BAKERY INDUSTRY MARKET AND PRODUCTION LINE INTELLIGENCE

Overview

EPTDA was founded as the European Power Transmission Distributors Association in 1998 on the initiative of a group of power transmission and motion control (PT/MC) industrialists who believed in bringing together PT/MC distributors and manufacturers on one unique platform. It has since become the largest organisation of PT/MC distributors and manufacturers in EMEA and is one of the most powerful and respected B2B executive platforms for the industry worldwide.

EPTDA’s mission is to strengthen its members in the industrial distribution channel to be successful, profitable, and competitive in serving customers to the highest standards. The association takes great pride in its values which focus on being a premier community for qualified members through open dialogue and mutual respect; acting with integrity, honesty, and fairness; and ensuring continuous growth and learning.

EPTDA continually strives to develop relevant tools for its members, helping them stay competitive in a constantly evolving marketplace and business environment. As part of the development of tools and resources for members, this document is designed to add value to their commercial understanding of specific markets and production line processes. This document, on the Bakery industry, follows reports on the Soft Drinks industry, Confectionery, the Automotive industry, Material Handling, Recycling, Aggregates and most recently, Forestry.

Purpose of this document

The purpose of this document is to provide distribution management and their sales forces with market and production line intelligence on the Bakery industry. This document explores trends, identifies products used in the production of bakery products and goods, clarifies key challenges, and considers the opportunities for distributors and how these can be capitalised, commercially.

This document has been divided into three parts:

1. Industry Overview

Pages 4-11

This first section provides an introduction and overview to the Bakery industry and gives key background information, market intelligence, and major players within the industry. It has been organised as follows:

a. Definition, segments within the industry, and market share

b. Market size and coverage

c. European sales data and evolution

d. Current and future market trends

e. Overview of challenges

f. Key producers

g. Major machine & system builders

2. Production Line Intelligence

Pages 12-19

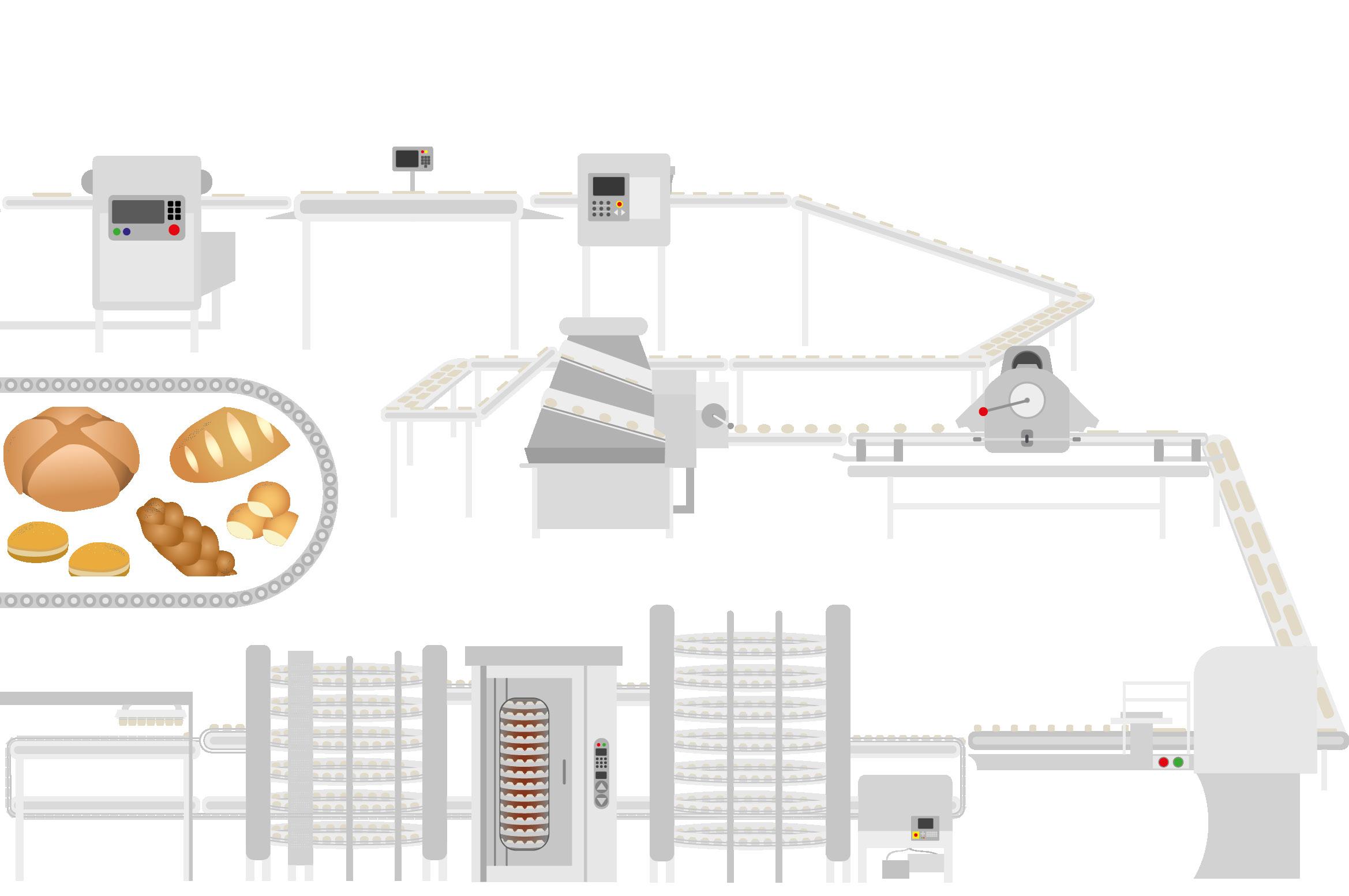

This section illustrates the production and processing of baked goods, focussing on bread products, with a fully detailed production line schematic, so as to provide an understanding of what is involved and where the opportunities lie. Key customer challenges, major product groups, typical maintenance, and improvement projects are identified throughout the line, as well as highlighting potential areas of commercial opportunity for the distributor. This production process, whilst being typical, does not represent how all types of baked goods are produced. This is because actual plant processes may vary according to the type of baked good being produced –such as variety of bread, viennoiserie, patisserie or savoury product – the type of packaging – for example, individual or multi-pack – as well as whether the bakery plant is an industrial or artisan producer.

3. Use of this Document

Pages 20-21

The opportunities within Bakery, both for MRO and OEM distribution, are significant – a minimum combined ‘scale of opportunity value’ (SOV) of 340m€ has been estimated as available for distribution of Power Transmission products in the bakery aftermarket. The final section proposes how the document could be used and provides open-ended questions that can be asked of prospective customers in order to reinforce the knowledge gained in parts one and two and to maximise the available opportunities.

3

PART ONE

Bakery industry overview

Definition, segments within the industry and market share

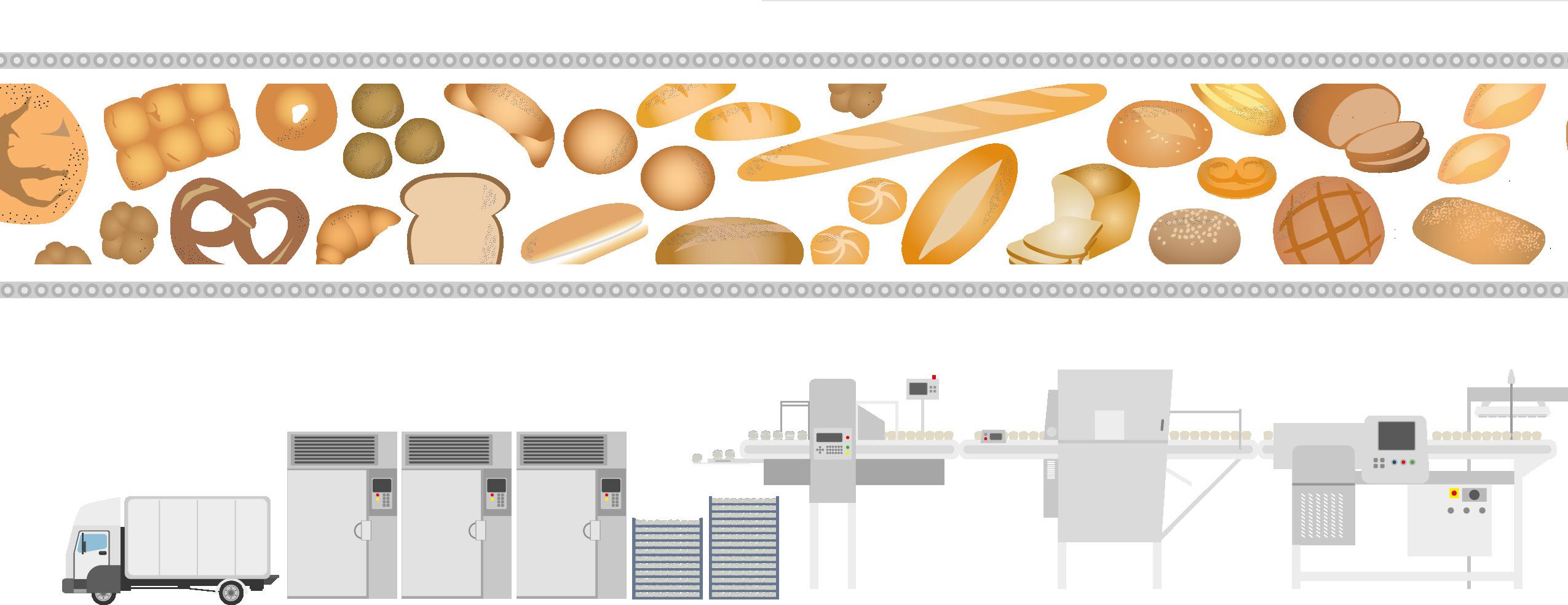

Bread is one of the oldest man-made foods and still, to this day, has deep roots in many diets, cultures, and religious rituals. Over time, baked goods have expanded and continue to grow in variety, shape, size and even production stage at which the goods are purchased.

The European bakery industry can be divided into three major segments: product type, distribution channel and geography.

At a consumer level, bakery products are broken down into fresh products, packaged products and bake-off products, which are partially baked products that are stored (either ambient, chilled or frozen) for consumers to then finish off baking at home.1

Bakery products and goods* – the focus of this production line report – include, but are not limited

Bread

- Standard white breads

- Speciality breads

- Soft breads

- Toast breads

- Flatbreads

Viennoiserie (dough-based products)

- Laminated dough

- Brioche/risen dough

- Danish pastries

- Fried dough/products

to:

Patisserie

- Cakes

- Tarts

- Chou

- Cream pastries

- Multi-layered cakes and pastries

Savoury

- Tarts/pies

- Pizza

- Topped breads e.g., baguettes

- Savoury puffed pastries

*These are the terms and definitions that will be used and referred to throughout this report.

