainty to private patients that their healthcare costs will be met in full by their insurer.

‘In this environment, we must secure the best possible value for our members to protect their interests, now and in the future, and to ensure that the private medical insurance market is maintained for the benefit of insurers and providers of healthcare services alike.’

AXA PPP said it was continuously working with hospitals to secure cost-effective, quality care.

Advertising watchdogs have ruled an advert claiming a clinic was ‘setting the gold standard’ should not appear again.

The advert from Aesthetic and Cosmetic Surgery Ltd, trading as The Harley Medical Group, appeared on a website, a banner ad on YouTube and in a magazine.

But the PIP Action Campaign challenged if the claim was misleading and could be substantiated and the Advertising Standards Authority (ASA) upheld the complaint.

ASA said Aesthetic and Cosmetic Surgery Ltd submitted it was confident it had provided the best quality of care to patients

throughout its trading history and always had skilled surgeons, expertise and patient care.

But it ruled it considered that, without qualification, consumers would understand the claim ‘setting the gold standard’ as an objective claim that Aesthetic and Cosmetic Surgery Ltd had been achieving the highest attainable standard as agreed by independent measures on areas such as patient care and surgical expertise.

‘Because objective evidence was not supplied to demonstrate that Aesthetic and Cosmetic Surgery Ltd had been “setting the gold standard”, we concluded that the ads were misleading.’

By Robin Stride

Four in ten business leaders claim the main barrier to offering their staff private healthcare is the expense.

But 28% would be more likely to pay for it if it was cheaper and 17% would do so if they believed it was better value, according to a survey.

Over half (55%) of the 1,081 decision-makers surveyed told the YouGov online research for Bupa that the sector lacked transparency, such as on quality.

The findings follow a call by the Competition and Markets Authority for more information on the

A new online resource to support doctors in their day-to-day care of older patients has been issued by the GMC.

The council said it had worked closely with partner organisations, including the British Geriatrics Society and Age UK, to create Better care for older people

The resource gives practical advice, including from leading clinicians, and shows how to use GMC guidance to handle patients’ clinical, emotional and psychological needs.

At the core of the resource is a

quality and value provided by the private healthcare sector.

Bupa Health Funding managing director Dr Damien Marmion said the research showed a strong appetite for private healthcare from employers – who pay for 75% of people covered by private medical insurance (PMI) – and employees.

But despite the UK’s economy starting to recover, there was no sign of growth in private healthcare. He believed the sector could grow but only if everyone focused on what the customer wants. For many would-be customers, this came down to cost.

The Bupa boss urged everyone

series of videos featuring interviews with older patients who talk of their experiences of dealing with doctors.

The resource also contains a mixture of guidance, case studies, scenarios, articles and tips to prepare doctors for caring for the growing number of older patients.

Over-65s make up over twothirds of NHS patients in the UK and there are now more people living with multiple, long-term conditions than ever.

GMC chief executive Niall Dickson said: ‘We hope these learning materials will stimulate discussion and help to support doctors working with older people.

‘The reality is that most medical care is already centred around later life and, in the future, this is going to be even more the case.’

Better care for older people will be regularly updated. Go to www. gmc-uk.org/oldercare.

to play their part to demonstrate to more customers that the private healthcare sector offered good value and quality healthcare.

Dr Marmion said: ‘Doctors in private practice and other clinicians have a key role in driving quality and value.

‘Many medical innovations and procedures can be cost-reducing or cost-neutral, and I urge clinicians to take a lead on finding creative ways to promote efficient medical practice that maintains excellence and reasonable clinical freedom.’

He called for private healthcare to be made ‘a beacon of excellence and value’, arguing that this

would see many more doctors enjoying a thriving private practice and more patients feeling the private healthcare’s benefits.

Dr Marmion said the cost barrier was why Bupa was pushing for the publication of outcomes from hospitals and consultants while seeking price cuts of up to 15% or more from some major hospital providers.

Costs were also a prime issue for potential younger PMI customers, he added: ‘Some 50% told us that the main barrier to having private healthcare was cost. And over a third (37%) would be more likely to have private healthcare if it was more affordable.’

Energetic doctors, nurses and staff are having little rest after helping London’s Wellington Hospital hit its £1m appeal target – because now they are doing it all again.

Money raised from the first appeal went to the Junior Diabetes Research Fund (JDRF) and The British Red Cross appeal for AIDSaffected children in South Africa.

Now both charities could see The Wellington’s contributions doubled after chief Mr Neil Buckley (right) announced the new target.

events led by the hospital’s then chief executive Keith Hague. These included cycling marathons in the UK and on the Continent, climbing Britain’s highest peaks, abseiling down multi-storey buildings, and a sponsored drive around the coast of Great Britain in a classic VW campervan.

For the first million, doctors, nurses, staff and others from around the HCA group, which owns the hospital, held sponsored

At a House of Lords reception to celebrate the unique fund-raising achievement, Lord True congratulated the fundraising team and said he found their ‘amazing success’ was inspiring.

Mr Hague thanked all the supporters and fundraisers and his successor.

Any independent practitioner receiving an Accelerated Payment of Tax notice is being advised to act fast.

Individuals and companies will be expected to pay tax up-front if HM Revenue and Customs believes they have invested

money in a disputed scheme. They will normally have just 90 days to pay.

Previously, the legal challenge process could mean many years of not paying tax before the courts decided the tax was due, freeing up that cash in the meantime for tax-

payers to make other investments.

International tax adviser Simon Concannon, of Leeds-based law firm Walker Morris, said: ‘If a challenge or appeal is eventually successful, the money will be returned, but the process and timings have been turned on their

head. You pay out at the start of the legal challenge – which takes away some of the incentives for these schemes.’

He warned anyone receiving a notice to act on it and if they thought a mistake had been made, then to quickly appeal.

By Robin Stride

Consultants at London’s independent mental health hospital Capio Nightingale are being promised more investment in services and new opportunities following a takeover.

French company Groupe Sinoué, a private mental health care specialist, bought the hospital in July.

