INDEPENDENT PRACTITIONER TODAY

The business journal for doctors in private practice

By Robin Stride

Private doctors face a huge defence cover shake-up under Government proposals advocating the merits of insurance rather than the discretionary cover provided by traditional medical defence organisations (MDOs).

Responses to the 51-page discussion document, reflecting widely different views, are being prepared by doctors’ representatives, private hospitals and interested parties.

The Department of Health and Social Care’s report, called ‘Appropriate clinical negligence cover – a consultation on appropriate clinical negligence cover for regulated healthcare professionals and strengthening patient recourse’, spells out two key observations:

‘At the heart of a contract of insurance is a legally enforceable obligation to provide some form of benefit – usually in the form of a

monetary payment – upon the occurrence of a certain event, which may be subject to specified caps and exclusions.

‘In contrast, MDOs offering discretionary indemnity do so on the basis that their discretion is absolute, that any assistance offered is at their sole discretion and they therefore are not obliged to pay out in any circumstances.

‘Consequently, regulated healthcare professionals have less visibility, certainty and assurance as to what incidents may or may not be covered under discretionary indemnity.’

The newly named Independent Healthcare Providers Network welcomed the consultation, saying private hospitals had long wanted fully comprehensive insurance indemnity cover to replace ‘simply not tenable’ discretionary cover.

It said it looked forward to working with the department, MDOs

and the insurance industry to ensure private patients got the same legal and financial protection as NHS patients.

A spokesperson added: ‘There is a lot of detail to work out, including how any risk-pool might work and what the cost will be. But looking at other industries that have moved from discretion to comprehensive cover, costs have not increased as some feared they might, with it also allowing for a greater level of risk adjustment.’

The Independent Doctors Federation has long voiced concern about discrepancies in indemnity cover for private doctors. It said all stakeholders had to have confidence in public and private arrangements, which were for the safety of doctor and patient.

Doctors and others have until 28 February to respond.

See more reaction at www.independent-practitioner-today.co.uk

We begin a major new series aimed at reducing human error in healthcare in a bid to improve patient outcomes See page 18

Patients are being advised to shop for the best prices as self-pay hits record levels.

The market rose 9% to £1.1bn for independent hospitals and clinics in 2017, according to market analysts LaingBuisson’s Private Healthcare Self Pay Report, in association with GoPrivate.com.

It said: ‘For patients seeking

prompt access to private treatment, it pays to shop around. There are wide price variations for fixed-price surgery across the UK.’

The report found prices for a total knee replacement vary from £9,559 to £15,202, while cataract surgery for one eye costs from £1,650 to £3,353 (average £2,464).

Providers are more actively pro-

moting their services and all major operators now publish ‘fixed-price surgery’ prices on their websites.

New types of service, such as direct access to GPs, diagnostics and consultants, are an increasingly important part of the market.

Cosmetic surgery accounts for around 25% of self-pay revenue.

Report author Liz Heath said bet-

ter marketing and payment plans were reaping rewards. ‘While the NHS is still highly valued and much loved, it demonstrates that people will use information to make informed healthcare choices, especially for more affordable procedures, and mix and match by selectively self-paying or choosing to wait for NHS-funded care.’

their views really count are you listening to your patients’ feedback? With more private doctors being subject to reviews, jane braithwaite gives some excellent advice on handling negative comments P14

be ‘time smart’ in the way you work the most successful private doctors ‘work smart’ and have been able to steal back time so they can focus on patients and developing their practice. Kingsley Hollis suggests five areas for suitable treatment P16

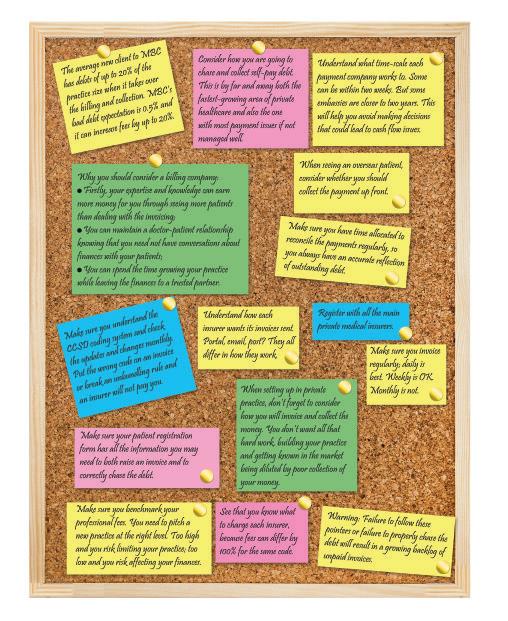

tips on getting the money in Heed these memos from Garry chapman to make your billing more efficient – and your bank account healthier P23

editorial comment

It is good to see independent practitioners enjoying positive results from private hospitals’ efforts to bring more fee transparency to patients.

Our front-page story shows operators are promoting their services much better than in the past and this has helped self-pay surgery and treatments flourish.

The market saw a 9% increase in self-pay in 2017 and analysts expect growth to continue. And that is not only where the alternative is a long and possibly painful wait; it is also for services that bring peace of mind, such as an earlier, more convenient GP appointment or diagnostic tests.

It is becoming much easier for patients to see prices for fixed-price surgery, as all the major providers now show these on their websites.

So if your hospital or clinic is lagging behind, then have a

word and do check just how easy it is for patients to find this information and understand it.

Sadly, as we reported six months ago, consultants are often missing out on the selfpay boom because their private hospitals have not geared up to make the most of it.

Complex websites and unclear pricing structures do not help, especially perhaps for many non-tech savvy older people –and be aware that market analysts LaingBuisson found the biggest growth in self-pay is among people over 60 who have greater disposable income.

There is much more price transparency to come this year when consultants’ fees are published by the Private Healthcare Information Network (PHIN). Achieving satisfying results with this for consultants and patients will be a much tougher task.

impress with an ‘a’ team competition among independent practitioners and private practices can be fierce, so making a good first impression with customers is vital. Stephanie Vaughan-jones discusses how you can do just that P24

chaperones’ vital role a chaperone should always be offered where any intimate examination is proposed, particularly if a patient has been sedated – says the mpS’s dr Gabrielle pendlebury P32

look after your entire family

What should you be asking your financial planner? Financial adviser dr benjamin Holdsworth shows what questions independent practitioners can ask to ensure they have the right help in place P38

Start a Private Practice: Self-assessment is getting trickier accountant ian tongue looks at the key considerations of the self-assessment scheme for income tax P44

doctor on the road: new breed with a famous pedigree motoring correspondent dr tony rimmer takes a new, premium, French brand for a spin P46

Profits focus: eyeing a healthy future our unique benchmarking series looks at the financial fortunes of ophthalmologists P48

tell US yoUr newS Editorial director Robin Stride at robin@ip-today.co.uk Phone: 07909 997340 @robinstride to advertiSe Contact advertising manager Margaret Floate at margifloate@btinternet.com Phone: 01483 824094

SUbScriPtion rateS £90 independent practitioners. £90 GPs and practice managers (private & NHS). £210 organisations. Save £15 paying by direct debit: individuals £75 (organisations £180). to SUbScribe – USe SUbScriPtion form on Page 28 or email: lisa@marketingcentre.co.uk Or phone 01752 312140 Or go to the ‘Subscribe’ page of our website www.independent-practitioner-today.co.uk chief sub-editor: Vincent Dawe Head of design: Jonathan Anstee Publisher: Gillian Nineham at gill@ip-today.co.uk Phone: 07767 353897

by edie bourne

Doctors are being urged to consider their position carefully in 2019 before following the rising number of medics opting out of the NHS Pension Scheme.

Financial experts blame the trend on harsh new tax rules which punish senior doctors for saving ‘too much’ in the pension scheme.

But specialist financial planners urged Independent Practitioner Today readers to proceed with caution.

Cavendish Medical technical director Patrick Convey said: ‘Doctors in the NHS who also run their own private practice may be caught by punitive new limits to their yearly and total pension contributions.

‘You will also undoubtedly have colleagues who are leaving the scheme and telling you to do the same. The truth is that it is not that simple.

‘Despite the challenges with the NHS scheme, there are too many advantages to ignore. The pension is Government-backed and indexlinked in retirement and also provides benefits for a surviving spouse.

