PRO Dealer

EDITOR-IN-CHIEF

Steve Payne steve@hardlines.ca

FEATURES EDITOR

Geoff McLarney geoff @hardlines.ca

CONTRIBUTING EDITORS

Rebecca Dumais rebecca@hardlines.ca

Sarah McGoldrick sarah@hardlines.ca

CONTRIBUTOR

John Caulfield

ART DIRECTOR

Shawn Samson shawn@twocreative.ca

PRESIDENT

Michael McLarney mike@hardlines.ca

FOURTH QUARTER/2025 // VOLUME 2, NO. 4

2060 Lakeshore Road, Suite 702, Burlington, ON L7R 0G2 • 905-330-3061 @Hardlinesnews • www.hardlines.ca

VICE-PRESIDENT & PUBLISHER

David Chestnut david@hardlines.ca

ACCOUNT MANAGER

Shannon MacLeod shannon@hardlines.ca

SENIOR MARKETING & EVENTS MANAGER

Michelle Porter michelle@hardlines.ca

CLIENT SERVICES MANAGER Jill MacLeod jillian@hardlines.ca

ACCOUNTING accounting@hardlines.ca

★ FREE TO HOME IMPROVEMENT DEALERS ★ To subscribe, renew your subscription, or change your address or contact information, please contact our Circulation Department at 866-764-0227; hhiq@mysubscription.ca.

Michelle Chouinard-Kenney GIBSON BUILDING SUPPLIES Aurora, Ont.

Brian Lavigne

EDDY GROUP TIMBER MART Bathurst, N.B.

Luc Léger

ELMWOOD GROUP HOME HARDWARE Moncton, N.B.

Brent Perry ALF CURTIS HOME IMPROVEMENTS Peterborough, Ont.

Gary Sangha CROWN BUILDING SUPPLIES

Surrey, B.C.

Hardlines PRO Dealer is published four times a year by Hardlines Inc., 2060 Lakeshore Road, Suite 702, Burlington, ON L7R 0G2. $25 per issue or $90 per year for Canada. Subscriptions to the Continental United States: $105 per year and $35 per issue. All other countries: $130 per year. (Air mail $60 per year additional.)

Canadian Publications Mail Agreement #42175020. POSTMASTER: Send address changes to Hardlines PRO Dealer, 8799 Highway 89, Alliston, ON L9R 1V1.

All editorial contents ©2025 by Hardlines Inc. No content may be reproduced without prior permission of the publisher.

Hardlines PRO Dealer is just one facet of the Hardlines Information Network. Since 1995, we’ve been delivering the most up-to-date information directly to you online, in print, and in person. Find out how you can get your message out with us. Contact: Shannon MacLeod, Account Manager 905-691-2492 • shannon@hardlines.ca

MARCH 30-APRIL 2, 2026

LAS VEGAS CONVENTION CENTER LAS VEGAS, NV

NHS

Find products, source suppliers, and build brands — smarter, faster, and more profitably.

CIL PAINT BRAND GETS RELAUNCHED IN CANADA

SPANCAN JOINS ARENA BUYING GROUP

ONE YEAR IN BUSINESS FOR ATLAS MACHINERY’S SECOND FLAGSHIP STORE

REMEMBERING PRO DEALER ALF CURTIS

SAINT-GOBAIN OPENS ZEROCARBON GYPSUM PLANT ONE PRO DEALER’S REACTION TO THE BUILD CANADA HOMES PROGRAM

PRO Dealer is about innovation and talent, above all

BY STEVE PAYNE Editor-in-Chief PRO DEALER

steve@hardlines.ca

This magazine, now in its fifth issue, was always going to be about two things: innovation and talent.

Last summer, when we drew up the game plan for Hardlines’ newest trade magazine, we already knew that telling PRO Dealer ’s 7,000-strong subscriber base about what they already understand was not going to cut it.

Only true innovation, and how to develop talent, was going to appear in our pages.

We think we’ve kept our word. On page 16 of this issue we cover SaintGobain CertainTeed’s remade gypsum plant in the Greater Montreal Area. It’s now the largest sustainable gypsum manufacturing facility in the world, powered by clean energy from Hydro Quebec.

On page 28, we talk about a diff erent kind of innovation— mass timber. The term has been going around the industry for a while. Element5’s new glulam production facility in St. Thomas, Ont., is going to impact the lumberyard industry soon, via wholesalers, says the president of the firm, Chris Latour.

And on page 20, we talk about the imperative of developing talent. Ramtin Attar is building complete houses with robotics in a Calgary factory. He makes the case for Canada not settling for being a producer of raw building materials, but going further with the value-added elements using AI.

And on page 58, we have a case study of a company that has never been afraid to innovate—Auto-Stak Systems.

Let me know what kind of new thinking your own company is delivering.

Telling our 7,000 subscribers what you already understand is not going to cut it.” “

“We had so much to learn in our first year of business and always felt Sexton’s support along the way. The entire team is approachable & willing to help. As a newer business, we have never once felt insignificant. From the President to Sales to Accounting, we know Sexton is just a phone call away and that responsiveness to all members is their biggest commitment. Sexton Group acts as an extension of our own team with a personal investment in our success. We would not be where we are today without the Sexton Group.”

Devon and Kelsey Brooks, Brooks Building Supplies

new business was subsequently named Pittsburgh Paints Company. The price was US$550 million. The U.S. and Canadian architectural coatings business was being sold so that PPG could “optimize its portfolio,” the company said in a press release at the time.

“It will result in increased capability to channel our growth resources to areas where we have the strongest right to win with our customers.” The division represented about US$2 billion out of PPG’s total global revenues of $15.8 billion sales last year.

Brian Carson, president and CEO of Pittsburgh Paints Co., says that launching CIL as an independent Canadian company will allow it to move faster, serve customers better, and invest more intentionally in the Canadian market.

One of Canada’s most historic paint brands, CIL, has been given new life by the Pittsburgh Paints Company. The Vaughan, Ont.-headquartered company announced on Sept. 9 that its Canadian paint business would be launched as a standalone company.

PPG sold its North American architectural coatings business to American Industrial Partners (AIP), an industrials investor, on Dec. 2, 2024, and the

PPG took over the CIL paint brand in 2014 when it acquired the North American architectural coatings division of AkzoNobel. CIL’s history dates back to 1910, when it was launched as an explosives company which later diversified into paints and varnishes. It was then renamed Canadian Industries Ltd.

“Launching CIL as an independent Canadian company will allow us to move faster, serve customers better, and invest more intentionally in the Canadian market,” said Brian Carson, president and CEO of Pittsburgh Paints Co. “This is about growth and building on the strength of our Dulux, Sico, and Betonel brands with a renewed focus on what Canadian customers need most.”

CIL also announced that Vince Rea will retire after more than three decades with the company. He had been PPG’s president in Canada. He is succeeded by Brendan Demler, president and general manager, commercial, and Tim Fisher, president and general manager, retail, who will co-lead the company from its Vaughan, Ont., headquarters.

Spancan, the hardlines buying group, has joined the European buying organization A.R.E.N.A. The membership of Spancan includes the Independent Lumber Dealers Co-operative, Federated Co-operatives Ltd., and TIMBER MART.

“Together with A.R.E.N.A., we are looking to dynamically grow our vendor partnerships to better our stores and customers. We are taking our Canadian buying group to a new global level,” said Doug Bitter, Spancan director of purchasing, in a release.

A.R.E.N.A. is an international alliance made up of 10 retail home improvement groups around the world. Its focus is on sourcing, negotiation, and quality control of hardware, lawn and garden, and home improvement products. It has offi ces in Paris, Shanghai, Ho Chi Minh City, Warsaw, and New Delhi.

The group claims to represent more than 20 billion euros (C$32.6 billion) of purchasing power through the following banners in Europe: Bricomarché, Bricorama, and Brico Cash in

recently at a

France (Groupement Mousquetaires); Hagebau in Germany; JUMBO in Switzerland; Gruppo BRICOFER in Italy; Dedeman in Romania; Pevex in Croatia; Brico, BricoPlanit and Praxis in Benelux (Maxeda DIY Group); and Woodie’s in Ireland.

However, in recent years, A.R.E.N.A. has been adding members in Canada. In June 2023, BMR Group joined up, becoming the first Canadian member. Kent Building Supplies followed suit in February 2024.

Just over one year ago, on the weekend of Oct. 18 and 19, a grand opening event for Atlas Tools & Machinery’s second store took place in Vaughan, Ont. The specialty retailer of power tools was set to “redefine the shopping experience for tools” with the store. The new location just north of Toronto would deliver an unparalleled selection of tools, expert service, and in the words of Atlas, “an immersive shopping experience.”

The store, located at 111 Creditview Road in Vaughan, spans over 35,000 square feet and will serve as destination for pros and those who shop like them.

With 70 years of tool expertise, the fl agship store in Vaughan boasts stadium-sized screens, hands-on demo stations, one-of-a-kind brand displays, and a café named after the company’s founder, Joe Ederman.

“Our new Vaughan store will provide high-quality tools, top notch service, and customer-centric experiences, creating an engaging and interactive shopping environment where every visit inspires,” said Shawn Ederman, president and CEO of Atlas.

“Coinciding with our 70th anniversary in business, we wanted our second store to provide an elevated tool experience that you can’t get anywhere else. From start to finish, our goal has been focused on getting every little detail right, from curating new brands to creating the ultimate jaw-drop when you step foot through the doors.”

Alfred “Alf” Curtis, founder of Alf Curtis Home Improvements, a pro dealer in Southern Ontario, died on Sept. 4 at 93 years of age. All three building supply stores (Peterborough, Lindsay, Belleville, Ont.) of the Castle member were closed on Sept. 12 for the funeral in Peterborough.

Current president, and Curtis’s grandson, Brent Perry delivered the eulogy. Perry spoke of Curtis

being “my mentor, my confi dant, and someone I could always count on. People would say we were so much alike, and that we looked alike. I do know we thought the same way about the business, solving problems, and dreaming about the future.”

Alf Curtis’s father, a Pontypool, Ont., farmer, died when Alf was in grade six. Alf dropped out of school to work on the family farm. His missing years of formal education did not mask the fact that he was a wizard at numbers, which would help him later in his business career.

At 15 years of age, Curtis started working for the Canadian Canoe Company. He became a lead hand, building cedar strip boats and canoes, until the Peterborough company went bankrupt in the late 1960s. He then went into business with his brother, installing aluminum siding, soffi t, fascia, and eavestroughs.

Curtis would make buying trips to Toronto—there wasn’t anywhere in Peterborough to buy the products he installed. He would load up his garage with inventory. Competing tradesmen would come around to buy products from Curtis—he was famous for helping anyone out. In a few years, Curtis and his wife opened up a “cash and carry” business called Alf Curtis Home Improvements in 1975.

Brent Perry became president of the business in 2011. Perry had started working full-time for his grandfather in 1990. Perry recalls Curtis’s “instant MBA” in lumber dealing, which kept the business out of cash fl ow problems consistently.