Florence Nightingale Hospitals Ltd managing director Martin Thomas told Independent Practitioner Today it was ‘business as usual’ at the hospital and the sale would make no difference to its day-to-day running.

He added: ‘The sale brings investment into the services currently offered at the hospital and will support the progression of consultants already working within Nightingale Hospital.

‘We will be urging the consultants to collaborate with their new colleagues over in France to draw on the shared expertise and knowledge, networks and research.’

Mr Thomas said the hospital was continually creating opportunities for new consultants to join the team and those who thought they could bring innovation and skill to the Nightingale should contact him or medical director Dr William Shanahan.

Capio Nightingale Hospital said it was an attractive proposition for Groupe Sinoué; the hospital has achieved over 20% sales

growth in the past four years and will account for a quarter of the Groupe Sinoué turnover.

The acquisition is the first UK venture for the group, founded in 1989 by consultant psychiatrist Dr Philippe Clery-Melin, who is now the president of the company that has eight hospitals in France, delivering the full spectrum of psychiatric care.

Groupe Sinoué has expressed support for the continuing development of Capio Nightingale’s portfolio of treatment centres and programmes, in addition to its core services of general and adolescent psychiatry, eating disorders and addictions. As a result of the sale, the hospital will rebrand over six months as Nightingale Hospital.

Dr Clery-Melin called the acquisition ‘a fantastic opportunity’, as Capio Nightingale Hospital, with its many leading consultants, was an ideal complement to his group’s existing clinics.

‘It also represents a great opportunity for our consultants and professionals to co-operate with

the capio nightingale is being rebranded as nightingale hospital

Specialist financial planners are advising senior doctors to take action to prevent their savings being eroded by inflation.

Despite the media fanfare surrounding the launch of New Individual Savings Accounts (NISAs) in July, the current interest rates make this cash savings option appear less attractive, warned Cavendish Medical.

Nightingale’s expert team over new care programmes and clinical innovation.’

The group said the sale ensured the Nightingale Hospital’s stability and ensured it continued to offer high-quality private services without the need to open out to patients on the NHS.

the Sinoué group is a healthcare company specialising in the field of psychiatry and mental health. it is based ‘on a philosophy of high-quality medical care, which aims to deliver innovation in its healthcare services’.

the group cares for patients from across europe and was founded by psychiatrists, led by dr philippe clery-Melin, its president of 12 years. it is still majority family-owned. it has developed its medical and managerial expertise to bring forward new offerings in health and the field of psychiatry.

The Healthcare Management Trust, owners and operators of Swansea’s Sancta Maria Hospital, plan to move it to a purpose-built

site outside the city. They believe moving to new purpose-built facilities will ensure the hospital continues to provide a full range of medical services and expects the venture to create new jobs.

Chief executive Tony Barrett said: ‘This ambitious develop -

ment will ensure that patients across Swansea and west Wales continue to benefit from access to leading clinical services within a facility designed to offer the very best patient experience.’

See ‘Varsity link gives unit access to best scans’, page 8

The company said senior doctors will find it very difficult to find accounts, even tax-exempt, that exceed the rate of inflation.

Currently, the best variable cash ISA interest rate is around 1.5%. But the consumer prices index (CPI) rate of inflation rests at 1.6% (down from 1.9% in June) meaning the savings of all doctors are still shrinking in real terms. At the moment, banks do not need to rely on savers’ deposits to fund their lending and are obtaining cheaper funds from other sources. So they are happy to make their accounts less appealing to customers.

Cavendish Medical’s managing director Simon Bruce told Independent Practitioner Today: ‘The rate cuts do not just affect the new ISAs opened last month. Doctors should make a concerted effort to check all historical bank accounts.

‘What interest rate are you getting and is it time to switch? There are better rates around but these may involve fixed deals for a minimum of one year.’

Bank of England governor Mark Carney recently implied a base rate rise would come towards the end of the year.

Although he has predicted a return to the days when 3% is the norm, the first rate rises – whenever they appear – may not be big.

Mr Bruce said: ‘Everyone needs a rainy day fund, but managing larger cash balances on deposit to stay within the protected limits can become problematic. Doctors need to check if these funds could be working harder for them elsewhere.’

By charles king

Consultants and private hospitals are hoping to benefit from a £250m NHS cash injection aimed at clearing the NHS backlog for knee, hip and cataract operations.

Some observers believe that independent practitioners could also benefit from self-payers because to achieve the target will mean a temporary rise in patients waiting over 18 weeks.

The Association of Independent Healthcare Organisations (AIHO) said it has been working with NHS England and Monitor on the independent sector’s ability to deliver capacity for NHS services.

AIHO chief executive Fiona Booth told Independent Practitioner

Today : ‘The independent sector provides vital capacity for NHS services by undertaking diagnostic and treatment activity to NHS patients at a price set by the NHS.

‘We note the Secretary of State’s focus on waiting times, and the independent sector is well placed to help reduce the amount of time that patients have to wait for treatment.

‘The sector will continue to coordinate with the NHS, playing a vital role in reducing waiting lists and providing excellent care.’

A quarter of NHS trust finance directors expect to overspend their budgets this year, according to the latest quarterly monitoring report from The King’s Fund, as a result of growing financial pres -

sures and rising demand for services.

Over three million people had been waiting at least 18 weeks for hospital treatment at the end of the last quarter, the highest number since 2008.

The number of patients waiting more than six weeks for diagnostic tests stood at more than 18,600 at the end of May 2014, nearly 12,000 up on the same month last year.

The fund’s chief economist John Appleby said: ‘Our latest quarterly report paints a picture of a service under huge pressure, with cracks beginning to appear in NHS performance. It once again underlines the need for new funding if services are to be maintained.’

The new executive director of the 52-bed BMI The Runnymede Hospital in Chertsey, Surrey, is Leon Newth. He was previously commercial finance manager at the hospital from 2007-09.

For the last two years, he has been executive director for BMI Syon Clinic, Brentford, and BMI Coombe Wing, Kingston.

