INDEPENDENT PRACTITIONER

THE BUSINESS MAGAZINE FOR DOCTORS WITH A PRIVATE PRACTICE

In this 60-page issue

No avoiding defence costs

A grip on staff illness

What can doctors do to manage sickness absence at their practice?

What can doctors do to manage sickness absence at their practice?

By Robin Stride

Ambitious plans to enable hundreds of consultants to see and treat their private patients in The Shard have been unveiled by HCA International.

The hospital group has applied for planning permission to relocate outpatient services from the neighbouring London Bridge Hospital onto three floors of the 1,016 foot ‘vertical city’ now dominating the capital’s skyline.

If approved, the multi-million pound development – covering 70,000 square feet on the fourth, fifth and sixth floors of Europe’s tallest and most iconic building –would be an international beacon for the private hospital sector.

Hospital chief executive John Reay told Independent Practitioner Today the decision to apply to develop The Shard was hugely influenced by customer demand.

He said: ‘There has been growing pressure on us to provide new and additional ultra-modern facilities for people living and working in the area. And if we get the goahead from the planners, we will also be able to expand our inpatient facilities at London Bridge Hospital itself.’

The outpatient centre, which would have a dedicated entrance, would represent the biggest expansion of any private hospital in London for many years.

It is envisaged there would ini tially be 80-100 consulting rooms for use by around 300 consultants from a wide range of specialties. They would have access to a huge range of state-of-the-art diagnos tic equipment and minor ill ness treatment rooms.

London Bridge Hospital, with 140 beds, is thought to have the highest number of MRI scanners of any in the UK. It has invested extensively in diagnostic treatment technology and has seen doubledigit revenue growth over the last decade.

An ambitious move to The Shard would release con siderable space for it to work with consult ants to expand the unit as a

centre of excellence for cardiac care, where there is demand for increasingly complex medical procedures. A planners’ goahead would also bring a boost to other specialties and free up room for 26 new inpatient rooms plus 30 new day patient beds. HCA declined to elaborate on the potential cost of the project other than to say it would be ‘very considerable – in the region of many millions’.

But HCA International president Michael Neeb is on record as saying the group has earmarked another £300m for development over the next two to three years. The London Bridge project, considered by some observers to be valued in the order of £60m, would represent a large chunk of that.

For the last five years, HCA has taken no profit out of its UK ventures, putting 100% back into investment. In the last three years, it has already spent £150m. It said 30% of its income was from abroad and increasing.

A spokesman said: ‘The facilities would be out of this world – one of the most dramatic and cheerful medical places to work in Europe.’

Units from other HCA hospitals could also have a presence in the complex along with new specialties.

The Shard is ideally placed to benefit from the area’s international transport hub status, which will see an estimated 54m people passing annually through the recently redeveloped London Bridge Station.

Towering above the London Bridge Quarter, The Shard so far comprises offices, three world-class restaurants, the five-star Shangri-La Hotel, exclusive apartments and a public viewing gallery.

Its website describes it as ‘a timeless reminder of the power of imagination to inspire change’.

December 2013-January 2014

www.independent-practitioner-today.co.uk

your bright ideas need protecting advice to doctors on how to get a patent to shield their ideas from plagiarism P14

your practice in the clouds

Graphic designer jonathan anstee reveals the principles of good website design P26

open up to new ways of reaching you Don’t just rely on old referral routes; open up to the magic of multiple doorways P32

Pressure on billing continue to build Big changes have affected doctors’ billing in recent years; what of the future? P42

don’t be bedazzled by lump sums planning to spend your pension lump sum may be exciting, but be very careful P46

solving your ethical dilemmas our medico-legal experts answers your questions about CCtV and abortions P50

Plus our regular columns starting a private practice planning ahead for tax P52 Doctor on the road Volkswagen Golf Gti P54 Profits Focus: ophthalmologists

ediTorial commenT

It’s certainly no time for ostriches in the costly and ever more complex realm of medical defence – as our feature on page 36 makes clear.

Keeping your head down makes sense to many in private practice, but as we enter 2014, there awaits an army of big issues facing private doctors.

And each one – there is no room here to name them all –demands doctors very much keep their heads up and watch carefully.

The Competition Commission inquiry will have a huge impact. We face a fastchanging landscape. Maintaining and

improving profitability will be a major challenge for many.

Then there are massive income implications from a raft of pension issues to deal with, changing requirements from HMRC and other bodies, and revised NHS contract considerations. If you are also an employer, then a raft of staff employment issues awaits too.

And you still have the main job to do! So we will do our best in the year ahead, as ever, to be your eyes and ears, alerting you to what is coming and providing expert advice to deal with it. Thank you for all your support in 2013.

Tell us your news Editorial director Robin Stride at robin@ip-today.co.uk

Phone: 07909 997340 @robinstride

To adverTise Contact advertising manager Margaret Floate at margifloate@btinternet.com Phone: 01483 824094

To subscribe lisa@marketingcentre.co.uk Phone 01752 312140

Publisher: Gillian Nineham at gill@ip-today.co.uk Phone: 07767 353897

Head of design: Jonathan Anstee chief sub-editor: Vincent Dawe Circulation figures verified by the Audit Bureau of Circulations

by leslie berry

Large numbers of senior doctors have started the New Year still unprepared for potentially massive cash hits due to the pension tax changes coming into force in April, warn financial planning experts.

Following a series of eleventhhour seminars with independent practitioners, specialist advisers revealed that many could face extra tax charges on their pension savings amounting to tens or even hundreds of thousands of pounds.

Experts from Cavendish Medical have been holding teachins to help doctors understand the severity of the Government’s changes.

They told Independent Practitioner Today that during the sessions, many doctors revealed they did not realise the extent of the issue or the potentially huge impact on their own retirement funds.

Cavendish Medical chairman Dr Mark Martin said: ‘Many of the doctors we spoke to have read the news reports about these changes but either haven’t had the time to act or don’t think the figures apply to them. They are shocked when we spell things out.’

To recap, the lifetime allowance for taxfree pension savings will fall from £1.5m to £1.25m.

Many high achieving doctors will be affected by this rate change. If they exceed it, then it could hit them with a 55% tax charge.

Both their NHS pension and any accumulated private pensions will be tested against this limit.

To increase the agony, at the same time, the annual allowance for taxrelievable pension contributions will drop from £50,000 to £40,000.

As reported in Independent Practitioner Today last October, many doctors have received notices for inadvertently exceeding the annual allowance when it fell from £255,000 to £50,000 in 2012.

But the fear is that many more could now be caught out by the next cut in April.

Dr Martin continued: ‘The bottom line is that if you breach one of these limits, you will be looking at a harsh tax penalty.

‘We are trying to help people now while they still have options available to minimise their liabilities. Unfortunately, there is little we can do after the event.’

He advised doctors to check their tax position without delay.

Advisers at the Medical and Dental Defence Union of Scotland (MDDUS) have revealed a 400% rise between 2010 and 2012 in doctors seeking guidance on the use of social media sites such as Facebook and Twitter.

Medical adviser Dr Naeem Nazem said: ‘Patients interacting with their doctors on social media may inadvertently create an uncomfortable and awkward situation.

‘It also risks blurring the boundaries in the doctor patient relationship, which could impact on the quality of care they receive.

‘Doctors must keep their relationship with patients professional or they risk becoming too close, which can cloud their judgement and affect their objectivity and clinical decisionmaking.’

Doctors on Twitter – see pages 18 to 24

by a staff reporter

King Edward VII’s Hospital Sister Agnes has got off to a very happy new year after being given an early Christmas present – its biggest ever gift, worth up to £30m.

Delighted bosses said they would use the money for expansion. Now they are working on plans to grow the facility by more than 25%.

Consultants are being promised additional facilities including operating theatres, extra wards and consulting rooms.

One possibility being pursued is to build a tunnel to link the hospital with new premises opposite at Macintosh House, Beaumont Street, Marylebone.

King Edward VII’s massive financial boost comes from The Michael Uren Foundation, which aims to advance any charitable purpose as the trustees at their discretion think fit.

The benefactor has given £5m to the hospital and said it was committed to providing such help and support as needed up to a maximum of £30m in the next decade.