While independent fresh bakeries are still relatively prominent around Europe, due to traditions and culture, a decrease has been seen in the number of independent bakeries as a result of the increasing preference for convenient, faster bakery production and consistency. The supermarket segment is predicted to hold the largest revenue share because they are able to offer accessibility and affordability, and other convenience stores and online platforms will also show stronger growth in the coming years due to enhanced ease in shopping experience and overall convenience.2

There are also big differences in trends across the eastern and western parts of Europe. With eastern European countries preferring the shelf-life of pre-packed bread from convenience stores or supermarkets and western European countries replacing dough-based products with alternatives like ready meals, bakeoff products and savoury products such as baguettes and pizzas.

4

Market size, coverage and sales evolution

Growth prospects in bakery products supplies EU14 - 2018/2023f Source3

In 2020, the global bakery products market size was estimated at €374.24 billion and is projected to grow at a CAGR of 5.12% to €555.43 billion by 2028.5 Of this, Europe accounts for the largest bakery products market, having reached €130 billion with over 32.5 million tonnes of baked goods consumed in 20206 and is expected to grow at a CAGR of 3.12% between 2020 to 2025.7

In 2016, the consumption of bakery products in the EU reached 40 million tonnes, of which bread took over three quarters of the market share.8

Bread production, specifically, is relatively stable but shows signs of slowing down in the long-term by about 1-2% per year in countries such as Germany and the UK.9 Although right now, most countries in Europe have an average bread consumption of 50kg annual per person,10 this is set to decline due to preferences for other baked products like pizzas or other convenient products, which, as opposed to bread, can be eaten alone as a meal.

In contrast, viennoiserie volumes have seen an increase in popularity, with croissants being the most consumed viennoiserie product in the industry. Consumption of savoury

5

2018-2023 growth ('000t) Artisan bakers Retailers in-store scratch Industrial fresh finished Industrial bake-off Industrial packaged 2016-2021 cumulative growth ('000t baked weight) Western

Artisan bakers Artisan bakers Retailers in-store Retailers in-store Industrial fresh Industrial fresh Bake-off Bake-off Packaged long-life Packaged long-life Packaged to bake Packaged to bake Source4

Europe Eastern Europe

Total bakery product consumption EU14 By product, 2018 (% Volume)11

Bread Viennoiserie Patisserie Savoury pastry 77% 9% 11% 3% 54% 16% 24% 6%

Total bakery product consumption EU14 By product, 2018 (% Value)12

Fresh bakery product distribution channels, EU14 and by country, 201813

*Commercial food services include restaurants, bars, catering and banquet facilities, recreation, and leisure outlets.

*Social food service includes supply to social services such as hospitals, schools and military or government organisations.

pastries has also rapidly increased, with the bulk being fresh market-filled puff pastries, whilst patisserie also continues to growth, albeit at a steadily slowing pace since 2013.14

There has also been a rise in niche sectors within the industry seeing an increasing number of different types of bread, where customers will pay more for qualities they personally value. This includes bread that caters to their dietary requirements, such as gluten-free options, or products that are made with the finest ingredients available, for example the “Roquefort and Almond

Bakery production value by country (2019)16

Sourdough Bread” that can be found in London’s premier department store Harrods, selling for €22.79 per loaf.15

There is also a small growing market for novelty breads, which typically contain ingredients differing from the standard recipe. The Gold Leaf Bread, coined as the most expensive bread type in the world, sells each loaf for €112.31. The bakery, located in Spain, produces around 50 different types of bread, but the Gold Leaf Bread is particularly pricey due to the use of 250mg of gold dust within the recipe.

6

Bakery chains Commercial food service Social food service Other retail sectors Modern retailers Artisan bakers TR RU UK HU NL DE FI BE IT EU14 DK PL SE PT CZ ES FR (%

weight)

voume baked

Rank Country Value in million euros 1 Germany 21,569 2 France 21,223 3 UK 10,668 4 Italy 7,711 5 Spain 5,899 6 Poland 3,968 7 Belgium 3,361 8 Austria 2,220 9 Sweden 1,710 10 Greece 1,426 11 Portugal 1,425 12 Romania 1,339 13 Czech Republic 1,101 14 Denmark 1,078 15 Norway 1,025 16 Finland 942 17 Ireland 810 18 Hungary 561 19 Croatia 532 20 Bulgaria 442

Current and future market trends

Consumer behaviour has and is continuing to evolve and adapt during what has been a turbulent time. As populations had to stay indoors during the COVID-19 pandemic (changing the way bakery products are consumed), as well as pressures on supply chains affecting product and ingredient availability, and increasing costs across industries – purchasing habits have shifted and grown significantly within quite a short space of time.

Demand for healthier bakery products, or ingredients used, has risen as the pandemic highlighted the importance of health and fitness for many, whilst convenience and ease of bakery products is still an important factor. Manufacturers in the bakery industry are therefore having to respond quickly amidst these challenges. However, despite the uncertainty of the market from geo-political and environmental factors, as a staple in many cultural diets, consumer trends for healthier bakery products, or ingredients used, and the increasing need for convenience and ease of bakery products, are just some of the market opportunities and trends from this evolving consumer demand.

Health and diet

Bakery products have expanded over time to cater to the modern consumer, who is much more conscientious as to the healthiness and quality of their food. Many avoid buying varieties that contain refined flour or additives intended to improve qualities like flavour, texture, colour, and shelf life, and prefer whole grain, whole wheat, multi-grain, high fibre, gluten-free, low-fat etc. specific to their dietary needs.

The bakery industry has also diversified to produce other sorts of baked goods like pastries, pizzas, muffins, cakes, biscuits etc., each with varying ingredients and nutritional values. 400 senior bakery industry professionals across Germany, France, and Spain have stated that “reduced sugar and calorie products are the biggest driver of business growth”.17 Whilst in the UK, the free-from food market is expected to grow at an average of 10% annually by 2025, with bakery products and cookies within that category to grow around 35%.18

Since the pandemic, the bakery industry has had to respond to changing consumer behaviour as new habits and preferences formed over the course of the two years affected by COVID-19.

For example, awareness of the relationship between food and health grew during the COVID-19 pandemic, whereby consumers during lockdowns struggled to access fresh produce, restaurants, and supply of certain products in supermarkets.

One of the outcomes of this has been the rise of “better-foryou-snacks” replacing the once calorie-dense treats consumers were having in lockdown. Bakery manufacturers are building new categories within the industry.20 For example in 2021, Mmmly, a U.S. based company, launched a plant-based cookie that contains 'clean' ingredients including probiotics, fibres, root vegetables, fruits and healthy fats that help fuel the brain and support gut health and overall well-being.21

Whilst some consumers used lockdown as an opportunity to change lifestyle habits and improve their diets, one study found that consumers reported having more meals and snacks whilst at home. Specifically, 44% of participants in one survey noted latenight snacking on less nutritious food (comfort foods) as a way to ease the stress and anxiety of the pandemic, and this has since continued.22 Bakery products, and specifically those in the bakeoff sector, are able to cater to this demand with pre-packaged and dough-based goods such as pizzas and ready-made pastries.

Packaging

Prior to the pandemic, there were growing pressures on manufacturers across industries to reduce and improve packaging in an effort to be more considerate of the environment. However, another area of the bakery industry that has been influenced by COVID-19 is packaging, which has seen a slight reversal in this environmentally fuelled trend. This has been seen in the increase in production of individually wrapped products as one way of meeting heightened customer awareness of food and product safety.23 In addition to this, with the increased variety in products now produced within the bakery industry, packaging lines within the production process must be able to accommodate this extensive range, whether individually wrapped baked goods –as part of a larger pack – or for individual sales.

Demographics

Social factors can also have a big influence on the bakery industry. For example, as the percentage of women in the workforce increases, this increases the number of double-income families – or extra wage-earning women. It is uncertain whether this will continue with the rising cost of living as seen across markets, but this demographic shift can influence how much families choose to eat out ,or rely on bakery products consumed in the home.

7

Fat reduction Sugar reduction Overall calorie reduction 54% 71% 74%

The most important aspects of health and wellness to bakery businesses and consumers19

Birth rates can also have an impact, whereby as families get smaller, the demand for full-size loaves of bread decreases as consumption is unable to outpace the longevity and freshness of baked goods.24

Regional trends

Even within Europe there are significant variations in the bakery industry as consumer preferences for bread and dough-based products are influenced by cultural and traditional norms. As described by Anne Lionnet (Business developer of LifyWheat by Limagran Ingredients in the Netherlands), bread is seen as “an eminently cultural product, so there are major differences in recipes, shapes, and tastes.”

For example, the French croissant remains relatively similar in flavour and texture across Europe despite having its origins in France. However, how, and when it is consumed, as well as the look, varies from region to region. In Belgium and France, a straighter croissant is preferred over the curved croissant in Germany. In Italy, the variation has extended to include filling. In France, it is mainly consumed as a breakfast food whilst in the Netherlands it is treated like the bread of a sandwich.25

Pre-packed bakery goods also represent a significant part of the market with surging demands particularly in supermarkets – with some investing in their own individual baking facilities in order to facilitate demand, as well as cultural and regional preferences. For example, in western parts of Europe there is greater preference for ready meals, pizzas, frozen baked goods, and other instant foods over simple loaves of bread. In the UK, 13% of dough-based products are prepared onsite in supermarket bakeries.26

Advances in technology

While there have not been revolutionary advances in the fundamentals of bakery technology, there have been improvements in the equipment that affect efficiency, quality, and longevity of baked goods. The emergence of COVID-19 especially, has sped up the digitisation of the baking industry, with many companies realising the benefits of moving away from traditional hands-on or manual processes.

A big theme throughout all advances in technology within the bakery sector is technology that accommodates shorter batch runs and faster equipment changeover and setup. Robots or “cobots” (collaborative robots) can help manufacturers produce the variety of goods demanded by consumers with multiple products on the

same line, particularly when it comes to packaging.27 However, since there is no blanket solution and each baked good is unique in its process, such technology requires a combination with traditional methods to achieve desired outcomes.

⊲ Vacuum cooling

In a vacuum chamber, air is removed using a vacuum pump, which reduces the pressure within the chamber and drops the boiling point to 30oc (normally 100oc). The batches of baked goods that are hot from the oven are then able to release heat in the form of steam. This boiling and evaporation process within the chamber helps reduces baking time by a quarter.28 Overall using the vacuum cooling system can extend the volume of the baked goods and provide better structure, texture and a crispier crust (elongated shelf life). However, businesses usually only start seeing the benefit of such investment one to three years later, which is the reason why it is not yet widely adopted in the industry.

⊲ Radio frequency heating

This technology uses an amplifier to transmit radio wave energy to heat an object in a closed cavity such as an oven,whilst at the same time keeping rate of evaporation high.29 This allows for more precision in the heating but is primarily more applicable to biscuit and cracker producers, because it is effective in preventing cracking in the products that occurs when water evaporates slowly from biscuits after its hardening.

⊲ 3D X-ray

3D X-ray technology can assess the quality and possible issues within batches of baked products before it leaves the bakery. Particularly things like holes in bread can cause hygiene problems if fillings or condiments seep through to the conveyor belt. Mito, a 3D X-ray system, creates images of bread loaves at processing speeds of around 15 metres/minute but can extend up to 40 metres/minute and can reveal large holes that are created during fermentation.30

Did you know? There are over 1,000 industrial bakery plants across Europe.