Mr Newth (pictured) said he was determined to continue the good work already in place to improve the hospital’s services and to help grow its relationships with local NHS providers and commissioners.

Mechanical engineers are warning of a threat to both the UK’s excellent academic research in the field of biomedical engineering and the resulting inventions of medical devices.

Too often the results of research are sold to international corporations for development and marketing because of the lack of long-term domestic venture capital, they say in a report.

According to the Institution of Mechanical Engineers, the development of many technologies – in particular m-health and e-health

– are also being hampered by a lack of international consensus on standards, practices and patents.

The body is calling for biomedical engineers to be given a bigger influence in the NHS to help cut the number of incidents caused by faulty medical equipment.

The institution said: ‘In 2013, 13,642 incidents related to faulty medical equipment were reported to the Medicines and Healthcare products Regulatory Agency (MHRA); leading to 309 deaths and 4,955 people sustaining serious injury.

‘These incidents can vary from faulty pacemakers to faulty equipment like CT or MRI scanners used to diagnose patients. This faulty equipment, or the unavailability of equipment, is also one of the major causes of cancelled operations.

‘As the technology used in hospitals becomes increasingly complex, the danger of improperly calibrated and validated equipment is also increasing.’

Dr Patrick Finlay, chairman of the Institution of Mechanical Engineers’ Biomedical Engineer ing

Association, said: ‘Technology is leading to huge advances in healthcare, but this technology is dependent on the work of biomedical engineers who are inadequately recognised and in short supply in most hospitals.

‘Clinicians and engineers need to work in partnership to ensure that advances in medical technology are applied in the best interest of patients.

‘The benefits of hospitals having a designated chief biomedical engineer responsible for healthcare technology are clear.’

Vasectomy inquiries in the UK have risen 164% in the past 12 months, according to research from private healthcare search engine, WhatClinic.com.

Vasectomy reversals are also on the rise, with searches almost doubling in the past 12 months.

Surgeons surveyed said the most

common age of men opting for a vasectomy is 41-45, although one in three are under 35. The youngest request for a vasectomy came from an 18-year-old and the oldest was well into his seventies.

For reversals, the youngest patient treated by the surgeons polled was 21 and the oldest 66.

Nearly all (98%) of the surgeons asked cited the most common reason for vasectomy reversals as patients wanting to start a family with a new partner, following a divorce or separation.

Waiting lists in the NHS can be several months, which is why some men go private. Private

vasectomies cost an average of £515, while reversals cost £2,582 – and are not available on the NHS.

WhatClinic.com is advising patients to do their research, ensure they find a clinic they are comfortable with and always read patient reviews.

By a staff reporter

Doctors’ defence body subscriptions are facing further pressure following a shock 20% rise in claims.

The Medical Defence Union (MDU) revealed that reforms aimed at reducing high claimant’s legal costs had lead to the surge.

In its Annual Report for 2013, it noted that legal changes affecting the amounts claimants’ solicitors could expect to be paid were introduced in April last year.

But as lawyers realised they were going to have to reduce their fees in future, they ‘rushed to take on claimants under the old arrangements which led to a surge in cases’.

MDU chief executive Dr Christine Tomkins said last year was its busiest in its 128-year history as staff answered more than 33,000 calls from members and opened a record number of new claims files.

A major factor in the increasing demand for its services was the rise in the number of new claims against members.

She said: ‘We fully support the legal costs reforms that came in to effect in April 2013, but in the

short term, we have seen claimant’s solicitors rushing to notify claims under the old arrangements, prolonging the disproportionately high costs the legal changes are intended to address.

‘Clearly, it is important that patients have access to justice if they believe they have been negligently harmed, but the system must be fair.

‘We are hopeful that, in the longer term, the changes will see a reduction in the large sums paid to claimants’ lawyers. There is some evidence that this is starting to happen with the numbers of claims being notified against our dental members slowing slightly towards the end of 2013. We hope this trend will continue and spread to medical claims.’

Dr Tomkins said compensation payments were also ‘spiralling’.

She said the MDU was working at Gover nment level to effect changes to control claims inflation so damages payments were affordable, sustainable and fair for all parties.

The MDU said it successfully defended 70% of medical claims where the doctor was accused of negligence and faced a compensation demand.

CUT OF THEIR JIB: Spire Liverpool Hospital orthopaedic surgeons (from left) Mr John Davidson and Mr Peter Brownson with crew enjoyed a day off work taking part in the JP Morgan Round the Island Race, circumnavigating the Isle of Wight. Light winds led to their early retirement, but at least they enjoyed close-up views while being passed by the Queen Mary II

Nuffield Health has bought nine Virgin Active Health Clubs – with five of the gyms being within 4.5 miles of a Nuffield Health Hospital.

The purchased clubs are in Birmingham Broadway Plaza, Gloucester Barnwood, Guildford, Ilford, Milton Keynes, Manchester Printworks, Taunton, Tunbridge Wells and Wolverhampton.

Dr Andrew Jones, managing director of the firm’s Wellbeing wing, said the acquisitions were an important step towards achieving the aim of a national network of fitness and wellbeing facilities.

‘The locations of the gyms allow us to either reach parts of the country that we do not have a presence in or to complement our

current offering in the area, whether that be a hospital or corporate wellbeing facility.

‘This will enable us to deliver healthcare across the UK and, by combining services and experts at our co-located facilities, support more local people with an integrated health and wellbeing proposition.’

The firm said it would introduce new services, including a free health MOT for every member and access to health mentors, physiotherapists and nutritionists.

Its 60-minute check measures waist-to-hip ratio, blood pressure and glucose, aerobic fitness, total cholesterol, sleep, stress, alcohol consumption and smoking habits and assesses fitness progress.

Sancta Maria Hospital, Swansea, has partnered with the Institute of Life Science (ILS) at the city’s university to offer its patients CT and MRI scanning facilities.

The partnership will see patients of the Glamorgan hospital having access to ILS’s on-site MRI and CT scanning equipment, including the 3-tesla MRI scanner, which offers two to three times the signal of ordinary scanners.