“Make sure your receivables and your inventory are larger than your payables and the money you owe to your bank,” Perry said “Alf taught me that and it has always served me well.”

Alf Curtis is survived by his wife of 73 years, June, who is 90.

Alfred “Alf” Curtis, founder of Alf Curtis Home Improvements, and current president, and Curtis’s grandson, Brent Perry.

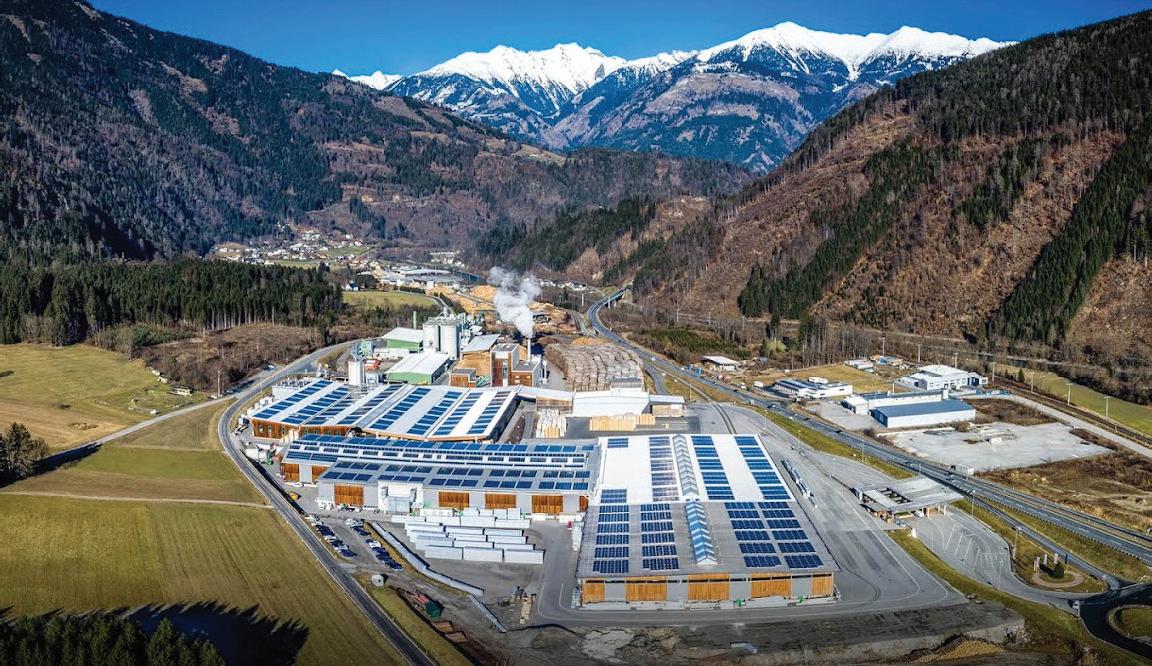

Saint-Gobain Canada held a ribbon-cutting on Sept. 26 for its newly electrified CertainTeed wallboard plant in Sainte-Catherine, Que., 25 kilometres south of downtown Montreal. It’s not only the first zero-carbon (scope 1 and 2) gypsum wallboard plant in North America, but it’s also the largest such plant in the world.

The launch followed two years of innovative and sustainable upgrades, undertaken in partnership with Hydro-Québec and the province’s environment ministry. A large grant from the latter’s EcoPerformance program of about $40 million, according to CertainTeed, was part of an overall investment of $91 million.

Among those in attendance for the ribbon-cutting was Marie Lapierre, French consul general to Montreal. She told the gathering that the facility’s launch “represents more than a factory opening; it represents the link between France and Canada, between France and Quebec.”

Saint-Gobain, a global leader in light construction, is headquartered in Courbevoie, France, a suburb of Paris.

The move to carbon neutrality, Lapierre added, was part of an eff ort toward a “more durable, more responsible, healthier world.”

Sainte-Catherine Mayor Jocelyne Bates said the plant “places our city and region at the forefront of the industrial innovation.”

Built in 1973, the plant alongside the St. Lawrence River was formerly powered by natural gas. Now it relies entirely on renewable energy from HydroQuébec. The conversion to electricity is a big part of the company’s sustainability eff orts.

Saint-Gobain Canada CEO Jean-Claude Lasserre acknowledged that electrification was “a very key element” of the company’s green transition and paid tribute to Hydro-Québec’s involvement in the project.

Mark Rayfield, Saint-Gobain’s senior vice-president and CEO for the North American region, called the transition to zero emissions a “win-win,” underscoring the company’s commitment to achieving zero carbon by 2050.

“We can offer Canadian homebuilders a low-carbon option, and with more capacity, we get more board out.”

Saint-Gobain has increased its estimated Canadian sales from $750 million four years ago to a reported $2.3 billion today. It has done this by a sequence of acquisitions in recent years. For example, it bought Kaycan, a manufacturer of aluminum and PVC siding and PVC windows for homes, in 2022.

Roofing producer Building Products of Canada Corp. (BP Canada) followed in 2023. And a major player in metal framing for lightweight construction, The Bailey Group of Companies, followed in 2024.

Le Figaro, the French daily newspaper of record, estimated that Saint-Gobain has spent more than C$4 billion on these acquisitions.

Saint-Gobain Canada’s remade plant near Montreal.

“

Hardware provided us with all the resources to succeed.

Malcolm Firkser

Owner

100% Canadian. 100% Dealer-owned and operated.

When you join the Home Hardware family, you become part of a tight-knit community that’s free from the pressures of external shareholders. Gain access to a trusted brand with personalized resources dedicated to helping your unique business thrive, plus a coastto-coast Dealer network ready to back you every step of the way.

Scan to learn more

In an eff ort to combat Canada’s housing shortage, the federal government recently announced it is spearheading the construction of aff ordable housing at scale through the utilization of factory-built and modular construction. The program is called Build Canada Homes and it was announced by Ottawa on Sept. 14.

The government touted the $13 billion project (the first phase of funding) as a way to help fi ght homelessness. It aims to build transitional and supportive housing through the initial construction of 4,000 factory-built homes on six federal land sites, with additional capacity of up to 45,000 units. However, some within the industry are questioning whether the project will deliver any real financial benefi t to the construction sector.

The industry has no issue with an additional supply of subsidized housing, says Peter Turkstra, CEO of

Turkstra Lumber, an I.L.D.C. member-dealer with 11 locations in Southern Ontario. But he believes that the way Ottawa has laid out the project simply won’t work.

“With a decline of 80 to 90 percent of townhouse construction, caused by their own [government] policies, many are still pointing fingers at developers, which is grossly unfair. They cannot build what they cannot sell,” Turkstra said.

As it stands today, he noted, many trades are already out of work or under-utilized, adding that he expects unemployment levels to exceed 100,000 jobs. “From retailers to window plants and all manufacturing related to new home construction, we are all down dramatically, and I expect to see a slew of bankruptcies in the coming year.”

He said the project is a refl ection of a bigger problem that exists within communities, noting that all materials and labour for a new home are, for the most part, Canadian.

“The cost per unit that they are publishing is staggeringly high. In the case of Ontario, these actions will not be enough to meet the housing needs of Canadians. If anything, some of the municipalities are focusing on sky-high-priced aff ordable and subsidized housing,” he said.

“What might help is changing the mindset of these charities and municipalities that will be awarded these ‘aff ordable’ housing projects. As it stands today, as sad as it is, most municipalities do not even support trades in their own community.”

Interview by Steve Payne

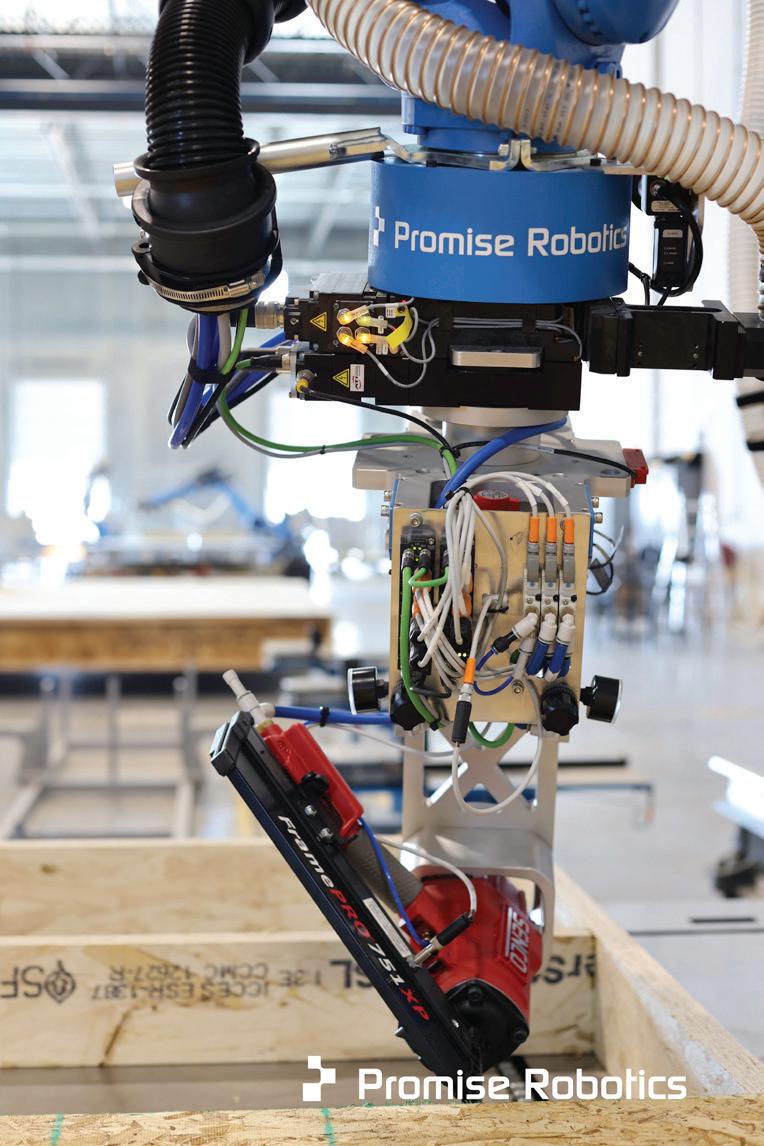

An interview with RAMTIN ATTAR, founder and CEO of Promise Robotics, on the launch of their new automated homebuilding factory in Calgary

On Oct. 15 you opened a homebuilding factory in Calgary to build houses using advanced AI and robotics. How is Mattamy Homes, the largest Canadian homebuilder, involved?

The factory is designed to build with almost any partner, but Mattamy is one of our anchor partners that jumped into this in a bold way. But the factory is already producing not only for Mattamy, but other homebuilders as well.

What is the biggest obstacle to innovation in the Canadian homebuilding industry?

It’s an industry that takes on a lot of risk and the folks that run those contracting businesses are small businesses. You’ve got contractors with a pickup truck, and maybe a framer and some subtrades. It’s not a structure that really thinks about what innovation means. Many companies that I meet, they’re happy to make 10 homes a year. It’s very diff erent from the automotive world, where you’ve got fi ve companies doing 16 million cars a year.