⊲ Continuous mixing technology

This allows bakeries to mix vast quantities of dough (up to 10,000kg/hour) non-stop with incredible accuracy. The result is consistent dough that is fermented perfectly. It is monitored and operated via a control system, allowing adjustments to be made as needed, quickly and easily. This technology is only recommended for bakers who require high product volumes and who produce fewer products on the same line. Therefore, it is recommended to keep product changeovers to a minimum.

⊲ Digital humidity sensors

These sensors, that monitor the humidity levels, allow for digital readouts of ovens, proofers, dryers and cooling tunnels and ensure the required humidity levels are applied at every step of the process. This provides the right environment for the baked goods to be consistent and of the highest quality.

Challenges

Supply and distribution

As a result of the increasing preference for alternative bakery products, there is also an increased demand for product innovation and an industrial means through which these products can be produced in larger quantities to increase turnover and generate more profit. According to The World Bakers, the bakery sector is one of the top industrialised sectors in the EU, with 80% of bread production being manufactured industrially, on mass, while the remaining 20% are still produced in smaller batches locally such as bakeries.

For both industrial and artisan or craft bakers, there is a constant tension to maintain profit margins, since many discount supermarket chains like Aldi or Lidl are building their own in-store baking facilities to produce bakery products offered at a lower price. While some consumers do purchase novelty or premium

⊲ Freezing technology

Bakeries have developed technology to freeze products at different stages e.g., raw, par-baked, and fully baked. This allows manufacturers to mass-produce baked goods without them deteriorating and also allows the products to be transported internationally.31 The main challenge is at what point to freeze their products to ensure that the taste, texture, and appearance remains consistent. A method called “blast freezing” is becoming one of the most common methods of freezing products. It operates by blowing cold air (typically around -30oc and -50oc) over the products. This stops all chemical reactions and converts all liquids into a solid state.32

quality bakery products, others are more inclined towards buying pre-packaged over-fresh, bake-off or non-perishable products found at these discounted supermarkets, leaving less room for artisan or craft bakeries.34

On the other hand, for industrial bakers the price pressures exerted from discount stores require them to constantly find new ways to optimise their processes, or recipes, to be able to generate profit. Furthermore, with the rising popularity of bake-off products, the competition between industrial bakers remains high.35

Given these factors, it should be noted that many countries within Europe still value freshly baked products as part of their deep-rooted culture. In one survey conducted across France, Germany, Italy, Spain and the UK, eight in ten agreed with the statement that “bread baked in bakeries tastes better than wrapped bread.” 36

9

Distribution Production Artisan baker Industrial baking Fresh products Produced and sold in the bakery shop Pre-packaged long-life Supermarkets Pre-packed part-baked Gas stations with convenience retail Fresh Bakery chains Bake-off Restaurants/catering Source33

Pressure on the supply chain and prices

In addition to the pressures on the supply chain during the COVID-19 pandemic, the recent Russian-Ukrainian conflict has caused further issues to the supply chain with blockades to Ukraine’s Black Sea ports, which prevents the flow of agricultural exports from reaching international markets and increases the general prices of food. Most recipes for bread and bakery products include oil and processed grains from the likes of wheat, corn, barley, and rye. Since Ukraine is one of the largest grain exporters in the world (feeding more than 400 million people) and one of the biggest exporters of sunflower oil (exporting 69% of the world’s sunflower oil), this conflict has greatly impacted the accessibility of ingredients on the whole, with wheat prices having shot up by more than 60% since the beginning of the crisis.37

Furthermore, whilst the market size continues to grow, the last five years have seen a decline in margins in every part of the value chain, therefore as the pressure on prices and supply increases, the players in the bakery industry need to find ways to meet these challenges.

Considering all the components of bakery products, if every ingredient were to only to rise by a small percentage, the overall price at the end increases significantly – directly affecting the prices consumers have to pay. As estimated by Carlos Mera, head of agri-commodities at Rabobank: “Such an increase will slowly make its way to the consumer and could result in prices of the cheapest breads rising by over 7%, where the cost of wheat comprises a higher percentage of the product’s total cost.”

Another factor is the escalating prices of energy sources like gas and electricity that greatly impacts the full range of commodities in small-scale and large-scale bakery production. Since there is uncertainty as to how the gas prices will evolve, producers are

Key producers* in the bakery industry41

preferring to resort to energy-saving methods that allow them to save on energy costs like using electrical-based baking ovens over gas ovens. Additionally, the higher costs of gas and fuel means that the transportation of goods and raw materials to and from various locations becomes more costly and less accessible. Many have started creating smaller batches of baked goods, so that energy costs and raw material costs are reduced whilst being able to keep production running.

Environmental impact of climate risk on the bakery industry

As with cement production, the bakery industry is a heavy consumer of water with up to 3 million litres of water used daily, of which half is discharged as wastewater. On top of this, other waste generated by the bakery industry include fats, oils and greases, which are detrimental to sewage systems and waterways, with the risk to marine life.38

Furthermore, as put by McKinsey, “the COVID-19 pandemic is exposing vulnerabilities in the global food system which could be compounded by climate change risks.”39 Extreme weather has become increasingly more common with Europe experiencing more frequent heat waves, flooding and drought. This has a significant impact on harvests for crucial ingredients heavily used in bakery – rice, wheat, corn, and soy – but also considered a core part of the human diet. These four ingredients are thought to make up almost 50% of the average global diet. Growing in concentrated regions around the world, reliance on these areas to supply these core ingredients becomes evermore fragile as the effect of climate change and the environment becomes more erratic.40 All four ingredients are used in the bakery industry, with wheat being the primary ingredient for flour, and as such, is heavily susceptible to environmental incidents impacting harvests.

10

Ranking Company Revenue (USD millions) Head-quartered in 1 Mondelez International 25,868 US 2 Associated British Foods Plc 20,627 UK 3 Kellogg Company 13,578 US 4 Grupo Bimbo 13,159 Mexico 5 Yamazaki Baking Co Ltd 9.995 Japan 6 Campbell Soup Company 8.107 US 7 JAB Holding Company 5,739 Luxembourg 8 Flowers Foods 4,124 US 9 Britannia Industries 1,466 India 10 Warbutons Ltd 638 UK

Other notable bakeries include: Allied Bakeries, Aryzta Bakeries, La Lorraine and Unibake.

Major machine & system builders

The AFE Group | United Kingdom | www.theafegroup.com

The AFE Group specialise in the design, manufacture and service support of professional cooking, baking and refrigeration equipment, and are also a business unit of Ali Holding Srl. Their brands include Williams Refrigeration (blast chillers and freezers), Falcon Foodservice Equipment (cooking equipment), Mono Equipment (professional bakery equipment), Millers Vanguard (specialist maintenance service) and Serviceline (catering equipment maintenance).42

Bongard | France | www.bongard.fr

Part of the Ali Group, Bongard is a French bakery equipment manufacturer specialising in their patented ‘Cervap’ oven and mixing machines and freezing lines. A leading company in the baking and pastry-making sector, 70% of bakeries in France are estimated to have at least one piece of equipment manufactured by Bongard.43

Debra-Blades | Belgium | www.debra-blades.com

A manufacturer of bread slicer blades using correctly dimensioned, hardened carbon steel to ensure high-quality slicing ability, durability, corrosion resistance and strength. Starting with sharpening knives, Debra-Blades now offer expertise in automated blade systems for the bakery industry.44

FRITSCH Group | Germany | www.fritsch-group.com

FRITSCH are the biggest German manufacturer of bakery machinery and cater to a variety of bakeries from artisans to industrial-sized. Part of the MULTIVAC group – a leader in food packaging solutions – FRITSCH develop manual, semi-automatic and fully-automatic equipment for the dough sheeting and processing section of the production line.45

Guéry SA | France | www.guery.fr

A sheet metal- and pipe-work company, Guéry focusses on three sectors – welding, the environment and baking. Providing an array of metal materials, including steel, blued steel, tinplate, aluminised steel, and stainless steel, Guéry manufacture industrial moulds, storage trolleys, plates, frames and industrial equipment and utensils.46

Kornfeil spol. S.r.o. | Czech Republic | www.kornfeil.com

Specialising in the manufacturing of bread ovens, Kornfeil offer an extensive range of oven types, as well as an automatic bread line for premium artisan bread. Supporting their oven range, Kornfeil also produce proofers, dampening units and conveying solutions such as spiral shuts, bread counters and a revolving table.47

MECATHERM | France | www.mecatherm.fr

Head-quartered in Barembach, France, MECATHERM manufacture both individual pieces of equipment and complete production lines (from proofing to cooling) for bread, bagels, patisserie and pastries.48

MIWE Michael Wenz GmbH | Germany | www.miwe.de

Beyond just production ovens, refrigeration technology, vacuum conditioning, loading, and transport, MIWE also provide expertise on energy optimisation along the production line. MIWE even originated the concept of ‘in-shop baking’, or 'sight-and-scent baking' as it was called by Prof. Edgar Michael Wenz, and have become leaders in bakery oven systems.49

Werner & Pfleiderer Bakery Technologies | Germany | www.wp-l.de

Specialising in artisan production, WP Bakery Technologies are a builder and installer of baking ovens, machines and production lines. Experts in ovens and loading systems, they have been developing new baking technologies for over 140 years. As a part of the WP Bakery Group they can provide a complete baking system for all types of bakeries – from artisan bakeries to fullscale industrial production lines.50

WP Haton | Germany | www.wp-haton.com

Another member of the WP Bakery Group, WP Haton manufacture automated dough processing equipment, including dividers, rounders, proofers and dividers. WP Haton also offer expertise on complete automatic production lines for baguettes, sweet breads and production lines for producing varieties of different types of dough.51