The ILS is the research and innovation arm of Swansea University’s College of Medicine.

Consultant spinal surgeon Mr Navin Verghese said the new partnership now allowed him to rapidly refer patients to undergo investigation ‘on our doorstep’, using the most sophisticated scanner in Wales.

He said: ‘I have a number of new patients presenting to my clinic

who have been suffering with long-term symptoms related to neck or back issues. Not uncommonly, their past scans had not shown any significant abnormality, but with the use of the innovative ILS scanner, we can now locate even the smallest abnormalities within the spine, which could be causative to the patients’ pain.

‘From a consultant’s point of view, this will now allow me to

deliver an optimal treatment plan focused on the patient’s symptoms and the abnormalities identified with the 3-tesla scan.

‘This could include more targeted physiotherapy and conservative measures, but occasionally could mean the difference between a patient being discharged or being admitted for potentially life-changing spinal injections or surgery.’

By Edie Bourne

Doctors have been urged by a defence body to stop prescribing drugs for family or friends overseas.

According to the MDDUS, it has dealt with a growing number of cases where doctors have faced GMC sanctions for prescribing drugs to those close to them, with some incidents involving medication issued to relatives living abroad.

But it warned that this practice brought added risks relating to laws on the import and export of medications as well as concerns over doctors’ access to the full medical history of patients outside the UK.

GMC fitness-to-practise proceedings have been raised against doctors for prescribing friends or family with drugs such as benzodiazepines and opiates as well as antibiotics and non-benzodiazepine hypnotics.

Medical adviser Dr Naeem

Guidance has been published to answer patients’ queries about travelling overseas for treatment.

The Patients’ Guide to Treatment Abroad is an editorial-based e-book, available as a free down load from www.treatmentabroad. com/medical-tourism/magazine.

Published by www.treatmentabroad.com, it is also available in print form and covers questions such as:

Will the NHS pay for your surgery abroad?

How much can you save by travelling overseas for treatment?

Is it safe to go abroad for treatment?

How do I choose a hospital or clinic?

Nazem said doctors should exercise caution in prescribing for friends or family, only doing so when absolutely necessary and based on clinical need rather than convenience.

‘It may be difficult to justify these actions with the ready availability of out-of-hours services, walk-in centres and A&E departments. The first issue to consider is the GMC’s guidance, which states doctors must, wherever possible, avoid prescribing for themselves or those with whom they have a close personal relationship.’

MDDUS said some doctors had sent drugs overseas to relatives or friends, which raised a number of important issues.

Dr Nazem said: ‘Treating family or friends abroad has additional complications. Doctors must consider the safe storage and transfer of prescribed medicines as well as the UK regulatory framework for the export of medicines and the import regulations of the recipient country.

The guide explores a number of the most common treatments that patients seek overseas, including eye surgery, infertility treatment, orthopaedic surgery, dental treatment and cosmetic surgery, highlighting some of the leading clinics in different countries for each type of treatment.

It also includes a check list for patients considering cosmetic surgery abroad, including questions to ask surgeons, plus things they should research before making a decision.

A spokesman said: ‘Our aim with this guide is for those patients thinking about going overseas, whether for medical treatment like hip replacement or fertility treatment or for a cosmetic procedure, to make an informed choice.

‘There are so many options for treatments, destinations and hospitals that it can be easy to be swayed by special offers or the “easy choice”.

‘Armed with this guide, patients can make the right decision for themselves and their bodies.’

‘In addition, doctors can encounter difficulties in prescribing for a patient they are unable to meet. In particular, doctors may not have access to the patient’s full medical history or their current medication.’

MDDUS has also handled cases involving doctors prescribing controlled drugs for family members. Dr Nazem said: ‘GMC guidance on prescribing controlled

drugs to family and friends is clear – yet we have dealt with cases where GPs have prescribed opiates, for example, for their wife or husband.’

‘We encourage doctors to play it safe and avoid diagnosing and treating themselves or loved ones with medicines. Otherwise, they may be called upon to justify why it was necessary for them to prescribe rather than the patient’s regular doctor.’

He added: ‘Doctors should recognise that self-prescribing drugs of dependence such as opiates or powerful painkillers is entirely unacceptable.

‘In some cases, pharmacists have refused to dispense the medication, but MDDUS has also encountered situations in which the pharmacist has dispensed the prescription and then reported the doctor to the GMC.’

GMC guidance Good practice in prescribing and managing medicines and devices can be found online at http://bit.ly/1nWOgar

Specialist eye hospital group Optegra has opened up its first specialist eye hospital in Asia, with the acquisition of New Vision Eye Clinic in Shanghai, China.

The purpose-built hospital has three surgical suites, 15 consulting rooms and 11 examination rooms.

Optegra, which aims to be ‘the world’s most trusted choice for eye care’, owns 24 hospitals, six in the UK. This launch is the first outside Europe.

Dr Michael Gu, managing director at New Vision Eye Clinic, said: ‘Because of our broad service offering and also payment options, our patients come from a wide variety of socio-economic groups and ages.

‘We see a large number of selfpaying patients, as well as privately insured patients and patients covered by government social insurance (Shanghai

HealthCare Insurance). Whereas in the UK there is a very clear divide between NHS and private hospitals, in Shanghai the mix is slightly different.’

John Behrendt, chief executive of Optegra’s owners Moonray Healthcare, said: ‘Shanghai has the largest population of any city in the world, estimated at around 24m people. That’s roughly the same as the total number of men in England (26m), and so it is a significant business opportunity for Optegra in a large and growing market.’

China’s private healthcare market is expanding rapidly, with central government encouraging private investment in healthcare to increase overall quality and choice of medical services and also to ease pressure on government hospitals.