Governors’ chairman Robin Broadhurst said: ‘This is the most generous gift the hospital has ever received. We are all extremely grateful to the Michael Uren Foundation for securing the longterm and independent future of the hospital.’

Michael Uren, chairman of the Michael Uren Foundation, said: ‘King Edward VII’s Hospital is very dear to my heart and I wanted to do all I could to ensure it has a long, successful and independent future. I hope this gift will secure that outcome.’

What’s a doctor worth? is the banner title of a programme of BMA events planned this year to engage consultants in discussions that could feed into a new contract for their NHS work.

Delivered in partnership with research company BritainThinks, the programme taking place in England and Northern Ireland aims to use the latest technology to draw out doctors’ views and ideas.

The events are part of a campaign, also using online resources

and discussion forums, to keep doctors informed and involved in the consultant contract negotiations now underway and the wider issues affecting their working lives.

BMA’s Consultants Committee chair Dr Paul Flynn said: ‘The NHS is facing a number of pressures, from rising patient demand and an ageing population to the increased costs of new technology and the impact of Government cuts.

‘These challenges are driving massive shifts in health care and changing doctors’ working lives. In meeting them, we must ensure the results are good for patients and fair to doctors, and by engaging in this way, we can ensure that we hear firsthand the experiences of doctors on the ground.’

Negotiations do not apply to consultants in Scotland and Wales. Doctors’ leaders there think a UKwide approach is not in consultants’ best interests.

King Edward VII’s Hospital, Sister Agnes’s boss John Lofthouse is leaving at the end of next month to start a new job in March as hospital director of the Leeds Nuffield Hospital.

He told Independent Practitioner Today: ‘I will be sad to leave here, as it is a truly exceptional hospital, now in good shape for the future with the £30m gift having been agreed (see story to the right).

‘However, I have spent the last five years – nearly – travelling up and down every weekend from my home in the north and the offer to manage Nuffield’s largest hospital, in commuting distance from home, proved very attractive.’

The hospital paid tribute to the ‘extraordinarily good job’ he had done and said he had guided it through ‘huge challenges’ following the well publicised tragic suicide of a nurse who took a hoax call about the Duchess of Cambridge in December 2012.

Clearer pricing is set to benefit patients in 2014, according to Fiona Booth, chief executive of the Association of Independent Healthcare Organisations (AIHO). Answering criticism about wrong invoices being sent by private units, she told Independent Practi tioner Today: ‘All independent providers work hard to ensure that invoice charges are accurate and clearly laid out. Where mistakes occur, they should act swiftly to update invoices and charge accurately.

‘Through transparent pricing, as published on providers’ websites, it is becoming easier for patients to understand the fees that apply for different services.

‘We anticipate that this transparency will be adopted by a broader range of providers, and across more treatments, in the future.’

Treatment sourcing specialists Medical Care Direct (MCD) had voiced concern about the number of wrong invoices being received

from private hospitals or clinics, with either overcharging or erroneous charges being most common.

Chairman Jan Lawson said: ‘We have been tracking this in detail for the last three months. During August, 11% of invoices received were wrong; in September it was 15% and October 14%.

‘Most of these relate to fixedprice procedures rather than normal itemised bills, so you would think that the scope for error is small. But they are totalling over

£20,000 each month – a significant sum.

‘Our worry is if we as experts in treatment sourcing are experiencing these error rates, what hope is there for an individual who arranges their treatment directly.’

She claimed her firm’s experience suggested there was a good probability of people being charged more than expected and/or getting a confusing bundle of bills.

See Fiona Booth’s vision of AIHO’s future, p12

By Leslie Berry

Doctors’ employment law advisers are drawing attention to changes from April 2015 when parents will be able to share the statutory maternity leave and pay currently only available to mothers.

New mums will have to use the first two weeks after birth but could transfer the remaining time off to their partner. So dads can tell employers they potentially

want as much as 50 weeks off work.

Parents could alternatively each take 25 weeks to run concurrently – taking the leave in turns, in different blocks, or at the same time.

Chris Inson, a partner at commercial law firm Capital Law, warned that private practice managers should be ready to ask relevant questions and assess how the changes could affect their business. They would need to know how they would manage patients’

All independent practitioners who have set up their business as a limited liability company are being advised to look carefully at new antitax avoidance legislation in the wake of The Chan cellor’s Autumn Statement.

Medical accountant

Susan Hutter, a partner with Shelley Stock Hutter, said doctors would need to find out if it was still tax efficient for them to have a corporate structure.

Today: ‘This will be particularly relevant where partnerships have been established which have limited company partners.

expectations and how they would ensure they had adequate cover for absent staff.

He said: ‘Many people have criticised the new laws as bringing an unnecessary level of complication to an already complex scenario. However, it is my belief that if communication lines are kept open between employers and employees, administrative headaches can be avoided and all parties could potentially benefit from

the new flexible parental leave arrangements.’

The overhaul is part of a Government drive to refute assumptions that women should stay at home to look after children.

Deputy Prime Minister and fatherofthree Mr Nick Clegg said the change was long overdue: ‘Women deserve the right to pursue their goals and not feel they have to choose between having a successful career or having a baby.’

Interest in facial rejuvenation has risen by 23% in the past 12 months, according to healthcare search engine WhatClinic.com

gical treatments are worth 75% of this market.

She told Independent Practitioner

‘This will be fertile ground for HMRC because of the disparity between corporate tax rates at 20% and income tax rates which could be as high as 45% – so even the most innocent commercial structures could be perceived to be tax avoidance, which is extremely worrying.’

Inquiries into laser skin tightening have gone up by 78% in the last year, while the average treatment price has dropped by almost a fifth (18%) during the same period.

Laser skin resurfacing has seen an increase of 70% over the same period with a 34% rise in the average price of treatments.

The value of the UK cosmetic surgery market in the UK is estimated to rise to £3.6bn by 2015, while it is estimated that nonsur

According to WhatClinic.com, pricing for facial rejuvenation laser treatment can start from £131 for laser skin tightening up to a £3,780 for four sessions of laser skin resurfacing at one Londonbased clinic.

Its CEO Caelen King is urging patients to research their practitioner and not be swayed by special offers or timesensitive pricing. She said a good question to ask practitioners was how many patients they had performed a treatment on and how often they did the treatment.

The Information Commissioner’s Office (ICO) is warning doctor employers about the importance of making sure temporary staff who regularly handle personal information receive adequate data protection training.

It said the problem was highlighted following four data breaches at the Great Ormond Street Hospital for Children NHS Trust. All occurred between 28

January 2012 and 18 June 2013 and were caused by letters being sent to the wrong address. The letters included information about the treatment of five patients.

The ICO’s investigation found that three of the incidents related to the work of temporary staff who had not received adequate data protection training, despite their role involving the handling of personal information. The trust also

had no measures to check whether letters were being addressed to the correct recipient before sending.

ICO enforcement group manager Sally Anne Poole said: ‘This time of year often coincides with a rise in the number of temporary workers being employed across the UK. However, the temporary nature of their employment doesn’t absolve employers of their legal responsibilities for making

sure people’s information is being looked after correctly.

‘If organisations are employing temporary or agency workers into positions that involve the handling and sending out of personal information, then they must make sure these staff have received adequate data protection training.’ Great Ormond Street was required to sign an undertaking with the ICO to improve its practices.

Three specialists have got together to transform an old railway station house into private medical consulting rooms in a prime spot on a major route to Belfast. Consultants Mr Sean McGovern (emergency medicine), Dr Brian Mangan (psychiatry) and Mr Niall Eames (spinal surgery) realised the building’s potential for them as Musgrave House Associates when it came on the market in 2012. Their centre boasts modern conference facilities, described as ‘excellent’ by Dr Martin Shields, director of postgraduate medical education in Northern Ireland. A wide range of courses are planned.

Mr McGovern told Independent Practitioner Today: ‘The vision was of a quality private medical facility for consultants and patients

offering state of the art medical consulting rooms with office facilities for medical secretaries in a building which could also accommodate educational facilities.’

Dr Mangan called it ‘a great site’ for patients and consultants because it was close to the main northsouth railway line, Belfast City George Best airport, the motorway and bus routes.

Mr McGovern said it had been a huge undertaking, but they were very proud of the finished article.