‘It should also be remembered that if you opt out, you will lose other benefits such as death in service and may also face reduced ill-health retirement options.

250,000 workers chose to opt out of the nHS Pension Scheme between 2015-17, with 102,755 doing so in 2016 – up 78% on the previous year. new figures show those aged 46-55 represented the highest number of scheme leavers – up 94% in 2016.

the government introduced the ‘tapered annual allowance’ in 2016, drastically reducing the standard yearly pensions savings cap from the general £40,000 to as low as £10,000 for higher-earning doctors. excess savings above this rate are taxed at the marginal income tax rate. a significant cut to the lifetime allowance, which governs total pension savings overall, also hit doctors. from a 2011-12 peak of £1.8m, the limit is now £1.08m, but is due to rise in line with inflation.

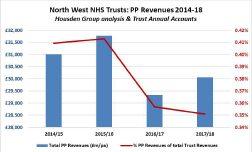

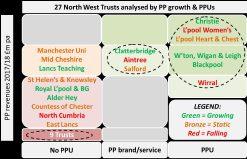

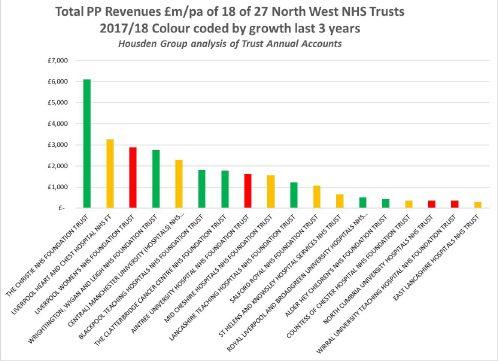

compiled by Philip Housden

Regional PPU group hopes to be kernel for national forum

A self-help forum for private patient units (PPUs) aims to be part of a future national network to increase their influence.

Mandy Simpson, new chairman of the South West NHS Trusts regional group of private patient managers, said PPUs needed to work together.

She told Independent Practitioner Today: ‘We need to work collaboratively and to mobilise our collec-

‘In truth, opting out of the NHS scheme is a financially sound move for a limited number of individuals. Before making any decision to leave, you should look at detailed financial modelling which can pinpoint whether this is the best move for you and, if so, when would be the best time to leave,’ Mr Convey added.

tive resource to be at least competitive with the chains of private providers. We aim to be recognised as a positive force and to be heard centrally in the same way independent providers are.’

Ms Simpson, head of operations and quality for the Bournemouth Private Clinic at Royal Bournemouth and Christchurch Hospitals NHS Foundation Trust, said PPUs represented under 10% of insurers’ activity and, as such, were not considered important clients.

But, together, they could have a louder voice and explore ways to work jointly to share resource and maximise impact.

‘While you could face additional tax charges by staying in the scheme, if you leave, you will

She said PPUs wished to work with insurers to establish what they wanted for their members and to deliver this without compromise. But that was a tough message in NHS trusts that were pushed to the limits and looked to PPUs to help out with beds and staff when under real pressure.

NHS PPU managers needed support to keep fighting to ring-fence resources for private patients.

The forum is the only regional group meeting regularly and attracts support from a wide area.

Philip Housden is a director of Housden Group. Read his feature article on p46

Consultants of The London Orthopaedic Clinic (TLOC) have left Wimpole Street to join forces with nearby King Edward VII’s Hospital. TLOC has grown to include 15 hand-selected consultants covering six subspecialities since launching

ten years ago as one of the first independent, multidisciplinary, musculoskeletal clinics in the capital.

Consultant orthopaedic surgeon Mr Brian Cohen said the move presented exciting opportunities for 2019, enabling the group to

continue its clinical and organisational development.

King Edward VII’s boss Lindsey Condron said TLOC would reinforce the unit’s renowned orthopaedic service following unprecedented investment in facilities.

miss out on valuable pension and ancillary benefits, which can be much higher than the possible tax charges. Each individual will require specific advice. The decision to opt out is not one that should be taken lightly.’

Around 150 existing and wouldbe independent practitioners are expected at the BMA’s private practice conference at its London headquarters on Friday 5 April.

Topics include indemnity, the changing landscape of private practice, and Care Quality Commission registration.

The annual event is an opportunity for doctors to discuss issues affecting them in their day-to-day work.

The conference is targeted at all doctors – including GPs – who are engaged wholly or partly in private practice, as well as those looking to establish a private practice – including juniors. Register your interest at confunit@ bma.org.uk.

By Robin Stride

The voice of private hospitals in the UK finally has a name doctors and others can easily recognise.

Following a long-awaited rebranding exercise, it is now the Independent Healthcare Providers Network.

Things got confusing for independent practitioners and others after the previous private hospitals’ trade body and pressure group, the Association of Independent Healthcare Organisations (AIHO), was absorbed into the NHS Partners Network last Spring.

But the latter title with its NHS tag was continued and Independent Practitioner Today criticised this

last March when we suggested a new name was needed because many private consultants and GPs had never heard of it.

We wrote: ‘The NHS Partners Network? Really? Starting with the first word, it is an unlikely name for a private healthcare voice. How it will take over AIHO’s work and truly speak for this sector’s interests, we can’t wait to see.’

The renamed body said it had changed its name to ensure its brand identity fully reflected the wider remit in representing the entire independent health sector, including in Scotland and Wales. It will stay a member of the NHS Confederation.

Network boss David Hare said:

Private health insurers, and the intermediary companies who sell policies, have been urged to continue to campaign ‘vocally and vigorously’ to protect the industry from unaffordable prices.

The chairman of the Association of Medical Insurance Intermediaries (AMII) urged them to work to convince the Government to review how it treats health insurance and cash plans.

Stuart Scullion told the body’s Health and Wellbeing Summit that they should be treated in the fiscal system in line with other zero-rated insurance products such as life or critical illness.

‘We strongly believe spending on healthcare should be zerorated,’ he told the meeting.

Health insurance escaped a fur-

Independent healthcare Providers network (IhPn) – formerly the nhS Partners network – is the representative body for independent sector healthcare providers. Members deliver a diverse range of services to nhS and private patients, including acute care, primary care, community care, clinical home healthcare, diagnostics and dentistry.

Independent healthcare Providers network wales – formerly The welsh Independent hospitals Association – is a voluntary association of independent acute, mental health and learning disability hospitals in wales and is the welsh representation of the IhPn

It aims to represent the individual and collective interests of member healthcare organisations and to make ‘a positive contribution to the development and review of public policy regarding healthcare in wales’.

Independent healthcare Providers network Scotland – formerly the Scottish Independent hospitals Association – is a voluntary association of independent hospitals, both acute and mental health, and is recognised as the main point of contact for independent healthcare providers by regulators and the Scottish Government and is the Scottish representation of the IhPn

It has ten acute hospitals and eight mental health/addiction treatment centres in membership and has the same aims for its country as wales.

‘With people rightly becoming ever more demanding about the quality and timeliness of the care they receive, our new name puts us in an ideal position to build on our work in representing the sec-

tor and speaking up for its members, ensuring that the safety, quality and efficacy of the work delivered by independent healthcare organisations can be accessed by as many people as possible.’

ther damaging rise in October’s Budget after the Chancellor kept the insurance premium tax element at 12%.

This followed strong lobbying and research by Bupa and economics consultancy Cebr showing previous hikes in the tax had driven thousands of people to cancel or downgrade their health cover, costing the NHS £126m a year.

Mr Scullion reported that intermediaries regularly express frustration about the frequency with which scheme benefits change, and how difficult that makes it to keep up, while others complain about a lack of innovation.

But he felt there was innovation in the healthcare sector, with GP apps and improved clinical path-

ways for cancer, musculoskeletal and mental health being examples where there had been significant improvements over the last few years.

He said: ‘Other examples include increased focus on wellbeing, as well as initiatives which enable individuals to take responsibility for their own health and wellness.’

Albion Capital has invested £5m in a new centre in Harley Street dedicated to caring for and protecting all aspects of fertility and gynaecological health.

The Evewell is led by medical director Mr Colin Davis, a surgeon in laparoscopic and endoscopic treatments, and the team includes fertility and gynaecology consultants Dr Dimitri Psaroudakis and Dr Moses Batwala and Dr Christian Ottolini, laboratory director.