Independent providers are preparing to meet the challenge of a paperless NHS. Sally Taber reports

Private hos P itals are being proactive in preparing for a healthcare system where digital technology will underpin the patient pathway across the two sectors.

a survey by the i ndependent healthcare advisory services’ it Council, a division of the association of independent healthcare o rganisations ( aiho ), recently shows some encouraging progress in small and large hospital groups.

i n January this year, h ealth secretary Jeremy hunt called for the Nhs to go paperless by 2018 and thereby realise savings of billions of pounds, improve services and meet the challenges of an ageing population.

We already do with most NHS commissioners

We could adapt our IT system readily, but would have to devote scarce resources to meet NHS requirements

We would probably stop accepting NHS commissions

s ubsequent announcements have focused on being more inclusive and engaging with a wider stakeholder group.

Dame Fiona Caldicott, the chairwoman of the now closed National i nformation Governance Board, had previously expressed her concerns about information governance in a paperless system

But however long the process takes to reach fruition, it is clear that the independent sector must prepare itself to interact with an increasingly paperless Nhs the it Council, under the chairmanship of s pire h ealthcare’s Martin r ennison, recently conducted a ‘state of readiness’ survey of its members in england.

it was pleased to note that the vast majority of aiho members already have:

a fully thoughtthrough plan for improving clinical recordkeeping and patient communication, or;

a re investigating changes as part of a wider improvement plan.

Given the mantra of ‘the patient at the centre’, ensuring a smooth digital transition from the Nhs to the independent sector and back again is critical.

eighty per cent of aiho members have reported that they already ‘mostly’ received patient referrals from clinicians in a digital form.

the three specific digital challenges for independent providers treating Nhs patients are:

1 Digitally assimilating N hs referrals into their own records;

2 Maintaining records of an episode that conforms to N hs standards and can be accepted into N hs individual patient records;

3 Being digitally aware of the patient’s complete treatment pathway and having the treatment provided by the independent provider identifiable.

l ooking towards interacting with an entirely paperless Nhs, 88% of aiho members responded either that they already do so with most Nhs commissioners or that could adapt their it systems fairly readily.

h owever, respondents highlighted the financial investment required to adapt their it systems.

i n terms of relationships between the independent sector and Nhs commissioners, it was disappointing to note that only 33% of aiho members would recommend their communication model with Nhs commissioners as a model to follow.

t his is obviously an area that requires both sectors to work together for the good of patients. overall, the survey was a useful exercise to check progress along the path of moving towards a paperless healthcare system. the outlook is overwhelmingly positive although there are challenges to overcome in the next few years, which the ihas it Council will regularly monitor.

Sally Taber (right) is director of Independent Healthcare Advisory Services

There’s a 1-in-4 chance of someone developing shingles during their lifetime.1 The risk increases with age, as does the likelihood of complications. 2

Year 2 of the national shingles immunisation programme started on 1st September 2014* for eligible patients. For full programme details and support items visit www.shinglesaware.co.uk

Help prevent shingles disrupting peoples’ lives

*Programme details may vary for each country. Please refer to local guidelines.

ABRIDGED PRESCRIBING INFORMATION

ZOSTAVAX® powder and solvent for suspension for injection in a pre-fi lled syringe [shingles (herpes zoster)vaccine (live)] Refer to Summary of Product Characteristics for full product information.

Presentation: Vial containing a lyophilised preparation of live attenuated varicella-zoster virus (Oka/Merck strain) and a prefi lled syringe containing water for injections. After reconstitution, one dose contains no less than 19400 PFU (Plaque-forming units) varicella-zoster virus (Oka/Merck strain). Indications: Active immunisation for the prevention of herpes zoster (“zoster” or shingles) and herpes zoster-related post-herpetic neuralgia (PHN) in individuals 50 years of age or older. Dosage and administration: Individuals should receive a single dose (0.65 ml) administered subcutaneously, preferably in the deltoid region. Do not inject intravascularly. It is recommended that the vaccine be administered immediately after reconstitution, to minimize loss of potency. Discard reconstituted vaccine if it is not used within 30 minutes. Contraindications: Hypersensitivity to the vaccine or any of its components (including neomycin). Individuals receiving immunosuppressive therapy (including

high-dose corticosteroids) or who have a primary or acquired immunodefi ciency. Individuals with active untreated tuberculosis. Pregnancy. Warnings and precautions: Appropriate facilities and medication should be available in the rare event of anaphylaxis. Zostavax ® is not indicated for the treatment of Zoster or PHN. Deferral of vaccination should be considered in the presence of fever. In clinical trials with Zostavax ®, transmission of the vaccine virus has not been reported. However, post-marketing experience with varicella vaccines suggest that transmission of vaccine virus may occur rarely between vaccinees who develop a varicella-like rash and susceptible contacts (for example, VZV-susceptible infant grandchildren). Transmission of vaccine virus from varicella vaccine recipients who do not develop a varicella-like rash has also been reported. This is a theoretical risk for vaccination with Zostavax ®. The risk of transmitting the attenuated vaccine virus from a vaccinee to a susceptible contact should be weighed against the risk of developing natural zoster and potentially transmitting wild-type VZV to a susceptible contact. As with any vaccine, vaccination with Zostavax ® may not result in protection in all vaccine recipients. Zostavax ® and 23-valent pneumococcal polysaccharide vaccine should not be

given concomitantly because concomitant use in a clinical trial resulted in reduced immunogenicity of Zostavax ® Pregnancy and lactation: Zostavax ® is not intended to be administered to pregnant women. Pregnancy should be avoided for one month following vaccination. Caution should be exercised if Zostavax ® is administered to a breast-feeding woman. Undesirable effects: Very common side effects: Pain/tenderness, erythema, swelling and pruritus at the injection site. Common side effects: Warmth, haematoma and induration at the injection site, pain in extremity, and headache. Other reported side effects that may potentially be serious include hypersensitivity reactions including anaphylactic reactions, arthralgia, myalgia, lymphadenopathy, rash and at the injection site, urticaria, pyrexia and rash. For a complete list of undesirable effects please refer to the Summary of Product Characteristics. Package quantities and basic cost: Vial and pre-fi lled syringe with two separate needles. The cost of this vaccine is £99.96. Supplier: Sanofi Pasteur MSD Ltd., Mallards Reach, Bridge Avenue, Maidenhead, Berkshire, SL6 1QP Marketing authorisation number: EU/1/06/341/011

Legal category: POM ® Registered trademark Date of last review: 25 April 2014

References 1. Miller E, Marshall R, Vudien J. Epidemiology, outcome and control of varicella-zoster infection. Rev Med Microbiol. 1993;4: 222-230 2. Gauthier A, Breuer J, Carrington D et al. Epidemiology and cost of herpes zoster and post-herpetic neuralgia in the United Kingdom. Epidemiol Infect. 2008; 137(1): 38-47

Adverse events should be reported. Reporting forms and information can be found at www.mhra.gov.uk/yellowcard Adverse events should also be reported to Sanofi Pasteur MSD, telephone number 01628 785291.