We’re a general AI automation company. We can process a lot of diff erent materials, including a lot of other forms of assemblies.

We reported previously that Promise Robotics uses the same robots that are used in auto manufacturing. Robotic arms have been around for a very long time. These are the same robotic arms that are used in automotive and traditional manufacturing. In automotive, where you have a very optimized plant, high volume, those robots’ costs come down to 30 cents an hour, which is incredible economics.

The breakthrough of Promise Robotics is that we have developed a brain for that robot to adjust to construction tools and be able to learn what an industrial carpenter does. We are able to assemble wall panels and fl oor cassettes with a degree of sophistication and much higher quality than what could have been done on-site.

Promise Robotics bills itself as a “Canadian AI and robotics company.” Not a homebuilder, per se?

Auto plants assemble metal components, which is a very uniform material. How do you get the robots to build with wood, which can vary from piece to piece? The sensing capabilities of these robots is almost the same as a human. How do you know when something fi ts into something else? From a sense of touch. If you watch our robots, you see them actually fi tting the tongue into the groove by using a sense of perception and touch. They essentially tell us, “This is the most perfect fi t that I’m able to produce.”

FlangeFlash

Typar FlangeFlash is designed for fl ashing non-fl anged doors and windows, forming a permanent mechanical bond between the window or door frame and the exterior wall. It simplifi es this critical detail and provides a verifi able air and water barrier. This double-sided, selfsealing fl ashing tape combines the strength of Typar Commercial building wrap with a high-performance all-temperature adhesive. typar.com

Performance Series Locks from Allegion

Schlage Performance Series Locks from Allegion bring trusted Schlage reliability to commercial real estate and multi-family projects where budgets are tight and applications require quality and security. The line includes the PM Series Grade 1 Mortise Locks, PC Series Grade 1 Cylindrical Locks, and PT Series Grade 2 Tubular Locks with four mechanical functions. allegion.ca

Great Stuff Wide Spray

Great Stuff Wide Spray is a one-component foam that quickly air seals and insulates seams, joints, large gaps, and irregular surfaces up to six inches wide. Its weather resistant formula is designed to adhere to vertical and horizontal surfaces without sagging, making it an ideal choice for challenging applications where traditional spray foam may not be suitable. dupont.ca

Compliant with ASTM F810 and made of high-density polyethylene (HDPE) with over 50 percent recycled plastics, Soleno’s triple wall pipe, TripleFlo, is available in three-metre lengths with a nominal diameter of 100 mm. It has been specifi cally designed to off er an exceptional level of rigidity in addition to being resistant to corrosion, abrasion, de-icing salts, and vibration. TripleFlo stands out favourably from PVC pipes due to its cost and reduced environmental footprint. soleno.com

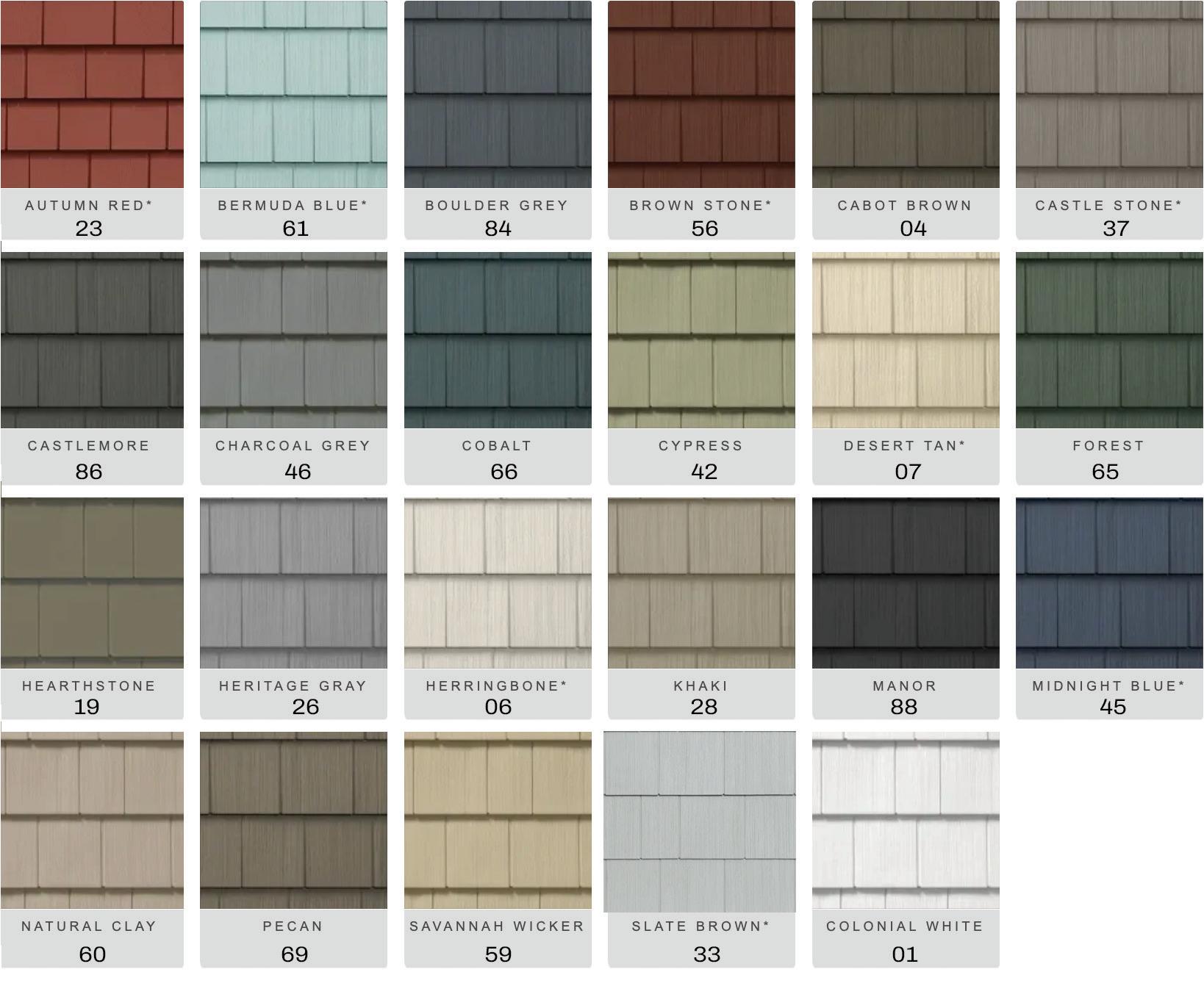

Deckorators has introduced a fire-resistant composite decking line, Altitude Decking, that combines protection with lasting style and performance—delivering outdoor spaces that are as secure, inspiring, and enduring as they are beautiful. Launching in select western markets in early 2026, Altitude features a fire-resistant core, has a Class B flame spread rating, and is ASTM E84 Standard Compliant. deckorators.com

SmartSide ExpertFinish Naturals

LP SmartSide ExpertFinish Naturals trim and siding is now available in the new LP Naturals Collection palette. Inspired by colour variations found in nature, this siding is available in six versatile colours with cedar texture and brushed smooth options. Ideal for wall applications or porch ceilings, it pairs beautifully with ExpertFinish core collection colours. taigabuilding.com

Cape Cod Engineered Custom Siding (ECS) is Eastern Canada’s first fully-serviced, custom-colour siding built on LP SmartSide. It combines style and durability to enhance homes’ curb appeal. ECS is available in a full selection of profiles, including lap siding, board and batten, panel, shake, and trims. For enhanced design versatility, ECS can be paired with the wood siding line to create striking, customized exteriors. marwood.com

Align Composite Cladding

Align Composite Cladding offers the authentic look of real wood in a high-performance, low-maintenance material engineered for today’s exterior expectations. Crafted with innovative composite technology, Align delivers lasting colour, dimensional stability, and energy efficiency, making it a smart choice for professionals seeking curb appeal and long-term value. gentek.ca

By Steve Payne

Mass timber is likely to come to a lumberyard near you for three good reasons

Reducing carbon emissions and the need for aff ordable housing are driving it. And the trades shortage is making its factory-built origin attractive.

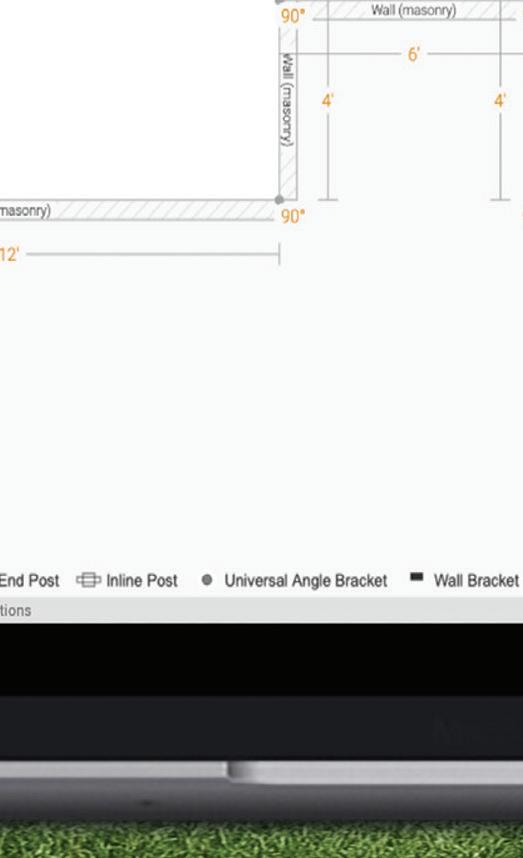

On Sept. 17 there was a grand opening of the expanded mass timber manufacturing plant in St. Thomas, Ont., owned by Element5. The company is a North American leader in the design, fabrication, and assembly of mass timber buildings.

Mass timber is a class of engineered structural building materials, including cross-laminated timber (CLT), laminated veneer lumber (LVL), and glue-laminated timber (glulam). All three are produced by this plant.

The product category is a hot topic right now. It’s a type of fabricated, high-precision lumber that is

very media-friendly. It locks in carbon emissions, as natural wood has always done. A cubic metre of mass timber can sequester up to a tonne of carbon— which is why it’s purported to be a sustainable replacement for steel and concrete.

PRO Dealer recently interviewed Chris Latour, president of Element5, which is located in both Toronto and St. Thomas, about his company’s $107 million expansion. Hasslacher Group, a large timber producer based in Sachsenburg, Austria, became the prime owner of Element5 at the beginning of 2024.

The Ontario government provided $8 million toward the plant’s expansion. Construction of the 137,000-square-foot plant was begun in 2019. That facility largely produced CLT. The latest expansion of the facility moves it up to 360,000 square feet, Latour says. A world-class glulam line has been added.

A big boost was given to the mass timber industry when B.C. and Ontario’s building codes raised the maximum height for timber structures to 18 storeys. Previously, a much lower height limit was permitted in those provinces. But Latour says it’s not so much regulatory changes as the experience of Europe that has made mass timber take off in North America.