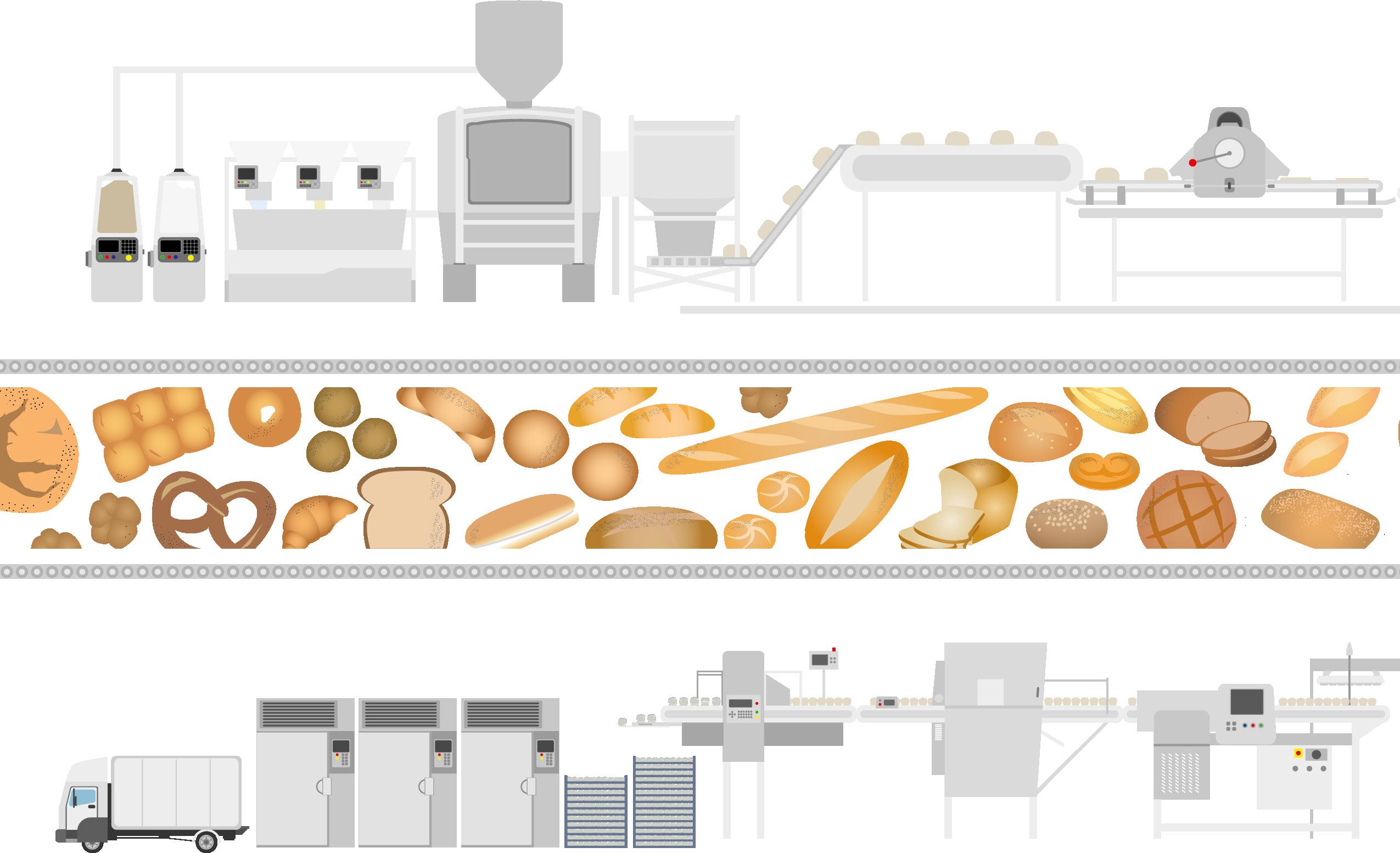

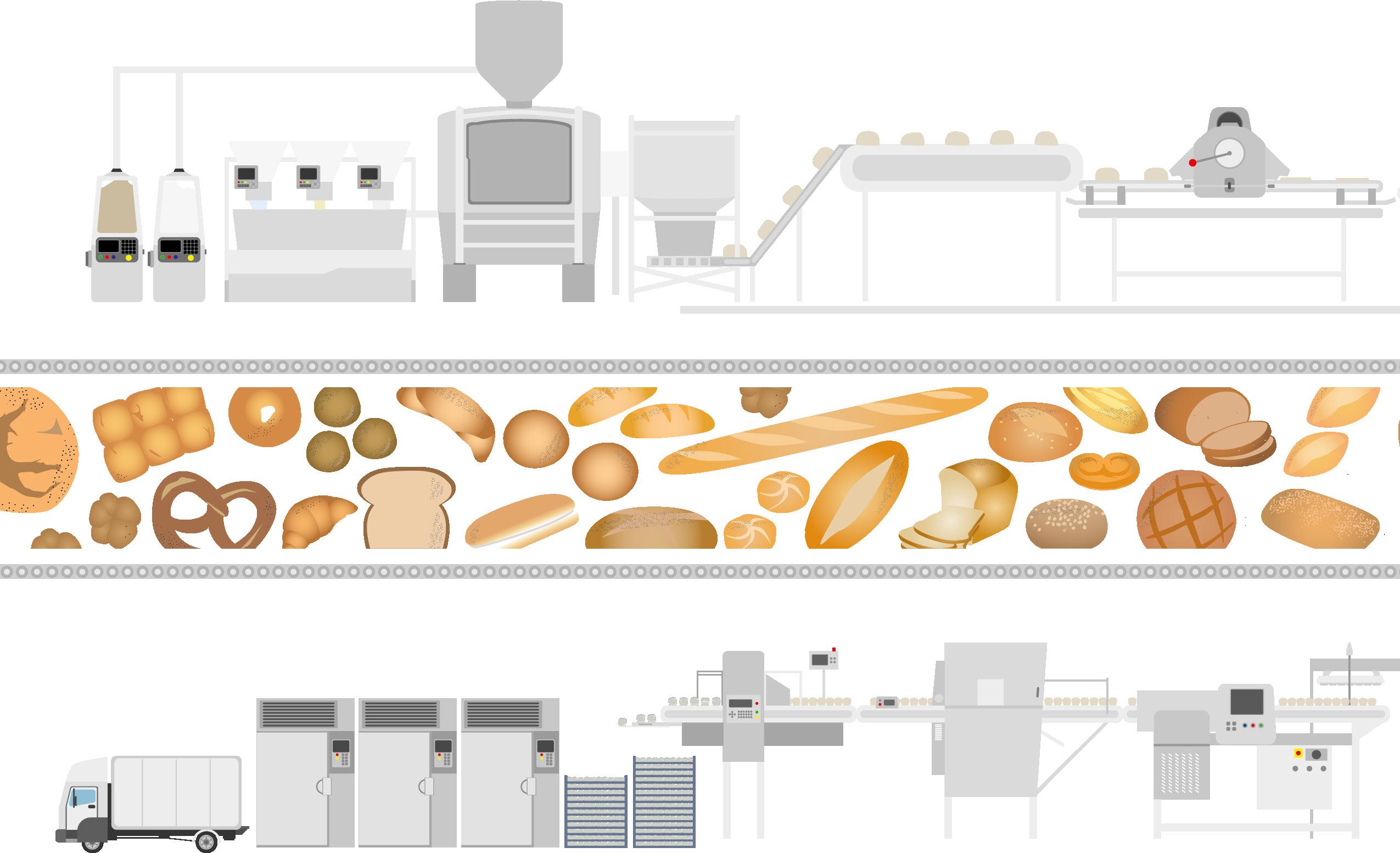

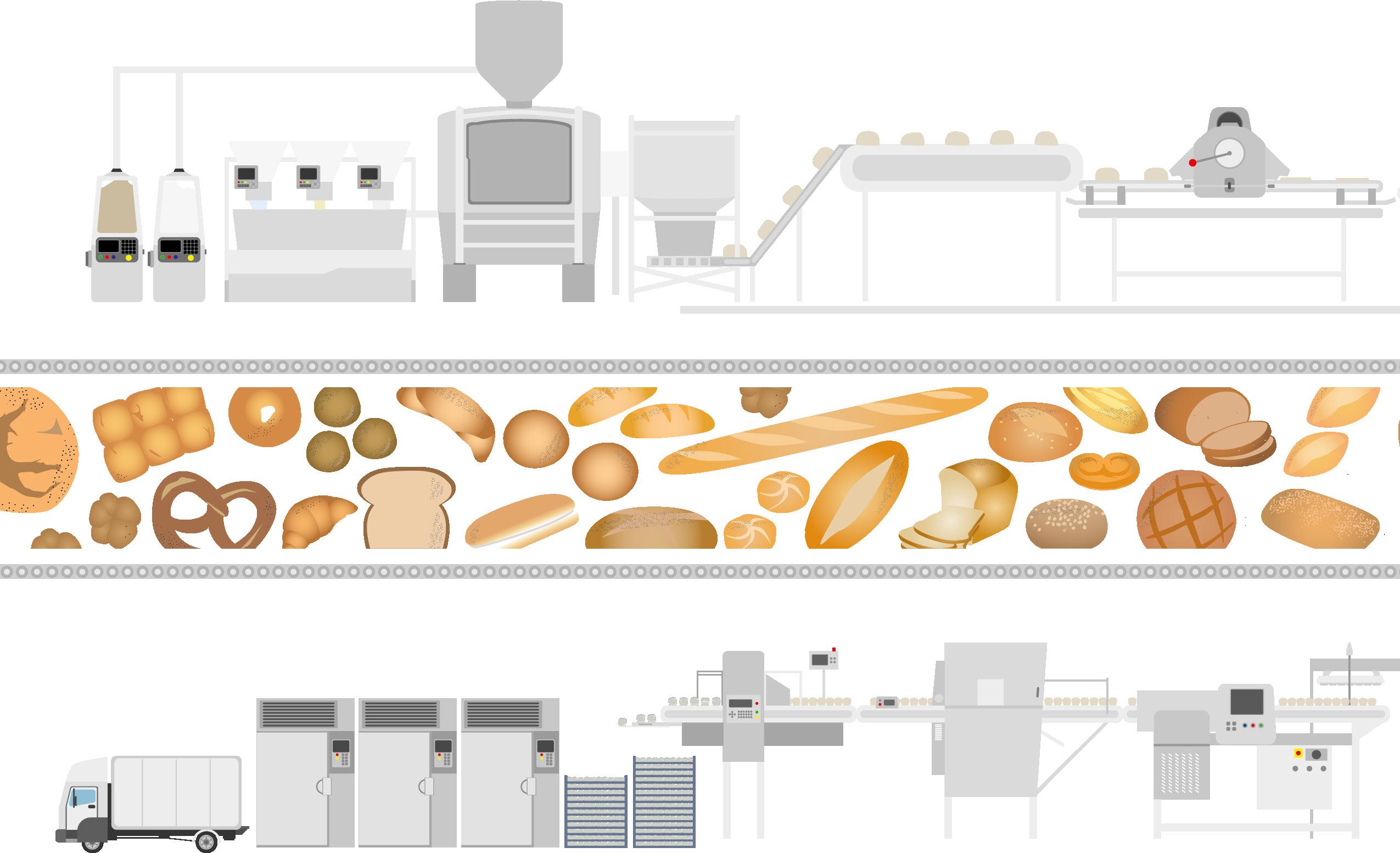

Production of bread

Process

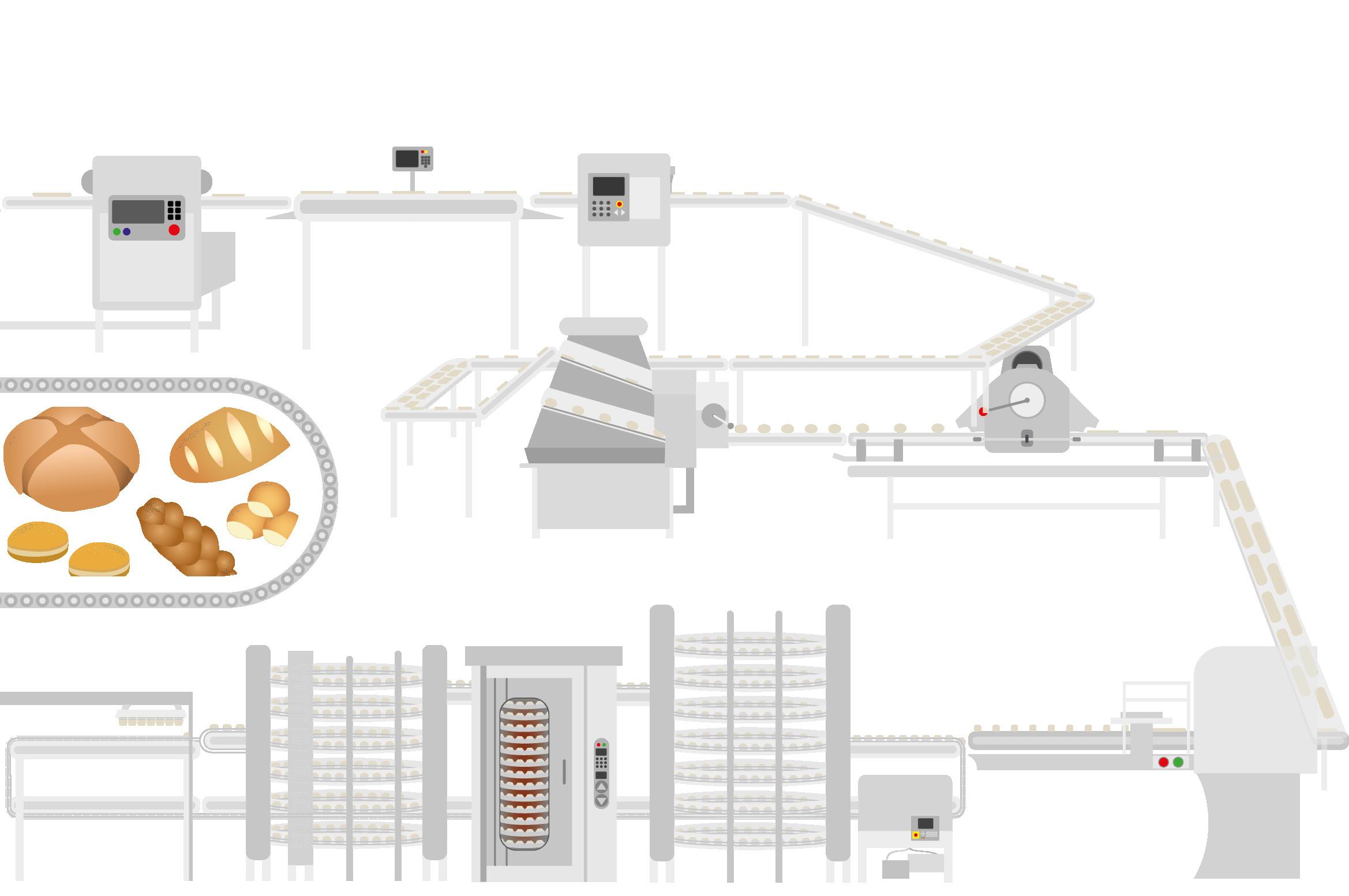

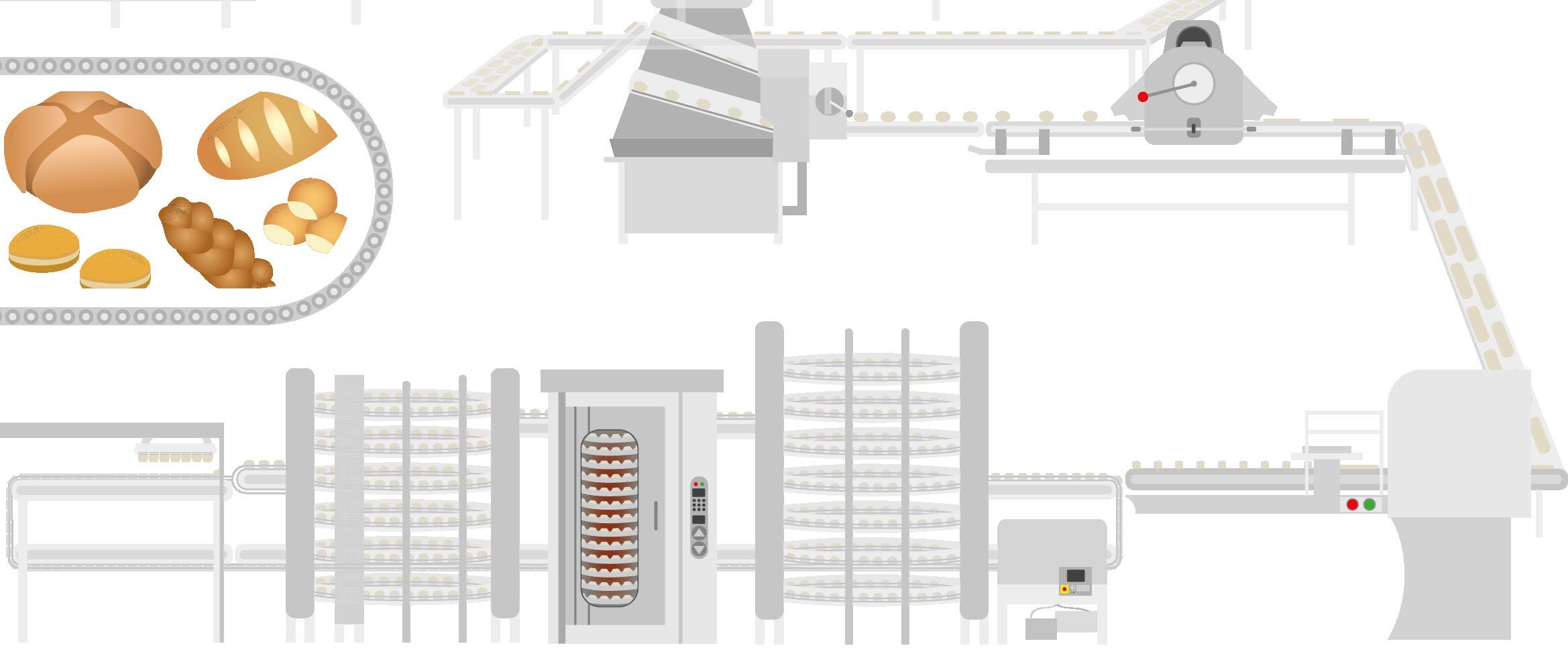

PART TWO Bread production line market intelligence

1. Storage

Dry and wet ingredients are kept in silos for protection from dust. These deliver the ingredients directly to the mixers via a piped system using vacuum or air pressure.

2. Weighing Oil, water and other liquid ingredients are delivered directly to the mixers via a piped system using vacuum or air pressure. This is carefully measured according to the chosen recipe.

3. Mixing

4. Live bottom hopper

The bread dough is pumped into dough hoppers through a screw system or vertical pinch / sandwich conveyor.

5. Dough elevator / sandwich conveyor

These elevators carry the dough vertically to a conveyor for feeding the dough divider. This eliminates the need for dough trough lifts.

Mixing the ingredients together begins the chemical process of baking – the blending and hydration of dry ingredients, air incorporation and gluten development for optimum dough-handling properties. Mixing time, energy input and dough temperature are all measured and controlled.