Too many consultants procrastinate when it comes to tax returns, warns Susan Hutter (below). The late filing penalty of £100 may not appear particularly expensive, but the consequences of leaving it until the last minute can be far more costly

While the deadline for filing 2013-14 tax returns to h M Revenue and Customs is not until 31 January 2015, it will come around quick enough.

By 31 January 2015, you must have all funds ready for the payment of tax relating to any balance of tax due for 2013-14 and the first payment on account for 2014-15.

the sooner it can be worked out what that tax liability is, the more time there is to plan for the actual payment.

As a rule of thumb, if the total income has increased compared to the previous tax year – that is to say, 2012-13 – there is likely to be a balance of tax to pay for 2013-14. this is because the payments on account for 2013-14 were originally based on the income received in 2012-13.

Obviously, the reverse is true: if income has decreased compared to the previous year, then there is likely to be a refund of tax for 2013-14.

if you still haven’t sent your tax

return information to your accountants, then do so as soon as possible.

A tip to bear in mind for the future: most firms of accountants are fairly quiet in the summer months of June, July and August.

So if you sent your tax return information to them during this time, you are likely to get the tax return prepared quickly which will give you time to plan the cash flow.

Also, if you are in the fortunate position to have over-provided for tax, you will know that you can release funds.

For those consultants who trade as a limited company and pay themselves by dividend, there is another angle to consider.

Your accountant will not be able to ascertain the accurate dividend position until the limited company accounts are prepared. the deadline for filing dates for limited company accounts is nine months from the year-end.

If you still haven’t sent your tax return information to your accountants, then do so as soon as possible

i f the year-end is later in the year – for example, October – they may not be finalised in time for the tax return filing deadline of 31 January 2015.

i n these circumstances, it is important to be able to provide accurate information to your accountant about the drawings you have made since the limited company’s previous year-end so that your accountant can advise you on the best dividend/salary policy for 2014-15, as this will have an effect in your personal tax return.

For those who have divided the share capital between themselves

and their spouse, it is equally important that the spouse’s tax return is prepared on a timely basis as well.

i f you do reward yourself by dividends, the dividends will be divided in shareholding ratios. if this income pushes you into the higher-rate tax bracket, extra tax will be payable.

it is sensible to look at yourself and your spouse as one ‘unit’ as far as tax return preparation and tax payments are concerned. it is the ‘family income’ that is important for tax planning purposes. if you leave everything until the last minute, it is virtually impossible to carry out sensible personal pension planning, and tax planning if you trade via a limited company.

t herefore give yourself some breathing space!

Susan Hutter is a partner with Shelley Stock Hutter LLP. She provides specialist accounting, taxation and business advice to the medical and healthcare industry

World Class International Faculty already includes:

Dr Raj Acquilla, Dr Raina Zarb Adami, Dr John Ashworth, Mr Jonathan Britto, Dr Erri Cippini, Mr Alex D. Karidis, Dr Vishal Madan, Miss Joy Odili and Dr Raffaele Rauso

CCR Expo is a major scale, multidisciplinary meeting packed with CPD accredited content for doctors, surgeons, nurses, clinic owners and other health professionals with an interest in aesthetic medicine.

From scalpel to syringe, CCR Expo provides a professional platform for the exchange of ideas, the pursuit of best practice and the sharing of knowledge, insight and expertise.

Visit www.ccr-expo.com/ipt4 to discover more.

REAlising A bUsinEss idEA

We are new, independent & free of advertising, offering Consultants a forum and a collective voice. Our technology allows you to reach more GPs & private patients, & receive online referrals.

Over the years, breast implant manufacturers and plastic surgeons have made great forward strides to refine the way they measure the breast, ensuring accuracy and an individualised result.

As a consultant plastic and reconstructive surgeon, I see a lot of women requesting breast reduction surgery because they are experiencing health problems that they think are due to having large breasts, but are actually due to wearing ill-fitting bras.

I wondered how easily surgical measuring concepts could be carried over to the lingerie industry, reducing health problems, reducing the number of surgical interventions and saving the N h S money.

having realised that what initially needed to change was the way women were measured for bras, I contacted De Montford University and was invited to speak at the 2010 lingerie-sizing seminar staged by the Association of Suppliers to the British Cloth ing Industry (ASBCI) on the theme: ‘Building an Interface Between Surgery and the Lingerie Industry’.

I had the idea that a threedimensional measuring system would be far superior to the traditional system, which is based only on two measurements.

My vision was, and still is, that we can cut down on the number of breast reduction operations by using an innovative measuring system, based on three-dimensional (3D) measurements.

Just by chance, at the British Association for Aesthetic Plastic Surgeons’ meeting in 2011, I met Sue McDonald, who is an experienced bra-fitter, and her business partner Linda Birtwistle.

Unique company

t hey had developed a 3D patented measuring system called the Optimeasure, which was similar to what I had in mind. I joined forces with Sue and Linda, and together we formed the Optifit Bra Company Ltd, which we launched at the Body Conference at the royal Society of Medicine (rSM) in 2012.

We are, I believe, the only lingerie company to launch in this manner to the surgical community.