“Our business model still had huge growth potential,” Latour said. “We used Europe as a guiding expectation of the market because it started earlier

than us. And the two trajectories, although 20 years apart, do have similarities.”

Mass timber is now enjoying a coast-to-coast market in Canada. And Element5 is shipping about 60 percent of its product south of the border, so far untroubled by the tariffs issue. After all, mass timber is classified as a free trade product under the Canada-U.S.-Mexico (CUSMA) agreement. Which everyone knows is up for renegotiation.

“We have been very open and talked to a number of our customers since the [trade war], about the potential that [CUSMA] could change. I would say it has never deterred anybody that we’ve seen from staying with mass timber, but it has affected the timing of their project.

“Our U.S. customers have in some cases needed to go back to do their due diligence to make sure that they can still have a positive business case. But in most cases, we are one of a number of products that’s impacted for them. And they’re

not just analyzing mass timber, they’re analyzing the impacts on steel, brick, specialty products, furniture, lights, etc.

“There are so many great Canadian products going across the border. They have to analyze all those. But it’s also been made clear that we have to continue to educate in the Canadian market and say that, regardless of what’s going on with the tariff structure down there, we need houses here and we can supply those houses.”

But with everything sustainable, like electric vehicles, there is a perception that new green technologies are prohibitively expensive.

“That’s definitely something that we’re challenged with,” Latour said. “We’ve spent a lot of time with our partners showing the complete end-to-end process and costs—and showing that we’re at least equal, if not better.”

We’ve spent a lot of time with our partners showing the complete end-to-end process and costs—and showing that mass timber is at least equal, if not better.”

The cost of construction is higher in a traditional trades world. The costs of putting up the building can arguably be lowered in a factory-built component environment. “People like to look at one very small slice of the cost,” Latour said.

“Anytime you go off site, there’s less impact from weather. Whenever you do something on site, if it rains or there’s traffic issues, all these things lead to delays on site. But the costs are still being incurred. Then on the sustainability side, wood has always been a carbon sequestering material, and it’s very efficiently grown, harvested, and logged.

“At the end of the life cycle of that mass timber building, the wood can be reclaimed with minimal

Pictured from left at the Element5 plant expansion opening are: Hannes Hohmuller, Hasslacher Group; Chris Latour, Element5; Kevin Holland, Ontario associate minister of forest products; Christoph Kulterer, Hasslacher Group; Vic Fedeli, Ontario minister of economic development; Kevin Rocchi, Element5; Gunter Gigacher, Hasslacher Group; Khawar Nasim, Invest Ontario.

impact. Whereas with concrete and steel, you tear that building down. The number of avenues is limited, and you’re releasing carbon as you’re tearing the building down.”

So far, Element5 has counted on sustainability-oriented public sector projects to make up the lion’s share of its sales.

One of the completed projects that Element5 widely promotes is the YWCA Supportive Housing building in Kitchener, Ont. It’s a four-storey, 41-unit, multi-residential unit that was built in record

time— and all out of mass timber. “It’s been heavily advertised by us, but we assembled the structure in about 18 to 19 days, which is by far an industry best. Element5 has completed 10 affordable housing projects to date, with five more currently in construction and six more in development.”

The four big wholesalers in our industry (Taiga, Doman/Canwel, Gillfor, and Goodfellow) have supplied engineered wood products to residential construction industry via lumberyards for a long time before mass timber became a buzzword. To the extent that companies like Element5 manufacture ready-made CLT panels, they provide an alternate method of construction to engineered i-joists and plywood on site. And Latour acknowledges that at less than three storeys, CLT is not as favourable from a price point of view.

“We do not operate in the residential market,” Latour explains. “It’s a big market, so we are using distributors to take our product, which is standardsized and standard engineering properties, to be distributed out to the various builders.”

This is all part of the launch of Element5’s new

Element5 is in conversations with wholesalers about providing their mass timber products to lumberyards.

glulam line. “We’ve already started with shipments to some of these distributors,” Latour said. “We’ve had a number of conversations on how we will continue to support and grow that market. We think that it’s a very important part of our strategy in terms of the efficiency of our production and also the efficiency of our clients. If we were going to have every home builder try to come to us, we wouldn’t be able to support the number of requests or provide the training that would be needed.”

Asked about the possibility of Element5 products soon being available in a lumberyard near you, Latour replies: “Absolutely.”

“That’s been our largest focus with the launch of our new line—having a substantial part of our glulam business dedicated specifically to those groups. With many of the groups we’ve been having conversations for upwards of a year. To make sure that they can answer the questions, can train their clients, and can sell their products efficiently.”

Mass timber is going to be a term that lumber dealers hear more about. Along with Element5, there are Canadian manufacturers such as Nordic Structures (based in Montreal) and Kalesnikoff (based in Castlegar, B.C.).

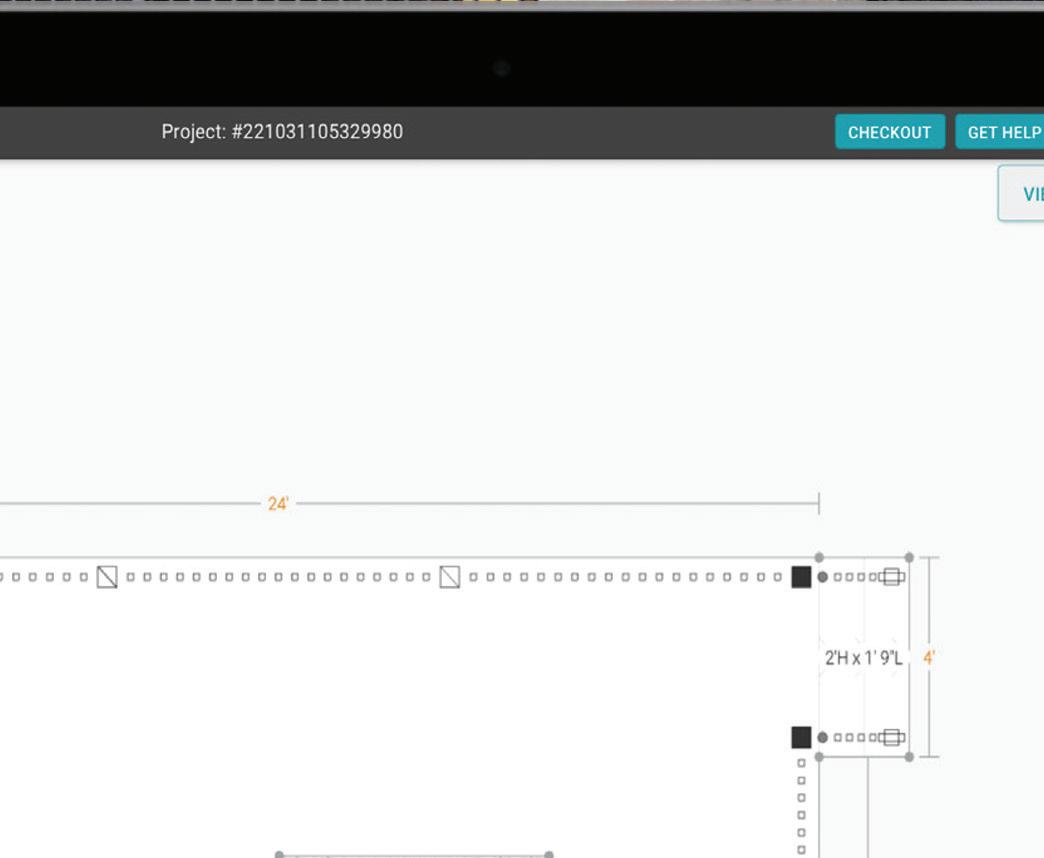

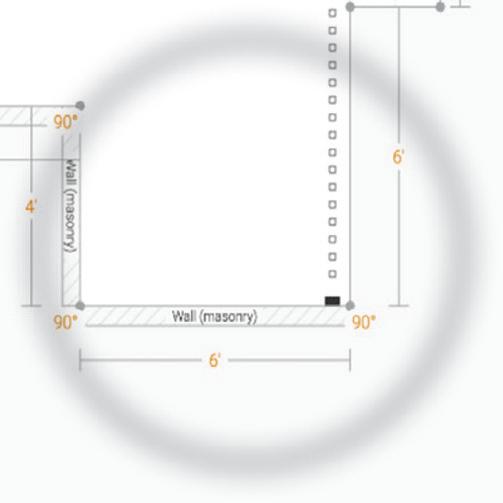

Online quote in 5 minutes with Deck Planner

Quick shipping: in stock and ready to ship

No rot, no structural degradation — ever

Ground level, floating rooftop frames, dock, or elevated deck

Lifetime warranty

NO ROT. NO RUST. NO WORRIES. THE ALUMINUM DECK FRAMING THAT MATCHES THE LIFE OF YOUR RAILING

Interview by Steve Payne

David Friesen and his wife, Katherine, started building homes in Winnipeg in 1951. Since then, the company has grown into a vertically-integrated real estate company with multiple business units. Almost 75 years later, one of the units, Star Building Materials, is a powerful pro dealer in the western provinces. We interviewed Star vice-presidents MARK KENNEDY and KEN CROCKETT to learn what makes their businesses tick.

Star Building Materials vice-presidents MARK KENNEDY

PRINCIPAL SHAREHOLDERS: Ruth and Brian Hastings

PRESIDENT: Kevin Vann

STAR BUILDING MATERIALS VICE-PRESIDENTS: Ken Crockett (Calgary)

Mark Kennedy (Winnipeg)

STAR BUILDING MATERIALS is a part of the home building and development company called Qualico Developments Canada Ltd.

Qualico is present in many provinces and the U.S. under various “verticals.” Under Qualico, there are land and commercial development divisions and property management companies, such as Rancho Realty. And there are numerous home builders doing business under names like Foxridge Homes, Kensington Homes, Pacesetter Homes, and Sterling Homes, among others. There are also verticals with names like Star Plumbing & Mechanical, Star Mechanical Edmonton, Star Ready to Move Homes, Building Products & Concrete Supply LP, Gypsum Drywall Interiors (GDI), and more.

It all started when David Friesen and his wife, Katherine, began building homes in the South River Heights neighbourhood of Winnipeg in 1951. As the company grew and more houses were being built, the need to vertically integrate the supply chain

became evident. As a result, Star Building Materials was born in 1965.

When David Friesen died in 2007, he had become a legend, commonly known as “Doc” within the company.

PRO Dealer sat down with Ken Crockett and Mark Kennedy, Star Building Materials vice-presidents in Calgary and Winnipeg, respectively, to talk about what makes their firms so successful.

Let’s start at the very beginning, with David and Katherine Friesen.