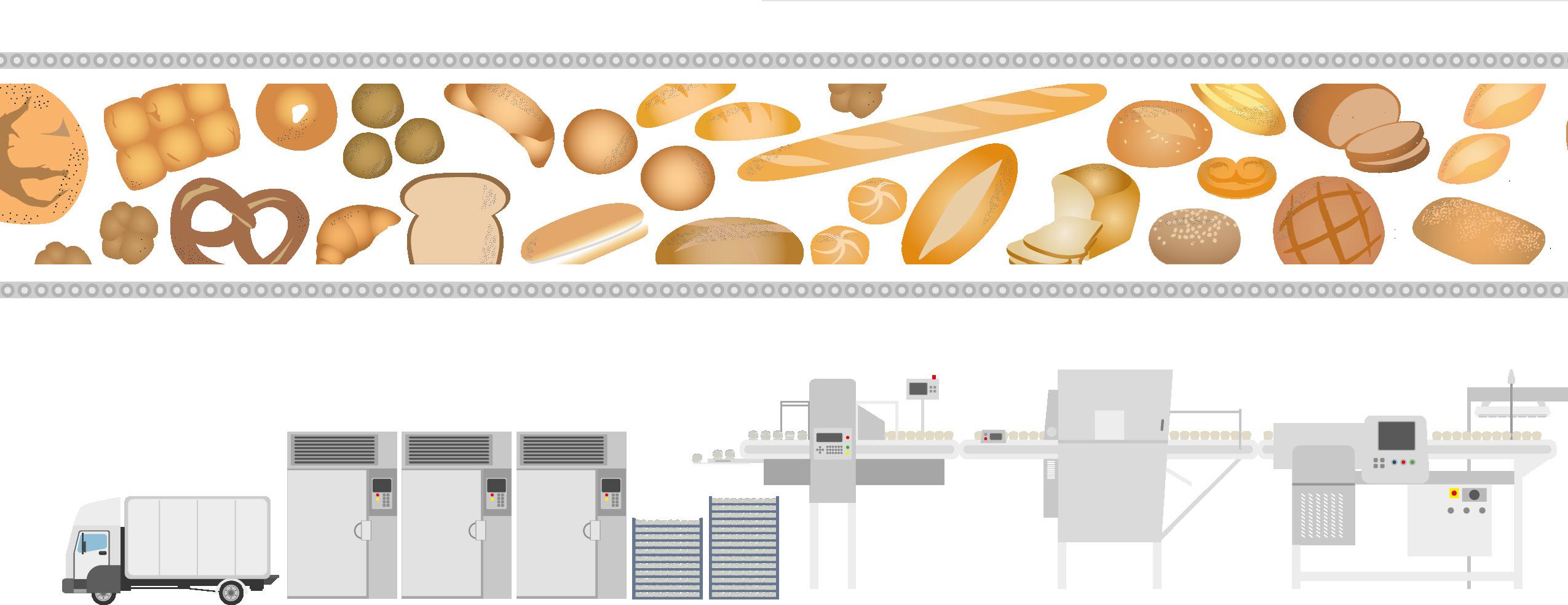

Packaging and transportation

29. Transportation

If owned by a supermarket chain, dedicated tractor trailers are often used to transport the baked good to certain warehouses before being sent to individual stores.

28. Freezing/ Blast freezing

Some baked goods are frozen so they can be stored for longer periods. A stream of cold air is blasted to quickly lower the temperature without damaging the goods.

27. Tote stacking

The totes are then stacked to the desired number and transported down a live roller conveyor or modular belted conveyor where the stack is manually removed by hand.

26. Internal transportation and toting

The packaged loaves are transported internally and are loaded into totes of 10 or 12, ready for stacking.

25. Bagging

The bread is bagged according to the product's requirements.

24. Slicing

Band-type blades, set to the spacing required, are used at high speed for high volumes to cut the bread into even slices.

23. Metal detector

In case of contact with metal throughout the production process, the bread passes through metal detectors before being prepared for packaging.