He added: ‘The house offers a beautiful reception area with modern fully equipped consulting rooms and offices upstairs for consultants to house secretarial staff. Disabled access and parking is excellent with on site parking for staff and patients as well.’

Prof Roger Williams, consultant physician and joint clinical director of The London Clinic Liver Centre, has been awarded the ‘Distinguished Achievement Award’ by the American Association of Liver Diseases. His career in hepatology began in 1959 when he was appointed as

Lecturer in Medicine at the Royal Free Hospital by the late Prof Dame Sheila Sherlock. He worked at King’s College London from 1966 to 1996, where he established the Institute of Liver Studies and served as its first director. In 1968, he was involved in the UK’s first liver transplant.

By Robin Stride

Independent practitioners claim Care Quality Commission (CQC) plans for registration fee increases are unfair compared to proposed charges for colleagues in the NHS.

The Independent Doctors Federation (IDF) says although the watchdog claims to be fair and consistent and to promote equality, there is ‘clear financial bias and discrimination against doctors working outside the NHS’.

According to the group, whose membership has just broken 1,200, it has seen no evidence to support differential fee structures.

The IDF noted that, taking into account the current charges and a proposed 2.5% fee increase across all providers, the fee structure is disproportionally geared against independent medical providers.

It said: ‘We have noted that as from 2014, the proposed fee for an independent medical provider at one location will be £1,540 compared with £565 for an NHS GP practice in one location with up to 5,000 patients.’

The IDF objections, in a formal

response to the CQC’s fees consultation document, are:

NHS GPs are independent contractors who provide services to the NHS. They are no different to independent doctors in nonNHS practices;

NHS practices are larger and more complex than non NHS practices, so will be more expensive to inspect and regulate. The IDF does not accept that the CQC does not yet know if it will cost more or take longer to inspect a larger establishment;

Most independent medical practices are not dissimilar to dental practices – they are generally in one location and may or may not grant practising privileges compared to the dental provider with a number of chairs. Yet dental practices are charged far less.

A CQC spokesman told Independent Practitioner Today: ‘We are encouraging as many people to put their views as possible. We try our best to listen to comments that come in and where possible modify our approaches.’

The CQC’s verdict is expected in March.

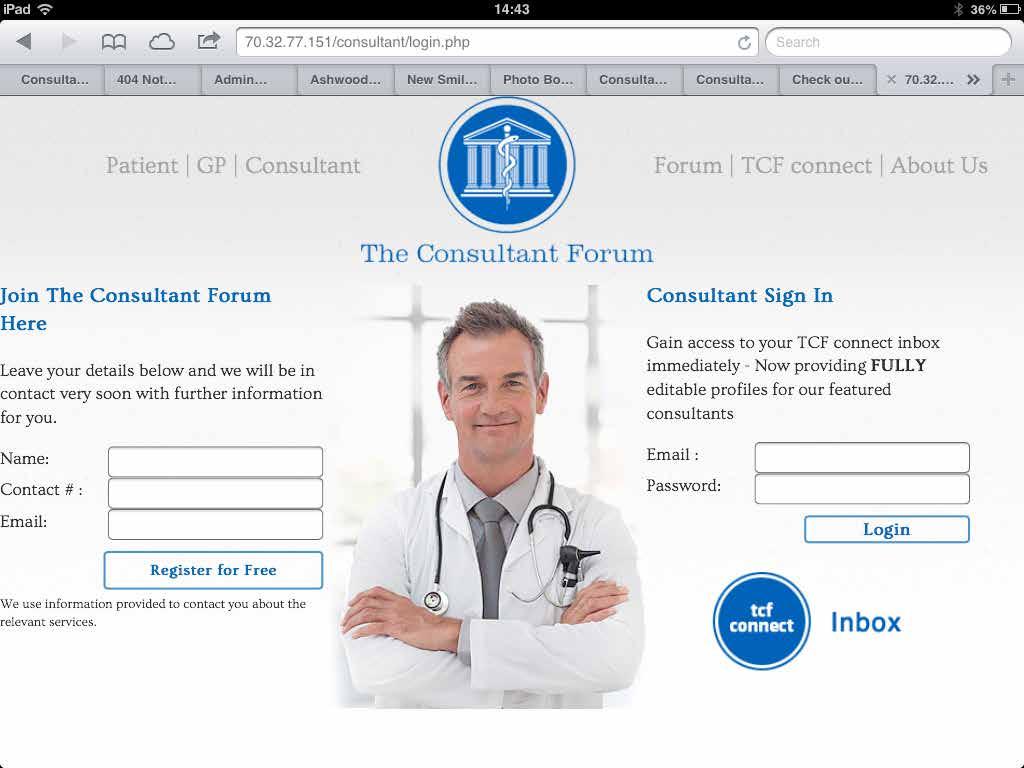

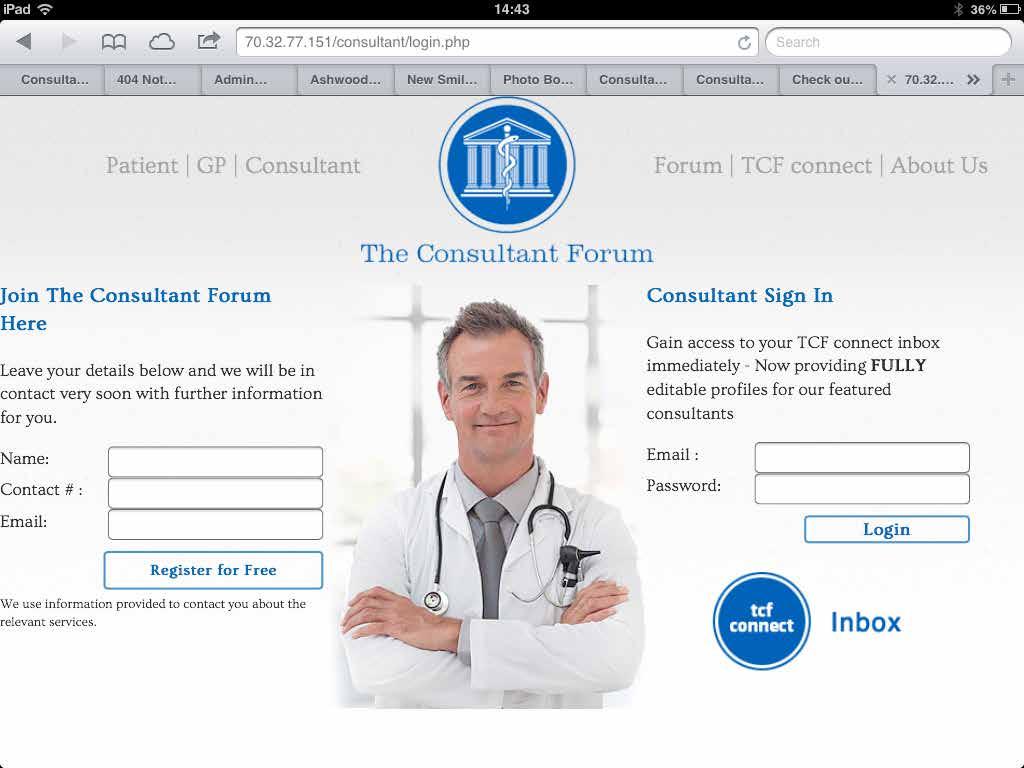

A new website being launched as we went to press – www.theconsultantforum.co.uk – is offering registration and a basic listing free of charge to all UKbased consultants working privately.

Director Gillian Zahir told Independent Practitioner Today the online directory would give consultants an independent platform to publish their private practice details for patients and GPs.

By Robin Stride

Consultants starting in private practice, or considering it, have been promised a new series of seminars in 2014 to help them make the most of their business.

The Medical Defence Union pledged to continue giving independent practitioners support following the success of a conference featuring wide-ranging advice from orthopaedic surgeon Mr Rob Ashford.

In a ‘warts ’n’ all’ talk, he pinpointed a number of reasons why doctors might decide against becoming independent practitioners. He said private practice could mean hassle on a number of fronts and, with so much pressure on their time, they might want to spend more with a young family.

Another big consideration now was the ongoing Competition Commission investigation into private healthcare, which was likely to result in huge changes for consultants and private hospitals.