KC: The Doc was, indeed, a legend. And Katherine, too. She quickly found her way within Rancho Realty. She got her real estate licence and started to sell the houses that David built. That grew into what is a huge arm of Qualico Developments now—a property management and commercial real estate company. We’ve got supply verticals beyond Star Building Materials throughout diff erent provinces. We are a

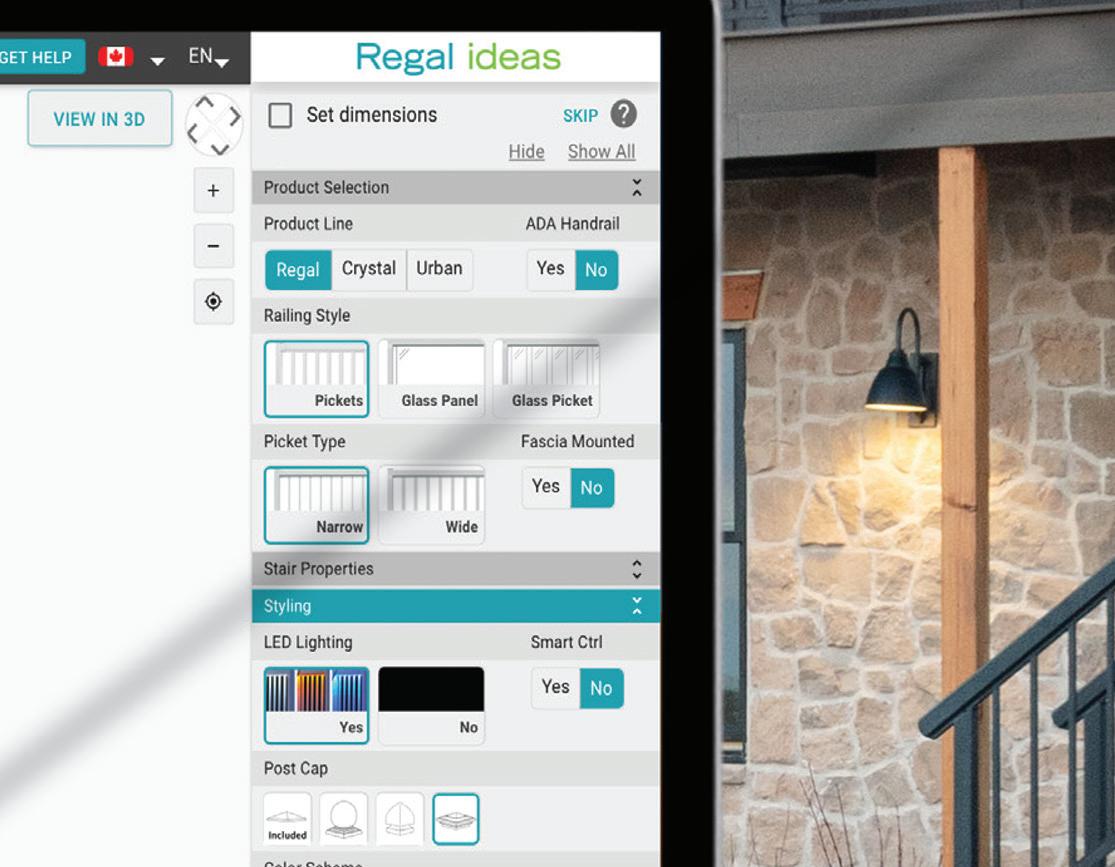

• Free, Cloud Based, Personalized Software

• Integrated Pricing and Inventory Lists

• Quick Product Changes

• Realistic 3D Renderings

• Order Builder

• Lead Generator

• And Much More

And it’s our job to ask: how do we make it easier? How do we make it more affordable? How do we get it to a better quality?

—Ken Crockett

fairly signifi cant leader within the building materials industry. Qualico is a customer of each of the supply chain companies, but they’re not our only customer. It’s an advantage we have because we’re so integrated.

Both Mark and I sit at the peer table of the land development and home building industry, right through to possession by the family that’s bought the house. We get an insider glimpse into the construction difficulties that come up from start to finish.

And it’s our job to ask: how do we make it easier? How do we make it more aff ordable? How do we get it to a better quality? All those things that go into the construction of a home or the design of a house from start to finish.

MK: It gives us an advantage in the marketplace. We don’t just sell lumber; we don’t just sell trusses. We sell complete homes! We really understand how important the construction cycle is.

What separates Star from our competitors is the service levels that we can provide. And part of the inside track that we’ve got is we know what the builder wants—because we talk to them every day! We’re part of those companies. Being able to provide better services to our customers is based on the needs of the builder.

And we get very honest feedback. It’s like asking your bigger brother, ‘Can I borrow fi ve bucks from you?’ I mean, you know exactly where you stand right away. We don’t have to guess between the lines. Because we’re told pretty quick if we miss the mark and how we should adjust. As hard as it is sometimes to hear it, we love that feedback because it allows us to make immediate adjustments. Ultimately, this benefi ts not just us but our customers and the industry as a whole.

Can you explain the diff erence between the Alberta and Manitoba operations of Star Building Materials?

KC: We just recently integrated our operations in Calgary to one full site, which opened in June of this

We control every part of the process, from inbound lumber to finished loads, so every bundle meets our expectation for consistency and quality.

No matter the region, no matter the season, you get the same dependable product, shipped through our integrated logistics network and ready to perform in the toughest outdoor conditions.

Start at taigabuilding.com

“ It gives us an advantage in the marketplace. We don’t just sell lumber; we don’t just sell trusses. We sell complete homes. We really understand how important the construction cycle is.

—Mark Kennedy

year. We supply five distinct categories there: lumber, prefabricated wall panels, trusses, and engineered wood products including flooring and interior finished products. In our Edmonton market, we recently expanded that facility as well. It supplies lumber, trusses, and engineered wood products. We have about 428 employees in Alberta.

MK: Winnipeg is very similar to Calgary with a couple of different nuances. The building materials store, which is our primary business, is actually a little bit more of a retail type of store where Ken

is more direct-to-contractor delivery. Alberta is more of a distribution style whereas we have an actual retail footprint in Winnipeg. Opened in 2019, it’s a 20,000-square-foot store. Along with our full e-commerce strategy, it’s a bit more of a walk-up scenario.

We also have the truss plant in Winnipeg, engineered wood products, and the floor systems. And in February we started a wall panel division. We do Ready to Move Homes here in Winnipeg. We don’t go to Alberta so much with that business. We primarily stick to the Manitoba and Saskatchewan markets.

KC: The diff erence between the provinces is that Mark distinguishes building materials, trusses, and ready-to-move homes independently. Whereas we have them under one banner in Alberta.

MK: That’s changing a little bit now. We are working to consolidate everything to be under Star Building Materials with diff erent services.

Do you have a diff erent percentage of contractor customers in the two regions?

KC: In Alberta it’s probably 99 percent contractors.

MK: We are probably about 70 percent contractors in Manitoba. And that’s primarily because of our store and our e-commerce.

KC: With our expansion in Calgary we’ve moved beyond a typical retail setup. You won’t find cashiers or boxes of product here. Instead, we’ve created

With our expansion, we’ve moved beyond a typical retail setup. You won’t find cashiers or boxes of product here in Calgary. Instead, we’ve created a collaborative, campus-like atmosphere, where everyone works together seamlessly.

—Ken Crockett

a collaborative, campus-like atmosphere, where everyone works together seamlessly. From anywhere on site, you can see the entire operation. And this transparency has strengthened collaboration across all our divisions.

Let’s talk about your backgrounds. Each of you took a diff erent route to Star.

KC: Yes, I worked for fi ve years for Jim Thorogood and ran a couple of his Totem stores. And when Jim sold to RONA in 2004, I was recruited by Star. Before Totem I worked at Home Hardware Building Centre in Kelowna, B.C., where I was the yard foreman and the contractor sales guy. I grew up in the industry from when I was about fi ve years old. My dad was a lumberjack up in the forest. I remember sitting in a skidder, you know, in the fallen trees. Totem kind of launched my career in this industry. I always say I got my MBA by working for Jim Thorogood [general manager and son of the founder of Totem, Cliff Thorogood].

MK: I went to Beaver Lumber University, as it’s called. It was my first part-time job in high school. I stayed there through my university days. I joined Star in 2015, after a stint at North American Lumber, where I was VP. It was a small, rural, community-

based company, with a lot of smaller stores. I really got to learn the supply chain. And working from a distribution centre—and how to make it effi cient. Early in my career, I worked for Revy. And it was from there that I went to Sexton Group, where I was a business development manager.

You both have had a lot of autonomy at Star. How does that work?

KC: The really interesting thing about working for a Qualico company is that all the leaders are given an opportunity to somewhat autonomously run their business units like we own them. It is very much an entrepreneurial spirit. We’re very fortunate to have the Qualico ownership group that capitalizes us well and uses their profi ts to continue to invest within each business unit. We make decisions as an owner would at the end of the day. And I think that’s where the nuances allow us to be diff erent but the same. We leverage the similarities between the two divisions in Alberta and Manitoba. It allows us to be our own business and do what is working in our own markets. It’s not this canned approach where you have to be a certain way. And yes, we both think

we run it better than each other. It is good to have a competitive spirit, right? It totally is!

The Canadian government has proclaimed that it’s trying to double the pace of home building. That can’t happen without the skilled labour on site. What do you think of this dilemma?

MK: That’s where the manufacturing process comes into play. Maybe you only need one or two journeymen on the job site and, instead, a bunch of guys standing up walls. Instead of having Red Seal carpenters trying to stick frame everything. So that’s obviously a part of the modular home building strategy.

KC: It’s hard to find skilled people. We have strategies in place to help highlight jobs in the industry— and get people to enter our trade. Neither Mark nor I thought we’d be in this position when we started. But we worked our way into VP roles of very successful businesses that are privately held. There are so many opportunities in this industry for young people. This year in Alberta, we launched an internship program with Supply-Build Canada, Careers

Alberta, and Careers Canada. We’re trying to give people an opportunity to experience what working in supply chains is like. Because there are more Kens and Marks out there that are just waiting for a spot. They don’t need as much knowledge as they used to need in order to enter our workforce. And we can train them faster. In the last few months in Calgary, we hired 41 staff.

MK: You kind of fall into this industry, but then you fall in love with the people and the opportunity. And I think Ken and I are prime examples of the opportunities available. It’s huge. Our job at Star Building Materials is to open eyes to various opportunities that are within our industry. On our truss side, it’s designers, it’s technical people. And on the creative side, it’s marketing people. It’s much more than driving a truck. Or out in the yard, hauling two-byfours. As vitally important as those jobs are. And I think the more that we can educate people about the opportunities that are in our industry, the more we’re going to attract better people. We are trying to get that message out to the young generations coming forth.

“

Our job at Star Building Materials is to open some eyes to the different jobs that are within our industry.

—Mark Kennedy

By John Caulfield

Home Depot and Lowe’s are now in the gypsum supply business thanks to acquisitions that cost the two companies US$14.3 billion

Skrepnek opened his first two Encore Drywall Material Supplies locations in Ontario in the summer of 2024, he thought his biggest competitive challenge would be off ering consistent personalized service to pro customers.

A year later, that strategy remains intact. But what Skrepnek couldn’t have foreseen was that Encore, as it expands, might also be vying for large pro customers against North America’s two largest home improvement retailers, Home Depot and Lowe’s.