12

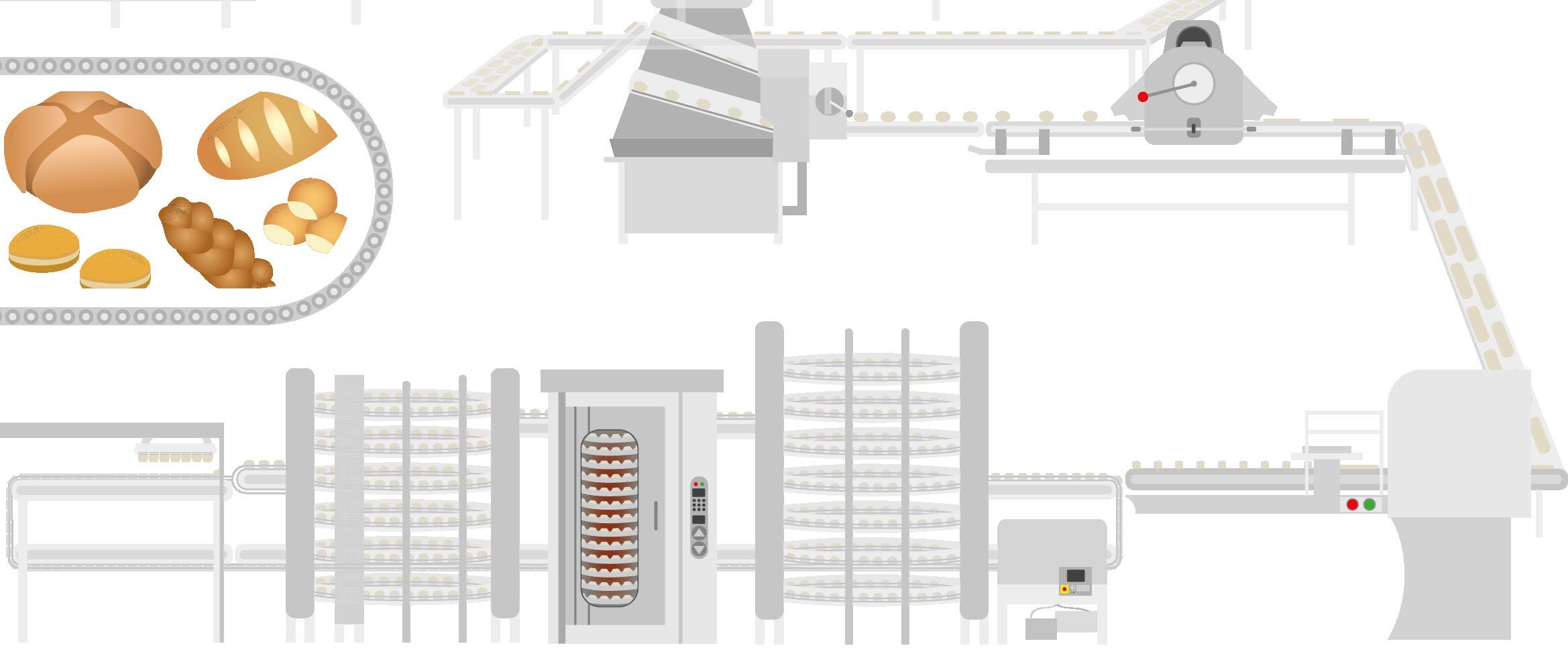

1 2 3 4 6 7 5 20 23 24 25 26 27 28 29

- dividing Mixing

Storage and weighing Makeup

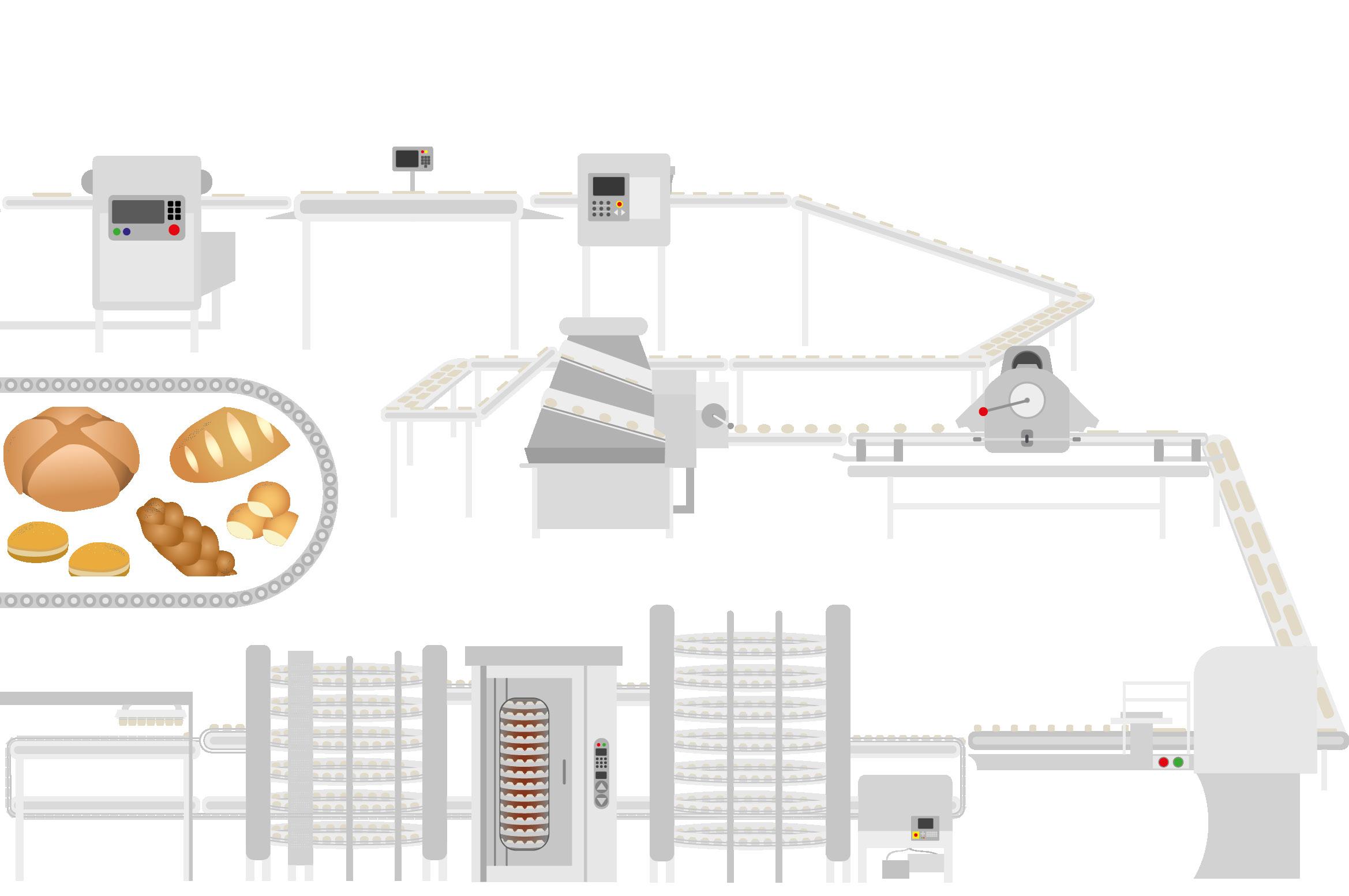

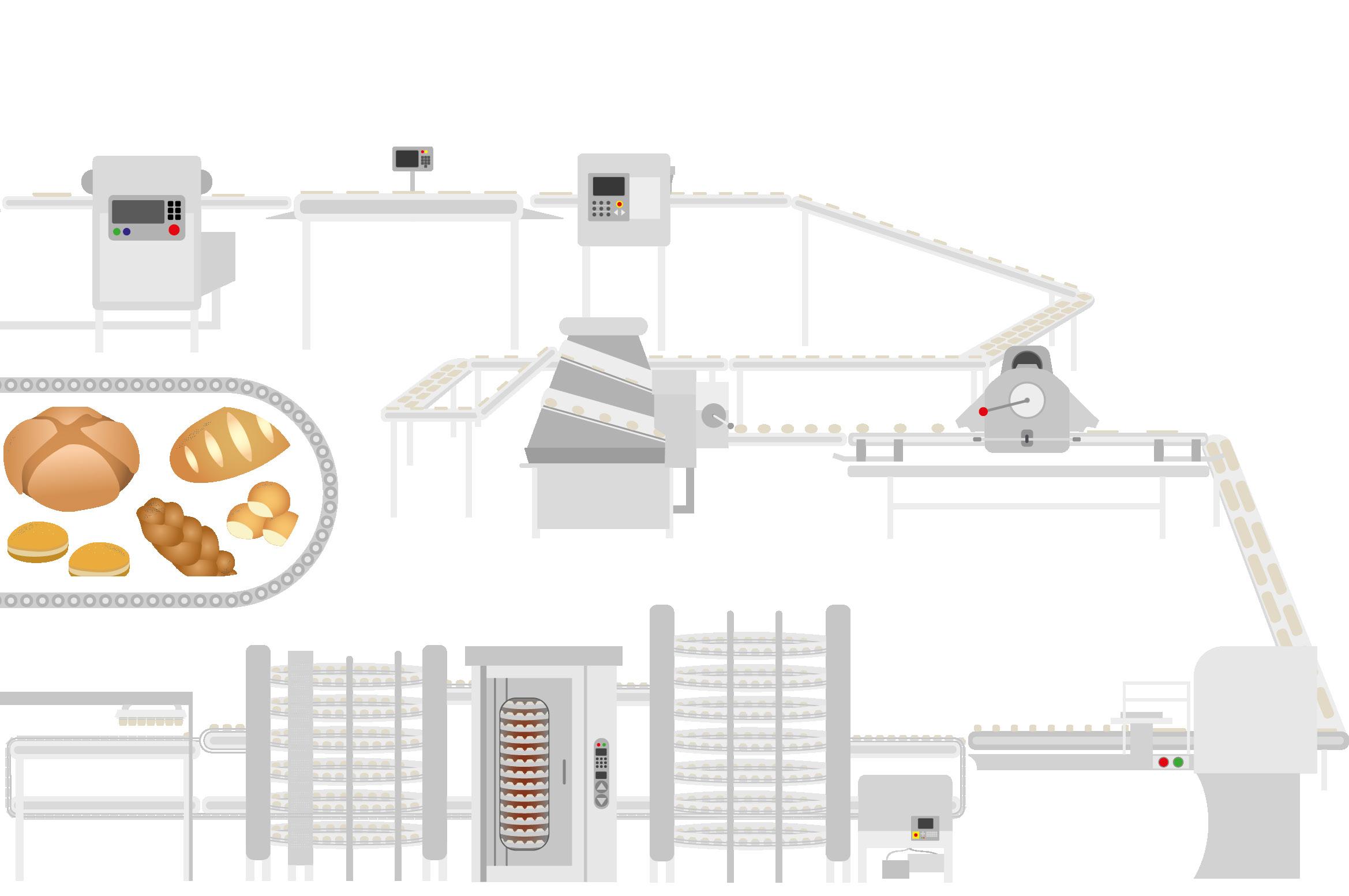

6. Dough transport / divider feed belt

Dough transport and divider feed conveyors transport the dough to pre-sheeters and dividers.

7. Dough sheeter / divider

The dough is cut into precise portion sizes, according to the weight and size of the intended bread product. Dough sheeters press the lump of dough into flat sheets to provide consistency in the quality of the bread produced. The type of bread determines whether a sheet or divider is used.