Albion’s head of healthcare Dr Andrew Elder said: ‘The Evewell is capitalising on an exciting opportunity to build a position as the leader in reproductive and gynaecological healthcare.’

By Olive Carterton

HCA’s The Wellington Hospital is the first London centre to install the Icon Gamma Knife and offer fractionated treatments via mask immobilisation to treat private and NHS patients.

The machine, seen as the most innovative and accurate brain and skull radiation therapy, treats patients with brain tumours, vascular and functional disorders.

HCA said the technology will provide more tailored and accurate treatment plans, meaning patients did not have to stay overnight, and shorter recovery times.

Patients can opt to use a custom face mask, as opposed to the traditional headframe used with previous Gamma Knife systems, which can cause discomfort.

Mr Ian Sabin, consultant neurosurgeon and medical director of The London Gamma Knife Centre said: ‘This new technology means

The London Clinic has announced it is the first UK private hospital to offer an innovative surgical service to above-the-knee amputees to improve limb function and reduce pain and skin-related complications.

Military veterans who have suffered serious injury are likely to be suitable candidates for surgery in London, when previously they have had to travel to Australia or the US for treatment.

Orthopaedic surgeon Mr Paul

Culpan, leading the service, said:

‘There’s robust clinical evidence that osseointegration, a pioneering operation for patients with amputations that removes the need for a socket prosthesis, significantly improves quality of life and long-term health.

The service also includes bespoke hip and knee replacement surgery using tailor made implants to fit the patient and complex trauma (fractures) and plastic reconstructive surgery.

Many patients are unaware of more minimally invasive techniques for hip replacements and so opt for standard surgery which can lead to longer recovery times, according to a consultant trauma and orthopaedic surgeon.

Mr Simon Mellor, who offers anterior hip replacement at Highgate Private Hospital, urged patients to shop around, as surgery options were more varied than ever.

we can offer patients the most accurate and precise radiosurgery completely tailored to them and their condition. Treatment times will be quicker, which means I will be able to treat more people within a day, and patients will be able to go back to their daily activities almost immediately after.’

The Wellington Hospital chief executive John Reay said: ‘We provide our consultants and clinicians with the most cutting-edge technology and equipment to provide patients with the very best care, and the acquisition of the Gamma Knife Icon furthers this promise and offering.’

Venous surgeon Prof Mark Whiteley, of the Whiteley Clinic, has launched a new book to ‘revolutionise’ leg ulcer care.

He says many patients and health professionals are unaware most venous leg ulcers can now be cured permanently or significantly improved using local anaesthetic endovenous surgery, provided the patient is able to walk. In venous centres, this is a ‘walk in, walk out’ procedure.

But most patients in the UK are not offered endovenous surgery, instead undergoing constant dressings and compression bandaging.

The cost of dressing and compressing a leg ulcer for one year is approximately the same as curing it with endovenous surgery.

Leg Ulcer Treatment Revolution is £6.99 from www.amazon.co.uk/ gp/product/1908586052

Specialist medical accountant Ray Stanbridge, of Stanbridge Associates, has joined the board of The Healthcare Property Group (HPG) to support a new focus on the development of private sector healthcare facilities.

The Healthcare Property Company, its main trading entity, has mostly worked with the NHS to developing a range of primary care facilities. It has also developed polyclinics in Germany.

Its move to working with the private sector was established four years ago when it partnered with IVF pioneer, Bourn Hall.

Highgate Private Hospital’s endoscopy department has been awarded JAG accreditation, the specialty’s gold standard of regulation and safety.

Lead consultant gastroenterologist Dr Deepak Suri paid tribute to the department for working hard over the last year to achieve the accolade.

Christine Etherington, clinical services and quality governance director, said: ‘For a new unit to receive this stamp of approval on first submission is quite simply amazing.’

Billing firm Medical Management Services Ltd, of Hemel Hempstead, has ceased trading, blaming EU General Data Protection legislation requiring it ‘to make very significant and costly operational changes’.

It said it would be unable to stay competitive on price for its customers while being a viable business.

The GMC full registration fee is going up from £390 to £399 on 1 April.

By a staff reporter

Breast surgeons must ensure women are aware of BIA-ALCL, a non-Hodgkin’s lymphoma associated with implants.

The warning was given to surgeons attending the London Breast Meeting, where they were told they must take more responsibility to diagnose and report cases.

Hundreds of breast specialists from around the world met at the Royal College of Physicians for the four-day conference, which heard that women receiving breast implants were not always being told of the risk of developing a cancer called Breast Implant Associated-Anaplastic Large Cell Lymphoma, or BIA-ALCL.

Consultant plastic surgeon Mr Nigel Mercer, who chairs the Plastic, Reconstructive and Aesthetic Surgery Expert Advisory

Group (PRASEAG) for the UK’s Medicines and Healthcare products Regulatory Agency’s (MHRA) committee looking at BIA-ALCL, said: ‘I know for certain, because I have seen patients who have not been warned there is a risk of BIAALCL by the clinic or surgeon they have seen.’

The conference urged surgeons to take the condition seriously. Mr Mercer, a past-president of the British Association of Plastic Reconstructive and Aesthetic Surgeons (BAPRAS), said all patients needed to be told from the outset about the risk and that for women who had already suffered from breast cancer, the implications of facing new cancer risk could be particularly devastating.

He said: ‘If you see a woman who has been one of the one in eight women unlucky enough to develop breast cancer and who is seeking an implant-based recon-

struction and then you say that type of reconstruction carries a 1 in 28,000 risk of developing another form of cancer that will need another form of cancer treatment – for that patient who has already undergone cancer treatment, that is pretty devastating news.’

The MHRA issued a joint statement with several of the UK’s leading surgeons’ associations last July, advising it was ‘essential’ that all patients considering a breast implant for reconstructive or cosmetic purposes are made fully aware of the potential risks by their surgeon.

Prof Jian Farhadi, co-chairman of the London Breast Meeting and former director of the Department of Plastic and Reconstructive Surgery at Guy’s and St. Thomas’ Hospital in London, said: ‘However small the risk may be, women must be made aware that

Mr Niger Mercer chairs the expert advisory group looking at the risk associated with breast implants

they could develop cancer associated with breast implants, and potentially even die.

‘Surgeons must do this before their patients agree to undergo procedures, although, in many cases, this does not appear to be happening.

‘Debate at the London Breast Meeting has highlighted the importance of greater investment in education, so that we can do more to identify cases of BIAALCL, better equip pathologists to support this mission, and better understand the state of the disease across the UK and the rest of the world.’

A leading light in the provision of private cancer services has called for a radical overhaul of the way the disease is diagnosed in Britain.

Prof Karol Sikora warned that the current system of incorporating diagnostic services within hospitals was simply not working and patients were facing drastic delays in getting crucial imaging and biopsies.

Prof Sikora, chief medical director of cancer services provider Proton Partners Inter national, said: ‘What we urgently need is for patients with certain symptoms to go straight to a non-hospital clinical environment where all relevant tests can be done at once and then referred to an appropriate specialist if necessary.

‘That would be a real gamechanger in cancer diagnostics in

the UK and more lives will be saved.’

He was commenting after a new Health Foundation report found that 10,000 deaths could be prevented each year with better diagnosis.

According to the report, at the heart of the problem is the ‘tight gate-keeping’ of the NHS: only GPs can refer patients for checkups and are pressured not to refer too many, while the NHS does not have enough equipment or staff to carry out the checks that it should.

Steve Powell, chief diagnostic officer at Proton subsidiary Rutherford Diagnostics, said: ‘At present, patients are having to wait at least six weeks for their diagnosis; that is not acceptable. We should be aiming to reduce those weeks of waiting to days and

ultimately be able to provide a 24-hour service.’

He said adding diagnostic equipment to hospitals would not solve the problem. They would simply be engulfed by the demand and patients would face the same structural obstacles of ‘tight gatekeeping’ highlighted by the report.

Added Mr Powell: ‘Patients with the relevant symptoms should be able to get all their tests in a pleasant specialised diagnostic environment, and then forwarded to the relevant specialist if diagnosed with cancer.

‘GPs need to be empowered to use CT, MRI and endoscopy services without having to make endless referrals. This will not only lead to quicker diagnoses but will prove hugely cost-efficient too.’