The number one and number two big box retailers in the world have recently entered the gypsum supply dealer (GSD) market.

Home Depot has closed the acquisition of GMS Inc. of Tucker, Ga., for US$5.5 billion. Lowe’s, just before press time, closed the purchase of Foundation Building Materials (FBM) of Santa Ana, Calif., for $8.8 billion.

GMS, which has a Canadian offi ce in Vaughan, Ont., has more than 300 locations in North America doing $5.5 billion. Foundation Building Materials has at least 370 branches that, in 2024, generated $6.5 billion in revenue.

These deals give the big box retailers direct access to large interior professional contractors in Canada, a customer cohort Home Depot and Lowe’s have struggled to capture, at least in the numbers

“

Two of the biggest GSDs in the world are no longer independent companies. Home Depot has purchased GMS Inc. and Lowe’s has bought out Foundation Building Materials.

desired. (Lowe’s claims that its pro sales rose to 30 percent of its total annual revenue in 2024, from 19 percent in 2019. Home Depot doesn’t break out its sales to pros, but at least one estimate pegs that number at close to half of Depot’s annual revenue.)

These deals also complement other recent pro-oriented acquisitions by the biggest big boxes in the world. In June 2024, Home Depot purchased SRS Distribution, a supplier of roofing and other building materials, for a staggering $18.25 billion. SRS has over 800 locations in 48 U.S. states.

This past summer, Lowe’s purchased Artisan Design Group (ADG) for $1.35 billion. ADG has at least 132 facilities in 18 states providing design,

distribution, and installation services for interior surface finishes, including flooring, cabinets and countertops, to national, regional, and local homebuilders and property managers.

Home Depot, Lowe’s, GMS Canada, and FBM either declined to make available their executives for interviews or did not return PRO Dealer ’s requests for comment. In an e-mail statement, Home Depot said that the GMS acquisition “accelerates our strategy to better serve specialty trade pros.” Home Depot’s goal is to become the “preferred destination for pros.”

In a prepared release, meanwhile, Lowe’s president and CEO Marvin Ellison said the FBM deal “allows us to serve the large pro planned spend within a $250 billion addressable market and aligns perfectly with our Total Home strategy.”

To meet their objectives, Depot and Lowe’s will need to seize at least some of the market share now controlled by other GSDs and their buying groups in Canada. Outwardly, though, the retailers and market watchers we spoke with did not think these deals were cause for panic for their companies or dealer memberships.

“I don’t hear a lot of concern [among independents] out there. And I think that things will continue as is,” said Brian McCormick, president of Regina, Sask.-based Kenroc Building Materials, with 14 GSD locations in Western Canada.

Home Depot’s and Lowe’s expansions in Canada “will ultimately be business as usual, but with different names” for the companies they’ve acquired, predicted Ken Jenkins, president of Castle Building Centres Group.

Castle is the buying group that the above-mentioned Encore joined in August 2024. Jenkins pointed out that during this recent spate of industry consolidation in Canada, Castle’s dealers have experienced “good growth.” He also noted, however, that what’s happening in the GSD market now “compels groups like ours to support the channel.”

The rearranging of the upper echelon of GSD dealers is likely to have an impact on competitors and pro customers’ purchasing choices. While there are still unanswered questions, one thing that everyone seems to agree on is that future GSD market success will be linked to the consistent execution of personalized customer service.

Last year, Home Depot opened only a dozen new stores in the U.S., and none in Canada. And Lowe’s added just two stores south of the border (it exited Canada in 2023). Each retailer’s revenue and net income through the first half of fiscal 2025 were essentially flat, perpetuating the pattern of the previous few years.

Jenkins thinks the big boxes may be reaching a saturation point for retail warehouse expansion

in North America and are looking to tap other market segments. Arenas where they aren’t as dominant, including pro customers, are an obvious choice. Demographics might also be a factor, Jenkins said, as aging homeowners transition from a Do-It-Yourself home-improvement mindset to Do-It-For-Me that calls upon pros to complete projects.

The GSD acquisitions that Home Depot and Lowe’s have made are tacit admissions that organic growth from their warehouse stores wasn’t working fast enough, and the best way to increase their sales penetration with contractors was to purchase businesses with established footprints and customer relationships.

FBM operates 27 locations in Ontario and four western provinces, and GMS Canada, as of mid-September, had 45 outlets in five provinces.

SEAL OUT THE COLD AND HEAT UP YOUR SALES WITH ENERGYEFFICIENT REGENCY® 400 SERIES – NOW FEATURING ARMOUR GUARD™ BLACK EXTERIOR TECHNOLOGY

• Extra-strong 4-1/2" thick fusion-welded frame accommodates a variety of installations

• Double-glazed 7/8" insulated glass;* triple-glazed also available

• Quanex® Super Spacer® structural foam spacer

• Customize with EnergyPlus™ QUATTRO, EnergyPlus or Solar Shield glass packs

DELIVERING THE BEST SOLUTION AT THE BEST PRICE

• High performance, lower cost

• 7X harder than standard water-based paint

• Superior fade resistance

• Faster turnaround time

See your Gentek Sales Representative to discover how Regency 400 Series with Armour Guard technology can help drive real savings and results for your business.

“If you can’t beat ’em, buy ’em,” quipped Mitch Wile, whose more than 30-year career has included management and consulting stints with the Canadian GSDs Winroc and Kenroc. Wile saw the big box acquisitions as part of a larger trend where “the big are getting bigger.” He pointed specifi cally to the completion this September of the gypsum manufacturer giant CGC’s acquisition of Imperial Building Products, a leading maker of steel frame components, drywall trim, and related accessories.

Skrepnek himself helped cobble together the GSD network known as WSB Titan, which formed in 2009 and grew to nearly $700 million in annual sales in 2018, when GMS Inc. acquired it for US$627 million. Skrepnek stayed on for a while to run GMS Canada, then detoured into other businesses before deciding last year to re-enter the gypsum business. He acquired a GSD location in Concord, Ont., from CSR Building Supplies, and developed a greenfi eld outlet in Trenton, Ont.

He told PRO Dealer that his decision was based on a number of variables: that owner-operators were becoming scarcer in this retail sector; and that barriers to entry—including capital, employees, materials, equipment costs—were easing after the COVID

shock a few years earlier. He also was hearing anecdotally from pros that the dealers they bought from had become complacent about customer service.

Skrepnek is now planning for Encore to expand organically and through acquisition, first in Ontario and then in other provinces. He doesn’t see the intrusion of Depot or Lowe’s into the GSD space altering those plans beyond his company responding to the competitive pressure that was already being exerted by GMS and FBM in Canada.

That pressure is partly the result of aggressive expansion over the past several years. American Securities, an investment firm that was FBM’s majority shareholder before Lowe’s, has said that from 2021 up to when it was bought, FBM completed over 20 acquisitions. During those four years, FBM strengthened its e-commerce off ering, opened more distribution centres, and added product categories such as commercial doors and hardware.

The website Tracxn stated that from 2016 through 2024 GMS acquired 23 building supply and service companies, the most recent being Yvon Insulation in Burlington, Ont.

Home Depot and Lowe’s have shown a willingness to spend lavishly on assets they covet. Aggregately, they laid out just shy of US$34 billion to purchase GMS, FBM, ADG and SRS. And it stands to reason that their growth ambitions in Canada include considering other acquisitions.

The big boxes have stated that they are looking for companies that are “scalable,” meaning their operations are replicable for growth. A prime example has been SRS Distribution, which between 2008 and September 2025 added 225 branches and closed 107 acquisitions in North America. On its website, SRS says it is looking to

Lowe’s, just before press time, closed the purchase of Foundation Building Materials (FBM) of Santa Ana, California, for US$8.8 billion.

add companies that have a consistent profitability, “clean” histories, and a “future vision.”

GSDs with regional networks in Canada, like Kenroc, which is owned by a private-equity firm; the eight-branch PacWest Systems Supply in British Columbia and Alberta; and six-branch Consolidated Gypsum in Alberta and Saskatchewan—are mentioned as possible future targets (even though none of these has indicated publicly that it’s for sale). PacWest declined to comment and Consolidated didn’t respond to our request for an interview.

If Home Depot and Lowe’s were to go on buying sprees in Canada, independent GSDs will need to ask themselves what critical mass allows them to stay in the game. Wile said, too, that current market dynamics could compel dealers to focus more on product niches that don’t have as much competition, like insulation or stucco. Market conditions might also lead to consolidation of some buying groups to strengthen their hands when it comes to buying directly from manufacturers.

Delroc Industries, Canada’s largest buying group in the GSD space with 33 members that operate 130 locations, did not respond to PRO Dealer ’s request for comment from its general manager Derrick Gray.

McCormick of Kenroc thought that it was too early to speculate about how all this market commotion will play out, especially when business conditions in 2026 are yet unknown. The sources we talked with thought that Home Depot and Lowe’s are likely to be cautious about expanding eastward in Canada into markets that put their GSD locations in competition with Kent Building Materials’ stores.

Some sources also wonder what would happen if ABC Supply, the largest building materials distributor in North America, decides to aggressively expand in Canada, where ABC currently operates 24 branches in three provinces.

Whatever happens, McCormick said he believes that independent GSDs will be ready for it, having

made strides in improving their customer service offerings through the application of technology and better equipment that facilitate smoother loading and logistics.

He conceded, though, that the presence of Depot and Lowe’s could usher in more “discipline” to the GSD market in terms of policies, pricing, credit, and even operations.

GSD best practices, said Skrepnek, must “under promise and over-deliver.” He adds that pro customers will favour GSDs that can quickly provide them with answers that help run their businesses. And dealers need to “buy right” to offer the mix of products and prices their contractor customers need and demand.

A consistent service experience that binds the pro customer to their stores will be the key to success for GSDs. “Anybody can buy assets, but business retention is the challenge,” said Jenkins.

By Geoff McLarney

Energy efficiency is one of the fastest-growing categories in any home improvement retailing store. Here’s what major insulation manufacturers are selling in 2026

Insulation is one of the fastest growing categories in any home improvement store. There’s no secret why the category has been doing so well for decades. Energy costs have become so high that Canadians have been upgrading their insulation choices since the 1970s, when energy spiked upward in a response to the OPEC embargo in 1973. The first of the lucrative insulation subsidy programs, the Canadian Home Insulation Program (CHIP), was born shortly after

that, in 1977. Now, governments are inexorably driving us to build greener and tighter because of climate change, not energy prices.

The largest component of the insulation market is glass wool insulation. But the fastest-growing type of insulation, multiple sources say, is spray-foam and EPS, because of the ramping up of energyeffi ciency building codes.

Here’s what insulation manufacturers are pitching to retailers and buying groups in 2026.

This fibreglass insulation is made with environmental sustainability in mind, Owens Corning says. It holds firm with no formaldehyde, maintains thermal control to meet codes and homeowners’ standards, and is made from 100 percent wind-powered electricity.