8. Gauging rollers

Rollers gently bring the dough down to the final thickening process.

9. Rotary dough slitter / cutter

Rotary dough slitters or cutters are used to trim the dough slabs to the required width.

10. Scrap release / take-away conveyor

Leftover scraps from the cutting are recovered and circulated back to the dough hopper before being fed through the first dough sheeter or divider.

11. Weigh scale

The dough is measured to determine the length that the dough will be cut in the guillotine cutter.

12. Guillotine cutter

Passing through a rotary slitter, the dough is cut into sections according to the requirements for the weight of the final baked product.

13. Rounder

The dough is rounded with a set of concave rails with light grooves that grab the upper edge of the dough as it is conveyed or rolled through the rail. The rail can be tapered to give the rolled dough ball an egg shape.

14. Final sheeter

The final sheeter flattens the rolled dough to the desired thickness before it is moulded.

15. Dough moulder

The dough is rolled into a cylinder shape and the ends sealed to allow the bread to bake as a single loaf and to prevent it from breaking or splitting whilst baking.

16. Panning

Bread panners automatically place the prepared dough into pans ready for proofing.

21. Empty pan transport conveyor

Table top chain and modular belting is used to transport the empty pans to the washer for cleaning.

22. Pan washing

20. Depanning

Once cool, the baked loaf is removed from the pans.

19. Cooling spiral

Similar to the proofer, the baked loaf is slowly cooled in a spiral with the required amount of heat-induced humidity to soften the crust a bit.

18. Oven

The proofed loaf goes into the oven either containing another large spiral conveyor, or a series of decks that move the baking product up and down the oven. Humidity is often added for the baking of bread products.

The empty pans are washed and dried via an in-line automated pan washing system. Once clean, the pans are fed back to the panning process to be used again.

17. Spiral proofer

The loaf pans slowly move up and down in a spiral as part of the proofing process.

13

8 9 10 11 12 13 14 15 16 17 18 19 21 22

Process

Baking

- sheeting and moulding

Makeup - rounding Makeup

Proofing

Production of bread

Key products and opportunities

Explaining the opportunities and projects

Key critical projects within the bakery industry have been highlighted along the schematic to make it easy to identify which areas of the process have the most opportunity.

2. Mixing

1. Storage and weighing

3. Makeup – dividing

1. Storage and weighing

Key product groups

Actuators

Air shockers

Bearings – angular contact ball bearings, high temperature bearings, housing units, small roller bearings, spherical roller bearings

Belts – plastic modular

Cam rollers

Chains – maintenance-free chains

Condition monitoring

Conveyor chain – screw conveyors

Couplings

Food-grade (FDA) grease

Linear – guidance and slide rails

Motors – electrical

Pillow blocks

Pneumatics – flow amplifiers, fittings, tubes

Pumps Seals

Slewing rings

Re-greasing systems

Valves – 2-port valves, dust collector valves

Opportunities / challenges

Convey optimal loads to maintain throughput with minimal product damage

Production line design with quick assembly and disassembly in mind

Reinforced designs minimise risk of product contamination

2. Mixing

Key product groups

Actuators

Bearings – food-grade (FDA) ball bearings, roller house units

Belts

Chain – roller chains

Discs – split shrink discs

Food-grade (FDA) lubrication

Locking assemblies

Mixers – spiral, horizontal, continuous

Motors

Pillow blocks (with high temperature grease)

Pneumatics – fittings, tubes

Seals

Valves – 2-port valves

Opportunities / challenges

Annual replacement of light duty split shrink discs. SOV: 12k€

To ensure food compliance, stainless steel is required

14

Key products and opportunities

4. Makeup – rounding

3. Makeup – dividing

Key product groups

Actuators

Air shockers

Bearings – food-grade (FDA) ball bearings, roller house units, stainless-steel bearing units with caps

Belts – conveyor, food-grade (FDA) flat belts

Chain – corrosion-resistant

Cutters

Linear

Motors

Pneumatics – fittings, speed controllers, tubes

Rollers

Seals

Valves

Opportunities / challenges

8 – 20m per line of belt in one dough sheet conveyor

Risk of spillage and dough carry back causing dough to stick to the belt and potentially mis-tracking

Lengthy downtime for replacements

4. Makeup – rounding

Key product groups

Actuators – Rodless actuators

Bearings – bush bearings, food-grade (FDA) ball bearings, roller house units, spherical bearings, stainless steel bearings

Belts – conveyor

Linear guides

Pneumatics

Water-resistant electric drives

Opportunities / challenges

Higher contamination risk along the production line

15

Production of bread

Key products and opportunities

8. Packaging and transportation

8. Packaging and transportation

Key product groups

Actuators – quick action actuators

Bearings – corrosionresistant ball bearings, food-grade (FDA) ball bearings, roller house units

Belt – conveyor, flat belts, metal detecting, module belts, round belts, wire belting, v-belts

Chain – corrosion-resistant chain, link, o-rings

Cutters

Gearboxes

Grippers

Linear technology

Motors

Pneumatics – fittings, speed controllers, tubes

Rollers

Seals

Sprockets

Vacuum pads and ejectors

Valves – 5/2 valves, vacuum valves

Opportunities / challenges

Some units can slice up to 100 loaves a minute

Weekly replacement of a set of blades

Annual replacement of belts slicing between 100 – 150m

Dust created through wear a challenge in a food environment which must be kept clean, as well as impacting longevity of product life

Curvature of production line also causes challenges to belts performing at optimal speed and efficiency

Speed is a factor, especially for drives – some lines can bag up to more than 60 loaves per minute

Bottleneck area – if bagging goes down, this has a trickle-back effect across the rest of the production line, requiring shutdown until the bagging area equipment is repaired

Some roller conveyors are driven by welded o-rings which can cause a challenge for replacements and increased downtime costs

Annual replacement of 500 – 2,000 pieces of belt SOV: 0.5 – 5k€

16

7. Baking

Key products and opportunities

6. Proofing

5. Make-up – sheeting and moulding

5. Make-up – sheeting and moulding

Key product groups

Bearings – corrosion-resistant ball bearings, food-grade (FDA) ball bearings, roller house units

Belts

Chain – hollow-pin conveyor chain, link chain, module chain

Motors

Rollers

Key product groups

Actuators

Bearings – special bearings, food-grade (FDA) ball bearings, roller house units, corrosion-resistant ball bearings

Belt – conveyor, chevron weave, balanced weave, flat wire, link belts, PU belts

Chain – corrosionresistant, large pitch conveyor chain

Fans

Linear technology – linear guides

Link chains, module chains

Motors

Pneumatics – damper, fittings, flow sensors, nozzles, speed controllers, tubes

Rollers

Seals

Opportunities / challenges

100 – 300m belt annual replacement, depending on the design and size of the spiral

Heavy load

Opportunities / challenges

10 – 30m annual fan replacement per oven

Annual replacement of damper. SOV: 5 – 10k€.

Conveyors must be able to withstand high temperatures of the oven

60 – 80m annual replacement of conveyors

Key product groups

Bearings – corrosion-resistant ball bearings, food-grade (FDA) ball bearings, roller house units, stainless steel bearing units

Belts – conveyor

Rollers

Linear technology

Motors

Seals

Opportunities / challenges

Depending on the size of the machine, annual opportunity of 10 – 20m of belt/roller chain replacement

Risk of spillage and dough carry back causing dough to stick to the belt and potentially mis-tracking

Shafts – idler, tail, head

Vacuum pads

Valves – process valves

20 – 40m replacement of flat wire belt to link belting

Wet environment in the pan-washing area

17

6. Proofing

7. Baking

Production of bread

‘Putting it all together’

General

Key product groups

Bearings – corrosion-resistant ball bearings, food-grade (FDA) ball bearings, roller house units

Belt – conveyor, flat belts, metal detecting, module belts, round belts, wire belting, v-belts

Chain – corrosion-resistant chain, link, o-rings

Cutters

Gearboxes

Linear technology

Motors

Rollers

Seals

Sprockets

Opportunities / challenges

Condition monitoring and emergency service – agree to stock products regionally so to be able to react quickly to failure

Stainless steel with food-grade (FDA) grease products are often used due to longwearing in tough environments as well as weekly water cleaning

Production lines are often run to the maximum efficiency which is then further stressed during seasonal periods e.g., Christmas and Easter or for seasonal products such as olive or tomato bread for BBQs in the summer

Special long-link chains with sprockets may run from one end of the production line, right through to the end

Blue plastic on slide rails is often used in areas that come into contact with the bakery product because when the plastic wears this leaves blue marks in the baked goods which is then noticeable (previously transparent, resulting in some recalls for goods if found by the end user)