Mr Ashford told the MDU ‘Setting Up In Private Practice’ seminar, organised in association with Healthcare Performance Ltd: ‘There are likely to be huge implications with this. If you haven’t established a private practice, it’s something worth keeping a close eye on.’

But there were good reasons to enter private practice too, as well

as income generation. Practitioners could benefit from different surroundings, new challenges and meeting different people. And everything was less rushed. Everyone else around them might be doing it and there could be pressure to go private from patients too.

His advice for those taking the plunge was to ensure there was a clear difference between their

NHS and private work. And he believed this extended to secretaries: ‘If you use the same secretary and the same environment, you are likely to run into trouble.’.

Mr Ashford, who practises in Leicester, said getting theatre time could be difficult, particularly at the beginning. He advised that with patients having access to more information in future, then

the independent practitioner’s choice of secretarial support is one of their most important decisions, said Mr Ashford. ‘the success of your business is down to them as well as you.’

Billing can be very stressful. it is complex, time-consuming and better done by somebody else – but not your private hospital.

check what your private hospitals and other promoters of your profile are actually saying about you on their websites. ‘Strange things’ can happen.

Have at least one website page saying who you are and where you are. ‘these days, you should probably put your fees on it.’

Do be nice to people behind the scenes in your private hospital, such as bookings. if you are not, then don’t expect those patients who are looking for a particular specialty doctor to be sent in your direction.

if you are doing GP visits or seminars, then find out first what it is they want to know about.

Be flexible on patients’ availability times. For example, be prepared to see just one patient in the evening if they cannot do it another time.

if you employ people, then be sure to keep everything above board.

it may be difficult to get operating time when you start out, but if you bring in work, then hospitals will want to give you better slots.

Get accountancy advice before you start. Ask colleagues whom they use. you need somebody with medical experience.

the outcomes of the work would be more important.

Doctors should identify their strengths and market them, but they should always remember they were now running a business and if they did not grasp that, then they would struggle. Billing properly was vital or they would not get paid.

As well as the well-known personal attributes of affability, ability and availability, independent practitioners now needed adaptability. But Mr Ashford, who has been in private practice for six years, warned doctors to stick to what they knew and not to be tempted to take on work they did not do in the health service.

If something went wrong, they would get ‘crucified’ by lawyers and colleagues, and lose goodwill. It was wise to take a considered approach to advice from colleagues and patients. Doctors would respect the consultant who sent someone on for treatment by a colleague. Consultants might even reciprocate.

He said doctors should make sure they were seen to be open and honest about their private work by putting it in their NHS job plan, even if it was an evening commitment.

And they would need to ensure they had got cover for their patients when they were going away.

A new 30-bed hospital opened by Nuffield Health in Bristol says it will be a centre of excellence for minimally invasive keyhole surgery and the first fully digital hospital in the South-west.

Opened on the former Chesterfield site in Clifton Village, the hospital represents a £20m investment, has created 50 new jobs and offers three digital operating theatres plus a diagnostic centre including MRI, CT,

digital mammography and high-definition endoscopy.

Treatments on offer include orthopaedics, neurospinal surgery, sports injury, weight loss surgery, endoscopy, cosmetic surgery, ENT, urology, pain management and dentistry.

The Grade II listed Georgian villa which fronts the hospital site was home to Nuffield Health’s first hospital in Bristol from 1961.

BMI Beardwood Hospital, Blackburn, hit a high note when singer and actress Linda Nolan – part of the sibling girl group The Nolans – brought some sparkle to the launch of its new MRI and CT scanning centre.

The scanners are part of the hospital’s £2.3m scheme to revamp its imaging and diagnostic centre and reduce diagnosis and treatment times.

Hospital bosses said the investment at the new imaging centre was made possible through a joint partnership with Alliance Medical. Executive director Sam Sheehan said: ‘The investment being made at the hospital will improve the patient pathway, speeding up the time between consultation, scan and diagnosis.’

David Loasby, business development director at Alliance Medical, said the company was delighted to be working with BMI The Beardwood Hospital to bring a much needed service to Lancashire and Cumbria.

‘Patients needing vital cardiac scans will no longer have to travel outside the area for a diagnosis, so it really helps in caring for the community,’ he said.

By Robin Stride

An independent practitioner has confessed surprise that she must conform to National Minimum Wage policies if she employs staff.

She told an MDU ‘Setting up in private practice’ seminar she thought she could pay what she wanted because, after all, she was the boss.

But advisers and other doctors at the meeting informed her that she would have to comply with the National Minimum Wage rules.

The misunderstanding surfaced as HM Revenue and Customs warned of tough action against employers following the cases of 2,400 care sector workers who are in line for nearly £340,000 in back-pay as a result of tax probes.

In the last two years, HMRC has investigated 224 employers in the sector. Some investigations are ongoing, but 88 cases have been found to be non-compliant.

These investigations identified nearly £340,000 in arrears for more than 2,400 workers and also over £110,000 in penalties to employers for breaking the law.

Employment Relations Minister Jo Swinson said: ‘Anyone entitled to the National Minimum Wage should receive it. Paying anything less than this is illegal and unacceptable. Government will take tough action on employers who break the law, as we can see through HMRC’s investigation into the care sector.

‘As well as financial penalties, employers who don’t play by the rules can be publically named and shamed and may even be prosecuted.’

Richard Summersgill, director for local compliance at HMRC, said: ‘Our investigations found that the reasons for not paying the legal wage varied from unpaid working time spent training or travelling between care appointments to making deductions from workers’ pay that brought their pay below the minimum wage.’

On 1 October 2013, the adult minimum wage rate increased by 12p to £6.31 an hour and for 18to 20-year-olds it rose by 5p to £5.03 an hour.

www.gov.uk/national-minimum-wage-rates

Radium-233 dichloride, a new radiotherapy treatment that treats the later stages of prostate cancer, is now available at The London Clinic.

Ashley Richmond, chief medical physicist at the hospital, said: ‘The demand for this treatment will be huge, due to the fact this is the first time a drug has offered the possibility of prolonged life expectancy for patients with such developed cancer, as opposed to the pain relief drugs currently on offer.’

Consultant oncologist Dr Stephen Mangar said improvement in the overall survival and quality of life with little side-effects, combined with the drug’s ease of administration, meant the treatment would be an attractive option for those chosing not to, or unable to have, systemic chemotherapy.

‘I believe this treatment will make a significant difference to the lives of many patients with prostate cancer and will form a valuable addition in the treatments and techniques available to medical staff at The London Clinic,’ he said.

BMI The Blackheath Hospital is spending £3.8m on modernising its theatre department and upgrading critical care provision.

It said the two-phase upgrade would improve facilities for consultants and clinical teams, while also increasing the level of complex care and procedures available to patients.

Phase one will deliver a new theatre department with a six-bed recovery unit, nursing station and upgrades to the hospital’s three theatres.

The development will also improve the theatre department’s staff areas, including offices,

changing rooms, corridors and a rest room. The infrastructure and support for the air handling units, which filter air coming into the operating theatres, and the medical

gas infrastructure will be upgraded. Two specialist orthopaedic theatres, which have air supplied through an ultra-clean ventilation system, will also be improved.

Accountant Susan Hutter shows how bigger private practices can ensure their ‘back-office’ procedures cope with the new methods of doing business

The working life of a specialist has changed over the last five years and many more are now working as part of a team and running fully fledged businesses.

Some have also broadened the scope of their business to include complementary therapists and online shops.

Are standard procedures in place?

if your administrative procedures are not keeping pace with the growth in the business, then you are likely to encounter serious problems, particularly in the areas of ‘patient’ service and finances, leading to cash flow issues.

You will need to look at all your standard procedures and update them where necessary. This includes:

Staff structuring;

how you use your professional accountants;

The trading vehicle – for example, should you incorporate or at least trade as a limited liability partnership (LLP);

e nsuring that your practice software keeps up with reporting and accounting requirements;

ensuring that your practice has a robust cash flow.

Don’t cut corners on recruiting your support team

Your in-house team is crucial and it is important to have strong personal assistant/secretarial back up. You may need more than one employee in this category

depending on the size of your business.

You will also need to look at your in-house accounting staff. Depending on the number of transactions that need to be processed, you may need a full-time book-keeper.

if not, you can start with a parttimer, who can attend on a weekly, monthly or quarterly basis. You will also need to ensure that the employees work together as a team to see that invoices are raised correctly – and on a timely basis – and that outstanding money is chased.