Canada improved energy efficiency by 13 percent between 2000 and 2021. That saved us $27.2 billion in energy costs. “

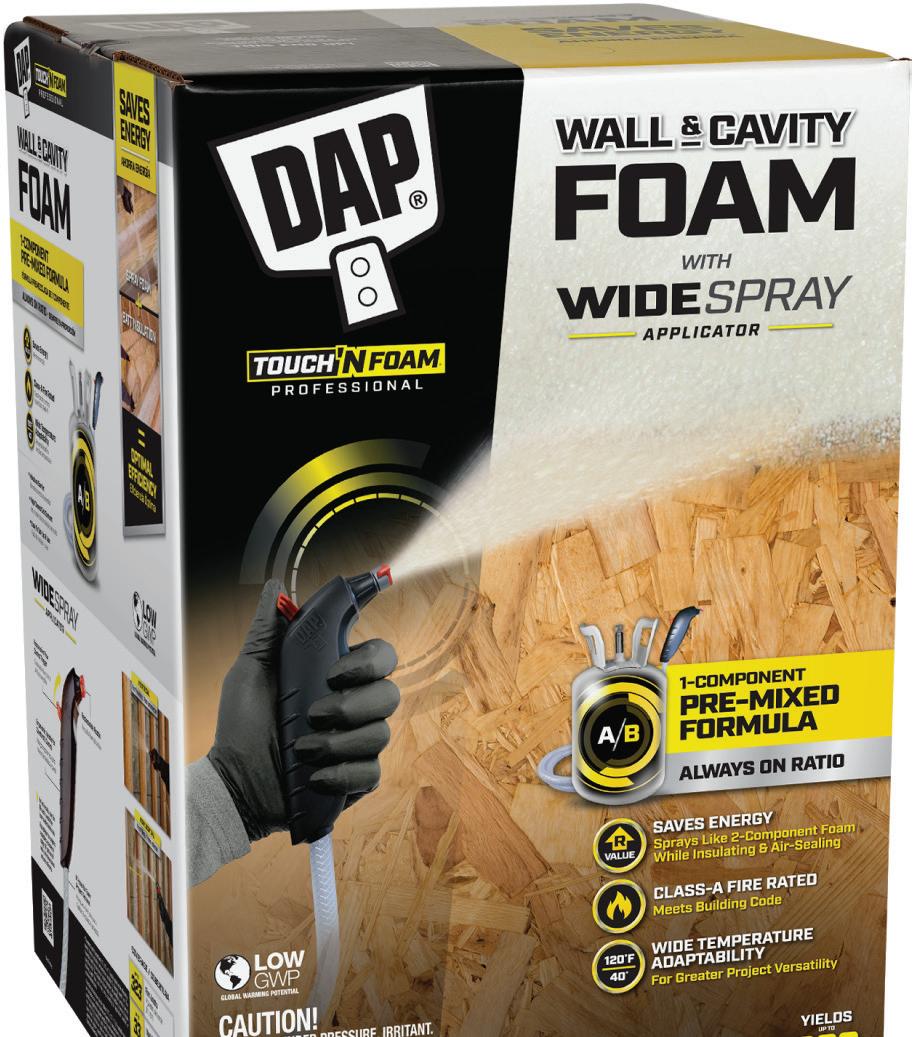

Billed as the first of its kind, DAP Wall & Cavity Foam is a wide spray applicator and pre-mixed formula that, like a two-component spray foam, air-seals and insulates with ultimate spray control. Homeowners can save up to 30 percent on energy costs by simply spraying a thin layout of this product before installing fibreglass insulation.

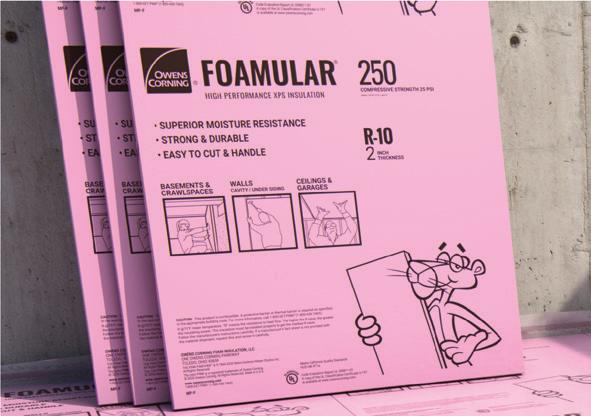

This insulation is a closed cell, highly moistureresistant foam board insulation available in thickness ranging from 0.74 to 4 inches. It’s easy to cut, shape, and install for a precise fi t.

This product is a series of fl exible, semi-rigid or rigid thermal and acoustical fibreglass insulating boards for custom curtainwall applications. Insul-Shield is fire-resistant and non-combustible. Available faced and unfaced.

With compressive strength of 25 psi, Johns Manville AP Foil25 Polyiso Continuous Insulation is a waterresistive barrier, vapour barrier, and air barrier all in one. It’s especially suited for commercial applications where higher compressive strength boards are preferred for certain exterior cladding systems.

Energy efficiency is the practice of using less energy to perform the same task. The best way to get a house to increase its energy efficiency is to improve its insulation. “

This new insulation is an easy-to-install, cost eff ective product to help save energy in residential and commercial new construction, as well as for renovating or retrofi tting existing builds. It is made of glass fibre that consists of rapidly renewable content, a high percentage of recycled glass, and a plant-based binder.

Extends product life up to 3x* and eliminates regular descaling service.

*compared to other tankless models without X3™ technology.

Interview by Geoff McLarney

With its Roofpro program, IKO is keeping its trusted contractors loyal—and educated. Rob Davidson, vice-president for residential sales in Canada, breaks it down for PRO Dealer.

What is IKO doing to encourage roofers not to chop and change and pick IKO as their specifi c roofi ng supplier?

Contractors are a very important part of our business. They are the people representing our products in the home with the consumer. We have a contractor loyalty program called Roofpro, and in that program we have three levels. The first is called Advantage level. There’s no cost to join, and this allows contractors access to our program.

The next level up is called Select. When a contractor advances to this level, we off er to put them on our website’s contractor finder, so that homeowners can learn about them and even ask for a quote. When consumers are looking for a contractor, they want somebody that they can count on and trust. And since we’re going to be promoting these contractors on our website, we put them through testing and a background check to make sure they meet the criteria.

The top level is called Craftsman Premier. These are guys that are extremely loyal. They do very large volumes of roofing. They’re going to be visible on the website as well. And on the website, we also allow them to have a contractor portal.

For example, if you’re a contractor and you’re listed on our website, the consumer can enter the contractor’s postal code and find their roofing business listed. They can click on it and open up another portal where contractors actually have the ability to put in information about their business and promote their business to that consumer.

Financing has become a very big part of our business. The economy is very tough. Not everybody has a lot of extra cash lying around. Often, a roof is

The feedback has been very positive and we understand that the contractors get a lot of value out of it. “

Anywhere from 75 to 100 contractors show up at these Roofpro events.

a surprise for people. You don’t necessarily plan on replacing your roof until one day somebody says, “Hey, you’ve got a problem.”

So having a finance option for our contractors is important because it gives them another alternative to the consumer instead of saying, “I need this big dollar amount right up front to be able to do your roof.”

What does IKO off er in terms of events, seminars, and the like for roofers throughout the year?

They can do it on a payment plan for the consumer as well. And that’s all managed by a third party; we connect the contractor with the financing organization. We’re using a company called FinanceIt and they specialize in the construction business.

Does the contractor get paid all at once or do they get paid month-bymonth as well?

When you do the financing, the financing company picks up the cost of the roof and pays the contractor outright. So now, the deal is between the finance company and the consumer. The roofer gets paid, he gets his money, he goes on. And the finance company, upon approval obviously, is dealing directly with the consumer on the payment piece.

On an annual basis, we normally have two to three Roofpro seminars that we put on for our Roofpro contractors. We try to do these seminars in both the east and west in our various markets. We invite our contractors in for the day and we bring in special guest speakers to present various topics.

We try to do these seminars in the off -season for contractors—in a February or March timeframe when we know they’re not actively out there trying to close work. Anywhere from 75 to 100 contractors show up at these events. The feedback has been very positive and we understand that the contractors get a lot of value out of it.

By Rebecca Dumais

Auto-Stak Systems’ rack-supported drive-through model trims costs and shrinks footprints. It also reimagines what “convenience” means for dealers and contractors alike

When it comes to innovation in the building supply sector, few ideas have reimagined yard effi ciency like Auto-Stak’s drive-through concept. It was developed to help dealers maximize space, reduce labour costs, and improve customer experience. The system has now evolved from a simple effi ciency upgrade into a transformative business model that changes how dealers build, store, and sell.

PRO Dealer spoke with Paul Tagarelli, president of Auto-Stak Systems Inc., who explained how the idea grew from a practical response to dealer pain points

into a defining solution for the modern building materials landscape.

“The drive-through started with a question,” Tagarelli recalls. “How can we make better use of existing buildings and create something more effi cient for the customer?” Many of Auto-Stak’s clients faced the same challenge: sprawling yards, constantly changing SKUs, and limited space to keep inventory dry and accessible.

Traditional lumberyards required vast open areas,

of often three or four acres, to handle volume. For smaller independents or expanding chains, the math didn’t work anymore.

“Customers were always struggling with inventory spread over large areas,” Tagarelli explains. “We thought, what if we could condense that? What if we could keep building materials, racking systems, and merchandising all in one drive-in environment?”

That question became the foundation for AutoStak’s now-signature drive-through concept: a covered, rack-supported warehouse where dealers or

“

The drive-through started as a question: how can we make better use of space? Today, it’s reshaping how the industry thinks about building and selling.

consumers can literally drive in, pick up what they need, and load out under one roof.

The drive-through reduces required yard space to less than one-third of traditional footprints. “It’s smaller yards, smaller staff requirements, smaller equipment needs,” he says. “It’s more effi cient from every angle.”

The compact design not only saves space, it transforms the economics of running a yard. “With a smaller covered area, you pay less tax, you need

Auto-Stak’s top racking system is in place at Woodstock, Ont.’s, brand-new Adams Building Supply.

fewer forklifts, and fewer people to manage stock,” Tagarelli notes. “You’re making the same amount of money, or more, while spending less to do it.”

Auto-Stak’s approach also challenges how dealers think about structures themselves. Many retailers assume a drive-through means building a full stick-frame or pre-engineered steel facility. Not by Auto-Stak’s standards. “A lot of our projects are rack-supported,” Tagarelli says. “That means the storage equipment itself becomes the support structure. You eliminate the need for a separate building shell altogether.”

It’s a system that has caught the attention of buying groups and independent dealers alike, from Home Hardware Building Centres to TIMBER MART, and others expanding into full-service operations. “It’s especially useful for dealers upgrading from hardware to full building centres,” Tagarelli adds. “They need efficiency, but they also need scalability.”

The drive-through concept has also changed how teams operate. Old-school yards were sprawling, open-air lots where materials sat exposed to weather and workers spent half their day chasing inventory. Today’s drive-through yards are organized, dry, and customer-friendly. “Everything is under a roof, clean, accessible, and safe,” Tagarelli explains.