‘LifeBox’ introduces the safety bar much higher, which means patient risk will be reduced and that will lead to increased quality of care and better outcomes

By Leslie Berry

A team of Brighton-based consultants and technology specialists are saving time and money after creating ‘the first interactive digital patient assessment app’.

Instead of filling in pre-assessment forms with a nurse, patients who need a medical procedure or operation can now answer questions about their health via a hand-held computer in the comfort of their own home.

Called ‘LifeBox’, the assessment tool has been in development for the past two years and was launched at The Montefiore Hospital in Hove, Sussex. It is hoped that its success will help it be adopted nationally by NHS trusts. The answers they give will generate more patient-specific questions to fully identify their level of risk. All patients are then called by a nurse to discuss the findings.

Those with low or no risk may not need to come back into hospital for further tests before they

have their medical procedure. The app will also generate information and videos specific to the patient’s condition, so they can prepare for the procedure.

Mr Sandeep Chauhan, consultant orthopaedic surgeon at The Montefiore and lead consultant for LifeBox, said: ‘When a consultant has just told you that you need a medical procedure, your head is not often in the best place to be answering questions or taking on board information about your condition and the forthcoming operation.

‘With LifeBox, you can answer questions in your own home, when you feel calmer. You will have easier access to paperwork, medication or the help of family members to ensure questions are answered correctly.

‘Patients can elaborate on their health with guided questions to enable the medical teams to better assess risk. For instance, we may have several patients with angina coming in for a similar procedure

place, in one digital box, and stays with them for life. They can take the app with them wherever they go – on their phone, tablet or computer – which can be very useful if they fall ill away from home or on holiday, or in a situation where they need to give details of their medical condition and health history but are too stressed or anxious to do so.’

LifeBox is not just about preassessment and health history. It also allows the patient to do a post-op questionnaire, so they can compare how they felt before and after the procedure. And they can give satisfaction feedback. The app will direct any complaints straight to the hospital manager.

The LifeBox team predicts that soon every patient in every GP surgery will have access to the technology and be able to update their own health records as they go.

Hospitals will be able to use LifeBox to send group messages with information to people with similar conditions and, as well as physical health, LifeBox users will be able to upload details about their lifestyle and mental well-being.

Eventually there will be a communication portal, so a patient can have a video call with a nurse at a time that suits them.

but the answers they each give will be specific to them and means we can grade their angina and therefore assess individual risk.’

By reducing paperwork and unnecessary testing, LifeBox is expected to save around £215,000 per 5,000 patients.

And there are also significant time savings. On average, a patient spends around 3.2 hours coming back into The Montefiore for a pre-op assessment and tests, including travel time.

If they are fit and well and do not need those tests, they will not need to come into the hospital before their operation or need to take time off work or find childcare.

Each patient is given their own unique LifeBox login and they can decide who the information can be shared with. As their health changes in the future, their individual LifeBox can be updated.

JP Hamilton Savory, a member of the LifeBox technical team, said: ‘It is their health story in one

Mr Chauhan called LifeBox ‘a supplement’, not a replacement, for human intervention.

‘You could have a traditional pre-assessment with a junior nurse or one who has been on a long shift. They may not dig deep enough into the answers that you give about your health, which means something could be overlooked.

‘LifeBox overrides human error. It introduces the safety bar much higher, which means patient risk will be reduced and that will lead to increased quality of care and better outcomes.’

LifeBox was tested on patients on wards at The Montefiore and more than 100 patients are using the app. From now, every new surgical patient at the hospital will be signed up.

The hospital has also invested in five iPads for its reception area so a patient can be guided through the LifeBox programme by a nurse if they prefer.

Info: allan@lifeboxhealth.com

More than 1,000 people attended healthcare market analysts LaingBuisson’s annual awards ceremony to celebrate the best in health and social care.

Held in the ballroom at the Park Plaza Westminster Bridge, London, the event was hosted by actor, singer and writer Alexander Armstrong, who entertained guests before presenting the awards with LaingBuisson’s chairman Stephen Dorrell.

Finalists were chosen by an independent panel of judges from over 350 nominations.

LaingBuisson chief executive Henry Elphick said: ‘The LaingBuisson Awards offer providers and advisers the opportunity to recognise and celebrate the most inspiring and innovative work across healthcare and social care in the independent sector.

‘The nominations were hugely impressive and included many deserving projects, organisations and professionals who are dedicated to tremendous health and care causes, and I know that the judges’ decisions were not easy ones.’

The Nuffield Health team (left) walked away with the award for best private hospital group, while Royal Marsden Private Care (below) picked up two awards in the Clinical Services category: the Health Outcome accolade and the Nursing Practice prize

a look back through our journal’s archives of ten years ago reveals that although times change, some issues are not so

The recession was rife this time ten years ago and independent practitioners were warned they could not expect their earnings to escape the economic downturn

Ambitious plans to attract a new generation of consultants to stateoftheart rooms in Harley Street were unveiled by the area’s property company owners.

Bosses at Howard de Walden Estates said they wanted to see ‘independent consulting houses’ providing quality services and medical equipment for 30 to 50 doctors.

Private consultants were being urged to ensure tough data security for their mobile devices following concerns that thousands of patients’ records had been put at risk.

More than a third of health professionals in a survey failed to properly secure patient records, images, contact details and other sensitive data on laptops, handheld units and USB sticks.

The transatlantic study, which included UK independent specialists, sparked criticism of NHS standards rather than private sector failings. But private doctors were being advised to be alert.

Researchers in the survey found 35% of health practitioners here were using just a password to secure work laptops and devices.

A quarter of the doctors polled were anxious about patient details being held on mobile devices.

Chief executive Toby Shannon said: ‘The difficulty is we are in a conservation area, so we have to work in that framework. But we aim to get two to three buildings in a row and do a lateral conversion.

‘Doctors are asking for more independent consulting rooms. We are trying to fill a gap in the portfolio. It’s going to provide more variety. We want the area to be the place where medical practitioners want to come to practise.’

Property director Simon Baynham said the company had previously prioritised the space needs of the area’s ‘key stores’ private hospitals. But now it wanted independent buildings with no hospital affiliation.

£3.5k tax hike faced

The average consultant with an £85,000 NHS salary, £65,000 private practice income, a non

working spouse, and two children was set to be £442 better off in terms of gross income and benefit in 200910 than in 200809.

But from 201011, under Labour’s new National Insurance rates, a 45% income tax rate on earnings over £145,000 and cut in personal allowances for the higher paid, he or she would be £3,626 worse off.

Accountants said Chancellor Alistair Darling’s plans represented a 2.4% fall in gross income benefit.

Private health insurers were coming under renewed pressure to improve coding system clarity.

Insurance fraud investigators said they were committed to getting companies to act, something Independent Practitioner Today had called for two months previously.

The move followed further criticism from a surgeon at the first gathering of the Health Insurance Counter Fraud Group.

Patients who wanted to complain about their private or NHS doctor were now able to get support from a new online information centre from the GMC, called Patients’ Help.

It claimed to be the first website to help patients navigate the complaints system. The site was

SubScribe today don’t miss out on what we report and advise in the future. Sign up for a £75 subscription today –consultants, GPs and practice managers can save £15 with a direct debit.

See page 28

set up to provide case studies, a timeline for the life of a GMC complaint, and an interactive map with contact details for local help and advice centres.

A special report from communications specialist Neil Huband lifted the lid on the press’s tricks and showed what doctors could do when faced with a media circus wanting to know about the famous patient they were treating. He advised anonymous cars and ambulances should be used to take the patient to hospital – not the Bentley that everyone knows.

‘Choose an admission time when there are less likely to be a lot of people around. Patients are gossips and will often be the source of tipoffs about other patients.

‘There are plenty of things a good hospital can help you with. If your patient is very well known, discuss privacy and security with it at the outset.

‘Choose a “new” name for the admission – not an obvious one –and arrange that the hospital has a specific list of visitors and callers with a code name each caller must use to be identified as genuine.

‘And tell them not to accept flowers at reception. When trying to find out where a famous singer was having her baby, as a reporter for the Sunday tabloids, I used to send flowers to several hospitals and the one that accepted them was…well…more than likely to be the one.’