All businesses need to take control of their cash flow – and doctors are no exception. Be aware of when the business liabilities are going to arise so that you can manage your cash accordingly.

You do not need to have a complex system for this. Usually, it is sufficient to have a monthly bank reconciliation and then a simple spreadsheet showing the approximate liabilities, together with payment dates over, say the next six months or 12 months.

You will need to plan for such items as:

Corporation tax or personal tax if you trade as an LLP or sole trader;

PAYe on staff and directors’ salaries;

Payment of suppliers and freelancers.

in order to plan the above, you will need to be able to make some estimate of income on a monthly basis. The forecast is usually best based on the previous year, unless your business has expanded or contracted materially since then.

The document should be updated on a monthly basis, when you have more accurate figures.

Keep on top of all money owed to the business

Shortfalls and slow payment can be a problem. You will need to review your agreements with all the main suppliers.

i t is recommended that you have procedures in place regarding your schedule of fees, particularly to ensure that your invoicing is in line with the published schedules, using the correct insurance company’s code for each procedure or operation.

A uniform policy is the best way forward so that all employees are certain of the procedures. This should make debt collection quicker and easier and also ensure that any disputes are dealt with in the most efficient manner.

i f different specialists within the practice have different procedures, this can prove divisive and confusing for staff.

For those private consultants or gPs who still remain in the more ‘traditional mould’, it is still crucial to have good back-office procedures.

You will probably not require

the complexity that is necessary for a larger business, but it is important that you keep up to date and ensure that your accounting procedures and practice software can cope.

You may have a PA who can cope with all the book-keeping. o therwise consider taking on a part-time book-keeper who, once again, can work with your PA to ensure that your practice runs efficiently.

i n many cases, your external accountant can provide advice in this connection and it is worth looking at this to make sure that your practice is running smoothly and the patient-facing side is all you need to worry about.

Susan Hutter (right) is a partner with Shelley Stock Hutter LLP. She provides specialist accounting, taxation and business advice to the medical and healthcare industry

Recording, editing and sending dictation files from your phone

The Olympus Dictation Delivery Service (ODDS)

EFFICIENT Dictate on the go, download, network or email your files back for typing

OPTIMISING Attach photos to your audio files for increased data accuracy

SECURE File encryption for maximum security

EASY Easy-to-use touch screen control for intuitive operation

For further information please email dictation@olympus.co.uk or visit www.olympus.co.uk/voice

Pioneer Prof Graham Hughes is calling for a new screening programme for women who miscarry.

It’s 30 years since Graham Hughes’s ‘eureka moment’: the day he discovered ‘sticky blood’ syndrome – a condition subsequently named after him, the Hughes syndrome.

Prof Graham Hughes, director of the London Lupus Centre at London Bridge Hospital, has helped revolutionise care for lupus patients over three decades, but in this anniversary year, he’s calling for automatic screening for women who miscarry.

Hughes s yndrome, an autoimmune condition which affects the blood and its ability to clot, is now in all the medical text books and if you Google it, you’ll find there’s more than 16,000 articles on the condition.

Prof Hughes, a pioneer in the modern treatment of lupus, set up the country’s first dedicated lupus clinic in 1971 at Hammersmith Hospital and, for many years, he has been recognised as one of the world’s leading authorities on this potentially devastating autoimmune condition.

He practises at the London Lupus Centre, where he works with seven other consultant physicians who all trained with him at s t t homas’ Hospital, and all specialise in lupus.

‘Patients tell us when they come here that they’ve finally reached a place where their condition is understood,’ says the professor. ‘the team have helped transform lupus from a dreaded, often fatal, disease to one where patients can look forward to living a normal life.’

The Hughes syndrome story

Prof Hughes, a consultant rheumatologist, is famous for his discovery of ‘sticky blood syndrome’ in

1983. realising that an overactive immune system produces antiphospholipid antibodies (aPL) which causes the blood to clot too quickly both in the veins and the arteries, Hughes identified a new medical syndrome.

the clotting can affect any vein, artery or organ in the body and the consequences may include potentially fatal conditions such as heart attacks, strokes and deep vein thrombosis (DVt).

In pregnancy, the antibodies can cause miscarriage, preeclampsia, small babies and still birth. a lthough Hughes s yndrome can be present in lupus, it can also exist independently on its own.

‘subsequently, we have discovered Hughes syndrome is probably more common than lupus and it has even wider implications for health,’explains Prof Hughes.

‘For example, oneinfive DVt cases test positive for Hughes syndrome, as do oneinfive cases of stroke in the under 45s, and oneinfive women with recurrent miscarriage.

‘Hughes syndrome is also internationally recognised as the commonest treatable cause of recurrent miscarriage.’

Eureka moment

Prof Hughes had his eureka moment when he was sent out to Jamaica for a year ‘on loan’ from the Hammersmith Hospital in the mid 1970s. With colleagues, he began to investigate female lupus patients, particularly those who had neurological symptoms.

‘It didn’t take us long to focus on Jamaican neuropathy, a devastating spinal cord paralysis affecting young women – the cause of this was subsequently found to be a virus – many of whom were to become wheelchair bound,’ he recalls.

‘We analysed their blood and found they had antibodies to

Thrombosis in a vein in the arm caused by ‘sticky blood’

phospholipids – these are delicate sausage skinlike structures which surround cells and platelets. In normal blood, platelets swim like salmon without touching, as they are negatively charged. But if you have aPL antibodies, the surfaces of platelets are damaged and they become sticky and clot.’

On his return to London, Prof Hughes began investigating more subsets of lupus patients. ‘In no time at all, a very clear picture had built up: this was a distinct syndrome – frequent in lupus and yet distinct from lupus,’ he remembers. In the late autumn of 1983, the team published their research in the British Medical Journal and the Lancet

‘We didn’t get much of a reaction at first – lots of people didn’t believe it,’ says Prof Hughes. ‘But, over the next two years, we published more on the other features of the syndrome, which included recurrent foetal loss, kidney thrombosis, stroke, liver thrombosis, chorea ( s t Vitus’s dance), low platelets, pulmonary hypertension, migraine, epilepsy, heart valve disease and even dementia.

‘In summary, we described a complex bloodclotting syndrome which clearly had the capacity to affect any organ in the body.

‘Just as when the petrol mix in a car is too rich, the car stutters, so in the human body “sticky blood” limits the supply of vital oxygen to any and every organ in the body.’

The human stories

Prof Hughes and his team have won many accolades for their research, including the International League a gainst r heumatism’s prize, but what matters most to him are the patients he has helped with treatment.

Blood platelets: their surfaces are damaged in patients with Hughes Syndrome due to the presence of aPL antibodies

t hey include the paralysed woman in a wheelchair – wrongly believed to have multiple sclerosis – now diagnosed with Hughes syndrome and being treated with the bloodthinning drug warfarin and living a normal life, and the patient who suffered ten miscarriages, but is now the mother of two healthy children. then there’s the teacher whose memory loss was wrongly attributed to depression, who was only

correctly diagnosed after she suffered a stroke – her brain returned to normal when anticoagulant treatment was started.

so what of the future?

Prof Hughes says the care of lupus has been transformed over the last 30 years mainly due to the introduction of newer diagnostic blood tests – ‘a real breakthrough’ – and also the introduction of more effective treatments, includ

ing lower dose steroids with far fewer sideeffects and the newer targeted biologic drugs which attack Bcells.

‘there are many more of these drugs on the way, which is good news,’ Prof Hughes says. ‘For lupus patients, this has made a huge difference; old high dose steroid treatments meant weight gain, infertility and hair loss and other unpleasant side effects. Now they can live normal lives.

‘In the past, women with lupus were advised not to have children – but now, thanks to the discovery of Hughes syndrome and anticoagulant therapies, these women can have healthy babies.

‘We can also help prevent strokes and damage to internal organs and other potentially fatal complications if patients are diagnosed early enough and given the right treatment.

‘the challenge that lies ahead is spreading greater awareness of both lupus and Hughes syndrome – women are still waiting too long for a diagnosis, sometimes more than two years. there’s so much we can do if these patients are diagnosed in the early days.