“Instead of walking through a gravel yard in the snow amongst forklifts and other equipment, customers and contractors can pick what they need in one aisle.” The result is a more professional experience— both for DIY homeowners and for busy contractors.

Perfection Shingles

Single 7” & Double 7’

Perfection Shingles available in Single 7” and Double 7”

the craftsmanship of real cedar, engineered for exceptional performance.

Durability

With a 0.090” thick panel and ¾” deep projection, these shingles deliver unmatched strength and curb appeal

TrueTexture™

Authentic woodgrain finish, molded from real cedar, captures every grain and shadow for a natural, high-end finish

Climate-Ready Precision

Stay accurate in any weather with the patented PanelThermometer™ and built-in temperature lines

Warranty

Protected by a Lifetime Limited Warranty, giving you and your customers lasting peace of mind

“Contractors especially love it,” Tagarelli says. “They know where to find straight, dry lumber. They’re in and out fast, and they can trust what they’re getting.”

From the outside, Auto-Stak’s drive-through may look like a clever convenience. But at its core, it represents something bigger: an economic model for the building-supply industry. By shrinking footprint requirements, reducing labour, and cutting operating costs, dealers can now expand or upgrade without massive capital investments. “It’s really about helping the dealer make more with less,” he explains. “Less land, less labour, less maintenance—but more efficiency, more safety, more profitability.”

Auto-Stak’s systems are now found in yards across Canada, from modest regional dealers to major retail groups. As demand grows, Tagarelli says the company continues to refine its methods and offer customized packages.

“It took some education in the beginning,” he says. “But once people saw the benefits, it spread

fast. Everyone wants to serve their customers better.” That focus on service, both to the dealer and to the end consumer, remains at the heart of Auto-Stak’s philosophy.

“At the end of the day, it’s about creating a better experience for everyone,” Tagarelli says. “For the dealer who saves time and space, for the staff who work safer and cleaner, and for the customer who just wants to get what they need and get back to the job.”

With over three decades of innovation behind it, Auto-Stak continues to demonstrate how practical engineering can deliver real results. The drivethrough may have started as a simple convenience, but it has become a symbol of what modern building supply operations can achieve when they blend creativity with practicality.

“It’s not about building bigger,” Tagarelli concludes. “It’s about building smarter.”

Reach qualified managers, executives, sales reps, and top-tier retail professionals with Hardlines Classified Ads featured in our exclusive Hardlines Weekly Report every Monday morning.

This industry-leading publication goes straight to the inboxes of decision-makers across Canada’s home improvement industry.

Why Choose Hardlines Classifieds?

Highly Targeted Exposure

Affordable Pricing

Immediate Placement

Trusted by Industry Professionals

RATES:

2 Weeks: $2.99/word (75-word minimum)

4 Weeks: $3.99/word (75-word minimum)

Logo Placement (optional): $149.99 (one-time fee)

Rebecca Dumais, Hardlines editor, talks to Nicole Gallucci, HR expert and Hardlines Conference speaker. Gallucci notes that your most important hardware isn’t on your shelves and didn’t come with an instruction manual: It’s your people. They’re the heart of your business and also the hardest part to manage. But there’s help available, starting with this podcast. You’ll learn practical tools to turn people challenges into people power.

In this episode, Hardlines’ own Michael McLarney talks about the Hardlines Annual Retail Report, the most comprehensive and trusted source of intelligence on Canada’s home improvement industry. Packed with proprietary year-end 2024 sales data, it’s the essential planning tool for sales directors and marketing managers. Michael talks about the size of the industry, and how Hardlines has been tracking its changes for some 30 years.

In this Hardlines podcast, editor Rebecca Dumais talks to Jason Tasse, the president and COO of Lee Valley Tools, one of the key players in the Canadian home improvement industry. Lee Valley was formed in 1978 as a mail order company. Since then it has become a brand known for quality Canadian products that help woodworkers, gardeners, and cooks across the nation. Tasse talks about the latest news from Lee Valley.

In this podcast, Rebecca Dumais talks to Stephen Bailey, the chief marketing officer of Fluevog Shoes. This podcast touches on some of the points from Bailey’s recent presentation at the Hardlines Conference in Banff, Alta. Bailey talks about how to improve audience reach as well as how to build brand loyalty by creating a retail experience based on excellence.

THE CHALLENGE Deliver lifesaving imaging equipment to healthcare facilities across Canada

THE COMPANY SDI is a leader in the installation of magnetic resonance imaging (MRI) and biomedical equipment

How SDI Canada, a Montreal company that specializes in the installation of medical imaging equipment, delivers by crane to hospitals

By Sarah McGoldrick

CLAIM TO FAME SDI was founded in 2003 as the only Canadian-based MRI shielding vendor

“ We’re talking about

transporting

THE JOBSITES Healthcare facilities and hospitals across Canada

a fully-built and -furnished

building

that can weigh up to

110,000 pounds.

So every detail must be carefully planned.

— ANTHONY SAOUD Sales and marketing manager SDI CANADA Montreal, Quebec

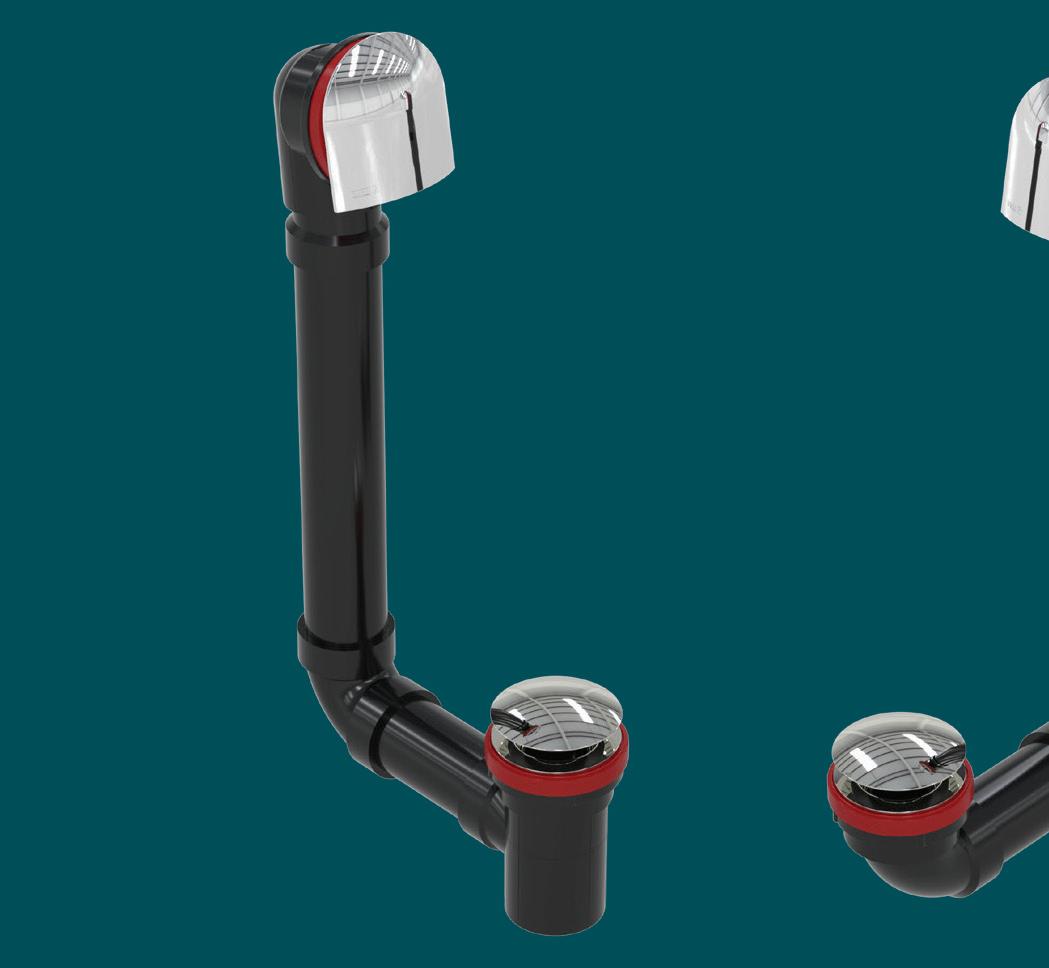

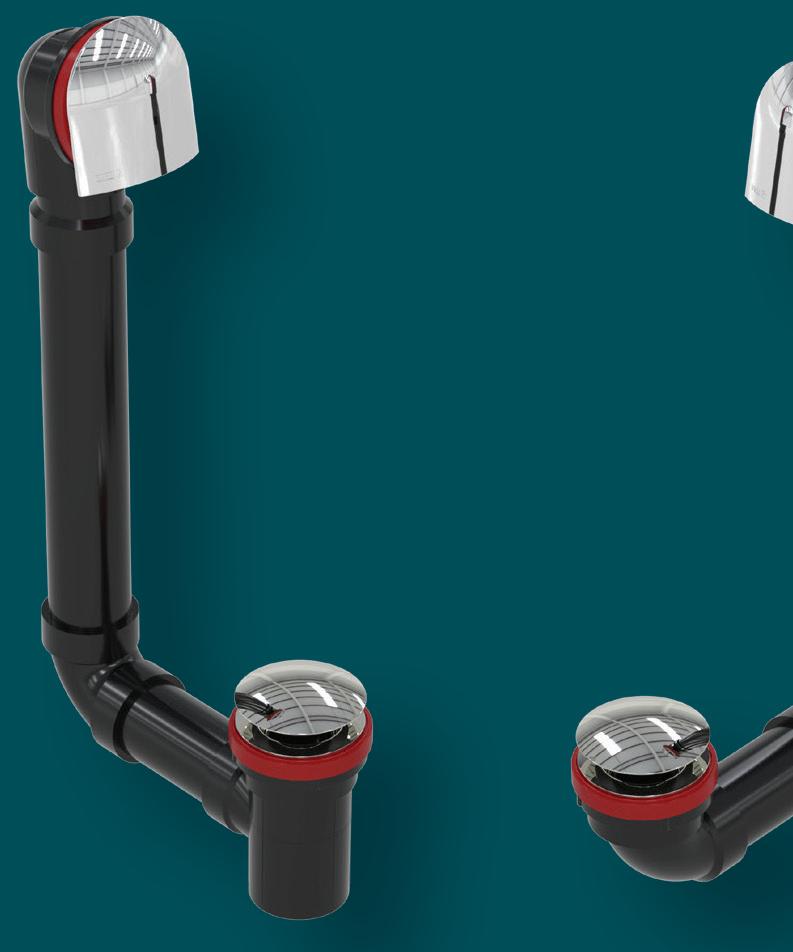

Introducing the 2-in-1 Total 1™ Bath Waste system with Offset & Direct waste configurations in one bagand no wasted parts!

Why carry two bath waste kits when one does it all? Our 2-in-1 design covers both key configurations, saving you space, time, and money. One kit, every job, zero hassle. and done.

Castle Building Centres has worked alongside building professionals for over 60 years. Our 300+ locations across Canada represent a national network of retailers devoted to supporting the growth of their communities.

Together… We Build Communities