If there is something you are unsure about regarding your business accounting, never be afraid to ask your accountant. In this month’s column,

Susan Hutter (right) answers more of the most frequent questions she receives from doctors

Qi am going to be filing my tax return – could you advise me what the taxman will accept as legitimate expenses against my practice income?

ARemember you can only claim expenses that are wholly and exclusively for the purpose of the trade.

Typical expenses that can be claimed are:

➲ Motor/travelling expenses –except from your home to your place of work. If you have more than one clinic/surgery, travelling between them would be allowable, as would travelling for workrelated meetings, work-related training and conferences.

For motor expenses, for the first 10,000 ‘business miles’ a year, you can claim 45p per mile. However, you will need to keep a record in case you are challenged by HM Revenue and Customs (HMRC). For rail and air fares, it is advisable to keep the receipt.

➲ Subscriptions to professional bodies, such as the BMA, and also subscriptions to any medical journals such as Independent Practitioner Today

➲ Internet charges where you use your computer for work –nowadays that is nearly every -

body! Also computer-related expenses such as hardware and software updates for business purposes can be claimed along with any professional courses and training including continuous professional development.

➲ If you travel for work-related conferences , the accommodation, subsistence and air fares can be claimed.

But if your stay is extended for a holiday, the ‘holiday part’ should be disallowed and so you should apportion the expenses accordingly.

➲ Accountancy fees for preparation of your practice accounts, although not your personal tax return.

➲ Professional indemnity insurance

➲ Use of home as office – this is an expense that is often challenged by HMRC and therefore it is important that you calculate it correctly.

For many, it is not worth the trouble. But if you do carry out a lot of work from home, such as report-writing and, say, have a

dedicated office that you use for no other purpose, the best way of claiming is to work out the square footage of the office compared to the total space of the dwelling and apportion certain household bills accordingly, such as electricity and gas.

The above is not an exhaustive list and there are grey areas. So if you have specific expenses you are unsure about, be sure to check with your accountant.

QA family member has asked me to invest £25,000 in their new business. in return, i will receive 25% of the share capital. Are there any tax advantages?

AIf the business is a start-up and you are among the first investors, then as long as you and connected parties hold less than 30% of the share capital, you may be able to benefit from the Seed Enterprise Invest ment Scheme (SEIS).

This is available to initial investors in a start-up, as long as the company meets the requirements for a qualifying trading business. The maximum that a company can raise under SEIS is £100,000 in total (not per person).

Also, the company must have been trading for less than two years. As long as everything stacks up, then you as the investor will get 50% tax relief on the amount invested.

Provided you hold the investment for three years and then sell the investment, there is no capital gains tax if you make a gain.

If the company fails, then you as the investor will have made a loss of £12,500 (50% of £25,000). You are eligible for Share Loss Relief against income tax for the £12,500.

This means that if you are a 45% tax-payer, you would have received total tax relief of 78% on the £25,000.

By the nature of the investment – a start-up – it is considered a high-risk investment. However, given all the relief and tax benefits, it is a more manageable risk due to the tax relief.

If SEIS isn’t available because the firm has already exceeded the limit and/or is out of the timeframe, investors could qualify for the Enterprise Investment Scheme (EIS) instead. Under EIS, they get 30% income tax relief on the amount invested.

Qi have heard that HMRc is making far more tax investigations. What is the likelihood i could be investigated and what is the process if i am?

AHMRC regularly conducts tax investigations, but, in my opinion, it is not the case that it is necessarily making more or indeed targeting a specific industry or profession.

You should definitely protect yourself by making sure that you do not bring yourself to the HMRC’s attention for the wrong reasons.

Therefore, ensure your tax returns and accounts are always filed on time and your tax payments are made on time.

If there are certain figures in your tax return that look very unusual compared to previous years, there is a box in the tax return for ‘notes’ which you should use to explain to HMRC why the differences arose.

If HMRC is satisfied with the notes, then it may not raise an inquiry.

If you do get an inquiry, it is advisable to enlist the services of your accountant to assist with the replies.

Be completely open and honest and reply within the time limit requested by HMRC. If the time limit is too tight, then contact HMRC and ask for an extension.

As long as you do this on a timely basis, it is normally very accommodating.

Ask your accountant about professional fee protection insurance. Generally, this costs no more than £500 a year and will cover your practice accounts and your personal tax return in most cases.

If you take out this insurance, the accountancy fees charged in dealing with the enquiry will be paid by the insurance company. This is a wise move, as accountancy fees for this type of work can be quite expensive.

Qi don’t have enough money to pay my tax bill, what is your advice?

AThere is no point in sugarcoating this. HMRC expects all taxpayers to put aside money from their earnings to pay their tax.

If you have not, you will need to have a good reason.

Either way, the best way of dealing with this is to call HMRC yourself and explain the situation.

Before you make the call, speak to your accountant about your particular circumstances so that he or she can advise you on the best way to tackle HMRC.

However, in recent years, HMRC has tended to do better deals with taxpayers directly than if they ask their accountants to intervene. The deal will not be a reduction in tax. But you may be given time to pay.

The time period will need to be negotiated. Be aware that HMRC will ask what private funds you have available and whether you can take out a loan.

Susan Hutter is a partner at Blick Rothenberg and part of the team that advises medical practitioners

more private doctors being subject to reviews, Jane Braithwaite gives some excellent tips and advice on handling negative comments

Most practices will be receiving patient feedback on a regular basis.

this can range from the quiet chat with the receptionist or medical secretary, to the hand-delivered box of chocolates or the – hopefully infrequent – irate phone call or email.

But how are you collecting these reviews, measuring your patients’ satisfaction and dealing with complaints?

Measuring patient satisfaction and assessing areas for improvement is an important aspect of the care Quality commission assessment process, but it should also give you the opportunity to

involve all your team members in taking responsibility for improving the patients’ experience.

Feedback sources

p articularly popular forums for online patient feedback can be your practice’s Facebook page or Google My Business account.

positive reviews here can boost search results, they are easy to request and receive and they give potential patients good insights into your services.

Great reviews can be shared on your website or in articles, but you must ask for the patient’s express permission first.

on these public channels, there

measuring patient satisfaction is an important aspect of the care Quality commission assessment process

1 establish an open team culture encouraging all feedback to be shared

2 encourage patients to share their reviews on your Facebook page, google and other social media accounts

3 send patients links to relevant medical websites where reviews are encouraged

4 share great reviews on your website (having asked the patient’s permission)

5 set up a monthly or quarterly programme of feedback requests from patients

6 decide on the best way to collect ad hoc patient feedback from team members

7 put in place a detailed complaints process

8 communicate your complaints process openly with your patients

9 respond to complaints and online negative reviews promptly and professionally

10 collate all your feedback regularly from all sources, to inform your improvement plan

is the danger that a negative review can be widely seen but, if this complaint is handled promptly and professionally, it can often result in a positive outcome.

Many of our clients at Designated Medical request patient reviews on specific medical sector websites such as Doctify, where feedback can be anonymous and complaints can be addressed.

p atients are sent a link to the website’s reviews page, or an ipad app is used to collect reviews at the practice. similar review options are available on iwantgreatcare.org and My Health specialist.

clinics and doctors may choose to set up and implement their own in-house patient satisfaction survey, perhaps on a monthly or quarterly basis.

Websites such as smart survey or typeform offer various options for customising questions and compiling responses. the results can be summarised into a report giving a focus for practice improvements. t hese could be reviewed at the monthly practice meeting and an action plan agreed to address any issues. t he ad hoc face-to-face or emailed feedback should also be consolidated to form the basis of your improvement plan, which can be used as evidence of listening to patients and demonstrates a strong focus on patient satisfaction. it’s important that an open and

understanding culture be fostered within the team, with no fear of blame being apportioned, so that all feedback is actively shared and acted upon.

positive reviews should be celebrated as a team, too.