Sue, Linda and I agree that the worldwide age-old measuring system is ineffective and completely out of date. It results in ill-fitting bras that cause functional posture problems, particularly in women with a high body mass index (BMI). Because ill-fitting bras are causing posture problems, women are suffering from headaches, back pain, neck pain and even irritable bowel syndrome. the Optifit bra and Optimeasure are truly revolutionary products that actively eliminate posture problems and dispose of the myth that a bra can fit properly based on just two measurements– one from around the ribcage and one from around the fullest part of the breasts. t his is an archaic measuring system and antiquatedly based on how soldiers were measured for uniforms during World War I. We create our bras based on 3D measurements, which can be ➱ p16

Avoid unnecessary payment

• Endorsed by all main Private Medical Insurers • An invaluable tool for your billing process to be as professional and efficient as possible

taken by the customer in the comfort of her home, taking into consideration the woman’s frame, depth and volume.

the Optifit bra does not require an underwire and it sits low on the back, elevating the breast, thus promoting better posture and a slimmer profile.

this, as well as being more comfortable and aesthetically pleasing, has meant an alleviation or complete disappearance of symptoms for a lot of women.

the Optifit bra has been gratefully received, and has had a lot of coverage in the press as well as being shown on the BBC tv show Dragons’ Den . It requires nerve and a firm belief in your product to enter in front of these entrepreneurs and investors.

It was an incredibly positive experience, and I take pride in the fact that I am probably the only plastic surgeon to have appeared on this popular programme. Following the show, our sales and queries rose considerably and are still on the up now.

loyal customers

We have a loyal customer base and although most sales are on the internet, people come from all over the UK to our shop in Saddleworth, Manchester, for a personal fit. We even had one lady pop in on her way from Italy to the Lake District, proving that an international customer base isn’t outside the realms of possibility.

I feel it is important to carry out clinical trials on women to find out what works and doesn’t work for them. My studies include research on bariatric patients and, more recently, 3D imaging of the support provided by the Optifit bra versus the support provided by traditional bras. through 3D scanning, using Birmingham Dental hospital’s medical photography team, preliminary results of a trial comparing subjects with their conventionally fitted bra and the Optifit bra have conclusively shown that an Optifit bra provides better support than a traditional bra.

t he Optifit bra provides a higher surface area contact, thus support all over breast area. the histograms back up our theories and prove categorically that traditional bras, even in large cup

sizes, do not conform anatomically to women’s bodies.

they demonstrate that the lateral chest wall is compressed within a traditional bra even when appropriately fitted, particularly for those with a high BMI.

this does not happen with an Optifit bra, as it does not compartmentalise the breast, but gives appropriate support to the lower pole of the breast.

I have also conducted a study on bariatric patients, entitled ‘Should the Breast Fit the Bra or the Bra Fit the Breast?’, the results of which I released at the British Obesity and Metabolic Surgery Society annual meeting earlier this year.

the study showed that 100% of women in the study group were wearing ill-fitting bras, with twothirds experiencing functional health problems because of this.

t hese are simply astounding findings. Put simply, over a third of the patients who were suffering ill health due to breast size would change their minds about having surgery if they could find a supportive garment that would alleviate their symptoms.

During the study, I coined the phrase ‘bra slide’, which is when the inferior part of the bra that sits on the chest wall migrates due to the mismatch of cup diameter to breast base.

this would not happen using a three-dimensional measuring system and a product that took that into account. Some of the ladies’ health issues were being exacerbated due to ill-fitting bras, while others had health problems that were caused entirely by the garments.

these problems could be alleviated if these women were being measured correctly and provided with a bra that fits them properly.

We also presented the findings of an independent survey at the r SM that showed that, of those who purchased the bra for health reasons, 83% found it improved posture and 72% felt it improved their functional problems.

It is well known that, statistically, 80% of women wear the wrong size bra, and all overweight women in my studies were wearing bras that didn’t fit.

the majority of women I see in my clinic feel that breast reduction surgery is the only answer, but I have found through research and studies that it is not. From a business perspective, the problems I encounter are because people seem to think that having a bra that fits them properly does not matter. It DOeS matter. this is all about education and change. People do not realise the extent to which an ill-fitting bra can cause problems.

Manufacturers know that women will go from shop to shop buying numerous bras and if the bra does not feel comfortable or causes problems such as straps digging in, bra slide or discomfort, they will just go to another shop or find another brand and buy a different style, shape or size. What is out there in the shops for the female public is – quite literally – not fit for purpose. In fact, I question whether women actu-

ally exist whose measurements conform to many of the large bras currently available in the market. this makes me wonder why we haven’t incorporated a threedimensional measuring system before; women’s shapes are changing, yet they are still being measured using this faulty system.

For larger women in particular, a three-dimensional measuring system is the only way in which they will be able to get proper support from a bra.

Statistics show that this could save the NhS millions of pounds in breast reduction surgery operations, and it is now all resting on the ability to convince people to change and believe in the science. traditional bras generally are not based on science, yet doctors will send their patients to highstreet stores to purchase something that has been designed for

What is out there in the shops for the female public is – quite literally – not fit for purpose

aesthetic purposes. Yet when I speak about Optifit, the first thing people always ask about is the scientific evidence behind it. the applications of my research are vast – sports science, for example. A traditional bra simply does not give the level of support that an athlete requires, and proving through scientific evidence that a three-dimensional measuring system and revolutionary bra-style can offer this support will show the industry that there are other options out there.

this bra has been found to be helpful as a maternity bra and also post-surgery. In the future, we will undertake further studies with regards to posture. t he research will continue and the Optifit Bra Company will, hopefully, continue to grow.

Mr Atul Khanna (right) is a consultant plastic and reconstructive surgeon in Birmingham

● Single-use

● High quality

● Excellent service

● Delivers the clinical value you need

Patient safety in private hospitals has been in the news following a controversial report from an independent think tank. Independent Practitioner Today looks at the claims, the inferences, and how the sector has been responding

Private hos P itals have expressed severe disappointment over an independent think tank’s decision to come out with a report questioning patient safety in the independent sector.

a ccording to the boss of the association of independent healthcare o rganisations ( aiho ), the claims are ‘questionable’, while one hospital chief executive expressed dismay about t he Centre for health and the Public interest’s (ChPi) ‘negative conclusions’ of its report.