‘I also think that all women who have suffered a miscarriage should be screened for Hughes syndrome – it could save so much heartache.’

go to www.londonlupuscentre.co.uk If not, please join us for one of our FREE tax and NHS pension seminars.

DATE:

VENUE: TIME:

Tuesday 14 January or Thursday 16 January 2014

Royal Society of Medicine, 1 Wimpole Street, London, W1G 0AE 18:15 for 18:30

To register contact Nena Blake on 020 8457 1812 or email medical@mninsure.com. Places are limited so book early.

Although J A nu A ry is traditionally a month to look forward to the year ahead, we are also spending some time at the Association of Independent healthcare organisations (AIho) reflecting on what we achieved during 2013 and how our work is preparing us for 2014.

As I have been in the role for a year now, it also seems like the right moment to consider what we have achieved together so far, and what we need to do in the coming 12 months.

AIho’s goal is to widen understanding of how independent healthcare providers contribute to improving the nation’s health.

We want to challenge perceptions about independent healthcare and the role it plays in this country.

our membership encompasses a range of independent healthcare institutions, so we have a very broad view of how we can complement the work of the nh S and deliver healthcare for everyone.

We decided to discontinue the use of the ‘Private h ospitals Alliance’ name early in 2013 because we wanted to accurately reflect the breadth of our membership, and we devised the AIho brand as a better replacement.

We also merged with the Independent h ealthcare Advisory Services (IhAS) in April and, as a united organisation, we are now able to represent the industry more fully.

We have been working hard to raise the profile of the independent sector and give it a voice in the media, in g overnment and

across the broader healthcare sector this year. that has involved building up relationships across a variety of outlets and increasing our visibility with stakeholders through our attendance at all three party conferences in the autumn last year.

We are also looking to inform decision makers across the healthcare sector in order to help them understand the contribution that independent healthcare plays. And we intend to continue this profile raising and engagement work into 2014 and beyond.

As part of that work, we plan to have a formal launch event in 2014. We will be inviting a range of stakeholders including government, nhS, commentators, regulators, patient groups, journalists and others who have an interest in the healthcare debate in this country.

We will also substantially redevelop our website to reflect our goals and our membership. We want to become a powerful voice for the sector among these communities, and ensure they understand how our members contribute not only to delivering healthcare, but to the economy more broadly – both in terms of investment and growth.

We also want to showcase some of the excellent research and development work being done by the sector – research which becomes the newest and best treatments for a broad base of patients.

to that end, we are in the initial stages of exploring a partnership with Itn Productions to create an hour long news programme on the independent sector.

As we continue to raise our public profile, we will look to inform opinion in the lead up to the 2015 general election.

We want to make sure the independent sector is represented as the main parties start to prepare their manifestos, and we want to feed into the thinking around healthcare policy for the period of the next government.

We will also continue to engage in issues which we have been working on. We want to continue alleviating pressure on the nhS, especially as the population ages, and diseases such as diabetes become more prevalent.

We can do this both in partnership with the nhS and through private provision, and we want to ensure the public understand our critical role.

to do that, it is crucial that we challenge perceptions about our place in the healthcare system, and ensure that the broader pub lic understand the role that we play in shortening waiting lists and providing high quality, safe care at a cost defined by the nhS.

We will continue to support the sector as the Competition Commission looks to conclude its findings on the private healthcare market come April.

We strongly believe that, through price transparency and the provision of appropriate data, we can help patients make the right choices about their health care.

We will continue our partner ship with the Private healthcare Information n etwork (P h I n ) to raise awareness of the outcomes data being published by the sector as a whole.

2013 was a very busy year at AIho, and we are satisfied with what we achieved.

now we are looking forward to broadening and deepening rela tionships throughout 2014, rais ing the profile of the sector and further engaging in the ongoing debate about care delivery in the future.

Consultants and GPs in private practice are well known for their inventiveness to improve patients’ lives. But how do you take those ideas to the wider world without others claiming your idea is their own? The answer is to get a patent. Kate Lees explains when your invention may – or may not –be patentable

Patents have been around for centuries to encourage innovation and reward inventors.

the grant of a patent provides a monopoly for a limited time period – generally 20 years – in exchange for the publication of details of the invention. t his information is then readily available and can be freely used following expiry of the monopoly.

Despite the fact that patents have always been available in the modern world, they remain a mystery to a large proportion of professionals and the public.

Many inventors – and indeed businesses – have, at most, a brief knowledge of the patent system, placing them in a weak position when it comes to protecting any new or improved products or processes.

been made available to the public by any means anywhere in the world;

Involve an inventive step – is not an obvious modification of what has been done before; Be capable of industrial application.

t he healthcare industry provides a huge source of potentially patentable material, with many doctors and surgeons arriving at an invention after seeking and researching a solution to a problem they have encountered during patient care.

It is important to know what to do in these circumstances to

ensure that their invention is adequately protected. so which inventions are patentable and how do you obtain one?

Are all inventions patentable?

a wide range of inventions are patentable. to be so, the invention must:

Be novel – meaning it has not

Products, such as orthopaedic devices, surgical instruments, dosage regimes and compositions may be patentable, as may improved processes for manufacturing a product, novel uses for a known product, such as a drug, and kits containing several items that may be used together.

But some inventions may fall within one of a number of exclusions from patentability. t he most relevant exclusions to the medical industry are as follows:

➱ p16

Book your place at the UK’s largest medical aesthetics meeting today.

Aesthetics is one of the fastest growing medical sectors in the UK today. Sales of aesthetic treatments totalled £2.3 billion in 2010 and are forecast to rise to £3.6 billion by 2015. However, it is estimated that only 15% of demand is being met.

Designed by leaders in the field of medical aesthetics, The Aesthetic Conference and Exhibition 2014 offers a comprehensive programme combining business and academia addressing the key topics relevant to all professionals interested in the practice of aesthetic medicine.

The two-day event also includes FREE exhibition access, showcasing leading suppliers and service providers, workshops and live demonstrations.

Visit ACE 2014 and find out how your practice can benefit from providing medical aesthetic services.

• Free exhibition entry

• Learn from leading industry experts

• Dedicated Business Track workshop programme

• Gain CPD accredited education (Up to 24 points available)

• Engage in workshops and live demonstrations

• Evening Question Time with a panel of leading experts

8th-9th MARCH 2014

THE BUSINESS DESIGN CENTRE, LONDON

Inventions contrary to ‘ordre public’ or morality;

Plant or animal varieties or essentially biological processes for the production of plants or animals – although this provision does not apply to microbiological processes or the products thereof;

Methods for the treatment of the human or animal body by surgery or therapy and diagnostic methods practised on the human or animal body – although this provision does not apply to products, in particular substances or compositions, for use in any of these methods.

Clearly, these exclusions particularly apply to healthcare inventions. however, while methods of treatment may be excluded, the products for use in these methods are not.

t herefore, what at first sight appears to severely limit an inventor’s ability to obtain a patent in this field is not, in fact, the case. so, while a method for surgically joining two organs together may be excluded, the surgical stapling apparatus for implementing that procedure may be patentable.

interpretation required the boundaries set by the above exclusions require interpretation using available guidelines, directives and case law. It is therefore always appropriate to seek professional advice as to whether a new invention may fall within the exceptions to patentability.

For example, certain subject matter is considered to fall within the ‘contrary to morality’ exception, such as cloning human beings or the use of human embryos for industrial or commercial purposes.

h owever, an element isolated from the human body, such as Dna, may constitute a patentable invention provided that a plausible industrial application is disclosed for that isolated element.

Methods of treatment by surgery have also been interpreted differently over the years. In recent years, the european Patents Office’s enlarged Board of appeal has held that methods which were ‘neither clearly suitable nor potentially suitable for maintaining or restoring the health, the physical integrity, or the physical well-being of human beings or

While methods of medical treatment are excluded from getting a patent, products for use in these methods are not

What at first sight appears to severely limit an inventor’s ability to obtain a patent in this field is not, in fact, the case

animals’ fell outside the legal exclusion. therefore, ‘cosmetic’ surgeries may be patentable. although they may involve a non-intentional physical intervention which may be regarded as a surgical operation, they are not ‘potentially suitable for maintaining or restoring the health, physical integrity, or physical well-being of a person or animal’.