➤ all clinics should have in place a complaints process that is openly communicated to patients and closely followed by the team

➤ that process should clearly define who will have the responsibility for managing the complaint

➤ complaints should be dealt with in a timely manner and it is important that the patient be made fully aware of the process details and given time-scales for responses to be provided

➤ good communication at every stage is vital. the gmc’s advice on complaints handling is clear: ‘You must respond promptly, fully and honestly to complaints and apologise when appropriate’

➤ when handling online negative reviews, your aim is to address the issues raised in the complaint, without going into personal details, and offer to contact the patient directly to help resolve the problem

Jane Braithwaite (below) is managing director of Designated Medical, which offers business services for private consultants, including medical secretary support, book-keeping and digital marketing

➤ You will also want to make sure that the way you publicly answer the complaint is seen as professional and helpful to anyone reading the review in the future

➤ if a complaint is handled well, the patient may refrain from sharing any negativity with other potential patients and, in the best-case scenario, it may actually generate increased loyalty

➤ in the case of serious medical complaints, these should, of course, be escalated to the appropriate professional body

The most successful independent practitioners ‘work smart’ and have been able to steal back time so they can focus more on patients and developing their practice. Kingsley Hollis suggests five areas for suitable treatment

Time is a precious resource in medicine and most doctors quickly become adept at managing their clinical workload and prioritising tasks according to patient need.

Understandably, doctors see starting their own practice as an opportunity to spend longer with their patients, so it can be a shock

to discover how much time is taken up by day-to-day administrative and business tasks.

Time-consuming tasks

On top of managing the caseload generated by each patient, independent practitioners need to oversee their appointments diary, be their own marketing, human

resources and iT director, and stay on top of their finances.

in my experience, every practice has time-consuming tasks that could be managed more effectively, often by making better use of technology.

Here are five of the most common administrative ‘bottlenecks’ to address:

m edical secretaries tell me they can spend up to 75% of their time typing, printing and dispatching letters to keep patients and their GPs informed about appointments, investigations and treatments.

While a letter is often their preferred form of communication, the process can be streamlined by using letter templates for common subjects which can be completed with the relevant patient details.

i would also recommend using software which allows you to select and batch-print multiple documents at a time, rather than laboriously opening each one and clicking on print.

Check whether your practice management system allows you to do this.

Practices regularly have to call around hospitals or insurance companies to confirm a patient’s insurance details, but this can be a time-consuming – and sometimes frustrating – exercise.

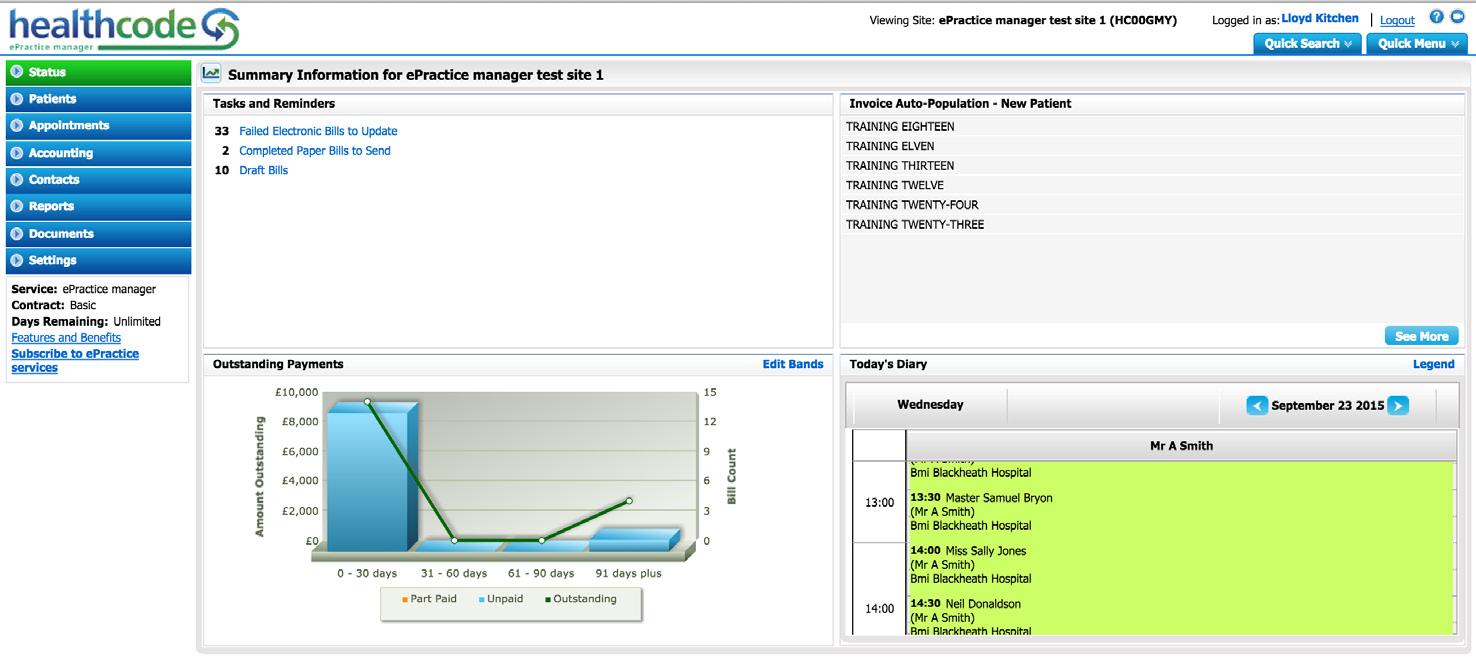

in response, Healthcode developed the online membership inquiry feature within ePractice which enables users to instantly check patients’ insurance policy numbers and address details against the insurers’ database.

Healthcode estimates that automating the invoice process can save £2.15 per invoice by eliminating printing, postage and manpower costs.

Creating and submitting bills to private medical insurers online takes a fraction of the time, improves accuracy and ensures the invoice is validated against the relevant insurer rules so it is ready for processing and payment. Plus, you have the reassurance of knowing that the invoice has been received by the insurer. All practices can reap the business benefits of e-billing, whether they use Healthcode’s own ePractice solution or through our validation and clearing system, which is compatible with most practice management software.

When payments arrive, every practice needs a system in place to record exactly what invoices are being paid and identify shortfalls, which then need to be queried with the insurer or charged to the patient.

This can be time-consuming with a manual system and, in some cases, practices have been obliged to write off outstanding debts because payments have not been reconciled against the correct invoice.

Before investing in practice management or invoicing software, check how easy it is to manage payments and shortfalls, as this feature could make all the difference to your credit control process.

Without access to accurate information, it is impossible to steer your business effectively. However, manual book-keeping and accounting systems require expertise and time to prepare even basic reports such as an aged debtor analysis, so an automated system is a must.

Before investing in a practice management system, check that it provides a range of real-time financial reports so you can measure your performance, analyse your strengths and weaknesses and make informed decisions.

Few doctors have experience of running a business. However, the most successful independent practitioners i know are those who draw on the time management skills they learned early in their professional career.

By identifying ways to work smarter and making the most of the latest practice management technology, they have been able to ‘steal back’ time to focus on patients and on developing their practice.

next month: common practice management errors and how to avoid them

Kingsley Hollis (right) is head of business development (ePractice) at Healthcode

HMRC tax investigations and disputes create difficult and stressful times.

As an award winning firm of tax experts, our highly experienced partners specialise in resolving problems relating to tax investigations and disputes with HMRC.

To find out, in confidence, how we can help call 0800 734 3333.

‘Here to help. Not to judge.’

Our trio of writers – two doctors and an airline pilot – are co-founders of a business on a mission to improve patient outcomes by helping healthcare professionals understand why errors occur.

John Reynard, Tim Kane and Peter Stevenson’s major new series for Independent Practitioner Today gives a startling insight into attitudes and aims to inspire you with a wealth of practical patient safety solutions

Human beings are prone to a number of potentially disastrous failings when working in an environment where error can cause harm.

We forget things, we misunderstand each other and we sometimes fail to hear people speaking.

and we fail to notice important but unexpected developments happening right in front of our eyes. so it seems that any system containing a human element must eventually fail – and in ‘high-hazard’ environments, these failures can be catastrophic.

While errors will probably never be entirely eliminated where the ‘system’ relies on humans, it is noteworthy that in the last three decades there has been an impressive reduction in the number of fatal accidents occurring in a number of different ‘safetycritical’ industries: notably airlines, railways and chemical and petrochemical processing. organisations have sometimes actually managed to achieve the goal of ‘zero fatal accidents’ and sustain that achievement for many consecutive years.

some – but only some – of this improvement in safety has undoubtedly resulted from the use of more reliable hardware; for example, better designed aircraft and computer systems.

psychologists who studied how this safety improvement was achieved have shown that organisations that have also managed to change certain behaviours of their staff have reduced accidents to very low levels. these organisations have come to be known as highly reliable – High reliability organisations (Hros).