Nuffield health Group’s David Mobbs voiced disappointment at the report’s inference that, in the absence of information similar to the Nhs, there must be increased risk.

he said Nuffield would have been happy to share data with the ChPi to support the report, but was not asked. ‘indeed, we would welcome the opportunity for followup discussions with any organisation in order to move the information transparency agenda forward.’

aiho chief executive Fiona Booth said: ‘We’re disappointed that the ChPi has chosen to publish what appear to be questionable claims about the quality of healthcare offered in independent hospitals.

‘the reality is that these institu

tions offer very high levels of care to N hs , insured and self paying patients, a fact that has been and continues to be independently verified by the the Care Quality Commission (CQC).

‘ t he independent sector acknowledges that we need to publish more data, and we have been working with the Nhs to do so in a way that enables patients, clinicians, regulators and other interested parties to make direct and meaningful comparisons.

‘ t he sector has established an independent body, the Private healthcare information Network (PhiN), to go further than this to help patients make informed choices about their care.’

Reaction from the industry’s umbrella organisation

aiho, the private hospitals’ trade body, dealt with the report’s claims in turn:

1‘Patients undergoing operations in private hospitals may be put at risk from inadequate equipment, lack of intensive care beds, unsafe staffing arrangements, and poor medical record-keeping.’

aiho commented: ‘ t he CQC regulates both Nhs and independent hospitals, and conducts regular inspections of institutions in

We’re disappointed that the ChPI has chosen to publish what appear to be questionable claims about the quality of healthcare offered in independent hospitals

fiona Booth: head of the Association of Independent healthcare Organisations

Caring touch: The hCA group, which offers

both systems. if the CQC found any serious care failing in an independent hospital, it would apply the appropriate enforcement measures in the same way that it does for Nhs hospitals.

‘the CQC publishes an annual ‘ s tate of Care’ report, covering care delivered by Nhs and independent hospitals. t he most recent ‘state of Care’ report found that ‘independent services generally perform better than N hs locations in terms of safety and quality of care’.

‘ t he report also found that independent hospitals met:

safeguarding and safety standards in 92% of inspections;

Care and welfare standards in 98% of inspections;

respect and dignity standards in 99% of inspections;

staffing suitability standards in 93% of inspections.

‘ i ndependent sector hospitals do not claim to be perfect, and there is no room for complacency in these figures – but they do throw into doubt the position taken by the ChPi

‘We acknowledge that the sector needs to do more on information availability, which is why, in 2008, private hospitals established a data sharing and reporting project.

this subsequently became the Private h ealthcare i nformation Network (P hi N). t he sector has also been working with the Nhs to publish directly comparable data.’ (see overleaf in section 4 for details).

2‘Between October 2010 and April 2014, 802 patients died unexpectedly in private hospitals, and there were 921 serious injuries. Because of the limited reporting requirements for private hospitals, we are unable to state whether these deaths and injuries should be cause for concern.’

aiho commented: ‘ l ike N hs hospitals, independent hospitals are places visited by people who are either unwell or in need of medical treatment. some of those will have complex healthcare needs and some will have underlying medical conditions.

‘ t he report states that, unlike Nhs hospitals, private hospitals are not required to report such incidents to the National reporting and learning system (Nrls). i n fact, the independent sector has been working with the Nhs to enable it to report incidents in the same way that Nhs hospitals do and would like to move this pro

report co-author Prof Colin Leys, emeritus professor at Queen’s University, Ontario, Canada, and an honorary professor at Goldsmiths, University of London, said: ‘The public and regulators have access to more information than ever before about how nhs services are performing, but this report shows that the same cannot be said for private hospitals.

‘The Government has recognised the crucial role of transparency in making hospitals safer, but reporting requirements should apply wherever patients are treated. With the taxpayer now providing over a billion pounds a year to private hospitals, this is too important to be left to the industry to address.’

Co-author Prof Brian Toft, emeritus professor of patient safety at Coventry University, said: ‘The report highlights some sobering examples of what can happen to patients without the right staffing, equipment and facilities. When patients choose to have an operation in a private hospital, they may be unaware of the difference in terms of risk between a big nhs hospital with surgical teams and intensive care beds and a private hospital with neither. Consent forms should make clear to patients the inherent potential risks in the way these facilities are run.’

The report’s recommendations include:

Private providers should be subject to the same requirements as the nhs to report patient safety incidents and to report on their performance.

Consent forms given to patients in private hospitals should detail not only risks inherent in the procedure offered but also any that stem from the facilities, equipment or staffing of the hospital.

regulations governing provision of care in private hospitals should require an on-site registrar-level surgeon or doctor for every specialty for which nhs patients are treated, for an anaesthetist to be on call and for medical records to be kept on the ward.

The Department of health should carry out a review of the nature and cost of admissions to the nhs from private hospitals, and the nhs should have the power to recoup costs resulting from a failure by a private hospital.

Peter Walsh, chief executive of Action Against Medical Accidents, said: ‘In our experience, there is plenty that can and does go wrong in private healthcare and it is usually the nhs that ends up picking up the pieces.

‘This report confirms it is time for the same level of scrutiny, regulation and protection of patients’ safety and rights to be afforded to private patients as is now being done for nhs patients. A comparable complaints procedure and access to independent advice on complaints would be a good starting point.’

‘Ill-fitting bras cause a range of problems, such as back and shoulder pain and even sores or welts as a result of straps and under-wires digging into the skin. Many women seek breast reduction surgery as a last resort,’ says plastic surgeon Mr Atul Khanna. his research led to a collaboration with experienced bra-fitter sue McDonald. Optifit offers a new bra design that will ‘elevate your breast without pressure of distortion’.

ject forward more quickly than is currently possible.

‘Furthermore, the N hs itself uses a variety of different reporting system to input this data.