In contrast, methods relating to breast enlargement or nose reconstructions which were meant to restore the physical integrity of the body following, for example, breast cancer or a car accident, were held to be non-patentable.

so the invention may be patentable, what then?

The invention must remain secret until the filing of a patent application if you are to obtain a valid patent

invention into effect and to cover all envisaged variations.

t his will also enhance any searching that is carried out prior to filing to assess the novelty of the invention.

a patent application can be filed in the inventor’s home territory that will provide provisional worldwide protection for a 12month priority period.

the pending application is generally subject to a search and examination procedure over a number of years prior to any patent being granted. If protection is required outside of the inventor’s home territory, it is necessary to submit separate national applications before the expiry of the priority period.

Crucially, the invention must remain secret until the filing of a patent application if you are to obtain a valid patent. s o it is important to seek professional advice early in the development of an invention prior to any public disclosure, including any testing of the device or publication in a trade journal.

a full and frank disclosure should be provided to the professional representative to ensure a patent application contains enough information to put the

Be aware, however, that some regional patent systems exist, such as in europe, and it is possible to file an international application to delay the major expense of filing in numerous separate territories until 30 months from the original filing date.

next time: patent litigation – 10 tips for private doctors

Kate Lees (left), an expert in intellectual property law including medical, chemical and biochemical inventions, is European patent attorney Harrison Clark Rickerbys

To learn more or to subscribe risk-free, visit learn.uptodate.com/UKanswer Or call 1-888-525-1299 (US and Canada) or +1-781-392-2000 (all other countries).

Patients don’t just expect you to have all the right answers. They expect you to have them right now. Fortunately, there’s UpToDate, the only reliable clinical resource that anticipates your questions, then helps you find accurate answers quickly – often in the time it takes to go from one patient to another. Over 700,000 clinicians worldwide rely on UpToDate for FAST clinical answers they trust. Shouldn’t you? Join your colleagues and subscribe to UpToDate risk-free today!

It is vaunted by some as the cheap, easy and effective answer to all our marketing woes, and dismissed by others as a time-wasting, hard-to-measure approach to building patient loyalty. In his series looking at the different media and communications options open to independent practitioners, Steve Bustin turns the spotlight on social media

S O c I al med I a is inescapable these days. Newspapers and broadcasters are regularly referencing Twitter as a news source.

Shop windows exhort us to ‘like’ highstreet brands on social networks. Teenagers are abandoning email in favour of online chat and no performance seems to be ‘live’ until it’s been snapped or videoed and shared online.

Twitter, Facebook and the like are now firmly embedded in people’s lives and are an intrinsic part of the online experience for many people, to a point where if they can’t find you on social media, they’ll assume you don’t exist or you’ve gone out of business.

Not having a social media presence is now akin to saying you don’t have a website, which is unthinkable to any growing business (see feature on page 26).

There are two usual comments I hear from doctors when talking to them about social media. The first is that ‘my patients don’t use it –it’s only for teenagers’.

But did you know that the fastest growing audience group on Facebook is middleaged women? many parents and even grandparents are now using social media to communicate with their teenage and grownup children.

If you think your patients don’t use social media, have you actually asked them? You might be surprised.

The other comment I often hear from practitioners is that ‘it’s just people telling me what they had for breakfast’ and so they see no relevance to their practice marketing strategy.

people open up

There is certainly a lot of ‘noise’ on social media and a very few strange people who insist on discussing and even photographing their latest meal – and imagine the openings that offers if you’re a nutritionist. But the majority of people are using social media to engage; to discuss and to share important aspects of their lives –such as their health – as well as the seemingly trivial.

One of the upsides of this is that it means people are very open on social media, sometimes too much so, which also makes them receptive, and this is where it can be useful to businesses looking to reach new patients.

Having said that, let’s get one thing clear: social media platforms such as Twitter and Facebook are not sales environments. People will ‘unfollow’ you very

quickly if they think they’re being sold to.

Social media platforms such as Twitter and Facebook are not sales environments. People will ‘unfollow’ you very quickly if they think they’re being sold to

Rather than seeing it as one big advert, you should view social media as a space for engaging, sharing and even generosity, not sales messages. Think of it as building a relationship and rapport, just as you do when you have a patient in front of you.

Before you get to the stage of engaging with other users, however, you’ve got to get yourself set up. I strongly suggest you aim to use one or two social networks well, rather than spread yourself too thinly across multiple networks. The most popular and – for most businesses – successful are Facebook and Twitter.

The process of setting up a profile is straightforward: just go to the homepage and simply follow the instructions. But it’s worth taking the time to complete your profile fully, upload an image –ideally a person rather than a logo, as people prefer to connect to other people rather than brands – and find a user name that will be instantly recognisable as you to other users.

Once you’re up and running, however, you’ve got to have something to say – so what can you tweet/post/update about?

The trick is to come up with a good mix of posts that reflects all aspects of your expertise and also your practice and its offerings. Have you just had a great meeting, been to a conference or seen a new product?

Talk about how what you’ve just seen or heard could potentially benefit your patients. Seen something in the paper that you thought was spot on – or vehe➱ p20

“MidexPro thinks like a doctor, not a computer expert”

All you need to run your private practice including document management, diary, clinical data, even test ordering and lab reports from TDL.

From paper billing (incl. VAT) to electronic billing (EDI) to management of bulk purchase contracts.

Grow seamlessly from a small solo practice through to a large group practice, remote access network system.

MidexPro is the cost effective practice management system with support second to none.

Free download of the full working package (30 day limited) from www.midexpro.com or call for a CD.

Try it for yourself with no sales pressure.

“MidexPro has revolutionised our lives; it is just so easy”

0845 505 0369

www.midexpro.com

sales@midexpro.com

mently disagreed with? Post a link to it and ask your followers what they think.

Just got a new qualification, taken on a new practitioner or started offering a new treatment? They’re all good topics for posts –although just as statements, not sales messages – as are comments about relevant TV programmes or celebrities, links to your blog posts or images of you or your practice, but not patients.

The more interesting, varied and relevant your postings are, the quicker you’ll start picking up followers on Twitter or ‘likes’ on Facebook.

Engage – don’t broadcast

One of the most common mistakes is to only ever post links to your blog or only ever plug your latest piece of kit, which comes across as dull and selfobsessed.

The maxim I encourage people to follow is ‘engage – don’t broadcast’, by which I mean you should set out to encourage and foster dialogue with people – whether they’re patients or not – as it’s an opportunity to prove you are (a) an expert and (b) an approachable human being.

The best way to engage is to ask a question. This could be as simple as ‘I’ve just blogged about an important topic – what’s your view?’ or ‘did you see dr X interviewed on This Morning earlier today? What did you think?’ ask people for their top tips on relevant health topics and, if necessary, use this as an opportunity to bust some myths that may come up. Or ask for their questions to you on a certain topic –

How about filming some short videos of you answering some of the frequently asked questions you get from patients?

although avoid getting into a situation where you are dealing with individuals’ problems and basically diagnosing or consulting online.

Keep it general, as this will keep it relevant to the widest number of people and keep you on the right side of any patient confidentiality issues.

On the topic of confidentiality and your responsibilities as a medic using social media, I can’t urge you strongly enough to read the G mc guidelines on http:// tinyurl.com/d3zkwcl and to make sure you follow common sense on what you do and don’t post, especially around sales messages and promotions and information about patients. It should also be needless to say, but alcohol and social media don’t mix.

images and video

a nother way of making your social media presence more engaging is to use ‘rich content’: more than just text and links in your posts. Images and video are popular and regularly and easily shared, so how about filming some short videos of you answering some of the frequently asked questions you get from patients? They don’t need to be huge production numbers; a smartphone is fine initially, and when posted on YouTube – itself now the secondlargest search engine in the world – not only does it give you great content to share on social media, it will help boost your search engine rankings, too. a lot of practitioners tell me they don’t have time to add social

The more interesting, varied and relevant your postings are, the quicker you’ll start picking up followers on Twitter or ‘likes’ on Facebook

Quarter page vertical 137 x93

Facebook pages are driving to your website. a sk new patients how they heard of you and make sure social media is added as an option to new patient forms. don’t, however, get too hungup on numbers of followers or ‘likes’. e ven though your competitor may have thousands of followers, it’s all about quality not quantity. Better to have a couple of hundred really engaged followers who are potential new or repeat patients than thousands who really couldn’t care less about your latest treatments and who just followed you because you followed them.