Hros provide their staff with ‘human factors’ training in the psychology of error and in simple techniques to mitigate or prevent mistakes.

problems with human memory can, for example, be largely mitigated through the use of check-lists and the practice of repeating back messages to their sender. other human failings can also be effectively managed through the use of other simple strategies.

Hros have come to realise that focusing on safety training not only enhances an organisation’s reputation, but also makes the organisation more efficient.

a major factor in this has been the improvement in the reliability of verbal communication between staff. not only does better communication enhance safety but it minimises confusion, wasted effort and delays.

these improvements in efficiency have resulted in the rise of the ‘low cost’ airlines in the last two decades, without compromising safety. budget airlines are therefore just as safe as the ‘high-end’ airlines and they are every bit as highly reliable.

in this series of articles for independent practitioner today, we discuss:

the scale and effects of healthcare error;

the High reliability organisation approach to error reduction and the development of a safety culture;

communication failure and simple tools to reduce communication errors in your practice;

crisis management and mismanagement.

Yes, there are great differences in the day-to-day operations of healthcare when compared to aviation and the railways, for example.

but much can be learnt about and much can be done to reduce error in healthcare by focusing on the psychology of human error in a way that Hros have done.

‘The medical profession has become a major threat to health’

Ivan Illich, Limits of Medicine

The landmark h arvard m edical Practice Study ( hm PS) quantified the scale of an age-old observation – that patients are harmed by their doctors and nurses [Brennan 1991, l eape 1991].

It was published in the New England Medical Journal in 1991 using data from 30,121 randomly selected records from 51 randomly selected acute care, nonpsychiatric hospitals in new York State, US.

The proportion of hospital admissions experiencing an adverse event, defined as injuries caused by medical management, was 3.7%. The percentage of these adverse events which were due to negligence was estimated to be 27.6%.

While most adverse events caused only minor harm – with complete recovery in one month – 13.7 % led to disabilities that lasted up to six months, 2.6 % caused permanent total disability and 13.6% caused death.

Of note is that the hm PS was originally conceived to determine the number of injuries that could lead to litigation and require compensation.

It was not conceived simply to quantify the scale or error, but rather it was driven by concerns over the cost of litigation and so was motivated and funded by the medical malpractice insurance industry.

a lmost as a by-product, but what became its legacy, was that it revealed a major issue with the scale of preventable harm.

Of course, there was nothing new in all of that; every doctor and nurse is aware of the concept of iatrogenic disease – doctor generated harm.

as far back as 1857, Semmelweis had observed that women delivered of their babies by medical students who had failed to wash their hands after dissecting cadavers had a substantial risk of death from streptococcal infection. Simple handwashing dramatically reduced the risk of such infection [Semmelweis 1860].

The study indicated that at least 44,000 and perhaps as many as 98,000 Americans die in hospital each year as a result of medical errors

So, there was nothing really new in the hmPS other than that it established the scale of an ageold phenomenon. nor was there anything new in the scepticism that greeted the authors of the hmPS.

a s a retort to Semmelweis, meigs stated: ‘doctors are gentlemen and a gentleman’s hands are clean’. Semmelweis was ridiculed by a medical community unable to accept the idea that they might be a cause of patient harm and he ended his days in an asylum. a nd that scepticism arose because the scale of the problem identified in the hm PS was almost too great to be believable.

Critics argued that those individuals who died at the hands of their doctors and nurses were sick anyway and that their primary pathology was likely to have been the cause of death rather than a ‘medical’ error – you only come into hospital if you are sick, after all.

That belied the truth. d eaths followed routine and elective surgery in fit individuals – ‘Betsy lehman, died from an overdose during chemotherapy. Willie king had the wrong leg amputated. Ben k olb was eight years old when he died during “minor” surgery due to a drug mix-up’. It was the errors that killed them [kohn 1999].

Uncomfortable reading a ll of this could have made uncomfortable reading for the medical and nursing professions, but it seemed to have little initial impact [leape 2000].

It was only with the publication in late 1999 of the Institute of

This report acknowledged that adverse events occur in around 10% of hospital admissions and that the cost in picking up the pieces was an estimated £2bn in extra bed days

m edicine (IO m ) report, To Err is Human , that the penny finally dropped – at least in the US Congress, which now cast the spotlight on quality and safety in healthcare – that we might have a really big problem on our hands. This report estimated the numbers of americans who die in hospitals as a result of potentially preventable adverse events based on extrapolations from the hmPS and the more recent UtahColorado study [Gawande 1999]. This was the bottom line: when extrapolated to the 34m admissions to US hospitals in 1997, the results of the hmPS and the UtahColorado study indicated that at least 44,000 and perhaps as many as 98,000 americans die in hospital each year as a result of medical errors.

d eaths due to preventable adverse events exceeded deaths attributable to motor vehicle accidents (43,458), breast cancer (42,297) or a I d S (16,516) [C d C 1999].

nonetheless, in a survey of doctors in the US published after the 1999 Institute of medicine report, only 13.8% of doctors agreed with the statement ‘a recent estimate that medical errors kill 44,000 to 98,000 americans yearly is accurate’ and 79% of doctors thought healthcare matched the safety records of other organisations [robinson 2002].

little insight

This latter finding is all the more interesting when one considers that since the kegworth air crash in leicestershire in 1989, almost 30 years ago, not a single death has occurred on a Uk airliner, at

the time of writing. d o doctors really think that healthcare even approaches the safety record of the aviation industry? have they so little insight?

That such a state of affairs could exist in a country as sophisticated and wealthy as the US galvanised other countries into investigating their own scale of medical errorinduced harm.

The result was that studies in a ustralia [Wilson 1995], n ew Zealand [ d avis 2001], France [michel 2004], denmark [Schioler 2001], the Uk [Vincent 2001] and Canada [Baker 2004], using the well-established methodology of the hmPS, demonstrated a stark set of statistics. n amely that roughly 10% of hospital admissions world-wide are associated with an adverse event that causes harm, and 5% of that 10% of harms (0.5% of all hospital admissions) led to death.

It has been estimated that half of these errors could have been prevented with, among other things, although not exclusively:

Better clinician-to-clinician communications;

Better standards of checking;

Better standard procedures.

These studies not only established the scale of the problem in a variety of different countries, they also indicated that the problem was even more prevalent than had been thought from the hmPS.

Furthermore, they also emphasised that error leading to harm in healthcare was a global phenomenon occurring irrespective of the way in which healthcare was funded – private or public, state or insurance.

From the Uk’s perspective, it has been estimated [Vincent 2001] that each year about 40,000 patients die following a potentially preventable adverse event. Vincent’s study followed within a year of the department of health report An Organisation with a Memory, published by e ngland’s Chief m edical Officer Sir l iam donaldson [2000].

This latter report acknowledged that adverse events occur in around 10% of hospital admissions and that the cost in picking up the pieces was an estimated £2bn in extra bed days. This, at a time of austerity. how can we be so profligate? Can we not do something to avoid such waste?

But the disease of error goes beyond just the cost to patients, their families and the taxpayer.

Below the tip of this iceberg of serious harm and extra bed days lies a mass of second victims of error: the doctors and nurses at the coal face of care and the harm caused to the reputation of hospitals and the medical and nursing professions – the third victims of error – through their alleged complacency.

The second victims must at the very least struggle with the psychological harm from having harmed someone and, for some, the weight of the law is called to bear on them.

impressive reduction

While errors will probably never be entirely eliminated where the system relies on humans, it is noteworthy then that, in the last three decades, there has been an

impressive reduction in the number of fatal accidents occurring in a number of different safety-critical industries, notably the airlines, the railways and the chemical and petrochemical processing industries.

as a consequence, these industries have come to be known as high reliability Organisations –hrOs. Some have actually managed to achieve the goal of ‘zero fatal accidents’ and sustain that achievement for many consecutive years. remember, at the time of writing, there has been no fatality on a Uk-registered jet airliner since the 1989 k egworth plane crash, when a British m idland a irways’ Boeing 737 crashed on the embankment of the m1 motorway.

d enial from the medical and nursing professions, cultural inertia and learned helplessness in healthcare organisations (‘I’m just an individual in a huge machine – what can I do to make the system safer?’) have limited the translation of hrO safety training techniques into the healthcare environment.