18

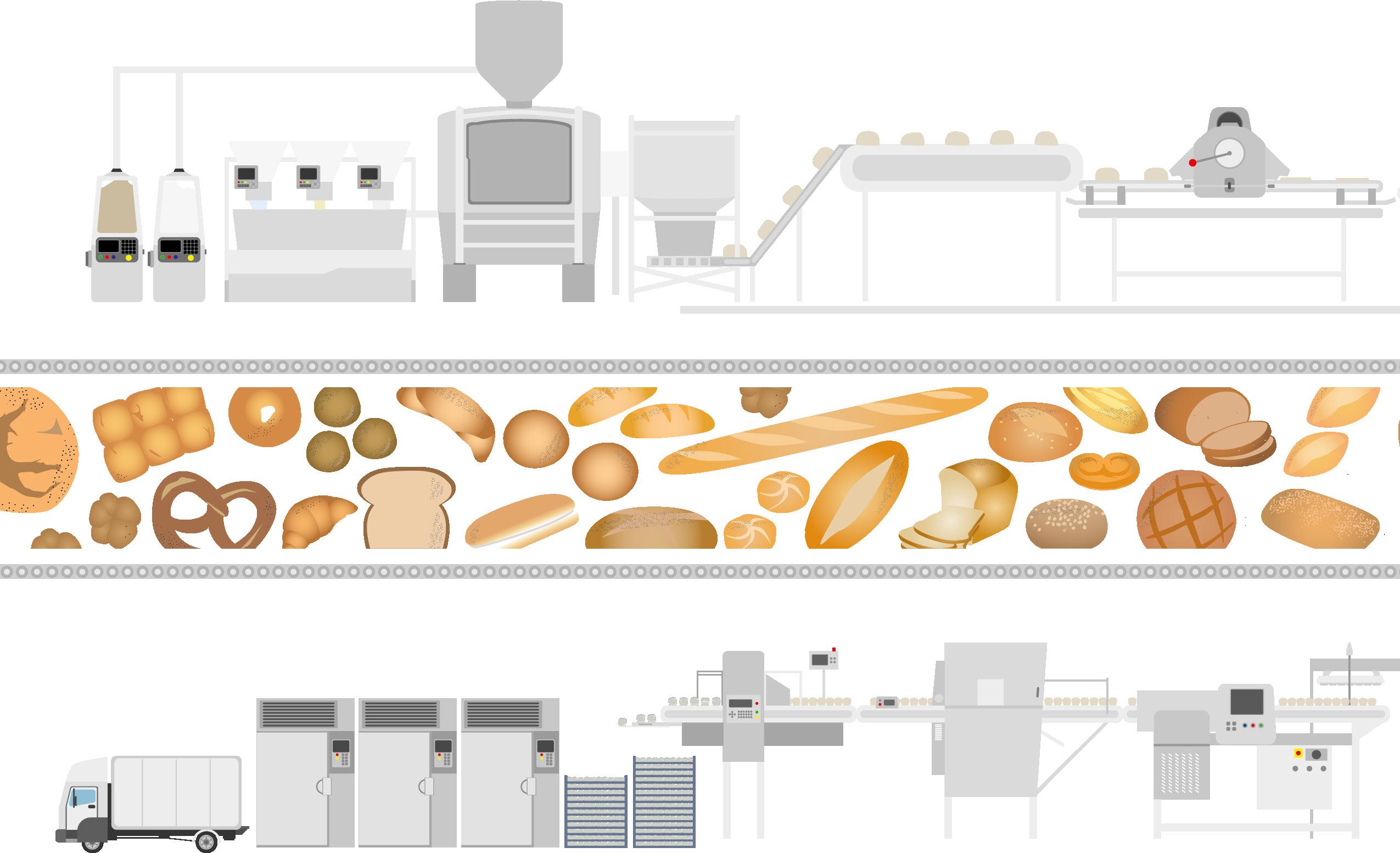

1. Storage and weighing

3. Makeup – dividing

2. Mixing

7. Baking

8. Packaging and transportation

4. Makeup – rounding

Proportion

6. Proofing

5. Make-up – sheeting and moulding

The approximate value of PT aftermarket sales in the European bakery industry

19

of replacement products

32% 19% 4% 12% 5% 16% 5% 7% Bearings Chain Belt Hydraulics Couplings Seals Pneumatics Linear technology 340k euros Annual plant replacement 340m euros Does not include ancillary products such as tools, DIN parts, industrial safety equipment and chemicals.

PART THREE

Using this document to develop business

The following provides the reader of this document, either General Managers or Sales Team members, with some template questions to help to generate revenue from this Production Line Intelligence overview and so develop business within the bakery industry. For many of these questions you may already know the answers. Others might be used on a regular basis when you visit customers and prospects in other industry sectors. It is meant as a resource to act as a prompt and reminder allowing your business to fully capitalise on this market intelligence and production information.

Preparing – before the visit

The producing company – makers of the ‘bakery products and goods' (End user / Brand manufacturer)

• What type of bakery production plant are you visiting (bread, viennoiserie, patisserie, savoury)?

• What do you already know about:

Its size in terms of capacity, output etc.?

– The types of bakery it produces – bread, viennoiserie, patisserie or savoury products?

– Who they produce for (bakery chains, commercial or social food services, the retail sector, artisan bakeries)?

– The product system they use and the manufacturers of those systems?

• How old is the bakery plant?

• How many people do they employ?

• Do they have their own maintenance engineers?

• Who makes the purchasing decisions?

• Does this company have other facilities in the region you service?

The people you might meet

• Who are you going to see?

• What is their role or speciality (production/maintenance manager/repair/purchasing)?

• What do you know about them already? (hint: search LinkedIn)

There are three parts that deal with:

1. The preparation – this provides questions to consider before going to the site, in two sections:

a. Detail of the company – is it part of a chain, or is it an independent?

b. Who are the people to be seen – technical, engineering, maintenance?

2. The meeting itself – what to ask during the meeting to understand the concerns, needs, requirements and potentials.

3. The follow up – questions to ask or to reflect on, at the end of the meeting or afterwards.

• What are your initial thoughts about the main challenges they are likely to face?

• What is your opening question, tailored to their role?

General

• What do you want to achieve from the meeting – your goal?

– Exploratory – trying to understand the pressures/ problems they face?

– Presentation – trying to suggest how your company's service can help?

– Breadth of service – showing that you are not simply a component provider?

• What will you fall-back on, if your intended goal seems impossible?

Ensure they know that you are interested/could add value?

Ensure that they have your name, title, services to hand for the future?

– Confirm that they would be willing to meet you again, in the future?

• What kind of questions will you ask (in relation specifically to who will be seen)?

• What is your plan for follow ups to this meeting?

• What kind of support material do you need to take with you?

20

–

–

–

The actual meeting 'Producers of the bakery products and goods'

Some of the preparation questions can be asked during the meeting, but some research beforehand is preferable).

The plant or facility

• What sort of production site is this e.g., dough production, wrapping and packaging, or a complete production line?

• How many production lines are there and what types of product are produced?

– What types of seasonal production are there (if applicable)?

– How do you deal with the change in product varieties?

– What method of baking is used e.g., Bulk Fermentation Process (BFP), Chorleywood Bread Process (CBP), or other?

• What are the processes used across the various stages of production (storage and weighing; mixing; make-up; proofing; baking; packaging and transportation)?

• How are the main machines maintained and repaired (internal team, external team, machine builder service engineers)?

Maintenance, planning and issues

• What sort of regular maintenance does the site undergo?

– Regular shut-down periods or other?

• What is the estimated annual spend on maintenance?

• What are the main issues in relation to maintenance or 'bottlenecks' in the process that affect speed or reliability?

– What are the main issues or concerns in relation to maintenance?

– What are they caused by?

– Are there on-going projects to deal with this?

The follow up

• What were the main points you learned from the visit?

• How and where are you going to store this information?

• How are you going to use this information for future business, either with this potential customer, or others?

• Who in your business do you need to share this information with?

– Are you using partners – suppliers or distributors –to assist you in this process?

• Do you have existing projects carried out in relation to maintenance or energy management etc.?

– Are existing partners – suppliers or distributors – assisting?

• What are the key maintenance/industrial supplies objectives for the facility?

The most utilised products

• What parts are used most on an annual basis?

– What are the issues/challenges faced getting those parts?

• What are the main concerns in relation to type of components that are needed to maintain and improve the line e.g., bearings, chain, belts, etc.?

• Where is the process most prone to failure or maintenance problems?

Suppliers

• What do you value most in relation to a supplier/ distributor like us?

• What kind of support do you look for from your service providers in relation to on-going or emergency maintenance?

• What is your biggest current problem with your aftermarket suppliers?

– How do you like your supplier partners to assist?

• Next steps?

– Can we come back with a proposal to help you with some of this?

• What are the next steps you need to take, when and how?

• What other types of follow up will you undertake and why?

Do you have success stories to describe, or do other members of you team have such success stories?

How can these be replicated?

• How will you ensure that these follow ups are completed?

21

–

–

Acknowledgements

Acknowledgements and a sincere thank you to the following manufacturer members of EPTDA for the generosity of the technical and commercial information and advice that they have supplied and which has given real authority to the document.

Also to a number of technical experts from distributor members of EPTDA operating in this sector, who have provided the concrete examples included in the text and without whose contribution the document would lack its operational and commercial relevance and power for distributors.

Finally to the individual members of the EPTDA Know Your Market Committee and particularly to its Task Group, who have freely given their advice, guidance and inputs throughout the process of producing this document.

Authored by:

Disclaimer:

The costed examples contained in this document are illustrations taken from real practice. They are, however, not predictions of future value achievable from various projects that can be undertaken in this sector. The authors, contributors and EPTDA do not accept any liability for any commercial decisions that may be taken as a result of these examples.

Sources:

1. Gira Food, 'A European Bakery Markets Overview'

2. Fortune Business Insights, 'Bakery Products, Market Size, Share & COVID-19 Impact Analysis, by Product, Type, Distribution Channel, and Regional Forecast, 2021 - 2028'

3. Gira Food, 'Bake-off Bakery Markets in Europe: Market Dynamics & Competitive Landscape'

4. Gira Food, 'Bakery Markets Overview'

5. Fortune Business Insights, 'Bakery Products, Market Size, Share & COVID-19 Impact Analysis, by Product Type, Distribution Channel, and Regional Forecast, 2021 - 2028'

6. Ibid.

7. Mordor Intelligence, 'Europe Bakery Products Market - Growth, Trends, COVID-19 Impact, and Forecasts (2022 - 2027)'

8. World Bakeries, 'Category Trend Analysis: Europe's Big Bakery Markets'

9. Federation of Bakers, 'European Bread Market'

10. Ibid.

11. Gira Food, 'A European Bakery Markets Overview'

12. Ibid.

13. Gira Food, 'A European Bakery Markets Overview'

14. Ibid.

15. Money Inc. 'The Five Most Expensive Types of Bread Money can Buy'

16. Nation Master, 'Bakery Products Production Value'

17. Tate & Lyle, 'Rising to the Challenge: European Bakery Industry Research Report'

18. Global Newswire, 'Worldwide Bakery Products Industry to 2026 - Europe Dominates the Consumption of Bakery Products'

19. Tate & Lyle, 'Rising to the Challenge: European Bakery Industry Research Report'

20. Ibid.

21. Fortune Business Insights, 'Bakery Products Market Size, Share & COVID-19 Impact Analysis, by Product Type, Distribution Channel, and Regional Forecast, 2021 - 2028'

22. Frontiers in Nutrition, 'The Impact of Lockdown During the COVID-19 Outbreak on Dietary Habits in Various Population Groups: A Scoping Review'

23. Snack and Bakery, 'State of the Industry 2021: Bakery Poised for Continuous Growth'

24. Bakery Business, 'Local vs. Global Battle Brewing in Europe's Bakery Markets'

25. Ibid.

26. BBM Magazine, 'World Bread & Bakery Products Market'

27. Snack Food & Wholesale Bakery, 'Automation Solutions for the Baking Industry'

28. Bakery Info, 'Bakery Technology: You Say You Want a Revolution?'

29.

30.

31. Baking Business, 'Local vs. Global Battle Brewing in Europe's Bakery Markets'

32. BAKERpedia, 'Blast Freezing'

33. Low Energy Ovens, 'Bakery and Bake-off Market Study'

34. World Bakers, 'Category Trend Analysis: Europe's Big Bakery Markets'

35. IFF Nutrition & Biosciences, 'Pre-packed Breads Leads in Europe'

36. IFF Nutrition & Biosciences, 'Taking Artisan Qualities into the Mainstream'

37. Bakery and Snacks, 'The Cost of War: Food Terrorism, Soaring Prices, Global Hunger & Jamie Oliver's "Eton Mess"'

38. IEEE Xplace®, 'Environmental Pressures Generated by Bakery Waste for Sustainable Management'

39. McKinsey, 'Will the World's Breadbaskets Become Less Reliable?'

40. Ibid.

41. BizVibe, 'World's Largest Bakery Companies - Leading Bakeries & Commercial Bread Companies'

42. The AFE Group, 'About'

43. Bongard, 'Our Company'

44. Debra-Blades BV, 'About Us'

45. FRITSCH, 'Company'

46. Guéry, 'Guéry's Universe'

47. Kornfiel, 'About'

48. MECATHERM, 'About Us'

49. MIWE, 'About MIWE'

50. WP Bakery Technologies, 'About Us'

51. WP Haton, 'About Us'

22

Ibid.

Ibid.

23

24 WWW.EPTDA.ORG Copyright © 2022 EPTDA. All rights reserved. This work is registered with the IP Rights Office Copyright Registration Service Ref: 284749230