Want to get started but not sure who to follow? Find me on Twitter at @medmediaTrain and say hello. I’ll be happy to answer any queries you may have.

Steve Bustin (left) is founder of Medical Media Training, which offers training courses in PR skills, media, presentation skills and social media

Today are attracted by our ability to reach 13,000 doctors with a private practice and their managers/administrators every month. But now the whole world can see your advert 24 hours a day, every day of the year when you advertise on our website.

Email Margaret Floate at margifloate@btinternet.com or phone her on 01483 824094 www.independent-practitioner-today.co.uk

OccasiOnal and sessiOnal cOnsulting ROOms

Monday to Friday 9am to 9pm

Saturday and Sunday 9am to 5.30pm FLEXIBLE, COST-EFFECTIVE, FULLY AIR-CONDITIONED

CONSULTING ROOM SOLUTIONS

SERVICED SUITES AVAILABLE

HIGH-SPEED WIRELESS INTERNET

PERSONALISED TELEPHONE ANSWERING AND VOICEMAIL

FULL SECRETARIAL SUPPORT

telephone 020 7467 8301

email: info@tenharleystreet.co.uk www.tenharleystreet.co.uk

Social media and Twitter use among plastic surgeons, in particular, is on the rise. Reza Nassab reports on a recent survey while Tingy Simoes has some timely advice

Social media, such as Facebook and Twitter, has become increasingly more popular. a survey of 500 american Society of Plastics Surgeons’ members has revealed that just over half used social media.

This study highlighted some positive and negative feedback about social media use in clinical practice which is summarised in the box on the right.

Twitter is a social media network that allows users to ‘tweet’ messages of 140 characters that are then visible to their followers and the public, unless you decide to keep your messages private. a staggering 500m tweets are sent daily.

We reviewed Twitter use among plastic surgeons and cosmetic surgery clinics in the UK. our study revealed 53 plastic surgeons that were BaPRaS (British association of Plastic, Reconstructive and a esth etic Surgeons) or B aa PS (British association of aesthetic Plastic Surgeons) members and ten major clinic groups.

The plastic surgeons had significantly fewer followers and tweeted less frequently than the clinics. all of the clinics utilised Twitter for marketing purposes, compared to 60% of plastic surgeons. all clinics were using Twitter on a regular basis, while 40% of plastic surgeons had not tweeted in the last three months.

o ur study revealed that 25% of plastic surgeons and 50% of clinics used Twitter to interact with patients. clinics were also significantly more likely to use Twitter to promote discounts on their services, with half utilising their tweets in this manner compared to only 2% of plastic surgeons.

i n fact, UK plastic surgeons have been late to adopt Twitter with the exception of a few early trend-setters. clinics are already actively using this platform for their marketing campaigns.

The US survey has shown potential benefits of social media, but using it may also have some negative consequences.

Below we review some useful tips for those considering developing their social media presence. in march 2013, the Gmc produced some guidance for doctors’ use of social media.1 Some recom-

This study highlighted some positive and negative feedback about social media use in clinical practice

Increased exposure of practice

Low-cost means of advertising New referrals

Effective as a patient educator

Improved efficiency with patient communication

Positive patient feedback on social media sites

Negative patient feedback

Time spent on social media away from patient care

Unwanted solicitations from advertisers

Compromise of patient privacy

Cost

mendations include creating separate accounts for personal and professional use.

it is important to monitor your social media presence and be aware of your online image. and it is crucial to maintain patient confidentiality at all costs. if there is contact with patients, then maintain appropriate boundaries.

Twitter etiquette

Research from 2011 shows that nine out of ten doctors in the US use social media for personal purposes. online physician communities came up as the most popular sites, followed by l inked i n, with Facebook and Twitter trailing behind. (See www. ➱ p24

Your sterile single-use solution, without compromise

+44 (0)1792 797910 www.dtrmedical.com

Whether you choose to participate in social media or not, you probably have a presence there already or are being talked about, even if you’re not aware of it

ama-assn.org/amednews/ 2011/09/26/bil20926.htm).

i t would be absurd to ignore these possible and very direct channels of communication. They can function as tremendous PR tools and enhance your credibility and make you – your practice, clinic or hospital – seem connected, interactive and responsive.

There are guidelines about doctors and social media regarding the separation of their personal and professional lives and we entreat you to follow those official, common-sense guidance.

There are published policies by the US2 and British medical associations,3 but the general gist is:

maintain patient confidentiality at all costs;

m onitor your own internet presence and be aware of your online image;

if there is contact with patients, maintain appropriate boundaries;

Keep personal and professional profiles separate;

libel laws apply in either case. Twitter, Facebook’s younger, ‘cooler’ and rather more anarchic sibling, should be cautiously treated like an ongoing, water cooler-side conversation which you can dip in and dip out of. it does allow you to connect with people from areas you find of interest: from celebrities and sports figures to industry peers and relevant organisations.

You can’t ignore it

The web as a whole terrifies many doctors and that’s no surprise. But it’s worth repeating the marketing adage: if you do not seek to position yourself, the public and your competitors will do it for you. Whether you choose to participate in social media or not, you probably have a presence there already or are being talked about, even if you’re not aware of it. There are thousands of review sites and forums where – whether you like it or not – you, your clinic or services will be discussed.

Just because you’re not on Twitter and Facebook, doesn’t mean you’re not on Twitter and Facebook, if you get our drift. Use them and linkedin, if it is appropriate with your brand image. every point of contact reflects on your brand – whether it’s your

Make it part of your routine. One of the main complaints of doctors who don’t want to engage in social media is ‘they don’t have the time’. Incorporate it into your daily schedule

Make liberal use of the mobile apps. Facebook, Twitter and Linked In are all available on your smartphone

The key word here is engagement. Constantly posting special offers and discounts without conversing with people will simply make you look like a spammer

Personalise and brand each of your sites. Use your logo or even better a photo of yourself; don’t just leave the anonymous Twitter ‘egg’ logo!

Monitor your sites. Empty pages and feeds are magnets for spammers who will post their own competitions or inappropriate messages

Respond to people. If someone comes to you with a question or an observation, interact with them. Otherwise they’ll think your practice or clinic may be equally unresponsive. If the comment is negative, thank them for their feedback and offer to tackle the issue

Don’t criticise peers. This should be obvious! There’s no such thing as ‘deleting’ something entirely from the Internet

Don’t re-tweet or re-publish others’ negative statements. By posting them, you are as responsible for what is being said as the person saying it

Don’t get overwhelmed. There are free (yes, free!) tools that will help you manage your social media presence and post to Linked In, Facebook and Twitter, such as HootSuite and TweetDeck.

linkedin profile, your website or even the front door of your premises. ensure all elements are in line with the image you wish to project.

We are not going to lie here; social media can be, on occasion, one big, nasty school playground where bullies abound. But to stress the point about media as a whole: you cannot ignore its existence and power.

dealing with negativity

i f you manage these feeds efficiently, negative experiences should be extremely rare. a courteous response and an offer of help via phone or email make you look good and detractors are the ones that could appear rude.

While we are speaking of negativity, we can’t ignore internet trolls: people who post inflammatory, inappropriate or even outright insulting or devious comments on webpages, forums and discussions. Their objective is mainly to cause disruption. The best way to deal with them is with one courteous reply before leaving well alone.

These people thrive on negativity, so don’t allow them the opportunity of engaging you in a public spat. in a similar vein, disgruntled patients may feel the need to post negative experiences for the world to see.

d on’t be tempted to criticise peers: this should be obvious.

There’s no such thing as ‘deleting’ something entirely from the internet, and that also applies for retweets and re-publishing. don’t re-tweet or re-publish others’ negative statements. By posting them, you are equally responsible for what is being said. and, finally, don’t foget to have fun with it. The thing about social media is it’s meant to be less formal. i t’s about conversations –how else could you find yourself chatting with a magazine editor in the UK, a company chief executive in australia and a Hollywood movie star all over the course of a ten-minute break or cab ride?

1. www.gmc-uk.org/guidance/ethical_ guidance/21186.asp

2. www.ama-assn.org/ama/pub/ physician-resources/medical-ethics/ code-medical-ethics/opinion9124.page