These factors are also likely to play at least some role in the absence of any substantial reduction in avoidable error reported in a 2010 study of patient safety carried out over six years in ten north Carolina hospitals in the US.

The rate of avoidable serious harm to patients remains at approximately the same rate as the 1991 study; the authors of the study concluding that there was ‘little evidence of widespread improvement’ in patient safety [landrigan 2010].

Since 2011, I have used CPS exclusively for all my histopathology. Altogether an excellent service that I recommend to all my consultant colleagues.

Mr George Fowlis – Consultant Urological Surgeon

Psychology of error h owever, there is hope on the horizon, because some healthcare organisations have woken up to the problem of error in healthcare and are taking initial steps to move towards hrO status.

One component required for any organisation to become highly reliable is staff training in the psychology of error.

We have argued for many years that there is no need to re-invent the wheel [reynard 2006] in this regard. Tried and tested training techniques for pilots and train drivers in the psychology of error as a means of reducing mistakes in those domains are equally applicable to healthcare.

although the scale of training required is probably greater in the healthcare setting, because there are many more healthcare workers relative to patients than there are air and cabin crew to flying passengers, the types of errors committed by pilots and train drivers share a remarkable similarity to those committed by doctors and nurses.

The reason of course is simple –we are all human and we share the same psychology, a psychology which at times makes us prone to error.

Next month: The hRo approach to error reduction and the development of a safety culture

John Reynard, Tim Kane, and Peter Stevenson are co-founders of Practical Patient Safety Solutions

see their biographies overleaf

John Reynard (left) is a consultant urological surgeon and honorary senior lecturer in the Nuffield Department of Surgical Sciences at the Univer sity of Oxford. He is an honorary consultant urologist to The National Spinal Injuries Centre at Stoke Mandeville Hospital. He holds a masters degree in Medical Law and Ethics.

Peter Stevenson (left) has been an airline pilot and human factors instructor for more than 30 years. He flies Airbus A330 airliners on intercontinental routes for a major UK airline.

Tim Kane (left) is a consultant trauma and orthopaedic surgeon at Spire Portsmouth Hospital and the city’s Queen Alexandra Hospital

References

Ivan Illich, Limits of Medicine. Medical nemesis: the expropriation of health. Pelican Books, London

Brennan TA, Leape LL, Laird NM et al. Incidence of adverse events and negligence in hospitalized patients: results of the Harvard Medical Practice Study I. NEJM 1991;324:370-7

Leape LL, Brennan TA, Laird NM et al. The nature of adverse events in hospitalized patients: results of the Harvard Medical Practice Study II. NEJM 1991;324:377-84

Leape LL. Institute of Medicine medical error figures are not exaggerated. JAMA 2000;284:95-97

Semmelweiss I. The Etiology, the Concept and the Prophylaxis of Puerperal Fever, 1860

Kohn L, Corrigan J, Donaldson ME. Institute of Medicine report: To Err is Human. Building a Safer Health System, 1999, National Academy Press, Washington DC, p1

Incidence and Types of Adverse Events and Negligent Care in Utah and Colorado. Med Care 2000

Gawande A, Thomas EJ, Zinner MJ et al. The incidence and nature of surgical adverse events in Utah and Colorado in 1992. Surgery 1999;126:66-75

Institute of Medicine (IOM) report, To Err is Human Building a Safer Health System 1999 www.nap.edu/catalog/9728.html

Centers for Disease Control and Prevention (National Center for Health Statistics). Births and Deaths: Preliminary Data for 1998. National Vital Statistics Reports. 47(25):6, 1999

Robinson AR, Hohmann KB, Rifkin JI et al. Physician and public opinions on quality of health care and the problem of medical errors. Archives of Internal Medicine 2002;162:2186-90

Wilson RM, Runciman WB, Gibberd RW, et al. The Quality in Australia Health Care Study. Med J Aust 1995;163:458-76

Vincent C, Neale G, Woloshynowych M. Adverse events in British hospitals: preliminary retrospective record review. BMJ 2001;322:517-9

Davis P, Lay-Yee R, Schug S, et al. Adverse events regional feasibility study: indicative findings. NZ Med J 2001; 114:203-5

Davis P, Lay-Yee R, Schug S, et al. Adverse events regional feasibility study: methodological results. NZ Med J 2001;114:200-2

Schioler T, Lipczal H, Pedersen BL et al. Danish adverse events study: Incidence of adverse events in hospitals. A retrospective study of medical records. Ugeskr Laeger 2001;163:1585-86

Michel P, Quenon JL, de Sarasqueta AM, et al. Comparison of three methods for estimating rates of adverse events and rates of preventable adverse events in acute care hospitals. BMJ 2004;328:199-200

Baker GR, Norton PG, Flintoff V et al. The Canadian adverse events study: the incidence of adverse events among hospital patients in Canada. Canadian Medical Association Journal 2004;170:1678-86

Department of Health (DoH). An organisation with a memory: learning from adverse events in the NHS. The Stationary Office, London 2000

Landrigan CP, Parry GJ, Bones CB et al Temporal Trends in Rates of Patient Harm Resulting from Medical Care. NEJM 2010;363:2124-34

Reynard J, Reynolds J, Stevenson P. Practical Patient Safety, Oxford Uni Press, 2006

Heed these memos from Garry Chapman (below) to make your billing more efficient –and your bank account healthier

Garry Chapman is executive chairman of Medical Billing and Collection

Competition among independent practitioners and private practices can be fierce, so making a good first impression with customers is vital. Stephanie Vaughan-Jones discusses how you can do just that

According to research, a mere seven seconds is all we have to win someone over when we first meet them.

it’s a small but magical window in which we can make a fantastic first impression. i n business terms, this means we have to be the best possible version of ourselves at all times.

i was reminded of the importance of this when i heard two friends talk about their recent experiences with private healthcare practices.

one created a brilliant impression and the other – well, it wasn’t quite so brilliant.

the first of these happened at a private clinic a few months ago. From the minute my friend walked through their front door, she was bowled over.

t he reception area was calm and tranquil, the staff were warm and caring and, within minutes of arriving, she was shown to a comfortable waiting area and offered a fresh cup of coffee.

t he whole experience was seamless and she left feeling like she was their most important patient, not just a visitor.

But the second encounter shared by another friend was very different. Arriving at the practice, she couldn’t see a sign for the main entrance, so rang the reception phone number to ask for directions.

t he person who answered, though, sounded less than happy to help and her abrupt instruc -

➱ p26

tions left my friend feeling like a nuisance. t he waiting area did nothing to improve matters either, with phones constantly ringing and bright lights creating a busy and slightly hectic atmosphere. the contrast in these two experiences couldn’t have been starker. Yet they are both private practices that would be competing for the same clients. And if i was a prospective patient, i certainly know which one i’d have chosen to use. So, how can healthcare practices make an unforgettable first impression? Here are ten simple things every practice can do.

1 the quest for making a fantastic first impression and offering excellent customer service starts with hiring the right people

When we choose our receptionists, we do so based on attitude, not just aptitude and we handpick each one to work with our healthcare clients. Why?

We’ve learned that a positive, can-do approach, a desire to provide amazing service and the right personality is far more important than a dazzling cV when it comes to recruiting staff. take time to explain why customer service and first impressions are so important to your team too. We consistently tell our receptionists how important they are to the success of our company, and how much we value the wonderful job that they do. recognition is essential. As well as making your team happy, it will boost productivity and motivate them to do a fantastic job.

2

At Moneypenny we talk about being a ‘GOFI’: a god/ goddess of first impressions it’s the term we use to describe the impression we want to create every time we answer the phone or a live chat inquiry. Why? We know that first impressions can be make or break when it comes to winning a prospective client.

our mystery shop of 300 businesses found that customers who were greeted with a curt ‘hello’, for example, thought the business was unprofessional, off-putting and even rude. that’s three adjectives that no private practice or clinic wants to be associated with. And, over the phone, this can be especially important, according to

the UK c ustomer Satis faction index 2018, which found the way calls were handled was one of the key differentiating factors between the top businesses and their competition.

3